The President's Proposal

for Health Reform

Over the past year the

House and the Senate have been working on an effort to provide

health insurance reform that lowers costs, guarantees choices,

and enhances quality health care for all Americans. On September

9, 2009 the President laid out his principles in an address to a Joint Session of

Congress.

Building on that

year-long effort, the President has now put forth a proposal that

incorporates the work the House and the Senate have done and adds

additional ideas from Republican members of Congress. The

President has long said he is open to any good ideas for

reforming our health care system, and he looks forward to

discussing ideas for further improvements from Republicans and

Democrats at an open, bipartisan meeting on Thursday.

The proposal will make

health care more affordable, make health insurers more

accountable, expand health coverage to all Americans, and make

the health system sustainable, stabilizing family budgets, the

Federal budget, and the economy:

- It makes insurance

more affordable by providing the largest middle class tax

cut for health care in history, reducing premium costs

for tens of millions of families and small business

owners who are priced out of coverage today.

This helps

over 31 million Americans afford health care who do not

get it today - and makes coverage more affordable for

many more.

- It sets up a new

competitive health insurance market giving tens of

millions of Americans the exact same insurance choices

that members of Congress will have.

- It brings greater

accountability to health care by laying out commonsense

rules of the road to keep premiums down and prevent

insurance industry abuses and denial of care.

- It will end

discrimination against Americans with pre-existing

conditions.

- It puts our budget

and economy on a more stable path by reducing the deficit

by $100 billion over the next ten years ? and about $1

trillion over the second decade ? by cutting government

overspending and reining in waste, fraud and abuse.

Progress

この法律は、一定の条件を満たす対象者(qualified beneficiaries)に対しCOBRA 保険料を補助するという条項を含んでいる。また、この保険料の補助は、COBRA に相当する、州法で義務付けられた一定の保険加入継続プログラムにも適用される。

COBRA(Consolidated

Omnibus Budget Reconciliation Act)は、会社を辞めた人や定年退職した人とその家族が、一定期間、辞めた会社で加入していた健康保険を、同じ団体用の保険料で維持できるという法律。ただ、保険料は全額自己負担となるので、会社に勤めていた時よりも出費は

かなり増える。家族ともども健康な人なら、COBRAよりも、個人保険に加入したほうが安くなる可能性も高い。

- The Recovery Act also invests $19 billion

in computerized medical records that will help to reduce

costs and improve quality while ensuring patients’

privacy.

- The Recovery Act also provides:

- $1 billion

for prevention and wellness to improve America’s health and help

to reduce health care costs;

- $1.1 billion

for research to give doctors tools to make the

best treatment decisions for their patients by

providing objective information on the relative

benefits of treatments; and

- $500 million

for health workforce to help train the next

generation of doctors and nurses.

Guiding Principles

President Obama is

committed to working with Congress to pass comprehensive health

reform in his first year in order to control rising health care

costs, guarantee choice of doctor, and assure high-quality,

affordable health care for all Americans.

Comprehensive health care

reform can no longer wait. Rapidly escalating health care costs

are crushing family, business, and government budgets.

Employer-sponsored health insurance premiums have doubled in the

last 9 years, a rate 3 times faster than cumulative

wage increases. This forces families to sit around the kitchen

table to make impossible choices between paying rent or paying

health premiums. Given all that we spend on health care, American

families should not be presented with that choice. The United

States spent approximately $2.2 trillion on health care in 2007,

or $7,421 per person ? nearly twice the average of other

developed nations. Americans spend more on health care than on

housing or food. If rapid health cost growth persists, the

Congressional Budget Office estimates that by 2025, one out of

every four dollars in our national economy will be tied up in the

health system. This growing burden will limit other investments

and priorities that are needed to grow our economy. Rising health

care costs also affect our economic competitiveness in the global

economy, as American companies compete against companies in other

countries that have dramatically lower health care costs.

President's plan, 2009

The President's plan, and

arguments on its behalf, are available on the White House

website.

During a June 2009

speech, President Barack

Obama

outlined his strategy for reform. He mentioned electronic

record-keeping; preventing expensive conditions; reducing

obesity; refocusing doctor incentives from quantity of care to

quality; bundling payments for treatment of conditions rather

than specific services; better identifying and communicating the

most cost-effective treatments; and reducing defensive medicine.

President Obama further

described his plan in a September 2009 speech to a joint session of Congress.

His plan mentions: deficit neutrality; not allowing insurance

companies to discriminate based on pre-existing conditions;

capping out of pocket expenses; creation of an insurance exchange

for individuals and small businesses; tax credits for individuals

and small companies; independent commissions to identify fraud,

waste and abuse; and malpractice reform projects, among other

topics.

President's plan, 2010

On February 22, 2010,

President Barack

Obama

released his plan for health care reform. In his plan he outlines the key

elements on which he wants to focus. Key elements of his plan

are: policies to improve the affordability and accountability;

policies to crack down on waste, fraud and abuse; policies to

contain costs and ensure fiscal sustainability; and other policy

improvements.

On February 25 President

Obama held a Bipartisan Health Care Summit at the Blair

House.

Among the topics discussed were the rising costs of health care

and unfair insurance practices. There were several issues that

Republicans and Democrats shared agreement on, issues such as:

Preventing waste and fraud in Medicare and Medicaid; addressing

medical malpractice reform; reforming the insurance market; and

giving individuals more choices in coverage, and giving small

businesses the opportunity to pool coverage for their employees.

One on the disagreements discussed was the

call from Republicans to throw out the current bill, and start

over. President Obama said he doesn’t want to scrap a year’s worth of work and start over

saying “the millions of Americans that are

suffering can't afford another year-long debate. There's too much

at stake.”

On March 2 President

Obama sent a letter to Speaker

of the House

Nancy

Pelosi,

Senator Harry Reid, Senator Mitch

McConnell,

and Representative John

Boehner.

In the letter he referenced four Republican ideas that he thought

deserved to be explored more. Those ideas were: random undercover

investigations of health care providers that receive

reimbursements from Medicare, Medicaid, and other Federal

programs; expanding the proposed grants of $23 million to $50

million for states that demonstrate alternatives to resolving

medical malpractice disputes; increasing Medicaid payments to

doctors; and the possibility of expanding Health Savings Accounts, and making clearer language in

the President’s proposal to allow for high

deductible plans.

He also spoke of provisions in the

legislation that he felt should not be in there, such as the

Medicare Advantage provision that provided transitional extra

benefits to Florida residents, and the Nebraska FMAP provision

which would have covered that state's expanded Medicare coverage

in perpetuity.

On March 8th, in

Glenside, Pennsylvania, the president gave a speech entitled

"Fighting for Health Insurance Reform", in which he

restated the country's need for a sustainable health care system.

He explained why he believes health insurance reform is a

necessity and called on Congress to put aside politics and hold a

final up-or-down vote on reform.

Congressional proposals

Summary

of differences between proposed Health Reform Bills

| |

H.R.

3962, Affordable Health Care for America Act

"House bill" |

H.R.

3590, Patient Protection and Affordable Care Act

"Senate bill" |

| Financing |

Places a 5.4% surtax on incomes over $500,000

for individuals and $1,000,000 for families. |

Increases the

Medicare payroll tax from 1.45% to 2.35% on incomes over

$200,000 for individuals and $250,000 for families. |

| Abortion |

Insurance plans

that cover abortions (except those already allowed by the

Hyde

Amendment)

will not be eligible for federal subsidies. |

Insurance plans

that participate in the newly-created exchanges will be

permitted to include abortion coverage, but a separate

payment, not using federal funds, must be made for the

portion of the premium attributable to abortion coverage.

Each state will have the option to

exclude plans covering abortions from their insurance

exchange. |

| Public option |

Yes. |

No. Instead, the

federal government will mandate that newly-created State

insurance exchanges include at least two national plans

that are created by the Office of Personnel

Management. Of these two national

plans, at least one will have to be a private non-profit

plan. |

| Insurance

exchanges |

A single

national insurance exchange will be created to house

private insurance plans as well as a public option.

Individual states could run their own exchanges under

federal guidelines. |

Each state will

create its own insurance exchange under federal

guidelines. |

| Medicaid

eligibility |

Expanded to 150%

of the federal poverty level |

Expanded to 133%

of the federal poverty level |

| Illegal

immigrants |

They are allowed

to participate in the insurance exchanges, but cannot

receive federal subsidies. |

They cannot

participate in the exchange or receive subsidies. |

| CBO estimate of outlays |

$1,050 billion

dollars over 10 years. |

$871 billion

dollars over 10 years. |

| CBO estimate of proposal's

net effect |

Deficit would be

reduced a total of $138 billion 2010-2019 after tax

receipts and cost reductions. |

Deficit would be

reduced a total of $132 billion 2010-2019 after tax

receipts and cost reductions. |

| Takes effect |

November 22,

2010 |

December 26,

2011 |

A health insurance exchange is an organized marketplace for the purchase of health insurance set up as a

governmental or quasi-governmental entity to help insurers

comply with consumer protections,

compete in cost-efficient ways, and to facilitate the

expansion of insurance coverage to more people.

Exchanges do not bear risk themselves - they are not

insurers. Rather, they would contract with private insurers

and possibly offer a public plan option to cover specified

populations (such as those obtaining coverage through small

employers and those without employer coverage).

Currently, there are two

major proposals being considered in Congress.

On November 7, 2009, the

House passed their version of a health insurance reform bill, the

Affordable Health Care for America

Act,

220-215.

On December 24, 2009, the

Senate passed their version, the Patient Protection and Affordable

Care Act,

60-39.

The two bills are similar

in a number of ways. In particular, both bills:

- Expand Medicaid

eligibility up the income ladder (to 133% of the poverty

line in the Senate bill and 150% in the House bill).

- Establish health

insurance exchanges, and subsidize those making up to 400

percent of the poverty line

- Offer tax credits to

certain small businesses (under 25 workers) who provide

employees with health insurance

- Impose a penalty on

employers who do not offer health insurance to their

workers

- Impose a penalty on

individuals who do not buy health insurance

- Offer a new

voluntary long-term care insurance program

- Pay for new

spending, in part, through cutting Medicare

Advantage,

slowing the growth of Medicare provider payments,

reducing Medicare and Medicaid drug prices, cutting other

Medicare and Medicaid spending, and raising various

taxes.

- Impose a $2,500

limit on contributions to flexible spending accounts (FSAs), which allow for

payment of health costs with pre-tax funds, to pay for a

portion of health care reform costs.

The two bills are also

similar in that neither would have much, if any, effect on the

rising costs experienced by most Americans who currently have

private health insurance.

Additionally, the seven million Americans with FSAs above

$2,500 would see an increase in taxes due to the proposed $2,500

cap on FSA contributions.

The biggest difference

between the bills, currently, is in how they are financed. In

addition to the items listed in the above bullet point, the House

relies mainly on a surtax on income above $500,000 ($1 million

for families). The Senate, meanwhile, relies largely on an

"excise tax" for high cost 'Cadillac' insurance plans, as well as an

increase in the Medicare payroll tax for high earners.

A Cadillac plan is

defined by the U.S. Senate Finance Committee as a health

insurance

plan with yearly premiums higher than $8,000 for

individuals or $21,000 for families, but colloquially refers

to any expensive plan.

The Senate Finance Committee approved provisions that would

lump FSAs together with high-cost insurance plans and subject

them to this excise tax.

Some economists believe

the excise tax to be best of the three revenue raisers above,

since (due to health care cost growth) it would grow fast enough

to more than keep up with new coverage costs, and it would help

to put downward pressure on overall health care cost growth.

Unlike the House bill,

the Senate bill would also include a Medicare

Commission

which could modify Medicare payments in order to keep down cost

growth. According to the Department

of Health and Human Services' Centers for Medicare and Medicaid

Services,

the Senate bill would increase the share of GDP consumed by

medical spending from the current 17% to 20.9% by 2019, compared

to 20.8% under current law, primarily as a result of increased

insurance coverage under the Act, including extension of coverage

to 33 million people currently without insurance.

The bills would need to

go to Conference where differences between them may be resolved.

If the Joint Conference Committee is able to resolve any

differences between each chamber's passed version of

comprehensive health care reform, the resulting Committee Report

becomes the lead proposal and goes back to each chamber to be

voted on by the full-body. The Committee Report, if passed, can

then be presented to President Barack

Obama

for his signature into law or be vetoed back to Congress.

Congressional leaders plan to bypass submitting the bills to a

conference committee in order to expedite the process.

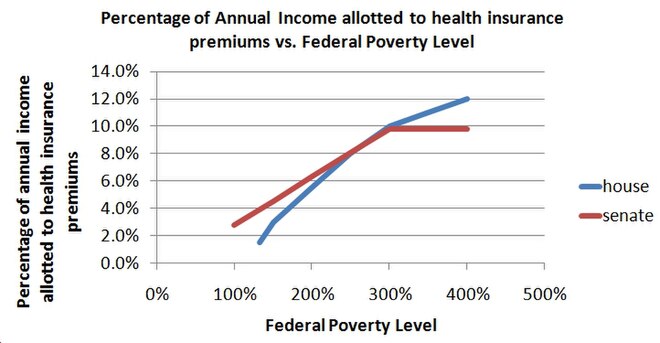

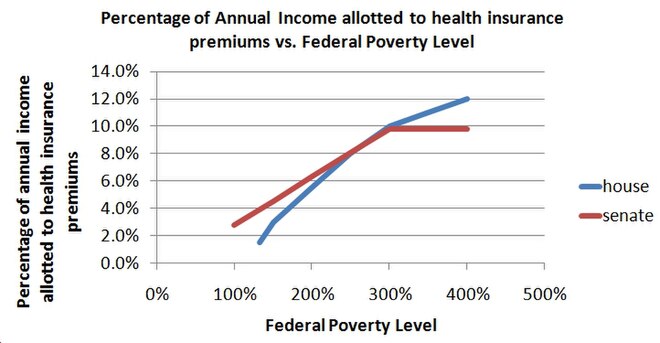

Differences in how each

chamber determines subsidies

The relationship between a family's poverty level and the percentage of their

income that is allotted to pay for health insurance. Note that

the Senate Bill provides for Medicaid coverage up to 133% of the federal poverty level while the House Bill provides for

Medicaid coverage up to 150% of the federal poverty level. Adapted from the texts of the

House Bill and Senate Bill.

The

2009 Poverty Guidelines for the 48 Contiguous States and

the District of Columbia

| Persons in family |

Poverty guideline |

| 1 |

$10,830 |

| 2 |

14,570 |

| 3 |

18,310 |

| 4 |

22,050 |

| 5 |

25,790 |

How each bill determines

subsidies also differs. Each bill subsidizes the cost of the

premium and the out-of-pocket costs but are more or less generous

based on the relationship of the family's income to the federal poverty level.

The amount of the subsidy

given to a family to cover the cost of a premium is calculated

using a formula that includes the family's income relative to the

federal poverty level. The federal poverty level is related to a determined

percentage that defines how much of that family's income can be

put towards a health insurance premium. For instance, under the

House Bill, a family at 200% of the federal poverty level will spend no more than 5.5% of

its annual income on health insurance premiums. Under the Senate

Bill, the same family would spend no more than 6.3% of its annual

income on health insurance premiums. The difference between the

family's maximum contribution to health insurance premiums and

the cost of the health insurance premium is paid for by the

federal government. To understand how each bill can affect

different poverty levels and incomes, see the Kaiser

Family Foundation's

subsidy

calculator

Subsidies under House

bill

The House plan subsidizes

the cost of the plan and out-of-pocket expenses. The cost of the

plan is subsidized according to the family's poverty level, decreasing the subsidy as the poverty level approaches 400%. The

out-of-pocket expenses are also subsidized according to the poverty level at the following rates. The

out-of-pocket expenses are subsidized initially and are not

allowed to exceed a particular amount that will rise with the

premiums for basic insurance.

| For

those making between |

This much of the

out-of-pocket expenses are covered |

And no more than

this much will be spent by the individual (family) on

out-of-pocket expenses. |

| up to 150% of

the FPL |

97% |

$500 ($1,000) |

| 150% and 200% of

the FPL |

93% |

$1,000 ($2,000) |

| 200% and 250% of

the FPL |

85% |

$2,000 ($4,000) |

| 250% and 300% of

the FPL |

78% |

$4,000 ($8,000) |

| 300% and 350% of

the FPL |

72% |

$4,500 ($9,000) |

| 350% and 400% of

the FPL |

70% |

$5,000 ($10,000) |

Subsidies under Senate

bill

The Senate plan

subsidizes the cost of the plan and out-of-pocket expenses. The

cost of the plan is subsidized according to the family's poverty level, decreasing the subsidy as the poverty level approaches 400%. The

out-of-pocket expenses are also subsidized according to the poverty level at the following rates. The

out-of-pocket expenses are subsidized initially and are not

allowed to exceed a particular amount that will rise with the

premiums for basic insurance.

| For

those making between |

This much of the

out of the out-of-pocket expenses are covered |

| up to 200% of

the FPL |

66% |

| 200% and 300% of

the FPL |

50% |

| 300% and 400% of

the FPL |

33% |

The Senate Bill also

seeks to reduce out-of-pocket costs by setting guidelines for how

much of the health costs can be shifted to families within 200%

of the poverty line. A family within 150% of the FPL cannot have more than 10% of

their health costs incurred as out-of-pocket expenses. A family

between 150% and 200% of the FPL cannot have more than 20% of

their health costs incurred as out-of-pocket expenses.

The House and Senate

bills would differ, somewhat, in their overall impact. According

to Congressional Budget Office estimates, the Senate bill would

cover an additional 31 million people, cost nearly $850 billion

for coverage provisions over ten years, reduce the ten year

deficit by $130 billion, and reduce the deficit in the second

decade by around 0.25% of GDP. The House bill, meanwhile, would

cover an additional 36 million people, cost roughly $1050 billion

in coverage provisions, reduce the ten year deficit by $138

billion, and slightly reduce the deficit in the second decade

----------------------

News Week 2009/8/4

特集

米医療保険改革

オバマ政権の「国民皆保険」構想に立ちはだかるこれだけの難題

アメリカの医療保険制度は最高だ!

以前癌になった私は失業したら2度と保険に入れない、治療費が生涯限度額を超えれば保険会社は一銭も払わない、さらに悲惨な無保険者は4700万人──いったい何が問題なのか

申し訳ないが、私はアメリカの医療保険制度は現状のままでいいと思っている。私は医療保険に加入しているし、4700万人の無保険者のことなど知ったことじゃない。誰かがバラク・オバマ大統領と議会を止めるべきだ。医療改革法案を葬れ! 私は今のままのほうがトクなのだ。

「医療の公営化」に反対する手紙を大統領に出し、「私のメディケア(高齢者医療保険制度)に手を出すな」と書いた女性に私は賛成だ。メディケアが公的医療制度であることはともかく、そうこなくては!

私が連邦議員たちと同じ高水準の保障を得ていい道理などあるだろうか。法案に反対していた民主党の保守派議員などは「ブルー・ドッグ(青い犬)」と言われるだけあって顔色が悪く、たくさんの医療サービスを必要とする。私のような一般人の保障など、それより少なくて当然だ。

私は数年前に癌を患った。今の職を失えば、もう2度と医療保険には加入できないという事実を、私は気に入っている。私の住宅保険とそっくりだ。空き巣に入られたら契約を解除された。

癌の再発については考えるのも恐ろしいが、そのときに直面する究極の選択にはぞくぞくする。数十万ドルの医療費を払うために家を売るか、死ぬかの選択だ。

高額治療費を保障する保険が存在しないというのも素晴らしい。私の医療保険(結構、恵まれたものだ)は、最先端の癌治療にかかった費用の75%しか保障してくれなかった。癌で苦しみながらも自己負担の大金を支払わされる──これこそあるべき姿ではないか。

年間保険料2万5000ドルが何だ

多くの医療保険に、生涯支払い限度額が設定されているのもこたえられない。契約書の文字が小さ過ぎて見落とした人のために解説すると、保険からの医療費支払いが一定限度額を越えると、それ以上はびた一文払ってもらえないということだ。実に公平だ。

公平と言えば、どんな治療が保険の保障範囲に入るかを決めるのが医者ではなく、コスト削減を至上命題とする保険会社の事務屋たちだというのも公平に思える。何と言っても、医療のことをいちばんよくわかっているのは保険会社の連中なのだから。

そう、現状は保険会社にとって最高だ。最近知ったのだが、私たちが支払う保険料には、保険会社の事務費やマーケティング費用、利益などが手数料として含まれている。ミネソタ大学の研究によれば、保険会社の保険料収入の最大47%は医療費以外の手数料に使われている。優良な保険会社でさえ、30%近くを医療以外の目的で使っている。素晴らしい。

さらに朗報がある。企業が提供する医療保険に加入するアメリカ人は現在、1世帯当たり年間8000ドルの保険料を支払っているが、大統領経済諮問委員会によれば、25年までにはそれが2万5000ドルまで増加するという。医療保険改革の支持者はこれを「持続不可能」と言うが、そんなことはない。

そもそも、彼らはどうしたら「公的保険」などというバカげた構想を信じられるのだろう。寡占状態にある保険業界に努力を促すには競争が必要だなどと、本気で信じているのだろうか。競争を尊ぶ資本主義などという言葉があったのは大昔のことだ。

私は、営利企業である保険会社が連邦政府の資金にタダ乗りして儲ける現状こそ望ましいと思う。私たちは、企業が困ると政府が助けるという優れた福祉制度をもっている。メディケア受給者向けの処方薬を提供するプログラムを政府の代わりに運営することで、保険会社は政府から数千億ドルの手数料を受け取っている。その制度に手を触れてはいけない。腕利きロビイストが手塩にかけて作り上げた傑作を、ぶち壊しにすることになる。

議論を始めてからまだたった97年

現状のうちでも最高なのは、医者がサービス単位で支払いを受ける仕組みだ。医者は、処置の一つ一つに対して支払いを受ける。自動車販売員が、車を売った対価ではなく、ハンドルを握ったりブレーキを踏んだりするたびにコミッションを受け取るようなものだ。近所のショッピングセンターで開業しているクリニックの医療のほうが、医者が給与ベースで働いているメイヨー・クリニックやスローン・ケタリング記念癌センターなどの大病院よりはるかに優れているのもそのおかげだ。誰がこのシステムを壊したがるだろうか。

よろしい、認めよう。私も本音では変化を望んでいる。自分たちも「改革者」だと言うために共和党議員が持ち出した政策を、私は支持する。彼らによれば、医療過誤訴訟で認める損賠賠償支払い額に上限さえ設ければ、医療保険制度全体を救うことができる。カリフォルニア州とテキサス州という全米最大の2つの州が数年前にその通りのことを実施したが、何も良くならなかった。だが、誰がそんなことを気にするだろう。何より、この政策は聞こえがいい。

だから、米議会が夏休みになって地元の議員が帰ってきたら、医療保険改革はまだ時期尚早だと訴えよう。何せ、私たちがこの議論を始めてからまだ

97年しか経っていない。1912年にセオドア・ルーズベルトが革新党の選挙公約に公的医療保険を掲げたのが最初だからだ。議会の公聴会もたった745回しか開かれていない(ちゃんと数えたわけではないが)。こんなものではとても足りない。何かをする前に、もっとこの問題を研究しよう。

たった今、私は「問題」と言ったか? 問題など何もない。私は現状維持が好きなのだ。