Hanwha Chemical

Corporation 歴史

Hanwha Acquires AZDEL, Inc. from

SABIC Innovative Plastics, PPG Industries

| |

|

2007/2現在 Ethylene plant1: 857千トン(510+347) |

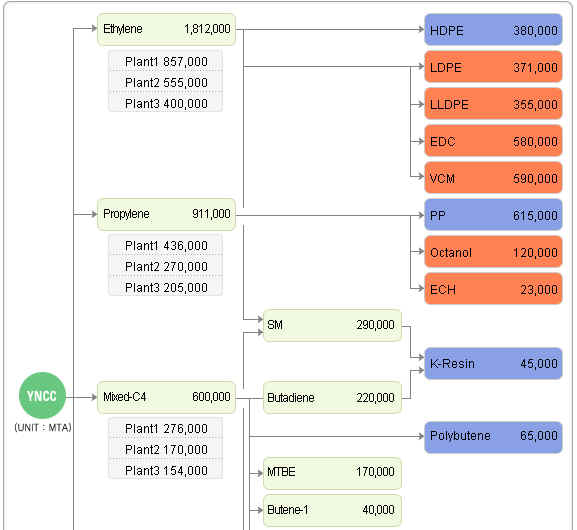

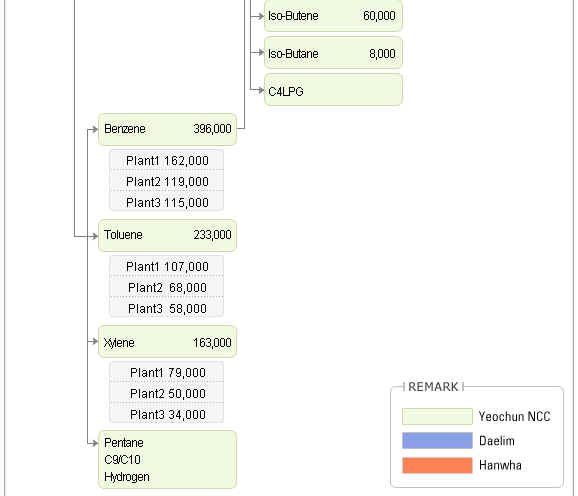

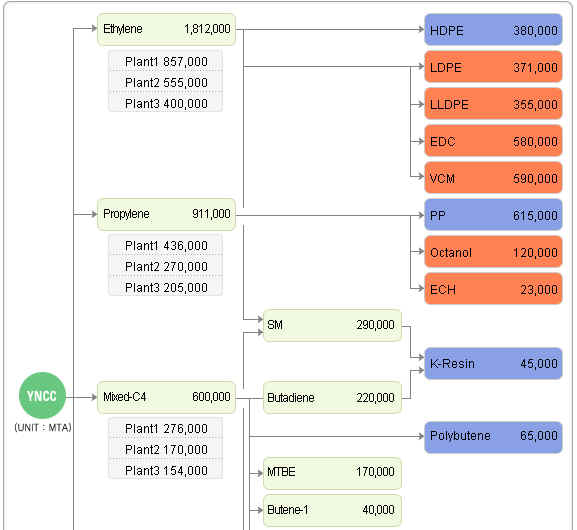

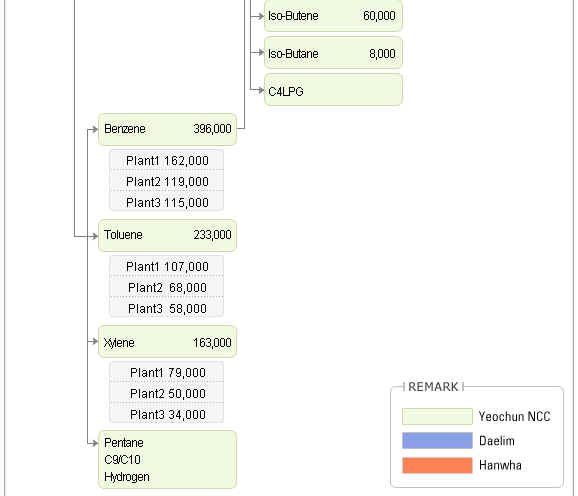

| 麗川NCC:ハンファ、大林 JV 単位:千トン

| |

SK 蔚山 |

大林産業 麗川 |

ハンファ 麗川 |

| C2 |

SK |

730

|

麗川NCC |

800

|

麗川NCC |

500

|

| HDPE |

|

|

大林産業 |

380

|

|

|

| L-LDPE |

|

|

|

|

ハンファ |

350

|

| LDPE |

ハンファ |

85

|

ハンファ

(大林から) |

120

|

ハンファ |

165

|

| EDC |

ハンファ |

150

|

|

|

ハンファ |

430

|

| VCM |

ハンファ |

216

|

|

|

ハンファ |

300

|

| PVC |

ハンファ |

210

|

|

|

ハンファ |

205

|

| SM |

|

|

麗川NCC

|

140

→285

|

|

|

| C3 |

|

|

麗川NCC |

455

|

麗川NCC |

250

|

| ブタジェン |

|

|

麗川NCC |

120

|

|

|

| MTBE |

|

|

麗川NCC |

150

|

|

|

|

|

|

http://hcc.hanwha.co.kr/english/english_1.htm

The Hanwha Group was established

from Korea Explosives Co., Ltd. in 1952, starting out by engaging

the petrochemical business. Korean economy was rapidly

industrializing in the 1960s, and the Hanwha Group was an

important driver of national ecnomic development. In the 1970s.

Hanwha developed its petrochemical and machinery operations and

expanded into trade, construction, food and retailing. In the

1980s, the group realized strong qualitative and quantitative and

growth, while resolute and progressive restructuring has enabled

Hanwha to remain healthy and strong in the 1990s.

Hanwha Chemical Corporation laid the groundwork for Korea’s debut into the Worldwide chemical

industry, when it pioneered PVC, LDPE, LLDPE, and Chlor-Alkali

manufacturing in Korea.

Following the currency crisis in Asia, Hanwha Chemical underwent

massive restructuring. In July 1999 it spun off processed goods

division, and then in December 1999 established a naphtha cracker joint

venture

and concluded a swap deal with Daelim for their Polyolefin

business in order to maximize

competitiveness in its core business.

Having a firm position in

domestic market in terms of its core business field

(Chlor-Alkali, Polyethylene, PVC), Hanwha Chemical aims to

enhance its competitive edge to a world-class level, while

searching, developing, and commercializing new non-commodity

chemicals. Also, Hanwha plans to make life science and e-business

as its new growth engine in the new century.

PE Division :

In 1972, Hanwha Chemical

Corporation(HCC), a pioneer in the polyethylene industry,

became the first company to produce polyethylene in Korea.

In 1999,

through a business swap, HCC took over the LDPE and L-LDPE

businesses of Daelim Industrial Co. and became the biggest

manufacturer in Asia.

Hanwha polyethylene plants currently produce 720 thousand

tons of LDPE and LLDPE annually.

Products:

LDPE

Hanwha plants produce 370

thousand tons of LDPE annually. Hanwha Chemical

Corporation(HCC) has various processes, including the

tubular process and autoclave process developed by DOW

and the autoclave process developed by ICI.

EVA

Hanwha Chemical

Corporation(HCC) began producing EVA based on its own

technology in 1986.

With the autoclave and tubular processes developed by

DOW, HCC produces various grades, covering a wide range

of VA content to meet the customer's stringent

requirements.

LLDPE

Hanwha LLDPE plants

produce 350 thousand tons annually using the Unipol gas

phase process of UCC and the Spherilene gas phase process

of Montell.

W&C Compound

Hanwha Chemical

Corporation(HCC) began producing the Wire & Cable

Compound based on its own technology in 1982.

Hanwha W&C Compound, a high performance composite

consisting of polyolefin and functional additives, is

well known for its various products and high quality. We

have 60% share of W&C Compound market in Korea.

We also have specialty products for foamed insulations

and halogen-free flame retardant sheaths.

PVC Division:

Hanwha Chemical Corporation

has firmly established a reputation for superior technology

and quality in the production of PVC since it first

introduced its products.

PVC (Polyvinyl chloride) is widely used as a raw material for

diverse products such as pipe, sheets, and compounds to daily

necessities like wallpaper, toys, and erasers.

Products :

PVC Resin

Since it became the first

Korean PVC manufacturer in 1966, Hanwha Chemical

Corporation has led the Korean PVC industry with

continuous quality improvement and innovative

development. It has supplied the industry with various

grades covering diverse applications such as pipe, sheet,

and compound.

Paste Resin

Hanwha Chemical

Corporation is meeting customer needs by producing

various grades of MSP resin, Blend resin, and Emulsion

resin and is making every effort to provide stable supply

while also seeking to promote new product development.

Plasticizer

Plasticizer is a raw

material used to adjust the plasticity of PVC processed

goods such as flexible applications and compounds. It

alters the quality and characteristics depending on

applied quantity.

Hanwha Chemical Corporation produces 90,000MT per year

and is expanding rapidly to keep up with the development

of PVC industry.

Chlor-Alkali Division :

Today,

HCC leads Korea's current Chlor-Alkali market and is involved

in activities from the production to sales of Caustic Soda

and Chlorine Derivatives.

Products:

ECH, HYPO, Chlorine, HCI,

NaOH, EDC, VCM, NH4CI, H2

OA (Oxo Alcohol) Division :

Just

as alcohol is ubiquitous in our lives, so is it in PVC

converting industries.

O.A Division, with cutting-edge technology, has been

providing alcohol products for use in plasticizers, a crucial

ingredient in PVC-processed goods.

Products:

2-Ethyl Hexanol, Butanol

and the related

関係会社

Yeochun NCC

Ethylene, Propylene, Benzene, Toluene,

Xylene, Mixed C-4, etc 製品

Established

in Dec 1999

(Joint Venture between Hanwha Chemical

and Daelim, 50:50)

Daelim and

Hanwha decided to merge their naphtha cracking centers to

boost efficiency and international competitveness in the new

millennium. Yeochun NCC, a 50:50 joint venture, is well

positioned to be a world-class petrochemical company with the

combined technology, management know-how and organizational

strengths of Daelim and Hanwha.

Yeochun NCC, located

in the Yeochun Petrochemical Complex, has the most advanced

facilities, including three fully-automated naphtha cracking

centers, turning out high-purity products through advanced

process control. The company is contributing to Korean

economic development by supplying 1.3 million tons of

ethyline, 705,000 tons of propylene and 1.5 million tons of

other downstream products a year. (http://www.yncc.co.kr/)

| 2007年02月15日

Chemnet Tokyo |

| YNCCの増設プラントが稼動を再開 |

| |

大手商社筋によると、韓国のエチレンセンターの一つであるYNCCは先週末に年産35万トン能力のエチレン新プラントの本稼動を再開した。

今回再稼動したエチレン装置は既存の第1号機に追加建設したもので、昨年10月に完工したもののメカニカル面の小トラブルが相次ぎ発生して安定操業に移行できない状態が続いていた。そこで今年に入り全面運休して抜本的な対策を講じたところ、高率操業を維持していける見通しが立ったため再稼動に踏み切ったもの。

YNCCのホームページではエチレン能力を1812千トン

内訳は ①857千トン(510+347)、②555千トン、③400千トン

APIC2006の資料では1465千トン(

①510千トン、②555千トン、③400千トン)

|

2004年9月6日 中国・ASEANニュース速報

【韓国】麗川NCC、SM設備を大幅拡充

http://www.e-plastics.gr.jp/japanese/nna_news/news/news0409_2/04090603.htm

石油化学素材メーカーの麗川NCCが、スチレンモノマー(SM)の生産設備を約2倍に増設する計画を明らかにした。総工費380億ウォンを投じ、来年10月の完成を目指す。

増設が完了すれば、年産規模は現在の14万2,000トンから28万トンに拡大。サムスンアトフィナ(年産67万トン)、LG化学(同50万トン)、現代石油化学(39万トン)などに次ぎ、SM生産で業界6位に浮上する。

同社はまた、国内最大の生産能力(年産143万トン)を持つエチレン設備の増設計画も推進中だ。

Platts

2005/8/24 計画

S Korea's Yeochon

plans SM expansion despite poor margins 麗川NCC

South Korea's Yeochon NCC plans to proceed with its

styrene monomer plant expansion in October despite being

dogged with poor margins for the past two years, a source

close to the firm said Wednesday. Yeochon is slated to boost

its plant capacity in Yeochon to 285,000

mt/yr from 140,000 mt/yr during a 40-day outage

scheduled for Oct 20 through Nov 30. Another local SM

producer, Dongbu Chemical, has postponed

its debottlenecking project from October to early next

year.

Hanwha Living and

Creative Corp.

Flooring, Window,

Home Door, PVC Compound, Film & Sheet, GMT, EPP,

Upholstery, SMC, Conpanel, Hanex, Decor Sheet, etc

Established in Jul 1999

(100% owned by Hanwha Chemical)

Hanwha Advanced Material

Co., Ltd

Woodstock,

etc

Established in Jun 1988

(Joint Venture between Hanwha Chemical and Solvay, Belgium,

50:50)

Hanwha

Polymer Co., Ltd

Tarpaulin,

etc

Established in Sep 1974

(61.3% stake by Hanwha Chemical Corp.)

ハンファ

In 1952,

the Hanwha Group was founded under the name, Korea Explosives

Corporation. The founding chairman, Kim Jong-hee, had built the

explosives company from the ruins of the Korean War with a sense

of duty, to build a patriotic business that could contribute to

the rebirth of the national economy.

He believed that in

order to achieve rapid recovery in the basic industries of a

devastated country, explosives production was needed above

everything. As Korea's only private powder plant, Korea

Explosives Co. showed remarkable growth to become one of Asia's

leading explosives suppliers within ten years. The monumental

step taken by Korea Explosives Co., which had risen in an area no

one else dared to harness, was the very starting point of today's

Hanwha Group.

韓国火薬

| Oct.1952 |

|

Founded Korea

Explosives Corporation |

| Oct.1955 |

|

Bought over

Inchon Power Plant |

| Oct.1957 |

|

Succeeded in

test production of NG (Nitro-Glycerin) |

| Jun.1958 |

|

Started to

produce dynamite |

| Aug.1965 |

|

Established

Korea Hwasung Industrial Co., Ltd. |

| Nov. 1969 |

|

Established

Kyungin Energy Co.,Ltd. |

| Dec.

1972 |

|

Korea

Hwasung Industrial Corp. was merged into Korea

Plastics Industrial Corp.

according to the government's policy to merge 5 PVC

companies. |

| Dec. 1979 |

|

Took over Korea

Plastics Industrial Corp. |

| Dec. 1982 |

|

took over

management rights of Dow Chemical Korea |

| Jan.

1984 |

|

Merged Hanyang

Chemical, Hanyang Chemical Corp, and Hanyang. Electronics

& Chemical into Hanyang Chemical |

| May 1988 |

|

Merged Hanyang

Chemical and Korea Plastics |

| Oct. 1998 |

|

Sold 'PMMA'

sector of Hanwha General Chemical to ATO, France |

韓洋化学

1966 Daehan Plastics (芙江)

信越技術(カ-バイド法)

現状:塩ビ加工工場(塩ビ工場は

scrap)

1967 Kongyoung Chemicals (蔚山)鐘化技術

現状:サス

146千トン、ペ-スト 50 千トン

1968 Korea Chemical(鎮海) 日本カ-バイド技術

現状:サス

48千トン

1969 Woopoong Chemical (群山) 鐘化技術

現状:サス

36千トン、ペ-スト 2.2千トン

1969 Tongyang Chemical (仁川) 現状 閉鎖

↓

↓

1972 上記5社の合併 ---韓国プラスチック

1969 Korea Pacific Chemical(麗川) ダウ技術(電解/EDC/VCM)

Dow/韓国総合化学

1990 鐘化技術 PVC 80千トン

1974 韓国火薬が韓国総合化学の政府持株を継承(Korea

Pacific Chem Holding Co)

1982 韓国火薬が Korea Pacificのダウ持株および韓国ダウを買収

1984 Korea Pacific Chem Holding, Korea Pacific Chem, Dow

Korea を合併し、韓洋

化学と改称

1988 韓洋化学が韓国プラスチックを吸収合併

1994 ハンファと改称

2004-3-5 Asia Chemical

Weekly

S Korea's Hanwha aiming to become

global top-10 PVC player

South Korea's Hanwha Chemical

Corp is planning to invest at least Won300bn

($256.3m/Euro210.1m) by 2007 to help build the company into

one of the world's top-ten polyvinyl chloride (PVC)

producers, a company spokesman said.

Hanwha is studying the feasibility of building new PVC plants

and lines, both in South Korea and China, but has yet to

decide on the locations or size of the facilities.

November

19, 2007 AZDEL

Hanwha Acquires

AZDEL, Inc. from SABIC Innovative Plastics, PPG Industries

Hanwha Living

& Creative (L&C) Corporation announced today that it has

finalized the acquisition of AZDEL

Inc.,

a 50/50 joint venture of SABIC

Innovative Plastics (formerly GE Plastics) and PPG Industries. The acquisition of

AZDEL will allow Hanwha to expand its offering of composite and

advanced material solutions for the transportation and industrial

segments. Terms were not disclosed.

| Hanwha

Living and Creative Corp. Established

in Jul 1999

(100% owned

by Hanwha Chemical)

Products:Flooring,

Window, Home Door, PVC Compound, Film & Sheet,

GMT, EPP, Upholstery, SMC, Conpanel,

Hanex,

Decor Sheet, etc

|

Going forward,

AZDEL has entered into a long-term strategic supply arrangement

with SABIC Innovative Plastics and PPG Industries, whereas SABIC

Innovative Plastics will supply thermoplastic resins to AZDEL and will

continue to work with AZDEL through a joint development agreement

to bring new innovative products to the industry. In the same

way, PPG will continue to supply

fiberglass reinforcement materials to AZDEL under a long-term supply

agreement.

朝鮮日報 2007/11/21

アズデル社は1972年に設立された高機能複合素材のメーカーで、自動車のバンパーの材料となるGMT、天井部分の内張りなどに使われるLWRTなどの分野において全米1位のメーカーだ。ハンファ・グループは「金升淵(キム・スンヨン)会長が今年1月、海外進出に関する戦略会議で、現在10%にとどまっている海外事業の売り上げを2011年までに40%に引き上げるという目標を打ち出して以来、初めて目に見える結果を導き出した」と話している。アズデル社の買収により、ハンファL&Cは世界最大のGMTメーカーとなり、自動車の部品や素材を全世界の自動車メーカーに供給できるグローバルネットワークの基盤を形成することになった、と同グループでは説明している。

AZDEL is a global

leader in the manufacture and supply of high-performance

thermoplastic composite materials serving a wide variety of

markets and industries including automotive, large truck,

materials handling, HVAC, and building & construction.

Joint Venture company between GE Advanced Materials and PPG,

Inc. - A fusion of two of the most successful companies in

the world.

Backed by the extensive sales and marketing resources of GEAM

throughout the globe, along with the glass-fiber technology

offered by PPG, AZDEL provides one of the most

comprehensive product portfolios in the thermoplastic

composites industry.

* The AZDEL Business was

established in 1972 by PPG.

* GE entered the business in 1986 to create a 50/50 joint

venture.

* A fusion of the two most successful companies in the world.

* The world's leading supplier of Glass Mat Thermoplastics

(GMT).

* Backed by extensive sales, marketing, and application

development efforts of GE Plastics throughout the

globe.

* The largest product portfolio in the GMT industry

* Materials and processes to suit both interior &

exterior structural applications across many different

industries.

AZDEL SuperLite®

A low pressure,

thermoformable composite of polypropylene and long chopped

fiber combined with outer layers as needed for the

application (i.e.; adhesive film, barrier film, tough PP

film, non-woven, reinforcing, or just the bare surface.)

AZDEL Laminate®

GMT

Also

known as Glass Mat Thermoplastic, or GMT, AZDEL Laminate is a

five layer composite of glass fiber and thermoplastic resin.

Usually compression molded in a process similar to SMC, this

material may also be thermoformed using several industry

standard methods of production.

宇部日東化成

1982年 岐阜工場でPPGより技術導入し熱可塑性スタンバブルシートアズデル生産開始

1999年 出光石油化学、日本板硝子と日本GMT設立し、移管

(1)宇部日東化成は、昭和57年にスタンパブルシートの生産を開始、以来現在に至るまで当該事業を展開してきた。

(2)出光石油化学及び日本板硝子は、昭和62年に折半出資で出光エヌエスジー(株)(注3)を設立し、スタンパブルシート事業を共同で展開してきた。

(3)しかしながらここにきて、当該製品の主力用途である自動車部品向けは輸入品や他素材(鉄、アルミ等)との競争が激化、一方の産業資材部品向けについても昨今の厳しい経済状況を受け、販売数量の減少等により業績が低迷、両社ともに抜本的なコスト合理化策を検討中であった。

(4)また、当該事業は大幅な設備過剰環境下にあり(国内生産能力20千トン/年に対し推定需要7千トン/年)、両社ともに低稼動を余儀なくされている。

(5)今般、三社共同出資による合弁新会社を設立し、宇部日東化成及び出光エヌエスジ-のスタンパブルシート事業を新会社に引き継ぎ、両社の生産・販売・研究開発の融合による事業競争力の強化と需給ギャップの解消を図ることとした。

2011/4/11 朝鮮日報

ハンファ・ケミカル、太陽光設備に1兆ウォン超投資

ハンファ・ケミカルは11日、太陽光発電事業の中長期運営基盤の安定化と収益向上を目指し、ポリシリコン製造設備に1兆357億7600万ウォン(約809億円)を投資することを決めた。これは、昨年末の自己資本比率34.55%に当たる。投資期間は2013年7月31日まで。

2013/12/20 朝鮮日報

ハンファ・ケミカルがイラク進出

ハンファ・ケミカルは原価競争力を確保するため、韓国の石油化学業界で初めてイラク進出を推進することを19日、明らかにした。40億ドル(約4170億円)を投資し、イラク南部にエチレン生産設備や石油化学製品生産工場などを建設する計画だ。ハンファは同日、ソウル市中区の同社ビルで、イラク産業省次官と以上の内容の合弁事業意向書を締結した。今後はイラク政府と具体的に事業性を検討していく予定だ。

ハンファがイラク市場に進出するのは、低コストの原料をほかに先駆けて確保するためだ。石油の産地に大規模な生産基地を建設し、中東・北米製品と同等の原価競争力を得ようという戦略だ。

ハンファ・ケミカル関係者は「イラクは低価格の原料が豊富なうえ、石油化学産業が未成熟な地域なので、ほかに先駆けて確保すればその効果はより大きいと見ている」と述べた。

Hanwha Chemical said today that it has signed

a letter of intent (LOI) to build a petrochemical complex in Iraq. The LOI was

signed at Seoul by the company’s president, Han-hong Bang; and Iraq’s deputy

minister of industry, Mohammed Zain. The complex will require an investment of

about $4 billion and include gas processing facilities,

ethylene, and other petrochemical production units, with a combined

capacity of 1 million m.t./year of petrochemicals. Completion is expected in

2020–21, the company says.

These facilities will be part of a larger ethylene and natural gas processing

complex planned to be built in southern part of Iraq.

2015-08-23

Hanwha Chemical to enter diaper materials market

Hanwha Chemical has launched a pilot production of

superabsorbent polymers, a material commonly used for baby diapers,

according to a news provider.

There are speculations in the market that Hanwha Chemical has currently carried

out trial production of 1,600 tons of SAP using raw materials from China in its

factory in Yeosu, South Jeolla Province.

A gram of SAP can absorb up to 500 grams of liquid, and is widely used for

materials such as diapers and sanitary napkins.

SAP is expected to be a lucrative industry as countries such as China and India

achieve higher economic growth and demand for baby diapers increase.

The news outlet reported that Hanwha Chemical is looking into the SAP industry,

but is hesitant on mass-production due to the difficulty of obtaining acrylic

acid, its base material.

To obtain acrylic acid, Hanwha must either purchase

them from LG Chem, the only company in Korea

producing SAP and acrylic acid, or import from China or

Japan.

Hanwha is reluctant to buy from a rival company, but is also wary of the quality

of Chinese-manufactured acrylic acid, as well as fearing potential customer

avoidance, according to speculations.

The global market size for acrylic acid was 4.9 million tons, and SAP was 2.3

million tons in 2014. The industries are expected to grow 5 percent and 6.5

percent, respectively, by 2020.

2016年03月25日

韓国ハンファ 塩素化塩ビ樹脂に参入 蔚山に年産3万トン設備

Hanwha Chemical

は3月22日、塩素化塩ビPVC事業への進出のために、蔚山石油化学産業団地の第2工場に3万トン規模の生産ラインの建設に入ったと明らかにした。

韓国の塩素化塩ビの消費量は9,000トンほどで、国内では生産技術を備えた企業がないことから全量を輸入してきた。

PVCに比べて倍以上に価格が高いうえに需要先が一定しており、安定した収益を期待できるとみている。

2012年から始めた研究開発が3年ぶりに実を結んだとしている。

今年中に生産ラインの建設が完成すれば、来年から3万トンほどを生産することになる。既存の生産工程に独自開発した新工程を加えてCPVCを生産する方式だ。それだけにハンファケミカルはCPVC工場の増設を通じ、中国産の低価格製品など押されているPVCの生産量(年間60万トン)を減らす効果とともに

CPVCを製造する、一石二鳥の効果が期待できることになった。

塩素化塩ビは世界的に米Lubrizol

Corporation、カネカ、積水化学工業(徳山積水)など数社のみが事業展開しており、ハンファの参入により競争が激しくなると見られている。

カネカは2013年7月、米国子会社のKaneka North

Americaの塩素化塩ビの生産能力を年産約20千トン増強し、年産50千トン体制とすることを決定した。

日米合わせた生産能力は年産76千トンに達する予定

徳山積水は2013年7月に生産能力を増強 (33千トン→40千トン)

Lubrizol is

a single-source provider of polymer technologies designed to solve today’s

toughest building and production challenges, and is an

innovator and world leader in chlorinated polyvinyl chloride (CPVC) resins

and compounds.

既存工場はLouisville, Ky.とOevel, Belgium.

2013年3月にPhase-1で 85千トン、Phase-2で85千トンの増設を発表した。

Phase I — Operational by end of

2014; Total capacity of 85,000 metric tons of CPVC

resin and 100,000 metric tons of CPVC compound; Total investment of

approximately $200 million

- Previously announced construction of

a new CPVC resin and compounding facility in the

United States. Initial resin capacity will be

55,000 metric tons and compound capacity will be 65,000 metric

tons with a total investment of $125 million.

- Construction of a new CPVC

compounding plant and warehouse in India. The total investment of $40

million will include an initial capacity of 35,000 metric tons. The

sites that are under final consideration are located in Gujarat and

Maharashtra.

- Previously announced joint

investment in a CPVC resin manufacturing facility in

Thailand. Initial capacity will be

30,000 metric tons with a total investment

of $50 million and subject to receipt of all necessary government

approvals. =積水化学とのJV

2015年6月稼動

Phase II – Operational by end of

2016; Adds 85,000 metric tons of CPVC resin and

100,000 metric tons of CPVC compound; Total additional investment of

approximately $200 million

- Addition of

55,000 metric tons of resin capacity and 65,000 metric tons of

compound capacity. Sites in the United States and India are under

consideration. Total additional investment of $125 million.

- Expansion of the Phase I India

compounding plant, adding 35,000 metric tons of capacity. Total

additional investment of $15 million.

- Expansion of the Phase I joint

investment Thailand plant, adding

30,000 metric tons of resin capacity. Total

additional investment of $50 million.