ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@ü@āgābāvāyü[āW

May 25, 2011 China Briefing

The China-Angola Partnership: A Case Study of Chinaüfs Oil Relations in Africa

Following our other recent articles concerning Sino-African oil relations and the role of Chinese national oil companies (NOCs), this article in our China-Africa series takes a look at the case of Angola, Chinaüfs largest source of oil in Africa. Oil is at the crux of the Sino-Angolan relationship and a main driver of Chinaüfs expanding relations with south-central African country. Major aspects of relations between the two countries are Chinaüfs loans in exchange for oil as well as involvement in Angolan infrastructure.

Angolan economic recovery

and oil

After struggling for over a decade, Angola gained independence

from Portugal in 1975 and lapsed into a long civil war that

lasted for 27 years until 2002. Since the end of the war, Angola

has focused on postwar reconstruction and has made great strides

in the development of its economic, largely propelled by oil.

According to the Economist Intelligence Unit, Angola had an

average GDP growth rate of 10.5 percent between 2006 and 2010 and

although the countryüfs GDP was adversely affected by

the Global Financial Crisis, it appears to be on its way to

recovery.

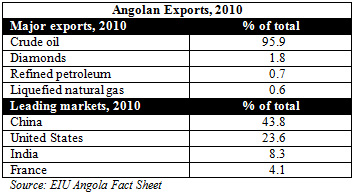

Angolaüfs main exports are oil, diamonds, coffee, timber, and other mineral resources. The country joined the Organization of Petroleum Exporting Countries in 2007 and since 2008 Angola has been the top oil producer in Africa. In 2009, oil comprised 85 percent of GDP, 95 percent of exports, and 85 percent of government revenue. The majority of its revenues come from oil and diamond exports, and the majority of oil production is concentrated in Cabinda Province.

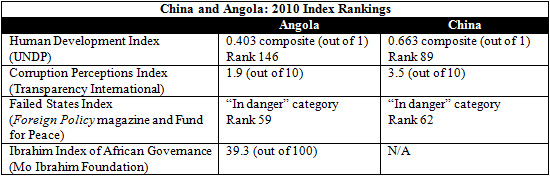

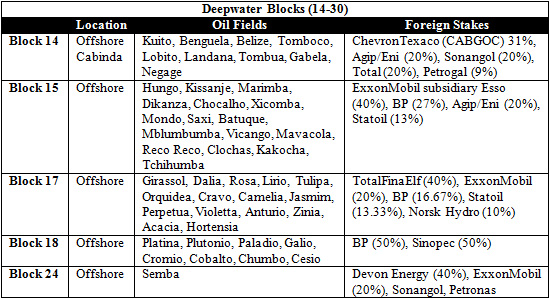

Angolaüfs state capacity remains limited, and organizations like the World Bank have recommended institutional reform of the oil and diamond sector. Poverty, corruption, lack of transparency, lack of infrastructure, and economic inequality issues continue to challenge governance and question whether economic growth can bring economic development benefits. With political power still centralized and the new constitution in 2010 further postponing elections, the process of Angolaüfs democratization remains in question. Below is a snapshot of Angolaüfs rankings in different development indices (with China for comparison).

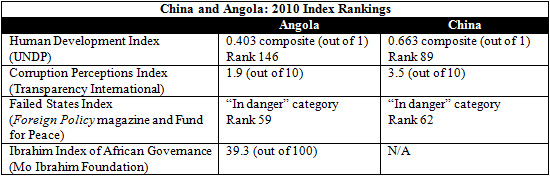

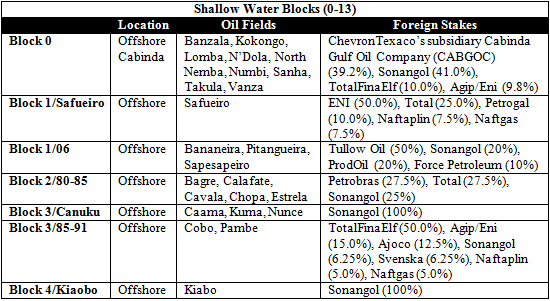

Angolan oil

Oil has become crucial for Angolaüfs government revenues and economic

growth. Created in 1976, Sonangol Group (Sociedade Nacional de

Combustiveis de Angola) is Angolaüfs powerful state-owned oil company

that oversees the production of oil. Sonangol mainly cooperates

with international oil companies through joint ventures and

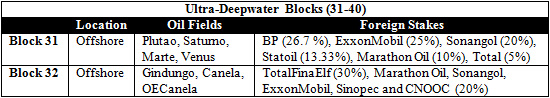

production sharing agreements. Africaüfs offshore oil is divided into 76

blocks, of which 35 are active. The following tables below show

the oil companiesüf stakes in some of the important

oil fields. Block 0 and Block 15 make up the

majority of Angolaüfs oil production.

China and Angolan oil

Chinese and Angolan economic and political ties expanded during

the late 1980s, with the signing of their first trade agreement

in 1984 and the establishment of the Joint Economic and Trade

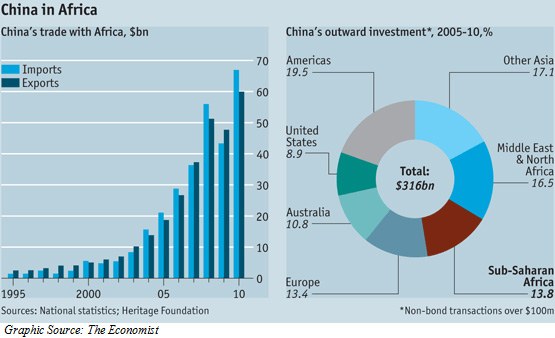

Commission in 1988. Since then, bilateral trade increased

steadily and jumped from 2005. In 2010, bilateral trade exceeded

US$120 billion and Angola is currently Chinaüfs largest African trade partner.

The single most significant commodity for the Sino-Angolan economic relationshipüfs expansion has been crude oil. According to the Economist Intelligence Unit, crude oil still composed over 95 percent of Angolaüfs exports, and China remained a significant player.

As the previous section shows, Western international oil companies (IOCs) still retain the biggest stakes and most operational rights in Angolan oil fields. Among the largest players are ChevronTexaco (U.S.), ExxonMobil (U.S.), TotalFinaElf (France), BP (UK), and Agip/Eni (Italy). Even so, Chinese NOCs have gained somewhat of a foothold in Angola. Chinaüfs oil deals with Angola are characterized by loans and credit lines in connection with infrastructure projects. There have been three major multibillion-dollar deals through China Eximbank:

In the Angolan oil blocks themselves, Chinese presence and activity includes:

Perspectives on China in

Angola

Chinaüfs presence in Angola presents a

fascinating case study of Chinaüfs oil relationships with African

nations, and there is a complex interplay of benefits and

challenges. In Angola, Chinaüfs presence remains modest relative

to that of the Western IOC giants. However, beyond the percentage

share of stakes, Chinaüfs loan-for-oil deals with Angola

represent its growing reach and point to many intangible

ramifications. Chinaüfs loans are an attractive

alternative to those from international institutions that can

have democratic-promoting strings attached. One common criticism

is that Chinaüfs economic policy is

resource-driven and goal-oriented; its means-to-an-end,

non-interference approach can thus challenge Western countriesüf

hopes for

democratic progress in Angola.

A fundamental question is whether moral responsibility is part of the equation, or whether oil deals are business transactions in essence ? one exchange for another. Another is what kind of balance is preferable between Angolaüfs economic growth and economic development objectives.

These perspectives can be useful for assessing the lens through which observers view Chinaüfs Angola policy. There is little doubt that an increase in Angolaüfs GDP output is necessary to increase its standard of living, but oil-rich countries ? Saudi Arabia and Oman, for example ? that experience ügwindfall gainsüh from oil may need more time to adjust.

Thomas L. Friedmanüfs ügFirst Law of Petropoliticsüh posits an inverse relationship between the price of crude oil and the pace of freedom. Yet China also provides Angola with much-needed infrastructure construction, at the opportunity cost of possible transparency and corruption improvements often required of International Monetary Fund assistance. Ian Taylor has remarked that Angolan elites are ügdeeply appreciative of Chinaüfs üenon-interferenceüf stance.üh Comparatively speaking, the low-interest, condition-free, and infrastructure-friendly Chinese loans remain attractive to the Angolan government.

From Angolaüfs side, analysts note that the Angolan government also wishes to diversify both its exports and its trade partners. A 2007 Chatham House paper ügAngola and China: A Pragmatic Partnershipüh found that the African officials interviewed wished to avoid overdependence on China as an economic partner. The Angolan government has also expressed this publically. For example, in 2008, Angolan President dos Santos remarked on the countryüfs economic relationships that ügglobalization naturally makes us see the need to diversify international relations and to accept the principle of competition, which has in a dynamic manner, replaced the petrified concept of zones of influence that used to characterize the world.üh The Peopleüfs Daily also reported that the Angolan Trade Minister Maria Idalina Valente said in January 2011 that Angolaüfs biggest challenge is diversification of its economy beyond oil.

The Sino-Angolan oil relationship will likely remain significant and sustained for the coming decades. Yet it is important to avoid overstating Chinaüfs presence in Angola and to conclude that an increase in Chinese NOC activity means ügcrowding outüh the IOCs in Angola. Principal-agent or neo-colonial conclusions of the bilateral relationship can overlook the two-way processes, as the Angolan government continues to bear in mind its relationship with China in context with its global economic partnerships and its long-term development. If the previous decade is any indication, China will continue to seek larger stakes in Angolaüfs oil sector, and both countries seem to favor the oil-for-infrastructure quid pro quo arrangement at present.

---------------

The Geopolitics of China-African Oil

Since the mid-1950s and 1980s, China has expanded its relations with Africa as part of its broader strategy of developing friendly relations with the ügThird World.üh In recent years, China has achieved deeper ties with many African countries, and the issue of Chinese energy security and geopolitics in Africa has received more attention. This article offers an overview of the Sino-African oil relationship to provide a foundation for future analyses.

Chinaüfs growing energy needs

Chinaüfs pursuit of energy resources has

generated great interest in the last decade, and energy concerns

are indeed a vital national security interest for China in order

to sustain both economic growth and economic development.

According to the International Energy Agency (IEA), as of July

2010, China surpassed the United States

as the worldüfs largest energy

consumer.

Analysts say that for China, energy security is crucial for its

economic health and directly relates to the legitimacy and

survival of the Communist Party. Chinaüfs push to secure energy resources

and raw materials is part of its energy security diversification

strategy, which is also evidenced in other regions such as the

Middle East, Latin America, and Central Asia.

Oil, or petroleum, is only one component of the energy resource picture, though an increasingly important one. China remains dependent on fossil fuels such as coal, oil, and natural gas. In 2008, Chinaüfs oil consumption made up just under 20 percent of Chinaüfs total energy use.

China is currently the second-largest consumer of oil in the world, and more than half of its crude oil is imported. By 2020, official sources estimate that China will import about 65 percent of its crude oil. China does produce oil domestically, though in 1993, China became a net importer of oil and has since increased its dependency on foreign imports. According to the EIA, China was the second largest net oil importer in the world in 2009; official statistics also record Chinaüfs oil imports at 204 million tons in 2009, and crude oil accounting for 52 percent of Chinaüfs oil consumption.

Chinaüfs presence in Africa to secure oil resources has been increasing. It is important, however, to contextualize these relationships, and not overestimate Chinaüfs oil demands. For example:

For China, the Middle East remains the most important source for oil. While Chinese oil imports from the Middle East are projected to increase in the future, China also seeks to reduce its dependence on Middle Eastern oil. While African countries are neither the top oil-producing nor the top oil-exporting countries in the world, there are opportunities for future expansion and production.

Key aspects of Sino-African oil relations

In discussing Sino-African relations, there is perhaps a tendency

to consider the African continent as one entity. While one can

make broader observations about Chinaüfs relations with Africa, there is

also much diversity and complexity in the many countries with

which China has oil relationships. Below are some of the

important points in contextualizing the China-Africa oil

relationship.

The Sino-African oil relationship can become complex due to other linked areas of concern. Oil, as part of Chinaüfs desire to acquire more natural resources, has brought criticism of Chinaüfs ügneo-colonialistüh presence in Africa, and questions whether Chinaüfs presence benefits governance and the African people. Some of the related areas of interest include:

Main African sources of

oil for China

The following chart provides information on the five African

countries that are Chinaüfs largest sources of oil in

Africa. With the exception of Sudan, Western oil companies are

the largest players. In these cases, oil relationships point to

comprehensive arrangements that involve trade and infrastructure

as well as oil extraction and export.

Other African sources of oil for China

This chart briefly outlines other countries in Africa that

provide sources of oil. In many of these countries, China has

focused on entry and exploration of potential oil resources,

again often seeking comprehensive development and economic

arrangements.

--------------

Chinaüfs Energy Strategy and the Role of Govüft Oil in Africa

In a follow up to last monthüfs article ügThe Geopolitics of China-African Oil,üh this article looks at the players in foreign policy on oil and, in particular, the role of Chinese national oil companies (NOCs), as well as potential opportunities for foreign businesses. Some of the main questions addressed are: Who are the main players in Chinaüfs African oil strategy? Are the NOCs really arms of the state? What opportunities exist for foreign companies in Africa?

Chinaüfs energy strategy

Chinaüfs diversification strategy is key

for energy security and seeks to be comprehensive and

maneuverable. In terms of oil, it is particularly significant in

the short- and medium-term. There appear to be a few main areas

of Chinaüfs energy strategy that take into

account short-term as well as long-term considerations:

In the short to medium-term, fossil fuels will continue to play a crucial role in Chinaüfs energy security. In addition to extraction, China also aims to secure a long-term presence in African states in order to gain continued access to these resources. Since fossil fuels are finite and polluting energy resources, the Chinese leadership is also concurrently developing greener renewable energy sources for its long-term strategy.

China energy security and

Africa

Given the importance of oil in Chinaüfs energy security, there has been

much discussion regarding oilüfs role in Chinese foreign policy.

Chinaüfs main energy strategy in Africa

emphasizes securing overseas contracts for exploration and

extraction. Historically, the development of the oil industry in

Africa required technologies and necessitated outside presence.

In particular, the upstream business ? exploration and production

? continues to see large foreign investors. For China, this means

generous investment infrastructure projects, for which oil-rich

African states give oil as payment. A few of the consequences and

perspectives are:

Oil continues to be a significant component of Sino-African foreign relations; in the context of energy insecurity, China has developed friendly relations with oil-supplying states, sometimes regardless of the internal ramifications in the country. China also appears to incorporate oil as part of the broader diplomatic and economic relationship. Sino-African trade has increased considerably over the past decade, and China sometimes links oil with infrastructure and other aid in ügpackage deals.üh It is important, though, that these observations be contextualized, since China has varying degrees of influence in different countries in Africa, and African NOCs and Western international oil companies still play enormous roles.

Main players in oil

Resource acquisition is the main push for Chinaüfs Africa strategy. The government

remains the most significant player that pushes to secure oil and

other resources. A number of commissions and ministries under the

State Council work in Chinaüfs oil strategy in Africa, as it is

inextricably linked to its economic growth and national security.

The National Development and Reform Commission (NDRC), formerly

called the State Development Planning Commission, focuses on

administration and formulation of plans for economic growth. It

coordinates strategies and manages Chinaüfs oil reserves as well as approves

overseas resource acquisition (e.g. The Global Times recently

reported that the NDRC approved 2 billion tons of iron ore

purchases by the Wuhan Iron & Steel Group in Madagascar.)

The Ministry of Commerce (MOFCOM) formulates trade policy and plays a role in approving investment, aid, and loan packages to Africa. A number of departments work together to coordinate Africa policy, including the Department of West Asia and African Affairs and the Department of Foreign Aid. The MOFCOM also coordinates with the Export-Import Bank on loans and projects in Africa, while the Ministry of Foreign Affairs focuses on diplomacy and works to expand Chinaüfs bilateral relationships with African countries.

Chinaüfs national oil companies are influential state-owned enterprises (SOEs) that dominate the oil industry in China, and among the largest oil companies in the world. The State-owned Assets Supervision and Administration Commission under the State Council manages these SOEs and appoint the leadership of the NOCs. The three main NOCs are China National Petroleum Corporation (CNPC), China Petroleum & Chemical Corporation (Sinopec), and China National Offshore Oil Corporation Ltd. (CNOOC). CNPC and Sinopec focus on a range of production and exploration (Sinopec more so on downstream), while the smaller CNOOC is more oriented toward overseas acquisition. Below is a comparison chart of Chinaüfs main NOCs.

National oil companies ?

Arms of the state or independent entities?

Chinaüfs three major oil companies are

state-owned and have state financial backing. The role of the

government vis-à-vis the NOCs has been subject to

much interest and debate. While there is government push for

energy resource acquisition, the NOCs also behave much like

private corporations and pursue their own objectives. The

interaction between the Party-State and the NOCs is an

interesting one, in which the players can exert influence and are

subject to mutual pressures.

The NOCs have a large degree of autonomy and do not always act at the behest of the state. Bates Gill and James Reilly wrote in their 2007 article ügThe Tenuous Hold of China Inc. in Africaüh that the State Council agencies such as MOFCOM and MOFA do not have much authority or overseas influence over the NOCs. A February 2011 report by the International Energy Agency also found that the NOCs have a great deal of independence. Far from being arms of the government, the NOCs are profit-driven in their commercial interests. Erica Downs of the Brookings Institution, who has written extensively on NOCs, also pointed out at a Center for Strategic and International Studies event in October 2010 that Chinaüfs NOCs are lobbyists who have a powerful political role and often gain a ügsympathetic earüh from the NDRC in pursuing their company interests.

Scholars have pointed out the tensions between the government and the NOCs, as well as between the NOCs themselves. The NOCs were created to obtain oil supplies for the country, but the state has encouraged commercial pursuit of interests. Chinaüfs NOCs also compete with each other to secure resources and increase influence at home. The IEA report noted that managers of the NOCs wear ügtwo hatsüh and must balance their state and corporate roles. Because the NOCs have relatively narrow interests, their actions can have unintended impacts for Chinese foreign policy. For example, the actions of the NOCs abroad ? for example, in Angola and Sudan ? can affect international perceptions of Chinaüfs role in Africa, and these issues also concern Chinaüfs political and diplomatic relationships with their African partners. Being self-interested and foreign investment-oriented entities, as well as an interest group with autonomy, the NOCs have potential to provide both benefits and challenges for the Chinese government.

Opportunities for foreign

businesses in Africa

Chinese NOCs may seek to establish ties with other firms,

including Western firms, in order to expand their global reach,

which can take the form of JVs. However, Chinese oil companies

still seek to increase competitiveness vis-à-vis international oil companies.

China likely sees more risk in bidding for Western firms as well,

a lesson gained from CNOOCüfs unsuccessful 2005 bid for the

U.S.-based oil company Unocal.

Even though the role of Chinese NOCs seems to be expanding in Africa, Western international oil companies are still the dominant foreign players in Africa, both in terms of asset holdings and production quantities. Some of the major plays are Royal Dutch Shell (UK/Netherlands), BP (UK), Eni (Italy), ChevronTexaco (U.S.), Exxon Mobil (U.S.), and Total (France). The exceptions are projects in Sudan and Nigeria, for example, where China has a larger stake. African NOCs enjoy significant power as well, and many African countries remain open to investment from Western companies.