Jan. 10, 2007 Eastman Kodak

Kodak

to Sell Health Group to Onex for up to $2.55 billion

Å@Sale

fulfills strategic intention to focus investment, increase

financial flexibility

Eastman Kodak Company announced today that it has entered into an

agreement to sell its Health Group to Onex

Healthcare Holdings, Inc., a subsidiary of Onex

Corporation, in a move that will sharpen KodakÅfs strategic focus on consumer and

professional imaging and the graphic communications industry.

Under terms of the agreement, Kodak will sell its Health Group to

Onex for up to $2.55 billion. The price is composed of $2.35

billion in cash at closing, plus up to $200 million in additional

future payments if Onex achieves certain returns with respect to

its investment. If Onex Healthcare investors realize an internal

rate of return in excess of 25% on their investment, Kodak will

receive payment equal to 25% of the excess return, up to $200

million.

Because of tax-loss carry forwards, Kodak expects to retain the

vast majority of the initial $2.35 billion cash proceeds. The

company plans to use the proceeds to fully repay its

approximately $1.15 billion of secured term

debt. Other

potential uses of the cash proceeds are under review and will be

discussed at KodakÅfs previously announced investor

meeting, scheduled for February 8.

About 8,100 employees associated with the Health Group will

continue with the business following the closing. Included in the

sale are manufacturing operations focused on the production of

health imaging products, as well as an office building in

Rochester, N.Y.

KodakÅfs Health Group, with revenue of

$2.54 billion for the latest 12 reported months (through

September 30, 2006), is a worldwide leader in information

technology, molecular imaging systems, medical and dental

imaging, including digital x-ray capture, medical printers, and

x-ray film.

Onex

Corporation, based

in Toronto, is a diversified company and is one of CanadaÅfs largest corporations,with annual consolidated revenues

of approximately C$20 billion and consolidated assets of

approximately C$20 billion. Onex has global operations in health

care, service, manufacturing and technology industries. The

health care operations include emergency care facilities and

diagnostic imaging clinics.

ÅgKodakÅfs Health Group is a business with

significant market presence and intellectual property assets,Åh

said Antonio M.

Perez, KodakÅfs Chairman and Chief Executive

Officer. ÅgThis sale maximizes shareholder

value by obtaining a full and fair valuation for this business,

and allows Kodak to increase its financial flexibility.

ÅgWe

now plan to focus our attention on the significant digital growth

opportunities within our businesses in consumer and professional

imaging and graphic communications,Åh Perez said.

Perez noted that Onex brings significant financial resources to

invest in the Health Group business and to ensure its continued

success.

ÅgOnex

is an ideal acquirer of KodakÅfs Health Group because they

understand the health industry and are committed to growing the

business for the benefit of customers and employees,Åh

Perez said. ÅgIÅfm very pleased that we have such a

favorable outcome for all of our constituents.Åh

ÅgThis is a great

opportunity to acquire and grow a business that has established

an impressive record in delivering innovative solutions to

customers around the world,Åh said Robert M. Le Blanc, an Onex

CorporationManaging Director. ÅgKodakÅfs Health Group has an

exceptionally strong management team and we share this teamÅfs vision for the future. We

recognize that growth is critical and that digital technology is

the future, and we believe strongly that customers and employees

must continue to be a top priority.Åh

Subject to

regulatory and other approvals, it is anticipated that the sale

will close in the first half of 2007.

Goldman, Sachs & Co. acted as financial advisor to Kodak on

the sale of its Health Group and Sullivan & Cromwell LLP

provided legal counsel. Lazard Freres & Co. provided a

fairness opinion in relation to the transaction.

Essar and Eastman Announce Memorandum of Understanding for Joint Oxo Project

Essar Chemicals Ltd., part of India's Essar Group, and Eastman Chemical Company have announced the signing of a memorandum of understanding and the completion of a joint feasibility study regarding potential opportunities for the production of oxo and oxo derivatives for the domestic market in India.

Anshuman Ruia, director, Essar Group, said "Essar Group is firmly on the path of expanding value chain in all their businesses, and entry into this business would further enhance potential of Essar Oils refinery from where main feedstock propylene will be supplied for oxo and oxo derivatives complex. Joining hands with Eastman, one of the most innovative companies in the world, to implement this project is the first step in the value chain integration of Essars refining business. We look forward to the establishment of a world-scale oxo chemicals plant at Essar's refinery site at Vadinar."

According to Robert J.

Preston, vice president and managing director of Eastman's Asia

Pacific Region, and Harish Davey, managing director for the

company's business in India, working with Essar on this project

offers the company a unique opportunity to leverage an

attractive, integrated feedstock supply position. "This

relationship with a great partner will enable us to expand our

presence in India's domestic market," Preston said. "We

have the oxo and oxo derivatives technologies, and Essar has

refinery products upstream of oxo processes at a significantly

advantaged cost. The combination will ensure that the investment

secures the margins we need. We're looking forward to jointly

undertaking this project to enhance each other's businesses in

this growing economy."

The feasibility

study includes plans for a 150,000 tons per year oxo aldehyde plant and

its derivatives. Oxo and oxo derivatives are part of Eastman's

performance chemicals and intermediates segment. These

intermediates are used to manufacture a variety of end-use

products such as coatings and paints, solvents and plasticizers.

About Essar Group

Essar Group is one of the fastest growing business groups in

India. The Groups businesses span the core and infrastructure

segments of the economy - steel, oil and gas, power, mobile

telecom, shipping and construction. The Group has an asset base

of $6 billion and has approximately 20,000 employees. Essar

Chemicals Limited is part of Essar Global Limited, an investment

arm of Essar Group. This company will be a vehicle to enter into

value added chemicals business and is currently evaluating

various options available based on feedstock streams from Essar

Oil Limiteds refinery at Vadinar, near Jamnagar in Gujarat.

2007/5/8 Eastman

Eastman Expands

Specialty Copolyester Capabilities

Eastman Chemical

Company announced today it is extending its specialty

copolyester production to its manufacturing site in Columbia, S.C. This action, coupled with the

recent expansion of CHDM capacity at its Kingsport,

Tenn., site,

positions the company to create the broadest, most competitive

manufacturing position possible for its specialty copolyester

products. The expansion is consistent with the company's

previously announced plans to increase its global

copolyester manufacturing capacity by transitioning large-scale

manufacturing assets to copolyester assets at its South Carolina

site.

The Columbia site

will become the second Eastman facility in North America

producing the copolyester family of specialty plastics. The

additional copolyester production is expected to come on-line in

the first half of 2008. The CHDM capacity expansion, which came

on-line earlier this year, doubles the company's CHDM capacity

and provides the scale and integrated assets to enhance Eastman's

global copolyester manufacturing capabilities. CHDM is a key

intermediate used in the manufacture of several of Eastman's

specialty copolyesters.

"These

investments support Eastman's long-term commitment to our

specialty copolyester customers as we continue our move toward

becoming an even stronger supplier to the global copolyester

market," said Dante Rutstrom, vice president and general

manager of Eastman's specialty plastics business. "We are

taking important steps to allow our customers to confidently grow

their businesses with Eastman as their specialty plastics

supplier. We believe the additional materials that will result

from the expansions and the enhanced reliability from a second

source of supply will go a long way towards doing that."

Known for their

excellent clarity and toughness as well as their ease of primary

and secondary processing, copolyesters from Eastman are used in a

broad range of applications including rigid medical and

electronics packaging, cosmetics & personal care packaging,

medical devices, plastic cards, point of purchase displays and

shrink film.

Eastman

manufactures and markets chemicals, fibers and plastics

worldwide. It provides key differentiated coatings, adhesives and

specialty plastics products; is the worldÅfs largest producer of PET polymers

for packaging; and is a major supplier of cellulose acetate

fibers. As a Responsible CareR company, Eastman is committed to

achieving the highest standards of health, safety, environmental

and security performance. Founded in 1920 and headquartered in

Kingsport, Tenn., Eastman is a FORTUNE 500 company with 2006

sales of $7.5 billion and approximately 11,000 employees. For

more information about Eastman and its products, visit www.eastman.com.

Eastman Announces Key

Roles in 2 Major Gulf Coast Gasification Projects

Projects Demonstrate Company's Continued Execution of Growth

Strategy

Gasification Is Environmentally Friendly Choice to Improve

Profitability

Eastman Chemical Company

today announced key roles in two industrial gasification projects

in the U.S. Gulf Coast, demonstrating significant progress in

leveraging Eastman's technology and operational expertise to

ensure future growth.

Eastman Chairman and CEO Brian Ferguson said the company will be the developer, operator, co-investor and customer of a new $1.6 billion project slated for Texas. As a participant in the recently announced Faustina Hydrogen Products LLC project in St. James Parish, LA, Eastman will be the operator, a co-investor and customer. Both projects would use petroleum coke primarily instead of natural gas to produce industrial chemicals used in a variety of consumer end products.

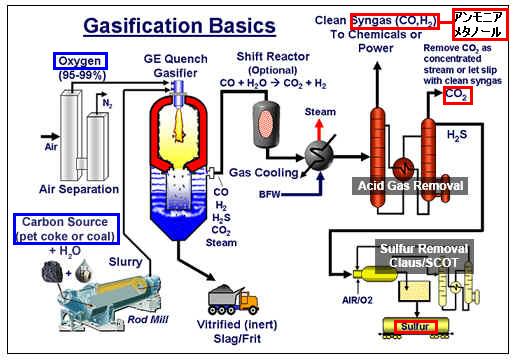

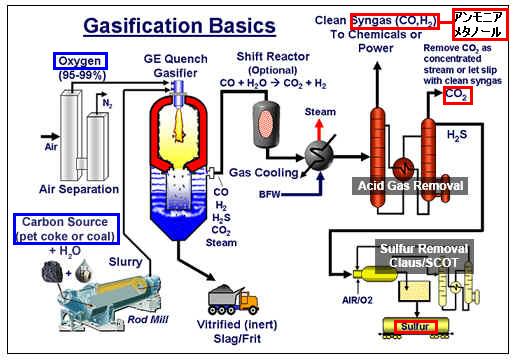

"Our gasification technology is good for Eastman because it's an important part of our efforts to achieve a low cost position and add to the company's earnings growth," Ferguson said. "It's good for the environment because the technology can minimize our carbon footprint when compared to traditional manufacturing processes. And, it's good for the U.S. because we can use readily available domestic feed materials such as coal and petroleum coke, which are less expensive and more stable when compared to oil or natural gas."

"Gasification is an

environmentally responsible choice," Ferguson said. "We

expect to sell nearly all of the carbon dioxide produced into the

enhanced oil recovery market in the Gulf Coast. Additionally,

this advanced process is essentially free of sulfur, mercury and

arsenic emissions."

"As the first

company to use gasification to produce commercial quantity

chemical products from coal, we've developed a strong track

record in our 24 years of experience," Ferguson said.

Texas

Project

Based on incentives on the order of about $100 million that have

been preliminarily approved by local officials in Beaumont,

Texas, Eastman intends to locate its gasification project there,

Ferguson said. That plant, which is expected to

be online in 2011, will produce low-cost intermediate chemicals,

such as methanol, hydrogen and ammonia.

Ferguson said Eastman anticipates a 50 percent equity position in the project and expects to announce a financial equity investor soon.

The company has acquired options on several pieces of industrial property in Beaumont, including assets currently owned by Terra Industries that include methanol and ammonia production facilities.

"We expect the Terra assets will fit in well with this project, and the result will be reduced capital costs, compared to building new methanol and ammonia facilities," Ferguson said.

Eastman has identified several key participants for the Beaumont project, including

Eastman expects the regulatory permit application process to begin later this year, and construction is expected to be under way by early 2009. Construction employment is expected to peak at 1300-1500 workers, with permanent employment expected to be approximately 250.

Louisiana

Project

Eastman also plans to participate in a project recently announced

by Faustina Hydrogen Products LLC as an investor, service

provider and customer. Faustina plans to build a plant

which will use petroleum coke and high-sulfur coal as feedstocks

to make anhydrous ammonia for agriculture, methanol, sulfur and

industrial-grade carbon dioxide.

Eastman has provided development funding for the project, with the intent to take a 25 percent equity position. Eastman will also provide operations and maintenance services and purchase methanol under a long-term contract, subject to customary reviews and approvals. The facility will be built in St. James Parish, LA., and is expected to be on line in 2010.

AP June 22, 2007

Louisiana Getting $1.6 Billion Ammonia Plant

A company plans to build a $1.6 billion plant in southern Louisiana that would produce anhydrous ammonia and other products for manufacturing through the use of petroleum coke and high sulfur coal instead of natural gas.

Faustina Hydrogen Products LLC, a subsidiary of U.S. TransCarbon LLC, received preliminary approval Thursday from the State Bond Commission for about $1 billion in financing through Gulf Opportunity Zone bonds. Bonds and tax incentives were made available by Congress to cover areas hit by hurricanes Katrina and Rita.

The plant would be located next to Mosaic Fertilizer LLC's phosphate fertilizer manufacturing facility near Convent in St. James Parish.

Mosaic has agreed to purchase a large, undisclosed percentage of the ammonia output, along with all of the sulfur the plant will produce, Faustina said. The remainder of the ammonia will be sold to Agrium Inc., another major fertilizer producer.

The project will create about 1,400 construction jobs and, once manufacturing begins, 200 permanent positions paying an average of $75,000 annually, along with benefits, said Steve Goff, Faustina's manager for Louisiana operations.

The domestic manufacturing of ammonia has been stymied in recent years by skyrocketing prices for natural gas in the United States, giving major inroads to foreign producers who pay much less for the feedstock. Petroleum coke is a much-cheaper byproduct of the refining process. ''It's extremely significant,'' Goff said of the cost savings. ''Our source of fuel is all domestic.''

In addition to ammonia and sulfur, the plant will produce methanol and carbon dioxide. Faustina said it is completing long-term agreements with major chemical companies, which it did not disclose, to sell the methanol output.

The carbon dioxide, which will be industrial grade, will be used to recover oil stranded or left behind after traditional rig drilling in petroleum fields. Goff said the carbon dioxide would be sequestered with virtually none going into the atmosphere, thus limiting the ''greenhouse gas'' effect on the environment.

Petroleum producer Denbury Resources Inc. has agreed to purchase nearly all of the carbon dioxide, Faustina said.

The plant will produce 4,000 tons of ammonia, 450 tons of sulfur, 600 tons of methanol and 16,000 tons of carbon dioxide per day. Goff said the company plans to apply for environmental permits in July and hopes to start construction in late 2007 or early 2008. Production should begin in 2010 following 28 months of construction, he said. Announcement of the Faustina plant comes shortly after St. James Parish was considered for the site of a $3.7 billion steel plant that will employ 2,700 people. Following competitive bidding, ThyssenKrupp AG decided to build the plant in southern Alabama.

U.S. Transcarbon LLC is primarily owned by Green Rock Energy, LLC, a company formed by D.E. Shaw & Co. and Goldman, Sachs & Co. to invest in coal and petroleum coke gasification projects.

bayoubuzz.com/

Louisiana Business Shorts: Major New Plant Announced

Faustina Hydrogen Products LLC, a subsidiary of U. S TransCarbon LLC, today announced plans to construct a $1.6 billion solid carbon gasification facility next to Mosaic Fertilizer, LLCÅfs phosphate manufacturing plant in St. James Parish, Louisiana.

The proposed facility would use petroleum coke and high sulfur coal as feedstocks to produce anhydrous ammonia for agriculture, methanol, sulfur and industrial grade carbon dioxide. The carbon dioxide will be sequestered and sold as an industrial feedstock and for enhanced recovery of ÅgstrandedÅh oil reserves in oil fields along the Gulf Coast.

The company will submit regulatory permit applications to the State of Louisiana in early July 2007, with construction expected to start immediately following receipt of appropriate permits and arrangement of debt financing. Faustina expects the 165-acre facility to be completed in 2010. Construction employment is estimated to peak at 1,400 workers, and once operational, the facility would employ 200 people.

ÅgAmmonia is an important fertilizer for U. S. agriculture. Natural gas is a feedstock for ammonia, and the cost of natural gas has skyrocketed in recent years causing some companies to import lower- cost ammonia from abroad,Åh said John Kinnamon, Senior VP Development.

ÅgWe believe this new facility will revitalize domestic production of ammonia, which is vital to our food supply.Åh

In the months leading up to todayÅfs announcement, Faustina Hydrogen Products has completed several engineering, design and supply agreements including:

In July 2006, Mosaic Fertilizer, LLC, a wholly-owned subsidiary of The Mosaic Company, signed a long-term ammonia purchasing agreement with Faustina Hydrogen Products to purchase a significant percentage of anhydrous ammonia produced by the facility. Mosaic also agreed to purchase all sulfur produced by the facility for use in its fertilizer operations.

Agrium, Inc. agreed to purchase the remaining production of anhydrous ammonia. Agrium is a leading global producer and marketer of agricultural nutrients, industrial products and specialty fertilizers, and a major retail supplier of agricultural products and services in both North and South America.

Faustina Hydrogen Products is near completing long-term agreements with major chemical companies to purchase the entire methanol output.

Denbury Resources Inc. has agreed to purchase nearly all the carbon dioxide, which will be used for enhanced recovery of oil stranded or left behind after traditional rig drilling, revitalizing old oil fields throughout south Louisiana and the Gulf Coast.

ÅgFaustina Hydrogen Products is committed to environmental stewardship,Åh said Stephen Goff, Louisiana Operations Manager. ÅgWe made sound, reliable process systems and environmental protection key requirements in our front-end engineering and design work. Our goal is to operate this facility with a strong emphasis on low emissions, waste minimization and recycling. In fact, the facility will be the first of its kind in the United States to capture virtually all of its carbon dioxide emissions.Åh

U. S. TransCarbon LLC is primarily owned by Green Rock Energy, L.L.C., a company formed by the D.E. Shaw group and Goldman, Sachs & Co. to invest in coal and petcoke gasification projects that address demand for more environmentally friendly sources of energy production.

Eastman buys out Green Rock in Beaumont gasification project

Eastman Chemical Co

announced Tuesday the acquisition of Green Rock

Energy LLC's 50% ownership interest in the Beaumont, Texas,

industrial gasification project.

With this acquisition, Eastman would become the full owner of the

Beaumont project and remains the sole developer. In addition,

Eastman announced the divestiture to Green Rock of its

25% ownership interest in the St. James Parish, La., industrial

gasification project and will no longer participate in the

project.

Terms of the transactions were not disclosed.

Richard Lorraine, Eastman senior vice president and CFO,

presenting at an investor conference in New York said, "We

have confidence in the success of both the Texas and Louisiana

industrial gasification projects, however differences in

strategic criteria

led us to agree with Green Rock to end our joint

investment."

Eastman expects to complete the front-end engineering and design

for the Beaumont gasification facility in the second half of

2008, and to obtain non-recourse project financing by year end

2008. The construction phase is expected to create between 1,300

and 1,500 jobs, with approximately 250 permanent US based jobs

expected to result from the project.

Mexico's Alfa to buy Eastman's Latin America PET business, assets

Mexico's Alfa announced

Monday that it has entered into definitive agreements with the

Eastman Chemical Company to acquire its Mexican and Argentinian

polyethylene terephthalate assets and related businesses.

The sale, which is subject to customary approvals, includes Eastman's PET

manufacturing facilities in Cosoleacaque,

Veracruz, Mexico,

and Zarate (close to Buenos Aires), Argentina. Their production capacity is

150,000 mt/year and 185,000 mt/year, respectively.

Terms of the transactions, which are expected to close during the

fourth quarter of this year, were not disclosed.

"This acquisition is another step forward in our strategy of

reinforcing the competitive position of our businesses and will

allow us to serve our customers in the growing Latin American

markets better," said Jose de Jesus Valdez, president of

Alpek, ALFA's petrochemical unit.

"We are buying modern production facilities. Furthermore,

the Mexican plant is next to our PTA facility, thus allowing us

to capture valuable synergies. In Argentina, a country of

strategic importance for Alfa, we enjoy logistical advantages for

our PTA, a key raw material for PET production," he added.

October 26, 2007 Eastman Chemical

Eastman and Green Rock

Energy, L.L.C. Agree to Joint Investment in Beaumont, Texas

Industrial Gasification Project

Å@Å@Å@Project to Develop Facility with

Advantaged Cost Position for Intermediate Chemicals

Eastman Chemical Company today announced that it has entered into an agreement with Green Rock Energy, L.L.C. (Green Rock). Green Rock is a company formed by the D. E. Shaw group and Goldman, Sachs & Co. to invest in gasification projects that address demand for more environmentally friendly sources of energy production. Eastman and Green Rock will jointly develop an approximately $1.6 billion industrial gasification facility in Beaumont, Texas. The facility, which is expected to be online in 2011, will use petroleum coke as the primary feedstock to produce hydrogen, methanol, and ammonia. Eastman previously announced its intention to co-develop the Beaumont facility as part of efforts to leverage its technology and operational expertise for future growth.

The project will be equally equity financed by Eastman and by Green Rock. A subsidiary of Eastman will operate, maintain, and provide other site management services for the facility. In addition, Eastman will purchase methanol produced by the facility under a long-term supply agreement. Other terms of the joint agreement with Green Rock were not disclosed.

ÅgEastman is pleased to work with Green Rock on this projectÅh said Brian Ferguson, Eastman chairman and CEO. ÅgThis project combines Green RockÅfs financial resources and development capabilities with more than 20 years of EastmanÅfs technology and operational leadership in industrial gasification to create a unique growth opportunity for both organizations. For Eastman, this will provide us with important chemical feeds that support future growth. We expect to sell nearly all of the carbon dioxide produced into the enhanced oil recovery market. This project also underscores Eastman's commitment to the long-term energy security of the U.S., the environment, and domestic job creation.Åh

ÅgWe welcome the opportunity to work with Eastman on such an innovative project,Åh said Bryan Martin, a member of Green RockÅfs Board of Managers and co-head of the D. E. Shaw groupÅfs U.S. growth and buyout private equity unit. ÅgWe believe the Beaumont gasification project is an environmentally responsible energy solution that takes advantage of abundant solid-carbon based resources available in the United States, and, like several other projects in which Green Rock participates, offers our strategic partner the opportunity to obtain a long-term cost advantage. We believe that gasification projects such as Beaumont can play a role in lessening our reliance on foreign energy resources and further enhance our nationÅfs energy security.Åh

Eastman and Green Rock expect to complete the front-end engineering design for the Beaumont gasification facility by mid-year 2008, and to obtain non-recourse project financing for the development, design, engineering, construction, start-up, and testing of the facility by the end of 2008. Construction is expected to begin in early 2009, creating between 1,300 to 1,500 jobs, with approximately 250 permanent jobs expected to be created by the project.

As previously announced, additional participants in the Beaumont project include:

Eastman also recently announced that it exercised its option to purchase the Terra Industries methanol and ammonia production facilities in Beaumont. These assets are expected to be purchased on or before January 1, 2009 and will operate in conjunction with the project.

Forward Looking Statements: This news release includes forward-looking statements concerning current expectations for financing, construction, and operation of the planned Beaumont, Texas gasification facility, purchase of methanol produced by the facility, and entry into related agreements. Such expectations are based upon certain preliminary information, internal estimates, and management assumptions, expectations and plans, including those mentioned with the specific statements, and are subject to a number of risks and uncertainties inherent in projecting future conditions, events, and results. Actual results could differ materially from expectations expressed in the forward-looking statements if one or more of the underlying assumptions or expectations prove to be inaccurate or are unrealized. Important factors that could cause actual results to differ materially from such expectations are included with the specific statements and in the "Risk Factors" section of the companyÅfs filings with the Securities and Exchange Commission, including the Form 10-Q filed for second quarter 2007 and the Form 10-Q to be filed for third quarter 2007, available on the Eastman web site at www.eastman.com in the Investors, SEC filings section.

About Eastman

Eastman manufactures and markets chemicals, fibers and plastics

worldwide. It provides key differentiated coatings, adhesives and

specialty plastics products; is one of the worldÅfs largest producers of PET

polymers for packaging; and is a major supplier of cellulose

acetate fibers. As a Responsible Care®

company, Eastman is

committed to achieving the highest standards of health, safety,

environmental and security performance. Founded in 1920 and

headquartered in Kingsport, Tenn., Eastman is a FORTUNE 500

company with 2006 sales of $7.5 billion and approximately 11,000

employees. For more information about Eastman and its products,

visit www.eastman.com.

About Green Rock Energy,

L.L.C.

Green Rock Energy, L.L.C. was formed by the D. E. Shaw group and

Goldman, Sachs & Co. to develop, own, and operate carbon

gasification projects that address demand for more

cost-effective, environmentally friendly sources of energy

production. For more information about Green

Rock, visit www.greenrockenergy.com.

Eastman to Sell PET, PTA Assets in Europe

Eastman Chemical Company today announced it has entered into definitive agreements with Indorama to sell its PET facility and related businesses in the United Kingdom, and its PET and PTA facilities and related businesses in the Netherlands. The total cash proceeds of the transaction are expected to be Euro226 million or approximately US $330 million, subject to adjustments in working capital. The transaction is expected to close during the first quarter of 2008 and will result in a gain on sale being reflected in the Company's consolidated financial statements.

"This transaction will complete the plan we announced one year ago to address our non-strategic PET assets outside the U.S.," said Gregory O. Nelson, Eastman executive vice president and polymers business group head. "This is an important step in our broader strategy to improve the overall performance of our PET polymers business."

The sale, which is subject to customary conditions and competition authority approval, includes Eastman's PET manufacturing facility in Workington, United Kingdom, and its PET and PTA manufacturing facilities in Rotterdam, the Netherlands. Eastman's acetate tow production at the Workington site is not included in the sale.

Financial results for all European PET facilities, including both Rotterdam, the Netherlands, and Workington, United Kingdom, as well as for the San Roque, Spain, site, which was divested in April 2007, will be reported as discontinued operations in fourth quarter 2007. The treatment of these financial results as discontinued operations is not expected to have a material impact on the Company's earnings from continuing operations in fourth quarter 2007 or its earnings from continuing operations excluding asset impairme.