Chemtura

Crompton and Great Lakes Chemical Announce Merger to Create Major New Specialty Chemicals Company

New Company Name is named 'Chemtura'

Great Lakes http://www.e1.greatlakes.com/corp/common/jsp/index.jsp

Crompton, Great Lakes finalize merger

Chemtura 設立 http://www.chemtura.com/

Chemtura Sells Its Interest in Davis-Standard, LLC

Chemtura to sell EPDM and some rubber chemicals businesses

Lion Chemical to buy Chemtura's rubber chemical, EPDM businesses

Chemtura Announces Agreement to Sell Oleochemicals Business to PMC Group NA Inc.

DuPont Acquires Chemtura Fluorine Chemicals Business

Chemtura's Optical Monomers Business Sold to Acomon AG

Blackstone and Apollo in talks to buy Chemtura

Chemtura Updates Strategic Alternatives Review

Chemtura Corporation's U.S. Operations File Voluntary Chapter 11 Petitions

Chemtura Completes Financial Restructuring and Emerges from Chapter 11

Chemtura plans PVC additives disposal SK Capital

Chemtura Plans to Build Multi-Purpose Manufacturing Plant in China

| Adiprene® / Vibrathane® | Chemtura offers more than 300 urethane polymer products. Adiprene®/Vibrathane® hot-cast prepolymers, curatives and systems are used in industrial and printing rolls, mining machinery and equipment, mechanical goods, solid industrial tires and wheels, and sporting and recreational goods. |

| Bromine & Intermediates | Chemtura’s chemical intermediates serve as building blocks for engineering highly complex organic molecules. They are used in rubber, soaps, medications, flavors and fragrances; they protect furniture and electronics from fire; and they enable industrial water systems to operate more efficiently. |

| Clear Brine Fluids | Chemtura’s brine fluids extend precious resources by enabling the oil field industry to drill oil in deeper water areas than ever before. They are used to flush oil out of the ground and control pressure, ensure stability under high temperatures, reduce corrosion and fluid loss, and minimize reservoir damage. |

| Crop Protection | Chemtura crop protection products are formulated for specific crops and geographic regions to enhance quality and increase yield. Chemtura products protect seeds from pests and disease to aid in germination; protect growing plants from insects, mites and diseases; eliminate unwanted weeds; and assist with pest control in soil preparation, commodity storage, and post-harvest food processing. |

| EPDM | Chemtura’s more than 30 EPDM

products, including Royalene®

EPDM

rubber, RoyalEdge® EPDM rubber and Trilene®

Liquid

EPDM, are used in automotive, construction, wire and

cable, and mechanical goods applications. An average car

carries about 20 pounds of EPDM in weather stripping,

brake parts, hoses and body cladding. Lion Chemical to buy Chemtura's rubber chemical, EPDM businesses |

| Fire Protection FM-200® | Chemtura’s waterless fire suppression products are applied to mission-critical and high-value assets to prevent extensive fire damage and eliminate collateral damage and downtime. Our products protect computer rooms, telecommunications operations, medical equipment and laboratories, document vaults and art museums. |

| Flame Retardants | Chemtura is a leading global producer of flame retardants, which reduce or eliminate the flammability of a wide variety of combustible materials. Our additives help stop fire before it starts by resisting ignition and slowing the rate of combustion. They are used in furniture, electrical components, and housing construction. |

| Fluorine Specialties | Chemtura’s fluorine specialty intermediates are co-polymerized with silicone to produce fluoro-silicone materials. They are used on off-shore oil rigs, in high-technology applications such as optical fibers and computer chips, refrigerants, and as propellants in metered-dose inhalers that help asthma sufferers breathe easier. |

| Home Care | Chemtura’s specialty and multipurpose cleaners and degreasers clean and disinfect kitchen, bath, laundry, patio, garage and automotive surfaces and include The Works® brand cleaners and Greased Lightning® brands multipurpose cleaners for tough cleaning tasks and everyday cleanup. |

| Industrial Water Treatment | Chemtura is a major producer of organic, polymer-based antiscalants and corrosion inhibitors and bromine-based biocides that help control scale, corrosion, foam and problem organisms in industrial cooling, industrial and municipal wastewater treatment, pulp and paper processing, food processing, and desalination processes. |

| Optical Monomers | Chemtura’s RAV-7® and Nouryset® ADC monomers are used in applications that require exceptional clarity and durability, such as lenses for prescription glasses and sunglasses, protection sheets for welding masks and screens, safety shields, photographic filters, lenses for welder's goggles, and lab equipment. |

| Petroleum & Performance | Chemtura is the world’s largest component supplier to the lubricants industry. Our products improve performance in motor oils, transmission fluids, industrial and hydraulic oils, metalworking fluids, and fuels, and are used in aviation, mining, electricity generation and gas pumping where machinery operates under high temperatures or operates continuously. |

| Plastics Additives | Chemtura is the world’s largest producer of plastic additives. Our products cover the entire supply chain, from monomers and polymerization to finishing and compounding. We are a world leader in polyvinyl chloride heat stabilizers, we offer one of the most extensive ranges of polyolefins and engineering polymers, and we are a leading producer of ABS-based impact modifiers. |

| Pool & Spa | Chemtura’s pool and spa products are marketed under several brand names, and include water treatment sanitizers, algicides, biocides, oxidizers, pH balancers, mineral balancers, shock chemicals, and specialty chemicals. We have multiple channels of distribution and a reputation for quality, convenience, and customer service. |

| Rubber Chemicals | Chemtura’s rubber additives

business is one of the largest in the world and offers

more than 100 products for rubber processing. Our

products are used to make rubber products for consumers

and industry, including tires, belts, hoses, seals,

elastic bands in clothing, and shoe soles. Lion Chemical to buy Chemtura's rubber chemical, EPDM businesses |

| Urethane Additives | Chemtura’s Fomrez® polyester polyols have broad application in flexible foam, thermoplastic urethanes, coatings, adhesives and elastomers. We also supply urethane additives for coatings in hardwood floors, paints and textiles. Witcobond® provides superior coating and adhesive properties for wood, plastics, fiberglass, textiles, leather and rubber as well as many other substrates. |

March 9, 2005

Great Lakes Chemical

Crompton Corporation and Great Lakes Chemical Corporation

Announce Merger to Create Major New Specialty Chemicals Company

http://www.e1.greatlakes.com/corp/news/jsp/recent_news_detail.jsp?contentfile=03092005_proposed_merger_with_crompton.htm

-- Creates Third Largest

U.S. Specialty Chemicals Company --

-- Company to Have Leading Positions in Multiple High-Value

Niches --

-- Accretive to EPS Beginning in 2006 --

-- Experienced Management Team to be Led by Crompton Chairman and

CEO Robert L. Wood --

Crompton Corporation (NYSE: CK) and Great Lakes Chemical

Corporation (NYSE: GLK) announced today that they have entered

into a definitive merger agreement for an all-stock merger

transaction, which will create the third-largest publicly traded

U.S. specialty chemicals company. The new company will have

combined pro forma 2004 revenues of more than $4.1 billion and a

market capitalization of nearly $3.2 billion. It will hold

leading positions in high-value specialty chemical

niche businesses including plastics additives, petroleum

additives, flame retardants and pool chemicals. Additionally, the

combined company will maintain strong positions in castable

urethanes and crop protection chemicals.

The new company will be owned 51 percent by

Crompton shareholders and 49 percent by Great Lakes shareholders on a fully diluted basis.

May 9, 2005 Great Lakes Chemical

Great Lakes Chemical

Corporation and Crompton Corporation Announce New Company Name,

Effective When Merger is Complete

http://www.e1.greatlakes.com/corp/news/jsp/recent_news_detail.jsp?contentfile=05092005_new_company_name.htm

Great Lakes Chemical

Corporation (NYSE: GLK) and Crompton Corporation (NYSE: CK)

announced today that once their merger is complete, the new company will

be known as “Chemtura”

(pronounced

chem-CHOOR-a) Corporation.

Crompton, Great Lakes

finalize merger

With the finalization of the Crompton Corp. and Great Lakes

Chemical Corp. all-stock merger on July 1, the combined company

becomes Chemtura Corp., the fourth-largest publicly traded U.S.

specialty chemicals company and the world's largest plastics

additives company. Chemtura, with combined pro forma 2004

revenues of $3.7 billion and a market capitalization of

approximately $3.3 billion, will begin trading under the New York

Stock Exchange ticker symbol CEM on July 5.

Great Lakes shareholders received 2.2232 shares of Crompton

common stock for each share of Great Lakes common stock, giving

an overall transaction value of $2.0 billion, including $354

million of Great Lakes net debt and minority interest.

* CROMPTON CORPORATION

AND GREAT LAKES CHEMICAL FINALIZE MERGER,

BECOME ‘CHEMTURA’

CORPORATION

http://www.chemtura.com/pressrelease.jsp

- Chemtura is

Fourth-Largest U.S. Specialty Chemicals Company -

- Becomes World’s Largest Plastics Additives

Company -

- Chemtura Has Leading Positions in Multiple High-Value Niches -

With the finalization of the Crompton Corporation and Great Lakes

Chemical Corporation all-stock merger today, the combined company

becomes Chemtura Corporation, the fourth-largest publicly traded

U.S. specialty chemicals company and the world’s largest plastics additives

company. Chemtura, with combined pro forma 2004 revenues of $3.7

billion and a market capitalization of approximately $3.3

billion, will begin trading under the New York Stock Exchange

ticker symbol CEM on July 5.

“Chemtura

is a unique new company with a portfolio of global businesses

that have achieved leading positions in high-value market niches,”

said Chemtura

Chairman, President and Chief Executive Officer Robert L. Wood.

Chemtura holds leading positions in several high-value specialty

chemical niche businesses, including plastics additives,

petroleum additives, flame retardants and pool chemicals.

Additionally, the company has strong positions in castable

urethanes and crop protection chemicals.

“Since

we announced our agreement to merge March 9, integration teams

have been working intensely to create a new company with a new

organizational design and new work processes. We are building a

world-class organization and adopting best business practices in

everything we do. As we said in March, this is a transformational

merger. Our vision is to create the world’s best specialty chemicals

company, not simply to add companies together.

“As

of today, while we still have a number of jobs to fill, our

organization is almost completely formed and employees at every

level are poised to take the actions needed to deliver strong

financial results. Our integration work will create immediate

value through the recognition of significant synergies throughout

the company. As a result, we are increasing our synergy estimate

to $150 million from the original target of $90 million to $100

million,” Wood said.

Cumulative synergy savings are expected to total $10 million in

2005; $100 million in 2006; and $150 million in 2007.

Approximately 30% of the total synergies is expected to come from

organizational redesign; 60% from savings in supply chain

operations, and the remainder from other areas. By combining

workforces, streamlining work processes and utilizing more

efficient systems, the company expects to reduce its total number

of employees by about 600 worldwide, or approximately 8 percent,

over the next year from its current level of approximately 7,300

people. In addition, Chemtura has expanded its geographic

footprint and access to key buyers globally and is putting into

place cross-selling and captive-sourcing opportunities across its

extended portfolio.

The company expects to incur one-time cash expenditures totaling

$125 million to $135 million relating to change in control

agreements, and $20 to $25 million related to severance and

related expenditures. Chemtura also will incur one-time cash

expenditures of $50 million to $55 million related to the closing

of the transaction. The company will have approximately $20

million in one-time cash expenditures to support the integration

of both companies and approximately $6 million of charges for the

write-off of unamortized fees relating to bank facilities that

are being replaced.

In addition to Chairman Wood, the board of directors has five

directors from each predecessor company, for a total of 11

directors. Chemtura expects to maintain a cash dividend level of

$.05 per quarter.

The new company’s strategy is to develop a

portfolio of global businesses with leading positions in

high-value market niches. CHEMTURA holds leading positions in

high-value specialty chemical niche businesses, including

plastics additives, petroleum additives, flame retardants and

pool chemicals. Additionally, the company has strong positions in

castable urethanes and crop protection chemicals.

Terms of the Transaction

Great Lakes shareholders received 2.2232 shares of Crompton

common stock for each share of Great Lakes common stock, giving

an overall transaction value of $2.0 billion, including $354

million of Great Lakes net debt and minority interest.

About Chemtura

Chemtura Corporation, with pro forma 2004 sales of $3.7 billion,

is a global manufacturer and marketer of specialty

chemicals, crop protection and pool, spa and home care products. Headquartered in Middlebury,

Conn., the company has 7,300 employees around the world.

Additional information concerning Chemtura is available at

www.chemtura.com.

Crompton brought to the new company the following businesses and

their respective products: plastics additives, petroleum

additives, urethane additives, urethane polymers, rubber

additives, EPDM and crop protection products.

Great Lakes brought flame retardants, brominated performance

products, fire protection products, fluorine

specialties, industrial water additives, performance additives

and fluids, polymer stabilizers, pool and spa care products, and

household-cleaning products.

Chemtura Sells Its Interest in Davis-Standard, LLC for $72 Million; Revises 2006 Earnings Expectations

Chemtura Corporation

announced that it has sold its majority interest in the

Davis-Standard, LLC polymer processing equipment joint venture to

partner Hamilton Robinson LLC for approximately $72 million in

cash, plus an additional $8 million that is contingent upon

certain post-closing determinations.

"This transaction is completely consistent with our strategy

of

focusing our resources on our core businesses.

British Plastics & Rubber 2006/11/3 Lion Chemical to buy Chemtura's rubber chemical, EPDM businesses

Chemtura to sell EPDM and some rubber chemicals businesses

Following on

from the sale of its Davis-Standard extrusion equipment

subsidiary Chemtura has now revealed that it has signed a letter

of intent to sell its EPDM business and the

rubber chemicals businesses based at Geismar in Louisiana, USA. It is also selling its

Flexzone antiozonants business.

The buyer has not been named, but a sale to Lanxess would fit neatly with

the German company's declaration earlier this year that it is

preparing to expand through acquisition. EPDM and more rubber

chemicals would dovetail with the existing Lanxess portfolio, and

the Lanxess track record of turning round ailing businesses would

match with Chemtura's comments that it has 'continued to

struggle' with its rubber additives and elastomers businesses in

its third quarter results published yesterday. Between them the

businesses being sold had revenues of $300 million in the year to the end of

September.

RubberWorld 2006/11/3

”This sale is an important milestone in our plan to divest non-core assets and businesses. We are pleased to be transferring these businesses to a buyer who is interested in growing them, which should benefit our customers," said Chemtura Chairman and CEO Robert L. Wood. Wood also said the buyer is a non-competitor in the businesses.

The EPDM and Rubber Chemicals businesses being sold had revenues for the twelve months ended Sept. 30, 2006 of approximately $300 million.

2006/11/15 RubberWorld

Chemtura studys new

metal alkyls plant

Al-Zamil

Group and Chemtura announced an agreement to further

develop formation of a joint venture to build a world-scale

metal alkyls manufacturing facility in Jubail Industrial City, Saudi

Arabia. The facility would be designed to satisfy growing

regional demand for aluminium alkyls that serve as specialty

catalysts for a variety of olefins, including polyethylene and

polypropylene.

The Chemtura - Al-Zamil joint venture would license Chemtura’s proprietary technology and serve

as the sales and marketing arm of Chemtura’s aluminium alkyls in Saudi Arabia

and other Gulf Coast Countries. Chemtura would be responsible for

sales of the joint venture outside the Gulf Coast Countries and

would provide technical service and product applications

knowledge.

The Al-Zamil Group and Chemtura also are partners

in an antioxidants manufacturing facility in Saudi Arabia that produces

stabilizers products and has been in operation since 2000.

Gulf Stabilizers Industries is a joint venture with one of Saudi Arabia’s industrial giants ZAMIL Group of companies and international manufacturer of specialty chemicals, Great Lakes Chemical Corporation. Gulf Stabilizers Industries manufactures polymer additives and customer specific blends of international quality.

Also GSI manufactures Phenolic and Phosphate Anti oxidants and Anoxic Non Dusting Blends according to customer specifications in a unique free flowing, mechanically resistant and palletized physical form. GSI also trades UV Absorbers, Light Stabilizers and Flame Retardants.

Chemtura expands capacity in Middle East

Chemtura Corp. will further grow its global antioxidant business with an additional expansion of its capacity at Gulf Stabilizer Industries (GSI), its joint venture facility in Al Jubail, Saudi Arabia. The company has commenced engineering work on an additional 4,000 metric tons of capacity. “We successfully expanded the Al Jubail facility in March with Chemtura's proprietary NDB III (non dust blend) production line, but we now need to invest further capacity to keep ahead of the growing demand for our products in the region. With this new investment, GSI will have reached critical mass and will be able to meet all of its customers’ requirements in terms of quality, service and value,” stated Fahad Al Zamil, Director of Al-Zamil Group, Chemtura’s joint venture partner. The expansion will deploy the NDB technology, producing a one-pack product that provides customers with both efficiency and safety benefits over the use of single-powder components. Total annual capacity at the Al Jubail site will increase to 21,000 metric tons. The new capacity will come on stream in 2010. Chemtura, a global manufacturer and marketer of specialty chemicals, reported 2008 sales of $3.5 billion.

Chemtura Announces Agreement to Sell Oleochemicals Business to PMC Group NA Inc.

Chemtura Corporation today announced that it has reached agreement to sell its global oleochemicals business to PMC Group NA Inc. for an undisclosed amount, subject to financing and other conditions including customary closing conditions. Included in the transaction is Chemtura's production facility at Memphis, Tenn. Proceeds from the sale will be used primarily for debt reduction.

Chemtura は2005年にCrompton とGreat Lakes Chemical が合併して設立された会社で、樹脂添加剤では世界最大のメーカー。

2008/5/28

domain-b.com

Blackstone and Apollo in talks to buy Chemtura

Private equity firms Blackstone Group LP and Apollo Management

LP, both basd in New York, are reported to be in early stage

discussions to acquire chemicals maker Chemtura

Corp,

which reported an operating loss of $6 million in the three

months ended 31 March compared with an income of $11 million in

the same period last year.

Apollo and Blackstone are familiar with the cehmicals industry

with the latter having teamed up with Goldman Sachs in 2003 to

acquire water treatment and process chemical technologies company

Nalco Holding's predecessor. Similarly, Apollo

owns Hexion Specialty

Chemicals Inc,

which bid $10.8 billion in June last year to acquire Huntsman Corp though the deal been held up due

to regulatory hurdles.

Subsequently in January, it agreed to sell its global

oleochemicals business to PMC Group for an undisclosed sum followed

by the sale of its fluorine chemicals business to

DuPont Co

next month. Prior to announcing its strategic review, Chemtura

had sold its optical monomers

business to Acomon AG, an affiliate of Munich private

equity firm Auctus Management GmbH & Co. KG. According to the

chemicals maker, theses sales were part of its efforts to

strengthen its main businesses, including its polymers additives

portfolio.

Chemtura's Optical Monomers Business Sold to Acomon AG

In order to place greater

focus on its core businesses, Chemtura Corporation announced that

it sold its optical monomers business to

Acomon AG, an

affiliate of Munich-based Auctus Management GmbH & Co. KG in

an all-cash transaction today for an undisclosed amount. Included

in the transaction is Chemtura's Ravenna, Italy manufacturing

facility. Proceeds from the sale will be used primarily for debt

reduction.

"This sale

represents continued progress in our portfolio refinement and

footprint optimization initiatives," said Chemtura Chairman

and CEO Robert L. Wood. "Optical monomers is a very good

business that just doesn't fit our portfolio at this time. We are

pleased to be transferring the business to a buyer who is

interested in growing it, which should benefit both customers and

employees," Wood concluded.

Optical monomers

are used in a variety of applications, including lenses for

eyewear; protection sheets for welding masks and screens;

photographic filters; and lab equipment. The optical monomers

business being sold had revenues for 2006 of approximately $35

million and employs approximately 45 people, the majority of whom

work in its Ravenna, Italy facility.

Chemtura Updates Strategic Alternatives Review

On Dec. 18, 2007, Chemtura Corporation announced that a special committee of its board of directors and the company's financial advisor, Merrill Lynch & Co., would explore a variety of strategic alternatives. Chemtura's board of directors announced today that, after thoroughly exploring a potential sale, merger or other business combination involving the entire company, it has concluded that shareholders' interests will be best served by continuing to operate as a stand-alone company and focusing on its own growth and efficiency initiatives. The board has terminated discussions on a potential sale, merger or other business combination after determining that such discussions are unlikely at this time to result in an offer at a sufficiently attractive price.

Chemtura Corporation's

U.S. Operations File Voluntary Chapter 11 Petitions to Facilitate

Financial Restructuring

Company's Non-U.S. Operations Not

Included in Filing; Worldwide Operations to Continue Without

Interruption

Receives Commitment for $400

Million of Debtor-in-Possession Financing

Chemtura Corporation today announced that it and 26 of its U.S.

affiliates (together, the "Company") have filed

voluntary petitions for relief under Chapter 11 of the United

States Bankruptcy Code in the United States Bankruptcy Court for

the Southern District of New York (the "Court").

Chemtura's non-U.S. subsidiaries were not included in the filing

and will not be subject to the requirements of the U.S.

Bankruptcy Code. Chemtura's U.S. and worldwide operations are

expected to continue without interruption during the

restructuring process.

Craig A. Rogerson, Chemtura's Chairman, President and Chief

Executive Officer, said, "Like other companies in our

industry and around the world, Chemtura's order volumes have

declined markedly

in recent months due to the impact of the global economic

recession on our customers and the industries they serve. This

has led to a significant decrease in our

liquidity and cash flow. Despite our efforts to increase

liquidity, including through the potential sale of a business,

our reduced liquidity position, combined with the anticipated

expiration of our bank waiver, led us to determine that a

court-supervised restructuring was the best course of action.

Through this process, we will continue to focus on operating our

business while continuing our efforts to strengthen our balance

sheet and gain financial flexibility in order to position

Chemtura as a strong, viable, and profitable competitor in the

specialty chemicals marketplace."

Today Chemtura announced that, in conjunction with the filing, it

has received a commitment for up to $400

million in debtor-in-possession (DIP) financing from Citibank,

N.A., as

administrative agent. Upon Court approval, the DIP financing,

combined with cash from the Company's ongoing operations, will be

used to support the business during the Chapter 11 process. In

addition, the Company anticipates that it will continue to meet

its obligations going forward to its employees, customers and

suppliers.

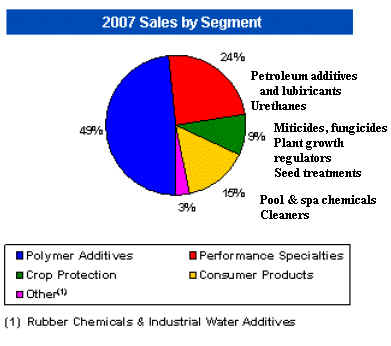

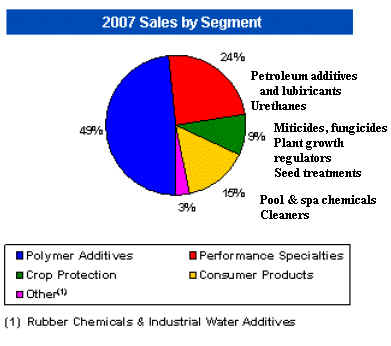

2008年度損益 (百万ドル)

| 2008 | 2007 | |

| Net sales | 3,546 | 3,747 |

| Operating (loss) profit | * -929 | 59 |

| Net loss | -1,020 | -3 |

*Impairment of long-lived assets -986 含む

| 2008 | 2007 | |

| Polymer Additives | 1,580 | 1,806 |

| Performance Specialties | 999 | 911 |

| Consumer Products | 516 | 567 |

| Crop Protection | 394 | 352 |

| Other | 57 | 111 |

| Total Net Sales | 3,546 | 3,747 |

2009/2/20

Chemtura Receives

Notice from NYSE on Continued Listing Standards

Chemtura Corporation

today announced that on February 17, 2009, it received notice

from the New York Stock Exchange (NYSE) that the Company had

fallen below the continued listing standard that requires a

minimum average closing price of $1.00 per share over 30

consecutive trading days.

The NYSE provides a period of six months, subject to extension,

for a company that receives such a notice to bring its average

share price back above $1.00. Under the NYSE rules, the company’s common stock will continue to be

listed on the NYSE during a cure period, subject to the company’s compliance with other NYSE

continued-listing requirements.

Chemtura plans PVC

additives disposal

Chemtura is selling its PVC additives business, probably to private equity firm

SK Capital Partners. The two companies have entered a definitive

agreement for the sale, but as Chemtura is currently under the

protection of the USA's bankruptcy

laws,

there has to be an auction - with SK Capital as the lead or

"stalking horse" bidder.

The PVC additives business makes tin stabilisers,

liquid and solid mixed metals, liquid phosphite esters,

epoxidised soybean oil, thiochemicals, organic-based stabilisers,

and impact modifiers

with product names including Mark, Drapex, Lowinox, Ultranox and

Blendex. It has plants in the USA and Europe - Chemtura Vinyl

Additives at Lampertheim in Germany. Revenues in 2008 were $374 million.

Solutia Agrees to Sell Nylon Business to an affiliate of SK Capital Partners II, L.P., a New York-based private equity firm

Chemtura Completes Financial Restructuring and Emerges from Chapter 11

Chemtura Canada Co./Cie Concludes CCAA Proceedings and Emerges from Chapter 11

Company Emerges with Strengthened Balance Sheet and Improved Cost Structure

New Chemtura Common Stock Expected to Be Listed on the New York Stock Exchange

Chemtura to Satisfy All Undisputed Claims in Cash and/or Stock and Provide a Distribution to Existing Equity Holders

Chemtura Corporation, today announced that it has successfully completed its financial restructuring and emerged from protection under Chapter 11 of the United States Bankruptcy Code. The Company also announced that Chemtura Canada Co./Cie has concluded its Companies' Creditors Arrangement Act proceedings and has emerged from Chapter 11 at the same time as the Company’s U.S. operations. In connection with the Company’s emergence, Chemtura expects to be listed on the New York Stock Exchange on November 11, 2010 and trade under the ticker “CHMT”.

“Today marks a new beginning for our company, and our employees, customers and suppliers,” said Craig A. Rogerson, Chemtura’s Chairman, President and Chief Executive Officer. “With the successful completion of our financial restructuring, we have significantly reduced our debt, improved our cost structure and resolved a considerable amount of environmental and other liabilities.”

Rogerson continued, “Looking forward, we will remain focused on our longer term corporate objective of growing a global portfolio of leading specialty chemical businesses, committed to innovation and the creation of value for our stakeholders. We will build from our current globally diverse assets that are well-positioned for success in each segment we serve. We look forward to working with all of our stakeholders for the long-term. I thank our dedicated employees for helping us to achieve solid results throughout this process, and our customers and suppliers for their support.”

Under the Plan, the Company will satisfy creditors’ claims in cash and/or stock in the reorganized Company and also provide value to equity holders. Additional information with respect to distributions under the Plan is available free of charge in the investors section at www.chemtura.com and at www.kccllc.net/chemtura.

Holders of allowed claims should allow 21 days from the Effective Date to receive both the new common stock and the cash. If either is not received after 21 days, please contact Chemtura’s claims agent at (866) 967-0261.

On November 3, 2010, the United States Bankruptcy Court for the Southern District of New York entered an order confirming Chemtura’s Plan of Reorganization. The Court’s order confirming the Plan is available free of charge at www.kccllc.net/chemtura.

June 6, 2011 Chemtura

Chemtura Plans to Build Multi-Purpose Manufacturing Plant in

China

‘Groundwork for growth’

in most rapidly

expanding market

Expected to support Petroleum

Additives & Urethanes with added capacity for other

businesses

Chemtura Corporation, a leading global specialty chemicals

company, today announced plans to build a new multi-purpose

manufacturing facility in Nantong, China, to support its growth

strategy.

“This

project lays the groundwork for growth through investment in the

world’s most rapidly expanding market.

It will enhance our ability to satisfy customer demand in China

and the wider Asia-Pacific region,” said Craig A. Rogerson, Chemtura’s chairman, president, and chief

executive officer.

As previously disclosed, Chemtura’s goal is to create value for

customers and other stakeholders by growing its business with new

manufacturing capacity in rapidly growing regions, among other

initiatives. The Nantong facility is expected to initially serve

Chemtura’s Petroleum

Additives and Urethanes businesses, and is expected to provide

sufficient additional capacity for other Chemtura businesses.

This planned investment will support the growth of Chemtura’s Urethanes business, including

its low-free (LF) prepolymer urethanes. This growth is driven by

the commercialization of our high-performance, greener AdipreneR

Duracast? product line coupled with increasing global and

regional demand for our LF products.

“Additional

LF prepolymer manufacturing capacity in China would allow us to

continue to grow our most advanced product lines and places

capacity in a region with strong demand growth, while preserving

existing capacity elsewhere to continue supplying customers in

other regions,” said Matthew Hellstern, president,

Urethanes.

The Petroleum Additives business requires local manufacturing and

storage capabilities for some of its product lines in order to

meet customer demand. These include synthetic finished fluids

(refrigeration lubricants, air compressor lubricants and gear

oils), and calcium sulfonate grease.

“Local

manufacturing capacity for synthetic lubricants is required for

the business to respond to the market’s demand for shorter lead times,”

said Sean O’Connor, president, Petroleum

Additives. “Installation of grease capacity in

China would provide our customers with a more secure global

supply capability, and place capacity in the region with the

highest growth rate.”

In addition to the

planned development of local manufacturing capacity, Chemtura

plans to build global scale with sales representation, technical

development centers, joint ventures and bolt-on acquisitions. “We will further empower our

regional teams to serve their growing customer base with robust

service functions and technical support capabilities,”

Rogerson added.

Chemtura Corporation, with 2010 sales of $2.8 billion, is a

global manufacturer and marketer of specialty chemicals,

agrochemicals and pool, spa and home care products. Additional

information concerning Chemtura is available at www.chemtura.com.

SK Capital completes its acquisition of the

antioxidant and UV stabilizer solutions business of Chemtura Corporation

Independent Company to Be Renamed Addivant

SK Capital Partners, a transformational private investment firm, announced today

that it has closed its previously announced acquisition of the

Antioxidant and UV Stabilizer Solutions business of

Chemtura Corporation. To be named

Addivant as an independent company, the business is

a leading global supplier of a comprehensive portfolio of additives including

antioxidants, antiozonants, inhibitors, polymer modifiers and UV stabilizers

used by customers to improve the production and performance properties of

polymers, plastics and rubbers.

November 12, 2012

SK Capital to Acquire the Antioxidant and UV Stabilizer Solutions Business of Chemtura Corporation

SK Capital Partners, a U.S.-based private investment firm, announced today that it has signed an asset purchase agreement to acquire the Antioxidant and UV Stabilizer Solutions business of Chemtura Corporation. The business is a leading global supplier of a comprehensive portfolio of additives including antioxidants, antiozonants, intermediates and inhibitors, polymer modifiers, and UV stabilizers used by customers to improve the production and performance properties of polymers, rubbers and plastics. The transaction is valued at approximately $200 million.

With a disciplined focus on the specialty

materials, chemicals and healthcare sectors, SK Capital has significant relevant

experience, as well as deep knowledge of the end markets served by Addivant,

gained through both previous and current portfolio companies in the polymers,

plastics and associated additives sectors. The acquisition is consistent with

SK Capital's strategy of acquiring niche market leaders

with strong brands, technologies and underlying growth trends and

actively supporting management in building thriving businesses with sustainable

competitive advantages.

"With its unique pedigree resulting from the merger of three leading polymer

additives companies, we believe Addivant is an attractive platform with

significant growth and performance improvement potential," noted Barry Siadat, a

Managing Director of SK Capital. "The transition from a non-core business within

a public company to a stand-alone organization will enable improved execution

and a renewed emphasis on growth. Management has done an excellent job of

redefining the business' strategy and successfully repositioning it as a

strategic partner and solutions provider to customers."

Jack Norris, a Managing Director of SK Capital, commented, "Having negotiated

the transaction directly with Chemtura, Addivant is another example of a

corporate carve out we've acquired outside of a broad auction. Similar to our

other investments, we believe the business can benefit significantly from SK

Capital's industry-specific knowledge and operational experience."

Addivant represents the fourth investment from SK Capital Partners III L.P., a

$500 million institutional pool of capital raised in 2011, and the fourth

corporate carve out among its current portfolio of six companies.

About SK Capital

SK Capital is a private investment firm with a disciplined focus on the

specialty materials, chemicals and healthcare sectors. Our integrated,

multi-disciplinary team utilizes its industry, operating and investment

experience to help transform businesses into higher performing organizations.

Located in New York, NY and Boca Raton, FL, we are currently investing from SK

Capital Partners III, L.P., a $500 million fund of committed capital. Our

portfolio companies generate revenues of over $6.0 billion annually and employ

more than

5,000 people.