中国石油事業 外資が攻勢

米エクソンとサウジアラムコ シノペックと共同 精製・小売り一貫で

2005/4/11 Foster Wheeler 内蒙古計画

Foster Wheeler/Huanqiu JV

Awarded Coal-to-Liquids Study Contract in China

http://www.corporate-ir.net/ireye/ir_site.zhtml?ticker=fwhlf.ob&script=417&layout=-6&item_id=693845

Foster Wheeler Ltd.

announced today that its UK subsidiary, Foster Wheeler Energy

Limited, in a joint venture with China Huanqiu Contracting &

Engineering Corp., has been awarded a feasibility study

Stage I contract

by Sasol

Synfuels

International (Proprietary) Limited (Sasol) and its Chinese

partners, China Shenhua Coal Liquefaction

Corporation

Ltd. and Ningxia 寧夏Luneng Energy and

High Chemistry Investment Group Co., Ltd. (jointly called

"the Combined Chinese Working Team").

The Foster Wheeler contract value was not disclosed. The project

will be included in the company's first-quarter 2005 bookings.

The contract is related to two 80,000 barrels per

day coal-to-liquids (CTL) facilities to be located at Ningxia Autonomous

Region and Shaanxi Province, respectively, both in the

coal-rich western part of the People's Republic of China.

"Foster Wheeler is delighted to be awarded this contract by

Sasol and the CCWT," said Steve Davies, chairman and chief

executive officer of Foster Wheeler Energy Limited. "This

first use of Sasol's CTL technology outside South Africa builds

on the relationship developed over the last eight years between

Foster Wheeler and Sasol, optimizing and engineering the

application of Sasol's gas-to-liquids (GTL) technology in the

global marketplace, and on our long track record of delivering

successful projects in China.

"Coal-to-liquids is a key part of the Chinese government's

energy strategy, and we are pleased to be involved at the early

stages of its implementation and to be involved with other

companies so well-placed to ensure its rapid and commercial

development," continued Mr. Davies.

Coal-to-liquids comprises an integrated process for the

conversion of coal into selected fuel products such as diesel,

naphtha and liquefied petroleum gas by using a combination of

three principal processes, i.e., gasification of coal to

synthesis gas, conversion of gas-to-liquids and hydrocracking the

converted products into fuel products. The three processes will

involve separate technologies, central to which is Sasol's

low-temperature Fischer-Tropsch technology for the conversion of

synthesis gas to liquid fuels.

The Foster Wheeler/Huanqiu joint venture will evaluate the

available technologies for the projects and complete feasibility

study Stage I work to integrate these with the associated

utilities and infrastructure systems in order to maximize the

value of the project to its shareholders. Huanqiu will provide

gasification experience together with the essential local

technical, commercial and legislative information to ensure the

study conclusions are robust.

The study is scheduled for completion by the end of the year.

Platts 2005/4/20

China may become net methanol exporter in several years: Tecnon

China could become a net methanol exporter in a few years, unless

the methanol price drops below $140-150/mt, said Russell

Phillips, consultant at Tecnon OrbiChem, at the opening of the

first International Methanol Conference in China, Wednesday. The

two-day conference in Shanghai, is organized by the International

Methanol Producers and Consumers Association in cooperation with

Tecnon and local chemical information service provider Chemease.

Methanol

imports in China

have slipped from 1.80-mil mt in 2002 to 1.40-mil mt

in 2003 and to 1.36-mil mt in 2004. The trend is likely to continue as

Chinese methanol producers are expanding their plants' capacities

over the coming years. However, as Chinese traditional methanol

producers use gas retrieved from coal-gas as feedstock, they need

a

minimum methanol price of around $140-150/mt to break even. As of last week, Chinese methanol

spot prices were steady at around $260/mt CFR, thus still largely

profitable for producers.

2005/5/13 Sinopec

Sinopec Chemical Sales Branch Company Set Up in Beijing

http://english.sinopec.com/en-newsevent/en-news/2518.shtml

On 10 May 2005, China

Petroleum & Chemical Corporation (Sinopec) had its Chemical Sales

Branch Company

(Chemical Sales Branch) officially set up in Beijing.

Zhang Jianhua, Senior Vice President for Sinopec, presided over

the conference in celebration of the incorporation of the

Chemical Sales Branch, and read out the written documents

regarding the incorporation of the Chemical Sales Branch Company

and the establishment of its three regional branches respectively

in Beijing, Shanghai and Guangzhou. Chen Tonghai, GM for China

Petrochemical Corporation (Sinopec Group) and Chairman for

Sinopec, Wang Jiming, Vice Chairman for Sinopec, jointly unveiled

the plaque for the Chemical Sales Branch. Chen Tonghai, Wang

Jiming and Wang Tianpu, President for Sinopec later conferred the

plaques to the three regional branches respectively.

Over more than past 2 decades, Sinopec has embraced quick

business expansions and also undergone multiple reforms, and has

now turned out China’s largest manufacturer and seller

of oil products, and chemical products. In terms of oil refining

capabilities and ethylene producing capabilities, Sinopec has

been ranked in the 4th place and the 6th place respectively among

other players in the world. Seen from the perspectives of oil

refining and sale of finished oil products, Sinopec has already

built up a oil products marketing network comprising oil

refineries, pipelines, oil depots, and petro stations. Besides,

Sinopec is now obtaining even stronger abilities in dominating

the domestic market of finished oil products. Seeing from the

perspectives of production and sale of chemical products, Sinopec’s ethylene production capacity has

accounted for 4.25 million tons/year in 2004, constituting more than 70% of

the country’s total in the same year. As the

Yangzhou-based BASF project and Secco-based ethylene project were

put into production already, and with the launch of new ethylene

projects and also expansion of certain existing ethylene

projects, Sinopec’s chemical products are going to

expand an increasingly expanding share in the market.

Due to many reasons (in historical and other terms) however,

Sinopec has always had its chemical products distributed in a

separated way,

and failed

to lick into

shape a “one-fits-all” distribution network, set up a uniform “Sinopec Brand”, and establish its

marketing edges

by means of its established competitive edges in terms of product

technology. As a consequence, Sinopec has been impeded from readjusting its

product mix,

developing

new products, exploring the market into depth, distributing its

resources, managing its customer base, constructing its

distribution network, planning out and optimizing its operation

strategy and marketing strategy, bringing into play its overall

advantages established

in the chemicals segment and gaining even stronger competitive

forces in the market; in the meanwhile, a vast number of Sinopec’s customers have also suffered

much inconvenience in purchasing products turned out by Sinopec .

In recent years, especially after China became a member of WTO

and with the quickened pace of economic integration worldwide,

the market scenario has undergone great changes; and the

competitions among players in the market of petroleum and

chemical products have grown fiercer and fiercer day by day. In

an aim to stand out in the market that features increasingly

intense competitions, Sinopec has adhered to its long-term

strategy for overall business expansion, and also quickened up

its pace in reforming its mechanism for marketing of petroleum

and chemical products; besides, Sinopec has set up a Chemical

Sales Branch Company, plus three regional branch companies in

Beijing, Shanghai and Guangzhou respectively, in order to strike

up and consummate a distribution network, which makes a fusion of

the direct selling mode and the distribution mode (the direct

selling mode plays a leading role). This move is of great

significance for Sinopec to have its industrial chain integrated,

give prominence to its core business, bring into full play its

holistic advantages established by means of its integrative

business operation, enhance its overall competitive forces in an

all-round way, strengthen its abilities in dominating the market

of petroleum and chemical products, and also maximize its

benefits as a whole.

Wang Tianpu pointed out in his speech delivered in the

plaque-unveiling ceremony that, “after this Chemical Sales Branch

Company was established, Sinopec shall, under the precondition of

retaining its current market share, distribution system and

customer base, and also realizing a smooth transition from the

old distribution system to the new distribution network, and

pursuant to the requirements in the new operating system and

mechanism, unify its marketing strategies, market exploration

practices, logistics optimization practices, resources deployment

practices, selling behaviors and brand awareness promotion

strategies; accomplish the planning and deployment of its

marketing network as quickly as possible; standardize its

customer relations management practices; put its distribution

channels in due order; consummate various intramural management

systems and measures of its own; do its utmost to start trial

operation in July, and put the ERP system into service, and

initialize the fresh mode of business operation in a

comprehensive way, by the end of the year. He hopes that those

oil refining and chemical production enterprises affiliated to

Sinopec shall take into account the holistic business needs of

Sinopec , coordinate closely with this Chemical Sales Branch

Company, follow the demands in the market, organize their

production work as planned, have such links as production,

distribution and research associated smoothly on their

initiatives, and concentrate their efforts on performing such

tasks as improvement of product quality, expansion of product

variety, substitution of imports by use of domestically-produced

counterparts, and reduction of operating costs, as well. During

the reform- reform-incurred transition period, it is necessary to

stabilize the team of marketing specialists, cling to the

marketing strategy featuring “follow the market demands closely,

sell out all products turned out, and realize the optimal selling

prices in the current period”, and do a brilliant job in

marketing work, for the nonce.

In the end, Wang Tianpu accentuated that after the Chemical Sales

Branch Company was set up, Sinopec would adhere to its business

motto, characterized by “effective competition and constant

opening-up” as ever, honor its guiding

principles of “standardized business practices,

integrity and solid creditworthiness”, stick to its creed “get adapted to the market demands

and serve customers with a considerate attitude”, intensify its communication with

a vast number of its customers further still, improve mutual

understanding of and cooperation with its business partners,

boost the common developments of both the buyer and the seller in

a balanced manner, and create a “win-win”

situation, as well

as contribute to the sustainable development of China’s petroleum and chemical industry.

日本経済新聞 2005/6/24

ユノカル買収

中国参戦 中国海洋石油が名乗り

シェブロンと対決 米政府・議会に懸念の声も

米石油大手ユノカル買収に中国海津石油(CNOOC)が再び参戦、買収に合意済みの米シェブロンと争うことになった。世界的に油田開発が困難ななか、米国を舞台に、資源確保に熱心な中国を巻き込んだ再編競争が始まった。米政府・議会には国営企業による買収は安全保障上好ましくないとの議論もあり、米中関係にも影響しそうだ。

ユノカルの昨年の確認可採埋蔵量は原油換算で約17億5400万バレルで、そのうち半分近くがアジア地域にある。CNOOCは地元に近い地域に新規の開発投資をせず有力油田を手中に収めることができる。生産量は2倍、埋蔵量も8割増やせる。

年初にCNOOCの買収の意向が明らかになったが、4月にシェブロンが買収合意し、両社の取締役会も了承、米連邦取引委員会(FTC)の許可も下り大詰めを迎えていた。シェブロンはこれまで比較的手薄な中国やインドヘの輸出を伸ばす格好の拠点とみている。

ユノカルの2004年12月期の売上高は約82億ドル、純利益は12億ドルで、シェブロンは買収しても米トップのエクソンモービルとの差は縮まらない。ただ、埋蔵量が伸び悩むなか、投資効率の悪い新規の油田開発より、手っ取り早く埋蔵量を増やせる企業買収が有利と判断、時価総額約176億ドルのユノカルは比較的手ごろだった。欧米メジャー4社の手元資金は合計400億ドルを超え、今後も有望な油田を持つ米企業が買収の対象になる可能性がある。

CNOOCはまず株主の同意を得る必要がある。ユノカル1株当たりの買い付け価格をシェブロンより2ドル高い67ドルに設定し、「我々の提案は友好的で内容はユノカル株主に魅力的」などと支持獲得に自信を見せる。シェブロンは今のところ大きな動きは見せていない。ユノカルも現状では合意済みのシェブロンによる買収を後押しする方針。仮にCNOOCが株主の支持を集め始めればシェブロンは買収金額の引き上げなど条件見直しを迫られそうだ。

CNOOC提案についてボドマン米エネルギー長官は「海外企業による買収が安全保障に抵触しないか検討する必要がある」などと述べた。有力議員の中にも国営企業による買収に批判的な見方が出ている。

中国海洋石油 資源確保を最優先

中国国有三大石油会社で最も規模が小さく財務体質も弱い中国海洋石油(CNOOC)が米ユノカル買収を目指す背景には、巨額投資のリスクより石油の安定確保を優先する国策と、生き残りのために事業拡大を急ぎたいCNOOCの事情がある。

関係者によると185億ドルの買収資金のうち30億ドルは自己資金で、残りは借り入れに頼る。財務体質を悪化させる

との見方も多く、投資判断引き下げの動きもある。

買収についてCNOOC内でも意見が割れた。董事会(役員会)メンバー8人のうち民間出身で外国人の非常勤董事4人が「リスクが大きい」として反対。董事会は23日午前2時までもつれ込んだ。「企業価値からすると高くない」とする国策優先派の董事長らが押し切ったもようだ。

同社は中国近海の海洋石油開発を独占してきたが、エネルギーの自由化を受け中国石油(ペトロチャイナ)など他の大手2社が同分野へ参入。収益の先行きは不透明感が強い。2006年までに16の海底油田で操業を始める計画をまとめるなど事業拡大に必死だ。

今回の買収案に政府の意向が強く働いたのは間違いない。中国は5月に「エネルギー指導小組」を設置し温家宝首相が組長に就任。同組織の最重要課題は石油の安定確保のために海外油田開発を強化すること。買収資金についてある国有金融機関は「石油のためならいくらでも貸す」としている。

中国海洋石油、ユノカル買収を断念・米議会の反発で

米石油大手ユノカルに買収提案していた中国海洋石油(CNOOC)は2日、買収を断念したと発表した。米議会からの反発が予想以上に強く、条件を引き上げても成功の見込みは薄いと判断した。中国企業による初の米エネルギー大手買収は自らの撤退で幕切れとなり、CNOOCと競合していた米シェブロンがユノカルを買収する可能性が濃厚になった。

CNOOCは6月22日、ユノカルに対しシェブロンを大きく上回る185億ドルで買収を提案した。しかし先週、米議会がCNOOCによる買収阻止条項を含むエネルギー法案を可決。買収を断念した。CNOOCは2日、ホームページに掲載した声明文で、買収提案取り下げの理由について「米国内の政治的な環境は、買収の不確実性を高め、受け入れがたいリスクを生じさせた」と説明した。

ユノカルは8月10日に株主総会を開き、シェブロンによる買収の承認を株主に求め最終決定する。

Vopak starts development

of sixth terminal in China

江蘇省張家港

http://www.vopak.com/press/137_591.php

* Vopak starts

development and construction of new chemicals terminal in

Zhangzijagang, China

* Vopak’s sixth terminal in China and the

first fully-owned

* Terminal to be

operational in 2008

Koninklijke Vopak

N.V. (Royal Vopak) announces that it has reached agreement with

the local authorities of Zhangzijagang in Jiangsu Province,

China, on the long-term lease of around 48 hectares of land to

build a state-of-the-art terminal. In this bonded area in the

industrial park of the Free Trade Zone in Zhangzijagang, Vopak

will start development and construction of a new chemicals

terminal.

Zhangzijagang is

situated on the southern banks of the Yangtze River, about 140

kilometres northwest of Shanghai, in the Yangtze River Delta

area. This area accounts for approximately 20% of China’s Gross National Product and 25%

of the country’s total industrial output.

The terminal will

serve partly as an industrial terminal supporting the

manufacturing activities of the multinational chemical companies

in the industrial park where it will be built. Furthermore, the

excellent location of Zhangzijagang will enable the terminal to

offer break bulk services of chemicals in the Yangtze River Delta

area.

In the first phase,

the terminal will have a storage capacity of around 200,000 cbm

and will be taken into operation in 2008. At present, the design

and scope of the terminal are being finalised in order to start

the selection process of the engineering/construction company.

Vopak has been

active in China since the beginning of the 1990s and has since

established a network of five terminals, in different joint

ventures, along the Chinese coastline. The new terminal in

Zhangzijagang will be the first Vopak terminal in China that is

fully-owned by the company.

Profile

Royal Vopak is a

global independent tank terminal operator specialising in the

storage and handling of liquid and gaseous chemical and oil

products. Upon request, Vopak can provide complementary logistics

services for customers at its terminals. Vopak operates 72

terminals with a storage capacity of more than 20 million cbm in

29 countries. The terminals are strategically located for users

and the major shipping routes. The majority of its customers are

companies operating in the chemical and oil industries, for which

Vopak stores a large variety of products destined for a wide

range of industries.

* 日本ヴォパックは、世界最大の液体貨物ロジスティクス

カンパニーであるRoyal

Vopak社(オランダ・ロッテルダム)、日本通運株式会社、長瀬産業株式会社のジョイントベンチャーです。

Shandong Business Net 2005/6/30

中国最大の民営石油連合企業が発足

http://www.trade.gov.cn/japanese/php/show.php?id=567

30余社の民営石油企業が加盟する「長聯石油株式会社」(英語名:Great

United Petroleum Holding Co. LTD、略称:長聯石油、GUPC)が6月29日北京で設立され、これはこれまでのところで、中国最大の民営石油連合企業であると見られている。

長聯石油株式会社(略称:「長聯石油」)は数多くの民営石油・天然ガス企業が共同で設立したもので、石油の探査・採掘、精製・石化、石油の輸入貿易、卸売り・小売を主な営業内容とし、「逐次拡大する」というパターンで上流、中流、下流の民営石油企業を加盟させ、さまざまな民営石油企業に「オープンな平等に参与し、協力して共にメリットを手にする」という受け皿をつくるものである。

同企業の短期間の戦略としては民営石油企業の資源の連合を通じて、石油と天然ガスの探査・採掘、精製・石化、石油貿易、石油の物流、石油の小売と卸売りを一体化させた石油産業のチェーンを逐次形成させ、比較的競争力のある大型石油会社を目指し、石油産業の国際競争と協力に参与し、海外の石油

・天然ガス資源の獲得などの分野で積極的な役割を果たすことになる。

背景としての資料:長聯石油株式会社(英語名:Great

United Petroleum Holding Co. LTD、略称:長聯石油、GUPC)は数多くの民営石油・天然ガスの企業が共同で設立した、石油の探査・採掘、精製・石化、輸入貿易、石油の卸売り・小売を主な経営内容とする合同経営実体である。現在、30余社の民営石油企業が加盟しており、さらに少なからぬ石油企業が今後これに加盟することになっている。

同企業の主旨としては、「中華民族の精神を発揚し、各方面の力を組み合わせて大手の民営石油企業をつくりあげることにある。海外の石油・天然ガス資源を開発して、国内における石油供給の不足を補てんし、中国のエネルギー安全を確保する」というものである。

長聯石油株式会社は石油・天然ガスの探査・採掘、原油の加工、精製、石油液化ガス、液化天然ガス、石油製品、燃料オイル、加工済みの石油製品(ガス、石炭、ディーゼル・オイル)、潤滑油の生産、卸売り、小売り、備蓄、輸送、石油産業への投資、情報提供、コンサルティングを主な経営内容としている。同企業の現在の資産規模は50-100億元で、経営資産は1000億元に達する。

*当初の社名案は Great Wall United Oil Group

Corporation

日本経済新聞 2005/7/13

中国石油事業 外資が攻勢

米エクソンとサウジアラムコ

シノペックと共同 精製・小売り一貫で

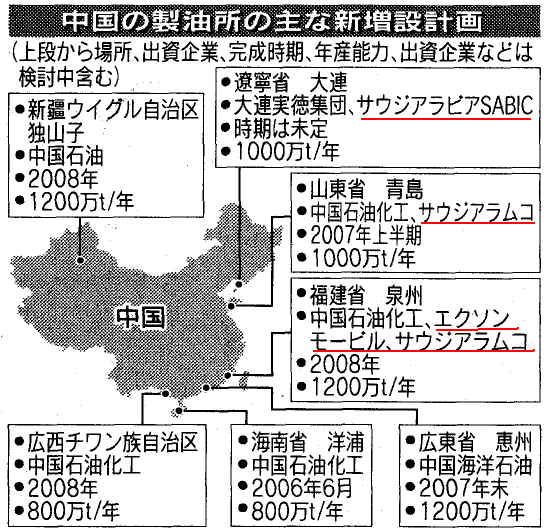

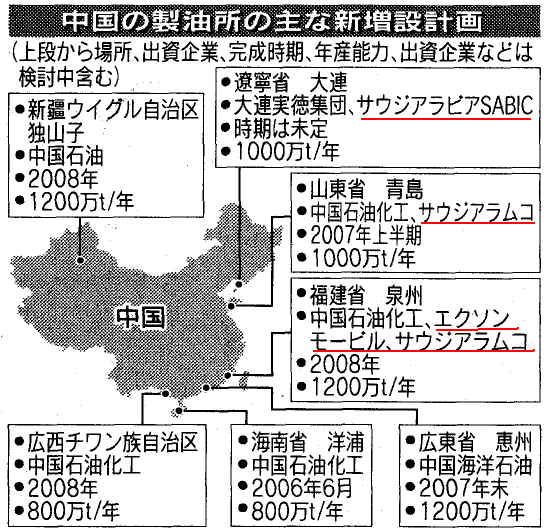

米エクソンモービル、サウジアラビア国営石油会社(サウジアラムコ)、中国石油化工(シノペック)の3社は福建省で石油精製、石化製品生産、小売りの一貫事業を共同で展開することで合意した。外資側は別の製油施設への出資も検討中で、成長市場に攻勢をかける。中国政府には石油資源を持つ欧米の石油メジャーや産油国企業を引き込み、原油の安定調達につなげる狙いもある。

シノペックは福建省の製油所の生産能力を現在の日量8万バレルから2008年には3倍の24万バレルに引き上げる計画。これにエクソンとサウジアラムコが参加する。総額35億ドルでエクソン、アラムコがそれぞれ25%、シノペックが50%出資する。

今回の合意では共同でエチレン、ポリプロピレンの生産設備を導入するほか、600カ所でガソリンスタンドも運営する。昨年末の小売り自由化以降、英蘭ロイヤル・ダッチ・シェルが江蘇省で、英BPは広東省で合弁によるスタンド出店に合意している。エチレン分野でもシェルが広東省、BPが上海で事業を進行中だが、欧州勢に比べ出遅れ気味のエクソンは外資で初めて石油精製、化学、小売りの総合事業に参加、成長著しい分野を一気に囲い込む。アラムコもサウジ産重質原油の輸出拡大を狙う。

エクソンはほかにも広東省で製油施設への出資を検討している。アラムコは「山東省で建設中の製油施設についても、シノペックと出資の話し合いをしている」(アブドラ・ジュ一マ社長兼最高経営責任者)という。

中国政府は原油の安定確保を経済政策の優先課題に掲げ、国有石油会社による海外鉱区への投資を後押ししている。並行して国内の製油や小売り分野を開放し、石油メジャーがそれに必要な原油を安定的に調達すれば、国際的なサプライヤーを築けるとみている。

Platts 2005/8/2

China Garson defers

indefinitely third EPS unit on over-capacity 嘉盛石化

China's Garson

Petrochemical

has postponed indefinitely the start up of its third expandable

polystyrene unit in Jiangyin, pending a sustained recovery in

cash margins, a source close to the company said Tuesday.

The delay is the

latest in a series of others by Garson, as local EPS producers

struggle against over-capacity in the country. Garson has two

exiting 60,000 mt/yr lines, which have been operating at 50-60%

capacity for nearly eight months, as have many other EPS plants

in China. China's booming construction sector had led to a

proliferation of new EPS plants coming onstream in the past five

years. Nearly all of them are stand-alone plants, dependent on SM

imports for feedstock. Until May, Garson had planned to

commission the third 60,000 mt/yr line in the second-half of

2006. Its two existing units form a single plant, and the third

60,000 mt/yr line would eventually be an extension of the plant

as well.

Asia Chemical Weekly 2004/4/23

China's Jiasheng defers launch of EPS line by 5 months to Aug-Sep

China's Jiangsu Jiasheng Petrochemical Industry (嘉盛石化) has deferred by five months the commissioning of its second expandable polystyrene line in Jiangyin, to August or September, a company source said.

Jiasheng, also known as Garson Petrochemical Industry, plans to start up its third EPS line in May-June next year. All three EPS lines have identical nameplate capacities of 60,000 mt/yr each. They will eventually be linked to form a single plant. Jiasheng's first line was operating at 70% capacity on Monday due to weak negative cash margins. Early Monday, China's styrene monomer and EPS markets were pegged at Yuan 9,000/mt ex-tank and Yuan 8,900/mt ex-work, respectively. This meant that local EPS producers were making losses of about Yuan 900/mt ($108/mt).

Platts 2005/8/26

China's Liaoyang to start PX line in Nov, capacity up to 650kt/yr

遼陽石油化学( PetroChina

group)

China's Liaoyang Petrochemical Co will commission a new 350,000 mt/yr

paraxylene

line by October or November this year, a company source said

Friday. This would boost its total PX capacity to 650,000 mt/yr.

Plans have also been drawn up to start up another 530,000 mt/yr PTA line this year, although further

details were unclear. The company's downstream production

capacity at its site in Liaoning遼寧省, northeastern China, include 270,000 mt/yr of

purified terephthalic acid, 100,000 mt/yr of monoethylene glycol

and 300,000 mt/yr of polyethylene terephthalate. Liaoyang Petrochemical comes

under the umbrella of PetroChina and represents the biggest fiber

production base in North China.

Given China's preference for reverse integration in the polyester

sector, China is one of the region's biggest consumers of PX, PTA

and MEG.

However, major expansion plans for PTA and MEG production will

change market fundamentals from a shortage to a surplus, possibly

as soon as 2006, while PX supply is expected to stay tight.

December 23, 2003 UOP

PetroChina Liaoyang Petrochemical Company to Add Additional Para-xylene Capacity Using UOP Technology

http://www.uop.com/pr/releases/PR.LIAOHUA.final.pdfUOP LLC has been selected by PetroChina Liaoyang Petrochemical Company (LIAOHUA) of Liaoyang, Liaoning, China to supply technology, basic engineering services, and equipment for a second para-xylene train for their facility in Liaoyang, Liaoning, China. The new plant is planned to start up in 2006 and produce 350 KMTA of para-xylene.

UOP’s project scope includes a new Parex? process unit for para-xylene purification and a new Isomar? process unit for xylene isomerization.

PetroChina Liaoyang Petrochemical Company of Liaoyang, Liaoning, China is a leading producer of polyester products in China. LIAOHUA has been operating a para-xylene production plant based on UOP technology since 1996.

UOP LLC, headquartered in Des Plaines, Ill., USA, is a leading international supplier and licensor of process technology, catalysts, adsorbents, process plants, and consulting services to the petroleum refining, petrochemical, and gas processing industries.

日本経済新聞 2005/8/29

中国製薬大手に外資出資 対未上場企業で過去最大規模

中国の製薬大手、哈薬集団は外資系投資会社の出資を受け入れた。従来は政府の全額出資だったが、米系のウォーバーグ・ビンカス(Warburg Pincus:WP)と香港に本社を置く中国系の中信資本(CITICキャピタル)が計45%の株式を取得した。両社は計約2億ドルを投じており、外資による中国企業の未上場株取得としては過去最大級とみられる。

哈薬集団の姜林奎総経理が、今月に増資の手続きが完了したことを明らかにした。ハルビン市国有資産監督管理委員会の出資比率が従来の100%から45%に低下した一方、WPと中信資本が各22.5%を取得。地方政府系の黒竜江辰能哈工大高科技風険投資が残り10%を出資した。

中国国際信託投資公司(CITIC)グループ

1979年に設立された中国最大級の金融コングロマリットで、商業銀行業務(CITIC Industrial Bank、CITIC Ka Wah Bank)、投資銀行、アセットマネジメント業務(CITIC Capital)、証券ブローカレッジ業務(CITIC Securities)や信託業務(CITIC Trust)等を経営している。同グループは、多国籍企業との間でこれまでに300を超える合弁事業を営んできている。

三菱化学の中国PTA計画のJV相手中信資本 CITIC Capital Markets Holding Limited

北京の中国国際信託投資公司、香港のCITIC Pacific、香港のCITIC International Financial Holding Limited を株主とするCITIC Capital Markets Holding Limitedは、CITICグループの世界水準の金融専門知識や広範なネットワークを活用し、投資銀行、アセットマネジメントや証券ブローカレッジ業務を展開している。CITIC Capitalは、香港、上海、東京に拠点を有している。

黒竜江省経済月報(2004年12月)

http://www.shengyang.cn.emb-japan.go.jp/jp/e-kokuryu0412.htmハルビン市国資委、哈薬集団(ハルビン製薬集団)と中信資本投資公司、米国華平投資集団、黒龍江辰能哈工大高科技風険投資有限公司の投資方3社は14日、哈薬集団に対する20.35億元の増資契約に調印した。増資後、哈薬集団の総資産は105億元になり、ハルビン市国資委が45%の株を所有。また、中信22.5%、華平22.5%、辰能10%の株式を所有する。哈薬集団はハルビンを代表する大型企業グループで、上場株式会社2社、全額出資の子会社24社を抱える。全国の化学工業医薬品業界139社を対象にした今年1〜9月のデータによると、販売収入で第2位、利潤で第3位を記録。同集団は近年、国内外市場の激烈な競争、同業界の資本再編の波、海外の医薬品産業の中国市場参入などに直面し、02年より増資を模索していた。

Business Day(Thailand) 2004/12/21

Warburg Pincus buys stake in drugmaker

Warburg Pincus, Citic Capital Markets Holdings and a Chinese venture capital company agreed to pay 2.04 billion yuan (US$246 million) for 55 percent of Harbin Pharmaceutical Group Holding to help the drugmaker restructure and cut its ties with failed Southern Securities.

The world's second-biggest buyout fund and Citic Capital will take 22.5 percent stakes, while Heilongjiang Chenergy HiT High-tech Venture Capital will buy 10 percent, according to a statement filed with the Shanghai Stock Exchange. The Harbin city government will remain the largest shareholder with 45 percent.

The drugmaker, also known as Hayao Group, will use the funds to help buy back all shares it doesn't own in Shanghai-listed unit Harbin Pharmaceutical Group. That includes a 60.9 percent stake illegally held by Shenzhen-based Southern Securities, which was taken over by the government in January for “illegal and irregular operations, and disorderly management.”

“It's highly likely that the drugmaker plans to list the entire group overseas, which is why investment banks and buyout firms are interested in buying a stake,” said Wang Ping, an analyst at Industrial Securities in Shanghai.

Shares of Harbin Pharmaceutical were suspended from trading today. They rose 1.8 percent to 5.58 yuan on Friday, paring their decline this year to 41 percent. The benchmark Shanghai Composite Index has fallen 15 percent in the same period.

New York-based Warburg Pincus and Citic Capital, a unit of China's biggest investment company, will each invest about $100 million for their stakes, the companies said in a release distributed before a press conference in Beijing. Harbin Pharmaceutical, based in the capital of China's northeastern province of Heilongjiang, sells Chinese and Western medicines and healthcare supplements under the Hayao brand.

“This funding provides us with necessary capital to leverage both domestic and international opportunities in this growing market sector,'' Jiang Linkui, general manager of Hayao, said in the release.

The deal is the biggest takeover of a state company in Heilongjiang. The state will remain the company's controlling shareholder and the three investors aren't acting in concert, according to the exchange statement.

The investment will help solve the “serious problem” of the stake held by Southern Securities, Warburg Pincus managing director Chang Sun said in an interview before the press conference. Hayao will decide later whether to sell shares, Chang said.

“Southern Securities' big holding in the listed company has seriously hurt the interests of the shareholders, influenced share liquidity and brought big uncertainty to the company's future business,” the company said in its exchange filing. “The purpose of the stake purchase is to erase that gravely negative impact.”

Southern Securities, the nation's fifth-biggest brokerage, bought shares in Harbin Pharmaceutical using many accounts without declaring its stake, said Meng Qingliang, a fund manager at Haitong Securities in Shanghai.

日本経済新聞 2005/9/8

伊藤忠 中国で総合商社認可 国内外での投資

自由に

伊藤忠商事は中国政府から国内販売と輸出入、国内外への投資活動が自由にできる総合商社としての認可を取得した。日本の商社では初めて。従来は外資規制に沿って中国に統括会社を置き、その傘下に営業活動をする現地法人を保税区に設立してきた。今後は統括会社1社で投資、営業活動を一貫して手掛けられるようになり、中国での事業効率化や収益拡大につなげる。

認可は全額出資の中国統括会社、伊藤忠(中国)集団が取得した。昨年12月の外資規制緩和で認められた「地域本部」と呼ぶ認可で、取扱品目に制限はなく、卸・小売りまでの国内販売、輸出入が可能になる。中国国外への投資活動も認められ、中国企業と共同で海外事業を進めやすくなる。

地域本部として認可されるには、資本金1億ドルで3千万ドル以上の投資残高があることが条件。このため、統括会社の資本金を3600万ドルから1億ドルに増やした。

日本の総合商社では双日が8月に「商業企業」と呼ぶ認可を取得。国内販売、輸出入を自由にできる新会社を上海に設立するが、この認可は投資活動に関しては上限が純資産の2分の1までで、中国国外への投資はできない。伊藤忠の場合は、本体の総合商社機能をそのまま中国で展開できる。伊藤忠の2005年3月期の中国での売上高は約5千億円、税引き後利益は48億円で、08年3月期までに利益を倍増させる計画だ。

地域本部(中国語は「地区総部」)とは、2004年2月、中国商務部が定める「外資系企業の投資による投資性公司の設立経営に関する規定」(商務部令2004年第2号、2004/11/23改定)に新たに追加された資格です。

持株会社の中でも条件(※注)をクリアし、地域本部の認定を受けた企業のみ、中国での輸入・販売・サービス・物流・財務面での規制が緩和されます。特に、これまで中国国内では、中国で生産した商品しか販売活動が認められていませんでしたが、地域本部の認定取得により、海外から自社製品の輸入・販売をダイレクトに行うことが可能となります。

(※注) 1. 払込済み登録資本金が1億米ドル以上、もしくは払込済み登録資本金5,000万米ドル以上

かつ申請前1年間の総資産が30億人民元以上、総利益額が1億人民元以上。2. 登録資本金のうち、最低3,000万米ドルが中国国内の傘下企業に投資されていること。 3. 既に研究開発センターを設立(当初は2つ以上) 地域本部の認定取得により許可される主な業務は下記の通り。

(1) 輸入権及び中国国内販売権(小売は含まず)

親会社の製品、親会社がマジョリティーの株式を保有する関連会社の製品

(2) 親会社製品のアフターサービス、およびアフターサービスに要する補修部品の輸入

(3) 地域本部の傘下企業に関する財務支援業務の提供

(4) 物流配送業務

(5) 中国国内企業に製品の生産・加工を委託し、その製品を国内外で販売する業務

日本経済新聞 2005/9/18

三井物産 中国で3社同時認可、輸出入や販売自由に

三井物産は中国政府から輸出入や国内販売が自由にできる商社3社の設立認可を同時取得した。外資企業に対する規制緩和を進めている中国政府の新しい制度を利用、事業拡大につなげる。日本の総合商社の中ではすでに双日や伊藤忠商事が同様の認可を受けているが、三井物産は3社同時に設立が認められた。

設立認可を受けたのは「三井物産(中国)貿易」(資本金3千万ドル)、「三井物産(広東)貿易」(同240万ドル)、「三井繊維物資貿易(中国)」」(同3600万元、1元=約13.5円)の3社。いずれも「商業企業」として認可された。三井物産(広東)は広州市に、残り2社は北京市に本杜を置く。

三井物産(広東)と三井繊維物資貿易(中国)は、香港企業に優先的に中国市場を開放する経済貿易緊密化協定(CEPA)を活用、三井物産の香港子会社が100%出資する。三井物産(広東)は広州市で産業集積が進む自動車業界向け事業を中心に、三井繊維物資貿易は繊維、ファッション関連事業を展開する。

認可を得たことで、3社はこれまで地方ごとに異なっていた輸出入や国内販売の手続きを中央政府が決めたルールで実施できるようになる。三井物産の中国事業規模は2005年3月期で532億円、06年3月期は800億円程度を見込んでいる。新会社3社の設立を機に、事業拡大スピードを速める方針だ。

September 5, 2005 Sarkaritel.com News and

Features-Corporate News

GAIL Ventures Into

Coal Gasification In China

http://www.sarkaritel.com/news_and_features/sep2005/05gailcoalgas.htm

GAIL (India) Limited is

set to venture into the coal gasification activities in

China. The

company plans to invest in Coal - to Methanol - to

Petrochemical plant in the Shaanxi province.

During his recent

visit to China, Shri Proshanto Banerjee, Chairman and Managing

Director, GAIL along with the GAIL team has agreed to enter into

a Memorandum of Understanding with Shaanxi Huashan

Chemical Industry group. As per the MoU, GAIL will

conduct a feasibility study for setting up a coal - gasification

based petrochemical plant for production of polyolefins and other

products in Shaanxi province in China. The Shaanxi province has

abundant quantity of coal, which can be availed at competitive

prices. During the meeting with the GAIL team, His Excellency Mr.

Pan Liansheng, Vice Governor, Shaanxi province has assured all

possible help to GAIL for setting up the plant.

The two companies

will subsequently consider setting up of a joint venture for

implementation of the proposed project and to set up distribution

and marketing network in China. Shaanxi Chemical is already

operating a fertilizer plant based on old coal gasification

technology and is willing to adopt the modern Shell coal

gasification technology to upgrade their plant. It may be

mentioned that the Shaanxi province is endowed with large

deposits of coal as well as oil and gas reserves.

Sinopec, the major Oil

and Gas Company of China, is working on the application of Shell

technology for coal gasification for production of ammonia, which

is eventually used for production of urea. During discussions,

Mr. Chen Qi, Director General, Sinopec has agreed to share their

experiences with GAIL regarding the construction, operation and

commercialisation aspects of coal gasification based projects.

Sinopec also agreed to develop a cooperation framework with GAIL

for coal gasification projects, apart from gas transmission and

distribution business after detailed discussions and

identification of projects for implementation jointly.

In China, 12 plants

based on Shell Gasification Process are under different phases of

construction and will be operations during the year 2006 onwards.

The synthesis gas produced from these plants will be used for

manufacturing fertilizers, methanol and hydrogen. There are

strong similarities between India and China as both have large

coal deposits and would need growing quantities of fertilizer and

chemicals / petrochemicals for the growing domestic markets.

GAIL is taking

initiative to bring modern technology to unlock the potential

value of coal acreage suitable for coal gasification in India.

The technology helps in reducing manufacturing costs besides

replacing existing, older and environment unfriendly facilities.

GAIL

will be using domestic coal to produce synthesis gas or ‘syngas’ by using Shell Coal Gasification

Process (SCGP),

which will used for the first time in India. SCGP has an inherent

capacity of handling high ash content and hence is suitable for

Indian coals.

GAIL plans to set

up a Rs. 750 crore coal gasification project in Eastern India

with coal handling capacity of 2000 tonnes per day to produce 3.4

MMSCMD of syngas. The industries in the eastern India which run

on liquid fuel for their feedstock / fuel will save huge costs

when they use synthesis gas which can be made available at US$ 3

per mmbtu.

GAIL’s focus in eastern India is

primarily due to the availability of abundant amount of coal in

West Bengal, Bihar, Jharkhand and Orissa. The identified

locations for setting up the project are Haldia, Durgapur and

Talcher. West Bengal Government is also very keen to revive the

fertilizer plants and Chief Minister of West Bengal has assured

GAIL of full support for setting up plants based on coal

gasification technology.

Shell has carried

out an initial Screening Study for GAIL, based on data of Indian

coal, which has high ash content, and the outcome is encouraging.

A Detailed Feasibility Report (DFR) by Uhde India Ltd. in

collaboration with their parent company M/s Uhde Gmbh, Germany is

expected to be ready by October 2005. The DFR will look into

various possible end uses of the synthesis gas, availability,

proximity of source and quality of coal and will facilitate a

commercial decision for investment in coal gasification project.

GAIL is also in

talks with Coal India Limited for jointly evaluating various

Overground Coal Gasification Technologies/clean coal technologies

available in the industry and for examining the suitability of

these technologies for Indian coal. GAIL and CIL will evaluate

the possibility of utilizing the product of Overground Coal

Gasification for use in various industries as fertilizer,

chemicals including but not limited to the production of

petrochemicals.

日本経済新聞 2005/10/7

中国国有石油2社 エクアドル油田も買収 調達安定化を狙う

中国の国有石油大手2社、中国石油天然気集団(CNPC)と中国石油化工集団(シノペック)は共同でカナダの石油会社エンカナが保有する南米エクアドルの油田権益を買収することを決めた。買収額は14億2千万ドル(約1570億円)。中国の石油大手にとってカザフスタンでの油田権益に続く海外での大型買収。エネルギー資源の安定確保へ向けた調達先の多様化が加速してきた。

CNPCとシノペツクの共同出資会社で海外の油田開発事業を手掛けるアンデス石油がエンカナの保有するエクアドルの油田権益を買収する。中国側とエンカナがこのほど合意した。年内に買収を完了する計画だ。

買収の対象になるのは原油埋蔵量が約1億4千万バレルで日量7万5千バレルを生産する油田やパイプラインなど。エンカナによるとエクアドル資産の売却は中核分野へ事業を集中させる戦略の一貫。

エクアドルは外資石油会社の進出に反対する住民によるデモが起こるなど外資による石油事業の環境が厳しくなっている。中国はエクアドルから原油を輸入しており、2003年8月にはエクアドル大統領が中国を訪問して胡錦濤国家主席らと会談。エネルギー分野などで関係を強化する方針で合意した。治安面などでリスクはあるが油田の権益買収を通じて同国での足場を一段と固める。

エクアドルの油田権益を巡ってはインド石油天然ガス公社(ONGC)も買収に名乗りを上げていたもようだが中国が条件面などで競り勝った。中国の05年の原油需要は04年比6%増の3億1千万バレルになる見通しで、輸入依存度は4割を超える。国内の原油生産は頭打ちで需要増に伴い輸入が増えるのは確実だ。原油輸入の半分を中東に依存する中国は、安定調達のためには調達先を多様化することが必要と考えている。だが8月には中国海洋石油(CNOOC)による米ユノカルの買収が米議会の反発などで失敗。米国での権益取得は困難な情勢だ。

このため中南米やアフリカ、中央アジア、カナダとの関係強化を急いでいる。胡錦濤主席は9月8日からカナダ、メキシコを訪問して資源開発の協力などで合意した。昨年11月にはブラジル、アルゼンチンなど中南米4カ国を歴訪し資源開発をはじめとする大型投資の計画を表明した。今回のエクアドル油田の権益買収はこうした資源外交の一つの成果ともいえる。

中国の国有石油会社による海外油田権益の買収が加速しており、最近の事例としては8月下旬にCNPCがカザフスタンに油田権益を持つカナダのペトロカザフスタンを41億8千万ドルで買収することを決めている。

中国の石油会社による海外権益取得の動き

| 時期 | 中国石油会社 | 買収、出資先 |

| 4月 | CNOOC | 加MEGエナジーの株式取得 |

| 8月 | CNOOC | 米ユノカル買収を断念 |

| CNPC | 加ペトロカザフスタン買収を決定 | |

| 9月 | CNPCなど | 加社からエクアドル油田権益買収決定 |

| 検討中 | CNOOC | 豪ウッドサイド買収を検討 |

| シノペック | 加ハスキー・エナジー買収目指す |

Platts 2005/10/11

China's Donghao commissions SM plant, commercial

sales from H2 Oct

China's Donghao Chemical 東昊

is in the process

of commissioning its styrene monomer plant in Changzhou(常州), and hopes to start commercial

sales in late October, a source close to the firm said Tuesday. Donghao fed the 150,000 mt/yr plant with benzene over the

weekend, followed by ethylene on Tuesday. The plant was expected

to start producing on-spec styrene by Oct 15.

Donghao's plant is

not backward-integrated, so the firm has to buy all its benzene

and ethylene feedstocks. It plans to source all its feed from the

spot market.

When fully on line,

the plant has the potential to tip the supply balance, sources

said. Last year, China's local styrene prices were depressed for

several months after Shanghai Secco Petrochemicals started up its

500,000 mt/yr plant. But unlike Secco, which uses more than half

its own styrene output captively to produce polystyrene, Donghao plans to sell all its styrene in

the merchant market. China's domestic market was pegged at Yuan

10,800-10,900/mt ex-tank Jiangyin on Tuesday.

2005/10/13 日本経済新聞夕刊

サハリン3の一部権益取得 シノペック

中国の国有石油大手、中国石油化工(シノペック)はロシア国営石油会社のロスネフチから「サハリン3」鉱区の一部区画に関して25.1%の権益を取得した。中国企業がロシア国内のエネルギー案件に参加するのは初めて。当面は探鉱が対象となるが、開発まで含めれば総投資額は数十億ドルから百億ドル近くにのぼる公算がある。

July 04, 2005 Kommersant

Rosneft Opens

Sakhalin to the Chinese

Sinopec to

take part is development of Venin block

International

Cooperation

http://www.kommersant.com/page.asp?idr=1&id=588631

Rosneft signed an

agreement with the Chinese Sinopec petrochemical company on

Friday on the joint development of the Venin block oil and gas

field in the Sakhalin 3 project. Gazprom had also declared its

interest in working with Rosneft but had made no concrete

proposals. A partnership with Sinopec is likely to mean that

Rosneft will keep a share in the Venin block under any

circumstances.

On Friday, in the

course of Russian-Chinese negotiations, Roneft signed a framework

agreement on collaboration with CNPC, the Chinese national oil and gas

company, and a protocol on the foundation of a joint venture for geological

exploration and study of the Venin block field of the Sakhalin 3

project with the Chinese oil and gas company Sinopec.

The oil resources

in the Venin block are preliminarily estimated at 114 million

metric tons ad gas at 315 billion cubic meters. Rosneft received

a license for geological study of the block in April 2003. It is

assumed that the operator of the project will be a specially

founded OOO Veninneft. There are three other blocks besides Venin in the Sakhalin 3 shelf project.

They are the Eastern Odopinsky, Ayashsky and

Southern Kirinsky,

licenses for which are held in an indivisible fund.

The agreement

between Rosneft and Sinopec means that the Chinese company will

receive a share in OOO Veninneft. Its size has nor yet been

revealed. Kommersant has information that Sinopec will receive a

40-50 percent share in the project operator. Rosneft president

Sergey Bogdanchikov announced on Friday that Sinopec will finance

all geological exploration work ad no less than half the funds

necessary for the development of the block. It is thus committing

itself to more than half of all the financing of the project.

On June 24, Alexey

Miller, chairman of the board of the Gazprom monopoly, stated

that that company was preparing to make an offer for the purchase

of a share in all the Sakhalin projects from Rosneft. Besides the

Venin block, Rosneft owns 20 percent of the Sakhalin 1 project

(operated by the American ExxonMobil, which owns 30 percent. The

Japanese SODECO also owns 30 percent of it and the Indian ONGC

owns 20 percent). Rosneft owns 51 percent of Sakhalin 4, the

project is developing the Western Shmidtovsky lot, along with

British Petroleum. Rosneft and BP are sharing in the same

proportions the Sakhalin 5 project at the Eastern Shmidtovsky and

Kaigansko-Vasyukansky lots. On Friday, a Gazprom representative

told Kommersant that no concrete offers had been made to Rosneft.

The fact that the oil company found an investor for the

development means that it will most likely retain a share in the

project in any case.

At the end of this

year or beginning of 2006, the Ministry of Natural resources

plans to auction off the three remaining blocks in Sakhalin 3.

Gazprom plans to take part in those auctions with LUKOIL.

Representatives of the companies have not said to what extent the

infrastructure of the Sakhalin 3 blocks will be interconnected,

but some cooperation between the participants in the project will

obviously be necessary.

日本経済新聞 2005/10/25

丸紅、山東省と包括提携 まず日本に紙の販社設立

丸紅は中国・山東省と経済・貿易分野で包括提携することで合意した。同省で機械や電機、化学品などの製造拠点を建設する事業に丸紅が積極参加、同省内の企業が日本などで事業展開する際にも協力する。第一弾として11月に山東省の製紙メーカー、山東晨鳴(チェンミン)紙業グループと共同で日本で紙・板紙の販売会社、CMJ(東京・干代田)を設立する。25日に包括的協力協議書を締結する。山東省は経済発展が急速に進んでおり、丸紅は現地政府と手を組むことで早期に事業を拡大する。

新会社の資本金は3千万円で丸紅と晨鳴が折半出資する。社長は晨鳴が派遣し、従業員5人程度でスタートする。晨鳴は年間210万トンの生産能力を持つ中国の製紙最大手。これまでも丸紅などを通じて日本へ輸出してきたが、一段の売り上げ拡大には品質や納期などの要求水準が高い日本に拠点を築く必要があると判断した。

丸紅は紙の調達先を拡大し、日本市場だけでなく中国に設立した紙の販売会社を通じ、中国国内の日系企業向けに晨鳴の製品を拡販する考えだ。

山東省は2004年の域内総生産(GDP)が江蘇省を抜いて広東省に次ぐ全国二位になるなど、経済が急速に拡大している。資源が豊富で、人件費が上海地区などに比べて安いことや人口9千万人を超える有望市場であることから、外国企業の投資が増えている。日本の商社では伊藤忠商事が2002年に山東省と「経済貿易全面合作協議書」を締結している。

山東晨鳴紙業集団股フェン有限公司 Shandong Chenming Paper Holdings Limited

主要業務は機械製紙、板紙及び紙原料の生産で、1995年から2001年にかけて連続7年、全国業界トップに立つ中国最大規模の製紙メーカー。新聞紙やダンボールが主力製品。電力を中心としたエネルギーも手掛ける。原材料を輸入に頼っており、有効的なコストコントロールが課題。

Platts 2005/10/24

PetroChina's

Lanzhou revises upward planned No 2 cracker capacity

China's Lanzhou

Petrochemical has revised upward the planned capacity of its No 2

ethylene plant, currently under construction, to 450,000 mt/yr

from the original plan of 360,000 mt/yr, a source at the company

said Monday. The revision would allow Lanzhou, a subsidiary of

PetroChina, to reap greater economies of scale from a bigger

cracker.

Construction of the

Yuan 6-bil ($742-mil) naphtha cracker is scheduled to be

completed by the end of 2006, the source said. The project would

lift Lanzhou's total ethylene capacity to 690,000 mt/yr. Lanzhou

currently has a naphtha cracker with an ethylene capacity of

240,000 mt/yr.

PetroChina aims to

market Lanzhou's output to consumers in Chongqing, Sichuan

Province, in southwestern China. Lanzhou is located in the

northwestern province of Gansu.

Lanzhou's

dowmstream capacities include the following units, according to

Japanese government estimates: 195,000 mt/yr combined LDPE and

LLDPE; 65,000 mt/yr styrene monomer; and 124,000 mt/yr PP

(supported by C3 from steam and catalytic crackers).

China Chemical Reporter 2005/10/24

Yunan Launches DME Project 雲南省

The dimethyl ether (DME)

project will be launched in Yunnan province, southern China

recently. With the total investment of RMB970 million and the

production capacity of 150 000 tons/a, this project is

implemented by Yunan Jiehua Group Chem Co., Ltd and will be

completed in the end of 2007. When the project put into stream,

it is estimated that 1.1 million poor coal will be consumed per

year, and the additional value of poor coal will be quintupled

with annual sales revenue of RMB447 million.

With local lignite as raw material, this project adopts

gasification technology to provide intermediate material gas and

produces DME and methanol products finally.

Nowadays, the key development goal of DME is being the substitute

for civil clean fuel and diesel oil. DME with the characteristics

similar to liquefied petroleum gas does no harm to human body and

ozonosphere after burning so that can be used as civil clean

fuel. Because fuel coals can cause pollution to the environment,

and the huge investment will be put into for the pipeline of fuel

natural gas and coal gas furnace gas, furthermore the limited

domestic supply for liquefied petroleum gas, so DME is no doubt

the best choice. As professionals estimate, the domestic demand

for DME will be 5 million to 10 million tons in the next five

years.

日本経済新聞 2005/11/1

中国石油 3子会社

上場廃止 全株、890億円で買取り

中国の石油大手、中国石油天然気(ペトロチャイナ)は31日、中国本土や香港などに上場する子会社3社の上場を廃止する計画を発表した。子会社の株式をすべて買い上げ、グループの経営資源の効率利用などを目指す。中国で親会社の株式買い取りによる上場廃止は初めてとみられる。

深セン証券取引所に上場している錦州石化と遼河金馬油田の2社、深センと香港、ニューヨークに預託証券を公開している吉林化学工業の株式を公開買い付けする。提示した買収総額は約62億6千万元(約894億円)。中国石油は現在、各社の67−82%の株式を保有している。

子会社3社の業務領域は油田経営や原油の精製、石油化学製品の生産などにまたがり重複部分が多い。中国石油は完全子会社化することで、業務や資源配置の見直しを進める。

子会社上場廃止の背景には、中国政府が推し進める証券市場改革に伴う一部株主とのトラブルを未然に回避する狙いもありそうだ。吉林化工のように複数市場に上場する企業については、市場で取引されない「非流通株」の解消過程で、株主間に不平等が生じるケースがあり、問題化している。

Platts 2005/11/14 PetroChina case

Sinopec to

privatize Zhenhai Refining & Chemical Co

Chinese oil company

Sinopec Corp plans to privatize Sinopec Zhenhai Refining &

Chemical Company Limited 鎮海煉油化工in a deal worth HK$7.672-bil

($989-mil), the company said Monday. The "merger by

absorption" is to be effected by a wholly-owned subsidiary

of Sinopec, Ningbo Yonglian.

Sinopec already

owns 1.800-bil or 71.32% of ZRCC's 2.524-bil shares. Ningbo

Yonglian is to be set up to to pay a cancellation price of

HK$10.60/share in cash to the holders of ZRCC's 724-mil

publicly-traded H shares. The completion of the merger is subject

to regulatory and ZRCC shareholder approvals.

"This

transaction would contribute to the continued development of

Sinopec Corp," the company, which is listed in both New York

and Hong Kong, said in a statement. "It also demonstrates

efforts of Sinopec Corp management to deliver their promises at

IPO which include restructuring its assets in order to strengthen

competence of its core business. From a long-term perspective,

the transaction will have a positive impact on Sinopec Corp's

profitability as well as shareholder value."

Sinopec said the

proposed merger would reinforce the business value chain of ZRCC

through the vertical integration of ZRCC's refining assets with

Sinopec's upstream refining operations, as well as offering

synergy effects in capital allocation, investment, branding,

resources, marketing, and distribution channels. It would also

eliminate related party transactions and intra-group competition,

and would allow for the consolidation and simplification of

management structure. "Moreover Sinopec Corp believes that

the merger should have a positive impact on Sinopec Corp's

profitability as well as shareholder value," the company

added.

The cancellation

price was "reasonable" for both Sinopec and ZRCC's

shareholders, the Chinese major said. The price represents a

premium of 12.17% over ZRCC's closing price of HK$9.45/share on

Nov 2, 2005, and is also 22.93% and 29.91% higher than the

company's average closing price of HK$8.62/share over the last

month and HK$8.16/share over the last 12 months respectively.

ZRCC is a Sinopec

holding subsidiary which listed on the Hong Kong Stock Exchange

in December 1994 and is one of China's largest processing bases

for crude, imported crude and sour crude and the largest export

base for oil products. The company has a crude oil processing

capacity of 18.5-mil mt/yr.

Downstream Zhenhai

also has a 650,000 mt/yr paraxylene plant and a 200,000 mt/yr of

polypropylene unit. Zhenhai currently has plans to build a

naphtha cracker with an ethylene capacity of 800,000 mt/yr by

2010, according to industry sources.

Based on 2004

financial data, ZRCC's net profit was RMB 2.61-bil ($323-mil) or

RMB 1.04/share on turnover of RMB 41.9-bil. At the end of 2004,

the company's total and net assets were RMB 15.49-bil and RMB

11.41-bil respectively.

Sale of Qenos to

ChemChina

http://www.qenos.com/internet/home.nsf/vwwebpages/aboutqenos-articles-news&informationsaleofqenostochemchina?opendocument

Qenos is pleased to

announce that international chemical group China National

Chemical Corporation (ChemChina) has signed a Heads of Agreement

with the company’s shareholders, Orica and

ExxonMobil, to purchase the Qenos business. The agreement is

subject to required regulatory approvals in Australia and China,

with settlement targeted to take place in early 2006.

Commenting on the

pending sale, Mr Ross McCann, Chief Executive Officer of Qenos,

said:

“ChemChina is a

global chemical industry player and Qenos is a strategic

acquisition that complements ChemChina’s global growth strategy and

portfolio of chemical businesses. The acquisition provides a

strong Australian platform for further business growth.”

“Qenos is an

attractive acquisition for ChemChina given its highly skilled

workforce, technical expertise, strong customer base, logistics

infrastructure and operational systems.”

Mr McCann added:

“The Qenos

strategy remains the supply of polyethylene and services to meet

the needs of the Australian polyethylene market and Qenos will

continue to be run by local management. Qenos offers ChemChina an

experienced management team and world-class systems in the areas

of operational and safety, health and environmental standards.”

ChemChina is a

large government owned enterprise in China with a portfolio of

chemical businesses. With sales of approximately A$9.6billion and

employing over 100,000 people, ChemChina is one of the largest

chemical companies in China.

Qenos was formed in

1999 when Orica and ExxonMobil joined their petrochemical

operations in Australia to form a stronger, more globally

competitive business. Qenos is Australia’s sole polyethylene manufacturer

focused on supplying the local market and has approximately 850

direct employees and A$800M annual revenue. With manufacturing

sites in Victoria and New South Wales, Qenos adds value to

Australian oil and gas reserves, through conversion into high

value petrochemicals and plastics that are used as raw materials

by hundreds of companies in the downstream Australian plastics

conversion industry. The final products are used in a myriad of

applications, including the key packaging, agriculture,

automotive, water management, mining and waste management

industries.

ChemChinaは昨年5月に国営のChina National Blue Star (Group) (藍星グループ)と China Haohua Chemical Industrial (Group) (昊華化工)が統合したもの。

99年10月 ケノス社(Qenos)設立(エクソンモービル53%、オリカ47%)

オリカ社(Orica 旧ICIオーストラリア)と

エクソンモービル 旧ケムコア社(Kemcor エクソンケミカルとモービルケミカルの折半出資)が、

両社の石油化学事業統合

At Qenos we use Australian oil and gas feedstocks from Bass Strait and the Moomba Basin. We employ 900 people. Our plants in Sydney and Melbourne produce olefins and a full range of polyethylene products (HDPE, LDPE and LLDPE). We also supply a diverse range of specialty polymers. That makes Qenos a vital link in the Australian manufacturing chain, supplying industries that employ hundreds of thousands of people.

Shanghai Gaoqiao becomes

China's biggest PET maker

China's Sinopec Shanghai Gaoqiao started up a new 80,000 mt/yr

polyester plant on Nov 20, according to a company announcement

posted Friday (Nov 25).

The plant consists of three lines. With the startup of the new

unit, SSGPC's total polyester capacity has reached 200,000mt/yr,

making the company China's largest polyester producer, overtaking

the 185,000 mt/yr CNOOC and Shell Petrochemical capacity to be

brought on stream in December, the statement said.

The operation rate of SSGPC is likely to lag behind its capacity

expansion, since the supply polyesters feedstock has been tight

for the last two years and feedstock prices have climbed steeply

recently, said an SSGPC official. No substantial increase in

actual polyester production will occur unless a significant

amount of feedstock supply is guaranteed, he added.

日本経済新聞 2005/11/26

中国、工場爆発相次ぐ 重慶でも河川汚染 増産急ぎ安全対策後手に

中国重慶市で24日、医薬・化学工場が爆発し、長江の支流へ有害物質のベンゼンが流出したことが25日明らかになった。13日には吉林省の化学工場の爆発で同じくベンゼンが松花江に流出し、下流のロシアに汚染が広がる懸念が高まっている。安全より増産を優先する中国企業の経営体質と不十分な情報公開が事故頻発の背景にある。国境を越えかねない環境汚染に周辺国は神経をとがらせている。

重慶市では桂渓河沿いにある民営企業、英特化工の工場が爆発した。1人が死亡し6千人が避難した。行政側は住民に桂渓河の水を使わないよう呼びかけ、川に大量のスポンジやワラを投入してベンゼンの除去を急いでいる。長江を給水源とする下流の上海市や湖北省武漢市など大都市の水道供給に影響を及ぼす事態は避けたい考えだ。

一方、松花江を給水源とする黒竜江省ハルビン市は22日から水道水の供給を停止。各地から調達した飲料水を搬送車で住民へ供給し、新たな水源確保のため井戸掘りにも着手した。中国政府は25日、汚染調査の作業班を現地に送った。

事故が相次ぐ背景には需要拡大に対応するため増産を急ぎ、安全管理が後手に回ったことがある。重慶の工場は安全経営許可証を得ずに操業していた。発電所向けの需要拡大で増産を続ける炭坑でも爆発事故が多発している。

再発防止に不可欠な情報公開と原因や責任の追及が不十分との指摘も多い。吉林省の工場爆発は13日。当局は爆発直後に松花江の汚染を把握していたもようだが、ハルビン市民への通知は約10日後。飲料水を求める市民が一時パニック状態になった。

非常事態亘言ロシア発動も 松花江汚染広がり警戒

中国東北部の化学工場の爆発による松花江の汚染を受け、ロシア当局は下流のアムール川も汚染されるとの見方を示した。

有害物質は凍った川を下り、12月1日までにハバロフスク市近郊に到達する可能性がある。アムール川はハバロフスク州を中心に約150万人が水源としている。ハバロフスク市の住民によると、買いだめの影響で飲料水が24日までに商店からなくなった。

ハバロフスク州の緊急事態局は25日、汚染がロシア国境に広がった時点で非常事態を宣言する考えを示した。取水停止になると温水暖房にも影響するため、市民には不安が広がっている。ロシア政府は現地に対策本部を置き、汚染状況を監視中。汚染が同国に及んだ場合、中国に補償を求める声も出ている。

China's Shenyang Chemical

to build cracker for 120kt/yr ethylene 瀋陽化工

China's Shenyang

Chemical Group held on Nov 28 a ground-breaking ceremony for

construction by 2007 of a 500,000 mt/yr catalytic thermal cracker

in China's northeast province of Liaoning 遼寧省, the company said Wednesday. This

unit is the first to use exclusively domestic Chinese technology

for ethylene production, using a Catalytic Pyrolysis Process

(CPP). The Yuan 3.6-bil ($445-mil) investment will use 500,000

mt/yr of residual oil for the production of about 120,000 mt/yr

of ethylene, according to an official from BlueStar, the parent

company of Shenyang Chemical Group. The ethylene was destined to

be used as feedstock for the production of polyvinyl chloride.

Shenyang Chemical

is the largest producer of PVC paste

resin in

China by market share.

The project was

approved by China's National Development and Reform Commission in

August 2004, when Shenyang brought on stream a 40,000 mt/yr epoxy

propane and polyethers complex.

新華社 2005/12/3

China begins methane resources exploitation

A 100-million-cubic-meter coalbed methane 炭層メタンexploitation project has been

completed in north China's Shanxi Province, marking the country

has finally began to make use of the gas on an unprecedented

scale.

Located in the southern part of the Qinshui Basin, Jincheng 晋城 City of Shanxi Province, the gas

exploitation project is the largest of its kind in China, with a

verified gas deposit of 40.2 billion cubic meters and an annual

production of 100 million cubicmeters.

At a price of 1.1 yuan (0.136 US dollars) per cubic meter, the

project's yearly output is expected to be worth 110 million yuan

(13.6 million US dollars), said Sun Maoyuan, general manager of

China United Coalbed Methane Corp. Ltd, the investor of the

project.

The company has pumped 360 million yuan (44.4 million US dollars)

into the project.

The first phase is capable of churnning out 80,000 cubic meters

natural gas daily, which will be supplied to gas companies and

power grids, said Sun.

Shanxi Province boasts an abundance of coal resources. It is also

China's largest reserve base of coalbed methane. The estimated

methane deposit is about one trillion cubic meters, or one third

of the country's total.

Experts said the methane could be burned for 6,682 years by one

million households, or be turned into 22 trillion kwh's

electricity.

"Coalbed methane is a valuable asset of Shanxi, which should

not be lying there underground uselessly," said Yu Youjun,

the acting governor of the province.

However, the methane, or more commonly known as natural gas,

could also be extremely hazardous.

In 2004, China's coal mines produced 14 billion cubic meters of

gas, a number experts say that it will increase to 17 billion

cubic meters in 2020.

Notably, 80 percent of the casualties in coal mine accidents

could be attributed to their deaths to gas explosions, which

cause direct loss of 750 million yuan (92.6 million US dollars) a

year.

"The proper use of the gas is meaningful in the sense of

environmental protection, work safety control, and profit

generation," said Yu.

In recent years, the province has been vigorously bringing in

foreign capital to tap the gas resources. It has kicked off an

exploitation program with two billion yuan (247 million US

dollars) in foreign loans.

The Asia Development Bank has vowed to provide over 1 billion US

dollars in loans under favorable conditions to assist the

province's endeavor in the next 10 years.

Another massive methane exploitation project with an

installedcapacity of 720 million cubic meters is also under

construction inShouyang County. By 2008, the gas will be sent to

Beijing, Shanghai and other major cities through the west-east

gas transmission routes, said sources with the provincial

government.

China is the third largest coalbed methane reserve country in the

world, only next to Russia and Canada. The latest evaluation

shows that China has 31.46 trillion cubic meters coalbed methane

lying above a 2,000-meter depth, 60 percent of which is suitable

for exploitation.

China's methane resources are distributed in 24 provinces, with

Shanxi Province and Xinjiang Uygur Autonomous Region accounting

for more than half of the country's total reserve.

日本経済新聞 2005/12/7 クウェート発表 PetroChina の誤り?

クウェート、中国に製油所 BP、シェル、シノペックと合弁で

50億ドル投資

広東省に

中国国有石油大手の中国石油化工(シノペック)とクウェート国営石油(KPC)、英BP、英蘭ロイヤル・ダッチ・シェルの4四社は合弁で、中国広東省に製油所を建設することで合意した。投資額は50億ドル(約6千億円)。原油資源が豊富な中東産油国と石油メジャーが協力して成長市場の開拓を目指す動きが広がる一方で、中国側は原油の安定調達の強化を迫られており、双方の思惑が一致した。

合弁製油所で原油からガソリンなどの石油製品を精製する能力は1日あたり20万−40万バレル。完成は2008年前後になる見通し。4社の出資比率は来年初めまでに決めるとしており、シノペックが50%以上を確保して、外資3社が残りを分け合う形になる可能性が高い。製油所で原料として使う原油は主にクウェートから輸入する。製油所には石油製品のナフサを原料にエチレンなどを生産する石油化学プラントも併設する計画。

中国の2005年の原油需要は前年度比6%増の3億1千万トンの見込み。国内需要に占める輸入比率は4割を超えている。今後も国内の需要増加が確実視されることから調達先の拡大を迫られている。輸入の中東依存度は約5割で、最近はアフリカや中南米での油田権益獲得を加速させているが、中東ともさらに太いパイプを築き、原油の調達ルートを多様化する。

中国ではガソリンなど石油製品価格が国際価格より3割前後低く抑えられており、原料の原油価格上昇でシノペツクの1−9月の製油所部門は赤字。製油事業に外資を加えることで赤字リスクを分散する狙いもある。KPCは今年3月、北京に事務所を開設して中国への原油の売り込みを強化している。中国の英字紙チャイナ・デーリーによると中国向け輸出を現在の2倍以上の日量40万バレルへ拡大する計画を持つ。欧米メジャーは中国で給油所の展開を加速させており、自社が出資する合弁製油所から直接、自社系列の給油所ヘガソリンや軽油を供給することを目指している。

シノペツクはサウジアラビア国営石油会社(サウジアラムコ)、米エクソンモービルとも福建省で製油所を建設中だ。中国政府は原油資源を提供することを条件に、外資へ製油所事業への出資を許可しているもよう。中東諸国や欧米メジャーによる中国の製油所事業への投資が今後も増える可能性が高い。一方、原油資源が乏しい日本の石油会社の製油所事業参入は難しいとみられている。

PetroChina confirms

Guangdong petchem partnership with Kuwait

Hong Kong- and New

York-listed Chinese oil giant PetroChina Wednesday confirmed its

intention to team up with Kuwait in developing a petrochemical

plant and refinery in China's southern Guangdong province.

"We've signed

a MoU (memorandum of understanding) with them (Kuwait) studying

the feasibility of developing the project" in Guangdong, a

PetroChina press official said Wednesday. He added that it was

still too early to give details of the proposed plan as the two

parties would only decide on the scale and the investment of the

project after they finish with the feasibility study.

Kuwait and China

signed the MoU on the proposed developed on Dec 5, according to

the official Kuwaiti News Agency. KUNA also cited Kuwaiti Energy

Minister Sheikh Ahmed Fahed al-Sabah as saying that although

technical specifications of the project had not yet been worked

out, the envisaged refinery would probably be expected to have a

processing capacity of between 200,000-400,000 b/d. He gave no

details about the petrochemical plant.

Examining the

project's financial and technical aspects would be the next step

after the MoU, he added.

The proposed

Guangdong refinery and petrochemical plant development is in line

with Kuwait's long-term strategy of entering more oil markets

which are able to utilize Kuwaiti crude, most of which is sour.

It would also fall in line with the emirate's target to raise

production capacity from a current 2.7-mil b/d to between 3.5- to

4-mil b/d in the coming decade, the minister said. He also said

that China's current level of Kuwaiti crude imports was lower

than desired, but that he expected they would increase after the

opening of a representative office in China for national oil

company Kuwait Petroleum Corp.

According to

Chinese and Kuwaiti media reports, the two parties would likely

complete their feasibility study and necessary approvals from

government

authorities in 2006. Construction of the estimated $5-bil project

would take about four years, which points to a 2010 completion

date if works progress smoothly. Other partners in the proposed

project are Kuwait's Petrochemical Industries Co and Kuwait

Petroleum International. Both China and Kuwait have agreed to

invite leading international companies in both refining and

petrochemical sectors to take part in the project, the reports

said.

PetroChina has long

had ambition to penetrate the south China oil product market with

the establishment of its own refining facilities there. It has

shown its interest earlier in establishing a 10-mil mt/yr

(200,000 b/d) refinery in Qinzhou city, China's southern Guangxi

Zhuang Autonomous Region.

Until now,

refineries owned and operated by PetroChina are in northern and

northwestern China. After meeting the oil requirements in the

northern and northwestern markets, PetroChina sells and

distribute a large part of its oil products output for the south

China market under term contracts through its counterpart Sinopec

Corp, which dominated the refining and petrochemical sector in

the country's southern, eastern and southwestern provinces. It

also sells and markets a small portion of its output through its

regional offices in the Sinopec-dominated markets. A refining

base in southern China would therefore not only expand

PetroChina's presence in the market, but also reduce

transportation cost to moving its products output from northern

provinces to the south.

日本経済新聞 2005/12/29 発表

東洋エンジ 石油代替燃料 中国で技術支援 最大プラント設計

東洋エンジニアリングは中国国営の大手石炭会社に、石油代替燃料として有望なジメチルエーテル(DME)分野で技術支援する。同国西北部に建設が計画されている年産21万トンのDMEプラント設計などを担当する。量産設備としては世界最大で、2007年末に完成の予定。環境規制が厳しくなる中、中東やロシアなどの資源国で受注につなげる狙いだ。

石炭大手の寧夏煤業集団(寧夏回族自治区)が総額400億円を投じて整備する化学コンビナート計画の一環。DMEは硫黄酸化物(SOx)など有害物質を発生しないため、石油代替燃料として有望視されている。中国ではエネルギー需要の拡大と同時に排ガス規制も強まっている。

東洋エンジは埋蔵量が豊富な石炭をガス化してできるメタノールからDMEを作り出す技術を供与。製造工程で必要な触媒なども提供する。

東洋エンジはDMEの実用化で先行している中国で、量産プラント建設にかかわっている。中国大手肥料会社の瀘天化集団(四川省瀘州市)から年産11万トンの燃料用DME量産プラントを受注し、来年3月にも稼働する見込み。

日本ではJFEエンジニアリングがダイハツディーゼルなどと組んでDME利用のディーゼルエンジンを開発するなど、新燃料の利用拡大を模索している。

同じく石油代替燃料のガス・ツー・リキッド(GTL)とともに、今後の需要拡大が見込まれる。

中国向けに大型DMEプラントを受注

http://www.toyo-eng.co.jp/jp/news/17/180104.html

東洋エンジニアリング株式会社(TEC、取締役社長

山田 豊)は、中国国営石炭会社である寧夏煤業集団有限公司が中国西北部に位置する寧夏回族自治区に新設する、石炭原料で世界最大の年産21

万トンの燃料用DME 製造設備のライセンス供与と基本設計並びに触媒提供の業務をこのたび受注いたしました。

このプロジェクトは、埋蔵される豊富な石炭を原料に石炭ベースの化学コンビナートを建設する一環であり、生産されるDMEは液化プロパンガスの代替品などとして地元で消費される予定です。中国では急激な経済成長によるエネルギー需要の増大に対応するために、DMEなどの代替エネルギーの活用を積極的に進めております。世界初の商業規模の燃料用DMEを中国で建設した当社は、この受注を契機に積極的にビジネス展開を図ってまいります。

<受注概要>

■ 客 先:寧夏煤業集団有限公司 (Ningxia Coal Group

Co., Ltd.) (注)

■ <本社:寧夏回族自治区・銀川市>

■ 受注者:TEC

■ 建設地:寧夏回族自治区東部 <添付>

■ 対象設備:年産21万トンのDME製造設備

<DMEはジメチルエーテルの略。原料は石炭をガス化して製造するメタノール>

■ ライセンサー:TEC

■

役務内容:ライセンス供与、基本設計、触媒供与及び技術サービスの供与

■ プラントの完成:2007年末を予定

■ 受注の意義:

* 世界で初めて年産1万トンの燃料用DME製造を完工し、引き続き年産11 万トンの設備を四川省瀘(ろ)州市で建設中の当社にとって、今回で3基目のDME受注となります。 * 中国では豊富な石炭をベースとした化学コンビナートの建設が多数計画されており、石炭からクリーンなエネルギーであるDMEを製造することは、石油への依存解消や公害防止の面からも、現代中国社会のニーズに適合したものとして注目されています。

(注)客先の寧夏煤業集団有限公司は、2002年に4鉱山が統合されて設立された国営石炭会社。14箇所の炭鉱を操業し、従業員5万7千人、年間売上は約35億人民元。客先が保有する埋蔵量約300億トンの高品質石炭を原料に、石炭のガス化による化学コンビナートを建設し、メタノール,DMEやメタノール経由のプロピレンの製造などを計画中。

Methanol plants in north

China close due to feedstock shortage

Methanol production

at

Weishi Chemical in

north China's Henan Province has been stopped for several months

due to a coal shortage, according to a source from the company.

"We cannot

find coal supply at present as many coal mines have been shut

down for safety concerns. We are unable to resume production

until we can get enough coal supply," the source said.

Weishi Chemical is

one of the major coal based methanol producers in north China

with a capacity of 180,000 mt/yr.

Puyang

Methanol, another

methanol producer in the same province, has also stopped

production due to a suspension of natural gas supply since Jan 1,

and is expected to be back in operation on Jan 15, according to a

source from the company. The company's natural gas supplier,

Chinese integrated oil major Sinopec Zhongyuan Oilfield,

explained that the supply cut was due to frozen pipelines.

Puyang Methanol Co

has a methanol capacity of 120,000

mt/yr, of which about 90,000 mt/yr is natural gas based and the

remaining 30,000 mt/yr is coal based. The coal based unit also stopped

operation due to the coal shortage.

The company has a

coal based methanol capacity expansion of 200,000 mt/yr scheduled

to be completed by 2008, the source added.

China's Tianji to build a

600 kt/yr methanol plant by end of 2007

Tianji Coal Chemical Industry Co of

Changzhi City in North China's Shanxi Province is set to build a 600,000 mt/yr

methanol plant by

the end of 2007, an official from the company said Friday. The

National Development and Reform Commission has approved the

project and preparation has been completed.

The company produces methanol via gas from associated coal cokers

of its own, and all its methanol products are to be sold on the

domestic markets.

The company is also evaluating the feasibility of building a

dimethyl ether plant, depending on the market situations of both

methanol and DME.

China's XinAo Group to

build 2.4-mil mt/yr methanol plant by 2010 新奥集団

内蒙古鄂尓多斯

China's XinAo Group

is scheduled to build a 2.4-mil mt/yr methanol plant by 2010,

said an official from its industrial base in Ordos Inner Mongolia

in North China Wednesday.

The project is to be built in two stages. In the first stage, a 600,000 mt/yr

methanol

plant and an associated 400,000 mt/yr dimethyl ether plant would be built by the end

of 2007. In stage two, a 1.8-mil mt/yr methanol plant would be finished by 2010.

The construction is scheduled to start on March 27, 2006, said

the official. And the construction of stage two of the project is

scheduled to start once stage one is completed at the end of

2007.

The methanol production is to be coal based, with all necessary

coal to be provided by the company, as it has already acquired

coal mining permits.

Its methanol and DME products are to be sold through its

distribution network across China, with its DME products also to

be used as fuel.

The company plans to study market situations to decide whether to

build an associated DME plant for the second stage methanol unit.

XinAo Group is a Hong Kong Exchange listed independent company,

specializing in urban gas distribution and gas vehicle and

storage facilities manufacturing, among other areas.

XinAo Group 新奥集団

http://www.xinaogroup.com/en/about/about.jsp

Founded in 1989 with its headquarter located at Langfang Economic & Technological Development Zone in Hebei province河北省廊坊, XinAo Group is a comprehensive business conglomerate engaged in the field of clean energy development and exploitation, with major industries covering urban gas, energy equipment, bio-chemical business, energy chemical business and real estate development etc. By the end of 2004, the Group employs over 10,000 staff with a total assets nearly RMB 10 billion, more than 80 wholly-owned firms, holding subsidiaries and various branches throughout 50 cities at home as well as international metropolises such as Hong Kong, Melbourne , London , and Boston .

2006/1/25 BASF

BASF, Huntsman and Chinese companies consider construction of

additional MDI plant in China

http://www.corporate.basf.com/en/presse/mitteilungen/pm.htm?pmid=2130&id=SmQ-c83tlbcp*hT

Plant to have world-scale

capacity of 400 kt/a crude MDI

Startup of new MDI plant planned from 2010 onward

Several sites being evaluated

MDI/TDI project in Caojing progressing as scheduled

BASF, Huntsman, and a group of Chinese companies - Shanghai Hua

Yi (Group Company), Sinopec Shanghai Gao Qiao Petrochemical

Corporation and Shanghai Chloro-Alkali Chemical Co., Ltd. - are

considering the construction of a new MDI (diphenylmethane

diisocyanate) plant in China to meet growing demand for this

product. Several sites for the plant are being evaluated. The

startup is planned from 2010 onward, and the plant is expected to

have a capacity of 400,000 metric tons per year of crude MDI.

“The

market for polyurethanes in China is expected to grow at a

double-digit rate and will become the largest in the world within

the next decade,” said Jean-Pierre Dhanis, President

of BASF's Polyurethanes division. “We want to participate in this

dynamic growth, and better serve our customers through local

production.”

MDI is an important

precursor in the manufacture of polyurethanes ? versatile

polymers that are used in the automotive and construction

industries, in appliances such as refrigerators, and in footwear.

As part of BASF's investment strategy for the Chinese market, an

integrated isocyanates complex is currently under construction at

the Shanghai Chemical Industry Park in Caojing. This project is

progressing as scheduled, and is expected to begin commercial

production by mid-2006. The complex is also a joint venture

between BASF, Huntsman, and the same group of Chinese companies

mentioned above. It will have a capacity of 240,000 metric tons

per year of crude MDI, and 160,000 metric tons per year of TDI

(toluene diisocyanate). The total cost for the complex is about

$1 billion.

BASF is one of the largest foreign chemical investors in China,

with sales of almost Euro1.9 billion in 2004 and a workforce of

4,000 employees. By 2010, BASF aims to generate 10 percent of its

global sales and earnings in its chemical businesses in China.

2006/1/23 AMEC

AMEC appointed project management contractor of billion dollar

coal-to-chemicals development, China

http://www.amec.com/news/mediareleasedetails.asp?Pageid=876&MediaID=1108

AMEC, the international

project management and services company, has been appointed by

the

Ningxia Coal Industry Group (NCG) as the project management

contractor for the development of a new US$1.5 billion

coal-to-chemical production complex in the Ningxia Hui Autonomous

Region in

northwest China.

The value of the multi-million dollar contract has not been

announced.

AMEC’s role, which it will carry out as

part of an integrated project team with NCG, will involve setting

up project management procedures and taking responsibility for

the contracting strategy, construction management advice and

support, safety, health and environmental issues, quality

assurance, commissioning and start-up management support and

several other operational and commercial functions. The project

will use AMEC's proprietary project management system, CONVERO.

Work on the new facility, which is designed to produce 540,000 tonnes of

polypropylene

per year, will begin in February this year and will be completed

in early 2009. Polypropylene is a chemical product usually

derived from oil refining and ethylene processing but the project

will use coal as the feedstock, which will come from large

reserves in the Ningxia area.

The complex will include a coal gasifier plant, a methanol

and methanol-to-propylene unit, and a polypropylene unit.

“China

is making major investments in plants to convert coal into oil,

gas and chemicals to reduce its reliance on foreign imports, and

the Ningxia contract marks our entry in to this new and

fast-growing sector, said Neil Bruce, managing Director of AMEC’s Oil and Gas business. “It also reinforces our position as

a leading project management contractor in China, building on our

success on the multi-billion dollar SECCO Ethylene plant and the

recent award of a technical services contract for Petrochina’s Dushanzi project.”

Notes to editors:

AMEC plc is an international project management and services

company that designs, delivers and supports infrastructure assets

for customers worldwide across the public and private sectors.

AMEC employs 44,000 people in more than 40 countries, generating

annual revenues of around £5 billion. AMEC’s shares are traded on the London

Stock Exchange where the company is listed in the Support

Services sector (LSE: AMEC.L).

Ningxia Coal Industry Group is a state-owned company, owned

jointly by provincial and central government. The major holder is

Shenhua

Group which

is the largest coal industry group in China, owned by the central

government.

住友商事 中国で医薬強化 増資へ新制度活用も

住友商事が中国での医薬事業強化に大きく踏み出す。同社が20%出資する中国の製薬会社、河南天方薬業が17日の臨時株主総会で、新株の発行に道を開く議案を可決したことがきっかけだ。住商は今後、中国政府が定めた新たな投資促進策を活用し、出資比率の引き上げを検討する。

上海証券取引所の人民元建てA株市場に上場する河南天方は総会で、市場で取引されない「非流通株」を解消し、一定期間後に全株式を市場で売買できる「流通株」に転換することを決めた。非流通株の解消は中国のA株上場企業が新たな株式発行などをするための前提条件となっている。

住商は河南天方を中国での医薬・バイオ事業の柱と位置づけている。2月末に20%の出資を完了し、2007年3月期から連結の持ち分法適用会社とるのに続き、30%をメドに出資比率を高めたい考えだ。

その際には、中国政府が1月30日付で施行した長期的な保有などを前提に、外国企業によるA株上場企業へ投資を明文化した新しい規定を活用する。現時点ではスイスのセメント大手ホルシムが計画を表明しただけで、住商が利用すれば日本企業で初めてとなる。

日本経済新聞 2006/3/23

中国 設備過剰で法的手段も

新規参入を制限・小規模企業を淘汰 地方に通達 電カでも懸念

中国国務院(内閣)は10業種を対象に、法的手段によって新規参入を制限したり小規模設備の淘汰を加速するよう地方政府などに通達を出した。国内の設備過剰を解消する狙い。かねて過剰が指摘されてきた自動車や鉄鋼だけでなく、足元では不足が問題になっている電力でも将来は過剰になる懸念があると指摘した。過剰対策はこれまでも取られてきたが効果は上がっておらず、強制力のある対策を打ち出すことで安定成長を目指す。

国務院によると、設備能力が過剰なのは自動車、鉄鋼、アルミニウム、カーバイド、合金鉄、コークスの6業種。過剰問題が将来、顕在化すると懸念しているのが電力、セメント、石炭、紡織の4業種。

通達では法律や行政的な手段で過剰業種への融資方法を見直したり、環境保護や資源・土地の有効利用の点から新規参入を厳しく選別するよう求めている。低品質の製品を生産し、環境汚染を発生させている小規模企業の整理や淘汰を加速させる。

自動車や鉄鋼では生産能力の3割が過剰とされ、いずれの業界も利益が縮小している。今回注目されるのが、2003年ごろから不足が深刻になった電力の過剰懸念を明確に指摘した点だ。

政府が発電能力増強を呼びかけ金融機関も積極融資してきた結果、もうかるとみた新規事業者が相次ぎ参入、乱立状態となった。05年末の発電能力は5億1千万キロワットで、05年中に着工した発電設備の合計能力は1億キロワット。これらが06年から07年にかけて稼働すると需要を上回る。発電所の稼働を維持できなくなり経営が不安定になる懸念がある。通達は乱立する小規模発電所計画を停止させ、大規模発電所を中心に新設するとの方針を盛り込んだ。

中央政府は04年ごろから素材などの設備過剰に危機感を強め、増産を抑制するよう指導してきた。しかし過剰な設備建設に対する明確な罰則がなく、地元経済発展のため地方政府が増産を奨励してきたため過剰に歯止めがかかっていない。

沿岸部より発展が遅れた内陸部などでは06年からの新5カ年計画で年率10%前後の高い経済成長目標を掲げ、自動車や鉄鋼などの増産を加速させる方針。

今回の通達を受けて地方政府などが具体的な対策を打ち出すとみられるが、どこまで実効性を上げられるか疑問視する声もある。

| 業種別過剰の状況 | ||

| 電力 | 2007年に需給均衡。20年に発電能力は7割増の約9億キロワット | |

| 自動車 | 現有の生産能力は800万台で、10年には1800万台へ | |

| 鉄鋼 | 05年の粗鋼生産は前年比24%増の3億5000万トン | |

| セメント | 05年の生産は04年比12%増。需要は旺盛だが能力増強も活発 | |

| コークス | 生産能力は3億2000万トン。政府は今後3年間、3億トンに抑制 | |

| アルミ | 年産能力約1200万トンのうち、4割前後が余剰とみられる | |

Platts 2006/3/28

China's Maoming

completes BTX expansion, first supply out H1 May

China's Sinopec

Maoming has completed expansion works at its 460,000 mt/year BTX

unit, slightly earlier than scheduled, a company source said

Tuesday. The company was expected originally to complete

expansion on Mar 30.

The BTX plant is

being expanded by 310,000 mt/yr from an original capacity of

150,000 mt/yr.

"We will

restart the expanded plant in April and supplies will be released

to the market by the first half of May," the source said.

Maoming's newly expanded BTX plant, with a total aromatics

capacity of 460,000 mt/year, includes a 179,000 mt/year benzene