トップページ

2010/8/3

BP Agrees to Sell

Colombian Business to Ecopetrol and Talisman

BP today announced that it has agreed to sell its oil and gas

exploration, production and transportation business in Colombia

to a consortium of Ecopetrol, Colombia's national oil

company (51 per cent), and Talisman of Canada (49 per cent).

The two companies will pay BP a total of $1.9 billion in

cash,

subject to customary post-completion price adjustments, for 100

per cent of the shares in BP Exploration Company (Colombia)

Limited (BPXC),

the wholly-owned BP subsidiary company that holds BP's oil and

gas exploration, production and transportation interests in

Colombia. Subject to regulatory and other approvals, the sale is

expected to be completed by the end of the year.

The sale of the Colombian business is part of BP's plan,

announced on July 27, to divest up to $30 billion of assets over

the next 18 months. On July 20 BP announced that it had agreed to sell assets in the USA, Canada,

and Egypt to Apache Corporation for a total of $7 billion, and

the company has also recently informed

governments in Pakistan and Vietnam that it intends to divest its

upstream interests in those countries.

Tony Hayward, BP group chief executive, said: "I am

delighted with the price we have achieved for these assets. BP

has been involved in Colombia for more than 20 years and played a

major role in finding and developing the country's major

oilfields. These have contributed significantly to BP's global

production over the years. But it now makes sense for the assets

to go to owners more willing than BP to invest in their future

development."

Under the terms of the agreement, Ecopetrol and Talisman are due

to pay BP a cash deposit of $1.25 billion with the balance of payment due

on completion of the sale.

BPXC has assets including interests in five producing fields in

four association contracts, four separate pipeline interests and

two offshore exploration blocks. Net proved

reserves total some 60 million barrels of oil equivalent (boe)

and BPXC's net production is approximately 25,000 boe a day.

Upstream, BPXC has interests in, and operates, the Tauramena (BP

interest 31 per cent), Rio Chitamena (31 per cent), Recetor (50

per cent) and Piedemonte (50 per cent) association contracts,

which are due to expire between 2016 and 2020. Producing fields

on the licences include the Cusiana oil and gas field, and the

Pauto and Florena fields. BPXC also has a 40.56% interest and

operatorship of the RC4 and RC5 exploration blocks offshore

Cartagena, awarded in 2007.

In the midstream, BPXC has interests in the Cusiana gas

processing facility and interests in four pipelines totalling

some 1,600 kilometres of crude and 400 kilometres of gas

pipelines, including a 24.8 per cent interest in the OCENSA crude

oil pipeline.

BPXC employs a total of approximately 470 staff. It is expected

that the majority of staff will transfer with BPXC to its new

owners.

This agreement does not affect BP's Castrol lubricants business

and other downstream oil activities in Colombia.

Barclays Capital acted as sole advisor to BP on this transaction.

Talisman

is one of the largest Canadian-based independent oil and gas

producers.

Talisman's

main business activities include exploration, development,

production, transportation and marketing of crude oil,

natural gas and natural gas liquids.

Established

as an independent company in 1992, Talisman has grown

production from 50,000 boe/d in 1992 to 452,000 boe/d in

2007. The Company's three core areas are North America, the North Sea and Southeast Asia.

The

Southeast Asia segment includes exploration and operations in

Indonesia, Malaysia, Vietnam and Australia and exploration

activities in Papua New Guinea.

Aug 02 2010 中国網日本語版(チャイナネット)

英BP、シノペックからの資産買収案を拒否

中国石油化工集団(シノペック)は先般、同社による英BP資産の買収案が拒絶されたことを明らかにした。

シノペックの章建華高級副総裁は、「同社はBPの一部優良資産の買収について交渉を進めていたが、BPは売却に同意しなかった」と述べた。

メキシコ湾の原油流出事故による損失に対処するため、BPは18カ月内に300億ドル規模の資産を売却することを計画している。BPはまた、債務を100億ドルに減らす方針だ。

消息筋によると、BPはコロンビア、ベネズエラ、ベトナムの油田の売却を検討しており、さらにアルゼンチンの石油大手パン・アメリカン・エナジーの株式60%を売却する方針だという。

ーーー

2010-07-30

中国日報 www.chinadaily.com

BP

has declined Sinopec's offer to buy its assets

China

Petroleum & Chemical Corp (Sinopec), Asia's biggest refiner,

said BP Plc has declined an offer by the Chinese company to buy

some of its assets.

"We've

talked to BP on some good assets, but they won't sell,"

Zhang Jianhua, senior vice president of the company known as

Sinopec, said in an interview in Shanghai today, without naming

the ventures. "We aren't in any talks with BP right

now."

Europe's largest oil

producer by volume plans to dispose of as much as $30 billion in

assets in the next 18 months to raise cash to meet the costs of

the Gulf of Mexico oil spill. BP said it has $16 billion of

unused credit lines and plans to cut its debt to as little as $10

billion over the same period.

"BP's

robust cash flow amidst resilient oil prices means they don't

have to sell assets at dirt-cheap levels, especially for

higher-quality assets," said Gordon Kwan, head of regional

energy research at Mirae Asset Securities Ltd. "Expect

Sinopec and others to come back to BP with higher bids."

The

London-based company is considering selling fields in Colombia,

Venezuela and Vietnam, a person with knowledge of the matter said

this month. BP may also dispose of its 60 percent holding in Pan

American Energy LLC, Argentina's second-largest oil producer, the

person said then.

BP

reported a record loss in the second quarter after the oil spill

triggered by an April 20 explosion on the Deepwater Horizon rig.

The shares closed at 413.45 pence in London trading yesterday,

down 37 percent since the blast.

'Strategic

resources'

China

has spent at least $21 billion on overseas resources in the past

year to meet domestic demand, including the acquisition in April

of a stake in a Canadian oil-sands project by Sinopec's parent.

"The

chances of Sinopec winning bids for BP assets are small, as the

European company is in the hands of the UK and US government and

would never give strategic resources to Chinese majors

easily," said He Wei, oil analyst with BOCOM International

Holdings Co.

Sinopec

has fallen 10 percent in Hong Kong trading this year, compared

with the 4 percent decline in the benchmark Hang Seng Index.

Chinese

oil demand

The

slowing Chinese economy hasn't affected domestic oil-product

demand so far, Zhang said. "We cannot see much impact right

now," he said.

Sinopec's daily fuel

sales haven't declined and the company's refineries are operating

at more than 90 percent of their designed capacities, Zhang said.

The Beijing-based refiner supplies 60 percent of the country's

oil products including gasoline and diesel.

Fuel

demand is poised to slow as Premier Wen Jiabao damps growth to

curb inflation. The economy may grow 10.1 percent this year,

according to the median of 27 economists' forecasts compiled by

Bloomberg, down from last year's 10.7 percent.

China

may face a surplus of fuel including diesel next year as refiners

add oil-processing capacity, Fu Bin, deputy general manager of

PetroChina Co's sales unit, said on May 27. The oversupply may

rise to 80 million metric tons by 2015, Fu said.

Sinopec's

August oil-processing volume will increase slightly from July,

Zhang said, without elaborating. China's fuel demand usually

peaks in summer from July to September.

28 November 2010

BP Agrees to Sell its

Interests in Pan American Energy to Bridas Corporation

BP announced today that it has entered into an agreement to sell

its

interests in Pan American Energy (PAE) to Bridas Corporation. PAE is an Argentina-based oil and

gas company owned by BP (60 per cent) and Bridas Corporation (40

per cent).

Bridas Corporation will pay BP a total of $7.06 billion in

cash for BP’s 60 per cent interest in PAE. The

transaction is expected to be completed in 2011.

The sale of its interests in PAE is part of BP’s plan, announced in July 2010, to

divest up to $30 billion of assets by the end of 2011. Before the

agreement to sell its interests in PAE, BP already had sales

agreements in place totalling some $14 billion. The proceeds of the sale

announced today will be used by BP to increase the cash available

to the group.

BP group chief executive Bob Dudley said: “Today’s agreement further demonstrates

both the high quality and attractiveness of the assets throughout

BP’s global portfolio and also the

company’s ability to meet our significant

financial commitments arising from the Gulf of Mexico tragedy.

“We

now have agreements in place that should secure the majority of

our divestment target. We will continue to identify further

assets that may be strategically more valuable to others than to

BP as we complete the programme.”

Under the terms of

the agreement, Bridas Corporation is required to pay BP a cash

deposit of $3.53 billion with the balance of the proceeds due on

completion of the sale. $1.41 billion of this deposit is due to

be paid on December 3, 2010, with the balance of $2.12 billion to

be paid by Bridas Corporation on December 28, 2010.

The transaction excludes the shares of PAE E&P Bolivia Ltd,

and the figures below exclude amounts attributable to PAE E&P

Bolivia Ltd.

Completion of the transaction is subject to closing conditions

including the receipt of all necessary governmental and

regulatory approvals, as well as the requirement that there has

been no material adverse effect on PAE and no material adverse

effect on BP’s ability to complete the

transaction. In the event that any of these closing conditions is

not met, BP will be required to repay the deposit to Bridas

Corporation. BP p.l.c. has guaranteed the payment obligations of

BP under the agreement.

The aggregate profit before taxation attributable to BP’s 60 per cent interest in PAE for

the purposes of calculating group profits for the year ended 31

December 2009 was $581.5 million. The aggregate value of the

gross assets attributable to BP’s 60 per cent interest in PAE for

the purposes of calculating the BP Group’s gross assets as at 30 September,

2010 was $2,602 million.

PAE is involved in the exploration, development and production of

oil and gas and has interests in the Southern Cone region of

South America. The company’s main interests are in Argentina, where it is the second largest

producer of oil and gas. It holds blocks in four hydrocarbon

basins in Argentina including Golfo San Jorge - including the

large Cerro Dragon block - Austral, Neuquen and Northwest. The

company also has interests in various portions of the oil and gas

value chain, including oil and gas transportation, oil storage

and loading, gas distribution and power generation.

As of 31 December, 2009, proved reserves attributable to BP’s 60 per cent interest in PAE

were, for BP Group reporting purposes, 917 million barrels of oil

equivalent. Net production associated with BP’s 60 per cent interest in PAE is

approximately 143 thousand barrels of oil equivalent per day.

China National Offshore Oil

Company Limited (CNOOC) said Sunday Bridas Corporation, a

joint-venture equally-owned by CNOOC International Limited

and Argentina-based Bridas Energy Holdings (BEH), will acquire a 60 percent

equity interest in Pan American Energy (PAE) from BP for

approximately $7.06 billion.

The acquisition excludes PAE's assets

in Bolivia,

according to a statement on the website of CNOOC, China's

largest offshore oil and gas producer.

CNOOC International, a wholly

owned subsidiary of the company, and BEH have agreed to

contribute about $4.94 billion to Bridas to finance 70

percent of the proposed acquisition.

The contribution will

be made in equal amounts of approximately $2.47 billion by

CNOOC International and BEH.

The remaining 30 percent, or

approximately $2.12 billion, will be satisfied by third party

loans to be arranged by Bridas and additional contributions

from CNOOC International and BEH.

Completion of the acquisition

is conditional on, among others factors, all necessary

government and regulatory approvals, and is expected to take

place in the first half of 2011.

In the first half of 2010,

CNOOC International and BEH completed the formation of a

half-half joint venture in Bridas.

2011/11/7 BP

Statement Regarding Sale of BP’s Interest

in Pan-American Energy to Bridas Corporation

On 5 November 2011, BP received from Bridas Corporation a

notice of termination of the agreement for their purchase of

BP's 60 per cent interest in Pan American Energy LLC (PAE). As a result

of Bridas Corporation’s decision and action, the share purchase agreement

governing this transaction, originally agreed on 28 November 2010, has been

terminated.

2010/12/1 BP、アルゼンチンのPan

American Energy の持株をBridas

Corporationに売却

The closing of this transaction had been

delayed because the Argentine anti-trust and

Chinese regulatory approvals required to satisfy

the conditions precedent to closing of the transaction had not been obtained by

Bridas Corporation. Under the terms of the agreement, Bridas Corporation had

exclusive responsibility for obtaining these approvals.

As a result of Bridas Corporation’s termination of the agreement, BP will now

repay the deposit for the transaction of $3.53 billion received at the end of

2010. This deposit had been held by BP as short-term debt and will be repaid by

14 November 2011. This repayment will not affect BP's level of gearing, which

stood at 19 per cent at the end of September.

PAE is a strong business. As a result of Bridas Corporation's decision to

terminate, BP is no longer in discussions with them regarding this transaction.

BP is happy to return to long term ownership of these

valuable assets, given the considerable improvement in its own financial

strength and circumstances, as well as the improved external trading

environment.

In November 2010 and under different circumstances from those at present, BP

agreed the sale of its interest in PAE as an early element of its divestment

programme to strengthen its balance sheet. Since June 2010, excluding the PAE

assets, BP has agreed asset sales totalling over $19 billion. As reported in its

third quarter 2011 results, at the end of September 2011, BP held $18 billion in

cash.

In October 2011, BP announced that it intended to extend its divestment

programme to $45 billion by the end of 2013. BP’s current divestment programme

is focussed on the sale of non-strategic assets and not driven by a requirement

to raise cash. As such, BP does not currently plan to

divest additional assets to offset proceeds which would have been

received from the PAE transaction.

Notes to editors:

On 28 November 2010, BP announced that it had reached agreement to sell its

interests in Pan American Energy LLC to Bridas Corporation for $7.06 billion in

cash. PAE is an Argentina-based oil and gas company owned by BP (60%) and Bridas

(40%). The transaction excluded the shares of PAE E&P Bolivia Ltd.

BP's investment in PAE has been classified as assets held for sale in the BP

group balance sheet at 30 September 2011.

After 1 November 2011, pursuant to the terms of the sale and purchase agreement,

if all of the conditions precedent were not yet satisfied,

each party had the right to terminate the agreement at any time without notice.

As at 6 November 2011, Argentine antitrust and Chinese regulatory approvals

required to satisfy key conditions precedent to complete the sale had not been

obtained by Bridas Corporation, nor had Bridas Corporation waived these

conditions precedent, as it was entitled to do under the sale and purchase

agreement.

BP will separately make a payment of $700 million to Bridas Corporation in full

settlement of any and all past claims between the two companies and also as

consideration for amendments to the PAE Limited Liability Company agreement

which terminate certain legacy restrictive covenants among BP, PAE and Bridas

Corporation.

2011年 11月 7日 WSJ

BPのアルゼンチン権益売却契約が破棄―財務状況好転で

英石油大手BPが、南米で石油事業を展開しているパン・アメリカン・エナジーの権益60%について、中国国有石油大手の中国海洋石油(CNOOC)とアルゼンチンのブリダス・エナジーの合弁会社ブリダスに70億6000万ドル(約5510億円)で売却する契約が破棄された。同契約は昨年締結されたもので、細目を詰めて1年後に最終調印される予定だった。

ブリダス社が5日、法的な理由とBPの対応を理由に同契約を停止することを明らかにした。これに対しBPは、米メキシコ湾油田の大量の原油流出事故に伴う資金難を克服し財務力は高まっているため、資産売却の必要性はなくなっていると指摘し、今回の契約破棄については懸念していないと表明した。BPはまた、アルゼンチンと中国の当局から独禁法上の認可などを得るのはブリダス側の責任だったが、6日現在認可は得られていないと指摘、ブリダスを非難した。

BPのスポークスマンは、原油価格の大幅上昇を受けて同社の資産は原油流出事故を起こした昨年に比べはるかに増強されていると強調。「財務力の強化や取引環境の好転を考えれば、貴重な資産を取り戻せたことはむしろ良かった」と述べた。

BPは、原油の大量流出事故を受け、流出原油の回収や補償のため400億ドル超の引当金を計上し、そのための資金手当のため最高300億ドルの資産を売却する計画だった。しかしパン・アメリカンの権益売却が打ち切られたため、資産売却は合計で190億ドルにとどまっている。

BPは、売却資金を手に出来なくなったことから、他の資産を追加売却するつもりはないとしている。同社によると、9月末現在の手元資金は180億ドルで、負債資本比率は11年前に比べ大幅低下しているという。

2012/4/25 朝日新聞

メキシコ湾原油流出で初の逮捕者 英BP社の元技術者

米南部沖のメキシコ湾で2010年4月に石油掘削基地が爆発し、大量の原油が海に流出した事故で、米司法省は24日、英BP社の元技術者を司法妨害(証拠隠滅)容疑で逮捕したと発表した。同事故で逮捕者が出たのは初めて。

同省によると、元技術者のカート・ミックス容疑者は、海底の壊れた安全弁に泥状のものを流し込む「トップキル作戦」に携わった際に携帯端末で受けたメッセージ200通以上を、その後に消去した疑いが持たれている。当時の公表より実際の原油流出速度が速く、現場では作戦失敗を予想していたとの機密情報も含まれていたという。

これを皮切りに、捜査当局は「米国史上最悪の環境災害」を引き起こした関係者の刑事責任を追及する方針だ。同事故では作業員11人が犠牲になったほか、海底の油井から原油約78万キロリットルが流出したと推定されている。

April 25, 2012

Associated Press

Engineer arrested, feds probe BP's spill response

By arresting a

former BP engineer Tuesday, federal prosecutors

for the first time showed their hand in the Gulf

oil spill case, saying they were probing whether

BP PLC and its employees broke the law by

intentionally lowballing how much oil was

spewing from its out-of-control well.

Two years and

four days after the drilling-rig explosion that

set off the worst offshore oil spill in U.S.

history, Kurt Mix, 50, of Katy, Texas, was

arrested Tuesday and charged with two counts of

obstruction of justice for allegedly deleting

about 300 text messages that indicated the

blown-out well was spewing far more crude than

the company was telling the public at the

time.

The charges

are not likely to affect a proposed class-action

settlement that would resolve more than 100,000

claims by people and businesses who blame

economic losses over the spill. A federal judge

is expected Wednesday to consider granting

preliminary approval of the $7.8 billion civil

settlement between BP and a committee of

plaintiffs.

The case

against Mix brings the first criminal charges in

the Justice Department's Deepwater Horizon

probe. If convicted, Mix could get up to 20

years in prison and a $250,000 fine on each

count. Mix was released on $100,000 bail.

In an

affidavit, the U.S. Department of Justice said

it was investigating whether BP and its

employees broke the law "by intentionally

understating" how much oil was leaking.

Legal experts

said this was likely just the first move by the

Justice Department. The federal agency made it

clear the investigation still is ongoing and

suggested more people could be arrested.

"Did anyone

else know about this? Was this gentleman, shall

we say encouraged or pushed to do this? Did he

do it under orders? Did he do it under duress?"

said Anthony Michael Sabino, a professor at St.

John's University School of Law in New York and

an expert in white-collar crimes.

"When you're

a prosecutor you start with the little fish and

you hope the little fish helps you catch a

medium-sized fish; then you go after the big

fish until you get the biggest fish of all,"

Sabino added. "It's going up the food chain ...

If you jump the gun, and you don't have the

pieces in place, you ruin the case."

Seth Pierce,

a Los Angeles-based commercial defense lawyer,

said the Justice Department's move was "almost

like you would see in a mafia case, where they

go and try to apply a lot of pressure on really

low-level guys in the hopes of turning them, or

flipping them, into witnesses for the state."

Pierce called

Mix a "weak spot" prosecutors might try to

exploit because he no longer works for BP.

"He might not

have as much loyalty to the company," he said.

An attorney

for Mix, Joan McPhee, described the charges as

misguided and that she is confident Mix will be

exonerated.

"The

government says he intentionally deleted text

messages from his phone, but the content of

those messages still resides in thousands of

emails, text messages and other documents that

he saved," she said. "Indeed, the emails that

Kurt preserved include the very ones highlighted

by the government."

Federal

investigators have been looking into the causes

of the blowout and the actions of managers,

engineers and rig workers at BP and its

subcontractors Halliburton and Transocean in the

days and hours before the April 20, 2010,

explosion.

It is now

clear that prosecutors also are looking at the

aftermath of the blast, when BP scrambled for

weeks to plug the leak.

In outlining

the charges, the government suggested Mix knew

the rate of flow from the busted well was much

greater than the company publicly acknowledged.

Prosecutors

also said BP gave the public an optimistic

account of its May 2010 efforts to plug the well

via a technique called a "top kill," even though

the company's internal data and some of the text

messages showed the operation was likely to

fail.

An accurate

flow-rate estimate is necessary to determine how

much in penalties BP and its subcontractors

could face under the Clean Water Act. In court

papers, prosecutors appeared to suggest the

company was also worried about the effect of the

disaster on its stock price.

In a

statement, BP said it is cooperating with the

Justice Department.

"BP had clear

policies requiring preservation of evidence in

this case and has undertaken substantial and

ongoing efforts to preserve evidence," the

statement said.

The FBI said

in court papers that Mix repeatedly was notified

by BP that instant messages and text messages

needed to be preserved.

In public

statements, the company professed optimism that

the top kill would work, giving it a 60 to 70

percent chance of success.

On May 26,

the day the top kill began, Mix estimated in a

text to his supervisor that more than 15,000

barrels of oil per day were spilling — three

times BP's public estimate of 5,000 barrels and

an amount much greater than what BP said the top

kill could probably handle.

At the end of

the first day, Mix texted his supervisor: "Too

much flow rate — over 15,000 and too large an

orifice." Despite Mix's findings, BP continued

to make public statements that the top kill was

proceeding according to plan, prosecutors said.

On May 29, the top kill was halted and BP

announced its failure.

BP stock

closed at $41.91 Tuesday, a drop of just 4

cents. Analysts said investors evidently

recognized the charges involved just one,

low-ranking employee and saw no hint yet of any

kind of larger cover-up on BP's part.

The explosion

aboard the Deepwater Horizon drilling rig killed

11 workers. More than 200 million gallons of

crude oil leaked from the well off the Louisiana

coast before it was capped.

Under the

Clean Water Act, polluters can be fined $1,100

to $4,300 per barrel of spilled oil, with the

higher amount imposed if the government can show

the disaster was caused by gross negligence.

Tom Becker, a

fisherman in Biloxi, Miss., and head of the

Mississippi Charter Boat Captains Association,

said he wasn't surprised by the allegations.

"I don't

trust BP one bit. That's what I've thought all

along. It's like, 'What are they trying to hide

today?'" Becker said.

He said his

mistrust of BP had led him to hold out and not

settle legally with the company over damages. He

said his business has not recovered and he has

no fishing trips booked for July, August or

September, his busiest months. He blames that on

the lingering perception that the Gulf is ruined

and on high gas prices.

"I just wish

we could get over it quick, but I don't see it

happening, even though BP wants to pay everybody

off and get them to shut up," Becker said.

Alabama

Attorney General Luther Strange said he was

pleased "the Justice Department is focused on

holding those with criminal culpability

accountable."

10 September 2012 BP

BP to Sell Non-Strategic US Gulf Of Mexico

Assets to Plains Exploration and Production Company

Deal marks further progress in divestment

program; BP looks to long-term growth in Gulf of Mexico

BP today announced it has agreed to sell its

interests in a number of oil and gas fields in the deepwater US Gulf of Mexico

to Plains Exploration and Production Company

(‘Plains’ an independent oil and gas company) for a total of $5.55

billion, as part of a previously-announced plan to divest the assets and

position its Gulf portfolio for long-term growth.

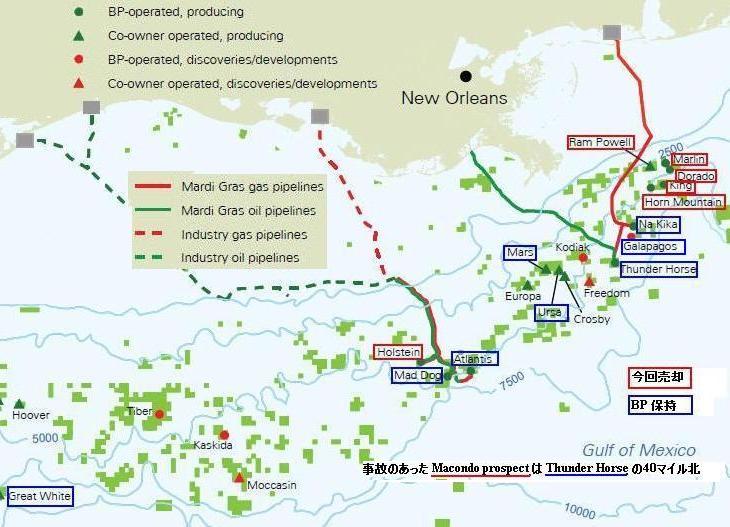

BP is selling its interests in three BP-operated assets: the Marlin hub,

comprised of the Marlin, Dorado and King fields (BP working interest 100 per

cent); Horn Mountain (BP, 100 per cent) and Holstein (BP, 50 per cent). The deal

also includes BP’s stake in two non-operated assets: Ram Powell (BP, 31 per

cent) and Diana Hoover (BP, 33.33 per cent). BP announced its intention to sell

these non-strategic assets in May 2012.

The divestment is in line with BP’s global

strategy of playing to its strengths, including the development of giant fields

and deepwater exploration. It also reflects a greater focus in the Gulf of

Mexico on producing more high-margin barrels from fewer, larger assets.

BP will concentrate future activity and investment in the Gulf on growth

opportunities around its four major operated production hubs and three

non-operated production hubs in the deepwater, as well as on significant

exploration and appraisal opportunities in the Paleogene and elsewhere.

"While these assets no longer fit our business strategy, the Gulf of Mexico

remains a key part of BP’s global exploration and production portfolio and we

intend to continue investing at least $4 billion there annually over the next

decade," said Bob Dudley, BP group chief executive.

"This sale, as with previous divestments, is consistent with our strategy of

playing to our strengths as a company and positioning us for long-term growth.

In the Gulf of Mexico that means focusing future investments on our strong set

of producing assets and promising exploration prospects."

Under the terms of the agreement, Plains will pay BP a total of $5.55 billion in

cash for the assets, subject to regulatory approvals, certain pre-emption rights

and customary post-closing adjustments. The parties anticipate the deal closing

by the end of 2012.

BP expects to divest assets with a total value of $38

billion between 2010 and 2013 as it focuses its business around the world

on its strengths and opportunities for growth. With today’s agreement, BP has

now entered into agreements to sell assets with a value of

over $32 billion since the beginning of 2010.

“This deal further demonstrates the value we have been able to unlock through

the targeted divestment of high-quality assets that sit outside the heart of our

strategy,” added Dudley.

On completion of the transaction, BP will continue to

operate four large production platforms in the region –

Thunder Horse, Atlantis, Mad Dog and Na Kika –

which produce from some of the largest deepwater oil and gas fields ever

discovered and each of which has a long production profile and future

development programme. BP will also continue to hold interests in three

non-operated hubs – Mars, Ursa and Great White.

BP currently anticipates investing on average at least $4 billion in the Gulf of

Mexico each year for the next decade. In June this year, production started from

the BP-operated Galapagos project – tied back to the Na Kika platform -- and a

further development of Na Kika is expected to come on stream in 2013. BP is also

progressing plans for a second phase of the Mad Dog field. BP now has six

drilling rigs operating in the Gulf of Mexico and expects to have eight rigs in

place by the end of the year, the most it has ever had in the region.

BP has been exploring in the deepwater Gulf for more than a quarter of a century

and is the leading acreage holder, holding more than 700 leases, with a strong

position in the emerging Paleogene play, including appraisal projects such as

Kaskida and Tiber. BP acquired 43 new leases in the deepwater Gulf in the June

2012 lease sale, which will be awarded subject to regulatory review.

Notes to editors:

The Marlin field came on stream in 1999, followed by Horn Mountain in 2002 and

Holstein in 2004.

BP directly employs more than 2,500 people in its Gulf of Mexico business and

supports tens of thousands of additional jobs in the region.

The company has been reshaping its business in the Gulf for a number of years,

selling its last shallow water continental shelf assets in 2006 and, most

recently, divesting the Pompano field in 2011.

September 28, 2012 BP

BP to sell Malaysian PTA interests to India’s Reliance

BP today announced that it has agreed to sell all its interests in purified

terephthalic acid (PTA) production in Malaysia to Reliance

Global Holdings Pte. Ltd. (Reliance). The agreement concerns BP’s 100 per

cent equity in BP Chemicals (Malaysia) Sdn Bhd (BPCM),

located at Kuantan on the east coast of Malaysia.

The Kuantan purified

terephthalic acid (PTA) plant is located in the State of Pahang on the east

coast of the Malaysia peninsula, 25 km from Kuantan.

It has an annual capacity of approximately 610,000 tonnes and employs over

170 full-time employees.

Reliance has agreed to purchase BP’s interest

in BPCM for $230 million in cash and both parties

anticipate completing the transaction in 2012.

James Yim, head of BP's aromatics business in Asia, said: “This is an efficient

plant with a good market position in the region. RECRON Malaysia, part of the

Reliance Group, is already our largest customer in Malaysia and Reliance

Industries is a significant feedstock supplier at Kuantan, so Reliance is a

natural owner of this plant.”

Nick Elmslie, chief executive of BP Petrochemicals said: “BP has a major, global

PTA business, with around one fifth of global PTA production capacity and a

track record of leading technology. We will continue to concentrate our PTA

strategy on deploying new technologies into high growth markets like China where

we are in the middle of a considerable expansion programme, and in OECD markets

where our technology gives us an advantage and high utilization rates.

“We are also building new revenue streams by licensing our PTA and paraxylene

technologies.”

All current staff of BPCM are expected to transfer to the new owners under

equivalent terms and conditions. BP’s acetic acid manufacturing and marketing

business in Malaysia is unaffected by this sale.

Notes to editors:

The $230 million in cash includes the net value of working capital and cash,

estimated at a Malaysian Ringgit to US Dollars exchange rate of 3.1. The final

value will be determined by prevailing Ringgit exchange rate before completion

of the sale.

Including this agreement, BP has agreed divestments of assets with a total value

of around $33 billion since the start of 2010. BP currently expects to increase

this total to $38 billion by the end of 2013.

BPCM’s PTA plant, commissioned in 1996, has nameplate production capacity of

610,000 tonnes per year (tpa).*

BP’s current net global PTA capacity is 7.5 million tonnes per year (mtpa) from

eight sites in the US (2), Belgium, China, Indonesia, Malaysia and Taiwan (2).

The largest is at Zhuhai, China where expansion of its current capacity of

1.5mtpa is expected to add a further 1.25mtpa by 2014, making it one of the

world’s largest PTA manufacturing sites.*

BP has been present in Malaysia since the 1960s and has over 850 staff in the

country, including BPCM.

BP has a 70 per cent interest in a 560,000tpa acetic acid plant in Kertih*; a

lubricants plant at Port Klang; and markets lubricants in Malaysia under both

the Castrol and BP brands.

The BP Petronas

Acetyls Sdn Bhd (BPPA) acetic acid plant in Kerteh is a joint venture

between BP (70%) and Petronas (30%), the national petroleum company of

Malaysia.

The plant has an annual production capacity of approximately 560,000 tonnes

of acetic acid.

2010/9/2 BP、マレーシアのエチレン、ポリエチレンJV持分をペトロナスに売却

BP is currently in the process of growing its

Asian Business Service Centre in Kuala Lumpur, which supports business and

functional operations both regionally and globally.

October 08 2012

BP Agrees to Sell Texas City Refinery to Marathon Petroleum Corporation for $2.5

Billion, Marking Second Major Milestone in Strategic Refocus of U.S. Downstream

Business

Refinery and portion of Southeast U.S.

retail and logistics network to be sold;

BP has now announced over $35 billion toward its goal of $38 billion

divestments

2012/9/14

BP、メキシコ湾の非戦略的石油資産を売却

BP announced today it has reached an

agreement to sell its Texas City, Texas refinery and a

portion of its retail and logistics network in the Southeast U.S. to Marathon

Petroleum Corporation for $2.5 billion (which includes $0.6bn of cash at

closing, an estimated value of $1.2bn for hydrocarbon inventories and a $0.7bn

six year earn-out arrangement based on future margins and refinery throughput).

“Today’s announcement is the second major milestone in the strategic refocusing

of our U.S. fuels business,” said Iain Conn, chief executive of BP’s global

refining and marketing business. “Together with the sale of our

Carson,

California refinery, announced in August, the divestment of Texas

City will allow us to focus BP’s U.S. fuels investments on our three northern

refineries, which are crude feedstock advantaged, and their associated marketing

businesses. Marathon Petroleum is a highly respected refiner and marketer. Their

ability to take on the responsibilities of this large and complex refinery will

be good for the long-term future of the business and its employees. Although

largely a merchant refinery, we have decided to also sell certain terminals and

marketing assets in the Southeast U.S.”

With today’s agreement the total value of the divestments that BP has agreed

since the beginning of 2010 is now over $35 billion. BP expects this total to

reach $38 billion by the end of 2013.

Subject to regulatory and other approvals, Marathon Petroleum will purchase the

475,000 barrel per day refinery, associated

natural gas liquids pipelines, and

four marketing terminals in the Southeast U.S. BP will also assign certain

branded jobber contracts supplying approximately 1,200 retail sites in

Tennessee, Mississippi, Alabama and Florida which could be supplied by the

refinery. BP will remain a significant retailer of fuels in the U.S., with

approximately 8,000 BP and ARCO-branded sites in the Midwest, Pacific Northwest

and along the East Coast. BP anticipates the transaction will close by early

2013.

“This sale will reduce BP’s presence in the Southeast U.S., however BP remains

firmly committed to growing and strengthening our BP-branded retail network and

the value of the BP brand east of the Rockies in partnership with BP-branded

jobbers and dealers,” said Doug Sparkman, president of BP’s East of Rockies

fuels business. “A number of valued jobbers are affected by this transaction and

we are committed to working very closely with Marathon Petroleum to make this

transition as smooth as possible.”

“During the past several years the Texas City Refinery has been transformed

through a resolute focus on safe, compliant, and reliable operations and in

recent months has returned to profitability. It does not, however, fit with the

long-term strategic direction of BP’s global refining portfolio,” said Texas

City Refinery manager Keith Casey. “I believe today’s announcement is good for

our workers, good for our community, and positions the refinery to achieve its

full potential over the long term as part of one of the leading

refiner-marketers in the U.S.”

BP continues to invest heavily in its three northern U.S. refineries. The

company is in the midst of a multi-billion dollar modernization effort at its

Whiting Refinery in Northwest Indiana. The BP Cherry Point Refinery in the state

of Washington is being upgraded to produce cleaner-burning diesel fuel and the

BP Husky joint venture near Toledo, Ohio is investing to improve its gasoline

making capabilities.

“BP remains committed to supplying U.S. customers with the fuels, lubricants and

petrochemicals they depend on while at the same time delivering long-term growth

and profits to our shareholders and we are pleased to be delivering on the

strategy we announced last year,” Conn added. “When we complete these sales and

our Whiting Refinery upgrade project next year, we will have a smaller,

well-positioned and highly competitive portfolio of refining and marketing

businesses in the U.S.”

About BP in the US:

BP has invested more in the United States over the last five years than any

other oil and gas company. With more than $52 billion in capital spending

between 2007 and 2011, BP invests more in the U.S. than in any other country.

The company is the second largest producer of oil and gas in the U.S., a major

oil refiner and a leader in alternative energy sources including wind power and

biofuels. BP provides enough energy each year to light the entire country. With

23,000 U.S. employees, BP supports nearly a quarter of a million domestic jobs

through its business activities. For more information, view our BP in America

animation video at: http://www.youtube.com/watch?v=I6n9cZ1xxQw or visit

www.bp.com.

Notes to editors:

BP announced plans to divest its Carson and Texas City refineries in February

2011 as part of a major strategic refocusing of the company’s global refining

portfolio.

The Texas City refinery became part of BP with the 1998 merger with Amoco. It is

a large, highly complex refinery with a nameplate 475,000 barrels per day of

refining capacity. The refinery employs some 2,150 BP staff and contractor

numbers can vary between 1,000 and 3,000 each day.

Three natural gas liquids pipelines connecting the Texas City Refinery with

local suppliers and customers and some out-of-service lines in the Gulf Coast

area are included in the transaction.

The adjacent South Houston Green Power cogeneration facility is an integral part

of the power infrastructure at the refinery and is included in the sale.

BP will continue to market in the Southeast US through more than 100 retained

jobbers and approximately 2,400 branded retail outlets. BP will continue to

supply retained BP-branded customers through its logistics network, including

the four divested product terminals in Nashville, Tennessee; Jacksonville,

Florida; and Selma and Charlotte, North Carolina.

BP’s Texas City Chemicals complex adjacent to the refinery is an independent

facility and has been a key part of BP’s global petrochemicals portfolio and is

not included in the sale. BP’s petrochemicals plant will continue to have

long-term commercial arrangements with the Texas City refinery.

Subject to applicable consents, BP will transfer 50,000 barrels per day of its

shipper history developed on the Colonial Pipeline.

BP is currently in the process of carrying out a number of major investments in

its other U.S. refineries, including a large investment program to transform its

413,000 barrels per day capacity Whiting, Indiana refinery; a clean-diesel

upgrading project at its 234,000 barrels per day Cherry Point, Washington

refinery; and the addition of a continuous catalytic reformer to the 160,000

barrels per day capacity Toledo, Ohio, refinery (a 50:50 joint venture with

partner Husky Energy Inc.).

BP currently operates large,

modern refineries in

Texas City, Texas;

Carson, Calif.;

Cherry Point, Wash.;

Whiting, Ind. and

Toledo, Ohio.

These five installations,

with total capacity for processing 1.5 million barrels of crude

oil every day, are part of a worldwide network of 17 BP

refineries.

They produce a wide range of fuels, petrochemicals and

lubricants for America’s highway and rail transportation;

industry; home, commercial and institutional heating; power

generation, and airlines.

Almost all of the BP refined products are marketed under the

brands of BP®, ARCO®, Amoco Ultimate® and Castrol®. Air BP is a

major supplier to airlines, with about 10 percent of the global

market.

A period of transition

Changing trends in global demand for gasoline caused BP to

reexamine its refining portfolio and led to the difficult

decision in early 2010 to divest the Texas City and Carson

refineries, together with Carson's associated integrated

marketing business in southern California, Arizona, and Nevada.

Subject to regulatory and other approvals, BP plans to complete

the sales by the end of 2012, thereby halving BP's US refining

capacity.

BP plans to focus its future downstream investment in the US on

further improving and upgrading its other, more advantaged

refining and marketing networks in the country - based around

the Whiting, Indiana and Cherry Point, Washington refineries and

its 50 percent interest in the Toledo, Ohio refinery.

These refineries have greater flexibility to refine a range of

crude oils including heavy grades, and on average are more

diesel-capable than BP's current portfolio. They are also

well-integrated with BP's marketing operations and benefit from

advantaged and focused logistics infrastructure.

"The US remains a very important market for BP's fuels,

lubricants and petrochemicals businesses,” says Iain Conn, BP

chief executive for refining and marketing. “The moves we are

making will give BP a smaller, but well-positioned and very

competitive portfolio of refining and marketing businesses."

BP's remaining US refineries

BP is currently in the process of carrying out a number of major

investments in its remaining US refineries. These include a

large investment program to transform the 405,000 bpd capacity

Whiting refinery, significantly increasing its capability to

process heavy Canadian crude.

In 2011, the 240,000 bpd Cherry Point refinery is undertaking a

$400 million investment to produce a full slate of ultra

low-sulfur diesel fuel and ultra low -benzene gasoline.

Finally, BP is constructing a new continuous catalytic reformer

to the 160,000 bpd capacity Toledo refinery, which is a joint

venture with Husky Energy, Inc. |

--------

August 13 2012

BP Agrees to Sell Carson Refinery and ARCO

Retail Network in US Southwest to Tesoro for $2.5 Billion

BP announced today it has reached agreement to sell its Carson, California

refinery and related logistics and marketing assets in the region

to Tesoro Corporation for $2.5 billion in cash (including the estimated value of

hydrocarbon inventories and subject to post-closing adjustments) as part of a

previously announced plan to reshape BP’s US fuels business.

"Today's announcement is a significant step in the strategic refocusing of our

US fuels business," said Iain Conn, chief executive of BP's global refining and

marketing business. "Together with the intended sale of Texas City, this will

allow us to focus BP's operations and investments exclusively on our three

northern US refineries, which are crude feedstock advantaged, and their large

and important marketing businesses."

Subject to regulatory and other approvals, Tesoro will acquire the

266,000

barrel per day refinery near Los Angeles as well as the associated logistics

network of pipelines and storage terminals and the ARCO-branded retail marketing

network in Southern California, Arizona and Nevada. The sale also includes BP's

interests in associated cogeneration and coke calcining 煆焼 operations. The closing

is expected to happen before mid-2013.

"As an established refiner and marketer, Tesoro provides a strong future for the

business and for its employees," said Conn.

BP will sell the ARCO retail brand rights and exclusively license those rights

from Tesoro for Northern California, Oregon and Washington and continue to

produce transportation fuels at its Cherry Point, Washington refinery. BP will

also retain ownership of the ampm convenience store brand and franchise it to

Tesoro for use in the Southwest.

In February 2011 BP announced plans to refocus its refining and marketing

business on its northern US refineries and find buyers for Carson and the Texas

City Refinery in Texas.

"We are pleased to be delivering on the plan we announced last year and when

complete we will have a smaller, but well-positioned and very competitive

portfolio of refining and marketing businesses in the US," Conn added. "BP

remains committed to supplying US customers with the fuels, lubricants and

petrochemicals they depend on while at the same time delivering long-term growth

and profits to our shareholders. We are investing heavily in the capabilities of

our businesses in line with that commitment."

BP is nearing completion of a multi-billion dollar upgrade at its Whiting

Refinery in Northwest Indiana. The largest private sector investment in Indiana

history, the project will transform Whiting's crude processing capabilities and

is expected to be completed in the second half of 2013. The company is also

upgrading the Cherry Point Refinery to produce cleaner burning diesel fuel and

investing in a cleaner gasoline project at its joint-venture refinery near

Toledo, Ohio.

Today's announcement brings the total value of the divestments that BP has

agreed since the beginning of 2010 to $26.5 billion. This is part of the

previously announced programme to divest $38 billion of assets by the end of

2013.

About BP in the US:

BP has invested more in the United States over the last five years than any

other oil and gas company. With more than $52 billion in capital spending

between 2007 and 2011, BP invests more in the US than in any other country. The

company is the second largest producer of oil and gas in the US, a major oil

refiner and a leader in alternative energy sources including wind power and

biofuels. BP provides enough energy each year to light the entire country. With

23,000 US employees, BP supports nearly a quarter of a million domestic jobs

through its business activities.

Notes to editors:

The price of the assets is $1,175 million, plus the value of inventory at the

time of closing. At current prices, the inventory is valued at approximately

$1,300 million.

The 266,000 barrel per day (bpd) Carson Refinery is one of the largest on the US

West Coast. It became part of BP through the 2000 acquisition of ARCO. It

employs over 1,100 staff and in total the divested business employs

approximately 1,700 staff.

The transaction includes the refinery and integrated terminals and pipelines, as

well as marketing agreements with about 800 retail sites in Southern California,

Arizona and Nevada.

The refinery is located on 650 acres in Los Angeles County, near the Long Beach

and Los Angeles Harbours. The refinery began operations in 1938. It processes

crude oil from Alaska’s North Slope, the Middle East, West Africa and other

sources. Processing equipment includes the largest fluid catalytic cracker in

California, two cokers and distillate hydrocracking.

BP's 51 per cent interest in a nominal 400 megawatt cogeneration facility

located at the refinery is included in the sale.

BP's Wilmington Coke Calciner located about five miles from the refinery is also

part of the sale. The plant occupies about 17 acres. The plant employs

approximately 40 people and produces 350,000 tonnes of calcined coke per year.

Logistics assets included in the sale include ownership of Berth 121 facility

improvements and equipment, Marine Terminals 2 and 3 and the LA basin pipelines

system that moves crude, products and intermediates to and from the refinery.

Terminals included in the sale are Carson Crude, East Hynes, West Hynes,

Hathaway, Carson Products, Colton, Vinvale and San Diego.

BP is currently in the process of carrying out a number of major investments in

its other US refineries, including a large investment programme to upgrade its

413,000 bpd capacity Whiting, Ind., refinery; a clean-diesel upgrading project

at its 234,000 bpd Cherry Point, Wash., refinery; and the addition of a

continuous catalytic reformer to the 160,000 bpd capacity Toledo, Ohio, refinery

(a 50:50 joint venture with partner Husky Energy Inc.).