2007/11/8 BHP Billiton

BHP Billiton notes the

recent speculation in relation to a potential offer for Rio Tinto

at a premium.

BHP Billiton now confirms

that it recently wrote to the Board of Rio Tinto outlining a

proposal in relation to a potential combination with Rio Tinto on

terms incorporating a premium, reflecting its confidence in the

benefits for both sets of shareholders of such a transaction. In

preparing its proposal, BHP Billiton has examined in detail the

regulatory issues and other practicalities of a combination.

In its letter, BHP

Billiton sought to pursue discussions with Rio Tinto regarding

its proposal. Rio Tinto rejected the proposal.

BHP Billiton has again

written to Rio Tinto and intends to continue to seek an

opportunity to meet and discuss its proposal with Rio Tinto.

There can be no assurance that any transaction or offer will

result from BHP Billiton's proposal.

November

8 2007 Rio Tinto

Rio Tinto rejects

approach from BHP Billiton

Rio Tinto notes the

recent announcement from BHP Billiton involving a proposed

acquisition of Rio Tinto. Under this proposal each Rio Tinto

share would be exchanged for three BHP Billiton shares.

The Boards of Rio Tinto

have given the proposal careful consideration and concluded that it significantly

undervalues Rio Tinto and its prospects. Accordingly, the Boards have

unanimously rejected the proposal as not being in the best

interests of shareholders.

Rio Tinto will continue

to focus on the implementation of its well articulated strategy,

including integrating Alcan operations.

November 9, 2007 Times

Rio

spurns BHP proposal to create $350bn mining giant

Rio Tinto has rejected an

offer from BHP Billiton to merge the two Anglo-Australian

companies and create an iron giant valued at some $350 billion (£166 billion).

A merger would create a

base metals colossus with powerful positions in coking coal, iron

ore, copper and aluminium. BHP's offer - three BHP shares for

every Rio share, which values the bid at more than $140

billion on

current prices - was rejected by Rio at a board meeting held

earlier this week to consider the proposal. Rio shares gained

956p, or 22 per cent, to £52.96 in response to news of BHP's

interest, while BHP fell 100p, or 5.6 per cent, to £16.56.

In rejecting the

proposal, Rio said it had given it careful consideration but

"concluded that it significantly undervalues Rio Tinto and

its prospects". One person with knowledge of the talks said

the offer was "a million miles away" from one that Rio

would contemplate. "What they have put forward is a skinny

premium . . . it's a long way away from the kind of value that

would be sensible."

BHP's offer coincides

with completion of Rio's $38 billion takeover of Alcan, the

Canadian aluminium group, where Rio outbid Alcoa, the American

aluminium producer.

A merger between Rio and

BHP could provoke a political storm and push the mining sector to

the fore-front of government concern about the

emergence of cartels in strategic commodities.

The price of iron ore and coal, key ingredients in the

production of steel, has soared over the past two years and a

combined BHP-Rio group would command more than a third of the

market in both iron ore and coking coal.

"There is going to

be a lot of noise from the Japanese and Chinese

steelmakers,"a leading mining analyst said yesterday.

Rio itself has been the

subject of takeover speculation. Once the leader in the mining

lists, Rio was overtaken in 2001 by the merger of Australia's BHP

and the Anglo-South African group Billiton.

Following that deal,

BHP's then chief executive, Brian Gilbertson, made an approach to

Rio. It was rebuffed and Mr Gilbertson's initiative caused a rift

in the BHP board that led to his departure.

Until its bid for Alcan,

Rio stood aside from the past year's frenzied dealmaking in the

mining sector. Analysts believed it was keeping its powder dry in

the expectation of a metal price downturn.

Instead, demand for iron

ore has continued to soar and a price leap of as much as 50 per

cent is expected in 2008. Queues of bulk carriers are creating

bottlenecks at terminals operated by BHP and Rio in Western

Australia. Pricing is negotiated annually by three producers,

BHP, Rio and CVRD, the Brazilian miner. BHP and Rio set prices in

Asia in benchmark deals with Japanese steelmakers while CVRD

negotiates with European steel mills.

Sources close to BHP

suggest the company would consider iron ore disposals to satisfy

competition concerns.

Nov 20, 2007 Reuters

Steel lobby to urge EU to ban Rio Tinto/BHP merger

Eurofer (European Confederation of Iron and Steel Industries),

the lobby group for the European steel industry, said on Tuesday

it will ask the European Commission to block BHP Billiton's plans

to buy rival Rio Tinto due to competition concerns.

"We will be urging the Commission to take a negative view on

it," Gordon Moffat, Eurofer Director General, told Reuters,

adding that contacts with the EU executive body would be made

this week.

A combined group would hold about 27 percent of the world market

for iron ore.

Moffat said that such a concentration fuelled worries among

European steel makers that a merged BHP Billiton and Rio Tinto

would have too much leverage on pricing, which could damage the

competitiveness of the industry and hurt consumers.

The International Iron and Steel Institute (IISI:ŹæŹ█ōSŹ|ŗ”ē’) took a similar view.

It said in a statement on Monday that CVRD, Rio Tinto and BHP

Billiton jointly accounted for more than 70 percent of seaborne

iron ore total world trade.

"Any further consolidation between the big three would

create a virtual monopoly in the business," IISI Secretary

General Ian Christmas said.

"This merger is not in the public interest and should not be

allowed to proceed," he added.

A number of steelmakers such as ArcelorMittal, the world's

largest steel producer, announced plans to increase their own

iron ore production to protect themselves against price increases

that could result from the concentration of the sector.

By contrast, other miners have supported the controversial deal.

Roger Agnelli, chief executive of CVRD said the merger of BHP

with Rio Tinto would be positive for the mining industry.

CVRD bought Canada's nickel producer Inco for nearly $18 billion

last year, which it says made it the world's second-biggest

integrated mining company.

Last week, Rio Tinto rejected BHP Billiton's takeover proposal,

which was worth $140 billion at the time, but on Monday BHP

mapped out its plan, promising to hand $30 billion to

shareholders via a share buyback if the deal goes through and

signalling it was ready for a long fight.

ō·¢{īoŹŽÉVĢĘü@2008/2/2

ÆåŹæāAāŗā~ü@āŖāIüEāeāBāōāgé╔ÅoÄæ

ü@12%üAĢ─āAāŗāRāAéŲŗżō»

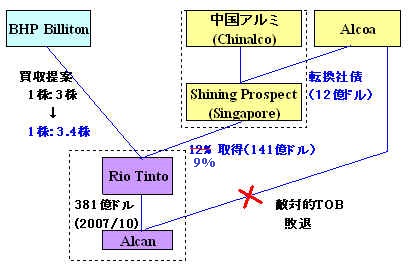

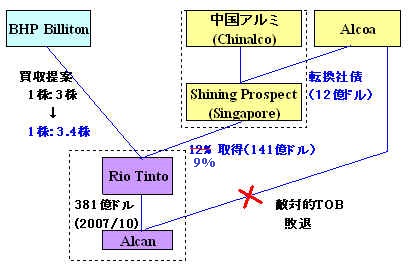

ü@ÆåŹæé╠ö±ōSŗÓæ«æÕÄĶüAÆåŹæāAāŗā~üiChinalcoüjéŲĢ─Źæé╠ō»ŗŲāAāŗāRāAé═éPō·üAēpŹŗÄæī╣æÕÄĶāŖāIüEāeāBāōāgé╠ŖöÄ«é╠éPéQ%éĵōŠéĄéĮéŲöŁĢ\éĄéĮüBĵōŠŖzé═¢±140ēŁāhāŗ(¢±éPÆøéTÉńēŁē~üjéŲé▌éńéĻüAÆåŹæīnŖķŗŲé╠ŖCŖOōŖÄæéŲéĄé─é═ē▀ŗÄŹ┼æÕŗēéŲé▌éńéĻéķüBāŖāIüEāeāBāōāgé╔é═üAēpŹŗBHPārāŖāgāōé¬öāĹéƱł─éĄé─éóéķüBŹĪē±é╠ÅoÄæé┼ŖCŖOé┼é╠Äæī╣īĀēvé╠ŖlōŠé╔ī³é»éĮÆåŹæÉ©é╠ÉŽŗ╔ÄpÉ©é¬Ģéé½ÆżéĶé╔é╚éķéŲéŲéÓé╔üAæĮéŁé╠Äæī╣éł¼éķāŖāIé╠öāĹŹćÉĒé╔öŁōWéĘéķē┬ö\ɽéÓéĀéķüB

ü@ÆåŹæāAāŗā~éŲāAāŗāRāAé═ŗżō»É║¢Šé┼üAī╗žé┼é═āŖāIé╠öāĹƱł─é═éĄé╚éóéŲéĄé┬é┬éÓüuöāĹƱł─ééĘéķīĀŚśéŖmĢ█éĄéĮüvéŲŗŁÆ▓üAŽŚłé═āŖāIæłÆDÉĒé╔ÄQē┴éĘéķē┬ö\ɽéÄ”Ź┤éĄéĮüB

ü@éĮéŠüAāŖāIöāĹé╔é═ŗÉŖzÄæŗÓé¬ĢKŚvé╚é▒éŲé®éńüAÄæī╣é╠ēŪÉĶē╗éÉ}éķBHPé╠āŖāIöāĹéæjÄ~éĘéķéĮé▀é╠ŖöīĵōŠéŲé╠ī®Ģ¹éÓéĀéķüB

ü@ÆåŹæāAāŗā~é═ō»ŹæŹ┼æÕÄĶé╠āAāŗā~āüü[āJü[é┼üAī┤Ś┐é╠ā{ü[āLāTāCāgŹ╠ī@é®éńÆnŗÓÉČÄYé▄é┼łĻŖčéĄé─ÄĶé¬é»éķüBāAāŗā~ÆnŗÓé╠ÉČÄYŚ╩é═ÉóŖEéTł╩üiéQéOéOéUöN)üB

ü@ŹĪē±üAāŖāIŖöéĵōŠéĄéĮé╠é═ÆåŹæāAāŗā~é╠Äqē’Äąé┼éĀéķāVāāāCājāōāOüE.āvāŹāXāyāNāg(āVāōāKā|ü[āŗ)üBāVāāāCājāōāOÄąé¬öŁŹséĘéķéPéQēŁāhāŗĢ¬é╠ō]ŖĘÄąŹ┬éāAāŗāRāA鬳°é½Ä¾é»é─é©éĶüAÆåŹæāAāŗā~éŲāAāŗāRāAé═Ä¢Ä└ÅŃüAŗżō»é┼āŖāIŖöéĵōŠéĘéķüB

ü@āAāŗāRāAé═ŹöNéTīÄüAāJāiā_é╠ō»ŗŲé┼éĀéķāAāŗāLāāāōé╔ōGæ╬ōIöāĹéÄdŖ|é»éĮé¬üAāAāŗāLāāāōé¬āŖāIé®éńé╠ŚFŹDōIöāĹƱł─éľé»ō³éĻéĮéĮé▀üAÆföOéĄéĮīoł▄é¬éĀéķüBāAāŗāLāāāōéÄĶé╔ō³éĻéĮāŖāIéāAāŗāRāAé¬öāĹéĘéĻé╬üAÉóŖEŹ┼æÕé╠āAāŗā~ŖķŗŲśAŹćé╠ī`ɼé╔é┬é╚é¬éķüB

ü@łĻĢ¹üAāŖāIé═āAāŗāLāāāōéÄPē║é╔Ĺé▀éĮÆ╝īŃé╔BHPārāŖāgāōé®éńöāĹƱł─éľé»éĮüBöāĹƱł─æŹŖz1500ēŁāhāŗé╔æ╬éĄüAāŖāIæżé═ÆßéĘé¼éķéŲéĄé─ŗæö█üBāŖāIé═ēpé╠M&AŖ─ō┬ŗ@ŖųéÆ╩éČé─üA2īÄ6ō·é▄é┼é╔ÉVƱł─éÅoéĘé®üAōPæ▐éĘéķéµéżé╔BHPé╔ŗüé▀é─éóéĮüBæ╝é╔éÓÆåŹæé╠Ģ¾Ź|ÅWÆcé╚éŪāŖāIöāĹéī¤ōóéĄé─éóéķéŲéĄé─ĵéĶé┤éĮé│éĻéķŖķŗŲé═æĮéóüB

ŹĪē±é╠ĵōŠē┐Ŗié═1Ŗö 6,000 penceü@üiÄ×ē┐é╔æ╬éĄé─

21% premiumüj

BHP Billiton é╠Ʊł─é═

4,431 pence æŖō¢üB

ÆåŹæüAÄæī╣ł└ÆĶÆ▓ÆBæ_éż

ü@ÆåŹæŹæŚLé╠ÆåŹæāAāŗā~é¬Ģ─āAāŗāRāAéŲægé±é┼ēpŹŗāŖāIüEāeāBāōāgāwÅoÄæéĘéķé▒éŲéīłé▀éĮöwīié╔é═üAÄ∙Śv鬢céńé▐āAāŗā~Äæī╣éł└ÆĶōIé╔Æ▓ÆBéĘéķæ_éóé¬éĀéķüBēpŹŗBHPārāŖāgāōé╔éµéķāŖāIé╠öāĹīÅ┬é╔éŁé│éčéæ┼é┐Ź×é▐é▒éŲé┼üABHPé╔éµéķÉóŖEé╠ōSŹzÉ╬ē┐Ŗié╠ÄxözéæjÄ~éĄéĮéóÆåŹæÉŁĢ{é╠łėī³éÓöĮēféĄé─éóéķüB

ü@ÆåŹæāAāŗā~é╠ŚģīÜÉņæŹŹ┘é═BHPé╠āŖāIöāĹé╔é┬éóé─üAüuÆåŹæé╔é®é╚éĶæÕé½é╚āCāōāpāNāgéŚ^é”éķüvéŲé»é±É¦éĄé─é½éĮüBÆåŹæé╠ÉŁŹ¶ŗÓŚZŗ@Ŗųé┼éĀéķŹæēŲŖJöŁŗŌŹsé¬ÆåŹæāAāŗā~é╠ÄæŗÓÆ▓ÆBéÄxēćéĘéķéŲéÓĢ±éČéńéĻé─é©éĶüAÆåŹæÉŁĢ{é═āŖāIāwé╠Äæ¢{ÄQē┴é╔æÕé½éŁŖųŚ^éĘéķī`é╔é╚éķüB

ü@ÆåŹæé╠éQéOéOéVöNé╠æeŹ|ÉČÄYé═éSēŁéXÉń¢£āgāōé┼éOéUöNöõ16%æØé”éĮüB

ü@BHPé╠āŖāIöāĹé╔éµéĶōSŹzÉ╬é╠ÆlÅŃé¬éĶé¬Éié▀é╬üAŹ|Ź▐é╠ē┐ŖiÅŃÅĖé╔é┬é╚é¬éĶüAÆåŹæé╠ÄYŗŲŖEé╔ł½ēeŗ┐éŗyé┌éĘüBÆåŹæāAāŗā~é╠ÅoÄæé╔é═üAé▒éżéĄéĮžŗĄéē±öéĄéµéżéŲéóéżÉŁŹ¶ōIé╚ÄvśféÓéĀéĶé╗éżéŠüB

ÆåŹæŖķŗŲé╠ÄÕé╚Äæī╣ŖķŗŲöāĹéŌīĀēvĵōŠ

| Äą¢╝ |

ōÓŚe |

| Ģ¾Ź|ÅWÆc(ōSŹ|) |

ŹŗātāHü[āeāXāLāģü[üEāüā^āŗāYüEāOāŗü[āvéŲŹŗōSŹzÉ╬ŹzÄRéŗżō»ŖJöŁ |

| ıŹ|ÅWÆc(ōSŹ|) |

ŹŗāIü[āXāgāēāēāWāAāōüEāŖā\ü[āVāYé╔30%ÅoÄæ |

| ÆåŹæŖjŹHŗŲÅWÆcüiī┤ÄqŚ═üj |

ājāWāFü[āŗé┼āEāēāōŹzŗµé╠ÆTŹĖüAŖJöŁīĀéĵōŠ |

| ÆåŹæŹæŹ█ÉMæ§ōŖÄæüiĢĪŹćŖķŗŲ) |

ŹŗāTāUāōüEāSü[āŗāhéųÅoÄæ |

2008/2/1 Alcoa

Alcoa Inc. Partners with Chinalco to Acquire a 12% Stake in Rio

Tinto

Alcoa Inc. announced today that it is partnering with Aluminum

Corporation of China (ügChinalcoüh) to acquire 12 percent of the UK

common stock of Rio Tinto plc. Alcoa will contribute up to $1.2

billion to the total investment.

Commenting on the investment, Alain Belda, Alcoa Chairman and

Chief Executive Officer, said, ügWe have long believed that Rio

Tinto has a world-class portfolio of assets and is very well

positioned to prosper in the current mining cycle. This

investment, made in partnership with Chinalco, allows us to

mutually benefit from developments in the sector. We have known

Chinalco for many years, dating back to our participation in the

successful launch of Chalcoüfs IPO, and are looking forward to

this new venture.üh

The investment will

be made through a Special Purpose Vehicle, called Shining

Prospect Pte. Ltd. (ügSPPLüh) created for this purpose. SPPL

is based in Singapore and wholly owned by Chinalco. Through its

investment, Alcoa will acquire an equity stake in SPPL

commensurate with its cash contribution to the investment.

About Alcoa

Alcoa is the world's leading producer and manager of primary

aluminum, fabricated aluminum and alumina facilities, through its

growing position in all major aspects of the industry. Alcoa

serves the aerospace, automotive, packaging, building and

construction, commercial transportation and industrial markets,

bringing design, engineering, production and other capabilities

of Alcoa's businesses to customers. In addition to aluminum

products and components including flat-rolled products, hard

alloy extrusions, and forgings, Alcoa also markets Alcoa®

wheels, fastening

systems, precision and investment castings, structures and

building systems. The Company has 107,000 employees in 44

countries and has been named one of the top most sustainable

corporations in the world at the World Economic Forum in Davos,

Switzerland. More information can be found at www.alcoa.com

2008/2/1 DOW JONES

NEWSWIRES

Chinalco, Alcoa Build A

12% Stake In Rio Tinto

Aluminum Corp. of China

Ltd., or Chinalco (ACH), and American aluminum giant Alcoa Inc.

(AA) Friday said they had purchased a 12% stake in miner Rio

Tinto PLC (RIO) for $14.1 billion, complicating BHP Billiton

Ltd.'s (BHP) effort to take over its smaller rival.

Analysts view the move by China's largest aluminum producer by

volume and its American partner as an effort to block the

proposed BHP Billiton bid or to break up Rio Tinto, though the

companies say that isn't the case.

Shining Prospect Pte. Ltd., a newly-created Chinalco subsidiary,

said in a statement that it acquired the stake but Chinalco and

Alcoa don't currently plan to make an offer for Rio Tinto.

However, it added: "Chinalco and Alcoa reserve the right to

announce an offer ... or participate in an offer ...for Rio Tinto

PLC."

Rio Tinto spokeswoman Christina Mills said the bid

"reinforces our position that BHP Billiton has undervalued

Rio Tinto."

Chinalco and Alcoa paid 6,000 pence a share for the stake, a 21%

premium to Rio Tinto's 4,956 pence closing price Thursday. BHP

Billiton's proposed bid would be valued at 4,431 pence a share at

Thursday's closing price.

Rio Tinto Nov. 8 rejected a proposed three-shares-for-one bid

from BHP Billiton as too cheap, and BHP Billiton now faces a Feb.

6 deadline, set by the U.K. Takeover Panel, to formalize or walk

away from the offer.

BHP Billiton spokesman Illtud Harri said the company had seen the

announcement but was making no further comment.

Chinese producers are concerned a BHP Billiton-Rio Tinto tie-up

would concentrate natural resources like iron ore in the hands of

dominant suppliers.

Analysts say the 12% stake would be enough to at least influence

if not block BHP Billiton's bid.

"We're not looking for Chinalco or Alcoa to launch its own

bid for Rio Tinto. We think they are looking to protect a

potential squeeze on supplies of alumina or bauxite to the

smelting community which might arise from a combination of Rio

and BHP," said Fairfax IS analyst John Meyer.

Bernstein Research in a note said the 12% stake may mean that BHP

Billiton's proposed bid would fall short of the compulsory

acquisition requirement of more than 90%. "And if it

continues with its bid, it may be left with a permanent minority

partner or an expensive buyout."

Liberum Capital analyst Michael Rawlinson said it is likely

Chinalco, Alcoa and the Chinese government are aiming for an

ultimate break-up bid of Rio Tinto.

"While BHPB has looked to consolidate by creating a super

major, the Chinese government is leading an effort to fragment

the industry," he said in a note.

Chinalco President Xiao Yaqing said this investment underlines

Chinalco's determination to increase and diversify its exposure

to the sector and to be well positioned within this changing

industry landscape.

It is the largest-ever cross-border deal involving a Chinese

company, said a person with knowledge of the transaction.

Alain Belda, chairman and CEO of Alcoa, said: "We have long

believed that Rio Tinto has a world-class portfolio of assets and

is very well positioned to prosper in the current mining cycle.

This investment, made in partnership with Chinalco, allows us to

mutually benefit from developments in the sector."

Chinalco and Alcoa didn't disclose the size of each company's

share in the newly acquired 12% stake. In a statement, they said

Alcoa had committed $1.2 billion to Shining Prospect.

Rio Tinto shares opened 15% higher following the announcement,

and at 1054 GMT, traded up 14%, or 697 pence higher, at 5,653

pence, outperforming a broadly stronger mining sector. The FTSE

350 mining index was up 7.4%.

BHP Billiton shares were up 11.2%, or 164 pence higher, at 1641

pence at 1054 GMT.

February 6, 2008

BHP BILLITON OFFER FOR RIO TINTO

BHP Billiton Announces Offer of 3.4 BHP Billiton Shares per Rio

Tinto Share to Create the Worldüfs Premier Diversified Resources

Company

The Board of BHP Billiton

today announced an offer for all of the shares in Rio Tinto

Limited and Rio Tinto plc. The combination of BHP Billiton and

Rio Tinto will create the worldüfs premier diversified natural

resources company with a unique opportunity to unlock value for

shareholders:

üE Unparalleled

exposure to the same key mineral basins will create significant

value by optimising production efficiencies and delivering

greater volumes on an accelerated basis to meet growing demand;

üE Creation

of substantial value through quantified synergies and benefits

which are expected to contribute a total incremental EBITDA of

US$3.7 billion nominal per annum within seven years of completion

of the Acquisition;

üE Efficient

development of the next generation of large-scale projects in new

regions for the benefit of its customers, the communities in

which it operates, and its shareholders; and

üE A

world-class management and operational team with strength and

depth across all levels of the organisation with a commitment to

the pursuit of excellence and the highest standards in safety and

sustainability and a focus on global best practice in community

and the environment.

This value will only be unlocked if the Offers are successful.

BHP Billitonüfs offer will deliver to Rio Tinto

shareholders:

üE

3.4

BHP Billiton shares for each Rio Tinto share;

üE Approximately

44 per cent of the Enlarged Group compared with approximately 36

per cent based on the market capitalisations of the companies

prior to the approach by BHP Billiton to Rio Tinto on 1 November

2007; and

üE A

45 per cent premium to the Rio Tinto share price prior to the

approach.

The Offers contain a minimum acceptance condition requiring

acceptances relating to more than 50 per cent of the

publicly-held shares in each of Rio Tinto Limited and Rio Tinto

plc. BHP Billiton also proposes a buy-back of up to US$30 billion

within one year of completing the Acquisition if its 3.4 for one

offer is successful.

BHP Billiton firmly believes that the combination creates value

for existing BHP Billiton shareholders who will own approximately

56 per cent of the Enlarged Group. Further, cash flow and

earnings per share will be accretive from the first full fiscal

year following completion (after adjusting for the proposed share

buyback and excluding depreciation on the write-up of Rio Tintoüfs assets).

2008/2/6

Rio Tinto

Rio Tinto rejects BHP

Billiton's pre-conditional offer

The Boards of Rio Tinto

have given careful consideration to BHP Billiton's

pre-conditional offers to acquire the whole of the issued share

capital of Rio Tinto plc and Rio Tinto Limited. Under this

proposal each Rio Tinto share would be exchanged for 3.4 BHP

Billiton shares.

The Boards have concluded

that the pre-conditional offers significantly undervalue Rio

Tinto. Accordingly the Boards have unanimously rejected BHP

Billiton's pre-conditional offers as not being in the best

interests of shareholders.

Rio Tinto's Chairman,

Paul Skinner said: "BHP Billiton's offers, while improved,

still fail to recognise the underlying value of Rio Tinto's

quality assets and prospects. Our plans are unchanged, and will

remain so unless a proposal is made that fully reflects the value

of Rio Tinto. Accordingly we are forging ahead with our strategy

of operating and developing large scale, long life, low cost

assets to generate significant value for shareholders".

Rio Tinto's chief

executive officer Tom Albanese said: "Rio Tinto has an

exceptional portfolio of assets and significant stand alone

growth opportunities, particularly in iron ore, copper and

aluminium. These assets and opportunities, combined with the

company's strong track record for value delivery, project

execution and successful exploration means Rio Tinto is very well

positioned to take advantage of strong global markets and the

growth in the resources industry, maximising value for

shareholders."

2008/2/6

BHP BILLITON OFFER FOR RIO TINTO

BHP Billiton Announces Offer of 3.4 BHP Billiton

Shares per Rio Tinto Share to Create the Worldüfs Premier Diversified Resources

Company

The Board of BHP Billiton today announced an offer for all of the

shares in Rio Tinto Limited and Rio Tinto plc. The combination of

BHP Billiton and Rio Tinto will create the worldüfs premier diversified natural

resources company with a unique opportunity to unlock value for

shareholders:

üE Unparalleled

exposure to the same key mineral basins will create significant

value by optimising production efficiencies and delivering

greater volumes on an accelerated basis to meet growing demand;

üE Creation

of substantial value through quantified synergies and benefits

which are expected to contribute a total incremental EBITDA of

US$3.7 billion nominal per annum within seven years of completion

of the Acquisition;

üE Efficient

development of the next generation of large-scale projects in new

regions for the benefit of its customers, the communities in

which it operates, and its shareholders; and

üE A

world-class management and operational team with strength and

depth across all levels of the organisation with a commitment to

the pursuit of excellence and the highest standards in safety and

sustainability and a focus on global best practice in community

and the environment.

This value will only be unlocked if the Offers are successful.

BHP Billitonüfs offer will deliver to Rio Tinto

shareholders:

üE 3.4

BHP Billiton shares for each Rio Tinto share;

üE Approximately

44 per cent of the Enlarged Group compared with approximately 36

per cent based on the market capitalisations of the companies

prior to the approach by BHP Billiton to Rio Tinto on 1 November

2007; and

üE A

45 per cent premium to the Rio Tinto share price prior to the

approach.

The Offers contain a minimum acceptance condition requiring

acceptances relating to more than 50 per cent of the

publicly-held shares in each of Rio Tinto Limited and Rio Tinto

plc. BHP Billiton also proposes a buy-back of up to US$30 billion

within one year of completing the Acquisition if its 3.4 for one

offer is successful.

BHP Billiton firmly believes that the combination creates value

for existing BHP Billiton shareholders who will own approximately

56 per cent of the Enlarged Group. Further, cash flow and

earnings per share will be accretive from the first full fiscal

year following completion (after adjusting for the proposed share

buyback and excluding depreciation on the write-up of Rio Tintoüfs assets).

2008/5/30ü@ü@ü@ http://www.telegraph.co.uk/money/main.jhtml?xml=/money/2008/05/31/cnbhp131.xml

BHP's Rio Tinto

submission finds opposition

BHP

Billiton finally made its long awaited submission to the European

Commission yesterday and immediately faced opposition from steel

producers seeking to block its plans to buy rival Rio Tinto.

The submission of documents seeking clearance from regulators

sets the clock ticking on BHP's audacious takeover approach. The

Commission typically takes around 20 working days to decide

whether to give the go-ahead or move into a "Phase Two"

process which would see the deal scrutinised in more detail.

The Commission set a deadline for

consideration of July 4. By that date the Commission must

either approve the deal, open an in-depth investigation, of

permit a short extension.

Few in the

industry expect BHP to be granted early clearance, and the

company itself expects to the process to move into the next

stage, which could take until the end of the year to complete.

Privately, BHP insists there are no regulatory hurdles that

cannot be overcome, but steel makers wasted no time in urging the

Commission to block the takeover, given the position the combined

BHP / Rio would have in the iron ore market.

More on mining

Gordon

Moffat, director general of European steel makers association

Eurofer, said: "We can not believe that the Commission will

authorise the merger of two of three mining companies which

dominate almost 75pc of the world market for seaborne iron ore.

"Such

market dominance increases disproportionately the pricing power

of companies concerned in iron ore and coking coal on top of the

huge price increases seen over the last years.

"This

is not in the interest of the European steel industry which has

already had to pass on huge increases in raw material

costs."

Between

them Rio Tinto and BHP Billiton have a market share of almost

40pc of the seaborne iron ore market at a time when iron ore

prices have already increased by more than 65pc this year.

2008/7/3 Thomson

Financial

BHP Billiton says US DoJ

cleared proposed acquisition of Rio Tinto

BHP Billiton said the

U.S. Department of Justice has cleared its proposed acquisition

of Rio Tinto, meaning the world's biggest diversified resources

company has in effect received U.S. approval.

'The early termination by

the DoJ represents an important milestone in the progress of our

merger clearances which are pre-conditions of our offer for Rio

Tinto,' said Illtud Harri, a spokesman for BHP Billiton.

The acquisition still

needs regulatory approval from the European Union, Australia,

South Africa and Canada. The E.U. is due to announce its decision

on the proposed takeover on Friday and is expected to move

towards a more detailed Phase 2 investigation with a final

decision not anticipated until the end of 2008 or early 2009.

Iron ore is expected to

be the main focus for regulators, and steelmakers - the biggest

users of the raw material - have expressed concerns over the

planned combination.

BHP Billiton made a

3.4-for-1 hostile share offer for the world's third-largest miner

in a deal worth an estimated $170 billion.

BHP Billiton said the DoJ

and the U.S. Federal Trade Commission have granted early

termination of the Hart-Scott-Rodino waiting period for the

proposed acquisition and that the DoJ has concluded its review

without further action. The decision allows U.S. regulators to

revisit the case if new information becomes available.

'We are very pleased that

we have received notice of early termination of the

Hart-Scott-Rodino Act waiting period and completion of the

Department of Justice merger review,' BHP Billiton chief

commercial officer Alberto Calderon said.

July 3 2008 BHP

Billiton

BHP Billiton

Announces Early Termination Of HSR Waiting Period For Its

Proposed Acquisition Of Rio Tinto

BHP Billiton today

announced that the U.S. Department of Justice (DoJ) and the

Federal Trade Commission (FTC) have granted early termination

of the Hart-Scott-Rodino (HSR) waiting period for BHP

Billiton's proposed acquisition of Rio Tinto and the

Antitrust Division of the DoJ has concluded its review

without further action.

Äi¢@Å╚éŲĢ─ŹæśA¢Mĵł°łŽł§ē’é¬1976 Hart-Scott-Rodino¢@üiĢ─ōŲÉĶŗųÄ~ŗŁē╗üjé╔éÓéŲé├éŁæęŗ@Ŗ·Ŗįé╠æüŖ·ÅIŚ╣éÅ│öF

Ģ─ŹæŖķŗŲéöāĹéĘéķÅĻŹćüAāNāīāCāgāō¢@æµéVaÅéŹ\ɼéĘéķHart-Scott-Rodino

Antitrust Improvement Act of 1976é╔ŖŅé├éŁō═Åoé¬ĢKŚvé╔é╚éķüB

ō»¢@é╔éµéķéŲüAŖķŗŲöāĹéŌāWāćāCāōāgāxāōā`āāü[é╠éżé┐łĻÆĶé╠ŚvīÅé╔ŖYō¢éĘéķéÓé╠é╔é┬éóé─é═Ä¢æOé╠Æ╩ÆméƱÅoéĘéķĢKŚvé¬éĀéķüBÆ╩Æmé╠ƱÅoé╠īŃüAæęŗ@Ŗ·Ŗįé╠ÉiŹsé¬ŖJÄnéĄüAĢ─ŹæÄi¢@Å╚ŗyéčśA¢Mĵł°łŽł§ē’é═üAć@Æ▓ŹĖŖłō«éŖJÄnéĄé╚éóüAćAī└ÆĶÆ▓ŹĖéŖJÄnéĘéķüAé╚éóéĄé═ćBÆ▓ŹĖŖłō«éŖJÄnéĘéķü\ü\é╠éóéĖéĻé®é╠æ╬ē×éæIæéĘéķé▒éŲé╔é╚éķüBæęŗ@Ŗ·ŖįÆåüAō¢Ä¢Äęé═üAÆ▓ŹĖŖłō«ōÖéŹsé┴é─éóéķÉŁĢ{ŗ@Ŗųé╠ŗ¢ē┬éōŠé╚é»éĻé╬üAĵł°éŖ«É¼é│é╣éķé▒éŲé¬é┼é½é╚éóüB

"We are very

pleased that we have received notice of early termination of

the Hart-Scott-Rodino Act waiting period and completion of

the Department of Justice merger review," BHP Billiton's

Chief Commercial Officer, Alberto Calderon said.

Termination of the

applicable HSR waiting period satisfies part of the US merger

control pre-condition to BHP Billiton's proposed offer for

Rio Tinto. The offer remains subject to the pre-conditions as

disclosed in Appendix I of the announcement on 6 February

2008, including that portion of the US merger control

pre-condition referring to certain actions that may be

brought by the DoJ or FTC.

ü@

Jul 3, 2008 Reuters

Japan antitrust watchdog

can only bark at BHP

Miner BHP Billiton is

expected to request Japanese approval shortly for its $170

billion bid for rival Rio Tinto, but while Japan can bark, it has

little power to bite on the deal, despite being home to some

grumpy big iron ore customers.

Outdated Japanese competition law will deter Japan's Fair Trade

Commission from taking harsh action against BHP's unsolicited bid

for Rio, lawyers say, despite strong opposition among Japanese

steelmakers.

The steelmakers oppose a deal that would give one company control

of a third of traded iron ore at a time of soaring prices but, with almost no Rio

or BHP assets in Japan, the country has little power to enforce

any regulatory block.

Japan's watchdog is instead seen working with its European Union

counterpart in hopes of influencing that investigation.

"If the EU body demands BHP divestments of some key assets,

Japan will do the same. If the EU moves into a second-stage

investigation, Japan will follow," said Fumio Koma, a

partner at law office Baker and McKenzie Tokyo.

"It would be much wiser if they could exert some influence

on the EU on disposals of certain assets, to better reflect

Japanese interests, rather than act on their own," he said.

Japan is home to two big steelmakers, world No.2 Nippon Steel

Corp and No.3 JFE Holdings Inc. Together they account for 6

percent of global steel output.

Japanese steelmakers have joined the chorus of global peers in

opposing the deal, worried that a combined group would have undue

pricing power over iron ore, contract prices of which nearly

doubled this year.

Analysts say battle lines are being drawn in Western Australia's

Pilbara region, the world's biggest source of high-grade ore,

where BHP is likely to be forced to give up key assets. Japan

imports 60 percent of its iron ore from Australia.

Rio has rebuffed BHP's

offer of 3.4-shares-for-one as too cheap, saying it fails to take

into account its growth prospects.

BHP said U.S. anti-trust authorities have cleared its bid but

sources familiar with the case say Europe is expected to announce

an in-depth investigation on Friday.

STRIKINGLY ODD

Japan's fractured parliament failed this month to amend the

anti-monopoly law, which would have required companies seeking a

merger to submit their plan earlier, before buying shares in a

target company.

Foreign companies do not have to seek Japanese regulatory

clearance unless they have Japanese offices with big assets.

"Japanese law is strikingly odd among the nations feeling

the impact of the possible merger of the world's two biggest

miners," said Akinori Uesugi, senior consultant at law

office Freshfields Bruckhaus Deringer.

Freshfields Bruckhaus

Deringeré═üA1743öNé╔ēpŹæé┼ænÉ▌é│éĻüAēpŹæé╠ÆåēøŗŌŹsé┼éĀéķāCāōāOāēāōāhŗŌŹsé╠ī┌¢ŌÄ¢¢▒ÅŖé¢▒é▀éķé╚éŪüAÉóŖEé┼Ź┼éÓī├éóŚÄjéŲō`ōØéÄØé┬¢@ŚźÄ¢¢▒ÅŖéŲéĄé─öŁōWéĄé─é½éĮüB

ÅŃÉÖÅHæźī│Ä¢¢▒æŹÆĘü@2006öN7īÄō³ÅŖüAōīŗ×āIātāBāXé╠āVājāA

āRāōāTāŗā^āōāgüBüB

"This is a typical

case that there are affected parties here and the Japanese

authorities have no means to control," said Uesugi, formerly

the secretary-general of Japan's Fair Trade Commission.

BHP, which has filed for regulatory approval in Europe, the

United States, Australia and Canada for its planned takeover, has

said it would file an application with Japanese regulators on a

voluntary basis. It has made similar applications in China and

other Asian countries.

Even if the Japanese competition body demanded the sale of assets

or other measures to try to preserve competition in a merger

deal, it has no effective means to penalise foreign companies if

they ignore such an order.

"They'll lose face if they issued an order and BHP simply

ignored that," said Koma of Baker and McKenzie.

The Japanese authorities say it's a matter of compliance.

"Even if they are not penalised, top-rated companies should

ensure full compliance with the Japanese law," said an

official at the commission, who talked on condition of anonymity.

"Or that will seriously hurt their reputation on the global

market."

July 5, 2008ü@Times

BHP

Billiton's bid for Rio Tinto investigated by EU

The European Union has

begun a full investigation into BHP Billiton's proposed

$170billion (£85.8billion)takeover of Rio Tinto,

its rival.

The EU's competition

watchdog said that there were sufficient concerns about the

integration of the world's largest and second-largest miners for

further study to be needed. The EU has already examined the deal

for two months and will now spend another six looking into the

ramifications of BHP's offer.

Rio Tinto, which has

rejected the BHP approach claiming that it undervalues the

company, welcomed the decision. BHP this week received regulatory

clearance from the United States Department of Justice to proceed

with the deal, but the EU and Australian competition reviews are

considered more important.

If the EU or Australia

requires BHP to divest large parts of Rio for the takeover to go

through, it could scupper the deal. Should competition regulators

give their blessing to the deal, Rio shareholders will have to

vote on the proposal.

BHP is offering 3.4 of

its shares for every one Rio share in a deal that will create a

huge merged multinational company with a market capitalisation of

about $350 billion.

The EU said: ügConcerns arise in particular as

regards the markets for iron ore, coal, uranium, aluminium and

mineral sands, because the proposed takeover could result in

higher prices and reduced choice for these companies' customers.üh

Steel companies are

particularly concerned about the proposed deal because a combined

BHP-Rio would control 36 per cent of the world's iron ore - the

raw material that is used to make steel.

The International Iron

and Steel Institute (IISI), which is based in Brussels, has

called on antitrust regulators to block the tie-up, warning that

such a deal would create a ügvirtual monopolyüh

in iron ore mining.

Neelie Kroes, the EU's

Competition Commissioner, said: ügThe recent surge in commodity

prices has had a serious impact on the industries buying these

commodities, their customers, and ultimately all the consumers in

Europe and elsewhere in the world. In this very sensitive context

any change making the situation worse could be extremely harmful.

ügTherefore

the commission will pay particular attention to ensure that this

takeover does not adversely affect competition in Europe.üh

Separately, BHP said

yesterday that it had matched Rio Tinto with a near- doubling in

iron ore prices, ending months of talks with steel makers.

BHP secured a 96.5 per

cent increase for iron ore lumps and a 79.88 per cent increase

for refined ore from China's Baosteel for 2008-09, and will roll

out these price rises to other customers in Asia.

BHP's share price rose

14p to £17.63 and Rio Tinto's rose 140p to

£56.

IP/08/1108

4th July

2008

Mergers:

Commission opens in-depth investigation into BHP

Billiton's proposed acquisition of Rio Tinto

The European

Commission has opened a detailed investigation under the

EU Merger Regulation into the proposed acquisition of Rio

Tinto by BHP Billiton. Both companies are

British-Australian dual-listed companies that mine and

market a range of commodities such as iron ore, coal,

uranium, aluminium, mineral sands, copper and diamonds,

as well as various other base metals and industrial

minerals. The Commission's initial market investigation

has indicated that the proposed takeover raises serious

doubts as to its compatibility with the Single Market.

Concerns arise in particular as regards the markets

for iron ore, coal, uranium and aluminium and mineral

sands,

because the proposed takeover could result in higher

prices and reduced choice for these companies' customers.

However, a decision to open an in-depth inquiry does not

prejudge the final result of the investigation. The

Commission now has 90 working days, until 11 November

2008, to take a final decision on whether the

concentration would significantly impede effective

competition within the European Economic Area (EEA) or a

substantial part of it.

Competition

Commissioner Neelie Kroes said, ügThe commodities produced

by BHP Billiton and Rio Tinto are basic inputs for major

industrial sectors and are therefore crucial for Europe's

competitiveness. The recent surge in commodity prices has

had a serious impact on the industries buying these

commodities, their customers, and ultimately all the

consumers in Europe and elsewhere in the world. In this

very sensitive, context any change making the situation

worse could be extremely harmful. Therefore the

Commission will pay particular attention to ensure that

this takeover does not adversely affect competition in

Europe.üh

The main

commodities at stake are iron ore, coal, uranium,

aluminium and mineral sands.

Iron ore and

metallurgical coal are the main inputs used in the

production of steel, and the levels of market

concentration following this merger would be very high.

BHP Billiton and Rio Tinto have substantial interests in

a number of iron ore mines and coal operations, mainly in

Australia.

The Commission's

preliminary investigation found that after the takeover

the new entity would in itself hold a significant share

in the supply of iron ore and together with its next

competitor would control a very large part of iron ore

supplies. As regards metallurgical coal, the proposed

transaction would reinforce the leading position of BHP

Billiton, with smaller competitors far behind.

By increasing the

new entity's market power in iron ore and metallurgical

coal, there is a serious risk that the planned takeover

could have a negative impact on the outcome of price

negotiations with steel customers. Furthermore there is a

serious risk that the merged entity might have the

incentive to reduce the scale of its investment projects

or slow down such investment, and so reduce supplies

available on the market and increase prices.

Uranium is

purchased by power companies for the production of

electricity in nuclear plants. Concerns were raised

during the Commission's preliminary investigation that

the proposed merger, by combining two significant

suppliers of uranium, would reduce the choice of

alternative suppliers.

Concerns were

also raised in relation to aluminium, which is used in

many applications such as packaging and aeronautics, and

in relation to mineral sands, which contain titanium

oxide which is used in paint.

|

Dow Jones August 25, 2008

Chinalco Reserves Right To Increase Rio Tinto Stake

Aluminum Corporation of China Ltd., or Chinalco, has reserved the

right to boost its stake in Rio Tinto Ltd. (RTP) after the

Australian government approved its current holding, but analysts

said Monday its ability to influence BHP Billiton Ltd.'s (BHP)

US$164 billion bid for Rio Tinto now looks limited.

Chinalco, together with Alcoa Inc. (AA), revealed in February

they had paid US$14.1 billion for a 12% stake in Rio

Tinto's London-listed shares which equates to 9% of

the total group and

had lodged a voluntary application with the Australian government

for approval of the stake.

Australian Treasurer Wayne Swan said Sunday the government had

given Chinalco approval to acquire a stake of 14.99% in the

London-listed stock of Rio Tinto, equating to about 11% of the

total group.

The approval was given on the undertaking that Chinalco wouldn't boost its

stake beyond this level without seeking Australian government

approval and

that it

wouldn't seek a seat on Rio Tinto's board while its holding was

below 15%.

Chinalco welcomed the approval and reserved the right to boost

its stake up to the approved level.

"Chinalco wishes to thank the Australian government for the

decision and Chinalco is pleased that it now has the flexibility

to increase its stake to 14.99% in Rio Tinto PLC, should it

choose to do so," it said in a statement.

Analysts and investors said the government's approval had been

widely expected, with little expectation that the government

would try to force a divestment of the shares, and that the

approval would have little impact on the ongoing takeover tussle

between BHP and Rio.

One person who is advising investors playing the deal for

arbitrage, said the approval was no surprise and that by securing

the undertakings the government had signaled the level of

investment it was willing to allow the Chinese- government backed

group to take.

Fat Prophets analysts Gavin Wendt said Chinalco's position was

unchanged in that it had a seat at the table but no real

influence.

"It may perhaps allow them to express their views on the

proposed takeover a little bit more loudly given that they are a

major shareholder," he said.

"But as it stands their stake isn't big enough to influence

the outcome and I don't think the government is going to allow

them to raise their stake from here."

Wendt said the Chinese may still seek to use the weight of their

stake to highlight their opposition to the takeover and, if the

deal did go ahead, they may also be hoping that the stake could

give them access to any assets that had to be sold to meet

competition concerns.

Chinalco President Xiao Yaqing has said the Rio Tinto stake is a

strategic investment, but has also raised concerns over the BHP

bid and said the Rio Tinto stake would allow Chinalco to have

some say in the company's development strategy.

2008/8/25ü@ō·¢{īoŹŽÉVĢĘŚ[Ŗ¦

ŹŗÅBé┼é═öāĹæŖÄĶé╠ŖķŗŲé╠öŁŹsŹŽé▌ŖöÄ«é╠éXŖäéĵōŠéĘéĻé╬üAÄcéĶé═ŗŁÉ¦ōIé╔öāĹé┼é½éķüBÆåŹæāAāŗā~é╠ÅoÄæöõŚ”é¬11%é╔Źéé▄éĻé╬üAöāĹé╔é═ÆåŹæāAāŗā~é╠ō»łėé¬Ģsē┬īćé╔é╚éķüB

October 1 2008

MarketWatch

BHP cleared for Rio bid

by Australian regulators

BHP Billiton Ltd.'s $119

billion bid for rival Rio Tinto has been cleared by Australia's

competition regulator, raising the likelihood European regulators

will also rule in the miner's favor, and adding to expectations

the hostile takeover will proceed.

The Australian Competition and Consumer Commission said Wednesday it will not

oppose the bid on

competition grounds.

"The proposed acquisition would not be likely to

substantially lessen competition in any relevant market,"

said ACCC chairman Graeme Samuel in a statement Wednesday.

"This conclusion was reached after conducting a

comprehensive review of the proposed acquisition, including

extensive market inquiries with a range of interested parties and

careful consideration of the internal documents of the merger

parties."

Analysts said the favorable ruling had been expected after the

commission's preliminary views were published in August. At the

time the ACCC said it was concerned the combined entity would be

able to influence global supply and prices of iron ore and

requested BHP supply additional information.

Shares of other miners rallied in Sydney trading Wednesday amid

expectations the ACCC ruling, which examined competition issues

affecting supplies to Australian consumers, would add to momentum

for European Union antitrust regulators to clear the deal.

The EU body is due to report back by Jan 15. The body suspended

its review in late August and requested additional information

from BHP.

"It practically gives the green light for a takeover,"

said Jonathan Barratt, managing director of Sydney-based

Commodity Broking Services.

Barratt said the chances of BHP's bid being a success were far

from certain given the competing interests of various

stakeholders.

"Somehow, something tells me that Rio doesn't want to see it

and given Rio's relationship with China, they want it to remain

pretty independent," he said.

Chinese aluminum producer Chinalco and U.S. firm Alcoa Inc.

jointly own 12% of Rio's London-listed shares.

Steel makers in Asia and Europe mostly oppose the merger which

will see the combined entity control more than a third of global

iron ore supplies.

Under its ruling, the ACCC said it was difficult for

companies to enter the ore-mining industry owing to large upfront costs, but

noted there had been "significant" expansion

of competitors in

response high ore prices in recent times. The watchdog added that

investments in new large-scale Australian operations had been

supported in some cases by funds from steel makers.

There was also little chance BHP would abuse its

dominant market position, the regulator said.

"The ACCC inquiries indicated that the merged firm would be unlikely to limit

its supply of iron ore given the uncertainty it would

face in relation to the profitability of this strategy and the

risk that limiting supply would encourage expansion by existing

and new suppliers as well [as] sponsorship of alternative

suppliers by steel makers," Samuel said.

Samuel added that Australian steel makers are unlikely to face

higher prices from any merger as they would have sufficient

alternative suppliers both in Australia and abroad with access to

rail and port infrastructure. In addition to domestic suppliers,

Australian steel makers source iron ore from Tasmania and Brazil,

among other nations.

The U.S. competition body gave partial approval to the bid in

July. Regulators in Canada and South Africa are also assessing

the deal. End of Story

| 2008/10/1 ACCC ACCC not to oppose BHP

Billton's proposed acquisition of Rio Tinto

The Australian

Competition and Consumer Commission has concluded that

the proposed acquisition of Rio Tinto Ltd and Rio Tinto

plc by BHP Billiton Ltd is unlikely to substantially

lessen competition under section 50 of the Trade

Practices Act 1974.

"This

conclusion was reached after conducting a comprehensive

review of the proposed acquisition, including extensive

market inquiries with a range of interested parties and

careful consideration of the internal documents of the

merger parties," ACCC Chairman, Mr Graeme Samuel,

said.

"The merged

firm would be a significant global supplier of a range of

commodities, including iron ore, coal, bauxite, alumina,

copper and uranium. In particular, the proposed

acquisition would combine two of the three major global

suppliers of iron ore," Mr Samuel said. "While

significant concerns were raised by interested parties in

Australia and overseas, the ACCC found that the proposed

acquisition would not be likely to substantially lessen

competition in any relevant market."

The ACCC issued

its preliminary views in a Statement of Issues published

on 22 August 2008 identifying the supply of iron ore lump

and iron ore fines as a potential competition concern.

"The

proposed acquisition would combine two of the three major

global seaborne suppliers of iron ore lump and iron ore

fines. While barriers to market entry are high, involving

significant sunk costs, market inquiries indicated there

has recently been significant new entry and expansion in

response to high demand for iron ore," Mr Samuel

said. "This increase in supply, which has included

new large scale Australian operations with associated

infrastructure, has frequently been supported by

commitments or investments by steel makers.

"The ACCC

considered whether the availability of alternative

suppliers and the ability of steel makers to facilitate

capacity expansions would be likely to undermine any

incentive the merged firm may have to seek to influence

the global supply and demand balance of iron ore in the

future.

"The ACCC's

inquiries indicated that the merged firm would be

unlikely to limit its supply of iron ore given the

uncertainty it would face in relation to the

profitability of this strategy and the risk that limiting

supply would encourage expansions by existing and new

suppliers as well sponsorship of alternative suppliers by

steel makers.

"In relation

to the supply of iron ore in Australia, market inquiries

indicated that steel makers in Australia are unlikely to

face higher iron ore lump and iron ore fines prices,

based on a move from export parity pricing to import

parity pricing. The ACCC found that alternative suppliers

are likely to be available to Australian steel makers,

including alternative suppliers with established rail and

port infrastructure in Australia."

In addition,

further market inquiries confirmed that the proposed

acquisition is unlikely to substantially lessen

competition in the remaining relevant markets.

The basis upon

which the ACCC has reached its decision will be outlined

in a Public Competition Assessment, which will be

available shortly on the ACCC's website, www.accc.gov.au/publiccompetitionassessments.

|

business.smh.com.au

2008/10/05

China pleads with Europe to reject 'harmful' bid

A TOP adviser to the Chinese Government has warned that a $132

billion hostile takeover of Rio Tinto by BHP Billiton would be

harmful to China and unfair to the global economy.

Xiaoye Wang ēż ŗ┼×@, a senior adviser to the State

Council Źæ¢▒ē@ü@and National People's CongressÉl¢»æŃĢ\æÕē’, has urged European regulators to

reject the proposed takeover, saying any merger will have an

impact on all Asian economies, which rely heavily on iron ore

imports for steel production.

The comments come at a sensitive time for BHP Billiton, as key

commodities, including oil, come under pressure over concerns of

some easing in China's growth.

"In my opinion this merger [will have] a very bad impact on

China," Professor Wang told a conference at Melbourne Law

School at the weekend. "The BHP merger should be reviewed by

the Chinese anti-monopoly agency. China is the biggest consumer

of iron ore products, and 40 per cent is from Australia. After

the merger there will be two competitors only. I believe this is

harmful for competition."

China accounts for more than $14 billion, or nearly 20 per cent,

of BHP Billiton's annual sales.

Professor Wang, who helped develop China's new anti-monopoly

laws, said the Ministry of Commerce had received objections to

the merger but has no regulatory jurisdiction

over any transaction

between BHP Billiton and Rio Tinto. "I hope very much [the]

European regulators will reject it."

The Australian Competition and Consumer Commission approved the

takeover last week, but it remains conditional on clearance from

the European Commission, Canada and South Africa.

Analysts believe European regulators could be the biggest

stumbling block. Their decision is due by January 15.

2008/11/4 AP

EU regulators object to

Rio Tinto takeover

BHP Billiton Ltd. said

Tuesday that EU regulators had highlighted antitrust problems

with its hostile bid for rival Rio Tinto Inc. that would create

the world's largest iron ore miner.

The company said it had

received a statement of objections from the European Commission -

a formal charge sheet that lays out how a deal may damage

competition.

The EU executive said it

would not comment.

Companies can try to

defend the deal or alter it to win antitrust approval before

regulators take a final decision to block or clear the

combination.

BHP Billiton said it was

continuing to work cooperatively with the European Commission and

would respond to the EU to address the issues it raised.

Regulators have been

scrutinizing the deal since July, saying they were worried about higher prices and

reduced choice

for European customers for metals and minerals.

Billiton's unsolicited

takeover of Rio Tinto would combine the No. 2 and No. 3 iron

miners and allow them to overtake Companhia Vale do Rio Doce, the

world's largest iron ore miner.

Rio Tinto opposes the

bid, saying BHP Billiton's offer undervalues it. BHP Billiton

made a hostile, all-equity bid in February, then valued at US$147.4

billion, for Rio Tinto. At 3.4 BHP shares for every Rio Tinto

share, the value of the deal fluctuates with share prices.

In May, European

steelmakers urged EU Competition Commissioner Neelie Kroes to

block the deal, saying it would create a company that could fix

prices for steel's key raw material, iron ore that have surged

this year.

2008/11/4

BHP

BHP Billiton confirms

that it has received a Statement of Objections ł┘ŗcŹÉÆmÅæ from the European Commission

in relation to its pre-conditional offer for Rio Tinto.

BHP Billiton is

continuing to work cooperatively with the European Commission

and, in accordance with the established merger review

process, will be responding in due course to address the

issues raised.