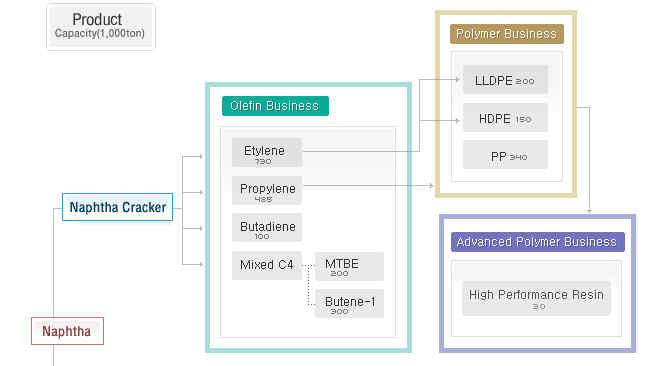

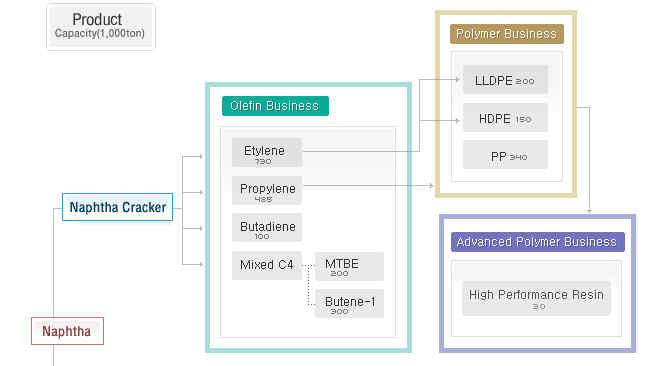

(unit:1,000ton)

| Etylene | 730 | |

| Propylene | 485 | |

| Butadiene | 100 | |

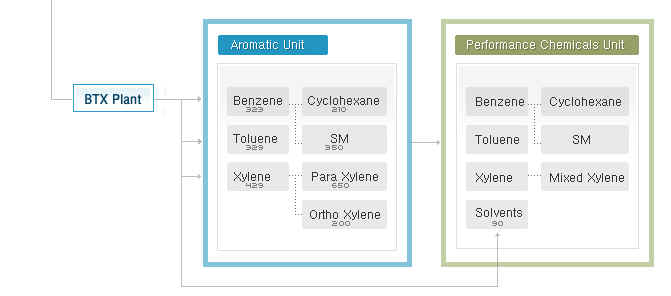

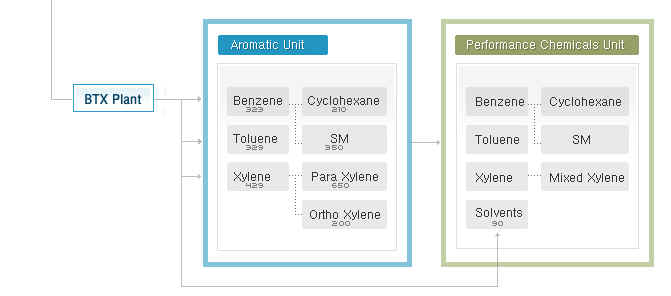

| Benzene | 323 | |

| Toluene | 329 | |

| Xylene | 429 | |

| Cyclohexane | 210 | |

| Ortho Xylene | 200 | |

| Para Xylene | 650 | |

| Mixed C4 | 213 | |

| LLDPE | 200 | |

| HDPE | 150 | |

| Polypropylene | 340 | |

| NCB | 57 | |

| Butene-1 | 30 | |

| MTBE | 200 |

他のページへ トップページ アジアの石油化学 アジアのPVC/VCM 韓国の石油化学(トップ) |

The SK Corporation (旧鮮京グループ 石油・石油化学は旧称 油公)

SKC Chemical Business Group (SKC Evertec + SKC ) SK Chemicals

SK Eurochem sees new 400 kt/yr Polish PET plant online Apr 1, '05

Korea's SK Corp to build solvents plant in China

SK signed agreement to acquire China's PS plant

S Korea's SK Networks set to finalize acquisition of Shantou PS

SK Energy eyes investments in Peru, in talks on petchem project

SK Corp. http://www.skchem.com/english/

In 1972 SK Corp. built the sector`s first naphtha-cracking plant with an annual capacity of 100,000 tons, which helped lay the matrix for Korea`s petrochemical industry. From that time on, SK Corp. has undertaken facility investment with a far-sighted view. To this end the naphtha-cracking capacity was expanded in 1997. The investment has kept up on construction of the 2nd polyolefin plant, the 2nd paraxylene plant, and a styrene monomer production line, which has enabled solid growth in domestic and overseas markets with increased capacity in commodity chemicals.

|

Product

Capacity (unit:1,000ton)

|

||||||||||||||||||||||||||||||||||||||||||||||||

|

Olefin Business

The olefin unit has played a central role in the domestic petrochemical industry as a critical supplier to the Ulsan Petrochemical Complex.

In 2004, we sold 1.05 million tons of olefin worldwide. Despite changing market conditions, we were able to be competitive because of past investments in facilities, research and development and technology. The olefin unit has played a central role in the development of the nation's mines and petrochemical industry as a stable supplier of high-quality products.

This unit provides base olefins, including ethylene and propylene, and intermediates, such as butadiene and butane-1, along with other essential feedstock used for petrochemical products. These are supplied to the SK petrochemical plants and downstream petrochemical manufacturers at the company's Ulsan Petrochemical Complex.

In 2005, we will focus on cutting costs and developing new technologies to remain competitive. We always commit to supplying high quality products in a timely manner to ensure our customers' satisfaction.

Aromatic Business

The aromatics unit is unrivaled in domestic markets due to process efficiency and self-sufficiency in raw materials.

In 2004, the unit created a stable profit base by producing and selling high-value-added chemical by-products such as benzene, toluene, and xylene, by-products of oil refining. Despite competition from overcapacity, the unit sold over 3.47 million tons of benzene, toluene, xylene, para-xylene, orthoxylene, styrene monomer, and cyclohexane and an additional 2.53 million tons of non-household use products.

We believe that worldwide demand for polyester will drive the aromatics business in 2005. To accommodate this, TPA and PX construction are already underway and raw materials such as benzene, toluene and xylene are expected to be in short supply. The main focus for the aromatics unit will be to improve process efficiency and cut costs, thereby supplying high quality products in a timely manner while maximizing profits.

Performance Chemicals Business

SK's performance chemicals business has focused on developing environmentally friendly solvent products and has become the leading solvent manufacturer in Korea.

Since its establishment as Korea's first solvent manufacturer, the performance chemicals business has focused primarily on developing environmentally friendly solvents that improve industrial cleanliness. The business now has more than 80 products, the leading market position and sales of 500,000 tons in 2004.

In 2005, SK's performance chemicals business is focusing on bolstering its business in China. It intends to establish a joint venture with a local Chinese performance chemicals company to secure a production base in Shanghai, China where it will build a plant with an annual capacity of 60,000 tons.

We will develop this plant as a joint venture with a group of major Chinese companies in China, creating a captive customer base for our products. Overall, SK is expanding its chemicals business product lineup and strengthening its customer services to actively meet customer demand for products and application technology support.

Polymer Business

This polymer unit set new value standards for customers in industries as diverse as automobiles, electro-communications materials and household products.

In 2004, the unit sold 710,000 tons of polymer products. Through specialized production systems for LLDPE, HDPE and PP, the unit manufactured a broad array of products including automobile components, materials for the electronics and telecommunication devices, toothpaste tubes, stationery and plastic containers.

In 2005, the polymer unit will focus on the development of new products that respond to the changing needs of consumers. To do this, we intend to be in greater contact with our customers to gauge changing market demand. We will also provide expanded customer service in information technology and management support. China, our largest polymer export market will also be a main target and we anticipate the formation of a larger marketing network there..LLDPE

SK produces LLDPE having excellent physical properties and processability, developed by the latest Sclairtech Process patented by Nova Inc. A variety of derivatives with outstanding physical properties are produced through film, extrusion coating, injection molding, and rotational molding, using octane and butane as co-polymers. Octane-film products excel particularly in all aspects of strength, tensile, tear, and impact, for which reason they are preferred in the film market as packaging, laminating, and wrapping materials.

MDPE

In the MDPE/HDPE plant, SK has the Sclairtech Manufacturing process. By capitalizing on the sterngths of each process, we produce thr finest quality products possible and achieve increased customer satisfaction.

- Sclairtech process

Rotational Molding / Pipe Coating / Injection Molding / MonofilamentHDPE

HDPE Plant employs both the Mitsui process and the Sclairtech Process of Nova Inc. Taking advantage of the best features of both processes enables it to manufacture high-end products which best suit the needs of customers.

Products manufactured with the Mitsui Process (YUZEX)

- Film / Blow Molding / Pipes / Injection Molding / stretching

Products manufactured with the Sclairtech Process (YUCLAIR)

- Rotation Molding / Pipe Coating / Injection Molding / MonofilamentPolyethylene

To manufacture its PP, SK uses the Spheripol process, now considered the highest quality process worldwide.

With our Advanced technology, and the specialized manufacturing system resident in our new plant, SK is now delivering more higher quality products than ever before.

Sk's Impact PP, with its high degree of homogenety, has excellent impact strength and dimensional stability.

Random PP, on the other hand, is distinguished by its superior clarity and gloss.

Advanced Polymer Business

This specialty polymer unit has invested heavily in technology-complex compounds and accelerated the development of high-value-added products.

During 2004, in order to maximize future growth, the specialty polymer unit made major investments in developing new technology-intensive high value products. Our new products include a breathable resin, Brespol; a high-performance adhesive, Polyglue; a barrier resin, Notran: a thermoplastic, Plastomer; and PP compound resins. In April 2004, the unit received approval for our Plastomer product to be used as an official component material by Daimler Chrysler. We also entered into a supply contract with JYCO, an automotive parts supplier for Daimler Chrysler and GM, to provide this product starting in the third quarter.

In 2005, the unit plans to become the leader in the compound polymer market based on its global Competitiveness and its local production system in China.Olefins

尉山コンプレックス

三星石油化学:三星グループ 47.4%、BP 47.4%、他 5.2%

Samsung-BP Chemical :三星/BP JV

SKC:Yukong ARCO Chemical →(ARCO撤退)Yukong Oxichemical

→ SK Oxichemical →SK Evertec

→SKC Co., Ltd., Chemical Business Group

BASF:SK EvertecからSM設備購入

東西石油化学:旭化成 100%

龍山三井化学:龍山化学/三井化学JV

韓国 PTG :龍山化学 33.33%/龍山 14.11%/愛敬石化 30%

愛敬油化(元 三敬化学):愛敬化学/三菱ガス化学JV

日本経済新聞 2003/7/7

韓国SKグループ 緩やかな企業連合に 不祥事機に本部廃止

韓国3位の財閥、SKグループが緩やかな企業連合に変質しつつある。系列企業の粉飾決算、背任によるオーナー一族への実刑判決などで求心力が急速に低下。外国人持ち株比率が40%を超えるSKテレコムはグループ企業の支援を拒否した。グルーブ本部もなくなり、「事実上の財閥解体」が進んでいる。

| 韓国の主要財閥ランキング 2003/4/1現在の資産規模ベース 単位:兆ウオン

注)韓国公正取引委員会調べ、 |

|

▼SKグループ

サムスン、LGに次ぐ韓国の大手財閥。資産規模は47兆5千億ウオン(約4兆7500億円=2003年4月1日現在、韓国公正取引委員会調べ)。2002年のグループ売上高は54兆ウオン、税引き前利益は3兆6千億ウオン。発足は1953年。シャツなどを製造する鮮京織物(現SKグローバル)が母体になった。創業者である実兄からバトンを受けた二代目会長の崔鍾賢氏の時代に油公(旧大韓石油公社=現SK)や韓国移動通信(現SKテレコム)を傘下に収め、大手財閥に浮上した。

他の韓国財閥が輸出関連事業を主力として急成長したのに対し、SKグループは石油、携帯電話サービスといった内需関連事業が中核だ。

98年、崔鍾賢氏の急死に伴い孫吉丞氏がグループ会長に就任した。崔泰源氏は崔鍾賢氏の長男で、グループ次期会長の最有力候補だった。

SK㈱、外国系会社になるか?

http://japanese.chosun.com/site/data/html_dir/2003/04/10/20030410000065.html

SK㈱の経営権が外国系ファンドに委譲される危機にさらされている。

SK㈱の株式を3月末から集中的に買収したバージンアイランドのぺ一パーカンパニー・クレストシーキュリティーズ社は最近、議決権があるSK㈱の株式をSKグループよりも多く手にしていることが分かった。

http://www.sk.com/home1/home.asp

SK is

Korea’s fourth largest

conglomerate and one of the leading business organizations in

Asia. We are a major player in energy production and

distribution, films, fibers, petrochemicals, telecommunications,

engineering and construction, and international trade and

finance. SK is made up of 40 member companies, including seven

that are listed on the Korea Stock Exchange. We have a presence

on six continents and number 25,000 employees of many

nationalities.

When was SK established?

Jong-Kun Choe founded SK in 1953 as a small textile firm. Since

then, we have grown to become one of the most successful

vertically integrated companies in the world. Against strong

odds, we became the first company in Korea to manufacture

polyester fiber. By the end of the 1980s, we integrated upstream,

moving into oil production, refining, and petrochemical

production. In 1991, we reached our goal of achieving complete

vertical integrationーcalling it From

Petroleum to Fibers.

The SK

Corporation is a leading supplier and marketer of Korea’s energy resources. The company also

engages in the development of oil fields and coal mines around

the world. In addition, it has expanded business nationwide in

city gas, lubricants, and other products. This is in line with

the government’s goal to

cultivate a resource-rich country.

Petroleum

In 1999, SK Corporation imported and refined 284 million barrels

of crude oil and sold 300 million barrels. Although we face

strong challenges, including multinational competition in the

domestic market, pricing struggles among domestic suppliers, and

skyrocketing oil prices, SK Corporation continues to maintain a

large share- over 34 percent- of the domestic market. This is a

result, in part, of our campaign to attract and retain customers

through superior performance and a strong presence in

non-petroleum business lines. For example, our BC Card, the

Enclean Bonus Card and other customer-friendly services have

captured and kept new customers.

In 1972,

SK Corporation laid the foundation for development of a

full-fledged petrochemical industry in Korea. It launched the

country’s first

naphtha-cracking facility with an annual production capacity of

100,000 tons. And in I999, SK Corporation sold nearly four

million tons of chemicals. After painstaking planning and

long-term preparation, the company successfully shaped a

vertically integrated organization, covering every aspect of the

business from oilfield development to polyolefin production.

Aromatics

SK Corporation produces aromatics that include benzene, toluene,

xylene, orthoxylene, paraxylene, cyclohexane and styrene monomer.

In 1999, the company sold 1.8 million tons of aromatics to other

chemical companies.

Olefins

SK Corporation produces base olefins including ethylene,

propylene and intermediates,the essential feedstock for

downstream petrochemical products. We supply olefins to our own

chemical plants as well as to other companies in the Ulsan

Petrochemical Complex. This operation has played a leading role

in the development of the domestic petrochemical industry. In

1999, our production capacity expanded to 1.7 million tons of

base olefins and intermediates per year.

Solvents

A trailblazer in the domestic solvent industry, SK Corporation

now produces 60 types of solvents. In 1999 alone, the company

sold 340,000 tons. Solvents are widely used in paints, coatings,

rubber, adhesives, agricultural chemicals, aerosols, magnetic

tapes, and cleaning agents such as dry cleaning oil and

industrial degreasers. In recent years, we have created

environment-friendly solvents including de-aromatic solvent,

isoparaffin solvent, and cyclopentane. We have also developed

processes for producing carbonless duplicating paper, paraxylene

desorbent, and other high-purity chemicals.

Polymers

SK Corporation produces polymers found in the plastics of

automotive parts, electronic goods, communications cable,

toothpaste tubes, ballpoint pens and even contact lenses.

Chemical Week 2002/4/17

SK Chemicals to Build PET Plant in Poland

SK Chemicals (Seoul) says it will build a 120,000-m.t./year polyethylene terephthalate (PET) plant in Poland with two separate, and undisclosed, joint venture partners. SK will hold 45% of the jv.

Platts 2002/10/25

Korea's SK Chem to build JV PET plant in Poland by 2004South Korea's SK Chemicals Co will build a joint-venture PET plant in Poland by 2004, a company source said Friday.

SK would hold a 60% stake in the JV, while the remainder would be controlled by local chemical producer Anwil, the European Bank for Reconstruction and Development, and several investors, the source explained.

Korean EXIM Bank News 2002/11/8

KEXIM Took Part in Project Finance with EBRD in Poland

http://www.koreaexim.go.kr/web/eng/exim/sblbd_jw.jsp?blbd_tp_cd=05&sblbd_mng_no=173A US$40 million Project Finance for SK Eurochem Sp. z.o.o., a joint venture company established by SK Chemicals Co., Ltd., SK Global Co., Ltd., and Anwil S.A. (Poland’s largest PVC manufacturing company), was arranged by EBRD. The US$40 million term loan facility is comprised of a US$15 million EBRD loan, US$20 million KEXIM loan, and US$5 million loan from local banks. KEXIM was invited to the facility by EBRD, the first time the two institutions have worked together since the Framework Agreement on Co-financing signed in April 1993. The loans are to be used by SK Eurochem to finance the construction and operation of a 120,000 tpa PET resin plant to be located within an industrial zone in Wloclawek, 150km north of Warsaw. The construction will be led by SK Chemicals under a lump-sum turn-key EPC contract, and the plant’s operation will have SK Chemicals’ technical support. PET from the plant will be sold to SK Chemicals’ existing customers, including Coca-Cola and SK Global, and to new customers, most notably in Poland and Eastern Europe. This Project Finance transaction with limited recourse to SK Chemicals will be secured by project assets, assignment of key contracts, and pledges of SK Eurochem’s shares. KEXIM also approved a US$5.8 million overseas investment credit to be disbursed to SK Chemicals, which will use the credit as part of its capital subscription to SK Eurochem. In addition, EBRD made a US$3.3 million capital subscription to the joint venture company, taking up 10% of SK Eurochem’s share.

SK Eurochem sees new 400 kt/yr Polish PET plant online Apr 1, '05

The planned construction of SK Eurochem's new 400,000 mt/yr PET plant project in Poland was on track, with supply to the market from this unit expected to start Apr 1, 2005, said KY Song, the company's marketing director, Tuesday.

The plant's initial capacity will be 120,000 kt/yr, with a two-stage expansion planned. The first expansion of a further 140,000 mt/yr was expected to take place at the end of 2005, while the second expansion of an additional 140,000 mt/yr would take place at the end of 2006, Song said.

europa korea 2005/6

SK opens synthetic resin plant in Poland

http://korea.be/content/view/900/152/The group said on Wednesday (June 22) that SK Chemicals held a ceremony to inaugurate a polyethylene terephthalate (PET) chip plant in Wloclawek, Poland.

The plant will be operated by its European chemical production affiliate SK Eurochem, a joint venture in which SK Chemicals holds a 53.9 percent stake.

Polish chemicals firm Anwil holds a 17.4 percent stake, SK Engineering & Construction 10 percent, LG International Corp. 10 percent and the European Bank for Reconstruction and Development (EBRD) 8.7 percent.

The plant will produce 120,000 tons of PET chips a year and is expected to post 130 million euro in sales in 2006. SK Chemicals plans to boost annual PET production capacity of SK Eurochem to 400,000 tons and grab 10 percent of the European market by 2007.

韓国SKケミカル、PETG樹脂を日本で拡販

韓国の大手化学メーカーであるSKケミカルが、環境に優しく透明性・加工性などに優れるPETG(グリコール変性ポリエチレンテレフタレート)樹脂「スカイグリーン」で、日本での販売戦略を加速する。

| 1962-69 | |||

| Born as the First Oil Refining Company in Korea | |||

| In the 60s when Korea strove to be economically independent and industrialized, SK Corp. (the first domestic oil refining company, originally called Korea Oil Corporation) started operating an oil refinery in 1964. SK Corp. has played a key role in the economic development of Korea by supplying oil steadily for almost 40 years since then. | |||

| 1962. 10. Korea Oil Corp. established. | |||

| 1970-79 | |||

| Playing a Major Role in the Economic Development of Korea | |||

| In the 70s when the Korean economy made rapid progress, SK Corp. started a petrochemical business which was the core business of the second five-year economic development plan. This business operated the first domestic aroma and ethylene production facilities to supply chemical materials nation wide. Therefore, it can be said that the SK Corp. opened a new chapter in an industry that is considered the essence of modern industry. | |||

| 1970. 5. | Aromatic plant started up (216,000 tons/yr.). | ||

| 1970. 6. | 50 percent equity share and management rights acquired by Gulf Oil Corp. | ||

| 1973. 3. | Naphtha cracking center started up (100,000 tons/yr. of ethylene). | ||

| 1980-89 | |||

| Forming Bases of a General Energy and Chemical Company | |||

| SK Corp., in becoming a member of SunKyong Group(鮮京)

in

1980, began to take challenging steps under a new

administration system with the aim of becoming a

world-class general energy and chemical company. SK Corp. launched successful oil search operations enhancing its gas business and coal business in addition to its oil refining business. SK Corp. expanded the petrochemical business that started from a plastics division into its lower areas. Therefore the company acquired characteristics of a general energy and chemical company both in name and reality. |

|||

| 1980. 8. | Gulf's 50% equity share and management right were acquired by SunKyung Co., Ltd. | ||

| 1980. 12. | SunKyong Co., Ltd. acquired the management right in accordance with government privatizing policy of the government owned company. | ||

| 1982. 7. | The company name was changed to "Yukong Co., Ltd."(油公) from Korea Petroleum Corporation. | ||

| 1989. 12. | No. 2 Ethylene plant was started up (400,000 tons/yr) | ||

| 1990-99 | |||

| Securing solid ground to be a representative general energy and chemical company | |||

| In January 1997, SK Corp.

introduced the 'Enclean Bonus Card' the first mileage

bonus membership card in the petroleum sector in korea,

gaining 8.2million customers with the help of a database

of customers from 3,700 nation wide gas stations. It has

provided services unique from other companies' causing it

to be ranked first in the market share. By launching the ZIC product (a 21st century type lubricant) and exploring for oil in 51 blocks in 24 countries, SK Corp. has consolidated its position as a general energy company that specializes in oil exploration, refining, and sales. SK Corp. has also started in the field of fine chemicals, studied in the life sciences, and has a foothold in the basic fertilizer business. It can be said that the company has nominally and virtually secured itself in the general chemical business. |

|||

| 1990. 8. | Polypropylene plant started up (150,000 tons/yr.). | ||

| 1994. 6. | Korea Mobile Telecom acquired. | ||

| 1997. 10. | Changed company name into SK Co., Ltd. from SK Yukong. | ||

| 2000- | |||

| Turning to a Globalized Innovative Marketing Company to Maximize Its Values | |||

| SK Corp.

diversifies its business lines to be reborn into a

company that supplies customers with what they want in

ways the customers prefer. In the digital area of the 21st century, SK Corp. accelerates maximizing its values under the new vision of an 'Globalized Innovative Marketing Company.' A marketing company that provides goods and services meeting customers' needs by means of networks between the customers and the suppliers. It's a value-innovative company that puts excellent technologies and knowledge into practice, and a global company that expands existing business and new projects throughout the world by building up global networks. These will be new outlooks of the SK Corp. in the 21st century. To be like this, SK Corp. will reform itself with the aid of life sciences research, possibilities in the venture incubating business, and the internet business along with the energy/petrochemical business. SK Corp. will do its best to provide customers with more value. |

|||

Originally established

as Sunkyong Chemical Fibers Limited in 1966, we have made

significant progress in varied areas of our business since then.

Fibers and Textiles

Obtained a patent on flame-retardant and anti-static polyester

filament

Petrochemicals

Introduced and approved the production technology for purified

terephthalic acid/dimethyl terephthalate (PTA/DMT), the base

material for polyester and film; built our own PTA/DMT plant in

1989 for production process efficiency.

Specialty Chemicals

The first company in Korea to develop SKYGREEN, a fully

biodegradable aliphatic polyester resin; and also developed

high-performance adhesives and special engineering plastics.

Advanced Materials

The third company in the world to develop super-engineering

plastic polyphenylene sulfide (PPS) resin, and the first company

in Korea to develop polyethylene terephthalate (PET) resin that

is used worldwide for containers of soft drinks, mineral water,

and cosmetics.

Life Science

The world’s first company to develop

third-generation platinum complex anti-cancer agents, recognized

as the first new medicine of this type in Korea.

SK Corp. to Invest $15

Mil. in China

http://times.hankooki.com/lpage/biz/200411/kt2004112615084211900.htm

SK Corp., the nation's

largest oil refinery, said Friday it plans to invest $15 million

in a solvent manufacturing facility in China as part of its

efforts to expand in the Chinese market.

SK Corp. will invest in a new solvent manufacturing plant in

Shanghai through a joint venture with leading Chinese chemicals

firm SINOPEC.

Under the deal, SK Corp. and SINOPEC will own a 50 percent stake each in the new solvent manufacturing

corporation, Shanghai Gaoqiao-SK Solvent, with a total investment of $30

million between the two companies.

(上海高橋)

SK said that the new

facility will be capable of churning out 60,000 tons of

environmentally friendly solvent products each year.

日本経済新聞 2005/7/19

発表

ソブリン、韓国SK株を売却

韓国エネルギー大手、SKの筆頭株主である投資ファンドのソブリン・アセット・マネジメントは18日、保有するSK株をすべて売却したと発表した。ソブリンは売却の理由を「経営改革を要求してきたが改善されないため」とした。推定で約9千億ウオン(約900億円)の売却益を手にしたとされる。

2005/7/18 Sovereign Asset Management

Sovereign Sells

Investment In SK Corp

Sale Reflects SK Corp’s Failure To Implement Substantive

Corporate Governance Reform

http://www.sov.com/english/11_1150.asp

Sovereign Asset

Management (“Sovereign”) confirmed today that its group

companies, including Crest Securities Limited (“Crest”), have sold their entire

14.82% stake in SK Corp.

Mark Stoleson, Head of Group Investments at Sovereign, said:

“Having

exhausted all of the legal rights currently available to

shareholders under Korean law Sovereign is now exercising the

only meaningful right remaining open to us - withdrawal from our

investment in SK Corp.”

The sale of the

Sovereign group’s entire holding in SK Corp

follows the repeated choice by the company’s Board to continue with

its discredited leadership and poor governance practices at the

world’s second largest

single-site oil refiner.

tential, and we wish the company and its shareholders much

success in the future.”

2005/6/12 Sovereign Asset Management

SK Corp - A Korean National Tragedy

Sovereign Asset Management (“Sovereign”) stated today that the continuing role of Chey Tae Won as Chairman of SK Corp, following the confirmation of his criminal conviction by the Korean Court on 10 June 2005, reinforces the need for ethical and credible leadership at SK Corp.

2005/2/19

Sovereign invests $1bn in 'model chaebol' LG chaebol=財閥

http://www.sov.com/english/11_221.aspSovereign Asset Management, the scourge of SK Corp, yesterday said it had invested almost US$1bn

to take strategic stakes in LG Electronics, South Korea's largest home appliance maker,

and LG Corp, the conglomerate's holding company.

The Monaco-based asset manager, which has been locked in an acrimonious corporate governance battle

with SK Corp, the world's second largest oil refiner, said its Won1,000bn (US$977m) investment underlined

its commitment to South Korea.

But Sovereign is unlikely to move its management battles to LG - it said it was investing in LG

because it was a "model chaebol".

South Korea's family-run conglomerates were notorious for their opaque management structures and

record of bailing out underperforming affiliates. At SK Corp, Sovereign has been trying to oust Chey Tae-won,

the chairman who was convicted for his part in a US$1.2bn accounting fraud at sister SK Networks.

However, LG is generally recognised as the chaebol that has made the most progress in reforming

its management practices.

韓国企業ニュース: SK Corp. May 03, 2004

Sovereign Asset Managementというモナコを拠点にした投資会社があります。日本のUFJ銀行の大株主になった投資会社です。

この会社が韓国第三位の企業グループである SK Group の事実上の親会社である SK Corp. の株式を買い進めて経営権を握ろうとしている、という記事が出ています。

ソブリンの意図としては、企業体の統治に問題のあった SK Corp. の経営権を握り、統治を構築しより優れた企業統治体制を築くことで、企業価値を高める、ということに主眼があったようです。

現・SK ChairmanのMr. Chey という人が、以前グループのSK Networks (商社) での汚職に絡んで逮捕され投獄されていたことを問題視し、他の経営陣に刷新しようとしたそうです。

ソブリンの提案は韓国側の株主によって拒絶されたようですが 結局 SK は企業統治体制を見直し、経営における透明性を向上させるべく行動を始め、それを受けてでしょうか SK の株価も2倍程度に高騰しているようなのでソブリンとしては実利を得た形です。

日本でもソトーに対するスティールパートナーズの敵対的買収の攻防がありましたが、韓国においても欧米の投資会社が同様に株式を買い進めている企業が多くあり、企業経営の透明性が高まりつつあります。

外国人持ち株比率としては、韓国企業の方が高いかも知れません。

日本経済新聞 2005/8/20

仁川精油売却入札 SKに優先交渉権 韓国 10月の本契約めざす

韓国の石油精製大手、仁川精油を売却するための入札を実施した仁川地裁は19日、エネルギー韓国最大手のSKに優先交渉権を与えた。

SKの石油精製能力は日量84万バレルで韓国首位。仁川精油は同27万5千バレルで同5位。仁川精油の買収で能力は同111万5千バレルに拡大、アジア・太平洋地域では新日本石油に次いで四位の規模となる。

仁川精油は経営危機に陥り法定管理(日本の会社更生法に相当)の適用を受け、裁判所の下で売却手続きに入っていた。2004年、中国化学大手の中国中化集団が優先交渉権を獲得。買収価格を巡り債権者の金融機関と折り合いが付かず、白紙となった経緯がある。

2005/08/18 聯合ニュース(Yonhap News)

仁川精油の買収入札、6社が提案書提出

http://japanese.yna.co.kr/service/article_view.asp?News_id=652005081802100&FirstCd=02

仁川地裁は18日、仁川精油売却の入札提案書の受付を締め切ったところ、SK、エスオイル、STXコンソーシアムの国内3社と、シノケム(中国中化集団公司)、シティ・ベンチャーキャピタル、モルガン・スタンレー・エマージング・マーケットの海外3社がプロポーザル(提案書)を提出したと明らかにした。

これに先立ち、裁判所は先月12日に仁川精油の買収意向書を提出した12社とファンドのうち9社に入札の機会を与えていた。このうち、国内企業であるGSカルテックスと湖南石油化学は入札に参加しなかった。外資系のシティベンチャーキャピタルは、仁川精油の最大債権者であるシティグループ・ファイナンシャルプロダクツとコンソーシアムを構成して今回の入札に参加した。

売却主幹事の三逸会計法人は、買収価格と資金調達能力、経営計画などを評価し、来週中に優先交渉対象者を決定する。本契約締結などの手続きを経て、早ければ10月ごろには仁川精油の売却を完了する予定だ。

2003年3月に法定管理(会社更生法に相当)の認可を受けた仁川精油は、昨年9月に中国の国営石油会社シノケムと6351億ウォンで売却契約を交わした。しかし、最大の債権者であるシティグループが反対し、自社が買収する意思を表明したことから契約が白紙になっていた。裁判所は6月に売却入札の公告を行い、売却作業が再開された。* STXコンソーシアム:STX Shipbuildingを中心とする consortium

湖南石火の積極攻勢 仁川精油再入札の変数に

http://www.sjchp.co.kr/koreanews/20050809/2005080905.htm国際原油価格が「超」のつく高止まり状態を続けている中、経営破たん後に「無用の長物」扱いされてきた仁川精油の受け皿作業が俄然注目を集めている。

中国のシノケムと1月に最終約直前までいったが、債権団から同意が得られず白紙化した。背景には、「かぼちゃ」が「馬車」に変わると判断した債権団の「変わり身」の早さがある。現在、原油価格高騰かそれを上回るピッチで、石油精製品価格も高騰を続けている。高原油価格下でも高い精製マージンが期待でき、スケールメリットが最も生かすことができるタイミングに入ったことが大きい。

《湖南石油化学の買収時に影響予想》

今回の買収戦は石化メーカー湖南石油化学の参加で、石火業界へも影響が出てくることが予想されている。

積極的な買収・合併(M&A)を通じてロッテ大山油化(旧・現代石油化学第2工場)とKPケミカルを買収したロッテグループが仁川精油を買収した場合、石化事業の垂直系列化が完成し、ナフサなど石油化学原料の安定供給が期待され、それだけ原価競争力やシナジー(相乗)効果が出る可能性がある。

S-Oil http://www.s-oil.com/eng/

S-Oil was founded in 1976 to ensure stable import of crude oil and the steady supply of petroleum products to the markets. The construction of an oil refinery began on a 400,000 pyong plot of land inside an industrial complex located in Ulsan City. In May 1980, 4 years after the construction started, commercial operation of the oil refinery began. As the Company began commercial operation of the lube base oil production plant in January 1981, the Company came to commence full-scale operation of the [oil refining and lubricant production] system.

In December, 1999, SsangYong (双竜)Cement Industrial Co., Ltd., then the 2nd largest shareholder in the Company, sold its equity as part of a group restructuring program. The Company was thus separated from the SsangYong Group and a stand-alone management system was established.

Remarkable growth continued thereafter to become a fully-functional oil refining company, and today, S-Oil runs a crude oil refinery with a capacity of 580,000 barrels/day, a B-C cracking center with a capacity of 292,000 barrels/day, BTX production plant with an annual capacity of 900,000 ton, a para-xylene production plant with an annual capacity of 650,000 ton, a lube base oil plant with a capacity of 24,000 barrels/day and a lube oil plant with a capacity of 1,500 barrels/day.

S-Oil is able to import a stable volume of crude oil from an oil-producing country at favorable conditions by maintaining close and friendly relations with the oil-producing country. The Company made special efforts to promote profitability and improve operating rate by pushing full-fledged crude oil processing projects by actively utilizing the prevailing overseas market situation. S-Oil also is continuously expanding the sales foundation in the domestic market. As a result, the Company was able to realize the trade surplus starting in 1982 and lay a foundation for stable growth. In May 1987, 7 years after the Company began commercial operation, the Company had its initial public offering as an enterprise that grows together with its shareholders, employees and customers.

2005/10/13

SK化学、石化部門を100%子会社に

SK化学は12月1日付けで石化部門を100%子会社にすると発表した。

同社の石化部門は、acetate filament yarn, acetate filter

tow,

DMT、PET、PTAを尉山で生産しており、売上高434百万ドルで全社の33%。残りは特殊化学品と医薬。

2006/6/23 Asia Chemical Weekly

SK signed agreement to

acquire China's PS plant

On June 9, Korea's

SK Group signed an agreement with Shantou Ocean Enterprises (SOE:汕頭海洋集団), to purchase SOE’s PS plant in Shantou - Shantou

Ocean First Polystyrene Resin Company(SOFPS:汕頭海洋第一PSレジン).

Using self-owned

technology, SOFPS has three production lines with total PS

capacity of 150 000 tonnes/year in Shantou, Guangdong Province.

SM feedstock is sourced from market, and the PS output sell to

the Pearl River Delta area.

For the sake of

high oil prices, however, the profit of PS producers was squeezed

by the cost of SM feedstock.; while the PS demand from downstream

customer(like home appliance makers, toy makers) is weak. SOFPS

was impacted mostly and fall into the edge of bankruptcy. So, the

company seeks SK for the business reconstruction.

The negotiation

between SK and SOE was held for more than one year. This is the

first milestone for SK to enter China petrochemical market. The

finance details of the agreement are undisclosed.

Currently, SOE

Group also operates 50 000 tonnes/year EPS by Shantou Ocean

Chemical Co, and 120 000 tonnes/year PS by Quanzhou Polystyrene

Resin Co Ltd in Quanzhou, Fujian Province.泉州

SOE http://www.soegroup.com/index.htm

SOFPS http://www.soegroup.com/adout_soe/as_%20b01.htm

Platts 2006/7/26

S Korea's SK Networks set to finalize acquisition of Shantou PS 広東省仙頭市South Korean trading firm SK Networks is on the verge of finalizing its planned acquisition of the Chinese polystyrene firm Shantou SOE First Polystyrene Resin, a company source said Wednesday.

SKN stopped styrene shipments in June when negotiations for the buy-out reached a temporary deadlock. SOE shut down operations at the 150,000 mt/year polystyrene plant in Shantou last month when the plant's SM feedstock was exhausted.

China Chemical Reporter | Date: July 6, 2004

Founded in 1984, Shantou Ocean Enterprise (SOE) is an enterprise group mainly engaged in production of polystyrene resin and polyester resin.

In 1991, SOE established its first Polystyrene production site, Shantou Ocean First Polystyrene Resin Co Ltd, with the technology introduced from USA, of which the production capacity was 50 000 tons per year at that time. After that, by absorbing introduced technologies and continuous research, development and innovation, SOE staff created its own "SOE Proprietary Technology for Polystyrene", approved by the former Ministry of Chemical ...

Asian Specialty Chemicals Newsletter 1999/5/3

Shantou Soe First Polystyrene Resin has dropped its proposed ABS project in China because of intense competition and poor profit margins. The project, proposed in 1996, was to be a JV with Sunkyong and Miwon Petrochemical, both of Korea.

SK Energy eyes investments in Peru, in talks on petchem project

South Korean energy giant

SK Energy, formerly known as SK Corporation, is looking at expanding its

energy investments in Peru and is in talks to build a $2 billion

petrochemical project there, the company said in a

statement earlier this week.

SK Energy is currently engaged in production in Block 8 and the

Camisea region with a daily total production of 80,000 barrels of

oil equivalent/day.

Peru's state-owned oil and gas company Petroperu recently

inked agreements with Brazil's Petrobras

and

India's Reliance

Industries for

energy cooperation including joint investments in petrochemical

projects. The Peruvian government is also considering a bill that

would grant tax benefits to the country's petrochemical industry.

SK Energy to buy 35 pct of naphtha JV with Sinopec

South Korea's largest

refiner SK Energy confirmed on Wednesday it had agreed to buy a

35 percent stake in a joint venture with Sinopec Corp to build a

petrochemical complex in central China.

SK Energy declined to reveal the value of the deal but an

industry source told Reuters last week the investment would be

around 1 trillion won ($956.2 million).

The deal, which coincides with South Korean President Lee

Myung-bak's visit to China this week, makes SK one of a handful

of foreign firms to invest in China's huge petrochemical

industry, which has been expanding at a double-digit annual rate

in recent years.

2007/4/9 中国、湖北省武漢市のエチレン計画を承認