Olin http://www.olin.com/about/history.asp

In October of 1996, Olin

announced a series of strategic initiatives that were designed to

create a stronger, more focused and more valuable company. To

begin with, Olin spun off to shareholders our former Ordnance and

Aerospace divisions as Primex Technologies, Inc.

We also announced the sale of our TDI and ADI isocyanates

businesses to Arco Chemical for

$565 million in cash. While Olin was a leading producer of TDI in

North America, we neither had a presence in important

complementary products such as MDI, nor a strong propylene oxide

position for flexible polyols. We also sold our surfactants

businesses at our chemicals' complex in Brandenburg, Ky. to BASF

and Pilot Chemical Company.

Olin used the proceeds from the TDI sale and other divestments to

repurchase Olin common stock, to pay down debt, and to purchase DuPont's 50% share in

Niachlor -- a joint venture

chlor alkali plant in Niagara Falls, N.Y. The company also

invested in a new

chlor alkali plant in McIntosh, Alabama. The new Sunbelt plant was built for $200

million as a joint venture between Olin and Geon, a major Olin customer in the polyvinyl

chloride (PVC) market. Geon takes 100% of the plant's chlorine

for its use in making PVC resins, while Olin in turn markets the

plant's high-purity caustic soda.

Once these strategic actions were completed, Olin had what

amounted to two different sets of businesses with entirely

different dynamics. On the one hand, the company's specialty

chemicals businesses were driven by the need to supply customers

with tailored chemicals and technology and a high level of

technical customer support. On the other hand, Olin's more

traditional basic materials businesses competed more on price and

sold into more mature, slower growth markets.

In mid-1998, Olin announced that it would spin off its specialty

chemical businesses as a separate, publicly traded company. The purpose of the spin off was to free

each of the new companies -- Olin and the spun off company -- to

focus exclusively on growing its own businesses and competitive

advantages. On February 8, 1999, Olin spun off its specialty

chemical businesses as Arch Chemicals, Inc.

Around that time, every Olin stockholder received one share of

Arch Chemicals stock for every two shares of Olin stock held.

Following the spin off of Arch Chemicals, Olin became a $1.5

billion company that is a leading North American producer of

copper alloys and other metals, ammunition, and chlorine and

caustic soda. One of the world's best basic materials businesses,

the company today is comprised of three divisions -- Olin Brass,

Winchester (both of which are headquartered in East Alton, Ill.)

and the Chlor Alkali Products Division, which is headquartered in

Cleveland, Tenn.

Olin Brass is the world's leading developer of high

performance copper alloys and is the U.S. market share leader in

copper and copper alloy strip. Winchester is the world's largest ammunition

producer and a leading producer of small caliber ammunition in

North America. And Chlor Alkali Products is the largest supplier of chlorine and

caustic soda in the eastern United States and the fourth largest

nationwide. Today, Olin has approximately 6,700 employees,

principally in North America.

We at Olin are excited to be writing a new chapter in our long,

proud history. In the months and years ahead, we will fulfill our

bright promise by capitalizing on our leadership positions in

copper alloys, ammunition and chlorine and caustic soda. We'll do

so by intensely focusing on customer needs, aggressively managing

costs and pursuing synergistic growth opportunities.

AstraZeneca PLC was formed on 6

April 1999 through the merger of Astra AB of Sweden and Zeneca Group PLC of the UK. The merger represented the

combination of two companies with similar science-based cultures

and a shared vision of the pharmaceutical industry.

The AstraZeneca Board believes that the merger will improve the

combined companies' ability to generate long-term growth and

shareholder value through:

Global power & reach in sales and marketing

・ Major primary care

presence, particularly in gastrointestinal, cardiovascular and

respiratory medicine

・ Leading position in a

number of specialist/hospital markets, including oncology and

anaesthesia

・ Ability to deliver the

potential of existing and future products through the power and

reach of a combined global sales and marketing resource

・ Widespread class

coverage in key therapy areas, such as cardiovascular and

respiratory disease, due to complementary nature of products

Stronger R&D platform for innovation led growth

・ Substantial research

and development (R&D) expenditure - over $2.5 billion

annually

・ Strong combined

development pipeline

・ Potential for further

strengthening of the pipeline by enhanced discovery and

development capability through greater scale and focus on

selected areas and technologies - in particular, complementarity

in cardiovascular, respiratory, central nervous system and

anaesthesia/ analgesia R&D should help to deliver significant

benefits

・ Research partnerships -

to supplement its own R&D expertise, AstraZeneca will

continue to work with external partners, such as academic

institutions and other pharmaceutical companies, to broaden its

range of early exploratory research and to allow access to a

wider base of scientists and new technologies

Greater financial strategic flexibility

・ Financial strength and

scale to give AstraZeneca's management greater strategic

flexibility to drive long-term earnings growth

・ Substantial operational

efficiencies resulting in cost savings

http://www.astrazeneca.com.au/AboutUs/1990s.htm

At Zeneca

The 1990s was a time of great change for ICI Pharmaceuticals with

the birth of Zeneca and then AstraZeneca, one of the world's

leading pharmaceutical companies, at the end of the decade.

By the 1990s, ICI Pharmaceuticals employed more than 12,000

people. It had 21 production sites and 150 sales offices around

the world, and major research laboratories in the USA, France and

the UK.

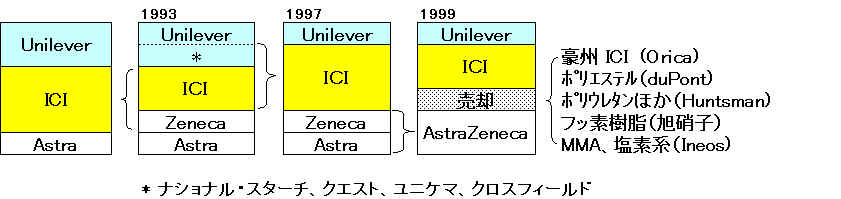

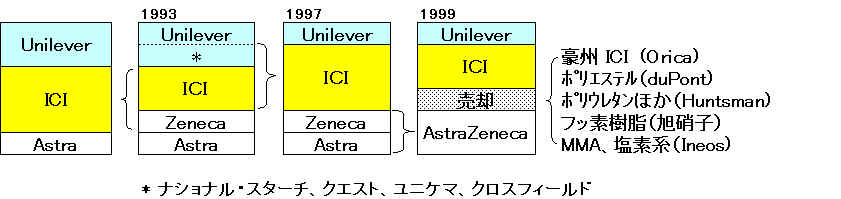

In 1993, ICI

demerged three of its businesses (Pharmaceuticals, Agrochemicals

and Specialties) to form a separate company, Zeneca.

Zeneca continued to build on its pharmaceutical inheritance in

cardiovascular, anti-cancer, anti-infective and anaesthetic

medicines. Research and effective licensing strategies in

respiratory and central nervous system medicine also brought

great rewards.

In 1995, Casodex (bicalutamide) was launched for the treatment of

advanced prostate cancer. A new long-acting 3-month depot

formulation of Zoladex (goserelin acetate) was also released,

which represented a significant development in drug delivery for

which Zeneca received the UK Queen's Award for Industry.

In respiratory medicine, the leukotriene receptor antagonist

Accolate (zafirlukast) was launched in 1996 for the treatment of

asthma. Leukotriene receptor antagonism represents the first

novel approach to asthma therapy in 20 years.

In central nervous system medicine, 1997 saw the release of

Seroquel (quetiapine), an atypical anti-psychotic agent, for the

treatment of schizophrenia and other psychotic disorders. Zomig

(zolmitriptan), a selective 5-hydroxytryptamine1B/1D

(5-HT1B/1D) receptor agonist, was also launched for the

treatment of acute migraine (licensed from Glaxo Wellcome).

↓

On 6 April 1999, Astra officially merged with Zeneca to form AstraZeneca. The merger represented the combination of two companies with science-based cultures and a shared vision of the pharmaceutical industry.

↑

At Astra of Sweden

Early in this decade, the

organisation of Astra's international marketing was expanded, and

several licensing agreements renegotiated to give the company

control over the marketing of its products in major markets.

Local marketing companies were acquired in Italy and Spain in

1990 and 1991. In 1994, Astra invested approximately SEK 8

billion in raised ownership (90%) in Astra Japan and in the

formation of Astra Merck Inc. in the USA.

The largest expansion of Astra's research and development in

modern times was carried out in 1995 with acquisition of new

research facilities in the UK (Astra Charnwood) and USA (Astra

Arcus USA).

In 1996, Losec (omeprazole) achieved the position as the world's

biggest-selling pharmaceutical. The success of the Turbuhaler

inhalation system for Pulmicort (budesonide), Oxis (formoterol)

and Rhinocort (budesonide) respiratory agents continued.

Astra shares were listed on the New York Stock exchange from May

1996.

In 1997, Astra launched Atacand (candesartan cilexetil), a new

angiotensin II type 1 (AT1)-receptor blocker, for the treatment

of hypertension to further support the broad portfolio of

cardiovascular drugs. In July 1998, the Astra Merck relationship

in the USA was restructured to form Astra Pharmaceuticals, L.P.,

and in the same year the advanced formulation of Losec, Losec

MUPS (Multiple Unit Pellet System) tablets, reached its first

markets.

1997/7/8 http://www.ici.com/pressoffice/news/08_07_1997.htm

ICI Completes Acquisition of Unilever Speciality

Chemicals Businesses

ICI has completed the acquisition of the Speciality Chemicals

businesses of Unilever for a debt free price of $8 billion (£4.9 bn). The businesses are:-

・ National Starch, a

world leader in industrial adhesives and number one in specialty

starches

・ Quest, one of the

world's leading fragrance, food ingredient and flavours companies

・ Unichema, a global

leader in oleochemicals

・ Crosfield, a major

producer of silicates, zeolites and silicas

ICI Chairman Sir Ronald Hampel welcomed the businesses into the

ICI Group. "The acquisition is a major milestone in

delivering a new ICI for the new century, "he said. "It

will move ICI's product portfolio more towards market driven

businesses supported by outstanding selling skills and science.

"The portfolio of businesses in ICI is well positioned to

develop and deliver sustainable profitable growth over the coming

years."

The deal was first announced in May 1997.

Pharmacia Corporation has emerged as a leading global pharmaceutical enterprise with a robust product portfolio, wide geographic reach and balance, and a $2 billion research engine to drive new product flow.

The roots of Pharmacia

Corporation date back almost 150 years to 1853 when a leading

Italian pharmacist, Carlo Erba, started his own company, which

later became Farmitalia Carlo Erba. This company would later

unite with Kabi Pharmacia, which began in 1931. These two

companies, along with Pharmacia Aktiebolag, form the three main

points of origin for Pharmacia AB, a Swedish-based company.

In the United States,

Pharmacia traces its roots back to 1886. It was then that W.E.

Upjohn, M.D., established The Upjohn

Pill and Granule Company of Kalamazoo, Michigan, (USA). The

company continued its growth throughout the 19th century,

eventually evolving into an innovative, international company.

In 1995, Pharmacia

& Upjohn was formed through the merger of Pharmacia AB and

The Upjohn Company. Pharmacia

& Upjohn became a global provider of human healthcare

products, animal health products, diagnostics and specialty

products. In 1998, Pharmacia & Upjohn relocated its global

headquarters from the United Kingdom to New Jersey (USA). In

September 1999, the company established its global headquarters

on a 70-acre campus in Peapack, New Jersey. This site is now the

management and pharmaceutical headquarters for Pharmacia

Corporation.

Monsanto was formed in 1901 when a high-school

dropout and entrepreneur, John F. Queeny, founded the company in

St. Louis, Missouri (USA), and began producing saccharin, an

artificial sweetener. Together with Dr. Louis Veillon, a chemist

from Switzerland, Queeny helped grow Monsanto into one of the

largest chemical companies in the United States. In 1927,

Monsanto registered as a public company and stock was first

issued on Oct. 10, 1929. Following saccharin, other products such

as aspirin, caffeine, and vanilla were being produced.

As Queeny and his son,

Edgar, grew Monsanto by aggressive licensing and acquisitions, as

well as by in-house research, another company also was

prospering. G.D.

Searle & Co., formed in

1888 by a young druggist named Gideon Daniel Searle, was an

innovative company developing many "firsts." These

include the first bulk laxative, the first motion-sickness drug,

the first oral contraceptive, the first once-a-day calcium

channel blocker for the treatment of hypertension, and many other

innovative products. Likewise, Searle discovered and introduced

aspartame, a hugely successful sugar substitute. G.D. Searle

& Co. had its headquarters in Skokie, Illinois. In 1985, G.D. Searle & Co.

became the pharmaceutical unit of Monsanto.

(モンサント社とアメリカン・ホーム・プロダクツ社の合併 → 破談)

Monsanto further defined

itself when, in August 1997, shareowners of the company approved

the spin-off

of its chemical business, Solutia Inc. In less than 100 years, Monsanto

established itself as a proven leader in the agricultural and

pharmaceutical businesses.

On April 3, 2000, Monsanto and Pharmacia

& Upjohn completed a merger creating a dynamic and powerful new

competitor in the pharmaceutical industry. This new companyーPharmacia Corporationーis a high-performance competitor. Working

in teams as part of a global organization, we are building one of

the best-managed companies in the industry. We are responding as

a partner to meet the diverse needs of the people we serve,

through a flow of innovative medicines, products and services. By

doing so, we are delivering best-managed performance for our

shareowners: superior long-term growth and profitability.

spin-off of its remaining 84% ownership of Monsanto to its current shareholders. →spin-off

Pfizer to acquire Pharmacia Corporation

As Pharmacia Completes Monsanto

SpinOff, Monsanto CEO Says Company Retains Focus and Strategic

Direction

As previously announced, at the close of business today Pharmacia

Corporation will distribute its 84-percent stake in Monsanto

Company to Pharmacia shareowners via a special stock dividend.

This distribution will complete Pharmacia's spinoff of Monsanto

and establish Monsanto as a 100-percent publicly traded company.

In marking the occasion, Monsanto President and Chief Executive

Officer Hendrik A. Verfaillie said Monsanto's focus would remain

on its long-term commitment to agriculture and the strategy it

has built around its customer base. "Today marks an

important milestone, affirming Monsanto's place as a company

solely dedicated to agriculture," said Verfaillie.

"However, this is just one milestone in a larger evolution.

We've assembled a company around our integrated solutions

strategy, and we believe that our strategy uniquely positions us

as a leader in the agricultural industry." Monsanto's

customer-driven integrated solutions strategy includes seeds,

biotechnology traits and agricultural chemistry. The company

enhances its strengths in these three individual elements by

combining them to provide integrated solutions for farm

productivity and food quality, Verfaillie said.

"In the past few years, commodity agriculture has been

besieged by challenges ranging from depressed prices to

extraordinary weather," said Verfaillie. "Our intention

is to focus our efforts on solutions that will improve farmers'

bottom-line productivity. This is something we see as a timeless,

underlying benefit that would be recognized in any market

condition." In addition to Monsanto's business commitment to

farmers, Verfaillie also has committed the company to the New

Monsanto Pledge, a code of conduct for doing business. The Pledge

includes five areas of commitment: delivering benefits to farmers

and the environment; dialogue with interested parties;

transparency with information and regulation; respect for other

points of view; and sharing of technology.

In connection with the spinoff of Monsanto from Pharmacia,

Verfaillie also announced that Christopher J. Coughlin, of

Morristown, New Jersey, will resign from the Monsanto board of

directors effective today. Coughlin, 50, is executive vice

president and chief financial officer of Pharmacia and has been a

member of the Monsanto board since March 2000. "We thank

Chris for his service and dedication to Monsanto shareowners

during the past two years on our board," said Verfaillie.

This change to the Monsanto board brings the number of directors

to nine. Verfaillie said Monsanto will look to add an independent

director to the Monsanto board in the future. Monsanto Company

(NYSE: MON) is a leading global provider of technology-based

solutions and agricultural products that improve farm

productivity and food quality. For more information on Monsanto,

see: www.monsanto.com.

2003/4/17 Aventis

Aventis Reduces its Shareholding in

Rhodia, Retains Economic Interest

Strasbourg, France -Aventis

announces today the reduction of its stake in Rhodia to

15.3% from 25.2% following a

definitive sale and purchase agreement with Credit Lyonnais

concerning 17.8 million Rhodia shares (40% of its Rhodia

shareholding). As a result of this transaction, Aventis will hold

27.5 million Rhodia shares and Credit Lyonnais will have acquired

9.9% of Rhodia’s share

capital. The sale will be formally completed by the end of April.

The price will be the market price of the Rhodia shares on the

day prior to the closing of this transaction.

Separately, Aventis and Credit

Lyonnais have reached agreement whereby Aventis will retain an

interest in the future evolution, whether positive or negative,

of the Rhodia share price, for a period of up to five years.

Commenting on this transaction,

Patrick Langlois, Vice Chairman and Chief Financial Officer of

Aventis, said: “This

transaction is an important step in our continued focus on our

core pharmaceutical activities

and reaffirms our commitment to our shareholders to exit the non-core

industrial activities. In

addition, this transaction is a first step to comply with the

requirement to

reduce the Aventis shareholding in Rhodia to below 5% by April

2004, pursuant to the 1999 agreement with EU and US antitrust

authorities. The structure of

this transaction enables us to retain the upside potential as

valuations of chemical companies improve in conjunction with a

recovery in the economic cycle and as Rhodia executes its’

business plan. Of course, we will

continue to seek ways to divest significant portions of our

remaining shareholding in Rhodia,” concluded Langlois.

In addition to Rhodia, Aventis holds

a 12% stake in the Swiss specialty chemicals company Clariant.

Given the recent decline in the market value of these companies,

Aventis intends to book a provision in its first quarter results

to reflect the current market value of these companies relative

to their book value.

About Aventis

Aventis is dedicated to treating and

preventing disease by discovering and developing innovative

prescription drugs and human vaccines. In 2002, Aventis generated

sales of ? 17.6 billion, invested ? 3.1 billion in research and

development and employed approximately 71,000 people in its core

business. Aventis corporate headquarters are in Strasbourg,

France. For more information, please visit: www.aventis.com

Statements in this news release

other than historical information are forward-looking statement

subject to risks and uncertainties. Actual results could differ

materially depending on factors such as the availability of

resources, the timing and effects of regulatory actions, the

strength of competition, the outcome of litigation and the

effectiveness of patent protection. Additional information

regarding risks and uncertainties is set forth in the current

Annual Report on Form 20-F of Aventis on file with the Securities

and Exchange Commission.

Notes to editors:

On the occasion of the creation of

Aventis in 1999, Aventis agreed to progressively dispose of its

stake in Rhodia pursuant to the antitrust review process carried

out by the European Commission in Europe and by the Federal Trade

Commission in the United States.

Specifically, in October 1999,

Aventis decided to sell immediately part of its stake in Rhodia

via an equity offering (thus reducing its interest in Rhodia from

67.3% to 25.2%) and to simultaneously issue Exchangeable Bonds

with respect to its remaining interest in Rhodia.

On November 28, 2002, Aventis

announced a cash tender offer to buy back the Exchangeable Bonds

in order to enhance its flexibility for the disposal of its stake

in Rhodia.

On January 17, 2003, all the

Exchangeable Bonds had been repurchased and cancelled and the

shares, which were underlying the tendered Bonds, are kept by the

Escrow Agent until Aventis completes their disposal. As a

consequence, the shares sold today to Credit Lyonnais will be

released by the Escrow Agent immediately prior to their transfer

to Credit Lyonnais.

May 14, 2003 Financial Times

In pole position/ PKN Orlen, Poland.

PKN Orlen is the largest chemical establishment in Poland. Its

history is indicated. Its turnover in 2002 was Zloty 16.8 bn (EUR

3.9 bn/$4.3 bn), which was 1.2% lower than in 2001. Earnings

before interest rose by 19% to Zloty 735 M.

The company has the largest refinery in Poland and it is the most efficient of its type

in Europe It makes feedstock for the integrated petrochemicals

and polymers plants.

Uhde is upgrading the aromatics plant by the addition of a new

unit using the Uhde Morphylane technology, coming on stream in 2Q

2004 to make 400,000 tonnes/y of benzene and toluene.

PKN Orlen holds 75% of Zaklady Azotowe Anwil, which has the biggest polyvinyl chloride (PVC) plant in Poland, and also makes nitrogen

fertilizers and polyethylene (PE) packaging, using ethylene from

PKN Orlen.

PKN Orlen made 2 m tonnes of petrochemicals in 2002 which was 30%

more than the 1.6 m tonnes it made in 2001. Demand in Poland for

polyolefins is increasing at 8-13%/y and half of the supply comes

from imports.

PKN Orlen and Basell have established a 50:50 joint venture (jv) Basell Orlen Poliolefins to construct a 400,000 polypropylene (PP) plant and a 320,000 tonnes/y high

density polyethylene (HDPE)

plant using the Spheripol and Hostalen Basell technology, and

starting up in 1H 2005.

PKN is expanding its ethylene capacity from 360,000 tonnes/y to 660,000

tonnes/y and its propylene capacity from 240,000 tonnes/y to

445,000 tonnes/y to supply the jv.

The PKN low density polyethylene (LDPE)

plant with a capacity of 150,000 tonnes/y will be taken into the

jv and the capacity will be reduced to 105,000 tonnes/y when the

HDPE plant is started up. The PKN PP plant has been recently

expanded to 140,000 tonnes and it will be part of the jv,

although the old PP plant will be closed. The advantages of the

jv are discussed.

http://www.millenniumchem.com/About+Us/Profile/Profile_EN.htm

Millennium

Chemicals (MCH - NYSE) is one of the leading chemical companies

in the world.

We supply millions of pounds of chemicals each year to

manufacturers for use in thousands of consumer and industrial

products. In short, we work hard to improve the fundamentals of

daily life.

Millennium Chemicals is…

| ・ | The world's second-largest producer of titanium dioxide (TiO2) and the largest merchant seller of titanium tetrachloride (TiCl4) in North America and Europe. |

| ・ | A leading producer of fragrance chemicals |

| ・ | The second-largest producer of acetic acid and vinyl acetate monomer in North America, and through its partnership interest in LaPorte Methanol Company, LP, a partner in a leading U.S.A. producer of methanol. |

| ・ | A 29.5% owner of Equistar Chemicals, LP, the second-largest producer of ethylene and the third-largest producer of polyethylene in North America. |

Millennium Chemicals' corporate headquarters are located in Red Bank, New Jersey. Millennium Chemicals' global network includes 4,000 employees on five continents. View our directory for a complete listing of office and manufacturing locations.

Ciba to focus on Asia for all new plants

Asia's fundamental importance to

the growth plans of Swiss specialty chemicals company Ciba was

underlined here on Tuesday by chairman and chief executive Armin

Meyer when he said all future capacity expansions would be

concentrated in the region.

Meyer, who was speaking at the company's annual results press

conference, said investments in the traditional regions of Europe

and the US would focus primarily on maintaining world-class

standards and process improvements.

"We don't plan any new plants in Europe or the US,"

said Meyer. "It doesn't make sense."

Meyer stressed that Ciba has very modern, well-equipped plants in

Europe and North America. "Of course we will modernise and

eliminate bottlenecks," he said. But all major new

greenfield plants will be located in Asia, with China the most

likely location.

Ciba has budgeted around SF250m ($198m/Euro160m) on annual

capital expenditure over the next two to three years, said Meyer.

About 60% will be spent on maintaining or improving environmental

health and safety, debottlenecking and further automation.

The remaining 40% will be invested in new production lines,

mainly in the home and personal care, plastic additives and

coating effects segments.

In defending the size of Ciba's capital expenditure budget, Meyer

said it did not include computers, software or research and

development (R&D). "And you need less money to build in

Asia," he added.

Meyer also explained that by using standardised technology and

systems, the cost of new plants could be reduced.

2004/2/17 Novartis 日本

Novartis completes strategic

acquisition to strengthen number two position in global medical

nutrition business

http://dominoext.novartis.com/NC/NCPRRE01.nsf/44aff02a639be034c1256b4b007b5f4d/f56ae6505bad1277c1256e3d00226082?OpenDocument

・ New presence in US retail

medical nutrition channel, access to Japanese market and strong

brand portfolio benefit Novartis Medical Nutrition

Novartis has completed the acquisition of Mead Johnson & Company's global adult medical

nutrition business in a USD

385 million cash transaction. No divestments were required to

obtain regulatory approval of the deal, which officially closed

February 13, 2004.

The acquisition adds strong brands like Boost® , Isocal® and Ultracal® to Novartis Medical Nutrition's portfolio

and expands its ability to meet the medical nutritional needs of

a growing outpatient and ageing population.

Novartis Medical Nutrition now enjoys a strong presence in the

fast-growing US retail channel for medical nutrition products, a

platform in the Japanese market and increased opportunities to

build its existing institutional medical nutrition business.

Announced on December 16, 2003, the acquisition includes the

brands, trademarks, patents and intellectual property assets of

Mead Johnson & Company's adult medical nutrition business.

Novartis Medical Nutrition, with global sales of USD 815 million

in 2003 (including Nutrition & Sante), offers a complete

range of enteral (tube feeding) and oral nutrition products and

devices tailored to the varying needs of patients and healthcare

professionals. The product range encompasses supplements, which

are taken orally, as well as other products administered through

tube feeds and specific medical devices. Its key brands include

Isosource® , Novasource®

, ResourceR, Impact® and Compat® .

About Novartis

Novartis AG (NYSE: NVS) is a world leader in pharmaceuticals and

consumer health. In 2003, the Group's businesses achieved sales

of USD 24.9 billion and a net income of USD 5.0 billion. The

Group invested approximately USD 3.8 billion in R&D.

Headquartered in Basel, Switzerland, Novartis Group companies

employ about 78 500 people and operate in over 140 countries

around the world. For further information please consult http://www.novartis.com.

Mead Johnson Nutritionals

http://www.meadjohnson.ca/about/Mead_Johnson_Nutritional_Heritage.htmMead Johnson Nutritionals' worldwide leadership in nutrition can be traced back nearly a century - to Edward Mead Johnson himself, the company's namesake and founder. In 1888, the life of E. Mead's baby son, Ted, was in danger because he was not thriving on his feedings and had to be fed a cooked "gruel" mixture. Years later, memory of this experience would inspire E. Mead to develop a product that would eventually lead to today's worldwide leader in infant formula sales, of Enfamil and Enfalac.

E. Mead first co-founded Johnson & Johnson with his brother. After a third brother joined the company, E. Mead decided to pursue other interests and formed the American Ferment Company, which he renamed Mead Johnson & Company in 1905. As he started his company, he explored a variety of products; however, his strongest interest was in scientifically based nutritional products.Mead Johnson & Company became a wholly owned subsidiary of Bristol-Myers Company (now Bristol-Myers Squibb Company) in 1967. Bristol-Myers Squibb is a diversified worldwide health company. It is a leading maker of innovative therapies for cardiovascular, metabolic and infectious diseases, central nervous system and dermatological disorders, and cancer, as well as osmotic care, wound management, nutritional supplements, and infant formulas.

日本における「成人向け医療用栄養食品」事業の移管について

http://www.novartis.co.jp/pdf/pr040218-2.pdf

ノバルティスファーマ株式会社(本社:東京都港区、代表取締役社長:通筋雅弘)は、ノバルティス社(本社:スイスバーゼル)が、ミードジョンソン社(本社:米国インディアナ州。米国ブリストル・マイヤーズスクイブ社の子会社)の「成人向け医療用栄養食品」事業を世界的に取得したとの発表に基づき、日本における同事業の移管について、次のとおり決定しましたのでお知らせいたします。

2004年2月14日より、ミードジョンソン株式会社(ブリストル・マイヤーズスクイブ(有)の100%子会社)の上記事業が、ある一定期間、ノバルティスファーマ(株)に移管され、将来的に、ノバルティスグループの中の別会社に移管される予定です。

この事業をより重要と位置づけるノバルティスの組織に組み込まれることにより、日本においても、今後の事業展開の新たな展望が開けるものと期待されています。

移管される「成人向け医療用栄養食品」事業は、日本において1987年より病院向け経腸栄養食品市場に本格参入し、現在、経腸栄養食品市場で約17%のシェアを獲得し、業界第2位の地位にあります。急速な高齢化社会に向けて病院、施設を中心に高い注目を浴びています。

ノバルテイスメディカルニュートリション(医療用栄養食品)事業部について

ノバルティスコンシューマーヘルス部門におけるノバルテイスメディカルニュートリション事業部の2003年度の売り上げは、8億1千500万ドル(937億円)で、患者さんならびにヘルスケアの専門家のさまざまなニーズに応える、経腸(経管)および経口の広範囲にわたる医療用栄養食品と関連医療器具を販売しています。

製品の範囲は経口で摂取するサプルメント、および管および特殊な医療器具により摂取するその他の医療用栄養食品など、多岐にわたります。

ノバルティスについて

ノバルティスは、医薬品部門とコンシューマーヘルス部門からなり、それぞれの分野における世界的リーダーです。ノバルティスグループ全体の2003年度の売り上げは249億ドル(約2兆8,600億円)で、純利益は50億ドル(約5,770億円)、研究開発への投資は約38億ドル(約4,370億円)でした。スイス・バーゼル市に本拠を置くノバルティスは、約78,500人の社員を擁しており、世界140カ国以上で製品が販売されています。詳細はインターネットをご覧ください→http://www.novartis.com

日本経済新聞 2004/2/21

海外会社研究 ロシュ

合併より利益率重視 中外製薬通じ日本事業拡大

規模ではなく質を追うーー。世界的な製薬業界再編のうねりを横目に、スイスの製薬大手ロシュが自社の中核事業強化を進めている。ライバルのスイス製薬大手ノバルティスからの合併提案をかたくなに拒否。医薬品と診断薬の2部門で足場を固める戦略だ。

「そうした(合従連衡の)流れには参加しない」。2月4日、スイス・バーゼルの本社で開いた年次記者会見。フーマー会長兼最高経営責任者(CEO)は断言した。

▼合従連衡とは一線

その1週間前、仏ソノフィ・サンテラボがアベンティスに敵対的TOB(株式公開買い付け)を発表。対抗してノバルティスもアベンティス買収に乗り出すとの観測が急浮上するなど、世界の製薬大手の再編機運が一気に高まっていた。だがロシュは合従達衡とは一線を画し、自主独立を明確にした。

背景にはいたずらに売り上げを拡大するより、まだまだ低い利益水準の向上を優先させたいとの思いがにじむ。2003年12月期の最終損益は30億6900万スイスフラン(約2600億円)の黒字。保有株の含み損を一掃して40億スイスフランの赤字となった前の年から急改善した。だがピークだった2000年12月期の86億スイスフランと比べると、まだ3分の1だ。

ノバルティスと比べても差は明らか。前期の売上高は日本円で約2兆6500億円とほぼきっ抗するが、ノバルティスの最終利益(約5300億円)は過去最高を更新、ロシュの2倍だ。

▼中核部門を強化

利益率改善改善ヘコスト圧縮を急いでいる。新薬開発に伴う研究開発費は48億スイスフランと12%増加。新薬発売に伴う営業費も増えたが、製造原価や一般管理費などを大幅に圧縮、吸収した。医薬品部門の売上高営業利益率は21.9%から23%に向上した。2004年12月期はこれを26%に引き上げる計画だ。

もうひとつの収益増強策が中核部門への「集中と拡大」。不採算だったビタミン・ファインケミカル部門を昨年9月末で売却。一方で診断薬事業の強化に力を入れた。

▼市場は好意的

大手同士の合従連衡は否定するが、部門強化のための小規模な事業買収にはむしろ積極的。昨年、スイスの医療機器メーカーで糖尿病治療用インスリンポンプ世界2位のディセントロニックを12億ドルで傘下に収めた。また、このほど14億ドルを投じて、米検査機器ベンチャーのアイジェン・インターナショナルの買収を完了した。

2002年秋に傘下に収めた中外製薬との連携効果にも期待を寄せる。リューマチ性関節炎治療剤などの分野で協力関係を強めていく方針で、利益面での貢献を期待する。世界2位の市場である日本での事業拡大を狙い、中外薬を通じた事業買収などにも前向きの姿勢をみせる。

大手との合併などを否定し利益重視を鮮明にするロシュの姿勢に、市場はおおむね好意的だ。最高財務責任者のフンツィカー執行役員も「世界には規模ではなく質が大事だと考える投資家も多くいる」と投資家の理解が得られていると強調する。実際、他の大手との合併に前向きなノバルティスの株価に比べ、昨年半ば以降の戻りはロシュ株に軍配が上がる。

ノバルティスとの合併話が棚上げになってからも株価は影響を受けていない。ノバルティスはロシュの議決権株の33.3%を持つが、同社のバセラ会長は「いまのところ買い増す予定はない」という。ロシュ側に配慮する形で、合併は両社経営陣の合意が前提という姿勢をとっている。

だが、ロシュが株式の3分の1をライバルに握られているという事実は揺るがない。大手同士の再編の流れと無縁でいられるかどうかは予断を許さない。