日本経済新聞 2010/9/16 カスピ海産天然ガス、黒海経由でLNGで輸出

カスピ海産天然ガス、LNGで輸出

黒海経由、欧州向け

アゼルバイジャンとグルジア・ルーマニア 3カ国共同で基地 中東・ロシア産に対抗

カスピ海産の天然ガスが初めて液化天然ガス(LNG)で輸出される見通しとなった。旧ソ連のアゼルバイジャン、グルジアとルーマニアは共同でLNG基地を建設し、黒海経由で欧州に供給する。アゼルバイジヤンなどガスピ海周辺のガス産出国はロシアが中心だった供給先を欧州に広げ、価格交渉力を高める。欧州のエネルギー市場を巡り中東、ロシア、カスピ海諸国による三つどもえの競争が激しさを増してきた。

3カ国の首脳が14日、アゼルバイジャンの首都バクーで会談し、LNG基地の建設を含むガス供給で合意した。同国沖のシャーデニス鉱区などで産出する天然ガスを既存パイプラインでグルジアに輸送し、黒海沿岸のLNG輸出基地を経由してLNG輸送船でルーマニアに運ぶ。ルーマニアにはLNG受け入れ基地を建設する。

3カ国のエネルギー企業が3分の1ずつ出資して事業会社を設立。今後6ヵ月で事業化調査を進める。ガス供給量は年80億立方メートルを見込む。建設総額は最大で45億ユーロ(5000億円)となる見通し。

アゼルバイジャンのアリエフ大統領は同日の式典で「ガス輸出は地域のエネルギー地図を塗り替える」と述べた。ハンガリーも同日、計画への参加を表明し、ル一マニア経由でほかの中東欧諸国に輸送される見込み。

アゼルバイジャンやトルクメニスタンなど旧ソ連のカスピ海諸国はすでに欧州向けの「ナブッコ・パイプライン」によるガス供給計画を検討している。これに並行してLNG輸出を進め、輸送手段を多様化する狙いだ。

アゼルバイジャンの天然ガス埋蔵量は1兆3000億立方メートルに達し、生産量は2020年に年400億立方メートルまで増える可能性もある。トルクメンも世界第4位の8兆立方メートルの埋蔵量を持つ。

一方、旧ソ連諸国への影響力を確保したいロシアは危機感を強めている。独占天然ガス企業ガスプロムは今年かろアゼルバイジャン産ガスの輸入を始め、来年の輸入量を今年比2倍の20億立方メートルに引き上げる方針。

同社のミレル社長は今月初めにアゼルバイジャンを訪問。「シャーデニス鉱区の権益を取得する準備がある」と述ベた。ナブッコに対抗するため、黒海を経由して欧州へ天然ガスを輸出する「サウス・ストリーム」計画も進めている。ただ、中東などでのガス増産に伴い、天然ガス価格は足元で低迷。供給過剰感が強く、「新規パイプランは事業採算に合うか疑問」との見方も多い。

September 15, 2010

Eurasia Daily Monitor

Black Sea LNG Project Draws on Gas from Azerbaijan

During a meeting on September 13-14 in Baku, Presidents Ilham Aliyev of Azerbaijan, Mikheil Saakashvili of Georgia, and Traian Basescu of Romania, as well as Prime Minister Viktor Orban of Hungary, announced the launching of a liquefied natural gas (LNG) project. Designated as the Azerbaijan-Georgia-Romania Interconnector (AGRI), and linking up with Hungary, this is the first-ever LNG project in the Black Sea.

AGRI

envisages five steps:

1) transporting Azerbaijani gas by an existing pipeline, eastward

across Georgia to the Black Sea port of Kulevi (oil terminal

owned by Azerbaijan);

2) liquefying the gas at Kulevi;

3) shipping the liquefied product by tankers to Romania's port of

Constanta;

4) re-gasifying and

delivering the product into Romania's pipeline system, partly for

that country's consumption; and

5) delivering the remainder into Hungarys gas transport system,

whether for use in that country, in Austria, or farther in EU

territory.

The heads of Azerbaijan's State Oil Company, Georgia's Oil and Gas Corporation, and Romania's Romgaz adopted a draft charter for the new joint venture AGRI. This shall be headquartered in Romania, with each of the three state companies holding an equal share in the joint venture. Other companies will be able to join AGRI as shareholders in the future. Basescu is keen for Turkmenistan to be included.

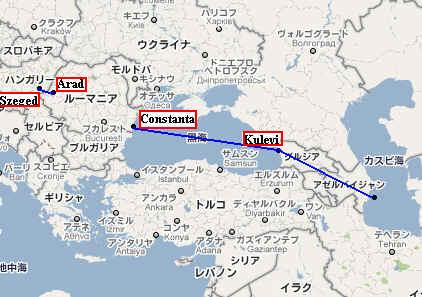

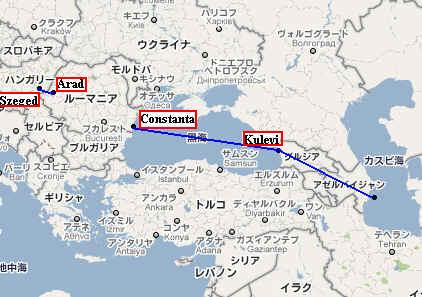

AGRI necessitates rehabilitation of that pipeline across Georgia and its prolongation for a short distance to Kulevi; building a liquefaction and a regasification terminal in Kulevi and Constanta, respectively; and investing in a shuttle line of small-capacity LNG tankers in the Black Sea. Meanwhile, Romania and Hungary are about to complete the short pipeline link Arad-Szeged, connecting the two countries' gas transport systems. Thus, AGRI can open the way for Azerbaijani gas exports into Central Europe, in a different mode than the Nabucco pipeline project.

Kulevi features an oil export terminal, installations with a throughput capacity being doubled to 20 million tons per year, a railroad for crude oil and products, a reservoir park (oil-tank farm), and two moorings for tankers of up to 120,000 dwt. Azerbaijan's State Oil Company owns the port and installations. Kulevi handles some oil volumes produced by Tengizchevroil at the onshore Tengiz field in Kazakhstan.

According to Azerbaijan's Industry and Energy Minister, Natig Aliyev, the AGRI project should start with a liquefaction capacity for 2.5 billion cubic meters (bcm) of gas per year, rising to 8 bcm per year in the next stage and up to 20 bcm ultimately. For his part, Basescu envisages developing the Constanta LNG terminal in three successive stages, involving 10 bcm in annual regasification capacity with each stage.

Romania and Hungary intend to ask European Union authorities to tender out a feasibility study for the project. Meanwhile, "preliminary" cost estimates range widely from 1.2 billion Euro to 4.5 billion Euro. No sources of financing have been identified as of yet. The duration of construction work is estimated to last four years.

AGRI answers to certain specific interests of each of the three stakeholders, at least theoretically. For Azerbaijan, it would provide the most direct transportation route for gas to Europe, apart from the Nabucco pipeline project. Georgia, already crisis-crossed by operating and potential transit routes, welcomes any additional project for confirming the country's reliability and buttressing Western interest in Georgia's stability. Romania would gain an additional import option through LNG, while Basescu (a former merchant marine captain) perceives in this an unprecedented opportunity for development of his native city, Constanta.

Basescu is a long-time proponent of LNG transportation in the Black Sea with a terminal in Constanta. For nearly a decade, Romania had hoped for an LNG deal with Qatar. Eventually Bucharest realized that Turkish authorities would not allow LNG tanker traffic, on top of the oil tanker traffic, through the over congested Bosporus Strait. Thus unable to share in the global LNG expansion, Romania is adopting an LNG solution internal to the bottled-up Black Sea. Cut off from global LNG markets, and inaccessible to ocean-going LNG tankers, the Black Sea basin may become a local market for small LNG volumes originating in Azerbaijan and, potentially, Turkmenistan.

The AGRI project, if pursued seriously, can undermine Nabucco by reducing the volumes of Azerbaijani gas available to that pipeline project. Azerbaijan's existing output level (reported at 23.5 bcm in 2009, anticipated at 28 bcm in 2010 --- Trend Capital, September 14), its internal consumption (10 to 11 bcm per year in 2009-2010), and its export commitments (some 8 bcm to Turkey and Georgia combined), do not seem to leave sufficient gas volumes to support both Nabucco's first stage (at 8 to 10 bcm per year) and the LNG project at the same time.

While Nabucco (main element in the EU-backed Southern Corridor) is strategic to European consumer countries and Caspian producer countries, AGRI is not of strategic significance to either group of countries. Within the current parameters of production and supply, and pending a boost in Azerbaijan's gas production or a trans-Caspian flow of Turkmen gas, a choice must be made between pursuing Nabucco or AGRI.