2003/2/3

Financial Times

Bataan PE

being liquidated.

All the assets of Bataan Polyethylene Corp (BPC) are in the

hands of the creditors and the company is being liquidated.

The shareholders in the joint venture are BP (38.5%),

Petronas (38.5%), Sumitomo Corp (5%) and Bataan PE Holdings

(18%). In Aug 2001, the company closed its HDPE/ LLDPE

facility which has a capacity of 250,000 tonne/y. A decision

to pull out of the joint venture was made by the shareholders

in Dec 2002. The company is understood to have debts of

around $170 M. Debt restructuring is under discussion.

Platts--2002/9/5

Malaysia Petronas seeks

protection for Philippine PE

Malaysia's state-owned Petronas,

which is to enlarge its stake in a polyethylene joint venture

in the Philippines, has appealed to the local government for

extended tariff protection, tax incentives, and more

vigilance against smuggling, a source close to the JV, Bataan

Polyethylene, said Thursday. The Philippines currently

imposes a 15% tariff on PE imports. Under the terms of the

ASEAN Free Trade Agreement, the tariff rate is to be reduced

to 5% from Jan 1, 2003. Petronas currently has a 39% share in

BPC. Late last year, Petronas had agreed in principle to

buy BP's 39% share in BPC as well as Sumitomo Corp's 6%,

which in the event would give it a controlling stake in the

firm. The balance of the

shares--16%--belong to Profinda Holdings, a consortium of

local Philippine investors.

Bataan's two PE

plants have been idle for more than one year due to poor economics and lack of

funds. They started up in 2000 and have a combined capacity

of 250,000 mt/yr. The plants had not been cost competitive,

because the Philippines does not produce ethylene locally.

The state-run Philippine National Oil Co-Petrochemical

Development Corp has tried for many years to solicit

financial support for the country's first naphtha cracker,

which would give BPC and another PE producer JG Summit a

cheaper source of ethylene feedstock. JG has the capacity to

produce 200,000 mt/yr of PE and 180,000 mt/yr of

polypropylene at Batangas. It is a tie-up between Marubeni

and the local Goconway.

Petronas itself may take a

larger than 20% stake in the proposed naphtha cracker at

Bataan, a source close to the project had told Platts last

week. The Brunei government is said to be interested too in

taking a stake. The cracker is to have an ethylene capacity

of 1-mil mt/yr. It is tentatively scheduled to start up in

2005 and has been estimated to cost $1.2-bil. Bataan is about

150km west of Manila Bay.

December 3, 2002 Dow Jones Online News

BP, Other Holders To Exit

Philippines Petrochemical JV

BP PLC (BP) said Monday that it and its fellow shareholders

have decided to exit from a petrochemical joint venture

company in the Philippines.

A spokesman for BP in London said shareholders in the Bataan

Polyethylene Company, including Malaysian national oil and

gas company Petroliam Nasional Bhd. (P.PET), or Petronas, plan to enter talks with the

financiers of the joint venture and Philippines authorities

to figure out the future of the joint venture and its assets.

BP said that though it was too early to know for sure how the

talks would pan out, "it is expected that the most

likely outcome will be to wind up/dissolve BPC."

The spokesman said the poor condition of the domestic

polyethylene market and difficult economic circumstances in

the Philippines were behind the decision to exit the joint

venture. He declined to comment on BP's investment in BPC.

BPC's main asset is a polyethylene plant with a 250,000

metric ton a year capacity, which began production in

February 2000 and reached full capacity in August 2000.

However, returns failed to meet expectations and production

was cut to half capacity in February 2001 and was stopped

altogether in August of that year.

The BP spokesman said the plant has around 190 employees,

which have been kept on the payroll since production stopped.

But he said he expects discussions on redundancy terms to

begin, though a small number of core staff would be retained

to insure the safe decommissioning of the plant.

BP and Petronas each hold around 39% of BPC. Sumitomo Corp.

(J.SUT) owns just over 6% and a consortium of mostly Filipino

investors called the Battan Polyethylene Holding Co. hold the

rest.

Eastern Petrochemical Company :SHARQ

サウディ石油化学(株)と、サウジアラビア法人のサウジアラビア基礎産業公社(Saudi

Basic Industries Corporation :SABIC)の合弁会社。

(SABICの石化コンプレックスについては別紙)

製品:

EG 2000年7月にはEG45万トンの新設備が完成

3系列合わせて年産135万トンと、単一工場では世界最大。

PE 2000/5 デボトルにより45万トンを75万トンに増強。

引取:

EG 135万トンのうち半分の675,000トンがペトロケミヤの持ち分

残りの半分がSHARQのオウンプラント

それをSABIC60%、SPDC40%の比率で分ける。日本側27万トン

PE 75万トンの40%(30万トン)が日本側引取量

(Chemnet Tokyo 2000年)

インタビュー SHARQの現状と今後の展開

サウディ石油化学 佐々木 和男社長

サウディ石油化学(SPDC)は1981年、サウジアラビアの豊富な資源を利用して一大石化事業を展開しようと、日サ合弁で設立された「SHARQ](シャルク)の日本側投資会社。日本政府もナショナルプロジェクトとして支援してきた。

1987年には第1期工事が完了して営業運転を開始、以来93年には第2期、そして今は2000年夏の完成を目ざして第3期増設計画に取り組んでいる。

「これまで順調に拡大してきた。サウジ品に対する市場の評価が高まったことが大きい」と佐々木社長。国際的に設備過剰感が広がりつつあるときだけに、今後どのように販売戦略を展開しようとしているのか注目される。

━ 工場はいまどんな状態ですか。

1994年に第2期工事が完了し、翌95年から商業生産を開始したが、EG(エチレングリコール)、PE(低密度ポリエチレン)とも順調な操業に入っている。立ち上がりのトラブルもなく、運転は非常にスムースだった。マーケットも気持よく受け入れてくれた。それこそ乾いた砂に水が滲み込むように、すうーと入っていったという感じだった。

━ 生産、販売とも順調というのは、どこに原因があったのですか。

PEは『カマール』の商品名で販売しているが、品質に対するマーケットの評価が高い。供給も安定している。このため中国を含む東南アジアをはじめ欧州など各地で買ってもらっている。他のPEより高いプレミアムつきで買ってくれているところもある。バックアップしてくれた三菱化学の技術支援がよかったこともあるが、これを吸収し、サービスをしっかりやってきたサウジ人たちの努力も大きい。

EGでは最高レベルの品質であるのに加え、専用船を駆使した安定供給によりお客さんの安心感を勝ち得ている。

━ 技術面でのトラブルがないというのは、今後の自信にもつながりますね。

その通りだ。サウジのプロジェクトというと、素材・汎用の量産型製品だけというイメージがつよいようだが、現地ではよく技術を使いこなし、キャッチアップしている。日本の石化業界には生産棲み分けという考え方があるが、これからはどうかな。サウジもダウンストリームをやる力をつけつつあるといっていいと思う。

━ SPDCの経営陣としても認識が変わってきたのでは。

そうともいえる。15年やってきた実績や経験がわれわれの認識を変えたということだと思う。サウジという国自体異文化の国で、どうもとっつきにくいという印象をもたれがちだが一緒に仕事してみるとそんなことは全然感じない。感じてはならないという方が正確な表現といえよう。

国自体は財政の80%以上を石油に依存しているから、石油価格の変動によって財政事情が変わるという厳しい情況にいつも置かれている。

しかし、今の王族をはじめ政治の実権をにぎっている人たちは皆よく勉強している。非常に向学心がつよく、世界の先進国に追いつけ追い越せと、技術にしてもマーケティングにしてもどんどん吸収しようとしている。彼らは世界の動きをよくみているし、調和も考え始めている。日本もアドバイスしながらやっていけば、パートナーとして不足のない相手になりつつあると思う。

━ 現地では第3期工事がはじまっています。

工事は順調だ。2000年7月にはEG45万トンの新設備が完成する。これで3系列合わせて年産135万トンと、単一工場では世界最大になる。PEは今の45万トンをデボトルによって75万トンに増強中だが、5月には完了の予定だ。そこで引取量だが、EGは135万トンのうち半分の675,000トンがペトロケミヤの持ち分、残りの半分がSHARQのオウンプラントで、それをSABIC60%、SPDC40%の比率で分けることになっている。従ってわれわれの引取量は27万トンとなる。

またPEは75万トンの40%、30万トンがSPDCの引取量になる。

━ SPDCとしては、これからどう売っていくと。

いや、もうどちらもほぼ販売のめどはついている。PEは日本もあるが、中心は中国、アジア、欧州の各地でということとなる。さっきも言ったようにマーケットで十分評価されている。みんなキャパが出てくるのを待っている状態だ。

EGも中国、アジアを中心にほぼめどはついている。私たちの売り方、パフォーマンスにユーザーたちは満足してくれている。

━ コスト競争力には自信がありそうですね。

競争力は圧倒的にある。他のメーカーがどんなに安い値段で出してもフォローできるだけの力はもっている。原料の中核はエタンだが、その価格一つとってみても、トン当たり37ドル。しかもずっとフラットで、この値段は変わらない。これだけみてもいかに競争力があるか、おわかりいただけると思う。しかし、だからといって、例えば日本市場をにらんで量を拡大していこうと考えているかというと、そんなことはない。日本に出て行かなくても、もっと近いところに市場はあるし吸収力もある。日本への輸出は、ロジスティックが高いし、SHARQ社の手取りはあまりよくない。「FOR THE SHARQ」で考えると、日本へ持ってくることは必ずしも良策ではない。が、当社がナショプロとして発足した経緯からして、日本市場に一定のプレゼンスを維持していく積りではある。

ブラジル Politeno Industria e Comercio S/A http://www.politeno.com.br/ingles/perfil/perfil_descricao.asp

Politeno

Industria e Comercio S/A, a petrochemical company located in the

Petrochemical Complex of Camacari, in the State of Bahia, Brazil,

was founded in 1974 and is currently the second largest in its

industry in Latin America. Its working philosophy is to formulate

outstanding products through the use of high technology, thus

addressing the aim of excelling the fulfillment of its client’s quality requirements.

An open-capital enterprise, Politeno is controlled by its main

shareholders:

Companhia Suzano de Papel e Celulose 35%

Conepar--- Companhia Nordeste

de Participacoes 35%

Sumitomo Chemical

20%

Itochu Corporation 10%

It was after a

decision to expand its business that Politeno Industria e

Comercio S/A started to use a technology licensed from Sumitomo

Chemical Co. Ltd. to produce Ethyl copolymers --- Vinyl Acetate,

EVA ---in 1982.

A swing unit was implemented in 1989, aiming the production of

linear low density polyethylene copolymers and high density

polyethylene (PEL plant).

Located in the Petrochemical Complex of Camacari, State of Bahia,

Politeno occupies an area of 184.250 sq. m., adjacent to COPENE , supplier of the company’s main raw material, the Ethene, a gas

resulting from the naphtha cracking, done by Petrobras. It is a

second-generation industry, its products being used as raw

material by third generation industries.

The production facility of Politeno is comprised of two

industrial plants operating on a 24 x 7 basis.

The first one,

LDPE, is the conventional low- and medium-density Polyethylene

and ethyl-vinyl-acetate (EVA) production facility, able to output

a production of 145.000 t/ year, employing the “Super High Pressure” technology, licensed from the Japanese

company Sumitomo. The unit has two production lines, both with

the same capacity. The main equipment is comprised of the primary

and secondary compressors and the reactors, operating at

pressures up to 2.000 kg/cm2.

LDPE/EVA

Plant -1978

Initial capacity: 100 thousand t/ year

Current capacity: 145 thousand t/ year

The second unit,

LPE, employs a technology called “Solucao”, licensed from the Canadian company Nova

Chemicals, to produce linear Polyethylene. It is comprised of one

production line, currently with a capacity of 195.000 t/ year.

Among its main equipment are the polymerization reactor, the

reactor loading pump, the main extrusion machine, the stripper

and the diluents recovery system.

LLDPE/HDPE

Plant - 1992

Initial capacity: 130 thousand t/ year

Current capacity: 195 thousand t/ year

The whole LDPE

plant is fully halted for a thorough inspection and maintenance

every year, and the LPE plant, every 2 years.

日本経済新聞夕刊 2002/8/20

Brazkem誕生背景

ブラジル石化5社が合併

ブラジルの石油化学最大手コペネなど同業5社は19日、合併して新会社「ブラスケン」を設立したと発表した。年間売上高は約70億レアル(約2800億円)で、中南米最大の石化企業となる。

合併したのはコペネ、コペスル、OPP化学など石化業界の上位4社と中位のニトロカルボノ。事業規模の拡大でコスト競争力を引き上げると同時に、市場での価格支配力を強める。

ブラスケンは国内13ヶ所に工場を持つ。同国の石化製品市場でのシェアはポリプロピレンで39%、ポリエチレンで31%に達し、売上高ではブラジルの民間企業で上位5社以内に入る見通しだ。

Odebrecht and MarianiがCopene(エチレンメーカー)を買収

自社グループのTrikem(PVC)や Politeno(PE)等を統合し,Braskem社を設立へ

http://www.platts.com/features/2001mergers/petchem.shtml

Odebrecht-Mariani

- Copene

Sep 3, 2001 Odebrecht President Emilio Odebrect said the consortium would

form a new company called Braskem which would incorporate

Copene and Odebrecht-Mariani's other assets at Camcari.

The Brazilian Odebrecht-Mariani consortium July 25, 2001 acquired a majority

stake in Copene, an ethylene, propylene and butadiene

producer

in a deal valued at $314-mil. The plants are located at the

Camacari petrochemical complex in the northeastern state of

Bahia.

Brazil's Central Bank sold Economico group's 63.82% stake in Conepar, a company

which has a 23.69% share in Norquisa, a holding company with

a 58.4% control stake in Copene. The sale was an auction in which

Odebrecht and Mariani were the sole bidders.

Odebrecht already had a 16.02% stake in Norquisa, through its

PVC-producing Trikem subsidiary. Mariani already had a 16.09%

stake in Norquisa via its Pronor holding company.

Odebrecht President Emilio Odebrecht Sep 3 said the takeover

of Copene would result in a new company called Braskem. It

would also incorporate the Odebrecht and Mariani's other

petrochemical assets at Camacari. They include Odebrecht's OPP Petroquimica, a

polyethelene producer; Odebrecht's Trikem, a PVC producer and

Mariani's Nitrocarbono, a caprolactam producer; a 66.6%

Conepar stake in Polialden, a high-density

polyethelene producer; a 35% Conepar stake in Politeno, a high and

low-density polyethelene producer; and Proppet, a jointly

owned PET resin producer.

The companies aimed to have the integration completed 6-9

months after the acquisition.

The Copene board had previously decided on a $210-mil

expansion plan to increase its ethylene capacity from 1.2-mil

mt/yr to 1.5-mil-mt/yr by 2004. The first expansion-stage

will increase production by 80,000 mt/yr in 2002. The second

stage will see production increase by 120,000 mt/yr in 2003

and an additional 100,000 mt/yr in 2004.

*Polialden was

started in 1978 and is presently controlled by COPENE,

which has Mitsubishi

Chemicals and Nissho Iwai of Japan as shareholders. Polialden is one

of a group of companies

to be merged in the near future to form BRASKEM, which

will be the largest petrochemical company in South

America.

http://www.braskem.com.br/

Polialden is one of the

largest Brazilian manufacturers of High Density

Polyethylene (HDPE) and the only producer of Ultra-High

Molecular Weight Polyethylene (UHWMPE) in Latin America,

market leader in domestic segments and a strong performer

on the overseas market. Located in the Camacari

Petrochemical Center in the state of Bahia, Polialden

currently produces a number of different types of High

Density Polyethylene for different transformation

techniques: extrusion, blowing, injection and pressing.

Its production capacity is 160,000 tons/year.

Since the beginning of its operations in 1978, the

company has considered that its research and development

activities are fundamental to the segmentation of its

competitive strategy, based on the quality of its

services and products. Within this context, in October

1994 Polialden obtained ISO 9002 certification and in

2002 ISSO 9001 certification renewal, version 2000.

Polialden maintains technical assistance and product

development services in order to ensure the correct

application of its resins, offering customers a full

range of commercial and technical services.

The only

manufacturer of Caprolactam in Brazil, NITROCARBONO is located in the

Camacari Petrochemical Center in the state of Bahia.

The company began production in October 1977, having been

designed with a capacity to produce 35,000 tons/year

using technology under license from Stamicar-bon b.v., a

subsidiary of DSM (Dutch States Mines).

Currently, production capacity is 56,500 tons/year.

Besides selling Caprolactam, NITROCARBONO sells

intermediate products such as Cycloexene, Cyclohexanone

and Ammonium Sulfate, which are generated during the

process.

April 10,

2003 Financial Times

Braskem boosts PVC/PP

capacity

In a $35 M project, PVC capacity at Braskem's plant in

Alagoas State, Brazil, will be raised by 50,000 tonne/y to

254,000 tonne/y. The new capacity will be available in 2005.

PVC capacity at facilities in Camacari will also be

increased. Ethylene capacity at Camacari will have been

raised from 1.18 M tonne/y to 1.28 M tonne/y by early 2004.

Polypropylene capacity at facilities in Triunfo, Rio Grande

do Sul, will be increased by 100,000 tonne/y, also in early

2004.

http://www.melma.com/mag/07/m00040007/a00000011.html

Brazil Today 2001 / 08 / 20 (14号)

カマサリコンビナート再編成

7月25日の競売にて、中銀管理下のエコノミコ財団よりコペネの支配権を得たオデブレヒト/マリアニは、8月2日付けの新聞紙上でカマサリ石油化学コンビナートの再編成構想および約束を発表した。コペネの支配権はオデブレヒト/マリアニは(議決権株55.78%、総資本48.03%)により持ち株会社ノルキザを支配、ノルキザは(58.41%、21.49%)でコンビナートの中核コペネを指揮、その下に100%出資の会社、新カマサリ社を設ける。この会社はプロペットおよびコネパル両社の100%の株主。コネパルはポリアルデン(66.6%、42.64%)、ポリテノ(35%、31%)の株主となる。

OPPとトリケンは既にオデブレヒトが過半数株主、プロノルとニトロカルボノはマリアニが支配する会社。オデブレヒト/マリアニが支配していないのはスザノと住友/伊藤忠が出資する前記ポリテノ(65%、56%)、スザノのポリパル(75%、71%)とダウが少数株主として参加するEDNとなった。

カマサリ構成会社への約束

新体制下においてオデブレヒト/マリアニは「緊急にカマサリコンビナートの近代化と拡張、ポリエチレン(プラスチック、合成繊維の原料)、ポリプロピレン(合成繊維、プラスチック)、PVC、PETなどの第二次工程の能力拡大を図り、唯一の原料センターから発してすべての関係社を横並びに発進させる」として統合されるコペネに対して下記の条件を約束した。

| (1) |

ペトロブラスのペトロキザ、およびペトロスとプレビの年金基金との了解事項である内部対立を解消させる。 |

| (2) |

コペネに統合される資産は第一級投資銀行の独立評価の対象となる。 |

| (3) |

同社は、出来得る限り早く、国家通貨審議会CMN指令第2829号に定められた第一次工程会社となるべく努力する。 |

| (4) |

第二次工程会社に対する指令第2829号の要請を満たした後、普通株、優先株を問わず、すべてのコペネの株主は、上記の統合の後、コペネ支配権譲渡の場合を含めて、その出資金の共同売却権を保障する。 |

| (5) |

指令第2829号に定められた財務内容開示制度の原則は既に適用されている。 |

| (6) |

資本市場監督機間である証券取引委員会CVM、消費者保護機間である経済防衛行政審議会CADE、および、大蔵省のSAE,法務省のSDEの要請に対して必要なすべての情報を提供し、これに従う業務を決議する。 |

| (7) |

ブラジル証券取引委員会に対すると同様、既に交渉中の米国証券取引委員会SECに対しても応対する。 |

Platts 2003/10/8

Brazil's Suzano voices interest

in Ipiranga PE/PP assets

Suzano Petroquimica, a major

Brazilian thermoplastics resin producer, could buy the

thermoplastic resin assets of Ipiranga Petroquimica, a

competitor, as part of a movement to consolidate the

petrochemical sector in Brazil, the company's CEO said Oct 8.

Ipiranga Petroquimica's resins assets are comprised of a 500,000

mt/yr swing polyethylene plant and a 150,000 mt/yr polypropylene

plant, both located at the Triunfo base petrochemical complex in

southern Rio Grande do Sul state. Suzano would only consider such

a purchase if Copesul, the cracker at Triunfo which is

co-owned/controlled by Ipiranga, guaranteed feedstock for the PE

and PP plants at competitive prices, according CEO Armando Guedes

Coelho. Ipiranga would not comment on Guedes Coelho's remarks and

hasn't indicated that the PE and PP plants are for sale.

2006/4/5 Braskem

Braskem acquires

Politeno and takes a new step forward in strengthening the

Brazilian petrochemical sector

Braskem assumes

100% of the voting capital of Politeno and plans to expand its

productive capacity

http://www.braskem.com.br/upload/Press_Release_Politeno_05-04-06_eng.pdf

Braskem announces that it

has bought Politeno in a move which represents an important step

forward in the implementation of its growth strategy, value

creation and the consolidation of its integrated business model.

The operation was concluded through an agreement to buy out the

stakes held by Suzano Petroquimica, Sumitomo Chemical and Itochu

in the capital of Politeno. This initiative means that Braskem

now holds 100% of the voting capital of Politeno and 96.15% of

its total capital.

“The acquisition

of Politeno marks an important step in the continuity of the

consolidation process of the Brazilian petrochemical industry and

is aimed at ensuring that the conditions are right for growth and

greater competitiveness throughout the productive chain, in order

to face the challenges from the globalization of the markets”, said Jose Carlos Grubisich,

chief executive officer of Braskem. “At the same time, Politeno brings

to our company a portfolio of products and complementary skills

highlighted by its experience in focusing on quality and

efficiency. It was so successful in these areas that it won the

National Quality Prize in 2002”, he added.

Politeno has had

average annual production of around 320,000 tons of polyethylene

over the last three years. Braskem intends operating the Politeno

plant, located at Camacari, to the limit of its current capacity

of 360,000 tons a year. Capacity will be expanded to 400,000 tons

a year by 2007 at an estimated investment cost of US$10 million.

The initial amount

to be paid in Reais by Braskem will be equivalent to US$ 111.3

million, with US$ 60.6 million going to Suzano Petroquimica and

US$ 50.7 million to the Japanese shareholders. The final amount

of the transaction will be calculated according to a formula for

adjusting the price, a mechanism which will take into account

Politeno´s performance over the coming 18

months ? reflecting the performance of the margins between

polyethylene and ethylene on the Brazilian market.

“The investment

is very attractive for Braskem and will bring synergies estimated

at US$ 110 million at the present net value, according to an

analysis carried out by the international consultancy, Monitor.

This is a way of creating significant value for all shareholders”, said Paul Altit, vice-president

of Finance and Investor Relations. The value of these synergies

includes the inter-exchange of good practices and technological

innovation.

The purchase of

Politeno was approved by the Boards of Directors of the companies

involved, and the Brazilian anti-trust regulator, the

Administrative Council for Economic Defense (CADE), has been

informed. With this acquisition, Braskem will further expand its

portfolio of products, which was already the most complete on the

regional market. It will now include a new family of resins ?

medium-density polyethylene, as well as EVA, a resin used in

footwear and educational toys, amongst other products. The

transaction will also allow Braskem to gain access to an

important client portfolio with a leading presence in the region.

“The acquisition

of Politeno and the plans to increase the capacity of this asset

demonstrate Braskem´s confidence in the growth of the

Brazilian economy and the positive performance of the

petrochemical sector”, Grubisich said. “At the same time, this transaction

reaffirms our strategy of consolidation and growth and represents

yet another important step in bringing about the commitment to

development which Braskem made when it was founded in 2002”.

Braskem, a world

class Brazilian petrochemicals company, is the leader in

thermoplastic resins sector in Latin America and among the three

largest privately-owned industrial companies in Brazil. It has 13

industrial plants distributed throughout the country and produces

5.8 million tons of thermoplastic resins and other petrochemical

products annually.

日本経済新聞 2007/4/30

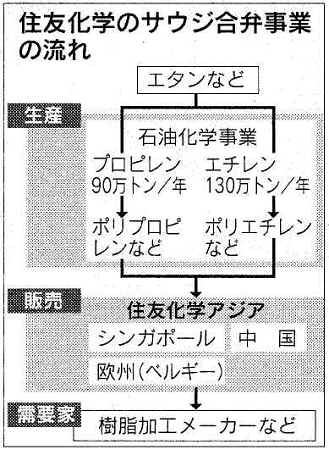

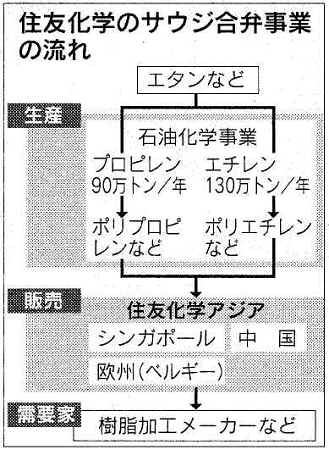

住友化学 世界3ヵ所に販売拠点 サウジ合弁事業 中国・欧州を開拓

住友化学は2008年に商業生産を始めるサウジアラビアでの石油化学合弁事業に絡み、世界3カ所で販売拠点を設ける。ポリエチレンなど汎用樹脂の需要拡大が期待できる中国や欧州市場を開拓する。サウジで生産する汎用樹脂は日本より品目を絞り、量産効果を高める方針。低コスト製品を武器に販路を早期に確立、09年度に約3千億円の販売を目指す。

既にシンガポールにはサウジで合弁生産するポリエチレンやポリプロピレンなどの石化製品を専門で販売する子会社、「住友化学アジア」を設立済み。主要輸出先を需要が旺盛な中国と、中東から近い欧州と位置づけ、それぞれ年内に販売拠点を設ける。

中国では上海と東莞(広東省)に住化アジアの支店を開設し、欧州はベルギーにある住友化学の販社に専門部隊を置く。08年後半の商業運転と同時に供給先を確保するため、今年10月から受注活動を始める。

サウジでの合弁生産では、石化製品の川上原料に現在日本で主流となっているナフサより大幅に安いエタンガスを使うのが特徴。量産効果をさらに引き出すため、石化製品の生産品目を大幅に絞り込むことも決めた。例えばポリエチレンの場合、住友化学の干葉工場(千葉県市原市)では、食品包装など顧客のニーズに合わせて100品目以上を生産しているが、サウジでは5−6品目に絞り込む。

住友化学は07−09年度の中期経営計画で、09年度の連結経常利益の目標を06年度予想比で約67%増の2500億円とする目標を掲げた。このうちサウジの合弁会社を通じ、500億円の利益貢献を見込んでいる。量産効果による価格競争力の底上げと、世界3カ所での販売拠点網の整備で目標達成につなげたい考えだ。