トップページ

Asia Chemical Weekly

2003-12-12

Saudi NIC, Al-Zamil to jointly develop new C2 at Al-Jubail

National Industrialisation Co (NIC) and the Al-Zamil Group are to combine their efforts to build

a cracker in Al-Jubail, Saudi Arabia, company sources said.

It was earlier understood that both companies were pursuing

their cracker projects separately. NIC had planned to build

an ethane/propane cracker for startup in the first half of

2007.

The Al-Zamil Group holds an 11% stake in Saudi International

Petrochemical Co (Sipchem) - originally believed to be the

former's vehicle for petrochemical investments - which had

earlier expressed interest in building a cracker.

It emerged last week that the Al-Zamil Group will set up a

new company, Zamil Petrochemical Co, in the next couple of

months to partner NIC's subsidiary, National Petrochemical

Industrialisation Co (NPIC) for the ethane/propane cracker

project. The Al-Zamil Group will own more than 10% of Zamil

Petrochemical, and local investors the rest.

September 2, 2004 CHEMICAL

WEEK

Saudi firm issues preliminary bids for olefins complex.

Sahara Petrochemical and its partners, National

Industrialization Co (NIC) and Saudi International

Petrochemical Co. (Sipchem) have issued preliminary bids for

a their olefins complex at Al Jubail, Saudi Arabia. The

complex will be based on ethane and propane feedstock, and

have capacity of over 1 M tonnes/y ethylene. It is due onstream in 2007. Fluor

Daniel is to provide project management consultancy services.

Sahara has invited ABB Lummus Global, Kellogg Brown &

Root, Linde, Stone & Webster, and Technip to submit

proposals for the provision of technology and engineering.

Sahara is also building a 450,000 tonnes/y

propane dehydrogenation plant and a 450,000 tonnes/y PP plant

at Al Jubail.

↓

Sipchem が実施

Sipchem Launches its Olefins

& Derivatives Complex

2004-3-5 Asia Chemical

Weekly

Gacic offered BDO plant contract

to Kvaerner

Gulf Advanced Chemical Industries Co

(Gacic) has signed a lump

sum contract with Aker Kvaerner to build its 75 000 tonne/year

butanediol (BDO) plant at Al Jubail, Saudi Arabia for start-up in December

2005.

Gacic confirmed that the technologies to be used in the project

will be provided by Davy Process Technology, Huntsman Corp and

UOP. The Huntsman technology will be the proprietary butane-to-maleic anhydride (MAH) system.

The technology provided by Davy will use the MAH to produce BDO.

November 28, 2005

Sipchem

Sipchem affiliate GACIC Starts Production at its 75,000TPA

Butanediol Project

Saudi International Petrochemical Company (Sipchem) has

announced that its affiliate Gulf Advanced

Chemical Company Ltd (GACIC) commenced production at its

Butaindiol (BDO) plant in Jubail, Saudi Arabia. The project

took just under 33 months to complete by its prime contractor

Aker Kvaerner of the Netherlands. The technology for the

plant was provided by Huntsman Corporation and Davy Process

Technology as well as UOP that provided the technology for

the reverse butamer unit. This is the first BDO plant in the

Middle East.

The plant successfully started initial production in October

2005 and is now going on stream with a total

capacity of 75,000 tons per year to meet the growing

demand for BDO and derivates in the world and domestic

markets.

No industrial lost time injury was recorded during the

construction and commissioning of the plant, which resulted

in a world class safety record achievement.

Dr. Abdelaziz A. Al-Gwaiz, GACIC Chairman expressed his

thanks and appreciation to the project team, contractors, and

the company’s operation and support

services personnel for their efforts focused on attaining

such eventful results, including the strict application of

safety, health and environmental regulations, and the

start-up of the project.

GACIC is majority owned by Sipchem, in joint venture with the

Public Pension Agency, GOSI, Huntsman Corp., Davy Process

Technology, Sabih Tahir Darwish Al Masri, and A.S. Albabtain

& Company.

Saudi International Petrochemical Company is a joint stock

company founded on December 22, 1999 with the aim of

investing in the fields of petrochemicals, chemicals and

basic hydro-carbon industries towards increasing national

productivity and expanding industrial development. The

Company’s first venture, a one million

ton per year methanol plant, began production a year ago.

With the Methanol Plant (IMC) and the BDO Plant (GACIC)

already on stream, the Company is currently on track to

setting up other projects, including the Acetyls Project

comprising three plants that it has planned to commence

operation by the 4th quarter 2008.

日本経済新聞 2004/5/8

住化発表

住友化、サウジ合弁 エチレン生産 3000億円投資

住友化学工業はサウジアラビア国営石油会社のサウジアラムコと合弁で、同国に石油精製品から石油化学製品までを一貫生産する大型プラントを建設する。今月中に両社で事業化調査を開始、2008年にも新プラントを立ち上げる。石化製品の基礎原料であるエチレンを年間100万トン生産する設備を設ける計画で、総投資額3千億円強の巨額プロジェクトになる見通し。

事業候補地はアラムコの石油精製設備がある紅海沿岸のラビ。

朝日新聞 2004/5/8

住友化学がサウジに世界最大級のプラント 数千億円投資

住友化学工業は7日、サウジアラビアに現地国営企業と合弁で、石油精製・石油化学の一貫プラントを建設する方針を固めた。世界最大級の年産百数十万トン規模のエチレンプラントをはじめ、国際市場に輸出する石化製品を一貫して作る大規模コンビナートを建設する。投資額は日本の石化メーカーとしては過去最大の数千億円となる模様だ。イラク情勢の悪化やアジアでの需要急増で原油価格や石油製品価格が上昇する中、安定的に資源を確保する取り組みとして、経済産業省も歓迎しており、政府として後押しする構えだ。

Dow Jones 2004-3-16

Japan Sumitomo Chem May Build

Mideast Cracker Project

Japan's Sumitomo Chemical Co. may be in negotiations with several

Middle East petrochemical companies to build an ethylene cracker

this year, industry sources familiar with the issue said.

Sources said it is more likely Sumitomo will secure a project in

Saudi Arabia given that it has already been shortlisted as one of

the possible partners for Saudi Arabian Oil Co.'s (SOI.YY)

planned Rabigh

petrochemical project. (下記)

http://www.tradepartners.gov.uk/oilandgas/saudi_arabia/profile/overview.shtml

Aramco is making its first

foray into the domestic petrochemical sector - Rabigh

expansion. Three companies have been shortlisted for this US$3,000

million 50:50 joint venture - Saudi Basic Industries Company

(Sabic), US' Dow Chemicals and Japan's Sumitomo Chemicals.

MOU for the project expected early January 2004 and once a

J/V partner has been appointed, a tender will be issued for

the FEED.

MEED 2003/9/12

Three in talks on Rabigh expansion

Saudi Aramco has shortlisted three international companies on

the estimated $3,000 million project to upgrade the kingdom's

largest refinery at Rabigh and add a petrochemical complex at

the site. Aramco, which is aiming to sign a memorandum of

understanding (MOU) for the project in early 2004, plans to

set up a 50:50 joint venture with at least one company to

carry out the expansion of the 325,000-barrel-a-day

hydroskimming export refinery at Rabigh.

In addition to expanding the refinery, the joint venture will

set up an ethane cracker with capacity of at least 1 million tonnes a

year of ethylene, which

will be used at feedstock for the production of polyolefin.

The new complex will be

located next to the existing refinery and will also include a propane

dehydrogenation (PDH) unit at the refinery for the production of

polypropylene.

Feedstock for the cracker

will be pumped from the Eastern Province via the east-west

pipeline.

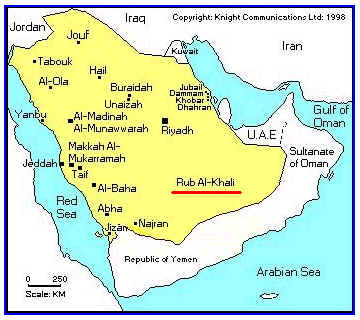

Saudi map

http://www.the-saudi.net/saudi-arabia/saudi-map.htm

2004/5/9 住友化学 事前報道 共同発表

解説ほか 調印式

サウジ・アラムコとサウジアラビア(ラービグ)での石油精製・石油化学事業開発の共同企業化調査実施の件

http://www.sumitomo-chem.co.jp/japanese/gnews/news_pdf/20040509_1.pdf

住友化学は本日、サウジアラビアン・オイル・カンパニー(サウジ・アラムコ)との間で、サウジアラビア紅海沿岸のラービグにおける石油精製と石油化学との統合コンプレックス開発計画(ラービグ計画)について基本的な枠組みを定めた覚書を締結しました。両社は今後、共同してフイージビリテイ・スタデイー(企業化調査)を実施し、その中で、計画の実現に向けての詳細について検討してまいります。投資額は、現在のところ約43億米ドルと予想しています。

【計画の概要】

両社は、本計画の事業主体として共同出資会社を設立します。サウジ・アラムコは、現在、ラービグにおいて所有する日量40万バレルの原油処理能力を持つ製油所をインフラも含めてこの会社に移管します。新会社は、これに加え新たに世界最大級のエタンクラッカーと流動接触分解装置(FCC)、さらに、エチレン、プロピレン各誘導品の生産プラントを新設します。この結果、これまで生産してきたナフサや重油などの石油精製品に、エチレン、プロピレンとその誘導品およびガソリンが新たな生産品目として加わります。年間生産能カはエチレンが130万トン、プロピレンが90万トンであり、その全量を石油化学誘導品の生産に充当する予定であります。

本計画に予定されている石油化学誘導品としては、次のものがあります。

| 1) |

|

ポリエチレン(PE)2系列(住友化学技術による新型ポリエチレン(EPPE)を含む)

なお、合計年産能力は約75−90万トンの予定 、→EPPE 25万トン、LLDPE 35万トン、HDPE 30万トン |

| 2) |

|

ポリプロピレン(PP)2系列で、合計生産能カは70万トン

ホモポリマー、ブロックコポリマー、ランダムコポリマー、ターポリマーのフルレンジをカバーし、コンパウンドも予定

コンパウンドの能カはフイージビリテイ・スタデイーで検討、決定予定 |

| 3) |

|

住友化学の技術によるプロピレンオキサイドまたは他のプロピレン誘導品

能力はフィージビリティ・スタディーで検討、決定予定 →

PO 20万トン |

| 4) |

|

上記以外のエチレン誘導品(侯補としてエチレングリコール、アルファオレフイン等)については、フィージビリテイ・スタデイーで検討、決定予定 →EG

60万トン |

サウジ・アラムコは、本共同出資会社に日量40万バレルの原油、95百万立方フィートのエタン、10〜15千バレルのブタンを供給します。一方、住友化学は多岐にわたる独自の石油化学製品の生産技術とアジア全体に及ぶ販売網を提供します。

Rabigh Refinery

http://www.saudiaramco.com/The Rabigh Refinery is

located on Saudi Arabia's west coast.

The Rabigh

Refinery is a 400,000 BPD crude topping facility located

160 kilometers north of Jiddah. Crude is

delivered by tanker through the Saudi Aramco Rabigh

port which has two berths. The main products are fuel oil

with a 38.1 percent yield, naphtha at a 19.4 percent

yield and jet fuel/kerosene at a 9.3 percent yield. LPG

and oil are used as fuel for the refinery recovered

sulfur is bagged and shipped.

A terminal

and its associated facilities are located outside the

refinery's security fence, 1.5 kilometer from the process

units. The entrance to the terminal has been dredged to a

depth of 28 meters, and two berths to a depth of 27

meters, to handle vessels up to 325,000 DWT.

Other

facilities include a 42,000 gallon-per-minute (MGPM)

waste water treatment plant, a 90-Megawatt power plant, a

1725 gallon per minute (GPM) desalination plant and a

560,000 lbs/hr steam plant. On-site tankage for crude,

naphtha, jet fuel, gas oil and fuel oil totals 3.47

million barrels. Housing for the workforce is provided by

a Saudi Aramco facility located some 20 kilometer north

of the main refinery.

Saudi Aramco

has increased the capacity of the Rabigh Refinery by

nearly 25 percent, from a design rate of 325,000

barrels per day (bpd) to 400,000 bpd. The increase

was completed on schedule after a 45-day test and

inspection. The project improved the refinery's crude

oil transfer system and upgraded furnace firing and

crude distillation unit (CDU) efficiency. Crude oil

is heated in the furnace and then sent to

fractionation columns in the CDU, where refined

products are separated out on trays at various

temperatures.

The

refinery, located on the Red Sea, produces naphtha,

kerosene, heavy and light gas oil, and heavy fuel oil

for the domestic market and for export.

1996/11/21

Alexander's Gas & Oil Connection

$ 2 bn Saudi Aramco Rabigh refinery upgrade PMC

tender

http://www.gasandoil.com/goc/company/cnm64801.htm

Saudi Aramco has

invited firms to bid for the project management

contract (PMC) on the estimated $2 billion upgrade of

its Rabigh oil refinery. The upgrade programme,

scheduled to be completed in the year 2000, will

increase the Red Sea plant's gasoline and kerosene

yields and reduce debottlenecking and heavy product

yields. The upgrade aims to enable the refinery to

operate at its full capacity on completion of the

project in 2000. Planning is expected to take nine

months with construction beginning in 1998. The PMC

was tendered much earlier than expected, possibly due

to an improvement in Aramco's cashflow from higher

than expected oil prices. PMC bids are due by the

middle of December. Some 280,000 barrels per day

(bpd) of Saudi crude is run at the refinery, well

below design capacity of 325,000 bpd because of the

plant's configuration and large surplus fuel oil

output. Despite its size, the plant is one of the

kingdom's least sophisticated and most inefficient

refineries.

| The Rabigh

Refinery is a 400,000 BPD crude topping facility

located 160 kilometers north of Jiddah. Crude is

delivered by tanker through the Saudi Aramco

Rabigh port which has two berths. The main

products are fuel oil with a 38.1 percent yield,

naphtha at a 19.4 percent yield and jet

fuel/kerosene at a 9.3 percent yield. LPG and oil

are used as fuel for the refinery recovered

sulfur is bagged and shipped. |

MEEDS情報

エタンクラッカーの原料は東部地区から東西パイプラインで送られる。アラムコでは2本の東西パイプラインの小さい方をガスを西部地区に運ぶよう転用する計画。転用のためのコストは8億ドル程度。新しいパイプラインが東西パイプラインとラービグをつなぐ。

|

2004/5/9 Saudi Arabian Oil Company/Sumitomo

Chemical Company

Saudi

Aramco/Sumitomo Chemical signing ceremony

http://www.sumitomo-chem.co.jp/english/gnews/news_pdf/20040509_1.pdf

Agreement of the Parties

The parties have successfully negotiated a Memorandum of

Understanding that sets forth the agreement between Saudi Aramco

and Sumitomo regarding the key parameters of the Project, the

Project configuration, and a broad range of the major technical,

commercial, legal, and financial terms.

As the next step in the Project development process, the parties

have agreed to undertake a comprehensive Joint Feasibility Study

which will, among other things, confirm the capital and operating

costs of the proposed Project. The definitive documents to

implement the Project will be negotiated in parallel with the

Joint Feasibility Study.

The Project

Saudi Aramco and Sumitomo have agreed to form a Joint Venture

company with equal ownership. In addition to its world-class

capabilities in hydrocarbon production and refining, and its

decades-long collaboration with the Kingdom's petrochemicals

industry, Saudi Aramco will supply the Rabigh Project with

400,000 barrels per day of crude oil, 95 million standard cubic

feet per day of ethane and 10,000 to 15,000 barrels per day of

butane. Sumitomo will provide its extensive and proprietary

petrochemical technology and marketing base to the venture.

The initial plans for the Project include, as the centerpiece of

the expanded site, a high olefins yield fluid catalytic cracker

complex integrated with a world scale, ethane based cracker,

producing approximately1.3 million tons per year of ethylene,

900,000 tons per year of propylene, and 80,000 barrels per day of

gasoline as well as other refined products. Petrochemical units

are to be included to convert all of the olefin production to

downstream products. The Project would be targeted for startup in

late 2008.

The following olefin derivative

units are included in the Project configuration:

| 1. |

Two LLDPE

units, one of which will be Sumitomo’s proprietary Easy Processing

Polyethylene unit. The total capacity is expected to be

approximately 750,000 - 900,000 tons per year; |

| 2. |

Two

polypropylene units with a total capacity of 700,000 tons

per year, producing a full range of polypropylene

polymers - homopolymer, block copolymer, random, and

terpolymer. A polypropylene compounding unit with a

capacity to be confirmed during the Joint Feasibility

Study is also included; |

| 3. |

A propylene

oxide unit utilizing Sumitomo’s proprietary oxidation technology

or other propylene derivative units with a capacity to be

confirmed during the Joint Feasibility Study; and |

| 4. |

Other

ethylene conversion units such as Mono-Ethylene Glycol

(MEG) and Alfa-olefin are proposed as candidates to

consume the balance of the ethylene. The selection and

size of these derivative units will be confirmed during

the Joint Feasibility Study. |

The companies

will retain a Project Management Services Contractor and other

necessary advisors to proceed as quickly as possible with the

execution of the Project.

Saudi Arabian Information

Resource 2004/3/1

Sahara Petrochemical Company

New Petrochemical Company has SR1.5 billion capital

http://www.saudinf.com/main/y6813.htm

The Riyadh-based Al-Zamil Group has

established Sahara Petrochemical Company, with a capital of SR1.5 billion, to

invest in the Kingdom’s

petrochemical industry.

Al-Zamil Group has completed all formalities to establish a new

holding company that will invest in the petrochemicals sector of

the Kingdom, according to a press statement issued by Al-Zamil

Group.

The company will be capitalized at SR1,500 million (US$400

million) and shares will be floated for the private placement has

already been oversubscribed by SR1 billion (SR1,000 million), the

statement said. The remaining sum of SR500 million will be open

for public offering, managed by the Riyadh-based Consulting

Centre for Finance and Investment (CCIF), of which Abdurrahman

Al-Zamil is President.

Al-Zamil, Chairman of Al-Zamil Group, signed agreements with

Riyadh Bank, the National Commercial Bank and the Saudi-American

Bank (Samba) authorizing them to receive public requests for

shares.

Sahara Petrochemical Company will invest in two petrochemical

projects in Jubail. The first project will produce polypropylene

in partnership with Bassell. The second project will establish an ethylene complex in collaboration with national and

international partners, the press statement said.

Asia Chemical Weekly 2004/3/5

Saudi's Al-Zamil forms new

company for PDH-PP project

Saudi Arabia's Al-Zamil Group has formed a new company which

will have an equity interest in a propane-dehydrogenation

(PDH)-polypropylene (PP) project and a planned cracker

complex, both in Al-Jubail, a company source said.

The new company - named Sahara Petrochemical Co - has been capitalised at SR1.5bn

(US$400m/Euro321.6m). Shares of the company have been offered

for private placement by local investors.

The Al-Zamil Group originally wanted to name the company as

Zamil Petrochemical, but changed the name to Sahara because

of government regulations over the usage of a family name in

a public company. The size of the Al-Zamil Group's stake in

Sahara was not immediately clear.

Sahara will form a joint venture with Basell for the PDH-PP

project following a memorandum of understanding signed last

October between the Al-Zamil Group and Basell. The project

will produce 450 000 tonne/year of PP. Mechanical completion is scheduled

for 2007. 調印

The new PP plant will use

Basell's Spheripol process technology.

Sahara will also be investing jointly with local company National Petrochemical

Industrialisation Co (Tasnee Petrochemicals) for a cracker complex which will use

ethane and propane as feedstocks. Both companies are expected

to partner a foreign major for the project. However, the

Zamil source declined to reveal the name of the third

partner. Market speculation has it that Basell could be the

foreign partner.

The 1m tonne/year cracker complex, which will produce mainly

polyethylene (PE), is scheduled for startup in the first half

of 2007. The complex will also produce 200 000 tonne/year of

propylene which will be used to expand a PP plant at Saudi Polyolefins Co (SPC), which is 75% owned by Tasnee and 25%

by Basell.

SPC is due to start up its PDH-PP facility later this month

in Al-Jubail.

Basell 2004/12/1

Sahara Petrochemical Co. and Basell sign agreement for

construction of PP & propane dehy complex

http://www.basell.com/

Sahara Petrochemical Company and Basell Holdings Middle East GmbH today announced the signing of an

agreement to construct a 450 KT per year polypropylene plant

and propane dehydrogenation unit at Al-Jubail Industrial City in the Kingdom of Saudi Arabia. The

facilities will be operated by a joint venture that Basell

and Sahara Petrochemical Company plan to establish in 2005.

Start-up of the new plants is targeted for the end of 2007.

The agreement includes a license to utilise Basell’s most advanced polypropylene

technology, the Spherizone process. The polypropylene from the new plant

will be marketed globally by Basell. The propane

dehydrogenation unit will be based on the UOP Oleflex process. Saudi Aramco will supply the propane

feedstock.

Basell’s excellent experience in establishing

Saudi Polyolefins Company, a joint venture with the National

Petrochemical Industrialization Company (Tasnee

Petrochemicals) that

started up at the beginning of this year, was a factor in the

company’s decision to

pursue additional projects in the Kingdom.

バゼル、サウジで現地企業と共同でPP建設

バゼルとサウジのサハラ石油化学(アル・ザミル・グループ)はこのたび、サウジのアルジュベイルで45万トン/年のPPプラントとプロパン脱水素プラントを建設する契約にサインをした。来年合弁会社を設立し、2007年稼動を目指す。

プロパン脱水素はUOPのOleflex法を使用、PPはバゼルのSpherizone法を使用する。原料プロパンはサウジアラムコが供給する。製品PPはバゼルが全世界で販売する。

本計画はバゼルにとってサウジでの2番目のPP計画。バゼルが25%、サウジのタスニー石油化学(National

Petrochemical Industrialisation Company)が75%出資するサウジ・ポリオレフィン(SPC)が本年初めにアルジュベイルで45万トン/年のPPをスタートしている。

なお、サハラ石油化学とタスニー石油化学は共同でエタンとプロパンのクラッカー建設を検討中で、計画ではエチレンは100万トン/年、プロピレンは20万トン/年。プロピレンはサウジ・ポリオレフィンのPP増設に使用する計画。

Platts 2004/10/21

SABIC denies take

over of Nova; Mexican plans close to fruition

SABIC's CEO Mohamed Al Mady, Wednesday, denied market rumors that

the company was seeking to buy US-based styrenics producer Nova

Chemicals, as

a platform to operate a petrochemical complex focussed on the

North American markets.

In related developments, Al Mady said that SABIC was close to

reaching an agreement with a Mexican company to build or operate

a naphtha-based cracker in Mexico.

日本経済新聞 2004/12/29

サウジ

原油生産能力増強 2009年にも150万バレル増

休止中の3油田も再開 供給不安解消狙う

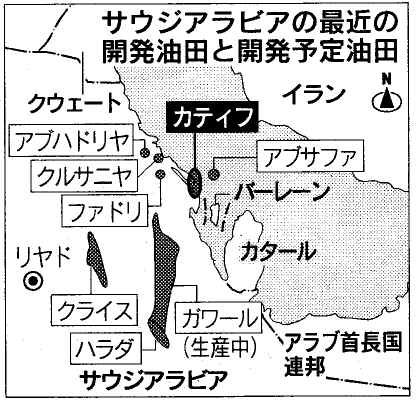

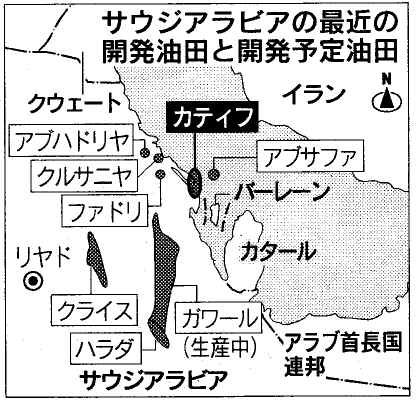

サウジアラビアが原油の生産能力増強を急いでいる。2油田の増強工事を予定よりも早く完成させたのに続き、休止中の3油田で2007年に生産を再開する。中国などを中心に世界の石油需要が強まっていることに対応、生産能力を2009年ころまでに現在よりも150万バレル(日量、以下同)多い1250万バレルに高め、供給不安の解消を急ぐ。

カティフ、アブサフアの2油田の生産量は合計80万バレル。当初の完成予定を3カ月早め8月に生産を始めている。

東岸の産業都市ジュベイル近郊に位置するクルサニヤ、ファドリ、アブハドリヤは1960年代に生産を開始した古い油田。80年代に休止したが原油と天然ガスを分離する設備などを新設、07年末をめどに合計50万バレルを生産する。

サウジ国営石油会社アラムコは世界最大のガワール油田西方に位置するクライス油田の開発準備に着手した。09年にも生産を開始する見通し。同油田の生産量は現在10万バレル前後。しかし、本格開発すれば80万−100万バレルの生産が可能とされる世界有数の大型油田だ。

アラムコ社長会見

需給にらみ機動的に 日中はともに重要市場

アラムコのアブドラ・ジュマ社長兼最高経営責任者(CEO)は28日、サウジ東部ダーランのアラムコ本社で日本経済新聞記者と会い、油田開発の方針やアジア市場への取り組みを語った。主なやり取りは次の通り。

「住友化学との石油精製・石油化学施設の事業化調査は順調に進んでいる。2005年前半に結論を出すが、このプラントの基本設計をすでに日揮に発注するなど、結果を待つのではなく並行して多くの作業を進めている。第三のパートナーを否定するつもりはないが、今は時期尚早だ」

「精製や販売事業で高い利益を見込めないことはわかっている。昭和シェル石油の株式を取得したのは世界第二位の経済大国との関係を築くことが狙いだ。昭シェルヘ30万バレルを供給することでわれわれは日本への最大の供給者となる。(現在9.96%の)昭シェルへの出資比率は、合意に基づき05年中に最大15%に高める」

「中国市場は重要だ。中国石油化工や米エクソンモービルと福建省に精製・石化施設を建設することで合意し、ほかにも話し合いを進めている。しかし、日本と中国のどちらかを取るという話ではない。どちらも重視している」

BP

2005/6/8

Ineos Confirms Cancellation of

Saudi Ineos-Delta ethylene Project

Innovene

and Delta Oil Agree To Explore Major Petrochemical Investment in

Saudi Arabia

http://www.bp.com/genericarticle.do?categoryId=2012968&contentId=7006623

Innovene,

BP plc's petrochemicals and refining subsidiary, and Delta

International, a leading Saudi-owned independent

development company, announced today the signing of a Memorandum

of Understanding (MOU) for a major investment in Saudi Arabia's

petrochemical sector.

The

memorandum marks the beginning of detailed negotiations between

Innovene and Delta for the construction of a

world-scale cracker and associated derivative capacity in the Kingdom, with

sites being explored in Jubail. It is intended that this

project, which is expected to cost around $2bn, will form a platform

for future long-term growth opportunities.

Innovene

and Delta will be equal partners within the joint venture.

It is anticipated that, subject to final approvals, an agreement

will be signed before the end of the year, with commissioning of

the first plants expected in late 2008.

Notes

to editors:

Innovene

*

Innovene was created as a wholly owned subsidiary of BP on April

1, 2005. BP may sell part of its stake in Innovene by way of an

IPO later in 2005, subject to necessary approvals and market

conditions.

*

Innovene has more than $15bn of revenues, 15 million tonnes of

petrochemical production volumes and $9bn in total assets.

*

Innovene’s major manufacturing

sites include Grangemouth in Scotland, Lavera in France, Koln in

Germany and Lima, Chocolate Bayou and Green Lake in the US.

SECCO, the joint venture between Innovene/BP, Sinopec and SPC in

Shanghai and the largest petrochemical complex in China to date,

became fully operational in March 2005.

*

Innovene manufactures petrochemicals, including olefins (ethylene

and propylene) and their derivatives such as polyethylene,

polypropylene, acrylonitrile, linear alpha olefins,

polyalphaolefins, and solvents. These chemicals are used to make

a wide variety of plastic goods, including food and drink

containers and wrappings, pipe work, automotive parts and

mouldings. Innovene also manufactures gasoline, diesel and other

refined products in the Grangemouth and Lavera refineries.

*

The company’s global headquarters are

located in Chicago.

*

For more information on Innovene, visit www.innovene.com

Delta

*

Delta International, a leading private Saudi-owned independent

development company, was founded by its Chairman and Chief

Executive Officer, Mr. Badr Al-Aiban in 1978, and its activities

have expanded significantly since its inception. Delta is

headquartered in Jeddah.

*

Delta played an important role in the conception of the “Contract of the Century”; the formation of the consortium

for the supergiant Azeri, Chirag, Gunashli field, offshore

Azerbaijan, and during that time identified and participated in a

number of other major projects within the Caspian region, Central

Asia and the Middle East.

*

Delta’s current activities

upstream projects are focused primarily on North and West Africa.

*

For more information on Delta, visit www.Delta-oil.com

Delta Oil

Company Limited (Saudi Arabia)

Delta Oil Company Limited, a private Saudi-owned company,

was founded by its Chairman and Chief Executive Officer,

Mr. Badr M. Al-Aiban. Mr. Al-Aiban established the

original Delta entity in Saudi Arabia in 1978, and its

activities have expanded significantly since its

inception.

Today, Delta and its affiliates comprise a diversified

group of companies involved in the energy industry, real

estate development, food processing and packaging, soft

drink bottling and distribution, agriculture and

manufacturing. The company's operations extend to Central

Asia, South East Asia and other countries in the Middle

East.

Delta has developed a number of strategic alliances in

the oil and gas industry. As a member of the Azerbaijan

International Operating Company (AIOC) and the North

Absheron Operating Company Limited (NAOC), Delta and its

affiliates are involved in exploring and developing oil

fields in Azerbaijan, as well as

other Central Asian countries.

1997年に、トルクメニスタン、アフガニスタン、パキスタンは、大規模な中央アジア天然ガス(Central

Asian Gas/セントガス)パイプラインを、山岳地のより少ないアフガニスタン南部を通ってパキスタンへ、そしておそらくは成長しつつあるインドの市場へとつなげるべく、建設することで合意した。

中央アジア天然ガス・パイプライン・コンソーシアムは、ユノカル(Unocal、アメリカ、シェア47%)、デルタ石油(サウジアラビア、シェア15%)、トルクメニスタン政府(シェア7%)、伊藤忠石油開発(日本、シェア6.5%)、インドネシア石油(INPEX/日本、シェア6.5%)、ヒュンダイ・エンジニアリング・アンド・コンストラクション(韓国、シェア5%)、クレセント・グループ(パキスタン、シェア3.5%)から構成されている。ユノカルが第一の開発企業であり、アメリカ政府が強力に肩入れしている。1997年12月、米国エネルギー省の高官たちはタリバンの閣僚たちとワシントンで会合し、このパイプライン計画を祝福承認したのである。

その後、タリバン政権との関係に亀裂。アフガニスタン攻撃。

|

2007/10/1 Chemweek's

Business Daily

Ineos Confirms

Cancellation of Saudi Project

Ineos has

confirmed CW's exclusive report that the company has shelved its

Ineos-Delta ethylene project at Al Jubail, Saudi Arabia. Speaking

exclusively to CW on the sidelines of the EPCA annual

meeting, currently taking place in Berlin, Ineos Olefins CEO

Tom Crotty said, "there is no Ineos-Delta project right

now, given the current feedstock

and capital cost constraints."

Crotty declined

to comment on CW's exclusive report that Ineos is negotiating

to join the $8-billion plus Sipchem (Al Khobar, Saudi Arabia)

olefins and derivatives project at Al Jubail, which has

secured feedstock supplies from the Saudi government.

"We are interested in a project in the Mideast and we

are looking at a number of options," Crotty says.

2005/9/13 Sipchem

Sipchem Appoints NCB to

Manage its Initial Public Offering

http://www.sipchem.com/sysadmin/NewsManagment/press.asp?a=246&z=4

Saudi International

Petrochemical Company (“Sipchem”) announces its plans for its

Initial Public Offering (“IPO”) by listing its shares on

Tadawul, the Saudi Arabian Stock Exchange. The Initial Public

Offer ("IPO") is primarily intended to facilitate a

capital increase to finance Sipchem`s expansion projects.

Sipchem is a Saudi Arabian closed joint stock company formed in

1999 to become a leading diversified and integrated international

petrochemical company. The Company`s first phase of development

comprises of two joint ventures with international partners for world-scale methanol (completed in

2004) and butanediol petrochemical projects (currently in the start-up

phase). Sipchem is currently developing as Phase II an integrated Acetyls petrochemical

complex.

Sipchem’s paid-in capital is SR 1,500 MM

(US$400 MM). The Company presently has 73 shareholders, all

leading individual and corporate investors from Saudi Arabia and

the GCC region.

Platts 2005/12/7

SABIC's Yansab receives

nod for 35% IPO on Saudi stock exchange

The Saudi Arabian Capital Market Authority has given approval for

the initial

public offering of 35% of shares in SABIC affiliate Yanbu

National Petrochemicals Company (Yansab) on the Saudi stock exchange,

SABIC announced Wednesday.

In addition to the 35% public offering, SABIC own 55% of Yansab shares. SABIC's

partners in Ibn Rushd and Tayf including

national and regional establishments and companies own 10%.

Platts 2006/1/4

Brazil's Ultrapar licenses Saudi Arabia use of output technology

Brazil's Ultrapar Participacoes's Oxiteno has authorized Saudi

Arabia's Project Management and Development

Co the use

of technology for manufacturing ethanolamines and ethoxylates

through a contractual-license agreement, Oxiteno said Wednesday.

The technology will be used by PMD to produce 100,000 mt/yr of

ethanolamines

and 40,000

mt/yr of ethoxylates

at the company's Al Jubail petrochemical complex in Saudi Arabia.

The project is part of a bigger PMD facility that will be

centered around a cracker with a projected ethylene

production-capacity of 1.35-mil mt/yr.

The Al Jubail complex will be integrated with other PMD

downstream plants, according to Wednesday's statement.

Ultrapar

Participacoes http://www.ultra.com.br/site/eng/ultrapar_perfilCorporativo.asp

Ultrapar Participacoes S.A. is one of Brazil's most solid

conglomerates. It unites three different companies, each

with a prominent position in its own segment: Ultragaz, the leader in Brazil's

distribution market for Liquid Petroleum Gas (LPG), with

a 24% market share; Oxiteno, the largest producer of

specialty chemicals in Brazil and the only manufacturer

of ethylene oxide and its main derivatives in Mercosur

area (comprising Brazil, Argentina, Paraguay and

Uruguay); and Ultracargo, a leading provider of

integrated road transport, storage and handling services

for chemicals and fuels.

Ultrapar was incorporated on December 20, 1953 and traces

its origins to 1937, when Ernesto Igel established

Companhia Ultragaz and introduced LPG for home cooking in

Brazil. It also pioneered the development of the

petrochemical industry in Brazil, which led to the

founding of Oxiteno S.A Indu'stria e Come'rcio in 1970 at

the newly established Maua' Petrochemical Complex in Sa~o

Paulo. |

| Project

Management and Development Co エチレン 1,350KT

ポリオレフィン 全てBasell技術

HDPE 400 KT

(Hostalen)

MDPE/HDPE 300

KT(Lupotech G )

PP 640KT(2

plants total) (Spheripol)

LDPE/EVA

copolymer 640KT(Lupotech

T )

EO 530KT

bisphenol A 300KT

ethanolamines 100KT

ethoxylates 40KT

|

MENA FN

2003/10/22

PMD $3.5 billion Saudi petrochemical project on track

http://www.menafn.com/qn_news_story_s.asp?StoryId=32388

Project Management

& Development Co. ('PMD') based in Al Jubail, Saudi

Arabia, announced that it has received a notice of allocation

of feedstock from Saudi Arabian Oil Company ('Saudi Aramco').

This follows a review by Saudi Aramco of PMD's project

proposal and its acceptance of PMD's planned integrated

petrochemicals complex project.

PMD's project will be the largest private sector

petrochemical project in the Middle East with an expected

total investment of $3.5 billion. The business plan envisages

that PMD will crack the allocated feedstock, comprising

ethane and mixed butanes, and will produce 1,350 KTA of

ethylene

in addition to commercial quantities of propylene and

benzene.

This ethylene, which is expected to have a significantly

competitive cash cost of production, since PMD enjoys the

benefit of low feedstock costs in line with the Kingdom of

Saudi Arabia's policies, will provide the basis for the

production of several downstream products in world-scale polyethylene,

polypropylene and ethylene glycol plants. These plants will form part of

a single integrated complex, located within the Royal

Commission's industrial area at Al Jubail.

In addition, the project is expected to produce bisphenol and

amines at

the integrated complex. Scheduled start up date is expected

in early 2008.

http://www.sabicamericas.com/january-2004-2?makePrintable=1

Jubail-based PMD is a

private developer with grand plans. Its planned $3,000

million complex will comprise a 1.35

million-tonne-a-year (t/y) mixed feedstock cracker, a

970,000-t/y polyethylene (PE) plant, a polypropylene (PP)

plant with capacity of at least 500,000 t/y and a 530,000-t/y

ethylene oxide unit for the production of ethylene glycol,

ethanolamine, methylamine and derivatives and ethoxylates. In addition, PMD plans to

build a facility to produce some 300,000 t/y

of bisphenol A,

which is primarily used for making polycarbonate and epoxy

resins.

2005/12/19 Basell

PMD selects Hostalen

& Lupotech G processes for new plants in Saudi Arabia

Project Management and Development Company Ltd. (PMD) has

selected Basell technologies for two new polyethylene plants

it intends to build in the Kingdom of Saudi Arabia. Hostalen

technology will be used in a high density PE plant with an

annual capacity of 400 KT and Lupotech G

technology will be used in a medium density/high density PE

plant with an annual capacity of 300 KT.

Earlier this year, PMD selected Basell's

Spheripol process for two new PP plants with a total annual

capacity of 640 KT and Basell's Lupotech T

technology for a new LDPE and EVA copolymer plant with an

annual capacity of 270 KT.

2006/5/11 Basell Saudi

Ethylene and Polyethylene Company

Tasnee & Sahara Olefins Company and Basell sign joint venture

agreement

Basell has signed a joint venture agreement with Tasnee &

Sahara Olefins Company for the construction of a new

integrated ethylene and polyethylene complex

at Al-Jubail Industrial City in the Kingdom of Saudi Arabia.

The complex will include a gas cracker and two 400 KT per

year polyethylene plants. One plant, based on Basell’s latest generation Hostalen

process, will produce high density polyethylene; the other plant, based on Basell’s Lupotech T technology, will

produce low density polyethylene. Scheduled to start up in 2008,

the units will be the largest Hostalen and Lupotech T process

plants in the world.

Basell

will have a 25% equity share in the project, while Tasnee &

Sahara Olefins Company will hold the remaining equity.

Tasnee & Sahara Olefins Company is a recently established

joint stock company. Its main shareholders are Tasnee Petrochemicals and Sahara Petrochemical Company with a minor shareholding by the

Saudi Arabian General Organisation for Social Insurance (GOSI).

“Basell

and Tasnee Petrochemicals have already another joint venture, Saudi Polyolefins Company, which includes a 450 KT per year

polypropylene

plant in Saudi Arabia,” said Volker Trautz, CEO of Basell,

who participated in a signing ceremony in Riyadh, Saudi Arabia. “Following the excellent success of

this joint venture, we look forward to extending our cooperation

into polyethylene.”

Volker Trautz

expressed his appreciation to Sahara Petrochemical Company which

is also a major shareholder in this project. Sahara Petrochemical

Company and Basell are currently developing a new 450 KT per year Spherizone

polypropylene plant and propane dehydrogenation unit in

Al-Jubail.

Zamil Group

Saudi Formaldehyde

Chemical Company Limited

http://www.zamil.com/zl/en/divisions_companies/joint_ventures_affliates.asp#sfccl

Saudi Formaldehyde

Chemical Company Limited (SFCCL) is a world-class producer of

petrochemicals and derivatives, which are used as conditioning

and anti-caking agents in the urea fertiliser industry; as

intermediate chemicals for oilfield formulation; as raw materials

for insulation / resin industries; as fumigants for poultry

farms; and as pharmaceutical agents.

More than 70% of its

production capacity of in excess of 200,000 metric tonnes per

annum is exported to more than 45 countries in the Middle East,

Indian Subcontinent, Africa, Europe, Asia, Australia and North

America.

SFCCL's current product

range comprises the following chemicals in 26 grades:

- Aqueous Formaldehyde

Solutions (AF-37 / Formalin)

- Urea Formaldehyde

Concentrate (UF-85 / Formurea)

- Hexa Methylene

Tetramine (HMT / Hexamine)

- Paraformaldehyde

(Paraform)

- Melamine & Urea

Formaldehyde Resins (Spray Dried)

- Glazing Powder

- Methanolic /

Butanolic Solutions of Formaldehyde

- Sulphonated

Naphthalene & Melamine based Superplasticizers

(SNF/SMF)

Since its inception in

1989 and its commissioning in 1991, SFCCL has achieved ISO 9002

certification for quality control and assurance.

July 10, 2006

Aramco

アラムコ石化計画

Dow is Selected for

Negotiations on New Petrochem Complex

The Saudi

Arabian Oil Company (Saudi Aramco) has selected The Dow Chemical

Company as its potential partner to engage in exclusive

negotiations concerning a joint venture company to construct, own

and operate a world-scale chemicals and plastics production

complex at Ras Tanura, in Saudi Arabia's Eastern

Province.

This joint venture would encompass an array of world-scale

facilities producing a very broad portfolio of plastics and

chemical products.

The proposed petrochemical project would be integrated with

the existing Ras Tanura refinery complex, which is one of the world's

largest refinery complexes. When fully operational, the new

petrochemical complex will be one of the largest plastics and

chemicals production complexes in the world and be ideally

situated to access most major world markets.

Chemweek's

Business Daily/Access Intelligence via COMTEX

Last

month, before Dow's involvement was disclosed, local sources

told CW that the project would upgrade Aramco's

325,000-bbl/day refinery at Ras Tanura and build a petchem

complex that will produce 1.2 million m.t./year of ethylene

and 400,000 m.t./year of propylene. The project also includes

an aromatics complex with capacity for 400,000 m.t./year of

benzene and 460,000 m.t./year of para-xylene, sources say.

Other products will include acrylonitrile, acrylonitrile

butadiene styrene, isocyanates, polyethylene terephthalate,

purified terephthalic acid, and styrene-butadiene rubber.

なお同地では2004年にJETROがアラムコと組んで、ブタン、ナフサおよび改質ガソリンを原料として、

(1)ベンゼンを抽出することによる既設ガソリンの品質改善および本プラントで新規に生産されるアルキレートによるオクタン価の向上

(2) 輸出向け石油化学中間製品、エチルベンゼン、クメンおよびターシャルブチルアルコールの生産

の事前FSを実施している。

平成15年度

石油・天然ガス資源開発等支援調査およびエネルギー使用合理化調査

「サウジアラビアラスタヌラ製油所の有機的複合化及び効率化調査」

http://www.jetro.go.jp/jetro/activities/oda/model_fs/oil/pdf/h15_4.pdf

Ras

Tanura Refinery

The most complex Saudi Aramco refinery is on the Arabian Gulf

at Ras Tanura with a crude distillation capacity of 550,000

barrels per day (BPD). Ras Tanura Refinery also has a 305,000

BPD NGL processing facility, a 960,000 BPD crude

stabilization facility, 145/158 MW (summer/winter) of

combined steam and gas turbine electrical power generation

plants, a combined 150 lb and 600 lb steam capacity of 6,217

Mlb/hr, and 75 crude oil and products storage tanks with a

combined capacity of 5.8 million barrels.

Ras Tanura Refinery's major refining facilities include a

325,000 BPD Crude Distillation Unit, a 225,000 BPD Gas

Condensate Distillation Unit, 50,000 BPD hydrocracker and a

total of 107,000 BPD capacity of catalytic reforming. Ras

Tanura Refinery is the only Saudi Aramco refinery that

contains a Visbreaker (60,000 BPD). This refinery also

produces 17,000 BPD of asphalt, more than any other refinery

in the Kingdom. Crude is normally transferred to Ras Tanura

through a pipeline and can also be supplied by ship. Most of

Ras Tanura’s production is for domestic

use and transferred to the Dhahran bulk plant, while some

products are exported.

Gulf Industry

2006/4

Aramco sees potential for

petchem plants

http://www.gulfindustryonline.com/bkArticlesF.asp?IssueID=236&Section=714&Article=4367

From its headquarters in

the eastern city of Dhahran, Saudi Aramco is overseeing a major

petrochemicals development programme involving three projects

that will be integrated with refineries

These projects are Petro-Rabigh, which is scheduled to start

production in 2008; the Ras Tanura petrochemical

complex

integrated with the existing Ras Tanura refinery and targeted for

commencement of commercial operations in 2012, and the Yanbu

Petrochemical Masterplan, currently in its initial stages

of conceptualisation and set to start in 2014.

The second project in the programme is Ras Tanura. Now in the preliminary

development phase, it will feature the first application in the

Middle East of cracking refinery liquids

(naphtha) coupled with ethane cracking and aromatics production.

This combination is in line with the company’s strategic direction to integrate

refining operations with petrochemicals to produce diverse

products that are essential for the establishment of an advanced

export-oriented conversion industry (such as synthetic rubber and

automobile parts).

The project will integrate with the 550 MBD Ras Tanura refinery

located on the east coast of Saudi Arabia to produce about 1.35 million tpy

of ethylene, 0.9 million tpy of propylene and 1 million tpy of

aromatics.

In the Yanbu Petrochemical Master Plan, the goal is to create an

integrated business opportunity with the existing Yanbu Refinery

and leverage streams from the existing and future joint venture

refineries in Yanbu’, on the West Coast.

The Master Plan is currently under development. “We are evaluating options to

expand and upgrade the existing 235,000 barrels per day Yanbu

Refinery into an integrated olefins and

aromatics complex

that will provide a diverse line of petrochemical products,”

said Shalabi.

“The

heart of the integration will be centred on a naphtha-based

steam cracker

that maximises production of propylene, butadiene, and benzene

for further conversion to semi or specialty type products.

Start-up is tentatively targeted for 2014.”

Shalabi said the

new petrochemical projects would have strong potential

macro-economic benefits for the kingdom, especially ventures

which would be based on refinery liquid

feedstocks in addition to gas.

Saudi Arabia’s existing petrochemical industry

is largely based on ethane, which has led to a strong focus on

commodity grade ethylene derivatives such as polyethylene, MEG

and styrene.

The cracking of liquid feedstocks, available from integration

with refineries, would broaden the product slate and result in

the production of additional products such as propylene and

butadiene.

Also, refinery liquids cracking will be the source for producing

the much-needed aromatics value chain.

Jan 12, 2008

Reuters

SABIC eyes Saudi

Aramco petrochemicals deal

Saudi Basic Industries Corp(SABIC) is considering a deal with

state-oil company Saudi Aramco to upgrade a Red Sea Coast

refinery and a build a petrochemicals complex there, a

magazine reported.

A deal would give SABIC, the world's largest chemical maker

by market value, access to Aramco feedstock and allow the

state oil firm to press on with plans to develop its Yanbu

project without a foreign partner, the Middle East Economic

Digest said.

The Yanbu venture is one of three refinery and petrochemical

plants belonging to Aramco, the world's largest oil company

by production. The other two, Rabigh and Ras Tanura, are

joint ventures with Japan's Sumitomo Chemical Co Ltd and the

Dow Chemical Co of the United States.

2006/11/5 SABIC

SABIC and ExxonMobil Chemical to study petrochemicals expansion

in Saudi Arabia

Saudi Basic Industries Corporation (SABIC) and ExxonMobil

Chemical announced that they have begun work on a feasibility

study to define a potential project that would grow their two

joint petrochemical ventures at Yanbu and Jubail. The project

would target a domestic supply of carbon black and rubber and thermoplastic

specialty polymers (EPDM, TPO, Butyl, SBR/PBR) to serve emerging local and

international markets. Expected project start-up is 2011.

The project would utilize feedstocks allocated by the Ministry of

Petroleum & Mineral Resources of the Kingdom of Saudi Arabia,

and additional feedstocks from other sources in the Kingdom that

will be processed at Saudi Yanbu Petrochemical Company (YANPET)

in Yanbu and Al-Jubail Petrochemical Company (KEMYA) in Jubail.

SABIC (www.sabic.com) is one of the world’s 10 largest petrochemicals

manufacturers and among the world’s market leaders in the production

of Polyethylene, Polypropylene, Glycols, Methanol, MTBE and

Fertilizers as well as the fourth largest Polyolefins producer.

It is also the largest steel manufacturing company in the Middle

East and North Africa. It operates globally and is committed to

providing outstanding quality and customer care.

ExxonMobil Chemical (www.exxonmobilchemical.com) is a global

leader in technology, product quality and customer service with

petrochemical manufacturing and/or marketing operations in more

than 150 countries around the world. Its products include

Olefins, Aromatics, Fluids, Synthetic Rubber, Polyethylene,

Polypropylene, Oriented Polypropylene packaging films,

Plasticizers, synthetic lubricant basestocks and additives for

fuels and lubricants.

2006/11/15 Basell

Basell JV with Sahara

Petrochemical Company secures Shariah compliant financing

Al-Waha Petrochemical Company, the joint venture between Basell (25%) and Sahara Petrochemical Company (75%) in Al-Jubail Industrial City in

the Kingdom of Saudi Arabia, yesterday completed the signing of

the Shariah compliant Financing Facilities

Agreement and all related financing documents with six regional

banks.

Engineering,

procurement and construction (EPC) activities for the 450 KT per year

Spherizone polypropylene plant and a propane dehydrogenation unit began in January this year based

on an early works agreement with Tecnimont and Daelim. The EPC

contract was signed on September 18, 2006 and commercial

production is foreseen in the first quarter 2009.

The Al-Waha joint

venture is Basell’s third major investment in

Saudi-Arabia. A first joint

venture with Tasnee Petrochemicals, involving a polypropylene plant

and a propane dehydrogenation unit, commenced commercial

operations in May 2004. Its current capacity of 500 KT per year

will be expanded to 800 KT by end 2008.

In June this year

Basell’s second joint venture in the

Kingdom, Saudi Ethylene and Polyethylene

Company, was established jointly with both

Tasnee Petrochemicals and Sahara Petrochemical Company. The new

company is currently constructing a cracker for the production of

1000

KT per year of ethylene and 285 KT per year of propylene; one 400

KT per year high density polyethylene (HDPE) plant using Basell’s latest generation Hostalen ACP

process, and one 400 KT per year low density polyethylene (LDPE)

plant using

Basell’s Lupotech T technology. The start

up of these facilities will be in the fourth quarter 2008.

Trade Arabia

January 22, 2006

Zamil Group and

Huntsman Company sign SR500 million ($135 million) JV agreement

Zamil Group and the

Huntsman Corporation of USA announced their intention to form a

joint venture to build a world scale Ethyleneamines

manufacturing facility in Jubail Industrial City, Saudi Arabia, through the

signing of the joint venture shareholders agreement. The total

investment cost in the project is put around SR 500 million ($135

million).

HE Mr. Abdul Aziz

AL-Zamil, Chairman of the Industrial Sector at Zamil Group and

Mr. Donald Joseph Stanutz, President of Performance Products

Division, Huntsman Corporation signed the shareholders agreement

on January 22, 2006 to form the joint venture, the Arabian Amines

Company (AAC).

The 66 million

pound (30,000 MTE) plant will produce Ethylenediamine

(EDA), Diethylenetriamine (DET A), Triethylenetetramine (TET A)

and higher molecular weight versions such as TEPA, E-100, AEP and

Piperazine.

The products serve as specialty intermediates for a variety of

end uses including epoxy curing agents, bonding agents and

lube-oil additives for gasoline and diesel engines. The companies

anticipate the plant being on line in 2008.

Huntsman and Zamil

Group will have equal ownership in AAC. The venture will use Huntsman's

proprietary technology that the company has optimized in

its U.S. plants. Huntsman will serve as the exclusive sales

and marketing arm

for the joint venture and will provide technical service and

product applications knowledge.

2006/11/2

Huntsman

Huntsman’s Saudi Joint Venture Achieves

Milestone in New Amines Project

Plant to Begin

Production in 2009

Huntsman

Corporation and its partner, the Saudi Arabia-based Al-Zamil

Group, today announced the signing of a definitive Project

Management Consultancy (PMC) agreement with Jacobs

Engineering for overall project management for the

development of the previously announced new ethyleneamines complex in Jubail, Saudi Arabia.

"All of

the pieces for this project are falling into place nicely,”

said Stanutz. “We are on schedule to start

production in the first quarter of 2009.”

2007/12/12

Huntsman

Huntsman, Al-Zamil Joint Venture Achieves Milestones

Huntsman Corporation and Saudi-based Al-Zamil Group today

announced three significant milestones in their joint

venture, to be named the Arabian Amines

Company: the venture, which will

construct a world scale 27,000 MT/yr ethyleneamines plant in

Jubail, Saudi Arabia, has been formally approved by the

boards of both Huntsman Corporation and the Al-Zamil Group;

they have selected Hyundai Engineering Co. Ltd and Hanwha

Engineering and Construction Corporation as the Engineering,

Procurement and Construction (EPC) contractors for the

project; and, in addition, they have received initial

approval from the Board of Directors of the Saudi Industrial

Development Fund (SIDF).

The planned facility will utilize proprietary ethyleneamines

process technology provided by Huntsman. The plant is

scheduled to break ground in early 2008 and start up in

January of 2010. Funding for the new plant

will come from the joint venture’s equity

capital, supported by senior debt, which will include loans

from the SIDF and commercial lenders.

Huntsman will license its technology to the joint venture for

use in the plant and will also serve as the exclusive sales

and marketing agent for the venture’s output, much

of which will be sold in Asia.

His Excellency Eng. Abdul Aziz Al-Zamil, Vice Chairman and

CEO of the Al Zamil Group, and Mr. Peter R. Huntsman,

President and CEO of Huntsman Corporation, meeting together

while attending the Gulf Petrochemicals and Chemicals

Association forum in Dubai, UAE, both expressed their

satisfaction in the project’s advancement

and their confidence in this strategic investment for both

companies.

2008/4/29

Huntsman

Huntsman, Al-Zamil Joint Venture Breaks Ground On New Plant

Huntsman Corporation and Saudi-based Al-Zamil Group today

announced that their joint venture, Arabian Amines

Company, has broken ground on its

world-scale ethyleneamines project in Jubail, Saudi Arabia.

The joint venture expects to finish construction of the

27,000 mt/yr facility by the end of 2009.

Hyundai

Engineering Co. Ltd and Hanwha

Engineering and Construction Corporation, selected by

Huntsman and Al-Zamil Group as the Engineering, Procurement

and Construction (EPC) contractors for the project, joined in

the ceremonial April 28th groundbreaking activities in

Jubail.

2007/4/5

MarketWatch

Saudi Aramco-Dow Chemical project costs surge to $22 bln

-industry

Saudi Arabian Oil Co. and Dow Chemical Co. are adamant they will

go ahead with building a large-scale refinery and

petrochemicals complex in eastern Saudi Arabia, company

officials said this week, despite industry estimates that costs

have more

than doubled to $22 billion.

A memorandum of understanding was due to be signed at the start

of this year, but neither company would be drawn on when this

will now happen.

The project, to come on stream in the second quarter of 2012,

will integrate Aramco's existing refinery at Ras Tanura with a

new petrochemicals complex on the oil-rich kingdom's Persian Gulf

coast.

Industry estimates put the cost for the complex at $10 billion when it was first mulled over by

Aramco and at $15 billion last July when Aramco announced that it had

selected Dow to enter into exclusive negotiations on developing

the project.

However, industry sources in and outside Saudi Arabia now say

building the complex may cost as much as $22 billion.

Aramco and Sumitomo Chemical Co. of Japan in 2005 signed a joint

venture agreement to develop a similar complex at Rabigh on the

Red Sea at a cost of $4.3 billion.

That project is now estimated to cost the two companies up to $10

billion to develop.

2007/12/17

Chevron Phillips

Saudi Polymers Company

Awards EPC Contracts

Chevron Phillips Chemical

Company LLC (Chevron Phillips Chemical) announced today that

Daelim Industrial Co., Ltd., of South Korea, and JGC Corporation,

of Japan, will provide the engineering, procurement and

construction services for Saudi Polymers Company's NCP Project (Saudi Polymers).

Saudi Polymers will

construct and operate an integrated petrochemicals complex at

al-Jubail, a Saudi Arabian industrial city located on the Persian

Gulf. Once complete, Saudi Polymers will include a world-class

olefins cracker, and will produce ethylene, propylene,

polyethylene, polypropylene, polystyrene and 1-hexene. Saudi

Polymers will begin construction in January 2008, with project

completion expected in early 2011. Commercial production is

scheduled to begin in September 2011.

JGC will perform the

engineering, procurement and construction services for Saudi

Polymer's 1.2 MM tpa cracker, 200 kta metathesis

facility and

100

kta 1-hexene facility. The cracker and metathesis

technologies will be provided by Lummus, and the 1-hexene

technology provided by Chevron Phillips Chemical.

Daelim will provide

engineering, procurement and construction services for Saudi

Polymer's 2 x 550 kta polyethylene trains, 400 kta

polypropylene

train and 2 x 100 kta polystyrene trains.

Saudi Polymers Company is

a new limited liability company incorporated in the Kingdom of

Saudi Arabia created to execute the NCP Project. Saudi Polymers

will be initially owned 50 percent by Arabian Chevron

Phillips Petrochemical Company Limited (ACP), a wholly-owned subsidiary of

Chevron Phillips Chemical Company LLC and 50 percent by

Saudi Industrial Investment Group (SIIG). Ultimately Saudi Polymers

Company will be owned 35 percent by ACP and 65 percent by

National Petrochemical Company (Petrochem), a new joint stock company

incorporated in the Kingdom of Saudi Arabia.

Saudi Polymers Company

will be the third

petrochemical complex built by Chevron Phillips and

SIIG at al-Jubail.

About Saudi Industrial

Investment Group

Saudi Industrial

Investment Group is publicly traded on the Saudi stock exchange.

It includes among its shareholders leading Saudi businessmen and

several Saudi public joint stock companies focused on industrial

investment in the petrochemical industry in Saudi Arabia. The

Chairman of the group is Sheikh Abdulaziz Zaid Al-Quraishi. The

group was originally founded in 1985 by the late Sheikh Ahmad

Juffali as the Saudi Industrial Venture Capital Group (SIVCG).

For more information about Saudi Industrial Investment Group,

visit www.siig.com.sa.

Platts 2008/1/22

Chevron Phillips Chemical,

which expects to start construction this month on a joint

venture steam cracker in Al-Jubail, Saudi Arabia, plans to

buy the plant's ethane and propane feedstocks from Saudi

Aramco, a company source said at the weekend.

2007/12/20 日揮

サウジアラビアで大型石油化学プラントを受注

日揮株式会社(代表取締役会長兼CEO

重久吉弘、横浜本社 横浜市西区みなとみらい2-3-1)は、日揮のサウジアラビア法人であるJGCアラビア社と共同で、サウジ・ポリマー社から大型石油化学プラント(NCPプロジェクト)を受注しましたのでお知らせいたします。詳細は以下の通りです。

| 1. |

顧客名 : |

| サウジ・ポリマー社 |

|

| [出資企業] |

|

| 米国シェブロンフィリップス・ケミカル社 |

50% |

| サウジ・インダストリアル・インベストメント社 |

50% |

|

| 2. |

建設地: |

サウジアラビア・ジュベイル工業地区 |

| 3. |

契約内容 : |

エチレンプラント(120万トン/年)

および付帯設備に係る設計、機材調達、建設工事(EPC)の一括受注 |

| 4 |

契約形式: |

ランプサム転換型契約 |

| 5. |

契約納期 : |

2011年中期 |

| 6. |

プロジェクトの概要: : |

本プロジェクトは基礎化学品需要の世界的かつ継続的な高まりを受けて、米国とサウジアラビアの合弁企業がサウジアラビアに建設する大型石油化学コンプレックスです。このうち当社はルーマス法によるエチレンプラント、メタセシス(プロピレン)プラント、ヘキセン-1(ポリエチレン中間原料)プラントなどのEPCを担当します。

当社は2004年に同地区で本プロジェクトと同じ出資企業2社による大型スチレンモノマープラント(JCPプロジェクト)のEPCを受注しており、今回は同じ顧客からの連続受注となります。

今回の受注は当社の中東地域、特にサウジアラビアでの豊富な実績と経験、HSE(衛生・安全・環境)遂行が高い評価を受けたことに加え、JCPプロジェクトを通じてプラント投資が集中する同国で建設リソースを早期確保し、必要な知見を発揮できる企業として選ばれたものと考えています。

今後も世界各国で多くの化学プラントが計画されており、当社はこれらプロジェクトの受注に向けて積極的な営業活動を展開していく所存です。

|

|

--------------------

2012/10/1 Chevron Phillips

Saudi Polymers Company Manufacturing Facility

Begins Commercial Production, Chevron Phillips Chemical Announces

Chevron Phillips Chemical Company LLC congratulates

Saudi Polymers Company (SPCo) and its joint venture partner,

National Petrochemical Company (Petrochem), as the

joint venture’s manufacturing facility located in Al-Jubail, Saudi Arabia,

begins commercial production.

2008/1/25 Chevron

Phillips のサウジ石化事業

"This is an exciting time for the SPCo team,

and we are proud to report we’ve safely achieved start-up and commercial

production for our new facilities," said Mike Zeglin, executive president of

Saudi Polymers Company. "We will now be working to fill the critical inventory

targets needed to ensure our long-term reliability as a supplier of quality

products."

The integrated SPCo petrochemicals complex includes world-class operating units

that are capable of producing Ethylene (1,220 kmta), Propylene (440 kmta),

Polyethylene (1,100 kmta), Polypropylene (400 kmta), Polystyrene (200 kmta) and

1-Hexene (100 kmta). In addition to direct sales to serve local Saudi demand,

SPCo will manufacture products to serve growing world demand outside the Kingdom

of Saudi Arabia through its exclusive distributor, Gulf Polymers Distribution

Company, utilizing Chevron Phillips Chemical’s global marketing network.

SPCo, which began construction in January 2008, has created approximately 950

jobs, with a high percentage being occupied by Saudi nationals.

SPCo is a limited liability company incorporated in the Kingdom of Saudi Arabia

that is owned 65 percent by Petrochem, a

joint-stock company incorporated in the Kingdom of Saudi Arabia and

35 percent by Arabian Chevron Phillips Petrochemical

Company (ACP), a wholly-owned subsidiary of Chevron Phillips Chemical.

立地:ジュベイル工業地区

| 製品 |

|

能力 |

EPC担当 |

技術 |

| エチレン |

エタンクラッカー |

1,220千トン |

日揮 |

Lummus |

| プロピレン |

metathesis |

440千トン |

日揮 |

Lummus

OCT(Olefins Conversion Technology) |

| 1-hexene |

|

100千トン |

日揮 |

Chevron Phillips

|

| PE |

|

550千トン 2系列 |

Daelim |

|

| PP |

|

400千トン |

Daelim |

|

| PS |

|

100千トン 2系列 |

Daelim |

|

2008/1/16

NorSun AS →変更 Polysilicon Technology Company to

build the region's first polysilicon manufacturing plant

NorSun forms JV with

Saudi partners to build polysilicon complex in Jubail industrial

city, Saudi Arabia

NorSun AS has signed a

joint venture agreement with the Saudi Arabian companies Swicorp-Joussour

(Swicorp)

and Chemical

Development Company (CDC) an entity having the Olayan Group

and the Shoabi Group as major shareholders. The purpose of the

agreement is to establish a joint venture company with the aim to

build and operate a polysilicon complex in the

industrial city of Jubail in Saudi Arabia.

The production capacity

of polysilicon at the initial plant will be the equivalent of 500 MW per year. Commercial production is planned

to commence in 2010. The site will allow for subsequent

expansions up to an annual production capacity equivalent to 2000

MW.

In conjunction with the

joint venture agreement, NorSun has signed a 10 year off-take

agreement for 50% of the output of the initial plant capacity.

NorSun and SunPower

Corporation have

also signed a put/call agreement for half of NorSun’s initial shareholding in the new

company. NorSun will initially own 50% of

the shareholding in the company, while Swicorp and CDC will hold

25% each.

About Swiscorp and CDC

Swicorp is a private equity firm based in the Middle East. CDC is

a private stock company owned by four major private groups in

Saudi Arabia; Olayan, Shoaibi, Al-Mojel and Salman Al-Jishi. CDC

is headquartered in Khobar, the Eastern province of Saudi Arabia,

and is mandated to invest in petrochemical and energy intensive

industries.

Norsun selects Singapore for its

new solar wafer plant

---

NorSun http://www.norsuncorp.no/?sc_lang=en

NorSun is a

subsidiary of Scatec AS and was established in December 2005.

NorSun signed an

agreement of intention with Årdal Framtid in June 2006 with

the intention of building a factory for the production of

silicone mono crystalline ingots and wafers.

The final decision to

construct the wafer factory in Årdal was taken by the NorSun

Board of Directors at the end of August 2006.

In December 2006,

NorSun raised through emissions: NOK 650 million, in new

equity.

The construction of

the new factory in Årdal commenced at the

beginning of 2007.

NorSun produces “Monocrystalline Wafers”

for the

international solar energy market. NorSun is aiming for

producing wafers to the high end market segment for

application in solar cells. The international solar energy

market is in strong growth and the product is in high demand

in the global market. NorSun currently operates a

manufacturing site in Finland and is constructing its first

large scale 185 MW manufacturing plant in Årdal, Norway. The construction of the Årdal factory started in

January 2007 and the start-up of production is planned to

take place in 1Q 2008.

NorSun has a

strong capital base allowing rapid expansion. In order to

honour contracted commitments, NorSun is aiming for high

speed execution and is presently initiating both an expansion

of ingot and wafer capacity as well as polysilicon production

internationally.

伊藤忠の出資比率は4% ノルスクヒドロは19%

NIKKEI NET 2006年12月18日

伊藤忠商事は太陽電池の原材料を製造するノルウェー企業に出資する。2008年から

シリコンウエハーなどの生産を始めるノルサン社に4%出資した。将来は原材料生産に

加え、太陽電池の販売まで手がける考えだ。

ノルウェーのエネルギー大手ノルスクヒドロが大株主である新興企業ノルサンに

約10億円出資した。第三者割当増資を一部引き受け、増資後の伊藤忠の出資比率は4%。

ノルスクヒドロは19%となる。

2006年12月18日

伊藤忠

ノルウェー太陽電池用シリコンウェーハ製造会社に対する出資について

伊藤忠商事株式会社はこの度太陽電池用シリコンウェーハ製造を開始するNorSun

AS社(本社 : ノルウェー オスロ市、社長 :

Jon Hindar、以下NorSun社)

の新規発行株式の一部を引き受け、経営参画していくことで現経営陣と合意を致しました。出資金額は約10億円、増資後の総発行株数の4%にあたります。

NorSun社は、現在世界最大の太陽電池関連企業群であるRenewable

Energy Corporationを創設、初代CEOを務めたDr. Alf

Bjorsethにより、太陽電池分野での広範囲に亘る事業展開を通じ、本業界の発展に貢献する事を目的として、2005年12月に設立されました。

本ウェーハ事業に関しては、ノルウェー西部のArdal市において、2008年初頭の量産開始を目指し工場建設を開始済であり、以後、順次生産規模を拡大し、2010年には年産能力を太陽電池換算で430MWにまで引き上げる予定です。

当社は本年春より社内に太陽電池専門チームを発足させ、本分野における取り組みを加速する事を決定致しました。

今回の出資によりNorSun社を本分野におけるコア事業と位置付け、人的交流も含めた関係強化、また今回の事業パートナーである現地大手資源会社、欧米大手投資銀行、他のパートナー各社、NorSun社顧客である有力セルメーカー等と本分野における連携強化を図って参ります。

その上で、新技術の発掘及び事業化、上流から下流までのバリューチェーン構築等、積極的な事業展開を推進し、今後が有望視されるクリーンエネルギーの一つである太陽電池分野のビジネス拡大を通じ社会へ大きく貢献していくことを目指して行きます。

---

2006/11/8

Norsk Hydro

Invests in Norsun for Solar Cell Production

---

2008/3/4

NorSun AS

Norsun selects

Singapore for its new solar wafer plant

The Board of

Directors of NorSun AS has decided that it intends to

establish its next solar wafer factory in Singapore, provided that satisfactory

final agreements will be completed with the authorities in

Singapore. Norsun plans to start the erection of the plant

during Q3 2008 which should allow start-up of commercial

manufacturing in Q3 2009. The capacity of the manufacturing

facility will be up to 350 MW. 原料のシリコンはサウジアラビアの合弁工場から調達。

NorSun has concluded

its site selection process for the location of its next solar

wafer Fab. This plant will come in addition to the existing

Fab in Vantaa (Finland), and the plant that soon will

become operational in Årdal (Norway).

---

SunPower Corporation

SunPower solar

technology was developed by Dr. Richard Swanson and his

students while he was professor of electrical engineering at

Stanford University.

Financial support for Dr. Swanson's early research was

provided in part by the U.S. Department of Energy and the

Electric Power Research Institute (EPRI).

In 1985, Dr. Swanson

founded SunPower Corporation to commercialize high-efficiency

photovoltaic cell technology for use in solar concentrators.

In January 2007,

SunPower acquired PowerLight Corporation, a leading global

provider of large-scale solar power systems. PowerLight has

designed, deployed and operates hundreds of large-scale solar

systems around the world with a total capacity of more than

150 megawatts and growing.

By integrating

processes and technologies across the value chain, SunPower

plans to reduce the installed cost of a solar system by 50%

by 2012. We believe solar systems will produce power that can

compete with retail electric rates and become a mainstream

energy resource.

日本経済新聞 2008/7/2

サウジで発電・造水事業 住商、総事業費6000億円

住友商事はサウジアラビアで発電・造水事業に乗り出す。総事業費は約6千億円で日本企業による海外発電事業としては過去最大。

サウジの東部湾岸のラスアズズールに石油火力発電所と海水淡水化設備を組み合わせた大型プラントを建設する。発電能力は100万キロワットと日本の通常の原子力発電1基分に相当する。造水能力は世界最大の日量100万トンで、日本の家庭なら300万人強の生活用水を賄える。サウジ全体の給水能力を3割押し上げる効果があるという。来年2月に着工し、2021年の運転開始を目指す。

サウジ政府が40%、住商とマレーシアの独立系電力事業者のマラコフインターナショナル、現地財閥企業のアルジョメが各20%出資して事業会社をつくり、建設から運営までを手掛ける。プロジェクトの主導権は住商が握り、主力設備は富士電機ホールディングス傘下の富士電機システムズ製を採用する考え。

2008年07月02日

住友商事株式会社

住友商事株式会社がサウジアラビア王国・ラスアズールIWPP入札にて一番札獲得

住友商事株式会社は、マレーシアの発電事業会社マラコフ社Malakoff

Corporation Berhad 、サウジアラビア民間財閥のアルジョメ社

Al-Jomaih Automotive Company.とコンソーシアムを組み、中東のサウジアラビア王国にて実施、6月28日に締め切られたラスアズール

造水・発電プロジェクト(Ras Azzour IWPP:Independent

Water and Power Producer)の入札に参加し、翌29日の開札結果、一番札(最安値提示)を獲得したことが確認されました。

本件はサウジアラビア東部、アラビア湾岸に位置するRas

Azzour (Ras Al Zour) 地区に、日量100万トンの造水プラントおよび850〜1,100MW原油焚き通常火力発電プラントの建設を行い、完工後は同プラントを操業し、20年間にわたりサウジアラビア水利電力省傘下のWater

& Electricity Company(WEC)に対して電気・水の販売を行う事業権入札です。

総事業費は、新設プラント建設費用他を含み、総額約60億ドル規模となる見込みです。今後、客先との交渉を経て、2008年度内でのWECとの売水・売電契約(PWPA)の締結およびコントラクターとのプラント建設契約の締結、国際銀行団との融資契約締結を目指します。新設プラントの完工は2012年夏を予定しています。

Jeddah, 22nd July

2003

A water and

electricity company was established, with a capital of SR30

million ($8 million), as the first practical partnership

between a government body and a semi-private establishment,

Asharq Al-Awsat reported.

The new company, which will be based in Riyadh, is a

partnership between the Saline Water Conversion Corporation (サウジ海水淡水化公団), a government body, and the

Saudi Electricity Companyサウジ電力会社, which has a 70% government

stake

On 29th

June 2008 in Riyadh, the Kingdom, WEC opened bids to

build, own and operate the Ras Azzour IWPP from each of

the following consortia:

- ACWA

Power Projects / Kepco

- Suez

Tractabel / Marubeni Corporation

- Sumitomo

Corporation / Malakoff International Limited /

Aljomaih Automotive Co. Ltd.

The Ras Az Zour IWPP

project is the third IWPP being undertaken by WEC after

successfully implementing Shuaibah and Shuqaiq IWPP.

Shuaibah

Expansion IWP

The Project was requested by the Government to be

developed on an urgent basis to add 150,000m3/d net water

desalination capacity. SAMAWEC, the successful bidder for

the Shuaibah IWPP, was invited to submit a proposal to

develop the Project broadly under the same economics and

contractual arrangements as the Shuaibah IWPP . The

Project is located on a reclaimed land south of Shuaibah

III IWPP.

The Project is under Construction and the overall Project

completion progress is 71.72 % as on 31st March, 2008.

Other Details

Project Company: Owned by SAMAWEC (60 %), PIF (32 %)

& SEC (8 %)

SAMAWEC is owned 30 % by ACWA Power & remaining 30 %

by Malaysian consortium (Tenaga Nasional Berhard,

Malakoff Berhard & Khazanah Nasional Berhard)

Shuaibah

IWPP

ACWA Power, Saudi Arabia

Malakoff Berhard, Malaysia

Tenaga Nasional Berhard, Malaysia

Khazanah Nasional, Malaysia |

Shuaibah

Expansion IWP

ACWA Power, Saudi Arabia

Malakoff Berhard, Malaysia

Tenaga Nasional Berhard, Malaysia

Khazanah Nasional, Malaysia |

Shuaibah-III IWPP

Project

The Shuaibah-III IWPP Project is the first of the IW(P)Ps

under development in Saudi Arabia and represents a major

development in Saudi Arabia’s water and power sector

to help satisfy the increasing national demand for power

and water. The Project serves as a template for similar

undertakings by Water & Electricity Company. Shuaibah

- III IWPP has been developed by Saudi Malaysian Water

Electricity Company (SAMAWEC) which owns 60 % of the

Project Company. The overall project completion is about

88.9 % as on 31st March, 2008.

The Project is based on BOO (Build, Own & Operate)

basis under a 20 year PWPA Agreement for the design,

construction, commissioning, testing, ownership,

operation and maintenance of a new 900 MW light crude

oil-fired power and 880,000 m3/day (194 MIGD:Million

Imperial Gallon per Day)

desalination plant and associated facilities based on

about 80:20 debt to equity project financing.

The Project is located adjacent to the existing SWCC

Shoaiba power and desalination complex 110 km

south of Jeddah, on the western coast of Saudi Arabia.

The project will serve the water requirements of Makkah,

Jeddah, Taif and Al-Baha cities and the electrical

requirement of Western Electricity grid.

The Power Plant will be operated as a base load plant

with the capability of following the daily and seasonal

load profile of KSA’s western region, where

peak power demand occurs during summer and the Hajj

periods, whereas water demand is generally constant

throughout the year.

Shuqaiq

IWPP

Implementation

of a 850 MW and 47 MIGD independent power and water

project on a BOO basis at Shuqaiq in the Kingdom of Saudi

Arabia. The project represents a major development in

Saudi Arabia's water and power sector to help satisfy the

increasing national demand for power and water.

The Shuqaiq phase II project will be developed as a

greenfield Arabian heavy crude oil-fired power and

seawater desalination plant located on land at Shuqaiq,

105 km south of Abha and 140 km north of Jizan, on the western coast of

Saudi Arabia. The proposed site is located next to the

existing Shuqaiq Phase I (128 MW and 26 MIGD).

The plant will be built, owned and operated by the

project company and upon award of the contract the client

will sell power and water for 20 years to the Water and

Electricity Company (WEC) on a PWPA basis (Power and

Water Purchase Agreement).

Shuqaiq is the second of four Independent Water and Power

Projects (IWPPs) in the KSA. The other three projects are

Shuaibah IWPP, for which ILF performed Technical Advisor

Services from the RFP issue until financial close, Raz

Azzour and Jubail IWPP Projects (canceled).

Shuqaiq

IWPP

ACWA Power, Saudi Arabia