Creating the no1 Pharmaceutical Group in Europe, no3 in the World

January 26, 2004

Jean-

Francois DEHECQ

Chairman & C. E. O.

| v | Å@ | A compelling strategic rationale: creating a platform for strong, sustainable, profitable growth |

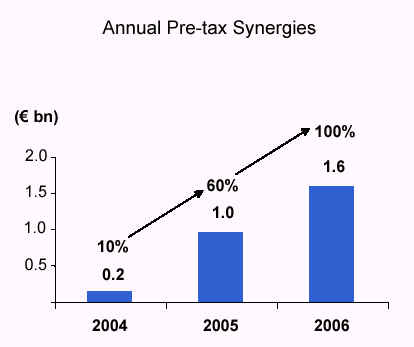

| v | Å@ | A rapid and efficient implementation led by Sanofi-Synthelabo, with expected annual synergies of Euro 1.6bn before tax in 2006 |

| v | Å@ | An attractive offer |

| v | Å@ | A transaction that creates value for the shareholders of both companies and that serves the interests of both employees and patients |

Å@Creating a Platform for Strong, Sustainable, Profitable Growth

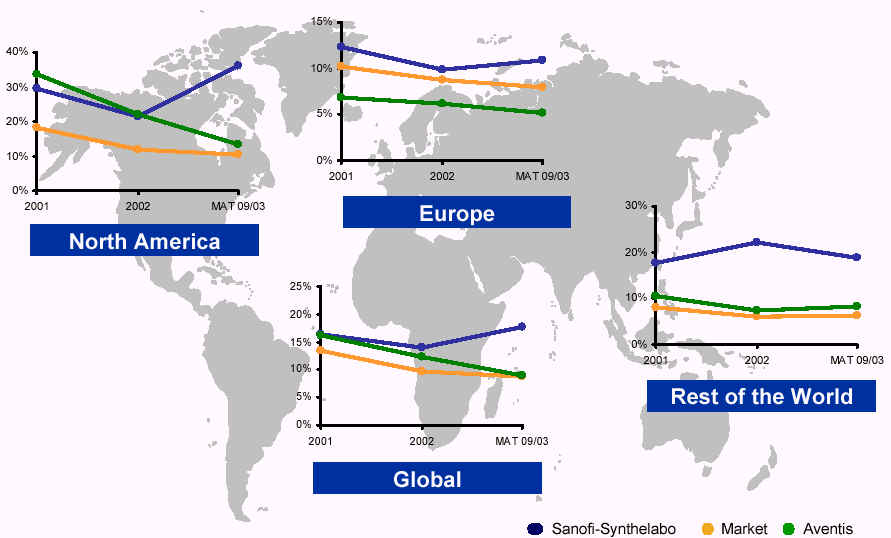

| v | Å@ | Accelerate expected sales growth by applying a product and country specific strategy |

| v | Å@ | Leverage marketing and sales forces to launch key products successfully |

| v | Å@ | Accelerate R&D by focusing combined resources on the most promising projects |

| v | Å@ | Improve profitability through a strategy based on rapid growth and an optimised organisation |

| A group: | ||

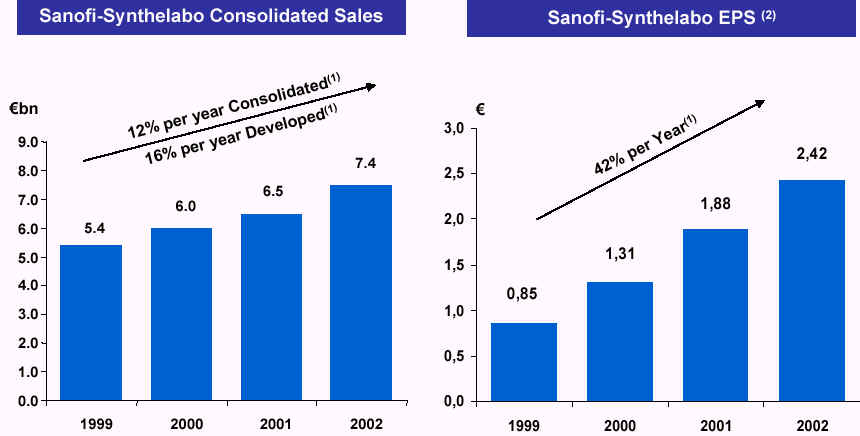

| v | Å@ | Which has consistently delivered on its promises |

| v | Å@ | With a class-leading sales and EPS growth rate |

| v | Å@ | Which will draw on core competencies of both the Sanofi-Synthelabo and Aventis teams |

| v | Å@ | Premium of 15.2% based on the average price over the last month(1), valuing Aventis at Euro47 bn(2) |

| v | Å@ | Offer comprises 19% cash /81% shares (with Mix and Match Election feature) (3) |

| v | Å@ | Transaction expected to be accretive from 2004 onwards,excluding the consequences of Purchase Accounting and integration & restructuring costs (4) |

| v | Å@ | Offer fully supported by Total and LÅfOreal |

(1)Based on Sanofi-Synthelabo and Aventis weighted average closing share price

Å@Å@for the month ended 21 January 2004 (inclusive)

(2)Based on non diluted share capital (excluding treasury shares)

(3)Cum Dividend-see page 28

(4)Based on Adjusted Net Income per share of core business

Å@Å@Å@Å@Å@Å@Å@Å@

Å@Å@Å@Creating a platform for strong, sustainable, profitable growth

Å@Å@Å@Å@Å@Å@Å@Å@Å´

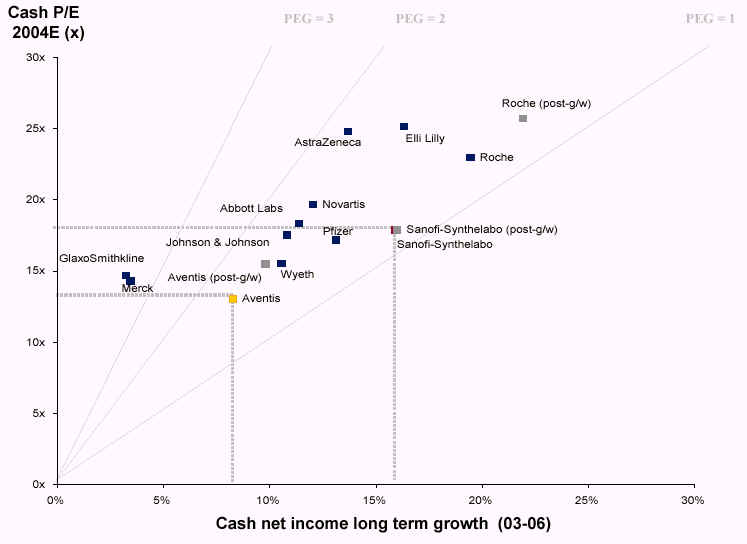

Å@Å@Å@Which should result in multiples in line with the best in the sector

Å@Å@Å@Å@Å@Å@Å@Å@Å´

Å@Å@Leading to valuation uplift

Å@Creating a Platform for Strong, Sustainable, Profitable Growth

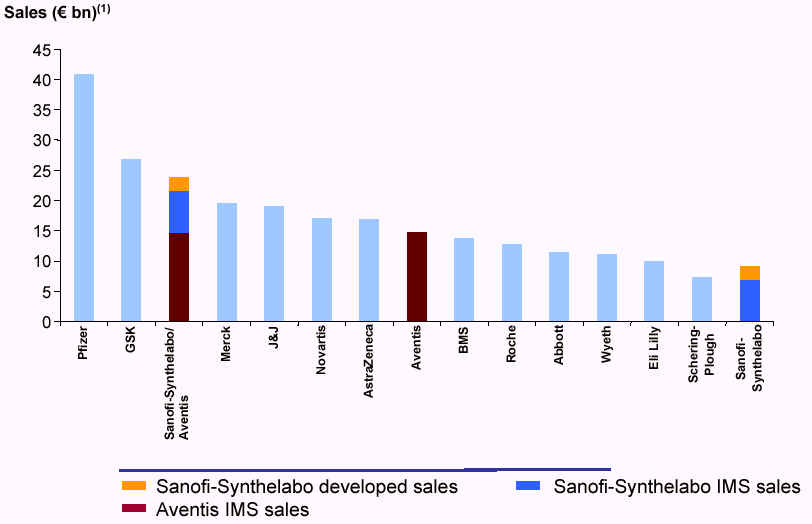

Å@Å@Å@(1) Based on IMS data for the 12 months ended 30 September 2003

| Å@ | Å@ÅF | Sanofi- Synthelabo Å@Å@Å@Å@Å@Å@Å@ | Å@Åv | Aventis |

| 2002 Sales | Å@ | ÅE Euro7.4

bn consolidated ÅE Euro9.6 bn developed |

Å@ | ÅE Euro20.6

bn consolidated ÅE Euro17.6 bn in core business (2) |

| 2002 Net income margin (1) | Å@ | ÅE 24% | Å@ | ÅE 15% for core business (2) |

| Market capitalisation (3) | Å@ | ÅE Euro40 bn | Å@ | ÅE Euro41 bn |

| Headcount (4) | Å@ | ÅE More than 30,000 | Å@ | ÅE More than 70,000 |

| Main therapeutic categories | Å@ | ÅE Cardiovascular,

thrombosis, Å@central nervous system (CNS), Å@oncology and internal medicine |

Å@ | ÅE Thrombosis,

allergy, oncology, Å@cardiovascular, diabetes and Å@vaccines |

(1) Net income before

exceptional items and goodwill amortisation

(2) Prescription drugs and human vaccines, as well as

Aventis 50% stake in Merial and its corporate activities

(3) Based on non diluted share capital (excluding

treasury shares) and on the average of Sanofi-SynthelaboÅfs and Aventis Å@Å@closing share price weighted by

volumes during the month ended 21 January 2004

(inclusive)

(4) As of 31 December 2002

| Å@ | Å@ | Å@ |

| v | Å@ | Euro 25bn proforma 2002 consolidated sales for core business |

| v | Å@ | 5% world market share |

| v | Å@ | R&D budget among top 3 in world |

| v | Å@ | Group headquarters in France,important operations in Germany and the US, and a direct presence in Japan |

Note: Globl R&D budget of Euro4.3 bn proforma 2002 consolidated for core business

Note:

Sales and ranks and market shares (IMS) are based on IMS

data for the 12 months ended 30 September 2003

(1) North American developed sales were Euro10.2bn, based

on IMS sales data for the 12 months ended 30 September

2003

| Å@ | Å@ | Å@ |

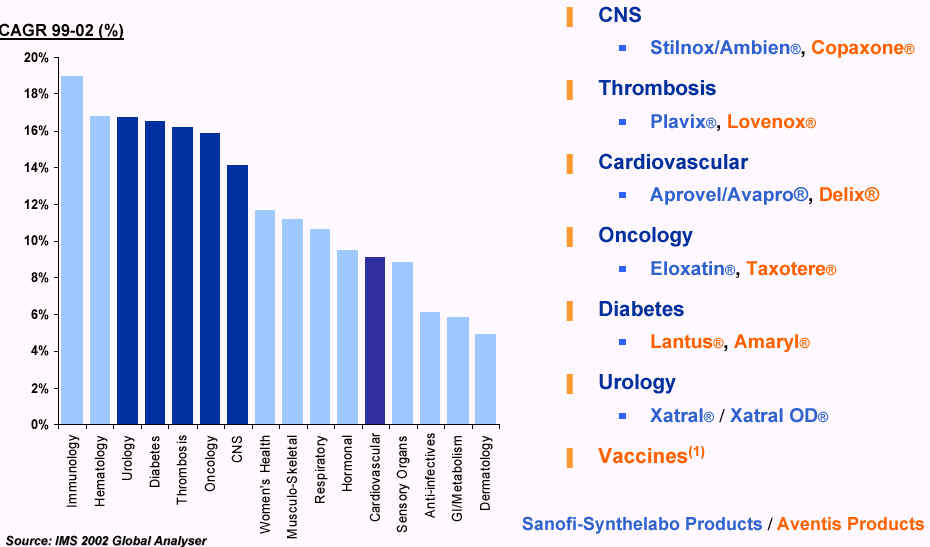

| v | Å@ | Well

established in key therapeutic categories: cardiovascular/thrombosis,oncology,diabetes,CNS,internal medicine, vaccines |

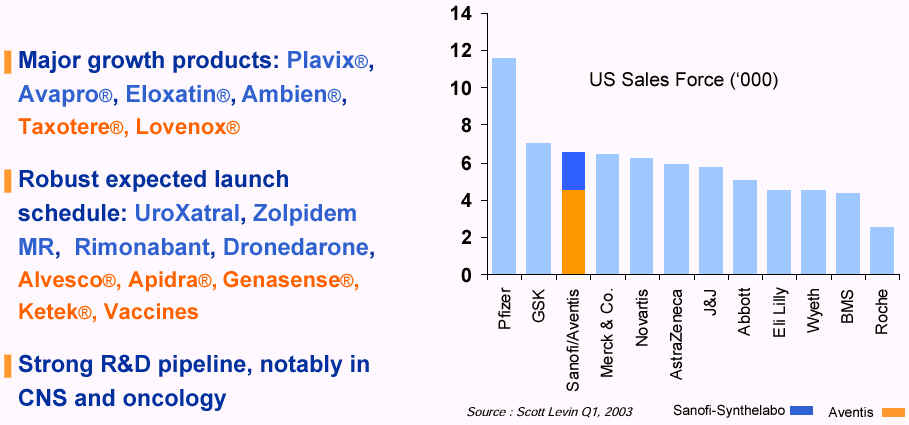

| v | Å@ | Sanofi-Synthelabo's

strengths : ÅER&D productivity ÅEBroad-based R&D pipeline with potential major launches ÅECapacity to manage mature products and to achieve strong growth in all regions |

| v | Å@ | Aventis's

strengths : ÅESignificant R&D resources ÅEProduct life-cycle management (LCM)expertise ÅELarge US sales infrastructure ÅEDirect presence in Japan |

| Å@ | Å@ | Å@ |

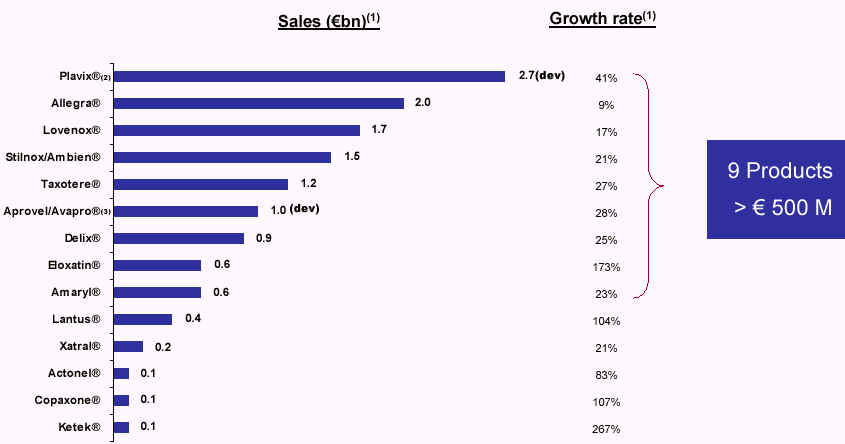

| v | Å@ | Enhance sales from the existing portfolio,with major products in fast growing therapeutic categories |

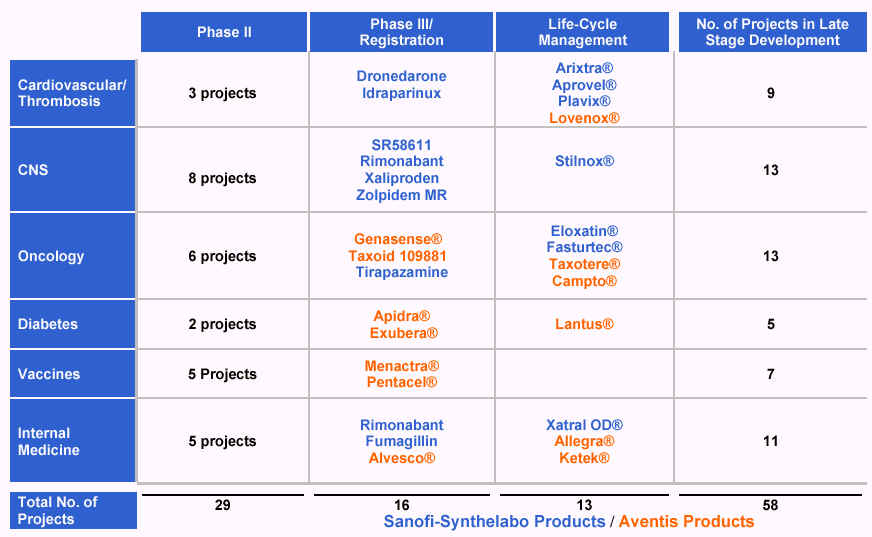

| v | Å@ | Focus R&D resources on most promising projects |

| v | Å@ | Leverage sales and marketing resources to support existing products as well as expected product launches |

| v | Å@ | Ensure rapid integration of teams and operations under a strong, committed,supportive management |

(1)Based on IMS data for the 12 months ended 30 September 2003

(2)IMS Consolidated sales of Euro0.9bn and growth of 44%

(3)IMS Consolidated sales of Euro0.6bn and growth of 31%

Note:the

dark lue bars indicate main focus of Sanofi-Synthelabo

and Aventis

(1) Historic growth rate for the global vaccines industry

is estimated at 12%

(Source:Aventis investor Presentation 26th

September,2003)

Source : Sanofi-Synthelabo and Aventis Company Information, and Equity Research

...Will all benefit from broad-based marketing and sales forces

| v | Å@ | Total expected synergies represent 6.4% of proforma 2002 core business sales |

| v | Å@ | Cost synergies resulting mainly from optimized structures |

| v | Å@ | Sales synergies mainly generated by improved growth from AventisÅfproducts on markets outside of the US |

| v | Å@ | Restructuring costs (non-recurring) of approximately Euro 2bn before tax |

Led by Sanofi- Synthelabo

(1) Before exceptional items and goodwill amortisation

Source:IMS data for the 12 months ended 30 September 2003

(1)

Compound Annual Growth Rate

(2) Before exceptional items and goodwill amortisation Å@Å@Åñearnings per

share

Creating the no1 Pharmaceutical Group in Europe,no3 in the World

| Å@ | Å@ | Å@ |

| Çñ | Å@ | A compelling strategic rationale:creating a platform for strong, sustainable and profitable growth |

| Çñ | Å@ | A rapid and efficient implementation led by Sanofi-Synthelabo, with Eruo1.6bn of annual synergies before tax in 2006 |

| Çñ | Å@ | An attractive offer |

| Çñ | Å@ | A transaction that creates value for the shareholders of both companies and that serves the intersts of both employees and patients |

Note : Based on average share price for the one-month ended 21st of January 2004, non diluted. Bristol-Myers Squibb and Schering-Plough are excluded (PEG not meaningful)