2011/12/30 日本経済新聞

中国、外資向け投資指針改定

自動車、新規参入難しく 奨励業種から除外

中国の国家発展改革委員会と商務省は29日、外資系企業が対中投資する際のガイドラインの改訂版を発表した。過剰生産能力を抱える自動車製造を奨励業種から除外しており、外資の新規参入が難しくなる見通し。電気自動車(EV)など新エネルギー車の高性能電池も外資の出資比率を50%以下に制限する。一方、医療機関などサービス分野を新たに開放する。 「外資系企業投資ガイドライン」は投資奨励業種、制限業種、禁止業種などを具体的に規定。改訂は2007年以来で、12年1月30日から施行する。発改委は改訂版について、「対外開放を進めた」としており、投資の奨励業種を増やし、禁止分や制限業種、出資制限業種を減らしたという。

2007年版 http://www.ndrc.gov.cn/zcfb/zcfbl/2007ling/W020071107537750156652.pdf

解説

http://www.knak.jp/blog/2007-11-1.htm#guideline

2011年版 http://www.ndrc.gov.cn/zcfb/zcfbl/2011ling/W020111229379511927834.pdf

これまで制限業種として進出が極めて困難だったとされる医療機関運営、金融・リースを容認業種に位置付けた。高齢化や所得向上による生活習慣病患者の増加で医療機関の不足が顕在化。外資導入で整備を狙う。

奨励業種としてはEVなど新エネルギー車に組み込む基幹部品や、充電所運営を指定した。ただ、新エネルギー車向け高性能電池の一部については、外資の出資比率を50%以下に制限することを明記した。世界自動車大手の中国でのEV戦に影響を与えそうだ。

一方、生産能力が過剰となっている産業は奨励業種から外した。自動車製造の除外は外資ブランドの低価格車販売で国内の独自ブランドメーカーが苦戦してい状況を勘案したとみられる。このほか、太陽光発電設備などに使う多結晶シリコンや石炭化学も奨励産業ではなくなった。

中国の外資優遇制度は段階的に縮小されており、奨励産業に選ばれても、メリットは製造設備の輸入関税の減免などに限られるという。中国には多くの日系自動車大手が進出しているが、中国法人幹部は「自動車が奨励産業から外れても、大幅にコストが増えることはない見通しだ」と話す。

ガイドラインは中国政府の外資企業の中国市場参入に対する姿勢を反映しているとされ、ある地方政府幹部は「中央政府の外資企業の進出認可などを左右する可能性は高い」との見方を示す。今回の改訂は日系を含めた外資企業の進出計画に影響を与える恐れもある。

外資企業投資ガイドラインの主な変更点

| 参入制限から容認に変更 |

医療機関

金融リース |

| 出資制限を撤廃 |

新エネルギー発電設備 |

| 奨励品目に追加 |

新エネルギー車の基幹部品、充電所運営

ベンチャー投資

知的財産権サービス

海洋汚染除去技術

次世代通信設備

職業訓練、

紡績・化学工業・機械などの新世代製品 |

| 奨励品目から外された産業 |

自動車製造

多結晶シリコン

石炭化学 |

| 2007年改定 |

2011年改定 |

| 奨励品目 |

| 1 |

年産80万トン以上のエチレン |

|

|

| 2 |

エチレン誘導品の製造、C4- C9副産品の活用(合成ゴム用ブタジエンを除く) |

|

|

| 3 |

年産20万トン以上のエチレン法PVC |

|

|

| 4 |

次亜塩素酸ソーダ、PVC、新しい有機シリコーン加工品 |

1 |

次亜塩素酸ソーダ、PVC、新しい有機シリコーン加工品 |

| 5 |

ベンゼン、トルエン、キシレン、エチレングリコール等有機化学原料およびデリバティブ |

|

|

| 6 |

ビスフェノールA |

過酸化水素法PO |

2 |

過酸化水素法PO、グリセロールのエピクロロヒドリン、ナフタレンジメチルエステル、1,4

- シクロヘキサン2メタノールのエステル |

| 7 |

合繊原料:精密テレフタル酸 |

カプロラクタム、ナイロン66塩、スパンデックス |

3 |

合繊原料:カプロラクタム、ナイロン66塩、スパンデックス、1,3-

propanediol |

| 8 |

合成ゴム:溶液法SBR、ブチルゴム、イソプレンゴム、ポリウレタンゴム、アクリルゴム、エピクロルヒドリンゴム、EPR、ニトリルゴム、フッ素ゴム、シリコーンゴム、他の特殊ゴム |

4 |

合成ゴム:溶液法SBR、高シスブタジエンゴム、ブチルゴム、イソプレンゴム、ポリウレタンゴム、アクリルゴム、エピクロルヒドリンゴム、EPR、フッ素ゴム、シリコーンゴム、他の特殊ゴム |

| 9 |

エンプラ:PPO、ナイロン11・ナイロン12、ポリイミド、ポリスルホン、ポリアリレート、液晶ポリマー |

5 |

エンプラ:年産6万トン以上の非ホスゲンPC、POM、ポリアミド(ナイロン6、ナイロン66、ナイロン11、ナイロン12)、EVA、ポリフェニレンサルファイド、ポリエーテルエーテルケトン、ポリイミド、ポリスルホン、ポリエーテルスルホン、ポリアリレート、液晶ポリマー、その他製品

|

| 10 |

ファインケミカル |

6 |

ファインケミカル |

| 18 |

大規模石炭化学製品 |

- |

|

| |

直径200mmシリコン単結晶、ポリッシュウェーハ、 |

多結晶シリコン |

|

直径200mmシリコン単結晶、ポリッシュウェーハ |

| 制限品目 |

| |

年産800万トン以下の製油所 |

|

年産1000万トン以下の蒸留精製、

年産150万トン以下の接触分解、

年産100万トン以下の連続改質(芳香族抽出を含む)

年産150万トン以下の水素化分解 |

October 17, 2011 Makhteshim Agan

Makhteshim Agan and ChemChina Complete Merger

Historic Transaction Realizes MAI’s Vision to Create a Global

Powerhouse in Crop Protection Solutions

Makhteshim Agan Group (MAI) , the world leader in branded off-patent crop

protection solutions, today announced that 60% of its

shares have been acquired by China National Agrochemical Corporation, a

full subsidiary of China National Chemical Corporation (ChemChina). ChemChina is

one of the top 500 companies in the world and the largest chemical producer in

China. The closing occurred following the satisfaction of several closing

conditions, including approval of the transaction by MAI shareholders and

European, US and Brazilian anti-trust authorities. As of today, MAI becomes a

private company, 60% of which is owned by ChemChina, and

40% by Koor Industries Ltd., part of the largest Israeli holding company - IDB

Group.

The merger between MAI and ChemChina is the largest transaction ever concluded

between a Chinese and an Israeli company, and represents a significant milestone

in MAI’s 66-year history. The transaction process was led by Mr. Ren Jianxin

chairman of ChemChina and Mr. Nochi Dankner chairman of IDB Group. The merger

will create a platform that is optimally suited to the changes in the global

agrochemical industry, while positioning MAI to tap the opportunities inherent

in these changes.

Based on the desire of both shareholders, MAI’s existing management team will

continue to lead the Company, and its headquarters will remain in Israel. The

Company intends to continue operating all of its existing global manufacturing

facilities. In parallel, it will seek to capitalize on its strong base in China

to further expand its global infrastructure and its ability to offer the

industry’s leading portfolio of crop protection solutions.

About Makhteshim Agan Group

Makhteshim Agan Industries Ltd is a leading manufacturer and distributor

worldwide of crop-protection solutions and the largest off-patent player in the

sector. The Company supplies efficient solutions to farmers that assist them in

combating disease and increase yields. In 2010 the Company’s sales revenues were

over USD 2.37 billion, and it is ranked number 7 in the world agro-chemicals

sector. The Company is characterized by its know-how, high-level

technological-chemical abilities, expertise in product registration, and

observance of strict standards of environmental protection, stringent quality

control and global marketing and distribution channels. For more information

visit us at www.ma-industries.com

2010/10/17 Israel

Business

ChemChina

transfers $2.4B for Makhteshim merger

Sale performed through Bank Hapoalim.

Public shareholders to receive $1.272 billion; Koor to receive $1.128

billion, expected to pocket net profit of as much as NIS 675 million from

deal

The deal for the merger of ChemChina and

Makhteshim Agan has been completed. Calcalist has learned that ChemChina has

transferred $2.4 billion to Israel, of which $960 million are a loan to Koor,

which will receive an additional $168 million for 7% of its shares in the

company.

The remainder of the proceeds – $1.272

billion – will go to the company’s public shareholders.

The entire payment has been transferred

to Bank Hapoalim, which will hold the money in trust for the next few days.

The closing agreement was made in Bank Hapoalim as well, and upon the

finalization of the deal Makhteshim Agan and IDB Group, controlled by Nochi

Dankner, together with ChemChina, the Chinese national chemical corporation,

issued an official statement of the deal’s finalization.

Makhteshim Agan has also announced that

it purchased the stock options of 130 of its employees as a prerequisite for

the merger. Once the deal reached its final stages, Makhteshim was required

as a prerequisite to the finalization of the deal to cancel all of the stock

options held by its employees and executives.

The company will pay more than 130

employees and executives who held stock options NIS 73 million (about $20

million), of which NIS 16 million ($4.4 million) will be pocketed by

Makhteshim CEO Erez Vigodman.

Makhteshim President and CEO

Asia-Pacific, Africa & Middle East Ran Maidan will receive NIS 4.3 million

($1.18 million), and director of Global Resources and Corporate Development

Chen Lichtenstein will pocket NIS 3.1 million ($850,000).

Koor announced that as a result of the

deal, the company will post a NIS 582-674 million ($160-185 million) net

profit for the fourth quarter of 2011, as well as an equity increase of NIS

655-747 million ($180-205 million).

IDB Chairman Nochi Dankner commented upon

the deal’s completion, “The finalization of the strategic partnership

agreement between ChemChina and IDB Group regarding Makhteshim Agan is an

important milestone in IDB’s aspirations for global expansion and in the

development of its global presence with a focus on China.

"The deal with ChemChina is an important

step for IDB Group and Israel’s industry, and we believe it will be

instrumental in forging economic relations between Israel and China – a

country which is the main growth engine of the world’s economy.

"During a fascinating year of

negotiations, I had the privilege and honor of working closely with my good

friend Mr. Jianxin Ren, chairman of ChemChina, who is a leader with unique

wisdom and business insight. He is an entrepreneur, a gifted negotiator and

an individual with ideals who always sees the big picture while at the same

time fully controlling the small details.

"We forged a particularly close friendship

which contributed to the excellent cooperation between the ChemChina and IDB

teams lead by Discount Investments President Ami Erel who with great

intelligence helped lead the deal to it successful completion.”

Jan 19 2012 Reuters

US to probe imports of China, Vietnam wind towers 風力発電タワー

* US producers warn of plant closings

* Chinese wind tower makers opposes U.S. probe

* Siemens says duties not warranted

* ITC to vote next month on case

The U.S. Commerce Department said on Thursday it was launching an investigation

that could lead to steep import duties on more than $100 million worth of

wind energy towers from China and Vietnam.

The decision adds to the friction in clean energy trade between the world's two

largest economies.

The Commerce Department is already investigating charges that Chinese solar

panel makers engage in unfair trade practices and will issue a preliminary

decision on duties next month.

2011/12/1

太陽電池で米国と中国が互いに貿易障壁調査開始

The Wind Tower Trade Coalition, a group of

U.S. producers, had previously said it was asking for anti-dumping duties of 64

percent on imports from China and 59 percent from Vietnam . .

But in its announcement, the department said China was alleged to undercut U.S.

wind tower prices by nearly 214 percent and Vietnam by 141

to 143 percent.

Some Chinese makers of wind towers said on Thursday they oppose the charge.

"We are talking to the China Commerce of Ministry about this," said Wang Debao,

a vice-director at Chengxi Shipyard Co, whose wind tower business made up nearly

10 percent of its annual revenue which exceeded $1 billion last year.

"We are hiring lawyers to challenge the allegations," said Wang, whose company

is a unit of China State Shipbuilding Corp.

Other Chinese wind tower makers Titan Wind Energy (Suzhou) Co and Shanghai

Taisheng Wind Power Equipment also expressed concerns, saying any anti-dumping

duties by the U.S. could hurt prospects in a growing market.

U.S. producers also want additional countervailing duties on wind towers from

China to offset alleged government subsidies, despite a recent U.S. court ruling

that struck down the use of such duties against "non-market economies" like

China.

A separate U.S. government agency, the International Trade Commission, held a

hearing on Thursday to probe whether U.S companies have been materially harmed

or threatened by the imports. The panel will vote next month on whether there is

enough evidence of harm for the case to proceed.

SHUT OUT OF SHEPHERDS FLAT

Imports of the wind towers from China and Vietnam were an estimated $103.6

million and $51.9 million, respectively, in 2010. The towers, which can stretch

more than 100 meters into the air, are made of individual pieces assembled on

site. They support the blades and housing for the wind turbines.

Kerry Cole, president of Trinity Structural Towers, said domestic producers

suffered a severe blow when they were shut out of the 338-tower Shepherds Flat

project in eastern Oregon, which is due to be completed next year and is billed

as the world's largest wind farm.

"All of it went to China ... This lone lost sale had ripple effects throughout

the industry ... After losing this sale, domestic producers were desperate to

fill their order books," putting them under tremendous pressure to cut prices,

Cole said.

U.S. producers will continue to face "reduced business volumes, margins and

reduced profits" unless the United States slaps duties on imports from China and

Vietnam, Michael Barczak, vice president of sales for DMI Industries, told the

ITC.

"Current production levels are low and because of imports are not projected to

improve in future years. If these trends continue, a number of domestic

producers will have to shut down plants or consolidate production," Barczak

said.

U.S. SUPPLIERS "UNRELIABLE"

Lawyers representing Chinese and Vietnamese producers, as well as the U.S.

operations of German manufacturing giant Siemens, argued that demand for wind

towers was driven by more than just price.

For wind projects near the coast, it can be cheaper to import towers from Asia

than to buy from a U.S. manufacturer and ship them across the country by rail,

said Christopher Hauer, director of Siemens tower operations in the United

States.

It also is critical manufacturers supply towers on time and to the

specifications Siemens needs, Hauer said.

"Domestic manufacturers have proved themselves unreliable

and unwilling often to provide supply. Siemens can not afford to be left

without supply alternatives," he said.

Max Schutzman, an attorney representing Chinese and Vietnamese producers, said

petitioners offered "no real evidence" that they had been materially injured or

threatened with material injury by the imports.

Chinese and Vietnamese producers have grabbed sales because of their

"reliability, capacity, track record and their ability to

deliver in a timely fashion," Schutzman said.

"Wind towers are typically 10-15 percent of all-in project costs so, if tariffs

are imposed, this will be negative for companies in wind farm investments," said

research partner Felix Fox at equity research Ji Asia.

China's biggest wind equipment players including China High Speed Transmission

Equipment Group and Xinjiang Goldwind have little direct wind tower exposure and

any impact would be limited, he said.

The U.S. Commerce Department agreed to launch the separate countervailing duty

investigation even though a U.S. appeals court recently ruled it did not have

legal authority to impose countervailing duties against "non-market economies".

That court decision could eventually force the Commerce Department to revoke

existing countervailing duty orders against 23 Chinese products. However,

department officials have said they are still considering their legal options.

2012/02/01 中国証券報

中国レアメタル輸出規制をWTOが規則違反認定

中国がレアメタルなどの鉱物資源を対象に行っている輸出規制が、世界貿易機関(WTO)のルールに違反していると欧米などが訴えている貿易紛争を巡り、WTOの最終審に当たる上級委員会は30日、欧米側の主張を認める第1審裁決を支持する報告書を発表した。中国商務部の関係者は1月31日、中国が一部鉱物資源に課している輸出関税が関税及び貿易に関する一般協定(GATT)20条に適用されないなどとする第1審裁決を上級委が支持したことについて、「遺憾だ」と表明した。

(i) export duties; (ii) export quotas;

(iii) minimum export price requirements; and (iv) export licensing

requirements.

中国証券報が関係各者を取材したところによれば、中国がマグネシウム、ボーキサイト、マンガンなどの9品目の鉱物資源に対して行っている輸出規制を巡って貿易紛争が起きた2009年以降、これら9品目の需給関係は大きく変化しており、WTOがこれに対する最終裁決を下しても、市場への影響は有限とみられる。ただ今後はこれら9品目に含まれていないレアアース、タングステン、アンチモンなどの小金属に対して中国が行う輸出規制がこの影響を受ける可能性がある。事実、WTOの最終裁決が発表されると、欧米のメディアのほとんどが中国のレアアース輸出への影響を重点的に取り上げた。

◆マイナス影響は有限的

商務部条約法律司の関係者は31日、「中国はWTOの裁決を真剣に評価し、またWTOのルールに基づき資源製品に対する科学的な管理を行い、持続的な発展を実現する」と表明した。

業界専門家はWTOの裁決による影響が中国政府の今後の対応方針を決めることになるとの分析を示す一方で、「短期的にみれば、中国が輸出関税を引き下げて輸出規制を解除したとしても、マイナスの影響は有限的だ」とする見方を述べた。

東興証券非鉄金属業チーフアナリストの林陽氏は中国証券報の取材に対し、「中国国内では亜鉛、マグネシウム、ボーキサイト、マンガンの需要が大きいが、世界経済が低迷する中で、欧米では原材料需要が伸び悩んでいる。中国政府がWTOの裁決に従って規制を解除したとしても、需給関係を速やかに変化させることはなく、短期的にみれば業界や企業への影響は限定的だ」と示した。

中でも亜鉛がこの状況を示す典型的な例になるとみられる。富宝資訊のアナリストによれば、2011年1月1日に施行された「2011年関税実施法案」で関税が課せられたのは1号亜鉛と2号亜鉛のみ。WTOの裁決によって中国が輸出関税政策において譲歩したとしても、世界経済の低迷が川下の需要不振を招いており、短期的には亜鉛の輸出や価格にもたらされる影響は小さいとみられる。

ボーキサイトの輸出環境もこれに類似している。中国の電解アルミ生産能力は大きいが、その原料となるボーキサイトは60%を海外に依存しており、中国のボーキサイト輸出量は極めて小さい。このためWTO裁決による影響は非常に限定的となる。

◆レアアース輸出に一石

金属製品を扱う外資系商社の北京駐在員は31日、中国証券報の取材に対し、「欧米がWTOの今回の裁決を機に中国のレアアース輸出問題に一石を投じるとの見方が業界内で普遍的。今後、中国が何らかのレアアース輸出規制の措置を採る可能性は大きい」と話した。

現在の経済情勢の下、欧米国にとって亜鉛や黄リンなどに対する中国の輸出規制に反対する意義は大きくない。中国がこれら2品目を含む9品目の鉱物資源に対して行っている輸出規制を巡って貿易紛争が起きた2009年時点は、レアアースの価格はまだ低かった。しかし現在はレアアース価格が過去最高の水準にあり、欧米国にとって今回の裁決は問題の対象をレアアースに向けさせることに真の意義がある。

WTOの最終判決が発表されるや否や、米メディアが「中国の原材料輸出規制紛争を巡る最終裁決は、中国のレアアース輸出規制に対していかに対応すべきかを決める判断材料になる」との政府高官の話を伝えたことや、英メディアが「EUは今後、中国にレアアース輸出規制の緩和を求めるだろう」と報じたことなどがこれを証明している。

このほか、錫、タングステン、アンチモンなどの小金属に対する中国の輸出政策も注目されている。商務部は昨年12月、タングステン、アンチモンなどの非鉄金属の2012年第1弾の輸出割当枠を発表。タングステンに1万1400トン、酸化アンチモンに3万3500トン、錫に1万800トンの枠を設定した。また中国工業情報化部はこのほど発表した非鉄金属工業の第12次五カ年計画の中で、今後数年は錫、タングステン、アンチモンの国内需要が旺盛な伸びを維持するとの見通しを示し、同5カ年期間中の国内需要の年間平均伸びをそれぞれ5%、9.3%、10.2%と予測した。

需要が旺盛な中で、輸出規制を緩和すれば、これら小金属の価格を押し上げることになると業界関係者はみている。

◆貿易紛争続く

WTO貿易紛争解決機関(DBS)は30日内に専門家チームの意見を採択するかどうかを決め、その後中国に裁決を遵守するよう提案する。

近年は中国と欧米国家との通商摩擦が激化。米国のタイヤセーフガード措置、中米間の音楽作品紛争、中国の原材料輸出制限などの一連の貿易紛争がWTOに提訴されている。

WTO上訴委が、GATT第20条は中国が鉱物資源に課している輸出関税に適用できないとするWTOの紛争処理委員会(パネル)による第1審判決を維持したことについて、中国の法律専門家は中国証券報の取材に対し、「環境保護目的あるいは資源不足を理由に輸出制限を行うことは非合理的なものではない」と指摘した。「その他の多くのWTO紛争処理の中で、ある措置がWTO加盟時の公約と矛盾があると認識された場合、それを弁護する理由は貿易制限的措置禁止の原則の例外を認めているGATT第20条だ。ただGATT第20条が適用されるためのハードルが高いにすぎない」と述べ、中国産肉製品の輸入に対する米のセーフガード措置を中国がWTOに提訴している件で、米国側がGATT第20条を理由に挙げていることを指摘した。

「人民網日本語版」2012年1月31日

WTO、中国の原材料輸出を違反と判断

中国商務部の公式サイトの情報によると、WTO(世界貿易機関)の上訴機構は、米国・EU・メキシコによる中国産原材料の輸出制限措置に関する訴えについて、裁決を発表した。中国商務部・条約法律司の責任者はこれを受け、談話を発表した。

同責任者は談話の中で、「WTOの上訴機構が、いくつかの重要な問題について中国側の要求を支持し、専門家チームによる裁決の一部を訂正したこと(原告側の専門家チームによる、『紛争解決に係る規則および手続に関する了解』の関連規定の違反、つまり専門家チームによる割当管理、輸出許可証、輸出最低価格、割当入札に関する裁決が全面的に無効となったこと)、また専門家チームの『関税および貿易に関する一般協定』(GATT)第20条の解釈の誤りなどを訂正したことを歓迎する。しかしWTOの上訴機構が、専門家チームによるGATT第20条は輸出関税に適用できないとする主張などの一部裁決を維持したことについて、中国は遺憾の意を表明する」と述べた。

同責任者はまた、「環境保護および限りある自然資源の保護による需要から、中国政府は近年、一部の資源類製品、特に環境汚染が深刻で、エネルギー消費が激しく、資源を消耗する製品に対する管理を強化している。WTOの規則は貿易の自由を強調すると同時に、加盟国が必要な手段により、資源と環境を保護する政策を実施することを認めるべきだ。中国はWTOの裁決を参考にし、WTOの規則に基づき資源類製品に対する科学的な管理を行い、持続的発展を実現する」と述べた。

情報によると、WTO上訴機構の報告書と専門家チームの報告書は、WTOの紛争解決機構の審査を経て、有効な裁決となる。WTOの専門家チームは2011年7月5日に報告書を発表し、中国の審査範囲、輸出の割当・分配・管理、輸出許可証の発行などにおける大半の意見と立場を支持し、中国による輸出価格制限の取り消しに関する措置、および中国による耐火粘土と蛍石に対する総合管理措置を認めた。専門家チームはまた、中国が関わる輸出関税と輸出割当の措置が、中国のWTO加盟当初の公約とWTOの関連規定に違反し、限りある自然資源の保護などの例外条項の条件を満たしていないとした。

February 1, 2012 China Briefing

WTO Orders China to Remove Export

Restrictions on Industrial Minerals

Following two years of investigation, the World Trade Organization’s (WTO’s)

Appellate Body ruled on Monday that China’s use of export duties and quotas on

nine types of industrial materials has breached free trade rules. The ruling

could affect the organization’s judging of other similar cases where export

restrictions are used to hoard domestic natural resources.

The case, filed in 2009 by the

United States, the European Union (EU) and Mexico,

accused China of imposing trade barriers to the exports of nine minerals:

bauxite, zinc亜鉛, yellow phosphorus, coke, fluorsparホタル石,

magnesium, manganese, silicon carbide炭化ケイ素and silicon metal, all of which

are widely applied in industrial production.

The plaintiffs argued that China’s export restrictions have led to the higher

prices of those raw materials, putting a wide range of industries in their

countries at a disadvantage.

As the world’s leading producer of most of the above-mentioned minerals, China’s

quota policy on these resources contributes to the global supply-demand gap, and

its export taxation is influential on international prices of these main

industrial raw materials. The country reported the world’s

largest production of zinc and fluorspar at the end of 2010, and proved to be

the second largest producer of bauxite in 2008.

Currently, China imposes export tariffs at various rates on the nine types of

minerals. Coal coke and semi coke – mainly used in iron production and as a fuel

– is subject to a comparatively high temporary export duty of 40 percent in

2012, according to China’s 2012 Tariff Implementation Plan. Yellow phosphorus –

mostly applied in the production of weapons and phosphoric acids – is subject to

an export tariff of 20 percent.

The world’s second-largest economy had previously emphasized the need to

restrain the exports of some unrecoverable natural resources due to

environmental considerations. The trade barriers – which in return put domestic

demand as a priority – have attracted many foreign companies to set up factories

in China to access such resources at a lower cost. From the perspectives of the

United States, the EU and Mexico, such investment migrations were “forced” and

should become a good reason for the WTO to bar the restrictive measures China

sets.

James Bacchus, a former chairman and longtime member of the Appellate Body,

expected China to abide by the WTO ruling, as the country still maintains a

heavy reliance on exports and has kept a strong record of adhering to adverse

WTO decisions.

Just as Bacchus predicted, the Chinese Ministry of Commerce showed a cooperative

attitude, saying in a statement on Tuesday that it would “conduct a scientific

management of resource products in line with WTO rules, to realize sustainable

development.”

Western countries called the WTO ruling a “big win,” as it could set a precedent

for them to challenge China’s export restrictions on other crucial resources,

such as rare earths – a category of 17 elements that are used in a wide range of

high-tech products, including solar panels, wind turbines and mobile phones.

China produces over 97 percent of the world’s rare earth supply, but has been

tightening rare earth exports since 2009. On September 1, 2009, the government

announced plans to reduce its export quota to 35,000 tons per year between 2010

and 2015, and the cap in 2011 was practically set at 30,184 tons. In addition,

during 2011, the allowance of production was limited to 93,800 tons, and

production at three major rare earth mines was halted.

Rare earths were not included in this trade dispute case that has just been

finalized, and there are no official reasons for that. Some experts believe rare

earths were not controversial back in mid-2009 as they were relatively cheap and

there are still large reserves in some Western countries.

However, just two months after the filing of the trade case, rare earth prices

grew sharply as a result of China’s restrictive measures.

The EU – which buys from China over EUR1 billion worth of the nine industrial

minerals cited in the case every year – has hoped their victory will convince

Beijing to loosen its policy on rare earth sales.

“China now must comply by removing these export restrictions swiftly and

furthermore, I expect China to bring its overall export regime – including for

rare earths – in line with WTO rules,” said the EU trade commissioner Karel De

Gucht.

China’s policy stance on rare earths is vital to Western high-end manufacturers,

as they are becoming more dependent on Chinese exports. Getting new mining

projects into production in Western countries will take time, and some mines

(such as the mine at Mountain Pass in California) have significantly reduced

production in recent years as a result of China’s cost advantages during the

extracting, separating and refining of rare earths.

In defense of its rare earth quotas, China has cited a legal exception under the

WTO’s predecessor, the General Agreement on Tariffs and Trade. The exception

allows countries to levy export duties and restrict

exports for the purpose of conserving a scarce natural resource or protecting

the environment. However, the Appellate Body confirmed this time that the

exception had been superseded by China’s agreement with

the WTO in 2001 to dismantle virtually all export restrictions.

In particular, China had argued in its

defence that some of its export duties and quotas were justified because

they related to the conservation of exhaustible natural resources for some

of the raw materials. But China was not able to demonstrate that it imposed

these restrictions in conjunction with restrictions on domestic production

or consumption of the raw materials so as to conserve the raw materials.

As for other of the raw materials, China

had claimed that its export quotas and duties were necessary for the

protection of the health of its citizens. China was unable to demonstrate

that its export duties and quotas would lead to a reduction of pollution in

the short- or long-term and therefore contribute towards improving the

health of its people.

http://www.wto.org/english/tratop_e/dispu_e/cases_e/ds394_e.htm#bkmk394abr

In fact, economic watchers have questioned

whether or not environmental concern is the main motivation for China’s rare

earth policy. After all, the export quotas are only applied to the rare earth

metals, not products made from those metals.

Echoing this point, an article published on the “Economist” in 2010 made the

following comments: “(China) slashing their exports of rare-earth metals has

little to do with dwindling supplies or environmental concerns. It is all about

moving Chinese manufacturers up the supply chain, so they can sell valuable

finished goods to the world rather than lowly raw materials.”

2012/2/15 RubberWorld

New EPDM plant slated for China

FasTech Srl of Italy signed a technology contract in Xi'an (西安) with Shaanxi

Yanchang Petroleum Yanan Energy and Chemical Co.陝西延長石油延安能源化工,

a leading petrochemical company in China, to manufacture

etylene-propylene-(diene)-rubber.

Shaanxi Yanchang will receive a license to utilize for its industrial

development project in Yan’an ((延安市陝西省Shaanxi

Province) FasTech innovative and proprietary technology (EPDM) in a plant with a

design capacity of 50,000 tons/year.

The Yanchang EPDM plant should start operations in the second quarter of 2014

and will be fed with monomers to be produced in the new

methanol to olefins (MTO) plant which Yanchang is building in the same

location. As provided in the contract, FasTech, will supply Yanchang with an

extended process design package (PDP) and other technical services. China

Chengda Engineering Co. of Chengdu, Sichuan, P.R. China will subsequently

develop the engineering services.

---

FasTech Srl is an Italian Technology Company,

offering updated and tailor-made solutions to petrochemical companies for the

construction of new plants and for the revamping or expansion of existing

plants.

Fastech is specialized in the selection and full development, up to the

commercialization, of the best and most suitable:

polymerization processes

catalytic systems and additives

in order to satisfy the specific needs of a broad range of companies.

FasTech can guarantee a very high level service and a complete assistance to

petrochemical companies thanks to its team of specialists, who have a rich

professional background, acquired in world-wide leader companies.

FasTech head office is located in Seregno (North of Milan, Italy);

FasTech technical department is located in Ferrara (Italy),

the historical original core of Italian petrochemistry

(Prof. Giulio Natta's school);

FasTech branch offices are located in Russia and in China.

FasTech Srl is an Italian Technology Company, offering updated and tailor-made

solutions to petrochemical companies for the construction of new plants and for

the revamping or expansion of existing plants.

Feb 16, 2012 Bloomberg News

China Solar Silicon Production Curbed 30% to

Lift Prices: Energy

China’s polysilicon industry, the biggest

supplier to solar-panel manufacturers worldwide, has idled almost one-third of

production and may keep the plants closed until prices recover from a 60 percent

plunge.

The price tumble spurred the smallest producers including units of Baoding

Tianwei Baobian Electric Co. and Dongfang Electric Corp. to halt plants,

according to Xie Chen, an analyst from the China Nonferrous Metals Industrial

Association, a trade group that advises the government. China has about 45

percent of global production capacity to purify silicon into polysilicon.

The suspensions may be short-lived because the average spot price for the most

expensive ingredient in making solar panels rose 9 percent since mid-December

from a decade low. A recovery would boost margins for the biggest makers such as

GCL-Poly Energy Holdings Ltd. , China’s largest, and Hemlock Semiconductor Corp.

of the U.S., which is No. 1 in the world by capacity.

“The freeze in production won’t last too long,” Xie said in an interview. “Many

companies have said they will return to manufacturing if prices rise to $47 a

kilogram” from the current level of about $28.80.

Xie forecast prices will jump to $40 to $50 a kilogram this year. That’s enough

to prompt a return to production in the first half of most of the halted plants,

which he estimated were about 30 percent of the total. Xie’s view was shared by

Lian Rui, a senior analyst in Beijing for New York-based research company

Solarbuzz.

Price Forecasts

Polysilicon will average about $30 this year, and companies including the units

of Baoding Tianwei and Dongfang Electric will probably resume production as

early as May, Lian said in an interview. Bloomberg New Energy Finance has

forecast polysilicon average spot prices to reach $25 per kilogram this year.

Two phone calls placed to Gong Dan, spokesman for Dongfang Electric, and an

e-mail sent to Yin Xiaonan, Baoding Tianwei’s spokesman, weren’t answered.

The rebound from polysilicon’s 10-year low of $26.31 a kilogram in mid-December

coincides with increased interest by China to install photovoltaic devices on

its own soil.

Chinese producers will double the number of panels that will be installed this

year from the 2.2 gigawatts erected in the country in 2011, according to

forecasts from manufacturers Suntech Power Holdings Co. (STP) and Trina Solar

Ltd. (TSL) That would absorb some of the industry’s excess inventory, which led

to the drop in prices and profits.

Demand for solar products is recovering and is expected to shift from Europe to

Asian and U.S. markets, Renewable Energy Corp. ASA (REC), a Sandvika,

Norway-based maker of polysilicon, said in its earnings presentation Feb. 8.

‘Suck up Supply’

The increase in panel demand in China “sucks up some of the excess supply,”

Pavel Molchanov, an analyst for Raymond James & Associates Inc. in Houston, said

by e-mail on Feb. 9.

The expectation that China will increase installations this year has led some

solar companies to keep plants running. GCL- Poly, LDK Solar Co. (LDK) and Asia

Silicon (Qinghai) Co. have continued to operate their plants, according to Xie.

His association acts as a conduit between the Chinese government and solar

companies, advising both ministers and executives.

Xinyu, China-based LDK Solar said in November that it plans to triple its

capacity and make 55,000 tons of polysilicon a year by 2014. GCL-Poly more than

doubled capacity last year to 46,000 tons. Korea’s OCI Co. (010060) is building

a plant capable of making 24,000 tons of the material annually in Saemangeum.

Jessy Fang, a spokeswoman of GCL-Poly in Hong Kong, declined to comment. Two

calls to Li Longji, an acting director for LDK’s public relations department,

weren’t answered.

Smaller Companies

It is the smaller companies that have struggled and may continue to do so, said

Lian of Solarbuzz.

Leshan Ledian Tianwei Silicon Science & Technology Co. and Xinguang Silicon,

units of Baoding Tianwei, halted production last year to reduce losses and

operating costs. Dongfang Electric Emei Semiconductor Material Co., a unit of

Dongfang Electric Corp. (1072), also stopped manufacturing.

Zhejiang Xiecheng Silicon Industry Co. filed for bankruptcy in December, the

first collapse of a solar company in China.

“Prices may be stuck near $30 a kilogram for a year or two, but this may be

enough for the bigger companies like LDK and GCL to continue with production,”

Lian said. It’s unlikely that the larger companies will seek to acquire those

that are struggling, he said. “Buying a company that can’t operate efficiently

is costlier than expanding organically,” he said.

Full Capacity

Daqo New Energy Corp., the nation’s fourth-largest polysilicon producer, can

produce polysilicon at a cost of $30 a kilogram and is operating at full

capacity, said Kevin He, its investor relations manager.

Companies can maintain operation at this price, “but it’s hard to make profits,”

he said. The Wanzhou, Chongqing-based company last year started building a

3,000-ton plant to increase capacity by as much as 70 percent.

The top five polysilicon producers including Hemlock and Germany’s Wacker Chemie

AG (WCH), more than doubled output in 2010 from 2008, data from New Energy

Finance show. The decline in the price of the raw material has been steeper than

the 47 percent decrease for panels last year because polysilicon plants have

higher operating costs, particularly for electricity.

“Power prices account for a substantial portion of the cost of a polysilicon

plant,” said Solarbuzz’s Lian. Prices of electricity are higher in some regions

where factories are located, including the eastern coastal provinces such as

Zhejiang where Zhejiang Xiecheng Silicon Industry’s plant is based, Lian said.

2012/4/2 China Daily

Joint industrial park launched with Malaysia

広西チワン族自治区

欽州市

China and Malaysia on Sunday launched a joint industrial park, which was hailed

as a model project that will improve cooperation between the two countries.

The China-Malaysia Qinzhou Industrial Park 中馬欽州工業園區 will be

developed in the Jingu River area near Qinzhou port in the Guangxi Zhuang

autonomous region, an important passageway for trade with Southeast Asian

countries.

The park will act as a demonstration project for cooperation, Premier Wen Jiabao

said at the launch ceremony, also attended by his Malaysian counterpart Datuk

Seri Najib Tun Razak.

The first phase of the project covers 15 square kilometers, with future

development expanding to about 55 sq km.

This will be the first government-to-government mega industrial park project

between China and Malaysia.

Companies from the two sides also signed an agreement to establish a joint

venture in the park.

In talks with Najib earlier in the day in Nanning, capital of Guangxi, Wen said

the two countries should consider building a similar

industrial park in Malaysia.

Najib agreed on building a similar park in Malaysia, which he said would help

Chinese companies leave a larger footprint in the Association of Southeast Asian

Nations.

China has already inked two such development deals with Singapore in the

China-Singapore Suzhou Industrial Park蘇州

and the China-Singapore Tianjin Eco-City.

The Sino-Malaysian project will enjoy existing preferential policies for the

national-level economic and technological development zone, and the Commerce

Ministry and other departments will also come out with additional policies to

provide a boost.

The park will focus on developing manufacturing, IT technology and modern

service industries.

It will offer services not only for businesses of the two countries but also for

ASEAN countries and global businesses.

Wen said China encourages more Chinese companies to invest in Malaysia.

The two sides should step up efforts in promoting cooperation on large projects

in energy, transportation, manufacturing and law enforcement, he said.

Wen urged the countries to enhance financial cooperation and accelerate the

realization of trading in local currencies.

He also said the two sides should make more efforts in maintaining regional

peace and prosperity.

Najib hailed China's fast economic development and Sino-Malaysian cooperation,

which he said have contributed to Malaysia's development. He said Malaysia is

ready to build the industrial park with China into a model project that creates

new growth points for future cooperation, and deepen cooperation in areas

including trade, energy and finance.

Luo Yongkun, an expert on Southeast Asian studies at China Institutes of

Contemporary International Relations, told China Daily that as cooperation has

mainly been in import and export businesses, the establishment of this

industrial park marks a new field on the economic exchange platform.

The relationship between the two countries has become better than ever before,

said Luo.

In 2011 bilateral trade volume amounted to about $100 billion, accounting for a

quarter of that between China and the ASEAN, he said.

"With the gradual stretching of cooperation in trade, finance, security and

other fields, prospects of Sino-Malaysian bilateral relations will be even

brighter," Luo said.

For three consecutive years, China has been Malaysia's biggest trading partner,

accounting for 13.2 percent of Malaysia's foreign trade. Malaysia is the biggest

trading partner of China among ASEAN countries.

Palm oil was a major commodity export to China while in manufactured goods,

technology products like computer chips took up some 40 percent of the trade for

both sides.

The proposal to create the industrial park was raised by Wen during his visit to

Malaysia in April 2011.

Najib said the speed for the realization of the park is a testimony of the

vibrant energy, the commitments of both sides and their deepening trade and

economic cooperation.

China-Malaysia Qinzhou Industrial Park (QIP

for short), planned to be 55 square km., is designed as an integrated modern

industrial district for industries, businesses and residence. It is part of

the agreement reached upon by Chinese and Malaysian Prime Ministers in April

2011, when Premier Wen Jiabao proposed that QIP is the first industrial park

collaborated by China and Malaysia in West China, and therefore holds

important model significance.

QIP will focus on equipment

manufacturing, electronic information, new energy & new materials, deep

processing of agricultural and sideline products and modern services. The

start-up district will be focused on trading, logistics, and processing &

manufacturing for import and export.

In accordance with the principles of being “guided by the governments, based

on the industrial park, operated by enterprises, driven by projects and

aimed at shared interests”, QIP will be built into an international

high-tech and low carbon industrial park, a landmark project for

Sino-Malaysian economic and trade cooperation and a model area of

cooperation in China-ASEAN Free Trade Area (CAFTA).

Feb 25, 2014 Xinhua

China's petrochemical Hengyi Industries,

Brunei's Damai Holdings enter new joint venture

Petrochemical giant Hengyi

Industries Sdn Bhd (Hengyi 紡織大手の浙江恒逸集団)

from China announced here Tuesday that the company and

Hongkong Tianyi International Holding Company Limited had entered into a

Joint Venture Agreement with Damai Holdings Limited,

a wholly owned subsidiary of Strategic Development Capital Fund (SDCF), a Brunei

government trust sub-fund to undertake the Oil Refinery

and Aromatics Cracker Plant Project at Pulau Muara Besar.

Hongkong Tianyi International Holding (Zhejiang

Hengyi Petrochemical ) 70%

Damai Holdings(Strategic

Development Capital Fund, a Brunei

government trust sub-fund) 30%

Integrated Oil Refinery and Aromatics

Cracker plant

Hongkong Tianyi

International Holding Company Limited, a wholly owned subsidiary of

Zhejiang Hengyi Petrochemical Co. Ltd. will hold 70

percent equity stake in the joint venture whilst

Damai Holdings Ltd will hold the remaining 30

percent. The parties will conduct the project through Hengyi Industries

as the joint venture company. "Hengyi Industries is delighted to join forces

with Damai Holdings Limited as our equity partner. This joint venture agreement

fits the investment strategy of Hengyi Petrochemical Co. Ltd. and marks a

significant milestone in the development of the petrochemical project at Pulau

Muara Besar," remarked Mr. Qiu Jian Lin, chairman of Hengyi Petrochemical Co.

Ltd.

"Our commitment in the Pulau Muara Besar

project in Brunei Darussalam has given potential partners in the petrochemical

industry much confidence in Hengyi Industries as a responsible and competent

operator. The signing of the Joint Venture Agreement with Damai Holdings Limited

is a testament to that confidence,"he added.

Hengyi Industries is planning the investment,

construction, operations and maintenance of an Integrated

Oil Refinery and Aromatics Cracker plant on Pulau Muara Besar. The

investment for Phase 1 of the project is expected to amount to approximately 4

billion U.S. dollars, creating about 780 job opportunities in the country.

The construction for Phase 1 is scheduled to

begin as soon as possible once all conditions for construction are satisfied.

Upon completion of Phase 1, the facility will be able to produce petroleum

products such as gasoline, diesel, Jet A-1 fuel and

petrochemical products such as paraxylene and benzene,

which would contribute in extending the value chain of the oil and gas sector in

Brunei.

ブルネイ湾に位置するPulau

Muara Besarで、ブルネイ経済開発委員会は、輸出加工区及び製造拠点となるコンテナ港を含む総合開発事業を開始します。

コンテナ港と製造コンビナート

プラウ・ムアラ・ブサール(PMB)は、ブルネイの主たる港・ムアラに隣接するブルネイ湾に位置する戦略的な島であり、深海コンテナ港として理想的な場所に創り上げています。

成長する国家と地域の輸送ニーズに備える機会を得て、国王陛下とその政府は2003年、PMBに955ヘクタールのサイトを確保しました。

将来性はさらに拡大しています。

アルミニウム精錬業者とハラール食品のための輸出加工区を含む主要産業の製造コンビナートは、PMBプロジェクトのプラント内の重工業地帯の中間にあります。

コンテナ港に関する実現可能性は、以下の理由のために実現可能です:

*東西海上貿易経路に沿った国家の戦略的な位置

*メガサイズのコンテナ船に必須である天然の且つ深海を伴った島の近接性

*積替作業に於ける成長傾向

港湾開発と概念

PMBの概念は、島を3つの主要な区域に発展させることです:

1. 経済水域

2. 生活文化と観光事業区域

3. 地域共同体

島は各段階に随って開発され、初期段階に含まれる開発は:

*島発展のための浚渫及び開拓並びに新しい東回り水路

*道路、PMBから本土への連絡橋のような基本的インフラ

*コンテナーターミナルのための660メートルの埠頭

初期段階の開発に含まれ設立される主要な産業は:

*コンテナーターミナル

*製油所

*船舶用品基地

December 29, 2014 zacks.com

Sinopec Starts Sourcing Natural Gas from

Yuanba Field

China Petroleum and Chemical Corporation, or Sinopec, has started a processing

plant in southwest China that treats high-sulphur natural gas pumping from

a new field at Yuanba. Sinopec is China's

second-largest energy major.

Located in China's top gas producing province of Sichuan, Yuanba 元壩 will have

the capability to produce 3.4 billion cubic metres (bcm) of gas a year by end of

2015, twice from the current yield of 1.7 bcm per year.

The news of the start-up of the new gas field is followed by Sinopec’s

announcement that it would increase its winter gas supplies to domestic users by

11% to meet the growing demand for heating.

Spread over an area of 3,200 square kilometers and covering the cities of

Guangyuan 広元市, Nanchong 南充市

and Bazhong 巴中市, Yuanba field has a proven

reserve of 219.4 bcm. The gas reservoir with an average depth of 6,700 meters is

among the deepest in Chinese conventional gas deposits.

Sinopec’s $10 billion Puguang venture 普光ガス田計画(2002年発見 was its first major

high-sulphur gas development project, while Yuanba is the company’s second major

development.

The majority of Yuanba’s gas will be transported through a pipeline to central

and east China once it is fully operational.

Sinopec has stated that it expects its total gas output to increase by 8% to 20

bcm in 2014. The world's highest energy user and the third-largest consumer of

gas, China, is competing to unlock supplies of the cleaner-burning fuel by

enhancing imports and by domestic exploration of both conventional and

unconventional reserves.

Sinopec is one of the largest petroleum and petrochemical companies in Asia. The

company is the second largest crude oil and natural gas producer, and the

largest refiner and marketer of refined petroleum products in China. It is also

the largest producer and distributor of petrochemicals in the nation.

April 23, 2015

Chang Chun Chemical (Jiangsu) Co., Ltd.

Starts Up New Bisphenol-A Plant Using Badger Technology in Changshu, Jiangsu

Province, China

Chang Chun Chemical (Jiangsu) Co., Ltd., a leading bisphenol-A (BPA)

manufacturer in China, has started operation of its second BPA plant using

proprietary technology from Badger Licensing LLC (Badger). The new

135,000 metric ton per annum grassroots BPA plant

is located in Changshu, Jiangsu Province, People’s Republic of China, and is

constructed on the same Chang Chun site as another 135,000

metric ton per annum BPA plant licensed by Badger which has been in

operation since 2013.

Chang Chun Chemical (Jiangsu) Co., Ltd. is an affiliate of Chang Chun Plastics

Co., Ltd. 台湾長春プラスチック which also operates two BPA plants in Taiwan, with

technology licenses from Badger.

2018/12/21

中国人民

銀行、中小企業向け融資対象の銀行向け

貸出制度を新設

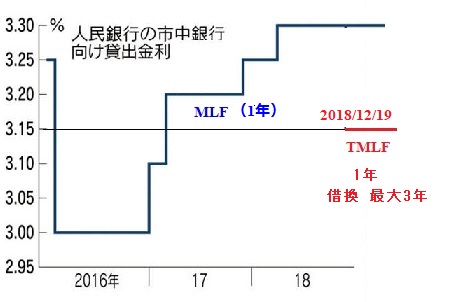

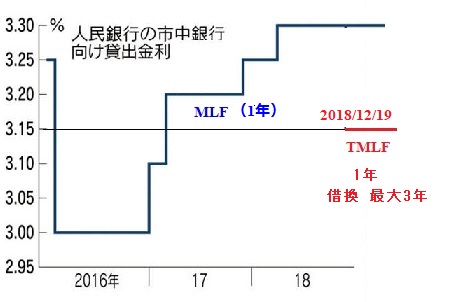

中国人民銀行(中央銀行)は12月19日、中小企業向け融資を増やした市中銀行を対象とする新しい貸出制度

Targeted medium-term lending facility (TMLF:定向中期借貸便利) を発表した。

既存の市中銀行向けの貸出制度(Medium-term

lending facility:MLF) の期間1年の利率は現在3.30%であるが、TMLFは3.15%に引き下げた。借り換えも最大3年まで認める。

これは「ターゲットを絞った金利引き下げ」だとみられている。金融機関が小規模・零細企業および民間企業に資金を貸し出すのを支援し、景気を下支えする狙い。

更に、市中銀行の中小向け貸出債権を担保として認める枠を1千億元(約1兆6千億円)拡大することも同時に発表し、中小企業の資金繰りを支援する姿勢を鮮明にした。

| |

参考 |

|

|

期間1年のMLFは2016年1月に導入され、同年2月に金利を3.25%から3%に下げた後、17〜18年春にかけて金利を3.3%まで小刻みに上げた。

金融アナリストは

新たな措置には3つのポイントがあると述べている。

1つ目は期間が長いことだ。操作期間は1年だが、満期を迎える時に継続申請を2回行うことができ、実際の利用期間は3年になる。

2つ目は費用が安く抑えられることだ。現在の金利は3.15%で、民間企業と小規模・零細企業の資金調達コストを引き下げる上でプラスになる。

3つ目はカバー範囲が広いこと

で、条件を満たした大型商業銀行、株式制商業銀行、大型都市商業銀行はいずれも申請資格がある。

2019/2/29

China Petroleum Engineering Construction Company

wins contract to build NGL plant in Iraq

China Petroleum Engineering Construction Company

(CPECC:中国石油工程建設)signed the contract on Feb 27, 2019 with Iraq's Basra Gas

Company to build a natural gas liquids (NGL) plant in Basra.

中国石油工程建設有限公司は27日、イラクでバスラ天然ガスと、1億7000万ドル規模のプロジェクトを共同で実施することで合意した。新華網が報じた

May 10, 2019 Reuters

Sinopec, CNPC skip Iran oil purchases for May to avoid U.S. sanctions

China Petrochemical Corp (Sinopec Group) and China

National Petroleum Corp (CNPC), the country’s top state-owned refiners, are

skipping Iranian oil purchases for loading in May after Washington ended

sanction waivers to turn up pressure on Tehran, three people with knowledge of

the matter said.

The United States has not renewed any exemptions from sanctions on Iran, taking

a tougher line than expected on the expiry of the waivers. The waivers were

granted last November to buyers of Iranian oil.

China is Iran’s largest oil customer with imports of 475,000 barrels per day

(bpd) in the first quarter of this year, according to Chinese customs data.

Two of the sources said Sinopec and CNPC have skipped bookings for cargoes

loading in May as the companies were worried that taking oil from Iran could

invoke U.S. sanctions and cut them out of the global financial system.

A third source said Sinopec, who buys the majority of China’s Iranian oil

imports, does not wish to breach a long-term supply contract but has opted to

suspend booking new cargoes for now due to the sanction worries.

All of the people with knowledge of the matter requested anonymity due to the

sensitive nature of the topic.

Of the five supertankers that loaded Iranian crude in April for China, two have

discharged, while another two are waiting off Ningbo 寧波and

Zhoushan 舟山in eastern

China to discharge, according to Refinitiv data and Refinitiv analyst Emma Li. A

fifth tanker is heading to Shuidong水東港 in southern Guangdong province. 広東省

The sources said they did not know how long the suspensions will last.

Both Sinopec and CNPC declined to comment. The National Iranian Oil Company (NIOC)

did not immediately respond to an email from Reuters seeking comment.

The two firms took a similar move last October by skipping shipments for

November, before Washington reimposed sanctions on Iran’s oil exports to push

the Islamic Republic to renegotiate a deal to stop its nuclear and ballistic

missile programs and curb its regional influence.

They later resumed bookings after the U.S. granted waivers to China and other

seven global clients of Iranian oil, and purchased additional cargoes to make up

the delayed shipments, according to the third source and trade flow data.

“There are no nominations so far...but companies are trying to find some

solution, such as offering to top up volumes in later months,” said the source.

Sinopec agreed in 2012 to lift an average of about 265,000 bpd oil from Iran in

a long-term deal that expires end of 2019.

While Beijing has criticized the unilateral U.S. sanctions on Iran and the end

to the exemptions, companies are erring on the side of caution unless they

receive a specific government mandate to keep ordering oil from Tehran, the

first two sources said.

CNPC, whose Iranian oil comes mostly from its investments at two Iranian oil

fields, is also skipping imports for this month, said one of those sources.

“For now it’s just not worth the risks as the volume is very small in (the

company’s) overall purchases,” said the source, adding that CNPC is entitled to

lift an average of 2 million barrels, about 67,000 bpd, of oil from its

investment a month.