Comalco Ltd http://www.comalco.com.au/

| : | Comalco is a supplier of bauxite, alumina and primary aluminium to world markets, with sales in 1999 of over $2.3 billion | |

Comalco New Zealand |

||

| A wholly-owned subsidiary of Comalco Limited which owns and manages the company's aluminium interests in New Zealand. | ||

| 拠点 | ||

| Bauxite mines | ||

| : | Weipa -

Queensland Boke - West Africa |

|

| Alumina refineries | ||

| Eurallumina -

Sardinia QAL - Queensland Comalco Alumina Refinery - Gladstone |

||

| Aluminium smelters | ||

| Bell Bay -

Tasmania Boyne Smelters - Queensland Tiwai Point - New Zealand |

||

株主 Rio Tinto (100%)

歴史

| 1955 | It was only in 1955, when Harry Evans, a geologist with Consolidated Zinc Pty Ltd, was searching for oil on Cape York Peninsula, that the significance of Weipa's red cliffs was realised. Evans identified the red earth as bauxite - good grade and easily extractable. | |

| 1956 | Commonwealth Aluminium Corporation Pty Ltd was formed to develop the bauxite deposits at Weipa. This marked the beginning of Australia's integrated aluminium industry. | |

| 1957 | The Commonwealth Aluminium Corporation Pty Ltd entered into a partnership with the British Aluminium Company Ltd, and soon afterwards the company became known as Comalco. | |

| 1970 | Comalco became a public company. | |

| 1971 | Tiwai Point plant officially opened. | |

| 1982 | Boyne Island smelter officially opened. | |

| 2000 | RioTinto obtains 100% ownership of Comalco. |

Rio Tinto http://www.riotinto.com/

Rio Tinto plc and Rio Tinto Limited operate as a single business entity with the same board of directors, a unified management, and a combined portfolio of mineral resources which is well balanced by both geography and commodity.

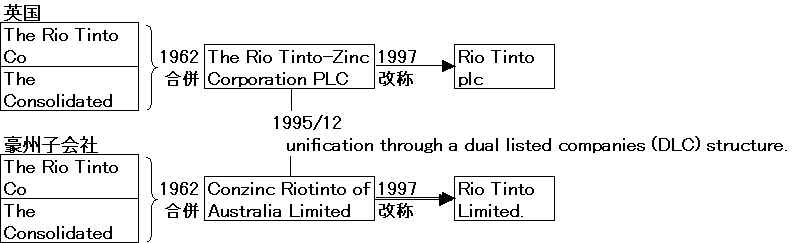

The Rio Tinto Company was formed in 1873 to mine the ancient copper workings at Rio Tinto in Spain. Two thirds of the Rio Tinto Company's Spanish business were sold in 1954 and the remaining interest was also subsequently divested. The Consolidated Zinc Corporation was incorporated in 1905, initially to treat zinc bearing tailings at Broken Hill in New South Wales, Australia which soon expanded into mining.

Following the 1962 merger, RTZ developed a number of major projects including Palabora (copper) in South Africa, Rossing (uranium) in Namibia, and Neves Corvo (copper and tin) in Portugal. It also grew through acquisitions, including the Borax group in 1968.

Between 1968 and 1985 significant interests in cement, chemicals, oil and gas and manufactured products for the construction and automotive industries were also developed. However, a major review of corporate strategy between 1987 and 1988 led to a series of disposals and acquisitions which refocused the company on mining and related activities.

As a result, between 1988 and 1994 non mining businesses were sold as going concerns, and interests in mining acquired. These included the 1989 acquisition of the major part of British Petroleum's international minerals businesses, and the 1993 acquisition of the Nerco and Cordero coal mining businesses in the US.

In mid 1995 a minority shareholding in Freeport-McMoRan Copper & Gold was also acquired together with a 40 per cent direct interest in the expansion potential of its Grasberg copper mine in Indonesia.

After 1962, CRA also grew through the development of several important mineral discoveries, including Hamersley (iron ore) in Australia, Bougainville (copper) in Papua New Guinea, Comalco (bauxite, alumina refining and aluminium smelting) in Australia and New Zealand, Argyle (diamonds) and Blair Athol and Tarong (coal) in Australia, and Kelian (gold) and Kaltim Prima (coal) in Indonesia.

Growth also came from acquisitions, including the Australian coal assets of BPAmoco in 1989 and a 70.7 per cent interest in Coal & Allied Industries' New South Wales operations.

Following the DLC merger in 1995, exploration, research and technology have been refocused on a global basis and the management structure reorganised to capture the potential of the merger for the future. Capital expenditure has also been substantial on Rio Tinto's wide range of projects.

Notice to London Stock

Exchange

Rio Tinto Limited has today completed the compulsory acquisition

procedures under its takeover offer for all shares in Comalco

Limited and Comalco is now wholly owned by Rio Tinto

Limited.

For the information of the market, a total of 2,142,634 Rio Tinto

Limited shares and 3,161,939 Rio Tinto plc shares have been

issued to those Comalco shareholders who elected to receive

shares under the Offers.

2000/2/24 Rio Tinto

Rio Tinto offer for full ownership of Comalco

Rio Tinto Limited announced today that it proposes to make a cash offer of A$9.50 per share for all the shares in Comalco Limited it does not already own. Comalco is already 72.43 per cent owned by Rio Tinto. The offer represents a premium of 17.3 per cent on the basis of the market closing price of A$8.10 for Comalco shares today. Compared with the average price for Comalco shares over the preceding month, the offer represents a premium of 21.6 per cent.

''This offer presents a timely opportunity for Comalco shareholders to dispose of their shares at a significant premium to their recent market value,'' said Rio Tinto chairman, Sir Robert Wilson. ''This offer addresses investor concerns arising from the reduced public float and the reduction in ASX index weighting of Comalco shares,'' he said.

Rio Tinto Limited announced that it is considering a scrip alternative, also including a possible option to elect for Rio Tinto plc scrip. A Rio Tinto Limited scrip alternative is likely to be attractive to certain shareholders given the recent introduction of capital gains tax roll-over relief for share for share exchanges.

The offer is subject to a number of conditions, including:

・FIRB (and any other necessary regulatory) approvals.

・The offeror becoming entitled to proceed to compulsory acquisition of outstanding Comalco shares.

・The usual condition as to prescribed occurrences.

・Rio Tinto expects to make its offer after the Corporate Law Economic Reform Program Act (''CLERP'') becomes effective on 13 March 2000.