Olin Corporation to

acquire chlor-alkali producer Pioneer

Acquisition of Pioneer Companies

Olin Corporate Strategy

1. Build on current leadership positions in Chlor-Alkali, Metals

and Ammunition

ー Improve operating efficiency and

profitability

ー Integrate downstream selectively

ー Expand globally where profitable

2. Allocate resources to the businesses that can create the most

value

3. Manage financial resources to satisfy legacy liabilities

Pioneer: A High Value Acquisition, Consistent with our Strategy

・ Synergistic,

bolt-on acquisition

・ Enhances

our chlor-alkali franchise

ー #3 in chlor-alkali, up from #4

− Diversifies geographic coverage

− Improves overall cost position

− #1 in industrial bleach

・ Further

low-cost expansion opportunities in the largest chlorine

consuming region of North America

・ Significant

near-term cost synergies of $35 million

・ Financial

metrics are very compelling

− Immediately accretive to EPS and

remains highly accretive throughout the cycle

− Balance sheet remains strong

Transaction Summary

Background

Structure

・ Olin Corporation to purchase

Pioneer Companies for $35.00 per share

Firm Value: $411 million

・ Equity value of $418 million at

the agreed purchase price

・ Net cash position of $7 million

assumed by Olin (cash of $129 million, total debt of $122

million)

Financial Impact on Olin Corporation

・ Immediately accretive to EPS and

remains highly accretive over the cycle

・ Balance sheet remains strong

Necessary Approvals

・ Pioneer shareholder approval

・ Regulatory approval

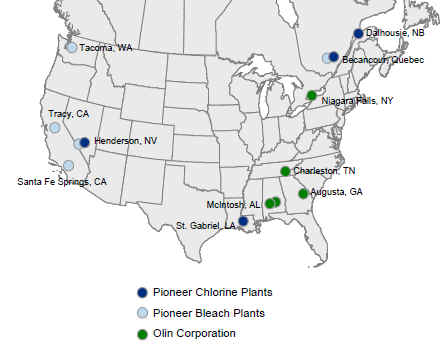

Pioneer: A Focused Company with Quality Assets

・ Pioneer is focused exclusively on

chlorine / caustic, bleach 漂白剤 and derivatives

・ World class operations

− St. Gabriel, LA: Strategically

positioned with pipeline to Gulf Coast customers;

expansion project lowers costs

− Becancour, PQ: Low cost

hydro-power based facility with downstream production

capabilities

− Henderson, NV: Western US facility

with captive consumption for downstream products

Pioneer purchased the Henderson Facility in October 1988 from a subsidiary of ICI Americas, Inc. (ICI). ICI acquired the facility in connection with the purchase of Stauffer Chemical Company.

− Dalhousie,

NB: Provides exposure to sodium chlorate markets

・ Strong downstream capabilities

− Chlorine pipeline to the major

urethanes, vinyls and ag chemicals customers

− 5 bleach plants in key parts of

North America

・ Superior financial results

− Excellent margins in chlor alkali

and downstream businesses

− Generated 2005 “peak” EBITDA of $126 million

− St. Gabriel project will further

lower costs and expand capacity

− Synergies provide enhanced

earnings throughout the cycle

Impact of the Combination on Olin

The

combination would make Olin the third largest producer of

chlor-alkali in North America

Enhanced Operational and

Geographic Platform

Strengthens Olin’s position in core businesses and adds a

strong bleach business in the West

|

* Sunbelt Chloralkali is a 50:50 joint venture between PolyOne and Olin Corporation |