2010/1/24 brazzilmag.com ブログ

New Braskem: a Brazilian

Petrochemical Giant Is Born

Petrobras and Odebrecht, two Brazilian companies announced the

purchase of Unipar's share of the Quattor

petrochemical company and its incorporation into the competing

enterprise Braskem,

resulting in the creation of the Americas' largest company in the

industry in terms of thermoplastic resin production capacity,

according to a press release issued by Petrobras.

Brazilian holding

company Unipar said on Friday it reached an accord with

petrochemical company Braskem and state-run oil company

Petrobras to sell its controlling stake in Quattor.

Unipar said it would

receive a total 870 million reais ($477.5 million) for its 60

percent stake in Quattor and stakes in other Unipar units.

($1=1.822 reais)

----

| |

Quattor

Participacoes SA |

Petrobras

40% |

Rio Polímeros(RioPol) |

Rio

Polímeros

SA |

Nova Petroquímica

(Suzano Petroquímica) |

SA Quattor

Petroquímica |

UNIPAR

60% |

Petroquímica União (PQU) |

Quattor

Basic Chemicals SA |

| Polietilenos

União |

Polyethylenes

Union SA |

| UNIPAR's

Chemicals Unit |

|

Quattor is a plastic

solutions industry, the result of a merger between the former

petrochemicals RioPol and Nova Petroquímica(formerly known

as Suzano Petroquímica),

both belonging to Petrobras, with a 40% participation; the

remaining 60% corresponding to Petroquímica União (PQU), Polietilenos União and UNIPAR's Chemicals Unit,

all of which belong to UNIPAR.

Quattor is a

Brazilian petrochemical company headquartered in Rio de

Janeiro. Founded on June 12, 2008, Quattor is the second largest

petrochemicals in Brazil, behind only the Braskem and one of

the largest petrochemical of the Americas.

Quattor is the fruit of the union of assets UNIPAR(60%)

and Petrobras(40%), and now the set of five

companies, Quattor Participações SA, Quattor Basic Chemicals

SA (ex-Union Petrochemical SA), SA Quattor Petroquímica (formerly Suzano

Petroquímica SA), Polyethylenes

Union SA

and Rio Polímeros

SA(Riopol).

The company has 11 production units located in three

Brazilian states: Rio de Janeiro, São Paulo and Bahia, in addition

to the support office in São Paulo. It also has

laboratories Quality and Development Centers, which assist in

the development and improvement of its products.

Quattor produces

PEBD, PEAD, PEBDL, mPELBD (metallocenes),EVA copolymers, PP

homopolymer and pp copolymer, hydrocarbon UNILENE resins,

basic chemicals, aromatic solvents and aliphatic solvents.

新会社の能力は以下の通りとなる。(単位:千トン)

| |

エチレン |

PE |

PP |

| Braskem |

1,340 |

1,220 |

|

| Riopol

|

520 |

540 |

|

| PQU |

500 |

|

|

| Polietilenos |

|

270 |

|

| Suzano |

|

|

750 |

| 合計 |

(2,360) |

(2,030) |

(750) |

| Copesul

|

1,135 |

|

|

| Ipiranga

|

|

550 |

|

Operating from the start of

the petrochemical chain and building quality into the plastic

resins - the base for the development of different industrial

fields along the chain ?, Quattor makes the consumers' daily

life a little easier in several ways. This can be seen in more versatile

packaging, more durable domestic utensils, toys, cosmetics,

paints, and varnishes, more advanced medical equipment,

lighter and safer cars, more comfortable clothes, more

innovative appliances, and even bolder construction projects.

BASIC CHEMICALS

Aromatic and Aliphatic

Solvents

BASIC PETROCHEMICALS

Unilene: Quattor’s brand of hydrocarbon resins. They

are used by rubber, wood, and cardboard industries. They are

the raw material for making adhesives, plastics, concrete

cure, putties, asphalt components, paints, varnishes, and

hot-melt, to name a few.

BASIC CHEMICALS: used in the

manufacture of rubber, latex, industrial detergents,

lubrication oil additives, and aerosols, among others. The

group has products such as Butadiene, Benzene, Ortho-xylene,

Aromatic Residue, Cumene, Nonene, Tetramer, and Propane.

Solvents: Raw materials for

paints, pesticides, cleaning solvents, protective, and

anticorrosive oils, printing paints, and lubricants.

POLYETHYLENES

EVA

Ethylene and Vinyl Acetate

Copolymer is mostly used by transformers in the segments of

extrusion, expanded sheets, and adhesives. It is a raw

material for making hot-melt films and adhesives, among

others.

Low Density Polyethylene

(PEBD): used in food packaging, industrial bags, trash bags,

agricultural tarpaulins, flexible films for packaging and

labels for toys, lids, flasks for pharmaceutical and hygiene

products, among others.

Low Density Linear

Polyethylene (PELBD): primary raw material used in the

packaging of food products (e.g. rice, beans, flour, and

sugar), freezer packaging, animal feed packaging,

petrochemical products, and fertilizers.

Medium Density Linear

Polyethylene (PELMD): used in the packaging of toilet paper

and napkins, in the composition of diapers and sanitary

napkins, as well as in rotational molding of water

reservoirs, tanks, toys, and shipping containers.

Metalocenic Polyethylene

(mPE): produced from special catalysts, has been used in

diverse applications (such as technical films for meats, poultry,

and cereal, and stretch films) requiring excellent final

performance in terms of mechanical resistance or weldability.

High Density Polyethylene

(PEAD): used in the production of supermarket plastic bags,

produce sacks, containers for hygiene and cleaning products,

cosmetics, pharmaceuticals, and food products, as well as for

gas, water and sewage pipes, fuel tanks, shade screens and

other products.

POLYPROPYLENES

Homopolymer Polypropylene:

used in the production of threads and fibers for carpets,

decorative fabrics, ropes, and technical fabrics (not

destined for diapers, and sanitary napkins), household

appliances, raffia bags, paltes, packaging straps, disposable

cups and pots, kitchen wares, films for flexible packaging

for textile and food products, furniture, construction

materials and other products.

Polypropylene Heterophasic

Copolymer : due to its high impact resistance, even at low

temperatures, it is used in the production of automotive

parts such as bumpers, panels and battery casings, metallic

tube coating, toys, household appliances, industrial buckets

and boxes, kitchen wares, flasks and lids for cosmetics,

hygiene and cleaning products, ice cream pots, honeycombed

sheets, and other products.

Polypropylene Random

Copolymer: with its main characteristic being high

transparency, it is used in the production of disposable cups

and pots, transparent smooth sheets, water bottles, household

appliances, transparent containers and lids for cosmetic,

hygienic, cleaning, pharmaceutical, and food products,

transparent kitchen wares, films, and other products.

Petrobras is a partner of

Braskem, a company controlled by Odebrecht, and of Quattor, of

which Unipar was the majority stakeholder up until now.

The shareholders' agreement signed by Petroquisa (Petrobras' oil

industry subsidiary), Odebrecht, Braskem and Unipar provides for

an

increase in Petrobras' stake in Braskem, and the petrochemical company's

capital will receive an additional 4.5 billion to 5 billion

Brazilian reais (US$ 2.5 billion to US$ 2.8 billion). The

proposal had been under negotiation for months, but there was a

divergence among Unipar stakeholders concerning the sale.

Another agreement signed by Petrobras and Odebrecht provides for shared

decision-making at Braskem, which will now have a

near-monopoly over the Brazilian petrochemical industry. The

agreement establishes 50.1% of the voting capital to Odebrecht.

In order to make the deal viable, Petrobras and Odebrecht are

going to establish a holding company named BRK

Investimentos Petroquimicos, which will hold all of the

Braskem shares owned by the two; BRK will receive 2.5 billion

reais (US$ 1.4 billion) from Petrobras and 1 billion reais (US$

558.5 million) from Odebrecht.

"Thus, Petrobras will concentrate its investment in the

petrochemical industry, including its share of Quattor, into a

company that will have greater competitive advantages on a global

scale. The company will also have a guarantee of stake ownership

in this new company, to be shared with Odebrecht," according

to the press release issued by Petrobras.

Petrobras, Odebrecht and Braskem have signed another agreement

concerning management and ownership of the Petrochemical Complex

of the State of Rio de Janeiro (Comperj) and of the Suape

Petrochemical Complex, in the state of Pernambuco, both of which

are being built by Petrobras. After all operations are concluded,

Braskem will have 26 petrochemical plants.

Hydrocarbon Discovery

OGX announced January 22 that it has found hydrocarbons in the

albian section (the layer of soil formed between 112 million and

99.6 million years ago) of well 1-OGX-5-RJS, located in block

BM-C-43, in shallow waters in the southern part of Campos Basin

close to Rio de Janeiro.

The company identified a 130-meter column of oil, with net pay of

around 30 meters in carbonate reservoirs. OGX should continue

drilling this well up to its total estimated depth, of 4,300

meters.

"These initial results from well OGX-5 are very encouraging,

as they confirm that the high-quality carbonate reservoirs

detected in wells OGX-2 and OGX-3 are also present in the

southern reaches of our blocks", commented Paulo Mendonca,

OGX's general executive officer.

OGX is the largest Brazilian private company in the sector of oil

and natural gas in terms of maritime exploration area. The

company has 100% participation in block BM-C-43. Well OGX-5 is

located some 79 kilometers away from the coast of the state of

Rio de Janeiro, at water depths of approximately 150 meters.

Poor Quality

Brazil's regulatory body for the fuels sector, National Agency

for Petroleum, Natural Gas and Biofuels (ANP) has issued warnings

to 31 ethanol distributors in the state of Sao Paulo since the

beginning of the year. According to a note from ANP, the problem

is "Irregularities in the quality of the ethanol they are

transporting."

ANP inspectors examined 253 trucks transporting ethanol in the

Ribeirao Preto, Sao Jose do Rio Preto, Sorocaba, Paulinia and Sao

Jose dos Campos areas of the state. Six samples were collected

for laboratory analysis.

The distributors, after an administrative process, can be fined

from 5,000 reais to 5 million reais (US$ 2,743 to US$ 2.7

million)

According to ANP, in 2009 they made 6,373 inspections in the

state of Sao Paulo, which resulted in 1,964 warnings and 221

interdictions. ANP did not release data on fines.

-----------------

2010/1/22

Braskem acquires Quattor

and prepares for international expansion

The integration will allow the company to be more competitive

globally and consolidate its presence in the Americas

Braskem announces the completion of negotiations for the

acquisition of Quattor through an Investment Agreement signed

today between Odebrecht, Petrobras, Braskem and Unipar. The

agreement will allow Petrobras to consolidate its main

petrochemical assets in Braskem, which will remain as a private

company publicly traded and expand its ability to compete

globally.

The consolidation of the assets to Braskem will position as the

largest company in the Americas in the capacity of thermoplastic

resins (PE, PP and PVC), placing it in a new level of scale and

efficiency to meet the challenges of the international market.

Listed on 3 bags (BM & FBovespa, and NYSE) stock exchanges,

the company is to have annual revenues from $ 26 billion. With

integration between 1st and 2nd generation petrochemicals, its 26

plants located in five states (Sao Paulo, Rio de Janeiro, Rio

Grande do Sul, Bahia and Alagoas), will have capacity to process

5.5 million metric tons of resins.

"The establishment of the first and second generation

petrochemical companies, which are capital intensive, creates the

conditions for the Brazilian player that is one of the global

industries most challenging and competitive market for

thermoplastic resins. Furthermore, it allows the necessary

investments to monitor the growth of national economy, "says

Bernardo Gradin, president of Braskem. "The creation of a

company with global business and vocation is in line with the

growing role of Brazil in the international market," he

adds.

The transaction is valued at $ 700 million, including the figures

for the acquisition of companies and Polibutenos Unipar

Commercial Braskem, which will also take commitments Unipar next

to BNDESPar.

Additionally, an association agreement signed between Petrobras,

Odebrecht, Braskem Braskem gives the right of first refusal to

participate as a member of the projects Petrochemical Complex of

Rio de Janeiro - Comperj - and Petrochemical Complex of Suape in

Pernambuco. These projects, already underway, will increase in a

significant supply of basic petrochemicals in the country, and

the resin.

Among the steps of the operation are provided: (1) the creation

of a holding company in which Odebrecht and Petrobras transferred

their actions and realize capitalization of U.S. $ 3.5 billion,

(2) followed by a capital increase at a Braskem value between $

4.5 and $ 5 billion by the current shareholders of Braskem and

Petrobras and Odebrecht to take part, through the holding company

created with the $ 3.5 billion it contributed in step (1), (3 )

acquisition by Braskem shares of Quattor held by Unipar and other

shares of Unipar, (4) the incorporation by Braskem shares of

Quattor owned by Petrobras.

The capital increase will strengthen the company's structure

allowing greater financial flexibility to continue its program of

investment and internationalization.

The president of Braskem, the integration of modern plants,

competitive and complementary geographic diversification (units

in five states) and raw materials (naphtha, ethane, propane, HLR,

propylene refinery and ethanol), Braskem will have won of scale,

flexibility and operational efficiency.

The Investment Agreement will be referred to the assessment of

CADE, the Administrative Council for Economic Defense, with the

offer of a voluntary agreement for the reversibility of Operation

- APRO.

Gradin said that Braskem will continue its internationalization

project, combining vocation for growth with the capacity to

invest and compete globally. "We will have a positive impact

on the close relationship with our customers through greater

integration in the supply chain, access to services of high added

value, innovative and consistent investments in research and

development."

The company will maintain the highest standards of corporate

governance prevailing in the international market, based on:

transparency and independence of executive management; search for

consistent results for shareholders; commitment to improving the

competitiveness of the productive chain and the promotion of

sustainable development .

--------------

five companies, ,

(ex-Union Petrochemical SA), , and (Riopol).

The company has 11 production units located in three

Brazilian states: Rio de Janeiro, São Paulo and Bahia, in addition

to the support office in São Paulo. It also has

laboratories Quality and Development Centers, which assist in

the development and improvement of its products.

Quattor produces

PEBD, PEAD, PEBDL, mPELBD (metallocenes),EVA copolymers, PP

homopolymer and pp copolymer, hydrocarbon UNILENE resins,

basic chemicals, aromatic solvents and aliphatic solvents.

Quattor is a product of the union

between UNIPAR (60%) and Petrobras (40%). A large company that

will grow further with the integration of , , UNIPAR - Divisão Química/UDQ -, / Riopol, Nova Petroquímica (formerly Suzano Petroquímica).

Quattor’s, established in

June, 2008, caused great repercussion in the market because it

brought more competition to the petrochemical sector. The first

and second generation integrated production chains involve the

production of basic petrochemicals (ethylene, propylene, and

etc.) and thermoplastic resins (polyethylene and polypropylene),

which allows Quattor to offer a complete product portfolio.

25 Sep 2012 Foster Wheeler

Foster Wheeler signs Petrobras Linhares

Fertilizer and Chemicals

Petrobras to build $3 billion Gas-to-Chemicals complex

Petróleo Brasileiro S.A. (Petrobras) from Brazil selected Foster Wheeler AG from

Switzerland for a greenfield world-scale Gas-to-Chemical

complex to be built at Linhares, in Esperito

Santo State, southeast Brazil.

Estimated around $3 billion capital expenditure,

the Linhares Gas-to-Chemical complex is identified

as UFN-IV, standing for the Unit of Nitrogen Fertilizer

N°4, as part of Petrobras program to reduce Brazil reliance on fertilizer

imports.

In its business plan 2012 – 2016, Petrobras will invest $13.5 billion in gas and

energy from which 42% will be dedicated to fertilizer.

This business plan is to solve two issues:

- The massive development of the offshore oil production is generating high

quantities of associated gas to be monetized

- Brazil imports more than half of its nitrogen fertilizer.

Therefore, Petrobras’s gas and energy business plan is to

use the natural gas available as by-product of the crude oil production as

feedstock to develop the fertilizer sector

in Brazil and contribute to its self sufficiency in ammonia and urea.

Petrobras monetizes gas by series of fertilizer projects

The Gas-to-Chemical project is also part of this monetization program of the

natural gas.

As part of this program, Petrobras is already proceeding with the construction

of a 303,000 t/y of ammonium sulphate production unit to be installed at the

Laranjeiras (SE) Petrobras fertilizer plant in 2013.

In 2014, Petrobras is expecting to start the commercial operation of the

UFN-III, the unit of nitrogen fertilizer N°3, in

progress at Tres Lagos, in the Matto Grosso do Sul Sate.

The UFN-III will have a capacity of:

- 1.2 million t/y urea

- 800,000 t/y ammonia

- 4,000 t/y urea granulation

In addition, Petrobras business plan 2012- 2016 is including the

UFN-V, the unit of nitrogen fertilizer N°5, to

produce ammonia in Uberaba, in Matto Grosso State.

Regarding the UFN-IV, the unit of nitrogen

fertilizer N°4, it will be integrated in the Gas-to-Chemical planned in Linhares,

in Esperito Santo State.

Estimated to $3 billion capital expenditure, the Petrobras Gas-to-Chemical

project should produce 1 million t/y of fertilizer including:

- Urea unit

- Ammonia unit

- Methanol unit

- Acid acetic unit

- Formic acid unit ギ酸

- Melamine unit

The Gas-to Chemical should be located near the Gas Treatment Unit of Cacimba (UTCG)

in order to facilitate the gas supply as feedstock.

Foster Wheeler to perform Basic, FEED and PMC

According to the contract signed with Petrobras for the UFN-IV project, Foster

Wheeler is in charge of:

- Basic engineering design

- Front end engineering and design (FEED)

- Technical assistance and training during the Basic engineering design phase up

to the commissioning and plant performances tests.

In parallel of the tasks mentioned above, Foster Wheeler will also conduct the

integration of the different production units of the Gas-to-Chemical complex

through:

- Process Licensors Management

- Brazilian sub-contractors Management

Petrobras and Foster Wheeler are planning to complete the basic design and the

FEED by the end of 2013 and to move into the EPC in 2014 for completion in 2016.

In addition to Petrobras Gas-to-Chemical project, the Esperito Santo State

expects to develop further downstream activities related to the fertilizer and

agriculture sector as well as in the petrochemical industry.

In that respect the State Government and the City of Linhares are working with

Petrobras to develop a framework of tax incentives for the development of the

infrastructures of the oil and gas industry.

More than the previous Petrobras fertilizer projects to help the local

development of the agriculture, the Linhares Gas-to-Chemical project awarded to

Foster Wheeler is a strategic link between Petrobras upstream crude oil

activities and Brazil reduction of fertilizer and chemical imports.

ーーー

2012年10月23日 ChemnetTokyo

千代田化工、自社酢酸技術をブラジル国営石油会社に供与

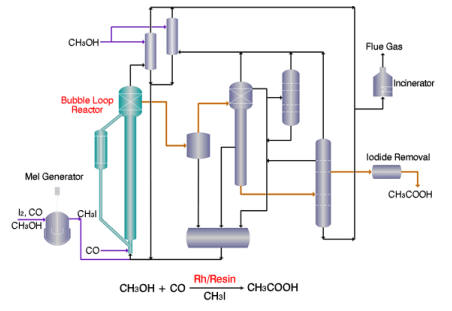

千代田化工建設は23日、自社開発した酢酸プロセスがブラジル国営石油公社ペトロブラス社の「UFN-IV

」プロジェクトに酢酸製造技術として採用されたと発表した。

年産20万トン規模で、2013年末までに初期設計を完了の予定である。契約金額は非公開。

ペトロブラス社は、同国エスピリト・サント州にガス化学コンプレックスの新設を計画しており、アンモニア、尿素、メタノール、酢酸、蟻酸、メラミンなどのプラントを建設する計画を進めている。

(1)契約内容 :酢酸製造技術の実施許諾、技術支援、トレーニング等

(2)装置能力 :年産200,000 トン規模

(3)契約金額 :非公表

(4)建設予定地 :ブラジル、エスピリト・サント州リニャレス

(5)スケジュール :2013 末までに初期設計完了予定

千代田化工建設が開発した酢酸製造技術(ACETICA)プロセスは、メタノール・カルボニル法酢酸製造プロセスのひとつで、同社が自社開発した固体触媒を利用し、原料のメタノールと一酸化炭素を高収率で酢酸に転換する。

(1)固体触媒のため取扱いが容易(2)高価なロジウムのロスが少ない(3)反応器の効率が高い(4)副生成物が少ない、(5)腐食性が低い、などの特徴がある。また、気泡塔ループリアクターの採用によりスチームや電力などの用役消費量を低減する。

ーーー

千代田が開発したACETICA®

PROCESSは、メタノールのカルボニル化反応によって酢酸を製造するプロセスです。高性能な固定化触媒及び循環気泡塔型反応器などのユニークな技術を採用することによって他社競合プロセスと差別化しています。

高性能な固定化触媒

メタノールのカルボニル化反応にはロジウム錯体が触媒としてよく使われるが、反応液に溶かすために、大量の水が必要で、大量の水は助触媒であるヨウ化メチル(CH3I)と反応して腐食性の高いヨウ化水素酸を生成し、プラントの腐食を引き起こす。

また、製品酢酸から水を分離するのに大量のエネルギーを消費する。

これらの課題を解決する狙いで、千代田は高温に耐えられるビニルピリジン樹脂を開発し、ロジウム錯体を樹脂上に固定化することに成功した。

循環気泡塔型反応器

ACETICA® PROCESSは、樹脂触媒を活用できる循環気泡型反応器を採用

2020/2/7

Brazilian state-run oil company Petrobras

continues its sales spree and is looking into fully divesting its stake in a

concession with Chevron, and reduce interest in a license with Sinopec,

Kallanish Energy reports.

The company said earlier this week it

started the process to sell its entire stake (62.5%)

in the Papa-terra field, located deepwater in the Campos Basin. The

asset is part of the BC-20 concession and started operations in 2013.

With two platforms, it produced an

average of 17,300 barrels of oil-equivalent per day.

Chevron owns the remaining 37.5% non-operating stake in the field.

In a separate statement, Petrobras said

it wants to sell part of its equity interest in two exploratory blocks

belonging to the BM-PAMA-3 and BM-PAMA-8 concessions, located in the Para-Maranhao

Basin offshore.

The Brazilian firm is the operator of the

blocks with 100% ownership in the BM-PAMA-3 concession

and 80% in the BM-PAMA-8 concession, in

partnership with China’s Sinopec. The plan is

to divest up to 50% of its holdings in the first license and 40% of holdings

in the second.

Sinopec could exercise its pre-emptive

right to acquire Petrobras’ stake in the shared concession.

“The concessions present a reduced

exploratory commitment with the potential to prove significant volumes and

establish position in a new frontier area,” said Petrobras.

These transactions are in line with the

company’s strategy to optimize its portfolio and improve its capital

allocation, in order to maximize value for shareholders. They are part of

its 2020-24 divestment plan targeting $20-30 billion in sales.