イランが核問題をめぐる経済制裁を解除されて以降、欧米石油大手とこうした合意に達したのは初めて。

|

|

SunPower and Total Partner to Create a New Global Leader in the Solar Industry

SunPower and Total today

announced that the two companies have entered into a broad

strategic relationship to shape the future of the solar industry.

Total Group will launch a friendly tender offer through a wholly

owned subsidiary for up to 60 percent of SunPower's outstanding Class

A Common shares and 60 percent of SunPower's outstanding Class B

Common shares at a price of $23.25/share for each class. The

offer price represents a 46 percent premium over the April 27th,

2011 closing price of SunPower's Class A common stock and a 49

percent premium over the April 27th, 2011 closing price of

SunPower's Class B common stock, and values SunPower's equity at $2.3 billion.

In addition, Total will provide SunPower with up to $1 billion of

credit support

over the next five years. Following closing of the transaction,

which has been approved by the boards of both companies, SunPower

will continue to operate with its current management team.

"Total's commitment and global presence will help accelerate our growth and solidify our position in the increasingly competitive solar sector," said Tom Werner, SunPower's CEO. "With Total's $1 billion credit support agreement, solar research and development investments and the other resources available through its global network, we have taken the next step in positioning our business for continued growth and long-term success. Our relationship with Total will improve our capital structure enabling SunPower to accelerate our power plant and commercial development businesses, and expand our manufacturing capacity with lower cash requirements" .

"The world future energy balance will be the result of a long-term transition in which renewable energies will take their place alongside conventional resources," said Philippe Boisseau, President, Total Gas and Power Division. "Over the past years, Total has built up sizeable renewable energy activities. Today, Total is executing on its strategy to become a major integrated player in solar energy. We evaluated multiple solar investments for more than two years and concluded that SunPower is the right partner based on its people, world-leading technology and cost roadmap, vertical integration strategy and downstream footprint."

"Solar is becoming a material addition to the new generation portfolio around the world, with more than 40,000 MW of solar photovoltaic power installed globally," continued Werner. "Total and SunPower will collaborate to ensure that solar becomes a platform for an efficient, competitive and sustainable energy future. Already, SunPower's high-efficiency, high-reliability solar photovoltaic power plant costs are competitive with other new resources."

"SunPower is preparing for rapid expansion through the next decade," added Boisseau. "We look forward to supporting SunPower as a strategic partner with whom we expect to find many synergies with our solar activities as well as with Total Group overall, while maintaining their entrepreneurial culture of rapid innovation."

Transaction Details

Under the terms of the tender offer agreement, SunPower

shareholders will receive $23.25 per share in cash at closing for

each share validly tendered in the tender offer, subject to

pro-ration in the event that more than 60 percent of SunPower's

Class A and Class B shares are tendered. Total expects to begin

its tender offer within 10 business days. Following the

completion of the transaction, SunPower's shares will continue to

trade on Nasdaq under the symbols "SPWRA" and

"SPWRB. The closing of the tender offer is conditioned on a

minimum of 50% of the outstanding shares of each of the Class A

and Class B common stock being tendered, clearance by U.S. and

European Union antitrust authorities, and other customary closing

conditions.

Under the credit support agreement, Total will offer to guarantee an amount up to $1 billion of SunPower's repayment obligations with respect to letters of credit issued over the next five years in connection with SunPower's global utility power plant and large commercial installation businesses. This credit support should allow SunPower to substantially reduce the total costs of its letters of credit and financing. SunPower's affilitation with Total is expected to benefit SunPower, lowering its cost of capital and increasing its access to uncollateralized debt financing.

In addition, SunPower and Total have entered into an affiliation agreement under which Total will nominate a majority of directors to SunPower's board of directors, which will be expanded to 11 members following the closing. This agreement also includes conditions on Total's ability to purchase additional shares of SunPower. Specified transactions between Total and SunPower shall be approved in advance by SunPower's independent board members.

SunPower and Total have also entered into a research and collaboration agreement under which the companies will focus on advancing photovoltaic technologies across multiple research and development projects.

SunPower intends to call a meeting of its stockholders within six months following closing to combine its Class A and Class B common stock into a single class of common stock with one vote per share. This plan is subject to the company's receipt of a tax opinion that such reclassification will be permitted on a tax free basis, and Total has agreed to vote its shares in favor of the reclassification.

SunPower will discuss this release and provide an update on its 2011 first quarter results, which will be released on May 12th, 2011, in a conference call on Thursday, April 28, 2011 at 2:00 p.m. Pacific Time. The call-in number is 517-623-4618, passcode SunPower. The call will be webcast and can be accessed from SunPower's website at http://investors.SunPowercorp.com/events.cfm.

About SunPower

SunPower Corp. designs, manufactures and delivers the highest

efficiency, highest reliability solar panels and systems

available today. Residential, business, government and utility

customers rely on the company's quarter century of experience and

guaranteed performance to provide maximum return on investment

throughout the life of the solar system. Headquartered in San

Jose, Calif., SunPower has offices in North America, Europe,

Australia and Asia. For more information, visit www.Sunpowercorp.com.

About Total

Total is one of the world's major oil and gas groups, with

activities in more than 130 countries. Its 93,000 employees put

their expertise to work in every part of the industry ?

exploration and production of oil and natural gas, refining and

marketing, gas & power and trading. Total is working to keep

the world supplied with energy, both today and tomorrow. The

Group is also a first rank player in chemicals.

As an energy producer and provider, Total is striving to diversify its supply to help meet growing energy demand in the long term. The Group is notably investing and actively taking part in a number of renewable R&D projects, such as solar and biofuels.

Total has been active in solar energy since 1983. Through its joint venture affiliates Tenesol and Photovoltech, Total has built strong expertise all along the photovoltaic solar power chain to make this technology more reliable, efficient and competitive. Tenesol is a leading French solar panel manufacturer with an industrial footprint in Toulouse (France) and Cape Town (South Africa). Total is also a large minority shareholder in US technology companies like Konarka, which develops products based on organic solar technologies, and AE Polysilicon, which specializes in a new solar polysilicon production technology. For more information, visit www.total.com.

TOTAL has signed a memorandum of understanding with Iran’s National Petrochemical Company to investigate building a world-class steam cracker in the country.

In a statement emailed to The Chemical Engineer, Total confirmed the partners are considering building the facility on the Iranian coast, with ethane as the primary feedstock.

Foreign investors are returning to Iran following the lifting last year of economic sanctions that hampered industrial development, including of the country’s vast reserves of oil and gas.

Total said the agreement is for a study into a possible project, and does not constitute a binding contract to build the facility.

イランが核問題をめぐる経済制裁を解除されて以降、欧米石油大手とこうした合意に達したのは初めて。

|

|

2017/07/03

2016/11/11

仏 Total、イランのSouth Par ガス田開発でNational

Iranian Oil と基本合意

Iran: Total and NIOC sign contract for the

development of phase 11 of the giant South Pars gas field

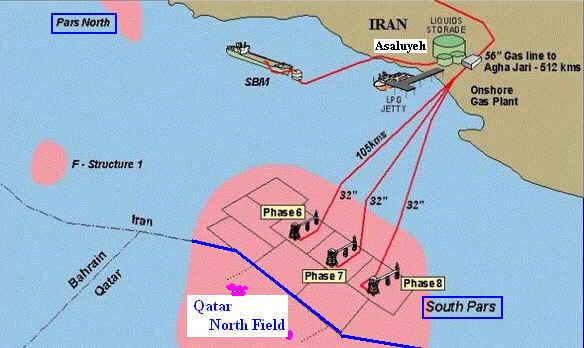

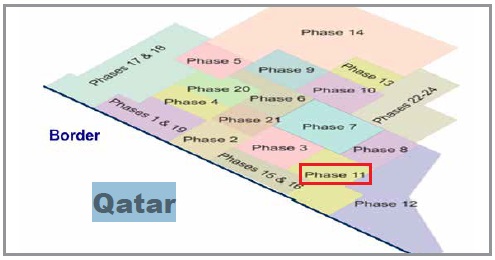

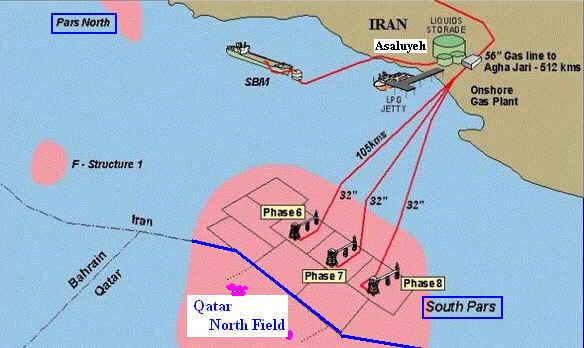

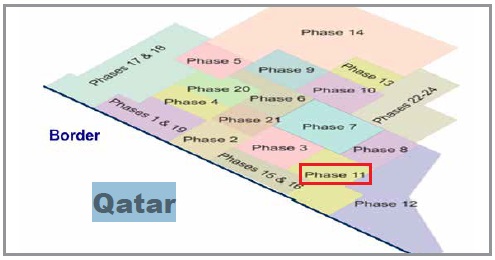

Total and the National Iranian Oil Company (NIOC) have signed a contract for the

development and production of phase 11 of South Pars (SP11), the world's largest

gas field. The project will have a production capacity of 2 billion cubic feet

per day or 400,000 barrels of oil equivalent per day including condensate. The

produced gas will supply the Iranian domestic market starting in 2021.

This contract, which has a 20-year duration, is the

first Iranian Petroleum Contract (IPC) and is based on the technical,

contractual and commercial terms as per the Heads of Agreement signed on

November 8, 2016. Total is the operator of the SP11 project with

a 50.1% interest alongside the Chinese state-owned

oil and gas company CNPC (30%), and Petropars (19.9%),

a wholly owned subsidiary of NIOC.

“This is a major agreement for Total, which officially marks our return to Iran

to open a new page in the history of our partnership with the country. We are

proud and honored to be the first international company to sign an IPC, which

offers an attractive commercial framework, following the 2015 international

nuclear accord (JCPOA) and to therefore contribute to the development of

relations between Europe and Iran. Total will develop the project in strict

compliance with applicable national and international laws”, said Patrick

Pouyanné, Chairman & CEO of Total. “This project is in line with the Group’s

strategy to expand its presence in the Middle East and grow its gas portfolio by

adding low cost, long plateau assets.”

SP11 will be developed in two phases. The first phase, with an estimated cost of

around 2 billion dollars equivalent, will consist of 30 wells and 2 wellhead

platforms connected to existing onshore treatment facilities by 2 subsea

pipelines. At a later stage, once required by reservoir conditions, a second

phase will be launched involving the construction of offshore compression

facilities, a first on the South Pars field.

Since the November 2016 HoA signature, Total has been conducting engineering

studies on behalf of the consortium and initiated calls for tender in order to

award the contracts required to develop the project by the end of the year.

Ningbo plant

The Ningbo plant produces 200,000 tons of polystyrene a year and has 54 employees. It also includes a unit that manufactures polypropylene compounds for automotive parts. After the closing of the transaction, the polypropylene compounds production will be exclusively dedicated to Total.Foshan plant

The Foshan plant produces 200,000 tons of polystyrene a year and has 86 employees.

In a highly competitive polystyrene market, Total considered it did not have the required critical mass in China, unlike its positions in Europe and the United States.

“The sale is in line with our active portfolio management strategy” commented Bernard Pinatel, President, Refining & Chemicals at Total. “Our polystyrene business will be now focused on Europe and North America, two markets where we are the No. 2.”

INEOS Styrolution has made clear commitments to maintain the business and jobs and meet commitments to customers.

The transaction is subject to the approval of the relevant regulatory authorities.