PVCメーカー

VESTOLIT LVM (The Tessenderlo group) Norsk Hydro Vinnolit

CertainTeed Borden Chemicals and Plastics Georgia Gulf

VESTOLIT GmbH & Co. KG in Marl Mexichem agrees to acquire Vestolit for 219 million euros

VESTOLIT GmbH & Co. KG operates in Marl the largest fully integrated PVC (polyvinyl chloride) production plants in Europe, with a capacity of 350.000 tonnes per annum. Integration means that, from the starting point of energy and the raw materials ethylene and rock salt via the intermediate products EDC (ethylene dichloride) and VCM (vinyl chloride), the production of PVC all takes place at one location.

On 01.01.1995, VESTOLIT GmbH & Co. KG, a wholly-owned subsidiary of today's Degussa-Huls AG, took over the appropriate business and production units of the then Huls AG. At 01.12.1999, VESTOLIT GmbH & Co. KG was acquired by a finance consortium. The consortium is led by a group of international investors under the leadership of Candover plc., based in London, and D. George Harris & Associates, based in New York.

Germany's Vestolit

secures Eur80-mil for Marl chloride plant

Germany's Vestolit has secured the finances to build a new,

environmentally-friendly, 260,000 mt/yr chloride plant at a cost of Eur80-mil ($96.3-mil)

at the Marl industrial plant, the company announced Tuesday.

Furthermore, Vestolit was planning to increase PVC production

capacity at Marl to over 400,000 mt/yr, at a cost of about Eur20-mil.

ーーーーーーーー

Mexichem agrees to acquire Vestolit for

219 million euros

Mexichem, S.A.B. de C.V. announced today that it has signed a definitive

agreement to acquire VESTOLIT GmbH, Europe’s 6th largest PVC manufacturer, from

accounts and funds managed by Strategic Value Partners LLC for a total of €219

million in cash and assumed liabilities, supporting Mexichem’s strategy of

global growth in high-end specialty products.

The acquisition is subject to regulatory approvals and is expected to close in

the fourth quarter of 2014. At that point, Mexichem will consolidate VESTOLIT

under the Company’s Chlorine Vinyl chain for accounting purposes.

Based in Marl, Germany, VESTOLIT is Europe’s only manufacturer of High Impact

Suspension PVC (HIS-PVC) for weather-resistant windows and is Europe’s

second-largest producers of paste PVC for floors and wallpapers. VESTOLIT also

produces alkyl-chlorides, a value-added intermediary used for a variety of

chemical and industrial applications. Total installed PVC

capacity is 415,000 tons per year.

The acquisition of VESTOLIT is in keeping with our strategy of becoming a

global, vertically integrated chemical company with a focus on high-end,

specialized products,” said Antonio Carrillo, CEO of Mexichem. “This transaction

is an opportunity to expand our European footprint, enter a new market segment

and acquire new technology and best practices for our global Chlorine Vinyl

chain.”

VESTOLIT will continue under current management once the transaction is

completed and will operate with its existing brand portfolio.

“We are pleased to be joining Mexichem, a globally-recognized name in specialty

chemicals. This transaction assures the future of the VESTOLIT businesses, and

our customers will benefit from dealing with a company with international reach

and multiproduct offering,” said Michael Traeger CEO of VESTOLIT.

VESTOLIT had sales and marketing representatives in more than 35 countries.

On 01.01.1995, VESTOLIT, a wholly-owned subsidiary of today's Evonik, took over the appropriate business and production units of the then Hüls AG. On 01.12.1999, VESTOLIT was acquired by a finance consortium. The consortium is led by a group of international investors under the leadership of Candover plc., based in London. In September 2006, VESTOLIT is positioning itself with a new investor: Strategic Value Partner, Greenwich, CT/USA managed funds and the VESTOLIT Management are acquiring all shares in the VESTOLIT Group.

-----

Mexichem は1998年にQuímica

Pennwalt とPolímeros

de Méxicoが合併して設立された。

フランスのElf Atochem

とメキシコのGrupo Empresarial

Privado Mexicanoが共同で所有したが、後者は1999年にCamesa

Groupと合併し、2003年にTotal

(Elf Atochem)の持株を買収し、メインの株主となった。

現在の同社の事業はビニルチェーンとフッ素チェーンの2つに分かれている。

1)ビニルチェーン:現在ラテンアメリカ最大の塩ビ樹脂、コンパウンド、塩ビパイプメーカー

Mexichemは2004年にメキシコ最大の塩ビレジン、コンパウンドメーカーのPrimexを買収した。

2006年に米国の塩ビコンパウンドメーカーBayshore Groupを買収。

2007年にはコロンビアの塩ビメーカーPETCOを買収、また、コロンビア最大の塩ビコンパウンドメーカーGeon Polímeros Andinosの株の50%を買収した。

2012年2月、欧州の塩ビパイプメーカーWavinを531百万ユーロで買収した。

現在の体制(子会社)は以下の通り。

子会社 工場 Mexichem Derivados メキシコ Coatzacoalcos 塩素 260千トン、ソーダ 286千トン、次亜塩素酸ソーダ 20千トン

塩素はVCM用にPemexに供給El Salto 塩素/ソーダ 40千トン、次亜塩素酸ソーダ 70千トン、塩酸 26千トン Mexichem Derivados Colombia コロンビア Zipaquira 苛性ソーダ、次亜塩素酸ソーダ、塩化鉄(5千トン) Quimir メキシコ 燐酸、燐酸ナトリウム、活性炭 Mexichem Resinas Vinilicas メキシコ Altamira I、II、

Tlaxcala、

La Presas-PVC 349千トン、e-PVC 12,500t Mexichem Resinas Colombia コロンビア 3工場 PVC 400千トン Mexichem America 米国 コンパウンドとリサイクルPVC

2006年にBayshore Vinyl Compounds、Bayshore Rigids、Ricicla の3社を買収Mexichem Compuestos メキシコ Altamira PVC compounds 60千トン Tlaxcala PVC compounds 12千トン C.I. Mexichem Compuestos Colombia コロンビア PVC, PE その他のコンパウンド 50千トン AlpahGary 米国 Compounds

2010年にRockwood Holding から買収

2)フッ素チェーン

Mexichemは2004年にQuímica Flúor を買収し、世界最大の蛍石埋蔵量を誇るCompania Minera Las Cuevasと統合してMexichem Fluorとし、フッ化水素酸の世界最大の垂直統合メーカーとなった。

・Mexichem Fluor -

San Luis Potosí:

世界最大の蛍石メーカー

能力はmetallurgic gravel

が350千トン、acid-grade

concentratesが280千トン

北米、南米、欧州、日本に輸出

・Mexichem Flúor

- Matamoros:

世界第二位のフッ化水素酸メーカー

能力 95千トン

98%を米国に輸出

2013/11/4 OxyChem、メキシコのMexichemとのJVでエチレン生産

http://www.tessenderlo.com/c/r000000.htm

The Tessenderlo group's plastics activities are managed through its LVM (Limburgse Vinyl Maatschappij) subsidiary, ranking amongst the top European polyvinyl chloride (PVC) manufacturers.

LVM、Vinnolit-Uhde boiling reactor technologyでEDC生産

VCM

The raw material for PVC, vinyl chloride monomer (VCM) is manufactured at Tessenderlo, in Belgium at the LVM subsidiary. With an annual production capacity of 550,000 tonnes, this unit is the largest in Europe.

PVC

Tessenderlo Group is currently the sixth largest producer of PVC in Europe. The two PVC suspension production units in the Netherlands (the Beek unit ) and France (the Mazingarbe unit) represent an overall capacity of 440,000 tonnes/year.

The Tessenderlo group

The group is structured to clearly reflect the five core activities which are closely linked :

-inorganic chemicals

-natural organic products

-fine chemicals

-PVC

-plastics converting

Contract for first

industrial-scale EDC plant using new Vinnolit - Uhde boiling

reactor technology

http://www.uhde.biz/aktuelles/news_show.en.epl?stamp=80000021

Uhde GmbH has been awarded a

contract by the Belgian chemical company Limburgse Vinyl

Maatschappij NV (LVM), a

member of the Tessenderlo group, for a new ethylene dichloride

(EDC) plant using the innovative new Vinnolit-Uhde boiling reactor

technology. The plant will be

built at LVM's site in Tessenderlo, Belgium, and will have an

annual capacity of 250,000 tonnes of EDC. It is scheduled to come

onstream in 2006. Uhde's scope of supplies includes the licence,

basic and detail engineering, procurement services, construction

management and supervision of the commissioning activities.

This will be the first industrial-scale application of the new Vinnolit-Uhde technology for the production of EDC through the

direct chlorination of ethylene using the new boiling reactor. In

this reactor, which has been developed jointly by Uhde and

Vinnolit, liquid-phase ethylene reacts catalytically with

chlorine to form EDC. The chlorine for the new plant will be

produced at a membrane electrolysis plant currently being built

by Uhde at the same location for Tessenderlo Chemie. The EDC

produced is of such a high quality that destillative purification

is no longer necessary and it can be used immediately as

feedstock for the production of vinyl chloride (VCM) or offered

for sale. VCM will be manufactured as an intermediate from the

EDC produced at the plant and this in turn will be used to

manufacture PVC.

2006/6/20

Tessenderlo

Tessenderlo Group presents recovery plan for the Chemicals

Business Group

Possible loss of 240 jobs, including 197 in Belgium

In the framework of its recovery plan ‘Target 2007’, the management of Tessenderlo

Group today informed the works councils of the Chemicals sites

involved of its intention to carry out a reorganisation. This

reorganisation could affect the Limburg factories in Tessenderlo

(TCT and LVM) and Ham (TCH), the Chemicals

department in Brussels and the other European production sites

and sales offices of the Chemicals business group.

http://www.certainteed.com/home_frames/ci_frmst.html

CertainTeed Corporation

is a manufacturer of exterior building materials for new

construction and home remodeling needs.

Products included;

insulation, vinyl windows, vinyl siding, roofing, ceilings,

PVC pipe, fencing, decking, railing, attic ventilation and

foundation systems.

In 1988, CertainTeed became a wholly owned subsidiary of Saint-Gobain. Renowned for its expertise in glass technology, Saint-Gobain is the world's largest building materials company. Its annual sales in 1999 were approximately $24.5 billion. Today, with the full support of this industrial leader, CertainTeed's financial and technological resources are stronger than ever.

Products:

Fencing

Fiber Cement Siding

Insulation

Pipe & Foundations Systems

PVC Polymer:Lake Charles, Louisiana

Roofing

Ventilation

Vinyl Siding

Windows: Profiles &

Specialty Shapes Company Profile

2006/11/3 Plastics News

CertainTeed to shut vinyl siding site in Kansas

http://www.plasticsnews.com/subscriber/headlines2.phtml?id=1162592375Building products giant CertainTeed Corp. announced it will shut down its vinyl siding extrusion plant in McPherson, Kan., effective Feb. 2.

About 120 will lose their jobs.

The Valley Forge-based company cited the usual suspects as the impetus behind the move: a sluggish housing market, eroding demand for vinyl siding and industrywide overcapacity.

“The market has declined enough that we can’t keep producing at the rate we produce it and sell it for more than we make it for,” CertainTeed spokes?man Mike Loughery said Nov. 3 by phone.

CertainTeed will continue to run its injection molded polymer siding and foundation drainage products plants in McPherson. Loughery said CertainTeed has been given the green light by parent company Cie. de Saint-Gobain in Paris to add pipe extrusion capacity in Kansas. That project is expected to ramp up in the next six months.

CertainTeed evaluated all four of its vinyl siding extrusion plants before choosing to close the McPherson operation, Loughery said. Geography ended up being the determining factor.

“Really it is a matter of where the projected growth markets are,” he said.

CertainTeed’s three other vinyl siding plants are in Jackson, Mich.; Hagerstown, Md.; and Social Circle, Ga. The South is heavily influenced by Spanish- and Mediterranean-style architecture, which is typically sided with stucco.

Borden Chemicals and Plastics Limited Partnership

http://biz.yahoo.com/p/b/bcpuq.ob.html

The Company is a limited partnership formed in 1987 to acquire, own and operate polyvinyl chloride resins, methanol and other chemical plants located in Geismar, Louisiana, and Illiopolis, Illinois, that were previously owned and operated by Borden, Inc. (Borden). In 1995, the Company, through its subsidiary operating partnership Borden Chemicals and Plastics Operating Partnership (the Operating Partnership), purchased a PVC resin manufacturing facility from Occidental Chemical Corporation (OxyChem), located in Addis, Louisiana (Addis Facility).The Company made the decision in 2000 to exit the Methanol and Derivatives and Nitrogen Products businesses. On April 3, 2001, the Operating Partnership and its subsidiary, BCP Finance Corporation, (collectively, the Debtors) filed voluntary petitions for protection under Chapter 11 of the Bankruptcy Code in the United States Bankruptcy Court for the District of Delaware.

plant 売却

Addis, Louisiana Facility → Shintech

Illiopolis, Illinois Facility → Formosa ExplosionGeismer 閉鎖 → Geismar Vinyls, an affiliate of The Westlake Group

Phased Start-Up of Geismar PVC Operations

Chemical Week Apr 10, 2002

Borden May Close Geismar ComplexBorden Chemicals and Plastics (BCP) is expected to close its entire Geismar, LA vinyls complex, sources say. The move is being forced by a shortage of chlorine and a lack of vinyl chloride monomer (VCM) demand as a result of the sale of two of Borden’s polyvinyl chloride (PVC) plants, sources add.

Chemical Week 2002/5/1

Borden Confirms that Geismar Site Will CloseBorden Chemicals and Plastics (BCP) has confirmed CW’s report that it will close its vinyls complex at Geismar, LA. The company says it has started to idle the site’s 1.2-billion lbs/year ethylene dichloride (EDC) and 1.2-billion lbs/year vinyl chloride monomer (VCM) plants, and expects to complete the shutdown in five to six weeks.

Business Wire 2002/12/30

Borden Chemicals and Plastics Operating Limited Partnership Completes Sale of Geismar, La., PVC Facility to Geismar Vinyls CorporationBorden Chemicals and Plastics Operating Limited Partnership (BCP) announced that it has completed the sale of the assets of its Geismar, La., polyvinyl chloride (PVC) facility to Geismar Vinyls Corporation (GVC), an affiliate of The Westlake Group, for $5 million cash plus a promissory note for up to $4 million depending on the earnings performance of the assets.

Geismar Vinyls acquired BCP's 575-million lb./year Geismar PVC resins plant, 650-million lb./year ethylene-based vinyl chloride monomer (VCM/E) feedstock plant, and certain related assets. BCP halted PVC production at Geismar in April 2002.

Westlake Chemical to Begin Phased Start-Up of Geismar PVC Operations

Westlake Chemical Corp. has announced that it is planning for a phased start-up of its vinyl chloride monomer and polyvinyl chloride facilities in Geismar, Louisiana. Westlake acquired these facilities from Borden Chemical in December 2002 and has been operating the ethylene dichloride (EDC) portion of the plant since November 2003.

In addition to a graduated start up of the PVC operations, the company will also be investing in additional capacity in the EDC unit at Geismar. This capacity increase is expected to expand total EDC capacity by an estimated 25%.

It is currently estimated that the first phase start-up will commence in 2005. All future phases, if any, will be determined by market conditions at the time.

Westlake Chemical is a global supplier of petrochemicals, polymers and fabricated products.

Borden, Inc (→ Borden Chemical →Hexion Specialty Chemicals) cf. Borden Chemicals and Plastics

Borden Chemical's roots trace back to 1929, when the Borden Company acquired Casein Company of America, a producer of milk-based resin systems.

In the 1930s the company began producing synthetic resins and adhesives. Over the next several decades, the Borden Company expanded through organic growth and acquisitions into a leading global source of resin and adhesives systems.

Borden, Inc. renamed its growing chemical operation Borden Chemical Company in 1958. The company continued its rapid growth through the 1970s, and went through an aggressive acquisition program in the 1980s and 1990s, adding new technologies and products.

Borden, Inc. was acquired by the investment firm of Kohlberg, Kravis, Roberts and Company in 1995. Over the next several years, dairy, packaging, food and other business operations were sold. In late 2001, Borden Chemical, Inc. was merged into Borden, Inc. with the remaining company retaining the Borden Chemical name.

Borden Chemical is one of the world's leading producers of industrial resins, adhesives and related chemical products. Our products provide sticking and bonding power and other performance enhancements for thousands of end-use applications, including:

Borden JV opens a formaldehyde and resin facility in China

US' Apollo Management buying Borden Chemicals for $1.2-bil

Borden Chemical, Inc. to Acquire Bakelite AG → Completion of Acquisition

Resolutionと合併し、Hexion Specialty Chemicalsに

Hexion Specialty Chemicals Completes Purchase Of Coatings & Adhesives Business From The Rhodia Group

2004/7/6 Platts

US' Apollo Management buying Borden Chemicals for $1.2-bilApollo Management LP, a US-based private investment firm announced Tuesday that it has signed a definitive agreement to acquire Borden Chemical Inc for $1.2-bil.

Apollo Management is acquiring Borden Holdings, the parent of Borden Chemical Inc, from BW Holdings LLC, an affiliate of Kohlberg Kravis Roberts & Co. Borden is the world's largest producer of formaldehyde, and also produces resins, coatings and adhesives.

October 7, 2004 Borden Chemical Completion of Acquisition

Borden Chemical, Inc. to Acquire Bakelite AG

http://www.bordenchem.com/aboutUs/newsReleases.asp?release=10-07-04.aspBorden Chemical, Inc., a leading supplier of thermoset and other high performance resins, adhesives and specialty materials, today announced it has signed a definitive agreement to acquire Bakelite AG from its parent company, Rutgers AG.

Based in Iserlohn-Letmathe, Germany, Bakelite is a leading source of phenolic and epoxy thermosetting resins and moulding compounds with 13 manufacturing facilities in Europe and Asia. Last year the company generated sales of $610 million. It has 1,700 employees. Borden Chemical reported 2003 sales of $1.4 billion and employs 2,400 associates.

Borden Chemical is owned by the investment firm Apollo Management, LP and is based in Columbus, Ohio.

RUTGERS AG, Essen (Germany), a wholly owned subsidiary of RAG Aktiengesellschaft, has today signed a sale and purchase agreement to sell its wholly owned subsidiary Bakelite AG, Iserlohn-Letmathe (Germany), to U.S.-based Borden Chemical, Inc. Terms of the agreement have not been disclosed. The transaction is subject to approval by the EU antitrust authorities. Following the disposal of Isola AG in the second quarter of this year, the process of selling RUTGERS' plastics business has therefore made further substantial progress.

Bakelite is one of the leading manufacturers of phenolic resins, epoxy resins and thermosetting molding compounds in Europe. It has also established market positions in Asia and the U.S. In fiscal 2003, Bakelite and its workforce of roughly 1,700 generated sales of approximately ? 540 million. Borden Chemical, Inc. is a leading producer of thermosetting binding and bonding resins, performance adhesives, formaldehyde and other products for various wood and industrial markets. Borden Chemical, based in Columbus, Ohio, has 2,400 employees and last year had sales of $1.4 billion. The Company is owned by the investment firm Apollo Management, LP, which acquired Borden Chemical in August.

Bakelite® - all over the world this name stands for first fully synthetic plastic

Dr. Leo Hendrik Baekeland (1863 - 1944) was the father of this idea and invented the still valid principle for the production of thermoset plastics.

1910/5/25

Baekeland and Rutgers AG founded Bakelite GmbH; establishment of production in Erkner near Berlin; start of phenolic resin production.参考 住友ベークライト

Georgia Gulf is a major manufacturer and marketer of two highly integrated product lines, which include chlorovinyl and aromatic products.

In our chlorovinyls business, we are:

・the third largest North American producer of vinyl chloride monomer (VCM);

・the fourth largest North American producer of polyvinyl chloride (PVC) resins;

・the second largest North American producer of PVC compounds.In our aromatics business, we are:

・one of the two largest North American producers of cumene, and

・a leading North American producer and marketer of phenol.

Our vertical integration, world scale facilities, operating efficiencies, facility locations and the productivity of our employees provide us with a competitive cost position in our primary markets.acquisition of North American Plastics

modification for its Plaquemine, Louisiana vinyl resins facility

Georgia Gulf Announces Agreement to Acquire Royal Group Technologies

Georgia Gulf Announces Royal Group Technologies Limited Name Change to Royal Group, Inc.

Georgia Gulf to close Manitoba window, door extrusion facility

Georgia Gulf Announces Closure of Sarnia PVC Resin Plant

GE Capital Provides $175 Million to Georgia Gulf Corporation

Plant Products and

Capacities

The following table sets forth the location of each chemical

manufacturing facility we own, the products manufactured at each

facility and the approximate processing capability of each,

assuming normal plant operations, as of December 31, 1999:

*2004/12/31

Plant Location |

Products |

Annual Capacity |

Segment |

| Aberdeen, MS (2) | PVC Resins | 1.0 billion pounds | Chlorovinyls |

| Vinyl Compounds | 135 million pounds * | Chlorovinyls | |

| Plasticizers | 22 million pounds * | Chlorovinyls | |

| Gallman, MS (3) | PVC Compounds | 500 million pounds * | Chlorovinyls |

| Jeffersontown, KY (3) | PVC Compounds | 40 million pounds | Chlorovinyls |

| Lake

Charles, LA (two locations) |

VCM | 1.5 billion pounds (1) | Chlorovinyls |

| Madison, MS (2) | PVC Compounds (two plants) |

230 million pounds * | Chlorovinyls |

| Mansfield, MA (3,4) | PVC Compounds | 100 million pounds | Chlorovinyls |

| Oklahoma City, OK (3) | PVC Resins | 500 million pounds* | Chlorovinyls |

| Pasadena, TX | Cumene | 1.5 billion pounds | Aromatics |

| Phenol | 160 million pounds | Aromatics | |

| Acetone | 100 million pounds | Aromatics | |

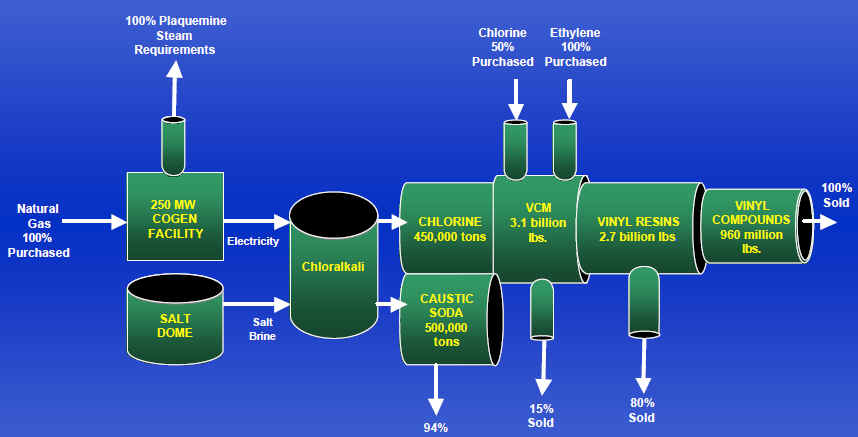

| Plaquemine, LA (3) | Chlorine | 450 thousand tons | Chlorovinyls |

| Caustic Soda | 500 thousand tons | Chlorovinyls | |

| Sodium Chlorate | 27 thousand tons | Chlorovinyls | |

| VCM | 1.6 billion pounds | Chlorovinyls | |

| PVC Resins | 1.2 billion pounds +450(2008) | Chlorovinyls | |

| Phenol | 500 million pounds | Aromatics | |

| Acetone | 308 million pounds | Aromatics | |

| Tiptonville, TN (3) | PVC Compounds | 95 million pounds * | Chlorovinyls |

| _________________ |

| (1) | Reflects 100 percent of the production at our owned facility in Lake Charles and our 50 percent share of PHH Monomers' 1,150 million pounds of total VCM capacity. |

| (2) | QS 9000 certified. |

| (3) | These plants are ISO 9000 certified except the VCM plant in Plaquemine. |

| (4) |

The property on which the Mansfield facility is located is leased under a five-year lease from CONDEA Vista Company, which is renewable at our option. Operations ceased in the third quarter of 2000. Georgia Gulf permanently shuts Tennesse, US compound facility |

Lake Charles,

Louisiana Facilities

We produce VCM at our Lake Charles, Louisiana facility. Also,

through our joint

venture with PPG Industries,

we have the right

to 50% of the VCM production of PHH Monomers, which is located in close proximity to

our Lake Charles VCM facility. The chlorine needs of our Lake

Charles VCM facility and the PHH Monomers' facility are supplied

by pipeline, under a long-term contract with PPG Industries, who

is also our partner in PHH Monomers. Ethylene is supplied to both

facilities by pipeline from the adjacent CONDEA Vista ethylene facility and by pipeline from

other third parties. The majority of our ethylene requirements

for our Lake Charles VCM facility are supplied under a

seven-year, take-or-pay contract, and PHH Monomers is supplied

under a requirements-based contract. All chlorine and ethylene

contracts are primarily market price-based. VCM from these

facilities supplies our Aberdeen, Mississippi and Oklahoma City,

Oklahoma PVC facilities. A portion of VCM products at the Lake

Charles facilities is sold in domestic and exports markets.

Plaquemine, Louisiana

Facility

Our operations at this facility

include the production of chlorine, caustic soda, sodium

chlorate, VCM, PVC resins, phenol and acetone. We produce

chlorine and its co-product caustic soda at our chlor-alkali

facility by electrolysis of salt brine. We have a long-term lease

on a nearby salt dome with reserves in excess of twenty years,

from which we supply our salt brine requirements. We use

substantially all of our chlorine production in the manufacture

of VCM at this facility and we sell substantially all of our

caustic soda production externally. We also use sodium

hypochlorite, a by-product from our chlor-alkali production

process, to produce sodium chlorate for sale to third parties.

All of the ethylene requirements for our VCM production are

supplied by pipeline. About 80% of our Plaquemine VCM production

is consumed on-site in our PVC resin production, and the

remainder is shipped to our other PVC resin facilities and sold

to third parties.

Aberdeen, Mississippi

and Oklahoma City, Oklahoma Facilities

We produce PVC resins at both our Aberdeen, Mississippi and

Oklahoma City, Oklahoma facilities from VCM supplied by railcar

from our VCM facilities and PHH Monomers. In addition, the

Aberdeen facility produces plasticizers, some of which are

consumed in internal PVC compound production and the remainder

sold to third parties.

Condea Vista Sells PVC Business To Georgia Gulf

Georgia Gulf Corp. in Atlanta has signed a definitive agreement to purchase the vinyls business of Condea Vista Co., Houston. Condea Vista is a wholly owned subsidiary of RWE-DEA of Germany, whose Condea chemical division is based in Hamburg. After this acquisition, Georgia Gulf will have capacity of about 2.6 billion lb/yr of PVC resin, 3.1 billion lb/yr of vinyl chloride monomer (VCM), and 850 million lb/yr of flexible and rigid vinyl compounds.

Georgia Gulf will acquire a VCM plant in Lake Charles, La.; a 50% share of a joint-venture VCM plant also in Lake Charles; two PVC resin plants in Aberdeen, Miss., and Oklahoma City, Okla.; and three vinyl compound plants in Aberdeen, Jeffersontown, Ky., and Mansfield, Mass.

(Georgia Gulf 2000/3/23)

Georgia Gulf Corporation today announced the completion of the initial phase of the transition and integration of the CONDEA Vista vinyls business it acquired in November 1999.

(VCM) Lake Charles (100 percent of the production at our owned facility in Lake Charles and our 50 percent share of PHH Monomers' 1,150 million pounds of total VCM capacity.

(PVC) Aberdeen, Mississippi and Oklahoma City, Oklahoma

originally Conoco → DuPont → Vista → CONDEA Vista → Georgia Gulf(VCM,PVC) Plaquemine, LA

originally Georgia Pacific → Georgia Gulf (1985)

(PVC) Delaware City, DE

originally Georgia Pacific → Georgia Gulf (1985) → Kaneka

24-Jan-2006 Item 7.01 Regulation FD Disclosure

Georgia Gulf Corporation has applied to the Louisiana Department of Environmental Quality for an air permit modification for its Plaquemine, Louisiana vinyl resins facility. The permit modification would allow the Company to modernize the facility by adding a new production line that would provide more efficiency, flexibility and productivity. The project would represent a $100 million investment in the facility. The Company hopes to receive permit approval by the second quarter of 2006, which it expects would result in completion of the modernization project in early 2008. This project would increase capacity by approximately 450 million pounds annually.

2006/6/7 Washington Group

Washington Group International to Expand Louisiana PVC Plant

Washington Group International Inc. announced today it has been selected for the $100 million modernization project at Georgia Gulf Corporation's polyvinyl chloride (PVC) resins production plant in Plaquemine, La.

Washington Group will provide detailed engineering, procurement, and construction services for plant modifications and the addition of another production line that will allow Georgia Gulf to both increase PVC production and improve operating efficiency. PVC resin has applications in a wide range of industries including automotive, medical, and building and construction.

Georgia Gulf Announces Agreement to Acquire Royal Group Technologies

Georgia Gulf Corporation announced today a definitive agreement to acquire all of the outstanding common stock of Royal Group Technologies Limited for CAD$ 13.00 per share in cash.

The total transaction is valued at approximately CAD$ 1.7 billion, which includes payments for Royal Group’s equity of CAD$ 1.2 billion and assumed net debt of CAD$ 491 million as of March 31, 2006. Based on an exchange rate of CAD$ 1.10 to USD$ 1.00, this translates to an offer of USD$ 11.82 per share and a total transaction value of USD$ 1.6 billion.

Royal Group is a leading producer of vinyl building and construction products, which include custom window profiles, decorative moldings, siding, pipe and fittings and other home improvement products. Royal Group is headquartered in Toronto, Canada with sales primarily in North America. Georgia Gulf manufactures commodity chemicals, vinyl resins and vinyl compounds, which are the basic materials used to manufacture vinyl building and construction products such as pipe, siding and windows. The combination of Royal Group’s diversified and innovative product portfolio with Georgia Gulf’s vinyl resins and compounding technology as well as operational efficiencies should result in a stronger, more competitive combined company in the vinyl building and construction products industry.

“We look forward to the completion of this transaction,” said Schmitt. “Our current management team has a proven track record of successfully integrating businesses and producing strong financial results, as evidenced by our 1998 acquisition of North American Plastics and our 1999 acquisition of Condea Vista.”

About Georgia Gulf

Georgia Gulf, headquartered in Atlanta, is a major manufacturer and marketer of two integrated product lines, chlorovinyls and aromatics. Georgia Gulf’s chlorovinyls products include chlorine, caustic soda, vinyl chloride monomer and vinyl resins and compounds.

Georgia Gulf’s primary aromatic products include cumene, phenol and acetone.

Capacity(百万ポンド)(発表)

VCM 1,570 + Vista 1,530

PVC 1,170 + Vista 1,530

Cpd 470 + NAP 190 + Vista 300

About Royal Group http://www.royalbuildingproducts.com/

Royal Group Technologies is a leading producer of innovative, attractive, durable, and low-maintenance home improvement and building products, which are primarily used in both the renovation and construction sectors of the North American construction industry. The Company has manufacturing operations located throughout North America in order to provide

industry-leading service to its extensive customer network.

Georgia Gulf Announces Royal Group Technologies Limited Name Change to Royal Group, Inc.

Georgia Gulf Corporation today announced that recently acquired Royal Group Technologies Limited will change its name to Royal Group, Inc. The name change will occur on February 5, 2007.

Georgia Gulf Goes Downstream with Compounder Purchase.(North American Plastics)

Polyvinyl chloride (pvc) producer Georgia Gulf has acquired North American Plastics (Aberdeen, MS), a privately held, $90-million/year manufacturer of flexible PVC compounds. According to Georgia Gulf, the acquisition will significantly increase its position in the market for flexible, high-value vinyl resins.

The deal will include North American Plastics' compounding facilities at Aberdeen and Madison, MS, which have capacity for 190 million lbs/year of plasticized PVC.

Platts 2004/11/29

Georgia Gulf permanently shuts Tennesse, US compound facility

US' Georgia Gulf Corp announced Monday that it will shutdown its

compound plant at Tiptonville, Tennessee, effective

immediately as part of its "ongoing commitment to

operational efficiency."

Platts

2007/8/24

Georgia Gulf to close Manitoba window, door extrusion facility

US' Georgia Gulf Corp announced Friday that it will close Royal

Group's Winnipeg, Manitoba window and door profile extrusion

facility later this year, with operations transferred to other

Royal Group plants.

Georgia Gulf acquired the Royal Group in October 2006.

"Customers purchasing window and door profiles from our

Winnipeg facility will be better served by our other facilities,

as these plants house the latest in extrusion technology,"

said Bill Doherty, Georgia Gulf's vice president custom products.

The Royal Group has profile extrusion facilities with unspecified

capacities at Toronto, Montreal, Pittsburgh, Reno Nevada, Bristol

Tennessee and Seattle.

Georgia Gulf is an integrated North American manufacturer of

chlorovinyls and aromatics and manufactures vinyl-based building

and home improvement products.

Georgia

Gulf Announces Closure of Sarnia PVC Resin Plant

Georgia Gulf Corporation announced today it is permanently

closing its Sarnia, Ontario (Canada) PVC resin plant. The plant

had operated only periodically in 2008 due to decreased demand in

the housing and construction markets. In response to continued

weakening in the markets, Georgia Gulf has made the decision to

permanently close the facility, which had the capacity to produce

450 million pounds of PVC resin annually.

"We operated the Sarnia facility as a swing plant with the

intention of re-starting production as soon as the markets

recovered and demand improved. In light of prevailing market

conditions, we have made the difficult decision to permanently

close this facility in an effort to better match our supply with

the realities of the marketplace," stated Paul Carrico,

President and CEO of Georgia Gulf Corporation.

As a result of the Sarnia PVC resin plant closure, the Company

expects to record a non-cash charge of about $50 million in the

4th quarter of 2008. The Company expects the cash costs related

to the Sarnia plant closure and other cash restructuring costs

incurred in the third and fourth quarters of 2008 to be

approximately $12 million. Under the terms of the last credit

facility amendment, these charges can be excluded from EBITDA for

purposes of Georgia Gulf's covenant calculations.

About Georgia Gulf

Georgia Gulf Corporation is a leading, integrated North American

manufacturer of two chemical lines, chlorovinyls and aromatics,

and manufactures vinyl-based building and home improvement

products. The Company's vinyl-based building and home improvement

products, marketed under Royal Group brands, include window and

door profiles, mouldings, siding, pipe and pipe fittings, and

deck, fence and rail products. Georgia Gulf, headquartered in

Atlanta, Georgia, has manufacturing facilities located throughout

North America to provide industry-leading service to customers.

Sasol North America, formerly CONDEA Vista Company, headquartered in Houston, Texas, is an integrated producer of commodity and specialty chemicals employing approximately 800 people. Manufacturing locations are in Baltimore, Maryland, Lake Charles, Louisiana and Tucson, Arizona. The Company's Research & Development facility is in Austin, Texas.

Formed from the chemical division of CONOCO, Inc., Vista Chemical became a private company in 1984. In 1986, it became a publicly traded company, and in 1991, a wholly-owned subsidiary of the German oil and gas producer, RWE-DEA, as part of the CONDEA Group. On March 1, 2001, RWE-DEA concluded an agreement with Sasol Limited (Johannesburg, South Africa) for the purchase of the CONDEA Group.

Sasol North America will operate as part of Sasol Chemie, headquarted in Frankfort, Germany. Sasol Chemie is part of Sasol Chemical Industries Ltd. headquartered in Johannesburg, South Africa. Sasol North America strives to deliver consistently high quality products to all our customers around the world.

April 18, 2003 Financial

Times

Borden Chemicals and Plastics in liquidation.

Borden Chemicals and Plastics Operating Ltd Partnership (BCP) of the USA has reported that the US Bankruptcy Court has approved the plan to liquidate the company and its general partner BCP Management Inc (BCPM).

GE Capital Provides $175

Million to Georgia Gulf Corporation

GE Capital’s corporate lending business today

announced it provided a $175 million accounts receivable

securitization facility to Georgia Gulf Corporation, a leading

chemicals company. The proceeds will be used for working capital

needs.

In this type of structure, GE provides an asset-based loan

secured by the company’s accounts receivables.

Georgia Gulf Amends

Credit Agreement and Enters Into New Accounts Receivable

Securitization Agreement

Senior secured credit agreement

covenants reset until March 31, 2010

Accounts receivable securitization

increased to $175 million and extended to March 2011