概要

Gas Authority of India Ltd

(GAIL), is primarily engaged in transportation and wholesale

distribution of natural gas. The company owns and operates a

network of over 4000 kilometres of pipeline, including a 2,702

kilometer pipeline located in northwestern India (the "HBJ

Pipeline"). The HBJ pipeline transports approximately 61mn

cubic metres of natural gas per day, which is 95% of the total

amount of natural gas transmitted through pipeline in the

country. The company registered a net profit growth of 31% in

FY01 to Rs 11262mn as compared to Rs 8613mn in the previous year.

The company has also diversified into other integrated energy and

petrochemical activities. GAIL has 6 natural gas processing

units, which produce liquefied petroleum gas and a petrochemical

complex, which produces high density and linear low density

polyethylene and butene.

Currently the company depends on ONGC and OIL for its gas supply.

However the company has plans to integrate backward to secure

access to additional gas supply. It has entered into strategic

alliance with ONGC & IOC to bid for selected gas-focused

exploration blocks in offshore regions. Additionally the company

has equity participation in Petronet LNG Ltd, a joint venture

formed between Oil companies in India, to import liquefied

natural gas at various locations in the southern and western

parts of India.

The Company also intends to focus on downstream opportunities.

GAIL has entered into retail marketing of gas, which it views as

a natural extension of its bulk transportation business. The

company has formed Mahanagar Gas Limited - a joint venture with

British Gas to promote the distribution and marketing of natural

gas to domestic, commercial and small industrial consumers in

Mumbai and compressed natural gas to the transport sector.

Indraprastha Gas Limited -is another such joint venture to

promote usage of natural gas in Delhi. The Company believes these

retail-oriented expansions would increase overall demand for gas

and offer increased margins for the Company.

事業

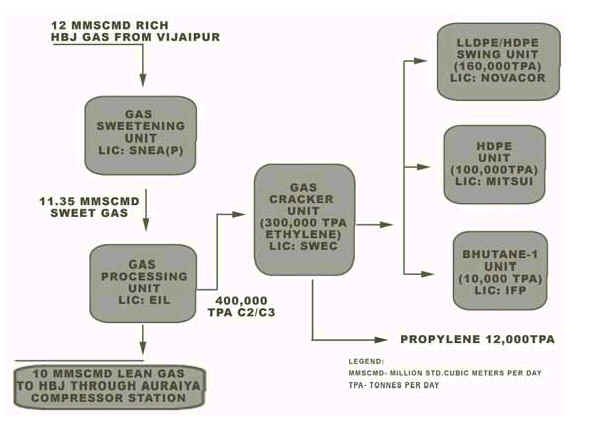

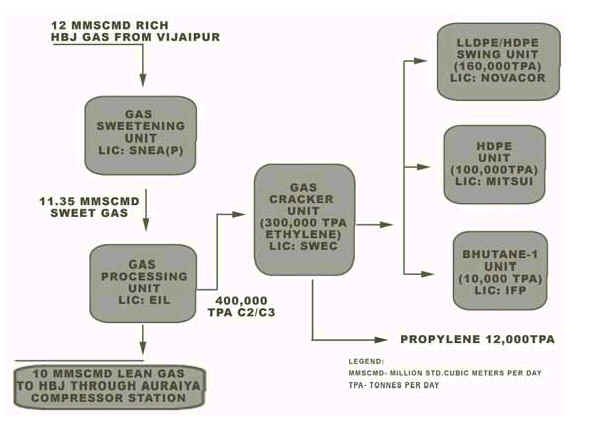

Petrochemicals is a major area of

GAIL's business activity. GAIL has set up a world-scale Gas

Cracker plant at Pata in Uttar Pradesh in Northern India at an

investment of Rs. 25 billion having a design capacity to produce 300,000 TPA of ethylene

(Expandable to 500,000 TPA).

The Plant was commissioned in March 1999. Downstream units

include an HDPE

production unit of 100,000 TPA

capacity and an LLDPE/ HDPE Swing plant of 160,000 TPA capacity.

GAIL's petrochemical complex,the first one outside Western India,

is introducing MITSUI's technology for production of HDPE in

India. Speciality grades from this technology are a replacement

to a very large extent. In addition to this technology which is

based on slurry process, GAIL's other downstream plant(swing

plant of HDPE/LLDPE) is based on solution process using

Sclairtech Technology of NOVA Chemicals, Canada. With the

availability of both the processes, GAIL can produce a very wide

grade range of HDPE. Besides, steady price and availability of

input raw material (Natural Gas) and same tariff exemptions are

the major advantages of GAIL in this highly competitive industry.

The current per capita consumption of plastics in India is about

1.8 kg compared with the world average of 17 kg. Demand and

supply projections indicate a progressively increasing domestic

offtake. Being the only plant outside the Western part of the

country, it offers easy access to polymer consumers in Northern

India and parts of Central India.

(Platts--17Apr2002)

India GAIL to boost PE capacity

by 50 kt/yr by Mar 2003

The Gas Authority of India plans to boost the capacity of its

polyethylene complex in Auraiya by about 50,000 mt/yr by March 2003, a company source said

Wednesday. This would hike the total nameplate capacity of the

complex to 310,000 mt/yr. GAIL would add two to three new

furnaces to its two existing PE plants for the expansion. One

plant currently has the capacity to produce 100,000 mt/yr of high

density PE and the other, 160,000 mt/yr of linear low density

grade. GAIL already has surplus ethylene capacity to support its

PE expansion. It has a 300,000 mt/yr ethylene plant which it

constantly operates below capacity. Auraiya is about 400km from

New Delhi.

Financial Daily (India) 2002/7/24

GAIL board okays 10 pc stake in

Haldia Petro

THE board of Gas Authority of India Ltd (GAIL) today approved a

proposal to take

a 10 per cent equity stake in Haldia Petrochemicals Ltd. The approval is contingent on the

financial restructuring taking place. The investment will be of

the order of around Rs 200 crore.

GAIL's entry into HPL follows the breakdown of talks with Indian

Oil Corporation, which was set to acquire a 26 per cent stake in

the company.

IOC had proposed an equity structure where they would hold 26 per

cent, WBIDC 24 per cent and Chatterjee Petrochem (Mauritius) 24

per cent. But The Chatterjee Group, holding 43%, was not willing

to cut it below 26 per cent. IOC was apprehensive that they would

be ousted once the project turns around in a few years and hence

was not willing to budge on the equity holding structure. The

GAIL board also approved a proposal to jointly bid with L&T

to acquire a controlling stake in Engineers India Ltd (EIL).

While L&T will hold a 51 per cent stake, EIL will hold the

rest.

Mr Tarun Das, HPL Chairman, told newspersons after the board

meeting on Tuesday: "We have agreed to IOC taking up 26 per

cent stake in the company with management control." Today's

meeting was attended by most of the members barring

representatives of the Tata group (holding 14%), which has

expressed a wish to exit, as it was not part of its core

business.

Representatives of LIC, IFCI and the State Finance Department

were also absent.

Financial Times December 3, 2002

Gail Board Approves Marketing Alliance With Haldia Petrochemicals

(GAIL and HPL to enter into 4 commercial agreements for selling

their petrochemi

The board of directors of the Gas Authority of India Ltd (GAIL)

has approved a strategic marketing alliance with Haldia

Petrochemicals Ltd (HPL), under which the 2 companies will enter

into 4 commercial agreements for selling their petrochemical

products. GAIL and HPL will enter into 3 separate long-term

offtake agreements for polypropylene, propylene and pentane.

They will also enter into a product-swap agreement for 40,000

million tonnes per annum of prime-grade polyethylene.

Under the terms and conditions of the agreement, GAIL has agreed

not the sell the products to any of HPL's regular customers. Both

the companies will save on freight costs that they are incurring.

2003/1/8 Asia Pulse

Businesswire via NewsEdge Corporation

GAIL INDIA FORGES ALLIANCE WITH HALDIA PETROCHEMICALS

State-owned gas firm GAIL India (GAIL) Ltd said it has

entered into a strategic alliance with Kolkata-based Haldia

Petrochemical Ltd for marketing of petrochemical products.

"The strategic alliance with HPL covers marketing of

HPL's polypropylene of 35,000 tones per annum by GAIL and

product swapping to the tune of 40,000 tonnes per annum of

polyethylene for marketing by HPL in domestic market and for

GAIL in export/domestic market," a company statement

said here Friday.

The tie-up on polypropylene is of high importance to GAIL as

it would increase their polymer product portfolio without any

additional capital investment.

"This would enable GAIL to consolidate their customer

base and service their customers effectively with multiple

polymer product portfolio," it said.

The product swapping arrangement is expected to provide

synergetic advantage to both the petrochemical majors as the

companies will leverage their location advantage for mutual

benefits i.e. GAIL will be able to fulfill its ongoing export

programme, through Haldia port by marketing HPL's

polyethylene to export market and also service their

customers in eastern region.

In exchange, HPL would be able to serve its customers located

in the northern India by marketing GAIL's polyethylene.

Platts 2006/2/21

India's Gail to increase

ethylene capacity to 450 kt/yr by Dec

Gail (India) Ltd is to increase its ethylene manufacturing

capacity at the Pata plant in Uttar Pradesh to 450,000 mt/yr from

the current 310,000 mt/yr by December, investing around Rupee

7-bil, Gail chairman and managing director Proshanto Banerjee

said on the sidelines of an industry conference Monday.

The state-run petrochemical company is augmenting its ethylene

capacity by increasing the number of cracker furnaces from four

to five, and is also setting up an additional LLDPE/HDPE (Swing

Plant) of 100,000 my/yr at the same petrochemical complex to

utilize the additional ethylene production.

The company manufactures a wide variety of polyethylene grades,

including injection moldings, blow moldings, raffia, monofilament

pipe, and film. The petrochemical complex consists of a gas

sweetening unit, a C2/C3 recovery unit, a gas cracker, and two

downstream polyethylene units. It also has a dedicated HDPE plant

of 100,000 mt/yr capacity licensed by Mitsui of Japan and an

LLDPE/HDPE (Swing plant) of 210,000 mt/yr capacity licensed by

Nova Chemicals of Canada. (三井化学発表では既存エチレン300千トン、LL/HD 160千トン)

2005/1/25 三井化学

インド GAIL社向け高密度ポリエチレン製造技術ライセンスについて

http://release.nikkei.co.jp/detail.cfm?relID=91545&lindID=4

当社(社長:中西宏幸)は、インドのGAIL(India)Limited(以下「GAIL社」。社長:Mr.

P. Banerjee)と、同社の高密度ポリエチレン製造No.2プラント向け技術ライセンス契約を2004年6月末に締結しておりましたが、このたび、インド政府による承認を得て、正式に発効しました。

<技術ライセンスの概要>

1.ライセンス対象技術:当社保有の高密度ポリエチレン(*)製造技術

*:包装材料、パイプ及び日用雑貨等の素材として利用される樹脂

2.対象プラント:GAIL社高密度ポリエチレン製造No.2プラント(生産能力:10万トン/年)

3.プラント建設地:インド国 ウッタル・プラデシュ州 パタ

4.プラント完工:2006年中(予定)

GAIL社は1984年にインド政府により設立されたガス供給会社で、1993年にはウッタル・プラデシュ州パタに天然ガスを原料とする石化コンビナートを建設して石油化学事業にも進出しています。同コンビナート内には当社から技術ライセンスを受けた年産10万トンの高密度ポリエチレン製造プラント(No.1プラント)があり、現在も順調に稼動中です。今回、GAIL社は同No.2プラントを建設するにあたり、同プラントにおいても当社技術を採用することとなりました。これは、No.1プラントにおける当社技術、アフターサービス、及び当社が開発した改良型チーグラー触媒の性能が高く評価されたことによるものであります。

本ライセンスは、当社にとってGAIL社No.1プラント(1993年)、Haldia Petrochemicals Ltd.(1996年)に次ぐインドにおける3番目の高密度ポリエチレン製造技術ライセンスであります。また、本ライセンス契約発効により、全世界における当社のポリエチレン製造技術供与は41系列、合計生産能力は年産450万トン超となります。

当社が保有するポリオレフィン製造プロセス技術は、世界的にも極めて高い水準にあると評価されており、豊富なライセンス経験を活かして今後とも全世界をターゲットにライセンス活動を展開してまいります。

<GAILの会社概要>

1.事業内容:ガス及び石化製品の製造販売

2.本社所在地:インド ニューデリー市

3.資本金:85億ルピー(約204億円)

4.売上(2003年度):1,200億ルピー(約2,880億円)

5.従業員数:約3,500名

6.石化工場立地:ウッタル・プラデシュ州 パタ

7.主要石化プラントの現有生産能力

ガスセパレーション 40万トン/年 エチレン 30万トン/年

HDPE(当社技術) 10万トン/年 HDPE/LLDPE 16万トン/年

2006/5/24 Gail

GAIL

to implement Rs. 5460 crore Assam Gas Cracker Project

http://gail.nic.in/pressreleases/press050000167.htm

With the recent

approval of the Cabinet Committee on Economic Affairs (CCEA),

GAIL (India) Limited led Joint Venture Company (JVC) will

implement the Rs. 5460.61 crore Assam

Gas Cracker Project. The project to set-up an

integrated Petrochemical Complex at Lepetkata, District Dibrugarh

shall be implemented by a Joint Venture Company (JVC) to be

promoted by GAIL with 70% equity

participation. The remaining 30% equity will be shared equally

among OIL(Oil India Ltd), NRL(Numaligarh Refinery Ltd ) and Govt.

of Assam.

The project will be completed in 60 months from the date of

approval.

The

project is expected to give rise to a substantial employment

generation as a result of investments in downstream plastic

processing industries and allied activities. It has been

estimated that about 500 plastic processing industries are likely

to come up in the north-eastern region if this project becomes

operational. The Government of Assam has agreed to grant

Exemption from Entry tax on capital goods, Exemption from Works

Contract Tax during construction and Sales Tax / VAT exemption on

feed stock and products for 15 years from the date of

commencement of production.

The

Feedstock for the Petrochemical Complex is 6.0 MMSCMD gas from

Oil India Limited (OIL) Duliajan and 1.35 MMSCMD gas from Oil

& Natural Gas Corporation Limited (ONGCL) upto 31/3/2012 and

1.00 MMSCMD thereafter. The Petrochemical Complex shall also

utilize 160,000 TPA of petrochemical grade Naphtha from

Numaligarh Refinery Limited (NRL).

The

petrochemical complex will comprise of a cracker unit, downstream

polymer and integrated off-site/utilities plants. The complex has

been configured with a capacity of 220,000

tons per annum (TPA) of Ethylene and 60,000 tons per annum of

propylene with

Natural Gas and Naphtha as feed stock. The site has been

identified by the Govt. of Assam and necessary Environmental

clearance has been obtained.

The

existing LPG plant of GAIL at Lakwa will be modified to process

gas for recovery of ethane and higher hydrocarbon fraction which

will be transported to Lepetkata through a pipeline.

The

Products from the Petrochemical Complex shall be 220,000

Tons per annum (TPA) of HDPE/LLDPE, 60000 TPA of Polypropylene,

55000 TPA of Raw Pyrolysis Gasoline and 12,500 TPA of Fuel oil. The Assam Gas Cracker

Project was proposed as a part of the implementation of Assam

Accord signed by Government of India on 15th August, 1985. Letter

of Intent was issued to Assam Industrial Development Corporation

(AIDC) in January 1991. In February 1997, LOI was transferred to

Reliance Assam Petrochemicals Limited (RAPL), a joint venture

company of Assam Industrial Development Corporation and Reliance

Industries Limited. RAPL was granted various concessions by

Government of India for implementation of the Gas Cracker

Project.

The

work could not be started due to non-availability of sufficient

feed stock and other reasons.

Ministry

of Finance decided on 20.2.2003 that GAIL would examine the

feasibility of taking up the Assam Gas Cracker Project on its

own. GAIL would also indicate the assistance required from other

PSU’s and Government of India

for setting up the project. GAIL engaged services of Engineers

India Limited (EIL) to workout the project viability.

A

Pre-Feasibility Report (PFR) for the project was prepared

considering an integrated Petrochemical Complex. Thereafter a

Detailed Feasibility Report (DFR) was prepared by GAIL & EIL.

The financial appraisal of the project has been carried out by

IFCI Ltd.

October 3, 2007 business-standard.com

GAIL plans $2.3 billion

petrochem plant in Iran

| At a time when

political and business relations between India and Iran

are under pressure, government-owned GAIL

India,

the country's largest transporter and marketer of gas,

plans to set up a mega $2.3

billion petrochemical plant in Iran. |

| |

| The Rs

16,047-crore company has appointed public sector

consultancy, Engineers India Ltd, to conduct feasibility

studies for the plant with a capacity of 3 million tonnes

a year that is likely to be set up near the gigantic South Pars

gas field in Iran. |

| |

| The largest

petrochemical plant to be set up by GAIL, the project

would have Reliance Industries Ltd

(RIL) and an Iranian government-owned company as

partners,

a senior GAIL official said. |

| |

| RIL is the

country's largest petrochemical company with a capacity

of one million tonnes after it acquired IPCL from the

government in June 2002, which has since merged with it. |

| |

| A source in the

Iran embassy here confirmed that GAIL was likely to set up

the plant in partnership with the Iranian National

Petrochemicals Company. |

| |

| "Our

petrochemical company has already completed the

feasibility study on the plant. GAIL wanted to do one on

its own too. Our company will wait for GAIL to complete

its studies,・the Iran official said. |

| |

| So far, however,

joint ventures between Indian and Iranian

government-owned companies have not been

fruitful.

An agreement signed two years ago by GAIL and Indian Oil

Corporation (IOC), India's largest oil refiner, and

National Iranian Gas Export Company (Nigec) to supply

liquefied natural gas (LNG) from Iran has not worked out.

|

| |

| Another

agreement between IOC and Iran to set up an LNG

liquefaction plant in Iran will not be extended after the deadline expires

this month. |

| |

| India is also

likely to be left out of the ambitious $7.4 billion Iran-Pakistan-India

(IPI) gas pipeline, which was to bring Iranian

gas from the South Pars field to India. |

| |

| As disagreements

arose with Iran over gas pricing and transportation

charges with Pakistan, India did not attend the last two

meetings on the pipeline at which Iranian officials

claimed major progress. A draft agreement between Iran

and Pakistan is likely to be signed at the end of this

month, Iranian officials claim. |

| |

| On the political

front,

relations between the two countries have also been

strained after India voted against Iran on two crucial

issues at the Governors・Board of the International

Atomic Energy Agency (IAEA) in 2005 and 2006 ・the first time to

criticise Iran for not meeting its obligations under the

Non-Proliferation Treaty and the second time to report

Iran's file to the UN Security Council for possible

possession of weapons of mass destruction. |

| |

| GAIL

will also set up another petrochemical plant in south

India with

a capacity of 1 million tonne a year. That plant is

likely to come up at Vishakapatnam near Hindustan

Petroleum Corporation's refinery. GAIL officials,

however, declined to disclose the possible investments in

that plant. |

| |

| The company

operates a 440,000 tonnes a year petrochemical plant at

Pata in Uttar Pradesh. It had planned another plant at

Kochi, which is yet to start. |

2007/9/24 plastemart.com

GAIL open to approach RIL

aboard Iranian petrochemical project

Gail India is open to

approach domestic private sector refiner and petrochemicals major

Reliance Industries Ltd (RIL) on board an Iranian petrochemical

project. As per an earlier plan, GAIL and Indian

Oil Corporation (IOC)

were to partner the project along with the National Iranian

Gas Export Company.

GAIL and IOC had signed a memorandum of understanding with the

Iranian government for using natural gas from South Pars field to

run the petrochemical plant.

Gail had earlier this year entered into general memoranda of

understanding with both IndianOil and RIL. As part of the MoU

with RIL, it would be taking up natural gas (including city gas

and marketing) and petrochemical projects within and outside

India. India had also signed a 5 mt LNG deal with Iran but the

future of the deal hangs in balance since the deal was linked to

development of Jufeyr and Yadavarn fields and Iran had informed

India that the latter deal had expired.

2008/10/31 GAIL

GAIL, IOCL ink MoU for cooperation in Petrochemicals

GAIL (India) Limited and Indian Oil Corporation Limited (IOCL)

today signed a Memorandum of Understanding (MoU) for cooperation

in the area of Petrochemicals to collaborate for exploring the

possibility of setting up of cracker complex

including downstream derivatives at Barauni. Dr. U. D. Choubey, Chairman and

Managing Director, GAIL and Shri Sarthak Behuria, Chairman, IOCL

signed the MoU in presence of Shri R.S. Pandey, Secretary,

Ministry of Petroleum and Natural Gas. Present on the occasion

were Shri R. K. Goel, Director (Finance), Shri Santosh Kumar,

Director (Projects), Shri B. C. Tripathi, Director (Marketing),

Shri Arun Singhal, Chief Vigilance Officer from GAIL and Shri

B.M. Bansal, Director (Planning & Business Development),

IOCL.

A Joint Working Committee consisting of two representatives from

each Company shall be formed for undertaking techno-economic

feasibility study of the project including feedstock (naphtha and

natural gas) management.

GAIL shall assess the prospect of natural gas availability from

the KG basin field including the potentiality of the rich gas to

be used as part of the feedstock for the Project and work out the

modality for distribution of the same from KG basin field to the

Project site. GAIL will subsequently develop appropriate

definitive agreement for supply of the gas to the joint venture,

once formed.

IndianOil shall assess the prospect of availability of off-gas

and naphtha not only from Barauni refinery but also from other

operating refineries of IndianOil, to be used as predominant

feedstock for the said Project and work out the modality for

positioning of the same to the Project location. IndianOil will

subsequently develop appropriate definitive agreement(s) for

supply of the feedstocks to the joint venture, once formed

The polymer market is growing rapidly in India and the growth

rate registered in the recent times has been significant. There

is a potentiality for considering a mixed feed cracker complex

based on Naphtha and natural gas at Barauni based on the raw

materials available from Barauni refinery and other nearby

refineries, besides the prospect of natural gas source in Eastern

region, resulting in availability of prospective feedstock for

the cracker complex.

India is amongst the fastest growing petrochemicals markets in

the world. Taking this into consideration and to enhance its

downstream integration, IndianOil and GAIL are focusing on

increasing their presence in the domestic petrochemicals sector

besides the overseas markets through systematic expansion of

customer base and innovative supply logistics.