01 September 2022

Rio Tinto and Turquoise Hill reach agreement in principle for Rio Tinto to acquire full ownership of Turquoise Hill for C$43 per share in cash

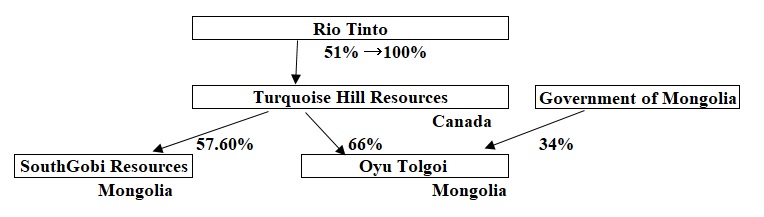

Rio Tinto and Turquoise Hill Resources Ltd. (“Turquoise Hill”) have reached an agreement in principle for Rio Tinto to acquire the approximately 49% of the issued and outstanding common shares of Turquoise Hill that Rio Tinto does not currently own for C$43 per share in cash (the “Transaction”). The agreement has the unanimous approval of the independent Special Committee of Turquoise Hill’s Board of Directors (the “Special Committee”), and values the Turquoise Hill minority share capital at approximately US$3.3 billion.

中国国有大手のAluminum Corp. of China (Chalco) 中国アルミは9月3日、モンゴル石炭大手SouthGobi Resources の買収を断念すると発表した。

SouthGobi ResourcesはモンゴルのOvoot Tolgoi炭鉱を運営しており、そのSouthGobi Resources(カナダで上場)にはカナダのTurquoise Hill Resources が57.6%を出資している。

Turquoise Hill Resources は旧称 Ivanhoe Mines で、2012年8月2日付で改称した。

Rio Tintoが51%を出資する。

Rio Tinto は2009年10月6日、モンゴル政府との間でモンゴル南部のOyu Tolgoi 銅・金鉱山開発のための投資契約を締結した。

Rioは2006年にIvanhoeに9.9%を出資したが、モンゴル政府との投資契約締結後に19.7%とし、更に固定株価で43.1%まで、またその後は時価で最終46.65%まで増やす権利を持った。

その後、2012年1月に49%から51%に増やした。

なお、現地で開発を担当するIvanhoe Mines Mongoliaにモンゴル政府が34%出資している。2009/11/28 Rio Tinto、モンゴルの鉱山開発で中国アルミと提携か?

2012/9/12 中国アルミ、モンゴルの石炭大手の買収を断念

The purchase price of C$43 per share in cash represents Rio Tinto’s best and final offer and a premium of:

- 67% to Turquoise Hill’s closing price of C$25.68 per share on 11 March 2022, being the day prior to Rio Tinto’s initial public non-binding proposal to acquire Turquoise Hill; and

- 125% to Turquoise Hill’s closing price of C$19.12 per share on 24 January 2022, being the day before agreeing on a path forward between the Government of Mongolia, Turquoise Hill and Rio Tinto that enabled commencement of the underground mine at Oyu Tolgoi (“OT”).

The Transaction is to be implemented by way of a plan of arrangement under the Business Corporations Act (Yukon) and both companies intend to expeditiously finalise an arrangement agreement (the “Arrangement Agreement”). An announcement will be made with details of the Arrangement Agreement once executed.

The Transaction will require the approval of 66.67% of votes cast by shareholders of Turquoise Hill (including Rio Tinto) and the approval of a simple majority of the votes cast by minority shareholders of Turquoise Hill. A special meeting of shareholders of Turquoise Hill to approve the Transaction is expected as early as possible in the fourth quarter of 2022 and, if approved, the Transaction is expected to close shortly thereafter.

Rio Tinto and Turquoise Hill have also agreed in principle to the following amendments to the financing Heads of Agreement (“HoA”), to become effective concurrently with the execution of the Arrangement Agreement, to support Turquoise Hill in addressing near term liquidity:

- Increasing the early advance facility agreed in May to US$650 million from US$400 million, provided that if there is an anticipated funding shortfall for March 2023 the parties will in good faith discuss increasing the early advance facility by up to an additional US$100 million;

- Extending the outside date by which the initial equity of US$650 million must be raised and early advance facility repaid from 31 December 2022 to 31 March 2023 and potentially to 31 May 2023 in the event of regulatory delays to the Arrangement Agreement;

- In the event the Transaction has not been approved when the December 2022 principal repayment obligation of US$362 million by Turquoise Hill under the OT project finance facility arises, Rio Tinto has committed to ensuring funds are available to Turquoise Hill. The funds for this payment would be made available on the same terms as the Early Advance and being repayable to Rio Tinto at the same time as the Initial Equity Offering; and

- Providing to Turquoise Hill Rio Tinto’s commitment to participate pro rata in the Initial Equity Offering subject to certain pre-conditions set forth in the HoA.

Rio Tinto Chief Executive Jakob Stausholm said: “Rio Tinto is committed to moving Oyu Tolgoi forward in direct partnership with the Government of Mongolia to realise its full potential for all stakeholders. This agreement represents another significant step following the recent commencement of the underground operations, and will simplify governance, improve efficiency and create greater certainty of funding for the long-term success of the Oyu Tolgoi project.”

Turquoise Hill Resources社が2019年第4四半期の生産レポート及び2020年の事業レポート、ガイダンスを 公表。

- Oyu Tolgoi社は2019年に146.3千トンの銅、241.8千オンスの金を含有した銅精鉱を生産。2020年に140〜170千トンの銅、120〜150千オンスの金を含有した銅鉱石を採掘する計画だ。また、露天掘り鉱山へ8千万〜1億2千万USD、坑内掘り鉱山開発事業へ12〜13億USDを融資する予定。

- 2019年7月に発表したとおり、坑内掘り鉱山の設計更新事業が2020年上半期に完成し、2020年下半期に全コストの見通しが明細になる。事前的な見通しで、投資額は12〜19億USDで増額する見込みである.

Rio Tinto Copper Chief Executive Bold Baatar said: “The transaction simplifies the ownership structure of Oyu Tolgoi and enables Rio Tinto to focus on working in partnership directly with Erdenes Oyu Tolgoi and the Government of Mongolia to create long-term value for all stakeholders.

“Turquoise Hill minority shareholders will realise a significant and immediate cash premium for their shares at a time when uncertainties inherent in the development of the underground operations remain. Turquoise Hill will also avoid the issuance of any equity component as part of the US$3.6 billion incremental funding requirement through to the completion of the Oyu Tolgoi project. Securing the approval of the Special Committee to our agreement in principle, following extensive negotiations, was essential for Rio Tinto to progress this proposed transaction.”

Notes to editors

If the Transaction is successful Rio Tinto will hold a 66% interest in Oyu Tolgoi with the remaining 34% owned by the Government of Mongolia.

Rio Tinto Canadian early warning disclosure

Rio Tinto currently beneficially owns 102,196,643 common shares of Turquoise Hill, representing approximately 51% of the issued and outstanding common shares of Turquoise Hill. Rio Tinto also has anti-dilution rights that permit it to acquire additional securities of Turquoise Hill so as to maintain its proportionate equity interest in Turquoise Hill from time to time.

A copy of the related early warning report may be obtained from Rio Tinto’s Group Company Secretary.

The head office of Turquoise Hill is located at 1 Place Ville-Marie, Suite 3680, Montreal, Quebec, Canada H3B 3P2.

Additional disclosures

This press release does not constitute an offer to buy or sell or the solicitation of an offer to sell or buy any securities. Any offers, solicitations or offers to buy, or any sales of securities will be made in accordance with registration and other requirements under applicable law.