Dec 16, 2008 (Reuters via

COMTEX) -

Sunoco says seeking sale

of chemicals business

U.S. refiner Sunoco Inc wants to sell its chemical business and

is looking for a partner to supply it with crude oil from the

Canadian oil sands, Chief Executive Officer Lynn Laverty

Eisenhans said on Monday.

Both rival companies and private equity firms are interested in

evaluating the chemicals business, said Eisenhans, who took over

the CEO job in August, in a presentation to analysts.

The chemicals business, which posted a profit of $26 million in

2007, operates facilities in Pennsylvania, West Virginia, Texas

an Ohio and produces products used to make nylon, resins,

adhesives and different types of plastics.

The company also operates under a limited partnership with

Equistar Chemicals LP.

"If we don't get a buyer who can get it done, we will

continue to run it," Eisenhans said, adding the company

planned to use proceeds from a potential sale to invest in more

profitable businesses.

Philadelphia-based Sunoco expects to boost its SunCoke unit's

coke-making operations to supply the steel-making industry.

Sunoco, like other refiners, has seen its margins suffer as the

U.S. economic recession has crimped demand for gasoline and other

products. Eisenhans said the business would remain

"challenging and volatile."

The company is also seeking a partner to supply crude oil to its

U.S. Northeast refining system and could convert its Tulsa

refinery into a terminal if it could not sell the plant, she

said.

Eisenhans said Sunoco, was also hoping to find a partner to

supply its Toledo, Ohio refinery with crude from the Canadian oil

sands.

The oil industry has spend the past two years seeking to link

Canada's vast oil sands reserves in Alberta with refining

capacity in the United States.

ConocoPhillips and EnCana have 50-50 stakes in Alberta reserves

and two U.S. refineries, and last year, BP Plc and Husky Energy

agreed to link BP's Toledo, Ohio, refinery with Husky Energy's

oil sands holdings.

Such arrangements provide a secure market for the extra-heavy

crude and allow companies to avoid building upgraders in Alberta,

where a tight labor market has led to skyrocketing costs.

Shares in Sunoco were down 1.8 percent to $35.29 per share on the

New York Stock Exchange, underperforming the broader Standard

& Poor's Energy index, which was up 2.2 percent.

2008/12/15

http://library.corporate-ir.net/library/99/994/99437/items/318512/8396E9FB-DBFC-4B97-9232-E78749AA1C0B_121508.pdf

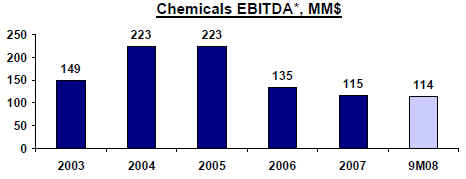

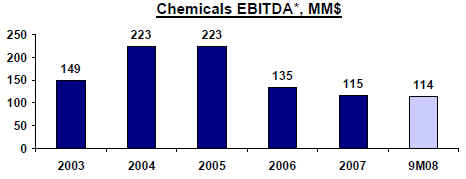

Chemicals

Assets consistently generate

income and cash but have not met targets for return on

investment

Weak global economic demand

negatively impacting market outlook

Actively pursuing sale of

business… execution depends on ability

to get reasonable value

北米の能力(10億ポンド) 同社推測

PP Lyondell 3.2

ExxonMobile 2.7

Sunoco 2.5

Total 2.5

Ineos 2.3

Formosa 1.8

Dow 0.9

Others 5.1

合計 21.0

フェノール

Sunoco

1.8

Shell 1.3

Ineos 1.3

Mount Vernon 0.7

(Sabic/citgo/JLM)

Dow/Carbide 0.6

Georgia Gulf 0.5

Others 0.2

合計 6.4

--------------------------------------

Sunoco HomePage

The Chemicals business

manufactures, distributes and markets refinery-based

petrochemicals used in the fibers, resins and specialties

markets.

Key products include

polypropylene, phenol and bisphenol-A used in many consumer and

industrial products. With production at nine plants and annual

sales of approximately five billion pounds, Sunoco Chemicals is a major force in its markets.

The primary focus of

Sunoco chemicals is to quickly adapt to the rapidly changing

marketplace in order to maximize profitability and better serve

its customers through safe and reliable operations while pursing

the necessary investments to remain competitive and enhance the

earning power of the business.

Sunoco Chemicals' product

line includes phenol, acetone, nonene, tetramer,

alpha-methylstyrene, toluene, xylene, benzene, cyclohexane,

bisphenol-A, and polypropylene. We are the number one producer of

phenol in the US and number two globally. We are now the number

three producer of polypropylene in North America due to the

acquisition of the Bayport production facility in Pasadena, TX

from Equistar in spring 2003. Further strengthening its position

in polypropylene is its Technology & Commercial Center in

Pittsburgh, PA, which is among the most advanced technical

support facilities worldwide dedicated to helping customers meet

market challenges.

We manufacture our products at sites located in Marcus Hook, PA,

Philadelphia, PA, Frankford (Philadelphia, PA), Eagle Point

(Westville, NJ), Haverhill, OH, Neal, WV, La Porte, TX and

Bayport, TX. Sunoco Chemicals, in partnership with Suncor Energy,

also markets petrochemicals manufactured at the Toledo, OH

refinery and Suncor's Sarnia refinery located in Ontario, Canada.

March 28, 2003 Equistar 参考 Sunoco, Inc.

Equistar Agrees to Supply Propylene to Sunoco for 15 Years

and Sell Bayport Polypropylene Unit in Pasadena, Texas

http://ir.thomsonfn.com/InvestorRelations/PubNewsStory.aspx?partner=Mzg0TlRNME5nPT1QJFkEQUALSTO&product=MzgwU1ZJPVAkWQEQUALSTOEQUALSTO&storyid=84053

Lyondell announced that its

joint venture Equistar Chemicals, LP, is entering into a long-term propylene

supply arrangement with Sunoco, Inc. and is selling its Bayport polypropylene

manufacturing unit in Pasadena, Texas, to Sunoco, subject to certain conditions. The

transaction will be effective as of March 31.

Beginning April 1, 2003, Equistar will supply propylene to

Sunoco for a period of 15 years, and a majority of the

propylene to be supplied will be provided under a cost-based

formula.

Equistar is selling its Bayport polypropylene unit

to Sunoco, but will retain ownership of its Bayport

low-density polyethylene (LDPE) unit. Sunoco will operate

both units.

Bayport,TX : PP、LDPE

built by El

Paso Products Company in the 1970s,

Lyondell

Petrochemical acquired the facility in 1990 from Rexene

Corporation.

三菱商事 アリステック・ケミカルをスノコ社に売却 Sunoco発表

能力:ポリプロピレン(PP)63万トン、フェノール42万7000トン、2−エチルヘキサノール12万000トン、フタル酸12万トンなど

三菱商事のアリステック取得の経緯は後記。

2003/3 Equister, SunocoにPPプラント売却、プロピレンを長期供給

2003/4 Sunoco Signs

Letter of Intent to Sell Its Plasticizer Business to BASF

April 25, 2003

Sunoco Signs Letter of Intent to Sell Its

Plasticizer Business to BASF

http://www.sunocochem.com/news/3975.htm

Sunoco, Inc. today announced the signing of a letter of

intent for Sunoco to sell its plasticizer operations to

BASF.

The sale includes the Sunoco Pasadena, Texas, site,

including the land, phthalic anhydride, and oxo

manufacturing plants, plus the plasticizer esters,

2-ethylhexanol, and phthalic anhydride businesses.

Although the Sunoco Neville Island site is not part of

the transaction, it will produce plasticizers for BASF

under a tolling agreement.

-------------

The Beginnings in Ohio

Sunoco got its start on March 27, 1886, when Joseph Newton Pew

and Edward O. Emerson, partners in The Peoples Natural Gas

Company in Pittsburgh, Pa., made a bold move to diversify their

business. Looking to the promising new oil discoveries in Ohio

and Pennsylvania, the partners paid $4,500 for two oil leases

near Lima, Ohio.

A Major Expansion

In a dramatic acquisition in 1980, Sun purchased the U.S. oil and

gas properties of Texas Pacific Oil Company, Inc., a subsidiary

of The Seagram Company, Ltd., for $2.3 billion. At the time, this

was the second largest acquisition in the history of U.S.

business. The year before, in 1979, Sun also had taken a wider

position in coal by acquiring eastern reserves from Elk River

Resources, Inc.

Focus on Refining and Marketing

Sun's strategic direction would now focus on the value added

businesses: branded gasoline marketing in the northeastern U.S.;

lubricants; chemicals and logistics.

In 2001, Sunoco took a quantum step in the growth of its

chemicals business, acquiring Pittsburgh-based Aristech Chemical

Corporation.

Included in the purchase were five Aristech chemical plants and a

state-of-the-art research center in Pittsburgh. This acquisition

not only doubled the size of Sunoco's chemicals business but also

enabled Sunoco to become a significant player in the world's

chemical markets.

Growing the Business

In March of 2003 Sunoco acquired a 400 million

pounds-per-year polypropylene facility from Equistar, and in

January 2004, it completed the sale of the plasticizers business

to BASF.