@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@@gbvy[W

@

Solvay@@@@@@Vinyloop-process

Solvin

Major activity exchange between

Solvay and BP

acquisition

of Ausimont@¨@æ¾FÂðÌÆp

Fluoropolymers to 3M

Solvay

expands VCM, PVC capacity in Brazil

Solvay

in new partnership to launch industrial operations on growing

Russin PVC compounds market

Solvay

America Inc. Consolidates U.S. Chemicals Operations as Solvay

Chemicals Inc.

Solvay Soda Ash takes first step toward

major chemical alliance in China

Solvay launches its vinyls

technology in China with ground-breaking license agreement

Solvay

to acquire PEEK and other specialty polymers business from Gharda

(India)

Solvay builds new Epichlorohydrin

plant to meet growing demand with innovative production process

EC approves sale of Solvay's

Industrial Foils business to Renolit

Argentina PVC

maker Solvay Indupa buys Brazilian HDPE producer

Argentina PVC

maker Indupa injects $15-mil into Brazilian unit

SolVin invests EUR 50 million to

concentrate vinyl production on global size plants

Solvay

Indupa launches ambitious plan to expand and upgrade vinyls

production in Brazil

BASF, Ciba Specialty Chemicals,

and Solvay invest in Pangaea Ventures Fund II

Solvay

expands, upgrades ultra polymer PEEK production in India

Solvayfs green chemistry technology for

the manufacturing of Epichlorohydrin is operational in Tavaux

(France)

Solvay Indupa mulls loan for PVC

expansion in Brazil

SOLVAY, SIBUR sign join venture

agreement to build Russiafs first

world-scale vinyls production plant

SOLVIN increases PVC capacity of Jemeppe (Belgium) from 400,000tpa to 475,000tpa

Dow and Solvay Form Joint Venture

to Build Hydrogen Peroxide Plant in Thailand

Solvay

launches Peracetic Acid production in China ß|_

Solvay to build world-class

epichlorohydrin plant in Thailand

Solvin to expand PVDC latex

production in world-class plant of Tavaux (France)

Solvay reinforces its presence and

plans for more investments in specialty polymers in China

Solvay signs agreement to sell

Caprolactones business to Perstorp

SolvayqïÐPipelifeAVAÅvX`bNÇEpè̶YJn

Solvay signs agreement to sell

polypropelene compounding activity to Basell

Solvay Indupa will produce

bioethanol-based vinyl in Brasil & considers state-of-the-art

power generation in Argentina

Solvay

Pharmaceuticals S.A. launches friendly bid to acquire

Innogenetics

Solvay strengthens position in

fluorinated high-performance materials in Asia

Solvay to convert French

chlor-alkali unit to membrane

Solvay

acquires Alexandria Sodium Carbonate company in Egypt

Abbott to Acquire Solvay

Pharmaceuticals Business

Solvay will expand compounding

capacity for specialty polymers in China

Solvay

to build large specialty polymers production plant in China to

continue serving fast growing demand

Solvay commissions the largest hydrogen peroxide plant in the world in Thailand

Solvay starts the production of specialty polymers compounds in China

Four Sectors of Activity, One

Strategy

It has always been the policy of the Solvay Group to focus its

efforts on product sectors where it has experience and know-how.

The diversity of Solvay's activities is the result of systematic

development of the by-products of each manufacturing process.

This diversification centers on four sectors of activity,

governed by a single industrial and commercial strategy.

PharmaceuticalsF Research with Life in Mind

ChemicalsFThe building blocks of Chemistry

Soda ash | Detergent |

Chlor Chemicals | Hydrogen Peroxide | Fillers | Salt

Fluor

| Barium

Strontium | Caprolactones |

Plastics FCustom-made Materials

ProcessingF From Plastics to Finished Products

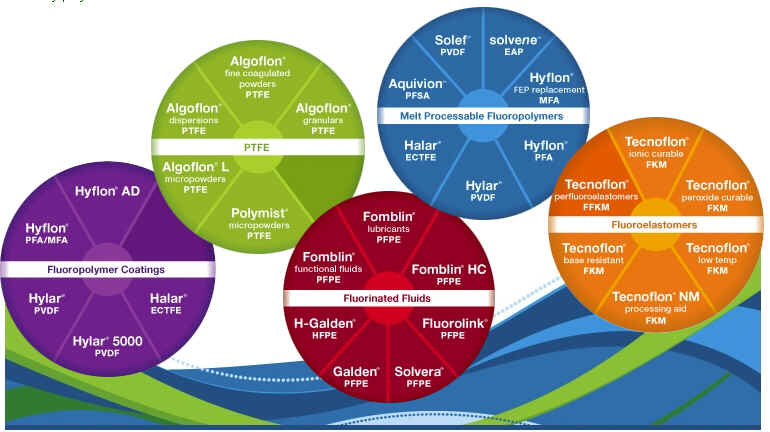

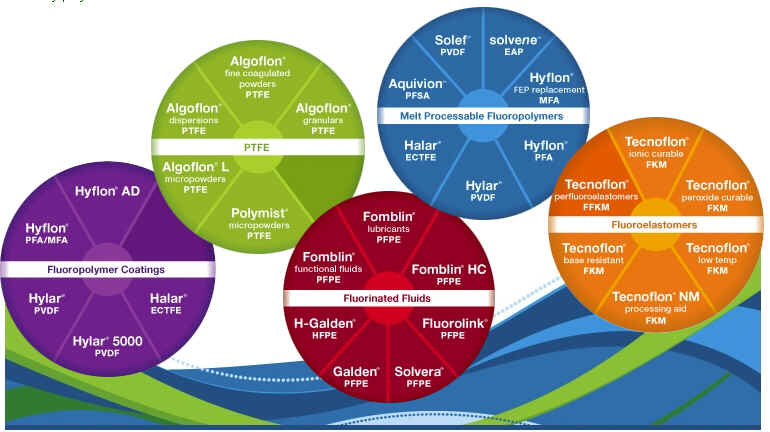

Plastics

The products offered

by the Solvay Plastics companies are commercialized under 15

different trademark names. They were designed to cover a

broad range of markets and applications and are classified in

four main Product Range categories:

| Company |

Brand |

|

| Solvay

Benvic |

BENVIC® |

PVC

Compounds (Polyvinyl Chloride) |

| Solvay

Engineered Polymers |

DEXFLEX®

SEQUEL® |

PP Compounds

(Polypropylene)

PP Compounds |

| Solvay Advanced Polymers |

IXEF®

PRIMEF® |

Polyarylamide

PPS (Polyphenylene Sulfide) |

| Solvay Fluoro Polymers |

SOLEF® |

PVDF (Polyvinylidene Fluoride)

|

| Solvay

Polyolefins Europe |

ELTEX® |

HDPE

(High-density Polyethylene) |

| Solvay

Polymers |

FORTIFLEX® |

HDPE |

| Solvin |

SOLVIN®

IXAN®

DIOFAN® |

PVC Resins

PVDC (Polyvinylidene Chloride)

PVDC |

| Padanaplast |

POLIDAN®

POLIDIEMME®

COGEFILL®

COGEGUM® |

PE Compounds (Polyethylene)

PE Compounds

PE Compounds

PE Compounds |

| Dacarto Benvic |

@ |

PVC Compounds |

| Solvay Indupa |

INDUVIL® |

PVC |

| Vinyloop |

VINYLOOP® |

Recycling Process |

| Vinythai |

SIAMVIC® |

PVC |

@@@SOLVAY

INDUPA DO BRASIL S.A.@Sao Paulo,Brazil

@@@SOLVAY

INDUPA S.A.I.C.@Argentina

@@@VINYTHAI PUBLIC COMPANY

LIMITED@RAYONGAThailand

(European Chemical News. 25 March-1 April 2002)

Planned acquisition of Italian fluorinated and

peroxides producer Ausimont

Solvay offers disposals to EC

Belgian chemical group Solvay

has proposed to divest some of its chemical activities in

order to obtain European Commission (EC) approval for its

planned acquisition of Ausimont.

now

called Solvay Solexis

Rubber World 2003/1/23

3M Completes Purchase of Solvay Fluoropolymers

Dyneon LLC, a

wholly-owned subsidiary of 3M, has announced the

completion of its acquistion of Solvay Fluoropolymers,

Inc., a subsidiary of Sol-vay America, Inc. Terms of the

transaction were not disclosed.

2002/8/27 Solvay

SOLVAY IN AGREEMENT WITH DYNEON TO SELL SOLVAY

FLUOROPOLYMERS, INC. IN DECATUR (USA)

@@http://www.solvaypress.com/pressreleases/0,6411,1142-2-0,00.htm

@

Sale of PVDF activities

taken to comply with conditions set by

competition authorities for Ausimont acquisition

Solvay America, Inc. and Dyneon LLC (a wholly-owned

subsidiary of 3M)

have entered into a binding letter of intent for the sale of the North

America - based Solvay Fluoropolymers, Inc. to Dyneon, subject to final

regulatory approvals.

May 22, 2003 Financial

Times

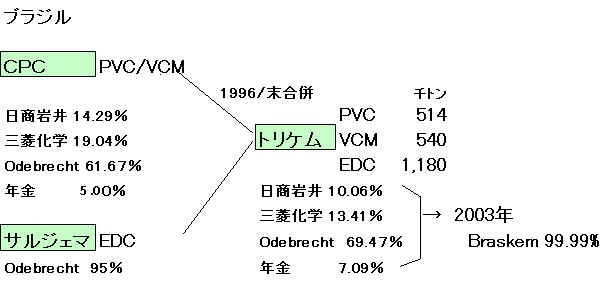

Solvay expands VCM, PVC capacity in Brazil.

$45 M is to be invested by

Solvay Indupa do Brazil, a subsidiary of Solvay, to increase

vinyl chloride monomer (VCM) capacity by 110,000 tonnes/y to

270,000 tonnes/y and PVC capacity by 40,000 tonnes/y to

280,000 tonnes/y at Santo Andre in Brazil.

@

2003/6/18 Solvay

Solvay in new partnership to launch industrial operations on

growing Russin PVC compounds market

@@@http://www.solvaypress.com/pressreleases/0,6411,3601-2-0,00.htm

Solvay announces today that it has signed an agreement with

Nikos, a private Russian industrial group, to create

Soligran, a polyvinyl chloride (PVC) compounds joint venture

in Russia. The new company, of which both partners will hold

50%, is scheduled to be operational from the autumn of 2003,

pending approval of the Russian authorities. It will mark the

return of Solvay's industrial activities in Russia after 85

years.

September 16, 2003

Business Wire

Solvay America Inc. Consolidates U.S. Chemicals Operations as Solvay Chemicals Inc.

@@http://www.solvayamerica.com/pdfs/SCI_announcement.pdf

Solvay America Inc. has begun the process of consolidating

its U.S. chemicals operations under the new name, Solvay

Chemicals Inc. The consolidation will be completed by Jan. 1,

2004.

Solvay

Minerals Inc. and Solvay Interox Inc. have already been combined to form the

new company, which is headquartered in Houston. Solvay Fluorides Inc., will become a wholly-owned

subsidiary of Solvay Chemicals as of Jan. 1, 2004, at which

time its St. Louis office will close.

2004/5/13 Solvay

Solvay Soda Ash takes first step toward major chemical alliance

in China

NCI, Subsidiary of Sinopec, identified as the appropriate

potential partner

http://www.solvaypress.com/pressreleases/0,,18322-2-0,00.htm

Solvay announces today that it

has signed a Letter of mutual interest with Nanjing Chemical

Industries (NCI), a unit of China PetroChemical Corporation

(Sinopec), aiming at setting up a joint venture for the operation

of NCIfs soda ash plant in

Lianyungang, China. Both parties will now enter into detailed

feasibility studies, with the objective of concluding successful

negotiations by the end of 2004 - and leading to the launch of

joint operations in 2005.

November 03, 2004 Solvay

Solvay sells its stake in BP Solvay Polyethelene joint ventures

to BP

http://www.solvaypress.com/pressreleases/0,,24381-2-0,00.htm

Exercise of put option confirms

Solvay's focus on specialty polymers

Solvay SA announces today that it has exercised its option to

sell its stakes in the BP Solvay Polyethylene joint ventures to

BP, effective early 2005 - pending approval by the relevant

authorities and information/consultation procedures with workers'

representatives. Solvay currently holds 50% of BP

Solvay Polyethylene Europe

and 51% of BP Solvay Polyethylene

North America. After

completion,

BP would become the full owner

of the European and American joint ventures.

Solvay and BP have also addressed and agreed on a number of

operational issues to ensure the seamless continuation of the

activities of the joint ventures.

The BP Solvay Polyethylene subsidiaries were created in August

2001 to combine both groups' high density polyethylene (HDPE)

activities, in parallel with two other transactions in which Solvay sold its

polypropylene activities to BP and acquired BP's specialty

polymers business. Later in

2001, to further its leadership in specialty polymers, Solvay acquired Ausimont, now called

Solvay Solexis. To help

the financing of this latter acquisition, Solvay monetized the

proceeds of its option to sell its stakes in the polyethylene

joint ventures to BP. To that effect, a fully consolidated

subsidiary of Solvay issued EUR 800 million of preferred shares,

which were subscribed by several banks. A substantial part of the

proceeds from the actual exercise of Solvay's option on BP will

be used to redeem all of the preferred shares for EUR 800

million.

2004/12/8

Platts

EC clears acquisition of BP Solvay HDPE by BP

The European Commission has granted clearance under the EU

Merger Regulation to the acquisition of sole control by BP of

its high density polyethylene HDPE joint venture with Solvay

SA of Belgium, the EC announced Wednesday.

@

2005/12/15

Solvay

Solvay signs agreement to

acquire innovative specialty polymers business from Gharda

(India)

http://www.solvay.com/services/newsfrompo/0,,36602-2-0,00.htm

Solvay announces today

that it has signed a binding Sale & Purchase agreement for the acquisition of

the Polymers Division of Gharda Chemicals in India. The operation will provide Solvay

with a new global platform for the development, manufacturing,

and marketing of a new range of specialty grades of ultra-high

performance polymers such as polyether

ketones (PEEK), high performance sulfones, and

related monomers. The

transaction is subject to certain conditions including approval

from the relevant authorities. Solvay and Gharda are aiming to

complete the transaction as soon as practical thereafter.

GHARDA CHEMICALS, established in 1967, is a research-based

company with three manufacturing units. The company has won

several national awards in India for technical innovation in the

chemical industry and has many firsts in the field of dyestuffs,

pesticides, veterinary drugs and polymers.

British

Plastics & Rubber 2003/8/1

PEEK producer pushes

protection

http://www.polymer-age.co.uk/archive66.htm#PEEK%20producer%20pushes%20protection

Indian agrochemicals manufacturer Gharda Chemicals has

extended the patent cover for its polyether ether ketone

polymer. Earlier this year it obtained a British patent, and

has now secured an American patent for Melt Processible PEEK.

Gharda's PEEK - tradenamed Gatone - is made in a different

process from Victrex PEEK in that it uses an

electrophillic process developed by Gharda, and does not

involve fluorine monomers. Gharda says that its process, only

commercialised in 2000, is cheaper than that used by Victrex,

but that the product is comparable.

January 31, 2006

Solvay

Solvay builds new Epichlorohydrin plant to meet growing demand

with innovative production process

A strategic outlet for boomingegreenfbiodiesel industry

http://www.solvay.com/services/newsfrompo/0,,38696-2-0,00.htm

Solvay announces today

that it will build a new epichlorohydrin plant on its industrial

site of Tavaux, France, implementing a novel process with greatly

enhanced environmental performance. The process, called Epicerol, was successfully developed by

Solvayfs R&D and is based on the

transformation of glycerine, a by-product of the biodiesel

industry. The new plant, which is scheduled to be operational by

the first half of 2007, will be fed with glycerine derived from

rapeseed oil and fits perfectly with the development of the

Biodiesel industry actively supported by the French government.

Notes to the Editors:

Epichlorohydrin is one of the most useful members of the epoxide

family of compounds, its major use being the manufacture of epoxy

resins, which have a large number of applications in the car,

housing, boating and leisure industries. Other applications

include the reinforcement of paper (used for instance in the food

industry to manufacture tea bags) and water purification.

Epichlorohydrin is traditionally derived indirectly by reacting

propylene with chlorine.

The Epicerol process developed by Solvay allows the direct

synthesis of dichloropropanol, an intermediate product, from

glycerine and hydrochloric acid. A second step -

dehydrochlorination - generates the final product,

epichlorohydrin. The entire process is marked by a lower specific

consumption of chlorine and water, consequently reducing

chlorinated effluents. Solvay developed the glycerine-based

process described in earlier scientific literature and made its

industrialization possible thanks to the creation of an entirely

new class of catalysts, among other innovations.

Glycerine is the main by-product of biodiesel production, with

the generation of approximately 100 kg of glycerine for every

1000 kg of biodiesel.

Platts 2006/2/23

EC approves sale of Solvay's Industrial Foils business to Renolit

The European Union's competition commission has approved the sale

of the Industrial Foils business of Belgium's chemicals group

Solvay to Germany's Renolit, the commission announced Thursday.

The sale include the production, marketing and sales of plastic

foils. According to Solvay, the closing of the transaction

"is now expected in the coming weeks, pending relevant

social procedures." The agreed price of the transaction is

Eur330-mil ($395-mil).

The vinyl flexible technical foils are used for the manufacturing

of stationery products, self-adhesive tapes and stickers,

packaging items or cinema screens, among other applications.

Renolit AG has more

than half a century of experience in the development and

production of plastic films.

http://www.renolit-werke.de/renolitag/englisch/frame.htm

@

2006/6/30 Solvay

Solvay to launch specialty polymer production in China @@@÷±q»³ê½PTFEiltb»G`÷jpE_[

PTFE

Micronized Powder Facility to Serve Buoyant Asian Markets

Solvay announces today that it has decided to build a new world-class

polytetrafluoroethylene (PTFE@ltb»G`) Micronized

Powder production unit in the People's

Republic of China, to serve the dynamic local demand for

innovative and high performance materials. Pending authorization

from the relevant authorities, Solvay would initiate production

in the second half of 2007.

PTFE Micronized Powders, marketed under the brand name

Polymist(R), are used in a variety of complex applications, such

as the manufacturing of cosmetics, high gloss inks, high

performance lubricants and heat-resistant materials. The demand for

micronized PTFE in Asia and particularly in China is fuelled by

both the fast development of a local customer base as well as by

the creation of local production facilities by a number of

Solvay's global clients.

The new Polymist(R) facility would be located in the Jiangsu High-Tech

Fluorochemical Industrial Park in Changshu ]hÈíns some 100

kilometers west of Shanghai - and operated through Solvay

Specialty Polymers Changshu, a newly created and fully-owned

subsidiary of the Solvay group.

September 24,

2008@Solvay

Solvay strengthens

position in fluorinated high-performance materials in Asia

@@@Second world-class production

plant of Polytetrafluoroethylene Micronised Powder

Solvay announces

today the inauguration of its new world-class Polytetrafluoroethylene

(PTFE) Micronised Powder production unit in the Peoplefs Republic of China, to serve

the dynamic local demand for innovative and high performance

materials. PTFE Micronised Powders, marketed under the brand

name Polymist(R), are used in a variety of complex

applications, such as the manufacturing of cosmetics, high

gloss inks, high performance lubricants and heat-resistant

materials.

This new facility is Solvayfs second

Polytetrafluoroethylene (PTFE) Micronised Powder production

unit, the first facility being in

Marshallton, Delaware, USA.

The new facility will

allow Solvay to continue to use its patented technology and

ability to customize products to meet the individual needs of

its customers. The new Polymist facility is in the Jiangsu

High-Tech Fluorochemical Industrial Park in Changshu some 100 kilometres west of

Shanghai - and is managed by the operating units of Solvay

Solexis, a fully-owned subsidiary of the Solvay Group.

¼ÌÅÌ®

nQt[ïR«iHFFR)sodARpEh

2005N@Solvay Padanaplast ÆShanghai Original Enterprise Development ª50/50iu@Padanplast

Original Advanced Compounds (Shanghai) ðݧ

Halogen Free Flame

Retardant (HFFR) thermoplastic and irradiation crosslinkable

compoundsÌ»¢

| rpCvÆ |

| @ |

@ |

| E |

1989NÉSolvayÆI[XgAÌWienerberger

Ì50/50iu

Pipelife International

ðݧA¢EÉWJ@ http://www.pipelife.com/ |

| E |

Pipelife International ÍWienerberger

ÌÆðûµ½B

lìȬss@

@@@@@pCvȢ@Chengdu

Chuanwie Plastic Pipes Co., Ltd.

@@@@@p転@@Sichuan

Chuanxi Plastic Co., Ltd.LÈLBiì¹j@

@@@@ pCvȢ@Pipelife (Guangzhou)

Plastic Pipe Mfg.,

Ltd@

ãC

@@@@ pCv»¢@iºLj

|

|

| E |

2000N9APipelife

International Æ ]hÈíBÌChangzhou Reinforced

Plastics FactoryÍ65/35Ìiu

Changzhou

Pipelife Reinforced Plastic Pipe Co., Ltd.

ðݧµ½B

Changzhou Reinforced Plastics FactoryÍrÆodÌÇEpèAPEKXÇÌ[J[ÅíBÌvgðoAPipelifeÍãCÌvgðo·éB |

2005/2/1

Solvay Padanaplast

Original Create HFFR Joint Venture in China

Solvay

Padanaplast S.p.A.

and Shanghai

Original Enterprise Development Co. Ltd. announce today that they have

signed an agreement to create a joint venture for the

development, production and marketing of Halogen Free Flame

Retardant (HFFR) thermoplastic and irradiation crosslinkable

compounds.

Both partners will hold 50% of the joint venture.

The joint venture, which was approved by the authorities of the

Peoplefs Republic of China, is scheduled

to be operational from beginning of February 2005 under the name PADANAPLAST

ORIGINAL ADVANCED COMPOUNDS (SHANGHAI) CO., LTD. in English and ãC³àNúºßãÚ¨LÀöi

in Chinese. The

joint venture, which is located in Shanghai and essentially aims

at serving the Chinese market, will have an initial production

capacity of 5,000 tons per annum. The size of the company may be

expanded at a later stage, in line with market demand.

gWe

welcome the decision of the PRC authorities to grant a business

license to the joint operation of Original and Padanaplast,h

said Hai Liang Hou,

President of Shanghai Original Enterprise Development Co., Ltd.. gWe are now in a position to

deliver international quality products best suited for the rapid

development of the Chinese market for HFFR compounds in the cable

industry, which we expect will grow by more than 10% per annum

over the next five years,h he added.

gPadanaplast

Original Advanced Compounds will be the leading provider of HFFR

compounds for the cable industry in China, with an extensive

range which will include 20 different compounds right from the

start of operations,h said Luigi. Dalpasso, Managing

Director of Solvay Padanaplast S.p.A.

Solvay Padanaplast S.p.A. is a global leader in the sector of

plastic compounds for crosslinkable pipe and cable markets, whose

headquarter, R&D and production facilities are located near

Parma in Italy, and is a major foreign supplier of Halogen Free

Flame Retardant compounds in China. The company, which has annual

global sales of some EUR 50 million, is a wholly-owned subsidiary

of Solvay SA, the international chemical and pharmaceutical

Group.

Shanghai Original Enterprise Development Co., Ltd., founded

in1997, has grown to be a major domestic player in the PRC wire

and cable compounds market, specializing in Halogen Free Flame

Retardant thermoplastic and irradiation cross-linkable compounds.

The company has been granted the status of Shanghai High Tech

Enterprise since 2002.

PADANAPLAST

SpA, located at Roccabianca, near Parma, Italy, is an

indipendent business unit belonging to Solvay Performance

Compounds SBU.

Padanaplast is world leader in Sioplas® PEX compound for pipe

applications and among the leader for HFFR TP & SXL,

SXL-EPR, SXLPE compounds for cables.

It was one of the first company to produce Sioplas® PEX compounds more than 20

years ago, and now commercialized worldwide.

We merge 25 years of experience in our

target markets with a continuous innovation.

Experienced , young, dynamic people work together in

efficient teams to combine the strength of the expertise with

the knowledge of the newest technologies.

September 05, 2000@

Pipelife

International sets up new company in China, strengthening its

position in the fast growing Shanghai area

PIPELIFE INTERNATIONAL, a

50/50 joint venture between SOLVAY (Belgium) and WIENERBERGER

(Austria), signed an agreement for the creation of a new plastic

pipe company with a Chinese partner, Changzhou Reinforced

Plastics Factory (CRPF).

CRPF is a medium-sized plastic pipe producer based in Changzhou

(200 km north-east of Shanghai), with annual revenues of

approximately $5 million. It manufactures PVC and polyethylene

water pressure pipes and fittings as well as polyethylene gas

pipes and has an annual production capacity of approximately

8,000 tonnes.

CRPF will bring its international standard facilities in

Changzhou into the joint venture, while PIPELIFE will contribute

with its Shanghai factory. PIPELIFE will own 65% of the capital

of the new company, to be named CHANGZHOU PIPELIFE

REINFORCED PLASTIC PIPE Co. Ltd., while CRPF will own the remaining

35% of the capital.

The new company will benefit from PIPELIFE's technical expertise

and CRPF's share of the fast-growing pipes and fittings market in

the Shanghai area. Furthermore, the joint venture will gain from

the fact that the Chinese authorities have already registered

CRPF's products -including gas pipes. Due to a booming economy,

the pipe market around Shanghai has grown by more than 20%

annually over the past three years. It is expected to expand at

the same pace in the coming years.

PIPELIFE, a 50/50 joint venture between SOLVAY and WIENERBERGER,

is one of the three largest European producers of plastic pipes

and fittings. PIPELIFE operates with 3,200 employees, in 34

plants in 24 countries and posted a turnover of some EUR 600

million in 1999. In China, PIPELIFE already operates five

companies: three in the region of Chengdu, one near Guangzhou and

one in Shanghai. The latter will be included in the joint venture

with CRPF.

SOLVAY is an international pharmaceutical and chemical group

headquartered in Brussels. It employs about 33,000 people in 50

countries. In 1999, its consolidated sales amounted to EUR 7.9

billion, generated by its four sectors of activity:

Pharmaceuticals, Chemicals, Plastics and Processing.

WIENERBERGER is an international building material group, with a

leading position on the European pipe market, and the number one

producer of bricks in the world. The group has more than 11,000

employees and over 200 plants in 26 countries. Group sales

reached EUR 1,338 million in 1999.

2006/8/30 Solvay

Solvay Indupa launches

ambitious plan to expand and upgrade vinyls production in Brazil

Capacity increase

in Santo Andre to meet fast-growing Latin American demand

Solvay announces

today that the Board of its affiliate Solvay Indupa has approved

a USD 150 million investment program to expand and modernize its

vinyls production plant of Santo Andre, Brazil, in anticipation

of rapidly growing demand in Latin America.

The investment

program includes upgrading the plantfs electrolysis unit through the

implementation of modern membrane technology with a nameplate

annual capacity of 150,000 metric tons of chlorine and the expansion of the

downstream vinyl chloride monomer (VCM) and polyvinyl chloride

(PVC) manufacturing facility, with the installation of larger,

more competitive equipment. As a result, by the end of 2008, the

Santo Andre plant will have a total annual VCM and PVC

production capacity of 300,000 metric tons, with world-class,

state-of-the-art installations. Subsequent developments will be

considered to further expand the plant, whose fully integrated

PVC capacity could be easily lifted in line with the demand

growth .

Solvay Indupa, a

company of the Solvay group, is one of the most important

petrochemical companies in the Mercosur. Its main products are

PVC resins and Caustic Soda. Solvay Indupa has its main offices

in Buenos Aires, Argentina and two industrial sites: one in Bahia

Blanca (Argentina) and the other in Santo Andre (Brazil). Solvay holds 62.7%

of Solvay Indupa,

which is listed on the Buenos Aires stock market.

Solvay

Indupa has

two industrial complexes: one located in Bahia Blanca

Petrochemical Pole, in Argentina , producing 210,000

ton/year of PVC and 180,000 tons/year of Sodium hydroxide

(NaOH);

and the other located in the industrial complex in Santo

Andre, Brazil ,

where it produces 240,000 tons/year of PVC (¨300,000tpaj@and 100,000

tons/year of Sodium hydroxide (NaOH).

2006/10/16 Solvay

Solvay expands, upgrades

ultra polymer production in Panoli (India)

Launch of KetaSpireTM, a new polyether ether ketone

(PEEK) product line

The Solvay group

announces today that it has decided to expand and upgrade its

facilities in Panoli (Gujarat State, India), which will result in

the creation of a new, world-class production unit for polyether

ether ketone (PEEK) and other materials in the ultra-performance

segment of the specialty polymers business. The installation will

be built to provide for a natural expansion of production,

resulting in a step-wise increase in capacity as warranted by

demand. It will come on stream in the first quarter of 2008, with

a production capacity of 500 metric tons per year of

KetaSpire,

the new line of PEEK products developed by Solvay Advanced

Polymers.

The R&D center and production plant in Panoli were formerly

operated by Polymers Division

of Gharda Chemicals, which Solvay acquired earlier this

year. The successful completion of this acquisition laid the

groundwork for Solvay's entry into the PEEK market. In parallel,

the extensive research carried out at Solvay Advanced Polymers'

R&D center in Alpharetta, (Georgia, United States) was

finalized and resulted in a fully operational, robust,

proprietary product and manufacturing technology for the new line

of KetaSpire PEEK materials.

2007/4/5 Solvay

Solvayfs green chemistry technology for

the manufacturing of Epichlorohydrin is operational in Tavaux

(France)

@Group

consolidates technological leadership of

Epicerol(TM) process

Solvay announces today that the first industrial unit

implementing Solvayfs novel process to produce Epichlorohydrin, Epicerol, was successfully

launched in Tavaux (France). The plant is fed with glycerine

derived from rapeseed oil and has an initial nameplate

capacity of 10 metric kilotons per year, easily expandable in

response to market demand.

This first industrial implementation of Epicerol reaffirms Solvayfs technological leadership with a

process based on the transformation of glycerine, which is a

by-product of the biodiesel industry, and paves the way for

future developments. Solvay is planning a further investment in a

100

kt/year unit in Thailand, in response to rapidly growing

demand for epichlorohydrin, in particular in Asia. In this

country, Solvay will take advantage of its integrated site of Map

Ta Phut. This new Epicerol production unit will startup mid 2009.

The Epicerol process developed by Solvay allows the direct

synthesis of dichloropropanol, an intermediate product, from

glycerine and hydrochloric acid. A second step -

dehydrochlorination - generates the final product,

epichlorohydrin. The entire process is marked by a lower specific

consumption of chlorine and water, consequently reducing

chlorinated effluents. Solvay developed the glycerine-based

process described in earlier scientific literature and made its

industrialization possible thanks to the creation of an entirely

new class of catalysts, among other innovations.

Glycerine is the main by-product of biodiesel production, with

the generation of approximately 100 kg of

glycerine for every 1000 kg of biodiesel.

http://www.knak.jp/blog/2006-8-2.htm#dow

_EÍ2006/89úAÅG|LVÆÅ5NÔÅ2hÌð·éÆ\µ½B

ܸA]hÈ£Æ`sÌgq]Û»wp[NÌù¶ÌHêÉ¢EÅåÌ10gÌtÌG|LV÷iLERjvgðÝ·éB2009NX^[gÌ\èB

¯nÅÍ2003N5ÉX^[gµ½G|LV÷iconverted

epoxy resinsCER) 41çgÌvgª éªA±êð2008NÉ34çgݵA75çgÉgå·éB

³çÉAG|LV´¿ÌGsNqhÌVHê15gðVÝ·éBêÉ¢ÄÍß\·éB±êÍ2010NX^[g\èÅA_EÌOZ@VZpðÌp·éBoCIfB[[Ì»¢Å¶·éOZð´¿Æ·éàÌB

@@¨@Shanghai

Site

2007/5/4 Platts

Argentina PVC maker Indupa mulls loan for Brazil expansion

Solvay

Indupa

The expansion project, first announced in August 2006,

will boost

production capacity of its plant in Santo Andre, Sao Paulo to

160,000 mt/year of caustic soda and 300,000 mt/year of PVC. The facility currently has

capacity to produce 240,000 mt/year of PVC and 100,000

mt/year of caustic soda.

Solvay Indupa, part of Belgium's Solvay, produces PVC in Bahia

Blanca, Argentina, where it recently completed a

$7.3 million expansion of the plant's PVC capacity of

240,000 mt/year from 210,000 mt/year.

2007/6/27 Solvay

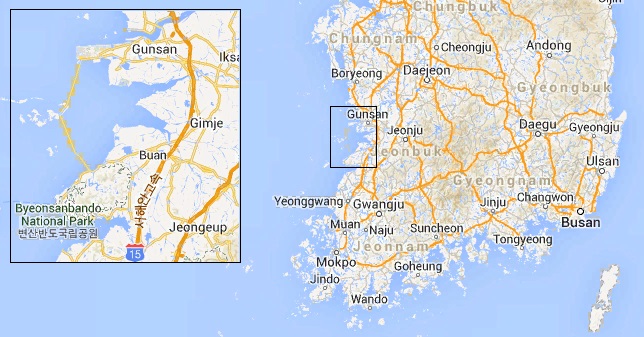

SOLVAY, SIBUR sign join venture agreement to build Russiafs first world-scale vinyls

production plant

State-of-the art technology for a fast-growing market

Solvay and SolVin, the joint subsidiary of Solvay and BASF for vinyls in Europe, announce today that they have signed a joint

venture agreement with Sibur LLC, an affiliate of Gazprom to build Russiafs first world-scale, fully

integrated vinyls plant in Kstovo, in the Nizhny Novgorod region

jWjEmShB.

Sibur HoldingF@@@Ú×

@VAÌ30ÐÈãÌÎû»wE»wéÆð·é¿ïÐÅAKX¸»©ç^C¶YÜÅL誯ĢéB

@VAcKXvªASibur HoldingÌ®ð100ÛLB

Solvin

@Solvay

holds 75% and BASF 25% of SolVin.

Pending relevant

regulatory clearance and the realization of appropriate

infrastructure works, the production site is scheduled to be

operational in 2010. It will require a total investment of EUR 650 million for the establishment of a total

annual capacity of 330 kilotons of vinyls resin and

225 kilotons of caustic soda. The operation will serve the fast

growing markets in the Commonwealth of Independent States (CIS)

and is designed to accommodate a possible expansion bringing

total capacity to 510 kilotons of vinyl resin and

335 kilotons of caustic soda.

The plant will be supplied with ethylene delivered

from the cracker owned by Sibur in Kstovo. The cracker will be expanded by

our Russian partner to meet the plant requirements as well as its

own internal needs.

To implement their agreement, SolVin and Sibur

Holding will create a joint venture company, RusVinyl, of which each partner will hold 50%. In addition, SolVin has entered

into talks with the European Bank for Reconstruction and

Development, aiming at a possible EBRD involvement in the

project.

Vinyl production capacity on the Kstovo plant would be split as

follows: 300 k/tons of polyvinyl chloride suspension (S-PVC), 30

k/tons of emulsion polyvinyl chloride resin (E-PVC), and 225

k/tons of caustic soda. A possible expansion would add a capacity

of 150 k/tons of S-PVC, 30 k/tons of E-PVC and 110 k/tons of

caustic soda per year, by 2014.

Platts

2007/7/11

Gazprom completes move to fully divest petchems business

Sibur

The stake of 25% plus one share has been transferred to

Gazfond, a Gazprom affiliate, the spokesman said.

Under the transaction, the 25% Sibur stake was effectively

exchanged for shares in Moscow utility Mosenergo, which were

previously held by Gazfond.

The remaining 75% minus one share in Sibur remains with

Gazprombank.

Gazprombank is 42%-owned by Gazprom. The remaining shares in

the bank are held by Gazprom-affiliated structures, including

opaque investment fund 'Leader'.

August 14, 2007

Solvay

Solvay launches Peracetic

Acid production in China

State-of-the-Art Proxitane® Plant now fully operational in

Suzhou

Solvay announces today that its new Peracetic Acid

(PAA ß|_) production plant in Suzhou, China

is now fully operational and will deliver advanced disinfection

solutions with a low impact on the environment. The market demand

in China for Solvay's PAA range, marketed under the Proxitane®

brand name, has

been growing strongly over recent years, particularly for

disinfection applications in the food & drinks packaging

industry and "clean in place" operations, which enable

the sterilization of food or pharmaceutical production equipment

on site.

The plant, based on

Solvay's world class technology, abides by stringent standards

and has been approved by the relevant authorities. It is operated

on behalf of Solvay by Suzhou Crystal Clear Co Ltd.

Solvay and the SCCC group

are already operating a joint venture to produce Ultra High Purity

Hydrogen Peroxide

for the semiconductor industry, in a new, world-class plant which

inaugurated last autumn in Suzhou.

2007/9/6 Solvay

Solvay to build

world-class Epicerol® plant in Thailand

Innovative green chemistry technology to serve strong demand for

epichlorohydrin

Solvay announces today that it has decided to build a world-class

plant in Map Ta Phut (Thailand) for the production of epichlorohydrin on the basis of the Epicerol® process, its proprietary technology with

enhanced environmental performance. Pending relevant regulatory

approval, the new plant is scheduled to be operational at the end

of 2009, with an annual production capacity of 100,000 metric

tons,

enabling Solvay to provide a fast response to the rapidly growing

demand for epichlorohydrin in Asia.

2007/4/13@SolvayAoCIfB[[¶OZð´¿Æ·éGsN̶YJn

SolvayÍ5úA¯ÐZpÅÌØíû©çÌoCIfB[[¶Y̶OZð´¿Æ·éGsNqh̶YðtXÌTavauxÅJnµ½Æ\µ½BÌ\ÍÍN10çgÅAùvɶÄÈPÉg£Å«éB

@

2007/9/24 Solvay

Solvin to expand PVDC latex production in world-class plant of

Tavaux (France)

A timely, competitive response to serve growing demand from food

& pharma industry

SolVin, a joint venture of Solvay and BASF, announces today that

it will build a new production line for polyvinylidene

chloride (PVDC) latex at its Tavaux (France)

manufacturing site. PVDC latex is a specialty barrier material

used as a coating in packaging applications where the integrity

of the goods is critical, especially in the food and

pharmaceutical sectors.

The new production line, which will add an annual

capacity of 10,000 tons, is expected to be operational by

mid-2009, in response to growing demand from the dynamic PVDC

market. The new production line will benefit from full upstream

integration of raw materials and from the expertise of the Tavaux

staff, who have developed this operation into the global

reference in terms of product quality and consistency.

While continuing to supply its international clients from Tavaux,

SolVin is planning to strengthen its logistics to further improve

its service to the rapidly expanding Asian market. SolVin will

also continue to assess opportunities to create an entirely new

production site in Asia or the North American Free Trade

Agreement (NAFTA) countries, pending further developments in

the PVDC market.

2007/10/8 Solvay

China : Solvay reinforces its presence and plans for more

investments in specialty polymers

PTFE Micronized Powder facility confirmed; more projects under

consideration

Solvay Solexis, a 100% subsidiary of the Solvay Group, today

confirms that its new polytetrafluoroethylene (PTFE) Micronized

Powder plant

currently under construction in Changshu, China,

will be

completed and operational in the first quarter of 2008. Solvay

Solexis also confirms its intention to further develop its

activities on the site, where it is considering producing other

high value added fluorinated polymers.

The new PTFE plant is located in the Jiangsu High-Tech

Fluorochemical Industrial Park in Changshu íns, some 100 kilometers west of

Shanghai. The location was selected last year because of its

proximity with Shanghai and the dedication of the Industrial Park

to complex technologies in specialty chemicals and polymers -

particularly in the area of fluor technologies.

Among the subsequent development projects considered in Changshu,

Solvay Solexis is planning to build, an integrated production

plant for the manufacturing of polyvinylidene

fluoride (PVDF)

for coating applications and related monomers.

@

2007/10/15 Solvay

Solvay signs agreement to sell Caprolactones business to Perstorp

@@Focusing on activities where the

Group has maximum control over raw materials

Solvay announces today that it has signed a sale & purchase

agreement with the Perstorp Group of Sweden to sell the latter its entire Caprolactones

business,

which is active in the production, marketing and sales of epsilon-Caprolactone. The transaction is expected to

be completed in the fourth quarter of 2007, pending the relevant

regulatory approvals. The agreed price for the transaction is EUR

200 million.

PERSTORP is a Swedish-based specialty

chemical company, world leader in the production of

oxo chemicals and polyols, derived mainly from propylene

and methanol. PerstorpLs products are used in the aerospace,

marine, coatings, chemicals, plastics, engineering and

construction industries. Perstorp currently employs approximately

1,800 people and has manufacturing units in ten countries in

Asia, Europe, North and South America. In 2006, Perstorp achieved

revenues of EUR 780 million. Details are available at

www.perstorp.com

Caprolactone: The existing portfolio of

Caprolactones products marketed by Solvay under the CAPAiRj brand includes a wide range of

commercial products used in applications such as paints &

coatings, thermoplastic polyurethanes, adhesives, cast elastomers

as well as in different solutions for the automotive, aerospace,

medical and shoe industries.

Oct 17,2007 Solvay

Pipelife starts up production in new russian factory

@@Solvay Affiliate Expands into One

of Europefs Fastest Growing Markets

Solvay announces today that its affiliate for

pipes and fittings, Pipelife, has started operating a new

factory located 130km southwest of Moscow, in the middle of one

of Europefs fastest growing economies.

Pipelife will produce a full range of plastic pipe

systems for water distribution, sewage networks as well as

in-house products. The

factory, which features brand new equipment, will offer the most

advanced products in Polypropylene (PP), Polyethylene

(PE) as well as Vinyls, to cover the growing needs of the

Russian customers. In a first stage, the factory will employ

around 60 people.

The Pipelife Group is a 50/50 joint venture between

Wienerberger, the Austrian construction materials manufacturer,

and Solvay.

It is one of Europefs leading Plastic Pipes and

Fittings groups. It is active in 29 countries and operates 30

factories with 2.800 employees achieving pro-forma sales of EUR

823 million in 2006.

2007/11/29 Solvay

Solvay signs agreement to

sell polypropelene compounding activity to Basell

@@Focusing on activities where the

Group has better opportunities to create business value

Solvay announces today that it has signed a Stock Purchase

Agreement with Basell to sell the latter 100% of its

subsidiary Solvay Engineered Polymers (SEP), a leading supplier

of polypropylene compounds. Pending relevant regulatory

approval, the transaction is expected to be completed early in

2008.

SEP, which is essentially active in the North American Free Trade

Agreement (NAFTA) region, has operations in Mansfield and Grand

Prairie, Texas, as well as in Auburn Hills, Michigan. The company is also represented

in Europe and China through sales offices. The annual sales of

SEP account for less than 2% of the turnover of the Solvay group.

Solvay is committed to the development and manufacturing of

specialty polymers, in a drive to offer the worldfs broadest range of high

performance and ultra-high performance materials. However, the

strategic fit of SEPfs polypropylene compounding

activities has become limited within Solvayfs Plastics Sector because, among

other reasons, the Group completed the

divestiture of its polypropylene resin production in 2001.

@

December 14, 2007

Solvay

Solvay Indupa will

produce bioethanol-based vinyl in Brasil & considers

state-of-the-art power generation in Argentina

Polyvinyl chloride (PVC)

Derived from Sugar Cane and Salt

Solvay announces today

that the Board of its affiliate Solvay Indupa has approved a

further USD 135 million investment program to expand and increase

the competitiveness of its vinyls production plant of Santo Andre,

Brazil. This

second stage of expansion, following the plan announced in August

2006, comprises the creation of an integrated plant to produce ethylene with

ethanol originating from sugar cane. Ethylene is one of the two main

feedstocks needed to manufacture polyvinyl chloride (PVC) -

together with chlorine, which is produced through a salt-based

electrolysis process.

Santo Andre would be the first industrial project in the Americas

implementing renewable resources for the production of PVC. This

innovation will prevent the emission of large quantities of C02

into the atmosphere.

Solvay Indupafs ambition is to complete the

expansion of Santo Andre by 2010. The plant would then have an

installed capacity of 360,000 tons/year of PVC; 360,000

tons /year of vinyl chloride monomer (VCM), 235,000 tons/year of

Caustic Soda and 60,000 tons/year of bio-ethylene.

Solvay Indupa is also

studying with Argentinean energy group Albanesi S.A. the

construction of a 165 megawatt combined cycle

electrical power plant on Solvay Indupafs site in Bahia Blanca, Argentina. The project would require an

investment of USD 135 million and would provide for a reliable

and competitive coverage of the sitefs entire energy needs.

Solvay Indupa, a company of the Solvay group, is one of the most

important petrochemical companies in the Mercosur. Its main

products are PVC resins and Caustic Soda. Solvay Indupa has its

main offices in Buenos Aires, Argentina and two industrial sites:

in Bahia Blanca (Argentina) and Santo Ande(Brazil). Solvay holds 70.1%

of Solvay Indupa,

which is listed on the Buenos Aires stock market.

Solvay

Indupa has two industrial complexes: one located in Bahia

Blanca Petrochemical Pole, in Argentina , producing 210,000

ton/year of PVC and 180,000 tons/year of Sodium hydroxide;

and the other located in the industrial complex in Santo André

,Brazil , where

it produces 240,000 tons/year of PVC and 100,000 tons/year of

Sodium hydroxide.

@

2008/10/1 Solvay

Belgian Solvay to convert

French chlor-alkali unit to membrane

Belgium's Solvay will

invest Eur55 million ($78 million) at its chlor-alkali production

site at Tavaux, France to transform its mercury-based

electrolysis process to membrane technology.

The European chlor-alkali industry has a longstanding voluntary

agreement through its industry body, Euro Chlor, to

convert chlor-alkali plants from mercury to the more efficient

membrane technology. The final phase-out is due to complete by

2020.

Last year membrane overtook mercury as the leading chlor-alkali

technology, accounting for some 43% of

production against 38% for mercury-based plants.

September 29, 2008

Solvay

Solvay invests EUR 55

milion in reduced electricity consumption and lower

environmental impact of its electrolytic unit at Tavaux

(F)Launch of membrane-based electrolytic technology

@

2008/10/20@Solvay

Solvay acquires Alexandria Sodium Carbonate company in Egypt

gExpansion

into growing Egyptian, Middle Eastern and North-African marketsh

Solvay announces

today that it has entered into a final agreement for the

acquisition of the acquisition of 100% of Alexandria Sodium

Carbonate Company (ASCC) from Holding

Company for Chemical Industries (HCCI), an Egyptian State-owned

holding company. The operation is part of Solvayfs geographical expansion strategy

and will allow the Group to attend to the growing needs of

Egyptian consumers and to support the projects of its customers

in the fast-growing Middle-Eastern and North-African (MENA)

markets.

Solvay had emerged as the preferred bidder as a result of the

final auction which the Egyptian authorities organized on March

27, 2008 - valuing ASCC at 760 million Egypt pounds (EUR 100

million).

ASCC produces both sodium carbonate \[_D and quicklime ¶ÎD; it is Egyptfs only sodium carbonate producer

and primarily serves the domestic market. ASCCfs plant was erected in 1974 near

the city of Alexandria. It was thoroughly modernized at the end

of the 1990s and currently has a nameplate

production capacity of 130,000 metric tons of soda ash.

gWith

this acquisition, Solvay gains a privileged access to the very

dynamic Egyptian market,h commented Christine Tahon,

Managing Director of Solvayfs Strategic Business Unit Soda Ash

and Related Products. gSolvay will continue the

development initiated by HCCI and ASCC, which aims at rapidly

increasing annual production capacity to 200,000 metric

tons of sodium carbonate. In the longer term, Solvay

considers producing up to 500,000 tons per year at the Alexandria plant,

to serve not only Egypt but also the vibrant Middle-Eastern and

North-African markets by using the facilities at the port of

Alexandria,h added Tahon.

October 10, 2010

Solvay will expand compounding capacity for specialty polymers in

China

@@EUR 21 million investment in new

capacity to satisfy surging demand ]hÈ

íns

Solvay announces

today that it has decided to build a specialty polymers

compounding plant at its site in Changshu in the province of

Jiangsu, China. Start-up of the plant is expected in the last

quarter of 2012. The plant will satisfy the growing demand for

specialty polymers in China and requires the investment of EUR 21

million.

The compounding plant will serve the fast growing markets in

China for electronics, automotive, consumer and industrial

applications and will initially start producing compounds of

Amodel(R) polyphthalamide (PPA), Ixef(R) polyarylamide (PARA) and

Kalix(R) (modified PARA). The facility will be fully

adaptable for future expansion for both overall capacity and for

other high performance and fluorinated polymers.

\xCÅÍAR¿VXeÉKµ½vX`bNƵÄAAmodel |t^A~hiPPAj¨æÑ

Ixef |A[A~hiPARAjÌñÂÌ@\«vX`bNt@~[ðñµÄ¢Ü·B

±êçÌvX`bNª{ÂoA«ÆÏR¿«ª¼ÌÁ¥IÈ«¿ÆgÝí³êA¨qlªKvÆ·é«\ðÀ»µÜ·B

AmodelÍ]Ìt»|}[â|tFjXtBhÈÇÌX[p[GvÅͼ§Å«È©Á½ÏMÆxðæèáRXgÅñÅ«éAÆÄàj[Nȼ»«GWjAOvX`bNÅ·B

Ixef PARA ÍAìzµ½oAÁ«Æ½í½lÈR¿ÖÌÏ«Æ¢¤_ÅAAf

PPA É޵ĢܷBdvÈá_ƵÄÍAlxef PARA Íæèá¢ÁH·xð½ßA««ÉxÞVµ¢|G`ERvZbVOZpðp·é±ÆªÅ«A±êÉæè

OEM [J[ÍæèRXgø¦Ì¢û@ÅK§vÖÌÎð}é±ÆªÅ«Ü·B

gOur

high-end specialty polymers are used in an increasing number of

applications in this very dynamic region of the world. We are

looking forward providing additional supply flexibility by

compounding in closer proximity to our expanding customer base

and providing them with more plastics with more performance,h

says George Corbin,

Senior Executive Vice-President of Solvay Group and President of

Solvay Advanced Polymers, one of the entities of Solvay's

Specialty Polymers Strategic Business Unit.

gThis

investment clearly illustrates Solvay's strategy to enlarge its

industrial base in fast moving markets such as China. Sales of

Specialty Polymers in Asia were above 25% of total sales in the

first half of this year and we see a growing trend,h

adds Augusto di

Donfrancesco, General Manager of the Strategic Business Unit

Specialty Polymers.

June 23, 2011 Solvay

Solvay to build large

specialty polymers production plant in China to continue serving

fast growing demand

Solvay will invest about

EUR 120 million to produce its high value-added products SOLEF(R)

PVDF and TECNOFLON(R) FKM and their essential VF2 monomer in

China

Solvay announced today it has launched a project to build a

specialty polymers production plant for SOLEF(R) Polyvinylidene

Fluoride (PVDF), TECNOFLON(R) Fluoroelastomers (FKM) and their

essential monomer VF2(tb»rjf) in China to satisfy the growing

demand for these high value-added specialty polymers in Asia.

The plant will be built at Solvay's industrial site in Changshu in the province of Jiangsu ]hÈíns

and is scheduled to

become operational at the beginning of 2014. It requires the

investment of EUR 120 million and will significantly boost

Solvay's global production capacity for these specialty polymers.

The TECNOFLON FKM product family is used for demanding sealing

applications in aggressive chemical and high heat environments

where high purity and long service life are essential such as

those found in the automotive, aerospace, oil & gas and

energy markets. Typical end use products include O-rings, seals,

gaskets and complex molded parts. Demand growth for TECNOFLON is

markedly driven by the buoyant China automotive market.

SOLEF PVDF can withstand heat and pressure, aggressive chemicals,

mechanical stress and abrasive particles in varied applications

and is widely used in Lithium-ion batteries, the chemical

industry, membranes for water purification and oil & gas

extraction.

The new plant in Changshu will be built next to the

compounding plant under construction for Amodel(R)

polyphthalamide (PPA), Ixef(R) polyarylamide (PARA) and Kalix(R)

(modified PARA) which is scheduled to become operational in the

last quarter of 2012.

gThis

new production plant will enable Solvay to capture a part of the

huge growth potential in this exciting and dynamic region. We'll

bring our customers more high value-added polymers which will

help them improve their environmental footprint and

sustainability profile,h comments Jacques van Rijckevorsel,

Group General Manager of Solvay's Plastics Sector and member of

the Executive Committee.

gThe

plant in Changshu will transform the site into a strong

industrial base for fluorinated polymers and their essential

strategic feedstock in China. We can this way leverage the

Chinese Fluorine supply chain, be closer to our customers and

diversify our supply basis by adding a new production base for

both SOLEFR PVDF and Fluoroelastomers TECNOFLON,h

adds Augusto Di

Donfrancesco, Senior Executive Vice President and General Manager

of Solvay's Global Business Unit Specialty Polymers.

2002N7A\xCO[vÍtbf»wi»¢ïÐÅ éAUSIMONTð»ÌeïÐÌMONTEDISONæèûµÜµ½BrWlXíªãÌRÆå«ÈÁ½gDÌRAÆ»ÉtH[JX·éÆÌrWÉæèAAEWgÍ\xCÌtbf|}[ÆÌêõÆÈèܵ½B

\xC

\NVXÐÍCAEWgÐÆ\xC tI|}[мÐÌÙÌÊC2003N11úÉݧ³ê½ïÐÅ·B

SolexisÌмÌRÍSOLvayÆ EXcellence In ScienceðgÝí¹½àÌÅ·B\xCÆAEWgÌtbf»wÆÌ|[gtHIÌgÝí¹ÍA¬·EtÁ¿lÌtbfXyVeBªìÅÌ\xCÌ|WVð2{ɵã°Üµ½B

1. [tbfIC]FFombliniPFPEjA2.

[tbf»t]FGaldeniPFPEjA3. [tbf»t]FH]GaldeniHFPEjA

4. [tbfn\ÊܨæÑÔÌ]FFluorolinkiPFPEU±Ìj

5. [tbfS]FTecnofloniFKMCFFKM

6. [ltb»G`÷]FAlgoflon PTFEiPTFEj

7. [p[tIARLV÷]FAlgoflon

PFAiPFAjA8. [p[tIARLV÷]FAlgoflon

MFAiMFAj

9. [At@X÷]FAlgoflon ADiTFE/TTDjA10.

[G`¨æÑNgtIG`¤dÌ÷]FHalariECTFEj

11. [|rjftICh÷]FSolefEHylariPVDFj

12. [tbfnÔÌ]

13. [tbfnm}[]

October 05, 2011 Solvay@

Solvay commissions the largest hydrogen peroxide plant in the world in Thailand

New world-class HP plant is serving mainly as dedicated raw material source for

propylene oxide production

Solvay announced today that

MTP HPJV (Thailand) Ltd, its

hydrogen peroxide joint venture with The Dow Chemical Company (Dow), has

successfully commissioned the largest hydrogen peroxide (HP) plant in the world.

The production process of the new plant in Map Ta Phut, Thailand, is based on

Solvayfs proprietary, high-yield hydrogen peroxide technology that enables such

unique, large-scale plants to benefit from advantages in both specific

investment and production costs. Solvayfs HP technology also brings significant

environmental advantages such as reductions in energy consumption and in waste

water.

The plant has a capacity of over 330,000 tons per year

of hydrogen peroxide at 100% concentration and serves mainly as a captive raw

material source for the manufacture of propylene oxide (PO) by Dow and Siam

Cement Group (SCG). Propylene oxide is primarily used to produce propylene

glycol, polyurethanes and glycol ethers. It is the second world-scale HP plant

dedicated to PO production, the first being the 230,000

tons HP plant (Antwerp, Belgium) commissioned at the end of 2008, which

serves a Dow and BASF HPPO plant. Producing PO with HP offers unique and

sizeable economic and environmental benefits compared with conventional

propylene oxide production technologies.

Although primarily constructed to provide HP for the Dow/SCG HPPO plant, up to a

quarter of the new HP plantfs production will also be supplied to Solvay

Peroxythai Limited (SPX). SPX is the leading manufacturer of HP in South-East

Asia and for over 20 years has been supplying products throughout the Asian

region including unique, high purity grades to the food and electronic

industries. This new project at Map Ta Phut will allow SPX to more than double

its current capacity, consolidating its industry leadership in the region and

offering greater long-term security of supply for its customers.

gThis new world-class plant gives Solvay the means to bring its Hydrogen

Peroxide business to a significantly higher level within this fast growing

region and consolidate its position as technology leaderh, said Eric Mignonat,

General Manager Strategic Development Unit Essential Chemicals at Solvay. gWe

look forward to serving the very dynamic market and customersh, he added.

@

2012/7/18 Solvay@

Solvay starts the production of specialty

polymers compounds in China

Solvay announced today that its specialty polymers compounding plant located in

Changshuín,

province of Jiangsu in China, has started to serve the local growing demand for

specialty polymers compounds. The plant is mainly serving China's customers in

the electronics, automotive, consumer and industrial applications markets with

compounds of Amodelpolyphthalamide (PPA)® , Ixefpolyarylamide (PARA)® and Kalix®

(modified PARA).

This plant required an investment of EUR 21 million and is fully adaptable for

future expansion of overall capacity as well as production of compounds made out

of other high performance polymers. It is adjacent to another specialty polymers

plant which is currently under construction for the production of SOLEF

Polyvinylidene Fluoride (PVDF)®, TECNOFLON Fluoroelastomers (FKM)® and their

essential monomer VF2.

gThe start-up of our compounding plant in Changshu is an important step in the

development plan of Solvay's growing industrial base in China where the Group is

committed to increase its customer base. Sales of Specialty Polymers in Asia

have already increased to over 30% of total sales and we see this trend

continuing,h comments Augusto di Donfrancesco, General Manager of the Global

Business Unit Specialty Polymers.

Ql@×ÚHê@2011/7/1

@SolvayAÉtbf»wivgÝ

September 18, 2012 Solvay

Solvay increases its specialty polymers production capacity by 70% in India

High quality and performance drive market acceptance

and demand

Solvay announced today a capacity increase of 70%

at its Panoli plant, India, for the production of its high performance polymers

KetaSpire polyetheretherketone (PEEK)® and AvaSpire®

polyaryletherketones (PAEK). Panoli is Solvay's

largest plant worldwide for these two innovative ultra performance polymers that

tower at the top of the plastics performance pyramid. Nearly half of this

capacity increase has already been implemented and successfully brought on-line.

The second phase of the project will be completed by mid 2013 and will allow the

plant to continue to satisfy growth in demand.

2005N12ASolvayÍChÌGharda©ç|}[åðû·é_ñɲóµ½B

2006/9/8

PESÆPEEK

The ultra-high performance of KetaSpire®

polyetheretherketone (PEEK) and AvaSpire® polyaryletherketones (PAEK) along with

their ease of processing provide substantial value for design engineers. The

products are used in a diverse range of applications spanning many industries

including aeronautic, automotive (e.g. mechanical components in cars),

healthcare (medical equipment and reusable medical devices), electronics, oil &

gas exploration and production, and process industries such as semiconductor

manufacturing (chip testing and wafer processing).

gSolvay is delighted with the growth of its line of polyketone materials and we

are very excited to be adding capacity for this business that we launched just a

few years ago,h commented Augusto Di Donfrancesco, General Manager of the Global

Business Unit Specialty Polymers. gOur focus from the start was to deliver

products with consistently high quality and performance and we believe this has

been a key driver in the rapid market acceptance of our KetaSpire® PEEK resins.

With AvaSpire® PAEK, we are impressed with how innovative design engineers are

capitalizing on the entirely new performance dimensions offered by these

materialsh, added Chris Wilson, Vice President for the Spire Ultra Polymers

business.

With this investment, the Group reaches a new milestone in realizing its

ambition to double its sales in India by 2015.

Last week Solvay announced it is acquiring a

controlling stake in Sunshield Chemicals, an Indian

company specializing in surfactants, and some

months ago it opened a major innovation centre in Savli (Gujarat State). The

Group has been doing business in India since 2000 through its Novecare,

Engineering Plastics and Specialty Polymers activities. With seven production

sites and about 900 employees, the Group generated net sales of EUR 180 million

in India in 2011.

@

2012/11/8 Solvay

Solvay inaugurates highly dispersible silica

capacity expansion in France

Solvay inaugurated today during an official ribbon-cutting ceremony at its

Collonges-au-Mont-dfOr site in France its highly dispersible silica capacity

production expansion and its modernized R&D facility. This investment follows a

similar volume expansion last year in the US and the start-up in 2010 of a new

plant in China. These three investments required in total EUR 74 million.

gOur worldwide highly dispersible silica production capacity

now exceeds 400,000 tons,h commented Tom Benner,

President of Solvayfs Silica Global Business Unit. gDemand for highly

dispersible silica is pulled by a growing need for safer and more

energy-efficient tires and the new European Tire labeling legislation applicable

from November1st,h he added. gWe can now meet our customersf needs globally as

this new legislation takes effect.h

Solvayfs benchmark range Zeosil® and Zeosil® Premium highly dispersible silica

is used by major tire manufacturers worldwide in the production of energy-saving

tires providing up to 30% reduction in rolling resistance, thereby decreasing

fuel consumption by up to 7%, while improving traction.

The investment in Collonges includes important upgrades in control technology,

ensuring the site has world-class performance for quality and environmental

protection. Equipped with the latest technologies, the modernized R&D facility

can now speed up innovation, and offers customers full support for development

and testing of innovative silica formulations by manufacturing improved end

products that meet the challenges of sustainable mobility. gThe refurbishment

provides more flexibility, increases productivity, and raises our best in class

standard, enabling us to better serve our customers worldwide,h added Site

Manager Sabine Gouvernel.

Solvayfs Silica Global Business Unit is the inventor and leading global provider

of highly dispersible silica, which finds its main application in the production

of fuel-saving tires. Solvayfs silica is also used in a wide range of other key

markets such as industrial applications, personal care and nutrition.

2012/2

Rhodia increases silica capacity

The inventor and leading world producer of highly dispersible silica, Rhodia

has increased capacity at its plant at Chicago Heights (Illinois, USA) with

a 16 000 tons extension, upping by one third

its capacity in the United States. Rhodiafs highly dispersible Zeosil®

silica is used in tire treads to save energy. It reduces rolling resistance

by 25%, decreasing fuel consumption and CO2 emissions by up to 7%, and

improves traction on wet ground.

Highly dispersible silica is also used in battery separators and other key

markets.

Rhodia produces this component on eight sites, the most recent to come into

operation being Qingdao in China, a little over a year ago. An expansion is

also being built in France at Collonges au Mont dfOr. It will be completed

during 2012. These three investments (United States, China and France)

increase by over 40% Rhodiafs production capacity for this product, allowing

it to respond in a sustainable fashion to growing demand for energy-saving

tires.

2011/4/12@SolvayARhodiaðFDIû@

2013/5/7 Ineos

Solvay and INEOS join forces to create a world-class PVC producer

Signature of a letter of intent to create a 50-50 joint venture with combined

sales of EUR 4.3 bn

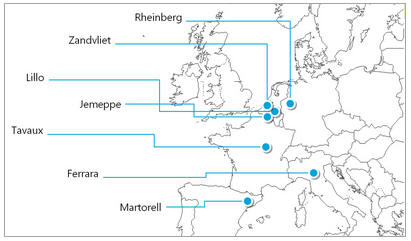

Solvay and INEOS today announce that they have signed a Letter of Intent (LOI)

to combine their European chlorvinyls activities in

a proposed 50-50 joint venture. The combination

would form a polyvinyl chloride (PVC) producer ranking among the top three

worldwide. It would build on the strengths of both our companiesf industrial

assets, the skills of our teams and the complementarity of our geographical

presence in order to enhance competitiveness.

The joint venture would have pro-forma net sales of EUR 4.3 billion and

REBITDA(1) of EUR 257 million, based on 2012 figures. The combined business

would have around 5,650 employees in 9 countries and would pool each companyfs

assets across the entire chlorvinyls chain. This includes PVC, which is the

third most-used plastic in the world, caustic soda and chlorine derivatives.

RusVinyl, Solvayfs Russian joint venture in chlorvinyls with Sibur,

is excluded from the transaction.

gThis proposed partnership is an ambitious and value-creating industrial

project. We want to create a world-class player that will benefit from the

high-quality assets of both companies. The joint venture will improve the

competitiveness of its operations in a very challenging environment regarding

feedstock and energy costs in Europe. We are convinced that this is the right

project to secure, for the long term, the development of Solvayfs European

chlorvinyls activities, of its employees and its plants,h says Jean-Pierre

Clamadieu, CEO of Solvay. gFurthermore, this transaction would substantially

change our portfolio of activities and allow us to accelerate Solvayfs

transformation into a chemical group focused on growth and high-margin

businesses.h

gThis agreement will result in the creation of a truly competitive and

sustainable business that will provide significant benefit to customers such as

reliable access to PVC,h said Jim Ratcliffe, Chairman, INEOS AG. gThe newly

combined business, which will be of world scale, will be able to better respond

to rapidly changing European markets and to match increasing competition from

global producers."

The joint venture would generate significant synergies thanks to:

@@Eshared best practices that improve production processes, particularly to

optimize energy consumption;

@@Estreamlined product mix and increased specialization of plants;

@@Eoptimized raw material and energy purchases and usage;

@@Ereduced logistics and transport costs;

@@Eand combined marketing and sales forces.

Solvay would contribute its vinyl activities, which

are part of Solvin(2), as well as

its Chlor Chemicals business, spread across seven

fully integrated production sites in Europe. These sites include five

electrolysis units converted into more energy efficient membrane technology,

which supports sustainable production of PVC.

Kerling, the subsidiary of INEOS and the largest PVC producer in

Europe, would contribute its chlorvinyls and related businesses that include

three modern and large-scale membrane electrolysis units. These assets are based

on ten sites in seven European countries.

The LOI provides exit mechanisms under which INEOS would acquire Solvayfs 50%

interest in the joint venture for a value based on a mid-cycle REBITDA(1)

multiple of 5.5x. The exit arrangements would have to be exercised between four

and six years from the joint venturefs formation, after which INEOS would be the

sole owner of the business. Solvay would be entitled to receive upfront cash

payments of EUR 250 million upon completion of the transaction.

The proposed transaction is subject to the applicable information/consultation

procedures with employee representatives in the countries involved. After

completion of such procedures, the parties would enter into legally-binding

agreements that would contain customary closing conditions, including anti-trust

approval from the relevant authorities. Until completion of the transaction, the

occurrence and timing of which is dependent on such approval and procedures,

Solvay and INEOS will continue to run their PVC businesses separately.

(1) Recurring EBITDA

(2) Solvin is a joint-venture between Solvay (75%) and BASF (25%)

----

Owned 75% by Solvay and

25% by BASF, SolVin is an uncontested leader on the

vinyls market. SolVin covers the entire vinyl chain, from salt to chlorine and

soda through dichlorethane, PVDC and vinyl. Our products are sold from our

manufacturing plants in Belgium, Germany, Italy, France and Spain and through

commercial agencies elsewhere in Europe and on export markets. The even

geographic distribution of these sites enables us to optimize the flow of raw

materials and finished products.

1400 employees work in

this motivating environment of teamwork, open communication, knowledge sharing

and leading edge technology. At SolVin, clearly defined industrial, commercial

and human values support a long-term and highly innovative sustainable

development strategy. Constant investment in product improvement and advanced

production technology profile SolVin as the long-term partner of choice for

vinyl processors.

September 2, 2013@Solvay@

Solvay and Sadara joint venture begins

construction of world-scale hydrogen peroxide plant in Saudi Arabia

Saudi Hydrogen Peroxide

Company, a newly created joint venture between Sadara Chemical Company (Sadara)

and the Solvay Group (Solvay), announced today that they have begun constructing

one of the worldfs largest hydrogen peroxide (HP) plants in the Kingdom of Saudi

Arabia. The plant will provide a key raw material to Sadara and will strengthen

Solvayfs global leadership position in HP technology and markets.

With a capacity exceeding 300,000 metric tons per

year (MT/yr) and a planned start up in 2015, the mega plant is being built at

Sadarafs chemical complex in Jubail Industrial City II. It will be the first HP

facility in the Kingdom.

Sadara will use output from the plant as a raw material for the HP-to-propylene

oxide (HPPO) manufacturing plant on the site, thereby supporting its propylene

oxide (PO) derivative units that produce polyols and propylene glycol.

For Solvay, this will be its third joint venture mega HP plant following the

230,000 MT/yr plant in Antwerp, Belgium, a JV with The Dow

Chemical Company (Dow) and BASF, and the 330,000

MT/yr mega plant in Map Ta Phut, Thailand, a JV with Dow.

ÅÌàÌÍ2009NÉÒµ½Ag[vÌ23gvgÅASolvayÆBASFÌJVÉDowªQÁµÄp[gi[Vbvðݧµ½BDowÆBASFÌJVÌ30gHPPOpɵĢéB

2009/3/12@_EÆBASFÌHPPO@on¶YJn

SolvayÍ2011N105úADowÆÌJVÌMTP HPJV (Thailand)

ª^CÌMap Ta

PhutÅ¢EÅåÌß_»

fHêðX^[g³¹½Æ\µ½B

\ÍÍ33g(100%x[XjÅADowÆSiam Cement ÌJVÌMTP

HPPO Manufacturing ÌPOiHPPOjÌ»¢pɳêéB

2007/8/3@Dow

Æ SolvayA^CÉHPPOpÌß_»

f»¢ÌJVݧ

2011/10/13

SolvayÌ¢EÅåÌß_»

fHêA^CŶYJn

¼ÉA

SolvayÍ2009N108úAHuatai Groupi华×W团jÆß_»

fȢJVAShandong Huatai Interox

Chemicalðݧ·éÆ\µ½B

RÈcsÉNY5gÝõðÝ·éB

iInteroxÍSolvayÌß_»

fÌCosmetic GradeÌuhj

gWe are delighted to be partnering with Solvay, a global leader in HP, to build

this world scale plant to feed our PO, PO derivatives and Polyurethane

business,h said Ziad Al-Labban, CEO of Sadara. gThis partnership will provide us

with a stable and reliable supply of a key raw material which is critical to

support our Polyurethane-based customers and downstream value chains.h

gSolvayfs high-yield HP technology enables such unique, large scale plants to

benefit from advantages in both specific investment and production costs,h said

Pascal Juery, President of Solvay's Essential Chemicals business unit. gWe are

proud to establish the first HP manufacturing activity in the region with our

leading technology and look forward to meeting future demand of the local HP

market.h

2011/7/18

| @ |

|

Solvay's high-yield

hydrogen peroxide production plant to supply hydrogen peroxide for

propylene oxide production at recently announced world-scale

chemicals project

Solvay announced today that it

has the intention to create a 50/50 joint

venture with Sadara Chemical Company (itself a planned joint

venture of Saudi Arabian Oil Company (Saudi Aramco) and The Dow

Chemical Company (Dow)) for the construction and operation of a

Hydrogen Peroxide Plant in Jubail industrial City, Kingdom of Saudi

Arabia. Scheduled to be operational in the second half of 2015, this

new plant is intended to supply Hydrogen Peroxide (HP) as a raw

material for the manufacture of propylene oxide (PO) by Sadara at

its world-scale, fully integrated chemicals complex.

Propylene oxide is used to produce propylene glycol, polyurethanes

and glycol ethers. Solvay will use its proprietary |

| @ |

2013/10/7 Solvay

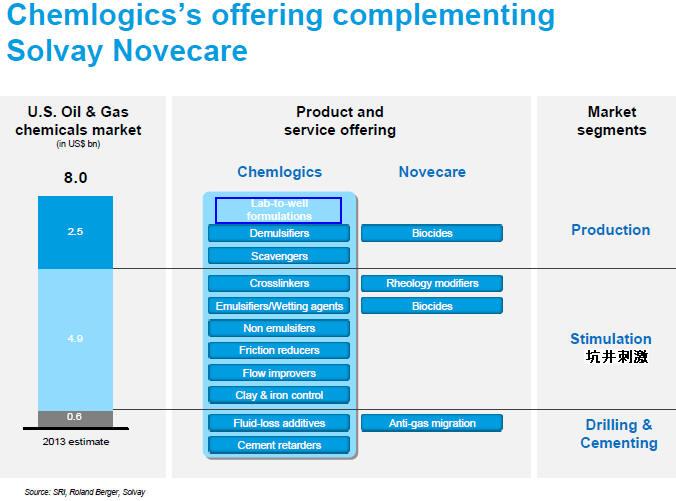

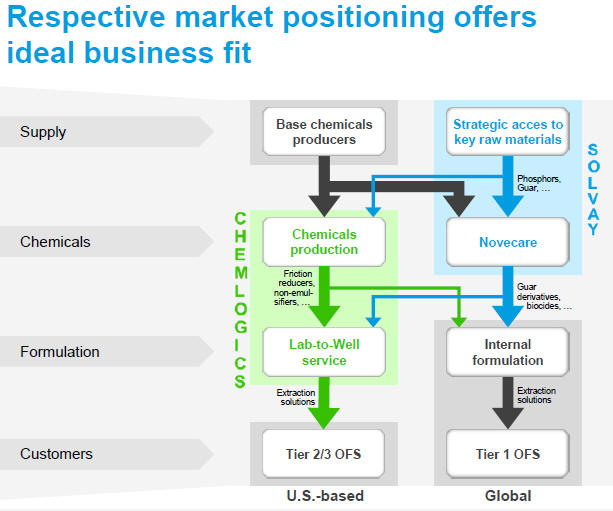

Solvay to acquire U.S.-based Chemlogics,

extending its oil & gas chemical solutions business

Acquisition highlights

- Optimal fit with Solvay Novecarefs products, technologies, customers and

geographies, leading to significant share of fast-growing $8 billion U.S.

oil & gas chemical market

- Fast-paced innovation model reinforcing R&D capabilities to enhance

competitiveness and sustainability

Financial considerations

- Enterprise value of $1.3 billion (€1 billion), at 10.7x EBITDA and 8.7x

net of tax benefit

- Double-digit EBITDA growth business; cash and EPS accretive from year one

- Solvay intends to issue hybrid bonds for approximately €1 billion to

further strengthen balance sheet

Strategic impact