2003/7/30 China Chemical Reporter

Blue Star Merges Tianjin Petrochemical Plant 中国藍星(集団)

Sinopec

Tianjin Petrochemical Company signed an agreement with China

Blue Star (Group) Corporation in Tianjin on July 18. According to the

agreement, most part of assets and 1 450 employees in Tianjin

Petrochemical Plant, a subsidiary of unlisted Sinopec Tianjin

Petrochemical Company, were incorporated into China Blue Star

(Group) Corporation.

Tianjin Petrochemical Plant is the oldest chemical industry

production base in Tianjin. For some reason including

unreasonable economy and product structure and weak

competitiveness, the refining facility stopped production in 2001

and the chemical plants keep running.

Sinopec Tianjin Petrochemical Company began to negotiate about

assets, personnel and management in Tianjin Petrochemical Plant

with China Blue Star (Group) Corporation from March 2001, and

reached agreement on July 18,2003.

It is reported that China Blue Star (Group) Corporation will

realize its investment and development strategy in Tianjin, based

on the regrouping.

China Blue Star (Group) Corporation is planning to establish the

large chemical production bases in north China. With investment

of RMB1.0 billion, China Blue Star (Group) Corporation will build

25 000 t/a 1,4-butanediol, 700 000 t/a road asphalt and 40 000 to

50 000 t/a SBS facilities.

China National Bluestar (Group) Corporation http://www.china-bluestar.com/eindex.html

China National

Bluestar (Group) Corporation is an enterprise of production and

management in diversified businesses. The Group owns

10specialized companies and is also the holding company of three

listed companies in the stock market, namely "Bluestar

Cleaning" "Star New Chemical Materials"

"South-West Chemical Machinery". Its leading businesses

include New Chemical Materials, Engineering Plastics, Chemical

Cleaning, and Membrane Technology.

・The first specialized cleaning company in

China

・The biggest capacity of industrial

cleaners and auto use chemical products

・The largest facility of producing organic

silicon

・The largest PBT unit by DMT continuous

process in Asia

・The biggest production plant in China of

series photosensitive materials

・The biggest production plant of Bisphenol

A and Epoxy Resin in China

・The biggest production of ionic membrane

electrobath for caustic soda

・The biggest company in the membrane

industry in China

・The largest auto service franchise group

・The No. 1 brand of Chinese fast food ----

Malan Noodle.

"BLUESTAR" has been recognized as the No.1 famous

industrial service trademark in China.

中国藍星、韓国双竜自動車を740億円で買収へ

韓国双竜自動車を中国の国有企業グループ、藍星集団が買収する見通しになった。買収額は約7400億ウォン(740億円)で中国企業による外国企業のM&A(合併・買収)としては過去最大規模。中国企業が韓国の大企業を買収するのも初めて。来年2月までに買収手続きを終える。藍星は買収後、韓国内の工場と中国の販売網拡充に10億ドル(1070億円)を投資、自動車事業に本格参入する。

双竜自動車は経営危機から、朝興銀行など債権銀行団の管理下に入っていた。銀行団は、同社が昨年までに2年連続黒字になるなど再建が順調に進んだと判断。銀行団が保有する同社株(持ち株比率55%)を売却する国際入札を実施した。仏ルノー、米ゼネラル・モーターズ(GM)など海外数社が入札に参加し、16日、藍星が最優先交渉企業に選ばれた。

藍星は2010年までに双竜自動車の韓国内の2工場と研究開発拠点に7億ドル、中国内の販売網整備に3億ドルを投資する。買収後は韓国で生産した車種を中国で輸入販売する。

China's

government approves merger of Blue Star, Haohua Chem

China's State Council has approved the merger of two state-owned

companies - China National Blue Star (Group) Corp and China Haohua Chemical

Industrial (Group) Corp, source said.

( http://www.haohuachem.com/eindex.htm )

A spokesman from Blue Star said the company expects to receive

formal documents from the Chinese government in the coming weeks,

after which a new company China United Chemical Industrial Corp

will be set up.

He added that the new entity would seek to become a leading

chemical company in China with a strong focus on production of

basic chemicals, polymers, speciality chemicals and fertilisers.

The merged company would have the financial muscle and resources

to lead China’s chemical industry as

local giants Sinopec and PetroChina have done in the country’s oil and gas sectors, he added.

The combined entity is expected to be worth Rmb30bn

($3.6bn/Euro3.1bn) in asset value.

The spokesman said there were plans to launch an initial public

offering (IPO) for the new company, but this was not a priority

at present. He said both companies would first look at

streamlining their operations and mapping out future developments

once they had received formal approval documents from the

government.

Blue Star produces chemicals through its subsidiaries - Blue Star

Cleaning, Blue Star New Chemical Material and Nantong Synthetic

Material. Its product slate includes toluene di-isocyanate (TDI),

phenol, bisphenol A, epoxy resin and polybutylene terephthalate.

The parent company has been seeking growth through acquisitions

of companies. Earlier this year, Blue Star acquired a refinery

and a polypropylene (PP) unit from Tianjin Petrochemical, a Sinopec subsidiary.

Both units were understood to be making losses before the

acquisition and have small capacities.

ACW earlier reported on Blue Star’s ambitious plans to build

several greenfield plants and expand its existing units in

various parts of China. The greenfield projects include

construction of polyvinyl chloride (PVC), purified terephthalic

acid (PTA) and methanol facilities.

Haohua is a

manufacturer of organic fluoro rubber and silicon rubber which are used in

mechanical hydraulic systems, lubricating systems, bearings and

driving seals because of their heat resistant properties, raw

materials such as calcium carbide, barium and strontium salts,

and other products including fertilisers, pesticides, fine

chemicals and chemical equipment.

The company has a strong focus in research and development

(R&D), especially in the coal chemical industry, petroleum

and natural gas chemical industry. The company is also strong in

chemical fertilisers, synthetic materials, synthetic rubber and

rubber processing, the fine chemical industry, chemical equipment

and engineering, new chemical materials and special gases,

environmental protection, chemical industry for national defense.

Haohua is also an information provider and holds the right to

exploit chemical mineral resources in China.

2004/5/10 China

Chemical Reporter 合併承認

China

National Chemical Corporation

http://www.ccr.com.cn/news_view.asp?ID=433

The state-run

chemical conglomerate was officially launched in Beijing on May

9th based on the merger between two state-owned chemical

giants-China National Blue Star (Group) Corporation and China

Haohua Chemical Industrial (Group) Corporation (CHC)

China National Chemical Information Center (CNCIC), a subsidiary

of China Haohua Chemical Industrial (Group) Corporation, has also

become part of the new conglomerate.

The new

conglomerate is named China National Chemical Corporation (CNCC).

Controlled by the State-owned Assets Supervision and

Administration (SASAC), the new conglomerate has a registered

capital of RMB5.7 billion (US$688.4 million) and some 100 000

employees.

China National Chemical Corp aims to have total assets of RMB50

billion (US$6.0 billion) and annual sales of more than RMB40

billion (US$4.8 billion) this year.

And CNCC expects to increase both total assets and annual sales

to more than RMB100 billion (US$12.1 billion) within the next

three years.

China National Chemical Corp is also seeking an overseas stock

market listing in one to two years after it becomes one of the

top 500 multinationals.

After the merger between Blue Star and CHC, there are 186

SASAC-controlled industrial giants, some of which have gone

public in the overseas capital markets, such as Sinopec,

PetroChina, etc.

Blue Star and CHC will continue to exist as two entities under

China National Chemical Corp.

Blue Star, founded in 1984, now has total assets of more than

RMB20 billion (US$2.4 billion) and reported RMB10 billion (US1.2

billion) in sales last year.

CNCC has three domestically listed subsidiaries - Blue Star

Cleaning, Blue Star New Chemical Materials and Southwest Chemical

Machinery.

CHC, established in 1993, its assets totaled RMB11.3 billion

(US$1.4 billion) at the end of last year. Its sales stood at

RMB4.37 billion (US$527.8 million) in 2003.

CHC also owns home-listed firm Southwest Chemical Industry

Research and Design Institute.

The new conglomerate will mainly focus on new and basic chemical

materials as well as chemicals for military use.

The automobile sector will also be a new business venture for

China National Chemical Corp.

In February, Blue Star signed a letter of intent with British

automaker Manganese Bronze Holdings to set up a vehicle joint

venture in Lanzhou, capital of Gansu Province, Northwest China.

The two parties plan to invest US$350 million in the expected

joint venture to build 50 000 taxis for the British company

annually.

The joint venture project and Blue Star Zhongche Auto Maintenance

(Group) Corp - the largest vehicle repairing chain in China -

will be combined into one of the 10 expected specialized business

divisions of China National Chemical Corp.

Chinese Chemical

Reporter 2003/8/18

Chinese Phenol Industry Meet with High Investment

The expansion plan of large-scaled enterprises has appeared and the competitiveness of the whole industry will be improved based on its expansion and technical renovation.

The reporter got

the news from the relevant department the expansion plans of

Chinese phenol industry have been confirmed and the production

capacity will be increased greatly in the coming two years.

It is reported the production capacity of domestic four big

phenol/ acetone production base will be expanded from the

existing 425 000 t/a to 760 000 t/a, nearly double the original

capacity.

The phenol

production capacity in Harbin Huayu Corp. will be increased from 45

000 t/a to 200 000 t/a. At present, the public service in Huayu

has been in construction and the phenol expansion project is

planning to put on stream at the end of next year. The phenol

production capacity in Jilin Chemical Industry Company (吉林) will be added to 120 000 t/a from the

existing 60 000 t/a and put into production in August this year. Sinopec Yanshan

Petrochemical Company (燕山) has two sets of phenol plants, one is an

80 000 t/a phenol unit in the east area and the other is a 100

000 t/a phenol unit in the west area. In September this year, 100

000 t/a phenol plant in Yanshan Petrochemical Company will be expanded to 160

000 t/a. Sinopec

Shanghai Gaoqiao Petrochemical Company(上海高橋) also has two sets of phenol plants with

capacity of 60 000 t/a respectively, which will be moved to

Shanghai Caojing Development Zone for reconstruction with

planning production capacity of 200 000 t/a.

After completing the expansion of domestic phenol industry, the

competitiveness of the whole industry will be improved based on

its expansion and technical renovation.

The experts explain the reason for high investment of domestic

phenol industry including the phenol price rising after China launched dumping

investigation of phenol made in Japan, South Korea, the United

States and Taiwan region on August 1, 2002, and the investigation

will be extended to February 1, 2004. The main reason is that

domestic producers has realized it very important to construct

large-scale units and develop large-scale production as the

global market is coming into being.

China Chemical

Reporter 2003-8-25

Sichuan Introduces Technique to Produce 1,4-butanediol

Sichuan Tianhua Co Ltd. (四川天化)signed a contract on

technique transfer of 1,4-butanediol with Du Pont of the United

States in Sichuan on August 14, 2003.

The project, located in the Western Chemical Park of Luzhou(瀘州), Sichuan Province, will produce

1,4-butanediol instead of imports, based on raw materials

including natural gas, adopting the mature technique of Du Pont.

It is reported that Sichuan Tianhua Co Ltd. is the first domestic

producer to produce 1,4-butanediol introducing the advanced

technique.

SICHUAN TIANHUA CO.LTD (LTH Group) http://yun.cdcom.com.cn/e-index.htm

The company possesses a large-scale nitrogen fertilizer unit with a capacity of 300,000 MTPY ammonia and 520,000 MTPY urea,which was introduced from Italy and enjoys the advanced process and technique level in the nineties.

Lutianhua Group Incorporated (hereinafter referred to as LTH Group) was born in November, 1959 in Luzhou-a well-known city famous for its rich culture and long history in the southern part of Sichuan, China. Endowed with abundant natural resources, charming mountains and the surging Yangtze River. The Group is constantly growing up. After 40 years' growth and through the efforts of hardworking and intelligence of its staff, it has now turned to a supper large-sized enterprise with production, scientific research, design, manufacturing, engineering construction, trading and services. LTH Group possesses and operates Sichuan Lutianhua Co. Ltd., the largest urea producer in china, Lutianhua oleo chemical Co. Ltd., the largest oleo chemical manufacturer in China, and Sichuan Tianhua Co. Ltd.. LTH Group owns a state level enterprise's technical center and enjoys the right of import and export in international trade. Up to now, LTH Group operates and runs several production units with 30 kinds of products and the following annual capacities:Ammonia 800,000 MT; Urea 1,240,000 MT; Oleo chemicals 30,000MT; Concentrated nitric acid 40,000MT;Ammonium nitrate 110,000MT; Methanol 6,000MT.

Asia Chemical Weekly 2003/8/27

China's Shaanxi Weihe begins 200 kt/yr methanol project

China's Shaanxi Weihe Coal Chemical Group Co ( 陝西渭河) has started building a 200 000 tonne/year methanol plant in Weinan, Shaanxi, according to a company source. The methanol project, which is scheduled for startup in H1 2005, will use local technology licensed by Hangzhou Linda Chemical Technology Engineering. Feedstock for the project will come from a nearby coal-gasification unit which uses Texaco's technology. The facility will be Weihe's first methanol plant. The company currently produces 300 000 tonne/year of ammonia and 520 000 tonne/year of urea at the same site.

China Chemical Reporter》News (2003-08-26)

Cooperation between Blue Star and

Tioz of Korea

Tioz of Korea signed a contract with

China Blue Star Group on July 29 on establishing a joint venture

photo-catalyst plant in

Beijing.

According to the contract, the

project has a total investment of US$4.0 million. Tioz and Blue

Star Group each holds 50% stakes and Tioz owns the right to

operation for 30 years. The joint venture plant has a capacity of

2 000 t/a photo-catalyst.

Photo-catalyst is a new product

using sunlight to remove contaminants or kill bacteria and

viruses. It is extensively used in air purification, odor removal

and bacteria prevention. The addition of such photo-catalyst in

outer wall coatings of buildings, in particular, can prevent

outer walls from pollution and keep them clean without cleaning

for long intervals.

Tioz separated itself from LG Electronic in January last year. It is specialized

in the operation of new environmental protection materials and

supplies photo-catalyst products to LG Group and Hyundai Group.

* Tioz 酸化チタン TiOz から

August 28, 2003 Business Wire

China to Be the Next Polypropylene Super-Power Predicts Phillip

Townsend Associates

China will soon surpass the United States as the largest single country

consuming polypropylene,

according to the recently released 9th edition of Phillip

Townsend Associates Inc.'s (PTAI) Polypropylene Annual Report.

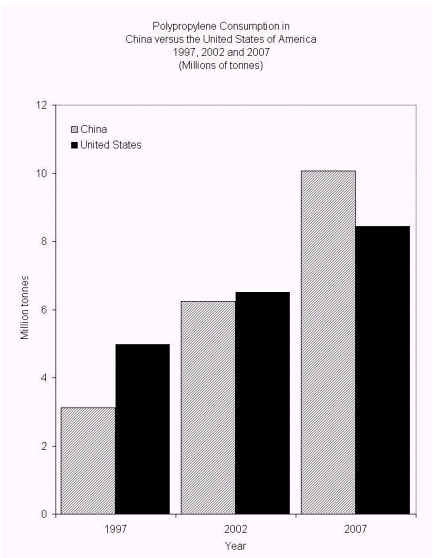

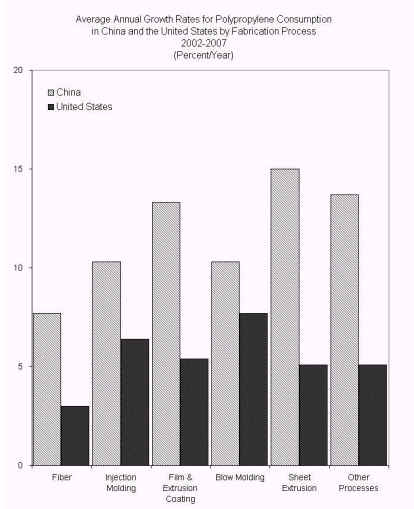

Five years ago, China consumed only 60 percent as much

polypropylene resin as the United States, but that ratio has

since grown to 95 percent. The report projects that China will

continue to grow for the next five years at a rate that is about

double that experienced by the United States, resulting in a

consumption ratio of 120 percent by 2007.

"The two primary Chinese producers, SINOPEC and PetroChina,

are already among the world's largest polypropylene

producers," Kevin Smith, project manager for the

Polypropylene Annual Report, said. "SINOPEC currently

ranks as the second-largest producer in the world, while PetroChina, the

13th-largest polypropylene producer, has signed a licensing

agreement with Basell that will essentially double its capacity

by 2007."

Despite this sizeable capacity position, China currently has a

2.5 million tonne shortfall in the amount of polypropylene

consumed versus domestically produced. This shortfall is

projected to almost double by 2007. There are several exporting

candidates to make up this shortfall: (1) South Korea, already a

major exporter to China (2) the Middle East, a region that is

gearing up to bring on significant new capacity and (3) India.

"India

is another country whose polypropylene consumption is growing

rapidly, even more rapidly

than China," Smith added. "India will add another 0.4

million tonnes of polypropylene capacity in the next five years.

However, over the same period, consumption will increase by

double this amount. If Indian producers wish to compete for the

Chinese market, then they will have to announce more capacity

soon."

The Polypropylene Annual Report estimates that the Asia/Pacific

region accounts for over one-third of the world's polypropylene

consumption. Demand for polypropylene in this region was nearly

12 million tonnes in 2002 -- an increase of 10.4 percent, or 1.1

million tonnes, over 2001.

The PTAI annual report also explains in great detail how this

resin was consumed in the Asia/Pacific and other regions in 2002.

For example, the Asia/Pacific region currently produces about

half of the world's polypropylene fiber. The fibers market in

this region, primarily raffia or slit film fiber, is predicted to

grow at almost 7.5 percent per year for the next five years,

representing an addition of 2 million tonnes to polypropylene

consumption.

On a global basis for the year 2002, polypropylene consumption

increased by nearly 7 percent, or 2.2 million tonnes, to reach a

total of over 34 million metric tonnes. PTAI's Polypropylene

Annual Report forecasts that total consumption will grow by 6.6

percent per year to reach over 47 million tonnes by 2007.

Phillip Townsend Associates Inc. is a global consulting company

based in Houston. Every year it publishes numerous multi-client

studies on the thermoplastic resin industry. For more information

about the Polypropylene Annual Report service contact Shari

Gangestad at 281-873-8733, ext. 132, or e-mail sgangestad@ptai.com.

Chemnet Tokyo 2003/8/29

テルモが中国の医療費大幅増を予測

2001年の7.4兆円が07年に13兆円に

中国の杭州市と長春市(合弁)で医療機器を生産しているテルモの原八郎取締役兼常務執行役員本社生産部管掌・中国部統括管掌は中国での医療費の見通しや中国進出企業へのアドバイスなどについて、次にように語った。

これは来日中の訪日杭州ミッションが杭州ビジネス環境説明会を東京で開いた席上で、在中日本企業代表として明らかにしたもの。同社は中国でカテーテル、輸液セットなどを生産している。

| ・ | テルモは1995年に杭州市と工場を建設する契約を結んだ。これまでに私は4年半中国に滞在して業務活動を行った。中国・杭州市では第3期工事を完成して、従業員が1,400人にふえた。 |

| ・ | 中国の医療費は一昨年の7兆4千億円から2007年末までに13兆円の規模まで伸びる見通しにある。当社の対象となる人口は4億〜5億人とみている。杭州は電力、水、交通などのインフラがよく整備されており、知的人材も豊富だ。 杭州市(人口124万人)のある浙江省には浙江大学、寧波大学、浙江財経学院、浙江林学院、浙江工業大学など58の大学があり、幹部職員が確保でき、企業成長のカギとなっている。 |

| ・ | 中国の人口は12億8,000万人(2001年)で平均寿命が男性69.93歳、女性73.33歳(日本は男性78.32歳、女性86.23歳)、都市部では75.21歳、農村69.55歳となっている。医療施設は31万(日本は9万9,000)か所、病院数は1万7,844(日本は18万3,000)。1,000人当たりの医師数は1.47人(日本は203人)。医療費は1人当たり5万8,000円(日本は25万3,000円)。 |

| ・ | 中国進出に当たっては中国国内販売か第3国への輸出を対象とすれば30%のコスト削減が必要。日本向け輸出であれば、日本と同等以上の品質確保が求められる。狙いが原価低減(労務費、原材料費、経費)か品質向上か、建物、設備コストの友好な投資方法かなどをはっきりさせる。 また現地での即断、即決ができる役員クラスを派遣し、自社トップに理解させる体制が必要。現地が早期に利益を出し自己投資型の仕組みを作ること、技術支援・品質管理体制を明確にすること、リスク管理を明確にすることなど。 |

なお、訪日ミッションによると現在までに杭州市には日本企業403社が進出、上位38社で15万4,000ドルの投資が行われたという。

エチレン90万トンセンターを早期実現、天津市

米ダウ・ケミカルなどに参加呼びかけ

中国・天津市は2010年までの同市発展計画を策定、日本、韓国などからの企業誘致にのりだしたが、引き続き米国の産業、金融などへの協力を要請、とりわけ同市浜海新区での石油・石油化学開発計画の早期実現をはかることになった。

中国は自動車、情報通信、建設などの発展によって、鋼材、セメントなどの資材の需要が活発化、最近では石油化学製品の需要も拡大している。

石油化学産業は石油からのナフサ、天然ガスを分解するエチレンセンターが中核となるが、中国では、目下、第2次大型化計画が続出して、激しい競争を展開している。

主なエチレンセンター計画としては英BP-アモコグループによる上海の年産90万トン、独BASFグループによる南京の120万トン、英蘭シェルグループによる恵州(広東省)の80万トン、米エッソモービルグループによる泉州(福建省)の60万トンなどがあり06〜08年の完成を目ざしている。08〜10年には倍増の1,000万tをこえると予想されている。

こうしたことから天津市も計画の早期達成をはかることになったもので、載相龍市長は先週、米国を訪問、ダウケミカルなどに投資協力を要請したといわれる。同市の浜海新区での石化計画は塘沽地区にエチレン年産90万トン規模のセンターを26億ドル投じて建設する予定。合弁、単独などの投資方式で今年中にも入札を行う方針。

天津市石油化工化繊企画事務室によると塩ビ年産108万トン、無水マレイン酸7万トン、1.4ブタンジオール21万トン、PBT

10万トン、ブタノール20万トン、アクリル酸・アクリル酸エステル10万トン、カプロラクタム10万トン、アジピン酸4万トン、ポリカーボネイト6万トン、テトラハイドロフラン5万トン、ポリテトラヒドロフラン5万トンなどが計画されている。浜海新区には大港油田の開発も予定されており、原料は自給する方針だ。

天津市計画 エチレン 90万トン、投資総額 26.06億ドル

| プロジェクト名称 | プロジェクト内容 | 投資総額 |

| VCM | VCM 108万トン/年 | 6.3 億USドル |

| 無水マレイン酸及び誘導品 | 無水マレイン酸 7万トン/年 1.4ブタンジオール 21万トン/年 PBT 10万トン/年 |

5.75億USドル |

| プロピレン誘導品 | ブチルオクタノール

21万トン/年 アクリル酸、同エステル 10万トン/年 |

5.54億USドル |

| テトラハイドロフラン ポリテトラメチレンエーテルグリコール |

テトラハイドロフラン 5万トン/年 ポリテトラヒドロエフラン 5万トン/年 |

0.90億USドル |

| カプロラクタム、アジピン酸 | カプロラクタム 12万トン/年 アジピン酸 4万トン/年 |

6.0 億USドル |

| ポリカーボネート | ポリカーボネート 8万トン/年 | 1.57億USドル |

窓口 天津市石油化工化繊企画事務室

Platts 2003/10/9

Sichuan Vinylon to complete new VAM unit commissioning by Oct 10

China's Sinopec Sichuan Vinylon Works has begun commissioning its

recently expanded 200,000 mt/yr vinyl acetate monomer plant in

Sichuan and hopes to complete the process by Friday, a company

source said Thursday.

China Blue Star to build 100

kt/yr phenol-acetone plant

http://www.chemweekly.com/ReadNews.asp?NewsID=872&BigClassName=Projects&BigClassID=28&SmallClassID=50&SpecialID=0

China Blue Star New Chemical Materials Co plans to build

a phenol-acetone plant with a combined capacity of 100 000 tonne/

year in Harbin, Heilongjiang, a company official said.

The new plant is expected to come onstream by end-2005. It will

be run by a subsidiary of the company, Harbin Huayu Co, which

owns a 50 000 tonne/year phenol-acetone plant at the same site.

Blue Star New Chemical also said its previously announced

phenol-acetone project with a combined capacity of 200 000 tonne/

year will be sited in Nantong, Jiangsu, China. It is preparing a

proposal on the project and plans to seek government approval by

end-2003.

China Blue Star New Chemical, a subsidiary of China National Blue

Star (Group) Corp, currently produces 20 000 tonne/year of

polybutylene terephthalate in Nantong.

The company official said it plans to use UOP's technology in the

Nantong phenol-acetone project, with startup set for 2006.

Feedstock will be sourced locally and through imports. Part of

the output will be shipped to China Blue Star New Chemical's 16

000 tonne/year bisphenol A (BPA) plant in Wuxi, also in Jiangsu.

The company is due to bring onstream a 30 000 tonne/year BPA unit

later this month.

It is understood that a potential customer for the phenol output

is Bayer, which is building a 200 000 tonne/year BPA unit and a

200 000 tonne/year polycarbonate (PC) plant in Caojing, Shanghai.

The German major plans to bring both units onstream in 2005.

March 09, 2004 UOP

Bluestar Selects Sunoco/UOP Technology to Add Phenol-Acetone Capacity

http://www.uop.com/about_uop/press_releases/2004PressReleases/03.09.04.BluestarSelectsPhenol.QMax.htmBluestar New Chemical Materials Co., Ltd., Beijing, China, has selected the Sunoco/UOP Phenol process for the expansion of their phenol-acetone facility in Harbin, Heilongjiang, China. Bluestar will also use the Q-MaxTM process to expand its cumene production by 175% to accommodate the increased phenol and acetone capacity. Bluestar's expansion is planned to start up in 2005 and produce a total of 120 KMTA of phenol and acetone.

Bluestar New Chemical Materials Co., Ltd, a subsidiary of China National Bluestar (Group) Corporation, is a leading producer of chemical products and the largest producer of phenolic resin and bisphenol A in China. Bluestar New Chemical Materials Co., Ltd. has been operating its phenol-acetone production plant based on Sunoco/UOP technology since 1993.

UOP LLC, headquartered in Des Plaines, Ill., USA, is a leading international supplier and licensor of process technology, catalysts, adsorbents, process plants, and technical services to the petroleum refining, petrochemical, and gas processing industries.

化学工業日報 2003年10月14日

http://www.chemicaldaily.co.jp/news/

インビスタ、中国社に1.4BD技術を供与

インビスタは中国の四川天華股〓有限公司に1・4ブタンジオール(1・4BD)の生産技術を供与することで合意した。四川天華は四川省濾州で1・4BD工場の建設を近く開始し、2006年から生産を開始する予定。同社がPTMG(ポリテトラメチレンエーテルグリコール)に関する製品の技術をアジア地域で供与するのは今回が初めて。

《China Chemical Reporter》News (2003-10-14)

20-Year Development of

Yangzi Petrochemical

http://www.sinocheminfo.com/topnews/r200310141014.htm

Sept. 19, 2003 is the

20th anniversary of Yangzi Petrochemical. In these 20 years

Yangzi Petrochemical has produced more than 50.0 million tons of

commodities and paid back RMB14.8 billion of loans. The total

asset value has increased from RMB7.0 billion at the time of

establishment to RMB22.8 billion, 2.6 times of the asset value in

1990 when the company started all-round production.Technical

renovationYangzi Petrochemical, a super large petrochemical base

in China, was constructed in the inter-tidal zone along the

Yangtze River in 1983 in a matter of 5 years and 5 months. Boiler

was ignited in July 1986, qualified ethylene was produced in July

1987, the world's biggest aromatic unit made startup in March

1990 and a profit and tax of RMB1.0 billion was accomplished in

1991.

Yangzi Petrochemical

conducted two rounds of major technical renovation from 1995. The

first round was the technical renovation to existing units.

Through three major overhauls in three years, the capacity of

the ethylene unit expanded from 300 000 t/a to 400 000 t/a. The overall capacity increased

by one-third, but the total investment was only RMB1.997 billion,

less than a half of the investment needed in constructing a new

unit with the same capacity. The company invested RMB3.7 billion

in 2000 and expanded the capacity of the ethylene unit further

to 650 000 t/a in a

matter of 22 months. The company accomplished a sales revenue of

RMB10.85 billion and a profit of RMB641.9 million in the first

half of this year, creating the best half-year performance in the

company. Joint ventureYangzi-BASF Styrene Products

Co., Ltd. with an

investment of RMB2.0 billion was established in November 1994.

BASF, a chemical giant from Germany, brought not only capital and

technology but also advanced management experience to Yangzi

Petrochemical. After seeing the unimaginably successful

cooperation with Yangzi Petrochemical, the chairman of BASF

expressed his willingness to further cooperate at a higher level

and in a higher scale. Yangzi BASF Co., Ltd. with a total

investment of over RMB20.0 billion (US$2.9 billion) was born in

November 2000. In

September of the following year the 'World-class, high-tech and

integrated' Yangzi-BASF project started construction. It was the

biggest overseas investment project in Germany and also the first

large joint venture petrochemical project in China. The project

will be completed at the end of 2004 and start commercial

operation in 2005.

Eastman and Shaw of

the United States, BOC of Britain and the other companies came

close at heels. A total of 7 joint venture enterprises were set

up in the company. According to statistics, joint venture

enterprises already starting commercial operation accomplished a

sales revenue of RMB2.0 billion and a profit of RMB176 million

last year, hitting the highest historical record.Listing in stock

marketYangzi Petrochemical has persisted in the innovation of

system, mechanism and management. It stripped off auxiliary

production facilities and logistics systems in 1993 and

established 10 collective enterprises and an industrial company.

After the partnership with BASF, the company formed a new

operational mode featuring the joint development of state-owned

enterprises, collective enterprises and joint venture enterprises

and became one of the first exemplary enterprises for mechanism

transformation. Yangzi Petrochemical Co., Ltd. was

established in April 1998. The company issued 350 million A-shares

to the public and was listed in Shenzhen stock market. Yangzi

Petrochemical changed its name into Yangzi Petrochemical Co.,

Ltd. in September 1998 and the framework of the modern enterprise

system was established.

After the

reformation of China Petrochemical Corporation in March 2000,

Yangzi Petrochemical actively conducted readjustments to

business, organization, personnel, assets, credits and debts,

made internal reforms, reduced staff and improved economic

returns.

Today Yangzi

Petrochemical owns 28 production units with the 650 000 t/a

ethylene unit and the 950 000 t/a aromatic integrated unit as the

core, processes 8.0 million tons of crude oil a year and produces

and sells 38 varieties of products in 4 categories including

polyolefin plastics, polyester raw materials, basic organic

chemicals and oil products.

After the third

round of technical renovation Yangzi Petrochemical will become a

first-rate domestic petrochemical supplier with a capacity of 1.0

million t/a ethylene production and 10.0 million t/a oil refining

at the end of the Eleventh Five-year Plan period.

October 20, 2003

Atofina to build a new organic peroxides plant in China

http://www.atofina.com/groupe/gb/f_elf_atofina_2.cfm?droite=actucomm/d_detail.cfm?IdComm=11502

Atofina, the Chemicals

Branch of the Total Group, has confirmed its intention to build a

new organic peroxides production plant in China.

With an initial 3,000 tpa capacity, this future plant will be

built on the Atofina Changshu industrial platform (Shanghai

area). It should consolidate Atofina's presence in Asia in order

to follow the demand for organic peroxides which is growing in

conjunction with demand for polymers in the continental Asia.

"With this capacity increase and bearing in mind the

region's growth possibilities, we should be in a position to meet

the marginal needs of the polymerisation initiators market until

2009 / 2010", explains Romuald de Haut de Sigy, General

Manager Organic Peroxides Europe & Asia.

This new 100% owned unit will complement the joint ventures

operated for many years in Korea, Japan and India, whose minority

partner has been bought out in October 2002. This move will

enable Atofina to serve a wider scope of local customers by

improving the logistics and secure operations within the frame of

the Group's safety and environmental standards.

Atofina operates 10 organic peroxides facilities around the

world. In addition to its three Asian sites, Atofina has plants

in the United States (States of New York and Texas) and in Europe

(Gunzburg in Germany, Spinetta in Italy, and Loison in France).

Atofina's organic peroxides range includes polymerisation

initiators, crosslinking agents for rubber and polyethylene, and

curing agents for unsaturated polyester resins, marketed under

the tradename LUPEROX(R).

China's Sinochem plans ABS, PTMEG

plants in Jiangsu province 江蘇省太倉

Sinochem International Co plans to

build a 60 000 acrylonitrile butadiene styrene (ABS) plant and a

20 000 tonne/year polytetramethylene glycol (PTMEG) at Taicang,

Jiangsu, China, according to a company source.

The projects, costing not more than $60m (Euro50.4m) in total,

will be the company's first major manufacturing investments.

Sinochem International is also taking a 10-20% stake in a planned

spandex facility at the same site. The project will be a joint

venture with Taicang-based companies.

The source said the PTMEG and ABS units would have less than

worldscale capacities because the company wanted to test out its newly

developed technologies before building larger-scale plants.

Construction work has started on both units. The PTMEG project is

scheduled to come onstream in July 2004, while the ABS unit is

due onstream at end-2004.

The capacity of the PTMEG unit could be boosted to 40 000

tonne/year and that of the ABS unit to 500 000 tonne/year in

stages if the technologies prove viable, the source said.

The technologies for both planned units are improved versions of

existing technologies. The improvements were made by the

company's R&D team.

Sinochem International is seeking to diversify into manufacturing

from chemicals trading. It is also enhancing its R&D efforts

to produce products that are technology-oriented, such as

engineering plastics.

Its parent company, Sinochem Corp, signed a memorandum of

understanding recently with the Petroleum Authority of Thailand

(PTT Plc) to cooperate in Thailand and China, including possible

participation in PTT Plc's cracker project, which is under study.

China Chemical Reporter

2003/12/1

600 000 T/A Ethylene Project in Lanzhou Approved

http://www.ccr.com.cn/news_view.asp?ID=382

A 600 000 t/a ethylene

renovation project in Lanzhou Petrochemical Co., Ltd. got

approved by the State Council on Dec.1 2003, and will be started

for construction soon, with a total investment of RMB 4.75793

billion.

Lanzhou Petrochemical Co., Ltd. is a giant of petrochemicals

under CNPC, with a crude oil processing capacity reaching 10.5

million tons per year currently. After the renovation, the

production capacity of ethylene will expand to 600 000 t/a from

the existing 240 000 t/a.

The complete sets for the down-stream equipment of the project

include the following units:

200 000 t/a high pressure polyethylene

unit;

200 000 t/a theoretical density

polyethylene unit, and

300 000 t/a polypropylene unit,

which will add a new capacity of 360 000 tons of ethylene,

400 000 tons of polyethylene, and

300 000 tons of polypropylene each year.

The renovation project has introduced advanced special

technologies for production of polypropylene and polyethylene and

taken full advantages of ethylene feedstock, materializing the

integration of refining and chemical process, so that it will

become the top ethylene production base in the West China.

On June 13, 2003, the ethylene production capacity in Lanzhou

Petrochemical Co., Ltd. reached 240 000 tons from the former 165

000 tons yearly, with the test run a success.

December 9, 2003 GE

GE PLASTICS EXPANDS OPERATIONS IN NANSHA

-Adding Local Production Capacities for

Plastics Compounding and Film Extrusion-

http://www.geplastics.com/press_pack/03_12_10.html

GE Plastics, a division

of General Electric Company (NYSE:GE), today announced expansion

plan for its production capacity in Nansha, Guangdong Province.

Joined by Mr. Gu Shiyang, Vice Secretary of Guangzhou Municipal

Government, Mr. Yu Yaosheng, Standing Vice Commander in Chief of

the Headquarters of Nansha Development Zone, Mr. Luo Zhaoci, Vice

Commander in Chief of the Headquarters of Nansha Development Zone

and other government representatives, GE Plastic executives

officiated the groundbreaking ceremony at the expansion site.

The new expansion of the Nansha plant will be worth approximately

US$60 million, primarily for building up eight new production

lines. Upon the completion of the expansion construction in

November 2004, the plant is expected to add more employment

opportunities.

"We are here today to demonstrate our commitment and strong

belief in the plastics industry in China," Mark Wall,

president for GE Plastics Greater China Region said excitedly

today at the groundbreaking ceremony. "Our plant in Nansha

after expansion will further assist our customers and all

industry players in China to raise the bar from commodity

plastics to higher end engineering thermoplastics."

The construction of the current Nansha plant began in1994, and it

was put into production in July 1996. Total investment reached US$70

million. The plant facility covers an area of 80,000 square

meters and employs over 200 people. In 1999, the Nansha plant

passed the ISO 14001 certification audit by Lloyd Register

Quality Assurance.

The GE Plastics Nansha plant specializes in plastics compounding

and film extrusion. Using raw materials such as PC, ABS,

additives and pigments, the plant produces various plastic

products ranging from LEXAN® resin, CYCOLOY® resin, NORYL® resin and CYCOLAC® resin to 8010 and 8B35 Graphic

Film.

About GE Plastics

GE Plastics is a leading producer of engineering thermoplastics

with major production facilities worldwide. GE Plastics

materials, including LEXAN polycarbonate, are used in a wide

variety of applications such as CDs and DVDs, automobile parts,

computer housings, cookware, outdoor signage, cell phones,

bullet-resistant shielding and building materials. Through its

LNP Engineering Plastics business, the company is a worldwide

leader in the custom compounding of engineering thermoplastics.

GE Plastics is also a global distributor of sheet, film, rod and

tube products through GE Polymershapes and GE Structured

Products. In 2003, GE Plastics is celebrating the 50th

Anniversary of LEXAN polycarbonate, discovered in 1953 by GE

chemist Dr. Daniel W. Fox. The company's web site is located at

www.geplastics.com.cn.