世界最大の肥料会社PotashCorp、BHP Billitonの買収提案を拒否

PotashCorp Adopts Shareholder Rights Plan

BHP Billiton Announces All-Cash Offer To Acquire PotashCorp

Billiton and Petrohawk Energy Corporation Announce Merger Agreement

PotashCorp's Board of Directors Rejects BHP Billiton's Unsolicited, Non-Binding Proposal as Grossly Inadequate

Potash Corporation of Saskatchewan Inc. today announced that its Board of Directors has received and unanimously rejected an unsolicited proposal from BHP Billiton Limited to enter into a transaction under which BHP Billiton would acquire PotashCorp for US$130 per share in cash. PotashCorp’s Board of Directors thoroughly reviewed BHP Billiton’s unsolicited proposal with the assistance of its independent financial and legal advisors and concluded that the proposal is grossly inadequate and it is not in the best interests of its shareholders for PotashCorp to enter into discussions with BHP Billiton.

PotashCorp is the world’s largest fertilizer company by capacity, producing the three primary crop nutrients - potash (K), phosphate (P) and nitrogen (N). As the world’s leading potash producer, we are responsible for about 20 percent of global capacity.

With operations and business interests in seven countries, PotashCorp is an international enterprise and a key player in meeting the growing challenge of feeding the world.BHPは肥料市場の拡大を見込んでカナダ中部でカリウムの事業化に取り組んでいる。

買収金額 296,596千株 @130 38,557百万ドル

"The PotashCorp Board of Directors unanimously believes that the BHP Billiton proposal substantially undervalues PotashCorp and fails to reflect both the value of our premier position in a strategically vital industry and our unparalleled future growth prospects," said PotashCorp Chairman Dallas J. Howe. "After careful consideration, and in the interest of transparency, our Board determined to proactively disclose BHP Billiton’s unsolicited, non-binding proposal to our shareholders. We believe it is critical for our shareholders to be aware of this aggressive attempt to acquire their company for significantly less than its intrinsic value. The fertilizer industry is emerging from the recent global economic downturn, and we feel strongly that PotashCorp shareholders should benefit from the current and potential value of the Company. We believe the BHP Billiton proposal is an opportunistic effort to transfer that value to its own shareholders."

PotashCorp President and Chief Executive Officer Bill Doyle commented, "Global demand for food is steadily increasing, creating an attractive operating environment for the entire fertilizer industry and, with our premier position, PotashCorp is uniquely poised to benefit. We believe our Board and management team are successfully executing our business plan and producing strong results. With our unmatched asset base and proven strategies, we believe we are well positioned to exceed the expectations of customers around the world and deliver compelling value to our shareholders."

In making its determination, the PotashCorp Board of Directors considered a number of factors including:

------

AUG 17 2010

PotashCorp Adopts Shareholder Rights Plan

Potash Corporation of Saskatchewan Inc. today announced that its

Board of Directors has adopted a Shareholder Rights Plan, subject

to TSX acceptance.

The Rights Plan is intended to ensure that in the context of a

formal take-over bid, the Board of Directors of PotashCorp has

sufficient time to explore and develop alternatives to enhance

shareholder value, including competing transactions that might

emerge.

In connection with the adoption of the Rights Plan, the Board of

Directors authorized the issuance of one share purchase right in

respect of each common share of PotashCorp outstanding as of the

close of business on August 16. Under the terms of the Rights

Plan, the rights will become exercisable if a person, together

with its affiliates, associates and joint actors, acquires or

announces an intention to acquire beneficial ownership of shares

which, when aggregated with its current holdings, total 20% or

more of PotashCorp’s outstanding common shares,

subject to the ability of the Board of Directors to defer the

time at which the rights become exercisable and to waive the

application of the Rights Plan.

Following the acquisition of more than 20% of the outstanding

common shares by any person (and its affiliates, associates and

joint actors), each right held by a person other than the

acquiring person (and its affiliates, associates and joint

actors) would, upon exercise, entitle the holder to purchase

PotashCorp’s common shares at a substantial

discount to their then prevailing market price.

BHP Billiton Announces All-Cash Offer To Acquire PotashCorp

Highlights

BHP Billiton today announced its intention to make an all-cash offer to acquire all of the issued and outstanding common shares of Potash Corporation of Saskatchewan Inc., at a price of US$130 in cash per PotashCorp common share. The Offer values the total equity of PotashCorp at approximately US$40 billion on a fully-diluted basis.

The acquisition will accelerate BHP Billiton's entry into the fertilizer industry and is consistent with the company's strategy of becoming a leading global miner of potash. PotashCorp's potash mining operations are a natural fit with BHP Billiton's greenfield land holdings in Saskatchewan, Canada.

Compelling Offer to PotashCorp Shareholders

The Offer represents an attractive premium of 20 per cent to the closing price of PotashCorp's shares on the NYSE on 11 August 2010, the day prior to BHP Billiton's first approach to PotashCorp. It is also a premium of 32 per cent and 33 per cent to the volume weighted average trading prices of PotashCorp's shares on the NYSE for the 30-trading day and the 60-trading day periods ended on the same date, respectively. The Offer is fully funded and provides PotashCorp shareholders with immediate liquidity and certainty of value regarding the company's growth potential in the face of volatile equity markets.

On 12 August 2010, BHP Billiton Chief Executive Officer Marius Kloppers made a proposal to PotashCorp's President and Chief Executive Officer, Mr William J. Doyle, to combine the two companies in which PotashCorp shareholders would receive US$130 in cash per PotashCorp common share. Mr Kloppers was advised by Mr Doyle that PotashCorp was not for sale and had no interest in discussing a combination at this time.

Subsequently, on 13 August 2010, BHP Billiton Chairman Jac Nasser reiterated the proposal in a letter to Mr Dallas J. Howe, the PotashCorp Board Chair, requesting a response from the PotashCorp Board by 18 August 2010. On 17 August 2010, Mr Howe advised Mr Nasser by letter that the Board of Directors of PotashCorp unanimously rejected BHP Billiton's proposal, and PotashCorp made BHP Billiton's proposal and PotashCorp's response publicly available. Notwithstanding PotashCorp's current position, BHP Billiton would welcome the opportunity to work with PotashCorp to achieve a successful outcome to this transaction.

Commenting on the Offer, Mr Nasser said "We firmly believe that PotashCorp shareholders will find the certainty of a cash offer, at a premium of 32 per cent to the 30-trading day period average, very attractive and we have therefore decided to make this Offer directly to those shareholders".

Consistent with BHP Billiton's Strategy

The acquisition of PotashCorp is consistent with BHP Billiton's strategy of developing, owning and operating a diversified portfolio of large, low-cost, long-life, expandable, export-oriented, Tier 1 assets. PotashCorp will provide BHP Billiton with an immediate leadership platform in the global fertilizer industry and further diversify BHP Billiton's portfolio of Tier 1 assets. In addition, the acquisition leverages BHP Billiton's global capability and experience in building, operating and expanding mining operations.

Furthermore, BHP Billiton believes that the proposed acquisition will be earnings per share accretive in the second full fiscal year following consolidation.

Commenting further on the Offer, Mr Kloppers said "This is an exciting opportunity to acquire a portfolio of Tier 1 assets. It accelerates our stated strategy of becoming a leading global potash producer and further diversifies our portfolio by commodity, geography and customer."

Benefits to Canada

BHP Billiton is committed to being a strong corporate citizen in Saskatchewan, New Brunswick and Canada and, in that regard, is prepared to make appropriate undertakings as part of its submission to Investment Canada. Amongst these is BHP Billiton's intention to establish a global potash business in Canada and to base the President and management of the Canadian potash operations in Saskatchewan.

BHP Billiton plans to maintain current levels of employment at PotashCorp's Saskatchewan and New Brunswick operations for the foreseeable future. BHP Billiton also intends to identify and propose a Canadian nominee to stand for election to the BHP Billiton Board.

BHP Billiton recognizes the significant and unique capabilities of PotashCorp's businesses and its employees and is firmly committed to ensuring that PotashCorp's businesses continue to play leading roles in the global fertilizer industry. Towards this end, BHP Billiton intends to continue PotashCorp's planned and previously announced capital programs. In addition, BHP Billiton will continue to progress its plans to develop its Jansen greenfield potash project.

BHP Billiton is committed to strong community relations and intends to bring PotashCorp's spending commitments on community programs in line with BHP Billiton's global commitment levels. BHP Billiton's policy is to spend 1 per cent of Profit Before Tax, on a 3 year rolling average basis, on community programs.

BHP Billiton has had business interests in Canada for almost 40 years, the most significant of which has been EKATI in the Northwest Territories - one of the world's premier diamond mines. BHP Billiton has invested approximately US$5 billion in Canada since EKATI began production in 1998. In recent years, BHP Billiton has acquired exploration rights in the Saskatchewan potash basin.

BHP Billiton estimates the total amount of funds required to consummate the Offer is approximately US$43 billion (including funds required to repay or refinance certain existing PotashCorp indebtedness if necessary). BHP Billiton has arranged a new multi-currency term and revolving facility agreement entered into for the purpose, among other things, of meeting the funding requirements of the transaction. The terms of the facility will include various representations and warranties, affirmative and negative covenants, and events of default customary for credit facilities of this type.

The acquisition financing facility will preserve BHP Billiton's financial flexibility. BHP Billiton remains committed to maintaining a solid A credit rating and a progressive dividend policy.

PotashCorp is the world's largest integrated fertilizer and related industrial and feed products company and the largest producer of potash worldwide by capacity. In 2009, PotashCorp estimated its potash operations represented 11% of global production and 20 per cent of global potash capacity. PotashCorp owns and operates five potash mines in Saskatchewan and one in New Brunswick. PotashCorp also holds mineral rights at the Esterhazy mine in Saskatchewan where potash is produced under a mining and processing agreement with a third party.

PotashCorp's phosphate operations include the manufacture and sale of solid and liquid phosphate fertilizers, animal feed supplements and industrial acid, which is used in food products and industrial processes. PotashCorp has an integrated phosphate mine and processing plant in North Carolina, a phosphate mine and two mineral processing plant complexes in northern Florida and six phosphate feed plants in the United States. PotashCorp can also produce a variety of phosphate products at its Geismar facility in Louisiana.

PotashCorp's nitrogen operations involve the production of nitrogen fertilizers and nitrogen feed and industrial products, including ammonia, urea, nitrogen solutions, ammonium nitrate and nitric acid. PotashCorp has nitrogen facilities in Georgia, Louisiana, Ohio and Trinidad.

For the year ended 31 December 2009, PotashCorp had audited consolidated revenues of US$3,977 million (2008: US$9,447 million), EBITDA of US$1,504 million (2008: US$4,963 million) and profit before taxation of US$1,071 million (2008: US$4,572 million). As at 31 December 2009 PotashCorp had audited gross assets of US$12,922 million and net assets of US$6,501 million. The PotashCorp financial information presented above has been extracted without amendment from published financial reports which are presented in US dollars and prepared under Canadian Generally Accepted Accounting Principles.

15 July 2011 BHP Billiton 別途 2011/2/23 BHP Billiton、米シェールガス鉱区を買収

Billiton and Petrohawk Energy Corporation Announce Merger Agreement

BHP Billiton and Petrohawk Energy Corporation announced today that the companies have entered into a definitive agreement for BHP Billiton to acquire Petrohawk for US$38.75 per share by means of an all-cash tender offer for all of the issued and outstanding shares of Petrohawk, representing a total equity value of approximately US$12.1 billion and a total enterprise value of approximately US$15.1 billion, including the assumption of net debt. The Petrohawk board of directors has unanimously recommended to Petrohawk shareholders that they accept the offer.

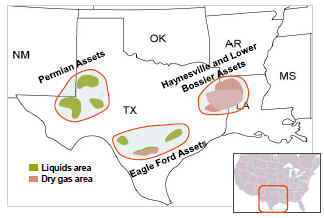

The transaction would provide BHP Billiton with operated positions in the three world class resource plays of the Eagle Ford and Haynesville shales, and the Permian Basin.

Petrohawk’s assets cover approximately 1,000,000 net acres in Texas and Louisiana, with estimated 2011 net production of approximately 950 million cubic feet equivalent per day (MMcfe/d), or 158 thousand barrels of oil equivalent per day (Mboe/d). At year-end 2010, Petrohawk reported proved reserves of 3.4 trillion cubic feet of natural gas equivalent (Tcfe). The company has a current non-proved resources base of 32 Tcfe for a total risked resource base of 35 Tcfe. Petrohawk reported gross assets of US$8.2 billion as at 31 March 2011 and US$390 million of profit before tax for the year ended 31 December 2010.

BHP Billiton CEO, Marius Kloppers, said the acquisition was a natural fit with BHP Billiton’s strategy.

“The

proposed acquisition of Petrohawk is consistent with our well

defined, upstream, Tier 1 strategy and provides us with even

greater exposure to the world’s largest energy market, while

also broadening our geographic and customer spread. Importantly,

our offer and the associated substantial premium represent a

unique opportunity for Petrohawk shareholders and recognise the

growth opportunities embedded in its portfolio immediately.”

BHP Billiton

Petroleum Chief Executive, J. Michael Yeager, said the Petrohawk

acquisition would add high quality growth to the company.

“Petrohawk has a focused portfolio of three world class onshore natural gas and liquids rich shale assets. With over a decade of significant investment and volume growth ahead, this transaction would build on our recent acquisition of the Fayetteville shale in Arkansas and provides the potential to more than double our existing resource base. Following completion of the Petrohawk transaction, BHP Billiton Petroleum will be on track to deliver a compound annual production growth rate of more than 10 per cent for the remainder of the decade as we accelerate our shale development program and leverage our strategic capability in the deep water.

“Importantly, BHP Billiton would retain Petrohawk’s sizeable U.S. based workforce, which has been at the forefront of the technological innovation that brought about the economic viability of U.S. shales. We look forward to extending our dedication to safeguarding the environment and the communities where we operate and continuing our commitment to safe and responsible operating practices across all of our shale gas plays, including the world-class assets that Petrohawk would bring to our portfolio.”

Petrohawk CEO, Floyd Wilson, stated: “We believe these premium oil and natural gas assets would benefit significantly by residing within a larger entity that can employ more capital intensity to accelerate their realised value. We are excited to see this transaction completed and to be part of the BHP Billiton organisation.”

The tender offer is expected to commence by 25 July 2011. The acquisition is subject to the terms and conditions set forth in the merger agreement, including a condition that at least a majority of the outstanding Petrohawk shares are tendered, that the waiting period under the U.S. Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, has expired or been terminated and that clearance is obtained from the Committee on Foreign Investment in the United States, and other customary conditions. If the tender offer is completed, un-tendered shares of Petrohawk will be converted into the right to receive the same US$38.75 per share price paid in the tender offer. The transaction is to be financed from existing cash resources and a new credit facility and is not subject to any financing contingency. The transaction is expected to close in the third quarter of 2011.

BHP Billiton has engaged Barclays Capital and Scotia Waterous as financial advisors in connection with this Offer. Its legal advisors are Sullivan & Cromwell LLP and Morgan, Lewis & Bockius LLP in the United States. Barclays Capital will act as Dealer Manager for the offer. Petrohawk has engaged Goldman Sachs as its financial advisor in connection to this Offer. Its legal advisor is Simpson Thacher & Bartlett LLP.