JUNE 2003 U.S. - Saudi Arabian Business Council

The Plastics Sector in the

Kingdom of Saudi Arabia

http://www.us-saudi-business.org/2003%20Plastics%20Report.pdf

The development of Saudi Arabia's plastics industry is part of

the country's overall economic diversification program away from

oil. Today, the industry, which started with one plastic unit

established in 1956, is showing signs of growing sophistication

and versatility. Saudi Arabia currently produces and exports a

variety of plastic resins, rigid and flexible tubes, floor

coverings, plastic film, sanitary ware, and medical and

pharmaceutical plastic products. The real turning point for the

Saudi plastics sector took place in 1987, when the state-owned Saudi Basic Industries

Corporation (SABIC) started

producing plastic resins for the 75 plastics manufacturing units

then operating in the Kingdom. SABIC and its manufacturing

network, consisting of 19 world class industrial complexes

operated by 16 affiliates, is now the source of raw materials for

over 700 chemical and plastics processing companies that employ

80,000 people. Together, they consume about 30 percent of SABIC's

annual output of 40.6 million metric tons per year(mt/y),

including over 4 million mt/y of polymer output. Over the past

decade, SABIC has provided Saudi Arabia's downstream plastics

industry with $2 billion in raw materials.

Low domestic energy costs, a ready supply of raw materials, and a

commitment to industrial diversification through foreign

investment have facilitated the development of a plastics

industry in Saudi Arabia. Fast-paced modernization and a lack of

competitive alternatives have also contributed to an

extraordinary demand for plastic products in the Kingdom. Since

1975, Saudi Arabia's per capita consumption of plastics has grown

by 800 percent. Today, per capita consumption of plastics in the

Kingdom has reached 40 kilograms, a rate higher than that of many

Asian countries, and more than double the per capita consumption

of the Middle East as a whole . The market is fueled by the

packaging requirements of the food, beverage and consumer goods

industries as well as the growing demand for construction

materials, such as plastic packaging, corrugated boxes and

double-lined bags. Because of Saudi Arabia's harsh natural

environment, plastics are widely used as a substitute for

traditional materials such as metal and wood. Saudi Arabia has

also sought to capitalize on its location at the crossroads of

global markets to export its plastics and plastics products to

the Middle East, Asia , Europe, and North America.

Both SABIC and other private sector companies have undergone

several waves of expansion and reorganization in order to

increase capacity and meet the rising demand for plastics in the

domestic market, and capitalize on the opportunities available in

regional and international markets. In April 2002, SABIC agreed

to purchase

the petrochemical subsidiary of DSM, a Dutch company, for $1.98 billion in

cash. The move, which is SABIC's first entry into Europe. The

acquisition pushed SABIC from its position as the 22nd largest

global petrochemical producer to the 11th position. SABIC's

purchase also propels the Middle East's largest non-oil

industrial company further downstream by providing it with access

to technology to produce the three main varieties of polyethylene

as well as other industrial and fine chemicals. As a result,

SABIC has become the third largest polyethylene producer and the

fourth largest polypropylene producer in the world.

The acquisition of DSM also gives SABIC geographical

diversification in manufacturing assets, bringing SABIC's

production in closer proximity to the immediate demands of its

customers.

The expansion of Saudi Arabia's plastics industry can also be

attributed to government encouragement in the form of financial

incentives and a supportive national policy. A rapidly increasing

population, half of which is under the age of fifteen, has also

been instrumental in this rapid market growth. Through a number

of incentives, the Saudi Government encourages industrial joint

ventures or licensing technology, and has helped the industry to

move away from import substitution to actual growth in

domestically manufactured plastic products. A testament to Saudi

Arabia's commitment to developing its economy and providing a

more favorable investment environment is the passage of a revised

foreign investment law. The new law allows foreign companies 100

percent ownership of their investment while enjoying the same

incentives given to Saudi companies. In addition, the law significantly

reduces corporate tax rates for foreign

companies. At the forefront of these reforms has been the Saudi

Arabian General Investment Authority (SAGIA), which has issued

inward investment licenses worth $13 billion since it was

established in April 2000.

UPSTREAM PLASTICS INDUSTRY

Home to more than a quarter of the world's proven oil reserves,

Saudi Arabia also boasts over 230 trillion cubic feet (tcf) of

gas reserves, 40 percent of which is non-associated - making the

Kingdom's reserves the fourth largest in the world behind Russia,

Iran and Qatar. By 2009, Saudi Arabia plans to expand its natural

gas production to 14 billion cubic feet (bcf) from its current

output of just below 6 bcf. The focus of this expansion hinges on

the

development of non-associated gas, which will ensure a steady

flow of energy and feed stock to its industrial base. Since more than 95 percent of Kingdom's

basic petrochemicals are derived from methane and natural gas

liquids (NGL), Saudi Arabia's commitment to expand its gas

infrastructure will enhance the Kingdom's competitive advantage

in world petrochemical and plastic markets.

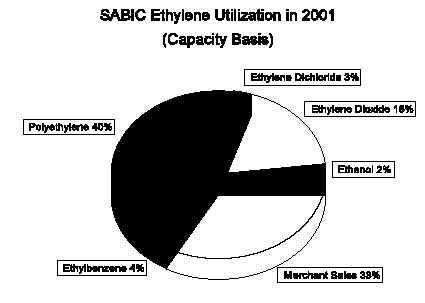

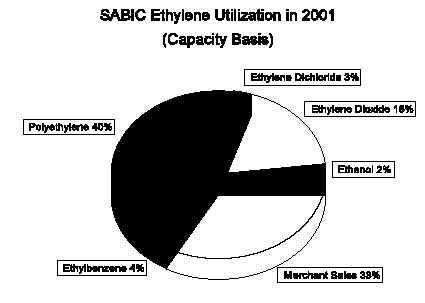

As a result of its natural endowments, Saudi Arabia is a major

producer of basic chemicals such as ethylene, propylene, ammonia,

and methanol. With seven world class crackers and an annual

production capacity of 5.8 million tons, Saudi Arabia is among

the world's lowest-cost producers of ethylene, accounting for

nearly half of all ethylene produced in the entire Middle

East/Africa region. This versatile chemical has been instrumental

to the development of the Kingdom's plastics industry. SABIC's

whollyowned subsidiary PETROKEMYA added 800,000 mt/y of ethylene

capacity in 2001 with its

Olefins III plant, raising its total ethylene production capacity

to 2.6 million mt/y. The new flexible 800,000 mt/y ethylene cracker at

affiliate YANPET also came online in 2001. Its flexible cracker uses propane,

natural gas and ethane as feedstock.

Even Saudi

Aramco has begun producing

ethylene. In March 2002, Aramco announced that it was taking a 25

percent stake along with ExxonMobil and Fujian Petrochemical

Company in a refining and petrochemical joint venture in the Fujian Province of China.

The construction of the 600,000 mt/y ethylene cracker marks

Aramco's first foray into petrochemicals.

Saudi Arabia is also a major producer of aromatics such as

styrene and benzene, which are used in the production of

disposable transparent containers, packaging and thermal

insulation. In April 2002, Chevron Phillips Chemical Company LLC

(CPChem) and the Saudi Industrial Investment Group (SIIG) annouced plans for a $1 billion expansion

of their joint-venture aromatics complex in Jubail Industrial

City. The new investment will result in the production of

benzene, ethylbenzene, styrene and propylene. The joint venture,

which is expected to be completed in 2006, is the largest private

sector project now underway in the Kingdom. According to CPChem,

a majority of the facility's styrene will be exported from the

Arab Gulf region while other products and co-products will be

marketed locally. Fluor Daniel was awarded the front-end

engineering and program management for the entire project in

addition to the detailed engineering, procurement, and

construction management for the off-plot facilities. The existing

Saudi Chevron Phillips facility, which started up in 2000,

currently produces benzene (utilizing CPChem's proprietary Aromax® technology)

cyclohexane and motor gasoline. CPChem and SIIG recently

announced a 60,000 metric ton-per-year (200 million gallons per

year) expansion of the cyclohexane unit.

SABIC and private producers in Saudi Arabia have made great

strides downstream and have become global leaders in the

production of chemical intermediates. Products from SABIC's

Chemical Intermediates SBU include ethylene glycol (EG), ethylene

dicholoride (EDC ), vinyl chloride monomer (VCM ), caustic soda

produced by SABIC affiliate SADAF in Jubail, 2-ethyl hexanol

(2-EH) and di-octyl phthalate (DOP) produced by SAMAD in Jubail.

SABIC is actually the world's second largest producer of ethylene

glycol. The company's 2001 output of 2.3 million mt/y of mono, di

and tri-ethylene glycol accounts for 18 percent of the global

supply. However, almost three quarters of EG production is

dedicated to the Asian market, with the remainder going to Europe

and the U.S. Jubail

United Petrochemical Company

(UNITED) is the latest SABIC affiliate in the Kingdom and once

completed, will be the second largest EG plant in the world.

UNITED will have annual production capacities of 1 million tons

of ethylene, 575,000 tons of ethylene glycol and 150,000 tons of

linear alpha olefins. The company also has a 50 percent stake in an

800,000 mt/y polyethylene plant being built at the neighboring

SABIC affiliate in Jubail, PETROKEMYA. In November 2001, Haliburton KBR, along

with the Chiyoda and Mitsubishi Corporations were awarded the

ethylene package. The UNITED plant will be the first grassroots

cracker to use Halliburton KBR's SCORE. (Selective Cracking

Optimum Recovery) technology, which is a combination of KBR and

ExxonMobil ethylene technologies. SCORE. will provide UNITED with

the highest selectivity to ethylene coupled to a low pressure

recovery scheme which reduces the capital investment of the

ethylene plant. Ticonex of the U.S. was also awarded the critical

safety and turbomachinery package in February 2003.

POLYMERS

With access to enormous hydrocarbon feedstocks, particularly

ethylene, Saudi Arabia is one of the world's largest and lowest

cost producers of polymers. In 2001, SAB IC's production of

polymers increased 55 percent to 4.2 million tons, largely as a

result of increased capacities and the debottlenecking of several

plants. With the acquisition of DSM last year, SABIC's polymer

production capacity is expected to increase by an estimated 2.6

million tons. Saudi companies are able to produce essential

polymers such as linear low density polyethylene (LLDPE),

high-density polyethylene (HDPE), lowdensity polyethylene (LDPE),

polypropylene (PP), polyvinyle chloride (PVC), polystyrene (PS),

polyethylene terephthalate (PET ), polyesters and melamine - a

thermoset resin.

Saudi Arabia's increase in polymer production has made Saudi

Arabia a primary player in the global polymer industry. The

Kingdom exported 2.8 million tons ($1.65 billion) of plastic

resins and goods in 2001, a 73 percent increase over the previous

year. Greater polymer production has also focused the Saudi

Government and SABIC's efforts towards developing a diversified

downstream plastics industry. SABIC's business development team

proactively markets new ideas from approximately 450 customers to

produce finished products in the Kingdom, replacing imports and

thereby maximizing usage of SABIC's polymers as a raw material in

domestic markets. In 2001, Saudi downstream companies consumed 27

percent of SABIC's polymer output. Despite the focus on domestic

development, the Kingdom still imports a large quantity of

polymer products from abroad, especially polyethylene,

polypropylene, polystyrene, PVC and petroleum resins. In fact,

Saudi Arabia imported $590 million worth of plastic polymers and

downstream products in 2000.

The Middle East, particularly Saudi Arabia, is quickly becoming

the global center for polyethylene production. With 17 new ethylene crackers

(including 7 in Saudi Arabia) being constructed throughout the

Middle East, the region's

annual polyethylene capacity will reach 28 billion pounds by 2007

- 9 billion pounds of which will be located in the Kingdom. SABIC

will be the world's fourth largest polyethylene producer by 2007

, a remarkable accomplishment considering it was not even a top

ten producer in 1997.

According to Plastic News, feedstock advantage allows manufacturers

to produce polyethylene at a cost of $300 per ton in the Middle

East, as compared to $500 per ton in North America and the global

average of $450 per ton.

SABIC continues its expansion with plans under way at PETROKEMYA for an

additional 800,000 mt/y from two new 400,000 mt/y lines of HDPE

and LLDPE coming on stream in

2004. In cooperation with SABIC R&T, PETROKEMYA achieved a

significant productivity increase of 10 percent at its

polystyrene plant through the introduction of technical

improvements to the production process from expandable

polystyrene (EPS) and solid polystyrene (SPS). Polymers will

increase by an additional 60,000 mt/y of PVC as a result of the

de-bottlenecking of the National Plastic Company (IBN HAYYAN)

affiliate and will further increase by an additional 250,000 tons

of PET when the Arabian Industrial Fibers Company (IBN RUSHD)

plant in Yanbu is completed. Meanwhile, Jubail Petrochemical

Company (KEMYA) began to produce ethylene, propylene and py-gas

as feedstock for its LLDPE/HDPE plants and new LDPE units. A

major expansion program to build a new tubular high pressure LDPE

plant with a capacity of 218,000 mt/y and an olefins cracker to

produce ethylene was also completed.

The expansion made the affiliate a fully integrated company. In

the private sector, Gulf Petroproduct Company, a joint venture

between Saudi Offset Limited Partnership and India's Tamilnadi

Petroproducts is planning to build a $300 million normal paraffin

and linear alkyl benzene project in Yanbu. In addition, a $533

million polypropylene plant will also be built in Jubail. The

projected plant, which will produce 450,000 mt/y of

polypropylene, will be constructed and managed under a new $160

million joint venture company to be named Saudi Polyolefins Company. Bassel Holding Middle East will hold a

25% stake in the project, and the other 75% will be held by

National Petrochemical Industrialisation Co.

DOWNSTREAM PLASTICS INDUSTRY

With increased investment and technological know-how, the

plastics industry in the Kingdom has undergone a major

diversification from basic to more sophisticated products.

Because of a lack of tradition al materials such as metal and

wood, products using more complex plastic composites are being

integrated into the Kingdom's packaging and construction sectors.

Laminated film, barrels, storage tanks, and multipurpose sacks

are used for packaging, while water and waste pipes, electrical

switches, windows, artificial marble, plastic sanitary ware, and

insulating products are used in the Kingdom's construction

industry. Saudi consumers are increasingly requiring more

sophisticated plastic products such as disposables, furniture,

pipes, water dispensers, thermal insulation materials, ceiling

tiles, kitchenware, and a number of other plastic products with

agricultural and construction applications. Not only is there a

great demand for importing these finished products from abroad,

but there is a growing market in the Kingdom for the

sophisticated machinery, equipment, spare parts and technical

services that can be used to manufacture them domestically.

Until recently, SABIC limited its involvement in the plastics

sector to being a domestic supplier of thermoplastic resins. In

1996 SABIC's affiliate IBN HAYYAN joined the downstream plastics

producers by taking a 57 percent stake in the national joint

venture, Tayf

(the Ibn Hayyan Plastic Products Company). Other partners in TAYF were the Saudi

Industrial and Commercial Agencies Company with 31 percent, the

Saudi Industries Development Company (Tatweer) with 10 percent,

and the Saudi Ceramic Company with 2 percent. The total project

investment for TAYF was around $93 million. TAYF, which went on

stream in December 1999, is strategically located in Jubail to

receive its raw materials from SABIC's other affiliates. IBN

HAYYAN and another SABIC affiliate, SAMAD, are responsible for

supplying TAYF with PVC resins and dioctylphtalate. TAYF's

initial product mix includes seven PVC-based products, namely,

synthetic leather, wall covering, floor covering, artificial

wood, book-binding material, calendered rigid film, and

calendered soft film. A part from synthetic leather, all of

TAYF's products are being manufactured for the first time in the

Kingdom. SABIC has secured technology contracts with leading

manufacturers of plastics products including Pickhardt and

Siebert GmbH, and Konrad Homschuch AG, of Germany.

JOINT VENTURE INVESTMENT

OPPORTUNITIES

The low cost of plastics raw materials, a dramatically rising

demand, and a liberal investment regime have contributed to a

flourishing partnership between Saudi Arabian and American,

European, and Asian plastics companies. Joint ventures have been

set up in both upstream and downstream plastics industries. Saudi

Arabia's plastics industry has attracted a number of the world's

leading companies, including ExxonMobil of the U.S., and

Mitsubishi of Japan. Through a number of incentives, the Saudi

Government encourages industrial joint ventures or licensing

technology, and has helped the industry to move away from import

substitution to actual growth in domestically manufactured

plastic products. Because of their role in the Kingdom's

diversification program, plastics projects benefit from

significant government incentives. Incentives include a 10-year

tax holiday, access to low-cost feedstock from Saudi Aramco and

SABIC, and loans on favorable terms commonly covering 50 percent

of the total capital cost from the Saudi Industrial Development

Fund (SIDF).

One of the most recent ventures established involves a 45,000

square meter plastics and packaging plant in Jeddah, which was

established in conjunction with Yousef Algosaibi Processing &

Packaging Limited, Bajrai International Group, and Omar Qandeel

Establishment. The factory uses manufacturing and converting

technology that incorporates print media production, high-speed

fiber printing, lamination, a quality assurance laboratory and

raw material and finished goods storage. According to Gulf

Industry, this is the first Tetra Pak 'green field' factory in the world to incorporate both

leading-edge fiber and plastic packaging technologies located on

one site. Having invested $65 million in the development, the

company now processes virtually all of the Middle East's Tetra

Pak material packaging orders in Jeddah, with the factory able to

produce up to 15 million packs a day, or about four billion a

year. Saudi staff now operate the world's fastest printers -

capable of printing one million packages per hour - modern

high-speed extrusion laminators, and fully automated

shrink-wrapping and palletizing machines.

There are excellent opportunities evolving from new joint venture

projects undertaken by SABIC and the private sector for U.S.

manufacturers and suppliers of industrial equipment to the

petrochemical and plastics industry. American design and

engineering companies/licensors have good opportunities to

license their processes or provide technical know-how through

licensing agreements. American technology and production

processes maintain a reputation for being technically advanced,

of high quality and durability. Arrangements already exist with a

number of U.S. and third-country companies, including UOP, Great

Lakes Chemical Corp., Union Carbide, Halliburton Kellogg Brown

& Root, Dow Chemical, and Bishop Technology Co.

SABIC Manufacturing Companies

| Company |

Location |

Partnership |

Feedstocks |

Products |

ALBA

Aluminum Bahrain |

Bahrain |

Bahrain

(74.9%), Brenton Investments, Germany (5.1%), the Saudi

Public Investment Fund, represented by SABIC (20%) |

Alumina |

Aluminum

(liquid metal, ingots, rolling slabs, billet) |

AR-RAZI

Saudi Methanol Company |

Jubail |

A 50/50

SABIC joint venture formed in 1971 with a consortium of

Japanese companies led by Mitsubishi Gas Chemical Company |

Methane |

Chemical

Grade Methanol |

GARMCO

Gulf Aluminum Rolling Mill Company |

Bahrain |

Kuwait

(16.97%), Bahrain (38.36%), Iraq (4.12%), Oman (2.06%),

Qatar (2.06%), Gulf Investment Corp. (5.15%) and Saudi

Arabia represented by SABIC (31.28%) |

Aluminum |

Aluminum

Sheets and Can Stocks |

GAS

National Industrial

Gases Company |

Jubail |

SABIC (70%)

and a group of Saudi Arabian producers of industrial

gases (30%) |

Air |

Oxygen,

Nitrogen, Argon, Krypton-Xenon |

GPIC

Gulf Petrochemical Industries Company |

Bahrain |

Joint

venture with equal partnership for the Petrochemical

Industries Company of Kuwait, the State of Bahrain and

SABIC |

Methane |

Ammonia,

Methanol, Urea |

HADEED

Saudi Iron and Steel Company |

Jubail |

A

wholly-owned affiliate of SABIC |

Limestone,

Iron Ore, Scrap Iron & Steel, Natural Gas |

Steel

Rebar, Wire Coil, Steel Sections, Flat Steel Products |

IBN

AL-BAYTAR

National Chemical

Fertilizer Company |

Jubail |

A 50/50

SABIC joint venture with SAFCO |

Methane,

Ammonia, Phosphate Rock, Sulphuric Acid, and Potash |

Ammonia,

Granular Urea, Compound and Phosphate Fertilizers |

IBN

HAYYAN

National Plastic Company |

Jubail |

SABIC

(86.5%), NIC, Saudi Arabia (10%), Saudi Plastic Product

Company, Arabian Plastic Manufacturing Co., Ltd. (3.5%) |

Ethylene

(Supplied by PETROKEMYA), Ethylene Dichloride (supplied

by SADAF) |

Vinyl

Chloride Monomer, Polyvinyl Chloride, PVC Paste |

IBN

RUSHD

Arabian Industrial Fibers Company |

Yanbu |

SABIC (70%)

and 15 Saudi Arabian and regional private sector partners |

Ethylene

Glycol (supplied by YANPET) |

Aromatics

(Xylenes and Benzene), Purified Terephthalic Acid (PTA),

Polyester Textile Chips, Textile Staple, Bottle Grade

Chips, Carpet Staple |

IBN

SINA

National Methanol Company |

Jubail |

SABIC

(50%),

Hoechst-Celanese - USA (25%),

Pan Energy - USA (25%) |

Methane,

Butane |

Chemical

Grade Methanol, MTBE |

IBN

ZAHR

Saudi European Petrochemical Company |

Jubail |

SABIC

(70%), Neste Oy-Finland (10%), Ecofuel-Italy (10%), Arab

Petroleum Investment Corporation(APICORP) (10%) |

Chemical

Grade Methanol (supplied by IBN SINA and ARRAZI), Butane |

MTBE,

Polypropylene |

KEMYA

Jubail Petrochemical Co. |

Jubail |

A 50/50

SABIC joint venture with ExxonMobil (USA) |

Ethylene

(supplied by Sadaf) |

Polyethylenes |

PETROKEMYA

Arabian Petrochemical Co. |

Jubail |

A

wholly-owned affiliate of SABIC |

Ethane,

Styrene, Propane,Butane, Natural Gas |

Ethylene,

Polystyrene, Butene-1, Propylene, Butadiene, Benzene |

SADAF

Saudi Petrochemical Co. |

Jubail |

A 50/50

SABIC joint venture with Pecten Arabian Company, a

subsidiary of Shell Oil Co. (USA) |

Ethane,

Salt, Benzene,

Methanol, Butane |

Ethylene,

Crude Industrial Ethanol,

Styrene, Caustic Soda, Ethylene

Dichloride, MTBE |

SAFCO

Saudi Arabian Fertilizer Co. |

Dammam

& Jubail |

SABIC

(41%), SAFCO Employees (10%), Private Saudi Arabian

shareholders (49%) |

Methane |

Ammonia,

Urea, Sulphuric Acid, Melamine |

SAMAD

Jubail Chemical Fertilizer Company |

Jubail |

A 50/50

SABIC joint venture formed in 1971 with Taiwan Fertilizer

Company |

Methane,

Propylene (supplied by PETROKEMYA) |

Ammonia,

Urea, 2-Ethyl Hexanol, DOP |

SHARQ

Eastern Petrochemical Co. |

Jubail |

A 50/50

SABIC joint venture with a consortium of Japanese

companies led by Mitsubishi Corporation |

Ethylene

(supplied by PETROKEMYA) |

Linear Low

Density Polyethylene (LLDPE), Ethylene Glycol |

TAYF

Ibn Hayyan Plastic Products Company |

Jubail |

SABIC

affiliate IBN HAYYAN (57.17%), Saudi Industrial &

Commerical Agencies Company (30.83%), Saudi Industrial

Development Company (TATWEER 10%), Saudi Ceramic Company

(2%) |

Polyvinyl

Chloride (supplied by IBN HAYYAN), Di-Octyle Phthalate

(sourced from SAMAD) |

Plastic

Boards, Wall Covering, Artificial Leather, Book Binding

Products |

YANPET

Saudi-Yanbu Petrochemical Company |

Yanbu |

A 50/50

SABIC joint venture with ExxonMobil (USA) |

Ethane |

Ethylene,

Polyethylene, Ethylene Glycol |

Platts 2004/2/11

Saudi Sabic to launch 800 kt/yr PE complex in Al-Jubail in March

Saudi Arabia's Sabic plans to start up its two new 400,000 mt/yr

polyethylene plants in Al-Jubail next month, a source close to

the firm said Wednesday. The plant's start-up had been delayed

since December last year due to various mechanical snags and a

serious shortage of butane feedstock.

The shortage has hindered Sabic's petrochemical production in

Al-Jubail and Yanbu by 20-30%, since Q4 2003. The butane shortage

has stabilized, the source added, even though supply would remain

tight through March when it fulfills its pending backlog orders.

The new PE plants were expected to reach maximum output rates in

the second half of the year, the source added. The plants would

be able to produce linear low density polyethylene and high

density polyethylene.

Chemical Week Mar 31, 2004

Sabic Eyes Mexico Project

Sabic is

exploring the possibility of setting up a petrochemical

production base in Mexico to serve the North American market,

says Sabic CEO Mohamed Al-Mady. The company is in discussions

with Petroleos

Mexicanos (Pemex; Mexico City) as a potential joint venture partner in

the Phoenix project, Al-Mady says. “North America is a strategic and important

market for us,” he says. Talks are in

early stages, however, he says. The proposed Phoenix project in

Mexico would include a cracker to produce 1 million m.t./year of

ethylene, and several derivatives units. Sabic’s growth in North America is more likely

via the establishment of a production base in the region than

through the acquisition route, which the company has been

pursuing in the past, Al-Mady says. Natural gas prices in the

U.S. are “unbearable for any

producer,” he says. “We are not looking at investments in the

U.S. but are open to acquisition opportunities,” he adds. The company has not identified

any attractive assets, however. Sabic currently supplies North

America with ethylene glycol, fertilizers, methanol and methyl

tert-butyl ether from its plants in Saudi Arabia and Europe.

Chemical

Week, June 4, 2003

Pemex

launches road show for $2.6-billion project. (New

Construction Projects).

Pemex Petroquimica (Mexico City) has begun a road show to

attract potential investors in the company's $2.6-billion

Phoenix Project, which consists of complexes producing

olefins and derivatives, and aromatics in Mexico. "We

are planning to build the complexes in association with

national and international industry leaders," Pemex

president Rafael Beverido Lomelin said at the recent Achema

chemical engineering exhibition at Frankfurt. Pemex plans to

hold a 25%-30% share, Beverido says. It intends to discuss

the project with 16 potential partners including Atofina,

BASF, Chevron Phillips Chemical, ExxonMobil Chemical, Repsol

YPF, and Sabic, sources say.

The olefins complex will cost about $1.8 billion. It will

have annual capacities for 1 million m.t. of ethylene; 125,000

m.t. of butadiene; 450,000 m.t. each of high-/linear

low-density polyethylene (HDPE/LLDPE) and low-density PE

(LDPE); 400,000 m.t. of polypropylene; and 500,000 m.t. of

styrene. The

location will depend on feedstock, Beverido says. It could be

built at Coatzacoalcos or Altamira if it is based on naphtha,

but it will definitely be built at Coatzacoalcos if it is

based on ethane, he says. The aromatics complex will cost

about $800 million, and its capacities will include 600,000 m.t.-700,000

m.t./year of para-xylene and 200,000 m.t./year of benzene.

"We are expecting to finish planning this year and to

have an agreement with joint venture partners in the first

half of next year," Beverido says. Basic engineering

would begin in the second half of 2004, and the complexes

would come onstream in 2008, Beverido says. Pemex has not

decided whether the two complexes will be built at the same

location. "This will depend on our partners,"

Beverido says.

Pemex is also spending about $1 billion to improve its

existing plants in Mexico, Beverido says. The company is

doubling vinyl chloride monomer capacity at Pajaritos to

405,000 m.t./year by December. It is adding 250,000 m.t./year

of ethylene capacity to its 600,000-m.t./year cracker, and

building a 300,000-m.t./year HDPE unit there, by end-2005.

Pemex also plans to expand ethylene capacity at Cangrejera by

250,000. m.t./year, to 850,000 m.t./year; styrene capacity by

100,000 m.t./year, to 250,000 m.t./year; and LDPE capacity

from 240,000 m.t./year, to 315,000, by first quarter 2004.

May 13, 2004 Dow

Jones

Germany's Linde Gets Petrochem Plant Deal In Saudi Arabia

Saudi petrochemical giant, Saudi Basic Industries Corp., or

Sabic, (SBI.SA) said Wednesday that it has awarded a lump sum

turnkey contract to Linde AG (LIN.XE) of Germany for the

engineering, procurement and construction of a new linear alpha

olefins plant.

Sabic didn't disclose the value of the deal.

The plant will be built in Jubail, an industrial city in the

eastern province of Saudi Arabia near the Persian Gulf.

The facility will be the first of its kind, utilizing a

technology jointly developed by Sabic and Linde, the Saudi

company said in a statement.

The facility is expected to be completed by the third quarter of

2006. The plant capacity will be 150,000 metric tons of linear alpha

olefins per

year, it said.

Platts 2004/7/1

Jubail United MEG

plant to start commercial sales in November

Jubail United of Saudi Arabia, a 100% subsidiary of SABIC, has

scheduled to start commercial operations at its first

monoethylene glycol plant in Al-Jubail by November, a source

close to the company said Thursday.

Over the next five years, SABIC will be starting up four new MEG

plants of 600,000 mt/yr capacity each. Three of the units will be

under its 100%-owned subsidiaries, Jubail United Petrochemical Co

and Yanbu United Petrochemical Co, although at different sites.

Two of the units will be in Al-Jubail while the third one will be

in Yanbu. The fourth MEG plant, however, will be under its 50:50

joint-venture with a Japanese consortium called Saudi

Petrochemical Development Corp.

2004/9/3 Platts

SABIC to

commission 600 kt/yr new MEG plant in Al-Jubail in Oct

Saudi Arabia's SABIC plans to commission its 600,000 mt/yr new

monoethylene glycol plant in Al-Jubail in October 2004, a company

source said Friday.Commercial operations were expected to start

by November, the source added.

The company had plans to bring on-stream four MEG plants, with

total capacity of 2.4 mil mt/yr, between 2004 and the first

quarter of 2008. Three of the units will be under its 100%

subsidiaries Jubail United and Yanbu United Petrochemical Co,

while the fourth one will be under its 50:50 joint-venture with a

Japanese consortium called Saudi Petrochemical Development Corp.

The second plant, JUPIC 2, is been slated to start operations in

Q3 2005, the third plant will be built in Yanbu by Q1 2007, while

the fourth plant will start by the first quarter of 2008.

Meanwhile, MEG spot prices were discussed $10/mt higher as of

Friday afternoon, compared to $1,210-1,220/mt CFR China last

week, on speculative demand and tight supply.

Platts 2004/10/21

SABIC denies take

over of Nova; Mexican plans close to fruition

SABIC's CEO Mohamed Al Mady, Wednesday, denied market rumors that

the company was seeking to buy US-based styrenics producer Nova

Chemicals, as

a platform to operate a petrochemical complex focussed on the

North American markets. "We have not had any discussion with

Nova," Al Mady said, addressing reporters at the K 2004

plastics and rubber show in Dusseldorf, Germany.

In related developments, Al Mady said that SABIC was close to

reaching an agreement with a Mexican company to build or operate

a naphtha-based cracker in Mexico. If this joint venture comes to fruition,

it will be SABIC's first successful foray in Mexico. The products

coming out of this cracker will mostly be to satisfy the local

market demand, he said, adding that if there will be any balance,

these products would then be exported. "We will make a

decision soon," he said. Al Mady said that SABIC is in

contact with Pemex Petroquimica, but declined to reveal further

details.

ameinfo

2005/5/12

SABIC awards contract to Technip for Yansab ethylene and

propylene plant

http://www.ameinfo.com/59915.html

Saudi

Basic Industries Corporation (SABIC) signed a Letter of Intent

(LOI) with the Italian company Technip for the engineering,

procurement and construction of an ethylene and propylene plant

at the YANSAB Complex in Yanbu

Industrial City, on the Red Sea coast of

The plant will have a nameplate ethylene

production capacity of 1.3 million metric tons per year (mt/y) and 400

thousand mt/y of propylene. The new large-scale plant will form

the core of future manufacturing units within the YANSAB project.

The LOI was signed by Eng. Abdulrahman Saleh Al-Fageeh, President

YANSAB on behalf of SABIC, and Mr. Riccardo Moizo, Vice CEO,

Middle East and South East Asia, on behalf of Technip Co.

Mohammed Al-Mady, SABIC's Vice Chairman and CEO, attended the

signing ceremony and said: 'This mega-project was undertaken by

SABIC at Yanbu Industrial City as an extension of SABIC's

ambitious plan to significantly increase production of basic

petrochemicals, intermediates and polymers by 2008. YANSAB

projects alone will add nearly 4 million mt/y of production from

Yanbu Industrial City to meet the growing global demand for

petrochemical products.

'The YANSAB project's major objective is to provide high-quality

and value-added products to boost the nation's domestic

industrial production, as well as strengthen the company's

competitive capabilities in global markets'.

2005/5/30

ameinfo

SABIC signs Letter of Intent (LOI) with the US Flour Company

http://www.ameinfo.com/61312.html

Saudi

Basic Industries Corporation (SABIC) today signed a Letter of

Intent with the US Flour Company to construct

utilities and site facilities at the SABIC

affiliate, Yanbu National Petrochemicals Company (YANSAB) in

Yanbu.

The LOI was signed in the presence of Mohamed Al-Mady, SABIC Vice

Chairman & CEO, by Abdulrahman Al-Fageeh, President YANSAB,

for SABIC, and Mr. David Seaton, Flour Sr. Vice President,

Chemical Products Business Line, Energy and Chemicals Group, for

the Flour Company.

Mohamed Al-Mady said, 'The utilities and site facilities are the

largest units of the YANSAB complex and are vital for feeding the

various complex plants with water, power supplies, steam and

chilled water.

'I expect that these works will be completed within 34 months.

Completion of the complex mechanical works is expected during

1Q2008. Initial annual production capacity will go beyond 4

million MTY of petrochemical products which will strengthen

SABIC's contribution to national development plans and boost its

competitive capabilities in the global markets.

'YANSAB will apply the latest state-of-the-art and cutting-edge

technologies in its production operations including Scientific Design

Ethylene Glycol technology, 50% owned by SABIC and 50% by German

Sud Chemi. It will also use Butene-1

technology developed by SABIC in cooperation with the French

Petrol Institute. In addition, the complex will

apply for first time a new technology for the manufacture of HDPE

and other technologies for conversion of pure aromatic compounds

into Benzene.

'Once operational, this mega project will employ 1,500 employees,

benefiting Saudi citizens.'

YANSAB will be one of the world's largest plants. It will produce

1.3

million MTY of Ethylene; 400,000 MTY of Propylene; 900,000 MTY of

High Density Polyethylene (HDPE) and Low Density Polyethylene

(LLDPE); 400,000 MTY of Polypropylene (PP); 700,000 MTY of Mono

Ethylene Glycol (MEG); 250,000 MTY of Benzene, xylene and toluene

compound. The complex will manufacture a

wide range of basic chemical, intermediate and polymer products.

SABIC has recently selected the ABN AMRO Group with Saudi

Hollandi Bank as the financial advisor for the YANSAB loan.

日本経済新聞 2005/7/19

サウジの石化プラント 東洋エンジが受注 450億円

東洋エンジニアリングはサウジアラビア基礎産業公社(SABIC)から、ポリエステル繊維の原料となるエチレングリコールの大型プラントを受注した。同国西海岸に年産70万トンと世界最大級の設備を建設する。2008年初めに稼働させる。受注額は約450億円とみられる。

SABICは約50億ドルを投じ、同国西海岸ヤンブー工業地区にヤンサブ石油化学センターとしてエチレン、エチレングリコールなどを生産する大型施設を計画中。このうち東洋エンジがエチレングリコールプラントの設計、資機材の調達、建設までを一括して請け負った。エチレンは仏大手エンジニアリング会社テクニップが手掛ける。

東洋エンジはSABIC傘下の別の石化会社か同国東部ジュベイルで年産63万トンのエチレングリコールプラントを受注しており、今年度中に完成させる。完成後はSABICが同製品分野で世界最大手になる。今回の受注は建設中のプラントを上回る大型プロジェクトで、中国などに輸出されて、衣料やペットボトルになる。

今回のプロジェクトは、国内産原料ガスを使い低価格の石油化学製品を生産するサウジアラビア政府の戦略の一環。石化製品の原料となる天然ガスの価格は、原油を精製したナフサに比べて4分の1以下になる。

2005 年12 月9 日 SABIC

SABIC、ヤンサブの工場建設をテクニップ・イタリア社と東洋エンジニアリングに発注

サウジ基礎産業公社(SABIC: Saudi Basic Industries

Corporation)は12 月6

日、テクニップ・イタリア社との間で、サウジアラビアの紅海沿岸にあるヤンブー工業都市のヤンサブ石油化学センターにエチレンとプロピレンの製造工場の建設を委託する契約を締結しました。さらに、その前日の12

月5 日には、東洋エンジニアリング(TEC)との間で、同じくヤンサブにエチレン・グリコール工場の建設を委託する契約を締結いたしました。

SABIC のモハマド・アルマディ副会長兼CEO、東洋エンジニアリングの山田豊社長兼CEO

が見守る中、契約書には、SABIC を代表してユーセフ・アルザメル基礎化学品副社長兼ヤンサブ会長、テクニック・イタリア社を代表してネロ・ウッセラッティ中東・東南アジアCEO、東洋エンジニアリングを代表して副島憲二常務が調印しました。

SABIC のアルマディ会長は「この2

つの契約の調印は、当社の子会社ヤンサブを世界最大級の石油化学センターとするための重要なステップであり、2008

年に生産が開始されますと、SABIC

の競争力が増強されます」と語りました。

「ヤンサブはサウジアラビア国内のSABIC

の子会社としては一番新しく、各種の石油化学製品を年間400

万トン以上製造する能力を備えることになり、SABIC

で最大の石油化学工場となります。内訳はエチレン130

万トン、プロピレン40 万トン、ポリエチレン90

万トン、ポリプロピレン40

万トン、エチレン・グリコール70

万トン、ベンゼン・キシレン・トルエン25

万トン、ブテン-1およびブテン-2 が10

万トンとなります」

「フェーズ1 とフェーズ2

におけるヤンサブの従業員数は1,500

人の予定で、サウジにとって有望な雇用機会の創出となります。ヤンサブでは、芳香族蒸留分からベンゼンを生産し、また、ポリエチレンを生産する新規プロセスなど、SABIC

が特許を保有する技術も含め、最新の技術を工場に投入いたします」。ヤンサブの資本金の55%をSABIC

が、また、SABIC の子会社のIBN RUSH とTAYF が計10%を、残りの35%は公募する予定です。

x x x x

サウジ基礎産業公社 (SABIC)は時価総額が中東で最大の企業であり(1,500

億米ドル以上)、世界の10大石油化学製品メーカーの1社です。ポリエチレン、ポリプロピレン、グリコール、メタノール、MTBE、肥料のマーケット・リーダーであり、世界第4

位のポリマー・メーカーです。

SABIC の利益は2004 年、前年比112%増となる38

億米ドルと創業以来の新記録に達しました。2004年の売上高は前年比47%増の183

億米ドルで、中東の上場会社の中で売上げ、利益とも最大を記録しました。

SABIC は相互に関連する6

つの戦略的事業単位(基礎化学品、インターミディエート、ポリオレフィン、塩化ポリビニール及びポリエステル、化学肥料、金属)で構成されています。研究開発資源も充実しており、リヤド、オランダのヘレーン、米国のヒューストン、インドのワドダラに研究開発センターを展開しています。SABIC

は世界で1 万6,000 名余りを雇用しています。

サウジアラビアのアルジュベールとヤンブーの2ヵ所に、18の世界的に大規模な生産施設を所有しています。そうした施設のいくつかは、エクソンモービル、シェル、三菱化学などとの合弁となっています。

SABIC の総生産能力は2001 年の3,540 万トンから2004

年には4,290 万トンに増強されました。

SABIC

は、サウジアラビアのリヤドに本社があり、原油採掘の副産物として産出する炭化水素ガスを原料として化学製品、ポリマー、化学肥料等を生産するため、サウジアラビア政府が1976

年に設立しました。現在、SABICの株式の70%をサウジアラビア政府が、残りの30%はサウジアラビア国内および湾岸協力会議(GCC)加盟国の民間投資家が保有しています。

SABIC Europe

はオランダのシタルトに本社を置き、2,300

名を雇用し、オランダのヘレーンとドイツのゲルゼンキルヘンにある石油化学工場で、ポリプロピレン、ポリエチレン、ハイドロカーボンを製造し、ヨーロッパのセールスオフィスとロジスティックス拠点のネットワークを通じて販売しています。SABIC

Europeは2004年には、ポリマー、基礎化学製品、インターミディエート合計600

万トンを主として欧州市場に販売しました。

2005/7/27

SABIC

SHARQ

signs Letter of Intent to construct olefins, ethylene glycol and

polyethylene plants

http://www.sabic.com/sabic-www/press_details.asp?id=183

SABIC

affiliate, Eastern Petrochemical Company (SHARQ), has signed

letters of intent to award contracts to:

| 1. |

Stone & Webster Ltd., UK,

to construct an Olefins Plant with a production capacity

of 1,300,000 MT per annum of

Ethylene; |

| 2. |

Samsung Engineering Company

Ltd., South Korea, to construct its Ethylene

Glycol Plant with a production capacity

of 700,000 MT per annum (increasing

overall Ethylene Glycol production capacity to more than

2,000,000 MT per annum). |

| 3. |

Linde, Germany,

to construct its Linear Low and High

Density Polyethylene plants with a production

capacity of 800,000 MT per

annum, which will increase polyolefins production at

SHARQ to reach more than 1,600,000 MT per annum. |

Mohamed

Al-Mady, SABIC Vice Chairman and CEO said, “SHARQ’s expansion project will add 2.8m

MT annually to SABIC’s production and

will further enhance SHARQ’s position as the

world’s largest single

producer of Ethylene Glycol. This will also enhance SABIC’s global ranking alongside the

other global petrochemicals companies who produce this product.

SABIC is currently ranked 2nd and is expected to become number

one once this project comes on stream. SABIC is the world’s 3rd largest producer of

polyethylene and number four for polyolefins.”

The

agreements will cover engineering, procurement and construction

of the plants at the SHARQ affiliate in Al-Jubail, Saudi Arabia.

These will be complete by the first quarter of 2008.

The letters of intent were signed by Mr. Mohammad Al-Jabri, SHARQ

President, with executive representatives from Stone Webster

Ltd., Samsung Engineering Company and Linde.

SHARQ is a joint venture equally owned by Saudi Basic Industries

Corporation (SABIC) and SPDC Ltd, a Japanese consortium led by

the government of Japan and the Mitsubishi group of companies.

2005/7/25 Aker Kvaerner

ASA (アーカー・クバナー社:本社ノルウェー)

Joint success as Aker

Kvaerner teams with SINOPEC for world scale project

http://www.akerkvaerner.com/Internet/MediaCentre/PressReleases/All/AKPressRelease_1003693.htm

As announced previously

today, Aker Kvaerner has agreed a strategic joint venture with

China Petrochemical Corporation (SINOPEC Group) to execute a

world scale polyolefins project for Saudi Basic Industries

Corporation (SABIC). In Yanbu, Saudi Arabia, the joint venture

has been awarded a letter of intent by YANBU National

Petrochemical Company (YANSAB) - an affiliate of SABIC - for the

engineering, procurement and construction of its world-scale

polyolefins complex.

"We are delighted with this joint achievement. Our

successful cooperation, hard work and mutual understanding has

demonstrated our combined strength in this highly competitive

international environment. This is the first opportunity to unite

our strength, creativity and resource in international bidding.

It establishes a sound basis for us to work together in the

future on a wide variety of business prospects," said Wim

van der Zande, President of AK Process, Aker Kvaerner's European

Process business.

He continued: "Our organisations are extremely focussed on

the successful delivery of this project and our integrated team

is already making preparations to ensure we get underway

quickly."

Aker Kvaerner will be the joint venture leader on this project

for YANSAB, and expects its involvement to be in the region of

USD400 million. The total contract value to the joint venture is

not disclosed. The joint venture will provide the engineering,

procurement and construction for a Linear Low Density

Polyethylene (LLDPE) plant and a Polypropylene (PP) plant, together with the associated

product handling facilities. The new plants, part of a major new

ethylene complex, will each have a nameplate capacity of 400,000

tonnes per annum. The PP plant will use Dow's UNIPOL(TM)

polypropylene technology, whilst the polyethylene plant will

utilise SABIC's LLDPE technology.

There will be an integrated management team, whereby Aker

Kvaerner's scope will include the overall project management

services, the extended basic engineering and procurement of the

critical equipment. SINOPEC will provide the detailed engineering

and a significant proportion of the skilled labour required for

the construction activities.

The project is scheduled to commence at the end of this month,

and the complex is expected to come on stream in April 2008.

1. AKER KV?RNER ASA, through its subsidiaries and affiliates

("Aker Kvaerner"), is a leading global provider of

engineering and construction services, technology products and

integrated solutions. The business within Aker Kvaerner comprises

several industries, including Oil & Gas, Refining &

Chemicals, Mining & Metals, Pharmaceuticals &

Biotechnology, Power Generation and Pulp & Paper. The Aker

Kvaerner group is organised into two principal business streams,

namely Oil & Gas and E&C, each consisting of a number of

separate legal entities. Aker Kvaerner is used as the common

brand/trademark for most of these entities. The parent company in

the group is Aker Kv?rner ASA. Aker Kvaerner has aggregated

annual revenues of approximately NOK 35.6 billion and employs

approximately 22,000 people in more than 30 countries.

2. AK Process is a trading name of Aker Kvaerner Netherlands

B.V., a wholly owned subsidiary of AKER KVAERNER ASA and the

legal entity responsible for the execution of the work. AK

Process serves the chemicals and polymers, refining and onshore

oil & gas industries. It provides the full life cycle of a

project from concept studies, through to design, engineering,

project management, delivery of process technologies,

procurement, construction and maintenance services. As a pure

project execution/EPC specialist, AK Process can provide

customers with strategic 'one-off' services or full turnkey

solutions under a single project management control. It works

with its customers in the development of major technological

innovations, having participated in the conceptualisation and

implementation of ideas, which are the foundation for world-class

production facilities.

3. SABIC is the largest petrochemical producer in the Middle East

and now the 6th largest manufacturer in polypropylene and 4th in

overall polyolefins production. The group produces almost 5

million tons of polyethylene and polypropylene per year. SABIC is

owned by the Saudi Government (70%) and the private sector (30%).

Private sector shareholders are from Saudi Arabia and other

countries of the six-nation Gulf Cooperation Council (GCC).

YANSAB is the newest SABIC affiliate. In addition to the PP and

LLDPE production capacity, YANSAB is planned to produce 1.3

million tpa of Ethylene; 400,000 tpa of Propylene; 500,000 tpa of

High Density Polyethylene (HDPE); 700,000 tpa of Mono Ethylene

Glycol (MEG); and 250,000 tpa of Benzene, xylene and toluene

compound. The complex will manufacture a wide range of basic

chemical, intermediate and polymer products.

4. Sinopec Corp. is one of the largest integrated energy and

chemical companies in China. It is China's largest producer and

distributor of oil products (both wholesale and retail of

gasoline, diesel, jet fuel) and No.1 producer and supplier of

major petrochemical products (including petrochemical

intermediates, synthetic resin, synthetic fibre monomers and

polymers, synthetic fibre and chemical fertilizer), as well as

the 2nd largest crude oil producer.

5. *Polyolefins are a family of polymers derived from propylene

and ethylene. As polymers, they form tough, flexible plastics

with a large variety of uses. Applications range from rigid

materials for refrigerators, computers and car parts, to soft,

flexible fibres. Some have high heat-resistance for microwave

food containers, while others melt easily and can be used for

heat-sealable food packaging. Generally easy to recycle,

polyolefins are steadily replacing traditional materials in many

applications.

2005/10/3 AME Info

SABIC affiliate SHARQ signs three contracts for the

implementation of mega expansion project at its complex in Jubail

Industrial City

http://www.ameinfo.com/69215.html

SABIC's affiliate,

Eastern Petrochemical Company (SHARQ), has recently entered into

three contracts with Stone & Webster Limited, Foster Wheeler

Energy Limited - United Kingdom and LINDE-KCA-Dresden GMBH -

Germany, for the implementation of a mega expansion project at

its complex in the Jubail Industrial city.

The new project's full capacity is expected to go on-stream by

2008.

The three contracts were signed by Dr. Abdulazzez Al-Jarbu ,

Chairman, SHARQ's Board of Directors, Mr. Tim Barfield Chief

Executive Operations, Stone & Webster Limited, Mr. S.J.

Davies Chairman & Chief Executive of Foster Wheeler Energy

Limited, and Dr. Helmut Honnicke of LINDE-KCA-DRESDEN GMBH.

Stone & Webster Limited will carry out the engineering,

supply and construction of Ethylene Plant with a designed annual

capacity of 1.3 million MT. The project completion date is

scheduled for 2Q2008. Foster Wheeler Energy Limited will

construct the utilities & offsite (U&O)

facilities for

SHARQ 3rd Expansion Project, while LINDE-KCA-DRESDEN GMBH will

engineer, supply and construct the Linear Low Density

(LLDPE) and high density (HDPE) polyethylene plants, with total annual

capacity of 800,000 MT which is expected to go on-stream by Q2

2008.

2006/12/18 Gulf

Daily News

Sabic

expansion scheme covers India and China

Sabic

is in talks to build a chemical plant in India

as

part of plans to boost capacity by almost 50 per

cent between 2009 and 2015, the company's CEO said yesterday.

The state-controlled firm, the world's largest chemical company

by market value, expects to reach agreement with a partner to

build the ethylene and other

chemicals-products plant by the end of next year, Mohammed Al Mady said

in an interview in Dubai.

He

declined to give further details.

Sabic,

which expects to produce about 51 million tonnes of chemicals and

steel this year, plans to boost total capacity to 100m tonnes by

2015, building plants in China, India

and Saudi Arabia, and acquiring companies in Europe and the US, Mady said.

It

has already committed to development plans worth at least $25

billion to boost capacity by a third to 68m tonnes in 2009, Mady

said.

In

September, it agreed to buy the

European operations of US chemical maker Huntsman Corp for $700m.

"It

is a huge market," Mady said of India, the world's

second-most populous country. The planned plant would supply the

local market where a surging economy is spurring demand, he said.

Sabic

is also in talks with China's Dalian Shide

and China Petroleum and Petrochemical Corp (Sinopec) about building a plant

in China. The discussions started three years ago, he said.

"Doing

business in China takes patience," Mady said, declining to

predict when he might reach agreement on a China plant.

Sabic,

set up in 1976 to help diversify the Saudi economy away from

crude oil, plans to acquire companies that make

"speciality" chemicals such as rubber and plastics for

vehicles, so that they account for 25 per cent of revenue within

15 years, compared with "very little" now, Mady said.

Last

month, it agreed with ExxonMobil to study setting

up a rubber plant in Saudi.

"Sabic

is looking to diversify its portfolio into specialities,"

Mady said. "We want to build this portfolio for cyclicality.

Also, it will give us a step up in our technological

knowhow," he said.

Oct. 22, 2007 Uhde

New contract for mega

size ammonia plant in Saudi Arabia

Samsung Engineering Co.,

Ltd. of Seoul has commissioned Uhde to provide the licence and

comprehensive engineering and supply services as part of a major

plant contract for the engineering and construction of a turnkey ammonia plant. The contract, worth the

equivalent of some US$950 million, was awarded to Samsung

Engineering Co., Ltd. in South Korea by Ma'aden, the

Saudi Arabian Mining Company.

The ammonia plant will

form part of one of the world's largest fully integrated

fertiliser production operations - a joint venture project

between Ma'aden and Saudi Arabian Basic

Industries Corp. (SABIC) to mine world-scale phosphate

reserves in the north of the country to produce fertilisers at

the new purpose-built processing facility in Ras Az Zawr, some

400km north-east of the Saudi Arabian capital Riyadh. The

facility will also comprise a sulphuric acid

plant, a phosphoric acid plant and two diammonium phosphate

plants. The

project, including the ammonia plant, is due for completion in

late 2010.

Uhde's scope of services

includes the process licence and basic engineering as well as the

supply of special equipment for a single-train ammonia plant,

which, with a production capacity of 3,300 tonnes per

day, will be

one of the world's biggest. For Uhde, the contract is worth a sum

in the three-figure millions of euros.

Ma'aden has decided in

favour of the Uhde Dual-Pressure Process as the technology to be

used in the ammonia plant. It is a particularly reliable and

environment-friendly plant concept which enables single-train

ammonia plants with capacities of 3,000 to 4,000 tonnes per day

to be built. In late 2006 Uhde successfully commissioned an

almost identical ammonia plant in Saudi Arabia for Saudi Arabian

Fertilizer Co. (SAFCO), an affiliate of SABIC.

"This new contract

is the logical continuation of our technological leadership in

the field of mega size ammonia plants and an indication of the

excellent reputation enjoyed by Uhde in the Saudi Arabian

industrial sector," said Klaus Schneiders, Chairman of

Uhde's Executive Board.

Uhde is a company in

the Technologies segment of the ThyssenKrupp Group and has a

workforce of more than 4,100 employees worldwide. The company's

activities focus on the engineering and construction of chemical

and other industrial plants in the following fields: fertilisers;

electrolysis; gas technologies; oil, coal and residue

gasification; refining technologies; organic intermediates,

polymers and synthetic fibres; and also coke plant and

high-pressure technologies. We also provide our customers with

professional services and comprehensive solutions in all areas of

industrial plant operation.

Platts

2007/10/25

Saudi Arabia's SABIC

mulls benzene plant build

Saudi Arabian producer

SABIC is considering building a benzene plant in the kingdom as

part of its strategy to increase aromatics production worldwide,

vice president and CEO Mohamed Al-Mady said Wednesday on the

sidelines of the K 2007 plastics and rubber exhibition in

Dusseldorf, Germany.

The company is already known to be concentrating on boosting

olefins production at home, but Al-Mady suggested there were

further opportunities to be exploited.

"Aromatics are becoming very important," said Al-Mady.

"We have to grow the business fast to complement the

styrenics and ABS business."

He offered no further details regarding the benzene plant.

However, he said that the company was trying to promote an

industry for auto parts in the country, given the abundant

availability of feedstocks.

Brian Gladden, CEO of SABIC Innovative Plastic, said a new

benzene plant in Saudi Arabia would "give SABIC access to

feedstocks and ensure surety of supply."

In the olefins sector, SABIC plans to reach a polyolefin capacity

of 9 million mt in Saudi Arabia by 2010, according to vice

president of SABIC Polymers Abdulrahman Al-Ubaid. This would take

the number of crackers in the area up to 20.

"[Saudi Arabia] is the best place to have polyethylene

manufacturing because of the feedstock availability," said

Al-Mady.

SABIC has a number of units coming on stream in its home country,

including a 500,000-mt/year polypropylene plant at Al Jubail in

2008; new units at Yanbu for 500,000 mt/year of linear

low-density polyethylene; 400,000 mt/year of high-density

polyethylene; and 400,000 mt/year of PP, also by 2008.

Meanwhile, SABIC's SHARQ affiliate is building plants that will

produce 400,000 mt/year each of HDPE and LLDPE from 2008, and

SAUDI KAYAN is constructing units with capacity to produce

400,000 mt/year of HDPE; 300,000 mt/year of LDPE; and 350,000

mt/year of PP from 2010.

2008/2/21 MEED

Petrokemya launches new downstream facility

Jubail-based Arabian Petrochemical Company (Petrokemya) is

planning to build the region's first acrylonitrile butadiene

styrene (ABS) plant at its Jubail olefins complex.

Petrokemya, a wholly-owned affiliate of Saudi Basic Industries

Corporation (Sabic), has invited companies for the contract to

engineer and build the plant, which will have a capacity of 200,000 tonnes a

year (t/y).

The work covers the construction of a polybutediene

plant, a latex unit, a higher rubber graft facility, a styrene

acrylonitrile plant and an ABS compounding unit. Process technology for the scheme

is being supplied by Sabic Innovative Plastics, formerly known as GE Plastics,

which Sabic acquired last year.

Butadiene, acrylonitrile and propylene feedstock for the facility

are likely to be sourced directly from Petrokemya.

The client says it expects to invite bids for the contract in

April, with bids due by the end of June. An award is likely by

the autumn.

Once built, the plant will be the first ABS production facility

in the Gulf. The joint venture of Saudi Aramco and the US' Dow

Chemical Company is also planning an ABS plant at its massive Ras

Tanura integrated refinery and petrochemical complex, although

that is at a less advanced stage of development.

Middle East producers are increasingly going downstream and

integrating their existing production with new products. A

shortage of ethane feedstock in the region is also a factor, with

producers unable to make high yielding ethylene-based derivatives

due to a lack of further gas allocations.

ABS is a thermoplastic commonly used to manufacture rigid, light

molded products such as car parts, musical instruments and pipes.

Total global ABS capacity is more than 7 million t/y.

2008/6/22 AME Info

SABIC and SINOPEC sign strategic cooperation agreement and agree

to expand Tianjin industrial complex

The agreement signed during the visit of Chinese Vice President

Xi Jinping (習近平副主席) is designed to expand the heads of

agreement (HOA) signed by the two companies on Jan 31, 2008,

whereby SABIC will have 50% of the Tianjin complex joint venture

together with a feasibility for adding a new product

(polycarbonates) by using raw materials(ビスフェノールA?) produced at the complex based on

SABIC Innovative Plastics technology.

The agreement also

called for joint work in other future projects in China depending

on each party capabilities in addition to cooperation in certain

areas such as engineering services, project implementation,

R&T, product marketing, and material procurement.

Prince Saud bin Abdullah bin Thenayan Al-Saud, Chairman of the

Royal Commission for Jubail and Yanbu, SABIC Board Chairman

signed for SABIC while Su Shulin, SINOPEC Board Chairman signed

for his company.

The complex is expected to be completed in September 2009 with

investments exceeding $2.5bn. The overall production capacity of

the complex will be approximately 4 million tons of different

petrochemical products including 1.2 million tons of ethylene and

other products such as poly propylene (PP), butadiene, phenol,

and butene-1.

China is the biggest world petrochemical market in light of high

growth rates realized by the Chinese economy. SABIC plans to set

up a manufacturing center in China to boost its presence in Asia

where China represents the biggest market in the Asian continent.

This ensures that SABIC is as close as possible to its customers

through its products and services. This move follows SABIC's

ambition to realize its vision 'To be the preferred world leader

in chemicals.'

2008/2/6 SABICの中国進出

SABICは1月31日、Sinopec との間で、50:50のJVを設立して天津にエチレン誘導品コンプレックスを建設する

Heads of Agreement を締結したと発表した。同日、北京で両社の会長により調印された。

50:50JVは天津に年産60万トンのPEと、40万トンのエチレングリコールのコンプレックスを建設する。

原料のエチレンはSinopecの子会社の天津石油化学(下記)から供給を受ける。

総投資額は17億ドルで、2009年9月に完成の予定

2007/2/13 GE Plastics、中国のPC計画延期

2007/7/5の報道では、GE Plastics を買収したSABICは、同社がサウジでPC計画を進めているため、中国での計画をやる考えはないと言明した。

ーーー

Last month,

Sinopec agreed to let South Korea's SK Energy buy a 35

percent stake, which industry experts said was worth roughly

$1 billion, in an ethylene complex Sinopec is building in

central China.

SABIC, 70 percent owned by the Saudi government, will not be

involved in building the 240,000 barrel per day (bpd) Tianjin

refinery, company officials have said, which is in line with

the petrochemical giant's investment pattern in other regions

such as India.

Sinopec and domestic rival PetroChina are set to add at least

half a dozen huge crackers, costing some $20 billion by 2010,

to cut China's import dependence of nearly half its

petrochemical consumption.

July 13 2008 Reuters

Saudi SAFCO and SABIC unit to build steel plant

Saudi Arabian Fertilizers Co (SAFCO) said on Sunday it had signed

a deal with a steel unit of Saudi Basic Industries Corp to set up

a steel plant with a capacity of 1.7 million metric tonnes a

year.

SAFCO and Saudi Iron and Steel Co (Hadeed) would jointly build

the plant to produce flat steel products at Jubail, with

completion expected in four years, SAFCO said in a statement on

the bourse website.

SABIC, the world's biggest chemicals firm by market value, owns

42 percent of SAFCO.

(SAFCO homepage では、SABIC 41%, SAFCO Employees 10%,

Private Saudi Arabian shareholders 49%)

The deal will "reflect positively" on the company's

results and help SAFCO maintain its level of profitability, SABIC

Chief Executive Mohamed al-Mady said in the statement.

SAFCO's profit surged 125 percent in the second quarter, beating

profit forecasts.

Hadeed will also set up a facility with capacity to produce

500,000 tonnes a year of steel rebar (reinforcing bar) and wire

rods, bringing the new total capacity to 2.2 million tonnes per

year, the company said.

Last year, SABIC said it planned to raise steel output at Hadeed

by 22.6 percent to 6.5 million tonnes by 2010.

"This will meet some of the (demand for) products which are

imported and currently required for the construction and

downstream industries now and in future," Mady said.

A construction boom in the Gulf, fuelled by windfall state

revenues from a more than seven-fold rise in oil prices since

2002, is encouraging more steel producers to expand their

operations in the region.

Global rebar consumption reached 218 million tonnes last year.

Around 65-70 percent of consumption comes from the Middle East

and Asia, while the highest consumption per capita is in the

United Arab Emirates.

The total value of civil projects in the Gulf is estimated at

around $1.5 trillion, and demand for housing is expected to soar

on robust population growth, particularly in Saudi Arabia,

analysts have said.

Gulf rebar consumption was expected to reach 14 million tonnes

this year, a 13 percent increase from 2007.

2008/11/19 albawaba.com

SABIC and ExxonMobil Chemical sign Heads of Agreement

for new Elastomers project in Saudi Arabia

Saudi Basic Industries Corporation (SABIC) and

affiliates of ExxonMobil Chemical have signed a Heads of

Agreement (HOA) and are progressing detailed studies for a new Elastomers project

at their petrochemical joint ventures, Kemya and Yanpet.

The agreement was signed by Mansour Al Kharboush, SABIC

Vice-President, Specialty Products, and by Robert G. Hutchinson,

Vice-President Chemicals, ExxonMobil Saudi Arabia Inc.

The HOA defines the principal terms for the proposed

multibillion dollar project including project scope, technology,

marketing and feedstock supply. The project would establish

a domestic supply of over 400

KTA of carbon black, rubber and thermoplastic specialty

polymers (EPDM, TPO, Butyl, SBR/PBR) to

serve emerging local and international markets. This

project, which includes a vocational training institute and

product application development and support center as part of the

scope, is aligned with Saudi Arabia's National Industrial Cluster

Development Program which is responsible for accelerating growth

and diversification of the manufacturing sector, including the

automotive manufacturing industry.

Nov 18, 2008 Reuters

Exxon, SABIC sign preliminary rubber deal

Saudi Basic Industries Corp 2010.SE (SABIC) and

ExxonMobil Chemical signed a preliminary agreement on Tuesday

to set up a multi-billion dollar synthetic rubber joint

venture in Saudi Arabia, ExxonMobil said in a statement.

The plant will have a production capacity of

400,000 tonnes. The company said in the statement that

detailed studies were progressing for the new elastomers

project at SABIC and ExxonMobil's petrochemical joint

ventures, Kemya (Al-Jubail Petrochemical Co) and Yanpet

(Saudi Yanbu Petrochemical Co).

The statement said Yanpet is a 50-50 joint venture

between Mobil Yanbu Petrochemical Co Inc, an affiliate of

ExxonMobil Chemical and SABIC, and Kemya is a 50-50 joint

venture between SABIC and Exxon Chemical Arabia Inc, an

affiliate of ExxonMobil Chemical.

The final decision to implement the project, which

will need Board of Direcctor approval from both joint

ventures, is subject to completion of more economic

feasibility studies and completion of all other statutory

procedures, the statement said.

SABIC's executives could not immediately be

reached for comment.