トップページ

2010/12/3 Rio

Rio Tinto and Chinalco to

form joint venture for exploration in China

Rio Tinto and Chinalco

today signed a non binding Memorandum of Understanding (MoU) to

establish a landmark exploration joint venture (JV) in China.

The JV will explore mainland

China for world-class mineral deposits and is expected to come into

operation in the first half of next year. It is intended that

between three and five large area exploration projects will be

selected for initial focus by the JV, with the potential for

additional regions to be added at a later date.

Chinalco

will hold a 51 per cent interest in the JV and Rio Tinto will

hold a 49 per cent interest.

Rio Tinto chief executive

Tom Albanese said: "This exploration JV is the latest

chapter in the rich history of partnerships between Rio Tinto and

China. The combination of skills provided by Rio Tinto and

Chinalco offers great potential to unlock value for mutual

benefit."

Chinalco president Xiong

Weiping said: "Against the backdrop of the globalisation of

resources supporting the globalisation of the world economy, for

both sides to build on our respective strengths and establish an

exploration JV is a win-win measure that will deepen our

cooperation and meet the challenges of the market".

Mr Albanese and Mr Xiong

attended a special MoU signing ceremony at the Diaoyutai State

Guesthouse in Beijing. Rio Tinto's Executive Committee, senior

Chinalco executives and Chinese Government officials were also

present.

Chinalco's expertise and

deep understanding of the Chinese environment will complement Rio

Tinto's application of world-leading technologies and experience

in operating global mining projects.

Rio Tinto will appoint

the chief executive of the exploration JV, with the chairman of

the five-member Board nominated by Chinalco.

About Rio Tinto

Rio Tinto is a leading international mining group headquartered

in the UK, combining Rio Tinto plc, a London and NYSE listed

company, and Rio Tinto Limited, which is listed on the Australian

Securities Exchange.

Rio Tinto's business is

finding, mining, and processing mineral resources. Major products

are aluminium, copper, diamonds, energy (coal and uranium), gold,

industrial minerals (borax, titanium dioxide, salt, talc) and

iron ore. Activities span the world but are strongly represented

in Australia and North America with significant businesses in

South America, Asia, Europe and southern Africa.

---------------------

03

December 2010

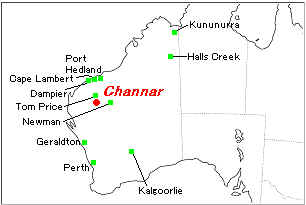

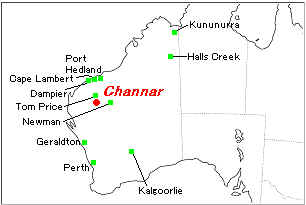

Rio Tinto and Sinosteel

announce extension of historic Channar Mining Joint Venture

Rio Tinto Limited and

Sinosteel Corporation 中国中鋼集団today announced the extension of

their Channar Mining joint venture (JV) in the Pilbara region of

Western Australia, leading the way for a further 50

million tonnes of iron ore to be produced under this ground-breaking joint

venture.

The extension of the

agreement was sealed at a special signing ceremony at the

Diaoyutai State Guesthouse in Beijing.

Senior executives

from Rio Tinto and Sinosteel, Chinese Government officials and

the Australian Ambassador to China attended the event.

The original Channar

agreements for the production of 200 million tonnes

were signed in 1987,

with strong Australian and Chinese Government support. This

marked an historic breakthrough as the first major Chinese

foreign investment in the Australian mining industry, with first

ore being produced in 1990.

Rio Tinto chief executive

Iron ore and Australia, Sam Walsh described the achievement as

the latest milestone in Rio Tinto's long history of close ties

with China, now its largest single market.

"Rio Tinto first

sent a shipment of iron ore from the Pilbara to China in 1973,

and the proven strength of a mutually rewarding partnership built

on those early days has stood the test of time, as now reflected

in this extension of the Channar agreement," Mr Walsh said.

Huang Tianwen, President

of Sinosteel Corporation, remarked that Sinosteel initiated the

industrial cooperation between China and Australia through the

Channar Mining Joint Venture, which, as one of the earliest and

largest investments made by Chinese companies in Australia, has

made major contributions to the marketing of Australian iron ore

in China and the prosperity of the local economy.

Mr Huang said:

"Channar iron ore enjoys a high reputation in the Chinese

market. The long-term friendly cooperation between Sinosteel and

Rio Tinto has become a model for Sino-Australian economic

interaction and the signing of the Channar Mining Joint Venture

Extension Agreement has significant meaning for the further

development of Sino-Australian economic relations."

The

Channar JV (Rio Tinto share 60 per cent, Sinosteel share 40 per

cent) owns

the Channar mine, 60 kilometres south of Tom Price, which is

managed by Rio Tinto. The agreement provides Sinosteel with 100

per cent take-off rights for Pilbara Blend product (into which Channar ore feeds).

Channar(チャナー)鉱山は西オーストラリア州のPilbara(ピルバラ)地域にある鉄鉱山。同州の都市Tom Price(トム・プライス)の南、Paraburdoo(パラバードー)鉄鉱山の近隣にある。

英国・オーストラリアの資源大手Rio Tinto(リオ・ティント)の完全子会社Hamersley Iron(ハマスレー)と、中国の鉄鋼大手である中国中鋼集団(Sinosteel)とのJV。

Channar鉄鉱山から生産される鉄鉱石は近隣のParaburdoo鉱山の処理施設へ運ばれる。年間鉄鉱石生産能力はChannar、Paraburdoo、Eastern Range鉄鉱山合わせて2000万トン。

Pilbara Blend products include contributions from mines at

Tom Price, Paraburdoo, Channar, Eastern Ranges, Marandoo,

West Angelas, Brockman2 and Nammuldi and Hope Downs 1.

At the current production

rate of 10 million tonnes a year, it is expected the 200

millionth tonne of the original joint venture will be produced in

the first quarter 2012.

Rio Tinto and Sinosteel

also signed a strategic cooperation framework agreement for

potential cooperation in, and joint development of, iron ore

opportunities within or immediately surrounding the Channar mine.

Sinosteel Australia

has 40% interests of the Channar Joint Venture which is

formed in 1987 between Hamersley Iron Pty Ltd and Sinosteel

Channar Pty Ltd, a wholly owned subsidiary of Sinosteel

Australia Pty Ltd.

Over the life of the

joint venture it will produce 200 million tonnes of high

grade iron ore. The joint venture project commenced

production on the 1st of January 1990 with approx. 3.5

million tonnes produced in its first year and quickly reached

its designed capacity of 10 million tonnes in 1998. By the

end of 2005 the total production had reached 131 million

tonnes in which all was being sold to the

Chinese market through Sinosteel Corporation.

At the time of the

Channar Joint Venture commencement it was the biggest

overseas investment between China and Australia and until

today remains one of the largest Chinese overseas investment

projects. The project received considerable attention and

strong support from both Australian and Chinese Governments

this included Chinese Government officials such as Hu

Yaobang, Li Peng, Zhu Rongji, Liu Qi and many other leaders

who visited Channar and gave their full support and

appreciation for the project, which will continue to be an

important cooperation between Australia and China at both

trade and government levels.

Channar is the first

overseas mineral resource project entered into by a Chinese

enterprise. Its commissioning provides a stable supply of

Iron Ore for the Chinese metallurgical industry which is

contributing to improving the development of this industry in

China. Due to China’s unprecedented economic

growth the West Australian iron ore industry is also enjoying

the tangible results. Due to the increasing industrialisation

in China and the need for developing global resources,

Sinosteel Australia Pty Ltd has been looking at many resource

projects since 2005 and have held discussions on various

potential projects involving both product off-take and equity

investment. Our main focus is on Iron ore, Manganese, Nickel,

Coking Coal and Mineral Sands and non-ferrous base metals.

The increasing interest in uranium has also resulted in

investigations in uranium projects during this period.

Sinosteel Australia Pty Ltd is seeking further opportunities

to invest in the mining & resources sector in Australia

and invites potential companies to contact us to develop,

market and trade Iron Ore, Chrome Ore, Manganese, Coking

Coal, Scrap Steel, Copper, Lead and Zinc into China. For all

enquires please contact Sinosteel Australia Pty Ltd, email:

sinosteel@sinosteel.com.au.

--------------

2010-12-03

Rio Tinto, Chow Tai Fook

Jointly Explore China Diamond Market

周大福

Rio Tinto will work with

Hong Kong retailer Chow Tai Fook Jewelry to explore China’s diamond market, reports the National Business

Daily. Chow Tai Fook general manager Huang Shaoji said the two

parties will focus on the extremely valuable pink diamond.

Rio Tinto, the world’s largest natural colored diamond

supplier, began supplying diamonds to Chow Tai Fook in 2001.

Publicly available data

shows that China is currently the second-largest diamond importer

in the world. According to Rio Tinto’s 2010 Interim Report, the company

earned $75 million from its diamond business, a marked

improvement over last year’s $6 million loss.

International diamond

demand grew at an annual rate of 10 percent over the last 15

years, while no new diamond mines were discovered, resulting in

3-5 percent annual growth in diamond retail prices. Existing

reserves of proven diamonds will be consumed in 25 years at

current annual output of 100 million carats.

Rio Tinto 2010 /12/1

Rio Tinto today confirmed

the important role China will play in the long term sales and

marketing strategy for its diamonds portfolio. Speaking at the

2010 China Diamond Conference in Shanghai, Jean-Marc Lieberherr,

general manager for the sales and marketing of all diamonds from

Rio Tinto's mines commented, “Diamonds have a small but

important position in Rio Tinto’s diverse portfolio and attract

much attention because of their growth potential. We see China

playing an important role in that growth.”

Rio Tinto recently

launched its strategic partnership with

leading retailer Chow Tai Fook to develop a fashion jewelry

category, separate to the existing bridal market in China. Chow Tai Fook's superior

expertise in the design, manufacture and retailing of diamond

jewellery in China, along with Rio Tinto's world class diamond

productions, makes for a natural alliance.

Lieberherr highlighted

the fact that China has entered a fast growth stage which will

change the face of the diamond jewelry market.

“The emerging

middle class demographic in China is an ideal entry point for

affordable diamond jewelry. Increasingly Chinese consumers will

be seeking to differentiate themselves through fashion and

fashion jewellery and this will be the driver of future growth in

retail diamond jewellery demand.”