Methanex Methanex

大株主 Novaが全持株売却

http://www.methanex.com/

Methanex was incorporated under the laws

of the province of Alberta on March 11, 1968 and was continued

under the Canada Business Corporations Act on March 5, 1992.

Our plants are

located in North America (Kitimat, Medicine Hat, Fortier), Chile and New Zealand. We are also currently evaluating Australia for the site of a new plant. We

source additional methanol through a marketing agreement with a

plant located in Trinidad, and also through spot market

purchases. In addition to these manufacturing facilities we also

have marketing offices in the United States, Chile, New Zealand,

Belgium, the United Kingdom and Korea. Our extensive global

marketing and distribution system makes us the largest supplier

of methanol to each of the major international markets. In 1999,

our sales accounted for roughly 24% of the total world market for

methanol.

As a result of our

worldwide production, marketing and distribution capabilities,

Methanex believes it has a competitive advantage as a supplier of

methanol to major chemical and petrochemical producers for whom

quality and reliability of supply are important. Methanex

believes it benefits from this competitive advantage through

greater stability and security of demand, resulting marketing and

transportation synergies, and an improved customer mix.

Since the early

1990's, Methanex has expanded its global methanol production and

marketing reach and has carried out a strategy designed to enable

us to become a low-cost producer and preferred supplier in the

methanol industry. As a result of this strategy, we have

developed a global presence in the methanol industry, allowing us

to provide reliable efficient and cost-effective delivery of

methanol from geographically diverse locations to customers in

the world's methanol markets.

Over the last five

years, Methanex's primary objective has been to maintain and

enhance our strong competitive position in the methanol industry.

The key elements of our strategy have been to:

・Reduce all aspects of our cost

structure;

・Maintain our

world leadership in methanol marketing, logistics and sales,

including taking a principal role in maintaining existing

markets and in developing new applications for methanol and

participating in industry restructuring and consolidation;

and

・Focus on

operating excellence in manufacturing and supply chain

management and other key areas of our business.

2003/3/13 Platts

Methanex puts on hold Australian methanol

project

Vancouver-based Methanex has put on hold its proposed 2-mil mt/yr

methanol project planned for the Burrup Peninsula of Western

Australia as the company studies alternatives for long-term

methanol supply to its customers in Asia Pacific.

"This proposed

development has become increasingly difficult to progress in its

originally intended form. For Methanex, the capital costs for a

greenfield project of this size have become disproportionately

high," said Bruce Aitken, Methanex's senior vice president

for Asia Pacific in a statement Thursday. "Northwest

Australia remains an attractive location to build a methanol

plant and we are evaluating several alternatives, including

installing capacity in smaller increments that would be more

manageable from a cost perspective," Aitken said.

Sept. 29, 2003 Methanex

Methanex Not to Proceed with Methanol Facility in Western

Australia

Methanex Corporation today announced that it will not proceed

with the construction of a 1.3 million tonne per year methanol

plant located on the Burrup Peninsula in Western Australia as

capital costs for the proposed project have escalated to an

unacceptable level. Methanex will take a one-time, non-cash

charge, which is expected to be approximately US$40 million, in

the third quarter to write-off the costs incurred in developing

the project.

Mr. Pierre Choquette, Methanex's Chairman and CEO, commented,

"We have rigorously studied several combinations of sites,

technologies and scale in Australia but we have been unable to

develop a methanol project that delivers acceptable returns for

our shareholders. We cannot proceed with large capital projects

that only deliver marginal returns."

Mr. Bruce Aitken, Methanex's President and COO, added, "We

remain committed to maintaining our strong presence in the

expanding Asian market and we are continuing to develop

alternatives to support our strategic customer base in

Asia." Mr. Aitken continued, "Our global supply chain

allows us the flexibility to effectively service key Asian

markets from our plants in New Zealand, Chile and North

America."

Methanex is the world's largest producer and marketer of

methanol. Methanex shares are listed for trading on the Toronto

Stock Exchange in Canada under the trading symbol "MX"

and on the Nasdaq National Market in the United States under the

trading symbol "MEOH."

World's largest methanol plant

designed to be ‘clean and

green’

http://www.hcasia.safan.com/mag/hcmar02/t58.pdf

High global standards of

environmental excellence are to be incorporated into the

construction and operation of the world's largest integrated

methanol production complex, which Methanex Australia is proposing to build

on the Burrup Peninsula, on the mid-north coast of Western

Australia.

If approval is given, the

A$2 billion complex will eventually comprise two plants and use

new generation large-scale technology to produce up to 5 million

tonnes per annum of methanol for the company's customer base in

the Asia-Pacific region. Methanex is carrying out detailed

front-end engineering and design for its facilities and has

applied to the Western Australian Environmental Protection

Authority to set the necessary requirements for an environmental

assessment of the Project.

The company has engaged

leading consulting firm, Sinclair Knight Merz, to assist with

gaining environmental approvals. Sinclair Knight Merz'

Environmental Group Manager, Perth, Dr Barbara Brown, said two

locations on the Peninsula were being considered for the

manufacturing facility, with the final choice dependent on

commercial and technical, as well as environmental

considerations.

“The Burrup Peninsula

and surrounding Dampier Archipelago are geomorphologically and

nvironmentally significant because of the physical and geological

setting, along with the vegetation diversity, heritage value,

archaeological richness and the complexity and diversity of the

terrestrial and marine habitats,” Dr Brown said. “The land identified for the plant process

and storage areas, pipeline corridor easements and jetty loadout

facilities is situated in areas either zoned industrial under the

Burrup Peninsula Land Use and Management Plan, or on an existing

industry lease,” she said.

“The proposed new

facilities would therefore be well removed from the pristine

areas identified in the Land Use and Management Plan,” Dr Brown noted. “Methanol manufacture is a clean process

anyway, in which the liquid petrochemical is made from natural

gas and steam,” she added.

Methanex Australia is a

wholly owned subsidiary of the Canadian-based Methanex

Corporation, the world's largest producer of methanol and

supplier to about a quarter of the world market and some 35% of

the Asia-Pacific market. The company has a global commitment to

responsible management and environmental excellence, as

demonstrated by the New Zealand Chemical Industry Council

awarding Methanex its prestigious ‘Prince Gold’ accreditation for the safety, health and

environmental performance of its NZ plant.

The new Western Australian

complex would also be built and managed in an environmentally

sensitive manner. It would be the cornerstone of several

gas-based projects being proposed for the Burrup Peninsula.

The Federal and State

Governments recognise the significance of this development and

are supporting it by providing infrastructure for the industrial

estate. The infrastructure would include facilities such as

roads, seawater supply and access corridors.

Following the recent

signing of a Sale and Purchase Agreement by Methanex and the

North-West Shelf Joint Venture partners, natural gas for the WA

Project would be provided from gas fields in the nearby Carnarvon

Basin. The Project is

expected to contribute significantly to Western Australia's

economy and lead to increases in Gross State Product, employment

and export earnings.

Studies predict that the

Project would employ more than 1,000 people during its

construction and provide about 150 permanent jobs when

operational. In addition, it would facilitate the development of

down-stream industries that use methanol, to create additional

opportunity and growth.

Construction of the

facility is expected to begin in 2003, subject to approvals and a

final investment decision in late 2002, with the first of the two

plants scheduled to start up in 2005.

New Zealand

http://www.methanex.com/corporateinformation/newzealand.htm

Methanex New Zealand, with a

staff of approximately 210, owns and operates two methanol

plants, Motunui and Waitara, and a port loading facility in the

province of Taranaki, near New Plymouth.

Natural gas from two Taranaki fields, Maui and Kapuni, is piped

to the plants.

The two plants have a combined annual operating capacity of 2,430,000 tonnes. Originally, the Motunui plant had a dual

capability. It was constructed to convert natural gas to

gasoline, with methanol as an intermediate step in the process.

In 1997 the gasoline production facility was permanently idled.

Now, the entire crude methanol production of Motunui is distilled

into chemical grade methanol.

Both plants are linked together by a four-kilometre pipeline with

another pipeline used to transport methanol to the port for

transfer to ship. The New Zealand facility is a key distribution

point to the Asia Pacific region.

Kitimat, British Columbia

The Kitimat methanol facility was

completed in 1982. It has an annual capacity of 500,000 tonnes and employs approximately 125 people. In

addition to the methanol plant, the 550-acre site contains an

ammonia plant that is owned by Pacific Ammonia Inc. and operated

by Methanex on their behalf.

Located at the end of the protected

Douglas Channel, the Kitimat facility is ideally positioned on

the great circle shipping routes for delivery of methanol to

customers in California and Pacific Rim countries, particularly

Japan. This location provides an ice-free tidewater port

accessible by all but the largest ocean-going vessels. The

Kitimat facility also utilizes rail to distribute its product to

Canadian destinations.

Medicine Hat, Alberta 停止中

The Medicine Hat site currently has

a production capacity of 470,000 tonnes. However, on August 28,

2001 Methanex shut down this facility for an indeterminate

period.

Fortier, Louisiana 閉鎖

The Fortier plant was built in 1994

and has an annual capacity of 570,000 tonnes. The facility was

Mothballed in March, 1999 and remains shut down today. In

November, 2002 Methanex announced the write-off of this facility.

Chile Punta Arenas

The Latin America Region of

Methanex Corporation, based in Chile, covers all South America

plus Mexico and South Africa. Methanex Latin America operates in

Chile under the company Methanex Chile Limited, Agencia en Chile.

The company started in 1985 and initiated production in 1988.

Manufacturing facilities are located at Cabo Negro, 28 km north

of Punta Arenas on the straits of Magellan in the heart of

Chile's petroleum and gas producing region.

The Cabo Negro facility is Methanex's largest and lowest cost

facility hub, with an annual production capability of 3,000,000 tonnes from three plants. The third and largest

plant, which has an operating capacity of 1,065,000 tonnes, was

commissioned in May 1999.

In November, 2002 Methanex announed the construction of an 840,000 tonne per year expansion of its production hub in Chile. This

expansion, which is expected to be completed by early 2005, will

increase the annual capacity of the Cabo Negro site to nearly

four million tonnes.

Positioned on the Straits of Magellan, the ship loading facility

is capable of handling the world's largest chemical tanker, the

Millennium Explorer. This vessel, which Methanex has on long-term

Time Charter, was delivered in January 2000 and can carry over

93,000 tonnes of methanol per voyage. The size of the production

hub in Chile Methanex's large market positions in Northern Europe

and the US Gulf allow us to use such a large vessel and reduce

our costs. Due to the strategic location of the plant, Methanex

is able to deliver to all the major world markets: Asia, North

America and Europe.

The skilled workforce of approximately 250 employees manage all

of Methanex's operations in Chile. Production processes utilize

state-of-the-art technology and are controlled through a

sophisticated Distributed Control System.

Platts 2002/11/12

Methanex proceeds with 840kt methanol expansion in Chile

Methanol giant Methanex Corp said

Tuesday that it will proceed with an 840,000mt/yr expansion

at its methanol production hub in Punta Arenas, Chile.

The expansion, which has a 20 year

natural gas supply contract, is expected to cost

approximately $275-mil, including capitalized interest of

approximately $25-mil and $17-mil already spent on the

project to September 30, 2002. The project is scheduled to be

completed by early 2005.

Methanex 大株主

Novaが全持株売却 2003/5/21

Nova Chemicals 46.9 million shares, or 37% of the outstanding

shares.

37.9 million shares ----- 売却

9.0 million shares ----- Methanexが買い入れ消却

2003/5/21 Methanex Corporation

Methanex corporation announces

secondary offering of its common shares

Methanex Corporation today announced that the Company and its

largest shareholder, NOVA Chemicals Corporation (NOVA), have

entered into an agreement with a syndicate of underwriters in

connection with a secondary offering of 37,946,876 of the

Company's common shares owned by NOVA at an offering price of

CAD$13.30 per share, or US$9.85 per share, for aggregate proceeds

of CAD$504.7 million, or US$373.8 million. Methanex will not

receive any proceeds from the offering. Closing is expected to

take place on or about June 5, 2003.

RBC Capital Markets is acting as lead manager for the offering

and CIBC World Markets is acting as co-lead manager. Other

members of the syndicate include Scotia Capital, TD Securities,

Citigroup and UBS Warburg.

The offering will be made concurrently in Canada and the United

States pursuant to the multi-jurisdictional disclosure system.

Methanex has filed a preliminary prospectus with regulatory

authorities in Canada. A registration statement relating to these

securities has also been filed with the U.S. Securities and

Exchange Commission but has not yet become effective. These

securities may not be sold nor may offers to buy be accepted

prior to the time the registration statement becomes effective.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy nor shall there be any sale of

these securities in any State in which such offer, solicitation

or sale would be unlawful prior to registration or qualification

under the securities laws of any such State. When available, a

copy of the preliminary prospectus may be obtained from RBC

Capital Markets Prospectus Department 60 South Sixth Street

Minneapolis, MN 55402-4422.

Methanex is the world's largest producer and marketer of

methanol. Methanex shares are listed for trading on the Toronto

Stock Exchange in Canada under the trading symbol “MX” and

on the Nasdaq National Market in the United States under the

trading symbol “MEOH.”

2003/5/21 Methanex Corporation

Methanex seeks shareholder approval to participate in exit of

Nova Chemicals

Methanex Corporation announced

today that it has agreed to purchase 9.0 million of its common

shares from NOVA Chemicals Corporation (NOVA). Currently, NOVA is

Methanex's largest shareholder, holding 46.9 million shares, or 37% of the outstanding

shares.

The purchase price for the shares will be US$9.85 per share,

which is the same price as NOVA will be receiving from the

underwriters of the secondary offering separately announced by

Methanex today. The repurchase will be subject to approval by a

majority of Methanex's shareholders other than NOVA and its

affiliates and would close following a special meeting of

shareholders to be held on June 30, 2003. The shares acquired

from NOVA would be cancelled. Methanex would finance the

repurchase with cash on hand.

After completion of the offering and assuming shareholders

approve the repurchase, NOVA will have no remaining equity

interest in Methanex.

Pierre Choquette, President and CEO of Methanex commented, “We believe that the market price of our

common shares has been adversely affected by the market perception that

NOVA would sell all or a portion of its common shares. If this

offering and our purchase from NOVA are successfully completed,

we expect this overhang will be eliminated.” Mr.

Choquette added, “Following

the successful completion of this offering and our purchase from

NOVA, it is also expected that our shareholders will be able to

enjoy improved liquidity for our common shares due to a

substantial increase in the public float.”

An independent committee of

Methanex's board of directors has recommended the repurchase.

Raymond James Ltd., who advised the independent committee, has

provided an opinion that the repurchase is fair from a financial

point of view. The board of directors will recommend that all

shareholders vote in favor of the transaction.

Upon the closing of the secondary offering, it is expected that

Mr. Jeffrey Lipton, the President and Chief Executive Officer of

NOVA and the Chairman of our board of directors, and Mr. A.

Terence Poole and Mr. Christopher Pappas, both senior executive

officers of NOVA, will resign as directors of Methanex. It is

expected that Mr. Pierre Choquette, our President and Chief

Executive Officer, will be appointed interim Chairman of the

board and Mr. David Morton will be designated as “lead” outside director. Mr. Morton is the

Chairman of the Corporate Governance Committee of our board. The

board will conduct a process to fill the vacant board seats and

to select a new chairperson.

Methanex is the world's largest producer and marketer of

methanol. Methanex shares are listed for trading on the Toronto

Stock Exchange in Canada under the trading symbol “MX” and

on the Nasdaq National Market in the United States under the

trading symbol “MEOH.”

December 15, 2003 Methanex

METHANEX ACQUIRES ADDITIONAL

PRODUCTION FLEXIBILITY

Methanex Corporation has entered into an agreement with Terra

Industries to acquire all of Terra's methanol customer contracts relating to

its 700,000 tonne per year methanol facility located in Beaumont,

Texas. In addition, Methanex will acquire certain production

rights to the facility and exclusive rights to all methanol

produced at the facility until the end of 2008.

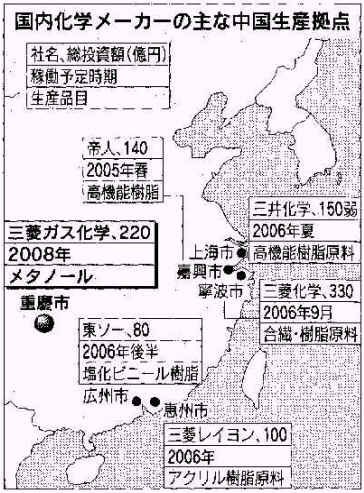

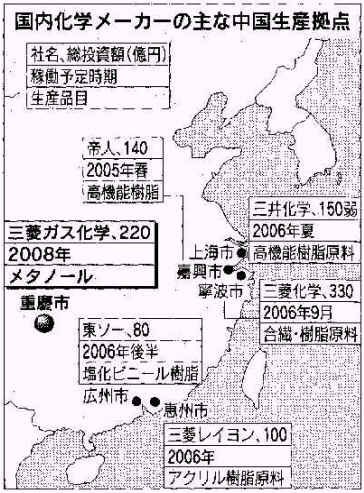

日本経済新聞 2004/9/14

中国最大、メタノール合弁 三菱ガス化学、重慶に

年産85万トン、2008年稼働

三菱ガス化学は合成繊維や塗料の基礎原料となるメタノールで中国最大となるプラントを重慶市に建設する。現地の国営化学メーカー、重慶化医(重慶市)と合弁で2008年の稼働を目指す。年産能力は85万トンで総投資額は約220億円。中国は合繊向けなどにメタノール需要が伸びているが3分の1を輸入に依存している。原料調達にメドがついたことから現地に大型プラントを建設し、旺盛な需要を取り込む。

合弁会社は2005年度をメドに設立。製造と販売を手掛け、三菱ガス化学が51%、重慶化医が49%を出資する。生産したメタノールはほぼ全量を重慶周辺や上海市など沿岸部の工業地帯を中心に中国市場向けに供給する。重慶化医グループは中国大手の化学品製造・販売会社で年間売上高は約1千億円。

メタノールは天然ガスなどガス成分から精製するため原料の搬送効率が悪く、原料の産地近郊にプラントを設ける方が競争力を確保できる。重慶市近郊はメタノールの主原料である天然ガスが豊富なことから、割安な原料の安定調達が可能と判断した。

中国の内需は年420万トン程度だが現地の生産設備は年10万−20万トンの小規模プラントが中心で、約140万トンを中東などからの輸入でまかなっているとみられる。三菱ガス化学もサウジアラビアの生産拠点から輸出で対応してきたが、現地に最大規模のプラントを設けコスト競争力を高め、拡大する中国需要をいち早く取り込む。

三菱ガス化学はメタノールの国内最大手で世界3位。サウジアラビアに年310万トン、ベネズエラに同73万トンの生産設備を合弁で設けている。重慶市同様、いずれも天然ガスが豊富に取れる地域で、原料調達に優位性があり、サウジが主にアジア向け、ベネズエラが北米向け拠点となっている。アジア需要の増大に対応するため、中国以外にもサウジ基礎産業公社と合弁で展開するサウジのプラントも生産能力を増強する計画だ。

国内石化大手 分野絞り対中投資

中国投資に慎重だった日本の石油化学産業が現地での生産計画を相次いで打ち出している。欧米大手が来年以降大型エチレンプラントを立ち上げるなか「このままでは中国市場での競争力低下は必至」(日本化学工業協会)との危機感を強めているからだ。

日本の石化大手は独BASFや米エクソンモービルなど欧米勢に比べ売り上げ規模、財務状況ともに格差が大きいため、千億円規模の投資が必要なエチレンプラントを中国で建設する体力的余裕はない。しかも「原料となる石油を中国に輸出可能な欧米メジャーに比べ資源を、持たない日本勢は競争力で劣る」(三井化学)。

このため日系各社は自動車、電機メーカー向けなど販売先が確保できる高付加価値分野を選び、リスクを考慮した上で投資を拡大していく戦略だ。

三井化学が上海で生産するのは光ディスクや自動車部品向けに需要増が見込めるポリカーボネート樹脂原料。三菱レイヨンは英蘭ロイヤル・ダッチ・シェルが広東省恵州市で建設中の石化コンビナート内で、液晶パネルなどに使うアクリル樹脂原料を生産する。

メタノールの合弁生産に乗り出す三菱ガス化学や塩化ビニール樹脂生産を進める東ソーは、欧米勢がまだ大規模な現地生産計画を打ち出していない製品分野を攻める。

日本国内の需要の伸びが期待できない中、成長の機会は中国市場に見いださざるを得ない。各社は今後も優位性が保てる分野を選んで積極投資を進める見通しだ。

September 30,

2004 Lurgi

Commissioning of the World’s Largest Lurgi

MegaMethanol® Plant

Expectations for the trendsetting Lurgi MegaMethanol® process fully met

http://www.lurgi.com/english/nbsp/index.html

Lurgi AG,

Frankfurt am Main, has successfully commissioned the world’s first MegaMethanol plant on the Caribbean

island of Trinidad. In less than three years time, Lurgi

completed the construction of the world’s largest methanol complex for its

customer Atlas

Methanol Company Ltd of Trinidad and Tobago. The single-train plant

now produces 5,000

tons of

methanol/day based on innovative Lurgi technology. Plant

operation has already reached full capacity. The test run for

guaranteed performance will be conducted soon. With the

commissioning of the plant, Lurgi has successfully implemented

its proprietary MegaMethanol technology in an industrial

application.

This plant marks the beginning of a new generation of plants for

the production of methanol from natural gas and associated gas

given the fact that the capacity of methanol plants operated with

the Lurgi MegaMethanol® technology is basically twice that of all

other processes currently available on the market. The current

standard capacities of conventional plants only range between

2,000 and up to max. 3,000 tons of methanol per day. The

synthesis gas production unit (MegaSyn®), too, is the largest

single-train facility in the world. Its autothermal reactor, for

example, was equipped with a new burner system to be able to

convert natural gas and around 80,000 Nm3 of oxygen per hour to

530,000 Nm3 of dry synthesis gas. This new technology, which

showed excellent results during plant operation, represents the

technology of the future, not only for methanol generation but

also for gas-to-liquid (GTL) and gas-to-chemicals (GTC®) complexes.

For the construction of the MegaMethanol plant in Point Lisas,

Lurgi managed the overall project as general contractor, supplied

the technology and was in charge for the erection and supervising

of commissioning of the methanol complex including offsites.

Consolidation of market leadership

Around 70 percent of the world’s methanol production will

in future originate from plants already built or still to be

completed by Lurgi. Lurgi is thus the world’s leading plant engineering contractor for

the construction of plants generating methanol from natural gas

and associated gas.

“The new Lurgi MegaMethanol® plant in Trinidad is an

important reference for future methanol projects. We expect that

it will enable us to win additional market shares and view this

as a confirmation of our strategic orientation towards innovative

technologies of the future“, said Michael Stratling,

Chairman of the Executive Board of Lurgi AG. “Because, with the proprietary technologies

for the MegaMethanol process and for the Methanol-to-Propylene

process (MTP®), Lurgi commands technologies for a

complete process chain: the MegaMethanol technology allows for

the economical production of methanol from natural gas and the

MTP®

process in turn allows for methanol processing to value-added

propylene, an important feedstock for the production of plastics.

Moreover, the low production costs for synthesis gas and methanol

open the door for other petrochemical applications and synthetic

fuel production. This so-called gas route with proprietary Lurgi

technologies already now offers in part substantially more

economical alternatives than oil-based processes.

Expanding market for synthesis gas and methanol

Lurgi recognized these global market trends early on. Demand for

methanol is substantial and the demand for methanol generated

from natural gas and associated gas is set to rise appreciably

over the next few years. This will be followed by methanol

produced from coal gas. As a chemically liquefied gas, methanol

is one of the main synthetic raw materials for synthesis in the

petrochemical industry. It is anticipated that the percentage of

plastics produced from natural gas will roundabout quintuple over

the next 20 years. In the petrochemical industry, the raw

materials basis will shift partially from petroleum to natural

gas over the next years. Synthesis gas and methanol will in part

replace petroleum-based feedstocks for the petrochemical

industry. Cheaper synthesis gas and / or methanol also opens up

very good opportunities for producing sulfur-free motor fuels.

Moreover, cost-efficient methanol is perfectly suited as a fuel

for gas turbine power plants.

Trinidad und Tobago already today is the world’s largest exporter of methanol and can now

extend this leading position further with the new Lurgi

MegaMethanol® plant. As the contractor who erected a

2,500 tpd methanol plant in the vicinity of the new plant back in

September 2000, Lurgi is a trusted partner for the construction

of methanol plants in Trinidad.

Nov. 1, 2004 Terra

Terra to Mothball Beaumont

Methanol Facility

http://www.terraindustries.com/latest/corp_activities/04-11/beaumont.pdf

Terra Industries Inc. announced

today that, at the request of Methanex Corporation and under the

terms of an agreement between the two companies, it will cease

production at its Beaumont, Texas, methanol manufacturing

facility on Dec. 1, 2004, and mothball the plant for an

indefinite period. Terra sold its sales

contracts and rights to the full output of the Beaumont plant to

Methanex for five years

ending Dec. 31, 2008. Under the terms of that agreement, Terra

received a lump-sum payment of $25 million and shares in a

percentage of cash gross profits generated from Beaumont sales.

The agreement gives Methanex the right to cease production at the

Beaumont facility and also stipulates that, beginning two years

from the date of the shutdown, Terra has the option to terminate

the agreement at a cost of approximately $417,000 per month

remaining on the contract.

The Beaumont facility has annual

production capacity of 225 million gallons of methanol and

255,000 tons of ammonia. The ammonia loop has historically used

hydrogen produced by the methanol plant in its manufacturing

process. Terra is evaluating the feasibility of alternative

sources of hydrogen for the ammonia loop.

Approximately 40 Terra employees

will lose their jobs after the methanol plant is mothballed.

Terra will retain some employees to operate the methanol storage

and distribution terminal and to potentially operate the ammonia

plant. Terra estimates that it will spend as much as $5 million

to mothball the plant and for employee separation costs.

Terra continues to produce

methanol at its Woodward, Okla., facility. That facility, which

primarily produces nitrogen products, has annual methanol

production capacity of 40 million gallons.

Terra Industries Inc., with 2003

revenues of $1.4 billion, is a leading international producer of

nitrogen products.

This news release may contain

forward-looking statements, which involve inherent risks and

uncertainties. Statements that are not historical facts,

including statements about Terra Industries Inc.'s beliefs, plans

or expectations, are forward-looking statements. These statements

are based on current plans, estimates and expectations. Actual

results may differ materially from those projected in such

forward-looking statements and therefore you should not place

undue reliance on them. A non-exclusive list of the important

factors that could cause actual results to differ materially from

those in such forward-looking statements is set forth in Terra

Industries Inc.'s most recent report on Form 10-K and Terra

Industries Inc.'s other documents on file with the Securities and

Exchange Commission. Terra Industries Inc. undertakes no

obligation to publicly update or revise any forward-looking

statement, whether as a result of new information, future

developments or otherwise.

Platts 2005/4/20

- New Americas methanol units

could lead to slack in market

The scheduled start-up of two "mega-methanol"

plants in the Americas during Q2-Q3 2005 could create

significant slack in the market at that time, even as

most of the new product already is sold under contract,

market sources said this week. "There's going to be

spare volume summer-time into fall," one distributor

said, adding that following the contracted allotment of

new product, about 300,000mt of "slack" would

remain.

The possible bearish market sentiment in mid-2005 comes

as Methanex readies for the startup of its 840,000 mt/yr

Chile IV methanol facility (currently in commissioning phase)

and Methanol

Holdings prepares for

the startup of its 1.89-mil mt/yr M5000 unit in Trinidad (expected late

July 2005). Methanex reportedly will shut down its

500,000 mt/yr methanol unit at Kitimat, British Columbia

following the startup of Chile 4, while Celanese's

500,000 mt/yr methanol unit at Bishop, Texas, and

Celanese and Valero's 600,000 mt/yr methanol unit at

Clear Lake, Texas, reportedly will be shut down following

the startup of M5000.

Taking into account the potential shutdowns along with

the startups, Americas methanol supply would increase

1.3-mil mt/yr. A producer source said a big key to avoid

a resulting bearish market will be if Chinese demand for

product holds during the year, adding that US demand is

expected lower in the near-future. Current methanol spot

levels in the Americas are fairly steady at 90.50-91

cts/gal FOB USGC.

Platts 2007/3/7

Methanex signs

10-year Chilean natural gas supply agreement

Methanex Corp reached a long-term

natural gas supply agreement which will supply the company's

Chilean methanol production facility, the company said Wednesday.

Methanex signed a memorandum of understanding with GeoPark

Holdings Ltd that includes a 10-year gas supply and purchase

commitment from GeoPark's Fell Block in southern Chile beginning

May 2007. The agreement provides incentives for volume of up to

100,000 Mcf/d of natural gas and includes provisions for the

financing of development operations and the potential joint

acquisition of new hydrocarbon blocks in Chile. The agreement is

subject to a final contract and requires Chilean government

approvals.

Methanex's methanol production facility in Chile has the capacity

to produce 3.8 million mt/year, or approximately 10% of

the world's methanol

supply, the company said.

GeoPark is a private-sector oil and gas producer in Chile and has

been supplying natural gas to Methanex in Chile since May 2006.

In October 2006, Methanex said its natural gas costs could

increase as much as $1.95/MMBtu as a result of Argentina's

decision to increase natural gas taxes on exports from that

country. At the time, Methanex said it sourced about 60% of its

natural gas for the Chile plant from Argentina.

It was unknown if the supply agreement with GeoPark would replace

any of the volumes of natural gas that Methanex receives from

Argentina and a company spokesperson was unavailable at the time

of press.

The government of Argentina passed a resolution that extended the

existing export duty on oil, natural gas and derivatives to the

province of Tierra del Fuego effective October 20, 2006. Exports

from this province had previously been exempt from the duty.

Tierra del Fuego, an archipelago at the southernmost end of South

America, produces 9.4% of Argentina's 147 million cu m/d of gas.

The province exports to neighboring Chile at around $2/MMBtu.

With the 45% tax, the price will rise to between $3.7-3.9/MMBtu,

which is what buyers in the rest of Chile pay for gas from other

parts of Argentina where gas exports are taxed at 45%.

平成19年4月12日

三菱ガス化学/伊藤忠商事

ブルネイ・ダルサラーム国におけるメタノール事業について

三菱ガス化学株式会社(本社:東京都千代田区、以下「MGC」という)、伊藤忠商事株式会社(本社:東京都港区、以下「伊藤忠」という)およびBrunei

National Petroleum Company(本社:ブルネイ・ダルサラーム国バンダル・スリ・ブガワン。以下「PetroulemBRUNEI」という)は、合弁会社であるBrunei

Methanol Company (以下、「BMC」という)において、年産85万トンのメタノール事業を行うことといたしました。建設資金は約4億ドルであり、2009年末の完工および2010年第2四半期の商業運転開始を予定しております。

MGC、伊藤忠およびPetroulemBRUNEIは、2006年3月にBMCを設立し、詳細な事業化調査を行なってまいりましたが、このたび合弁事業に関する諸条件が確定したことから、投資の最終決定に至ったものです。

本合弁事業の特性として投資規模が大きくかつ投資回収が長期に亘ることから、BMCは国際協力銀行を中心とする銀行団から、同国初となるプロジェクトファイナンスによる資金調達を行なう予定です。また、ファイナンシャルアドバイザーとして株式会社三菱東京UFJ銀行を起用しております。なお、プラントは三菱重工業株式会社とフルターンキーベースでの建設契約を締結いたしました。

メタノールは多くの川下製品を持つ基礎化学品の一つで、主にホルマリン、酢酸などの化学品用途の原料として使用されています。また今後はバイオディーゼルやDME(ジメチルエーテル)の原料など幅広い用途での利用拡大も見込まれております。現在の世界需要は年間約36百万トンですが、今後も年率3%の成長が見込まれており、特に本合弁事業のメタノール輸出先である日本を含むアジア市場では、経済成長に伴う高い伸びが期待されています。

本合弁事業は、アジア市場の中心に位置するため、ロジスティックスにおけるコスト優位性を有し、また安価な原料天然ガスを利用できることから、他の事業者に対して十分な競争力を有しております。

MGCおよび伊藤忠は、本合弁事業を通じて、メタノール事業における世界でのプレゼンスをさらに高めてまいります。

(合弁事業の概要)

1. 出資比率 MGC 50%

PB Petrochemical 25%

※ PetroulemBRUNEIの関連会社

伊藤忠 25%

2. 生産能力

日産2,500トン(年産850,000トン)

3. 生産技術 三菱(MGC/MHI)メタノールプロセス

※ MGCと三菱重工業株式会社が共同保有するプロセス技術

4. 事業立地 ブルネイ・ダルサラーム国

スンガイ・リアング工業地区

5. 天然ガス供給者 Brunei Shell Petroleum Company Sdn

Bhd(BSP)

6. 製品引取権者 MGC

7. 建設完了時期 2009年第4四半期

8.商業生産開始 2010年第2四半期

9.資金調達方法

国際協力銀行を中心とするプロジェクトファイナンス(予定)

10.従業員数 約160名(現地採用従業員)