Bayer's Polymers segment

comprises five business groups: Plastics, Rubber, Polyurethanes,

Coatings and Colorants, including the subsidiaries Bayer Faser

GmbH (fibers).

Plastics

The Plastics Business Group supplies a broad range of engineering thermoplastics and high-tech semifinished products to meet the differing requirements of a wide variety of industries.

Films Makrofol / Bayfol PC / PC-Blends Polyamides and Polyesters Durethan A PA 66 Durethan B + T PA 6 Pocan PBT / PET Polycarbonates Apec PC-HT Makrolon PC Styrenics Bayblend PC+ABS Lustran ABS ABS Lustran SAN SAN Novodur ABS ABS Triax ABS+PA Thermoplastic Polyurethanes Desmopan TPU

Rubber

As a leading supplier of raw materials, Bayer is among the most important partners to the rubber and tire industry. The portfolio of the Rubber Business Group comprises synthetic rubber, rubber chemicals and modifiers for the plastics industry, along with special preparations and processing chemicals from Bayer subsidiary RheinChemie and latices from PolymerLatex, a joint venture with Degussa-Huls AG.

Tradename Chemical Description Abbreviation Bayer Bromobutyl Bromobutyl rubber BIIR Bayer Butyl Butyl rubber IIR Bayer Chlorobutyl Chlorobutyl rubber CIIR Baypren® Chloroprene rubber CR Buna® BL Styrene-butadiene diblock copolymers SB Buna® CB Butadiene rubber for plastic modification BR Buna® EP Ethylene-propylene rubber EPM/EPDM Buna® SL Solution styrene-butadiene rubber S-SBR Buna® VSL Solution vinyl-butadiene-styrene-butadiene rubber S-VSBR Krylene® Emulsion styrene-butadiene rubber E-SBR Krynac® Acrylonitrile-butadiene rubber NBR Krynol® Emulsion styrene-butadiene rubber E-SBR Levamelt Ethylene-vinyl acetate rubber EVM Levapren® Ethylene-vinyl acetate rubber EVM Perbunan® NT Acrylonitrile-butadiene rubber NBR Polysar® S Styrene-butadiene rubber SBR Taktene® Black masterbatches BR Taktene® Butadiene rubber for plastic modification BR Taktene® Butadiene rubber BR Therban® Hydrogenated acrylonitrile-butadiene rubber HNBR

Polyurethanes

The Polyurethanes Business Group (PU) is the world's leading supplier of polyurethane raw materials and systems. The development of new products and technologies, along with intensive customer support in all regions of the world, is an integral element of PU's strategy for success. Regional business service centers strengthen our ties to customers and accelerate business processes.

We offer our customers a comprehensive service package that includes expertise in the processing of polyurethane systems and in the design and functional performance of polyurethane products. The broad spectrum of applications for Bayer polyurethanes stretches from solid materials to foams with a wide range of properties.

Coatings and Colorants

This business group consolidates all products used as raw materials in coatings, sealants and adhesives and as colorants for plastics and construction materials.Environmental compatibility is at the forefront in the development of new products such as high-grade, high-solids and aqueous binders.

Fibers

Established in 1994 in Dormagen, Germany, Bayer Faser GmbH is one of the leading fiber manufacturers in the world. Bayer fibers are used in all kinds of products - from clothing through carpets and home furnishings to fishing lines.

2002/7/1 社内体制として発足

2002/10/1 Bayer CropScience AG 独立

2003/4/25 株主総会で分社承認 (上記CropScienceに加え)

Bayer HealthCare AG, Bayer Polymers AG and Bayer Chemicals AG.

Bayer Business Services GmbH, Bayer Technology Services GmbH

and Bayer Industry Services GmbH & Co. OHG.持株会社の下に、4事業会社、3サービス会社体制

2003/4/28 Bayer USA 新組織発表

Bayer CropScience LP, Bayer Chemicals Corporation, Bayer HealthCare LLC,

Bayer Polymers LLC and Bayer Pharmaceuticals Corporation.

Bayer Corporate and Business Services LLC.持株会社の下に、5事業会社、1サービス会社体制

(本社のHealthCareをHealthCareとPharmaceuticalsに分割)2003/10/2 バイエル ヘルスケア社、ケミカルズ社、テクノロジー サービス社が独立

2003/11 中核の化学事業分離 経営資源、医薬などに集中

2002/7/1 Bayer

New Bayer AG structure operational

Aiming for sustainable increase in corporate value / better

placed for strategic options

Effective July 1, 2002, the Bayer Group is operating within its

new organizational structure. In the future, the four operating

subgroups and three service companies ー under the umbrella of a management holding

company ー will focus more

strongly on their core competencies, making better use of growth

opportunities and aiming for a sustainable improvement in

performance. "In just seven months we have entirely

realigned the Group and adapted it to both current and future

market challenges," commented Bayer AG Management Board

Chairman Werner Wenning. "In this way we have accomplished

an important part of Bayer's restructuring."

For the moment the new structure only applies internally, with

the future legal entities still being run as organizational units

of Bayer AG. In October 2002 Bayer CropScience AG will also become legally independent ー

with retroactive economic effect

from January 1, 2002. The carve-out of the other companies is

planned to take place in July 2003 with retroactive economic

effect from January 1, 2003, after approval has been received

from the 2003 Annual Stockholder's Meeting.

This biggest reorganization in Bayer's history is designed to

enhance the Group's international competitiveness. According to

Wenning: "With this reorganization we are separating

strategic management from business operations to ensure that the

future subgroups Bayer Chemicals, Bayer CropScience, Bayer

HealthCare and Bayer Polymers

can act flexibly in their markets, make rapid, focused decisions

and capitalize more quickly on innovations." They are also

considerably better positioned for strategic options, including

cooperations, joint ventures or strategic alliances, as well as

acquisitions and divestments. "We expect the new structure

to bring a sustainable increase in corporate value ー in the interests of shareholders,

customers and employees alike," said Bayer's CEO.

In future the Bayer Group will be run by the Management Board of

the new holding company which, apart from Wenning as Chairman,

includes Klaus Kuhn (responsible for Finance), Dr. Udo Oels

(Technology and Environment), Dr. Richard Pott (Strategy and

Human Resources, labor director) and Werner Spinner (Business

Excellence, Regions and Services). The holding company will deal

with portfolio issues, strategy, budgets, finance and

appointments to the principal managerial positions.

Chairman of the Board of Management of the future Bayer HealthCare AG, which comprises the Pharmaceuticals,

Consumer Care, Diagnostics, Biological Products and Animal Health

business groups, is Dr. Frank

Morich. The Management Board Chairman of Bayer CropScience AG, which combines Bayer's crop protection

business with the recently acquired Aventis CropScience, is Dr. Jochen Wulff. Dr. Ulrich Koemm

has been appointed Chairman of the Board of Management of Bayer Chemicals AG, which comprises the current Basic and Fine Chemicals

and Specialty Products business groups along with subsidiaries H.C. Starck and

Wolff Walsrode. Dr. Hagen Noerenberg becomes Chairman of the

Board of Management for Bayer Polymers AG, which unites the activities of the

current Plastics,

Rubber, Polyurethanes, and Coatings and Colorants business

groups.

* Service

companies

Bayer Business Services,

Bayer Technology Services and Bayer Industry Services

Consent is given to the Hive-Down

and Transfer Agreements between the Company and Bayer HealthCare AG, Bayer

Polymers AG and Bayer Chemicals AG.

Consent is given to the Hive-Down

and Transfer Agreements between the Company and the service

companies Bayer

Business Services GmbH, Bayer Technology Services GmbH and Bayer

Industry Services GmbH & Co. OHG..

(Bayer USA)

April 28,2003 Bayer USA

Bayer Launches New North American Organization and New Leadership

Bayer AG shareholders voted at their annual meeting to adopt a

new organizational structure proposed by the Bayer AG Board of

Management. The proposal represents for Bayer far-reaching

changes that are expected to provide maximum operational and

strategic flexibility and meet new challenges in the marketplace

where the company competes. The company's Supervisory Board has

approved the new global structure and executive appointments.

Consistent with the global reorganization, Bayer's U.S.

subsidiary, Bayer Corporation, announced its new organizational

structure and leadership team for North America. The new

organization includes five operating companies and a service

company within a management holding structure.

In 2002, Bayer had global sales of Euros 29.6 billion, of which

approximately Euros 9 billion were from North American

operations.

Bayer's new organization in the United States comprises five

operating companies: Bayer CropScience LP, Bayer Chemicals

Corporation, Bayer HealthCare LLC, Bayer Polymers LLC and Bayer

Pharmaceuticals Corporation.

Separately, it has also created a service company, Bayer

Corporate and Business Services LLC. These six businesses are

under the umbrella of the holding company, Bayer Corporation.

As previously announced, Dr. Attila Molnar, the Senior

Representative of Bayer in North America, is President and CEO of

Bayer Corporation.

Bayer Polymers, Bayer Chemicals, Bayer Corporate and Business

Services and the Bayer Corporation holding company are based in

Pittsburgh.

Bayer's five operating companies -- CropScience, Chemicals,

HealthCare, Polymers and Pharmaceuticals -- produce a broad range

of products found in nearly every house, hospital, farm and

factory across America. Its products help diagnose and treat

diseases, purify water, preserve local landmarks, protect crops,

advance automobile safety and durability and improve people's

lives.

One of Fortune magazine's Most Admired Companies, Bayer promotes

science literacy and hands-on education through its Making

Science Make Sense educational initiative. Approximately 5

percent of Bayer's 21,600 employees volunteer in local schools,

and more than 500 charitable organizations receive funding from

the Bayer Foundation. In 2002, Bayer's diversity efforts were

honored with the Catalyst Award for its Women: Leaders for the

Global Marketplace program.

The worldwide Bayer Group is based in Leverkusen, Germany, and

has some 120,000 employees. Its stock is a component of the DAX

and is listed on the New York Stock Exchange (ticker symbol:

BAY).

2002年10月03日 Chemnet Tokyo

バイエル、EQTに子会社の香料メーカー売却完了

バイエルは3日、子会社の香料メーカーであるハーマン・アンド・ライマー社(H&R)をEQTノーザン・ヨーロッパ・プライベート・エクイティ・ファンズ(EQT)に売却したと発表した。200年10月1日に契約、即時に発効し、EQTはH&Rを取得した。バイエルは売却益を債務削減にあてる。

バイエルグループは、H&Rの売却により事業ポートフォリオの合理化を一段と加速させた。この数ヶ月間にバイエルは住宅部門、アグファ社の株式、フランス、スペインの後発医薬品事業などの売却を行なってきた。さらに近くラインケミー、ポリマーラテックス両社および家庭用殺虫剤事業も売却する予定だという。

October 1, 2002

Portfolio streamlining continues

Bayer divests Haarmann & Reimer

Bayer AG, Leverkusen, has sold its non-core Haarmann & Reimer subsidiary to the EQT Northern Europe Private Equity Funds. Closing of the deal today, October 1, 2002, means EQT acquires the business of the Holzminden, Germany-based fragrances and flavors manufacturer with immediate effect. Bayer will use the proceeds to reduce net debt.

The sale marks the completion of another stage in the streamlining of the Bayer Group's business portfolio. In recent months Bayer already divested company housing units, the interest in Agfa and the generics business in France and Spain. The further planned divestments of Rhein Chemie, PolymerLatex and the household insecticides business are expected to be accomplished in the near future.

October 4, 2002

Bayer plans to sell Rhein

Chemie to Advent

International → 売却取り止め

Transfer scheduled

for November 2002

Bayer AG intends to

sell its subsidiary Rhein Chemie Rheinau GmbH, Mannheim, Germany,

to a group of financial investors advised by Advent International

Corporation, Boston, for EUR 215 million, including the

assumption of debt. The transaction would include the wholly

owned subsidiary iSL-Chemie GmbH & Co. KG of Kurten, Germany,

as well as Rhein Chemie affiliates in the United States and Japan

and a Chinese joint venture in which Rhein Chemie owns a 90

percent interest. It is planned to complete the sale at the

beginning of November, subject to the approval of the relevant

antitrust authorities.

"Under this new

ownership, Rhein Chemie would have excellent prospects of further

expanding its strong market position," commented Bayer AG

Management Board Chairman Werner Wenning. In December 2001, Bayer

announced its intention to divest Rhein Chemie and other

subsidiaries so as to focus more closely on its core businesses.

The sale of Holzminden, Germany-based subsidiary Haarmann &

Reimer to the financial investor EQT was completed only a few

days ago.

Founded in 1889,

Rhein Chemie has been a subsidiary of Bayer AG since 1971. The

company is an internationally successful supplier of specialties

to the rubber, lubricant and plastic industries. Its 1,100

employees in Germany and around the world, including 550 in

Mannheim, generated global sales in 2001 of approximately EUR 320

million. Rhein Chemie operates production facilities in Germany,

the United States, China, Japan and other countries.

With more than 50

investments worldwide in the chemical and pharmaceutical

industry, Advent International Corporation has extensive

experience in this sector. Its investments in European companies

include Vinnolit in Germany, Materis in France and Pemco in

Belgium.

Advent International

is one of the world's largest private equity firms with EUR 6

billion under management and offices in 14 countries. The company

employs more than 100 experts in the United States, Europe, Latin

America and Asia. Since its founding in 1984, Advent

International has invested in over 500 companies. The chemical

and pharmaceutical sector is one of Advent International's main

fields of expertise in Europe.

December 5, 2002 Bayer

Strategic options for Rhein Chemie under review

An agreement concluded in October 2002 between a U.S. financial investor and Bayer concerning the sale of Rhein Chemie has been dissolved by common consent of the parties, who were unable to agree on a number of outstanding points. Various strategic options are currently being considered.

Rhein Chemie is an internationally successful supplier of specialties to the rubber, lubricant and plastics industries. It also has a wholly owned subsidiary, iSL-Chemie GmbH & Co. KG in Kurten, Germany, affiliates in the United States and Japan, and owns a 90 percent interest in a joint venture in China.

March 26, 2003 Financial Times

Bayer to keep Rhein Chemie.

After looking for a buyer for 15 months, Bayer AG of Leverkusen, Germany, has decided not to sell its Rhein Chemie Rheinau GmbH subsidiary. A $212 M deal with the US equity form Advent International Corp fell through in Dec 2002. Rhein Chemie has been a Bayer subsidiary since 1971, employs 1100 people and had sales of $275 M in 2002. The company supplies products for the plastics industry, including release agents, vulcanisation agents and polymer-bound chemicals. The company also distributes Bayer's rubber polymer and rubber chemical products in the USA. It is likely to remain operating as an independent unit rather than joining the new Bayer Polymers AG structure.

独バイエル 渦中の医薬継続 「総合化学」維持

道探る 「内向き」志向の改革カギ

独バイエルが高脂血症治療薬「バイコール」の副作用事故で揺れる医薬事業の継続を決めた。事故後の情報開示の遅れも手伝って信用を失ったが、低成長の化学事業だけでは世界大手として生き残れないと判断したからだ。BASF、ヘキスト(現アベンティス)を加えたかつての「独三大化学」の中で、化学・医薬の両立にこだわる同社の総合路線が問われる。

「挫折を味わったが、医薬は今後も中核事業」ーー。米同時テロの衝撃が冷めない9月13日、バイエルのマンフレッド・シュナイダー社長は、いったんは検討した医薬事業の売却を撤回した。

米で「副作用死者」

最高意思決定機関の監査役会は同日、医薬事業を保持すると決定。生え抜きのべルナー・ベニング取締役最高財務責任者を2002年4月に次期社長にすることも決めた。監査役会会長に就任予定のシュナイダー社長は「10年の任期満了に伴う交代」を強調。「バイコール」の副作用事故による引責辞任説を否定した。同社株価はその後一段と下げた。

挫折の発端は、米食品医薬品局(FDA)が8月発表した「副作用と見られる米国の死者31人」という報告。同薬品の全面回収を余儀なくされたほか、政府への情報開示の遅れから独検察庁が薬事法違反の疑いで捜査に乗り出し、消費者の信用も失墜した。

同社の医薬の売上高比率は32%。バイコールは年2倍近い増収を続けただけに、今年12月期の営業利益が前期比大幅減の見通しとなる打撃を受けた。

労組が売却反対

日本のエイズ薬害にみるように、信用を失った医薬事業の存続は難しい。同社は死亡事故が表面化した後、「出資比率が5割を切ることも辞さない」と、競合2社と医薬部門の売却交渉に入った。それを土壇場で撤回した裏には、労組幹部らが「百年の伝統を持つ医薬事業は保持すべきだ」と、雇用・国益面から売却を反対したことがある。

労使折半参加の監査役会が、協調を重視する余り、「大胆な改革を妨げた」との指摘もある。一般株主の利害が二の次になりがちな監査役会制度は独国内でも批判がある。ダイムラークライスラーは9月、北米部門の不振を十分監視できなかった反省から、監査役会の否定にもつながる社外取締役による米国型の経営評議会の発足を決めている。

化学と異なる性格

バイエルは化学を低成長ながら安定収益源とした上で、医薬を高成長部門に位置付けてきた。だが、規模の効果を追求する装置産業の化学と、知識集約型の医薬は性格が異なる。医薬の場合、先端技術の吸収は米国での買収・投資戦略に負う部分が大きい。米診断薬メーカーに出資したほかゲノム分野の提携先も多い。診断薬の本部も米国にある。市場・開発の両面で米依存が強いだけに、英米型の厳しいルールの中で勝負するほかない。

一方で、化学事業は独大手銀行との連携を通じて大型投資をしてきた歴史がある。金融機関の株式保有率が過半数に達する中で、ドイツ的な企業統治も変えにくい。米独のこの溝を埋めない限り、米市場での摩擦は続く。副作用による最も多くの死者が出た米国で複数の賠償訴訟が発生。ニューヨーク証券取引所への株式上場も来年に延期した。 バイエルは9月、FDAに男性用性的不全治療薬の新薬承認を申請し、新たな事業拡大を狙っている。だが、責任追及と抜本改革を怠れば再び対応を誤る懸念も残る。

他メーカー 得意分野に特化

「三大化学」と呼ばれ、独経済の屋台骨だったBASF、バイエル、ヘキスト。だが、総合化学メーカーと呼べる独企業は今やバイエルだけとなった。売上高で世界最大の化学メーカー、BASFは今年3月に投資がかさむ医薬部門を売却し、化学専業に転換した。ヘキストは仏ローヌ・プーランとの合併で生命科学大手のアベンティスに変わった。

3社を含む独化学5社は1925年、合併によって「IGファルベン」を形成、ナチス時代に世界最大の総合化学コンツェルンに発展した。戦後の集中排除で再び3社に分かれたが、目指したのは複数分野を網羅した総合化学大手だった。

だが、グローバル競争の進展に伴い投資規模が膨らみ、同業他社は得意分野に事業を集中し始める。その中でバイエルはアベンティスから遺伝子組み替え技術を含む農薬部門を買収することで合意。業容拡大策は不変だ。業績が悪化していても、継続投資を要する先端分野をどこまでカバーできるかが焦点となる。

October 28, 2002 Bayer

Bayer CropScience AG to sell a range

of products to BASF

Company on track with regulatory divestments

subsequent to acquisition of Aventis CropScience

Bayer CropScience AG today announced

that it intends to sell a package of selected insecticides and

fungicides to BASF AG while retaining certain back-licenses for

non-agricultural applications. The total package is valued at EUR

1,330 million. Taking into consideration the back-licenses the

cash purchase price amounts to EUR 1,185 million. With the

completion of the envisaged transaction, Bayer CropScience would

fulfill within the given timeframe a major condition imposed by

the European Commission and the U.S. Federal Trade Commission

(FTC) as part of the Aventis CropScience acquisition. This

transaction is subject to the approval by the European Commission

and the U.S. Federal Trade Commission.

Following the respective consent

orders the agreements with BASF contain assets and rights related

to two insecticides (active ingredients: Fipronil, Ethiprole) and

a number of fungicides (active ingredients: Prochloraz,

Iprodione, Triticonazole, Fluquinconazole and Pyrimethanil) for

certain regions and application fields. BASF will also acquire

the Aventis CropScience manufacturing plant in Elbeuf, France.

The total revenue from the products and operations involved in

the transaction amounted to about EUR 500 million in 2001.

"After the sale of these

products, Bayer CropScience can now focus entirely on developing

its business and expanding its market position", said Werner

Wenning, Chairman of the Board of Management of Bayer AG.

"Cash-in from the sale also

contributes to improving the Group´s financials, as does the cash inflow from

the other divestments we have already announced."

"Following a very competitive

auction process and intensive negotiations with several

interested parties we are pleased to have reached an agreement

with BASF," added Dr. Jochen Wulff, Chairman of the Board of

Management of Bayer CropScience AG. "The purchase price

agreed represents a fair compensation for the required

divestments. I am also pleased that we were able to retain

licence rights to market Fipronil and its mixtures in certain

non-agricultural markets within the scope of the FTC consent

order," emphasized Wulff. "The integration of the

Aventis CropScience operations is moving ahead quite rapidly and

we continue to focus our efforts on the further integration and

strategic development of the new Bayer CropScience."

Bayer CropScience AG, a subsidiary

of Bayer AG with annual sales of some EUR 6.5 billion, is one of

the world's leading innovative crop science companies in the

areas of crop protection, seeds and green biotechnology, as well

as non-agricultural pest control. The company offers an

outstanding range of products and extensive service backup for

modern, sustainable agriculture and for non-agricultural

applications. Bayer CropScience has a global workforce of 22,000

and is represented in 122 countries, ensuring proximity to

dealers and consumers.

Chemnet Tokyo 2003/03/06 発表文

バイエル、ポリマ−ラテックス社の売却決る

バイエルは6日、デグサ社との折半出資会社であるポリマーラテックス社(本社:ドイツ)を金融投資会社のソロス・プライベートエクイティ・パートナーズ社に売却すると発表した。売却金額は約2億3,500万ユーロ。

バイエルはこれまでに子会社ハーマンアンドライマーをはじめ、アグファ社株式の30%、バイエル社の社宅、ジェネリック医薬品、家庭用殺虫剤事業などの売却、整理を行ってきたが、今回のポリマーラテックス社の売却により、一連の戦略的再編プロジェクトを完了する。

2003/3/4 Bayer

Bayer and Degussa

sell PolymerLatex to Soros Private Equity Partners

Bayer AG of

Leverkusen, Germany, and Degussa AG of Dusseldorf, Germany, are

selling PolymerLatex GmbH & Co. KG, their Marl, Germany-based

50:50 joint venture, to the financial investment company Soros

Private Equity Partners. The sales price amounts to approx. 235

million euros. The transaction is subject to the approval of the

relevant antitrust authorities.

The sale of

PolymerLatex completes the divestment program which Bayer

launched at the end of 2001 as part of its Group-wide

reorganization and strategic realignment project. The divestments

included the subsidiary Haarmann & Reimer, the 30 percent

interest in Agfa, a large proportion of the Bayer company

apartments, the generics business in France and Spain and the

household insecticide business. In addition, Bayer sold off numerous crop

protection products and active ingredients which had to be

divested or licensed out as a result of conditions imposed by the

anti-trust authorities following the take-over of Aventis

CropScience. Through the cash inflow from the divestment program

Bayer has been able to cut its net debt, which had increased

significantly in 2001 through the acquisition of Aventis

CropScience, to less than 10 billion euros by the end of 2002.

In fiscal 2001,

PolymerLatex generated sales of 344 million euros with about 730

employees. The joint venture, which was founded in 1996 by

Degussa and Bayer, produces latex products in the paper,

carpet/moulded foam and speciality applications fields, and holds

a leading position among latex suppliers. PolymerLatex has been

able to expand its leading market position even further over the

past few years thanks to significant investments in its five

European production sites, and continuous development of

customized products.

Soros Private Equity

Partners ("Soros") is a global private equity investor

which, together with its affiliates, currently manages in excess

of US-Dollar 4 billion of equity capital. Soros has announced

that it intends to develop PolymerLatex's operations in the

coming years and will consider possible add-on-acquisitions to

consolidate its market share.

Bayer is an

international, research-based group with major businesses in

health care, crop science, polymers and specialty chemicals. For

2001, the group recorded sales of 30.3 billion euros. Capital

expenditures totaled 2.6 billion euros in 2001 and 2.6 billion

euros were invested in research and development. The total number

of employees worldwide at the end of September 2002 amounted to

about 123.500. For more information visit www.bayer.com.

日本のバイエル、組織改革進む

バイエル ケミカルズ ジャパン株式会社を7月1日に設立

バイエルグループ、世界および日本における化学品事業を更に強化

バイエル株式会社(本社:東京都港区、社長:ミヒャエル・ポートフ)は、2003年7月1日付で、同社の基礎・精密化学品およびスペシャリティ製品等の化学製品を取り扱う事業部門を新設分割の方法により、全額出資子会社としてバイエル ケミカルズ ジャパン株式会社を設立する。代表取締役社長には、バイエル(株)日本・韓国バイエル ケミカルズ代表のエッカード・ベンデロートが就任する。なお、新会社の所在地はバイエル(株)に同じ。

これに伴い、同事業部門の従業員は同日付で全員新会社に移籍する。

また、バイエル(株)が所有している豊橋事業所(愛知県豊橋市)を従業員を含めバイエル ケミカルズ ジャパン(株)に移管する。同事業所は、物流センターおよび顧客技術サービスセンターとして、紙パ用化学品、繊維加工用化学品、およびイオン交換樹脂などの試験施設を擁している。

今回の組織改革は、バイエルグループが世界規模で推進している戦略的な4事業部門の再編の一環として実施される。本改革は、ヘルスケア、農薬、高分子材料、化学品の各事業の独立性の拡大と世界市場における競争力の維持・強化を目的としたもの。なお、バイエルグループ(ドイツ)においても本年中に化学品事業を担うバイエル ケミカルズ社が独立子会社として発足し、ドイツ・バイエル社が持株会社として運営する予定。

バイエルグループの化学品事業の売上は、33億ユーロ(2002年)で、すでに世界的なリーダーとしてのポジションを確立している。一方、日本における化学品事業グループは、基礎・精密化学品およびスペシャリティ製品等の化学製品を取り扱う化学品事業部門とH.C.スタルクで構成されており、売上は330億円(2002年)。化学品事業部門は、11ユニットで構成されており、中間体製品、添加剤、着色剤や技術ソリューションを多岐に渡る産業に提供している。バイエルの化学品事業グループの商品や業績の詳細はホームページ http://www.bayerchemicals.com (英語)にて閲覧可能。

H.C. スタルク社は、ドイツ・バイエル社の関連企業であり、世界各地で耐熱性金属やスペシャリティ製品の生産・販売をしている。日本においては、日本のバイエルのグループ企業であるスタルク ヴイテック(株)が同事業を引き続き行なう。

| バイエル ケミカルズ ジャパン株式会社概要 | |||

| 会社名称 | : | バイエル ケミカルズ ジャパン株式会社(Bayer Chemicals Japan Ltd.) | |

| 設立日 | : | 2003年7月1日 | |

| 資本金 | : | 4億円 (バイエル株式会社100%出資) | |

| 従業員数 | : | 61名 | |

| 事業内容 | : | 有機・無機化学品原材料の輸入・販売・スペシャリティ製品に関する研究 および技術サポート |

|

| 本社 | : | 東京都港区高輪4丁目10番8号 | |

| 事業所 | : | 豊橋事業所(愛知県豊橋市) 顧客技術サービスセンター(愛知県豊橋市)--- イオン交換樹脂ラボ、紙パ用化学品ラボ、繊維加工用化学品ラボ 顧客技術サービスセンター(兵庫県姫路市)--- 皮革用化学品ラボ |

|

| 役員 | : | 代表取締役社長 エッカード・ベンデロート 取締役 ミヒャエル・ポートフ 取締役 ブルース・オルソン |

|

China Chemical Reporter

2003/7/29

Bayer Plans to

Invest in the Construction of a HDI Project in Shanghai

Bayer of Germany has

signed with Shanghai Chemical Industry Development Zone an MOU on

the construction of a 30 000 - 50 000 t/a HDI (hexamethylene

diisocyanate) project in the next 3 years. Bayer is one of the

first chemical giants launching projects in Shanghai Chemical

Industry Development Zone and has so far put a total investment

of over US$3.0 billion. The coating project starting construction

by Bayer in January 2001 has been completed and put on stream and

the annual output value of the project can hopefully reach RMB150

million. The polycarbonate project jointly funded by Bayer and

Shanghai Chlor-alkali Chemical Industrial Co., Ltd. will start

construction in the fourth quarter this year. Preparations of the

MDI/TDI project that has already been approved are also under

way. Bayer has a keen interest in the increasing market of

high-tech chemical products in China and intends to make further

investments in the integrated base in Shanghai. According to the

MOU, Bayer will construct a 30 000 - 50 000 t/a HDI unit in the

compounds of its coating plant and put the project on stream in

2006. HDI is a major raw material for coatings and adhesives

produced in Bayer Coating Co., Ltd.

August 11, 2003 Bayer Polymers

Asian center for high performance coating raw materials

Bayer Polymers plans large-scale investments at its Caojing,

China, site

Bayer Polymers, a division of Bayer AG, plans to expand its

Caojing site near Shanghai, China, making it Bayer Polymers' most

important production facility for coating raw materials in the

Asia Pacific region. Production plants for aliphatic (脂肪族) and aromatic polyisocyanates as well as the monomer hexamethylene

diisocyanate (HDI) will be

constructed in three phases at the Shanghai Chemical Industry

Park. This project is being managed by Bayer Coatings Systems

Shanghai Company Limited (BCSS), a wholly-owned Bayer subsidiary

that develops, produces and markets raw materials for coatings

and adhesives and also provides associated technical services.

"The demand for raw materials for the manufacture of high

performance polyurethane coatings is growing strongly in this

region. With this large-scale investment program, we aim to

optimally exploit the excellent market opportunities there,"

says Dr. Joachim Wolff, Senior Vice President of Global

Operations Base and Modified Isocyanates (BMI) at Bayer Polymers,

"We expect our coating raw materials business to continue

its outstanding performance because the coatings formulated from

these products satisfy highest requirements with respect to

appearance, chemical resistance, mechanical strength,

lightfastness and weather stability.

In April 2003, a plant with an annual capacity of 11,500 tons was

brought on line for the production of the Desmodur® N line of aliphatic

polyisocyanates, a segment in

which Bayer Polymers holds a leading position. These raw

materials are used primarily in the formulation of general

industrial and automotive refinishing coatings, as well as

coatings for plastics.

A production plant for the Desmodur® L line of aromatic polyisocyanates is currently under construction. These

raw materials have proved ideal for the formulation of high

performance polyurethane coatings, e.g. for wood and furniture.

With the start of operation of this plant in late 2004, Bayer

Polymers will have a total capacity of 11,000 tons for Desmodur® L

products at the Caojing site, enabling Bayer Polymers to maintain

its strong position in the field of low-monomer raw materials for

these coating systems. Bayer Polymers' goal is to be the first

local producer of low-monomer TDI adducts in support of a Chinese

government initiative to reduce the free TDI content in wood and

furniture coating systems for interior applications.

The third project is the construction of a plant for the

production of

HDI,

which is used as a raw material for aliphatic polyisocyanates.

The plant will ultimately have a total capacity of 50,000 tons,

with 30,000 tons available by 2006. Capacity can be expanded by

roughly 20,000 tons in a second phase of construction if

warranted by market growth in the region.

2003年10月2日 バイエル株式会社

バイエルグループの組織再編進む

バイエル ヘルスケア社、バイエル

ケミカルズ社、バイエル テクノロジー

サービス社が独立

http://www.bayer.co.jp/bgj/newsfile/news/news-190_j.html

バイエル(本社:ドイツ、レバクーゼン、社長:ヴェルナー・ヴェニング)は、2003年9月30日、バイエル

ヘルスケア社、バイエル

ケミカルズ社、およびバイエル テクノロジー

サービス社が、商業登記を終え、法的に独立子会社になったことを発表した。これは、2002年よりバイエルグループ全体で始まった組織改革の一環であり、2003年末までには事業グループのバイエル

ポリマーズと、サービス事業部のバイエル

ビジネス サービスおよびバイエル

インダストリー サービスも独立を完了する予定。すでに2002年10月1日には、バイエル

クロップサイエンス社が独立子会社として事業を開始している。

ドイツ・バイエル社のヴェニング社長は、「今回の組織再編は将来の成功に向けたさらなる一歩である。新しい企業構造によって子会社の個々の責任が強化され、より柔軟な体制になる。当社の狙いは、各社の潜在能力を存分に活用し、価値創出と持続的な業績向上を実現することにある」と語った。

バイエル

ヘルスケア社は、医療用医薬品、バイオロジカルプロダクト、コンシューマーケア、診断薬、動物用薬品の5分野から成り、世界各地でヘルスケア事業を展開している。バイエル

ヘルスケアは現在、世界各地に約34,000人の社員を擁しており、2002年の売上高は94億ユーロ。バイエル

ヘルスケア社のロルフ・クラッソン社長は、「バイエル

ヘルスケアは、人間と動物の健康にかかわる広範な製品群を提供している。当社の強みは、高い競争力を持つ広範な製品ポートフォリオだ。当社の5部門中4部門がそれぞれの市場で上位5社に入っている。当社は良好なスタート地点に立っており、ここからさらに強力なヘルスケア事業を構築していく」と述べている。

バイエル

ケミカルズ社は、革新的なスペシャリティ化学品の大手企業であり、世界130地域に約14,500人の社員を擁している。バイエル

ケミカルズには既存のバイエルの化学品事業と子会社ウォルフ・ワルスローデが含まれており、H.C.スタルク社の事業運営も担当する。製品群は、染料、紙・パルプ用化学品、皮革用化学品、繊維加工用化学品、機能性化学品、医薬品・農薬向け中間体など多岐にわたる。2002年の売上高は33億ユーロ。バイエル

ケミカルズ社のウルリッヒ・ケム社長は「当社は、技術を革新し、常に前進する企業である。高品質の製品と第一級の顧客サービスによって、当社は長期的な成功の基盤を固めつつある」と語っている。

バイエル テクノロジー

サービス社は世界中で事業展開しており、化学品および医療用医薬品生産施設の開発、計画、建設、そして工程の最適化を担当している。ドイツ、レバクーゼンに本社を置き、テキサス州ベイタウン(米国)、メキシコシティ(メキシコ)、サンパウロ(ブラジル)、上海(中国)に地域事務所を設置している。全従業員数は2,300人。2002年の売上は6億9,000万ユーロ。バイエル

テクノロジー

サービス社のウォルフラム・ヴァーグナー社長は「我々は、技術革新と費用効果の高いソリューションを提供し、顧客の世界的な利益の確保と拡大を手助けすることを目的としている。この新会社の設立により、約2,300人の技術者と科学者が数十年にわたって蓄積してきた経験と専門知識が、さらに広範な社外の顧客にも利用可能となった」と述べている。

バイエルについて

バイエルは、ヘルスケア、農薬、高分子材料および化学品の4つの事業グループを柱に持つ、研究開発を基礎とする国際的な企業グループ。全世界の従業員数は122,600人(2002年末)。

グループ全体の2002年の売上は296億ユーロ、純利益は11億ユーロを計上した。

日本のバイエルについて

日本においてバイエルは、発売以来すでに100年以上経過している解熱・鎮痛剤「アスピリン」を発明した会社として知られている。

日本のバイエルは、ヘルスケア、農薬、高分子材料および化学品事業を展開している。

日本におけるバイエルグループ全体の2002年の売上げは2,110億円で、従業員数は約2,900名。

バイエルにとって、日本は世界第3位の市場。

日本経済新聞 2003/11/8

発表

独バイエル 中核の化学事業分離 経営資源、医薬などに集中

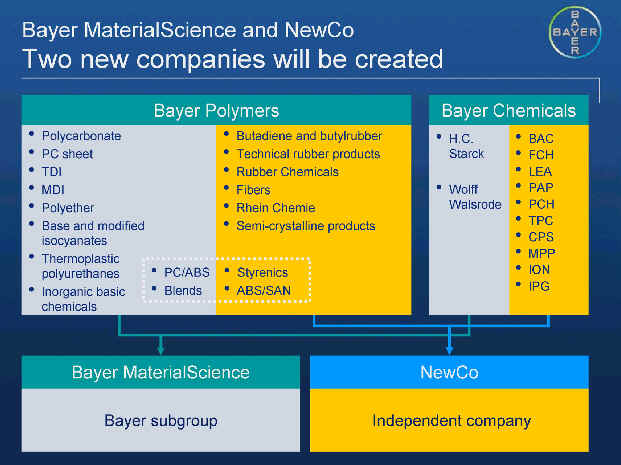

独バイエルは7日、ポリマーと化学事業部門を再編して新会社を設立し、2005年初めまでに株式上場させると発表した。化学部門の各種中間剤や繊維・製紙化学製品などをポリマー部門と統合し、新会社をつくる。中核の化学事業を分離独立させ、バイエル本体は医薬や農業化学など開発投資がかさむ事業に経営資源を集中する。

バイエルは今年から統括会社が4事業子会社を管理する体制を敷いた。医薬を含むヘルスケア、農業化学、ポリマー、化学の4子会社がある。このうちポリマー子会社を中核にして化学子会社の一部事業を統合し、新会社「NewCo(ニューコ)」を設立する。

新会社の年売上高は56億ユーロ(約7170億円)、従業員は2万人になる見通し。新会社を05年初めまでに上場させて、統括会社を核にしたバイエルグループの経営から切り離す。

主要な化学事業の分離に伴いバイエルグループはヘルスケア、農業化学、素材科学という新たな3事業子会社体制に変わる。同グループの売上高は現在よりも約20%減って約220億ユーロになる。新会社上場による売却益はこれら3事業分野に集中投資する。特に医薬や農業化学分野は開発費用がかさむ傾向にあり、3つの事業に特化して投資効率を高める狙いだ。

Werner Wenning continues

systematic realignment:

Bayer plans stock

market flotation for chemicals activities and strategic refocus

of health care business

http://www.press.bayer.com/News/News.nsf/id/0029E5ECD27BC2F7C1256DD70043DABF

Supervisory Board

approves Management Board plans /

Focus on core

businesses should enhance Bayer's competitiveness /

New company to be

positioned among Europe's leading chemical enterprises /

Pharmaceuticals

business to be retained as stand-alone solution

Following its

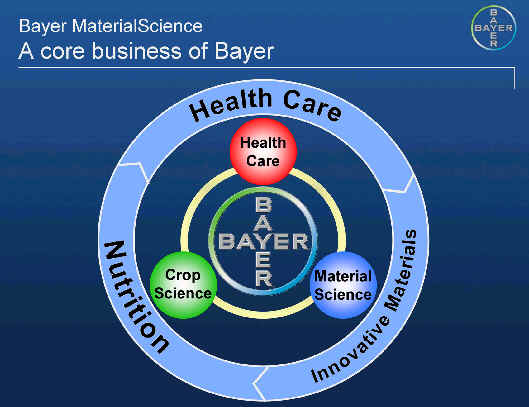

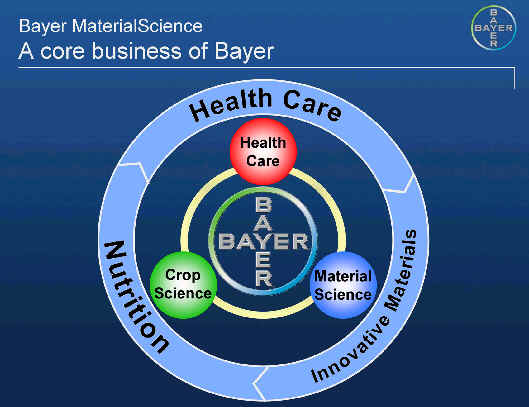

successful reorganization, the Bayer Group intends to maintain

its focus on its core businesses and in the future concentrate on

health care, nutrition and innovative materials. For this reason, Bayer

Chemicals (excluding H.C. Starck and Wolff Walsrode) is to be

combined with certain parts of the polymers business in a new

company with the provisional name "NewCo". The aim is for this company to

be listed on the stock market under a new name by early 2005 at

the latest. The Supervisory Board approved these plans of the

Group Management Board at its meeting today. CEO designate of the

new company is Dr. Axel Claus Heitmann (44), currently a member

of the Executive Committee of Bayer Polymers and head of that

company's Asia region, headquartered in Shanghai.

"Both Bayer and

NewCo will benefit from the split, because a stock market listing

will be highly attractive for both shareholders and

employees," explained Bayer CEO Werner Wenning.

"Following the separation, Bayer ー with sales of around EUR 22

billion ー will be able to focus more closely on the

core businesses in which we have excellent technologies, strong

market positions and above all growth areas that we intend to

further strengthen by pooling all our resources. In this way, we

aim to safeguard the success of our company in the long term and

generate additional value. Bayer's reorganization was a key

requirement for this significant step. Equally, we will be

safeguarding the future of our chemicals business because, as an

independent company, NewCo will be able to respond faster and

more flexibly. In this new scenario, chemicals and polymers will

be the core businesses and therefore the top priorities of the

company's new management team."

In the future Bayer

aims to concentrate all its financial and management resources on

developing and expanding its core activities in health care,

nutrition and innovative materials, which are predominantly

research-intensive areas. Wenning sees high growth potential in

these areas but also a corresponding need for investment.

"This means we do not have sufficient resources available to

maintain or enhance the market positions of our chemicals

business or all of our polymers activities," said Bayer's

CEO. The separation should trigger the necessary entrepreneurial

impulses and create the conditions for optimizing the strategies

of each company according to their different business needs.

Bayer's wealth of

knowledge with respect to humans, animals, plants and materials,

coupled with the respective products, will provide the foundation

for sustainable growth in the long term in the promising markets

in which Bayer plans to specialize. Following the reorganization,

Bayer will have three operating subgroups: Bayer HealthCare,

Bayer CropScience and Bayer MaterialScience.

Growth will come

primarily from products containing newly researched active

ingredients, from the consumer healthcare business and from

growth in Asia. However, contributions to value creation should

be achieved by the Group-wide utilization of technology

platforms, nanotechnology and the expansion of biotechnology and

genetic engineering as key innovation drivers.

Biotechnology is

used not only by CropScience to achieve sustainable qualitative

improvements in food crops and higher yields, but also to open up

a range of new applications in other areas such as gene-based

diagnostics.

Bayer's new

realignment also includes repositioning the Pharmaceuticals

business. "We

have examined all the options for this business ー especially

the possibility of partnerships. We found that none of these

solutions would have adequately reflected the value of our

Pharmaceuticals business. In our view, they would not have

offered a value-creating alternative," explained Werner

Wenning. "We therefore intend to focus on our own

strengths and steer our Pharmaceuticals Division with

significantly modified structures towards a successful future." Bayer will concentrate its

research effort on the therapeutic areas where it already plays a

leading role and has developed successful products:

anti-infectives, cardiovascular (including diabetes and obesity)

and urology. Bayer also has a number of promising product

developments in the oncology (cancer) field.

"We intend to

position our Pharmaceuticals Division as a mid-size European

pharmaceuticals business because we are convinced that this will

generate the greatest value for our shareholders," stated

Wenning. In the future, the division's activities will be focused

more strongly on Europe, though without neglecting the important

markets in the United States and Asia. According to Wenning,

considerable progress has already been made in restructuring

Pharmaceuticals. Successful new product launches have given

grounds for optimism. For example, sales of LevitraR, Bayer's

treatment for erectile dysfunction, are very encouraging. Also,

major progress has been made in the area of cancer research. A

raf kinase inhibitor for the treatment of advanced renal cell

carcinoma, developed in collaboration with U.S. company Onyx, has

now entered phase III clinical trials.

Wenning also sees

particular opportunities for growth in the consumer

healthcare business.

Bayer's Consumer Care, Diagnostics and Animal Health divisions

hold strong or very strong positions worldwide. The company

intends to further expand these activities.

The

CropScience business units

Herbicides, Insecticides, Fungicides and Seed Treatment hold

excellent positions, and the aim is to grow faster than the

market in these areas. Environmental Science is the market leader

in the supply of pest control products for the home and garden.

The Bio Science unit is a pool of impressive expertise in the

field of biotechnology for which experts predict annual growth

rates of 15 percent.

In MaterialScience, Bayer holds global leadership

positions in polyurethanes, polycarbonates and coating raw

materials. It has access to internationally acknowledged

leading-edge technologies and a wealth of expertise acquired over

many years. It is intended to continue expanding the growth areas

of innovative plastics and coatings materials ー with a

special investment focus on the growth markets of Asia. In China

alone, Bayer is currently building or planning several new

production facilities. The MaterialScience subgroup will in

future also include the subsidiaries H.C. Starck and Wolff

Walsrode.

In addition to these

three operating subgroups, the three service companies will also

remain within the Bayer Group. These companies will also perform

services for NewCo. Employees of the service companies whose work

centers on areas that will be part of NewCo are to be transferred

to NewCo.

With sales of EUR

5.6 billion and a workforce of around 20,000, NewCo will rank

among Europe's leading chemicals suppliers, occupy leadership

positions in more than two thirds of global market segments and

be a technology leader in manufacturing. "Independence will

trigger strong entrepreneurial impulses, enabling NewCo to

enhance the competitiveness of its production technology, too,

and generate above-average growth and value," said Wenning.

Independence from

Bayer should put NewCo in a position to utilize capital resources

more efficiently for the enhancement of its competitiveness and

to seek partners or investors at its discretion. The new

structure will also make it easier to focus management resources

on the specific needs of the chemicals business, conform

structures and processes to the requirements of the chemical

industry and activate niche markets utilizing new business

models. The aim is to continue to grow through a stronger focus

on innovation, efficient use of resources and targeted expansion

of attractive specialty applications.

NewCo will have a

broad-based portfolio of around 5,000 products covering basic,

specialty and fine chemicals as well as polymers. These products

include: intermediates for the manufacture of active ingredients

for pharmaceuticals and crop protection products; material

protection products; chemicals for the leather, textile and paper

industries; ion exchange resins for water treatment applications;

inorganic pigments for coloring concrete and plastics; polymer

additives such as flame-retarding agents and plasticizers; solid

rubber and rubber chemicals for the rubber and tire industries;

ABS (styrenics) and semi-crystalline thermoplastics which are

used primarily in automotive engineering, as well as for the

manufacture of covers and housings. NewCo will have a global

presence with production facilities and sales organizations in 40

companies and 20 countries.

Media briefing on November 26,

2003, Shanghai, China

http://www.news.bayer.com/News/News.nsf/id/29E09CD16BF08DC6C1256DE90037A77C

"Photo: Bayer MaterialScience"

2003/12/15 Bayer

バイエル、約22億ユーロの減損費用を計上

キャッシュフローと配当支払い能力には影響なし

バイエル(本社:ドイツ、レバクーゼン、社長:ヴェルナー・ヴェニング)は、2003年第4四半期(2003年9月〜12月)に合計22億ユーロの資産減損費用(asset impairment

charges) を計上することになった。この費用は、製品群の戦略的な再編、分社化が決定した新会社(化学品事業と一部の高分子材料事業より構成)の株式上場計画、並びに今後のバイエル

マテリアルサイエンス事業グループの経営条件の変化と関係している。なお、金利・税金支払い前収益(EBIT)へのこれら特別項目の影響は約20億ユーロになると予想されており、営業外収益は約2億ユーロ減少する見込み。

高分子、化学品事業における資産減損費用は、17億ユーロに上る見込みで、その大半は分社化される新会社に移転される事業活動に関係している。なお、この金額には、現在進行中の効率改善プログラムの一環である施設統合の費用も含まれている。

バイエル ヘルスケア事業グループは約5億ユーロの資産減損費用を計上する予定で、その一部は医療用医薬品研究施設の統合と関連している。

営業外収益関連での資産減損費用は、ダイスター社およびバイオリサーチ会社であるキュラジェン社が保有する株式の評価引き下げから発生する。

この減損費用は現金収支を伴わない会計項目であり、この引当金はキャッシュフローにもドイツ・バイエル社の配当支払い能力にも影響を及ぼさない。

この資産減損費用を考慮し、バイエルグループは2003年通年ではマイナスのEBIT並びに純損失を計上すると予想している。しかし、バイエルは引き続き、同特別項目計上前のEBITはこれまでの予想どおり二桁増になると見込んでいる。

December 11, 2003 Bayer

Bayer and DuPont

expand leading position in engineering thermoplastics

Dedication of

world-scale plant for the production of polybutylene

terephthalate (PBT)

Operator is

the joint venture DuBay Polymer GmbH / Total investment 50

million euros / Annual capacity: 80,000 tons

http://www.news.bayer.com/News/News.nsf/id/2003-0589

With the dedication of a

world-scale plant for the production of polybutylene

terephthalate (PBT)

in Hamm-Uentrop, Germany, Bayer and DuPont are building on their

position as leading manufacturers of engineering thermoplastics.

With an initial capacity of 80,000 tons per year, the plant is the biggest of its

kind in the world. It will be operated by DuBay Polymer

GmbH, a joint venture between Bayer and DuPont. The two companies have together

invested some 50 million euros in the plant, in which 61 people

are employed.

For a company to

thrive in today's highly competitive market, it must be able to

supply top-quality PBT at competitive prices. In Europe, this is

only possible with large world-scale plants and state-of-the-art

production technology. "Neither of the two companies, DuPont

or Bayer, can make adequate use of such a plant immediately on

their own, despite the favorable growth forecasts," said Dr.

Hagen Noerenberg, head of Bayer Polymers, at the dedication

ceremony. "With the jointly operated facility, both partners

will strengthen their positions in the keenly contested global

market for PBT," said Ferdinand Bauerdick, DuPont´s

Director Europe Engineering Polymers, who is also responsible for

the global polyester business of DuPont. Both companies use the

straight resin from the production facility and compound it into

products for their PBT ranges ー Crastin® in the case of DuPont, and Pocan® in

Bayer's case.

In 2002, some

140,000 tons of the polymer were processed in Europe. Global

demand for PBT will grow in the next few years at an

above-average rate of somewhere between six and eight percent a

year.

One of the strengths

of PBT is its broad, well-balanced property profile. The

high-tech plastic is noted among other things for its good heat

and chemical resistance, its high stiffness and its ease of

processing. It also has outstanding electrical insulating

properties, produces parts with an excellent surface finish and

can be readily combined with other plastics to produce blends.

The material has a

particularly promising future in the automotive and

electrical/electronic industries. These two segments are the main

customers for PBT, accounting together for around 80 percent in

more or less equal shares. Products for medical, sport and

leisure applications are also made from this high-performance

plastic.

The new production

plant at DuPont's Hamm-Uentrop site is integrated entirely into

the infrastructure of the Chemical Parkー from the energy supply to the

traffic links and raw material logistics. The new PBT plant,

which was built in just under two years, also sets new standards

in terms of environmental protection and occupational safety. For

example, no solvents are used to manufacture the plastic, and the

only by-product, methanol, is fed back completely into the

production process. "Virtually 100 percent of the raw

materials go into the desired product. In this way, we conserve

valuable resources," said Dr. Hubert Fink, chairman of the

members committee of DuBay Polymer GmbH.

March 22, 2004 Bayer

CropScience

Bayer CropScience to purchase Crompton's share of Gustafson seed

treatment business

Acquisition for 124 million US Dollar in North America and Mexico

http://www.bayercropscience.com/bayer/cropscience/cscms.nsf/id/D50F9538CF30D718C1256E5F0052372E?Open&ccm=400190000&L=EN&markedcolor=%23003399

Bayer CropScience LP in

the U.S. and Bayer CropScience Inc. in Canada today signed

agreements to purchase Crompton Corporation's 50 percent share of

the Gustafson seed treatment business in the United States,

Canada and Mexico [NAFTA] for the purchase price of U.S.$124

million in cash.

The action would give Bayer CropScience, which already holds a 50

percent share of the U.S. and Canadian Gustafson joint ventures, full ownership of

Gustafson's NAFTA business, subject to customary closing conditions.

The transaction is expected to close by the end of the first

quarter.

Gustafson manufactures and markets seed treatment products and

related equipment. Based in Plano, Texas, and Calgary, Canada,

the company employs approximately

250 people in the NAFTA region. In 2003, Gustafson sales were

approximately U.S.$130 million.

“Purchase of the Gustafson seed treatment

business would allow us to participate directly in this

increasingly important segment of the NAFTA crop protection

markets,” said Emil Lansu, President & CEO of

Bayer CropScience LP and head of Bayer CropScience for the NAFTA

region. According to Lansu, the acquisition would give Bayer

CropScience the benefit of the full range of Gustafson’s

products, including certain products from third parties, which

would continue to make up a key component of the Gustafson

product portfolio. “We presently have several strong seed

treatment products,” Lansu added. “With the

Gustafson purchase we look to more fully realize the potential of

this business while enhancing our ability to provide solutions

for growers.”

Crompton

Corporation, with annual sales of $2.2 billion, is a producer and

marketer of specialty chemicals and polymer products and

equipment. Additional information concerning Crompton Corporation

is available at www.cromptoncorp.com.

Bayer CropScience, a subsidiary of Bayer AG with annual sales of

about EUR 5.8 billion (2003), is one of the world’s

leading innovative crop science companies in the areas of crop

protection, non-agricultural pest control, seeds and plant

biotechnology. The company offers an outstanding range of

products and extensive service backup for modern, sustainable

agriculture and for non-agricultural applications. Bayer

CropScience has a global workforce of about 19,000 and is

represented in more than 120 countries, ensuring proximity to

dealers and consumers.

May 4, 2004 Bayer

Agreement signed to build a plant for the coating raw material

HDI

Bayer: Investments to strengthen growth in China

http://www.news.bayer.com/News/News.nsf/id/2004-0258

In the presence of

Gerhard Schroder, the German Chancellor, and Wen Jiabao, the

Chinese Premier, Werner Wenning, the Chairman of the Board of

Management of Bayer AG, and Prof. Gottfried Plumpe, a member of

the Board of Management of Bayer MaterialScience AG, signed an

agreement with Ruan Yanhua, President of the Shanghai Chemical

Industry Park Corporation, to build a world-scale production

plant for the coating raw material HDI

(hexamethylene diisocyanate). The ceremony was held during the third

German-Chinese high-technology dialogue forum on May 4, 2004, in

Berlin.

The HDI project involves a total capacity of up to 50,000 t/y and an investment of some USD

100 million. Construction of the new facility is scheduled to

begin in fall 2004. HDI is a precursor for aliphatic

polyisocyanates, which serve as raw materials for high-grade

polyurethane coating systems. Such systems are used predominantly

for automotive, industrial and plastics coatings. Bayer is the

market and technology leader in this field.

"China is already one of our most important markets,"

said Management Board Chairman Wenning during the signing of the

agreement. "China's importance for the chemical and

pharmaceutical industry will increase further in the coming

years. Bayer wants to play a leading role in the economic

development of the People's Republic. With our investments in

Caojing, we are creating ideal conditions for strengthening our

growth in this key market."

Over the next few years, total investments of some USD 3.1

billion are scheduled for the integrated production site at

Caojing near Shanghai. Of this, Bayer will spend some USD 1.8

billion on new facilities for polymer production - construction

work has already begun in some cases. Other projects worth a

total of USD 1.3 billion are also planned, but these will be

tackled later.

With the building of large capacities for polyisocyanates,

Caojing will become the main production site for Bayer

MaterialScience's coating raw materials in the Asia-Pacific

Region. Initial production capacity for the precursor HDI will

reach 30,000 t/y by 2006. Depending on the way the market

develops in the region, capacity could be extended by a further

20,000 t/y as part of a second construction phase. Since April

2003, coating raw materials in the Desmodur® N range have been produced in a

neighboring plant that has an annual capacity of 11,500 t. At the

end of 2004, a production facility for Desmodur® L with a capacity of 11,000 t/y is also

due to go on stream.

Also at the Caojing site, construction has started on a new

world-scale production plant for Makrolon® polycarbonate. The intention is that the

plant will go on stream in 2006, and will gradually be expanded

to reach a total capacity of 200,000 t/y - in line with market

developments. A further focus of investment is the construction

of world-scale production facilities for the two polyurethane raw

materials, MDI and TDI, which are used predominantly in the

manufacture of polyurethane foams. The plants for MDI and TDI are

scheduled to begin production by 2008 and 2009 respectively.

With sales of around EUR 1.1 billion in 2003, the Greater China

country group is Bayer's second-largest single market in Asia

after Japan. The company employs more than 2,700 people in

Greater China and is also represented there by a total of 24

firms. Eleven manufacturing companies from all Bayer's areas of

business are now producing in the region, with the result that an

increasing proportion of sales is being covered by local

production.

July 19, 2004 Bayer

Bayer to Acquire Roche Consumer Health

http://www.news.bayer.com/News/News.nsf/id/2004-0448

Acquisition creates global

consumer health care company that will rank among top three

worldwide / Acquisition price EUR 2.380 billion including U.S. joint

venture

With the acquisition of Roche Consumer Health, Bayer is going to

extend its portfolio of long-standing brands for commercial

success.

Bayer announced today that it has agreed to acquire Roche

Consumer Health. By acquiring this business Bayer will become one

of the top three over-the-counter (OTC) consumer health companies

worldwide. Additionally, Bayer will acquire Roche's 50 percent

share of the 1997 Bayer/Roche joint venture in the U.S., (an element not included in Roche's

original offering) and five Roche production sites in Grenzach

(Germany), Gaillard (France), Pilar (Argentina), Casablanca

(Morocco) and Jakarta (Indonesia). The OTC business of the Japanese company

Chugai, in which Roche has a majority stake, is not included. The acquired business has yearly sales of

around EUR 1 billion. The EUR 2.380 billion transaction is

subject to approval by relevant antitrust authorities.

“It is our intention to

further strengthen Bayer’s

OTC business to become world leader, and with this acquisition we

make another large step towards this goal,” said Werner Wenning, Chairman of the Board

of Management of Bayer AG. “By

combining the two businesses we can realize significant

synergies. Additionally, the acquired business is of high value -

the combined product portfolios are very complementary and

contain strong trusted brands. The acquisition also provides

growth and attractive profit margins in an interesting and fast

developing part of the health care market -- one which is

characterized by increasing consumer interest in overall health

and self-medication. This is a good opportunity for our products.”

Bayer HealthCare's Consumer Care

Division and Roche Consumer Health share a heritage of building

on their long-standing brands for commercial success. Both have a

number of significant analgesic, dermatological, gastrointestinal

and nutritional brands that offer outstanding growth potential

across the globe. Combined brand equities include such well-known

brands as Bayer's Aspirin®, Alka-Seltzer®, Midol® and One-A-Day® and Roche's Aleve®, Bepanthen®, Berocca®, Flanax®, Redoxon®, Rennie®, and Supradyn®.

Both companies have a strong market presence in Europe and the

Americas and the move also builds greater presence for Bayer

HealthCare in the growing Asia-Pacific region. “Through this acquisition we intend to

leverage the capabilities, reputation, and strong brands of both

companies to create a world leading OTC company,” said Arthur Higgins, chairman of the

Executive Committee of Bayer HealthCare. “The new organization will be uniquely

positioned to exploit the growth potential in the OTC-market and

emerge as a partner of choice for future Rx/OTC-switches.”

Assuming approval from the relevant

antitrust authorities and subsequent closing of the transaction

by the turn of the year 2004/2005, after one time charges of

about EUR 300 million Bayer expects an EPS impact (earnings per

share) of 0.25 EURO /share in 2005 and a positive impact on

results from 2006 forward. The synergy potential is estimated at

approximately EUR 100-120 million. It is planned to realize the

synergy potential gradually over the next three years.

Bayer plans to finance the acquisition out of existing

facilities. Bayer had liquid assets of EUR 2.6 billion at the end

of the first quarter 2004 and thus a sound basis for financing

the transaction.

The combined company will have sales of EUR 2.4 billion and 6,700

employees in 120 countries. It will be headed by Gary Balkema,

currently president of Bayer HealthCare’s global Consumer Care Division and have

its global headquarters in Morristown, New Jersey, U.S.A. Mr.

Balkema is an experienced Consumer Care executive who has

successfully enabled Bayer’s

consumer health business to consistently outperform the OTC

market for the past five years. The European headquarters will be

in Switzerland in the Basel area. Research and development for

the new organization will be situated at Bayer Consumer Care

headquarters in Morristown and at the Roche Consumer Health site

in Gaillard, France.

About Bayer

Bayer is a research-based, growth-oriented global enterprise with

core competencies in health care, nutrition and high-tech

materials. In 2003, Bayer employed some 115,400 people and had

sales of EUR 28.6 billion. The capital expenditure budget for the

current year is EUR 1.8 billion, the R&D budget EUR 2.3

billion. The Bayer Group is committed to the principles of

sustainable development ? with economic growth, ecological

integrity and social responsibility accorded equal priority in

its corporate activities throughout the world. For more

information on Bayer go to www.bayer.com.

About Bayer HealthCare

Bayer HealthCare, a subgroup of Bayer AG with sales of

approximately EUR 8.9 billion in 2003, is one of the world's

leading, innovative companies in the health care and medical

products industry.

The company combines the global activities of the divisions

Animal Health, Biological Products, Consumer Care, Diagnostics

Professional Testing Systems and Diagnostics Self Testing Systems

and Pharmaceuticals. 34,600 people are employed by Bayer

HealthCare worldwide. Bayer Consumer Care, a division of Bayer

HealthCare, is headquartered in Morristown, N.J. Bayer Consumer

Care is among the largest marketers of over-the-counter

medications and nutritional supplements in the world. Some of the

most trusted and recognizable brands in the world today come from

the Bayer portfolio of products. For more information on Bayer

HealthCare, go to www.bayerhealthcare.com.

About Roche

Headquartered in Basel, Switzerland, Roche is one of the world’s leading innovation-driven healthcare

groups. Its core businesses are pharmaceuticals and diagnostics.

Roche is number one in the global diagnostics market and is the

leading supplier of pharmaceuticals for cancer and a leader in

virology and transplantation. As a supplier of products and

services for the prevention, diagnosis and treatment of disease,

the Group contributes on a broad range of fronts to improving

people’s health and quality

of life. Roche employs roughly 65,000 people in 150 countries.

The Group has alliances and research and development agreements

with numerous partners, including majority ownership interests in

Genentech and Chugai.

Alka-Seltzer, Aspirin, Midol and One-A-Day are registered

trademarks of Bayer AG.

Aleve, Berocca, Flanax, Redoxon, Rennie and Supradyn are

registered trademarks of F. Hoffman-LaRoche Ltd.

Roche and Bayer to form an OTC

joint venture in the United States

http://www.roche.com/media-news-1996-09-16-e.pdf

Roche Holding Ltd., Basel,

Switzerland and the US subsidiary of Bayer AG, Leverkusen,

Germany, have entered into a letter of intent to form a 50-50

joint venture to market several over-the-counter (OTC) drugs in

the United States.

Subject to the approval of the relevant authorities, the joint

venture will combine the companies' US OTC businesses in

analgesics (except for Bayer Aspirin) and women's health. Brands

included in the joint venture will be Roche's Aleve analgesic and

Femstat 3 vaginal yeast infection treatment and Bayer's Actron

and Vanquish analgesics, Midol menstrual pain reliever and

Mycelex-7 vaginal yeast infection treatment.

Bayer will be responsible for sales and marketing of the joint

venture products within its overall Consumer Care portfolio.

Financial terms of the agreement were not disclosed.

In addition to Bayer Aspirin, the joint venture will not include

other leading Bayer brands such as Alka-Seltzer, Alka-Seltzer

Plus and One-A-Day and Flintstones vitamins.

Anthony J. Jamison, head of Roche Consumer Health, Roche's

worldwide selfmedication business, said the agreement with Bayer

is "an excellent opportunity for Roche to build on the

success already gained with Aleve and Femstat-3 in the United

States and to develop a substantial OTC presence in the US

market. We are very pleased to join forces with a strong partner

in those segments of the OTC market where Roche has leading

products.”

"With this joint venture, we

will further strengthen Bayer's presence in the US OTC

marketplace,” said Werner

Spinner, head of Bayer's worldwide Consumer Care Business Group.

"Bayer will now be a contender for third place among the

nation's largest OTC health care marketers and will compete even

more significantly in the US OTC analgesic market.”

A committee with an equal number of

members from each company will exercise joint effective control

of the venture. Operational management will be contracted by the

joint venture to Bayer Corporation Consumer Care Division, based

in Morris Township, New Jersey.

This new agreement follows the June 1996 acquisition by Roche of

Procter & Gamble's 50 percent stake in a 50:50 joint venture.

In this agreement, Procter & Gamble had marketed Roche's

Aleve and Femstat 3 brands in the United States.

With the new joint venture, marketing and distribution services

will be transferred from Procter & Gamble to Bayer, with

Procter & Gamble maintaining responsibility for professional

selling until the end of 1997. "This process will be

non-disruptive and transparent to our trade and retail

customers," explained Werner Spinner. "We will begin

working immediately to ensure a smooth transition and expect the

transfer to be completed by the end of the year."

2004/09/13 Bayer

バイエル社とシェリング・プラウ社、医療用医薬品事業で戦略的業務提携に合意

http://release.nikkei.co.jp/detail.cfm?relID=81176

■米国と日本でマーケティング・販売の業務提携を締結

■米国の医療用医薬品事業のポジショニングを修正

■がん領域における世界的な事業部を設立

バイエル社は、同社ヘルスケア事業(バイエルヘルスケア社)の組織的再編を引き続き行い、米国に本拠を置くシェリング・プラウ社(本社:ニュージャージー州ケニルワース)と医療用医薬品事業に関する広範な業務提携を締結したことを本日発表しました。この合意内容に基づき、米国でのバイエル社のプライマリーケア製品(主にかかりつけ医で最初の治療として処方される薬剤)は、シェリング・プラウ社がマーケティングおよび販売を行ないます。

また両社は、日本におけるシェリング・プラウ社の循環器系疾患治療薬ゼチア(R)の将来的な共同販売についても合意しました。さらに、バイエル ヘルスケア社の医療用医薬品事業部は、米国を拠点としたがん領域のグローバル事業部を新たに設立し、米国の同社組織を高収益で専門性の高い製品とバイオテクノロジー製品に特化するよう方向転換させます。

バイエル社経営委員会代表ヴェルナー・ヴェニングは次のように述べています。

「一般消費者向けビジネスでの拡大を狙ったロシュ社の一般用医薬品事業買収に続き、バイエル ヘルスケア社は新たな戦略的節目を迎えました。シェリング・プラウ社との提携により、両社はお互いが得意とする地域での強みを生かすことができます。本提携により、米国におけるバイエルのコスト構造とリソースを調整して戦略的業績目標達成を可能にし、当社製品の潜在的可能性を更に引き出すことができます。同時に、日本での事業拡大を推進します」。

この合意内容に基づき、シェリング・プラウ社は米国およびプエルトリコにおけるバイエル社のプライマリーケア製品のマーケティングおよび販売を担当し、米国におけるバイエル社のマーケティングおよび販売組織の大部分はシェリング・プラウ社に統合されます。シェリング・プラウ社の増強された営業組織による情報提供活動は、季節的な活動量の変動にも柔軟に対応することが可能で、バイエル製品のポテンシャルを大きく引き出します。バイエル社では、米国での同社プライマリーケア製品のマーケティング・販売に携わる約1,800人の社員が、シェリング・プラウ社への移籍、または組織縮小によって影響を受けると見ています。

バイエル社の製品は、引き続きバイエル社がその所有権および法的責任を保有し、バイエルのブランド名で販売されます。本契約は既存製品だけに適用され、開発中の製品は含みません。

シェリング・プラウ社はバイエル社の抗菌剤アベロックス(R)とシプロ(R)、循環器系疾患治療薬アダラート(R)、そしてその他のプライマリーケア向け製品を米国およびプエルトリコで販売することになります。シェリング・プラウ社は、これらの製品の実質売上に応じたロイヤルティーをバイエル社に支払います。またシェリング・プラウ社は、バイエルヘルスケア社とグラクソ・スミスクライン社(GSK)が共同販売契約を結んでいるレビトラ(R)についても、米国での販売責任を担います。シェリング・プラウ社とバイエル社は米国におけるレビトラの販売利益のうちバイエル社に分配される分を分け合います。その他にもシェリング・プラウ社が米国およびプエルトリコにおいて販売する製品として、アレルギー・呼吸器疾患治療薬ナゾネックス(R)、クラリネックス(R)、フォラジール(R)、および循環器系疾患治療薬バイトリン(R)、ゼチア(R)があります。

この発表と同時に、バイエル社は世界市場を担うがん領域の事業部を新たに設立し、その営業組織を構築します。このがん領域事業部はコネチカット州ウエスト・ヘブンに本部を置き、オニックスファーマシューティカル社と共同開発中の抗がん剤BAY 43−9006の承認取得および発売の準備を行います。進行性腎細胞がんの治療薬として臨床試験で有望な結果を示しているこの開発候補品は、現在第III相臨床試験が行われています(日本国内では第I相臨床試験)。今回の契約に基づき、バイエル社は米国および欧州の主要な市場でシェリング・プラウ社のがん領域製品の販売活動を一定期間行ないます。前立腺がん治療に使われるバイエルのヴィアデュール(R)もこのがん領域事業部で取り扱います。

バイエル ヘルスケア社経営委員会代表のアーサー・ヒギンズは次のように述べています。「シェリング・プラウ社との提携は、重要な米国市場における私たちのプライマリーケア製品群の業績を高め、バイエル社医療用医薬品事業にコスト構造と利益率の改善をもたらします。また、がん領域のグローバル事業部を設立し、この重要な治療分野での基盤を築くなど、医療用医薬品事業の将来への投資能力を向上させることができます。」

日本では、シェリング・プラウ社の新規コレステロール吸収阻害剤ゼチア(R)(現在、申請中)の共同販売契約が含まれています。バイエル社の日本法人であるバイエル薬品は、循環器系疾患領域において長年にわたる経験があり、その強みを活かすことによって同製品の上市をサポートします。

バイエル ヘルスケア社、米国医療用医薬品事業部でプライマリーケア以外の組織は、これまで同様ウエスト・ヘブンを本部とし、主に専門医が扱う高収益な専門領域の製品とバイオテクノロジー製品に集中します。がん領域の製品に加え、血友病治療薬コージネイト(R)と、開胸心臓外科手術で使われるトラジロール(R)が、その製品ポートフォリオです。

本契約は、2004年10月1日に効力が生じ、速やかに実行に移される予定です。この組織縮小と臨時的な一時経費のため、バイエル社は5,000万から7,000万ユーロの特別費用を計上する見込みで、その大半は2004年度中に発生します。本契約は、翌年以降から収益に貢献すると予想しています。

■ドイツ・バイエル社について

バイエル(http://www.bayer.com)は研究開発を基盤とする成長志向のグローバル企業であり、今後、ヘルスケア、農薬関連、先端素材の3つの領域において中核事業に専念していく方針です。これにともない、既存の化学品事業と高分子材料事業の一部を新会社「LANXESS」に移管し、2005年初頭までに株式市場への新規上場を予定しています。バイエルグループは「持続的な発展」を企業理念に掲げ、経済成長、環境保全、企業の社会的責任において調和のとれた活動をグローバルに展開しています。全世界の従業員数は115,400人(2003年末)。2003年の売上は286億ユーロ。設備投資には17億ユーロ、研究開発には24億ユーロを投入しました。

■バイエル ヘルスケア社について

ドイツ・バイエル社の事業グループであるバイエル ヘルスケア社の年商は約89億ユーロに達し、ヘルスケア、医療製品業界における世界の主要企業の一つです。バイエルヘルスケア社は、バイエル社の関連事業(動物用薬品、バイオロジカル プロダクト、コンシューマーケア、診断薬、医療用医薬品)の世界規模の活動を統括しており、世界中で3万4,600人以上の従業員によって支えられています。全世界の人類と動物の健康を向上させるため、革新的な製品を開発・製造することがバイエルヘルスケアの使命です。私達の製品は、疾患の診断、予防そして治療を通じて、健康とQOL(クオリティ・オブ・ライフ)の向上に貢献します。

2004/12/13 バイエル

バイエル社、血漿分画製剤事業を米国投資会社

Cerberus社とAmpersand社に売却

http://release.nikkei.co.jp/detail.cfm?relID=88770&lindID=4

−コージネイト®は、バイエル ヘルスケア社の製品として継続販売−

「血漿分画製剤事業の売却は、バイエルヘルスケア社のビジネス再構築を進める上で重要なステップです。バイエル社はこれまで以上に、コンシューマー向けヘルスケア製品、人と動物向けの画期的医薬品と高性能診断機器のビジネスに注力します。バイエル社が行ったロシュ社一般用医薬品事業の買収とシェリング・プラウ社との医療用医薬品事業提携は、この新たな戦略的再編を強調するものです」とバイエル社社長ヴェルナー・ヴェニングは述べています。

本契約の内容には、バイエル ヘルスケア社バイオロジカルプロダクト事業部の血漿分画製剤事業に関連する製品、施設そして社員が含まれています。血友病Aの治療に使用される遺伝子組換え型血液凝固第VIII因子製剤コージネイト®は売却対象ではなく、バイエル ヘルスケア社の製品としてこれまでどおりに販売されます。

「コージネイトFS®およびコージネイト®は、バイエル ヘルスケア社のポートフォリオの中で最も貴重で、戦略的にも重要な製品のひとつです。今後さらにビジネス再編を計る上で、この製品は長期戦略に不可欠で、それによって世界中の血友病市場でリーダーシップを発揮することができるのです」とバイエル ヘルスケア社経営委員会代表アーサー・ヒギンズ氏は述べています。

バイエル社血漿分画製剤の2004年1月から9月までの売り上げは4億8100万ユーロでした。主要製品には、免疫不全の治療に用いられるポリグロビン®/ガミュミューン®/ガミュネックス®、そして先天性肺気腫に用いられるプロラスチン®があります。本事業は、米国ノースカロライナ州リサーチトライアングルに本部を置き、米国では約1600名の社員が勤務しています。

「非常に幅広い製品パイプライン、卓越した製造技術、病原体混入防止に向けた安全性研究、患者さんに対する強い責任感をもつ会社へ投資できることを大変うれしく思います。この戦略の一環として、NPS

Bio Therapeutics社は現在バイエル社へ血漿分画工程業務を提供しているPrecision

Pharma Services社を統合する予定です。現行の経営陣との連携の下、新しい経営組織は、NPS

Bio Therapeutics社の業界でのリーダーシップをさらに発揮していきます。医療従事者と患者団体へのより良いサポートを推進しながら、この事業を成長させ強化していきます」とCerberus社の統括メンバーで、NPS

BioTherapeutics社の会長に就任するラリー・スターン氏は述べています。

【 ドイツ・バイエル社について 】

バイエル(http://www.bayer.com)は研究開発を基盤とする成長志向のグローバル企業であり、今後、ヘルスケア、農薬関連、先端素材の3つの中核事業に専念していく方針です。これにともない、既存の化学品事業と高分子材料事業の一部を新会社「LANXESS」に移管し、2005年初頭までに株式市場への新規上場を予定しています。バイエルグループは「持続的な発展」を企業理念に掲げ、経済成長、環境保全、企業の社会的責任において調和のとれた活動をグローバルに展開しています。全世界の従業員数は115,400人(2003年末)。2003年の売上は286億ユーロ。設備投資には17億ユーロ、研究開発には24億ユーロを投入しました。

【 バイエル ヘルスケア社について 】

ドイツ・バイエル社の事業グループであるバイエル ヘルスケア社の2003年総売り上げは約89億ユーロに達し、ヘルスケア、医療製品業界における世界の主要企業の一つです。バイエルヘルスケア社は、バイエル社の関連事業(動物用薬品、バイオロジカル プロダクト、コンシューマーケア、ダイアベティスケア、診断薬、医療用医薬品)の世界規模の活動を統括しており、世界中で3万4,000人以上の従業員によって支えられています。全世界の人類と動物の健康を向上させるため、革新的な製品を開発・製造することがバイエルヘルスケアの使命です。私達の製品は、疾患の診断、予防そして治療を通じて、健康とQOL(クオリティ・オブ・ライフ)の向上に貢献します。

【 Cerberus Capital Management, L. P.社について 】

Cerberus Capital Management, L. P.社は、ニューヨークに拠点を置く1992年創立の民間投資会社で、140億ドル超える投資資産を管理しています。Cerberus社は、北米、欧州、アジアでの事業を含む、様々なビジネス分野において40社以上の経営権を保有しています。Cerberus社は、資産価値を重視する投資会社で、長期に渡る高収益力の業績を求め、自社とのパートナーシップによる収益性を追求します。

【 Ampersand Ventures社について 】

Ampersand Ventures社は、Panie Webber社から分離した1988年創立の民間の株式投資会社で、積極的な事業提携を通じて資産価値の増やすことに注力しています。Ampersand社は、広範囲の技術産業の分野に渡って独自の投資戦略を追求します。会社の資産の大半は、売却会社、拡大融資、中規模の企業買収そして業績回復のための資本再構成のポートフォリオに投資されます。Ampersand社は、1995年から血液製剤事業積極的な投資を行っており、現在バイエル社へ血漿分画工程業務を行っているPrecision

Pharma Services社の経営権を保有しています。

Miles' switch to Bayer

adds to global identity

http://waw.wardsauto.com/ar/auto_miles_switch_bayer/

Keenan, Tim

Customers and

employees of Bayer Corp. - formerly Miles and once Mobay - may

need to take a couple of the company's aspirin tablets now that

it has changed its name for the second time in a little more than

three years.

The latest revision

of the Pittsburgh, PA-based plastics supplier's nomenclature will

give the company one worldwide name and a stronger position as

the auto industry progresses toward globalization, says H. Lee

Noble, president of Bayer's polymers division.

The Miles-to-Bayer

switch comes five months after Miles acquires Sterling Withrop's

North American over-the-counter drug business, including Bayer

aspirin and the Bayer trademark. Mobay-Miles Miles always had been a

subsidiary of Bayer AG, the German-based international chemical

and health care company.

"Until we

acquired the Bayer aspirin business we could not use the name in

the U.S.," explains Mr. Noble, who adds that the company was

known as Miles only in the U.S. and Canada."

Now Mr. Noble again

must establish an identity for a new name. In January 1992 the company, which had been

called Mobay since it was established in 1954, changed its name

to Miles. He admits

the frequent changes have caused a bit of confusion among

customers, but believes this transition will be easier.

"There was some

confusion for a while when we changed the name to Miles,"

Mr. Noble recalls. "We had the Mobay name pretty

recognizable." He says it took about a year to get everyone

acclimated to the new name then. That move was made because Miles

had better global recognition at the time than Mobay.

"This change

will be accepted more quickly in the auto industry because of the

Big Three's "connections to the European industry,"

says Mr. Noble. "Globally, Bayer is an automotive name. Most

of Detroit has recognized for years that we are a subsidiary of

Bayer in Germany."

Bayer supplies raw

materials for many automotive components including seat cushions,

bumpers, interior pieces and exterior coatings. The company

claims it's the world's largest supplier of polyurethane.

With the new name,

Mr. Noble says the company will have a renewed global orientation

"It's something you really have to work at," he says of

the industry's globalization trend, which Bayer anticipated 15

years ago when it instituted its World Automotive Committee.

"It takes a real effort to get that coordination, preventing

working at cross purposes," he adds.

Mr. Noble says he's

not concerned about the industry's recent slowdown. hi fact, he's

excited about Bayer's potential to pounce on several industry

growth opportunities.

"But even if

(the market) does slow down more than we expect, our products are

still taking a greater share of the materials market," he

says. "The value of plastics will continue to grow."

Body panels,

interiors, side-impact energy absorption and recycling are the

most fertile ground for plastics industry growth, says Mr. Noble.

"We recognize

the importance of recycling to the auto industry and have focused

our research and development efforts on solving this

challenge," he says.

Fruits of these

efforts include a proprietary technology allowing polyurethane

RIM scrap to be molded into new parts. The 1994 Jeep Renegade

features a close-out panel molded completely of recycled RIM

polyurethane. The part was compression molded from RIM scrap from

Chrysler minivans and replaced a part originally made from new

material.

Bayer believes the

100% recycle-content material will see future uses in fender

liners, wheel-well liners, air ducts, air deflectors and other

parts requiring strength but not a high-gloss surface.

The company's other

primary recycling initiative is a process to recycle seat-cushion

foam.

バイエル、日本において市場成長率を上回る発展に注力

−2005年1-9月期の売上は7.8%増の1,490億円

−2008年までに1億3,000万ユーロ以上を投資

http://www.bayer.co.jp/bgj/newsfile/news/news-248_j.html

「日本におけるドイツ年2005/2006」に積極貢献

バイエルグループ(本社:ドイツレバクーゼン、代表取締役社長:ヴェルナー・ヴェニング)は、日本においてさらなる発展を目指しており、2008年までに1億3,000万ユーロ以上を日本に投資する計画である。「日本におけるドイツ2005/2006」の一環として開催されたバイエル主催のイベント週間「バイエルウイーク」中に東京で行われた記者会見の席上、ヴェルナー・ヴェニングは次のように述べた。「バイエルにとって日本はアジア太平洋地域最大の市場であり、また最も成功した市場です」2005年1-9月期の日本のバイエルグループの売上高は前年同期比7.8%増の1,490億円であった。日本はバイエルにとって、米国、ドイツに次ぐ第3位の市場となる。「バイエルは、日本でさらにプレゼンスを拡大し、市場成長を上回る発展を達成するという強い意志があります」とヴェニングは語った。

「日本では、すでに全ての事業グループが極めて強固な基盤を確立しています」とヴェニングは 続けた。グループ総売上のうち最大の割合を占めるのは、ヘルスケア事業グループ(バイエルヘルスケア)であり、2005年1-9月期の同事業グループの売上は前年同期比5.6%増の730億円を計上した。これは日本のバイエルの売上のほぼ半分に相当する。ヘルスケア事業で最大の割合を占める医療用医薬品事業は、厳しい市況にもかかわらず、安定した成長となった。特に「アダラート(R)」、「グルコバイ(R)」、「バイアスピリン(R)」をはじめとする脳・心血管系リスクマネジメント製品が好調であった。ヘルスケア事業のダイアベティスケア、診断薬、動物用薬品も2005年1-9月期にそれぞれ27%、11%、17%という優れた成長率を達成した。

ヴェニングはバイエルの展望に明るい見通しを立てており、「日本において、ヘルスケア部門は成長を遂げており、今後も市場成長率を上回る成長を達成できると確信しています」と述べた。10月には、広範な抗菌スペクトルを有すニューキノロン系抗菌剤「アベロックス(R)」の輸入販売承認を得た。呼吸器感染症のプライマリーケアに使用できる本製品の販売を行う塩野義製薬(株)は、年内の上市を見込んでいる。日本の経口抗生物質市場は、2004年現在で年商 約20億ユーロの規模を持つ。

ヘルスケア事業をさらに強化する計画として、米国シェリング・プラウ社が開発したコレステロール吸収阻害剤「ゼチア

(R)」を、日本の当局の承認後発売する予定である。シェリング・プラウ社とバイエル薬品との間で、日本における同製品の共同販売契約がすでに 締結されている。また、バイエルが開発中の製品には、例えば、新たな抗がん剤「ネクサバール(R)」、血栓症治療を目的とした経口直接作用型Xa因子阻害剤など非常に有望な製品が含まれているとヴェニングは説明した。

農薬関連事業グループ(バイエルクロップサイエンス)の売上は260億円で、前年同期に比べて減少した。これは主に複数の製品の売却が原因である。しかし、コスト管理の強化により純利益は増加した。今後5年間に農薬関連事業グループは7つの有効成分を日本市場に導入する計画である。

素材科学事業グループ(バイエルマテリアルサイエンス)は、2005年1-9月期において前年 同期比24.7%増という大幅な成長を達成し、売上は500億円となった。ポリカーボネートおよびポリウレタン市場、特にハイテク樹脂「マクロロン(R)」や硬質フォーム用原料MDIの市場において強い需要が見られ、その結果、原料費の高騰を背景に製品価格が上昇し、満足すべき事業展開となった。ヴェニングは、特に「マクロロン(R)」、塗料原料、発泡素材が今後も成長すると予測している。

「バイエルには日本市場において長い成功の歴史があります」とヴェニングは強調した。バイエルが 日本で最初に事業を行ったのは1886年であり、1911年にはすでに最初の100%子会社を設立。2004年には日本で約2,500人の従業員を雇用し、14億4,900万ユーロの売上を達成した。バイエルは、ヘルスケア、農薬関連そして先端素材の分野において、全ての製品ポートフォリオを日本市場に提供している。技術革新はバイエルグループの最大の強みのひとつである。1990年以来、バイエルは約9億ユーロの研究費を日本に投じてきた。

さらに、ヴェニングはアジア太平洋地域の重要性を強調した。2003年には主に為替差損の影響で若干の低迷が見られたが、過去14年間の同地域におけるバイエルの業績は、力強い長期的な成長の可能性がこの地域にあることを示している。アジア太平洋地域におけるバイエルグループの売上(ランクセス社を含む)は、1990年から2004年の期間において、同グループの世界平均を2倍以上上回る年平均5.2%のペースで増加してきた。

「バイエルは、アジア太平洋地域に非常に強い関心を抱いており、この地域がここ10年間の資本投資の焦点になります」とヴェニングは指摘する。1990年から2004年にかけて、アジア太平洋地域におけるバイエルグループの設備投資と研究開発費の総額は29億ユーロに及ぶ。バイエルは、より一層の成長を促進するために、この地域にさらに資源を投入する計画である。

2005年1-9月期において、すでに約1,400人の従業員が新規に採用されている。これは他の地域を上回る実績である。

しかし、バイエルの現在の投資計画の中心を占めるのは中国である。バイエルは上海近郊のCaojing(カオジン)において、「マクロロン(R)」とポリウレタン原料の生産施設を中心に、2009年までに18億米ドルを投資する計画である。日本においては、世界第2位の医薬品市場であり、アジア最大の農薬市場であるために、ヘルスケアおよび農薬関連事業における革新的な 製品パイプラインの強化に重点を置く。ヴェニングは「バイエルは、グループ全体の売上高に占めるアジア太平洋地域の売上比率を2010年までに現在の17%から25%に引上げることを目指しています」と述べた。

バイエル、上海近郊の新生産基地に関する基本契約に調印

中国に31億ドルを投資