2003/7/17

Shell, Total strike Saudi gas

deal

http://www.pipelinedubai.com/press/pr_0818.htm

The Royal

Dutch/Shell Group of Companies and Total signed an agreement with the Government

of the Kingdom of Saudi Arabia, to form a Joint Venture with

Saudi Aramco for the exploration of gas in an area of 200,000 km2

in the southern part of the Rub Al-Khali (the Empty Quarter).

Shell, as leader of the Consortium, will retain a participation

of 40 per cent of the new Joint Venture, with Saudi Aramco and

Total each 30 per cent participation.

Jeroen van der Veer, President of Royal Dutch and Vice Chairman

of the Royal Dutch/Shell Group of Companies, representing the

Consortium, met today with His Excellency Ali bin Ibrahim

Al-Naimi, Minister of Petroleum and Mineral Resources of the

Kingdom of Saudi Arabia, to finalise the agreement.

Mr van der Veer was accompanied by Mr. Alain Lechevalier, Vice

President Middle East, Exploration & Production of Total.

Mr van der Veer commented: ÅgThis

agreement is an important breakthrough as it heralds the first

time after the creation of Saudi Aramco that foreign

International Oil Companies have gained access to gas acreage in

the Kingdom of Saudi Arabia, holder of the worldÅfs largest reserves of oil and gas. Shell,

on behalf of the Consortium, is naturally proud to be part of

this historic moment.Åh

2004/4 ShellÅ@

Shell and Saudi Aramco join Total in

the South rub Al Khali Company

http://www.shell-me.com/english/apr04/profiles2.htm

"Saudi Aramco is truly proud

of its relationship with shell, and that cuts across the whole

business," says Khalid Al-Falih, Vice President of New

Business Development at Saudi Aramco Chairman of the new South Rub Al Khali Company

Limited (SRAK).

He notes that SRAK is only the

latest chapter in an ongoing story of co-operation between the

two companies. "The relationship between Shell and Saudi

Aramco is one of the strongest partnership that Saudi Aramco has

with an international oil compant [IOC]," he says.

"This relationship has its foundations in two joint

ventures: the Saudi Aramco Shell Refinery Company [Sasref] in

Jubail on the east coast of Saudi Arabia, and in Motiva, the

retail fuels joint venture in the United States.

"The Kingdom's Natural Gas

Initiative and the South Rub Al Khali Company, which brings

together Saudi Aramco, Shell and Total, will build on that

strength," he adds.

Central to the genesis of SRAK was

Saudi Arabia's desire to attract more foreign direct investment

and increase the reserves of natural gas available to the

nation's burgeoning industrial and utilities sectors. "The

kingdom of Saudi Arabia indicated its desire to increase

investment opportunities in the country with the announcement of

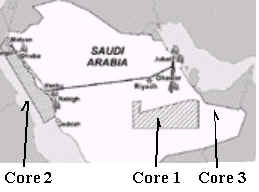

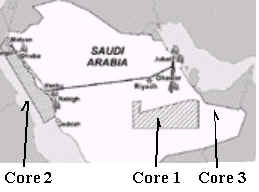

the three Core Ventures," says Khalid Al-Falih. "This

initiative was an attempt to find areas of overlap between the

IOC's expressed areas of interest and the development needs of

the Kingdom, and was to span both upstream and downstream

operations.

"Shell was in the vanguard of

the Natural Gas Initiative, and following the signing of the

preparatory agreements in 2001, we began working with the

signatories to tailor development programmes that would prove

mutually beneficial to both the Kingdom and the IOCs.

Unfortunately, it became clear that these Core Ventures as originally

conceived were too commercially and technically complex, and that

it would not be feasible to implement their downstream

elements," he says.

"The result was that, in

consultation with the IOC consortium led by Shell, the Saudi Government

restructured Core Venture 3 to focus on the upstream," he continues. "This resulted

in the signing last year of a contracted for the exploration and

development of 210,000 square kilometers of the Rub Al Khali

desert and the

formation of the South Rub Al-Khali joint venture."

As a result of his close involvement

in the gas development programme, Khalid Al-Falih has a thorough

understanding of the joint venture and its operating mandate.

"I was seconded from Saudi Aramco to the Government's

negotiating team for the Natural Gas Initiative for two years,

and was very proud when we concluded the agreement with Shell,

Total Saudi Aramco," he says.

The Saudi Aramco executive is also

well acquainted with larger context in which SRAK will operate,

having helped to formulate the Kingdom's gas strategy during his

stint with Saudi Aramco's Corporate Planning organisation.

"The ultimate objective of the joint venture is to find gas

and produce it at the lowest cost for the Kingdom," he

explains. "Ours is a growing economy, and maintaining a

reliable, affordable supply of natural gas to industries and

utilities is vital for continued growth. SRAK, along with Saudi

Aramco's own gas development projects and the creation of other

joint venture companies in the gas sector, will provide the

energy needed for sustained expansion."

The new company itself has been

designed to maximise the value that each partner provides to the

joint venture, he emphasizes. "Shell has undertaken the

leadership role in SRAK, which will be able to capitalize on the

experience and knowledge of two of the world's leading IOCs as

well as the world's leading national oil company, Saudi Aramco.

All three companies bring to the joint venture their business

competencies and considerable expertise," he says.

It's a formula in which the total is

greater than the sum of its parts, according to Khalid Al-Falih.

"Saudi Aramco has a great deal of experience with the

Kingdom's geology and reservoirs, as well as its own proprietary

technologies. It also understands local business and logistical

considerations. At the same time, we are looking forward to

having Shell and Total bring their technology to bear on the

project. In addition, rather than having a single operator, we

have chosen a model which will allow all the three companies to

share in the operations of SRAK by having staff from each firm

seconded to the joint venture."

He notes that Shell will assume

point position in the joint venture. "Shell procedures will

be used in the exploration phase, and we are looking forward to

the success of this venture under Shell's leadership. To date,

Saudi Aramco has been happy to have Shell apply it operating

systems in both Sasref and Motiva, and I am sure that we will

work well with Shell in the joint venture," he says.

Integrating SRAK's operations into

the Kingdom's existing gas infrastructure provides both a

challenge and an opportunity, he remarks. "We will be

working hard to ensure that there is a real synergy between the

joint venture and Saudi Aramco's existing operations to ensure

the safe and successful delivery into Saudi Aramco's Master Gas

System of the gas which will be found in the Rub Al Khali.

"The challenges ahead will not

be easy," he concludes. "We are a newly born company,

but we must run from the start and cannot afford to crawl.

However, this joint venture brings together three companies known

for their ability to meet challenges head-on and to master

difficult operating environments, like the Rub Al Khali. As a

result, I believe that the joint venture will be bringing in

results and producing gas very soon and that these results will

please everyone concerned."

http://www.shell-me.com/english/apr04/profiles1.htm

The South Rub Al Khali

Company Limited (SRAK) was formed in December 2003 with three shareholders: Shell with

40 per cent and Saudi Aramco and Total, each with a 30 per

cent shareholding. SRAK was established to explore and

develop the natural gas and associated liquids in a 210,000

square kilometre concession in the Kingdom of Saudi Arabia's

South Rub Al Khali (Empty Quarter) - an area five times the

size of Holland, the same size as the UK or equivalent to

1,000 North Sea exploration blocks.

2004/3/7 AP

Foreign firms move into Saudi

http://www.finance24.co.za/Finance/Companies/0,6778,1518-24_1494720,00.html

In a milestone agreement, Saudi

Arabian officials signed contracts with foreign oil executives on

Sunday to explore jointly for natural gas in the country's vast

southern desert known as the Rub al-Khali, or Empty Quarter.

Saudi Arabia boasts the world's

fourth-largest deposits of gas, but the government had never

before invited foreigners to make competitive bids for rights to

explore for this resource. The four winning companies, including

two from Russia and China, said they expected to invest several

billion dollars to develop any gas they might discover.

US firms were conspicuous for their

absence among the winners of these landmark deals. However, Saudi

Oil Minister Ali Naimi played down any significance in that

regard and instead stressed the advantages of working with a

mixed group of what essentially are second-tier energy companies.

"We actually chose the best

bidders, and we are in fact very pleased at this

diversification," he told a news conference at a government

conference center in Riyadh.

Saudi Aramco, the

state-run oil concern, took a 20% share in each of the three contracts awarded.

Its partners are Lukoil Holdings of Russia; China Petroleum

& Chemical Corp., or Sinopec; and a consortium comprising

Italy's Eni SpA and Repsol-YPF of Spain.

Although Saudi Aramco announced the

awards in late January, the deals did not become official until

now. The contracts are to last for 40 years, with exploratory

surveys and drilling to begin immediately.

Saudi Arabia wants to use its

undeveloped gas as fuel for an ambitious range of planned

industries, including plants to treat and desalinate water and

factories to make petrochemicals, steel and cement.

Saudi Arabia began opening up its

gas industry to foreigners after abandoning in 2002 the so-called

Saudi Gas Initiative, a huge and unwieldy investment scheme that

would have coupled upstream gas exploration and production with

downstream petrochemicals and utilities. In a much more modest

deal last summer, Royal Dutch/Shell and Total won rights to

explore for gas in an area of the eastern Rub al-Khali.

The Oil Ministry offered up for

auction three areas in the northern Rub al-Khali in July.

Although 41 companies expressed interest, only six placed bids,

and of these only one - ChevronTexaco Corp. - was American. It

placed second in the bidding for all three contracts.

Russia is Saudi Arabia's main rival

as an oil producer, and the Saudis have had little success so far

in winning its cooperation for Opec's policy of keeping crude

supplies tight and prices high. Saudi Arabia, with the world's

largest oil reserves, is the most powerful member of the

Organisation of Petroleum Exporting Countries.

China, meanwhile, is a major buyer

of Saudi crude. Its rapid economic growth will make it a still

bigger market in the future.

Saudi Arabia hopes to build closer

ties with both countries.

Å@

May 18, 2001 Exxon Mobil

ExxonMobil Selected as Leader in Saudi Gas Venture

http://www.exxonmobil.com/Corporate/Newsroom/Newsreleases/Corp_xom_nr_180501.asp

Exxon Mobil Corporation announced

today that the Kingdom of Saudi Arabia has selected ExxonMobil as

the leader in a significant project, Core Venture 2 in the Saudi

Arabian Natural Gas Initiative, and that ExxonMobil has also been

selected to participate in the implementation of another major

project, Core Venture 1.

The two projects, known as Core Ventures 1 (Northern Rub' al Khali) and 2 (Red Sea) could result in a total estimated

industry investment of over US$20 billion and are designed to

underpin the Kingdom's goals of economic growth and job creation

by developing and providing energy to diverse industries.

Exxon Mobil Corporation Chairman Lee Raymond said, "We are

very pleased to have been selected by the Kingdom of Saudi Arabia

to lead Core Venture 2, participate in Core Venture 1 and are

hopeful that we will also be selected to lead Core Venture 1. We

look forward to building on our successful working relationship

with the Government of Saudi Arabia to realize the Kingdom's

objectives of maximizing the economic and social benefits from

its natural gas resources through partnership with the

International Energy Industry."

As a result of the announcement, ExxonMobil will become the lead, majority

participant in Core Venture 2 and

a significant

participant in Core Venture 1.

Following the signing of Preparatory Agreements, ExxonMobil will

work with the Saudi Government and other participants to define

and evaluate each Core Venture element, and develop project

execution plans.

Core Venture

1 will significantly expand

the Kingdom of Saudi Arabia's power, water desalination,

petrochemical and gas system and provide for exploration and

development of the Kingdom's gas resources in the Northern Rub'

Al-Khali region. The project includes field production and

gathering facilities, gas processing and fractionation plants to

recover and separate liquids from existing and new gas

production, gas and liquids transmission and downstream

investment in power, petrochemicals and water desalination. The

project includes up to 4000 MW new power generation capacity

integrated with water desalination, and two new petrochemical

facilities, one each on the east and west coasts of Saudi Arabia.

Core Venture

2 includes development of

discovered gas resources in Northwest Saudi Arabia, power and

desalination facilities in that region and exploration in the

Northern Red Sea with the opportunity for additional investment

in chemicals, power and desalination facilities on the West Coast

depending on exploration success.

"ExxonMobil has a strong track record of bringing large

scale projects on-stream in a safe, cost effective and timely

manner," said Raymond. "We will put this expertise to

work, combined with proprietary, leading edge technology, to

ensure that the people of the Kingdom of Saudi Arabia and our

shareholders benefit from this Initiative."

ExxonMobil has invested more than $5 billion in Saudi Arabia and

is the largest foreign investor in the Kingdom. The company is

also the largest foreign purchaser of crude oil and other

hydrocarbons from Saudi Aramco. Existing projects include two

petrochemical joint ventures with Sabic, Yanpet and Kemya, and

the Samref refinery -- a joint venture with Saudi Aramco.

Joint ventures in which ExxonMobil has interests (in Saudi

Arabia) currently employ more than 3,200 Saudi nationals. The

hiring and training of Saudi nationals will continue to be a key

component of ExxonMobil's project leadership strategy. ExxonMobil

will actively seek to recruit qualified Saudi employees from

universities and technical institutions throughout the Kingdom.

Raymond concluded, "ExxonMobil has had a significant

presence in Saudi Arabia for over half a century and we're

looking forward to many more years of continued success. We

believe this investment opportunity complements our existing

portfolio in the region and positions us well in this

strategically important part of the world."

Exxon Mobil Corporation is the world's premier petroleum and

petrochemical company. The company has subsidiaries or operations

in about 200 countries and territories worldwide.

Å@

Gulf News 2003/7/6

New Saudi gas initiatives need to be attractive

http://www.gulfnews.com/Articles/print.asp?ArticleID=91952

Saudi Arabia's original

Natural Gas Initiative (NGI) had been all but totally terminated

due to differences between international oil companies (IOCs) and

the government. The authorities reportedly intend to make a new

revised offer during a meeting in London later this month.

Crown Prince Abdullah revealed the gas initiative in 1998 during

a visit to the U.S. Total initial investments were projected

around $25 billion in the first ten years covering upstream,

midstream and downstream projects.

The integrated programme stipulated exploration and

processing of gas plus construction of power stations, water

desalination plants and petrochemical schemes. The gas sector was excluded from a

negative list that specifies activities prohibiting foreign

investments.

In June 2001, the government granted a group of IOCs from the

U.S. and Europe exclusive rights to explore and process gas in

three core ventures across the kingdom.

ExxonMobile led venture one, known as South Ghawar, requiring

investments of up to $15 billion. Likewise, the American

corporation led core venture two in the Red Sea area, which

required outlay of nearly $5 billion all while Royal Dutch/Shell

controlled venture three in the Shaybah region, requiring fund of

$5 billion.

Differences

From the onset, the NGI looked complicated in many respects.

Despite several rounds of negotiations, the two sides could not

agree on a course of action leading to implementation agreements. At the core of

the disagreement was the internal rate of return (IRR).

The IOCs insisted on solid profitability from the gas development

as well as from the required ancillary power and water

desalination plants and petrochemicals projects.

While not looking for commercial gains, the Saudi government

wanted to seal a deal that would not appear to be wasting natural

resources. Riyadh had reportedly offered between 10 to 12 per

cent return while the IOCs were demanding around 18 to 20 per

cent.

Other restrictions made the gas ventures even less attractive.

For example, the offer was valid only for areas of

non-associated gas.

Additionally, areas with proven gas reserves were off limits.

Also, the two sides disagreed on the interpretation of the

seismic surveys. Saudi Aramco, which represented the government,

had estimated the three areas to contain 35 trillion cubic feet

of gas.

But the IOCs believe only 20 per cent of that is recoverable for

commercial purposes. Hence, the IOCs felt that the proposed gas

acreages were inadequate. To be sure, Saudi Arabia has

substantial gas reserves, nearly 230 billion cubic feet.

Also, political developments proved detrimental for American

firms to commit major investments in Saudi Arabia. Some experts

believe that the September 11th terrorist attacks in the US had

complicated matters not least because 15 of 19 hijackers were

Saudi nationals.

Setback

In January and as part of moves to avoid collapse of the entire

deal, the government terminated the

second core venture, considered the most difficult to explore. But in early June, the first core

venture, the most prized was terminated. Thus, progress on the third core

venture, regarded as the easiest of all, remained valid.

The NGI formed the flagship of crown prince Abdullahs economic

reforms programme and its near collapse could undermine the

entire efforts.

The push to open up the economy, as stipulated in the five-year

plan extending to 2005, is partly aimed at reducing dependence on

oil, which constitutes nearly 75 per cent of income, 85 per cent

of exports and 35 per cent of the GDP.

Among others, the government had sought foreign investments in

order to boost economic infrastructure and provide employment

opportunities for locals. However, in order to reach fruition,

any new gas offer needs to be attractive enough to the IOCs.

2008/5/14 Saudi Aramco

Saudi Aramco and Total confirm Jubail Refinery Project

The Saudi Arabian Oil Company (Saudi Aramco) and Total have both

confirmed their decision to invest in a 400,000 barrel per

day

world-class, full-conversion refinery in Jubail, Saudi Arabia.

The refinery will process Arabian Heavy crude to high-quality

refined products that will meet the most stringent global product

specifications and is expected to begin operations at the end of

2012. The refinery will benefit from the proximity to the Arabian

Heavy crude supply system and from the excellent facilities of

the Jubail industrial city such as King Fahad Industrial Port,

power and water grids and residential area.

ÅgAt

Saudi Aramco we are pleased to announce our commitment to

strengthen our strategic partnership with Total by moving forward

with the Jubail export refinery project. Our vision of this

world-class refinery is to further expand the KingdomÅfs refining and petrochemical

infrastructure and create job opportunities here at home. This

facility will provide our customers, both domestic and

international, with high quality fuels and petrochemicalsÅh, Khalid G. Al-Buainain, Saudi

Aramco Senior Vice President of Refining Marketing and

International said.

ÅgLaunching

this project is a major achievement, enabling Total and Saudi

Aramco to build a strong strategic partnership. By developing

this world-class project in Jubail, Saudi Aramco and Total will

contribute to supply growing demand for transportation fuels and

petrochemicals, especially in Asia and the Middle-East, but also

in Europe where the deficit of diesel is growingÅh, declared Michel Benezit,

President of Total Refining and Marketing.

In a comprehensive, joint Front-End Engineering and Design (FEED)

study launched in May 2006, Saudi Aramco and Total have selected

state- of- the- art proven technologies for a full conversion

refinery scheme geared to maximizing the production of diesel and

jet fuels. In addition, the project will produce 700,000 tonnes per

year (t/y) of paraxylene, 140,000 t/y of benzene and 200,000 t/y

of polymer grade propylene.

A joint venture company for the refinery will be formed during

the third quarter of 2008. Saudi Aramco will initially own

62.5% of the company and Total will own the remaining 37.5%. Subject to required regulatory

approvals, the parties are planning to offer 25% of the

company to the Saudi public while the two founding shareholders

each intend to retain a 37.5% ownership interest. Saudi Aramco

and Total will share the marketing of the refineryÅfs production.

Saudi Aramco and Total are planning to release invitations-to-bid

for the projectÅfs construction in June 2008 with a

view to awarding all packages during the first quarter of 2009.

Orders for long-lead items will be placed as soon as the third

quarter of 2008. The project will be introduced to the lending

community in the second part of 2008 with a targeted financial

close in early 2009.

May 16, 2008 Saudi Aramco

Saudi Aramco and

ConocoPhillips Confirm Yanbu Export Refinery Project

The Saudi Arabian Oil Company (Saudi Aramco) and ConocoPhillips

today announced they have approved continued funding for the

development of the Yanbu Export Refinery Project.

The Saudi Aramco and ConocoPhillips project would construct a

grassroots, 400,000 barrel-per-day,

full-conversion refinery in the Yanbu Industrial City, in The Kingdom of Saudi Arabia.

The refinery is being designed to process Arabian heavy crude

which would be supplied by Saudi Aramco. The refinery would

produce high-quality, ultra-low sulfur refined products that will

meet current and future product specifications. Saudi Aramco and

ConocoPhillips would each be responsible for marketing one half

of the refinery's production. The refinery is targeted to start

up in

2013.

The companies have completed the initial evaluation and front end

engineering and design (FEED) outlined in the May 2006 Memorandum

of Understanding (MOU). The next phase will include the

solicitation of bids, commitment of long lead items and site

preparation work.

ÅgWeÅfre pleased to be entering the next

stage of development for the Yanbu export refinery project,

together with our partner, ConocoPhillips,Åh

said Khalid G.

Al-Buainain, Saudi Aramco senior vice president for Refining,

Marketing & International. ÅgThis facility will bolster the

KingdomÅfs refining capacity, and provide

additional quantities of high quality refined products for global

and domestic markets. This partnership is important to Saudi

Aramco, and this initiative is an important aspect of our companyÅfs expanding downstream business

portfolio,Åh he added.

ÅgConocoPhillips

is pleased to continue working with Saudi Aramco towards adding

needed capacity to the international refining system,Åh

said Jim Gallogly,

ConocoPhillips executive vice president of refining, marketing,

and transportation. ÅgThe Yanbu project fits well with

the companyÅfs overall strategy to invest in

projects that expand our global refining presence and provide

significant new supplies of clean products in an environmentally

sound manner.Åh

ConocoPhillips and

Saudi Aramco are planning to form a joint-venture company, with equal

interests to

own and operate the proposed new refinery. Subject to required

regulatory approvals, the parties plan to offer an interest in

the refinery to the Saudi public.

ConocoPhillips is an integrated international energy company with

interests around the world. For more information, go to

www.conocophillips.com.

Owned by the Saudi Arabian Government, Saudi Aramco is a

fully-integrated, global petroleum enterprise, and a world leader

in exploration and producing, refining, distribution, shipping

and marketing. The company manages proven reserves of 260 billion

barrels of oil, the largest of any company in the world, and

manages the fourth-largest gas reserves in the world.

Å@

May 25, 2008 Reuters

Saudi Aramco eyes $129 bln investment in next 5 yrs

State oil giant Saudi Aramco plans to invest $129 billion on

new energy projects in the next five years, the company's executive vice

president of operations said on Sunday.

Saudi Arabia is the world's largest oil exporter and Aramco is

expanding to increase crude, gas, refining and petrochemical

capacity.

About

$70 billion

of the total would be spent by international and domestic joint

ventures, and the remaining $59 billion on projects solely undertaken by

Aramco, Khalid al-Falih told Reuters.

The $129 billion figure is nearly $40 billion higher that

previous estimates given by Saudi official for expansion.

"We are updating our figures all of the time. This figure

includes more projects," Falih said. This includes refinery projects

in the United States and China, a second phase of

the Saudi-based PetroRabigh 2380.SE, and a giant petrochemical

plant at Ras Tanura to be built by Dow

Chemical.

Total investment would be higher as it would include some of the

$65 billion that Aramco is investing in projects that are already

under way.

"We are clearly focused on the downstream as the area of

greatest potential for future growth and impact," he said

earlier in a speech to a conference.

Movements in crude oil prices and the physical market are

disconnected due to oil's increased use as a financial instrument

by investors, Falih said.

"Buyers and sellers (are) taking their cues not just from

production numbers, demand projections and inventory levels, but

from a whole host of factors which lie beyond the realm of the

petroleum industry itself," he said.

High energy prices were attracting investment in new and

alternative energy supplies, creating "significant

uncertainty about the outlook of future demand for petroleum

products," he said.

Saudi Oil Minister Ali al-Naimi said last month that, because of

falling projections for future demand, the kingdom had no plans

to further boost output capacity after it completes it current

expansion program.

Aramco's oil output capacity would reach 12 million barrels per

day by the end of 2009, Falih said.

Aramco capacity does not include production from the Neutral Zone

between Saudia Arabia and Kuwait. Including the zone, Saudi

Arabia is aiming to reach a total crude capacity of 12.5 million

bpds.

Refining margins are expected to fall over the next several years

due to increased capacity and a economic slowdown in key markets,

Falih said.

2008/7/12 Saudi Aramco

Accord Inked with SABIC for Marketing Polyolefin Products of

Fujian Joint Venture

Sino Saudi Aramco Company Ltd, a wholly owned subsidiary of Saudi

Aramco, signed a mutual cooperation agreement with SABIC Shenzhen

Trading Company Ltd, a SABIC subsidiary in the PeopleÅfs Republic of China.

The agreement was signed on the afternoon of Saturday, July 12,

2008, at the offices of the parent company, Saudi Aramco, in

Dhahran.

Under this agreement, SABIC Shenzhen Trading Company Ltd will

market Saudi Aramco Sino Company LtdÅfs 25 percent share of polyolefin

products produced by the Fujian Refining and Petrochemicals

Company of

the PeopleÅfs Republic of China.

The agreement was signed on behalf of Saudi Aramco Sino Company

Ltd., by Saudi AramcoÅfs senior vice president, Refining,

Marketing and International, Khalid G. Buainain, while signing on

behalf of SABIC Shenzhen Trading Company Ltd was SABICÅfs vice president, Corporate

Finance, Mutlaq Al-Morished.

The signing ceremony was attended by Saudi Aramco president and

CEO Abdallah S. JumÅeah, by Mohamed Al-Mady, SABIC's

vice chairman of the Board of Directors and chief executive

officer, in addition to a number of senior officials of Saudi

Aramco, SABIC and Saudi Aramco Sino Company Ltd.

JumÅeah remarked: ÅgLast year, we celebrated with

Sinopec, the government of Fujian district of China, and

ExxonMobil, the official inauguration of our joint processing

venture in Fujian, the "Fujian Refining and Petrochemicals

Company Ltd," which is considered to be the first-ever

refining and petrochemical industries integrated project to be

established with a foreign company in China, and here we are

today ready to harvest the fruit of this new investment with our

partners, through this momentous step we are taking together with

SABIC.Åh

JumÅeah added, ÅgIn itself, this agreement

constitutes, from the Kingdom's perspective, an extra relative

advantage for SABIC, which grants it the right to market

polyolefins in support of Saudi investments abroad.Åh

JumÅeah concluded his statement by

saying, ÅgWe believe this cooperation

between Saudi Aramco and SABIC will, in the future, add value to

the Kingdom's internal and external investments.Åh

In turn, SABICÅfs vice chairman and CEO Mohamed

Al-Mady said, ÅhThe agreement signed between Saudi

Aramco and SABIC is a qualitative leap in the history of Saudi

industrial development. The agreement incarnates the integration

between two giants

each occupying a pioneering position worldwide, the first in the

field of oil industries and the other in the area of the

petrochemical industry.Åh

He added; ÅgI look forward to this agreement

to serve as a launching pad for more extensive strategic

cooperation between the two companies. SABIC has anchored its

success over the years on its close cooperation with Saudi

Aramco. We are looking forward to promoting this cooperation to

include various industrial, marketing and technological aspects

in a way that will accelerate national industrial development and

maximize the gross domestic product.Åh

Khalid G. Buainain

explained that the marketing studies, conducted by Sino Saudi

Aramco Company Ltd, showed that the distribution and marketing of

the polyolefins production of Fujian Refining and Petrochemicals

Company would cover a large base of customers inside China.

The two parties agreed that this task should be undertaken by

SABIC through a polyolefins marketing agreement, on account of

SABICÅfs local and foreign experience in

petrochemical marketing.

He added: ÅgThis agreement will underscore the

depth of the cooperation between Saudi Aramco and SABIC to

maximize the benefit of their investment projects in the best

interest of the Saudi economy. Saudi Aramco's share in the

products to be marketed by SABIC will amount to 320,000 tons

annually, representing percent of the total production of the

joint venture in China. Implementation of the agreement is

expected to start with the commercial startup of the project in

the second quarter of 2009.Åh

This agreement is

regarded as one of the significant pillars in the progress of the strategic

partnership between SABIC and Saudi Aramco, and the agreement is expected to

boost and support the strong leading position of SABIC in the

field of production and marketing of polyolefins, worldwide.

Through its representative, Saudi Aramco Sino Company Ltd, Saudi

Aramco holds a 25 percent interest in the refining and

petrochemical joint venture along with Fujian Petrochemicals

Company of China, a subsidiary of Sinopec Corporation and the

Fujian Government, which owns a 50 percent stake, while

ExxonMobil owns 25 percent through a subsidiary.

The projectÅfs products will include such

polyolefins as Liner low density polyethylene

(LLDPE), at a production capability of 400,000 tons annually,

high density polyethylene (HDPE), at a production capacity of

400,000 tons annually. The project will also produce

polypropylene (PP), at a production capacity of 470,000 tons

annually.

Headquartered in Riyadh, SABIC was founded in 1976 when the Saudi

Arabian Government decided to use the hydrocarbon gases

associated with its oil production as the principal feedstock for

production of chemicals, polymers and fertilizers.

The Saudi Arabian Government owns 70 percent of SABIC shares with

the remaining 30 percent held by private investors in Saudi

Arabia and other Gulf Cooperation Council countries.

Saudi Basic Industries Corporation (SABIC) is the worldÅfs 5th largest petrochemicals

company. The company is among the worldÅfs market leaders in the production

of polyethylene, polypropylene and other advanced thermoplastics,

glycols, methanol and fertilizers.

In Saudi Arabia, the company has 20 world-scale complexes and 19

of them are located in the industrial cities of Al-Jubail and

Yanbu. Some of these complexes are operated with multinational

joint venture partners such as ExxonMobil, Shell and Mitsubishi

Chemicals.

Elsewhere, SABIC manufactures on a global scale in more than 45

countries in the Americas, Europe and Asia Pacific. SABICÅfs overall production has increased

from 27 million metric tons in 2001 to 55 million metric tons in

2007.

June 16, 2009

Saudi Aramco and Total

Award EPC Contracts for Jubail Export Refinery

Saudi

Aramco Total Refining and Petrochemical Company (SATORP) finalized the awarding

plan for Engineering, Procurement and

Construction (EPC) contracts that constitute

the thirteen

different process packages of their Jubail joint

venture refinery,

following a meeting of the SATORP Board of Directors. The

awarding of these contracts marks an important step in the

execution of this 400,000 barrel per day world-class, full-conversion

refinery in Jubail, Saudi Arabia, which plans to be fully

operational by the second half of 2013.

When completed, the

export refinery will be one of the most advanced refineries in

the world and will process Arabian Heavy crude to products

fulfilling the most stringent specifications, to meet rising

demand for environmentally-friendly fuels. A portion of Jubail

refineryÅfs production will be consumed

locally to meet spikes in domestic demand. In-Kingdom refineries,

such as the Jubail joint venture, have the location advantage to

effectively and efficiently supply both international and

domestic demand.

The full-conversion

refinery will maximize production of diesel and jet fuels, and

will also produce 700,000 tons per year (t/y) of

paraxylene, 140,000 t/y of benzene and 200,000 t/y of

polymer-grade propylene.

ÅgToday

we are marking a major milestone in our partnership with Total,

which has been strong historically but is now stronger than ever,Åh

said Khalid

Al-Falih, President and CEO of Saudi Aramco. ÅgThe Jubail Export Refinery is a

strategic project for Saudi Aramco and the Kingdom of Saudi

Arabia, and its timely implementation will ensure that global and

regional markets will be well supplied with high quality products

in the next decade. Our commitment to fund a project of this

scale demonstrates our confidence that energy markets will grow

in the years to come, and our confidence that the Kingdom is the

ideal location for energy investments by global investors.Åh

ÅgI am

delighted that we have decided to launch the development of the

Jubail refinery project with Saudi Aramco,Åh

said Christophe de

Margerie, Chief Executive Officer of Total. ÅgToday, we have passed an important

milestone, which shows the quality of the strategic partnership

between our two companies and their determination to bring off

such a far-reaching project, even in a weaker economic

environment. As a result, we will be able to meet, from 2013, the

increasing demand for high-quality refined products from Asia and

the Middle East.Åh

The synergies between

Saudi Aramco and Total lie in the fact that both companies bring

knowledge and expertise to the joint venture company. Saudi

AramcoÅfs crude oil supply is located near

Jubail, a world-class industrial area, while Total is an

international oil company with a fully integrated value chain and

a global presence.

The project adds value to

the local economy through job creation and opportunities for

further downstream investments by local businessmen. It is

estimated that the refinery will create approximately 1,200

direct employment opportunities in the Kingdom, each of which

typically creates five to six indirect job opportunities.

On May 6 and May 8, 2008,

respectively, the Executive Committee of Total and the Board of

Directors of Saudi Aramco decided to launch the project, and on

June 22, 2008, a ÅeShareholder AgreementÅf

was signed in

Jiddah, Saudi Arabia, by Saudi Aramco and Total S.A.

Following the signing of

the agreement, SATORP was formed during the third quarter of

2008, and the project remains on schedule. Saudi Aramco and Total

will ultimately

own 37.5 percent of the company each. Subject to required regulatory

approvals, Saudi Aramco plans to offer 25 percent of the company

to the Saudi public in an Initial Public Offer (IPO) during the

last quarter of 2010.