September 28, 2007 Dow

Dow Releases White Paper

on Joint Ventures

http://www.dow.com/about/pdf/djv_0907.pdf

The Dow Chemical Company today released a White Paper providing greater clarity around the Company's joint venture activities.

The Paper has a specific focus on the Company's principal joint ventures, numbering around a dozen in total, which last year accounted for approximately 90 percent of Dow's equity earnings and cash distributions from nonconsolidated affiliates.

The significance to Dow of its joint venture activities - as contributors to current earnings and cash flow, as well as vehicles for future value growth - has risen markedly in recent years.

In 2006, the Company's nonconsolidated affiliates contributed equity earnings of almost $1 billion, while Dow's share of cash distributions from these operations totaled more than $600 million.

Dow formed its first joint venture, Dow Corning Corporation, in 1943. Today, joint ventures are an integral part of the Company's business model, providing access to key markets, growth geographies, new technologies and advantaged feedstocks, while at the same time lowering capital investment and reducing risk.

ーーー

Financial performance in

2006

In 2006, Dow's proportionate share of its nonconsolidated

affiliates' sales was substantial, almost $5.9 billion, an

increase of 7 percent compared with the previous year, despite

the divestiture or dissolution of two substantial joint ventures

during 2005 (DuPont Dow Elastomers L.L.C. and UOP LLC).

Equity earnings totaled $959 million in 2006, roughly unchanged

from $964 million in 2005, despite the divestitures noted above,

while cash distributions (principally dividends) increased 16

percent to $622 million. Dow's return on its average investment

in nonconsolidated affiliates was 38 percent, close to the level

of the prior two years.

Recent events

During the first nine months of 2007, Dow has advanced several

activities in the joint venture arena. These include:

| ・ | In April, the Company signed a Heads of Agreement with the National Oil Company of Libya to operate and expand the Ras Lanuf petrochemical complex. The venture is a strong example of Dow’s joint venture agenda for its Basics businesses - lowering capital investment while capturing the benefits of a strategic location and cost-advantaged feedstocks. |

| ・ | Also in April, Dow announced the execution of a Memorandum of Understanding with Chevron Phillips Chemicals, for a polystyrene and styrene monomer joint venture in the Americas. The joint venture would unite Dow’s industry-leading polystyrene activities with Chevron Phillips Chemicals’ solid position in styrene monomers. |

| ・ | In May, Dow announced the start of a detailed feasibility study with Shenhua Group for the construction of a world-scale coal-to-chemicals complex in the People’s Republic of China. |

| ・ | The same week, the Company signed a Memorandum of Understanding with Saudi Aramco to move further forward with the Ras Tanura chemicals and plastics production complex in Saudi Arabia. KBR was subsequently appointed as the project management company for the feasibility study. |

| ・ | And in July, Dow signed a Memorandum of Understanding with Crystalsev, one of Brazil's largest ethanol producers, to form a joint venture to design and build a world-scale facility to manufacture polyethylene from sugar cane. |

Principal nonconsolidated

affiliates

Although Dow participates in many joint ventures, the most

significant joint ventures from a financial perspective are:

| Compania MEGA S.A. | Dow Corning | EQUATE Petrochemical | |

| Formed: | 1997 (in operation since 2001) | 1943 | 1995 |

| Ownership: | Dow

28% Repsol YPF 38% Petrobras 34% |

Dow

50% Corning 50% |

Union

Carbide 42.5% Petrochemical Industries Co. K.S.C. 42.5% Boubyan Petrochemical Co. K.S.C. 9% Al-Qurain Petrochemical Industry Co. K.S.C. 6% |

| Headquarters: | Buenos Aires, Argentina | Midland, Michigan, U.S.A | Jleeb Al-Shyoukh, Kuwait |

| Production

facilities: |

Loma

de la Lata and Bahia Blanca, Argentina |

worldwide | Shuaiba, Kuwait |

| Capacities: metric tons per year |

Ethane:

570,000 Propane: 390,000 Butane: 264,000 Natural gasoline: 229,000 |

(Silicones

and silicon-based products) capacities: Not applicable |

Polyethylene:

600,000 Ethylene glycol: 500,000 |

| 2006 revenues: | $690 million | $4.4 billion | $990 million |

| Equipolymers | MEGlobal | Univation Technologies LLC | |

| Formed: | 2004 | 2004 | 1997 (reorganized 2001) |

| Ownership: | Dow

50% Petrochemical Industries Company of Kuwait 50% |

Dow

50% Petrochemical Industries Co. K.S.C. of Kuwait 50% |

Union

Carbide 50% ExxonMobil Chemical 50% |

| Headquarters: | Horgen, Switzerland | Dubai, United Arab Emirates | Houston, Texas, U.S.A |

| Production

facilities: |

Ottana,

Italy and Schkopau, Germany |

Fort

Saskatchewan and Red Deer, Alberta, Canada |

|

| Capacities: metric tons per year |

PET: 485,000 | EG: 1,000,000 | (licenses

UNIPOL PE process technology to companies worldwide) |

| 2006 revenues: | $470 million | $2.4 billion | Not disclosed |

マレーシア(PETRONAS とのJV)

| OPTIMAL Olefins (Malaysia) Sdn Bhd |

OPTIMAL Glycols (Malaysia) Sdn Bhd |

OPTIMAL

Chemicals (Malaysia) Sdn Bhd |

|

| Formed: | 1998 | ||

| Ownership: | Union

Carbide 23.75% PETRONAS 64.25% Sasol Polymers International Investments 12% |

Union

Carbide 50% PETRONAS 50% |

Union

Carbide 50% PETRONAS 50% |

| Headquarters: | Kuala Lumpur, Malaysia | ||

| Production

facilities: |

Kertih, Terengganu, Malaysia | ||

| Capacities: metric tons per year |

Ethylene: 600.000 | Ethylene glycol: 385,000 | Butanol: 140,000 |

| 2006 revenues: | $810 million | ||

タイ(Siam Cement とのJV)

| Pacific

Plastics (Thailand) |

Siam

Styrene Monomer |

Siam

Synthetic Latex |

Siam Polystyrene | Siam Polyethylene | |

| Formed: | 1975 | 1988 | 1990 | 1993 | 1995 |

| Ownership: | Dow

49%; Siam Cement 48%; Others 3% |

Dow

49%; Siam Cement 49%; Others 2% |

|||

| Headquarters: | Bangkok, Thailand | ||||

| Production

facilities: |

Map Ta Phut Industrial Estate, Rayong Province, Thailand | ||||

| Capacities: metric tons per year |

Polyol | Styrene

monomer: 300,000 |

Latex | Polystyrene:

120,000 |

Polyethylene: 300,000 |

| 2006 revenues: | $890 million | ||||

Dow Officially Opens Complex at Asia

Industrial Estate; Marks 45th Anniversary of Dow in Thailand and 25th

Anniversary of SCG-Dow Joint Venture

The Dow Chemical Company officially announced the grand opening of its new

production complex in Asia Industrial Estate (AIE), Ban Chang, Rayong province.

This comes at the same Dow marks its 45th anniversary in Thailand and the 25th

anniversary of the SCG-Dow partnership, part of the SCG-Dow Group. A portion of

an investment totaling more than USD $3 billion, the new production complex is a

joint venture project between Dow, SCG and Solvay S.A.

under the project named ‘Thai Growth Project.’

The project, which was announced in 2006, has involved the building of

world-class production facilities including an advanced naphtha cracker plant

operated by Map Ta Phut Olefins Co., Ltd. (JV between Dow

and SCG Chemicals), and downstream facilities to produce

polyethylene (SPEII),

specialty elastomers, propylene oxide and hydrogen

peroxide, operated by Solvay. The successful completion of all plants

under the ‘Thai Growth Project’ today makes Thailand Dow’s largest manufacturing

base in Asia Pacific.

State-of-the-art technology and an emphasis on achieving the highest levels of

environmentally-friendly production in operational processes throughout the

entire complex are the hallmarks of the Thai Growth Project, with the overall

aim of carbon footprint reduction in a sustainable industrial environment.

A recent example is the award-winning hydrogen peroxide to propylene oxide (HPPO)

technology invented by Dow and BASF that received both the 2010 Presidential

Green Chemistry Challenge Award and the 2009 Institution of Chemical Engineers'

Innovation and Excellence Award in Core Engineering. This breakthrough HPPO

technology uses simpler raw material integration and can achieve a 70-80%

wastewater reduction and 35% energy consumption reduction compared with existing

HPPO technology.

“The success of the Thai Growth Project has enabled Thailand to become the

largest Dow manufacturing hub in Asia Pacific and underlines Dow’s commitment to

continue long-term investment in Thailand,” said Andrew Liveris, Chairman and

Chief Executive Officer of The Dow Chemical Company. “This year, Dow is also

constructing a Propylene Glycol (PG) plant and ENLIGHT™ Polyolefin plant for

encapsulant films used in solar panels. The objective of these projects is to

expand Dow’s business portfolios, especially its specialty products, to address

the world’s evolving needs and to support Thailand’s economic development.”

Jirasak Singmaneechai, Managing Director of Dow Chemical Thailand, Ltd., said,

“The full operations of this new production complex not only support Thailand’s

economic growth but also help create jobs for local people. The continued growth

of Dow’s operations in Thailand and the company’s investment in world-class

petrochemical technology in the country will provide a strong platform for

competing in the often specialized international market, leading to sustainable

Thailand-based growth in the industry. For making this major opportunity

possible, I would like to thank our partners and all who have contributed to the

Thai Growth Project and to acknowledge the dedication of our employees, whose

commitment to safety has resulted in a record-breaking achievement of 41 million

man-hours with no lost injury time.”

Kan Trakulhoon, President and CEO of SCG, stated, “SCG is proud to be part of

the success in the Thai Growth Project with partner, Dow. This project

highlights Thailand’s high investment potential, making it the manufacturing

base for Thai and international investors. Several key factors that make

Thailand an attractive place to invest include our strategic location in the

ASEAN region, strong manufacturing clusters, good infrastructure, commitment to

research and development, and continuous support by the government. I am

confident that Dow and SCG Chemicals will continue to make Thailand a strong and

sustainable manufacturing base.”

Cholanat Yanaranop, President of SCG Chemicals Co., Ltd., a subsidiary of SCG,

stated, “SCG Chemicals is honored to be a part of Thai Growth Project’s success.

This success not only increases the integration of the naphtha cracker, operated

by Map Ta Phut Olefins Co., Ltd., and raises proportion of our high value added

products, but it also emphasizes the strong 25-year partnership between Dow and

SCG Chemicals and commitment to sustainable growth.”

Vincent De Cuyper, Group General Manager of Chemicals Sector and member of the

Executive Committee of Solvay, said, “Solvay is proud to be a partner in this

exciting world-class hydrogen peroxide plant in Thailand and looks forward to

continue sharing its hydrogen peroxide technology with Dow in other regions of

the world. Our new hydrogen peroxide unit represents the latest flagship of our

peroxide leadership technology. This investment in production facilities with a

strongly enhanced ecological footprint clearly shows Solvay's commitment to

sustainable development.”

Dow in Thailand - Thai Growth Project

In 2006, The Dow Chemical Company reinforced its commitment to Thailand by announcing that it would jointly invest in a naphtha cracker with Siam Cement Group. The Map Ta Phut Olefin Company (MOC) is closely located to the downstream plants. This new liquids cracker includes a metathesis unit to convert C4s to propylene. MOC started up successfully in March 2010.

By locating the cracker in close proximity to the joint ventures of the SCG-DOW Group, existing and new assets can be leveraged to create a source of advantaged raw materials for downstream derivative businesses.

This new investment will make Thailand Dow's largest manufacturing site in Asia and heralds Dow's third wave of investment in Thailand. It also sends a clear message that Dow is in Thailand to stay.

When it made that announcement, the company indicated the naphtha cracker would lead Dow and partners to develop a number of downstream facilities that would strengthen the Company's presence in Asia Pacific, support customer's business growth in the region and provide a competitive platform on which to develop a range of higher margin performance products.

By the end of 2008, Dow had announced multi billion dollar investments in five plants, which are collectively known as the Thai Growth Project.

Siam Polyethylene Co., SPE II

Special Elastomers

Propylene Oxide

Hydrogen Peroxide

Power, Utilities & Infrastructure

Rayong Terminal Co.,Ltd. ( RTC)

Map Ta Phut Olefins Co., Ltd. ダウは2006年10月、タイでサイアムセメントとのナフサクラッカーJV計画を進めると発表した。

サイアムの発表では、11億ドルを投じてRayongに新しいナフサクラッカーを建設するもので、能力はエチレン90万トン、プロピレン80万トン。サイアムが67%、ダウは33%出資する。

2006/10/24 ダウ、アジア進出を促進The Naphtha cracking units produces 900,000tpa of ethylene and 800,000tpa of propylene.

Downstream production plants include 400,000tpa of high density polyethylene (hdPE) and 400,000tpa of polypropylene. The plant commenced operations in March 2010.

Two new polyolefins plants, High Density Polyethylene (HDPE) and Polypropylene (PP), are the extension of existing plants and will produce polyolefins with total capacity 800,000 tons per year divided into HDPE 400,000 tons and PP 400,000 tons per year respectively.

When combined this new HDPE production capacity with existing plant, the production capacity of HDPE will be boosted to 960,000 tons per year, making SCG Chemicals the third largest HDPE producer in Asia. The production capacity of PP will also increase to 720,000 tons per year, which can accommodate the demand in the region.

Thai Polyethylene TPE (Thai Polyethylene)はサイアムセメント子会社。

Siam Polyethylene はサイアムセメントとダウのJV

19 January 2010 10:03 [Source: ICIS news]

Thailand’s petrochemical major Siam Cement plans to start trial production at its new 400,000 tonne/year high density polyethylene (HDPE) and 400,000 tonne/year polypropylene (PP) plants at Mab Ta Phut this month, company sources said on Tuesday.

The existing PE facilities consist of three HDPE plants with a combined capacity of 580,000 tonnes/year, a 100,000 tonne/year low density PE (LDPE) unit, and a 120,000 tonne/year linear LDPE (LLDPE) plant.

他に Siam Polyethylene

Dow 49%;

Siam Cement 49%;

Others 2%LLDPE 300千トン

ーーー

10 November 2010 08:57 [Source: ICIS news]

Thailand’s Siam Polyethylene has started commercial production at its new 350,000 tonne/year polyethylene (PE) plant in Mab Ta Phut, said an industry source familiar with the matter on Wednesday.

For the first year, the plant would produce C8 metallocene linear low density polyethylene (MLLDPE), which was earmarked for export especially for the Chinese market, he said.

The old 300,000 tonne/year LLDPE plant at the same site would produce C8 MLLDPE and C4 LLDPE, the source said.

TPP (Thai Polypropylene) 320 TPP (Thai Polypropylene)はサイアムセメント子会社。

Downstream production plants include 400,000tpa of high density polyethylene (hdPE) and 400,000tpa of polypropylene. The plant commenced operations in March 2010.

The production capacity of PP will also increase to 720,000 tons per year, which can accommodate the demand in the region.

----------------

Solvayは2011年10月5日、ダウとのJVのMTP HPJV (Thailand)が世界最大の過酸化水素プラントを稼働させたと発表した。生産能力は年産39万トンと世界規模

2007/8/3 Dow と Solvay、タイにHPPO用の過酸化水素製造のJV設立Dow Chemical は10日、タイのSiam Cement Group (SCG)とのJVの MTP HPPO Manufacturing がタイでPO工場の建設に着手したと発表した。2012年1月4日、正式スタートアップを発表。能力は39万トン。

2008/6/16 Dow、タイで過酸化水素法PO工場建設------------

Dow in Thailand - Businesses

タイ(Siam Cement とのJV)

Pacific Plastics

(Thailand)Siam Styrene

MonomerSiam Synthetic

LatexSiam Polystyrene Siam Polyethylene Formed: 1975 1988 1990 1993 1995 Ownership: Dow 49%;

Siam Cement 48%;

Others 3%Dow 49%;

Siam Cement 49%;

Others 2%Headquarters: Bangkok, Thailand Production

facilities:Map Ta Phut Industrial Estate, Rayong Province, Thailand Capacities:

metric tons per yearPolyol Styrene monomer:

300,000Latex Polystyrene:

120,000LLDPE:

300,000

What started in 1967 with a small sales office in downtown Bangkok has blossomed into one of Dow's largest operations in Asia-Pacific.

Our products are used in the manufacture of many everyday objects. From the moment we wake up and take a shower, then head off to work, where we use labor-saving devices, we are using materials from petrochemical industry. No wonder we like to say that Dow is a part of everyday life for people all around the world. Our five main businesses in Thailand are:

SCG Dow Group Plants:

*Siam Synthetic Latex Co., Ltd. (SSLC)

(Styrene Butadiene Latex Plant)Start up: 1993

Product : Synthetic Latex(Specialty Elastomers Plant)

Start up: 2011

Product: Specialty Elastomers, AFFINITY™ Polyolefin Plastomers and ENGAGE™ Polyolefin Elastomers*Siam Polystyrene Co., Ltd. (SPCL)

(Polystyrene Plants)Start up: 1995

Product: Polystyrene*Siam Styrene Monomer Co., Ltd. (SSMC)

(Styrene and Ethyl Benzene Plants)Start up: 1997

Product: Styrene Monomer and Ethyl Benzene*Siam Polyethylene Co., Ltd. (SPE)

(SPE I)Start up: 1999

(SPEII)

Start up: 2010

Product: Higher Alpha Olefins Linear Low Density Polyethylene

*Map Ta Phut HPPO Manufaturing., Ltd. (MTP HPPO)

(Propylene Oxide Plant)Start up: 2011

Product: Propylene OxideDow Chemical Thailand Ltd.(DCTL)

(Polyol and Formulated Polyol Plant)Start up: 1993

Product: Polyols and Formulated PolyolsCarbide Chemical (Thailand) Ltd.

(Synthetic Latex Plant)Start up: 1995

Product: Synthetic LatexRohm and Haas Chemical (Thailand) Ltd.

*Emulsion PlantStart up: 1996

Product: Acrylic Emulsion*Poly-Acrylic Acid (PAA) Plant

Start up: 1999

Product: Poly-Acrylic Acid Solution*HPJV (JV between Dow and Solvay)

Start up: 2011

Product: Hydrogen PeroxideDow AgroSciences (Thailand) Ltd.

imports and distributes agricultural chemical and urban pest management products (herbicides, insecticides, and fungicides). The major markets for chemical include crops, such as rice, vegetables, field crops and fruit trees, while pest management focuses on termite control.

Main Project Financing Completed for Sadara

The Dow Chemical Company today announced the signing of the main financing for

the Sadara project.

Sadara Chemical Company (Sadara), Dow’s joint

venture with Saudi Arabian Oil Company (Saudi Aramco), entered into definitive

agreements with certain export credit agencies, commercial banks and the Public

Investment Fund of the Kingdom of Saudi Arabia for approximately

$10.5 billion of additional project financing. The financing supplements

the $2 billion raised through a Sukuk Islamic bond

issuance in April, 2013, bringing the total Sadara project financing

raised to approximately $12.5 billion, which will be used to fund the

construction and start-up of the joint venture(建設費 $19.3 billion).

Financial close of the project financing is expected to occur in the third

quarter of this year.

DowとSaudi Aramcoは7月25日、両社の取締役会が、サウジのJubail Industrial Cityにワールドクラスの統合石化コンプレックスを建設するJVの設立を承認したと発表した。

JVの名称は "Sadara Chemical Company"(Forefront Chemical Companyの意味)で、一部を公募し(2014年初めを予定)、残りを両社が均等出資する。(Dowは一部を技術供与などの形で出資する)

総投資額は200億ドルと見込み、自己資本で35%、輸出信用機関や金融機関からの借入金で65%を賄う。2011/7/26 DowとSaudi Aramco、石油化学JV設立を最終決定

米国のEx-Im Bankは9月27日、アラムコとダウのJVのサウジの石油化学会社 Sadara Chemical に対し、過去最大の49億75百万ドルの直接融資を承認したと発表した。

2012/10/2 米国Ex-Im Bank、アラムコとダウのサウジJVに過去最大の49億75百万ドルを融資April 2, 2013

Sadara Chemical Company (Sadara) announced the successful closing of the sukukイスラム債 issued through its subsidiary Sadara Basic Services Company (SBSC). The sukuk has received strong investor demand, resulting in 2.6 times oversubscription based on the initial offering size of SR 5.25 billion. In keeping with this demand, Sadara has up-sized the issuance to SR 7.5 billion ($2 billion).

The sukuk have a floating rate and will have a tenor of approximately 16 years. The sukuk investors will receive an expected return of 6 month SAIBOR(Saudi Arabia Interbank Offered Rate) plus 95 basis points per annum, to be distributed semi-annually.

The net proceeds of the issue of the sukuk will be used to provide finance for, and procure the construction and delivery of, plants forming part of a chemicals complex located in Jubail Industrial City II in the Eastern Province.---

The split between the different portions of the facility were changed from an original outline released in May 2012 after the success of the sukuk, which was completed at the start of April, two of the bankers said.

Sadara raised 7.5 billion riyals ($2 billion) from the local currency Islamic bond, having increased the deal size from 5.25 billion riyals on strong demand from investors.

Also included is a $4.975 billion direct loan from the U.S. Export-Import Bank. Signed in September, it was the largest ever loan from the institution.

“Securing the financing for this historic

project is the achievement of a significant and critical milestone,” said Andrew

N. Liveris, Dow’s chairman and chief executive officer. “Sadara is a cornerstone

of Dow’s growth strategy. The joint venture will introduce a differentiated

product slate from a competitive, low-cost position which will transform the

landscape of our industry and the chemicals and plastics sector in Saudi

Arabia.”

“The response to the Sadara joint venture financing has been very strong,” said

Bill Weideman, Dow’s executive vice president and chief financial officer. “This

high-quality investment is expected to provide a competitive cost position for

the Company, while capturing customer demand in emerging regions and driving

high-margin, sustainable global growth.”

The formation of this joint venture is a major step forward in Dow’s strategy to

drive long-term profitable growth in its downstream, innovation-driven

businesses and in fast-growing regions such as Asia Pacific, the Middle East and

Africa, and Eastern Europe. The joint venture is expected to deliver EBITDA

margins of 35-40 percent and a stream of equity earnings for Dow averaging $500

million annually during the first 10 years following its start-up.

Sadara is building a world-scale, fully integrated chemicals complex in Jubail

Industrial City II, Kingdom of Saudi Arabia. The complex will be comprised of 26

manufacturing units, will possess flexible cracking capabilities and is expected

to produce more than 3 million metric tons of high-value performance plastics

and specialty chemical products. The first production units are expected to come

on-line in the second half of 2015, with full production starting in mid-2016.

総勢約40行の銀行団は主導役を果たした三井住友など邦銀勢のほか、英HSBCやドイツ銀行の欧州銀、米大手銀、中東各国の銀行で構成。

This phase of the financing involved the participation of seven export credit agencies, including COFACE (of France), Euler Hermes (of Germany), FIEM (of Spain), K-Exim and K-sure (both of Korea), UK Export Finance (of the United Kingdom) and US Ex-Im Bank (of the United Sates). The lenders included Saudi Arabia’s Public Investment Fund, as well as Saudi and international commercial banks and Islamic institutions participating in Wakala and Procurement facilities.

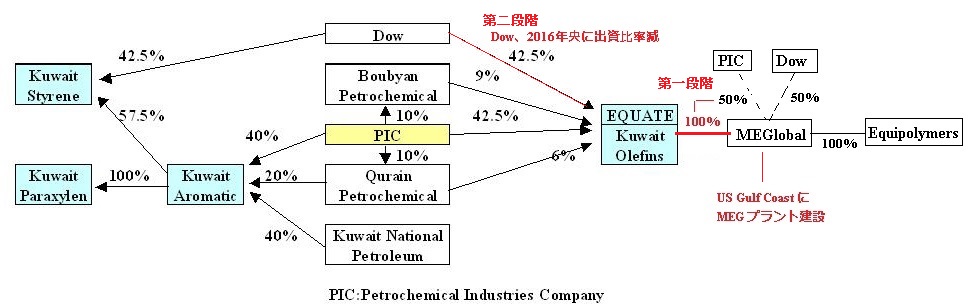

Dow to Reduce Equity Base in Kuwaiti Joint Ventures

“We have been reviewing every aspect of our joint venture portfolio through our best-owner mindset, with the primary objective of identifying opportunities to deliver further value to our shareholders,” said Andrew N. Liveris, Dow’s chairman and chief executive officer. “As a result of that analysis, we plan to reduce our equity position in MEGlobal and Equate. This strategic action allows us to redeploy capital to more strategic purposes, while still maintaining our commitment to these industry-leading joint ventures, which will continue to be an integral component of our strategy to be low-cost and integrated in key products.”

MEGlobal is a world leader in the manufacture and marketing of monoethylene glycol and diethylene glycol (EG), and is headquartered in Dubai, UAE. Established in July 2004, MEGlobal currently markets over 2.5 million metric tons of EG per year globally. EG is used as a raw material in the manufacture of polyester fibers (clothing and other textiles), polyethylene terephthalate (PET) resins, antifreeze formulations and other industrial products. MEGlobal is a joint venture between Dow and Petrochemical Industries Company (PIC) of Kuwait.

(1) MEGlobal

MEG、DEGの製造販売で、ダウのカナダの2工場 (合計能力100万トン)を移管した。他社製品の販売も行っている。

Fort Saskatchewan EO/EG plant 340千トン

Prentiss I EO/EG plant 310千トン

Prentiss II EO/EG plant 350千トン(2) Equipolymers (現在はMEGlobal の100%子会社)

工場 PTA PET Schkopau, Germany 335千トン

No.1:160千トン

No.2:175千トンOttana, Italy (190千トン) (160千トン) 売却 イタリアの工場は2010年7月、同地で発電所と用役工場を運営しているOttana Energia とタイのIndoramaのJVに売却した。

Established in 1995, EQUATE is the operator of an integrated world-scale manufacturing facility producing more than 5 million tons annually of high-quality petrochemical products, including polyethylene, ethylene, and EG, that are marketed throughout the Middle East, Asia, Africa and Europe.

Formed in 2004, The Kuwait Olefins Company (TKOC) is an international joint venture among Dow, Petrochemical Industries Company (PIC), Boubyan Petrochemical Company (BPC) and Qurain Petrochemical Industries Company (QPIC). EQUATE is the single operator of Greater EQUATE, which includes TKOC, TKSC, and Kuwait Paraxylene Production Company (KPPC) under one fully integrated operational umbrella at Kuwait’s Shuaiba Industrial Area.

10/22/2015

Dow to Optimize Its Ownership in Kuwaiti Joint Ventures, Expands Relationship

with Greater EQUATE on U.S. Gulf Coast

The Dow Chemical Company today announced it intends to restructure its participation in its group of Kuwaiti Joint Ventures with the objective of optimizing its investment and expanding its relationship with Greater EQUATE on the U.S. Gulf Coast. This announcement aligns with Dow’s prior stated commitments to optimize its investments in certain joint ventures.

The optimization is expected to occur in two

phases.

Under the first phase, EQUATE would acquire MEGlobal

for a total equity consideration of $3.2 billion. The transaction will result in

Dow receiving $1.5 billion in pre-tax proceeds.

Following completion of this acquisition, which is expected to close by year-end

2015, Dow will retain a 42.5 percent ownership stake in MEGlobal through its

ownership of Greater EQUATE. This acquisition is also expected to drive

efficiencies and cost savings due to existing synergies between MEGlobal and

EQUATE.

In the second phase, Dow and PIC have agreed that Dow will further reduce its overall ownership interest in Greater EQUATE. The target to complete this second phase of the transaction is mid-2016.

In a related move, MEGlobal will build an MEG plant on the U.S. Gulf Coast – enabling MEGlobal and its parent companies to enjoy growth in a highly strategic region of the world and drive significant expansion of MEGlobal’s geographic footprint and capacity. Final location of the asset is contingent upon pending incentives.

“This announcement demonstrates Dow’s commitment to evaluate our joint venture portfolio to unlock value for shareholders and simultaneously expand our relationship with a key strategic partner,” said Andrew N. Liveris, Dow’s chairman and chief executive officer. “This transaction allows Dow to maximize shareholder value, while maintaining our commitment to these industry-leading joint ventures.”

MEGlobal is a world leader in the manufacture and marketing of monoethylene glycol and diethylene glycol (EG), and is headquartered in Dubai, UAE. Established in July 2004, MEGlobal currently markets over 2.5 million metric tons of EG per year globally. EG is used as a raw material in the manufacture of polyester fibers (clothing and other textiles), polyethylene terephthalate (PET) resins, antifreeze formulations and other industrial products. MEGlobal is a joint venture between Dow and Petrochemical Industries Company (PIC) of Kuwait.

Established in 1995, EQUATE is the operator of an integrated world-scale manufacturing facility producing more than 5 million tons annually of high-quality petrochemical products, including polyethylene, ethylene, and EG, that are marketed throughout the Middle East, Asia, Africa and Europe. Formed in 2004, The Kuwait Olefins Company (TKOC) is an international joint venture among Dow, Petrochemical Industries Company (PIC), Boubyan Petrochemical Company (BPC) and Qurain Petrochemical Industries Company (QPIC). EQUATE is the single operator of Greater EQUATE, which includes TKOC, The Kuwait Styrene Company (TKSC), and Kuwait Paraxylene Production Company (KPPC) under one fully integrated operational umbrella at Kuwait’s Shuaiba Industrial Area.

参考 2014/11/17 Dow、非戦略事業の売却を拡大、KuwaitのPICとのJVの出資を減らす

Dow Delivers Progress on JV Consolidation Commitments

The Dow Chemical Company announced that it has finalized the transaction to sell its ownership interest in MEGlobal to EQUATE Petrochemical Company K.S.C. and has received $1.5 billion in pre-tax proceeds. Dow had previously announced its intent to optimize its ownership in its Kuwaiti Joint Ventures and the closure of this transaction represents progress toward delivering this commitment.

In the second phase, Dow and PIC have agreed that Dow will further reduce its overall ownership interest in Greater EQUATE. The target to complete this second phase of the transaction is mid-2016.

“This is a significant step in our Kuwaiti JV consolidation activities and demonstrates Dow’s drive to review our entire joint venture portfolio with a best-owner mindset, with the objective of delivering maximum value to our shareholders,” said Andrew N. Liveris, Dow’s chairman and chief executive officer. “This transaction enables Dow to maintain our commitment to these long-standing joint ventures, while returning value to our owners.”

MEGlobal is a world leader in the manufacture and marketing of monoethylene glycol and diethylene glycol (EG), and is headquartered in Dubai, UAE. Established in July 2004, MEGlobal currently markets over 2.5 million metric tons of EG per year globally. EG is used as a raw material in the manufacture of polyester fibers (clothing and other textiles), polyethylene terephthalate (PET) resins, antifreeze formulations and other industrial products. MEGlobal is a joint venture between Dow and Petrochemical Industries Company (PIC) of Kuwait. Through its ownership interest in EQUATE, Dow retains a 42.5 percent ownership stake in MEGlobal.

Established in 1995, EQUATE is the operator of an integrated world-scale manufacturing facility producing more than 5 million tons annually of high-quality petrochemical products, including polyethylene, ethylene, and EG, that are marketed throughout the Middle East, Asia, Africa and Europe. Formed in 2004, The Kuwait Olefins Company (TKOC) is an international joint venture among Dow, Petrochemical Industries Company (PIC), Boubyan Petrochemical Company (BPC) and Qurain Petrochemical Industries Company (QPIC). EQUATE is the single operator of Greater EQUATE, which includes TKOC, The Kuwait Styrene Company (TKSC), and Kuwait Paraxylene Production Company (KPPC) under one fully integrated operational umbrella at Kuwait’s Shuaiba Industrial Area.