OVL in a consortium

with SINOPEC has acquired Omimex de

Colombia

on 20th September, 2006. The acquired company has been

subsequently merged into Mansarovar Energy Colombia Limited

(MECL), a 50:50 Joint Venture between OVL and SINOPEC.

Earlier, Omimex de Colombia was a subsidiary of Omimex

Resources, Inc. which is a privately held company based in

Fort Worth, Texas, U.S.A.

Mansarovar

Energy Colombia Limited holds 100% interest in the Velásquez fee

mineral property

located in the Middle Magdalena Basin and also holds 100%

interest in the Velásquez-Galán Pipeline, which runs 189 km from the

Velásquez property to Ecopetrol’s Barrancabermeja refinery. In

addition, Mansarovar also holds a 50%

interest

in the nearby Nare and Cocorná

Association

Contracts, surface rights, drilling and other oil field

equipment for a self sustained operation. The other 50%

interest in Nare and Cocorná Association Contracts are held

by Ecopetrol, the National Oil Company of Colombia Mansarovar

is the operator of all the fields and the pipeline in

Colombia. Mansarovar currently produces approximately 21,500

bbl per day.

中国・インド国有会社による共同買収

?? 2006年9月に中国の国有石油化学企業Sinopecとインドの石油ガス公社ONGC(Oil and Natural Gas

Corporation Ltd)はOmimex de Colombia(デラウェア法人)を8億5000万ドルで買収した。Omimex de Colombiaは米国独立系石油会社Omimex Resources(本拠地:テキサス州)の子会社。

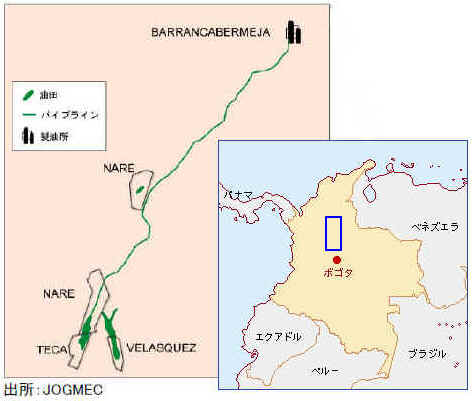

?? SinopecとONGCは、それぞれOmimex de Colombia50%の株式を取得し、合弁会社Mansarovar Energy Colombia Ltd(バミューダ法人)を通し、今後の事業を行う。24

?? この買収によって、SinopecとONGC が取得した資産は次のとおり。25

・ 確認埋蔵量約3億バレル、2万b/dの原油生産

・ カリブ海域(オンショア)CoralesにおけるTEA契約(Technical Evaluation.

Agreement)

・ Velasquezの100%権益と採掘権

(API比率21〜24度)

・ Nare、Teca鉱区の共同開発権

(API比率12〜13度)

(Ecopetrolが残り50%の権益を保有)

・ 上記権益取得鉱区からBarrancabermeja精油所までのVelasquez-Galanパイプライン(189km)

<表10参照>

インドのReliance Industries LimitedはANHと2006年6月にTEA (Technical Evaluation Agreement) 契約を結び、太平洋のTumaco海域157万ヘクタールの採掘権を獲得。現在すでに探鉱を行っている。

中国石油、シリアの油田権益を印企業と共同購入

中国石油天然気集団公司(CNPC)は21日、インド石油天然ガス公社(ONGC)とともに、ペトロカナダ(PC)社との油田権益獲得協定に調印したこと

を明らかにした。これにより、CNPCとONGCはぺトロカナダ社がシリアにもつ油田の権益を共同で獲得することになる。

PCの公式サイトによると、CNPCとONGCの提示額は4億8400万ユーロ(約5億7600万ドル)。

CNPCの関係者によると、CNPCとONGCはPCと英蘭ロイヤル・ダッチ・シェルが合弁設立したシリアの石油大手・アルフラット社の株式のうち、PCが出資する38%の株式を共同で買い取り、年間約300万トンの原油を生産する油田の権益を得ることになる。

(37%が正しい)

油田権益獲得は来年初めに完了する予定で、それまでにシリア政府の承認を受ける必要がある。CNPC関係者は「これはCNPCと

ONGCの海外石油・天然ガス市場における初めての共同入札。以前、ONGCはカナダの石油会社・ペトロカザフスタン(PK)の買収をめぐり、CNPCと激しい競争を展開したことがある」と述べた。

China National Petroleum Corporation (CNPC) and India's Oil and Natural Gas Corporation (ONGC), the two largest oil companies in the respective countries, announced on December 20 that they had jointly won a bid to acquire 37% of Petro-Canada's stake in Syrian oilfields for US$573 million. ONGC and CNPC, both state-owned, will have equal stakes in the al-Furat oil and gas fields.