Kent Wells Technical Update: Subsea Containment & Relief Wells - 28 June

![]() Technical briefing

presentation slides (pdf, 563KB)

Technical briefing

presentation slides (pdf, 563KB)

|

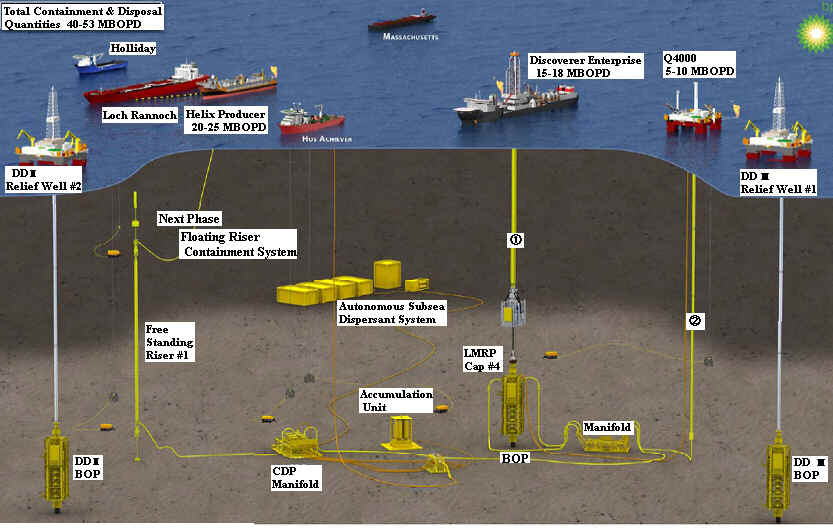

| * MBOPD=Thousand Barrels of Oil Per Day ①:原油は回収、ガスは燃焼 ②:原油、ガスともに燃焼 |

| BOP=Blowout Preventer LMRP Cap=Lower Marine Riser Package Cap |

Company agrees to pay BP

$75M to settle claims

A BP PLC contractor has agreed to pay the British oil giant $75 million to settle all potential claims

between the companies over last year's deadly rig explosion and

the massive oil spill it spawned in the Gulf of Mexico.

In exchange for the payment, BP has agreed to cover Weatherford U.S.

LP for

compensatory claims related to the disaster, including those over

environmental damage and economic losses. Civil and criminal

fines and penalties and claims for punitive damages aren't

covered by the indemnity agreement.

BP said in Monday's announcement that it will apply the money to

the $20 billion fund it created to compensate individuals and

businesses after the Deepwater Horizon rig exploded, killing 11

workers.

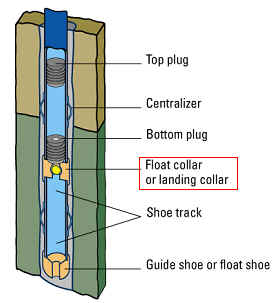

Weatherford, a Swiss-based oilfield service company, manufactured the

float collar used in BP's blown-out well. The device was designed to help

contain the cement at the bottom of the well.

Weatherford isn't the first company to settle out of court with

BP. MOEX Offshore 2007 LLC, one of BP's minority partners on the

project, agreed last month to pay BP $1 billion to settle all

claims between them.

"This settlement allows BP and Weatherford to put our legal

issues behind us and move forward together in strengthening

processes and procedures, safety and best practices in offshore

drilling," BP America Chairman and President Lamar McKay

said in a statement.

BP said the two companies agree with a presidential commission's

conclusion that the disaster "was the product of complex

causes involving multiple parties." Weatherford said the

companies have agreed to work with each other to improve the

safety of offshore drilling.

"We are extremely pleased to have reached an amicable

resolution with BP, a valued customer, that gives our

shareholders finality with respect to the vast majority of any

potential exposure Weatherford might have from last year's

incident in the Gulf," Weatherford president and CEO Bernard

J. Duroc-Danner said in a statement.

Weatherford said its insurance policies will cover the entire $75

million payment.

BP Well Partner Must Take Claims to Arbitration, Judge Rules

BP Plc can halt litigation with minority business partner Anadarko Petroleum Corp. so the companies can arbitrate liability over costs of the blown-out well in the Gulf of Mexico, a judge said.

Anadarko sued BP, asking a federal judge in New Orleans to declare it isn't responsible for damages and cleanup costs created by the worst offshore oil spill in U.S. history. The Woodlands, Texas-based Anadarko, which owned 25 percent of the well, said BP's conduct caused the blowout and the spill.

BP asked U.S. District Judge Carl Barbier to stall the lawsuit, contending that a partnership agreement required the companies to first attempt arbitration to resolve disputes. Barbier today sent the claim to arbitration.

"Anadarko has not met its burden to overcome the presumption in favor of arbitration," Barbier said in his ruling. "Accordingly, Anadarko's claim against BP must be stayed pursuant to the arbitration clause" in the joint operating agreement between the parties, he said.

John Christiansen, Anadarko's spokesman, didn't immediately Return a voice-mail message seeking comment. Tom Mueller, a BP spokesman, declined to immediately comment.

Racketeering Claims

Barbier also dismissed lawsuits against BP claiming the company defrauded government regulators about the safety of its drilling operations and its ability to respond to oil spills, including its response to the Macondo incident. The plaintiffs claimed that BP engaged in racketeering, causing them damages to property and lost earnings.

The judge also dismissed a racketeering charge against BP brought by residents and businesses affected by the spill who said BP had defrauded U.S. regulators about safety issues. The judge said that the plaintiffs did not prove they were harmed by the alleged racketeering.

Barbier said today the plaintiffs didn't show a link between their losses and any alleged fraud.

"Plaintiffs' failure to allege a direct relationship between BP's alleged defrauding of government regulators and their economic injuries is the fatal flaw in their" racketeering claims, the judge said.

The April 2010 Macondo well blowout and the explosion that followed killed 11 workers. The accident and spill led to hundreds of lawsuits against London-based BP and its partners and contractors.

BP is trying to get its partners to help pay billions of dollars of costs resulting from the explosion and spill. Anadarko has refused to pay its share of the bills, BP said in court papers.

Moex Settlement

BP also sought payment from a second minority partner, Moex Offshore 2007 LLC, which owned 10 percent of the well. Moex, a Mitsui & Co. unit, agreed May 20 to pay $1.07 billion to settle BP's claims.

Anadarko contends in its lawsuit filed in April that it had no fault in the explosion and spill. Investigations into the incident "raise serious questions" about its contractual obligations to reimburse BP for costs of responding to the well blowout, Anadarko said in an April 19 filing.

The company also is seeking damages from BP for the loss of oil in the exploration area, loss of investment and lost profits caused by the blowout and subsequent spill.

Anadarko's claims conflict with promises not to resort to court remedies, BP said in an April 27 filing. The three companies in the Macondo contract agreed to take such claims to arbitration, BP said.

Anadarko said BP's argument for arbitration was meritless and would hamper the minority partner's defense of lawsuits brought over the spill.

The case is part of In re Oil Spill by the Oil Rig Deepwater Horizon in the Gulf of Mexico on April 20, 2010, MDL- 2179, U.S. District Court, Eastern District of Louisiana (New Orleans).