2011/6/30 日本経済新聞

期待のシェールガス、「割安」は神話か

米紙報道に波紋

福島第1原子力発電所の事故以来、火力発電の需要が世界的に高まるなかで、期待を一身に集める新たな発電燃料が「シェールガス」だ。これ

まで開発困難だった硬い頁岩(けつがん=shale)の岩盤に含まれるガスで、近年の技術開発で大量生産が可能になった。30日には三井物産が新たな権益

取得を発表するなど、日本企業の参入も相次ぐ。だが、開発ブームの原動力だった「シェールガス=割安」の“神話”に米有力紙が疑問を呈し、波紋が広がって

いる。

三井物産は米テキサス州の鉱区権益を6億8000万ドル(約550億円)で米石油会社から取得するという。日本勢によるシェールガス・オイル関連投資では過去最大だ。

シェールガスの新規開発は世界中で引きも切らない。日本企業では三井物のほか、三菱商事、住友商事など大手商社がそろって参入済み。中国は

27日、同国南部のシェールガス4鉱区を対象に初の入札を実施し、国内開発・量産へ一歩前進した。先週は英石油大手BPのロシア合弁会社TNK−BPも、

ウクライナのシェールガス田開発に18億ドルを投じる計画を明らかにしたばかり。米ではガスの供給拡大に伴うパイプライン需要逼迫(ひっぱく)の思惑か

ら、パイプライン会社のM&A合戦が過熱するなどの余波も広がっている。

ただ、ブームにあやうさはつきもの。シェールガスを巡ってはかねて、乱開発による環境への悪影響が指摘されてきた。金融危機を招いた米金融

機関のずさんな経営を暴き、2年連続でピュリツァー賞を受賞した非営利組織(NPO)の「プロパブリカ」も、シェールガス開発による河川の汚染問題などを

頻繁に取り上げている。

今回、冷水を浴びせかけたのはニューヨーク・タイムズだ。27日付の1面記事でシェールガス開発の経済性に真っ向から疑問符を突きつけた。

その根拠は、同紙にリークされた米政府エネルギー情報局(EIA)内の。

一部のEIA職員はシェールガス開発の費用対効果に懐疑的で、ガス開発会社は「失敗のために設立されたようなもの」「その多くは破綻する可能性が高い」と

書いた。ある高官は企業側の産出予測について、最も生産性の高いガス井をもとに算出した楽観的なもので「理性を失った誇張」と批判。同紙はこのほか、

シェールガスの開発ブームに警鐘を鳴らす数多くのメールを紹介した。

EIAは中立の立場から政府のエネルギー政策を支えるのが主な役割で、シェールガスについては推進の立場をとっている。賛否両論が渦巻いていたEIA内部の事情が明らかになり、エネルギー業界は蜂の巣をつついた騒ぎとなった。

真っ先に反応したのは米ガス開発2位のチェサピーク・エナジー。27日の寄り付きで株価が急落したこともあり、マクレンドン最高経営責任者

(CEO)は同日、報道を批判する声明を発表。米エクソンモービルやBPに混じって「ミツビシやミツイ」の名も挙げ「シェールガスの経済性について、合計

でが

2兆ドルにも上るエネルギー業界の優良企業が、ニューヨーク・タイムズの一記者や一握りの活動家よりも詳しくないことがあろうか」といささか挑発的に反論

した。「伝説のオイルマン」と呼ばれる米有力投資家ブーン・ピケンズ氏も「業界よりニューヨーク・タイムズが詳しいわけがない」と同調した。

一方、勢いづく勢力もある。ニューヨーク州選出のモーリス・ヒンチー下院議員(民主)は、報道は「ウエイクアップ・コール(目覚まし)」と述べ、米証券取引委員会()に対し、業界が「投資家や世間を欺いたかどうか」調べるよう要請した。

ニューヨーク・タイムズは「複数の関係者がメールを提供した」と書いた。メールが寄せられた背景が義憤なのか、EIA内部の主導権争いなの

かは判然としない。まだ議論百出といった状況で、本当の費用対効果はヤブのなかだ。ただ、シェールガスの将来に過度な期待は禁物ということなのかもしれな

い。30日の三井物の株価も小幅に上昇しては押し戻される展開が続いている。

June 26, 2011 New York

Times

Drilling Down

Behind Veneer, Doubt on Future of Natural Gas

Energy companies have worked hard to promote the idea that

natural gas is the fossil fuel of tomorrow, and they have found

reliable allies among policy makers in Washington.

“The

potential for natural gas is enormous,”

President Obama

said in a speech this year, having cited it as an issue on which

Democrats and Republicans can agree.

The Department of Energy boasts in news releases about helping

jump-start the boom in drilling by financing some research that

made it possible to tap the gas trapped in shale formations deep

underground.

In its annual forecasting reports, the United States Energy

Information Administration, a division of the Energy Department,

has steadily increased its estimates of domestic supplies of

natural gas, and investors and the oil and gas industry have

repeated them widely to make their case about a prosperous

future.

But not everyone in the Energy Information Administration agrees.

In scores of internal e-mails and documents, officials within the

Energy Information Administration, or E.I.A., voice skepticism

about the shale gas industry.

One official says the shale industry may be “

set up for failure.”

“It is quite

likely that many of these companies will go bankrupt,”

a senior adviser to

the Energy Information Administration administrator predicts.

Several officials echo concerns raised during previous bubbles,

in housing and in technology stocks, for example, that ended in a

bust.

Energy Information Administration employees also explain in

e-mails and documents, copies of which were obtained by The New

York Times, that industry estimates might overstate the amount of

gas that companies can affordably get out of the ground.

They discuss the uncertainties about how long the wells

will be productive as

well as the high prices some companies

paid during the land rush to lease mineral rights. They also raise concerns about

the unpredictability

of shale gas

drilling.

One senior Energy Information Administration official describes

an “irrational exuberance” around shale gas. An internal

Energy Information Administration document says companies have

exaggerated “the appearance of shale gas well

profitability,” are highlighting the performance

of only their best wells and may be using overly optimistic

models for projecting the wells'productivity over the next

several decades.

While there are environmental and economic benefits to natural

gas compared with other fossil fuels, its widespread popularity

as an energy source is relatively new. As a result, it has not

received the same level of scrutiny, according to some

environmentalists and energy economists.

The Energy Information Administration e-mails indicate that some

of these difficult questions are being raised.

“Am

I just totally crazy, or does it seem like everyone and their

mothers are endorsing shale gas without getting a really good

understanding of the economics at the business level?”

an energy analyst

at the Energy Information Administration wrote in an April 27

e-mail to a colleague.

Another e-mail expresses similar doubts. “I agree with your concerns

regarding the euphoria for shale gas and oil,”wrote a senior officialin the

forecasting division of the Energy Information Administration in

an April 13 e-mail to a colleague at the administration.

“We

might be in a ‘gold rush'wherein a few folks have

developed ‘monster'wells,”

he wrote, “so everyone assumes that all the

wells will be ‘monsters.'”

The Energy

Information Administration's annual reports are widely followed

by investors, companies and policy makers because they are

considered scientifically rigorous and independent from industry.

They also inform legislators'initiatives. Congress, for example,

has been considering major subsidies to promote vehicles fueled

by natural gas and cutting taxes for the industry.

In any organization as big as the Energy Information

Administration, with its 370 or so employees, there inevitably

will be differences of opinion, particularly in private e-mails

shared among colleagues. A spokesman for the agency said that it

stands by its reports, and that it has been clear about the

uncertainties of shale gas production.

“One

guiding principle that we employ is, ‘look at the data,'”

said Michael

Schaal, director of the Office of Petroleum, Natural Gas and

Biofuels Analysis within the Energy Information Administration. “It is clear the data shows that

shale gas has become a significant source of domestic natural gas

supply.”

But the doubts and

concerns expressed in the e-mails and correspondence obtained by

The Times are noteworthy because they are shared by many

employees, some of them in senior roles. The documents and

e-mails, which were provided to The Times by industry

consultants, federal energy officials and Congressional

researchers, show skepticism about shale gas

economics, sometimes

even from senior agency officials.

The e-mails were provided by several people to The Times under

the condition that the names of those sending and receiving them

would not be used.

Some of the e-mails suggest frustrations among the staff members

in their attempt to push for a more accurate discussion of shale

gas. One federal analyst, describing an Energy Information

Administration publication on shale gas, complained that the administration

shared the industry's optimism. “It seems that science is pointing

in one direction and industry PR is pointing in another,”

wrote the analyst

about shale gas drilling in an e-mail. “We still have to present the

middle, even if the middle neglects to point out the strengths of

scientific evidence over PR.”

The Energy Information

Administration, with its mission of providing “independent and impartial energy

information to promote sound policymaking”

and “efficient markets,”

was created in

response to the energy crisis of the 1970s because lawmakers

believed that sound data could help the country avoid similar

crises in the future.

As a protection from

industry or political pressure, the Energy Information

Administration's reports, by law, are supposed to be independent

and do not require approval by any other arm of government.

Its administrator,

Richard G. Newell, who announced this month his plans to resign

to take a job at Duke University, has hailed the prospects for

shale gas, calling it a “game changer”

in the United

States energy mix. “The energy outlook for natural gas

has changed dramatically over the past several years,”

Mr. Newell told the

Natural Gas Roundtable, a nonprofit group tied to the American

Gas Association. “The most significant story is the

transformative role played by shale gas.”

A number of factors have

also helped create more interest in shale gas. The nuclear

disaster in Japan in March has focused attention on the promise

of natural gas as a safer energy source.

And last year, as energy

market analysts warned about tougher federal regulations on oil

and coal, particularly after the BP oil spill and the Massey coal

mining accident, they also pointed to natural gas as a more

attractive investment.

But a look at the Energy

Information Administration's methods raises questions about its

independence from energy companies, since the industry lends a

helping hand to the government to compile those bullish reports.

The

Energy Information Administration, for example, relies on

research from outside consultants with ties to the industry. And some of those consultants

pull the data they supply to the government from energy company

news releases, according to Energy Information Administration

e-mails. Projections about future supplies

of natural gas are based not just on science but also some

guesswork and modeling.

Two of the primary

contractors, Intek and Advanced Resources International, provided

shale gas estimates and data for the Energy Information

Administration's major annual forecasting reports on domestic and

foreign oil and gas resources. Both of them have major clients in

the oil and gas industry, according to corporate tax records from

the contractors. The president of Advanced Resources, Vello A.

Kuuskraa, is also a stockholder and board member of Southwestern

Energy, an energy company heavily involved in drilling for gas in

the Fayetteville shale formation in Arkansas.

The contractors said they

did not see any conflict of interest. “Firstly, the report is an

extremely transparent assessment,” said Tyler Van Leeuwen, an analyst

at Advanced Resources, adding that many experts agreed with its

conclusions and that by identifying promising areas, the report

heightened competition for Southwestern.

Intek verified that it

produced data for Energy Information Administration reports but

declined to comment on questions about whether, given its ties to

industry, it had a conflict of interest.

Some government watchdog

groups, however, faulted the Energy Information Administration

for not maintaining more independence from industry.

“E.I.A.'s

heavy reliance on industry for their analysis fundamentally

undermines the agency's mission to provide independent expertise,”

said Danielle

Brian, the executive director of the Project on Government

Oversight, a group that investigates federal agencies and

Congress.

“The

Chemical Safety Board and the National Transportation Safety

Board both show that government agencies can conduct complex,

niche analysis without being captured or heavily relying upon

industry expertise,” Ms. Brian added, referring to two

independent federal agencies that conduct investigations of

accidents.

These sorts of concerns

have also led to complaints within the administration itself.

In an April 27 e-mail, a

senior petroleum geologist who works for the Energy Information

Administration wrote that upper management relied too heavily on

outside contractors and used “incomplete/selective and all too

often unreal data,” much of which comes from industry

news releases

“E.I.A.,

irrespective of what or how many ‘specialty'contractors are hired,

is NOT TECHNICALLY COMPETENT to estimate the undiscovered

resources of anything made by Mother Nature, period,”

he wrote.

Energy officials have

also quietly criticized in internal e-mails the department's

shale gas primer, a source of information for the public, saying

it may be “on the rosy side.”

The primer is written by

the Ground Water Protection Council, a research group that,

according to tax records, is partly financed by industry.

The Ground Water

Protection Council declined to respond to questions.

Tiffany Edwards, a

spokeswoman for the Department of Energy, said that the shale gas

primer was never intended as a comprehensive review and that

further study was continuing.

Asked about the views

expressed in the internal e-mails, Mr. Schaal says his

administration has been very explicit in acknowledging the

uncertainties surrounding shale gas development.

He said news reports and

company presentations were included among a range of information

sources used in Energy Information Administration studies. Though

the administration depends on contractors with specialized

expertise, he added, it conforms with all relevant federal rules.

And while production from

shale gas has not slowed down and may not any time soon, he said,

a lively debate continues within the administration about shale

gas prospects.

June

28, 2011

Lawmakers

Seek Inquiry of Natural Gas Industr

Federal lawmakers called

Tuesday on several agencies, including the federal Securities

and Exchange Commission, the Energy Information

Administration and the Government

Accountability Office, to investigate whether the natural gas industry has provided an accurate

picture to investors of the long-term profitability of their

wells and the amount of gas these wells can produce.

“Given

the rapid growth of the shale gas industry and its growing

importance for our country's energy portfolio, I urge the S.E.C.

to quickly investigate whether investors have been intentionally

misled,” wrote Representative Maurice D. Hinchey, Democrat of New York, in one of

three letters sent to the commission by four federal lawmakers,

all Democrats.

The calls for

investigations came amid growing questions about the

environmental and financial risks surrounding natural gas

drilling and especially a technique known as hydraulic

fracturing, or hydrofracking, used to release gas trapped

underground in shale formations.

Members of the House

Committee on Natural Resources said they hoped to hold a hearing

in the next several weeks to discuss natural gas drilling.

Senator Benjamin L. Cardin, Democrat of Maryland, sent a

letter to the Government Accountability Office, the investigative

arm of Congress, asking it to look into questions about the

environmental impacts of hydrofracking, the accuracy of reserves

estimates, and industry regulation.

State lawmakers also

sought more information.

In Maryland, Delegate

Heather R. Mizeur, Democrat of Montgomery County, sent a letter

to the state comptroller and the attorney general calling for an

investigation into disclosures related to the financial and

environmental risks of drilling.

In New York,

Assemblywoman Barbara S. Lifton, a Democrat and longtime critic

of drilling, sent a letter to the New York State comptroller,

Thomas P. DiNapoli, calling for a similar investigation and

citing roughly $1 billion in state pension funds invested in

shale gas companies.

The New York attorney

general, Eric T. Schneiderman, sent subpoenas to five oil and gas companies ordering them

to provide documents relating to the disclosure the companies

made to investors about the risks of hydrofracking, according to

sources briefed on the investigation.

A spokesman from Mr.

Schneiderman's office declined to provide copies of the

subpoenas.

The five companies

subpoenaed - Talisman, Chesapeake Energy, E. O. G. Resources,

Baker Hughes and Anadarko - all declined to comment.

The calls for

investigations follow articles in The New York Times describing

doubts reflected in internal e-mails from federal regulators and

natural gas industry officials about the costs associated with

shale gas and the reliability of company reserves estimates.

Oil and gas companies and

energy market analysts strongly rejected the views expressed in

the industry and federal e-mails published by The Times.

In an open letter to his

employees, the chief executive of Chesapeake Energy, Aubrey

McClendon, said the company's prospects were bright.

“There

is no reason to believe that shale gas wells will have shorter

lives than our conventional wells ? some 8,000 of which are 30

years old or older,” Mr. McClendon wrote.

Some financial services

companies also released research notes saying they believed shale

gas was now profitable for many companies.

But four federal

lawmakers - Mr. Hinchey; Representative Edward J. Markey, Democrat of Massachusetts; and

Representatives Carolyn B. Maloney and Jerrold Nadler, both Democrats of New York -

sent letters calling for the S.E.C. to reconsider recent rule

changes that allow companies to avoid disclosing details about

the proprietary technology used to predict future gas production

and to avoid some third-party audits of those predictions. They

asked the commission whether third-party reserves audits should

be made mandatory.

The lawmakers also called

for an investigation into industry representatives'accusations of

possible illegality or reserves overbooking. A spokesman for the

S.E.C. declined to comment.

In a letter to Steven

Chu, the secretary of energy, Ms. Maloney and Mr. Nadler asked

his department to assess how inaccuracies in production

projections could affect energy policy.

The federal Energy

Information Administration also faced questions from Mr. Markey

and Mr. Hinchey about its reports related to natural gas and its

use of industry-tied contractors in writing those reports.

Voicing strong support

for the natural gas industry, a bipartisan group of eight federal

lawmakers from gas-producing states sent a letter to President

Obama on Monday asking him to promote continued natural gas

development “by any means necessary, but most

specifically, by unconventional shale gas recovery.”

“The

need for the United States to move toward energy independence

becomes more crucial as the crisis in the Middle East and North

Africa worsens,” the letter said.

2011/9/7 日本経済新聞

国連、シェールガス採掘に国際標準

環境汚染の懸念払拭狙う

国連は新型天然ガスの「シェールガス」の普及を後押しするため、地下水の汚染などの環境問題を起こさない採掘方法の国際標準をつくる。フランスが生産を禁止するなど採掘時の環境汚染への懸念が開発の妨げとなっているためだ。欧米各国の政府のほか、資源開発会社や非政府組織(NGO)を加え、11月に欧州本部で開く会合で具体的な基準について議論を開始する。

シェールガスは地中の頁岩(けつがん)に含まれ、化学物質や砂を含んだ水を高圧で注入して岩盤に亀裂をつくり、採取する。しかし、採掘によって地下水が汚れたり、ガスが地表に漏れ出したりする危険性が指摘され、北米以外では商業生産は本格化していない。

国連は注入水が含有する化学物質や採掘方法を一つ一つ点検し、最も安全性の高いやり方を特定し、それを国際標準にして各国に示す。今のところ、地下水に悪影響を与える化学物質の使用は禁じ、注入水は最終的に抜き出すよう求める方針。セメントで地下水と隔離することも有効と見ている。飲用水の水脈近くでの採掘を避けるため、水脈を確認する地質調査の実施も盛り込む見通し。

北米以外での採掘が本格化すれば開発会社にとってもメリットが大きいため、欧米の主要企業が議論に参加する意向を示しているという。環境関連のNGOも議論に参加させ、慎重派の意見も国際標準に反映させる。

国際エネルギー機関(IEA)の予測では、2035年時点の天然ガス需要は08年に比べて63%増え、世界のエネルギー需要の4分の1を賄う。開発が順調に進めば、35年に天然ガス全体の11%をシェールガスが占める見通しだ。

2012年 3月 13日 WSJ

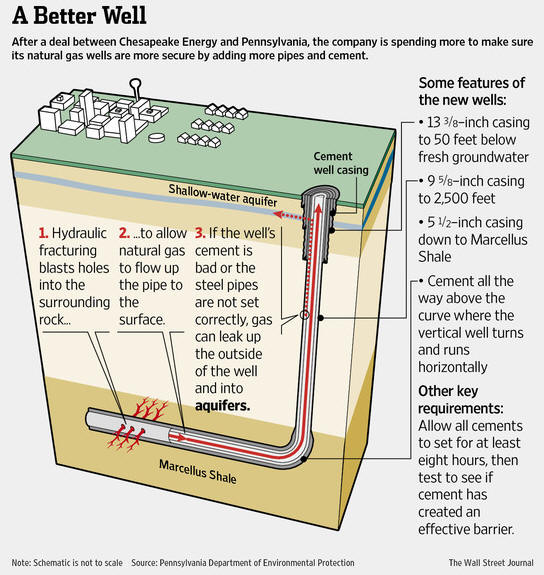

天然ガス採掘大手サウスウエスタン・エナジーのマーク・ボーリング副社長と、米非営利団体(NPO)環境防衛基金のシニア政策アドバイザーのスコット・アンダーソン氏らは、天然ガスの採掘が水質汚染につながったといわれるケースを共同で調査し、原因は採掘坑の構築の仕方であり水圧破砕法(フラッキング)ではないとの結論に達したことを明らかにした。

その上で、両者はセメント工事の改善や試験の徹底などガス井の構築への基準強化を求めた。

環境保護論者の間には水質汚染は水圧破砕法が原因だとして激しい批判が起きていたが、最近は、エネルギー関連業者や環境問題の専門家、規制当局の間で、多くのケースで不適切な工事が原因だという見方が強まっている。

水質汚染のあった採掘坑では、水道水を汲み上げる帯水層に接する部分がセメントで適切に隔離されておらず、汚染物質が帯水層に流れ込んだという。

2010年4月に発生したメキシコ湾のディープウォーター・ホライズンでの原油流出事故も、セメントによる採掘坑が適切に構築されていなかったことが主な原因であると米連邦当局は明らかにしていた。