トップページ

Huntsman Corporation

History

1998/6 Huntsman Announces Expansion and Upgrade

of ethanolamine Unit

2002/6 Huntsman

Restructures Debt

2002/9 Huntsman

completes financial restructuring

2003/4 Huntsman to build world's

largest LDPE plant in the UK.

2003/5 Huntsman

Buys Out Minority Interests In Huntsman International Holdings

2004/9 Huntsman

announces go-ahead for 400,000t/y LDPE plant at Wilton

2005/7 HUNTSMAN SELLS TDI BUSINESS TO

BASF

2005/9 Huntsman to Build

Polyetheramine Manufacturing Facility in Singapore

2005/10 Huntsman Breaks Ground For New £200 Million Polyethylene Project

At Wilton

2006/2 Bidders

in talks to buy Huntsman

Huntsman Ends

Discussions On Company's Sale

2006/2 チバ・スペシャルティ・ケミカルズ、テキスタイル機能材ビジネスの売却でハンツマン社と合意

2006/2 Texas

Petrochemicals, Inc. announces intent to purchase assets of

Huntsman Corporation’s U.S. butadiene

business

2006/2 Huntsman Selects

Geismar as Site for Maleic Anhydride Expansion

2006/8 Huntsman Announces

Major Pigments Production Increase

2006/8 US chemical giant

Huntsman to boost China investment

2006/9 Huntsman

to Sell European Commodities Business to SABIC

2006/11 Arabian Amines Company 着工

2007/2 Huntsman

and NMG Announce Polyurethanes JV in Russia and Former Soviet

States

Huntsman to Sell

U.S. Commodities Business to Flint Hills Resources

2007/4 Huntsman

Scales Up Process to Convert a Biodiesel By-product to Propylene

Glycol

2007/5 Huntsman to Open New

Polyetheramines Plant in Singapore

2007/6 Hunstman to take

majority control of JV with BCI

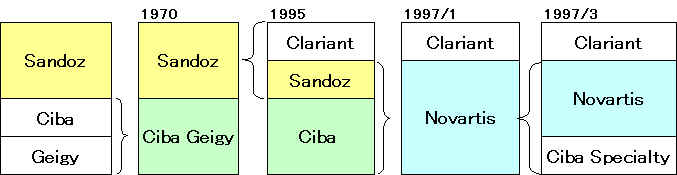

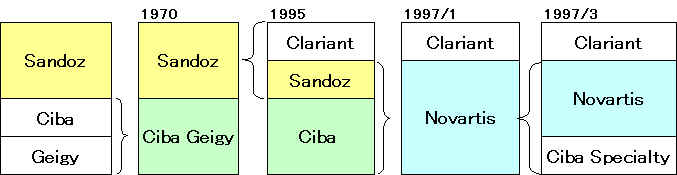

2007/6 Huntsman eyes Clariant, Ciba

takeovers

Basell to acquire

Huntsman for $25.25 per share

2007/7 Huntsman to

Acquire textile dyes and intermediates manufacturer based in

India

Huntsman

Receives Merger Proposal From Hexion

Hexion Increases Offer for

Huntsman Corporation to $28.00 Per Share

Hexion confirms to buy

Huntsman in 10.6 bln usd deal

Huntsman says

enters alliance for Texas biodiesel plant

Huntsman Acquires Global

Fluorochemical Product Line for Nonwovens from DuPont

2007/8 Huntsman

sells U.S. Polymers Business to Flint Hills Resources

2007/11 Huntsman

and Flint Hills Resources Close On Sale of Base Chemicals

Business

2008/2 Huntsman

Commences Design and Feasibility Studies to Expand its Global MDI

Manufacturing Capacity

2008/4 Huntsman Joint Venture To Pursue

Major Maleic Anhydride Expansion In Germany

2008/6 Hexion

files suit alleging that transaction with Huntsman is no longer

viable

Huntsman

Sues Apollo and Its Top Executives Over Hexion Deal

2008/7 European

Commission Approves Merger With Hexion

2008/8 Huntsman Shareholders Offer

Capital On Merger Closing

その後

2008/9 Huntsman All But

Wins Fight

Huntsman

Obtains Temporary Restraining Order Against Credit Suisse and

Deutsche Bank

2008/10 Huntsman

Obtains Solvency Opinion for Hexion Merger

Hexion

gets additional funding commitments

Hexion and Huntsman to complete

pending merger; Banks refuse to fund

2008/12 Huntsman

terminates merger agreement and settles with Hexion and Apollo

for $1 billion.

2009/1 Judge dismisses

Huntsman suit

2009/2

Huntsman Suspends Work on Planned MDI Plant in Europe

Huntsman JV

Completes Project Financing for Maleic Anhydride Expansion

2009/3 Huntsman to expand MDI facilities

in Shanghai

2009/6 Huntsman

Reaches Settlement with Banks for $1.73 Billion of Cash and

Financing

2009/10 2010 And 2011 Will Be More

Difficult Than 2009: Peter Huntsman

2009/12 Zamil, Huntsman plan Jubail JV

2010/1 Huntsman Announces Chinese Polyols

Joint Venture with Jurong Ningwu Chemical Company

2010/5 Huntsman

to Expand its Polyetheramine Manufacturing Capacity in Singapore

2010/7 Huntsman to Purchase Chemicals

Business of Laffans Petrochemicals Ltd.of India

2012/4

Huntsman to expand

Texas ethylene oxide plant

2012/11

Huntsman and Sinopec Form

Joint Venture to Build and Operate PO/MTBE Facility in Nanjing, China

2013/3 Huntsman、日本の断熱材企業に出資

Jon

Meade Huntsman, Jr. (born March 26, 1960 in

Palo Alto, California) is the

governor of the state of Utah, having won the office in

the 2004 election. He was elected with 57% of the vote

over Democrat Scott Matheson Jr..

His term as the 16th governor of Utah began on January 3,

2005.Huntsman

is the son of billionaire businessman and philanthropist Jon

Huntsman of Huntsman Corporation.

|

2003/5/9 Huntsman

Huntsman Buys Out Minority Interests

In Huntsman International Holdings

http://www.huntsman.com/ShowPage.cfm?PageID=1159&News_ID=855

Jon M. Huntsman, Founder and

Chairman, and Peter R Huntsman, President and CEO, of the

Huntsman companies today announced the purchase of ICI's debt

and equity holdings in Huntsman International Holdings LLC

(HIH), and the additional purchase of two financial

institutions' minority interest in HIH.

(Note: Huntsman International

was formed when Huntsman

purchased a majority stake in ICI’s industrial chemical

business)

With the buyouts, HMP Equity Holdings

Corporation (HMP), which

is controlled by the Huntsman family, now owns 100% of all

principal Huntsman business entities.

(Note: HMP Equity Holdings:51% owned by the Huntsman family and

49% owned by New York private equity firm MatlinPatterson )

Platts 2002/9/30

Huntsman completes financial restructuring

Huntsman Corp

reported Monday the completion of its financial

restructuring.

Huntsman Corporation http://www.huntsman.com/

Huntsman Corporation is the

world's largest privately held chemical company. Its operating

companies manufacture basic products for a variety of global

industries including chemicals, plastics, automotive, footwear,

paints and coatings, construction, high-tech, agriculture, health

care, textiles, detergent, personal care, furniture, appliances

and packaging.

Businesses:

Huntsman's six major

businesses manufacture and market over 33 billion pounds of

product each year.

Performance Chemicals

Petrochemicals

Polymers

Polyurethanes

Surface Sciences

Tioxide

Petrochemicals

Huntsman's worldwide

petrochemicals operations are made up of three major regional

businesses in the Americas, Europe and Asia Pacific.

USA

Odessa, Texas

Polypropylene

Polyethylene

The REXellョ

Linear Low

Density Polyethylene

The High Pressure Low

Density

Port Arthur, Texas

Huntsman Corporation's

Jefferson County Operations (JCO) employs 1400

associates.

JCO has four main sites: Oxides & Olefins , C4, PO/MTBE Plant, all in Port Neches; and Aromatics &

Olefins in Port

Arthur.

The A&O Plant in Port Arthur covers a land area of

229 acres and employs approximately 250 associates. Three

major products are made here: ethylene,

propylene, and cyclohexane.

Port Neches, Texas

The C4 Plant in Port

Neches covers a land area of 585 acres and employs

approximately 250 associates. Two major products here are

butadiene and MTBE (methyl tertiary butyl ether.) The

plants have a capacity to produce 750 million pounds

per year of butadiene and 3.8 barrels per year of MTBE.

The Oxides & Olefins Plant in Port Neches cover a

land area of 2400 acres and employs approximately 450

associates. A wide variety of products are made here: ethylene,

propylene, ethylene oxide, ethylene glycol, propylene

glycol, ethanolamines, surfactants, morpholine,

diglycolamine, and other smaller by-products.

Alongside the O&O plant is the PO/MTBE plant. The

PO/MTBE Plant covers a land area of 195 acres and employs

approximately 150 associates. The plant can produce 400 million pounds

of propylene oxide and 2.2 billion pounds of MTBE per

year.

Europe

Huntsman European

Petrochemicals is a major manufacturer of bulk commodity

chemicals. These provide the key raw materials for a vast

range of end products, which are essential for today's modern

lifestyles.

Our production facilities comprise:

・the Olefins business, manufacturing ethylene,

propylene and butadiene on the world-scale Olefins

'Cracker' plant at the Wilton International Site. From

here, we also store and distribute products and

feedstocks via ship and cross-country pipelines.

・the Aromatics

business,

manufacturing benzene, ethyl benzene, xylenes,

cyclohexane and cumene at our North Tees Site and

Paraxylene at Wilton International.

・at North Tees, we

also manufacture brine, operate ethylene liquefaction

facilities and store feedstocks

and products for distribution by road and ship.

These manufacturing operations are highly integrated and

closely linked in terms of both feedstocks and finished

products.

Huntsman European

Petrochemicals came into existence on 1 July 1999 when the

business was purchased by Huntsman Corporation from

ICI as part of a major acquisition which also included the

Polyurethanes and Tioxide global operations.

Virtually all of the European

Petrochemicals manufacturing operations are based at two

large chemical complexes on Teesside, UK - Wilton and North

Tees sites.

ANZ

Huntsman Chemical Company

Australia (HCCA) Pty Limited's origins go back to 1928 and

the founding of the Monsanto Southern Cross Chemical Company.

Huntsman Chemical Company Australia manufactures and

distributes a diverse range of plastics and chemicals -

Styrene Monomer

Polystyrene

EPS

Polyester Resins

Gelcoats

Phenol, Acetone and Cumene Hydroperoxide

Phenolic Resins

Phenolic Laminating Resins

Other Petrochemicals

Chemical Week 2002/6/25

Huntsman Restructures Debt; Family

to Cede 49.9% Stake

By Robert Westervelt

Huntsman Corp. has agreed to

a financial restructuring with its largest bondholder that

includes the

exchange of most of its outstanding bond debt for a 49.9%

stake in the Huntsman family’s chemical holdings.

Huntsman

International, formed

when Huntsman purchased a majority stake in ICI’s industrial chemical business, has performed relatively well under

a separate financing facility and continued to make bond

interest payments.

April 16, 2003 Financial

Times

Huntsman to build world's largest LDPE plant in the UK.

Huntsman is to build a

375,000-400,000 tonnes/y, EUR 200 M - EUR 220 M, low density

polyethylene (LDPE) plant in Wilton, Teeside, UK, which would

be the largest in the world.

Huntsman makes

800,000-900,000 tonnes/y of ethylene on the site and

currently stores it cryogenically for export. The new plant

will save the cost of cryogenic storage(低温保管)

of 400,000 tonnes/y of ethylene

by replacing it with PE storage and transport.

Petrochemical News 19 JULY

2004 (Vol. 42, No. 29)

Huntsman Mulling Construction Of Wilton, U.K., LDPE Facility 参考

http://www.petrochemical-news.com/P-V42N29.pdf

Kurt Dowd, vice president of

finance and investor relations for Huntsman, told PCN that

Huntsman's board is expected to make a decision by the end of

this year on building a 400,000-t/y LDPE plant at the Wilton

complex.

Huntsman acquired

the Wilton cracker from BP and ICI in 1999. At that time, the cracker was reported

to have about 1.9-billion

lbs/yr of ethylene and 880-million lbs/yr of propylene capacity.

2004/9/7 Platts 発表 事前情報

Huntsman announces go-ahead for

world's largest LDPE plant

Huntsman has finalized its decision to build a 400,000 mt/yr low

density polyethylene plant at Wilton, UK. The GBP200-mil ($355-mil)

plant will mark Huntsman's entry into the European polyethylene

market.

The company expects to begin construction in 2005, with the plant

being operational in the third quarter of 2007, subject to

technology licensing.

January 21, 2005 BUSINESS

WIRE

ExxonMobil Chemical Announces a Licensing Agreement for the

World's Largest LDPE Tubular Reactor

ExxonMobil Chemical Technology Licensing, LLC announces it

has signed an agreement with Huntsman Petrochemical (UK)

Limited to license ExxonMobil's tubular process technology

for Huntsman's new world-scale low density polyethylene

(LDPE) plant. The 400 kilotonnes-per-year (kta) plant, to be

built in Teesside, England, will be the world's largest LDPE

reactor. Work is expected to start on the new facility in

January 2005 with completion expected in late 2007.

2004/9/8 Huntsman

Huntsman to Proceed With

Construction of World's Largest Polyethylene Plant

http://www.huntsman.com/index.cfm?PageID=816&News_ID=1239&style=8

Huntsman President and Chief

Executive Officer Peter R. Huntsman today announced the go-ahead

for plans to build the world’s largest low density polyethylene (LDPE)

manufacturing facility, on Teesside in the UK. The announcement

was also made simultaneously in London by UK Secretary of State

for Trade and Industry, Patricia Hewitt, MP

The 400,000 tonnes per year plant, Huntsman’s first venture into the growing European

polyethylene market, will be built at the Wilton International

site at a cost of around £200

million. The company anticipates the main plant will cost

approximately £180 million

with a further £20 million

covering logistics and infrastructure.

2005/10/6 Huntsman

Huntsman Breaks Ground

For New £200 Million Polyethylene Project

At Wilton

http://www.huntsman.com/index.cfm?PageID=5549&News_ID=1411&style=4544

Huntsman Corporation

President and Chief Executive Officer Peter R Huntsman today

(Thursday, 6 October) launched the start of construction of the

world’s largest Polyethylene facility at

the Wilton International chemical complex near Redcar.

Piling and ground preparation work will start on site shortly and

construction of the 400,000 tonnes a year polyethylene

facility will

be spread over two years, with completion due in the fourth

quarter of 2007.

Platts 2005/11/16

US Huntsman to break

ground for Singapore polyetheramines plant ポリエーテルアミン

Huntsman of the US

is scheduled to launch construction of a new polyetheramines

plant in Singapore on Nov 30, a company source said Tuesday.

下記参照

2005/9/14 Huntsman

Huntsman to Build

Polyetheramine Manufacturing Facility in Singapore

http://www.huntsman.com/index.cfm?PageID=1159&News_ID=1390&style=40

Peter R. Huntsman,

President and CEO of Huntsman Corporation today announced the

company plans to build a world scale polyetheramine manufacturing

facility in Jurong Island, Singapore.

The company expects the facility, which will have an annual

capacity of approximately 30 million pounds, to be operational in the first

quarter of 2007.

“We

currently have polyetheramine production facilities in Conroe, Texas and

Llanelli, Wales.

Completion of the Singapore plant will increase our capacity by

approximately 25% and give us a truly global platform for the

manufacture and marketing of this specialty product.”

Key polyetheramines

applications include epoxy coatings, concrete additives, organic

pigments, fuel and lube additives, and herbicides and pesticides.

20 May 2010

Huntsman to Expand its JEFFAMINE(R) Polyetheramine

Manufacturing Capacity in Singapore

The Performance Products division of Huntsman Corporation

announced today that it will expand manufacturing capacity of

its JEFFAMINE(R) polyetheramine manufacturing facility

located on Jurong Island, Singapore. The planned expansion is

anticipated to occur by the end of the third quarter of this

year and will increase existing capacity by more than 50%.

Daniele Ferrari, President of Performance Products said, “We have been extremely pleased

with this Singapore investment and the ongoing support

provided to us by our customers and the Singapore

authorities. It is very gratifying to have this opportunity

to invest further in the Jurong Island facility.”

“This

facility, which began operations in 2007, has been a critical

strategic manufacturing platform in meeting the regional

demands for JEFFAMINE polyetheramines in Asia over the past

three years. Rapidly growing regional demand necessitates

this additional investment to meet the markets’

increasing

requirements,” said Steve Stilliard, Vice

President, Performance Products - Asia Pacific.

British Plastics

& Rubber 2006/2/1

Bidders in talks to buy Huntsman

The giant American chemicals company Huntsman Corporation is in

takeover talks.

Reports from the USA have

linked Huntsman, which went public last year but is still owned

substantially by its founder Jon Huntsman, with interest from a

number of private equity firms. Apollo Management, which has just

bought Tyco's plastics and adhesives business, has been tipped as

a leading bidder with a price of in excess of $4・3 billion in discussion.

2006/2/5 Huntsman

Huntsman Ends Discussions

On Company's Sale

http://www.huntsman.com/index.cfm?PageID=5549&News_ID=1473&style=4544

Huntsman Corporation

announced today that it has terminated discussions regarding

existing proposals to acquire the Company.

After careful review of the proposals received, the Company’s prospects and other strategic

initiatives available, as well as thorough discussions with the

parties, the Board of Directors of the Company and its special

committee have concluded that none of the proposals were in the

best interests of the shareholders.

2006/2/24 Texas

Petrochemicals

Texas

Petrochemicals, Inc. Announces Intent to Purchase Assets of

Huntsman Corporation’s U.S. Butadiene Business

http://www.txpetrochem.com/ci/pdf/tpcnews/TPC-PurchaseofHuntsmanCorpAssets.pdf

Texas Petrochemicals,

Inc. (the “Company”) today announced that Texas

Petrochemicals LP

has signed a letter of intent to purchase the assets of the

United States butadiene and related MTBE operations of Huntsman

Corporation, which includes a manufacturing facility located in

Port Neches, Texas, for a purchase price of $275 million, subject

to customary adjustments. The transaction is expected to close in

mid-2006.

The Port Neches

manufacturing facility has a capacity of approximately 900

million pounds of butadiene per year. The addition of these

assets creates a business with more than $1.7 billion in revenues

on a pro forma basis based on calendar year 2005

results.

2006/2/24

Huntsman

Huntsman To Sell U.S. Butadiene Business

http://www.huntsman.com/index.cfm?PageID=1159&News_ID=1481&style=40

Huntsman has owned

the business since its 1994 acquisition of Texaco

Chemical Company.

The manufacturing facility has a capacity of approximately 900 million

pounds of butadiene per year and approximately 11,000 barrels

per day of MTBE.

The business has about 240 employees. The business had 2005

revenues of approximately $626 million and EBITDA of

approximately $43 million.

2006/4/6

Huntsman

Huntsman, Texas

Petrochemicals Enter Into Definitive Agreement On Butadiene

Business

http://www.huntsman.com/index.cfm?PageID=5549&News_ID=1490&style=4544

Huntsman Corporation

announced today that it has entered into a definitive

agreement to sell the assets comprising its U.S. butadiene and

MTBE

business to Texas Petrochemicals, L.P. for a sales price of

$269 million, subject to customary adjustments. The companies

expect to close the transaction in May.

The companies had signed a letter of intent regarding the sale in

February.

Texas Petrochemicals LP http://www.txpetrochem.com/ci/ci.htm ↑

Texas Petrochemicals LP

(TPC) specializes in C4 hydrocarbons. The company's integrated

manufacturing facility focuses on production and marketing within

four main business units: C4 Olefins, Specialty Chemicals,

Fuel Products and Polyisobutylene. TPC maintains its leadership in

the industry with an innovative ability to bring high-quality

products to the marketplace. Among the diverse product lines

available to TPC customers are Butadiene, Butene-1, Isobutylene

and Isobutylene derivatives.

Texas

Petrochemicals LP (TPC) became a significant C4 producer with the

acquisition of its Houston C4 chemical processing site in 1984.

In 1996, after 12 successful years of growth and safe operations,

the company's employees, management and a group of investors

acquired the company. Under the new employee ownership, TPC has

moved forward to become the world's best-known processor and

supplier for high-quality C4 chemical products and derivatives.

| 2010/1/28 Texas

Petrochemicals Inc. Changes Its Name to TPC Group Inc.

TPC Group Inc., formerly Texas Petrochemicals Inc., today

announced that it has changed its name to TPC Group Inc.

effective January 22, 2010. The Company's new name

reflects the increasing breadth and scope of its product

lines and the value-added services it provides to its

customers and suppliers and will not affect any

contractual obligations.

|

2003/7/21

Texas Petrochemicals

Texas Petrochemicals

LP and Affiliates File Chapter 11 Petitions to Facilitate

Financial Restructuring

http://www.txpetrochem.com/ci/pdf/tpcnews/03-07-21.pdf

Texas Petrochemicals

LP (TPLP), and its affiliates Texas Petrochemical Holdings,

Inc. (TPH), Petrochemical Partnership Holdings, Inc, TPC

Holding Corp, and Texas Butylene Chemical Corporation,

announced today that to facilitate a financial restructuring,

they have filed voluntary petitions for relief under Chapter

11 of the U.S. Bankruptcy Code in the United States

Bankruptcy Court for the Southern District of Texas.

TPLP owns and operates petrochemical manufacturing facilities

in Houston, Texas and operates product terminals in Baytown,

Texas and Lake Charles, Louisiana.

The Chapter 11 filings were necessitated primarily by the drastic

and likely permanent reduction in MTBE demand, arising from regulatory

changes, and by recent higher raw material and energy costs.

We expect TPLP to

emerge from the reorganization with a significantly improved

financial structure that will position TPLP for long-term

success in our core butadiene, specialty chemicals and

gasoline alkylate businesses, while phasing out our

on-purpose MTBE production."

Platts 2006/6/15

Texas Petrochemicals announces Baytown, Texas, expansion plan

Texas Petrochemicals LP announced Thursday the start of an

expansion project at its Baytown, Texas, facility, which will

expand the company's product portfolio to include nonene and

propylene tetramer.

The expansion project, which is scheduled for completion in

the first quarter of 2007, will include construction of a

twin reactor, propylene derivatives plant that will produce nonene and

propylene tetramer, as well as polymer gasoline

and propane, the company said.

ノネン プロピレンの3重合体

Platts

2007/7/27

Texas

Petrochemicals leaving MTBE market by year's end: source

Texas

Petrochemicals (TPC) will step out of the merchant MTBE

market by the end of this year, a source familiar with the

operations told Platts Friday.

TPC

is one of the largest producers of MTBE in the US.

2007/11/19

Platts

US' Texas

Petrochemicals to double its polyisobutylene capacity

Texas Petrochemicals

Inc (TPC), a petrochemical company specializing in products

derived from C4 and C3 hydrocarbons, confirmed Monday its

plans to more than double its current

production of polyisobutylene (PIB) by mid 2008 with the addition of a new

manufacturing facility in Houston, Texas.

2006/2/27 Huntsman

Huntsman Selects Geismar as Site for Maleic Anhydride Expansion

http://www.huntsman.com/index.cfm?PageID=5549&News_ID=1482&style=4544

Peter R. Huntsman,

President and CEO of Huntsman Corporation, today announced the

selection of Huntsman's Geismar, Louisiana site as the location

for the Company's previously announced new 100 million pound

world scale maleic anhydride facility. The Company will

commence detailed engineering and reactor procurement

immediately. Huntsman has chosen a fast track implementation

model that will enable the plant to startup in the 3rd quarter of

2008.

Huntsman is a leading global producer of maleic anhydride and

currently has the annual capacity to produce 240 million pounds

at its Pensacola, Florida facility. Huntsman also owns a 50% interest in a joint

venture in Moers, Germany that currently

has an annual capacity of 125 million pounds.

* CONDEA-HUNTSMAN is a 50:50 joint venture of RWE-DEA Aktiengesellschaft fur Mineraloel

und Chemie of Hamburg, Germany, and Huntsman Corporation of Salt

Lake City, U.S.A. RWE-DEA conducts its global chemical business

under the CONDEA brand name.

RWE Dea AG

http://www.rwe.com/generator.aspx/rwe-dea/unternehmen/language=en/id=226960/unternehmen.htm

RWE Dea AG is one of the

leading petroleum companies in Germany, with a special focus on

activities relating to the exploration and production of crude

oil and natural gas. This is a field in which RWE Dea enjoys more

than 100 years of experience, cutting-edge drilling and

production technologies, as well as a broad reservoir of

know-how.

In Germany, the company's activities focus on the exploration and

production of natural gas, development of the Mittelplate

offshore field in the North Sea tidelands and the operation of

large underground natural gas storage facilities. Increasingly,

the company's international upstream activities, first and

foremost in Norway and Egypt, as well as in Dubai, Denmark,

Poland and Kazakhstan, are being pursued with growing commitment

in collaboration with competent partners.

RWE occupies top rankings in its core businesses, electricity,

gas, water & wastewater, waste disposal & recycling.

2006/8/16 Huntsman

Huntsman Announces Major

Pigments Production Increase 着色料 二酸化チタン

Huntsman Corporation

today announced plans for a 50,000 MTE expansion of its flagship titanium dioxide

manufacturing facility at Greatham, U.K., bringing the facility’s annual capacity to 150,000 MTE.

The expansion will be based upon Huntsman’s proprietary ICON chloride

technology and is the second significant project at the Greatham

site since Huntsman acquired the TiO2

business in 1999.

The company expects the new capacity to be operational in the

second half of 2007 and fully completed in early 2008.

2008/8/24

AsiaPulse via COMTEX

US chemical giant Huntsman to boost China investment

US chemical giant Huntsman Corp will step up its investment in

China in order to tap into strong domestic demand in the world's

largest market for textile effects chemicals.

Peter Huntsman, the company's president and chief executive

officer, made the remarks at yesterday's inauguration of Huntsman

Textile Effects (China), in Guangzhou, southern China's Guangdong

Province.

The new firm was the result of Huntsman's acquisition of the

global textile effects business of Ciba Specialty Chemicals

Holding Inc

for US$253 million, which was completed last month.

New York-listed Huntsman has so far invested US$1 billion in

China, including the acquisition of Ciba's China-based textile

effects operations.

Huntsman also has a one-third share in a US$1 billion Shanghai chemical plant that mainly produces polyurethane.

The project, which also has investment from BASF and Chinese

partners, will become operational today, supplying the

shoemaking, automobile and electrical appliance industries.

2007/2/1 Huntsman

Huntsman and NMG Announce Polyurethanes Joint Venture in Russia

and Former Soviet States

ZAO HUNTSMAN-NMG TARGETS HIGH GROWTH MARKETS

Huntsman Corporation and NMG today announced the creation of a

new, Russia-based joint venture, ZAO Huntsman - NMG, to manufacture and sell polyurethane

systems to

the adhesives, coatings, elastomers and insulation markets in Russia and other

areas in the former Soviet Union. The financial terms were not

disclosed.

Huntsman NMG will be based at NMG’s existing headquarters in

Obninsk, close to Moscow, and will be managed by a General

Director Sergey Ovcharov. The company employs over 200 employees,

and has state of the art manufacturing and distribution

facilities in Obninsk and a network of branch offices across the

region, including in Belarus and the Ukraine.

NMG was founded in 1992 and has grown to be one of the leading

polyurethanes companies in the former Soviet Union supplying a

wide range of industries including construction, footwear and

insulation with specialised polyurethanes systems optimized to

meet specific user needs. Through its far reaching network of

branch offices, NMG aims to provide it’s customers with the highest level

of innovation and service.

2007/2/15 Huntsman

Huntsman to Sell U.S.

Commodities Business to Flint Hills Resources

Sale Will Complete Final Step in Transformation to Differentiated

Portfolio

Peter R. Huntsman,

President and CEO of Huntsman Corporation, today announced that

Huntsman has signed definitive documents with Flint Hills

Resources, LLC,

a wholly owned subsidiary of Koch Industries, Inc., for Flint Hills Resources to

acquire Huntsman's U.S. Base Chemicals and

Polymers business.

Huntsman is expected to

realize a total value from the sale of approximately $761 million. Under the agreement, Flint Hills

Resources will acquire the manufacturing assets of Huntsman's

U.S. commodities business for $456 million in

cash plus the value of inventory ($286 million at Dec. 31, 2006) on the date of closing.

Huntsman will retain other elements of working capital, including

accounts receivables, accounts payable and certain accrued

liabilities (net, $19 million at Dec. 31, 2006), which will be

liquidated for cash immediately following the closing.

The transaction includes

Huntsman's olefins and polymers manufacturing

assets located at five U.S. sites: Port Arthur, Odessa and

Longview, Texas; Peru, Illinois; and Marysville, Michigan. The business employs about 900

associates. The captive ethylene unit at the

retained Port Neches, Texas, site of Huntsman's Performance

Products division is not included in the sale. This

asset, along with a long-term post-closing arrangement for the

supply of ethylene and propylene from Flint Hills to Huntsman,

will continue to provide feedstock for Huntsman's downstream

derivative units.

About Flint Hills

Resources:

Flint Hills Resources is

a leading producer of fuels, base oils for lubricants, and other

petrochemical products, based in Wichita, Kan. It owns refineries

in Alaska, Minnesota and Texas, a chemical intermediates plant

near Joliet, Ill., pipelines, and an interest in Excel Paralubes

in Westlake, La. The company produces pseudocumene at its Corpus

Christi, Texas, facility, as well as other building-block

chemicals such as metaxylene, orthoxylene, paraxylene, benzene,

cumene and toluene. In Illinois, the company produces maleic

anhydride, trimellitic anhydride and purified isophthalic acid.

Flint Hills Resources

became an independent, wholly owned subsidiary of Koch

Industries, Inc., in January, 2002 in order to focus on growth

opportunities. This proposed acquisition is a direct result of

that business mandate, and adds to assets acquired in 2003 and

2004.

Flint Hills Resources

- Refining

Business - Flint Hills Resources operates refining

complexes in Alaska (North Pole), Minnesota (Pine

Bend) and Texas (Corpus Christi) with a combined

crude oil processing capacity of

about 800,000 barrels of crude oil per day. These

facilities are served by strategically located

terminals and pipelines, some of which are operated

by Koch Pipeline Company, L.P.

- Canadian

Businesses - Flint Hills Resources' interests in

Canada include Calgary-based crude oil marketing,

transportation and storage activities. These

businesses are primarily focused on providing a

supply of Canadian crude oil to the Pine Bend

Refinery.

- Chemicals -

Flint Hills Resources is a leading producer of

petrochemicals and related products, with primary

manufacturing facilities at the Corpus Christi

refining complex.

The company produces chemical intermediates -- used

in the manufacture of items such as polyester resins

and automotive, agricultural and consumer products --

from its plant near Joliet, Ill.

Corpus Christi,

Texas, the petrochemicals facility produces about 4

billion pounds of building-block chemicals - such as

paraxylene, orthoxylene, mixed xylene, benzene, cumene,

toluene and pseudocumene - annually.

Joliet, Ill., facility, near Chicago, manufactures

chemical intermediates, including purified isophthalic

acid, maleic anhydride and trimellitic anhydride.

- Base Oils -

Flint Hills Resources markets Group II base oils -

the primary feedstock in motor oil - from the Excel

Paralubes facility in Westlake, La.

- Crude Oil -

Supply for the refineries is secured through crude

oil purchasing offices located in Calgary and

Houston.

- Fuels Marketing

- The company markets a full slate of petroleum

products - gasoline, jet fuel, diesel, heating oil

and others - including value-added fuels such as

cleaner-burning gasolines and performance diesel

fuels.

2007/4/30 Huntsman

Huntsman Scales Up

Process to Convert a Biodiesel By-product to Propylene Glycol

Company Continues

Sustainable Chemistry Initiative

Huntsman

Corporation today announced a further step in its plan to

commercialize a process for manufacturing propylene glycol

from a renewable raw material, and will make it available for

customer trials as early as next month.

The production of biodiesel from

vegetable and seed oils creates the by-product glycerin, which then can be used to

manufacture propylene glycol for the global market’s four-and-a-half billion pound

annual demand for the material. Propylene glycol is used to

de-ice commercial aircraft prior to take-off, and in the

manufacture of construction materials, among other end uses.

Oct. 11, 2006 Cargill

Cargill

to Lead Commercialization of Renewable Propylene Glycol from

Glycerin

Cargill

is leading efforts to commercialize a proprietary process for

using glycerin -- an abundant, low cost co-product of

biodiesel production -- as feedstock for a platform of

biobased products, beginning with renewable propylene

glycol (PG).

Through a new company being formed, the venture will provide

commercially competitive PG from renewable feedstocks

manufactured in multiple geographies.

Biodiesel

Magazine December

2006

Cargill makes plans for

glycerin supply

Cargill, an

experienced agricultural company but a relatively new

biodiesel producer with a 37 MMgy(million

gallons per year) plant

in Iowa Falls, Iowa, announced plans to form a new company

that will make a variety of bio-based products from glycerin,

a by-product of transesterification. The name of the future

company wasn't available at press time.

Cargill plans to commercialize a proprietary process that

turns glycerin into propylene glycol (C3H8O2), a sweet,

colorless, viscous, hygroscopic liquid used as an antifreeze,

in brake fluid, and as a humectant in cosmetics and personal

care items.

参考 Solvay、Dow、バイオディーゼル副生グリセリンを原料とするエピクロの生産

Glycerin C3H5(OH)3

Epichlorohydrin C3H5CLO

Propylene Glycol C3H8O2

31 May 2007

Huntsman

Huntsman Poised to Open

New Polyetheramines Plant in Third Quarter

New Plant to Meet Growing Demand

for JEFFAMINE® Product Line

Huntsman Corporation

today announced mechanical completion of its first Asia Pacific

polyetheramines plant. With this announcement, Huntsman

expects to introduce feedstock to the plant in mid-June and be in

commercial operation by the third quarter.

Huntsman and its

engineering contractor, Jacobs Engineering, achieved mechanical

completion of the 15,000 tonnes per annum JEFFAMINE®

polyetheramines

plant, after

an 800,000 man-hour construction process, without a single lost

time incident. Huntsman’s total investment in the project,

located

at Jurong Island, Singapore, is approximately US$40 million.

2007/6/14 Platts

Hunstman to take majority

control of JV with BCI

Huntsman Corp and Basic Chemicals Industries Limited (BCI) have

signed an agreement that will see Huntsman take over majority

ownership of Arabian Polyol Company (APC), a joint venture between Huntsman

and BCI, the companies announced Thursday. Majority control of

the company was previously held by BCI.

The joint venture, which manufactures and sells MDI-based

polyurethane systems in the Gulf countries, will assume a new

name, Huntsman APC and will be based at a previously

existing facility in Damman, Saudi Arabia. Financial terms of the

transaction have not yet been disclosed.

Tamimi Group

http://www.altamimi.com/about.asp

The

extraordinary development of Saudi Arabia to a modern nation

from a desert kingdom in five decades is unrivaled.

Throughout this period, in all areas of activity and at all

levels, The Tamimi Group of Companies rose to the challenge

to work in concert with foreign and local partners. Today the

results of these efforts are everywhere in evidence - in

commerce, in services, in industry, in manufacturing, in both

the public and private sectors.

Basic

chemical Industries

Tamimi

Group has

sizable shareholdings in Basic chemical Industries. BCI is a

pioneer in private sector chemical manufacturing industry

with an extensive stock of commodity and specialty chemicals.

BCI located in

Dammam, Saudi-Arabia, is a producer and distributor of

more than 600 chemical products in the inorganic and

specialties segments (hydrochloric acid, adhesives,

polyurethanes, water treatment, resins etc.). The Group

has 400 employees and an annual turnover of $ 150

million. BCI was established in 1975 as a manufacturer of

commodities and specialties chemicals for local Saudi and

export markets.

Arabian

Polyol Company (APC)

APC

is a BCI subsidiary and a joint venture with Huntsman

Corporation.

Commissioned in 1985, APC was the Kingdom‘s first manufacturer of

polyurethane chemicals offering products for different levels

of density including rigid, semi-rigid and soft foams.

Jun 19, 2007

Reuters

Huntsman eyes Clariant,

Ciba takeovers

U.S. chemicals group Huntsman Corp. is keen on buying Swiss peers

Clariant

and Ciba,

the head of Huntsman was quoted as saying, reinforcing the view

either group may be taken over.

But Huntsman said he would not make a hostile offer.

"First, Clariant or single divisions must officially be for

sale," Huntsman told the newspaper.

Ciba last year sold its Textile Effects unit to Huntsman for some 330 million Swiss francs

($266.1 million).

2007/7/2 Huntsman

Huntsman to Acquire

Baroda Division of Metrochem Industries

Huntsman Corporation

today announced that its Textiles Effects business has signed an

agreement to acquire the Baroda division of Metrochem Industries

Ltd for $46.5 million in cash. The division to be acquired by

Huntsman is a textile dyes and intermediates

manufacturer based in Baroda, India. The transaction, which is subject

to regulatory approvals, is expected to close in January 2008.

2007/7/4 Huntsman

Huntsman Receives Merger

Proposal From Hexion For $27.25 per Share in Cash

Huntsman Corporation

announced today that it has received from Hexion Specialty Chemicals, Inc. ("Hexion"), an entity

owned by an affiliate of Apollo Management, L.P.,

a proposal (the

"Hexion Proposal") to acquire all of the outstanding

common stock of Huntsman for $27.25 per share in cash.

詳細及び解説

July 9, 2007 Hexion

Hexion Increases

Offer for Huntsman Corporation to $28.00 Per Share

Hexion Specialty

Chemicals Inc., an Apollo Management L.P. portfolio company,

today announced that it has increased its definitive proposal

to acquire Huntsman Corporation to $28.00 per

share,

in cash (transaction value $10.5 billion

including debt),

and has presented this proposal to the Huntsman Board of

Directors and its Transaction Committee (comprised of

independent Huntsman directors). The Huntsman Transaction

Committee and the Board had previously determined that

Hexion's proposal to acquire Huntsman for $27.25 per

share,

in cash constituted a Superior Proposal under the terms of

the current merger agreement between Huntsman and Basell AF.

Hexion's proposal is otherwise subject to the terms

previously disclosed by Hexion and Huntsman. Until Huntsman's

Board or Transaction Committee takes further action pursuant

to the terms of the Basell agreement, it continues to

recommend the transaction with Basell to its shareholders.

There can be no

assurance that a transaction between Hexion and Huntsman will

be agreed. Any such transaction would be subject to

regulatory approvals and the affirmative vote of Huntsman's

shareholders, as well as other customary conditions. Hexion's

proposal is fully financed pursuant to commitments from

affiliates of Credit Suisse and Deutsche Bank.

AFX News 2007/7/12

Hexion confirms to buy

Huntsman in 10.6 bln usd deal

Hexion Specialty

Chemicals Inc, an Apollo Management LP portfolio company, said it

has

signed a definitive agreement to buy rival chemical company Huntsman

Corp for 28.00 usd per share cash, or 10.6 bln usd, including 4

bln usd debt.

2007/7/12

Huntsman

Huntsman Agrees to Be

Acquired By Hexion for $28.00 Per Share

Terminates Merger Agreement With Basell

Huntsman Corporation

today announced that it has terminated the merger agreement

with Basell AF ("Basell") dated June 26, 2007 (the

"Basell Agreement") and has agreed to a

definitive merger agreement (the "Hexion

Agreement") with Hexion Specialty

Chemicals, Inc.

("Hexion"), an Apollo Management, L.P.

("Apollo") portfolio company, pursuant to which

Hexion will acquire Huntsman in a transaction with a total

value of approximately $10.6 billion, including the

assumption of debt (the "Hexion Transaction").

Huntsman's Board of

Directors authorized the delivery of a notice of

termination of the Basell Agreement, along with the payment

of the $200 million break-up fee required by the Basell

Agreement.

Hexion funded $100 million of the Basell break-up fee while

Huntsman funded the remaining $100 million.

2007/7/11 Basell

Basell reconfirms its

offer for Huntsman

Basell,

the global leader in polyolefins, confirmed that it will

stand by its $25.25 a share offer for Huntsman Corporation

(NYSE: HUN).

On

June 26, 2007, Basell and Huntsman signed a merger agreement

which valued Huntsman at a full and fair price, and offered

certainty and the ability to close rapidly. The majority

shareholders of Huntsman signed a voting agreement with

Basell in support of the merger agreement.

Basell

has since been notified by Huntsman that an offer by Hexion

Specialty Chemicals Inc. is “superior”

to Basell’s existing merger agreement.

Under the terms of Basell’s agreement, Basell will be

entitled to a $200 million payment if Huntsman terminates the

Basell merger agreement to accept the Hexion offer.

Basell

understands that the Hexion offer faces a lengthy and complex

regulatory approval process and that closing the Hexion

transaction will require many months and is subject to

uncertainty. Basell will monitor the situation.

2007/7/12

Hexion

Hexion Specialty

Chemicals, Inc. To Acquire Huntsman Corporation For $28.00

Per Share In Cash

Hexion Specialty

Chemicals, Inc., an Apollo Management L.P. portfolio company,

announced today the signing of a definitive agreement to

acquire Huntsman Corporation in an all-cash transaction

valued at approximately $10.6 billion, including the

assumption of debt.

Joshua J. Harris, founding partner with Apollo Management

L.P., said: "This acquisition will build Hexion into

one of the world's largest specialty chemical companies. The combined enterprise will

have annual sales of more than $14 billion and more than

21,000 associates and 180 facilities around the world. We are

pleased to welcome the Huntsman team and look forward to

building on their many accomplishments in the industry."

Platts 2007/7/19

Huntsman says enters alliance for Texas biodiesel plant

Huntsman said Thursday it entered an agreement with RBF Port

Neches for the construction of a biodiesel plant to be located at

an existing Huntsman facility in Port Neches, Texas.

Under the agreement, RBF will design, finance, build and own the

new plant, which is to have an initial capacity of 89 million

gal/year of biodiesel, with plans to expand to nearly 180 million

gal/year of production, Huntsman said in a statement. The

chemical giant would operate and maintain the plant, which is

expected to come online in mid-2008. RBF would then be

responsible for the marketing of the output of the plant.

2007/7/25 Huntsman

Huntsman Acquires Global

Fluorochemical Product Line for Nonwovens from DuPont

Huntsman Corporation today announced that its Textiles

Effects business has signed an agreement to acquire DuPont's

global fluorochemical business for the nonwovens industry. The DuPont(TM) Zonyl(R)

fluorochemical product line is used on nonwovens as effective

repellents for water, alcohol and oil based fluids. Nonwoven

textiles are primarily used in medical, filtration, automotive

and construction applications.

Following a brief

transition period to ensure a smooth handover and uninterrupted

supply, Huntsman will assume

responsibility for all future activities related to the business. The transaction with DuPont

includes a long-term supply agreement for

finished products and intermediates, but does not include the

transfer of DuPont employees or the sale of DuPont manufacturing

assets. The

parties also entered into a joint development agreement to bring

new innovations to the nonwovens marketplace.

Aug 01, 2007

Huntsman Huntsman

to Sell U.S. Commodities Business to Flint Hills Resources

Huntsman And Flint Hills

Resources Close On Sale Of U.S. Polymers Business

Sale of Port Arthur Base Chemicals Business to Close upon Plant

Restart

Peter R. Huntsman, President and CEO of Huntsman Corporation,

today announced that Huntsman and Flint Hills Resources, LP, an

independent, wholly owned subsidiary of Koch Industries,

Inc., have

closed on the sale of Huntsman’s U.S. Polymers business. The parties will close on the

sale of Huntsman’s remaining U.S. Base Chemicals

business

upon the restart of Huntsman’s Port Arthur, Texas, olefins

manufacturing facility, commissioning of which is expected to

occur later this year.

Included in the closing announced today are Huntsman’s manufacturing assets located at

four U.S. sites: Odessa and Longview, Texas; Peru,

Illinois; and Marysville, Michigan. Huntsman’s amorphous polyalphaolefin (or

APAO) products, which Flint Hills will manufacture for Huntsman

at the Odessa site under a long-term supply arrangement, are not

included in the sale.

Platts 2007/8/29

Huntsman to

restart Port Arthur in October, complete sale to FHR

Huntman's Port Arthur, TX

olefins plant was due to come back online in early October, a

company source reported Wednesday. With the restart, the

ownership of Huntsman's base chemical business would be

transferred to Flint Hills Resources.

The 1.36-billion lb/yr plant had been down since late April

2006 following an explosion at the site. The

acquisition by Flint Hills had been subject to the plant

being declared operational.

Nov 05 2007

Huntsman

Huntsman and Flint Hills

Resources Close On Sale of Base Chemicals Business

Sale Completed Upon Port Arthur Plant Restart

Peter R. Huntsman,

President and CEO of Huntsman Corporation (NYSE: HUN), today

announced that Huntsman and Flint Hills Resources, LP, an

independent, wholly owned subsidiary of Koch Industries, Inc.,

have closed on the sale of Huntsman’s Base Chemicals

business.

The sale of the Base

Chemicals business is the second closing in a two-part

transaction valued in total at approximately $770 million.

The parties had

previously closed on the sale of Huntsman’s

U.S. Polymers business in August.

2008/2/25 Huntsman

Huntsman Commences Design and Feasibility Studies to Expand its

Global MDI Manufacturing Capacity

2008/1/25

Hexion and Huntsman agree to FTC request to extend

review time for proposed merger to May 3, 2008.

|

Huntsman Corporation

announced today that it has commenced design and feasibility

studies to increase its global capacity for the manufacture of

methylene diphenyl diisocyanate (MDI) through investment in a

new, world scale MDI plant at its site in Rozenburg, the

Netherlands.

Feasibility studies, including preliminary engineering for the

new unit, are now underway and a final investment decision is

expected during 2008, with the new 400,000 metric

tons capacity

unit coming on-stream by mid-2011. The final plan may also

incorporate the closure of older, less efficient capacity in

Europe.

Pursuant to the studies, Huntsman also intends to expand its MDI

and downstream asset capacity in all three major regions through

the deployment of new proprietary technologies in aniline,

methylene dianiline (MDA) and MDI production, which will both

increase raw material yields and improve energy efficiency by up

to 40%, as compared with previous generation technology.

2008/4/1 Huntsman HuntsmanのサウジInternational Diol

Company 計画(Maleic Anhydride技術供与)

Huntsman Joint Venture To

Pursue Major Maleic Anhydride Expansion In Germany

Sasol-Huntsman

GmbH & Co. KG,

a 50/50 joint venture between affiliates of Huntsman Corporation

and Sasol Limited located in Moers, Germany, today announced

plans to pursue the expansion of its maleic anhydride manufacturing capacity by 45,000

mt. The new capacity, which is

expected to be on-line in first quarter 2011, will increase

Sasol-Huntsman´s production capacity by 75%, to 105,000 mt.

The expansion will

be funded by the joint venture’s internal cash flow and its

non-recourse financing.

The new plant’s design is similar to Huntsman’s 45 kt plant under

construction in Geismar (USA), which is expected to be

operational in late 2008.

2008/6/18 Hexion

Hexion files suit

alleging that transaction with Huntsman is no longer viable

Combined Company Determined to be Insolvent

Hexion Specialty Chemicals, Inc. (“Hexion”) announced today that it and

related entities have filed suit in the Delaware Court of

Chancery to declare its contractual rights with respect to its

$10.6 billion merger agreement with Huntsman Corporation (“Huntsman”). Hexion said in the suit that it

believes that the capital structure agreed to by Huntsman and

Hexion for the combined company is no longer viable because of

Huntsman’s increased net debt

and its lower than expected earnings. While both companies

individually are solvent, Hexion believes that consummating the

merger on the basis of the capital structure agreed to with

Huntsman would render the combined company insolvent.

2008/6/19 Huntsman

Huntsman Rejects

Apollo Attempt to Back Out of Merger Agreement

Huntsman Corporation

today commented on yesterday’s lawsuit by Hexion Specialty

Chemicals and Apollo in which they claim they would not be

required to consummate the Merger Agreement.

Peter Huntsman,

President and CEO stated, “We believe Hexion and Apollo’s actions are inconsistent

with the terms of the Merger Agreement and the obligations to

Huntsman and its shareholders. These actions appear to be a

blatant attempt to deprive our shareholders of the benefits

of the Merger Agreement that was agreed to nearly a year ago.”

Huntsman intends to

vigorously enforce all of its rights under the Merger

Agreement and seek to consummate the merger on the agreed

terms.

NYT 2008/6/23

Huntsman

Sues Apollo and Its Top Executives Over Hexion Deal

The gloves are off in the

Huntsman-Hexion Specialty Chemicals dispute.

In an expected move,

Huntsman on Monday sued its now-reluctant acquirer’s parent, Apollo Management, and

two of the private equity firm’s founders, accusing them of

tortiously interfering in the $10.6 billion merger of the two

chemical makers. The lawsuit, filed in Texas state court, is the

latest salvo in one of the few deals remaining from the buyout

boom of last year.

Huntsman is claiming that

in besting a rival offer from Basell, an industrial conglomerate,

Apollo made a promise it did not intend to keep. The Texas-based

chemical maker argued that the private equity firm is seeking to

renegotiate a lower price.

In its complaint,

Huntsman said that it is seeking $3 billion in damages and $100

million to cover its breakup fee payable to Basell. Huntsman is

also seeking unspecified damages related to its business and its

value.

2008/7/1 Huntsman

European Commission

Approves Merger With Hexion

Huntsman Corporation

today announced that the European Commission has approved the

proposed merger between Hexion and Huntsman contingent on, among

other things, divestment of a portion of Hexion’s global specialty epoxy resins

business to a purchaser approved by the European Commission.

Peter Huntsman, President

and CEO, stated, “We believe this step ratifies our

view that regulatory approval for our transaction can move

forward and repeat our request that Hexion promptly move to fully

comply with the European Commission’s conditions for approval and take

any and all other actions necessary to obtain all required

regulatory approvals, including from the FTC.”

2008/8/29 Huntsman

Huntsman Shareholders

Offer Capital On Merger Closing

Huntsman Corporation

announced that it received notice of an independent shareholder

initiative to invest at least $500 million in

Hexion on the closing of the merger between Hexion and Huntsman

Corporation. The Huntsman family has indicated

its expectation to join the shareholder initiative by providing a

portion of the $500 million.

As previously

stated, Huntsman’s shareholders are entitled to

their $28 per share and 8% ticking fee.

We are gratified by

the confidence in the merged company expressed in this

shareholder initiative. However, Huntsman management

firmly believes that the combination of Hexion and Huntsman

Corporation will be solvent.

A trial on whether

Hexion can abandon its proposed acquisition is scheduled to

begin in Delaware Sept. 8.

In an effort

seemingly aimed at prodding Hexion to drop its objection to

completing the merger before the trial begins, Huntsman

investors that included Citadel Investment Group, D.E. Shaw

& Co., Matlin Patterson Global Advisors and Pentwater

Growth Capital Management proposed loaning the

Ohio-based chemical maker at least $500 million to help it

finance the acquisition.

And if some conditions are met, the loan

wouldn't have to be repaid.

"This financing serves the dual purpose of enhancing

what we believe is your already reasonable rate of return and

facilitating a mutually beneficial resolution of the current

disagreement between you and Huntsman," the investors

wrote in a proposal letter filed Thursday with the U.S.

Securities and Exchange Commission.

Those investors indicated they would commit $245 million and

that the Huntsman family was expected to commit $186 million.

Another $69 million would come from other large stockholders,

according to the proposal.

nyt 2008/8/28

In a letter sent to

Hexion and Apollo on Thursday, the shareholders - including

Citadel Investment Management and D. E. Shaw - offered to

provide additional financing to help persuade Apollo to close

the deal.

The plan involves the

use of contingent value rights, financial instruments that

would guarantee repayment only if a combined Huntsman-Hexion

met certain financial performance targets. If the new

company failed to meet those expectations, the investor group

would not be repaid.

Though the investors’

said that they

are making the offer independently of Huntsman, the group

said that trusts for the eponymous Huntsman family have

agreed to contribute about $186 million of the proposed

financing.

Driving the investors’

proposal is the

severe slide in Huntsman’s stock price since June, when

the deal began to founder. Huntsman’s shares have fallen more than

41 percent over the last three months, closing Thursday at

$13.10.

Other members of the

investor group include the private equity firm

MatlinPatterson, which helped prod Huntsman to sell itself

last year, and the hedge fund Pentwater Capital.

In a statement issued

late Thursday, Hexion said that it is interested only in

terminating the deal.

2008/8/28 Hexion

Hexion comments on

proposal by Huntsman shareholders

Hexion Specialty

Chemicals, Inc. today issued the following statement in

response to a Report on Schedule 13D filed by several

shareholders of Huntsman Corporation with the Securities and

Exchange Commission, in which they propose an alternative

transaction for the combination of Hexion and Huntsman.

“While we appreciate the

efforts of these shareholders, due to the dramatic increase

in Huntsman’s net debt and decrease in its

earnings since last July, their proposal does not come close

to making the combined company solvent. Huntsman’s shareholders lack this

information because Huntsman has, despite our repeated

requests for more than two months, refused to permit its

shareholders to review our Delaware complaint and the Duff

& Phelps solvency analysis. If this information were made

public, Huntsman shareholders would understand that this

proposal is inadequate. Furthermore, the proposal is for

incremental, not alternative debt financing, as specified

under the merger agreement.

We are not seeking to renegotiate this transaction. We are

seeking to terminate it, and obtain judicial confirmation

that Hexion has no obligation to pursue the acquisition or to

pay Huntsman a termination fee.”

2008/9/30 Huntsman

Huntsman Obtains

Temporary Restraining Order Against Credit Suisse and Deutsche

Bank : Court Orders Banks to Not Impair or Terminate Merger

Financing Prior to a Full Hearing

This afternoon, District

Judge Fred Edwards of the Montgomery County Texas District Court

awarded a Temporary Restraining Order in favor of Huntsman.

Judge Edwards found

that irreparable harm would result if the Banks were not

immediately enjoined from terminating their financing commitment

pending a full hearing on Huntsman's request for a temporary

injunction. Accordingly, Judge Edwards ordered

that the Banks, among other things, must not take any action that

could reasonably be expected to materially impair, delay,

terminate, or prevent consummation of the financing contemplated

by the agreement between the Banks and Hexion.

2008/9/30 Forbes

Huntsman All But Wins

Fight

Hexion may have billionaire Leon Black, but Huntsman has the law

on its side.

On Tuesday, shares of chemical maker Huntsman soared 71.7%, or

$5.27, to $12.62, in late-afternoon trading, after the Delaware

Court of Chancery in Wilmington rejected Black's Apollo

Management and its unit Hexion Specialty Chemicals' attempt to

pull out of its $10.6 billion deal to acquire Huntsman.

In his ruling, Judge Stephen Lamb said if the deal did not close

by Oct. 1, the termination date for the merger would be extended

until the court determined that Apollo and Hexion had complied

with the order.

That's not to say Hexion has to close the deal. The judge said if

the company refuses to close, it would be liable to Huntsman for

damages not capped by the $325.0 million break-up fee.

Huntsman said that in addition to denying the relief sought by

Apollo and Hexion, the court also found that Hexion had breached

a number of obligations and covenants under the merger agreement.

Huntsman said it continued to seek damages exceeding $3.0 billion

in its Texas lawsuit against Apollo and its partners Leon Black

and Joshua Harris.

2008/10/24

Huntsman

Huntsman Obtains Solvency Opinion for Hexion Merger : Independent

Valuation Firm Concludes Hexion-Huntsman Combination Would be

Solvent

Huntsman Corporation announced it has received a written opinion

from

American Appraisal,

a leading valuation firm, which has concluded that the company to

be formed from the pending merger of Hexion Specialty Chemicals,

Inc. and Huntsman Corporation would be solvent. Specifically,

American Appraisal found that the combined Hexion-Huntsman

company would satisfy all of the solvency tests

commonly used in transactions of this nature.

About American Appraisal

American Appraisal is a leading valuation and related services

firm that provides expertise in all classifications of tangible

and intangible assets. It is comprised of more than 900

employees, operating from major financial cities throughout

Asia-Pacific, Europe, North and South America. American Appraisal’s opinion was provided solely for

the use and benefit of Huntsman in connection with the pending

merger with Hexion, is subject to various assumptions,

limitations and qualifications, does not constitute advice or a

recommendation to any person with respect to the pending merger

with Hexion or any other matter and may not be relied upon by any

other person.

2008/10/27 Hexion

Hexion Specialty Chemicals announces additional funding

commitments to support merger with Huntsman Corporation

Apollo Increases Cash Equity Investment to $750 Million

Additional Commitment from Certain Huntsman Stockholders

Increases Commitment to $677 Million

Hexion Specialty Chemicals, Inc. announced that it continues to

proceed expeditiously to close its merger with Huntsman

Corporation. Hexion has been informed that certain stockholders

of Huntsman agreed to make an additional cash commitment to

Huntsman of approximately $217 million, conditioned upon closing

of the merger. Together with the other commitments announced by

Huntsman on September 11, 2008 or received by Huntsman subsequent

to that date, the additional commitment announced today raises the total amount of

committed payments from Huntsman stockholders to approximately

$677 million.

In addition, investment funds managed by affiliates of Apollo

Management, L.P. have agreed to make an additional cash equity

investment of $210 million in Hexion. Together with the $540

million cash equity investment announced by Hexion on October 9,

2008, investment funds managed by affiliates of Apollo

Management, L.P. have now agreed to make an aggregate cash

equity investment of $750 million in Hexion. The new cash equity investment is

not required by any contractual obligation of Hexion or Apollo.

The cash equity investment is conditioned upon closing of the

merger and the funding of the Huntsman stockholder commitments

noted above.

2008/10/28

Hexion AP記事

Hexion and Huntsman

prepared to complete pending merger;

Credit Suisse and Deutsche Bank refuse to fund today

Hexion Specialty Chemicals, Inc. announced today that late last

night Hexion received correspondence from counsel to affiliates

of Credit Suisse and Deutsche Bank stating that the banks do not

believe that the solvency opinion of American Appraisal

Associates and the solvency certificate of Huntsman Corporation’s Chief Financial Officer meet the

condition of the commitment letter, and stated that as a result

the banks do not plan to fund the proposed closing of the merger

scheduled for this morning. Accordingly, Hexion does not

expect the merger to close today.

Hexion strongly disagrees with the banks’

position and has

advised them of their obligation to fulfill the financing

commitment for the merger. While Hexion intends to meet and work

with the banks today to try to complete the merger, if the banks do

not fund their commitment, Hexion will vigorously enforce all of

its contractual rights.

2008/10/28 Huntsman

Huntsman Receives Notice That Banks Unwilling To Close Merger

Today

Huntsman Corporation announced today that Hexion Specialty

Chemicals, Inc. informed Huntsman late last night that Hexion had

received correspondence from counsel to Credit Suisse and

Deutsche Bank that the banks do not believe that the solvency

opinion and certificate proposed to be provided meet the

condition of the commitment letter and effectively said that as a

result the banks do not plan to fund the proposed closing of the

merger scheduled for this morning. Accordingly, Huntsman does not

expect the merger to close today.

Hexion further informed Huntsman that it is working to resolve

the banks’ concerns and is still seeking to

close the merger.

Huntsman

will continue to enforce its rights under the Merger Agreement

and various court orders and will seek to consummate the merger

promptly.

2008/12/15 Huntsman

Huntsman terminates

merger agreement and settles with Hexion and Apollo for $1

billion.

Huntsman continues multi-billion dollar Texas lawsuit against

Credit Suisse and Deutsche Bank

Huntsman Corporation

today announced it has terminated its Merger Agreement with

Hexion Specialty Chemicals, Inc. ("Hexion").

In addition,

Huntsman announced that it reached an agreement with Hexion,

Apollo Management, L.P. ("Apollo") and certain of its

affiliates to settle Huntsman's claims against Hexion, Apollo and

its affiliates arising in connection with Huntsman's Merger

Agreement with Hexion. Payments to be made to Huntsman

under the Settlement Agreement total $1 billion.

The settlement with

Hexion, Apollo and its affiliates does not resolve the claims

asserted by Huntsman against the Banks in its ongoing litigation

against the Banks in Montgomery County, Texas.

Huntsman's suit

against the Banks includes claims that the banks conspired with

Apollo and tortiously interfered with Huntsman's prior merger

agreement with Basell, as well as with the later Merger Agreement

with Hexion. A jury trial on those claims

currently is set to begin on May 11, 2009.

As part of the

Settlement Agreement, Apollo and its principals have agreed to

fully cooperate in connection with Huntsman's litigation against

the Banks.

2009/2/10 Huntsman

Huntsman Suspends Work on

Planned MDI Plant in Europe - Project to resume upon improvement

in global demand

Huntsman Corporation

today announced it has suspended work on design and feasibility

studies for its planned investment in a new methylene diphenyl

diisocyanate (MDI) plant at its site in Rozenburg, the

Netherlands, because existing production capacity is adequate to

meet current demand for MDI-based polyurethanes following the

downturn in global economic growth.

The design and

feasibility studies, which include preliminary engineering for

the planned 400,000 metric tons capacity unit, will be halted at a

stage to allow quick and efficient re-engagement at a future

date. Until such time, all third party

work on the project will be suspended.

Geismar

- Started

production in 1966. Current annual saleable

output is approximately 1.1 billion lbs (500

ktonnes), including 860

million lbs (390 ktonnes) of MDI, 160 million

lbs (68 ktonnes) of polyols, and 60 million

lbs (27 ktonnes) of aniline sales.

- A major

expansion was completed in Q1 2000 to meet

the growing worldwide demand for MDI (methyl

diphenyl diisocyanate) and to retain

leadership in the market. This expansion

increased the output of polymeric MDI and of

high-quality pure MDI, and enhanced the

Geismar plant's position as the world's

largest producer of these materials.

- The

polyols plant, commissioned in 1991, produces

flexible and rigid specialty polyols and

polyol system formulations.

- The

world's leading producer of aniline (40

percent of US capacity), a key ingredient in

MDI manufacturing. Annual aniline capacity is

880 million lbs (400 ktonnes).

Rozenburg,

the Netherlands

MDI, Polyol

and Formulations production started in 1971;

Flexibles in 1974 and Variants in 1976.

Current MDI

production is 300 Ktpa; and Polyols 54 ktpa.

|

March 14, 2005

Huntsman to

Significantly Expand Its Global MDI Manufacturing Capacity

Huntsman Corporation

announced today that it will significantly increase its

global capacity for the manufacture of methylene diphenyl

diisocyanate (MDI).

The initiative

involves expansions at the company's two major MDI

manufacturing facilities located in Geismar, Louisiana and

Rozenburg, Netherlands. The capacity of the Geismar plant will be expanded by 130

million pounds per year to 990 million pounds per year, while the capacity

of the Rozenburg plant will be expanded by 220

million pounds per year to 880 million pounds per year. The capacity

expansions will be completed in increments beginning in the

first quarter of 2005, with final completion expected by late

2006.

February 26, 2008 Huntsman

Huntsman to raise MDI

production capacity at Rozenburg site

Huntsman Corporation

announced that it has commenced design and feasibility

studies to increase its global capacity for the manufacture

of methylene diphenyl diisocyanate (MDI) through investment

in a new, world scale MDI plant at its site in Rozenburg, the

Netherlands.

Feasibility studies, including preliminary engineering for

the new unit, are now underway and a final investment

decision is expected during 2008, with the new 400,000 metric

tons capacity unit

coming on-stream by mid-2011. The final plan may also

incorporate the closure of older, less

efficient capacity in Europe.

Pursuant to the

studies, Huntsman also intends to expand its MDI and

downstream asset capacity in all three major regions through

the deployment of new proprietary technologies in aniline,

methylene dianiline (MDA) and MDI production, which will both

increase raw material yields and improve energy efficiency by

up to 40%, as compared with previous generation technology.

Huntsman announced in early 2006 that it was evaluating the

construction of a second MDI unit in China, with its partners

from the existing 240,000 metric tons capacity joint venture

MDI plant in Caojing, Shanghai. Studies for this new plant

continue, with a number of different locations being

considered.

"These investments are required to satisfy the sustained

demand growth that we're seeing across a wide range of MDI

based applications , said Polyurethanes Division President,

Tony Hankins.

We anticipate that during the next decade the global MDI

market will continue to grow well ahead of global GDP, at

around 7-8 % per year - and in Asia well above 10%.

We are determined to maintain our leading position in MDI,

and to ensure that we can continue to support our global

customers as their markets grow."

2009/2/11 Huntsman

Huntsman JV Completes Project Financing for Maleic Anhydride

Expansion - New unit necessary to meet projected global demand

Huntsman Corporation today announced that Sasol-Huntsman GmbH & Co. KG, its maleic anhydride production

joint venture with Sasol Limited, has successfully completed

negotiation of project financing agreements. The project

financing is non-recourse to the joint venture’s parent companies and will add no

debt to Huntsman’s balance sheet.

The new financing will be used to expand the joint venture’s maleic anhydride production site

in Moers, Germany, from its existing yearly capacity of 60,000 tonnes to a

new capacity of 105,000 tonnes by addition of a second world

scale reactor. Like the existing reactor, the new unit will use

Huntsman’s proprietary technology and

catalyst.

The new reactor and other major equipment is already on order,

detailed engineering is under way, and the EPCM contract has been

awarded. Basic engineering and site preparation were completed

early last year. Start-up of the new unit is scheduled for the

first quarter of 2011.