SK

Corp. to build naphtha cracker in China

SK Chemical sold its TPU business

to Lubrizol Corp.

SK Chemicals, Eastman Chemical

Form JV for cellulose acetate tow

BASF

sells styrene monomer plant in Korea

SK to build $1.1 bil China petchems complex with Sinopec, BP

SK Corp

1962/10 Korea Oil

Corp. established.

Born as the First Oil

Refining Company in Korea

In the 60s

when Korea strove to be economically independent and

industrialized, SK Corp. (the first domestic oil refining

company, originally called Korea Oil Corporation) started

operating an oil refinery in 1964. SK Corp. has played a key

role in the economic development of Korea by supplying oil

steadily for almost 40 years since then.

1970-79

Playing a Major Role in

the Economic Development of Korea

In the 70s

when the Korean economy made rapid progress, SK Corp. started

a petrochemical business which was the core business of the

second five-year economic development plan. This business

operated the first domestic aroma and ethylene production

facilities to supply chemical materials nation wide.

Therefore, it can be said that the SK Corp. opened a new

chapter in an industry that is considered the essence of

modern industry.

| 1970.

5 |

|

Aromatic

plant started up (216,000 tons/yr.). |

| 1970.

6 |

|

50

percent equity share and management rights acquired

by Gulf Oil Corp. |

| 1973.

3 |

|

Naphtha

cracking center started up (100,000 tons/yr. of

ethylene) |

| 1978.

3 |

|

Naphtha

cracking center expanded to 155,000 tons/yr. of

ethylene. |

「人民網日本語版」2004年10月29日

韓国・SKグループ、中国法人設立 石油事業展開へ

韓国大手財閥・SKグループの傘下企業が28日午後、投資額3千万ドルの中国法人「SK(中国)投資有限公司」の設立を発表した。新会社の金相国総裁(社長)は「中国は今後、SKのグローバル化の重心となる。このため、SKが中国から上げた利益はすべて中国へ再投資し、中国事業の発展を促進していきたい」と表明した。

金相国総裁は、新会社の発展方向を次のように位置付けている。

実力ある中国の現地企業との協力を展開し、中国政府の開放政策にあわせて原油の卸売・小売分野に進出するほか、中国事業の長期的発展に着目し、製油業などの事業も展開していく。これにより、企業の競争力を確保し、産業のバリューチェーンを構築する。中国における投資方針の柱は、(1)中国国内に設立した法人をSK(中国)投資に統合し、管理構造を簡素化する、(2)今後中国に設立する法人は、SK(中国)投資有限公司からの直接出資とする――の2つ。

朝鮮日報 2007/05/30

SKグループ、7月から持ち株体制に

SKグループが、持ち株会社体制への移行を最終決定した。同社は29日、汝矣島63ビルで臨時株主総会を開き、持ち株会社体制への移行に伴う会社分割案件などを決議した。

これにより、SKは7月1日からSKグループの持ち株会社となり、精油、化学事業などを担う新設法人はSKエナジーという社名で新たに出発する。

May 29, 2007

SK

Shareholders

of SK Corporation today overwhelmingly approved the company’s shift to a holding-company

structure and the split into two entities, SK

Holdings Company Ltd and SK

Energy Company Ltd. Shareholders at an

Extraordinary General Meeting held today in Seoul, showed

their strong support for the SK Corp. Board’s recommendation.

SK

Corp.’s structural

reorganization splits the company into a holding company and

an operating company. The new holding company, SK Holdings

will concentrate on business investments, while SK Energy,

the operating affiliate, focuses on the energy and chemical

businesses. SK Holdings will also carry out the role as the

incubator for new business areas, taking charge of the life

science business sector.

2007/7/2 SK

SK Corporation

Restructures to Enhance Shareholder Value and Corporate

Governance Transparency

o

Reorganization Splits Company into SK Holdings and SK

Energy as of

July 1

o Two New Entities Hold First

Board Meetings to Appoint Chief Executives

SK Holdings and SK Energy today held their first Board of

Directors meetings following the structural reorganization of SK

Corporation, which has been split into a holding company and an

energy operating company as of July 1.

The

two new entities will be listed separately on the Korea Stock Exchange. With

the split-off effective July 1, SK Holdings and SK Energy will

begin trading separately on July 25. Trading has been suspended

for SK Corp.’s existing shares since the

closing of the Korea Stock Exchange on June 27.

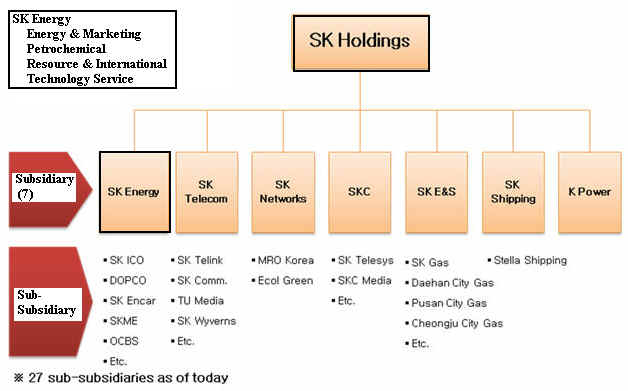

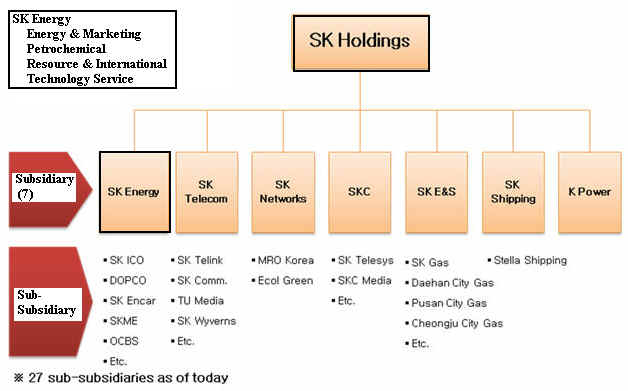

<About SK’s Holding Company Structure >

The following illustration describes the new structure of SK

Holdings following the reorganization.

The Lubrizol Corporation

2008/10/13

Lubrizol Expands Estane Engineered Polymers Product Offerings

The Lubrizol Corporation announced today that it will expand its

Estane(R) Engineered Polymers product line with the purchase of

the thermoplastic polyurethane (TPU) and conductive polymer

business and assets from SK Chemicals Co., Ltd., a global leader

in specialty chemicals and life sciences. In 2007 this business

had annualized revenues of approximately $30 million. The deal

closed on October 10, 2008.

With 50 years of industry experience, Lubrizol is a global leader

in thermoplastic elastomers, marketing products under the Estane

Thermoplastic Polyurethane brand name. Estane TPU is an

engineered, highly versatile thermoplastic elastomer that can be

processed through film, sheet and fabric coating, extrusion

molding, injection molding, calendaring, overmolding, and

blowmolding for markets like wire and cable, hose and tube,

optical, industrial, agriculture, and others.

“The

combination of SK Chemicals’ market presence in Asia Pacific,

in particular Korea, along with Lubrizol’s significant global position

creates synergies and expanded product offerings that we believe

will benefit all of our customers,” said Mike Vaughn, Lubrizol vice

president, Estane Engineered Polymers.

The agreement includes all commercial, production and

research and development assets of the TPU and conductive polymer

business of SK Chemicals, a Republic of Korea corporation.

Over the next 12 to 18 months, marketing and production will be

transitioned from SK Chemicals to Lubrizol, unifying the product

offerings under the Estane Engineered Polymers product line.

Financial terms of the agreement were not disclosed.

* SK Chemical sold its two polyurethane plants in Korea and China

to U.S. chemical company Lubrizol Corp.

January 22, 2009 Dow

Jones

SK Chemicals, Eastman Chemical Form JV

South Korea's SK Chemicals Co. said Thursday that it has signed a

preliminary deal with U.S.-based Eastman Chemical Co. to set up a

joint venture, according to Yonhap News Agency.

The joint venture, to be named Eastman Fibers

Korea Ltd.,

will build a plant with annual capacity of 2,700 metric tons

of cellulose acetate tow (酢酸セルロース繊維の束), a raw material used primarily

in cigarette filters, Yonhap said.

The plant is scheduled to be built in the city of Ulsan, 414

kilometers southeast of Seoul, sometime between early this year

and the second half of next year, it said.

Eastman

will hold an 80% stake in the joint venture with SK

Chemicals owning the remainder, it said.

2009-08-03

BASF sells styrene monomer site in Korea

BASF has announced that it will sell its styrene monomer site in

Ulsan, Korea, to SK Energy, a South Korean refining company.

The contract comprises the plant with a capacity of 320,000

metric tons of styrene monomer per year and the 50,000 square

meter site, which is situated within SK’s production complex . The two

companies have agreed not to disclose financial details of the

transaction.

Hyung Tae Chang, Group Vice President Styrenics Asia explained: “The styrene monomer plant in Ulsan

has been

idled since October 2008 because of an oversupply in the

regional market. We are now obtaining styrene monomer from other

sources and will continue to supply our Asian customers with the

plastics polystyrene, acrylonitrile-butadiene-styrene copolymer

(ABS) and expandable polystyrene (EPS) from a production plant at

another BASF site in Ulsan.” The sale will affect 34 employees,

most of whom have accepted early retirement programs.

Joachim Streu, President of BASF’s global Styrenics unit added: “We are working intensively to

restructure and significantly improve profitability in the

styrenics value chain. In order to shape the business

sustainably, we are considering all options, including capacity

reductions such as the closure of an 80,000 ton per year

polystyrene plant in Ludwigshafen, Germany, in June 2009.”

BASFは8月3日、蔚山のSKコンプレックスにある年産32万トンのSMプラントをSK

Energy に売却すると発表した。

このプラントはアジア市場の供給過剰のため昨年10月から休止していた。

BASFは蔚山にPS(25万トン)、EPS(8万トン)、ABS(25万トン)のプラントを持つが、原料SMは外部購入する。

このSMプラントはBASFが2001年にSKから購入したもの。

SKは同地に元 SK Oxichemical のSM/PO(384千トン/180千トン)の併産設備を持っている。

Platts Feb 23, 2012

S Korea's SK to build $1.1 bil China petchems

complex with Sinopec, BP

South Korea's SK Group, which owns the country's top oil refiner, has agreed to

build a Won 1.2 trillion ($1.1 billion) petrochemicals complex in China jointly

with China's state-owned Sinopec and BP, the

company said Wednesday.

SK, which signed a preliminary deal with Sinopec and BP Wednesday, said the

complex will have the capacity to produce 200,000 mt/year

of butanediol, 600,000 mt/year of acetic acid and 250,000 mt/year of ammonia.

Butandiol 200,000t SK &

Sinopec

Acetic acid 600,000t BP & Sinopec

Ammonia 250,000t Sinopec

"The complex in the southwestern Chinese city

of Chongqing 重慶 breaks ground as early as July or

August and is expected to reap more than Yuan 2 billion ($318 million) in

pre-tax profits after completion in late 2014 or 2015," SK said.

The butanediol plant, which will cost Yuan 3.7

billion, will be built and run by a joint venture between

SK and Sinopec. It will be the biggest plant in China producing

butanediol to make spandex, synthetic leather and polyurathane, SK said.

The acetic acid plant will be constructed and run

by a joint venture between BP and Sinopec, while

the ammonia plant will be built and run solely by

Sinopec, SK said, without providing shareholding

details on the ventures.

The Chongqing butanediol plant will be SK's third petrochemical project with

Sinopec. The two companies built a $26.5 million solvents

plant, with a capacity of 60,000 mt/year, in Shanghai in 2004.

Shanghai Gaoqiao-SK Solvent

Last December, SK and Sinopec signed a

memorandum of understanding to build an 800,000 mt/year

ethylene plant in Wuhan, central China's Hubei province.

2008/6/2 韓国SK

Energy、シノペックの武漢エチレン計画に出資

"The Chongqing project is expected to

accelerate SK's push for expanding projects in China," the company said.

The SK Group is a family-run business conglomerate which owns South Korea's

biggest oil refiner SK Innovation which in turn has a petrochemical arm SK

Global Chemical. The group controls dozens of affiliates in various industrial

segments, including the country's biggest LPG distributor, SK Gas.

2013年02月04日 Chemnet

SK Chemical と帝人 PPS事業で合弁会社設立

韓国・SK Chemical は、ポリフェニレンサルファイド(PPS)事業で帝人と合弁会社を設立することを明らかにした。

SKは塩素を使用しない独自の技術を開発し、プラントを建設するが、ポリカーボネートなどのコンパウンド材料を持つ帝人と提携する。

7月末にSKが66%、帝人が34%出資の合弁会社を設立する。

合弁会社は蔚山に2300億ウォン(200億円弱)を投じ、年産12千トンの工場を建設し、2015年にスタートさせる予定で、その後需要の増大に合わせ増設し、20千トンに増やす計画。

SKによると、現在のPPSの能力の世界合計は94千トン。

SKは2009年3月、年産30トンの独自技術のPPS工場を完成させた。

PPSの既存の製法はパラジクロロベンゼンと硫化ソーダを反応させるが、SKの製法は塩素を使用しないもので、世界初の環境に優しいPPSであるとしている。

同社は2012年12月20日、PPSへの大規模投資を決めたと発表した。

同社では、塩素を使用しないので、廃液処理を必要とせず、また、製品に塩素を全く含まないので、特に電気・電子部品市場で差別化を確保できるとしており、「環境に優しい」差別化で2019年の世界市場シェア20%確保を目指す。

2015/08/27

SKC, BASF in talks to build hydrogen peroxide

plant in S. Korea

South Korean chemicals maker SKC Inc. and

Germany-based chemical firm BASF are close to

clinching a deal later this year to build a hydrogen

peroxide plant in the southern industrial city of Ulsan, company

officials said Thursday.

SKC, a chemical unit under SK Group, has sought to use BASF's production license

to build a propylene oxide facility with a 400,000-ton

capacity in Ulsan, 414 kilometers southeast of Seoul.

If an agreement is reached by year-end, the two firms will start investing in

the project early next year to complete it by 2018, SKC said.

Propylene oxide is a key raw material used for a wide range of industrial and

commercial products.

BASF also has been negotiating with Belgium's Solvay

to build a hydrogen peroxide plant with a 280,000-ton

capacity in the city, a major hub for the nation's chemical and heavy

manufacturing industry, the provincial government said.

On Thursday, senior officials of the three companies met with Ulsan city

officials to discuss ways to launch the project, the provincial government said,

noting that the deal is estimated at 1 trillion won (US$833.8 million).

SKC has been stepping up cooperation with global players to expand its business,

forming a joint venture with Japan's Mitsui Chemicals last month for

collaboration in R&D and overseas marketing.

ーーーー

HPPOはDowとBASFが共同で開発し、過酸化水素についてはSolvayが協力している。

DowとBASFはアントワープでJVでHPPOを生産している。

2009/3/12 ダウとBASFのHPPO法PO生産開始

Dow Chemical

はまた、タイのSiam

Cement Group (SCG)とのJVの

MTP HPPO Manufacturing

でHPPO工場を建設している。

2008/6/16 Dow、タイで過酸化水素法PO工場建設

Evonikはこれとは別に、Uhdeとの共同開発でHPPO製造技術を開発した。

EvonikとUhdeはこの技術を韓国のSKCに供与し、SKCは蔚山に100千トンのHPPOプラントを建設、2008年にスタートした。

SKCは旧称・油公ARCOで、ARCOのPO/SM併産法で180千トンのPOを生産しており、HPPOを加え、POの合計能力を280千トンとした。

なお、Evonikは子会社Evonik Degussa Peroxide

Koreaで過酸化水素を製造しているが、2010年11月、SKCはこの子会社に45%出資し、協力関係を強化した。

2022/8/23

SK, SABIC to invest $150 mn to boost

Korean capacity

Their Korean joint venture will

increase its annual production of high-performance chemical products by

43%

SK Geo Centric Co. and Saudi Basic

Industries Corp. (SABIC) plan to co-invest 200 billion won ($150

million) to increase their production of high-performance petrochemical

products in South Korea, SK said on Tuesday.

SK総合化学は2021年に社名を「SK geo

centric」に変更した。

Their 50:50 Korean joint venture,

SABIC SK Nexlene Co. (SSNC), signed a

memorandum of understanding with the Ulsan metropolitan government on

Aug. 23 to expand its production lines of

polyolefin elastomers (POEs).

JV設立 2015/7/9

SK Chemical とSABIC、ポリエチレンJV設立

Regarded as an eco-friendly chemical

product, POEs are increasingly used in automobiles and solar cells. The

material reduces the weight of plastic parts of automobiles. POE film is

also used for solar panels thanks to its energy efficiency relative to

other types of film.

The new production lines in Ulsan, about 400 km southeast of Seoul, will

be built on 1,322-square-meter land by July 2024. If completed, it will

boost SSNC's production capacity by 43% to 300,00

tons a year. More than 90% of its output will be exported, SK

said in a statement.

SSNC already operates a 68,100-square-meter plant in Ulsan, in which

both SK and SABIC had invested a combined 605.1 billion won. The plant

produces 210,000 tons of Nexlene, an

ethylene-based high-performance petrochemical product developed by SK

Geo Centric in 2010.

The JV produces POEs, polyolefin plastomers (POPs) and linear

low-density polyethylene, cracking open the high-performance

petrochemical market dominated by global giants such as Dow Chemical Co.

POPs boast greater sealability than other chemical materials, thus

adopted for food and medical packaging. The market of both POEs and POPs

is expected to grow at an average rate of 5% per year, SK said.

SABIC is a Saudi chemical company, a majority owned by Saudi Aramco.