日本経済新聞 2008/3/13

天然ガス版OPEC構想 親ロシア国でカルテル

年内にも発足、イラン参加も 米欧揺さぶり狙う

世界最大のガス埋蔵量を持つロシアが、カザフスタンなど旧ソ連の親ロ国と天然ガスの価格や供給網の建設を調整する事実上のカルテルを設立することが明らかになった。イランなどにも参加を要請し、年内にも発足させる。

旧ソ連6カ国(ロシア、カザフ、ウズベク、ベラルーシ、タジキスタン、キルギス)が加盟するユーラシア経済共同体(EurAsEC)が4月にロシアで開く会議で構想を発表する。既にカザフのほか欧州向けガス通過国であるベラルーシが参加に合意した。

EurAsECはロシア、ベラルーシ、カザフスタン、キルギス、タジキスタンの5カ国が2000年に結成に合意、01年に正式発足した。アルメニアやモルドバ、ウクライナがオブザーバーとなり、06年にはウズベキスタンも正式加盟した。加盟国間の関税やヒトやモノの移動の管理を統一して地域の通商貿易運輸を促進するのが狙い。

独立国家共同体(CIS)関税同盟を発展、改組しユーラシア経済共同体を発足させることで合意した。

AESはカザフスタンのナザルバエフ大統領が提唱した構想に沿ったものであり、将来的に欧州連合(EU)のような機構を目指している。

まず欧州向け支配 主要輸出国影響力拡大

天然ガス埋蔵量のシェア

(2006年宋、BPエネルギー統計)

| ロシア |

26.3% |

|

|

| 旧ソ連5カ国 |

2.7% |

旧ソ連6カ国 |

29.0% |

| イラン |

15.5% |

旧ソ連+イラン |

44.5% |

| カタール |

14.0% |

|

|

| サウジアラビア |

3.9% |

|

|

| UAE |

3.3% |

|

|

| その他 |

34.3% |

|

March 11 2008

On working meeting of

Alexey Miller and heads of gas companies from Kazakhstan,

Uzbekistan and Turkmenistan

The

Gazprom Headquarters today hosted a working meeting of Alexey

Miller, Chairman of the Management Committee of Gazprom, Uzakbai Karabalin, President of KazMunaiGaz, Nurmmukhamad Akhmedov, Chairman

of the Management Committee of Uzbekneftegaz and Yagshigeldy Kakaev, Chairman

of Turkmengaz. The meeting addressed the

outlook for cooperation in the gas sector.

During

the meeting the heads of the gas companies from Kazakhstan,

Uzbekistan and Turkmenistan stated that “based upon the interests of the

national economies and considering the international commitments

with regard to the energy supply reliability and continuity,

starting from 2009 natural gas will be sold at

European prices”

−−−

2008/3/14

turkmenistan.neweurasia.net

The above information has

immediately caused a sensation and produced a number of comments

in the Russian and Western media. Most of the commentators have

proclaimed the emergence of a gas OPEC in the

Central Asia, with

members as follows: Turkmenistan, Kazakhstan, Uzbekistan and…

Russia. Media also

anticipated problems that Ukraine will face after the expected

rise of gas prices. Above all, the news was considered as the

success of Moscow who - by announcing the information - has

allegedly hampered the construction of a Trans-Caspian gas

pipeline, instead pushing the Caspian Coastal gas pipeline ahead.

Arkady Dubnov of ‘Vremya Novostey’

wrote:

‘Clearly,

the cartel’s emergence has been triggered

by American and European diplomatic activity in the region.

This activity focused on lobbying an export route of the

Central Asian gas to Europe that would circumvent Russia.

Paradoxically, Gazprom’s consent for the ultimatum

will decisively bury the Trans-Caspian

project, backed by Washington. (…) Moreover, it will reinforce

the common urge of Russia and its Central Asian partners to construct

the Caspian Coastal gas pipeline.

The activity of

Brussels and Washington envoys, who have been persuading

Gurbanguly Berdymukhammedov and Nursultan Nazarbayev to

support the Trans-Caspian pipeline, has played a vital part,

too. (…). By late February a special

US representative in the region Steven Mann actively traveled

between Baku, Ashgabat and Astana, luring local leaders with

promises of European prices for gas. (…) However, the Central Asian

leaders have opted for an easier way of obtaining extra funds

for their gas and started joint talks with Gazprom.’

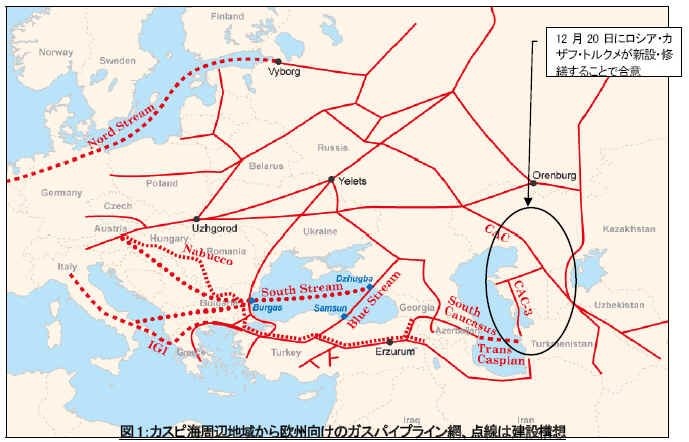

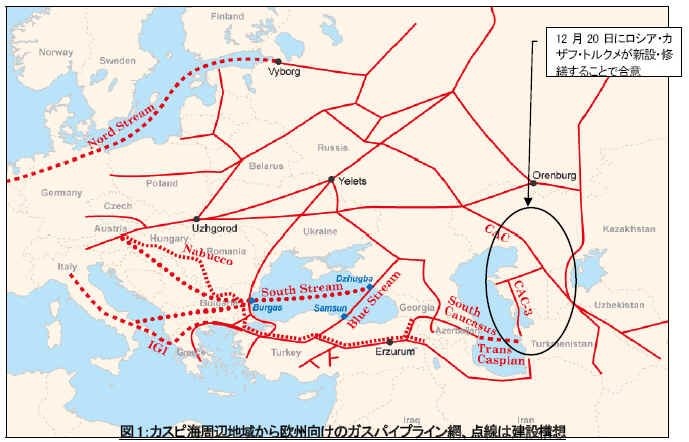

2007/12/20、ロシア・カザフスタン・トルクメニスタン3カ国間で、トルクメニスタンからロシアまでカスピ海沿岸ガスパイプライン(CAC3)の新設すること等について、合意書に調印した。

既存のカスピ海沿岸パイプラインを改修することに加え、2008年後半から2010年にかけてCAC3を新たにカスピ海沿いに新設することが定められている。

Nonetheless, the Central

Asian ultimatum issued to Moscow makes me draw different

conclusions. In my opinion, it may be a proof of Moscow’s weakness. The ineffectiveness of

Russian policy in the region is being cunningly used by

Turkmenistan, Kazakhstan and Uzbekistan. One of the key

principles of Russian policy in the whole post-Soviet area has

been to divide the former republics as much as possible and to

prevent them from coordinating their policies. Suddenly it turned

out that Ashgabat, Tashkent and Astana have joined forces and

started dictating their terms to Moscow.

Besides, the fact that Russia may pay ‘European prices’ for the Central Asian gas next year does not necessarily

mean that the Great Game is over and that the West and China have

nothing to look for in the region. It should be born in mind that

the Central Asian states are concerned with something more than

just money. They also strive to become politically independent of

Moscow and to balance Russia’s influence in the region by

cooperation with China and the West. Uzbekistan’s recent permission for Americans

to use the airbase in Termez might be an illustration to this

point.

Why then did the Russians

disclose this information themselves? A simple answer comes to

mind: what else could they do? They must have realized that they

are no longer dealing with separate states but, willingly or not,

they must face the three states together. They also realized that

paying more for gas is unavoidable. Therefore Moscow must have

decided to use this unpleasant information to cause some

confusion around the Trans-Caspian pipeline and to demonstrate

that it is capable of paying more for gas, so in this sense the

West has no advantage over Russia.

The fact is, something

like a ‘Central Asian gas OPEC’

has indeed emerged.

However, it is made of three and not four members.

---

2008/3/14 eurasianet.org

Russia makes financial

gamble to retain control of Central Asian energy exports

Kazakhstan, along with

its Central Asian neighbors Turkmenistan and Uzbekistan, will

receive a huge increase in energy-related revenue following a

flurry of regional diplomatic activity. Ukraine, meanwhile,

stands to lose the most under the new pricing framework for

Central Asian natural gas.

The most important

development over the past week or so was a March 11 announcement

by the Russian state-controlled conglomerate Gazprom that,

starting in 2009, it would pay European market prices for Central

Asian natural gas. Gazprom did not specify a price, but given the

current market conditions, Kazakhstan, Turkmenistan and

Uzbekistan can expect to receive somewhere in the range of $200-$300 per

1,000 cubic meters (tcm)

of gas next year. At present, Gazprom is paying up to 180/tcm for Central Asian gas. A statement

issued by Gazprom said the deal was is "based upon the

interests of the national economies and considering the

international commitments with regard to the energy supply

reliability and continuity."

The deal is certain to

hit Gazprom’s bottom line. It could also

potentially cause supply disruptions down the road by sparking

pricing disputes, likely involving Ukraine, which is the key

transit nation for European energy exports. But the Russian

conglomerate’s action helps solidify Moscow’s position as the gatekeeper for

Central Asian energy exports to Western European markets. Over the past year, the

competition over Caspian Basin energy has intensified, with the

United States, European Union and China all seeking to break

Russia’s current stranglehold over

regional export routes.

Gazprom officials have

indicated they do not intend to absorb all of the shock of the

higher costs, but will pass along some of the added expense to

its own consumers. On March 14, Gazprom CEO Alexei Miller

announced that the gas price for European customers could reach

$400/tcm by the end of 2008. Earlier estimates for late 2008 had

pegged the price at $310/tcm.

In addition to the price

hike, Turkmen and Russian officials on March 12 signed a deal on

the transfer of Soviet-era geological and geophysical data

covering Turkmen deposits that had heretofore been kept under

tight control in Moscow. The information could prove useful to

Ashgabat’s efforts to hasten the

development of the country’s energy resources. The pact grew

out of a joint declaration issued in 2007 in connection with the

unveiling of a grand Russian-backed energy export scheme,

centering on the expansion of the Prikaspiisky pipeline network.

The Russian decision to hand over the data at this time is seen

by many regional energy observers as an incentive for

Berdymukhamedov to remain loyal to the notion of Russia’s export primacy in Central Asia.

Russian leaders may now

be feeling more confident about their ability to stay on top of

the regional energy game, but there are plenty of indicators that

their position still cannot be considered secure. The Gazprom

agreement signals that Central Asian energy producers are

developing a sense of unity that could enhance their collective

clout in energy dealings with outside players. For most of the

post-Soviet era, Central Asia’s cohesion has have been hampered

by the inability of regional leaders to work together on a wide

variety of economic and social issues, in particular the

development of natural resources and the distribution of scarce

water resources.

Regional leaders,

however, are clearly working to set aside differences.

Kazakhstan, which will chair the Organization for Security and

Cooperation in Europe in 2010, has been exerting diplomatic

pressure on its neighbors to promote regional stability and

cooperation.

One of the region’s more complicated bilateral

relationships in Central Asia involves Turkmenistan and

Uzbekistan. Relations had been frosty since 2002, when

then-Turkmen leader Saparmurat Niyazov accused the Uzbek

government of involvement in an alleged attempted coup against

his regime. But on March 11, at the conclusion of a state visit

by Berdymukhamedov to Tashkent, the Turkmen leader and his Uzbek

counterpart, Islam Karimov, saluted the restoration of friendly

ties.

If Central Asian leaders

can maintain unity on energy issues, they can become formidable

negotiating partners not only for Russia, but for China and the

West, regional analysts believe. "The boosting of

cooperation in the oil and gas sector between Turkmenistan and

Uzbekistan is capable of dealing a blow to Gazprom’s interests," said a

commentary published in the Kazakhstani newspaper Liter noted.

Meanwhile, a commentary

published in the Vremya Novostei newspaper indicated that Gazprom

did not develop the new gas pricing structure on its own

initiative, but instead had to react to new demands put forward

by Central Asian officials, who perhaps used the Chinese and

trans-Caspian export options as leverage.

"Moscow, which has

speculated several times in international diplomacy with the

threat of setting up a gas OPEC with other major gas exporters,

encountered for the first time a consolidated position from

Turkmenistan, Uzbekistan and Kazakhstan in price

bargaining," the commentary said.

The United States and EU

certainly cannot take comfort from the recent developments, which

would appear to severely dent hopes for the construction of the

planned trans-Caspian-Nabucco export network that would establish

a Western-controlled route that ferries Central Asian gas to

Europe.

But the biggest loser

from recent developments may well be Ukraine, which has long wrestled with

Russia over energy supplies. On March 13, Neftogaz, the Ukrainian

state energy concern, reached a deal with Gazprom that brought an

end to the latest round of bickering between the two countries.

Under the agreement, Ukraine fixed the price it will pay for gas

starting in March and running for the rest of 2008 at $179.50/tcm

Ukraine faces a severe

price increase in 2009, once the higher rates for Central Asian

gas kick in. The skyrocketing prices prompted Ukrainian Prime

Minister Yulia Tymoshenko to declare that Ukraine would like to

conclude a medium-range supply agreement, covering up to five

years, with Gazprom.

During the

Ukrainian-Russian wrangling over the price of gas, Ukrainian

President Viktor Yushchenko headed to Astana for talks with

Kazakhstani President Nursultan Nazarbayev. The discussions

proved bitterly disappointing for the Ukrainian leader, however.

Yushchenko had hoped he could tempt Nazarbayev into an export

arrangement that cut out Russia, striving to gain a Kazakhstani

commitment to the Odessa-Brody pipeline, which Ukraine seeks to

expand. Nazarbayev stated clearly that Russia, in control of oil

transportation, held the key to any decision. "The question

of the Odessa-Brody project remains open. We have to agree with

Russian oil transportation organizations to supply the necessary

volumes to Ukraine," Nazarbayev told a news conference.