ameinfo.com 2007/3/6

Saudi Aramco statement on AOC sale of strategic stake to Hanjin

Energy

The Board of Directors of S-Oil Corporation, an affiliate of

Aramco Overseas Company B.V. (AOC), a subsidiary of the Saudi

Arabian Oil Company (Saudi Aramco), today agreed to sell 31.9

million treasury shares 金庫株, previously owned by Ssangyong

Cement Co. Ltd.雙龍セメント, to Hanjin Energy Co. Ltd., a

subsidiary of the Hanjin Group韓進グループ

incorporated under

the laws of Korea (Hanjin Energy).

Mr. Adil Al-Tubayyeb, Saudi Aramco Executive Director of Joint

Venture Development & Coordination and board member of AOC

who signed on behalf of AOC, said that with this partnership of

one of the world's largest logistics and shipping conglomerates,

all parties are expected to derive important synergies.

S-Oil will enhance its marketing capabilities by securing

long-term supply arrangements of fuel products to members of the

Hanjin Group, including both Korean Air Lines and Hanjin

Shipping. In turn, S-Oil may also develop shipping arrangements

of crude oil and petroleum products through Hanjin Shipping.

Entering into partnership through this transaction, S-Oil can

achieve its long term vision to reestablish itself as a

successful Korean company with a strong and reputable Korean

partner.

Company sources indicated that the total transaction value will

be approximately KRW 2.4 trillion (US$ 2.5 billion). This major capital transaction

will further enhance the already strong financial position of

S-Oil. After the closing of this transaction, S-Oil and Korean

Air will be able to expand their reach to customers and provide

better customer service through co-marketing and co-branding, as

well as joint promotional programs. S-Oil presently supplies 20%

of Korean Air's annual oil consumption, and 30% of Hanjin

Shipping's annual oil consumption.

S-Oil is a very successful model for economic interdependency

between consuming and producing nations, so this transaction will

contribute positively to that goal.

AOC

invested in S-Oil in 1991 and continues to support the

expansion and the growth of S-Oil. With this new partnership with

Hanjin Energy, the growth of S-Oil will continue.

Saudi Aramco, the parent company of AOC, has long supported

Korea's economic development by providing a reliable and stable

supply of crude oil. As a result, S-Oil has become a symbol of

economic cooperation between the Republic of Korea and the

Kingdom of Saudi Arabia.

Korean Air-Led Group to Buy $2.5 Billion S-Oil Stake

Korean Air Lines Co., the country's largest airline, will become a shareholder in oil refiner S-Oil Corp. as part of a 2.4 trillion-won ($2.5 billion) deal to secure a stable supply of jet fuel.

Hanjin Energy Co., formed last month by Hanjin Group, a conglomerate that controls Korean Air Lines, will buy 32 million shares of S-Oil for at 74,979 won each, the Seoul-based airline said in an e-mailed statement today. That's a 14 percent premium over the closing price of S-Oil, South Korea's third-largest oil refiner.

The agreement may allow S-Oil to build a second refinery and gives Korean Air part of a fuel supplier as the price of jet kerosene has soared 60 percent in the last two years.

``The price is better than what the market expected,'' said Ryu Je Hyun, an analyst at Mirae Asset Securities Co. in Seoul, who expected an offer of 70,000 won to 90,000 won a share. ``It won't be a big burden on Korean Air.''

S-Oil shares fell 1.9 percent to close at 65,900 won in Seoul, while Korean Air's stock dropped 0.3 percent to 34,250 won. Korean Air disclosed the agreement after the end of trading in Korea.

Saudi Aramco

The purchase of the 28.4 percent stake would make Hanjin Group the refiner's second-largest shareholder after Saudi Aramco, Saudi Arabia's state-owned oil company, which owns 35 percent. The affiliates will participate in S-Oil's management, justifying the premium offered for the shares, Ryu said.

The final acquisition price may change depending on S-Oil's dividend payout, Korean Air said in the statement.

S-Oil plans to invest 3.6 trillion won to build a second refinery as demand rises in China.

Crude oil prices, which have tripled since 2001, climbed to a record $78.40 a barrel in July. Fourth-quarter jet fuel prices rose 6.3 percent from a year earlier to $74.84 a barrel in Singapore after climbing to a record in August, according to Bloomberg data.

Hanjin Energy, established on March 2, is 82.5 percent owned by Korean Air, 14.6 percent held by Hanjin Shipping and Korea Airport Service has 2.9 percent. All the companies are controlled by Hanjin Group.

Korean Air sought to borrow most funds for the acquisition through loans from domestic banks, officials familiar with the transaction said in January.

Joo Ick Chan, an analyst at Daewoo Securities Co. in Seoul, wrote in a report last month that Korean Air would face interests costs of about 153 billion won annually based on a purchase price of 94,600 won a share and be forced to borrow the entire acquisition cost.

The transaction, scheduled for completion on April 2, is pending government approval, the statement said.

They also believe that the stock sale would help S-Oil finance its 3.5 trillion won ($3.7 billion) investment in new refining facilities and pay back its 800 billion won debt.

The company is set to build a 480,000 barrel-per-day crude refinery by 2010 in Seosan, South Chungcheong Province.

The mammoth project would raise its total refining capacity by almost 70 percent to 1.06 million barrels per day, outstripping the 650,000 barrels of the nation's No. 2 GS Caltex Corp.

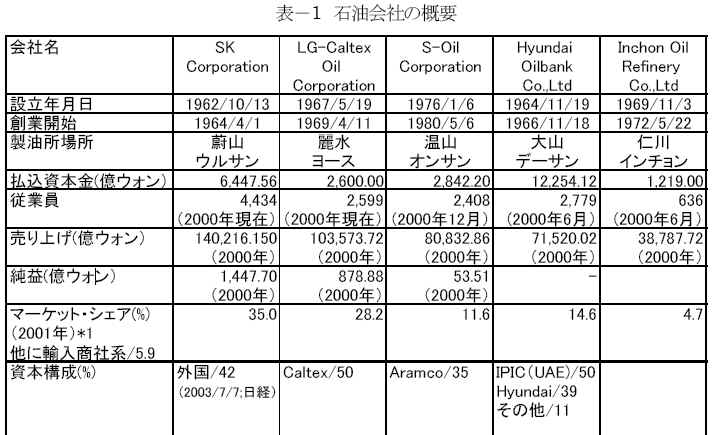

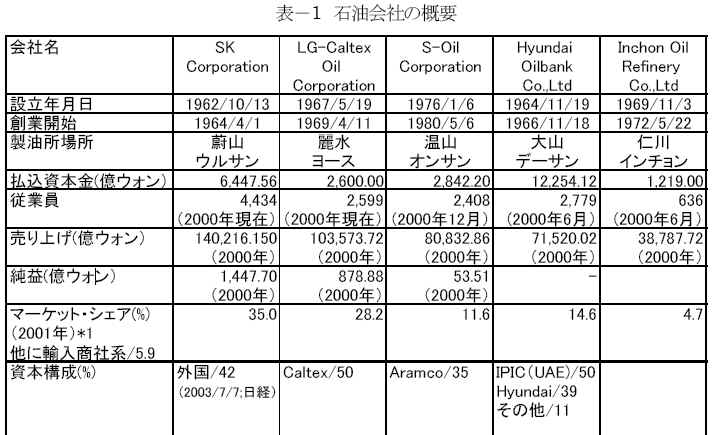

韓国の石油会社は仁川精油を含め、旧大韓石油公社の流れをくむ SK(SK Corporation). を筆頭にLG-Caltex Oil、S-Oil、現代オイルバンク(Hyundai Oilbank)の5社寡占体制である。

http://www.pecj.or.jp/japanese/division/division07/pdf/2003/2003034.pdf