毎日新聞 2011年7月25日

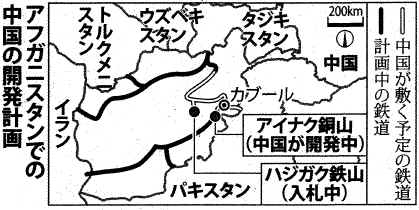

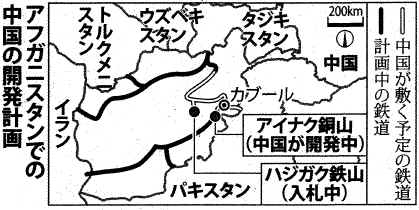

「9・11」後の10年:米軍撤収のアフガン 中国、埋蔵資源を皮算用

◇治安悪化で事業に懸念も

アフガニスタンの首都カブールから約35キロ南のロガル州Aynak アイナク。荒涼とした褐色の丘陵地に、推定埋蔵量3000万トンの世界有数の銅鉱が眠 る。かつては国際テロリストのウサマ・ビンラディン容疑者(5月に殺害)が潜んでいた地区だが、今は中国の国有企業「中国冶金(やきん)科工集団 (MCC)」が銅山開発を進めている。

「土地を接収された親戚は補償金をたっぷりもらった。周辺地域の道路も整備してくれた。中国人は素晴らしい」

地元の男性ルスタム・カーンさん(65)が言った。この10年、米軍が夜間に民家急襲を繰り返し、村人は恐怖のどん底にいた。米軍撤収と中国企業参入が、ともに「悲願」として語られている。

◇

アフガン資源調査所のセディキ所長によると、80年代当時、軍事侵攻していたソ連の調査団が国内約1万カ所で石油や天然ガス、金、宝石類などの埋蔵資源地を見つけた。

しかし、紛争で開発は進まず、ソ連軍は撤退。タリバン政権崩壊後の05年ごろ、米国防総省を含む米英の調査団が入り、ソ連が残した膨大な資料を調べ直し、資源価値は3兆ドルでレアアースも豊富だと分かったという。

アイナク銅山の開発事業は、にわかにアフガンの資源に注目が集まったのを利用した、カルザイ政権による「国家再生」の大型開発計画第1弾となった。鉱業省のジャワド報道官は08年の入札で中国が落札した理由について「群を抜いて条件がよかった」と語った。

中国側などの発表では2014年ごろに生産を開始し、中国国内の年間生産量の5分の1に当たる年30万トンの産出を目指す。銅山に直結する鉄道、 その周辺地域では病院、発電所、学校、モスク(イスラム礼拝所)も建設。初期投資総額は約44億ドルで、1万人の雇用も生み出すという。

世界で資源外交を進める中国がアフガンにも触手を伸ばした格好だが、必ずしも順調ではない。

入札に絡み、多額のわいろが中国側から当時の鉱業相に渡ったとの疑惑を09年に米紙が報じ、アフガンで存在感を増し始めた中国への米国の警戒感を 示した。また、来年始まる鉄道工事は、パキスタン国境からアイナク銅山やカブールを経由して中央アジアに至る長大な計画だ。しかし、米軍撤収に伴い、各地 で武装勢力による妨害が懸念され、14年の生産開始を危ぶむ声も高まり始めた。

北京の外交関係者は「中国にアフガンの復興や平和を本気で支える気があるとは思えない」と語る。チベットや台湾などの問題を抱える中国は他国への内政不干渉の原則を掲げている。治安や復興で深入りすれば、周辺国の親タリバン勢力を刺激する恐れもある。

◇

アフガン政府の大型開発事業第2弾はバーミヤン州のハジガク鉄山だが、中国はこのほど入札を取り下げた。「中国はアイナクすら実現が難しいと自覚し始めた」(地元記者)との臆測が飛び交う。

Afghanistan expects enough gains in security from the surge in foreign military efforts to set the Aug 3 target date for iron mining bids. In January it invited 22 companies, including 15 from India, to bid for the development of the Hajigak iron ore deposits, described as a high-quality ore vein and the largest un-mined iron deposit in Asia. Kabul said it expected exploration to begin in 2012 and production two years later. The government sees the value of the iron reserves as some US $350 billion.

The deposit was first discovered by British geologists in the 1890s, and mapped in more detail by Russians in the 1960s, who estimated it held some 1.8 billion metric tons of ore. Thirty years of invasion, civil war and insurgency have meant the ore, containing an estimated 62 per cent iron, has never been exploited commercially. Exploiting the deposit 80 miles west of Kabul is a cornerstone of plans to build up the Afghan economy and defeat the Taliban-led insurgency, according to the government..

中国は、資源確保で多くの投資をしてきたリビアでもカダフィ政権の先行きに不安が強まると、反政府勢力と接触し始めた。資源確保を巡る「したたか さ」だが、攻勢を強めるタリバンとも接触を試みる可能性はあるのか。アフガンの未来に影響を与え始めた中国の動向に関心が集まる。

Times May 15, 2008

Afghanistan copper

deposits worth $88 billion attract Chinese investorsJeremy Page

in Aynak

In a dusty, windswept

valley 20 miles southwest of Kabul there stands a cluster of

derelict buildings, littered with shrapnel, shell casings and

unexploded ordnance.

It is an

unremarkable scene by Afghan standards - at first sight, just

another sad monument to three decades of war.

Yet this desolate,

seemingly hopeless, place is the source of Afghanistan’s most recent chapter of violence

- and possibly now of a brighter economic future.

It was here, in the Aynak valley, that al-Qaeda trained and

planned for the 9/11 attacks that triggered the US-led invasion

of Afghanistan in 2001. And it is here, seven years on, that

Afghanistan - with the help of British geologists and a Chinese

mining company - will lay the foundations of a new economy in the

next few weeks.

Somewhere beneath

the valley’s floor lies one of the world’s biggest untapped copper

deposits, estimated to be worth up to $88_billion (£44 billion) - more than double

Afghanistan’s entire gross domestic product

(GDP) in 2007. In November, a 30-year lease was sold to the China

Metallurgical Group for $3 billion, making it the biggest foreign

investment and private business venture in Afghanistan’s history. Last week the Afghan

Government approved the contract, clearing the way for the

revival of an industry that dates back to Alexander the Great.

“After ten to 12

years, Afghanistan’s people will have fair living

standards,” declares Ibrahim Adel, the

Minister of Mines, and one of the few optimists left in Kabul. “Afghanistan will not need to

borrow or ask for any money.”

To put it in

perspective, Aynak’s price tag equalled 20 per cent

of all foreign aid to the country since 2001, and the annual

royalties of $400 million represent 45 per cent of its state

budget.

The obstacles are

still formidable: security is negligible here and it will take

five years to build the mine, as well as a power station,

railway, schools, hospitals and even mosques.

Detractors echo

concerns about Chinese investment in Africa, saying that

Afghanistan is ill-equipped to absorb such huge sums of money or

to assess the social and environmental costs.

Nevertheless, Aynak

is perceived as a test case for dozens more companies with an eye

on Afghanistan’s rich mineral resources,

including copper, iron, aluminium, oil, gas, marble and

gemstones.

In addition, if it

succeeds, experts say that it could help to wean the country off

the opium that accounts for a quarter of its GDP, and helps to

fund the Taleban insurgency.

“Afghanistan has

abundant known mineral resources,” said Stephen Peters, of the US

Geological Survey, which completed a two-year survey of the

country last year. “All the ingredients are there to

build a modern society.”

Plans are already

afoot to auction off further deposits of iron ore, oil and gas,

which Mr Adel has marked out on an old Soviet geological map in

his office in Kabul. He admits that security is a problem, but

says that mining companies are used to working in unstable

countries.

“If we can create

jobs for the people, give them salaries, they will be satisfied

with their lives,” he says.

“This is one way

to control extremism.” Aynak and its 400 megawatt power

plant will employ 5,000 people directly ? 90 per cent of them

Afghans, and another 15,000-20,000 indirectly. Up to 4,000 others

will build a railway to the Pakistani border, and several

thousand security guards will be recruited from surrounding

villages.

“All of this is

in the contract,” says Mr Adel. “The Chinese have to build mosques.

They have to build schools. They have to build hospitals, markets

and small bazaars.”

Aynak, he

continues, is more than just a copper mine: it encapsulates

Afghanistan’s modern history. The site was discovered in 1974

by the Soviets,

who built the now derelict buildings, mapped the area and took

thousands of rock samples.

Their plans were

thwarted by Mujahidin rebels who surrounded Aynak and cut off all

transport and telecommunications links. “We were ambushing them all the

time,” recalls General Hatiqulluh Luddin,

who led the rebels around Aynak and still commands 30,000 men in

the area.

After the Soviet

troops withdrew in 1989, the new Government tried to continue

their work but was soon engulfed by civil war.

The Afghan

Geological Survey, which contained the Soviet Aynak research, was

then destroyed in a battle for Kabul in 1994.

When the Taleban

took over in 1996 they showed no interest in Aynak and allowed

al-Qaeda to turn it into its main training camp.

Only after the

Taleban’s overthrow did Aynak rise back to

the top of the economic agenda. In 2003 President Karzai asked

Britain to help to rebuild the Afghan Geological Survey and

prepare Aynak for an injection of foreign investment.

Soon afterwards a

team from the British Geological Survey arrived in Kabul to start

recovering and organising the 78 reports and 1,300 maps on Aynak,

which were mostly in Russian and based on obsolete Soviet

methodology.

That work helped to

attract bids last year from 14 international mining companies, of

which the Kabul Government shortlisted nine, from countries

including Russia, the United States and India.

When the Government

selected the Chinese company, some rivals grumbled that it should

not benefit from the security and aid that Western countries were

providing. Others accused the Chinese of paying

kickbacks,

as their offer was $1 billion higher than expected.

Integrity Watch

Afghanistan, a non governmental organisation which published a

report on Aynak, says that Afghanistan does not have the capacity

to regulate the project or to assess the environmental costs,

such as acid waste polluting water supplies.

“They are sitting

on treasure, but do they have a Finance Ministry that can handle

it?” asks Lorenzo Delesgues, IWA’s director.

Around Aynak, some

people share the concerns, and local MPs have threatened to form

a human chain around the mine if its revenues do not benefit the

community.

For most, however,

the mine has offered a glimmer of hope on an otherwise bleak

horizon.

“This project

will save us,” said Khalil Stanakzai, a

27-year-old doctor in Kandahari-Pul, the nearest town to Aynak.

“People need jobs

and don’t mind who provides them ?

Americans, British or Chinese.”

中国資源大手がアフガン鉱山相に多額わいろか、銅山開発権の見返り

2009年11月18日、米紙ワシントン・ポストは、アフガニスタンのイブラヒム・アデル鉱山相が、銅山開発権落札の見返りに中国企業から多額のわいろを受け取っていた疑惑を報じた。瀟湘晨報の19日付の報道。

中央政府直轄の国営企業で、冶金・天然資源開発・製紙・不動産開発などを行う「中国冶金科工集団(中冶集団)」と、中国最大手の銅生産企業「ジアンシー・コッパー(江西銅業)」は07年11月、共同でアフガンのアイナク銅山の開発権を落札。しかし、軍事情報に詳しい米国の政府関係筋の情報では、落札に際して、中冶集団からイブラヒム・アデル鉱山相に3000万ドル(約27億円)が渡っていたという。

アイナク銅山はアフガニスタンとソ連が共同で74年に発見した世界最大級の銅山。アフガンの首都・カブールの東南約30kmに位置し、長い戦乱のため未開発のままになっていた。その埋蔵量は推定1000万トン、中国国内全体の埋蔵量の3分の1にあたるという。

中冶集団と江西銅業による35億ドルの投資は、アフガンにとって過去最大額の外国による投資となり、さらに中国側からは、開発事業に付随するイン

フラ整備事業として、発電所や鉄道の建設を申し出た。これは銅山本体の3倍にあたる投資額と推定される。米紙の報道では、中国側はこれを足がかりに、鉄・

金・宝石などアフガンのほかの天然資源開発を狙っていると指摘する。

サイド・タイェブ・ジャワド駐米大使はこれについて、「落札過程はクリーンなもの」と強調。アデル鉱山相は「これまでの在任中において、いかなる

わいろも受け取っていない」と疑惑を否定している。中国企業による落札については、「彼らの提案したインフラ建設などが競合他社よりも条件的には圧倒的に

優れていたため」と説明している。