Asia Chemical Weekly 2003-12-12

Saudi NIC, Al-Zamil to jointly develop new C2 at Al-Jubail

National Industrialisation Co (NIC) and the Al-Zamil Group are to combine their efforts to build a

cracker in Al-Jubail, Saudi Arabia, company sources said.

It was earlier understood that both companies were pursuing their

cracker projects separately. NIC had planned to build an

ethane/propane cracker for startup in the first half of 2007.

The Al-Zamil Group holds an 11% stake in Saudi International

Petrochemical Co (Sipchem) - originally believed to be the

former's vehicle for petrochemical investments - which had

earlier expressed interest in building a cracker.

It emerged last week that the Al-Zamil Group will set up a new

company, Zamil Petrochemical Co, in the next couple of months to

partner NIC's subsidiary, National Petrochemical

Industrialisation Co (NPIC) for the ethane/propane cracker

project. The Al-Zamil Group will own more than 10% of Zamil

Petrochemical, and local investors the rest.

A source from Sipchem said that the project being pursued by the

Al-Zamil Group was different from Sipchem's. He said Sipchem

remained committed to building its own cracker.

On whether there could be a conflict of interests, a source from

the Al-Zamil Group said Sipchem and Zamil Petrochemical were

separate companies with different management teams and different

business plans. Sipchem was focused on its butane- and

methane-based projects, including methanol, butanediol and maleic

anhydride units, as well as acetic acid and vinyl acetate monomer

projects, he said. However, he did not dismiss the possibility of

Sipchem pursuing a cracker project later.

NPIC and Zamil Petrochemical are expected to seek a strategic

foreign partner for the cracker project. Basell is a possible

contender.

Zamil Petrochemical will also form a joint venture with Basell

for a propane dehydrogenation-polypropylene project in Al-Jubail.

2004-3-5 Asia Chemical Weekly

Gacic offered BDO plant contract

to Kvaerner

Gulf Advanced Chemical

Industries Co (Gacic) has

signed a lump sum contract with Aker Kvaerner to build its 75 000 tonne/year

butanediol (BDO) plant at Al Jubail, Saudi Arabia for start-up in December

2005.

The turnkey contract covers engineering, procurement,

construction, commissioning and start-up services for the

facility being built for Gacic, an affiliate of Saudi

International Petrochemical Co (Sipchem).

Financial terms of the contract were not disclosed. No one was

immediately available at either Gacic or Kvaerner to provide

further information on Monday. Previously, the total cost of the

project was put at around $140m-150m (Euro113m-121m).

In a statement, Gacic said Kvaerner has undertaken preliminary

engineering of the BDO project under an early work agreement,

signed in March 2003. Last September, Kvaerner said it

anticipated that the full contract would be signed early this

year.

Previously, the full contract had been expected to come into

force mid-2003 but despite the delay of more than six months the

scheduled start-up remains the fourth quarter of 2005, as

planned.

Gacic confirmed that the technologies to be used in the project

will be provided by Davy Process Technology, Huntsman Corp and

UOP. The Huntsman technology will be the proprietary butane-to-maleic anhydride

(MAH) system. The technology provided by Davy will use the MAH to produce

BDO.

In December 2003, Gacic received approval from Saudi Industrial

Development Fund (SIDF) for a Riyal 400m ($107m/Euro86m) term

loan towards the funding of the project.

Dow Jones 2004-3-16

Japan Sumitomo Chem May Build Mideast Cracker Project

Japan's Sumitomo Chemical Co. may be in negotiations with several

Middle East petrochemical companies to build an ethylene cracker

this year, industry sources familiar with the issue said.

Sumitomo Chemical may be eyeing opportunities either in Iran or

Saudi Arabia, the sources said.

An official at Sumitomo said the talks were still "in

preliminary stages" and declined to comment further on the

company's involvement in the project.

Sources said it is more likely Sumitomo will secure a project in

Saudi Arabia given that it has already been shortlisted as one of

the possible partners for Saudi Arabian Oil Co.'s (SOI.YY)

planned Rabigh petrochemical project.

Three companies have so far been shortlisted for the US$3 billion

joint venture - Saudi Basic Industries Co., Dow Chemicals of the

U.S. and Sumitomo Chemical.

http://www.tradepartners.gov.uk/oilandgas/saudi_arabia/profile/overview.shtml

Aramco is making its first

foray into the domestic petrochemical sector - Rabigh

expansion. Three companies have been shortlisted for this US$3,000

million 50:50 joint venture - Saudi Basic Industries Company

(Sabic), US' Dow Chemicals and Japan's Sumitomo Chemicals.

MOU for the project expected early January 2004 and once a

J/V partner has been appointed, a tender will be issued for

the FEED.

MEED 2003/9/12

Three in talks on Rabigh expansion

Saudi Aramco has shortlisted three international companies on

the estimated $3,000 million project to upgrade the kingdom's

largest refinery at Rabigh and add a petrochemical complex at

the site. Aramco, which is aiming to sign a memorandum of

understanding (MOU) for the project in early 2004, plans to

set up a 50:50 joint venture with at least one company to

carry out the expansion of the 325,000-barrel-a-day

hydroskimming export refinery at Rabigh.

The three companies shortlisted are Saudi Basic Industries

Company (Sabic), the US's Dow Chemicals and Japan's Sumitomo

Chemicals. Once a joint venture partner has been appointed, a

tender will be issued for the front-end engineering and

design (FEED) contract.

In addition to expanding the refinery, the joint venture will

set up an ethane cracker with capacity of at least 1 million

tonnes a year of ethylene, which will be used at feedstock

for the production of polyolefin. Aramco plans to award a

third-party concession for the cracker. The new complex will

be located next to the existing refinery and will also

include a propane dehydrogenation (PDH) unit at the refinery

for the production of polypropylene. The UK office of Foster

Wheeler has recently completed a pre-feasibility study for

the project.

Feedstock for the cracker will be pumped from the Eastern

Province via the east-west pipeline. Aramco plans to convert

one of the two coast-to-coast crude pipelines, the smaller

48-inch-diameter line, to carry gas to the Western Province.

The conversion is estimated to cost about $800 million. A new

pipeline spur will then link the east-west line with the

Rabigh spur.

日本経済新聞 2004/5/8

住友化、サウジ合弁 エチレン生産 3000億円投資

住友化学工業はサウジアラビア国営石油会社のサウジアラムコと合弁で、同国に石油精製品から石油化学製品までを一貫生産する大型プラントを建設する。今月中に両社で事業化調査を開始、2008年にも新プラントを立ち上げる。石化製品の基礎原料であるエチレンを年間100万トン生産する設備を設ける計画で、総投資額3千億円強の巨額プロジェクトになる見通し。サウジでの日本企業の合弁事業としては過去最大級。海外で日本企業が上流の石油精製から下流の石化製品生産まで携わる初のケースにもなる。

事業候補地はアラムコの石油精製設備がある紅海沿岸のラビ。9日に両社で事業化調査の覚書に調印、調査に入るとともに折半出資の合弁会社を設立する。新設備では天然ガスから安価なエタンガスを抽出し、石化製品の基礎原料であるエチレンを生産。これを基に合成樹脂のポリエチレンなどをつくる。エチレン生産設備は1基で年100万トンと世界最大級にする計画。

国際競争カを確保 住化サウジ合弁 原料を安く調達

住友化学工業がサウジアラビアで大型の石油精製・石油化学事業に関する事業化調査に乗り出す。原油価格が高騰する中、原料の調達手段を多様化することで国際競争力を強化するのが狙いだ。

同社はすでにシンガポールで英蘭系ロイヤル・ダッチ・シェルと共同でナフサ(粗製ガソリン)を原料に代表的な石化基礎原料であるエチレンを生産している。今回、サウジで現地生産を計画するエチレンは天然ガスの一種であるエタンガスを原料とする。原油相場に左右されにくく安価なのが特色。急騰したナフサ原料に比べ4分の1から5分の1程度とされるコスト競争力が武器だ。

住友化学はエタンを安く現地調達できるサウジでエチレンを生産することで、原油相場に左右されやすいナフサに依存する事業構造を改善し、リスク分散を図る。日本企業がエタンからエチレンを生産するのは初めて。

同社はエタンからはつくれない自動車部品原料用のプロピレン生産ではシンガポールの石化プラントを重点的に活用。原料を最も効率的に調達できる場所で石化製品を生産する国際分業体制を明確にする。

需要が急増しているアジア市場では、今後中東からエタンを原料とする安価な石化製品の供給が増える見通し。ナフサベ−スだけに偏った製品供給では競争上不利と見て、自ら中東への大型投資に踏み込むことで原料調達を多様化する。

ただ、中東地域はテロ不安も含め政情が不安定なうえ、石油化学ブロジェクトは日本企業にとって大型の成功例がない分野。事業の実現までになお慎重な見方もある。

エチレン系とプロピレン系製品の需給バランス見通し

(経済産業省まとめ、単位:万トン、▲はマイナス)

| |

|

エチレン系 |

: |

プロピレン系 |

| |

|

アジア |

|

中東 |

|

アジア |

|

中東 |

| <2002年> |

|

|

|

|

|

|

|

|

| 生産 |

|

2,880 |

|

750 |

|

1,930 |

|

140 |

| 需要 |

|

3,370 |

|

220 |

|

2,040 |

|

130 |

| ギャップ |

|

▲ 490 |

|

530 |

|

▲ 100 |

|

10 |

| |

|

|

|

|

|

|

|

|

| <2008年> |

|

|

|

|

|

|

|

|

| 生産 |

|

3,470 |

|

1,380 |

|

2,440 |

|

300 |

| 需要 |

|

4,970 |

|

370 |

|

2,900 |

|

220 |

| ギャップ |

|

▲1,510 |

|

1,010 |

|

▲ 460 |

|

80 |

朝日新聞 2004/5/8

住友化学がサウジに世界最大級のプラント 数千億円投資

住友化学工業は7日、サウジアラビアに現地国営企業と合弁で、石油精製・石油化学の一貫プラントを建設する方針を固めた。世界最大級の年産百数十万トン規模のエチレンプラントをはじめ、国際市場に輸出する石化製品を一貫して作る大規模コンビナートを建設する。投資額は日本の石化メーカーとしては過去最大の数千億円となる模様だ。イラク情勢の悪化やアジアでの需要急増で原油価格や石油製品価格が上昇する中、安定的に資源を確保する取り組みとして、経済産業省も歓迎しており、政府として後押しする構えだ。

世界最大の産油国であるサウジとの石油共同事業を巡っては、日本政府も支援した日本石油(現新日本石油)などによる石油精製プロジェクトが90年代前半に破談。日本最大の自主開発原油だったアラビア石油の採掘権も00年に失効するなど必ずしもうまくいっていない。産油国の強みを背景とするサウジ側の出す条件が厳しく、日本側の採算がとりにくい事情がある。

住友化学が今回、大規模事業に踏み出すのは、中国などでの需要が急増する中で最大産油国の安価な原料を安定確保するのが狙い。コスト面での国際競争力がつけば、欧米の巨大化学メーカーに劣勢だった供給力を一気に高めることが可能となる。

サウジの国営石油会社「サウジ・アラムコ」と9日に覚書を調印して詳細を発表。共同で近く企業化調査に着手する。完成するのは08年の見込み。建設予定地は紅海沿岸のラービグ。アラムコ社の製油所があり、精製プラントと石化製品の原料をつくるエチレンプラント、汎用(はんよう)樹脂のポリエチレン製造プラントなどを新設するとみられる。

日本の石化メーカーが国外にエチレンプラントを建設するのは、住友化学のシンガポールに次いで2例目で、中東では初めて。住友化学にとっては社運をかけた大事業となる。

中東での大規模プロジェクトでは、70年代の日本とイランの合弁会社、イラン・ジャパン石油化学(IJPC)が代表例。イラン国営石油化学会社と三井物産など三井グループが、中東最大の石油化学コンビナート建設を目指したが、イラン・イラク戦争の影響で経営難に陥り、未完成のまま終わっている。サウジアラビアへの投資では、三菱商事などが80年代に汎用樹脂の製造施設をつくった例がある。

国内コンビナートは基礎原料にナフサ(粗製ガソリン)を使っているが価格が安定せず、価格高騰に悩まされている。中東のプラントなら安価なエタンが原料として使える利点がある。

2004/5/9 住友化学

サウジ・アラムコとサウジアラビア(ラービグ)での石油精製・石油化学事業開発の共同企業化調査実施の件

住友化学は本日、サウジアラビアン・オイル・カンパニー(サウジ・アラムコ)との間で、サウジアラビア紅海沿岸のラービグにおける石油精製と石油化学との統合コンプレックス開発計画(ラービグ計画)について基本的な枠組みを定めた覚書を締結しました。両社は今後、共同してフイージビリテイ・スタデイー(企業化調査)を実施し、その中で、計画の実現に向けての詳細について検討してまいります。投資額は、現在のところ約43億米ドルと予想しています。

本計画は、石油会社と石油化学会社とがお互いの強みを生かし、石油精製と石油化学の統合コンプレックスとしては世界最大級の設備を建設することでスケールメリットを追求するととともに、両事業の完全なインテグレーションによりシナジーを最大限に発揮しようとするものであります。

住友化学は、本年から始まった新しい中期経営計画において、ポリオレフインを中心とする石油化学事業を重点事業のひとつと位置づけておりますが、同事業の中長期的な収益性を向上させるためには、安価原料を安定的に確保することが最重要課題であると考え、鋭意具体的な施策を検討してまいりました。その結果、本計画は、そのための最善のプロジェクトであり、これにより世界市場における当社の競争力が飛躍的に強化されるものと判断し、覚書の締結を決定いたしました。住友化学は、すでに石油精製地であるシンガポールにおいて石油化学の海外事業を手がけておりますが、本計画は、さらに初の産油地立地を目指すものとして、グローバル戦略の新段階をなす画期的なものであります。

また、本計画はサウジ・アラムコにとって、幅広い川下関連産業の発展を通じ、工業のさらなる多様化に貢献するものであり、外国企業を誘致して経済発展を促進し、サウジアラビア国民の就業機会を増やすという同国の戦略にも合致したものであります。

【計画の概要】

両社は、本計画の事業主体として共同出資会社を設立します。サウジ・アラムコは、現在、ラービグにおいて所有する日量40万バレルの原油処理能力を持つ製油所をインフラも含めてこの会社に移管します。新会社は、これに加え新たに世界最大級のエタンクラッカーと流動接触分解装置(FCC)、さらに、エチレン、プロピレン各誘導品の生産プラントを新設します。この結果、これまで生産してきたナフサや重油などの石油精製品に、エチレン、プロピレンとその誘導品およびガソリンが新たな生産品目として加わります。年間生産能カはエチレンが130万トン、プロピレンが90万トンであり、その全量を石油化学誘導品の生産に充当する予定であります。

本計画に予定されている石油化学誘導品としては、次のものがあります。

| 1) |

|

ポリエチレン(PE)2系列(住友化学技術による新型ポリエチレン(EPPE)を含む)

なお、合計年産能力は約75−90万トンの予定 |

| 2) |

|

ポリプロピレン(PP)2系列で、合計生産能カは70万トン

ホモポリマー、ブロックコポリマー、ランダムコポリマー、ターポリマーのフルレンジをカバーし、コンパウンドも予定

コンパウンドの能カはフイージビリテイ・スタデイーで検討、決定予定 |

| 3) |

|

住友化学の技術によるプロピレンオキサイドまたは他のプロピレン誘導品

能力はフィージビリティ・スタディーで検討、決定予定 |

| 4) |

|

上記以外のエチレン誘導品(侯補としてエチレングリコール、アルファオレフイン等)については、フィージビリテイ・スタデイーで検討、決定予定 |

サウジ・アラムコは、本共同出資会社に日量40万バレルの原油、95百万立方フィートのエタン、10〜15千バレルのブタンを供給します。一方、住友化学は多岐にわたる独自の石油化学製品の生産技術とアジア全体に及ぶ販売網を提供します。

本計画の操業開始は2008年後半を目標にしています。

なお、両社は、本計画をできるだけ迅速に進めるため、プロジェクト・マネジメント・コンサルタントおよびその他のアドバイザーを起用する予定であります。

2004/5/9 Saudi Arabian Oil Company/Sumitomo

Chemical Company

Saudi

Aramco/Sumitomo Chemical signing ceremony

http://www.sumitomo-chem.co.jp/english/gnews/news_pdf/20040509_1.pdf

The Saudi Arabian Oil Company

(Saudi Aramco) and Sumitomo Chemical Co., Ltd. (Sumitomo) today

signed a comprehensive Memorandum of Understanding related to the

planned development of a large, integrated refining and

petrochemical complex in the Red Sea town of Rabigh (“Rabigh Project” or “Project”).

Once implemented, the proposed Rabigh Project would be one of the

largest integrated refining and petrochemical projects ever to be

built at one time. A total of 2.2 million tons of olefins, along

with large volumes of gasoline and other refined products, would

be produced. The cost for the direct Project investment is

currently estimated to be U.S.$4.3 billion; however, this

estimate is subject to change based on the results of a Joint

Feasibility Study that will be undertaken by Saudi Aramco and

Sumitomo. In addition, this project is expected to create

third-party investment opportunities in the private sector for

utilities and other related infrastructure.

For the companies, the Project represents an opportunity for the

world's largest producer of hydrocarbons to partner with an

outstanding, world-class petrochemical producer to achieve

economies of scale unsurpassed by any other project previously

undertaken. For the Kingdom of Saudi Arabia, it presents an

opportunity for increased industrialization and a platform for

broad downstream conversion industry development in the Kingdom.

This Project represents a concrete example of the Kingdom's

strategy of attracting foreign investment to expand its economy

and provide increased job opportunities for Saudi nationals. It

is also consistent with the objective of creating opportunities

for private local investment in service and other related

industries.

Sumitomo has identified petrochemicals, particularly polyolefins,

as one of its core businesses, and it considers securing a stable

supply of feedstock that is competitively priced as necessary for

strengthening its medium- and long-term competitiveness. This

Project is closely in accord with that strategy and constitutes

an important step forward in enhancing the global competitiveness

of the company's petrochemical operations. Although Sumitomo has

been operating a large-scale complex in a petroleum-refining

center, Singapore, since 1984, this Project is the company's

first attempt to establish a foothold in an oil and gas-producing

country, thereby assuring the basic feedstock supply for the

Project. The Project will, therefore, open a new stage in

Sumitomo's worldwide business strategy.

Background

Saudi Aramco currently owns and operates a topping refinery at

Rabigh with a nominal crude distillation capacity of 400,000

barrels per day. The existing site and infrastructure will serve

as the base platform for the development of the proposed Rabigh

Project.

Saudi Aramco studied various upgrade alternatives for the

refinery since the company became its owner in June, 1995. These

studies led to the conclusion that the best alternative to

capture the synergies of the existing large crude capacity,

together with significant investment in site and infrastructure,

would be to expand the site into a large, fully-integrated

refinery and petrochemical complex.

Agreement of the Parties

The parties have successfully negotiated a Memorandum of

Understanding that sets forth the agreement between Saudi Aramco

and Sumitomo regarding the key parameters of the Project, the

Project configuration, and a broad range of the major technical,

commercial, legal, and financial terms.

As the next step in the Project development process, the parties

have agreed to undertake a comprehensive Joint Feasibility Study

which will, among other things, confirm the capital and operating

costs of the proposed Project. The definitive documents to

implement the Project will be negotiated in parallel with the

Joint Feasibility Study.

The Project

Saudi Aramco and Sumitomo have agreed to form a Joint Venture

company with equal ownership. In addition to its world-class

capabilities in hydrocarbon production and refining, and its

decades-long collaboration with the Kingdom's petrochemicals

industry, Saudi Aramco will supply the Rabigh Project with

400,000 barrels per day of crude oil, 95 million standard cubic

feet per day of ethane and 10,000 to 15,000 barrels per day of

butane. Sumitomo will provide its extensive and proprietary

petrochemical technology and marketing base to the venture.

The initial plans for the Project include, as the centerpiece of

the expanded site, a high olefins yield fluid catalytic cracker

complex integrated with a world scale, ethane based cracker,

producing approximately1.3 million tons per year of ethylene,

900,000 tons per year of propylene, and 80,000 barrels per day of

gasoline as well as other refined products. Petrochemical units

are to be included to convert all of the olefin production to

downstream products. The Project would be targeted for startup in

late 2008.

The following olefin derivative units are included in the Project

configuration:

| 1. |

Two LLDPE

units, one of which will be Sumitomo's proprietary Easy

Processing Polyethylene unit. The total capacity is

expected to be approximately 750,000 - 900,000 tons per

year; |

| 2. |

Two

polypropylene units with a total capacity of 700,000 tons

per year, producing a full range of polypropylene

polymers - homopolymer, block copolymer, random, and

terpolymer. A polypropylene compounding unit with a

capacity to be confirmed during the Joint Feasibility

Study is also included; |

| 3. |

A propylene

oxide unit utilizing Sumitomo's proprietary oxidation

technology or other propylene derivative units with a

capacity to be confirmed during the Joint Feasibility

Study; and |

| 4. |

Other

ethylene conversion units such as Mono-Ethylene Glycol

(MEG) and Alfa-olefin are proposed as candidates to

consume the balance of the ethylene. The selection and

size of these derivative units will be confirmed during

the Joint Feasibility Study. |

The companies will retain a

Project Management Services Contractor and other necessary

advisors to proceed as quickly as possible with the execution of

the Project.

April 19, 2004 - Acetex

Corporation

Acetex announces $1 Billion

expansion project

http://www.acetex.com/300/index.html

Acetex Corporation announced today that it has finalized

definitive joint venture agreements with National Petrochemical

Industrialization Company (TASNEE Petrochemicals) regarding the construction of world class

acetic acid,

vinyl acetate monomer (VAM) and methanol projects to be established in Jubail, Saudi

Arabia. Once completed, the project will extend Acetex's global

acetyls position as well as establish Acetex as the lowest cost

supplier of acetyls into the Far East market. The projects will

benefit from the favourable natural gas supply as well as from

Acetex's proprietary integration technology for the co production

of acetic acid and methanol. It is anticipated that this

technology will reduce investment by more than US $100 million as

well as reducing operating costs.

The projects will be located at the petrochemical complex site of

TASNEE Petrochemicals (an affiliate of National Industrialization

Company) in Jubail Industrial City, Saudi Arabia, with an annual

production capacity of approximately 500,000 tonnes of acetic acid, 275,000

tonnes of VAM and 1.8 million tonnes of methanol. Acetex, in cooperation with TASNEE

Petrochemicals, will be responsible for the marketing of the

acetyls products and will integrate this new business with the

existing acetyls business into one global marketing organization.

It is expected that production will begin in 2007. The investment

in these projects is estimated at US $1 billion. The projects

will create approximately 800 opportunities for permanent direct

and indirect employment and several thousand man-years of

employment during construction. Saudi Aramco has allocated the

required amount of natural gas for this industrial complex. Acetex will own 50% of the

acetyls (acetic acid and VAM) company and 25% of the methanol

company.

Acetex intends to enter long-term methanol supply agreements with

the Joint Venture to cover its methanol requirements in Saudi

Arabia and Europe.

"These projects fit well with our long term growth strategy

of becoming a global chemical company," said Brooke N. Wade,

Chairman and Chief Executive Officer of Acetex Corporation.

"The joint venture will maximize opportunities by combining

Acetex's proprietary technology for the integrated production of

acetic acid and methanol with a strong local partner in TASNEE

Petrochemicals with their first class infrastructure and

capability in an excellent strategic location. Financing of the

project will be on a non-recourse basis utilizing attractive

regional sources. It is anticipated that after recognition of

credit for technology contributions and financial support

available from industrial offset programs Acetex will fund its

contribution to the projects without the requirement to issue

additional equity."

"From a shareholder's point of view, this project confirms

the substantial value of our proprietary integration technology

and, when complete, will almost double the acetyls capacity of

our company and make us the low cost producer in both Europe and

the Far East."

Acetex Corporation has two primary businesses - its European

Acetyls Business and the Specialty Polymers and Films Business.

Our Acetyls business is Europe's second largest producer of

acetic acid and polyvinyl alcohol and third largest producer of

vinyl acetate monomer. These chemicals and their derivatives are

used in a wide range of applications in the automotive,

construction, packaging, pharmaceutical and textile industries.

Specialty polymers developed and manufactured by Acetex are used

in the manufacture of a variety of plastics products, including

packaging and laminating products, auto parts, adhesives and

medical products. The films business focuses on products for the

agricultural, horticultural and construction industries.

Acetex directs its operations from its corporate head office in

Vancouver, Canada. Acetex has plants in France, Spain, and

Canada, and sells to customers primarily in Europe, the United

States, and Canada. Acetex's common shares are listed for trading

under the symbol "ATX" on The Toronto Stock Exchange,

which has neither approved nor disapproved the information

contained herein.

Tasnee

Petrochemicals was

established by and is majority owned by National Industrialization

Company (NIC) with the

participation of a number of strategic partners including Gulf Investment

Corporation (GIC), which is

owned by the GCC countries with headquarters in Kuwait, Saudi Pharmaceutical &

Medical Appliances Co. (SPIMACO), National Industries Group (NIG), Kuwait, and Al-Olayan Financing Co., Riyadh, Saudi

Arabia. TASNEE Petrochemicals

had established its first plant in Jubail for the production of

about 500,000 tonnes of

propylene and polypropylene annually which is currently under start

up.

Basell 2004/12/1

Sahara Petrochemical Co. and Basell sign agreement for

construction of PP & propane dehy complex

http://www.basell.com/

Sahara Petrochemical Company and Basell Holdings Middle East GmbH today announced the signing of an

agreement to construct a 450 KT per year polypropylene plant and

propane dehydrogenation unit at Al-Jubail Industrial City in the Kingdom of Saudi Arabia. The

facilities will be operated by a joint venture that Basell and

Sahara Petrochemical Company plan to establish in 2005. Start-up

of the new plants is targeted for the end of 2007.

The agreement includes a license to utilise Basell's most

advanced polypropylene technology, the Spherizone process. The polypropylene from the new plant will

be marketed globally by Basell. The propane dehydrogenation unit

will be based on the UOP Oleflex process. Saudi Aramco will supply the propane

feedstock.

“This is an important step

forward in Basell's strategy to establish world class

manufacturing facilities in locations with attractive feedstock

conditions and an infrastructure that is strong and reliable,”

said Volker Trautz, Basell's

president and CEO. “This is

Basell's second project in the Kingdom of Saudi Arabia again

based on excellent cooperation with our partners in this

undertaking, Sahara Petrochemical Company and the Al-Zamil Group

of companies.”

Trautz said Basell's excellent

experience in establishing Saudi Polyolefins Company, a joint venture with the National

Petrochemical Industrialization Company (Tasnee Petrochemicals) that started up at the beginning of this

year, was a factor in the company's decision to pursue additional

projects in the Kingdom.

Ian Dunn, president of Basell International, said Basell is well

prepared to market the output from the new Spherizone process PP

plant. “Basell is the

leading polypropylene marketer in the world with an annual volume

of 8 million tonnes, including its joint ventures, and with

marketing experience in more than 120 countries,” Dunn said. “Our global marketing presence and

expertise is a key strength of Basell, and we are delighted to be

able to combine this with the strengths of our new partners.”

“Spherizone technology is the most

significant breakthrough since the launch of the Spheripol

process 20 years ago,” said

Just Jansz, president of Basell's Technology Business. “The Spherizone process offers the benefit

of expanded product capabilities and enhanced performance for a

range of applications at reduced operating costs. I am

particularly happy that one year after announcing that this new

technology is available for commercial licensing, the aggregate

capacity licensed to date has already reached one million tonnes.”

In addition to being the world's

largest producer of polypropylene, Basell is the largest producer

of advanced polyolefin products, a leading supplier of

polyethylene and catalysts, and a global leader in the

development and licensing of polypropylene and polyethylene

processes. Basell, together with its joint ventures, has

manufacturing facilities around the world and sells products in

more than 120 countries. Additional information about Basell is

available at www.basell.com.

日本経済新聞 2004/12/29

サウジ

原油生産能力増強 2009年にも150万バレル増

休止中の3油田も再開 供給不安解消狙う

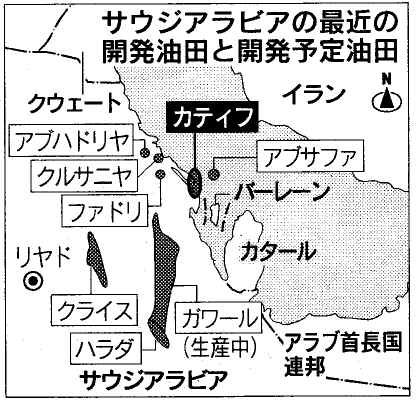

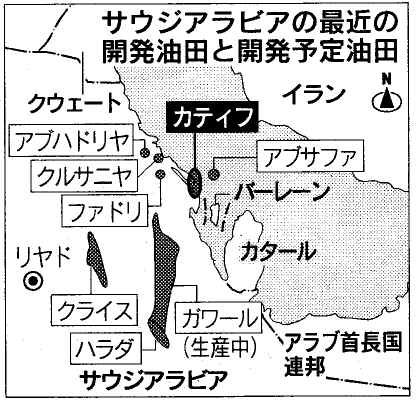

サウジアラビアが原油の生産能力増強を急いでいる。2油田の増強工事を予定よりも早く完成させたのに続き、休止中の3油田で2007年に生産を再開する。中国などを中心に世界の石油需要が強まっていることに対応、生産能力を2009年ころまでに現在よりも150万バレル(日量、以下同)多い1250万バレルに高め、供給不安の解消を急ぐ。

カティフでは26日、事実上の元首であるアブドラ皇太子らが出席してカティフ、アブサフアの2油田の完成式典を開いた。2油田の生産量は合計80万バレル。当初の完成予定を3カ月早め8月に生産を始めている。

ヌアイミ石油鉱物資源相は式典で「(カティフの生産開始で)能力は1100万バレルに達した。今後数年間でアブハドリヤ、ファドリ、クライス、クルサニヤ油田を開発する」と具体的な油田名をあげて能力増強を続ける意向を明らかにした。

東岸の産業都市ジュベイル近郊に位置するクルサニヤ、ファドリ、アブハドリヤは1960年代に生産を開始した古い油田。80年代に休止したが原油と天然ガスを分離する設備などを新設、07年末をめどに合計50万バレルを生産する。

サウジ国営石油会社アラムコは世界最大のガワール油田西方に位置するクライス油田の開発準備に着手した。09年にも生産を開始する見通し。同油田の生産量は現在10万バレル前後。しかし、本格開発すれば80万−100万バレルの生産が可能とされる世界有数の大型油田だ。

サウジの積極姿勢は油田開発用の掘削井(リグ)の急増から見て取れる。アラムコは今年後半から掘削設備調達の入札を相次ぎ実施、来年上半期には稼働する掘削井は現在の5割増の70−80本に増える見通しだ。

クルサニヤなど3油田の再開発には10億ドル(約1千億円)、クライス油田の開発には30億ドル規模の投資がそれぞれ必要とされる。

原油価格は今年、記録的水準に高騰した。投機マネーの流入だけでなく、世界的な石油の消費拡大に産油国の供給能力が追いつかないとの分析も背景にあった。ヌアイミ石油相は「サウジの可採埋蔵量は(現在の2600億バレルに)2千億バレル上乗せすることも可能だ」と発言し、一部専門家が指摘する“サウジの能力限界説”を強く否定した。

アラムコ社長会見

需給にらみ機動的に 日中はともに重要市場

アラムコのアブドラ・ジュマ社長兼最高経営責任者(CEO)は28日、サウジ東部ダーランのアラムコ本社で日本経済新聞記者と会い、油田開発の方針やアジア市場への取り組みを語った。主なやり取りは次の通り。

ー 今後の開発は。

「ハラダ油田の30万バレルが2006年に加わりアブハドリヤなど3油田の50万バレルが07年に生産を始める。クライス油田の生産開始は09年だろう。重要なのは常時150万−200万バレルの生産余力を維持することだ。需給に目を配り、必要なら速やかに開発する」

− アラムコは今年、日本企業と大型案件に着手した。

「住友化学との石油精製・石油化学施設の事業化調査は順調に進んでいる。2005年前半に結論を出すが、このプラントの基本設計をすでに日揮に発注するなど、結果を待つのではなく並行して多くの作業を進めている。第三のパートナーを否定するつもりはないが、今は時期尚早だ」

「精製や販売事業で高い利益を見込めないことはわかっている。昭和シェル石油の株式を取得したのは世界第二位の経済大国との関係を築くことが狙いだ。昭シェルヘ30万バレルを供給することでわれわれは日本への最大の供給者となる。(現在9.96%の)昭シェルへの出資比率は、合意に基づき05年中に最大15%に高める」

ー 中国市場への取り組みはどうか。

「中国市場は重要だ。中国石油化工や米エクソンモービルと福建省に精製・石化施設を建設することで合意し、ほかにも話し合いを進めている。しかし、日本と中国のどちらかを取るという話ではない。どちらも重視している」

BP 2005/6/8

Innovene

and Delta Oil Agree To Explore Major Petrochemical Investment in

Saudi Arabia

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7006623

Innovene,

BP plc's petrochemicals and refining subsidiary, and Delta

International, a leading Saudi-owned independent

development company, announced today the signing of a Memorandum

of Understanding (MOU) for a major investment in Saudi Arabia's

petrochemical sector.

The

memorandum marks the beginning of detailed negotiations between

Innovene and Delta for the construction of a

world-scale cracker and associated derivative capacity in the Kingdom, with

sites being explored in Jubail. It is intended that this

project, which is expected to cost around $2bn, will form a platform

for future long-term growth opportunities.

Innovene

and Delta will be equal partners within the joint venture.

It is anticipated that, subject to final approvals, an agreement

will be signed before the end of the year, with commissioning of

the first plants expected in late 2008.

The

MOU was signed last night at a ceremony in Riyadh by Ralph

Alexander, CEO of Innovene and Mr Badr Al-Aiban, Chairman and CEO

of Delta in the presence of His Highness Prince Saud Bin

Thunayyan Al-Saud, Chairman of the Royal Commission for Jubail

and Yanbu.

Commenting

on the joint venture with Delta, Ralph Alexander said: "We

see this joint venture as the first chapter in a long and

fruitful partnership between Innovene and the Kingdom of Saudi

Arabia. It confirms Innovene's position as a truly global

petrochemicals player, including Delta on the list of highly

respected companies with whom we have partnerships around the

world and adding a major Middle East position to our existing

portfolio of assets in North America, Asia and Europe."

Badr

Al-Aiban commented: "We are delighted to be partnering with

Innovene, one of the largest petrochemical companies in the

world, and look forward to a successful venture. Delta has a long

reputation for its ability to forge highly successful long-term

strategic alliances with both major companies and the countries

in which we operate. As a Saudi company with domestic and global

activities, we are pleased to be able to play such an important

part in the continuing development of Saudi Arabia's

petrochemicals industry."

Notes to

editors:

Innovene

*

Innovene was created as a wholly owned subsidiary of BP on April

1, 2005. BP may sell part of its stake in Innovene by way of an

IPO later in 2005, subject to necessary approvals and market

conditions.

*

Innovene has more than $15bn of revenues, 15 million tonnes of

petrochemical production volumes and $9bn in total assets.

*

Innovene's major manufacturing sites include Grangemouth in

Scotland, Lavera in France, Koln in Germany and Lima, Chocolate

Bayou and Green Lake in the US. SECCO, the joint venture between

Innovene/BP, Sinopec and SPC in Shanghai and the largest

petrochemical complex in China to date, became fully operational

in March 2005.

*

Innovene manufactures petrochemicals, including olefins (ethylene

and propylene) and their derivatives such as polyethylene,

polypropylene, acrylonitrile, linear alpha olefins,

polyalphaolefins, and solvents. These chemicals are used to make

a wide variety of plastic goods, including food and drink

containers and wrappings, pipe work, automotive parts and

mouldings. Innovene also manufactures gasoline, diesel and other

refined products in the Grangemouth and Lavera refineries.

*

The company's global headquarters are located in Chicago.

*

For more information on Innovene, visit www.innovene.com

Delta

*

Delta International, a leading private Saudi-owned independent

development company, was founded by its Chairman and Chief

Executive Officer, Mr. Badr Al-Aiban in 1978, and its activities

have expanded significantly since its inception. Delta is

headquartered in Jeddah.

*

Delta played an important role in the conception of the “Contract of the Century”; the formation of the consortium

for the supergiant Azeri, Chirag, Gunashli field, offshore

Azerbaijan, and during that time identified and participated in a

number of other major projects within the Caspian region, Central

Asia and the Middle East.

*

Delta's current activities upstream projects are focused

primarily on North and West Africa.

*

For more information on Delta, visit www.Delta-oil.com

Delta Oil

Company Limited (Saudi Arabia)

Delta Oil Company Limited, a private Saudi-owned company,

was founded by its Chairman and Chief Executive Officer,

Mr. Badr M. Al-Aiban. Mr. Al-Aiban established the

original Delta entity in Saudi Arabia in 1978, and its

activities have expanded significantly since its

inception.

Today, Delta and its affiliates comprise a diversified

group of companies involved in the energy industry, real

estate development, food processing and packaging, soft

drink bottling and distribution, agriculture and

manufacturing. The company's operations extend to Central

Asia, South East Asia and other countries in the Middle

East.

Delta has developed a number of strategic alliances in

the oil and gas industry. As a member of the Azerbaijan

International Operating Company (AIOC) and the North

Absheron Operating Company Limited (NAOC), Delta and its

affiliates are involved in exploring and developing oil

fields in Azerbaijan, as well as other Central Asian

countries.「ビンラディン一族が経営するデルタ石油」

|

2005/9/13 Sipchem

Sipchem Appoints NCB to

Manage its Initial Public Offering

http://www.sipchem.com/sysadmin/NewsManagment/press.asp?a=246&z=4

Saudi International

Petrochemical Company (“Sipchem”) announces its plans for its

Initial Public Offering (“IPO”) by listing its shares on

Tadawul, the Saudi Arabian Stock Exchange. The Initial Public

Offer ("IPO") is primarily intended to facilitate a

capital increase to finance Sipchem`s expansion projects.

The Company has appointed The National Commercial Bank

("NCB") as Financial Advisor, Lead Manager and Lead

Underwriter to the IPO in a ceremony that took place today in

Sipchem's offices in Al-Khobar. Sipchem's President, Ahmed A.

Al-Ohali is quoted as expressing his confidence in the past

performance of the Company as well as the potential for the

future, and his pleasure at the imminent participation of the

Saudi public in Sipchem's future success. The Deputy General

Manager of NCB, Mr. Abdulkareem Abu AlNasr stressed the

importance of this milestone offering and the positive impact of

listing a leading industrial Company with the financial strength

of Sipchem on the performance of the Saudi Arabian stock market

and the Saudi economy in general. Both Sipchem and NCB are

looking forward to working closely with CMA and the Ministry of

Commerce and Industry to achieve a smooth and successful process.

Sipchem is a Saudi Arabian closed joint stock company formed in

1999 to become a leading diversified and integrated international

petrochemical company. The Company`s first phase of development

comprises of two joint ventures with international partners for world-scale methanol (completed in

2004) and butanediol

petrochemical projects (currently in the start-up

phase). Sipchem is currently developing as Phase II an integrated Acetyls

petrochemical complex. Sipchem's paid-in capital is SR

1,500 MM (US$400 MM). The Company presently has 73 shareholders,

all leading individual and corporate investors from Saudi Arabia

and the GCC region.

Platts 2005/12/7

SABIC's Yansab receives

nod for 35% IPO on Saudi stock exchange

The Saudi Arabian Capital Market Authority has given approval for

the initial public offering of 35% of shares in SABIC affiliate

Yanbu National Petrochemicals Company (Yansab) on the Saudi stock

exchange, SABIC announced Wednesday. The amount of the offering

is approximately Riyal 2-bil ($500-mil) of the total company's

capital which exceeds Riyal 5.6-bil ($1.5-bil).

The IPO will be managed by Saudi American Bank as of the start of

business on Dec 17, 2005 and until up to the closing of business

on Dec 29, 2005, the company said. The starting price per share

will be its listed par value of Riyal 50.00 ($13.30). The minimum

allocation is 10 shares and the maximum is 5,000 shares.

In addition to the 35% public offering, SABIC own 55% of Yansab

shares. SABIC's partners in Ibn Rushd and Tayf including national

and regional establishments and companies own 10%.

"Yansab, which is currently under construction at Yanbu

Industrial City, will be one of the world's largest

petrochemicals complexes with an annual capacity exceeding 4-mil

mt. It is expected to go on stream by 2008," said Mutlaq

Al-Morished, the vice president for corporate finance said.

Platts 2006/1/4

Brazil's Ultrapar licenses Saudi Arabia use of output technology

Brazil's Ultrapar Participacoes's Oxiteno has authorized Saudi

Arabia's Project Management and Development

Co the use

of technology for manufacturing ethanolamines and ethoxylates

through a contractual-license agreement, Oxiteno said Wednesday.

The technology will be used by PMD to produce 100,000 mt/yr of

ethanolamines

and 40,000

mt/yr of ethoxylates

at the company's Al Jubail petrochemical complex in Saudi Arabia.

The project is part of a bigger PMD facility that will be

centered around a cracker with a projected ethylene

production-capacity of 1.35-mil mt/yr.

The Al Jubail complex will be integrated with other PMD

downstream plants, according to Wednesday's statement.

ポリオレフィン 全てBasell技術

HDPE 400 KT (Hostalen)

MDPE/HDPE 300 KT(Lupotech G )

PP 640KT(2 plants total) (Spheripol)

LDPE/EVA copolymer 640KT(Lupotech T ) |

MENA FN 2003/10/22

PMD $3.5 billion Saudi petrochemical project on track

Project Management & Development Co. ('PMD') based in Al

Jubail, Saudi Arabia, announced that it has received a notice

of allocation of feedstock from Saudi Arabian Oil Company

('Saudi Aramco'). This follows a review by Saudi Aramco of

PMD's project proposal and its acceptance of PMD's planned

integrated petrochemicals complex project.

PMD's project will be the largest private sector

petrochemical project in the Middle East with an expected

total investment of $3.5 billion. The business plan envisages

that PMD will crack the allocated feedstock, comprising

ethane and mixed butanes, and will produce 1,350 KTA of

ethylene

in addition to commercial quantities of propylene and

benzene.

This ethylene, which is expected to have a significantly

competitive cash cost of production, since PMD enjoys the

benefit of low feedstock costs in line with the Kingdom of

Saudi Arabia's policies, will provide the basis for the

production of several downstream products in world-scale polyethylene,

polypropylene and ethylene glycol plants. These plants will

form part of a single integrated complex, located within the

Royal Commission's industrial area at Al Jubail.

In addition, the project is expected to produce bisphenol and

amines at

the integrated complex. Scheduled start up date is expected

in early 2008.

PMD envisages that the project will be developed jointly with

one or more international partners. PMD will shortly approach

selected potential partners on a formal basis, many of whom

have already contacted PMD to express interest in the

project.

Joint venture partners are expected to provide key

operational and technical support to the project company

including operation and maintenance of the plant and product

offtake. The project economics suggest that the project

company is likely to generate an attractive return on

investment for PMD and its partners, which are also expected

to include selected Saudi and GCC shareholders.

PMD has previously announced the appointment of Arab Banking

Corporation as strategic and financial advisor for the

project.

http://www.sabicamericas.com/january-2004-2?makePrintable=1

"I have always

believed that the country needs more than 10 SABICs,"

says Majed Al-Ahmadi, president and chief executive officer

(CEO) of Project Management & Development Company (PMD).

"Petrochemicals is one of the things we are good at and

we have the feedstock. And the private sector is interested

and has the financial capabilities."

What the new players may lack in size, they make up for in

ambition. Jubail-based PMD is a private developer with grand

plans. Its planned $3,000 million complex will comprise a 1.35

million-tonne-a-year (t/y) mixed feedstock cracker, a

970,000-t/y polyethylene (PE) plant, a polypropylene (PP)

plant with capacity of at least 500,000 t/y and a 530,000-t/y

ethylene oxide unit for the production of ethylene glycol,

ethanolamine, methylamine and derivatives and ethoxylates. In addition, PMD plans to

build a facility to produce some 300,000 t/y

of bisphenol A,

which is primarily used for making polycarbonate and epoxy

resins.

"This is not a world for small players," says

Al-Ahmadi, a former SABIC executive. "This is why PMD is

a big baby. [With these capacities], it will push us

immediately into the top 10 in the kingdom and even establish

us on a worldwide level."

Al-Ahmadi says progress on the scheme has been encouraging so

far. On the project's equity side, a joint venture partner is

expected to provide 50 per cent of the required $1,000

million, with the remainder to be covered by PMD and

investors. Al-Ahmadi says a "good number" of mostly

regional investors have expressed strong interest in taking a

stake in the project. An advisory team has been appointed and

a joint venture partner should be selected in early 2004.

Finding a world-class joint venture partner with technology

know-how will be essential for PMD, especially when it comes

to ensuring commitments from financial institutions. "I

believe the private sector has a future in Saudi

Arabia," says a petrochemicals company executive based

in Europe. "There is enough money in the country to

provide equity for several projects in the range of $1,000

million-2,000 million.

But it will be difficult for PMD because it does not have a

name and it is therefore harder to find commitments from

banks for the planned $3,000 million-4,000 million complex.

That is why a foreign partner is so important."

2005/12/19 Basell

PMD selects Hostalen

& Lupotech G processes for new plants in Saudi Arabia

Project Management and Development Company Ltd. (PMD) has

selected Basell technologies for two new polyethylene plants

it intends to build in the Kingdom of Saudi Arabia. Hostalen

technology will be used in a high density PE plant with an

annual capacity of 400 KT and Lupotech G

technology will be used in a medium density/high density PE

plant with an annual capacity of 300 KT.

Earlier this year, PMD selected Basell's

Spheripol process for two new PP plants with a total annual

capacity of 640 KT and Basell's Lupotech T

technology for a new LDPE and EVA copolymer plant with an

annual capacity of 270 KT.

All five plants will be part of a new petrochemical complex

in the industrial city of Al Jubail, Saudi Arabia. Start-up

is scheduled for 2009.

“Basell is the only polyolefins

technology company offering a complete portfolio of PP and PE

technologies,” said Just Jansz, president of

Basell's Technology Business. “PMD has decided to source all

of its polyolefin technology needs from a single supplier,

Basell. A single reference point for technology facilitates

project implementation, competitiveness and project

financing.”

PMD has

licensed all of its 1.6 million tonnes of polyolefin capacity

from Basell including gas phase, slurry and high pressure

tubular polyethylene processes as well as the world's leading

polypropylene technology.

2006/5/11 Basell

Tasnee & Sahara Olefins Company and Basell sign joint venture

agreement

Basell has signed a joint venture agreement with Tasnee &

Sahara Olefins Company for the construction of a new

integrated ethylene and polyethylene complex

at Al-Jubail Industrial City in the Kingdom of Saudi Arabia.

The complex will include a gas cracker and two 400 KT per

year polyethylene plants. One plant, based on Basell’s latest generation Hostalen

process, will produce high density polyethylene; the other plant, based on Basell’s Lupotech T technology, will

produce low density polyethylene. Scheduled to start up in 2008,

the units will be the largest Hostalen and Lupotech T process

plants in the world.

Basell

will have a 25% equity share in the project, while Tasnee &

Sahara Olefins Company will hold the remaining equity.

Tasnee & Sahara Olefins Company is a recently established

joint stock company. Its main shareholders are Tasnee

Petrochemicals

and Sahara

Petrochemical Company with a minor shareholding by the

Saudi Arabian General Organisation for Social Insurance (GOSI).

“Basell

and Tasnee Petrochemicals have already another joint venture, Saudi Polyolefins

Company,

which includes a 450 KT per year polypropylene plant in Saudi Arabia,”

said Volker Trautz,

CEO of Basell, who participated in a signing ceremony in Riyadh,

Saudi Arabia. “Following the excellent success of

this joint venture, we look forward to extending our cooperation

into polyethylene.”

Volker Trautz

expressed his appreciation to Sahara Petrochemical Company which

is also a major shareholder in this project. Sahara Petrochemical

Company and Basell are currently developing a new 450 KT per

year Spherizone polypropylene plant and propane dehydrogenation

unit in Al-Jubail.

Trautz said, “The implementation of this major

ethylene and polyethylene complex with the combined strengths of

Tasnee, Sahara and Basell will create a world-class facility with

competitive feedstock and operating costs as well as sustainable

product property advantages in an increasingly competitive world

market. Basell is the largest polyethylene producer in Europe,

and this project is part of our strategy to expand our geographic

presence by establishing, together with strong local partners,

new world-class manufacturing facilities with attractive

feedstock conditions in close proximity to target markets.”

Just Jansz,

President of Basell’s Technology Business, said, “Basell’s latest generation Hostalen

technology can produce high performance multi-modal HDPE. These

grades offer advantages in demanding applications such as caps

and closures and blow molding, as well as in specialty films,

which are among the fastest growing applications in the Middle

East.”

Lupotech T is a

high pressure tubular reactor process for the production of LDPE.

“The

Lupotech T technology has a long and successful history, but

recent advances have further enhanced its competitiveness,”

Jansz said. “The process features broad product

capability, high conversion rates and stable and flexible

operation.”

Basell’s complete portfolio of licensed

technologies includes:

・ Spheripol

: polypropylene

technology for the production of homopolymer, random and

heterophasic copolymers.

・ Spherizone

: next

generation polypropylene technology based on new multi-zone

reactor technology.

・ Spherilene

: swing

gas phase process for the production of LLDPE and HDPE.

・ Hostalen

: low-pressure

slurry process for the production of bimodal HDPE.

・ Lupotech

T : high pressure tubular reactor

process for the production of LDPE and EVA copolymers.

Basell also produces and commercialises advanced catalyst systems

which are sold under the Avant trade name.

Basell is the world's largest producer of polypropylene and

advanced polyolefin products, a leading supplier of polyethylene

and catalysts, and a global leader in the development and

licensing of polypropylene and polyethylene processes. Basell,

together with its joint ventures, has manufacturing facilities

around the world and sells products in more than 120 countries.

Additional information about Basell is available at

www.basell.com.

July 10, 2006 Aramco

Dow is Selected for

Negotiations on New Petrochem Complex

The Saudi

Arabian Oil Company (Saudi Aramco) has selected The Dow Chemical

Company as its potential partner to engage in exclusive

negotiations concerning a joint venture company to construct, own

and operate a world-scale chemicals and plastics production

complex at Ras Tanura, in Saudi Arabia's Eastern

Province.

This joint venture would encompass an array of world-scale

facilities producing a very broad portfolio of plastics and

chemical products.

The proposed petrochemical project would be integrated with

the existing Ras Tanura refinery complex, which is one of the world's

largest refinery complexes. When fully operational, the new

petrochemical complex will be one of the largest plastics and

chemicals production complexes in the world and be ideally

situated to access most major world markets. The joint venture

would produce an extensive and diversified slate of chemicals,

and introduce new value chains and specialty products to the

Kingdom. The availability of these chemicals in the Kingdom will

facilitate the development of downstream conversion industries

and the further industrialization of the Kingdom.

About Saudi Aramco

Owned by the Saudi Arabian Government, Saudi Aramco is a

fully-integrated, global petroleum enterprise, and a world leader

in exploration and producing, refining, distribution, shipping

and marketing. The company manages proven reserves of 260 billion

barrels of oil (nearly a quarter of the world's total) the

largest of any company in the world, and manages the

fourth-largest gas reserves in the world. Saudi Aramco owns and

operates the world's second largest tanker fleet to help

transport its crude oil production, which amounted to 3.3 billion

barrels in 2005. In addition to its headquarters in Saudi

Arabia's Eastern Province city of Dhahran, Saudi Aramco has

affiliates, joint ventures and subsidiary offices in China,

Japan, Netherlands, Philippines, Republic of Korea, Singapore,

United Arab Emirates, United Kingdom and the United States. More

information about Saudi Aramco can be found at

www.saudiaramco.com.

About Dow

Dow is a diversified chemical company that offers a broad range

of innovative products and services to customers in more than 175

countries, helping them to provide everything from fresh water,

food and pharmaceuticals to paints, packaging and personal care

products. Built on a commitment to its principles of

sustainability, Dow has annual sales of $46 billion and employs

42,000 people worldwide. More information about Dow can be found

at www.dow.com.

Chemweek's

Business Daily/Access Intelligence via COMTEX

Last

month, before Dow's involvement was disclosed, local sources

told CW that the project would upgrade Aramco's 325,000-bbl/day

refinery at Ras Tanura and build a petchem complex that will

produce 1.2 million m.t./year of

ethylene and 400,000 m.t./year of propylene. The project also

includes an aromatics complex with capacity for 400,000

m.t./year of benzene and 460,000 m.t./year of para-xylene,

sources say. Other products will include acrylonitrile,

acrylonitrile butadiene styrene, isocyanates, polyethylene

terephthalate, purified terephthalic acid, and

styrene-butadiene rubber.

なお同地では2004年にJETROがアラムコと組んで、ブタン、ナフサおよび改質ガソリンを原料として、

(1)ベンゼンを抽出することによる既設ガソリンの品質改善および本プラントで新規に生産されるアルキレートによるオクタン価の向上

(2) 輸出向け石油化学中間製品、エチルベンゼン、クメンおよびターシャルブチルアルコールの生産

の事前FSを実施している。

平成15年度

石油・天然ガス資源開発等支援調査およびエネルギー使用合理化調査

「サウジアラビアラスタヌラ製油所の有機的複合化及び効率化調査」

http://www.jetro.go.jp/jetro/activities/oda/model_fs/oil/pdf/h15_4.pdf

Gulf Industry 2006/4

Aramco sees potential for

petchem plants

http://www.gulfindustryonline.com/bkArticlesF.asp?IssueID=236&Section=714&Article=4367

From its headquarters in

the eastern city of Dhahran, Saudi Aramco is overseeing a major

petrochemicals development programme involving three projects

that will be integrated with refineries

These projects are Petro-Rabigh, which is scheduled to start

production in 2008; the Ras Tanura petrochemical

complex

integrated with the existing Ras Tanura refinery and targeted for

commencement of commercial operations in 2012, and the Yanbu

Petrochemical Masterplan, currently in its initial stages

of conceptualisation and set to start in 2014.

The second project in the programme is Ras Tanura. Now in the preliminary

development phase, it will feature the first application in the

Middle East of cracking refinery liquids

(naphtha) coupled with ethane cracking and aromatics production.

This combination is in line with the company’s strategic direction to integrate

refining operations with petrochemicals to produce diverse

products that are essential for the establishment of an advanced

export-oriented conversion industry (such as synthetic rubber and

automobile parts).

The project will integrate with the 550 MBD Ras Tanura refinery

located on the east coast of Saudi Arabia to produce about 1.35 million tpy

of ethylene, 0.9 million tpy of propylene and 1 million tpy of

aromatics.

In the Yanbu Petrochemical Master Plan, the goal is to create an

integrated business opportunity with the existing Yanbu Refinery

and leverage streams from the existing and future joint venture

refineries in Yanbu’, on the West Coast.

The Master Plan is currently under development. “We are evaluating options to

expand and upgrade the existing 235,000 barrels per day Yanbu

Refinery into an integrated olefins and

aromatics complex

that will provide a diverse line of petrochemical products,”

said Shalabi.

“The

heart of the integration will be centred on a naphtha-based

steam cracker

that maximises production of propylene, butadiene, and benzene

for further conversion to semi or specialty type products.

Start-up is tentatively targeted for 2014.”

The petrochemicals sector

provides further opportunities for Saudi Aramco to develop a

position of sustainable competitive advantage, said Shalabi

“The

petrochemicals business is attractive, with strong projected

growth rates expected to exceed global GDP growth.

“Saudi

Arabia offers a stable and secure supply of feedstock to support

petrochemical opportunities, a competitive energy cost

environment to enhance the operations of these ventures, and the

financial resources to make them happen. In a global environment,

which is becoming increasingly concerned with stable hydrocarbon

supplies, locating petrochemical ventures closer to the feedstock

source is becoming a considerable strategic advantage,”

he remarked.

“Saudi

Aramco’s existing and planned refining

assets present attractive petrochemical integration

opportunities. Furthermore, the kingdom’s geographic location, close to

growing markets, also makes us a strong contender for

export-oriented petrochemical facilities.”

Shalabi said the

new petrochemical projects would have strong potential

macro-economic benefits for the kingdom, especially ventures

which would be based on refinery liquid

feedstocks in addition to gas.

Saudi Arabia’s existing petrochemical industry

is largely based on ethane, which has led to a strong focus on

commodity grade ethylene derivatives such as polyethylene, MEG

and styrene.

The cracking of liquid feedstocks, available from integration

with refineries, would broaden the product slate and result in

the production of additional products such as propylene and

butadiene.

Also, refinery liquids cracking will be the source for producing

the much-needed aromatics value chain.

These primary petrochemical products will be the foundation on

which secondary industries will develop, producing a broad

product slate of raw materials for competitive export-oriented

plastics conversion industries producing.

Not only traditional plastic finished products but also new more

value-added converted products will be created.

Support for these conversion industries is one of the key metrics

Saudi Aramco employs with potential partners in developing new

downstream projects

Saudi Aramco’s strategic thrust in downstream

activities is in line with the kingdom’s long-term vision for economic

development and diversification.

“The

longer-term vision for Saudi Arabia moves us beyond exporting

feedstocks and basic chemicals to producing more value-added

chemical derivatives and even converted finished goods,”

observed Shalabi.

“We

will leverage our advantaged cost position to capture more of the

value chain, including labor-intensive conversion opportunities

which would create more economic diversification and generate

additional employment opportunities.”

2006/11/15 Basell

Basell JV with Sahara

Petrochemical Company secures Shariah compliant financing

Al-Waha

Petrochemical Company, the joint venture between Basell (25%) and Sahara

Petrochemical Company (75%) in Al-Jubail Industrial City in

the Kingdom of Saudi Arabia, yesterday completed the signing of

the Shariah compliant Financing Facilities Agreement and all

related financing documents with six regional banks.

“We are proud

that together with our partner Sahara Petrochemical Company we

have succeeded for the first time to arrange non-recourse project

financing in the Kingdom based on a Shariah compliant structure,”

said Volker Trautz,

President and CEO of Basell.

Trautz added, “With the combined strengths of

both partners we will jointly create a world class manufacturing

complex with competitive feedstock and operating costs. With the

most advanced technology and using Basell’s global marketing capability we

will be able to establish and maintain a robust and profitable

operation in an increasingly competitive market.”

Engineering,

procurement and construction (EPC) activities for the 450 KT per year

Spherizone polypropylene plant and a propane dehydrogenation unit began in January this year based

on an early works agreement with Tecnimont and Daelim. The EPC

contract was signed on September 18, 2006 and commercial

production is foreseen in the first quarter 2009.

The Spherizone

process is Basell’s most advanced polypropylene

technology and can produce the full range of PP grades, as well

as new families of propylene-based polymers with enhanced product

properties. Basell operates a Spherizone plant in Brindisi,

Italy, and has granted eight Spherizone process licenses with an

aggregate capacity of 2.5 million tonnes per year.

The Al-Waha joint

venture is Basell’s third major investment in

Saudi-Arabia. A first joint

venture with Tasnee Petrochemicals, involving a polypropylene plant

and a propane dehydrogenation unit, commenced commercial

operations in May 2004. Its current capacity of 500 KT per year

will be expanded to 800 KT by end 2008.

In June this year

Basell’s second joint venture in the

Kingdom, Saudi Ethylene and

Polyethylene Company, was established jointly with both

Tasnee Petrochemicals and Sahara Petrochemical Company. The new

company is currently constructing a cracker for the production of

1000

KT per year of ethylene and 285 KT per year of propylene; one 400

KT per year high density polyethylene (HDPE) plant using Basell’s latest generation Hostalen ACP

process, and one 400 KT per year low density polyethylene (LDPE)

plant using

Basell’s Lupotech T technology. The start

up of these facilities will be in the fourth quarter 2008.

Basell is the

world's largest producer of polypropylene and advanced polyolefin

products, a leading supplier of polyethylene and catalysts, and a

global leader in the development and licensing of polypropylene

and polyethylene processes. Basell, together with its joint

ventures, has manufacturing facilities around the world and sells

products in more than 120 countries. Additional information about

Basell is available at www.basell.com.

For more

information contact Chantal Sohm of Basell’s Corporate and eBusiness

Communications Department at + 33 1 55 51 21 19 or

chantal.sohm@basell.com

Trade Arabia January 22,

2006

Zamil Group and

Huntsman Company sign SR500 million ($135 million) JV agreement

Zamil Group and the

Huntsman Corporation of USA announced their intention to form a

joint venture to build a world scale Ethyleneamines

manufacturing facility in Jubail Industrial City, Saudi Arabia, through the

signing of the joint venture shareholders agreement. The total

investment cost in the project is put around SR 500 million ($135

million).

The Saudi Arabian

General Investment Authority (SAGIA) hosted the signing ceremony.

'SAGIA's hosting of this event is in line with its strategy to

promote investments in the energy sector, one of the vital

sectors on which the agency is focused,' commented SAGIA

Governor, His Excellency Mr. Amr Al-Dabbagh.

HE Mr. Abdul Aziz

AL-Zamil, Chairman of the Industrial Sector at Zamil Group and

Mr. Donald Joseph Stanutz, President of Performance Products

Division, Huntsman Corporation signed the shareholders agreement

on January 22, 2006 to form the joint venture, the Arabian Amines

Company (AAC).

The 66 million

pound (30,000 MTE) plant will produce Ethylenediamine

(EDA), Diethylenetriamine (DET A), Triethylenetetramine (TET A)

and higher molecular weight versions such as TEPA, E-100, AEP and

Piperazine.

The products serve as specialty intermediates for a variety of

end uses including epoxy curing agents, bonding agents and

lube-oil additives for gasoline and diesel engines. The companies

anticipate the plant being on line in 2008.

"The signing

of the shareholders agreement between Huntsman Corporation and

Zamil Group today is an advanced milestone in the realization of

the joint venture and the execution of the Ethyleneamines project

which will source its feedstock from operating companies in

Jubail Industrial city," commented Mr. Al-Zamil.

Huntsman and Zamil

Group will have equal ownership in AAC. The venture will use Huntsman's

proprietary technology that the company has optimized in

its U.S. plants. Huntsman will serve as the exclusive sales

and marketing arm

for the joint venture and will provide technical service and

product applications knowledge.

Zamil Group and

Huntsman expressed their thanks to the Saudi Government agencies

for their support of the project development and especially to

the Ministry of Commerce and Industry, Royal Commission for

Jubail and Yanbu, Saudi Arabian General Investment Authority

(SAGIA), Saudi Industrial Development Fund (SIDF), Saudi Offset

Program, Saudi British Offset Program and Saudi Basic Industries

Corporation (SABIC).

2006/11/2 Huntsman

Huntsman’s Saudi Joint Venture Achieves

Milestone in New Amines Project

Plant to Begin

Production in 2009

Huntsman

Corporation and its partner, the Saudi Arabia-based Al-Zamil

Group, today announced the signing of a definitive Project

Management Consultancy (PMC) agreement with Jacobs

Engineering for overall project management for the

development of the previously announced new ethyleneamines complex in Jubail, Saudi Arabia.

“This new

facility is a key part of our growth strategy,”

said Don

Stanutz, President for Performance Products, a division of

Huntsman Corporation. “With this joint venture, we

can continue to stay focused on serving our customers and

doing what we do best, which is manufacturing and marketing

our differentiated chemicals.”

As part of the

joint venture arrangement with Al-Zamil, Huntsman will

license its technology for the plant and will also serve as

the exclusive sales and marketing agent for the venture’s output, much of which will

be sold in Asia.

The estimated

$150 million amines complex will produce approximately 30,000

tons of amines per year, including ethylenediamine (EDA),

diethylenetriamine (DETA), triethylenetetramine (TETA) and

higher molecular versions. These specialty intermediates will

serve as end products in the production of epoxy curing

agents, bonding agents and lube oil additives for gasoline

and diesel engines.

"All of

the pieces for this project are falling into place nicely,”

said Stanutz. “We are on schedule to start

production in the first quarter of 2009.”

The

engineering, procurement and construction contract will be

awarded in early 2007.

Huntsman is a

global manufacturer and marketer of differentiated and

commodity chemicals. Its operating companies manufacture

products for a variety of global industries, including

chemicals, plastics, automotive, aviation, textiles,

footwear, paints and coatings, construction, technology,

agriculture, health care, detergent, personal care,

furniture, appliances and packaging. Originally known for

pioneering innovations in packaging and, later, for rapid and

integrated growth in petrochemicals, Huntsman today has

15,000 employees and 78 operations in 24 countries. The

Company had 2005 revenues of $13 billion.

Statements in

this release that are not historical are forward-looking

statements. These statements are based on management’s current beliefs and

expectations. The forward-looking statements in this release

are subject to uncertainty and changes in circumstances and

involve risks and uncertainties that may affect the company’s operations, markets,

products, services, prices and other factors as discussed in

the Huntsman companies’ filings with the Securities

and Exchange Commission. Significant risks and uncertainties

may relate to, but are not limited to, financial, economic,

competitive, environmental, political, legal, regulatory and

technological factors. Accordingly, there can be no assurance

that the company’s expectations will be

realized. The company assumes no obligation to provide

revisions to any forward-looking statements should

circumstances change, except as otherwise required by

securities and other applicable laws.

2007/4/5 MarketWatch

Saudi Aramco-Dow Chemical project costs surge to $22 bln

-industry

Saudi Arabian Oil Co. and Dow Chemical Co. are adamant they will

go ahead with building a large-scale

refinery and petrochemicals complex in eastern Saudi Arabia, company

officials said this week, despite industry estimates that costs

have more than doubled to $22 billion.

A memorandum of understanding was due to be signed at the start

of this year, but neither company would be drawn on when this

will now happen.

Aramco plans to float a 30% stake in the Ras Tanura complex in an

initial public offering later this year.

"Negotiations between our two companies are going well. Both

Dow and Saudi Aramco are very enthusiastic about the

project," Earl Shipp, Dow's president for the Middle East,

Africa and India, told Dow Jones Newswires in an e-mail this

week.

Saudi Aramco said in an e-mailed response to questions that the

companies "are in the scoping and negotiation phases of the

project, and will announce more detail as decisions are

finalized."

The project, to come on stream in the second quarter of 2012,

will integrate Aramco's existing refinery at Ras Tanura with a

new petrochemicals complex on the oil-rich kingdom's Persian Gulf

coast.

Industry estimates put the cost for the complex at $10 billion

when it was first mulled over by Aramco and at $15 billion last

July when Aramco announced that it had selected Dow to enter into

exclusive negotiations on developing the project.

However, industry sources in and outside Saudi Arabia now say

building the complex may cost as much as $22 billion.

Aramco and Sumitomo Chemical Co. of Japan in 2005 signed a joint

venture agreement to develop a similar complex at Rabigh on the

Red Sea at a cost of $4.3 billion.

That project is now estimated to cost the two companies up to $10

billion to develop.

Project costs in the Middle East have soared as governments are

spending record oil revenues on building and expanding industries

and infrastructure, leading to a shortage of contractors, raw

materials, equipment and qualified labor, which in turn has

driven up prices.

Thursday, Total SA Chief Executive Christophe de Margerie told

reporters that rocketing costs on a planned $10 billion liquefied

natural gas project in southern Iran are a serious threat to it

going ahead, echoing a chorus of concern from energy producers

over the viability of their expansion plans.

De Margerie said costs at the project, which aims to extract gas

from Iran's massive South Pars field in the Persian Gulf,

"are so high that they are close to damaging the

project."

Qatar's Oil Minister Abdullah bin Hamad Al Attiyah also said

Thursday that he had met in recent weeks with the chairmen of oil

and gas contractors to detail his deepening worries about project

costs that are delaying projects globally.

"We're being forced to halt projects in hydrocarbons and

petrochemicals. It's a big concern," he said. "Cost is

a big concern" and is "one of the issues we should be

concerned about before it snowballs."

Al Attiyah flagged up the example of a proposed new 615,000

barrel-a-day refinery in Kuwait, Al Zour.

Kuwait expected it to cost around $6 billion but contractor

consortia came in with prices in excess of $15 billion, forcing a

rethink.

In February, ExxonMobil Corp. and partner state-run Qatar

Petroleum agreed to abandon a gas-to-liquids partly due to

spiraling cost.

Aramco and Dow declined to provide details on the Ras Tanura

project's latest cost estimates and the timeframe for signing a

memorandum of understanding, originally due in the beginning of

this year.

"Once a memorandum of understanding is signed and approved

by the two companies' boards of directors, the next phase will be

the feasibility study," Dow's Shipp said.

"At this point, we are not providing any specific

information on the project size, product slate, timing and other

aspects of this project", the Aramco spokesman added.

"This information is confidential between the two companies

and the small number of suppliers who are bidding on the project

management services contract and technology license

agreements."

Jan 12, 2008 Reuters

SABIC eyes Saudi Aramco

petrochemicals deal-report

Saudi Basic Industries Corp(SABIC) is considering a deal with

state-oil company Saudi Aramco to upgrade a Red Sea Coast

refinery and a build a petrochemicals complex there, a magazine

reported.

A deal would give SABIC, the world's largest chemical maker by

market value, access to Aramco feedstock and allow the state oil

firm to press on with plans to develop its Yanbu project without

a foreign partner, the Middle East Economic Digest said.

Any tie-up between the two companies would have the blessing of

the Saudi government, the London-based weekly said in its latest

edition, citing unnamed industry sources.

The Yanbu venture is one of three refinery and petrochemical

plants belonging to Aramco, the world's largest oil company by

production. The other two, Rabigh and Ras Tanura, are joint

ventures with Japan's Sumitomo Chemical Co Ltd and the Dow

Chemical Co of the United States.

Aramco announced plans for Yanbu in 2005, including upgrading the

235,000-barrel-a-day refinery and adding a steam cracker and

aromatics complex, the magazine said.

"It will almost certainly produce a different range of

products to the Rabigh and Ras Tanura complexes to avoid

competing with them," it said.

State-controlled SABIC, which makes chemicals, fertiliser and

steel, in October posted its fifth consecutive record profit in

the third quarter on higher prices for its products and more

production.

2007/12/17 Chevron

Phillips

Saudi Polymers Company

Awards EPC Contracts

Chevron Phillips Chemical

Company LLC (Chevron Phillips Chemical) announced today that

Daelim Industrial Co., Ltd., of South Korea, and JGC Corporation,

of Japan, will provide the engineering, procurement and

construction services for Saudi Polymers Company's NCP Project (Saudi Polymers).

Saudi Polymers will

construct and operate an integrated petrochemicals complex at

al-Jubail, a Saudi Arabian industrial city located on the Persian

Gulf. Once complete, Saudi Polymers will include a world-class

olefins cracker, and will produce ethylene, propylene,

polyethylene, polypropylene, polystyrene and 1-hexene. Saudi

Polymers will begin construction in January 2008, with project

completion expected in early 2011. Commercial production is

scheduled to begin in September 2011.

JGC will perform the

engineering, procurement and construction services for Saudi