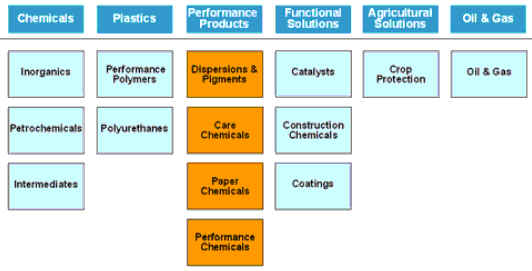

| BASF's new segment structure (Effective January 1, 2008) |

|

BASF reorganizes its businesses: Faster to market, closer to customers, increased efficiency and greater cyclical resilience

BASF's new segment structure (Effective January 1, 2008)

BASF Aktiengesellschaft -

The Chemical Company - is reorganizing its businesses. With

effect from January 1, 2008, the company will consist of the

following six segments: Chemicals, Plastics, Functional

Solutions, Performance Products, Agricultural Solutions and Oil

& Gas.

A new operating division, Care Chemicals, will be established in

the Performance Products segment. In the Plastics segment, the

Specialty Plastics and Foams business units will be transferred

from the Styrenics division to the Performance Polymers division.

"We are focusing our businesses even more closely on our

customers," said Dr. Jürgen Hambrecht, Chairman of the

Board of Executive Directors of BASF Aktiengesellschaft.

"This will enable us to bring our products and system

solutions faster to market and will create additional potential

for value-adding growth. In addition, our investors will be

better able to assess BASF because we are combining similar

businesses in each of our segments."

Greater orientation toward customer industries

The new segment Functional

Solutions will

combine the operating divisions Catalysts, Construction Chemicals

and Coatings. These divisions work closely with their customers

and supply industry- and customer-specific system solutions and

innovative products, in particular for the automotive and

construction industries.

The

Performance Products segment will consist of the new Care

Chemicals division and the Acrylics & Dispersions (previously

Functional Polymers) and Performance Chemicals divisions. As a

result, BASF will be better able to supply its customers

worldwide with the products and innovations they need to optimize

their products and processes.

The new Care Chemicals division will combine the activities of

the former Fine Chemicals division - for example, products for

the pharmaceutical industry and for food and feed, as well as

aroma chemicals - with the Performance Chemicals division's

detergents and cleaners business. This will enable BASF to better

serve the needs of its customers in the nutrition, cosmetics and

personal care sectors of the consumer goods industry and in the

pharmaceutical industry. The new division will employ

approximately 4,600 employees worldwide and will be headed by

Gabriel Tanbourgi. The division's annual sales are approximately

Euro3 billion.

The Performance Chemicals division provides solutions that can be

used to optimize industrial goods. These solutions include

performance chemicals for the oil and refinery industries, for

coatings and plastics and for the leather and textile industries.

The Performance Chemicals division will have around 5,000

employees worldwide and will be headed by Hans W. Reiners. The

division's annual sales are approximately ?2 billion.

In the Plastics segment, the Specialty Plastics and Foams

business units will be transferred from the Styrenics division to

the Performance Polymers division. This structure reflects on the

one hand the planned divestiture of the business with standard

styrenics. On the other hand, by combining its competence in

specialty plastics and foams with its businesses in the

Performance Polymers division, BASF is also able to offer its

customers optimal solutions for their requirements. The

Performance Polymers division will account for approximately

5,000 employees worldwide. The division's annual sales are

approximately Euro5 billion.

Structures at the Ludwigshafen site further improved

The structures at BASF's main site in Ludwigshafen will be further improved by building on the successes of the Site Project. The goal is to strengthen the network of knowledge and expertise among employees and to encourage the exchange of information about the environment, health, safety, energy and engineering throughout BASF. The global roles of the Environment, Health & Safety and Engineering & Maintenance competence centers will be strengthened in order to achieve this.

BASF expands plasticizers business in Asia Pacific

ÅEOxo-C4

production capacity in Nanjing to be expanded to 305,000 metric

tons

ÅEPlasticizer

applications laboratory inaugurated in Shanghai

ÅEFocus

on innovative products Hexamoll(R) DINCH and Palatinol(R) 10-P

BASF today (January 9, 2008) outlined several key initiatives for

its Asia Pacific plasticizers business. To meet growing demand

for solvents and plasticizers the company plans to expand the

annual production capacity of its oxo-C4 plant in

Nanjing, China, by 55,000 metric tons to 305,000 metric tons by the fourth quarter of 2008.

This move will ensure reliable supplies of the precursor alcohols

n-butanol and 2-ethylhexanol. In Asia, and in China especially,

demand for plasticizers is expected to grow by 4 to 5 percent per

year through to 2015.

At the same time, BASF inaugurated the region's first plasticizer

applications laboratory in Shanghai. The new laboratory's research and

development efforts will focus on flexible PVC applications for

innovative products such as BASF's Hexamoll DINCH, a

non-phthalate plasticizer specially designed for sensitive

applications for use in food contact and medical devices, and the

recently introduced Palatinol 10-P, a new C10 plasticizer with a

superior performance in the area of automotive and wire and cable

applications. A team of technical experts will provide

specialized services ranging from trials, tests and on-site

technical advice to formulation adjustments and joint development

with customers.

ÅgThis

is a sign of the times ? China in particular and Asia Pacific in

general are the markets of today and the future for chemicals,Åh

said Johnny Kwan,

Chairman of the BASF Greater China Country Board. ÅgOur state-of-the-art laboratory

will provide our customers in the region with the innovations

they need to be successful.Åh

ÅgDebottlenecking

the oxo-C4 plant prior to the launch of our expansion plans for

our other facilities at the Nanjing site is crucial for our

customers,Åh said Dr. Albert Heuser, President

of BASF's Petrochemicals division. ÅgWe will be able to meet rapidly

growing demand in Asia, particularly in China, which accounts for

about half of the demand for oxo-alcohols in the region. With the

introduction of a technical service center in Shanghai and the

expansion of our production capacity in Nanjing as well as that

of our established facilities in Europe and the United States,

BASF is strengthening its position as a leading global player in

the field of plasticizers and plasticizer alcohols.Åh

Plasticizers

provide flexibility to normally rigid and brittle PVC, thereby

opening up a large number of applications in consumer goods.

Plasticizers are essential in the production of numerous everyday

products including flooring, cable insulation, toys and cling

film. BASF is one of the world's leading producers of

plasticizers with a production capacity of more than 500,000 tons

per year. It offers its customers the widest range of standard

and specialty products to meet their individual requirements.

BASF Plant Science and Academia Sinica (Taipei) to cooperate on gene discovery

BASF Plant Science and

Academia Sinica ë‰òpíÜâõå§ãÜâ@, the leading research institute

in Taiwan, today signed a cooperation agreement. Focus is on the discovery of genes

that increase yield and improve stress tolerance in major crops

such as rice and corn. Financial details have not been

disclosed.

Within the scope of the cooperation, Academia Sinica will

continue their work on the detailed functional analysis of genes

in rice. BASF will evaluate genetically modified rice plants and

further develop the most promising genes in rice as well as other

crops. Target is to market several genetically enhanced crops

with improved yield. The duration of the cooperation has

initially been set for two years.

ÅgWe

are impressed by the broad expertise that our partner brings to

the coopera-tion,Åh said Dr. Jürgen Logemann, Vice President

Technology Management, BASF Plant Science. ÅgBASF was able to select those

genes from preliminary studies at Academica Sinica that show the

largest potential to increase and secure yield in crops.Åh

ÅgWe are delighted

to partner with BASF Plant Science for identification of rice

genes that control stress tolerance and beneficial agronomic

traits through study of our gene library and database called

TRIM,Åh said Dr. Su-May Yu of the

Institute of Molecular Biology at Academia Sinica, who heads the

project. TRIM stands for Taiwan Rice Insertional Mutant library

and database.

ÅgEssential

genes identified during the cooperation could be used to improve

yield in rice and other cereal crops such as wheat, corn, and

grass species, which are very much needed in order to ensure food

and bioenergy security for the rapidly growing world population,Åh

Dr. Yu added.

After agreements with CFGC (South Korea) and

NIBS (Beijing),

the agreement with Academia Sinica is the third cooperation

agreement that BASF Plant Sci-ence has entered within the past

eight months. ÅgBASF Plant Science highly values

the quality of work carried out by research institutes in

Asia-Pacific,Åh said Logemann.

January 24, 2008 BASF

BASF Plant Science and National Institute of Biological Sciences,

Beijing enter cooperation and license agreement

ÅE BASF

Plant Science intensifies biotech cooperation activities in Asia

Pacific

ÅE Research

focuses on higher yield in major crops such as corn (maize),

soybeans and rice

BASF Plant Science and

the National Institute of Biological Sciences, Beijing (NIBS) ñkãûê∂ñΩâ»äwå§ãÜèä today announced a cooperation and

licensing agreement in biotechnology. It is the first cooperation

to be made by BASF Plant Science in the People's Republic of

China and focuses on increasing yield in staple crops such as

corn, soybeans and rice.

ÅgAsia

is emerging as a key player in plant biotechnology both in

research and cultivation and we are striving to intensify

partnerships in this dynamic region. Europe, on the contrary, is

losing its competitiveness due to slow and contradictory

political decisions,Åh said Dr. Hans Kast, President and

CEO of BASF Plant Science. In October 2007, BASF Plant Science

announced another cooperation agreement with the South Korean

Crop Functional Genomics Center, CFGC.

ÅgNIBS

was established in 2003 to advance the frontier of basic research

in life sciences in China,Åh explained Professor Deng Xing

Wang, plant biologist and one of two co-directors at NIBS. ÅgWe are very proud that our efforts

in this area have lead to groundbreaking results in a little more

than four years.Åh

NIBS has identified

a family of genes that have shown to increase crop yield. Under

the agreement, the institute will further analyze the detailed

functions of the identified genes before they enter BASF Plant

Science's strong yield R&D pipeline.

ÅgDiscoveries

in yield increase like those made by NIBS will help meet booming

worldwide demand for food and feed,Åh Kast and Deng agreed. Increasing

yield in staple crops is a key target of modern agricultural

research. In countries such as China, rising standards of living

have caused meat consumption to increase by 300 percent in the

past 20 years and the demand for animal feed has risen

accordingly.

At the same time, factors such as urbanization are reducing the

amount of arable land in Asia.

Under the agreement, BASF Plant Science obtains exclusive rights

to develop and commercialize transgenic crops with the discovered

genes outside China. NIBS retains the right to market crops in

China.

Financial details of the agreement have not been disclosed.

About the National Institute of Biological Sciences, Beijing

The National Institute of Biological Sciences, Beijing (NIBS,

Beijing) was established to advance the frontier of basic

research in the life sciences in China. Founded in 2003 as part

of a strategic government initiative to further national

development of science and technology, NIBS aims to become a

first rate, internationally competitive research institution. Its

faculty will educate future generations of life scientists and

explore a new model for operating scientific institutions in

China. NIBS currently has six plant biology laboratories with

focus on research in the mechanisms of plant development and how

plants respond to internal and environmental signals. Many of

their research discoveries have direct implications to

agribiotechnology and improvement of crops.

BASF Plant Science and Crop Functional Genomics Center sign R&D agreement in South Korea

BASF Plant

Science and Crop Functional Genomics Center (CFGC), the

leading Korean consortium for crop research, today

(October 4, 2007) signed a coopera-tion and licensing

agreement in Seoul, South Korea. The agreement includes

the discoveries by 200 top researchers from 40 renowned

research institutes over 10 years. |

| About CFGC: The Ministry of Science and Technology of Korea has developed in 2000 the 21st Century Frontier R & D Program to boost national competitiveness in science and technology, improve the quality of life, and benefit humanity. The Crop Functional Genomics Center (CFGC), which belongs to the program, focuses on the func-tional genomic study for crop improvement. Unraveling the complex relationship between genes and phenotypes and applying this information to the development of better crops are dependent on cooperative works in genomics, transformation, and molecular breeding, and should eventually make a significant contribution to global food security. CFGC is a virtual institution supporting research projects that are carried out in universities, research institutes and industries throughout the nation and about 250 PhD scientists are working for the program. For 10 years of the program pe-riod, the CFGC will run target-oriented basic research and their application pro-jects in the fields of plant functional genomics, crop transformation, and plant mo-lecular breeding. Science and technology have made extraordinary progresses in the last century, contributing tremendously to the improvement of human life. We are among those responsible for leading 21st century science and technology, being convinced that all our goals can be achieved through establishing a new paradigm for global collaboration. To find more about CFGC, please visit our Internet website at: www.cfgc.snu.ac.kr |

Jul 30, 2008 Reuters

BASF looking at takeover targets

German chemical group BASF is considering taking over U.S. rival W. R. Grace &

Co, the

Financial Times Deutschland said on Wednesday, citing middle

management and banking sources.

As well as assessing Grace, which has $3.1 billion in annual

turnover, BASF will also be looking closely at the strategy,

company structure and business development of U.S. group Rockwood and Germany's Cognis COGN.UL with a view to acquisitions, the

paper said.

All three potential targets have been given project names, a sign

that they are being considered seriously for takeover, the report

said.

BASF Chief Executive Juergen Hambrecht said this month that

consolidation in the sector will accelerate, driven by cost

pressures, lower asset prices and financial investor problems.

Earlier this month, rival Dow Chemical said it would acquire

specialty chemical maker Rohm and Haas Co for $15.3 billion to

tap higher-margin markets such as paints, coatings and electronic

materials.

A BASF spokesman said on Wednesday that the company would not

comment on the newspaper report or individual companies. He said,

however, that BASF continues to look at potential investments as

part of its strategy.

BASF, which enjoys the highest credit rating among European

chemicals, has said it could buy any company that fits its terms.

It had said it could spend up to 10 billion euros ($16 billion)

on acquisitions.

The German group is in the process of selling its styrenics

operation with annual sales of around 3.2 billion euros.

BASF has trimmed highly cyclical businesses. It spent about 7

billion euros in 2006 to buy U.S. catalyst maker Engelhard, the

construction chemicals business of Degussa and U.S. resin maker

Johnson Polymer.

W. R. Grace & Co

Grace is a premier specialty chemicals and materials company.

First Choice for Packaging Assurance

Grace Materials and Packaging Technologies provides sealants, coatings and closures to the food and beverage industries that are used in more than 300 billion containers each year.

Worldwide Leader in Construction Products

For more than 50 years, Grace Construction Products has offered commercial and residential construction products used in projects ranging from major infrastructure to minor home repair.

Global Specialty Chemical Supplier

Grace Davison is the second longest continually operating chemical company in the United States, offering discovery sciences, engineered materials, packaging technologies, catalysts and refining technologies.

We help biorefineries manufacture alternatives to gasoline and diesel that promote clean energy sources.ÉOÉåÅ[ÉXÉPÉ~ÉJÉãÉYÇÕïƒçëÉRÉìÉNÉäÅ[Égç¨òaçÐÇÃç≈ëÂéËÉÅÅ[ÉJÅ[Ç≈ÇÝÇÈW.R.ÉOÉåÅ[ÉXÇÃé¿ê—Ç∆ÉZÉÅÉìÉgÅEì¡éÍç¨òaçÞÉÅÅ[ÉJÅ[ÇÃìdãCâªäwçHã∆áäÇÃäJî≠ÇåãÇ—ÅAëΩólâªÇ∑ÇÈÉjÅ[ÉYÇ…ëŒâûǵǃǮÇËÇÐÇ∑ÅB

Rockwood

Rockwood Holdings, Inc. is a world-class specialty chemicals and advanced materials company committed to delivering exceptional value through continued leadership in customer service, quality, on-time delivery and innovative technology and is currently composed of 15 individual business units.

2007 net sales by end-use market

Å@Chemicals and Plastics 13%

Å@Life Science 8%

Å@Electronics and Telecommunications 11%

Å@Consumer Products 4%

Å@Metal Treatment ang General Industrial 16%

Å@Paper 3%

Å@Construction 14%

Å@Specialty Coatings 7%

Å@Automotive 14%

Å@Environmental 2%

Å@Others 8%Cognis COGN.UL

ÉhÉCÉcÅEÉÇÉìÉnÉCÉÄÇ…ñ{é–ÇíuÇ´ÅAê¢äE30ÉJçëÇ…ãíì_ÇéùÇøÇÐÇ∑ÅBÅ@ñ˚éââªäwÇÉoÉbÉNÉ{Å[ÉìÇ…ÅA160îNÇ…ãyÇ‘åoå±Ç∆é¿ê—ÇóLÇ∑ÇÈÅAê¢äEìIÇ»ëççáâªäwâÔé–Ç≈Ç∑ÅBé©ëRóRóàÇÃã@î\ê´êHïiÅAâhó{ï‚èïêHïiëfçÞǻǫåíçNÇÃå¸è„Çñ⁄ìIÇ∆Ç∑ÇÈêªïiÅAí·éhåÉÇ»âªèœïiÇ‚êÙçÐÅAǪǵǃìhóøÅEÉCÉìÉNǻǫÇÃå¥óøÅAÇ™éÑÇΩÇøÇÃêªïiåQÇ≈Ç∑ÅB

Cognis is a leading specialty chemicals company with activities around the world. Utilizing its 160 years of experience in oleochemicals, Cognis markets innovative products and solutions for personal care, home care and modern nutrition, as well as high-performance products for numerous industrial markets.

Care Chemicals Nutrition & Health Functional Products PulcraChemicals Cognis Oleochemicals ÅEHair / Body / Oral Care

ÅEHome Care

ÅEIndustrial & Institutional

Å@Cleaning

ÅESkin Care

ÅESilicatesÅEDietary Supplements

ÅEPharmaceuticals & Healthcare

ÅEFood Technology

ÅEFunctional Food &

Å@Medicamental Nutrition

ÅEAdhesives

ÅEConsumer Coatings

ÅEEmulsion

Å@Polimerization

ÅEGraphic Arts

ÅEIndustrial Coatings

ÅEPolymer

Å@Building Blocks

ÅESynlubes Technology

ÅEAgroSolutions

ÅEMining Chemicals

ÅEIon-Transfer TechnologyÅETextile Technology

ÅEFiber Technology

ÅELeather Technology

ÅEFatty Acids

ÅEGlycerin / Triacetin

ÅEOzon Acids

ÅEPlastic Additives

ÅEOilfield ChemicalsÅ@

BASF takes a further step

in the divestment of its styrenic activities![]()

BASF is continuing the

divestment process of its global styrenic business and plans to

reorganize the business into new subsidiaries as appropriate. The new companies

are expected to be established in January 2009.

In addition, the scope of the activities to be sold will be

expanded to include the styrene copolymer business. This expansion includes styrenic

copolymer production plants in Ludwigshafen and Schwarzheide,

Germany as well as the styrene copolymer global marketing, sales

and logistics activities.

The new subsidiaries will operate the global styrenics business

independently. They will combine the commodities styrene monomers

(SM), polystyrene (PS),

styrene butadiene copolymer (SBS) and acrylonitrile butadiene

styrene (ABS) as

well as the styrene copolymers consisting of the Luran®

(SAN), Luran®

HH (AMSAN), Luran®

S (ASA), Terblend®

N (ABS/PA),

Terluran® HH (ABS-HH), Terlux®

(MABS) and

Styroflex® (SBS) brands. The styrenic

commodities and copolymers with around 1,600 employees had total

sales of about Euro 4 billion in 2007 and production sites

located in Antwerp, Belgium; Ludwigshafen and

Schwarzheide, Germany; Altamira, Mexico; São José dos Campos,

Brazil; Dahej, India; and Ulsan, South Korea. BASF will concentrate its

remaining styrenic plastics activities on its foams business

for the construction and packaging industries as part of the

Performance Polymers division.

ÅgWe

are reorganizing our styrenics business to improve its future

success and give us new options outside of BASF,Åh

said Dr. Martin

Brudermüller, member of the Board of

Executive Directors of BASF SE and responsible for the Plastics

segment.

Styrene commodities are mainly used for household and office

equipment, information technology, as well as cosmetics and in

packaging. Styrene is a colorless liquid and is the basis for

these plastics. Styrenic copolymers are thermoplastics on the

basis of the monomers styrene and acrylonitrile. They are highly

resistant to chemicals and temperature which makes them versatile

materials for use in the automotive and electronic industries as

well as in many everyday products.

2008/9/15 BASF

BASF makes offer to acquire Ciba

* Cash offer of CHF 50.00 per share provides attractive premium

* Ciba's Board of Directors supports offer

* BASF to expand its leading position in specialty chemicals with

additional products and services

* Repositioning and restructuring of paper chemicals operations

to create leading supplier with extensive portfolio

* Basel to remain an important site for parts of the combined

business

* Conference call at 9:00 a.m. CEST, press conference in Zurich

at 11:00 a.m.

BASF plans to acquire Ciba Holding AG, Basel, Switzerland, a

leading specialty chemical company, and will make a public

takeover offer to Ciba's shareholders. BASF will pay CHF 50.00 in

cash for each nominal share in Ciba. BASF and Ciba have reached a

transaction agreement in which the Board of Directors of Ciba

supports BASF's attractive offer and recommends its acceptance to

Ciba's shareholders. The offer corresponds to a premium of 32

percent above the closing price for Ciba's shares on September

12, 2008 and a premium of 60 percent above the volume-weighted

average share price for Ciba shares in the 30 days prior to

announcement of the public takeover offer. Based on all

outstanding Ciba shares and including all net financial

liabilities and pension obligations, the enterprise value would

be CHF 6.1 billion (approximately Euro 3.8 billion).

Convincing strategic logic

ÅgWith

the acquisition of Ciba, we are strengthening our portfolio and

expanding our leading position in specialty chemicals with

products and services for a variety of customer industries, in

particular the plastics and coatings industries as well as water

treatment. In paper chemicals, we will intensify the urgently

needed restructuring process and become the leading supplier with

an extensive portfolio. We will grow profitably in accordance

with our clear and successful strategy. The transaction meets our

acquisition criteria. We expect that it will make a positive

contribution to earnings per share in the second year,Åh

said Dr. Jurgen

Hambrecht, Chairman of the Board of Executive Directors of BASF

SE. ÅgOur attractive cash offer gives

Ciba shareholders the opportunity to realize the full value of

their investment plus a high premium immediately,Åh

he added.

ÅgWe

recognize the strength of broad areas of Ciba's portfolio, even

if the company's performance has disappointed analysts and

investors, especially in the second quarter of 2008. Ciba has a

leading market position, in particular with its portfolio of

plastics additives and coating effect materials, and offers its

customers significant benefits,Åg continued Hambrecht. ÅgThe integration of Ciba's

activities into BASF and the necessary further restructuring

measures will give the businesses sustainable strength and offer

them a long-term perspective for profitable growth. The

precondition for this is to rigorously improve operational

excellence.Åg

Hambrecht stressed:

ÅgWe

look forward to working with Ciba's highly committed executives

and employees. We offer the company and its employees a new home

with a long-term, viable perspective. Basel will remain an

important site for parts of the combined business, in particular

research, and we will establish a global operating division

there. We are convinced that there is a good match between the

cultures and traditions of our two companies. BASF plus Ciba is a

recipe for both consolidation and profitable growth.Åh

ÅgAgainst the

backdrop of increasingly challenging conditions within our

industry, this is a transaction which combines a fair price with

an industrially compelling solution for Ciba,Åh

said Dr. Armin

Meyer, Chairman of the Board of Directors of Ciba. ÅgCiba's businesses will be

strengthened substantially thanks to integration into BASF's

Verbund and the access to BASF's research, production and

marketing platform. This applies particularly in the Plastics,

Coatings and Paper divisions. BASF is a long-standing customer

and supplier of Ciba and well-acquainted with our people and our

business. The acquisition of Ciba by BASF will provide a

long-term perspective for profitable growth of the Basel

operations in particular and our other businesses around the

world.Åh

top of page

Clear advantages in global competition

ÅgIn

the current consolidation phase in the chemical industry, the

acquisition of Ciba offers clear advantages in terms of global

competition,Åh said Hambrecht.

The merger of the activities of BASF and Ciba would extend BASF's

leading position as a preferred supplier to the plastics industry

and make BASF the second-largest supplier of coating effect

materials. In the fast-growing and highly profitable market for

plastics additives, BASF would expand its portfolio by gaining

important product segments such as UV stabilizers and

antioxidants. In the area of coating effect materials, the

combination of BASF and Ciba would offer an extensive range of

pigments, resins and additives.

Thanks to economies of scale and greater efficiency, the

resulting leading supplier of chemicals for the paper industry

would offer the broadest product portfolio in the industry and

with its global reach would provide customers with the best range

of products and services in a difficult market environment.

Extensive restructuring is necessary throughout the entire paper

value chain. By combining and repositioning the paper chemicals

businesses of BASF and Ciba, BASF would start this urgently

needed process with the aim of ensuring the long-term

profitability of these activities.

Stronger growth in the markets of the future

In addition, the planned acquisition would strengthen BASF's

presence in fast-growing emerging countries and improve its

market position in important industries such as automotive,

packaging, construction, electronics and water purification.

Thanks to the integration in BASF's Verbund, Ciba's businesses

for attractive niche markets such as oil and mining would benefit

from wider market access and BASF's extensive application and

product know-how. This would open up additional growth

opportunities. The two companies also complement each other very

well with regard to research and development. Combining the

specific application know-how of Ciba with BASF's strong R&D

platform would make it possible to provide customers worldwide

even faster with better products and solutions.

Offer period expected to begin on October 1, 2008

BASF will today (September 15, 2008) publish the formal advance

notification in which the offer is officially announced and which

contains all the fundamental information on the planned offer.

The offer prospectus is scheduled to be published on October 1,

2008. The offer is expected to begin with the publication of the

offer prospectus following the approval of the offer by the Swiss

Takeover Board and, subject to later extension, will be valid for

20 trading days plus an obligatory extension of 10 trading days

in accordance with Swiss law. The offer is subject to a number of

conditions. These include the tendering of at least 66.67 percent

of all nominal shares, approval by the relevant authorities, as

well as the removal of various takeover defenses in Ciba's

statutes. BASF expects to finalize the transaction in the first

quarter of 2009 at the latest. The financing for the offer is in

place.

top of page

Selected key data for BASF and Ciba (2007)

BASF

Sites: ~100 major sites

Employees: ~95,000

Sales: Euro 57.9 billion

EBIT before special items: Euro 7,614 million

EBITDA margin: 18.2 percent*

Ciba

Sites: ~60

Employees: ~13,000

Sales: Euro 4.0 billion

EBIT before special items: Euro 336 million

EBITDA margin: 13.9 percent*

* before special items

Å@

BASF reduces production

worldwide

Å@*

Massive decline in demand in key industries

Å@*

Previous year's earnings level will not be achieved

BASF is taking measures to avoid the creation of overcapacities

as a result of a massive decline in demand. The company is

temporarily shutting down around 80 plants

worldwide. In

addition, BASF is reducing production at

approximately 100 plants. This was already announced for

polystyrene and caprolactam. Scheduled maintenance work is being

brought forward.

ÅgWe

already drew attention to the difficult economic situation at the end of

October.

Since then, customer demand in key markets has declined

significantly,Åh said Dr. Jurgen Hambrecht,

Chairman of the Board of Executive Directors of BASF SE. ÅgIn particular, customers in the

automotive industry have canceled orders at short notice.Åh

In addition, sales

volumes are being negatively impacted by increased reduction of

inventory by customers and a lack of credit in customer

industries.

ÅgIn

2008, BASF will therefore not achieve the previous year's

excellent EBIT before special items. How the coming year will

develop is difficult to foresee. BASF is preparing for tough

times,Åh said Hambrecht.

Worldwide, approximately 20,000 employees will be affected by the

production cuts. Flexible working time arrangements will be used

wherever possible.

At the company's main site in Ludwigshafen, Germany, BASF SE has

signed an agreement with the works council under which the

measures will be implemented through the flexible use of working

time arrangements such as overtime and vacation. According to

current plans, the measures are expected to affect approximately

5,000 employees in Ludwigshafen.

ÅgWe

are responding flexibly to market developments and are acting

quickly,Åh explained Hambrecht. ÅgBASF will now focus even more

closely on cost and budget discipline, and will use opportunities

arising from the crisis. We will also proceed swiftly with the

planned acquisition and integration of Ciba to further optimize

our business.Åh

The adjustments are

primarily being carried out in units that supply the automotive,

construction and textile industries. Value chains affected

include ammonia, styrene and polyamide, which manufacture

precursors for engineering plastics, coatings and fibers. The

shutdowns will be coordinated throughout BASF's global production

Verbund and will involve all six Verbund sites in Europe, Asia

and North America, as well as other sites. Implementation of most

of the measures has already started; reduced capacities are

expected to last until January 2009 for individual plants. Should

the period of weak demand continue and if all other flexible

working time models have been exhausted, the company cannot rule

out the need for short-time working at individual sites

worldwide.

BASF will continue to follow market developments very closely and

will adjust production planning accordingly. ÅgWe are realistic, but we are

nevertheless confident when we look to the future,Åh

said Hambrecht. ÅgWe have made BASF more resilient

in the past years. The strength of our better balanced portfolio

makes itself apparent in the current difficult situation. We are

solidly financed, and we have the best team on board to navigate

the route ahead successfully.Åh

2009/1/15 BASF

BASF to change PolyTHF feedstock supply in Korea

* Shutdown of local BDO and THF production

* Local PolyTHF production will continue to operate

* Supply of BDO and THF to customers will continue via global

network

BASF plans to permanently close its production facility for

1,4-butanediol (BDO) and tetrahydrofuran (THF) in Ulsan, which

has been temporarily shut down since August 2008, and the company

will continue to supply related customers via its global network.

BASF's PolyTHF plant in Ulsan will continue to operate with

feedstock from the network accordingly.

ÅgBASF

Korea will work closely with local labor representatives to

minimize the impact of the shutdown,Åh said Dr. Peter Schuhmacher,

responsible for the Asia-Pacific business of BASF's Intermediates

operating division. 27 people work at the affected plant and BASF

has started to communicate with labor unions already. BASF

currently employs 940 people in Korea.

BASF will continue to maintain a reliable supply of BDO and THF

to its PolyTHF plant at Ulsan from BASF's global network,

including the company's THF plant in Caojing, China, which is

operating with a new BASF-owned technology. Dr. Schuhmacher

emphasized, ÅhThe announced move strengthens our

global leadership position in PolyTHF. We now supply BDO and THF

to Ulsan from BASF plants with access to more economic feedstock

sources.Åh

Using THF as a

major feedstock the Ulsan PolyTHF plant provides standard PolyTHF

grades for high quality spandex fibers. The plant, inaugurated in

1998, is also a production hub for specialty PolyTHF grades for

adhesives, coatings, and thermoplastic elastomers.

BASF produces THF at its plants in Ludwigshafen (Germany),

Geismar (USA), Caojing (China) and Kuantan (Malaysia). With BDO

produced at these plants and at BASF's Chiba (Japan) site, the

total global capacity for BDO equivalents amounts to 535.000

metric tons per year. In addition to Ulsan, BASF produces PolyTHF

in Ludwigshafen, Geismar and Caojing with an annual capacity of

185.000 metric tons.

BASF Korea is a wholly owned subsidiary of BASF, currently

employing 940 employees at six production sites and at its Seoul

office. BASF Korea maintains three production sites in Ulsan, and

one each in Yeosu, Gunsan and Ansan, under four BASF units:

Styrenics, Polyurethanes, Performance Chemicals, and Specialty

chemicals.

BASF takes steps to

optimize its structures

*Performance Products segment sharpens focus on customer

industries

*New operating division Paper Chemicals established

*Preparations to integrate Ciba businesses

*BASF reviews strategic options for its leather and textile

chemicals business

BASF is taking steps to optimize its structures in order to

sharpen the companyÅfs focus on its customer

industries. At the same time, BASF is laying the foundation for

the rapid and efficient integration of CibaÅfs businesses. In particular, BASFÅfs Performance Products segment is

being developed further. The initial organizational changes will

be effective as of April 1, 2009.

BASF expects the approvals of the relevant antitrust authorities

and the closing of the Ciba transaction toward the end of the

first quarter of 2009. The so-called ÅgDiscovery PhaseÅh

will begin

immediately after closing. During this phase, which is expected

to last about two months, joint teams consisting of BASF and Ciba

employees will analyze the acquired businesses in depth. The goal

of the analysis is to define a market-oriented positioning for

the combined businesses as well as the optimal organizational

structure. The actual integration process is then expected to

start in the second half of 2009 on the basis of these results.

Dr. John Feldmann, member of the Board of Executive Directors

responsible for the Performance Products segment, explained the

benefits of the changes: ÅgWith these initial steps, we are

very clearly focusing our business on the needs of our customers

and markets and sharpening the profile of the segmentÅfs divisions. At the same time, we

are creating the conditions that we need to integrate the new

Ciba businesses rapidly and efficiently in the next step. After

closing, we will develop the detailed organization for the

combined businesses with our new divisions together with

colleagues from Ciba.Åh

Details of the

organizational changes as of April 1, 2009 are as follows:

BASF's new segment structure (Effective January 1, 2008)

The Performance Products segment currently consists of the

Acrylics & Dispersions, Care Chemicals and Performance

Chemicals divisions. As of April 1, 2009, the new division Paper Chemicals will also form part of the

segment. This division will initially consist of BASFÅfs business with paper chemicals

business, binders and kaolin minerals, which is currently part of

the Acrylics & Dispersions division. The head of the new division will

be Dr. Ehrenfried (Fred) Baumgartner (56), who is currently

responsible for BASFÅfs Inorganics division. Following

the completion of the Discovery Phase, CibaÅfs business with products for paper

manufacturing will be integrated into the new division.

The current Acrylics

& Dispersions division will be renamed Dispersions &

Pigments.

This division will bundle BASFÅfs business with raw materials for

the coating and paint industry. As a result, the existing

dispersions business will be complemented by the pigments and

coatings resins business that is currently part of the

Performance Chemicals division. The acrylics business will be

reassigned to the Petrochemicals division, which will then

encompass the key steps in the propylene value chain. The

superabsorbents business will be assigned to the Care Chemicals

division. The majority of CibaÅfs Coating Effects business will be

integrated into the Dispersions & Pigments division after the

Discovery Phase.

In the Care Chemicals division, BASF is now combining all

businesses that contribute to cleaning, personal care and hygiene

in addition to human and animal nutrition as well as pharma. The

assignment of the superabsorbents business to Care Chemicals will

strengthen the divisionÅfs portfolio with additional

consumer-related products for personal care.

In the future, the Performance Chemicals division will primarily

offer innovative and specific solutions for a broad range of

industries including plastics processing, automotive, refineries,

oil fields and mining, as well as leather and textiles. CibaÅfs plastics additives business,

among others, will be assigned to this division after the

Discovery Phase.

BASF reviews strategic options for leather and textile chemicals

The leather and textile chemicals business also forms part of the

activities of the current Performance Chemicals division. For

several years, this business has been characterized by low market

growth and high competitive pressure. In order to improve

competitiveness, BASF has implemented a series of restructuring

and efficiency programs in the past years. However, these

measures have not been sufficient to ensure the long-term

profitability of the business.

Hans W. Reiners, head of the Performance Chemicals division,

said: ÅgOur employees have worked hard to

improve the business in recent years. In view of the difficult

market situation, the results are not sufficient to ensure

long-term success with our own means.Åh The business unit has therefore

introduced an additional program to increase efficiency, which is

expected to reduce costs by Euro 25 million by 2011.

In addition to implementing this cost-reduction program, BASF is

reviewing future strategic options. In particular, these include

the formation of a joint venture or the complete sale of the

business. ÅgThe market requires this step not

just because of the fragmented supplier structure and the low

market growth,Åh said Reiners.

BASF operates production plants for leather and textile chemicals

in Germany, Spain and Turkey, as well as in Brazil, India and

China. The business, which employs approximately 1,300 people,

posted global sales of about Euro 400 million in 2007. Leather

and textile chemicals include products and concepts for weaving,

pretreatment, optical brightening, analog and digital printing,

coating and finishing, as well as dyeing auxiliaries in addition

to chemicals for all wet-end and finishing processes in the

leather and fur industries.

| Å@ | Å@ | Å@ | ãåèäëÆ |

| Performance Products segment | Dispersions

& Pigments Å@Å@Å@Å™ (Acrylics & Dispersions) |

dispersions | Acrylics & Dispersions |

| pigments and coatings resins | Performance Chemicals | ||

| CibaÅfs Coating Effects | Ciba | ||

| Care Chemicals | cleaning, personal care and hygiene | Å@ | |

| human and animal nutrition | Å@ | ||

| pharma | Å@ | ||

| superabsorbents | Acrylics & Dispersions | ||

| Performance Chemicals | plastics processing, automotive, refineries, oil fields and mining | Å@ | |

| leather and textiles | Å@ | ||

| CibaÅfs plastics additives | Ciba | ||

| Paper Chemicals ÅiêVêðÅj |

paper chemicals business, binders and kaolin minerals | Acrylics & Dispersions | |

| CibaÅfs business | Ciba | ||

| Chemicals segment | Petrochemicals | Å@ | Å@ |

| acrylics ÅiÉvÉçÉsÉåÉìóUì±ïiÅj | Acrylics & Dispersions |

2009-07-06

BASF specifies restructuring plans

*23 of 55 acquired production sites worldwide under review

*Synergies of at least Euro400 million per year expected

*Fair and transparent decisions

BASF has finalized its plans for the integration of Ciba Holding

AG, which it acquired in April 2009. Under the plans, former Ciba

businesses are to be integrated into the operating divisions in BASFÅfs Performance Products segment where their potential can best be

realized and developed. The integration will involve extensive

restructuring measures that BASF expects to generate synergies of at

least Euro400 million per year from 2012 onward. By the end of

2010, savings of approximatelyEuro300 million are to be achieved.

At the same time, the integration process is expected to entail

cash costs totaling approximately Euro550 million, about Euro150

million thereof in 2009. BASF will report details of non-cash

integration costs as part of its second-quarter interim reporting

on July 30, 2009.

The restructuring plans include a reduction of approximately

3,700 positions by 2013, the majority of which will be eliminated

by the end of 2010. BASF is reviewing strategic options -

including restructuring, sale or closure - for 23 of the 55

former Ciba production sites worldwide. Decisions will be made about

these sites by the end of the first quarter of 2010. The

remaining 32 production sites are to be optimized as part of BASFÅfs global production network or

restructured. By the end of 2010, BASF also aims to consolidate

36 of the former CibaÅfs 70 sales and administrative

offices and research sites with existing BASF activities.

As already announced, the company will retain a strong presence

in the Basel region. BASFÅfs new Paper Chemicals division,

formed in April, and the two associated business units Coatings

& Starch Europe and Wet End Chemicals have been based in

Basel since July 1, 2009. In addition, the European business unit

for plastic additives and the global units for technology

management and the restructuring of the pigments business have

been relocated to the former headquarters of Ciba Holding AG in

Basel. BASF is also establishing a new Business Center

Switzerland in Basel that will function as a service platform for

sales, finance, human resources and other activities in

Switzerland. A BASF research center will be based in Basel as

well.

BASF aims to implement restructuring measures in a socially

responsible manner and has begun talks with local employee

representatives. ÅgThis is unfortunately not good

news for some of our employees,Åh said BASF Chairman Dr. Jurgen

Hambrecht. ÅgBut the combined businesses can be

successful in the long term only if we optimize them and exploit

the full potential for synergies. I promise all our employees

that we will keep the period of uncertainty as short as possible

and will make decisions in a fair and transparent way.Åh

Key elements of the

integration are:

*CibaÅfs and BASFÅfs paper businesses will be bundled

and restructured within the newly formed Paper Chemicals

division. BASF will become a world leader with a comprehensive

portfolio in a market that is currently undergoing major

structural transformation.

*All CibaÅfs coatings effects activities are

to be integrated into BASFÅfs Dispersions & Pigments

division, which is organized in regional business units. BASF

will become the worldÅfs second-largest provider of raw

materials for the coatings and paints industry.

*CibaÅfs plastic additives business will

be integrated into the Performance Chemicals division. This will

extend BASFÅfs portfolio to cover important

product segments such as UV stabilizers and antioxidants, making

BASF the world leader in plastic additives.

*The majority of CibaÅfs water treatment business will be

integrated into the Performance Chemicals division. A strategy

for the water treatment business will be developed by 2010.

*CibaÅfs Home & Personal Care

business will be integrated into the existing structure of the

Care Chemicals division.