Celanese

Blackstone sells its remaining stake of Celanese

2004年に化学品のセラニーズを16億7000億ドルで買収したブラックストーンは、セラニーズ株を上場させた後、

株価上昇に伴い徐々に保有株を売却、2007/5 完全離脱。

経緯

Celanese http://www.celanese.com/home_e.html History

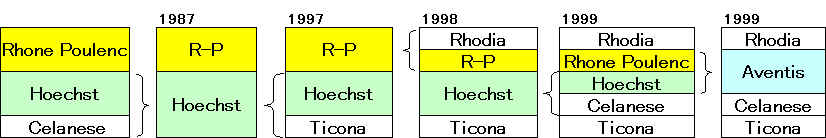

| 1987 | Hoechst AG acquires Celanese Corporation for $2.85 billion. After the approval of the friendly takeover by the U.S. cartel authorities on February 20, 1987, Celanese and American Hoechst Corporation join forces to form Hoechst Celanese Corporation in the U.S. Celanese strengthens Hoechst's fiber, organic chemical and specialty chemical businesses. |

| 1997 | As a result of the strategic realignment of Hoechst AG, the various businesses are transferred to independent companies. The global basic chemical, cellulose acetate, phosphorous and chlorine businesses become part of Celanese. The independent company Ticona - market leader in the field of polyacetals - runs the technical polymers business. |

| 1998 | At its autumn press conference, Hoechst announces plans to demerge most of its chemical activities to the new Celanese AG because it is the most direct, quickest and simplest way to speed up the transformation of the Group. On December 1, Hoechst and Rhone-Poulenc S.A. announce their plans to merge their life science businesses into the new company Aventis S.A., based in Strasbourg. |

| July 16, 1999 | At an Extraordinary General Meeting of Hoechst AG, the overwhelming majority of shareholders agrees to spin off Celanese AG into an independent company. The so-called demerger is part of Hoechst's strategy of focusing on its life science businesses. |

| October 25, 1999 | Celanese AG becomes a publicly traded German stock corporation listed on the New York and Frankfurt stock exchanges. |

Celanese to Build Acetic Acid Plant in China

European Commission clears Celanese-Degussa oxo alcohols JV

Dow Chemical to acquire Celanese acrylics business

Ticona セラニーズAGのエンジニアリングプラスチックス事業担当

中国におけるPOM製造合弁会社設立 三菱ガス化学/ポリプラスチック/Ticona

The Blackstone Group agreed to acquire Celanese AG

2006/12 Celanese Reaches Agreement to Acquire Celanese AG Minority Shares

Celanese Parent Signs Agreement to Acquire Acetex Corporation

Celanese Announces Acquisition of Emulsion Polymer Business from ICI

Celanese to Build Emulsions Plant in China

ダイセルとポリプラスチックス、チコナ社の環状オレフィン・コポリマー事業買収

Acetic acid projects in Nanjing: BP vs. Celanese

Celanese to Construct World-Scale Vinyl Acetate Monomer Plant in China

Celanese Brings Suit Against Saudi Arabian Acetyls Company

Celanese Signs Agreement to Sell Oxo Products and Derivatives Businesses to Advent International

Ticona selects Nanjing, China, for new ultra-high molecular weight PE plant

Ticona Selects Nanjing for Celstran Long-Fiber Reinforced Thermoplastic Plant

Ticona to create new Customer Application Development Center in Shanghai

Celanese starts up acetic acid project in Nanjing

Celanese Selects Frankfurt-Hoechst Industrial Park as Site for Ticonas Kelsterbach Relocation

Celanese Opens Integrated Chemical Complex in Nanjing

Ticona adds compounding unit to Nanjing complex

Ticona to Build Vectra LCP Unit at Celanese’s Nanjing Integrated Chemical Complex

Celanese Develops Advanced Technology for Production of Industrial-Use Ethanol

Ashland to sell PVAc business; integrate ISP elastomer business

Nanjing Industrial Park site

600,000 metric-ton acetic acid → 1,200,000tons

300,000 metric-ton vinyl acetate monomer

100,000 metric-ton acetic anhydride 無水酢酸

constructing specialty acetyl derivatives units

to produce vinyl acetate ethylene emulsions and conventional emulsion polymers.

Ticona new ultra-high molecular weight PE

http://www.celanese.com/index/about_index/about_home.htm

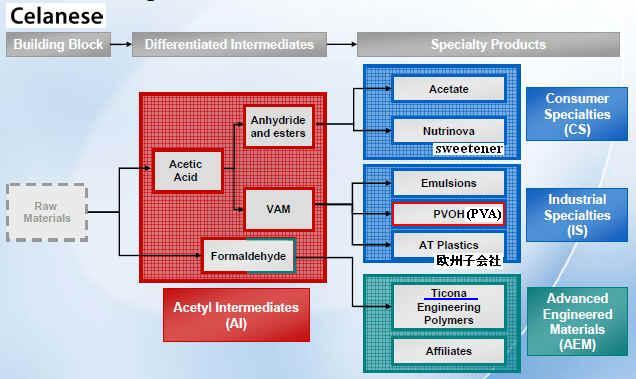

Celanese is a global chemical company with leading positions in its key products and world class process technology. The Celanese portfolio consists of four main business segments: Chemical Products, Acetate Products, Technical Polymers Ticona and Performance Products. The Performance Products business consists of Nutrinova sweeteners and food ingredients.

Celanese generated sales of around Euro 4.1 billion in 2003 and has about 9,500 employees. The company has 24 production plants and six research centers in 10 countries mainly in North America, Europe and Asia.http://www.celanese.com/investor_day_2006_complete_presentation.pdf

2003/3/4 Celanese Acetic

acid projects in Nanjing: BP vs. Celanese

Celanese to Build Acetic Acid Plant in China Celanese Signs Key Raw Material

Contract for Nanjing Site

http://news.eians.com/wire/2003/03/06/06biz8.html

Celanese AG today announced that it has received Chinese government approval to build a world-scale acetic acid plant in the Jiangsu province. The plant will be located at the Nanjing Chemical Industry Park, Nanjing City, in eastern China.

The facility will have an annual capacity of 600,000 metric tons.

2007/6/26 Asia Chemical Weekly

Celanese starts up acetic acid project in Nanjing

In mid Jun. 2007, Celanese has started up its 600,000 tonne/year acetic acid project in Nanjing Chemical Industry Park (NCIP), Nanjing , Jiangsu Province.

According to the company, it has passed commercial qualifications and was running successfully at full production rates. Using its self-owned AO plus technology, the total investment for this project is USD 148 million.

Celanese had signed a long-term contract with WISON ( Nanjing ) Chemical Company惠生(南京)化学 for the supply of CO and methanol feedstock. Earlier, Wison has started up its projects of 300,000 tonne/year CO and 200,000 tonne/year methanol in NCIP, and has produced on spec products. Wison uses the clean coal gasification process to produce products and it also plans to expand the methanol capacity to 280,000 ton per year (and to build additional CO plant of 320,000ton per year).

For Celanese, the acetic acid plant is part of a new integrated acetyls complex, which includes a 300,000 tonne/year vinyl acetate monomer (VAM) project scheduled for start-up in late 2007 or 2008.

In 2006, China produced acetic acid around 1.42 million ton and consumed about 2.1 million tone.なお、同じ南京ケミカルパークで、BPとシノペックの合弁会社BP YPC アセチル(南京)が本年3月23日に酢酸工場の鍬入れ式を行い、建設を開始した。

BPが50%、シノペック子会社の揚子石化が50%出資するもので、メタノールとCOを原料に、BP Amoco がモンサント技術を基に開発したCativa 法で年産50万トンの酢酸を製造する。

2005年11月に設立され、当初は本年下半期のスタートを目標としていたが、建設開始の遅れで、スタートは2009年上半期となっている。BPとシノペックは重慶にも酢酸の合弁会社・揚子江アセチル社(Yaraco)を持っている。BP 51%、Sinopec 44%、地元 5%の出資で、当初能力は20万トンであったが、2005年11月に35万トンに増強している。

January 6, 2004

Blackstone Goes Chemical Friendly

Takeover Offer

http://www.atofina.com/groupe/gb/f_elf_2.cfm

In yet another high-profile chemicals deal-almost an oxymoron before 2003-The Blackstone Group agreed to acquire Celanese AG in a transaction valued at roughly R3.1 billion, or $3.8 billion.

It was these low multiples that brought Blackstone to the chemical arena in 2003. The Celanese purchase represents its second big-ticket chemical deal, having participated in the $4.3 billion purchase of Ondeo Nalco. Apollo Management and GS Capital Partners also took part in the Ondeo Nalco transaction.

Other chemical deals that occurred last year include: Bain Capital's $983 million LBO of SigmaKalon; Texas Pacific Group's $800 million purchase of Kraton Polymers; Soros Private Equity's $256 million buyout of PolymerLatex; and Arsenal Capital Partners' $65 million acquisition of Rutherford Chemicals.

Blackstone Announces Intention to

Launch Friendly Takeover Offer for Celanese AG

http://www.blackstone.com/news/press_releases/12-16-03.pdf

・Voluntary tender offer of EUR

32.50 per share

・Transaction with an

enterprise value of EUR 3.1 billion

・Celanese Management Board

and main shareholder KPC support tender offer

Celanese AG’s largest shareholder, Kuwait Petroleum Corporation (“KPC”), holding approximately 29% of the shares of Celanese AG (excluding treasury shares), has undertaken to accept the tender offer.

ブルームバーグニュース

2004/4/1

米ブラックストーン、独セラニーズ買収を最終決定ーTOB成功で

セラニーズ歓迎

米投資会社ブラックストーン・グループは1日、株式公開買い付け(TOB)が成功したため、接着剤などに使われる酢酸生産最大手、ドイツのセラニーズを16億ユーロ(約2126億円)で買収する計画の完了を最終決定したことを明らかにした。

セラニーズの株式全体の83.6%を保有する株主が、ブラックストーンの買収提案を受け入れた。

2004/4/2 Celanese

Management welcomes positive outcome of Blackstone takeover offer

83.6% of outstanding Celanese shares tendered

Subsequent acceptance period runs until April 19, 2004 inclusively

http://www.celanese.com/mr_news_fullpage?id=21429

"We are very pleased that the vast majority of shareholders have accepted the offer and that all conditions for the successful conclusion of the takeover have been satisfied", said Celanese AG chairman Claudio Sonder. "Blackstone is an excellent global financial investor and partner for Celanese and has clearly expressed its support and intended continuation of the growth and productivity strategy we have initiated."

Oct 27 2004 Celanese AG

Celanese Parent Signs Agreement to Acquire Acetex Corporation

http://www.celanese.com/mr_news_fullpage?id=22799

Blackstone Crystal Holdings Capital

Partners (Cayman) IV Ltd.

(BCP Crystal) and Acetex Corporation (Acetex) announced today that they have signed an

Arrangement Agreement for BCP Crystal to acquire Acetex in a

transaction valued at approximately CDN $600 million (USD $492

million). Under the terms of the Arrangement Agreement, BCP

Crystal will acquire all of the issued and outstanding common

shares of Acetex for CDN $9.00 (USD $7.38) cash per share. Acetex

option and warrant holders are eligible to receive CDN $9.00

cash, less the exercise price of each option or warrant.

Acetex will

be operated as part of BCP Crystal’s global Celanese

chemicals business.

Acetex with 2003 revenues of USD $484 million and approximately

900 employees worldwide has two primary businesses - its Acetyls Business and

the Specialty Polymers and Films Business. The Acetyls business, based in Europe,

produces acetic acid, polyvinyl alcohol and vinyl acetate

monomer.

Acetex is headquartered in Vancouver, Canada. The Company

operates production facilities in France, Spain, and Canada, and

sells to customers primarily in Europe, the United States, and

Canada. Acetex’s common

shares are listed for trading under the symbol “ATX” on

The Toronto Stock Exchange, which has neither approved nor

disapproved the information contained herein.

Acetex has

announced plans for a joint venture for the

construction and operation of a USD $1 billion integrated

world-scale acetyls facility in Al Jubail, Saudi Arabia. Acetex is proceeding, in conjunction with

its partners, with the front-end engineering design for the

construction of the plant. The JV partner is National Petrochemical

Industrialization Company (TASNEE). The project will benefit from favorable

natural gas supply as well as from Acetex's proprietary

integration technology. Acetex will own 50% of the acetyls

company (acetic acid and VAM) and 25% of the methanol company and

expects to enter long-term methanol supply agreements with the

joint venture to cover its methanol requirements in Saudi Arabia

and Europe.

Acetex Corporation http://www.acetex.com/100/index.html

Acetex Corporation is Europe's second largest producer of acetic acid and polyvinyl alcohol and third largest producer of vinyl acetate monomer. These chemicals and their derivatives are used in a wide range of applications in the automotive, construction, packaging, pharmaceutical and textile industries. We direct our operations from our corporate head office in Vancouver, Canada and our European head office in Paris, France. Acetex has plants in France and Spain and sales offices throughout Europe. Our shares trade on the Toronto Stock Exchange under the symbol ATX.

On August 5, 2003, Acetex Corporation announced the completion of its amalgamation with AT Plastics Inc.. The AT Plastics business of Acetex develops and manufactures specialty polymers and films products. Specialty polymers are used in the manufacture of a variety of plastics products, including packaging and laminating products, auto parts, adhesives and medical products. The films business focuses on products for the agricultural, horticultural and construction industries.

November 23, 2004 Celanese

Celanese Announces Acquisition of Emulsion Polymer Business from

ICI

Celanese announced today that it has agreed to purchase Vinamul Polymers, the emulsion polymer

business of National

Starch and Chemical Company (NSC), for $208 million, subject to

regulatory approvals and other customary conditions. NSC is a

subsidiary of Imperial Chemical Industries PLC (ICI).

Emulsion polymers enhance the performance of adhesives, paints

and coatings, textiles, paper, building products and other goods.

The Vinamul Polymers product line includes vinyl acetate-ethylene

(VAE) copolymers, vinyl acetate homopolymers and copolymers, and

acrylic and vinyl acrylic emulsions.

2005/7/6 Celanese

Celanese to Build Emulsions Plant in China

http://www.celanese.com/index/mr_index/mr_news/c_news_fullpage-link?id=29639

Celanese Corporation

announced today the intention of a strategic investment in the

construction of a state-of-the-art Vinyl Acetate

Ethylene and

Conventional

Emulsion Polymer facility in China. The new plant will

incorporate the leading technology from the other emulsions

plants that Celanese operates around the world. The site

selection process is in an advanced stage and the facility is

planned to be operational in the first half of 2007.

Celanese made its first emulsions acquisition from

Clariant in

2002 and completed the acquisition of the Vinamul

emulsions business from ICI in February 2005. Celanese’s global emulsions business has 10

production facilities in Europe and North America and a leading

position in its respective markets. The Celanese Emulsions

buisness serves a wide variety of markets, including paints and

coatings, adhesives, non-wovens, glassfiber, construction, paper,

and textiles.

Celanese has been doing business in China since the 1960s and

began to establish joint ventures in China in the 1980s. It has

long-standing ventures in cellulose acetate and recently

established a new polyacetal engineering

plastics joint venture site in Nantong. In addition, Celanese operates a

trading company in Shanghai and offices throughout the mainland

China.

Celanese is currently building a 600,000

metric ton acetic acid plant in the Nanjing Chemical Industry

Park in Nanjing, China. The plant will be ready for

production in late 2006 or early 2007. The company also recently

announced the investment in a world-scale 20,000 ton GUR(R)

ultra high molecular weight polyethylene (UHMW-PE) plant in Asia that will be operational in the

second half of 2007.

Ticona Completes 30,000 Ton Plant for GUR(R) Ultra-High Molecular Weight Polyethylene in Bishop, Texas

New Plant to Meet Increased Demand, Provide Manufacturing Efficiencies

http://www.celanese.com/index/mr_index/mr_news/c_news_fullpage-link?id=10288Ticona, a business of Celanese AG, today announced completion of its new 30,000 metric tons/year (approx. 60 million lbs/year), $50-million plant at Bishop, TX, to manufacture GUR(R) ultra-high molecular weight polyethylene (UHMW-PE). Startup of the new GUR plant is set for early July this year. As previously announced, the new plant doubles the company's GUR capacity in North America and will replace its existing GUR plant in Bayport, TX.

GUR(R) UHMW-PE has an extremely low coefficient of friction and provides outstanding abrasion resistance and toughness. It is often used in demanding material handling applications in bottling machines, papermaking equipment, chemicals and other process industries. Typical GUR applications include bulk containers, truck linings, conveyor chain guides, marine dock fenders, automotive battery separators, pump housings, and ski and snowboard bottoms. GUR is also used to produce porous products for writing instruments, air and water filters for industrial and residential use, and wear resistant and texturing additives for thermoplastics, elastomers, paints and coatings.Ticona, the world's leading producer of UHMW-PE, also operates a GUR plant in Oberhausen, Germany. When the new plant is completed, the company's total GUR capacity will be about 60,000 metric tons/year (approx. 120 million lbs/year).

Celanese Brings Suit Against Saudi Arabian Acetyls Company

Celanese Corporation announced today that it has filed suit in district court in Harris County, Texas, against Saudi International Petrochemical Company, International Acetyls Company and International Vinyl Acetate Company seeking injunctive relief to prevent the defendants from using Celanese's trade secrets, confidential information and know-how in the construction and operation of vinyl acetate monomer and acetic acid facilities the defendants plan to build in Al Jubail, Saudi Arabia.

"Celanese commenced this action as part of its continuing efforts to ensure that its technology and other valuable intellectual property are not misappropriated or illegally used by our competitors," said John O'Dwyer, president of Celanese Chemicals, "Celanese will take all appropriate actions to protect its critical technological advantages."

Celanese's Petition alleges that the defendants engaged in a calculated campaign to misappropriate and commercialize Celanese's confidential information. The Petition asserts that defendants, acting directly and through agents, among other acts, aggressively recruited and hired former or current Celanese employees, identified and retained engineering and construction firms that had extensive experience working on Celanese's acetyl projects, and vendors and other suppliers with intimate knowledge of Celanese's trade secrets.

Acetex announces $1 Billion expansion project → Saudi Sipchem, Helm Arabia sign AA-VAM projects JV, offtake deal

Tasnee 2006/3期末報告

Acetic acid and Methanol Project :

It has been agreed with Celanese Co., the foreign partner of this project, to temporarily suspend negotiations as a result of current international obligations relating to contractors and equipment suppliers. Presently, the company is studying available alternatives.

2006/11/20 Sipchem

Sipchem denies alleged claims in a lawsuit

Sipchem has learned that Celanese Ltd. has filed a lawsuit against it and two of its affiliates in Texas, USA. Sipchem strongly denies Celanese's claims that Sipchem has misappropriated Celanese's alleged trade secrets in connection with Sipchem's design and construction of its acetic acid manufacturing plant and vinyl acetate monomer manufacturing plant in Al Jubail, Saudi Arabia. Sipchem intends to defend vigorously against Celanese's claims. Contrary to those claims, which are baseless and without merit, the relevant Sipchem's affiliates' facilities have been designed and are being built using technologies properly licensed from Eastman Chemical and DuPont.

Celanese to Construct

World-Scale Vinyl Acetate Monomer Plant in China;

Announces New VAntage Plus(TM) Technology for Vinyl Acetate

Celanese Corporation, announced today that it will build a 300,000 metric ton, world-scale vinyl acetate monomer (VAM) plant at the company's Nanjing, China chemical complex. The plant is expected to be operational in late 2007 or early 2008.

"As the world's leading producer of VAM and other acetyl-based products, we believe it is important to have a manufacturing presence in the world's fastest growing region to supply our customers with a reliable, locally produced product," said David Weidman, president and chief executive officer. "This investment is consistent with our strategy to maintain our number one position in the VAM market."

The VAM plant will receive acetic acid, a key raw material, from Celanese's 600,000 metric ton acetic acid plant in Nanjing, which will begin commercial sales in early 2007. The company currently operates seven plants around the world to produce VAM, which is used to make such products as paints, coatings, adhesives and fibers.

The company also announced today that in 2006 it will begin implementation of its next generation of VAM technology called VAntage PlusTM. The new technology will further improve production efficiency and lower operating costs as it is phased into Celanese's VAM units over the next several years. In 2005, Celanese completed implementation of its VAntageTM technology in the last of its six ethylene-based VAM units. VAntageTM not only enhanced production efficiency, but also increased Celanese's overall VAM production capacity by 265,000 metric tons,

Dec 13, 2006

Celanese

Celanese Signs Agreement to Sell Oxo Products and Derivatives

Businesses to Advent International

Celanese Corporation today announced that it has entered into an

agreement to sell its oxo products and derivatives

businesses, including European Oxo GmbH (“EOXO”), a joint venture between

Celanese AG and Degussa AG, to Advent International, a

global private equity firm, for the purchase price of EUR 480

million, which is approximately USD $630 million at current

exchange rates. This sale is consistent with Celanese’s strategy to optimize its

portfolio and divest non-core businesses.

The sale includes oxo and derivative businesses at Celanese’s Oberhausen, Germany, and Bay City, Texas, facilities; and portions of its Bishop, Texas, facility. ?EOXO’s facilities within the Oberhausen and Marl, Germany, plants are also included in the sale. As part of the transaction, Celanese will transfer all of the EOXO business to Advent International, including Degussa’s 50 percent interest of the venture.

Dec 22, 2006 Celanese

Celanese Reaches Agreement to Acquire Celanese AG Minority Shares

Celanese Corporation, a global hybrid chemical company, announced

today that it has reached an agreement with the minority

shareholders of Celanese AG, its German subsidiary, to acquire

their shares for EUR 66.99 per share, the same price offered by

Celanese in May 2006. The total purchase price for the minority

shares, representing 2 percent of the outstanding shares, is

approximately USD $80 million.

The minority shareholders have dismissed their

legal actions challenging the completion of the acquisition of

Celanese AG,

which began in 2004.

経緯:

2004/4/1 米ブラックストーン、独セラニーズ買収を最終決定ーTOB成功で

セラニーズを16億ユーロ(約2126億円)で買収する計画の完了を最終決定セラニーズの株式全体の83.6%を保有する株主が、ブラックストーンの買収提案を受け入れた。

提示額は1株当たり32.50ユーロ (発表前の2003年12月16日の終値に比べ15%上乗せした水準)

セラニーズの株主総会決議に対し、少数株主9人が手続き違反を理由に訴訟。

February 15 2007

Ticona

Ticona Selects Nanjing, China, for New GURR Plant

Ultra-High Molecular Weight Polyethylene Plant to Be Operational

in Second Half of 2008

Ticona, the engineering polymers business of Celanese

Corporation, announced today that it will locate a new GUR(R) ultra-high

molecular weight polyethylene (UHMW-PE) facility at the

Celanese integrated chemical complex in Nanjing, China.

The new, world-class 20,000 metric ton plant will increase the company’s global GUR UHMW-PE capacity to

90,000 metric tons and is expected to begin commercial operations

in the second half of 2008.

Ticona Completes 30,000 Ton Plant for GUR(R) in Bishop, Texas

Ticona, the world's leading producer of UHMW-PE, also operates a GUR plant in Oberhausen, Germany. When the new plant is completed, the company's total GUR capacity will be about 60,000 metric tons/year.

1999年12月22日

独Ticona社、超高分子量ポリエチレン事業で日本法人設立

ドイツのセラニーズ社のエンジニアリングプラスチック事業部門会社であるTicona社は、超高分子量ポリエチレン「GUR」に関するアジア地域における事業を手掛ける日本法人のTiconaジャパンを設立することを、99年12月20日に発表した。本社は東京に置く予定。また、ダイセル化学との合弁会社であるポリプラスチックスは「GUR」を手掛けないことも併せて発表した。

Celanese is currently

developing its fully integrated acetyls complex at the Nanjing

Industrial Park site, which consists of a 600,000

metric-ton acetic acid facility, a 300,000 metric-ton vinyl

acetate monomer plant and a 100,000 metric-ton acetic anhydride 無水酢酸 unit. The company is also constructing

specialty acetyl derivatives units to produce vinyl acetate

ethylene emulsions and conventional emulsion polymers.

2分子の酢酸を脱水縮合させると無水酢酸が得られる。

Apr 30, 2007 Celanese

Ticona Selects Nanjing, China, for Celstranョ

Long-Fiber

Reinforced Thermoplastic (LFRT) Plant

Facility to be Operational in Early 2008

Ticona, the engineering polymers business of Celanese

Corporation, announced today that it will co-locate a new

Celstran(R) long-fiber reinforced

thermoplasic

(LFRT) plant at Celanese’s integrated chemical complex in

Nanjing, China, scheduled to become operational in early 2008.

This new investment supports the companies’

Asia growth

strategies, which also include previously announced plans to

construct production facilities for Ticona’s GURR ultra-high molecular weight

polyethylene at the Celanese Nanjing integrated

chemical complex in Nanjing, China.

"Asia is a region of impressive growth opportunities for us

and our customers,"said Roeland Polet, vice president of

Ticona. "Targeted investment in the construction of

compounding and production facilities in this region will

strengthen our position as a leading global supplier of LFRT.

When the new facility is operational in Nanjing, we will have a

global production capacity of more than 35,000 tons per

year," Polet said.

At the present time, Ticona produces LFRT in Kelsterbach,

Germany, and Winona, Minn.

| http://www.daicelpolymer.com/ja/plastron/plastron.html ダイセルポリマーではプラストロン

を、米国TICONA社との技術提携によって、日本を含む東南アジア地区で開発・生産・販売しております。また北米、欧州においてはTICONA社(商品名

CELSTRAN)との提携による現地でのサポートを提供いたします。 |

May 23 2007 Ticona

Ticona to create

new Customer Application Development Center in Shanghai

Wide range of

locally based services in Asia as part of global support network

Ticona, the

engineering polymers business of Celanese Corporation, announced

plans today at Chinaplas 2007 to create a Customer

Application Development Center in Shanghai. When completed, the new Center

will be part of a global support network that includes similar

Ticona centers in Kelsterbach, Germany, and Auburn Hills,

Michigan, USA.

In mid-May, Ticona

also held a ground-breaking ceremony in Nanjing, China for two

new production plants- one for GURR ultrahigh molecular weight

polyethylene (UHMW-PE) and the other for Celstran(R)

long fiber-reinforced thermoplastic (LFRT). Both facilities are being built in

the Nanjing Chemical Industrial Park adjacent to the Celanese

integrated acetyls complex. The LFRT facility will come on stream

in the first half of 2008, while the UHME-PE plant will be

completed in the second half of 2008. The new production

facilities will bring Ticona’s annual global capacity for GUR

to more than 90 000 tonnes and raise its annual global Celstran

LFRT capacity to more than 35 000 tonnes.

November 15, 2004 Chemical & Engineering News

Nalco Launches An IPO; Celanese Readies One

Seven months after

completing the $3.8 billion buyout of Germany's Celanese,

Blackstone has filed a preliminary prospectus with the Securities

& Exchange Commission to raise $750 million in an IPO of some

of its stock in the now U.S.-based firm. Blackstone hasn't set a

date for the offering yet, but says that funds raised will go to

paying itself a dividend and cutting Celanese debt.

Instead of waiting the typical three years or more to begin

selling their positions in chemical assets, "investment

bankers are being opportunistic," given the fairly strong

demand for U.S. chemical stocks, says Michael Judd, an analyst at

independent research firm Greenwich Consultants.

2004/12/22

Blackstone has raised anticipated proceeds from its planned initial public offering (IPO) of a partial stake in Celanese to $1 billion, up from $750 million, according to regulatory filings last week. Share pricing or size of the stake to be offered was not disclosed....

January 14, 2005

CBS.MarketWatch.com

Blackstone's $1B Celanese IPO kicks off '05

The Blackstone Group kicks off the 2005 season for initial public

offerings in coming days with a $1 billion deal from chemical

firm Celanese, one of many IPOs expected from private equity

firms this year.

Celanese to raise $1 billion

Celanese plans to offer 50 million shares at $19 to $21 each in a

bid to raise about $1 billion via underwriters Morgan Stanley,

Goldman Sachs and Lehman Brothers.

The company plans to trade on the New York Stock Exchange under

the ticker symbol "CE."

Blackstone issued plans in December 2003 to buy the firm for

about $3.8 billion. Celanese AG of Germany traded U.S.-listed

shares under the ticker CZ.

Celanese is going public amid an expected upswing in the chemical

business this year, according to industry observers.

2007/5/29 www.plasteurope.com 経緯

Celanese:

Blackstone sells its remaining stake

Private equity giant Blackstone has completed its exit from

chemicals and plastics producer Celanese. Blackstone received

nearly USD 785m (EUR 581m) from the offering. Celanese, parent

company of engineering plastics producer Ticona, did not receive

any of the proceeds. This was the last of several major stock

transactions by Blackstone since acquiring the chemicals arm of

the former Hoechst in 2004. In all, it is believed have earned USD 5 bn on

the takeover.

2007/5/16 www.financialnews-us.com

Blackstone gains to top $5bn with final Celanese exit

US-based alternatives investments firm Blackstone Group is preparing to raise another $777m (?571m) by selling the remainder of its shares in chemicals company Celanese to complete its exit from Europe's most successful buyout.

Blackstone will have made more than $5bn in profit from Celanese, which it delisted from the main German stock market in 2004 and re-listed a year later in New York.

Morgan Stanley is handling Blackstone's final sale of 22.1 million shares, which are to be sold at market prices.

Celanese shares closed at $35.17 each last night, which is more than double the January 2005 flotation price of $16 per share. Blackstone sold 50 million shares in the IPO, raising US$800m. The flotation also gave Blackstone more than $1bn in a special dividend while the buyout firm took another $500m and $750m of equity through two refinancings in 2004.

Blackstone originally paid $4bn, including $850m in equity, to take the company private.

In November 2005, Blackstone cut its stake to near 50% with the sale of 12 million shares at $17.10 each through Credit Suisse. The buyout firm's stake was reduced down to 14%, 22 million shares, since that time.

Blackstone was unavailable for comment but its success has caused consternation in the German press and among rivals as its profits have been seen as excessive and detrimental to the chances of further buyouts in the country.

However, those close to Blackstone have previously argued its success came partly from taking advantage of the different multiples available by re-listing in New York compared to Germany but primarily from the upturn in the chemicals pricing cycle and operational and strategic improvements, including acquisitions and divestments.

In December, Celanese sold its German products and derivatives business, Oxo, to buyout firm Advent International for $635m. Last year, the company had net sales of $6.7bn, with more than 60% of revenues generated outside of North America.

July 27 2007

Ticona

Celanese Selects

Frankfurt-Hoechst Industrial Park as Site for Ticonas Kelsterbach

Relocation

Celanese Corporation, a global, hybrid chemical company, today announced that Frankfurt-Hoechst Industrial Park has been selected as the new site for Ticona’s Kelsterbach production operations in Germany.

In November 2006, Celanese and Ticona, the engineered materials business of Celanese, along with Fraport, the operator of the Frankfurt airport, agreed that Ticona’s Kelsterbach chemical plant would relocate by mid-2011 in order to make room for an airport expansion.

Celanese Opens Integrated Chemical Complex in Nanjing

On September 19th, 2007

Celanese Corporation, a global hybrid chemical company,

celebrated the inauguration of its integrated chemical complex in

Nanjing. The Complex is located in the Nanjing Chemical

Industrial Park, Jiangsu province, East China, one of the two

national chemical parks approved by the National Development and

Reform Commission.

Celanese's integrated chemical complex in Nanjing brings

world-class scale and leading technology to one site for the

production of acetic acid, vinyl acetate

monomer, acetic anhydride, emulsions, Celstran (R) long

fiber-reinforced thermoplastic (LFRT) and GUR(R) ultra-high

molecular weight polyethylene (UHMW-PE).

The complex will further enhance

Celanese's capabilities to better meet the growing needs of its

customers in a number of industries across Asia. The acetic acid

facility has been running at full production rates since June

2007 and production of vinyl acetate emulsions is set to commence

by the end of 2007. Operations for four other plants will begin

throughout 2008.

2007/2/22 セラニーズの中国での活動

Ticona adds compounding

unit to Nanjing complex

The 15,000 tonnes a year operation to grow Ticona’s Asian footprint.

Ticona is to add an integrated compounding unit at the recently

opened plant of its parent company Celanese at

Nanjing, in China,

further extending its strong position in the Asian market.

The new 15,000 tonnes a year operation, scheduled to

start up in the first quarter of 2009, will produce advanced

engineered compounds for customers in the region in a variety of

the company’s engineering thermoplastics. The

polymers from which compounds will be made at the Nanjing plant

include Vectra liquid crystal polymers, Hostaform polyacetal,

Celanex thermoplastic polyester, Riteflex TPE and Fortron PPS.

Ticona to Build Vectra LCP Unit at

Celanese’s Nanjing Integrated Chemical

Complex

Facility to be Operational in 2010

Ticona, the engineering

polymers business of Celanese Corporation, announced today that

it plans to build a new Vectra(R) liquid crystal

polymer (LCP) production facility co-located at the Celanese

integrated chemical complex in Nanjing, China. Construction is

slated to begin in the first half of 2009, and the facility is

projected to be operational in 2010. (7,000t/a)

Ticona currently

produces Celstran(R) long fiber reinforced

thermoplastic (LFRT)

and GUR(R) ultra-high molecular weight

polyethylene (UHMW-PE) at the Nanjing complex. The GUR

unit successfully began commercial operations in July 2008. A

compounding unit is scheduled to be operational in early 2009.

Oct 26, 2009 Celanese

Corporation

Celanese Announces Emulsions Expansion in China

New investment responds to growing demand for VAE emulsion

technology; Expansion to support company’s growth throughout Asia

Celanese Corporation, a leading, global chemical company, today

announced it is expanding its vinyl

acetate/ethylene (VAE) manufacturing facility at its Nanjing, China, integrated

chemical complex. The investment will support

continued growth plans for the Celanese Emulsion Polymers

business throughout Asia, including China, India and Southeast

Asia and Australia. The expanded facility will double the company’s VAE capacity in the region and is expected to be operational

the first half of 2011.

“This

expansion anticipates continuing strong growth for high

performing VAE emulsions in the region,”

said Doug Madden,

Celanese corporate executive vice president. “Celanese is committed to growth

within China and across Asia, and this expansion is a solid

example of our ongoing investment in the region. We recognize the

importance of planning for the future growth of our Emulsions

business and are preparing for growth by building upon our past

success at our Nanjing facility.”

The emulsions

expansion is the latest in a number of investments by Celanese in

China. Nanjing is currently the largest integrated site in the

Celanese global manufacturing network with six production units

including acetic acid and vinyl acetate

monomer (VAM), several units from Celanese’s Ticona business and the existing

emulsions plant.

“Since

our first manufacturing activities in China just over three years

ago, Celanese Emulsion Polymers has grown into a thriving

organization in China and is presently expanding across Asia,

into India and surrounding countries, Southeast Asia, and

Australia,” said Phil McDivitt, general

manager, Celanese Emulsion Polymers. “As a global leader in vinyl-based

chemistries, Celanese Emulsion Polymers brings innovation to our

customers and we will continue to introduce cutting-edge products

such as our EcoVAEョ emulsions,”

said McDivitt.

EcoVAE emulsions, introduced in 2008, are

high-performing binders used in low odor, low VOC,

environmentally-friendly paints and coatings. In addition, the

emulsions expansion will support many industries including

adhesives, waterproofing, building and construction.

The new VAE emulsions plant will yield manufacturing and supply

chain synergies with the company’s current facilities that

manufacture vinyl-based homo- and copolymers, pure acrylic and

VAE emulsions. The expanded facility will be built utilizing

best-in-class technologies drawn from the company’s global manufacturing footprint

including Europe and the Americas.

Dec 3, 2009 Celanese

Corporation

Celanese Signs MOU with China National Tobacco Corporation to

Expand Flake and Tow Capabilities at Nantong Facility

Celanese Corporation, a leading, global chemical company, today

announced it has previously signed a memorandum of understanding

with its acetate joint venture partner, the China National

Tobacco Corporation, to expand flake and tow capacities at its

joint venture facility in Nantong, China. Additionally, a

feasibility study has been completed by the partners and the

expansion project is currently under review and is awaiting final

approval by the appropriate Chinese government agencies.

JV

Nantong Cellulose Fibers Co.,

Zhuhai Cellulose Fibers Co. and

Kumming Cellulose Fibers Co

Celanese Develops

Advanced Technology for Production of Industrial-Use Ethanol

Manufacturing Capability Planned for China and U.S.

Celanese Corporation, a global technology and specialty materials company, today announced its intention to construct manufacturing facilities in China and the U.S. to utilize recently-developed advanced technology for the production of ethanol for chemical applications and other industrial uses. Celanese's innovative process technology builds on the company's industry-leading acetyl platform and integrates new technologies to produce ethanol using basic hydrocarbon feedstocks.

In Nanjing Chemical Industry Park (NCIP), by using syngas feedstock sourced from Wison, and its self owned AO Plus process, Celanese is operating a world scale acetic acid plant with total capacity of 1.2 Mt/a.

"We are very excited about our technology advancement as it allows us to address growing global demand for ethanol in industrial applications," said Dave Weidman, chairman and chief executive officer. "The company has successfully integrated newly developed technologies with elements of our proprietary advanced acetyl platform to provide an economically-advantaged solution for global ethanol needs."

Following necessary approvals, Celanese intends to construct one, and possibly two, industrial ethanol complexes in China to serve the fast-growing Asia region. Initial annual production capacity of each complex is expected to be approximately 400,000 tons. The company could begin industrial ethanol production within 30 months after project approvals. Current chemical application demand for ethanol in China is approximately 3 million tons annually and is expected to grow between 8% and 10% per year. Celanese's technology allows capacity to be more than doubled at significantly less than the original investment to meet future demand. The China units would utilize coal as the primary raw material.

Celanese also intends to build an approximately 40,000 ton industrial ethanol production unit at its Clear Lake, Texas, facility for either internal use or merchant demand. The unit will also support continuing technology development efforts over the next several years. Following approvals, construction of the unit is anticipated to begin in mid-2011 and to be completed by the end of 2012. The Clear Lake facility would utilize natural gas as its primary raw material.

Weidman also said: "While we are focusing on industrial uses at this time, we are also exploring opportunities to apply this technology to fuel ethanol applications in regions where the commercial environment is supportive."

According to the data from ASIACHEM Consulting, in China , the research institutes of syngas to ethanol including DICP-CAS and NICE of Shenhua. If use coal as the primary feedstock, the syngas to ethanol will have 3 steps: firstly, production of syngas by coal gasification (CO, H2); secondly, conversion of syngas to ethanol by catalyst; thirdly, distillation of ethanol (high purity).'s uses in chemical and industrial applications include the manufacture of paints, coatings, inks and pharmaceuticals.

National Institute of Clean-And-Low-Carbon Energy (NICE) was setup in December of 2009. Funded by the Shenhua Group - the largest coal producer in China, NICE is the national research institute focused on energy and covers the R&D for clean utilization of coal, and develop other clean energy technology.

2011/1/19

Celanese Signs Letters of Intent for Ethanol Production Facilities in Nanjing and Zhuhai, China

Celanese Corporation, a global technology and specialty materials company, today announced that its wholly owned subsidiary, Celanese Far East Limited, has signed letters of intent to construct and operate industrial ethanol production facilities in Nanjing, China, at the Nanjing Chemical Industrial Park and in Zhuhai, China, at the Gaolan Port Economic Zone.

Pending project approvals, Celanese could begin industrial ethanol production within the next 30 months with an initial nameplate capacity of 400,000 tons per year per plant with an initial investment of approximately USD$300 million per plant. The company is pursuing approval at two locations to ensure its ability to effectively grow with future demand.

The projects will use Celanese’s newly developed advanced technology to produce industrial ethanol. This innovative, new process combines Celanese’s proprietary and industry-leading acetyl platform with highly advanced manufacturing technology to produce ethanol from hydrocarbon-sourced feedstocks. To meet future demand, Celanese’s technology also allows capacity at each facility to be more than doubled at significantly less than the original investment.

Industrial ethanol is used in chemical and industrial applications for the manufacture of paints, coatings, inks and pharmaceuticals. Current demand for industrial ethanol in China is approximately 3 million tons annually and is expected to grow between 8% and 10% per year.

In September 2007, Celanese’s Nanjing Integrated Chemical Complex officially opened with world-class scale, technology and production facilities. The primary products at the site include acetic acid, vinyl acetate, acetic anhydride, vinyl acetate-ethylene copolymer emulsion, Celstran ® long fiber reinforced thermoplastics and GUR ® ultra-high molecular weight polyethylene (UHMW-PE). The Celanese Nanjing Integrated Chemical Complex is the company’s largest integrated chemical plant, reflecting the company’s long-term commitment to the Asia region.

About Celanese

Celanese Corporation is a global technology leader in the

production of specialty materials and chemical products which are

used in most major industries and consumer applications. Our

products, essential to everyday living, are manufactured in North

America, Europe and Asia. Known for operational excellence,

sustainability and premier safety performance, Celanese delivers

value to customers around the globe with best-in-class

technologies. Based in Dallas, Texas, the company employs

approximately 7,400 employees worldwide and had 2009 net sales of

$5.1 billion, with approximately 73% generated outside of North

America. For more information about Celanese Corporation and its

global product offerings, visit www.celanese.com.

Ashland to sell PVAc business; integrate ISP elastomer business

Ashland has entered into a definitive agreement to sell its polyvinyl acetate homopolymer and copolymer (PVAc) business to Celanese. Revenues of the product lines were approximately $45 million in 2010. The purchase price was not disclosed. The proposed transaction includes the transfer of the PVAc business, inventory and related technology. The sale does not include any real estate or manufacturing facilities.

Ashland is making the transaction to better focus its resources on more strategic assets and product lines. The transaction is expected to close within 60 days, subject to fulfillment of certain conditions, and the parties have agreed to work together to ensure a seamless transition with no disruption in customer service. To better support the transition, the products will be temporarily toll manufactured for Celanese.

The ISP elastomers business is being integrated into the Ashland Performance Materials commercial units. Elastomers had significant sales in the transportation market, as well as the position in specialty adhesives, both of which complement Performance Materials. In 2011, elastomers accounted for $410 million of ISP’s $1.9 billion of sales.

08/23/2011Ashland Inc., a global leader in specialty chemical solutions for consumer and industrial markets, today completed its acquisition of privately owned International Specialty Products Inc. (ISP), a global specialty chemical manufacturer of innovative functional ingredients and technologies. The purchase was an all-cash transaction for $3.2 billion, subject to post-closing adjustments for changes in net working capital and certain other items.

2013年5月15日 三井物産 2015/10 米テキサス州でのメタノール生産開始

米セラニーズコーポレーションとテキサス州でメタノール製造事業に参画

三井物産と米国化学品大手の Celanese Corporation(本社:テキサス州ダラス市)は、折半出資の事業会社を設立しテキサス州クリアレイクのセラニーズ社工場内でメタノール製造を行うことで合意し、合弁契約書を締結しました。

三井物産は米国シェールガス・オイル革命により安定供給と価格競争力が期待できる原料ガスの優位性に着目し、世界第2位のメタノール市場である米国で事業参画の機会をうかがってきました。一方、メタノール需要家であるセラニーズ社は、パートナーとの合弁によるメタノール製造事業を検討しており、両社の意向が合致した結果、同事業を共同で推進することとなりました。

同事業では、グローバルに販売ネットワークを持つ三井物産と世界最大のメタノール需要家の一社であるセラニーズ社がパートナーを組み、年産130万トンの大型プラントを建設します。原料の価格競争力に加え、セラニーズ社のインフラを活用することで建設費用を抑え、更にコスト競争力を高めます。製造したメタノールは両社が引取り、三井物産は主に米国内で販売し、セラニーズ社は自社の川下製品の原料として使用します。

三井物産とセラニーズ社は、今後同事業に続く共同事業の検討などを通じて長期的なパートナーシップを構築していきます。また、三井物産が既に取り組んでいる米シェールガス関連事業とも連携して、天然ガスから化学品へのガスバリューチェーンを築き、エネルギー事業と化学品事業の共同取組により総合力を発揮していきます。

メタノールは接着剤や合成樹脂、医薬品などに加え、近年では中国を中心にエネルギー関連製品や石油化学製品の主要原料であるエチレン・プロピレンの製造にも用いられるなど多岐にわたる産業の基礎原料として使用されており、今後も安定的な需要の伸長が見込まれます。三井物産とセラニーズ社は、メタノールの安定的な供給や川下製品の供給を通じ、メタノールを使用する幅広い産業の発展に貢献していきます。

合弁契約書の概要

事業内容 メタノール製造事業

出資構成 三井物産100%出資米国子会社:50%

セラニーズ社100%出資米国子会社:50%

所在地 米国テキサス州

総プロジェクトコスト 約8億米ドル

年間生産量 約130万トン

稼働開始時期 2015年央

出資形態 LLC

LLC(リミティッド・ライアビリティー・カンパニー)とは、米国州政府が制定した法律に基づき設立される有限責任の企業形態の一つです。

スキーム図

Celanese and Mitsui Entered Into an Exclusivity Agreement for Potential Methanol Unit at Bishop, Texas

The potential methanol unit at Bishop is expected to have an annual capacity of 1.3 million tons and would leverage the design benefits of the Clear Lake, Texas methanol unit that is currently under construction. Celanese has filed for air permits with the Texas Commission on Environmental Quality for a potential methanol unit in Bishop, Texas and a final decision to build the unit will consider several factors, including prevailing methanol market conditions as well as construction costs.

The companies also entered into an amended five year arrangement for Celanese to purchase methanol from Mitsui, upon completion of the methanol unit at their joint venture in Clear Lake, Texas. Start-up of the unit is expected in October 2015.

“We are pleased to expand our partnership with Mitsui. Together with Mitsui, we will explore the benefits of an additional methanol unit at our Bishop, Texas facility to ensure our long-term and competitive supply of methanol,” said Mark Rohr, chairman and chief executive officer, Celanese Corporation. “The supply agreement, along with our own methanol production at Clear Lake, Texas, will ensure that we are balanced in our methanol needs in the US, but it will not completely offset our methanol-related earnings headwinds.”

Celanese to Acquire ExxonMobil’s Santoprene™ TPV Elastomers Business

Brings a global leader and flagship brand in thermoplastic vulcanizates (TPV) to Engineered Materials’ leading customer solution set

Celanese Corporation, a global chemical and specialty materials company, today announced the signing of a definitive agreement to acquire the Santoprene™ TPV elastomers business of Exxon Mobil Corporation. Celanese will acquire the industry-renowned Santoprene™ brand as part of a comprehensive TPV product portfolio, along with intellectual property, production and commercial assets, and a world-class organization.

“With the acquisition of the Santoprene™ business, we are further expanding the unrivaled portfolio of engineered solutions we bring to our customers,” said Lori Ryerkerk, chairman and chief executive officer. “This transaction represents a high-return opportunity to drive future shareholder value by deploying our excess cash from the monetization of our passive ownership in Polyplastics and continued strong cash generation in our businesses. We are eager to welcome the Santoprene™ team to Celanese and look forward to their contributions to our continued growth in Engineered Materials.”

“This transaction substantially strengthens our existing elastomers portfolio, allowing us to bring a wider range of functionalized solutions into targeted growth areas including future mobility, medical, and sustainability,” said Tom Kelly, senior vice president Engineered Materials. “The reputation of the Santoprene™ brand in TPV is consistent with Engineered Materials’ flagship brands including Hostaform® in POM and GUR® in UHMW-PE. With this product as part of the Engineered Materials portfolio and project pipeline model, we are confident that our joint commercial and technical teams across the globe will generate meaningful shareholder value.”

Transaction Overview

The Santoprene™ business of ExxonMobil is a leading global producer of TPV serving a variety of end-uses including automotive, construction, appliance, medical, and industrial. TPV is a chemically cross-linked, high-performance material which leverages a unique combination of engineering thermoplastic and elastomer properties. The Santoprene™ portfolio is highly functionalized to specific application requirements and is supported by industry-leading intellectual property.

According to the terms of the definitive agreement, Celanese will acquire the Santoprene™ business from ExxonMobil for a total purchase price of $1.15 billion on a cash-free, debt-free basis. As part of the transaction, Celanese will acquire the following:

Santoprene™, Dytron™, and Geolast™ trademarks and product portfolios

All customer and supplier contracts and agreements

Two world-scale production facilities in Pensacola, Florida, U.S. and Newport, Wales, U.K. with over 190 kt of total annual production capacity

Comprehensive TPV intellectual property portfolio with associated technical and R&D assets

Approximately 350 highly-skilled employees including world-class manufacturing, technical, and commercial organization

The Company expects the transaction to be immediately accretive to 2022 adjusted earnings per share and free cash flow.

The acquisition is expected to be financed by excess cash and available liquidity on the Celanese balance sheet.

The transaction is subject to regulatory approvals, carve-out preparations, and other customary closing conditions, which will determine the timing of close. The transaction is expected to close in the fourth quarter of 2021.

Celanese is advised by Kirkland & Ellis LLP as principal legal counsel and Goldman Sachs & Co. LLC as financial advisor.