Petrobras, Ultra Group and Braskem conclude deal to purchase Ipiranga Group

In one of the biggest transactions ever seen in Brazil, Petrobras, the Ultra Group and Braskem have reached an understanding to purchase Ipiranga Group businesses, consolidating and increasing petrochemical and fuel distribution sector businesses.

The transaction is worth

approximately US$ 4 billion.

By acquiring the

Ipiranga Group businesses, the three companies reinforce their

commitment to growth in Brazil, Rio Grande do Sul and the same

stakeholders targeted by Ipiranga: the shareholders, employees,

partners, community and consumers.

The

Ipiranga Group,

one of the largest and most traditional in Brazil, operates in

the oil refinery, petrochemical and fuel distribution sectors.

Last year it registered R$30 billion in net revenues, with Ebitda

at R$1 billion and net earnings of R$534 million.

Petrobras'

president, JoseSergio Gabrielli de Azevedo, said the deal is in

line with the company's strategic plan, reinforcing its active

presence in the Brazilian petrochemical industry, in which it

already has important holdings. To Gabrielli, "Petrobras

intends to have a more relevant role in petrochemicals than it

has had in the past few years. The Ipiranga negotiation is yet

another step in the strategy of consolidating important economic

groups in Brazil, with a relevant Petrobras presence in them.

From the downstream viewpoint, the executive also highlights the

operation is important as it increases the company's North,

Northeast, and Midwest network synergy.

Pedro

Wongtschowski, the Ultra Group president, emphasized the growth

that is expected with the transaction. "With this

incorporation, we take-on important assets, committed

professionals and, moreover, the Ipiranga flag, which is among

Brazil's ten most valuable brands and one of the country's most

respected companies. With the acquisition, we significantly

boosted our operations in the fuel distribution area, now holding

two of the sector's main brands: Ultragaz and Ipiranga. It is an

investment in the fuel, biofuel, and in the Brazilian markets.

Braskem's

president, JoseCarlos Grubisich, said the Rio Grande do Sul

group's incorporation is a water divider in the strategy at the

company he leads: "we are among the world's top ten

petrochemical companies. We are committed to Brazil, to Corporate

Governance, to and sustainable development.

"This new

petrochemical sector consolidation brings an important growth

potential to Braskem, with a new competitiveness and

profitability benchmark for our business," concluded

Grubisich.

Transaction procedure

The first stage involves Ultra Group acquisition of the shares

held by the families controlling the Ipiranga Group. The Ultra

Group will then make a public offering to purchase common shares

held by Ipiranga Group minority shareholders.

In the third step, Braskem and Petrobras will submit offers to

shareholders to delist Copesul.

In the fourth step,

the Ultra Group will incorporate preferred shares held by

Companhia Brasileira de Petrleo Ipiranga (CBPI), Distribuidora de

Produtos de Petrleo Ipiranga (DPPI) and Refinaria de Petrleo

Ipiranga (RPI) minority shareholders, who will receive preferred

shares in Ultrapar.

In the fifth and

final step, petrochemical assets will be sold

and handed over to Braskem and Petrobras. Fuel distribution

businesses absorbed by Petrobras will reinforce the company's

distribution activities in the North East, North and Midwest.

The assets will be distributed as follows:

Fuel distribution sector

Refining

Details of this transaction are included in the Relevant Fact issued this morning for Brazilian Securities Commission (CVM) consideration. The same information was filed with the Securities and Exchange Commission (SEC), the New York Stock Market (NYSE), Latibex in Madrid and the Buenos Aires Stock Market (MERVAL).

The transaction is

subject to regulatory approval in Brazil from the Economic

Defense Board (CADE), Economic Law Secretariat (SDE) and the

Economic Oversight Secretariat (SEAE).

In the fuel

distribution sector, the Ultra Group already owns the leading GLP

brand, Ultragaz, and will incorporate a highly significant brand

into its business, Ipiranga. This will result in a significant

increase in its sector presence based on best corporate

governance and management practices.

The petrochemical sector, Braskem will strengthen its Latin

American market leadership in thermoplastic resins, increasing

its stake in Copesul and advancing its strategy of building

growth by creating value.

Ipiranga's historical commitments to Rio Grande do Sul and to

Brazil will be upheld by Petrobras, the Ultra group and Braskem.

The company's social, cultural and environmental activities and

programs will also remain in place.

Petrobras, Ultra, Braskem to buy Brazil's Ipiranga for $4 billion

Brazilian oil giant

Petrobras, petrochemicals company Braskem and energy holding

Grupo Ultra said Monday they had agreed a joint deal to buy

Brazil's second-largest oil company, Grupo Ipiranga, in a deal

worth $4 billion.

In a presentation Monday, Petrobras said it would spend $1.3

billion to buy a stake in Grupo Ipiranga, while Braskem will

spend $1.1 billion and Grupo Ultra will pay for its stake by

issuing 52.8 million shares.

The deal is expected to close by the end of the year, and in

several stages, the buyers' group said.

Ultra Group will acquire all of the shares of Grupo Ipiranga,

later passing stakes on to Petrobras and Braskem.

"Petrobras is growing its role in Brazilian petrochemicals

and consolidating its position in distribution (of fuels),"

Petrobras CEO Jose Gabrielli said in a statement Monday.

Petrobras said the buyers' group would divide Ipiranga's more

than 4.200 service stations around Brazil, as well as its 730,000 mt/yr

petrochemicals capacity, its 17,000 b/d refining capacity and other assets, including

natural gas distribution and oil and gas exploration concession

stakes.

The buyout marks a major consolidation for Brazil's hydrocarbons

industry, as the five Brazilian families that control the 70-year-old

Ipiranga Group agree to sell their interests to some of Brazil's

biggest energy and petrochemicals players.

The buyers' group said Grupo Ultra would take control of

Ipiranga's network of service stations in the industrialized

south and southeast of Brazil, where fuel consumption is by far

the highest in the country.

Ipiranga S.A

One of Brazil's largest privately held companies, Ipiranga S.A. focuses on the domestic oil and petrochemical sectors. The company operates through the following primary divisions: Companhia Brasileira de Petróleo Ipiranga (CBPI); Distribuidora de Produtos de Petróleo Ipiranga (DPPI); Refinaria de Petróleo Ipiranga S.A. (RPISA); Ipiranga Petroquímica; Ipiranga Comercial Química; and others. Ipiranga also holds stakes in rival Copesul, among others. The company is one of Brazil's top three oil refiners--although far smaller than state-owned Petrobrás, which has long operated a near-monopoly on the country's refining market. Ipiranga is also in the top three in the distribution market, particularly through its network of nearly 3,500 Ipiranga gasoline stations. The company's active implementation of a franchising strategy, adding a variety of new services and amenities, such as convenience stores and the like, in its service stations, has contributed strongly to that operation; these services account for as much as 15 percent of the group's total sales, which topped BRL 21 billion ($6.9 billion) in 2003. Unable to compete with Petrobrás in the refined oil market, Ipiranga has shifted its focus to lubricants and related products, and also has targeted expansion in the GNV (vehicular natural gas) arena. Through Ipiranga Petroquimica, the company is a leading Brazilian producer of petroleum derivatives, such as polypropylene, solvents, and asphalt, among other products. Although the Ipiranga holding company remains privately held (and owned in part by the founding families), the company's DPPI, CBPI, and RPISA subsidiaries are all listed on the Brazilian stock exchange, Bolsa de Valores do Rio de Janeiro.Ipiranga Petroquimica produces four thermoplastic resins present in several day-by-day products.

The High, Medium and Linear Low Density Polyethylenes (HDPE, MDPE and LLDPE), besides Polypropylene (PP), are produced in the five industrial plants in the Petrochemical Complex of Triunfo-RS.

Ipiranga Petroquimica was founded in 1976 and it was first called Polisul Petroquimica. Hoechst (Germany), Petroquisa (state owned company) and Empresas Petroleo Ipiranga (one of the largest private company in Brazil) were the only Polisul shareholders.

It was in 1992 that Ipiranga and Hoechst bought Petroquisa's shares, taking over the control of Polisul. By that time, each shareholder had 50% of the company.

By the year 1997, Hoechst shareholders decided to focus their investments in science and health business. That was the opportunity when Ipiranga bought Hoechst shares and the name Polisul Petroquimica was changed to Ipiranga Petroquimica (now 100% owned by Empresas de Petroleo Ipiranga).

The petrochemical site of Triunfo (South Brazil) has many companies but Ipiranga was the first one to start up in 1982 (together with the cracker - COPESUL). It first began with a HDPE 60.000 ton/year capacity.

In 1986, the industrial plant was debottlenecked in order to produce 100.000 ton/year.

In 1990, a second industrial plant was built and it raised the HDPE production capacity to 220.000 ton/year.

The third unit to start up was built in 1996, reaching 350.000 ton/year HDPE production capacity.

The 150.000 ton/year PP plant and the 150.000 ton/year HDPE/LLDPE swing plant started producing in 1999.

In its Brazilian site (Triunfo), Ipiranga is able to produce 150.000 ton/year of PP, 400.000 ton/year HDPE and 150.000 ton/year HDPE/LLDPE in its five (05) petrochemical units.

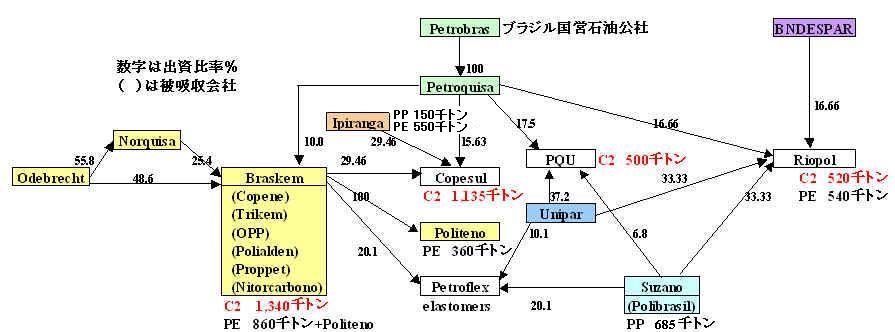

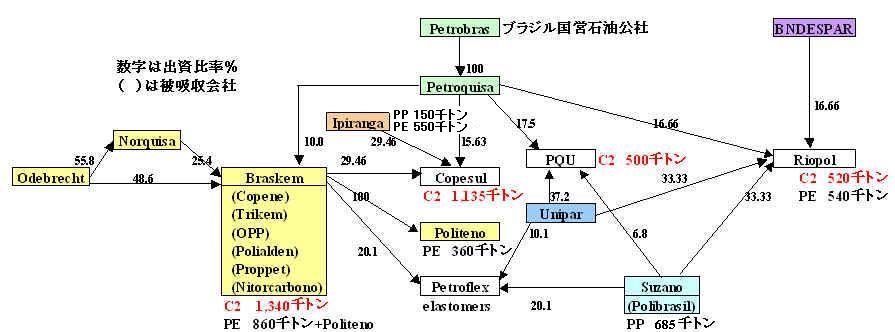

Ipiranga Group 29,46 % Braskem Odebrecht Group 29,46% Petroquisa 15,63% Others* 25,45% * Banks, pension funds, other investors.

Ultrapar Participações S.A. is one of Brazil's most solid conglomerates. It unites three different companies, each with a prominent position in its own segment: Ultragaz, the leader in Brazil's distribution market for Liquid Petroleum Gas (LPG), with a 24% market share; Oxiteno, the largest producer of specialty chemicals in Brazil and the only manufacturer of ethylene oxide and its main derivatives in Mercosur area (comprising Brazil, Argentina, Paraguay and Uruguay); and Ultracargo, a leading provider of integrated road transport, storage and handling services for chemicals and fuels.

Ultrapar was incorporated on December 20, 1953 and traces its origins to 1937, when Ernesto Igel established Companhia Ultragaz and introduced LPG for home cooking in Brazil. It also pioneered the development of the petrochemical industry in Brazil, which led to the founding of Oxiteno S.A Indústria e Comércio in 1970 at the newly established Mauá Petrochemical Complex in São Paulo.

The company currently

employs more than 6,500 people, operating in Brazil and Mexico.

The LPG operation is present in every state, excluding the Amazon

region, reaching more than 10.5 million homes. Oxiteno supplies a

broad range of market segments, particularly agricultural

chemicals, food, cosmetics, leather, detergents, packaging for

beverages, thread and polyester filaments, brake fluids,

petroleum, paints and varnishes. Ultracargo is a leading provider

of integrated logistics for chemicals and fuels, with 21% of

Brazil's tank storage capacity for chemical products. Ultracargo

accounts for approximately 71% of all tank capacity for liquids

at the Aratu terminal in the State of Bahia, which serves South

America's largest petrochemical complex.

The combined net revenues

of these three businesses in 2005 amounted to R$ 4.7 billion,

with EBITDA of R$ 546 million, and net income of R$ 299 million.

Since 1998 (the last year before the Company's IPO), Ultrapar has

reported an annual average compound growth of 18% in EBITDA terms

and 31% in net income terms.

LPG

Distribution:

Ultragaz is the leading distributor of liquid petroleum gas (LPG)

in the Brazilian domestic market, with a 24% market share. It

operates in the South, Southeast, Central West and Northeast of

the Country, catering to all market segments - residential,

commercial and industrial.

Chemical and Petrochemical: Oxiteno is the sole Brazilian producer of ethylene oxide, ethylene glycol, ethanolamines, glycol ethers and methyl-ethyl-ketone. Oxiteno is also a major producer of specialty chemicals. Oxiteno's products are used in many growing domestic and international industries, including polyester, packaging, paints, varnishes and cosmetics.

Logistics

of oils and chemical products: Ultracargo is the Brazilian

market leader in chemical products and fuels logistics. The

company offers transportation solutions using its own and

third-party fleets as well as storage services through

warehousing facilities at port terminals and rail junctions for

the transportation of chemical products. Transportation services

include integrated multi-modal transportation as well as

receiving and dispatching customers' goods. The company also

offers ship loading and unloading services, pipeline operations,

logistics programming and installation engineering.

2007/8/13 Bloomberg Notice Unipar 拡張

Petrobras, Unipar Plan New Brazilian Chemical Company

Petroleo Brasileiro SA, Brazil's state-controlled oil company, and União de Industrias Petroquimicas (Unipar) are in talks to join their stakes in Brazilian plastics and chemical plants into a single company.

The new company, to be called Cia. Petroquimica do Sudeste (CPS), will control factories producing thermoplastic resins and basic petrochemicals in Brazil's industrialized southeast, Petrobras, as the Rio de Janeiro-based oil company is known, said in a statement on its press Web site. Unipar, as Petrobras's prospective partner is known, will control the new company.

``We want to simplify and consolidate the Brazilian petrochemical industry so it can compete on a world scale,'' Petrobras Chief Financial Officer Almir Barbassa said in an interview. ``Right now, the Brazilian petrochemical industry has scale in Brazil but not internationally.''

The talks follow Petrobras's agreement to pay 2.7 billion reais ($1.4 billion) for Suzano Petroquimica SA on Aug. 3. The purchase, expected to be complete by year end, is part of Petrobras's plan to expand its petrochemical holdings so it can earn more from rising oil output, Chief Executive Officer Jose Sergio Gabrielli said at the time.

Petrobras, Unipar and Suzano previously were partners in petrochemicals plants in Sao Paulo and Rio de Janeiro, Brazil's two most industrialized regions. The plants include Petroquimica Uniao SA, Petroflex SA and Rio Polimeros SA.

Petrobras will invite other companies and investors in Brazil's chemical industry, such as the state development bank, BNDES, to participate in the new company, Jose Lima de Andrade Neto, head of Petrobras's chemical unit, told reporters today in Rio de Janeiro.

Petrobras and Unipar plan to sign an agreement within 90 days on how the new company will be structured, Petrobras said.

Unipar is controlled by Vilha Velha SA Administracao e Participacoes, a holding company controlled by Brazil's Geyer family.

NOTICE TO THE MARKET

Petroleo Brasileiro S.A. - PETROBRAS and UNIPAR - Uniao de Industrias Petroquimicas S.A. hereby announce that they have started negotiations on the constitution of Companhia Petroquimica do Sudeste (hereinafter “CPS”). CPS will aggregate PETROBRAS and UNIPAR assets for basic petrochemicals and thermoplastic resins in the Southeast of Brazil in order to achieve global production scale and a greater competitiveness, both key issues in this sector.

In the evaluation of the assets that will make up CPS, identical assumptions, criteria and principals will be applied, always recognizing and respecting the rights of UNIPAR, PETROBRAS and the other signatories of the Shareholders’ Agreements of Petroflex and RioPolimeros, including, in the latter case, Petroquisa, in order to acquire the shares of said companies, as a result of the acquisition, by PETROBRAS, of the controlling shares in Suzano Petroquimica S.A..

UNIPAR will be the controlling shareholder of CPS, retaining the majority of the company’s voting capital, while PETROBRAS will have an important role as a CPS shareholder. Thus PETROBRAS and UNIPAR will enter into a Shareholders’ Agreement, which will ensure that CPS will be supported by professional management, in line with the best corporate governance practices adopted by large nationally-owned publicly-held companies.

PETROBRAS and UNIPAR will make their best efforts to entering into an Investment Agreement within not more than 90 days of this date, establishing the conditions for the constitution of CPS.

Uniao de Industrias

Petroquimicas S.A. (UNIPAR) announces that on June 25, 2007 it

entered into the following legal transactions with Dow Brasil S.A.

(DOW):

(i) Irrevocably pledged to acquire 6,500,000 common shares and

6,500,000 preferred shares issued by Petroquimica Uniao S.A.,

owned by DOW(13% of voting capital and 12.97% of total capital);

(ii) Acquired 277,372 common shares and 277,372 preferred shares

(0.55% of PQU's voting and total capital ) issued by Petroquimica

Uniao S.A., owned by DOW;

(iii) Acquired from DOW, via its wholly-owned subsidiary Polietilenos Uniao

S.A.,

140,000 t p.a. LDPE plant located in Cubatao , in the state of

Sao Paulo.

(the production capacity of this subsidiary reached 270,000 t

p.a., as of 2007/8/1. As of the 3Q08, with the conclusion of

Capuava's ongoing expansion project, Polietilenos Uniao will have

a capacity of around 500,000 t p.a.)

The total value of said transactions amounts to R$ 210 million.