ConocoPhillips

Basell USA, ConocoPhillips sign PP marketing agreement

ConocoPhillips Opts Out of Yanbu Refinery Investment

ConocoPhillips’ Board of Directors Approves Spin-off of Phillips 66

2002/8/30

ConocoPhillips Merger Completed

http://www.phillips66.com/newsroom/NewsReleases/rel403.html

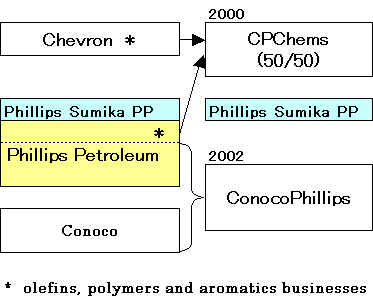

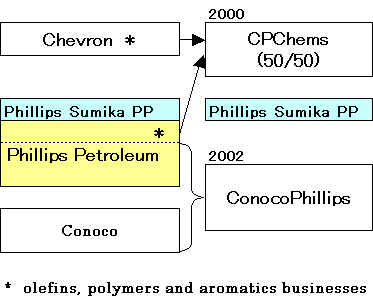

ConocoPhillips has completed the merger of Conoco Inc. and Phillips Petroleum Company, following clearance by the U.S. Federal Trade Commission earlier today. Shareholders of both companies and all U.S. and foreign regulatory authorities cleared the merger earlier this year.

2002/3/12

Phillips Shareholders Approve Merger with Conoco

http://www.phillips66.com/newsroom/NewsReleases/rel382.html

The shareholders of Phillips Petroleum Company voted to approve the proposed merger of equals with Conoco during a special meeting held here today.

2001/11/18

Conoco and Phillips Agree to Merger of Equals

$35 Billion

Strategic Combination Creates Third-Largest Integrated U.S.

Energy Company

http://phillips66.com/newsroom/NewsReleases/rel368.html

Conoco Inc. and Phillips Petroleum Company today announced that their boards of directors have unanimously approved a merger of equals, and that the companies have signed a definitive merger agreement. The new company, which will be named ConocoPhillips, will be a strong competitor with enhanced returns and accelerated growth opportunities from an excellent financial and operational position.

Basell USA, ConocoPhillips sign PP marketing agreement

Basell USA Inc and ConocoPhillips announced Tuesday the signing of an agreement under which Basell will be the exclusive purchaser and marketer of the polypropylene resins produced at ConocoPhillips' new Bayway plant in Linden, NJ The 775-mil lb/yr plant is scheduled to start up early next year.

ConocoPhillips has informed the Saudi Arabian Oil Company (Saudi Aramco) it will end participation in the new refinery project being built in Yanbu Industrial City.

"The quality of Saudi Aramco as a partner and significantly reduced capital costs from the recent re-bidding process made it a very difficult decision for us," said Willie Chiang, senior vice president, Refining, Marketing and Transportation, ConocoPhillips. "We ultimately decided this project was not consistent with our current strategy to reduce our downstream footprint. We value and look forward to continuing our relationship with Saudi Aramco."

ConocoPhillips is an integrated energy company with interests around the world. Headquartered in Houston, the company had approximately 30,000 employees, $153 billion of assets, and $149 billion of revenues as of December 31, 2009.

07-14-2011

ConocoPhillips Pursuing Plan to Separate into Two Stand-Alone,

Publicly Traded Companies

Plan creates two leading,

independent energy companies

Consistent with ConocoPhillips’ previously stated strategies and

focus on value creation for its shareholders, ConocoPhillips’

board of directors

has approved pursuing the separation of the company’s Refining &

Marketing

and Exploration

& Production

businesses into two stand-alone, publicly traded corporations via

a tax-free spin of the refining and marketing business to

ConocoPhillips shareholders.

Following the completion of the proposed separation,

ConocoPhillips will be a large and geographically diverse pure-play 専業 exploration and

production company

with strong returns and investment opportunities. The company’s strategy of enhancing returns on

capital through developing new resources, growing reserves and

production per share, continuing the asset sale program and

increasing shareholder distributions will not change.

As a separate company, the Refining and Marketing business of ConocoPhillips will be a

leading pure-play independent refiner with a competitive and

diverse set of assets. In addition to executing the company’s initiatives to improve

downstream returns through portfolio rationalization and other

operating efficiencies, the new downstream company will be able

to further position its portfolio by pursuing transactions and

investments across the value chain. Under the contemplated plan,

both companies will be well positioned with financial strength

and flexibility and experienced management teams committed to

continued value creation.

"Consistent with our strategy to create industry-leading

shareholder value, we have concluded that two independent

companies focused on their respective industries will be better

positioned to pursue their individually focused business

strategies," said Jim Mulva, chairman and chief executive

officer. "Both companies will continue to benefit from the

size and scale of their significant high-quality asset bases and

free cash flow generation, allowing them to invest and create

shareholder value in a changing environment."

The separation of the companies is expected to be completed in the first half

of 2012.

Upon completion of the separation, Mulva intends to retire. Until

that point, he will continue to serve as ConocoPhillips’

CEO and lead the

separation efforts. The work to determine the detailed allocation

of assets and liabilities, the management and governance of the

companies, and the mechanics of completing the separation will

begin immediately. Further details will be disclosed as they are

determined over the next several months.

The contemplated separation of ConocoPhillips into two companies

does not require a shareholder vote. The separation is subject to

market conditions, customary regulatory approvals, the receipt of

an affirmative IRS ruling, the execution of separation and

intercompany agreements, and final board approval.

ConocoPhillips will hold a conference call and webcast at 8:30

a.m. EDT on July 14. Interested parties can get information

regarding the conference call and webcast on the ConocoPhillips

Investor Relations website, www.conocophillips.com/investor.

Replays of the conference call and a transcript should be

available later today.

ConocoPhillips is an integrated energy company with interests

around the world. Headquartered in Houston, the company had

approximately 29,600 employees, $160 billion of assets, and $226

billion of annualized revenues as of March 31, 2011.

ConocoPhillips’ Board of Directors Approves

Spin-off of Phillips 66

ConocoPhillips announced today that its board of directors has given final

approval for the spin-off of its downstream businesses. The resulting upstream

company will keep the ConocoPhillips name and will

be led by Chairman and CEO Ryan Lance. The downstream

company, led by Chairman and CEO Greg Garland, will be known as

Phillips 66. Both companies will be headquartered

in Houston.

The two new companies will be separated through the distribution of shares of

Phillips 66 to holders of ConocoPhillips common stock. This distribution is

expected to occur after market close on April 30, 2012.

ConocoPhillips shareholders will receive one share of Phillips 66 common stock

for every two shares of ConocoPhillips common stock held at the close of

business on the record date of April 16, 2012. Fractional shares of Phillips 66

common stock will not be distributed and any fractional share of Phillips 66

common stock otherwise issuable to a ConocoPhillips shareholder will be sold in

the open market on such shareholder's behalf, and such shareholder will receive

a cash payment with respect to that fractional share.

Following the distribution of Phillips 66 common stock, Phillips 66 will be an

independent, publicly traded company, and ConocoPhillips

will retain no ownership interest. Phillips 66 has received approval for

the listing of its common stock on the New York Stock Exchange under the symbol

PSX.

ConocoPhillips has received a private letter ruling from the Internal Revenue

Service to the effect that, based on certain facts, assumptions, representations

and undertakings set forth in the ruling, for U.S. federal income tax purposes,

the distribution of Phillips 66 common stock and certain related transactions

generally will not be taxable to ConocoPhillips or U.S. holders of

ConocoPhillips common stock, except in respect to cash received in lieu of

fractional share interests, which generally will be taxable to such holders as

capital gain.

No action is required by ConocoPhillips shareholders in order to receive shares

of Phillips 66 common stock in the distribution, and ConocoPhillips shareholders

should retain their ConocoPhillips stock certificates. Shareholders entitled to

receive the distribution will receive a book-entry account statement reflecting

their ownership of Phillips 66 common stock, or their brokerage account will be

credited for the shares.

ConocoPhillips expects that a "when-issued" public trading market for Phillips

66 common stock will commence on or about April 12, 2012 under the symbol PSX WI

and will continue through the distribution date. ConocoPhillips also anticipates

that "regular way" trading of Phillips 66 common stock will begin on the first

trading day following the distribution date. In anticipation of this trading,

the company will issue a first-quarter interim update to provide investors with

an update on the company as well as market and operating conditions experienced

during the first quarter of 2012. A full first-quarter earnings announcement is

scheduled for April 23, 2012.

Beginning on or about April 12, 2012, and through the distribution date, it is

expected that there will be two ways to trade ConocoPhillips common stock –

either with or without the right to receive shares of Phillips 66 common stock.

Shareholders who sell their shares of ConocoPhillips common stock in the

"regular-way" market (that is, the normal trading market on the NYSE under the

symbol COP) after the record date and on or prior to the distribution date will

be selling their right to receive shares of Phillips 66 common stock in

connection with the distribution. It is anticipated that shares of

ConocoPhillips common stock will also trade ex-distribution (that is, without

the right to receive the Phillips 66 distribution) during that period under the

symbol COP WI. Investors are encouraged to consult with their financial advisors

regarding the specific implications of buying or selling shares of

ConocoPhillips common stock on or before the distribution date.

Prior to the distribution, ConocoPhillips expects to mail an information

statement to all shareholders entitled to receive the distribution of shares of

Phillips 66 common stock. The information statement will describe Phillips 66,

including the risks of owning Phillips 66 common stock, and other details

regarding the distribution.

Upon repositioning, Phillips 66 will offer a unique approach to downstream

integration, comprising segment-leading refining and marketing, midstream and

chemicals businesses, while ConocoPhillips will be the industry’s largest and

most diverse global, pure-play, upstream company. The repositioning into two

leading energy companies will help grow the value of both companies for

shareholders by unlocking the potential of their assets and employees.

ConocoPhillips is an integrated energy company with interests around the world.

Headquartered in Houston, the company had approximately 29,800 employees, $153

billion of assets, and $245 billion of revenues as of Dec. 31, 2011. For more

information, go to www.conocophillips.com.

ConocoPhillips today announced that it has entered into a set of agreements with PetroChina Company Ltd. (PetroChina) whereby PetroChina will acquire an interest in two Western Australia exploration assets and establish a Joint Study Agreement (JSA) for unconventional resource development in Sichuan Basin in China.

Under these agreements, which still require government and partner approvals, PetroChina will acquire a working interest in the Poseidon offshore discovery in the Browse Basin, and in the Goldwyer Shale in the onshore Canning Basin. In addition, ConocoPhillips will enter into a Joint Study Agreement to identify unconventional resource reserves in the Neijiang-Dazu Block(内江-大足)in China’s Sichuan Basin.

“ConocoPhillips is pleased that PetroChina has recognized the significant resource potential and value of the Australian opportunities. Likewise, ConocoPhillips recognizes the Sichuan Basin as having some of the most prospective marine shales in China and looks forward to working with one of the world’s leading energy companies,” said Don Wallette, executive vice president, Commercial, Business Development and Corporate Planning, ConocoPhillips. “The signing of these three agreements marks a significant step toward increased global collaboration between our companies.”

Under the terms of the agreement with ConocoPhillips, PetroChina will acquire working interest in the two Australian projects; specifically 20 percent of Poseidon in the Browse Basin and 29 percent of Goldwyer in the Canning Basin.

WA-314-P, WA-315-P and WA-398-P

Operator: ConocoPhillips (60.0% WA-315-P, WA-398-P / 10% WA-314-P)

Co-venturer: Karoon Gas (40.0% WA-315-P, WA-398-P / 90% WA-314-P)

The first well, Poseidon-1 in WA-315-P, was a discovery, and two subsequent wells, Poseidon-2 and Kronos-1 in WA-398-P, also successfully encountered hydrocarbons.Canning Basin

EP443, EP450, EP451 and EP456

Operator: New Standard Onshore (25.0%)

Co-venturer: ConocoPhillips (75.0%)During 2011, ConocoPhillips executed an agreement to earn up to 75 percent working interest in the Goldwyer Shale Project, located in the Canning Basin onshore Western Australia. Drilling is expected to commence in 2012. Upon completion of the initial phase of the drilling program, ConocoPhillips will have the right to assume operatorship of the project.

Under the JSA, ConocoPhillips and PetroChina will study the potential for unconventional resource development in the approximately 500,000 acre Neijiang-Dazu Shale Block in the Sichuan Basin. The joint study will be an important step in evaluating the potential for unconventional resource exploration in the area. If technically and commercially viable, the companies will advance development under a production sharing contract, which would be agreed upon during the study period.

Todd Creeger, President, ConocoPhillips Australia-West said the agreement with PetroChina was significant for the company’s growth plans in both China and Australia. “We welcome PetroChina as a new joint venture participant in our Australian offshore and onshore exploration projects. We look forward to jointly delivering two successful assets,” Creeger said.

Jim Taylor, President, ConocoPhillips

China stated, “This is a great opportunity for ConocoPhillips to cooperate

with PetroChina in order to study the potential for unconventional resource

development here in China. We believe that the cooperation between the two

companies will form an important driver in promoting clean energy supply to

China and contributing to the country’s transition into a clean energy

economy.”

Medco Energi to acquire ConocoPhillips

Indonesia

PT Medco Energi Internasional Tbk, an

Indonesia-based oil and gas exploration and production company, has signed a

share sale and purchase agreement to acquire

ConocoPhillips Indonesia, Inc., Ltd. from ConocoPhillips Company, a

US-based company engaged in exploration and production of liquids and natural

gas.

ConocoPhillips Indonesia is a British Virgin Islands-based company that holds a

40% working interest in the South Natuna Sea Block B PSC,

consists of producing oil and natural gas fields, and the operator of the

West Natuna Transportation System.

|

South Natuna Sea Block

B PSC Operator: Conocophillips Partners: ConocoPhillips (40.0%) INPEX (35.0%) Chevron (25.0%) |

The 654-kilometre West Natuna Transportation

System is the first Singapore cross border sub-sea gas pipeline carrying gas

from the West Natuna Sea to Singapore

Concurrently, Medco Energi has signed a share sale and purchase to acquire

ConocoPhillips Singapore Operations Pte., Ltd. from ConocoPhillips.

Both the transactions are expected to close in the fourth quarter of 2016.

October 19, 2020

ConocoPhillips to Acquire Concho Resources in All-Stock Transaction

ConocoPhillips and Concho Resources Combination Built Upon Shared Vision to Deliver Superior Returns Through Price Cycles

All-Stock Transaction Valued at $9.7 Billion Honors Proven Financial Framework and is Expected to be Accretive on Consensus Key Financial Metrics

米石油会社コノコフィリップスは株式交換方式により、同業のコンチョ・リソーシズを買収することで同社と合意した。買収額は約97億ドルと、今年に入ってエネルギー需要が急速に減少して以来、シェール業界では最大規模の買収。コンチョ買収により全米有数の産油地帯パーミアン盆地で大型掘削業者が誕生する。

コンチョ1株につきコノコ株1.46株が支払われる。買収額はブルームバーグがコノコとコンチョの買収協議を最初に報じた日の前日にあたる13日のコンチョ株終値を15%上回る水準。

新型コロナウイルスのパンデミックで原油価格が急落し、世界経済の回復の足取りも鈍い中で、パーミアン盆地で操業する石油業界の統合が加速している。2020/10/2 米シェール各社、業績悪化に悩む Oasis PetroleumがChapter 11 申請

ConocoPhillips and Concho Resources today announced

that they have entered into a definitive agreement to combine companies in an

all-stock transaction. Under the terms of the transaction, which has been

unanimously approved by the board of directors of each company, each share of

Concho Resources common stock will be exchanged for a fixed ratio of 1.46 shares

of ConocoPhillips common stock, representing a 15 percent premium to closing

share prices on October 13.

The transaction combines two high-quality industry leaders to create a company with an approximately $60 billion enterprise value that will offer stakeholders a superior investment choice for sustainable performance and returns through cycles.

Highlights of the transaction include:

Two best-in-class asset portfolios that create a combined resource base of

approximately 23 billion barrels of oil equivalent

with a less than $40 per barrel WTI cost of supply and an average cost of supply

below $30 per barrel WTI.

High-quality balance sheet that offers superior sustainability, resilience and

flexibility across price cycles.

ConocoPhillips and Concho expect to capture $500 million of annual cost and

capital savings by 2022.

A financial framework that delivers greater than 30 percent of cash from

operations via compelling dividends and additional distributions.

Elevated commitment to environmental, social and governance excellence with a

newly adopted Paris-Aligned Climate Risk strategy, available at

www.conocophillips.com.

“The leadership and boards of both companies believe today’s transaction is an

affirmation of our commitment to lead a structural change for our vital

industry,” said Ryan Lance, ConocoPhillips chairman and chief executive officer.

“Concho is a tremendous fit with ConocoPhillips. Together, ConocoPhillips and

Concho will have unmatched scale and quality across the important value drivers

in our business: an enviable low cost of supply asset base, a strong balance

sheet, a disciplined capital allocation approach, ESG excellence and great

people. Importantly, the transaction meets our long-stated and clear criteria

for mergers and acquisitions because it is completely consistent with our

financial and operational framework.”

“Through this combination, we are joining a diversified energy company with even

more scale and resources to create shareholder value in today’s markets and

beyond,” said Tim Leach, chairman and chief executive officer of Concho

Resources. “Thanks to our team, Concho is one of the largest unconventional

shale producers in the United States, with a high-quality asset base, a culture

of operational excellence, safety and efficiency, and a strong balance sheet.

Through consolidation, we will apply our assets, capabilities and superior

performance to the business model of the future, creating a better-capitalized

company with enhanced capital discipline, more flexibility and an unwavering

commitment to sustainability. From our position of strength and in light of

market trends, our board of directors and management team evaluated a wide range

of options and unanimously determined that combining with ConocoPhillips is the

best path forward for Concho and our shareholders. We look forward to bringing

together our complementary operations, teams and cultures to realize the upside

potential of this exciting combination.”

Today’s transaction brings together two companies with the leadership, assets

and a capital allocation approach to generate growing free cash flow, supported

by a top-tier investment-grade balance sheet that provides investors with

sustainability, resilience and flexibility. The combined company will have

competitive advantages across sector fundamentals:

Transaction Rationale and Benefits

Combination creates leading company with scale and relevance: The transaction

offers a compelling combination of size, best-in-class assets, financial

strength and operating capability. The new ConocoPhillips will be the largest

independent oil and gas company, with pro forma production of over 1.5 million

barrels of oil equivalent per day (MMBOED).

Massive, diversified and low cost of supply resource base provides years of

high-value investments: The combined company will hold approximately 23 billion

barrels of oil equivalent (BBOE) resources with an average cost of supply of

below $30 per barrel WTI. The transaction brings together contiguous and

complementary “core-of-the-core” acreage positions across the Delaware and

Midland basins to create an unconventional powerhouse that also includes leading

positions in the Eagle Ford and Bakken in the Lower 48 and the Montney in

Canada. The expanded Permian position provides a strong complement to

ConocoPhillips’ other globally diverse, low-capital-intensity legacy positions.

Disciplined capital allocation criterion will drive investment decisions: The

company’s portfolio will be developed for value and free cash flow. The company

will target an average reinvestment level of less than 70 percent of cash from

operations to ensure sufficient free cash flow generation to fund compelling

returns of capital to shareholders.

Significant cost and capital savings will drive uplift in value and sustained

cost structure improvement: The companies announced that together they expect to

capture $500 million of annual cost and capital savings by 2022. The identified

savings will come from lower general and administrative costs and a reduction in

ConocoPhillips’ future global new ventures exploration program. This de-emphasis

of ConocoPhillips’ organic resource addition program is driven by the addition

of Concho’s large, low-cost resource base. Additional supply chain, commercial

and drilling and completion capital efficiency savings are not yet included in

these cost-reduction estimates.

Proven technical and operational expertise will be applied across the combined

portfolio to unlock value: Both ConocoPhillips and Concho are already recognized

leaders in oil and gas technology and operations. As part of the planned

integration, the company will adopt a “best practices” approach that will share

learnings and select best practices focused on the North American unconventional

portfolio.

High-quality balance sheet provides resilience through cycles and supports

commitment to sustainable shareholder return of capital: ConocoPhillips will

offer a compelling ordinary dividend supplemented by additional distributions as

needed to meet its target distribution of greater than 30 percent of cash from

operations. The company seeks to maintain a strong investment-grade credit

rating across price cycles. On a pro forma basis, the combined company net debt

is approximately $12 billion as of June 30, 2020, representing an attractive

leverage ratio of 1.3 at 2021 consensus commodity prices.

The companies share a track record of and commitment to ESG excellence: The

combination creates a platform for leading the sector into the energy transition

and a low-carbon future. The combined entity will be the first U.S.-based oil

and gas company to adopt a Paris-aligned climate risk strategy to meet an

operational (Scope 1 and Scope 2) net-zero emissions ambition by 2050.

Leadership and Governance

Upon closing, Concho’s Chairman and Chief Executive Officer Tim Leach will join

ConocoPhillips’ board of directors and executive leadership team as executive

vice president and president, Lower 48. This transaction will enhance the

company’s competitive position in Midland.

Transaction Details

The transaction is subject to the approval of both ConocoPhillips and Concho

stockholders, regulatory clearance and other customary closing conditions. The

transaction is expected to close in the first quarter of 2021. In the meantime,

an integration planning team consisting of representatives from both companies

will be formed to ensure required business processes and programs are

implemented seamlessly post-closing. In light of the pending merger,

ConocoPhillips has suspended share repurchases until after the transaction

closes.

Lance continued, “Opportunities to consolidate quality on the scale of these two

companies do not come along often, so we are seizing this moment to create a

company to lead the necessary transformation of our vital sector for the benefit

for all stakeholders in the future.”

ConocoPhillips will host a conference call today at 8 a.m. Eastern time to

discuss this announcement. To listen to the call and view related presentation

materials, go to www.conocophillips.com/investor.