Mar 9, 2008 Reuters

China's Wahaha says

Danone talks at impasse

Hangzhou Wahaha Group, China's top beverage firm, said on Sunday

talks with joint venture partner French food group Danone to

resolve a long-running dispute have hit an impasse as a deadline

nears.

Group Chairman Zong Qinghou told reporters on the sidelines of

China's annual National People's Congress, or parliament, that he

could not accept Danone's demands for ending the feud.

The French company had accused Wahaha of setting up parallel and

illegal operations alongside their venture that sells Wahaha

branded products such as soft drinks and bottled water.

Zong said Danone has proposed that their joint venture along with

the businesses at the centre of the dispute be listed as one

entity and that Wahaha guarantees the value of

Danone's share of the listed firm will not fall below 50 billion

yuan ($7 billion).

Danone and Wahaha

were to hold 40 pct each in in the proposed company, leaving

the remaining 20 pct to the public, Xinhua said.

Danone wants to ensure at least 50 bln yuan in market value

if its stake in the new company is lower than 40 pct, said

Zong.

"How can anyone

guarantee a share price?" said Zong. "It's up to the

market. It doesn't make any sense."

Zong said he has proposed that Danone buy his

share of the joint ventures or that it be bought by a third

party, but that the French company has rejected those options.

In December, Danone and Wahaha agreed to cease all lawsuits in

their highly public and acrimonious dispute and enter talks to

resolve the dispute.

The firms failed to resolve the issue and extended the talks for

another month, a deadline that will expire at

the end of March,

said Zong.

"For negotiations to succeed there must be trust and

benefits for both sides. These are not negotiations," he

said.

"If we don't reach an agreement, then we have to go back to

the courts to decide," he said.

Previously the two companies traded a series of lawsuits and

countersuits that at one point had spread to California, Sweden,

and China's Supreme Court.

The feud became highly personal and eventually involved several

Danone executives based in the mainland as well as Zong's wife

and daughter. French President Nicolas Sarkozy and his Chinese

counterpart Hu Jintao also discussed the issue during a state

visit last year.

The maker of LU cookies, Evian mineral water and Activia yoghurt

has a 51 percent stake in a joint venture with Wahaha -- named

after the sound of a laughing child.

Danone began investing in China in the 1980s and its widespread

network helped sales in Asia expand almost 21 percent to 2.4

billion euros in 2006, becoming the mainland's packaged water

market leader and number two in the biscuit market.

----------

毎日新聞 2007/6/12

仏ダノンが中国で合弁企業と対立

「ブランド勝手に流用」 役員人事も宙に浮き

仏食品メーカーのダノンが出資する中国の合弁企業「杭州娃哈哈(ワハハ)集団」(浙江省)の飲料水「娃哈哈」のブランド使用をめぐって、ダノンと杭州娃哈哈を実質的に経営する宗慶後董事長(会長)の対立が深刻化している。

発端は5月。杭州娃哈哈が使用権を持つ「娃哈哈」ブランドを、宗氏の娘が経営する会社がブランドを勝手に使い競合製品を製造・販売しているとして、ダノンがストックホルムの裁判所に仲裁を求めた。ダノンは先週、米カリフォルニア州の裁判所にも提訴した。

これに対し、宗氏は「ダノンは中国市場の特性を理解せず商機を逸している」と反発。ダノンのアジア本部幹部らが宗氏を侮辱したとする書簡をダノン本社に送り(ダノンが出資する中国の合弁企業29社すべての董事長を辞任した。書簡は、ダノンが経営路線の対立を北京のフランス大使館に持ちかけ外交問題にしようとしたり、宗氏らを24時間態勢で尾行監視したりした

と非難している。

宗氏の辞任を受けて、ダノンはアジア地区のエマニュエル総裁を急きょ董事長代行に任命したが、杭州娃哈哈の社員らがダノンからの役員受け入れに猛反発。エマニュエル氏らの人事は宙に浮いている。

杭州娃哈哈は、宗氏らが87年に設立。96年にダノンから出資を受け入れ中国有数の飲料品メーカーに育てた。宗氏は中国の国会に当たる全国人民代表大会の浙江省代表を務める有力者の一人でもある。

NYT 2007/6/8

Rancor Level Rises in

Rift Over Danone China Venture

A dispute between Groupe

Danone, the French dairy and beverage maker, and its Chinese

partner, the beverage maker Wahaha, became even stranger on

Friday when Wahaha released several letters written by employees

that denounced Danone for being run by "rascals" who

were committing "evil deeds."

The letters, which were

filled with vitriol and old-fashioned Communist slogans, came a

day after the founder and chairman of Wahaha, Zong Qinghou,

resigned in anger, saying that his reputation was being ruined by

the dispute.

The resignation had

appeared to be a victory for Danone, which is trying to gain

control of the venture. On Thursday, Danone named Emmanuel Faber,

the head of its Asian operations, as the interim chairman of

Wahaha.

But by Friday, there were

indications that Wahaha was still being controlled by Mr. Zong or

a management team loyal to him.

A spokesman for Danone

declined to comment.

Mr. Zong, an entrepreneur

who has been ranked as one of China's wealthiest individuals,

could not be reached for comment on Friday.

But Danone's dispute with

its joint venture partner is turning into an increasingly nasty

affair, complicating the company's control over one of its

biggest and most lucrative investments in China, a beverage maker

with sales of more than $1.4 billion a year.

The dispute erupted this

year after Danone, which owns 51 percent of the Wahaha joint

venture that was founded in 1996, accused Mr. Zong of operating mirror

companies that independently sold goods in China under the Wahaha

brand name and then pocketing huge profits.

But Mr. Zong has insisted

that Danone executives knew about the affiliated companies and

even audited them. He said Danone was seeking to acquire most of

them but was unwilling to pay a hefty price, setting off the

dispute.

Earlier this year, Danone

imposed a deadline on its Wahaha partner to stop the companies

from selling Wahaha products outside of the joint venture

company.

On Monday, after that

deadline had passed, Danone filed a lawsuit in the United States

against one of Mr. Zong's Wahaha-affiliated companies, claiming

that Danone had been cheated out of at least $100 million.

The target of the lawsuit

was a company controlled or owned by Mr. Zong and his wife and

daughter, who are listed as the company's legal representatives

and who live in California.

Angered by the lawsuit,

Mr. Zong resigned from Wahaha on Thursday, saying that Danone had

used dirty tactics to smear his name and harm his family.

Mr. Zong also said that

Danone executives had him followed and photographed, and that the

French company had turned the dispute into a public fiasco.

"I can no longer

bear the abuse and slander of the two directors from your

company," Mr. Zong wrote in a lengthy letter that offered a

detailed assessment of how the joint venture with Danone began to

collapse. "So I have to resign as chairman of the 29 joint

ventures between Wahaha and Danone and the 10 subsidiaries."

The counterattack against

Danone continued late Friday, when Wahaha released letters from

workers in various parts of the company.

In angry tones, the

letters defended the former chairman, and the workers vowed never

to accept a chairman appointed by Danone.

In one letter, which

claimed to represent the entire sales force of Wahaha, the group

called itself "the army of only Chairman Zong."

The letter denounced and

made fun of Danone and its directors and insisted that the

Chinese people could not be bullied. The workers also said that

Danone had engaged in a campaign of slander and intimidation to

bring down the former chairman.

At times, the letters

seemed to hark back to the days of Chairman Mao, who was known as

the Great Helmsman.

"How can our

respectable helmsman be forced away by Chinese traitors and

rascal directors," one passage said. "We only want

Chairman Zong and we firmly reject Danone!"

| 2007/5/9 Danone Danone Announcement on the

Wahaha Dispute

On April 9th, as

the majority shareholder of Wahaha joint ventures, Danone

sent a formal letter to the Chairman of the Wahaha joint

ventures, requesting him to take legal actions against

Hangzhou Wahaha Food and Beverage Marketing Co. Ltd, who

illegally sells the products which are the same of Joint

Venture's products under Wahaha trademark without proper

authorization. This is our first step of legal actions,

and we set a time frame of 30 days to solve the dispute.

As of today, Wahaha Joint Venture management has not

taken any actions against non JV's illegal activities.

Therefore Danone has commenced appropriate proceedings

today. Danone will not comment further on such procedures

and its discussions with its partner.

Groupe Danone still hopes we can solve the dispute

through peaceful discussion, and we are working hard

towards this direction.

Groupe Danone appreciates all your attention, and we will

update you in timely manner when we can report further

progress.

2007/6/7 Danone

Media Statement

Groupe Danone

announced today that Mr Zong Qing Hou resigned from his

position of Chairman of Wahaha Joint Ventures. The board

has accepted his resignation, and will appoint Mr

Emmanuel Faber, currently serving as Vice Chairman, as

the interim Chairman of Wahaha joint venture companies.

Mr. Faber hopes that the Wahaha joint ventures operate as

usual. He said: "Danone7s objective has been, and

will always be to ensure the development of the JV

companies, their brands and employees. We are looking

forward to the continuous development of the Wahaha Joint

Ventures."

He added : "As part of its global social

responsibility policy, Groupe Danone commits to the

Wahaha Joint Ventures employees to guarantee their job

security, their benefits, the improvement of working and

living conditions, personal respect and

development".

Danone has been in contact with Hangzhou government on

the matter of management continuity at the Wahaha Joint

Ventures and trusts government will continue to show

support for a smooth management transition, both as

regulatory authorities and as a significant minority

holder in the Joint Ventures.

1908

パスツール研究所所長、メチニコフがノーベル賞受賞

食菌作用の研究においてノーベル生理学・医学賞を受賞

ヨーグルトのバクテリア機能解明

ロシア人でメチニコフ(1845-1916)という名前のノーベル賞を受賞した科学者がいます。フランスのパリにあるパストゥール研究所の部長も勤めた免疫学の大家でした。

乳酸菌が善玉菌といわれる理由はいくつかありますが、ロシア出身のノーベル賞受賞の研究者メチニコフの研究(メチニコフの仮説)が良く引用されます。

メチニコフは、動脈が硬化するのは自家中毒によるとの仮説を考え付きました。

メチニコフの仮説は、「腸内の細菌は自家中毒の原因となる毒を作る、人は大腸を切り取っても生活することができる、大腸はこのような毒を作る細菌の住みついているところである」ということから導きだされました

メチニコフは、ブルガリアには百歳を超える元気なお年寄りが多いことと、彼等はブルガリア菌と呼ぶ細菌で作ったヨーグルトを毎日好んで飲んでいることを確認しました。

このブルガリア菌で作ったヨーグルトこそ、大腸内の細菌の繁殖を防ぎ、自家中毒を防ぐ原因であると信じ込み、このヨーグルトを毎日飲む事を奨励しました。と同時に啓蒙のみでは効果を確認するのに時間が掛かるので、彼は自らヨーグルト製造会社を作って、製造と販売を開始しました。彼自身も、またこのヨーグルトを毎日大量に飲用しました。そうしてメチニコフは、当時としては珍しく長生きをし71歳で生涯をまっとうしました。

※メチニコフは海洋生物(ヒトデ)の研究から、細胞性免疫の基礎となる「捕喰細胞」(Macrophage、食細胞)の研究で1908年にノーベル賞を受賞しています。乳酸菌に関連してノーベル賞を受賞したのではありません。

1919

アイザック・カラソー、世界で初めてヨーグルトの工業化に成功

●パスツール研究所から乳酸菌の株を取り寄せ、研究。

●息子のDANIELの名前をもじり、「DANONE」を商標に。

●最初ヨーグルトは医師を通じて薬局で販売。

1929

息子ダニエル・カラソーがフランスでダノン社創設

- N? 1 worldwide in Fresh Dairy

Products

- N? 1 worldwide equally placed in

Bottled Water (by volume)

- N? 2 worldwide in Biscuits and

Cereal Products

Fresh Dairy Products: Danone, Actimel,

Activia, Danonino and Vitalin?a (Taillefine, Vitasnella

or Ser in certain countries)

- Bottled Waters: Evian,

Volvic,

Wahaha, Aqua

- Biscuits and Cereal Products: LU, Prince

|

June 7, 2007 Agence

France-Presse

China's largest drink

brand accused Danone of takeover

China's largest drink company accused France's Danone on

Wednesday of using the courts to force a cheap takeover, in a

bitter feud over a joint-venture agreement, branding the action

"despicable".

Groupe Danone SA said Tuesday it filed a lawsuit in the United

States against companies linked to Wahaha Group, its joint

venture partner, for illegally producing identical products and

selling them on the Chinese market.

The complaints alleged that the firms broke a Wahaha-Danone

agreement by selling the same products as those made by the two

parties' joint ventures in China.

A spokesman for Wahaha said Wednesday Danone was trying to

pressure Zong Qinghou, the company's millionaire founder and

chairman, to sell his firms that make the disputed products

cheaply and branded the action "despicable and

laughable."

"Danone is bluffing and applying worldwide pressure to force

Chairman Zong Qinghou to give in," said Shan Qining.

"What it doesn't realize is Zong's resolve gets harder. Once

the public knows the truth, then the departure of Danone from

China and the capital market is not far away.

"Danone's real intention... for their actions against Zong

is to force him to yield and annex Wahaha at a low price."

The French company, which produces Evian mineral water and Danone

yogurts, set up five joint ventures with

Wahaha in 1996

under an agreement that bars the Chinese company from making

products that compete with it.

Danone

owns 51 percent of the joint ventures with Wahaha and the two sides

recently agreed for the French firm to

invest another 4 billion yuan ($519 million) for controlling

stakes in Wahaha subsidiaries.

These subsidiaries, which Zong controls, make the disputed

products. But Zong apparently wants to back out of the deal.

The agreement would give the joint venture the exclusive right to

produce, distribute and sell food and beverage products under the

Wahaha brand.

Danone said Tuesday it had filed its lawsuit in Los Angeles.

"Hangzhou Wahaha Food and Beverage

Sales Co. Ltd.

is illegally selling products that are the same as those sold by

Wahaha joint ventures and is making unlawful use of the joint

ventures' distributors and suppliers," Danone said in a

statement.

June 7, 2007 Bloomberg

Danone Seeks $100 Million

in Damages in Chinese Venture Lawsuit

Groupe Danone SA, the

French bottler of Evian, is seeking at least $100

million in damages from

companies linked to Chinese partner Zong Qinghou as it sues them

for illegal fruit-juice and mineral-water sales.

Danone, based in Paris,

said it's losing $25 million every month from unlawful sales of drinks

under the Wahaha brand, according to documents filed in Los

Angeles Superior Court three days ago. Danone said in a statement

June 5 it's suing companies and people that control Hangzhou

Wahaha Food & Beverage Sales.

The defendants ``continue

to compete unfairly against Danone's joint venture affiliates,''

the filing said. The suit aims to ``stop the defendants'

collective scheme to wrongfully interfere with Danone's valuable

customer relationships.''

Danone set up ventures

under the Wahaha brand in 1996 with Zong, the 23rd richest

person in China according to Forbes magazine. Danone's growth in the country

has slowed since the dispute with Zong began last year. Hangzhou

Wahaha Food & Beverage on June 6 called Danone ``despicable

and laughable'' and said it expects the French company to leave

China.

Danone is suing Ever Maple

Trading Ltd.,

based in the British Virgin Islands, and Hangzhou

Hongsheng Beverage Ltd., as well as their representative Kelly Fuli Zong

and You Zhen Shi.

Hangzhou Wahaha Group, the Zong Qinghou-owned company that has a

share of the Danone venture, wasn't named in the lawsuit.

A woman who would only

identify herself as Xu and answered the spokeswoman's telephone

line at Wahaha Group said the company had no further news to

release. Xu said that Wahaha Food & Beverage is a production

company that isn't reachable, and Hangzhou, China-based Wahaha

Group represents both companies.

Shares of Danone, little

changed today in Paris, closed yesterday at the lowest since

January.

`Friendly Solution'

``We have always said

that we remain open to a friendly, out of court solution,''

Danone spokeswoman Stephanie Rismont- Wargnier said from Paris

today. ``We continue to hold discussions with our Chinese

partners.'' She said the company was asking for $100 million in

damages as well as additional $25 million for every month elapsed

from the date of the filing to compensate for lost income.

Kelly

Fuli Zong is Zong Qinghou's daughter and You Zhen Shi is her

mother,

Danone says. The French company yesterday said records in

Hangzhou show Ever Maple controls Hangzhou Hongsheng Beverage,

the parent company of Hangzhou Wahaha Food & Beverage.

Kelly Zong, a U.S.

citizen, and her mother live in San Marino, California, Danone

says. A message left on the telephone of a You Zhen Shi listed in

San Marino wasn't returned. A recorded answer message identified

the resident as ``Kelly.''

`Hidden Structure'

In the filing, Danone

says Kelly Zong and her mother created a ``hidden corporate

structure'' to siphon profits from the joint venture's products

into their own companies.

Danone said Ever Maple, created by Kelly Zong in January

2003, owns 90 percent of Hangzhou Hongsheng Beverage Co., which Zong founded in October

2003 with her mother, who owns the remaining 10 percent.

Hangzhou Hongsheng

Beverage in turn owns Hangzhou Wahaha Food &

Beverage Sales,

created last year with the purpose of selling Wahaha products,

the French company said.

Danone has faced other

setbacks in China this year. Last week, Shanghai customs

officials seized about 118 tons of Evian for health violations.

Danone said bacteria found in Evian occur naturally, and that

China's health-inspection criteria are different than those of

the World Health Organization.

Chinese Assets

In the past 20 years,

Danone has bought stakes in Chinese firms such as Bright Dairy

& Food Co., Shenzhen Health Food Co., Guangdong Robust Group

and Shanghai Aquarius Drinking Water Corp

Danone is the

second-biggest shareholder of Hong Kong-listed China Huiyuan

Juice Group Ltd., the nation's largest maker of pure-fruit

drinks, and last December formed ventures with China Mengniu

Dairy Co., the country's biggest producer of liquid milk.

Revenue growth at

Danone's beverage unit slowed to 9.1 percent in the first three

months from 22 percent in the previous quarter. Danone Chief

Financial Officer Antoine Giscard d'Estaing said in April that

the company's sales grew slower than the 15 percent pace for the

overall Chinese beverage market, and blamed the disparity on

Wahaha.

The case is Groupe Danone

v. Kelly Fuli Zong, No. BC372121, Superior Court, Los Angeles

County (Los Angeles.)

International Herald

Tribune 2007/6/12

Brawl threatens huge investment by Danone in China

By David Barboza and James Kanter

HANGZHOU, China: An investigation that began two years ago has

blown up into a brawl that threatens the huge investment made by

a French multinational firm in one of the best-known Chinese

companies.

It began in 2005, when executives at Groupe Danone, the French

beverage and yogurt giant, say they noticed something peculiar in

the financial figures coming from their joint venture in China

with the Wahaha Group.

After a lengthy investigation, Danone officials concluded that

their closest partner in China, Wahaha's longtime chairman, Zong

Qinghou, was operating secret companies outside the joint venture

- companies that were mimicking the joint venture and siphoning

off millions of dollars.

Last week, after months of negotiation between Danone and Zong

failed to resolve the dispute over those companies and who has

the rights to the Wahaha brand, Danone filed a lawsuit in

California against a company controlled by Zong's relatives.

That lawsuit has intensified a quarrel between Danone and its

Chinese partner into a nasty, and at times bizarre, battle for

control over the largest beverage maker in China.

Analysts say the Wahaha dispute is a reminder of the pitfalls

that foreign companies face when doing business in China.

"This is a cautionary tale," said Steve Dickinson, a

lawyer based in Shanghai at Harris & Moure. "This is not

a message that you can't do business in China. But if you come to

China and let the Chinese run the business without supervision,

they can do this kind of thing."

Of course, Danone officials acknowledge they took a risk on Zong,

who is known for his brash management style. But they also say

that the 61-year-old entrepreneur helped transform Wahaha into

one of the most successful Chinese beverage makers, a company

that last year had sales of more than $1.5 billion.

Now, however, Danone is trying to figure out how to deal with

what suddenly looks like a corporate revolt at Wahaha.

Zong, one of the wealthiest businesspeople in China and the man

who founded Wahaha in the 1980s, angrily resigned as chairman

last Wednesday, disputing Danone's claims about secret companies

and saying he could no longer deal with what he called Danone's

harassment and smear campaign against him and his family.

Two days later, Wahaha - which is 51 percent owned by Danone -

released a series of harshly worded employee letters that

attacked Danone officials for ignorance and bullying.

In one of the letters, which Wahaha said represented the opinions

of large groups of employees, the workers vowed to stand by

"Chairman Zong" and to punish Danone's "evil

deeds."

And then, over the weekend, Wahaha issued another statement,

saying the company's management and staff "strongly

disapprove" of two directors appointed by Danone.

Wahaha officials declined to comment for this article.

At a news conference in Shanghai on Tuesday, Danone officials

defended their actions and said they were working to resolve the

dispute.

But Emmanuel Faber, the head of Danone's Asia operations, also

said he was worried that Zong might attempt to destroy the Wahaha

brand and start up his own competing company, absorbing Wahaha

units.

In a statement released at the news conference, Danone said:

"We think that it is inappropriate for anyone to seek to

leverage employees, business partners and the public to support

their goal of maximizing their own personal wealth, while

endangering the business continuity of the company."

The series of heated statements raises another question: Who is

now running Wahaha, a company that Zong ruled with an iron fist

for more than 20 years, controlling nearly every aspect of the

business?

Danone says it still has contact with Wahaha. But the French

company also acknowledges that it does not have a single

executive based at Wahaha's headquarters in Hangzhou and that

Danone officers never participated in the day-to-day operations

of the joint venture.

The boardroom drama has cast a dark cloud over Wahaha, a

fast-growing beverage company known for its popular children's

drinks, fruit juices and bottled water.

According to Danone, most of the problems are tied to Zong, the

former chairman. Danone says he and several of his family members

began operating a series of parallel companies sometime after

2003.

In 2005, Danone says, those "illegal" Wahaha-related

companies began expanding aggressively, manufacturing a growing

share of the company's products.

In late 2006, after Danone says it discovered the parallel

companies, Zong agreed to sell a majority stake in those

companies to Danone, which intended to fold them into the joint

venture.

But after signing the agreement, Danone says, Zong pulled out of

the deal and then began creating even more mirror companies,

including his own separate sales division.

Those moves, Danone say, prompted the company to file a lawsuit

in California last week against a group of British Virgin Islands

corporations that were registered by Zong's wife and daughter,

who have run some of the mirror companies and who list California

as their state of residence.

Zong has fought back in public. In a letter posted on the

Internet last week, Zong said Danone officials had been fully

aware of the outside companies, which he said had been partly

funded by company employees, and that Danone wanted to acquire

them cheaply.

"To put it seriously, they were trying to bribe me to

infringe the interest of small shareholders to achieve the goal

of a cheap acquisition," Zong wrote. "When they failed

the acquisition attempt, they used the media to spread rumors to

attack me and my family, complained to the government and tried

to ruin me."

Whether the local Hangzhou government, which owns a piece of

Wahaha, will step in is unclear.

But analysts who follow Danone are worried about how the dispute

will affect the company's bottom line and its future growth in

China.

"If this was settled over a period of months, then it would

have been all right for Danone," said Cedric Lecasble, an

analyst with Kepler Equities in Paris. "But things have been

going in the wrong direction. The situation has turned out to be

tougher than I could have imagined."

Some analysts are questioning why Danone did not have better

supervision of Zong and Wahaha.

"This was a great business Danone had in China, and over

time it was going to give them an awful lot of growth, perhaps 10

to 15 percent each year over the next five years," said

Jeremy Fialko, an analyst at ABN AMRO in London. "The joint

venture is a very practical business model, but you've got to be

cognizant of the risks involved."

Faber, however, suggested that the fraud began slowly, picked up

only in 2005 and then accelerated again after negotiations broke

down last December. In February, Danone says, it discovered that

even more secret companies had been established.

Asked whether Danone's oversight of the joint venture was

typical, Faber called it a "fairly unusual or unique

case."

But, Faber added: "Wahaha is what it is today because Danone

was able to take the risk of letting Zong run the show. This man

created a great company. But he has not been very rational

recently."

Analysts in China say this was a typical structure for old joint

ventures, but often those partnerships ran into trouble once they

became profitable and there was a battle for control.

"This is why a lot of companies don't do joint ventures any

more," said Dickinson at Harris & Moure. "Many of

them ended up like this. You have to have supervision. You need

to have protections in place."

Faber, though, says Danone is hoping to find a solution that

allows both sides to benefit now.

"At the end of the day, we want a fair share of the

pie," he said. "We don't want to destroy the pie."

David Barboza reported from Hangzhou and James Kanter reported

from Paris.

June 13,

2007 International Herald Tribune

Wahaha

executives threaten to quit Danone venture

The former chairman of

the Wahaha Group and many of the company's top executives joined

forces Wednesday to denounce their longtime partner, Groupe

Danone, and threatened to bolt from a joint venture with the

French food and beverage giant and to form a separate company.

At a press conference in

Hangzhou, where Wahaha is based, the company's top executives

made clear for the first time that they intend to leave Wahaha if

Danone does not give in to a list of demands, including a promise

to stop investing in competing Chinese beverage companies and an

apology for harming the 11-year-old joint venture.

"If Danone

apologizes and agrees to remove two restrictive articles, we're

still willing to continue the cooperation," said Yang

Xiuling, a Wahaha sales executive. "Otherwise we'll see them

in court."

Also among the Wahaha

demands is a call for Danone to drop its exclusive claim on

rights to the Wahaha brand name.

When asked whether the 13

executives who appeared at the press conference would join the

former chairman of Wahaha, Zong Qinghou, in forming a new company

if Wahaha and Danone could not resolve their differences, the

spokesman for Wahaha answered for the group:

"Absolutely."

The stunning announcement

further escalates a remarkable and often bizarre corporate battle

for control of China's largest beverage maker.

A spokesman for Danone

declined comment Wednesday.

But on Tuesday, Danone

said it hoped to find an amicable solution to the crisis and had

no interest in selling its 51 percent stake in Wahaha.

Yet Danone is now

struggling to gain control over a joint venture that went astray

last year, after Danone officials accused Zong of forming a

series of secret parallel companies that produced identical

products and also siphoned off millions of dollars from the joint

venture.

To stop the outside

companies from proliferating and mimicking the joint venture,

Danone filed a lawsuit in California last week against a group of

Wahaha-related offshore companies that are controlled by Zong's

relatives.

A few days later, Zong,

who founded Wahaha in the 1980s and is now one of China's

wealthiest businessmen, angrily resigned as chairman of Wahaha,

saying he and his family had been harassed and slandered by

Danone.

Zong then penned a fiery

open letter to Danone, defending his tenure and ridiculing Danone

and its executives.

Since then, Zong and

Wahaha have aggressively battered Danone in public, posting

venomous letters on the Internet and vowing to punish Danone's

"evil deeds" and to even destroy the French company in

a legal battle.

Zong said on Wednesday he

would file for arbitration in Hangzhou. "We will file with

the Hangzhou Arbitration Commission as soon as possible."

And Tuesday, a group of

Wahaha employees even showed up at Danone's Shanghai

headquarters, where they unfurled a poster in protest against the

French company.

Zong and Wahaha say these

actions were a counterattack against Danone.

Zong, for instance,

insists Danone officials knew all along about the outside

companies and that Danone officials jealously tried to acquire

the companies cheaply after they learned how profitable the

companies had become.

Zong also said Danone had

violated the joint-venture contract by investing in some of

Wahaha's biggest competitors in China.

"Thinking back on

the 11 years of our cooperating with Danone, we've done

everything and they've done nothing," Zong said at the press

conference Wednesday. Zong was joined by a group of senior Wahaha

executives, who took turns attacking Danone's leadership.

The executives insisted

they had a right to use the Wahaha brand and that the brand was

not completely owned by the joint venture, despite Danone's

statements.

And they said the joint

venture's products had been struggling recently, while the new

products offered by the outside companies formed by Zong and some

employees were showing strong growth.

Part of the problem,

Wahaha executives said, was that Wahaha retail dealers had turned

sour on the joint venture products after Danone went public with

its dispute with Zong.

Some dealers are now

favoring the non-joint-venture products, produced by the outside

companies controlled by Zong and the employees, company officials

say.

Liu Zhimin, vice chairman

of the sales department at Wahaha, said that the joint venture's

profits were in decline. And they said that Danone had done

little to manage it.

"They don't do

anything, except get a share of the profit," Liu said.

"They've gotten about $450 million over the past 11

years."

June 18, 2007 Xinhua

Wahaha says its

arbitration application accepted over trademark dispute with

Danone

China's beverage giant

Wahaha Group said on Sunday that the company's application for

arbitration over a trademark dispute with its French partner

Danone, has been accepted by the Hangzhou Arbitration Committee.

The application asks the

committee to terminate a trademark transfer

contract signed

between Hangzhou Wahaha Group and the joint venture of Wahaha and

Danone in 1996, said Shan Qining, a spokesman for Hangzhou Wahaha

Group.

Wahaha said its contract

with Danone was never approved by China's trademark authority,

which means the transfer is invalid and thus the contract should

have terminated.

Shan said the Wahaha

trademark belongs to Hangzhou Wahaha Group

and not with Danone.

Danone, which owns 51

percent stake of the 39 joint ventures, has accused Wahaha of

setting up independent companies and selling products identical

to those sold by the joint ventures.

Danone is demanding a

51-percent stake in the non-joint venture companies, which Wahaha

Group has rejected.

Danone filed its first

lawsuit against Wahaha on May 9 in Stockholm.

On June 4, Danone filed a

lawsuit in the Los Angeles-based Superior Court against Ever

Maple Trading Ltd. and Hangzhou Hongsheng Beverage Co Ltd, and

two individuals related to the companies.

Ever Maple Trading Ltd.

is the controlling shareholder of Hangzhou Hongsheng Beverage,

which is the parent company of Hangzhou Wahaha Food and Beverage

Sales Co., Danone's joint venture partner in China.

On June 6, Zong Qinghou,

founder and chairman of Wahaha Group, resigned from his post as

chairman of its 39 joint ventures with Danone.

Emmanuel Faber has been

named interim chairman of the joint ventures.

2006/7/26 APWahaha Steps

Up Heat Against Danone

Chinese beverage maker

Hangzhou Wahaha Group Co. threatened legal action Tuesday against

its French joint venture partner Danone, the latest fusillade in

the companies' feud over one of China's best-known brand names.

Group Danone SA and its

Chinese joint venture partner, multimillionaire Zong Qinghou -

the chairman of Hangzhou Wahaha Group - have been publicly

battling for more than two months.

Danone accuses Wahaha of

illegally selling products identical to those sold by the

companies' joint ventures and has filed a lawsuit in Los Angeles

seeking more than US$100 million for the alleged illegal sales.

It also filed for arbitration in Stockholm to help resolve the

dispute.

Zong resigned from the

chairmanship of the joint venture after the lawsuit was filed.

Wahaha,

which filed for arbitration in its home base of Hangzhou, in eastern China, "wants to

raise a counterclaim" and claim up to 5

billion yuan (US$656 billion) in damages, the Chinese company said in a

statement distributed by e-mail.

"Danone has no

evidence of legal violations by us," it said.

Spokesmen for Danone had

no immediate comment. Earlier this month, the company said it

believed an amicable resolution of the dispute was still

possible, but it criticized Zong's public complaints.

Relations with Danone

soured after Zong rejected a plan by

Danone to buy out some of Wahaha's assets, accusing the French

company of attempting a hostile takeover.

Zong has sought to rally

support through public appeals, insisting that the

government-owned parent company of Wahaha has full rights to use

the brand name.

Zong founded the Wahaha

group in the late 1980s. Beginning in 1996, Wahaha and Danone set

up a string of nearly 40 joint ventures, each 51 percent owned by

Danone. Earlier this year, Danone officials accused Zong of

undermining their business with a parallel network of

distributors selling many of the same products.

The dispute between the

two companies has resulted in the airing of antagonisms build up

over the years.

"Essentially, we

functioned as cheap labor for the creation of their wealth and

received little in return," Wahaha said in another

statement, issued Tuesday.

The Chinese company

accused its French partner of "total indifference" to

innovative ideas and of trying to "brazenly slander"

Zong.

"Wahaha and Mr. Zong

cooperated diligently, though not always easily, with Danone for

11 years," it said, adding that it sought to keep the French

company from "interfering with our successful operation and

management, simply giving them a share of the profits."

"We really could not

comprehend why Danone was not satisfied with such a good

deal," it said.

BBC 2007/6/26

Under the

terms of their 11-year agreement, Wahaha is prohibited from

making products that compete with Danone's range.

Danone

recently agreed to invest a further four

billion yuan (£262m;

$519m)

in the deal, in return for control over several Wahaha

subsidiaries and the right to sell foodstuffs under the

Wahaha brand.

It is these

subsidiaries that make the disputed products.

Mr Zong

founded Wahaha in 1987, selling milk products from a school

store.

The Danone

deal enabled Wahaha to invest in advanced production

facilities, doubling its output between 1996 and 1997.

With its

headquarters in Hangzhou in eastern China, Wahaha has 70

subsidiaries spread across 40 manufacturing sites.

2007-07-04 Xinhua

Wahaha to sue 3

joint-venture directors from Danone

Chinese

beverage giant Wahaha Group on Tuesday confirmed its plan to sue

three executives of Danone, Wahaha's French joint venture

partner.

"If Danone do not sue the

three directors, Wahaha will do it," said Liu Xiangwen,

lawyer of Wahaha, at a press conference in Hangzhou, capital of

east China's Zhejiang Province.

Zong Qinghou, chairman of Wahaha

Group, said he would sue for a total of one million yuan (131,000

U.S. dollars).

Emmanuel Faber, who recently

replaced Zong Qinghou as chief of Danone and Wahaha's 39 joint

ventures, Qin Pang, China director for Danone Asia and Francois

Caquelin, a financial director, are the targets of Wahaha's

lawsuits.

Liu claimed that the three men

were

hired by more than 20 counterpart firms of Wahaha-Danone and carried out a series of

investment, marketing and management projects for the firms,

which are competitors of the joint-venture in the beverage

industry.

"Their employment in these

competitive companies is against China's corporate law ... and

their actions have damaged the interests of the joint ventures

and the interest of Wahaha's shareholders," Liu said.

Danone's purchase of three drinks

companies - Robust, Shenzhen Yili and Shanghai Jianguanghe - also violated Danone and

Wahaha's non-competition agreements, the lawyer added.

Danone was unavailable for comment

on Wahaha's intentions announced at the press conference.

The move was the latest in the

dispute between the Chinese drink group and the French giant that

first emerged in April but has since taken on a highly public

tone.

On June 26, Wahaha said it had

decided to "demand justice by legal procedures" after

Danone had filed for arbitration and lawsuits against it.

Wahaha said in a statement,

"We will respond actively to the lawsuits filed by Danone in

Stockholm and the United States, and we plan to launch a counter

suit demanding compensation of two billion, three billion or five

billion euros."

The statement continued, "We

have conclusive evidence that Danone has broken the law.

"Wahaha is not against the

opening-up policy of China, or cooperation with others, or

cooperation with foreign investors. However, we want the

cooperation to be equal, mutually beneficial, complementary,

mutually respectful with equal interest," the statement

said.

Wahaha has applied for

arbitration over a trademark dispute with Danone at the Hangzhou

Arbitration Committee, asking the committee to terminate

a trademark transfer contract signed between Hangzhou Wahaha

Group and the joint venture of Wahaha and Danone in 1996.

Wahaha said its contract with

Danone was never approved by China's trademark authority, which meant the transfer was

invalid and the contract should be terminated.

Danone, which owns 51 percent

stake of the 39 joint ventures, has accused Wahaha of setting up

independent companies and selling products identical to those

sold by the joint ventures.

Danone is demanding a 51-percent

stake in the non-joint venture companies, which Wahaha Group has rejected.

Danone filed its first lawsuit

against Wahaha on May 9 in Stockholm.

On June 4, Danone filed a lawsuit

in the Los Angeles-based Superior Court against Ever Maple

Trading Ltd. and Hangzhou Hongsheng Beverage Co. Ltd, and two

individuals related to the companies.

Ever Maple Trading Ltd. is the

controlling shareholder of Hangzhou Hongsheng Beverage, which is

the parent company of Hangzhou Wahaha Food and Beverage Sales

Co., Danone's joint venture partner in China.

http://chinabusinesslaw.blogspot.com/2007/06/wahaha-v-danone-who-will-have-last.html

First,

the occasion warrants a brief intro of the players.

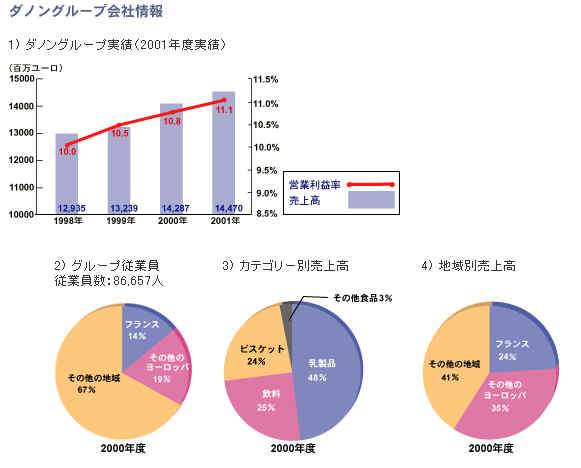

Danone

is currently one of the world’s leading

global corporations in fresh dairy products and bottled

water, and its production and sales spans around the world.

Wahaha

is a bit more complicated. Wahaha Group consists of three

large blocks of corporate entities. The first is the original

Wahaha

Group Ltd., and the City of Hangzhou owns 46% of the stock,

and the rest of stocks of the company are unevenly

distributed among Mr. Zong, the management, and employees

(before 2000, Wahaha Group was a solely state-owned

enterprise). The second one is the Wahaha-Danone

Joint Equity Venture Group. Wahaha Group

Ltd. Controls 49% of the shares, and Danone holds 51%. The

third bunch is a host of non-joint venture

companies established and operated in essence by Wahaha Group

Ltd. and Hangzhou Wahaha Food Products Ltd.

Second, the following is the chronology of the relationship

between Danone and Wahaha.

1.

02/29/1996-----Joint Venture Agreement between Wahaha Group

Ltd. and Danone, including trademark transfer agreement,

non-compete agreement, and confidentiality agreement

2. 03/28/1996-----Wahaha Group Ltd., Danone, and a Hong Kong

enterprise agreed to form five joint ventures in China.

3. 04/1996-----Mr. Zong became the chairman of board of

directors of the said five joint ventures.

4. From 1996-2007, the original five joint ventures evolved

into 39 joint ventures, and everybody made a ton of money.

5. Problems began to surface in 2000 after the reorganization

of Wahaha Group Ltd., which became a private entity with the

Hangzhou government holding 46% of its stocks. The

reorganized Wahaha Group Ltd. began to establish its own joint

ventures and separate subsidiary entities, which totaled 17

entities in a span of six years. Apparently, Wahaha Group

Ltd. used the Wahaha-related trademark in violation of the

Wahaha-Danone Joint Venture Agreement.

6. Danone kept quiet with respect to Wahaha Group’s use of the trademark and

apparent breach of the non-compete agreement inherent in the

Joint Venture Agreement.

7. In late 2006, Danone initiated an offer to buy all of

Wahaha Group Ltd.’s companies which are

developed outside of the Joint Venture Agreement, and Wahaha

Group Ltd. rejected the offer. The dispute went public in

early 2007, escalating into a full blown fight over the

ownership and usage of the Wahaha trademark.

8. 05/09/2007, Danone Asia submitted the disputes with Wahaha

Group Ltd. with respect to the Joint Venture Agreement to the

Stockholm Arbitration Institute.

9. 06/04/2007, Danone sued, in the Superior Court of Los

Angeles County, Ever Maple Trading, a company based in the

British Virgin Islands, and Hangzhou Hongsheng Beverage, as

well as two individuals related to these companies. The two

companies are believed to have ties with Wahaha Group Ltd.

and Mr. Zong.

10. 06/05/2007, Mr. Zong tendered his resignation as the

chairman of the board of directors of the Wahaha-Daone Joint

Venture.

11. 06/13/2007, Mr. Zong announced his plan to submit the

trademark dispute arising out of the Joint Venture Agreement

to the Hangzhou Arbitration Commission.

June 15, 2007 Wahaha v. Danone: Partnership

at Grace’s End

When Danone Asia Pte Ltd. (“Danon Asia”) and other Danone

subsidiaries located in Asia submitted the dispute to

arbitration in Sweden, things between the two partners have

turned from the good, to the bad, then to the ugly. And

Danone has hired the British law firm Freshfields to

represent it in the Swedish arbitration deal. As a side note,

Article 26 of the Joint Venture Agreement stipulates that

disputes between the contracting parties, if unresolved, are to be

arbitrated in the Arbitration Institute of the Stockholm

Chamber of Commerce.

My research reveals some of the details of Danone’s contentions and complaints

in the arbitration.

The plaintiffs/petitioners are: Danon Asia, Jinjia

Investments Ltd., Myen Ltd., Novalc Ltd. The

defendants/respondents are: Wahaha Group Ltd., Wahaha Shiye

Ltd., Hangzhou Food Ltd., Hangzhou Wahaha Investments Ltd.

The pith of Danone’s complaints is that Wahaha

Group and its non-joint venture companies violated the

original Joint Venture Agreement (“Original Agreement”) between Danone and Wahaha

Group, and that such violation consequently resulted in the

infringement of the trademark transfer clauses of the

Original Agreement. Danone alleged that the defendants,

without approval from the joint venture companies,

manufactured products that are same as those of the joint

venture companies. These products competed against the joint

venture companies’ products, injuring the

interests of the joint venture companies.

In addition to the corporate defendants, Danone also joined

Mr. Zong, the former chairman of the board of directors of

the joint venture companies and the man behind all the

non-joint venture companies, as a defendant in the

arbitration. Danone, expectedly, complained of Zong’s violation of the non-compete

agreement (“NCA”) and non-disclosure agreement

(“NDA”). And it also alleged that

Zong created conflict of interests, violating his duty to the

joint venture company as a board member.

In an attempted strategic move, Zong

submitted the same case to the Hangzhou Arbitration

Commission

on Wednesday (June 13, 2007), hoping to capture a little bit

of the home-court advantage. He avers that the trademark

transfer clause in the Original Agreement is void for

violation of the Chinese law at the time of contract in 1996, and that Danone fraudulently

induced Wahaha into the contract.

From a legal stand point, Zong is caught in a tight spot.

First, his choice of venue for arbitration is against the

express provisions of the Original Agreement, notwithstanding

his “need”

of a friendly

forum. Second, the disputes have already been accepted by the

Stockholm Arbitration Institute, where Zong and the other

four non-joint venture companies are defendants. So, whether

the Hangzhou Arbitration Commission will dismiss the petition

remains a very curious legal and possibly political riddle.

And then, to make thing a little more uncomfortable for Mr.

Zong, Danone lit a fire in his back yard where he could not

even get to. Danone’s lawsuit in Los Angeles

against Ever Maple Trading Ltd., Hangzhou Hongsheng Beverage

Co Ltd., and Zong’s daughter & wife really

added “insult to injury.”

Zong’s immediate response to this

suit is to resign his position on the Danon-Wahaha Joint

Venture board, which demonstrates how enraged he might have

been. Aside from making him comfortable, Danone’

choice of forum

in California could not have been better since here Danone is

immune from the heat of nationalism manipulated by Zong,

local politics in Hangzhou (the city is a shareholder of

Wahaha Group, remember?), and unpredictable courts.

Wahaha v. Danone: My Arbitration is Better Than Yours

Ok, this is getting really interesting!

Remember that Danone submitted the whole dispute to the

Stockholm Institute of Arbitration on May 9, 2007? The

arbitration is pending there in Sweden.

Remember that Wahaha also applied to have the Wahaha

trademark transfer portion of the dispute with Danone

arbitrated in the Hangzhou Arbitration Commission (“HAC”) on June 13, 2007?

In my last post, I was not sure whether HAC would take the

case since the matter, on a bigger scale, is pending in

Sweden.

But, surprise!! HAC accepted the petition for

arbitration the very next day on June 14, 2007.

According to a report, Wahaha wants the HAC to determine

whether the trademark transfer agreement, as a matter of law,

is void since the Chinese Trademark

Law requires such transfer to be approved by the China

Trademark Office at the time of transfer (1996).

My hunch is that this might be Wahaha’s strongest argument. Wahaha

Group in fact competed against Wahaha-Danone joint ventures;

Wahaha Group actually used the trademark without the approval

of the joint venture pursuant to the joint venture agreement.

Therefore, without attacking the legality of the contract,

Wahaha will have a very tough job in convincing the tribunals

or a jury.

The next question that I anticipate to be raised after the “verdict”

on the transfer

issue is whether the contract in its entirety will be held as

void. In my previous post, I discussed that Chinese Contract

Law allows per se illegal clauses to be stricken in an

otherwise enforceable contract. Assuming that the trademark

transfer agreement is held as void by the HAC, will the

original joint venture agreement (“Original Agreement”) survive the ordeal?

From a legal perspective, the rest of the Original Agreement

should stand and continue to be effective given Article 56 of

the Chinese Contract Law. But the really issue is what good

is there for Danone if the Trademark transfer portion of the

contract is void. Without the right to the Wahaha trademark,

Danone’s joint ventures in China

would only be a shell without its core value with which the

Chinese consumers identify. Of course, Danone can rely on its

own trademarks acquired elsewhere, but that is the topic of

another day.

Given

nationalistic sentiments against Danon (the “foreign

devil”), many distributors of

Danon-Wahaha joint venture companies have ceased to sell

and distribute their products. Legal fees and judicial

assessment of damages against Danon would do far less

damages than consumer sentiments. After all, that is what

ultimately makes or breaks a company.

|

Danone-Yili

The company is a joint venture of Yili Mineral Spring

Incorporated of Shenzhen Cities and Danone.

Shanghai Jianguanghe

Robust

Eurofood, March 16,

2000

Danone, the giant French food and drink group, has continued

its expansion in the bottled water market with the

acquisition of Robust, one of the country's biggest producers

of bottled water and dairy-based drinks, from the Chinese

authorities.

The Chinese buy comes just a few weeks after the French group

acquired the US bottled water group McKesson. Danone is

making water one of its core sectors, alongside biscuits and

dairy. It is thought likely to offload its Kronenbourg

brewing arm, which sits increasingly uncomfortably with its

core activities.

The Robust deal is expected to boost Danone's presence in

China, which currently accounts for 7.5% of the firm's annual

turnover. Some 80% of its business there is drinks, including

the Wahaha bottled water brand, the Chinese market leader.

2007-07-12 AP

Danone files counter

claim against Chinese joint venture partner in trademark dispute

China-French food and

drink maker Danone said Thursday it has filed a counter claim

against its estranged Chinese joint venture partner in an

increasingly bitter trademark dispute.

Danone legal counsel

Randall Lewis said Wahaha failed to fulfill a 1996 agreement

to transfer the Wahaha name to the joint venture and recently lied in saying

that the State Trademark Office had rejected such a transfer.

Thus far "there has

been no circumstance or event that is sufficient to result in the

termination of the rights and obligations of the parties under

the Trademark Transfer Agreement," Lewis said.

Wahaha last month filed

for arbitration claiming the Chinese government never approved

Danone's request that their joint venture, set up in 1996, have

exclusive use of the Wahaha brand name.

Danone accuses Wahaha of

illegally selling products identical to those sold by the

companies' joint ventures and has filed a lawsuit in Los Angeles

seeking more than US$100 million for the alleged illegal sales.

It also filed for

arbitration in Stockholm to help resolve the dispute. Wahaha's

founder Zong Qinghou resigned from the chairmanship of the joint

venture after the lawsuit was filed.

The months-old dispute

has been increasingly played out in public, with Zong accusing

the French company of launching a personal vendetta and Danone

asserting their legal rights.

wsj

Danone Claim Seeks to Win Wahaha Trademark in China

France's Groupe Danone SA said its Chinese joint venture with

Hangzhou Wahaha Group Co. has filed a counterclaim against

Hangzhou Wahaha to the Hangzhou Arbitration

Commission

in an effort to secure ownership of Wahaha trademarks.

AFX News Limited

2007/7/23

France calls for

'amicable settlement' of Danone-Wahaha dispute

The French ambassador in China, Herve Ladsous, has called for an

'amicable settlement' of the dispute between Danone and its

Hangzhou-based partner, Wahaha.

Speaking at a press conference, Ladsous said that France takes

the affair 'very seriously', and has been consulting public

authorities with a view to resolving the battle between the two

companies, which has been ongoing for several months, marked by a

series of lawsuits.

Danone has accused Wahaha of creating 20 independent companies

selling products identical to those sold by their joint ventures.

Ladsous, citing the examples of Airbus, Alstom and

Peugeot/Citroen, remarked that he hoped the deadlock between

Danone and Wahaha would not detract from more successful

experiences of joint ventures between French companies and their

international partners.

2007-09-01 China Daily

Trademark body sued in

latest Wahaha-Danone twist

The legal wrangle between

Danone and Wahaha has spread beyond the two companies to the

nation's trademark authority.

Hangzhou Wahaha Foods Co,

one of five joint ventures set up by the two firms, has sued the

Beijing-based State Trademark Bureau over what it claims was

"improper administrative behavior" in 1996 and 1997.

Hangzhou Wahaha Foods is

51 percent-owned by French food giant Danone Groupe SA, with the

rest controlled by China's largest drinks producer Wahaha Group.

The Beijing No 1

Intermediate People's Court told China Daily on Friday that

Wahaha Foods has demanded the trademark bureau rescind its

rejection of applications to transfer the Wahaha brand from the

Chinese company

to the joint ventures because it did not issue a

written notice or give a reason for its decisions at the time. The court has accepted the case.

A spokesman with the

trademark bureau said on Friday that it has yet to be notified of

the legal action by the court. Danone declined to comment on the

matter.

Danone, the world's

largest yogurt maker, signed an agreement with Wahaha in 1996

that required the transfer of the Wahaha brand from the Chinese

company to the joint ventures.

Under the contract, the

Chinese company was barred from making products that compete with

those produced by the joint ventures, or from using the Wahaha

brand without Danone's consent.

But the two parties are

divided on the validity of the agreement after Wahaha Group

opposed an acquisition proposal from Danone to take 51 percent of

non-joint ventures set up by the Chinese side.

Zong Qinghou, founder of

Wahaha Group, claims the transfer was not properly approved by

the authorities, citing a reply from the State Trademark Bureau,

which twice rejected applications for the transfer of the Wahaha

brand in 1996 and 1997.

Wahaha claims Danone was

aware of the situation and that the two sides had joined forces

to get around the rules.

Danone

initially said Wahaha had not applied properly for the transfer

of the brand,

for which Danone paid Wahaha Group 100 million yuan (US$13.25

million).

ShanghaiDaily

2007/8/31

Bureau sued for blocking Wahaha trademark sale

A BEIJING court has accepted an appeal from a joint venture

partially owned by French beverage maker Groupe Danone SA,

which claimed the State Trademark Office broke the law when

it denied the company's request to transfer trademarks from

Wahaha Group Co.

The lawsuit is the latest legal battle front in an almost

months long fight between Danone and Wahaha over China's most

famous beverage trademark.

Danone filed a claim with the Hangzhou arbitration bureau

against Wahaha Group in July, accusing the biggest Chinese

beverage maker of failing to transfer the Wahaha brand to

Wahaha Food Co, a joint ventures set up by the two companies

in 1996, in compliance with contract obligations.

Danone said in the suit that the joint venture paid 50

million yuan (US$6.6 million) in cash in 1996 to Wahaha Group

for the transfer of the trademark.

Danone accused Wahaha Group of setting up more than 20

separate companies that produce competitive products and used

the same Wahaha brand without the joint venture's permission.

But Wahaha claimed that the brand still belongs to the group

on the basis of a reply from State Trademark Office, saying

it "did not consent to the transfer."

In yesterday's appeal to the Beijing No. 1 Intermediate

Court, Wahaha Food Co said that since the bureau had made no

written explanations for the denial of the trademark

transference from Wahaha Group Co, the decision should be

"withdrawn" as it has breached the country's

regulations of implementation of the trademark law.

The appeal said Wahaha Group applied to the bureau in April,

1996 and September, 1997 to ask for permissions to transfer

more than 200 registered trademarks to Wahaha Food Co.

Both the applications were refused by the bureau, which cited

the Regulations on Corporation Trademarks Management, a rule

that went into effect in 1995 to prevent the loss of

ownership of company trademarks.

In May, Danone also filed a lawsuit in Los Angeles seeking

more than US$100 million for the alleged illegal sales in

addition to arbitration in Stockholm for compensation of 800

million euros (US$1.1 billion).

Wahaha responded in July by filing a lawsuit against three

foreign directors appointed by the French dairy giant to

their 39 joint ventures for taking a parallel position in

other competitive enterprises that breached China's Company

Law. It demanded Danone pay one million yuan in compensation.

2007-9-1 Shanghai

Daily

Wahaha venture sues

trademark office

A BEIJING court has

accepted an appeal from a joint venture partially owned by

Groupe Danone SA, which claimed the State Trademark Office

broke the law when it denied the firm's request to transfer

the trademarks from Wahaha Group Co.

In yesterday's appeal to the Beijing No. 1 Intermediate

Court, Wahaha Food Co, a venture formed by the French dairy

maker and Hangzhou Wahaha Group, said that since the bureau

had made no written explanations for denying the transfer of

the trademark from the Chinese group, the decision should be

withdrawn.

"It has breached the country's regulations governing

implementation of the trademark law."

No dates have been set for the court to hear the appeal.

The appeal said Wahaha Group applied to the bureau in April

1996 and September 1997 to ask for permission to transfer

more than 200 registered trademarks to Wahaha Food Co.

But the two applications were refused by the bureau, which

cited the Regulations on Corporation

Trademarks Management, a rule that went into effect in 1995

to prevent the loss of ownership of company trademarks.

The lawsuit is the latest legal battle front.

Danone filed a claim with the Hangzhou arbitration bureau

against Wahaha Group in July, accusing the Chinese firm of

failing to transfer the Wahaha brand to Wahaha Food Co.

But Wahaha claimed that the brand still belongs to the group

based on the reply from the trademark office, saying it

"did not consent to the transfer."

2007/10/16 AFP

Danone to sell 20 percent stake in China's Bright Dairy

French food giant Groupe Danone SA, which is embroiled in a long

and bitter public feud with a Chinese partner, said Tuesday it

was backing out of another venture in the fast-growing Asian

market.

Danone will sell its entire 20.01-percent stake in

Shanghai-based Bright Dairy and Food (光明乳業)for 955 million yuan (127 million

dollars), the Chinese company said.

ダノンは中国では複数の企業と並行して提携。光明と競合する内蒙古蒙牛乳乳とも合弁会社を設立しており、光明からは不満が出ていた。(日本経済新聞)

Danone agreed to sell

104.24 million shares in Bright Dairy at 4.85 yuan per share to

each of Bright Dairy's parent Shanghai Dairy Group and S.I.

Products Holdings Ltd, Bright Dairy said in a statement to the

Shanghai Stock Exchange.

The statement did not give out any reasons for the sale.

Besides its partnership with Bright Dairy, Danone also has a

less-than-satisfying tie-up with China's top drinks company

Wahaha Group.

The two companies have been going through bitter disputes over

their joint ventures and ownership of the Wahaha trademark.

Danone said Tuesday in a statement on the Bright Dairy

transaction that "the decision of equity transfer is reached

on mutually agreed basis, in viewing of the needs of development

strategies of both parties".

"Danone started collaboration with Bright Dairy in 2000

through investment. The two companies have cooperation in product

development, technology and management, which has achieved

favorable results in the past few years".

The two companies will also terminate an agreement under which

Bright Dairy sold and promoted Danone-branded products and used

the French company's technologies, the Chinese company said.

Danone will pay 330 million yuan to Bright Dairy as compensation

for marketing and distribution expense for Danone, it added.

Bright Dairy said the end of cooperation will "not have any

significant negative effect on its financial performance or

sustaining operations", although it could impact short-term

profit growth.

The deal is still subject to approval from a shareholder meeting

on October 31, the China Securities Regulatory Commission and the

Ministry of Commerce.

Danone also forged an alliance with Hong Kong-listed China

Mengniu Dairy in December last year to form yogurt joint

ventures.

Danone-Wahaha

Dispute: No End in Sight

As the Danone-Wahaha

dispute drags on, no end seems near for each party in their

multi-country, multi-continent war. Lately, Danone has received

some good news, whereas Wahaha is feeling the heat of loosing its

original lawyers in the United States and some adverse judicial

rulings against its off-shore assets.

By way of background, the following are the battle fronts:

1. Danone v. Wahaha in arbitration in Stockholm

2. Danone v. Wahaha, Zong Qinghou’s daughter and wife, Wahaha

off-shore companies in a Los Angeles Superior court

3. Wahaha v. Danone in arbitration in Hangzhou, China

4. Danone v. Wahaha off-shore companies in a British Virgin

Islands court

5. Danone v. Wahaha off-shore companies in an American Samoa

court

6. Wahaha v. Danone in derivative action in Shenyang Intermediate

People’s Court in China

Wahaha was shocked to learn that its litigation lawyers withdrew

from the representation in the case pending in Los Angeles. Some

speculate that Latham & Watkins withdrew because its client

provided false testimony. In any international litigation,

changing lawyers midstream always adds a strain to the case, in

terms of finances, preparedness, and possibly momentum. Wahaha

quickly found new lawyers for its case, and let’s hope that the new lawyers will

get up to speed on the case for Wahaha. Because of the change, it

will probably take more time for the parties to conduct

discovery, thus pushing the trial to a later date if they do not

settle.

Bad news also arrived for Wahaha from the courts in the British

Virgin Islands and the American Samoa. Reportedly, both courts

ruled in favor of Danone, freezing assets of Wahaha’s off-shore companies in both

jurisdictions, respectively. The courts also appointed receivers

for said companies. Given the two rulings, Wahaha should be

evaluating its overall strategies because it has been defending

itself in multiple jurisdictions, with less than satisfactory

results. It is unknown whether Wahaha will challenge these

rulings.

November 21,

2007 AHN

The already soured

relationship between French food giant Danone and the Wahaha

Group has turned bitter on Wednesday after a court froze the

assets of two more foreign companies associated with the

Chinese drinks maker.

The Samoan Supreme

Court put two Wahaha subsidiaries, Mega Source Investments

and Honour Bright Investments, under receivership 管財人の管理下 on Wednesday on Danone's

request.

The British Virgin

Islands High Court had already placed Golden Dynasty

Enterprise, Gold Factory Developments, Platinum Net, Sunworld

Enterprises, Great Base International, Bountiful Gold

Trading, Ever Maple Trading Ltd and Wintell Enterprises under

the control of a court-appointed receiver on Nov. 9.

These offshore

companies are believed to be connected to Hangzhou-based

Wahaha and may be used to dissipate the assets of the China's

largest beverage company.

"They (Wahaha)

are actually majority shareholders of these so-called

non-joint venture companies who are producing Wahaha branded

products without permission," said Michael Chu, a

spokesman for Danone in Shanghai.

The receivers,

including accounting firm KPMG, are required to locate and

secure the assets of the identified companies.

Danone and Wahaha

forged a partnership in 1996. Danone owns 51 percent of the

39 joint venture companies with Wahaha.

The French food firm

sued its Chinese partner in June for allegedly selling Wahaha

beverages without its permission. Danone claimed losses and

foregone revenues of more than $100 million.

Aside from Samoa and

the British Virgin Islands, Danone also filed similar

lawsuits in Sweden and the U.S.

Wahaha filed a

countersuit claiming Danone illegally operates in China.

In addition, final

arbitral decisions are also pending in Stockholm and Hangzhou.

Overall, Wahaha has a pretty tough road ahead, while Danone is

having the upper hand on the legal matters. Of course, Danone’s business prospect in China is a

totally different matter, since winning in courts does not

naturally and necessarily translate into winning consumers’

hearts in China.

Wahaha is apparently preparing for the worse by using a brand new

trademark-Qili

With no end in sight for

this international dispute, both parties are probably feeling the

battle fatigue, and the bite of their legal fees. Will they try

to work things out with some kind of compromise on their own?

Will they attempt to reach some kind of agreement with the French

president as an intermediary (if he chose to intervene during his

trip to China)? Or will they continue the knock-down, drag-out

fight? As far as Danone is concerned, the last option seems most

likely if Wahaha does not give up a few inches, because Danone

currently stands in a very strong position.

2007/12/11 Forbes

Danone Denied In Wahaha

Ruling

Shares in French dairy

firm Danone turned sour on Tuesday, after the company vowed to

appeal a Chinese legal ruling that robbed it of the ownership of

the Wahaha beverage trademark after nearly ten years of effective

control.

Shares in Danone fell 1.75 euros ($2.57), or 2.9%, to 59 euros

($86.63), during midday trading in Paris. The Wahaha brand of

bottled water is the market leader in China, and Danone's

beverages sales in Asia accounted for 2.0 billion euros ($2.9

billion) last year.

"We will demand that the commission's decision be cancelled

by the relevant court," said Tao Wuping, Danone's chief

legal counsel, in Shanghai. He voiced his suspicions of

"local protectionism" in the ruling, which turned the

clock back ten years by awarding ownership of the Wahaha brand to

billionaire Zong Qinghou.

Monday(12/10)'s arbitration

decision in Hanghzou marked

the latest move in a long line of litigation disputes between

Danone and Zong Qinghou, the founder and owner of Wahaha Group.

The erstwhile partners are now bitter enemies after Danone built

up a majority stake in their joint venture in 1998, setting off a

chain of events that resulted in lawsuits against Zong and his

family this year.

Danone lost Monday's case on a technicality,

for failing to meet a deadline when filing for the arbitration. The company said that it rejected

this decision because of Wahaha's own failure to comply with the

terms of the joint venture created in 1996. According to Danone,

Wahaha never complied with its agreement to transfer its brand to

the joint venture in exchange for a total of 100 million renmibi.

Political obstacles from China's trademark office meant the two

companies chose to settle for a license agreement in 1999, which

Danone still sees as valid.

Yesterday's ruling by

the Hangzhou Arbitration Commission found that the agreement

to transfer the Wahaha brand to its joint ventures with

Danone, a focus of their high-profile row, has terminated.

The commission also

said Danone's demand for Wahaha Group to abide by the brand

transfer agreement had exceeded the lawsuit's time limit.

"This changes

nothing," said a Danone spokesperson on Tuesday. "The

impact is nil." She told Forbes.com that even though Wahaha

was now considered to be the owner of the brand, the 1999

trademark transfer agreement still allowed Danone to use it, as

majority shareholder of the former joint venture with Wahaha.

According to Dresdner Kleinwort analyst Warren Ackerman, the

Wahaha brand represents 3% of Danone's earnings-per-share. He

told Forbes.com that worries that Danone had lost the rights to

the brand appeared to be "wide of the mark."

The dispute has escalated to international levels, with Danone

successfully demanding a freeze on companies' assets linked to

Wahaha in Samoa and the British Virgin Islands. And French

President Nicolas Sarkozy's visit to China at the end of November

included the Wahaha dispute on the list of topics to discuss with

Chinese President Hu Jintao.

日本経済新聞 2007/12/20

仏ダノン 中国蒙牛と合弁解消

仏ダノンと乳業大手、中国蒙牛乳業は中国での乳製品分野での合弁事業を解消すると発表した。10月に別の中国乳業大手、光明乳業との資本・技術提携の解消を発表したのに続く中国企業との連携解消。

ダノンは飲料水などの合弁相手である杭州娃蛤蛤集団とのブランド使用などを巡って係争中。娃蛤蛤はダノンが蒙牛など他の食品関連企業と提携したことを「合弁事業の利益を損なう」と批判してきた。

Paris, December 21st 2007

Joint Statement between

Hangzhou Wahaha Group and Groupe Danone

Complying with the

expectation of both Chinese and French governments, both Wahaha

Group and Groupe Danone agree to finish antagonism and return

back to peace talks. Both parties agree to temporarily suspend

all lawsuits and arbitrations, stop all aggressive and hostile

statements and create a friendly environment for peace talks.

Both parties agree to carry out the talks on the basis of

adhering to the principles of equality and mutual benefits, to

seek common grounds by tolerating minor differences, to reach

mutual understandings and to strive for the success of peace

talks. Both parties will work together to further develop all

entities operating under the Wahaha brands and contribute to

develop the Sino-French friendship and promote the co operation

between the companies of the two countries.

China Post December

14, 2007

France's Danone says

it wants "appropriate process" to end dispute with

Chinese partner

French food and drink maker Danone said Friday it is willing

to suspend legal action against its Chinese joint venture

partner if the partner shows "concrete actions" to

reunify their group.

The offer from Emmanuel Faber, president of Danone Asia

Pacific Group, comes after Wahaha Group won an arbitration

ruling allowing it to use the popular Wahaha brand name

outside of the 39 joint ventures operated by the two.

There needs to be "an appropriate process of

negotiations with what we believe is an appropriate platform

for an agreement," Faber told a news conference.

"It would be held with appropriate guidance from

authorities," he said.

He said Wahaha was aware of the offer. He did not give

details or a timeframe.

December 22, 2007 NYT

Truce Reached in Fight

Over Chinese Beverage Company

After months of legal

skirmishes and name-calling over who controls Wahaha, one of

China’s biggest beverage makers, Groupe

Danone

of France and the Wahaha Group of China have agreed to return to “peace talks.”

In a joint announcement

late Friday, Danone and the Wahaha Group pledged to “suspend all lawsuits and