トップページ

July 01, 2009

Dow to Achieve More Than $100 Million in

Annual Savings via Additional Portfolio Management Actions to Streamline

Manufacturing Footprint

Company Remains On Track to Reach $1.3

Billion in Cost Savings Related to Rohm and Haas Acquisition

The Dow Chemical Company announced today

that on June 30, its Board of Directors approved a restructuring plan which

calls for the shutdown of a number of manufacturing assets, including ethylene

and ethylene-derivative assets in the Company's basics portfolio.

Consistent with the Company's $1.3

billion synergy commitment related to the acquisition of Rohm and Haas Company,

the restructuring plan includes a charge for the elimination of approximately

2,500 positions, which has been previously announced.

Dow will also recognize an impairment

charge due to an expected loss on the divestiture of certain acrylic monomer and

specialty latex assets, which is required for United States Federal Trade

Commission approval of the Rohm and Haas acquisition.

"Consistent with Dow's practice of

active portfolio management, we continue to take quick and aggressive action to

right-size our manufacturing footprint, particularly in our basics portfolio,"

said Andrew N. Liveris, Dow chairman and chief executive officer. "These actions

are also aligned with our strategic transformation, which focuses on

preferentially investing for growth in our performance and advanced materials

portfolios. In addition, we are making excellent progress on achieving $1.3

billion in cost synergies from the acquisition, and today's steps demonstrate

our speed and determination to deliver these savings."

Specific sites in the Company's Basics

portfolio that will be impacted include:

Ethylene Production

- An ethylene cracker in Hahnville,

Louisiana (900 million lbs/year)

Ethylene Derivatives

- An ethylene oxide/ethylene glycol

production unit in Hahnville, Louisiana (385,000mt/year/330,000 mt/year)

- An ethylene dichloride and vinyl

chloride monomer facility in Plaquemine, Louisiana (970,000 mt/year/590,000

mt/year)

These shutdowns are in addition to

numerous other ethylene-derivative closures that have occurred as part of a

restructuring program announced in the fourth quarter of 2008, specifically:

- A production unit in Seadrift,

Texas, for the manufacture of NORDEL hydrocarbon rubber ceased production in

the first quarter of 2009

(Dow Elastomers announced in

December 2008 the closure of a large EPDM plant in Seadrift, Texas. )

- A low density polyethylene unit in

Freeport, Texas, ceased production in the first quarter of 2009

(The Poly 2 line had a capacity of 225

million lbs/year).

- A production unit in Plaquemine,

Louisiana, for the manufacture of TYRIN chlorinated polyethylene ceased

production in the first quarter of 2009

- A styrene monomer production unit

in Freeport, Texas, ceased production in the fourth quarter of 2008

These shutdowns, when taken in total,

will reduce the Company's ethylene demand by approximately 30 percent on the

U.S. Gulf Coast. As a result, Dow expects to eliminate its purchases of ethylene

from the merchant market (approximately three billion pounds annually),

improving the Company's cost position while fully integrating ethylene

production with internal demand in order to better meet customer needs.

Platts 2009/7/1

Conversely the US VCM market is likely to tighten further and will likely

push downstream PVC prices higher, sources said. The VCM market in the US

remained tight prior to the Dow announcement on the back of a fire at Georgia Gulf's

727,000 mt/year VCM plant at Plaquemine and the idling of Oxy's 2.4 billion

lbs/year VCM unit at LaPorte, Texas. Dow's shutdown at Plaquemine would only

exacerbate the situation, sources said.

June 16 2009

Fire at Georgia Gulf plant may further

squeeze US VCM

A fire at a Georgia Gulf plant in Plaquemine, Louisiana, could further

restrict US supplies of vinyl chloride monomer, buyers said on Tuesday.

Georgia Gulf shut down VCM production at its

Plaquemine site after a fire on Monday (6/15) morning, a source close to the

company said.

The fire was extinguished after 20 minutes and did not affect ethylene

dichloride (EDC), polyvinyl chloride (PVC) and chlor-alkali production at

the site, according to the source.

VCM capacity at the facility is 725,000 tonnes/year, according to ICIS

plants and projects.

July 8,

2009

Dow to Close its Ethylene Oxide & Glycol Plant in England

The Dow Chemical Company announced today that it intends to close its ethylene

oxide and glycol (EOEG) production facility at Wilton, United Kingdom by the end

of January 2010. The site employs 55 people. The actual number of jobs that

could be impacted by the intended closure will be determined following an

employee consultation period.

Several factors contribute to the intention to close the Dow Wilton EOEG plant,

including the site’s disadvantaged input costs. In addition, demand

and profit margins for the site’s outputs, particularly monoethylene glycol

(MEG), began to soften in early 2008. MEG economics have been significantly

worsened by the global economic recession, further placing the Wilton site at a

disadvantage. The ongoing recession is expected to prolong difficult global EOEG

industry conditions for several years and has expedited the need for Dow to come

to a decision regarding the Wilton facility.

The Ethylene Oxide / Ethylene Glycol (EO/EG) Plant at Wilton was built by ICI in 1969.

It was sold to Union Carbide Ltd in 1995 and became Dow's when the companies

merged in 2001.

Jul 8, 2009

Croda to shut Wilton manufacturing site

Britain's Crodais to close its Wilton manufacturing site in North East

England following a decision by Dow Chemical to close an adjoining facility which produced

a key raw material.

The manufacturer of ingredients for cosmetics and personal care products

said on Wednesday it will enter into consultations over jobs with the site's

125 employees within the next two weeks.

It has taken the decision because Dow is the only UK manufacturer of

Ethylene Oxide, a critical raw material, and it would be expensive for it to

transport it from the continent.

July 30, 2009

Dow to Divest Ownership in OPTIMAL Group

of Companies to PETRONAS for $660 Million

The Dow Chemical Company and Petroliam

Nasional Berhad (PETRONAS) today announced that they have reached an agreement

for Dow’s Union Carbide Corporation subsidiary to sell its entire shares of ownership in the

OPTIMAL Group of Companies (OPTIMAL) to PETRONAS for $660 million. PETRONAS would fund this acquisition through

internally generated funds. The transaction, subject to customary conditions

and approvals, is expected to close by the end of the third quarter of 2009.

Dow and PETRONAS have agreed to enter

into a commercial supply agreement allowing the two companies to continue

serving the current customer base with products manufactured by OPTIMAL. Dow

will market OPTIMAL’s basic and performance chemicals products to Dow’s existing customer base in Asia Pacific.

“OPTIMAL has been a

great investment, thanks to the dedication and hard work of our joint venture

employees and our partner PETRONAS,”

said Andrew N. Liveris, Dow

Chairman and Chief Executive Officer. “With this transaction, we hand over the

management of these businesses to PETRONAS, while at the same time remaining

committed to our customers in the region. This divestiture and commercial

arrangement demonstrate Dow’s ability to increase its financial flexibility

and to continue to de-leverage the balance sheet."

“Our purchase of Dow’s equity in OPTIMAL would enable us to strengthen

our presence in Olefins and reinforce the growth of the Malaysian petrochemical

industry,”

said Mohd Hassan Marican,

President and Chief Executive Officer of PETRONAS. “We have had an excellent working relationship

with Dow over the years in OPTIMAL, and we expect that will continue, with Dow

now becoming one of OPTIMAL’s largest customers.”

The change in ownership is not expected

to have any immediate effect on employment in the region. OPTIMAL’s focus continues to be operating safely,

responsibly and effectively while providing world-class products for customers

throughout Asia.

Today’s announcement of Dow’s divestiture of OPTIMAL follows other actions

designed to increase Dow’s financial flexibility, improve its cash flow,

and pay down its bridge loan. Recent actions include:

- Announced the $1.7 billon sale of

Morton Salt, a transaction expected to close in the second half of 2009

- Sold

the Company’s Calcium Chloride business to Occidental

Petroleum for a value in excess of $210 million

- Announced a definitive agreement

for the sale of interests in Total Raffinaderij Nederland N.V. (TRN) for an

enterprise value expected to be approximately $725 million, also expected to

close in the second half of 2009

- Issued $6 billion of new long-term

debt

- Issued $2.25 billion of new equity

- Eliminated $3 billion of perpetual

preferred securities from the capital structure.

As a result of these actions, the

Company is ahead of all of its financial milestones, including the paydown of

the bridge loan utilized to acquire Rohm and Haas.

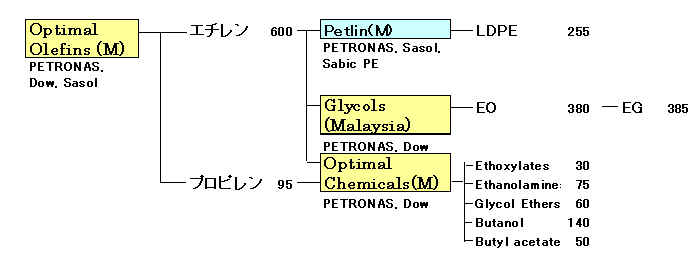

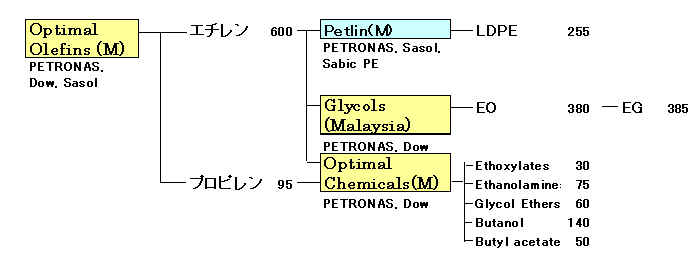

About The OPTIMAL Group of Companies

Established in July 1998, the OPTIMAL

Group of Companies currently comprises three joint ventures involving PETRONAS,

Malaysia's national petroleum corporation, and Union Carbide Corporation, a

wholly owned subsidiary of The Dow Chemical Company:

OPTIMAL Olefins (Malaysia) SDN. BHD. (PETRONAS: 64.25%, UCC: 23.75%, Sasol:

12%),

OPTIMAL Glycols (Malaysia) SDN. BHD. (PETRONAS: 50%, UCC: 50%) and

OPTIMAL Chemicals (Malaysia) SDN. BHD. (PETRONAS: 50%, UCC: 50%).

Headquartered in Kuala Lumpur, OPTIMAL

manufactures more than 70 products and serves key markets in the Asia-Pacific

region from its world-scale petrochemical facility located in Kerteh,

Terengganu, Malaysia.

Products include ethylene and

propylene feedstocks, Ethylene Oxide, Ethylene Glycol, Butanol, various Ethylene

Oxide derivatives, basic chemicals and specialty chemicals.

About PETRONAS

PETRONAS was incorporated in 1974. It is

wholly-owned by the Malaysian government and is vested with the entire ownership

and control of the petroleum resources in Malaysia. Over the years, PETRONAS has

grown to become a fully-integrated oil and gas corporation and is ranked among

FORTUNE® Global 500's largest corporations in the world.

For the fiscal year ending March 31, 2009, PETRONAS had a consolidated revenue

of RM264.2 billion.

PETRONAS has four subsidiaries

listed on the Bursa Malaysia and has ventured globally into more than 30

countries worldwide in its aspiration to be a leading oil and gas multinational

of choice. For more information, visit

www.petronas.com.my

August 20, 2009

MEP, UNEP and Dow Join Forces to Set

Standards for Chemical Safety and Emergency Preparedness in China

MEP, UNEP and Dow Launch Safer Operation and

Emergency Preparedness Pilot Project in Zhangjiagang

A pilot project aimed at boosting

operational safety and emergency preparedness among chemical companies in China

was launched today at the Zhangjiagang Yangze River Chemical Park.張家港

It follows an agreement signed last

September by China's Ministry of Environmental Protection (MEP), the United

Nations Environment Programme (UNEP) and The Dow Chemical Company (Dow).

The pilot, in which Dow's Zhangjiagang

facility has been selected as the primary demonstration site, was launched at a

workshop involving close to 30 chemical and petrochemical companies alongside

local and regional authorities and community bodies.

The pilot and workshop, jointly held by

MEP, UNEP and Dow, is believed to be the first cooperative effort of its kind in

China to explore and provide practical information on safer operation and the

implementation of community-based emergency preparedness under the approach of

UNEP's Awareness and Preparedness for Emergencies at Local Level (APELL)

process.

"Dow is a proud partner in this standard

setting collaboration with UNEP and MEP. This project will not only positively

impact the sustainable development of China's chemical industry but also benefit

the society as a whole," said Neil Hawkins, vice president for sustainability

and EH&S at Dow. "Dow has always been committed to setting the standard for

sustainability in locations where we operate, by engaging communities,

establishing joint goals and taking action for the long-term success of all

involved."

"This pilot project will draw together

the global and local management expertise of UNEP and MEP as well as the

operational excellence of industry leaders such as Dow, and will provide

valuable information and experience for the future nation-wide promotion of

safer production and emergency preparedness in China," said Arab Hoballah, Chief

of the Sustainable Consumption and Production Branch of UNEP.

"UNEP remains committed to supporting

the Chinese government and local communities to develop and implement policies

and practices that preserve the environment and improve quality of life," he

added.

"As our economy grows, it has become

increasingly important to effectively utilize energy, reduce pollution, decrease

the frequency of safety accidents, prevent the environmental emergencies and

safeguards lives. Multi-sector cooperation such as this project plays a vital

role in providing corporate and international best practices in our effort to

support China's sustainable development," stated MEP.

The Zhangjiagang pilot is a crucial

component of a two-year program initiated in 2008 between MEP, UNEP and Dow, to

support the development of a safer production and chemical safety management

system in China's chemical industry value-chain, and the awareness of emergency

preparedness to enterprises, and the enhancement of management capacity

emergency response, and relevant industrial environmental

emergencies.

Companies participating in the pilot

project should benefit from improved chemical safety: fewer accidents, safer

production, fewer employees' injuries, fewer environmental emergencies and

improved preparedness of the local community and of the local industry and its

value-chain/buyers. Documents and experience generated from the project will be

used in a case study for the further promotion of safer production and emergency

preparedness promotion in China.

Building local capacity is a strong part

of Dow's sustainability strategy in China.

In 2005, Dow sponsored the

three-year national pilot project with the China's State Environmental

Protection Administration (now MEP). Dow also partnered with China's State

Administration of Work Safety to launch a national demonstration project on the

safe management of hazardous chemicals promoting a better understanding and

awareness among small and medium-sized enterprises.

September 10, 2009

Dow Announces Shutdown of Styrene

Monomer and Ethylbenzene Plants in Freeport, Texas

The Dow Chemical Company announced today

that it will close styrene monomer and ethylbenzene

production units at its Dow Texas Operations site in Freeport, Texas

by the end of the year.

Dow would not confirm the capacity of the unit, but

said industry reports had listed the unit with a capacity of 460,000

tonnes/year. Global business director Brian Ames said a smaller production

unit at the same site was closed in the 2008 fourth quarter.

The closures are part of a broad

restructuring plan the Company announced at the end of June 2009, which is

designed to right-size Dow's manufacturing footprint and reduce exposure to its

capital intensive Basics portfolio.

"Closing these assets will help align

Dow's styrene supply with U.S. demand and is another outcome of our plan to

optimize our ethylene and styrene envelopes," said Brian Ames, global business

director, Olefins, Aromatics and Aromatic Derivatives.

"This decision also aligns with

Dow's asset light strategy and improves our competitive position in North

America."

Dow has secured a long-term contract for reliable

styrene supply in the marketplace to meet the styrene demand of its derivative

businesses.

Participants speculated that a

supply contract, which Dow said it secured for the remainder of its

styrenics businesses, was likely made with Lyondell and not joint venture Americas Styrenics. Dow

would not divuldge the supplier.

A source said Americas Styrenics did not have sufficient capacity for a

long-term supply contract.

SM producers in the US include

Americas Styrenics (Dow/Chevron Phillips Chemical), Cosmar (Total/Sabic),

INEOS NOVA, LyondellBasell and Westlake

In the second quarter of 2009, Dow

announced a restructuring plan

which included actions to fully integrate ethylene production with internal

demand - reducing the Company's ethylene demand on the

U.S. Gulf Coast by approximately 30 percent. As a result, Dow expects to eliminate its purchase of ethylene

from the merchant market

(approximately three billion pounds annually) while improving the Company's cost

position.

Dow remains committed to the North

American market and to the Dow Texas Operations site in Freeport. Dow Texas

Operations is the Company's largest integrated manufacturing site in the world,

with approximately 70 production units on site.

・Freeport (Texas):Styrofoam、latex、ABS の原料

PSはChevron Phillips Chemical

との間で北南米のSM/PSの50/50JV Americas Styrenics

---

July 01, 2009

ブログ

Dow to Achieve More Than $100 Million in

Annual Savings via Additional Portfolio Management Actions to Streamline

Manufacturing Footprint

Company Remains On Track to Reach $1.3

Billion in Cost Savings Related to Rohm and Haas Acquisition

The Dow Chemical Company announced today

that on June 30, its Board of Directors approved a restructuring plan which

calls for the shutdown of a number of manufacturing assets, including ethylene

and ethylene-derivative assets in the Company's basics portfolio.

Consistent with the Company's $1.3

billion synergy commitment related to the acquisition of Rohm and Haas Company,

the restructuring plan includes a charge for the elimination of approximately

2,500 positions, which has been previously announced.

Dow will also recognize an impairment

charge due to an expected loss on the divestiture of certain acrylic monomer and

specialty latex assets, which is required for United States Federal Trade

Commission approval of the Rohm and Haas acquisition.

"Consistent with Dow's practice of

active portfolio management, we continue to take quick and aggressive action to right-size our manufacturing

footprint, particularly in our basics portfolio," said

Andrew N. Liveris, Dow chairman and chief executive officer. "These actions are

also aligned with our strategic transformation, which focuses on preferentially

investing for growth in our performance and advanced materials portfolios. In

addition, we are making excellent progress on achieving $1.3 billion in cost

synergies from the acquisition, and today's steps demonstrate our speed and

determination to deliver these savings."

Specific sites in the Company's Basics

portfolio that will be impacted include:

Ethylene Production

- An ethylene cracker in Hahnville,

Louisiana

Ethylene Derivatives

- An ethylene oxide/ethylene glycol

production unit in Hahnville, Louisiana

- An ethylene dichloride and vinyl

chloride monomer facility in Plaquemine, Louisiana

These shutdowns are in addition to

numerous other ethylene-derivative closures that have occurred as part of a

restructuring program announced in the fourth quarter of 2008, specifically:

- A production unit in Seadrift,

Texas, for the manufacture of NORDEL™

hydrocarbon rubber ceased

production in the first quarter of 2009

- A low density polyethylene unit in

Freeport, Texas, ceased production in the first quarter of 2009

- A production unit in Plaquemine,

Louisiana, for the manufacture of TYRIN™

chlorinated polyethylene

ceased production in the first quarter of 2009

- A styrene monomer production unit

in Freeport, Texas, ceased production in the fourth quarter of 2008

These shutdowns, when taken in total,

will reduce the Company's ethylene demand by

approximately 30 percent on the U.S. Gulf Coast. As a result, Dow expects to eliminate its purchases of

ethylene from the merchant market (approximately three billion pounds annually),

improving the Company's cost position while fully integrating ethylene

production with internal demand in order to better meet customer needs.

September 10, 2009

OMNOVA to Buy Hollow Sphere Plastic

Pigment Product Line from Dow 中空球プラスチック顔料

OMNOVA Solutions Inc. and The Dow

Chemical Company have signed an agreement for the sale of Dow's hollow sphere

plastic pigment product line to OMNOVA.

The transaction is necessary to meet

U.S. Federal Trade Commission (FTC) required divestitures related to Dow's

acquisition of Rohm and Haas Company. The agreement comes ahead of the November

27 FTC deadline.

The selection of OMNOVA as the buyer

must be approved by the FTC, and the acquisition is subject to normal closing

conditions.

The transaction is expected to

close in the 4th quarter of 2009.

Terms of the transaction are not

being disclosed.

September 14, 2009

SCG-DOW Group Commemorates Thailand HPPO

Progress with Stone Laying Ceremony

PO

facility at Map Ta Phut on schedule to start up in 2011

The Dow Chemical Company (Dow) announced

today that the SCG-DOW Group, a joint venture between Dow and The Siam Cement

Group (SCG), and Solvay Peroxythai Ltd.

recently commemorated significant milestones on the hydrogen peroxide to

propylene oxide (HPPO) related investments with a foundation stone laying

ceremony at the Asia Industrial Estate (AIE) site near Map Ta Phut, Thailand,

where the HPPO facility is being built.

The SCG-DOW Group has procured all

equipment and entered the initial construction phase on a world-scale propylene

oxide (PO) plant, with an anticipated start-up in the first half of

2011.

Once complete, the facility will manufacture PO via HPPO technology jointly

developed by Dow and BASF, and will have a name plate capacity of 390 kilotons per annum (KTA).

The AIE site will also feature a

specialty elastomers plant; a hydrogen peroxide plant built as a joint venture

between Dow and Solvay; and power utilities and infrastructure. Nearby, a new liquids cracker, also

jointly owned by SCG and Dow, will come on stream in 2010.

The integrated Thailand plants

represent a significant increase of the asset base for Dow in Thailand and Dow's

largest manufacturing investments in Asia Pacific.

January 18, 2010 plasticsnews.com

Dow Chemical agrees to clean up dioxin

contamination

Dow Chemical Co. has signed an agreement

with the U.S. Environmental Protection Agency and Michigan to evaluate dioxin

contamination in the Tittabasassee River and the Saginaw River and Bay and their

floodplains.

The agreement also requires Dow to

identify cleanup options and "design the remedy that EPA ultimately selects,"

the federal agency said.

"The agreement spells out tasks and a

schedule that Dow must follow," said Richard Karl, Superfund Director for EPA

Region 5, which includes Michigan. "While the Superfund work proceeds, Dow must

also continue to comply with its Michigan-issued RCRA license."

---

Epoch Times Jan 18, 2010

Dow Chemical Ordered to Clean Polluted

Michigan Site

Dow Chemical is being ordered by state

and federal government entities to clean up rivers it contaminated in Michigan.

The U.S. Environmental Protection Agency (EPA) and the state of Michigan have

signed an administrative order to make Dow Chemical design and implement a

cleanup plan for contamination at a Michigan site.

Dow Chemical’s Midland-based plant has significantly

contaminated the area with dioxins, which has spread for 50 miles down the

Tittabawassee and Saginaw rivers and into Saginaw Bay. The agreement outlines a series of steps Dow must take

in making a comprehensive Superfund evaluation of dioxin contamination in these

waterways and their floodplains. It also requires Dow to identify

cleanup

options as well as design the remedy that the EPA will ultimately select.

"While the Superfund work proceeds, Dow must also continue to comply with its Michigan-issued RCRA license," stated Superfund Director for EPA Region 5

Richard Karl in a press release.

Although Dow admitted responsibility for the pollution, they expressed

frustration that the EPA’s Region 5 administrator terminated negotiations

so early. They argued that an agreement on a plan going forward would have

resulted in dramatically speeding progress toward resolving the situation.

“This was

a real opportunity to actually accelerate resolving the situation; now we’re faced with additional barriers and delays,” said Dow’s Senior Vice President David Kepler in a

statement.

The EPA and the Michigan Department of Environmental Quality offered a nearly

three-month comment period (including an extension) to influence the proposed

Superfund administrative order on consent of the chemical company and received

comments from more than 60 individuals and organizations.

According to the EPA, the vast majority of the comments were in support of the

measure. The administrative order the agencies signed on Jan. 15, 2010, was

unchanged from the original draft made in October 2009.

The EPA says that with the agreement signed, the next steps include establishing

a segmented approach to the Tittabawassee River and planning a method to address

high-use properties along the rivers and the erosion of highly contaminated soil

and sediment.

“We are

also redoubling our efforts to provide guidance on the science of dioxin health

effects to inform cleanup decisions at this site and protect other communities,

in Michigan and across the country, facing dioxin contamination,”

stated EPA Administrator Lisa P.

Jackson in a press release.

March 02, 2010

Dow Announces Sale of Styron Division to

Bain Capital for $1.63 Billion

The Dow Chemical Company and

Bain Capital Partners, a

leading global private equity firm, announced jointly today that they have

signed a definitive agreement under which Dow's Styron Division will be divested to an affiliate of Bain Capital for $1.63 billion. As part of the transaction, Dow has an option to

receive up to 15 percent of the equity of Styron

as part of the sale consideration. Additionally, the transaction includes several

long-term supply, service and purchase agreements which will generate

substantial value for both Dow and Styron.

With the purchase price and the

significant long term contracts, Dow will be able to substantially deleverage

and achieve an attractive value for the Styron divestment. The transaction is

expected to close by August 2010, subject to completion of customary conditions

and regulatory approvals.

"This transaction is yet another step in

our disciplined approach to portfolio management, and is consistent with both

the timeline and value we previously communicated for these assets," said Andrew

N. Liveris, Chairman and Chief Executive Officer. "We are committed to further

focusing our portfolio by shedding non-strategic assets

that can no

longer compete for growth resources inside the Company, and in the process

generating funds for further debt reduction and liberating resources for Dow's

higher growth, higher margin portfolio of technology, market driven businesses."

"We are delighted to embark on a

long-term partnership with Dow," said Steve Zide, a Managing Director at Bain

Capital. "Dow's culture of global excellence and integrity is well-represented

in Styron and its people. We are greatly impressed by the exceptional quality of

the Styron business, and look forward to working with our new partners to

continue to grow and strengthen Styron's leadership position in the global

marketplace."

As a standalone, privately held

business, Styron will be a leading diversified chemicals and plastics company

with attractive global positions in a related set of markets and a unique

product portfolio with a large presence in the styrenics value chain.

Styron brings together a balanced

portfolio of plastics, rubber and latex businesses that share feedstocks,

operations, customers and end users. The company will benefit from a leadership

position in its two flagship products, polystyrene and latex, as well as global

scale, unrivalled customer relationships, and a robust innovation pipeline.

Styron is expected to have approximately

$3.5 billion in revenue (based on 2009 data), with 40+ manufacturing plants in

all geographic regions, and approximately 1,900 employees. Its businesses serve

a diverse customer base in markets such as automotive, appliances, packaging,

paper & board, carpet, durables, electronics, optical media, tires, and

technical rubber.

Businesses and products in Styron

include: Styrenics - Polystyrene (PS), acrylonitrile

butadiene styrene (ABS), styrene acrylonitrile (SAN) and expandable polystyrene

(EPS); Emulsion Polymers (paper and carpet latex); Polycarbonate (PC) and

Compounds & Blends; Synthetic Rubber; and Automotive Plastics including PULSE™ engineering resins, MAGNUM™

acrylonitrile butadiene styrene, INSPiRE™

performance

polymers, and VELVEX™

reinforced

elastomer. Also included will be some styrene monomer assets.

Dow announced its plan to form Styron

and explore divestiture options in July 2009.

--------

June 17, 2010 Dow

Dow Closes Sale of Styron Division to

Bain Capital for $1.63 Billion

The Dow Chemical Company and Bain Capital Partners, a leading global private

equity firm, announced jointly today that they have closed the sale of Dow’s Styron Division to an affiliate of Bain Capital.

Dow has elected to retain a 7.5 percent equity position

in Styron, which is now a privately held, global materials company. Also

included in the transaction are several long-term supply, service and purchase

agreements between Dow and Styron that will generate substantial additional

value for both companies.

“The

Styron divestiture is another major step in Dow’s transformation and a strong example of our

disciplined approach to portfolio management and business prioritization,” said Andrew N. Liveris, Dow Chairman and Chief

Executive Officer. “With the close of this transaction, we have

exceeded our goal of divesting $5 billion of non-strategic assets, and we have

done so in just five quarters. These divestitures have enabled Dow to both

reduce debt and liberate capital and resources for Dow’s higher growth, higher margin businesses.”

"We are excited to see Styron

emerge as an independent company. The Styron management team, together with our

new partners at Dow, have worked tirelessly to provide Styron with the

capabilities to pursue its global growth strategy," said Steve Zide, a Managing

Director at Bain Capital. "We are confident that the management team led by

Chris Pappas, and all of Styron's employees around the world, will further

expand and strengthen the Company's leadership positions with a continued

commitment to excellent service to customers and business partners."

Styron is positioned as a leading materials company with global reach and a

unique product portfolio, bringing together plastics, rubber and latex

businesses that share feedstocks, operations, customers and end users. Styron

has approximately $3.7 billion in revenue (based on 2009 data), with

manufacturing facilities at 20 locations in 13 countries around the world.

Styron has approximately 2,000 employees based in 30 countries worldwide.

Businesses and products included in this transaction are:

Styrenics - Polystyrene (PS),

acrylonitrile butadiene styrene (ABS), styrene acrylonitrile (SAN) and

expandable polystyrene (EPS); Emulsion Polymers (paper and carpet latex);

Polycarbonate (PC) and Compounds & Blends; Synthetic Rubber; Automotive

Plastics; and some styrene monomer assets.

Dow announced its plan to form the Styron Division and explore divestiture

options in July 2009. A definitive agreement between Dow and Bain Capital

Partners was signed and announced in March 2010.

About the Products in Styron

Polycarbonate (PC) is an engineering thermoplastic used in applications such as

optical media, electrical and lighting. Styrenic plastics (polystyrene, ABS and

SAN) are well known for their performance in an array of applications from

packaging and food service, to large appliances, portable appliances, consumer

electronics, automotive and building and construction. Synthetic rubber is used

in a broad portfolio of products from tires to hoses, conveyor belts and

footwear, to specialized high- performance elastomers. Expandable polystyrene

(EPS) is typically used in rigid foam products such as heat insulation,

packaging, impact sound insulation and drainage. SB and SA Latex are used in

paper/paperboard and flooring applications. Automotive plastics are used in many

different automotive applications such as instrument panels, mid consoles, door

panels, interior trim, seat structures and bumpers.

About Bain Capital

Bain Capital, LLC is a global private investment firm that manages

several pools of capital including private equity, venture capital, public

equity, high-yield assets and mezzanine capital with approximately $65 billion

in assets under management. Bain Capital has a team of over 300 professionals

dedicated to investing and to supporting its portfolio companies. Since its

inception in 1984, Bain Capital has made private equity investments and add-on

acquisitions in over 300 companies in a variety of industries around the world.

Bain Capital has a long history of investments in industrial businesses,

including such leading companies as Innophos, Brenntag, Sensata, SigmaKalon,

FCI, Feixiang Chemicals, Novacap, and Himadri Chemicals. Headquartered in

Boston, Bain Capital has offices in New York, London, Munich, Hong Kong,

Shanghai, Tokyo, and Mumbai.

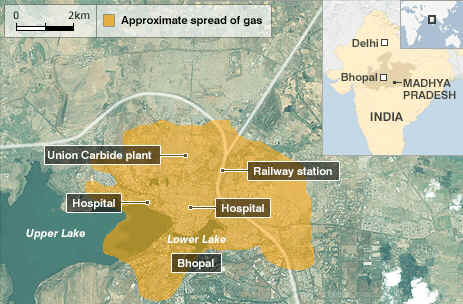

June 7, 2010 BBC

Bhopal trial: Eight found guilty of

India gas leak

A court in the Indian city of Bhopal has convicted eight people in connection

with the gas plant leak that killed thousands of people more than 25 years ago.

The eight face a maximum sentence of up to two years in prison for causing

"death by negligence".

Chief judicial magistrate Mohan P

Tiwari pronounced the verdict in a packed court room convicting 85-year-old

Mahindra, and seven others in the case relating to leakage of deadly methyl

isocyanate gas in the intervening of Dec 2 and 3 1984.

They were held guilty under Sections

304-A (causing death by negligence過失致死), 304-II (culpable homicide not amounting to

murder), 336, 337 and 338 (gross negligence) of the Indian Penal Code.

However, there was no word on Warren

Anderson, the then chairman of Union Carbide Corporation of the US, who was

declared an absconder after he did not not subject himself to trial in the

case that began 23 years ago.

Others found guilty areVijay Gokhle,

the then managing director of UCIL, Kishore Kamdar, the then vice-president,

JN Mukund, the then works manager, SP Choudhary, the then production

manager, KV Shetty, the then plant superintendent and SI Quershi, the then

production assistant.

The sentencing in the case is

expected later.

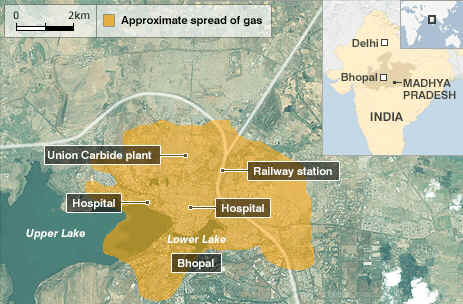

The Union Carbide plant leak was the

worst industrial disaster in history.

Forty tonnes of a toxin called methyl isocyanate leaked from the factory and

settled over slums on 3 December 1984.

Campaigners say at least 15,000 people were killed within days, and say the

horrific effects of the gas continue to this day.

The site of the former pesticide plant is now abandoned.

It was taken over by the state government of Madhya Pradesh in 1998, but

environmentalists say poison is still found there.

The eight people convicted include former senior officials of the Union Carbide

company, including senior Indian businessman Keshub Mahindra, who was the

chairman of the Indian arm of the company when the incident happened.

The sentences are expected to be announced soon.

More than a dozen judges have heard the criminal case since 1987, when India's

leading detective agency, the Central Bureau of Investigation (CBI), charged 12

people with "culpable homicide not amounting to murder".

That charge could have led to up to 10 years in prison for the accused.

BHOPAL'S DEATH TOLL

Initial deaths (3-6 December): more than 3,000 - official toll

Unofficial initial toll: 7,000-8,000

Total deaths to date: over 15,000

Number affected: Nearly 600,000

Compensation: Union Carbide pays $470m in 1989

Source: Indian Supreme Court, Madhya Pradesh government, Indian Council of

Medical Research

However, in 1996, India's Supreme Court

reduced the charges to "death by negligence", carrying a maximum sentence of up

to two years in prison if convicted.

Among those charged were Warren Anderson, the chairman of Union Carbide at the

time of the incident in 1984.

Campaigners say Bhopal has an unusually high incidence of children with birth

defects and growth deficiency, as well as cancers, diabetes and other chronic

illnesses.

These are seen not only among survivors of the gas leak but among people born

many years later, they say.

Twenty years ago Union Carbide paid $470m (£282m) in compensation to the Indian government.

Dow Chemicals, which bought the company in 1999, says this settlement resolved

all existing and future claims against the company.

But according to the International

Campaign for Justice in Bhopal, survivors have received an average of only

$500 each in compensation.

Union Carbide says neither the

parent company nor its officials are subject to the jurisdiction of Indian

courts.

ーーー

All eight of the

Indian officials charged in connection with the Bhopal gas

leak more than 25 years ago have been found guilty by a district court in

Bhopal, Indian news channels reported Monday.

The officials were charged with

"causing death by negligence," a charge that carries a maximum prison term

of two years and is most often used in connection with hit-and-run traffic

accidents, according to representatives of the victims. This is the first

legal verdict in the long-standing case and will likely be appealed to a

higher state court and eventually to the Supreme Court.

At least one of those convicted is a

key member of the business world today. Keshub Mahindra, now chairman of

Mahindra & Mahindra Ltd., was among those found guilty. A Mahindra

spokeswoman for the company said the firm would be issuing a comment later

Monday.

Mahindra & Mahindraはインドの自動車製造企業で、インドのコングロマリットの一つ「マヒンドラ・グループ」の中核企業。

1949年にはジープの生産を開始、現在、多目的車(MUV)、 小型商用車(LCV)、オート三輪、トラクターなどを製造・販売している。

仏ルノーとの合弁会社「マヒンドラ・ルノー」を設立、ルノーグループの戦略低価格車ロガンの製造・販売を2007年4月から開始し、乗用車分野への進出を果たした。

December 02, 2010

Dow Announces Plans to Increase Ethane

Cracking Capabilities; Reviews Joint Venture Options for Natural Gas Liquids

Fractionator

The Dow Chemical Company announced today that it plans to increase ethane cracking capabilities on the U.S. Gulf

Coast over the next two to

three years, and improve its ethane cracking capabilities by 20- 30 percent in

this timeframe.

In addition, Dow announced it is reviewing joint venture options for

building a Natural Gas Liquids (NGL) Fractionator精留

to secure this supply of ethane.

Both actions are intended to capitalize on the current favorable supply dynamics

in North America, and further bolster the competitive advantage of Dow’s Plastics franchise, as well as its high-margin,

downstream performance businesses.

Dow is the world’s largest ethylene producer. The Company plans to

use its well-developed infrastructure to participate with producers in

fractionation, transportation and storage of NGLs.

Dow produces approximately 55 percent of the Company’s ethylene from ethane, and the Company’s competitive U.S. cost position provides a key

strategic advantage for its higher-margin specialty plastics businesses, such as

Linear Low Density Polyethylene, as well as its Performance and Advanced

Materials businesses.

“Ethane is

an advantaged feedstock in the United States and we anticipate a favorable oil

to gas ratio to continue,”

said Raja Zeidan, Global Business

Vice President for Dow Hydrocarbons. “Bringing additional fractionation capacity online

and expanding our ethane cracking capabilities will further improve Dow’s feedstock flexibility and competitive positions

in the United States. Couple that with our feedstock flexibility in Europe and

with our advantaged feedstock positions in the Middle East, Western Canada and

Argentina, we truly have a competitive advantage ? evidenced by the strong

returns delivered by Dow’s ethylene derivatives this year.”

November 02, 2010

Dow Elastomers Completes EPDM Expansion Project

Debottleneck helps Dow meet growing demand for

NORDEL(TM) IP, while maintaining cost-competitive position

The Dow Chemical Company has completed a

25-million-pound debottleneck project at its Plaquemine, La.,

ethylene-propylene-diene monomer (EPDM) manufacturing site. The expansion will

help Dow continue to meet growing EPDM demand among current customers.

"The excellent performance and unmatched

processing advantages of NORDEL IP Hydrocarbon Rubber continue to make EPDM an

excellent choice," said Luis Cirihal, business director at Dow Elastomers.

"NORDEL IP is an important product for Dow Elastomers and our customers. The

expansion project is a strategic investment to meet increasing demand while

maintaining Dow's cost-competitive position."

NORDEL IP's consistent structure lends

itself to easy processing and lot-to-lot consistency. Producers using this EPDM

product enjoy better control and precision that yields fewer blemishes, defects

and rejects. End-use applications include automotive weather-stripping,

automotive hoses and belts, building profiles, footwear soling and general

rubber products.

April 21, 2011 Dow

Dow

Announces Plans to Fully Integrate and Grow North American Performance

Businesses with Shale Gas Liquids

The Dow Chemical Company today announced

comprehensive plans to increase the Company’s ethylene and propylene production -- and to

integrate its U.S. operations into feedstock opportunities available from

increasing supplies of U.S. shale gas in the Marcellus and Eagle Ford shale

regions.

“The improved outlook

for U.S. natural gas supply from shale brings the prospect of competitively

priced ethane and propane feedstocks to Dow ? and the promise of new

manufacturing jobs to America,” said Jim Fitterling, Dow executive vice president

and president of Corporate Development & Hydrocarbons. “Our plan is to further integrate Dow’s businesses with the advantaged feedstocks,

based on shale gas deposits and long-term ethane and propane supply agreements.

These actions will strengthen the competitiveness of our Performance Plastics,

Performance Products and Advanced Materials businesses, for example the

Elastomers product family and the full Acrylates chain, as we continue to

capture growth in the Americas.”

Dow Increases Ethylene Supply and Ethane

Cracking Capabilities in U.S. Gulf Coast

Dow is currently finalizing plans to

increase the Company’s ethylene supply and increase its ethane

cracking capabilities at existing U.S. Gulf Coast facilities by:

- Re-starting

an ethylene cracker at the Company’s St. Charles Operations site near

Hahnville, LA by the end of 2012;

- Improving

ethane feedstock flexibility for an ethylene cracker at the Company’s Louisiana Operations site in

Plaquemine, LA in 2014;

- Increasing

ethane feedstock flexibility for an ethylene cracker at the Dow Texas

Operations site in 2016;

-

Constructing a new, world-scale ethylene production plant in the U.S. Gulf

Coast, for start-up in 2017.

Dow Increases Propylene Supply

Dow is currently finalizing plans to

increase the Company’s propylene supply by:

-

Constructing a new, world-scale, on-purpose propylene production facility at

Dow Texas Operations, for start-up in 2015;

- Exploring

an option to commercialize its own technology to produce propylene from

propane, with the potential start-up of a new production unit in 2018.

Dow Pursues Additional Feedstocks from

the Eagle Ford and Marcellus Shale Regions

Dow plans to supply the required ethane

and propane for these projects through a variety of supply arrangements,

including: a possible joint venture fractionator in Texas, supply from existing

fractionators, supply from future new fractionators to be built within the

industry, and potential supply deals from various shale gas opportunities such

as the Eagle Ford and Marcellus shale regions. Dow has signed ethane and propane

supply contracts based on the Eagle Ford shale gas and is pursuing several more

agreements from this area.

In addition, Dow has signed a Memorandum

of Understanding (MOU) with a wholly-owned subsidiary of Range Resources

Corporation (NYSE: RRC), stating plans to enter into a long-term supply

agreement for the delivery of ethane from the Marcellus Region in southwest

Pennsylvania to Dow’s existing operations in Louisiana.

“As the largest

consumer of propylene in North America, Dow has a unique opportunity to invest

aggressively for on-purpose propylene production from propane. Additionally, Dow

is the largest producer of ethylene in North America, which provides

capabilities to increase our use of ethane in existing ethylene production units

? and to grow,” Fitterling said. “All of these investments, combined with Dow’s planned agreement with Range Resources, will

dramatically increase our capability to consume ethane, while maintaining our

industry-leading feedstock flexibility.”

About Range Resources Corporation

Range Resources Corporation is among the

leading independent natural gas companies operating in the United States through

subsidiaries in both the Appalachia and Southwest regions of the country. The

Company has pioneered the Marcellus Shale development since 2004. Range has a

dominant position in the southwestern portion of the Marcellus Shale development

associated with the liquid-rich area which will be the source of the ethane

production. Range is currently the largest producer of natural gas liquids in

Appalachia. Range pursues an organic growth strategy at low finding costs by

exploiting a multi-decade inventory of drilling opportunities. Range replaced

with the drill-bit 840% of its production in 2010 with new proved reserves at a

finding and development cost of $0.70 per mcfe primarily from its Marcellus

holdings. At December 31, 2010, Range had 4.4 Tcfe of total proved reserves, a

42% increase over the prior year and a 25% increase in proved developed

producing reserves. In addition, Range estimates 35 to 52 Tcfe in net unrisked

resource potential from its unbooked drilling inventory and emerging plays.

June 6, 2011 Bloomberg

Dow, Aksa of Turkey in Talks to Form

Carbon Fiber Joint Venture

Dow Chemical Co. (DOW), the largest U.S.

chemicals manufacturer, and Aksa Akrilik Kimya Sanayii (AKSA) AS, a Turkish

maker of synthetic acrylic fibers, are in talks to form a joint venture to make

carbon fiber and derivatives, the companies said.

Dow and Istanbul-based Aksa signed an

accord to “examine opportunities to develop and market a

broad range of products and technical service offerings in the carbon

fiber-based composites industry,”

the companies said today in a

statement.

The manufacturers will work on products

aimed at “increasing the energy capture of wind turbines,

improving the fuel economy of automobiles, and extending the life of roads and

buildings,”

Andrew Liveris, chairman and chief

executive officer of Midland, Michigan-based Dow, said in the statement.

Aksa planned to double its annual carbon fiber production to 3,000 tons in 2010,

Chairman Mehmet Ali Berkman said last year. That compares with total global carbon fiber

production capacity of 30,000 tons a year, he said. The fibers are used in ships, planes,

wind turbines, sports equipment and other products.

東レ 17,900

東邦テナックス 13,500

三菱レイヨン 8,150

小計 39,550

2006/9/9

炭素繊維

Aksa is the world’s largest producer of acrylic fiber, with more

than 13 percent of the worldwide market, the Turkish company said in the

statement. The manufacturer had revenue of about $850 million last year and

expects to exceed $900 million this year, it said.

ーーー

June 06, 2011 Dow

Dow and Aksa

Sign Memorandum of Understanding to Form Integrated Carbon Fiber and Derivatives

Joint Venture

Business to offer carbon fiber and derivatives to

growing energy, transportation and infrastructure markets

The Dow Chemical Company, through its

wholly-owned subsidiary Dow Europe GmbH, and Aksa Akrilik Kimya Sanayii (Aksa)

today announced a Memorandum of Understanding (MOU) with the intent to form a

joint venture to manufacture and globally commercialize carbon fiber and

derivatives.

Through this agreement, both companies

will work together to explore opportunities to create fully-integrated

production facilities for the manufacture and global supply of carbon fibers and

derivatives. The companies will examine opportunities to develop and market a

broad range of products and technical service offerings in the carbon

fiber-based composites industry.

“This new partnership

with Aksa is another example of how Dow continues to advance its innovation

agenda and broaden our down-stream, integrated solutions offering,” said Dow Chairman and CEO Andrew N. Liveris.

“Together, Aksa and Dow will apply science,

world-class manufacturing capabilities and technical expertise to deliver

innovative solutions that address some of the world’s most pressing challenges such as increasing the

energy capture of wind turbines, improving the fuel economy of automobiles, and

extending the life of roads and buildings.”

Very strong and lightweight,

carbon-fiber based materials are used in a variety of applications in many

growth industries, such as wind energy, transportation, and infrastructure,

where weight savings, durability and energy efficiency are key performance

factors.

“By partnering with a

global leader such as Dow, we will further strengthen Aksa’s leadership position in both our local community

and global markets. Aksa has been a pioneer at introducing new products and

technologies and with this partnership will accelerate our pace in the future.

In addition to the continued efforts of our dedicated, hard working, competent

employees, we also count on strong contributions of all our partners in the

process chain, including our governments, to create and meet the demand for this

interesting new technology,”

said Mehmet Ali Berkman, Chairman

of the Board of Aksa. “This technology race to develop carbon fiber

composites will offer improved products and solutions for the betterment of

mankind.”

“By partnering

together, Aksa and Dow will create the carbon fiber composites industry’s only large scale, full-service, fully

integrated solution provider serving the growing needs of the world’s leading industries,”

stated Heinz Haller, Dow’s Executive Vice President and Chief Commercial

Officer. “Current megatrends underpin increasing demand for

alternative energy resources as well as safer, more efficient vehicles.

Therefore, innovative technologies that deliver strong, light-weight materials

are in great demand. This partnership combines the individual strengths of each

company to provide the market with better solutions while also helping solve

some of the world’s most pressing challenges.”

“Today, the fiber

composite market is experiencing tremendous growth on a global scale and,

customers are not only demanding products that perform better, they need

suppliers that combine reliability, technical expertise and affordability,”

said Mustafa Yilmaz, Aksa Board

Member. “As the world’s largest producer of acrylic fibers and a carbon

fiber producer since 2008, Aksa is very excited about the opportunity to partner

with Dow to explore large, downstream opportunities, and expand our carbon

fiber-based product offering world-wide. By combining our technical and market

knowledge and our significant positions in industry, we will accelerate the

development and commercialization of these new products and at the same time

raise the industry standard for performance.”

About AKSA

AKSA Akrilik Kimya Sanayii is the world’s largest producer of acrylic fiber with 308.000 mt per

year capacity and more than 13% market share of the worldwide

market. Products include acrylic textile fibers, technical fibers, and carbon

fiber. Aksa’s mission is to be the choice for acrylic-based

textiles and technical fibers, to work efficiently and in harmony with the

environment, to be innovative and customer focused. Aksa has around 1,000

employees working at its production site in Yalova Turkey and offices in

Istanbul. Aksa’s turnover in 2010 was more than US$850 million,

and is expected to exceed $900 million in 2011. Aksa is a member of the AKKÖK Group of Companies

which is comprised of 40 companies operating in Turkey’s chemical, energy, real estate and textile

sectors. The Group has more than 4.000 employees. In 2010, the Group’s turnover was more than US$2.5 billion. More

information about Aksa can be found at www.aksa.com.

Akrilik Kimya Sanayi Anonim ?irketi

is a accompany affiliated with the AKKÖK Group of Companies and was established in

1968. AKSA began to produce fiber in 1971 at its factory in Yalova, with a

capacity of 5000 tons/year. In 1974 AKSA began to increase its capacity and

reached a capacity of 100,000 tons in 1986 , 200,000 tons in 1997 and

finally 300,000 tons in 2007. Today our annual

production capacity is 308.000 tons. AKSA is the “world's largest acrylic fiber producer under

a single roof”.

Without receiving any external

support and solely with the effort

of its technical staff, AKSA

began in 2006 to develop a technology of its own ito manufacture carbon

fiber. Today this study has reached to a production phase.

--------------------------

December 20, 2011 Dow

Dow and Aksa Sign Joint Venture Agreement for Carbon Fiber and Derivatives

・Business to offer integrated carbon fiber composite solutions to growing

energy, transportation and infrastructure markets globally

・JV expected to invest up to $1 billion U.S. dollars within 5 years; potential

to create up to 1,000 jobs in Turkey

2011/6/17 SABIC、カーボンファイバーの技術導入;DowもJV設立の覚書

The Dow Chemical Company, through its wholly-owned subsidiary Dow Europe

GmbH, and Aksa Akrilik Kimya Sanayii A.Ş. today signed a definitive

agreement to form a joint venture to manufacture and

commercialize carbon fiber and derivatives.

The joint venture will develop and globally market a broad range of products and

technical service support in the rapidly expanding carbon-fiber based composites

industry. Very strong and lightweight, carbon-fiber based materials are used in

a variety of applications in growth industries such as wind energy,

construction, transportation, and infrastructure, where weight savings,

emissions reduction, durability and energy efficiency are key performance

factors. Currently, the carbon fiber composites industry is estimated at $10

billion U.S. dollars globally and is expected to reach $40 billion US dollars by

2022.

Under terms of the agreement, Dow and Aksa will each hold

a 50 percent stake in the joint venture. Following initial equity

investments from the two companies, the JV will finance its growth through cash

flow from operations and financial institutions. Total investment in the

project, including third party investments, is expected to reach

$1 billion U.S. dollars in five years and create up to 1,000 employment

opportunities.

The JV will expand on Aksa’s existing carbon fiber

production assets in Yalova, Turkey, and will capture growth by creating

a large-scale, integrated production capability for the manufacture and supply

of advanced carbon fiber technologies. The venture will have a particular focus

on bringing solutions to market that reduce overall costs, thereby enhancing

economics and driving adoption in a broader array of markets.

Dow Chairman and CEO Andrew Liveris said, “This partnership with Aksa is

another strong example of how Dow is advancing its innovation and growth

strategy, and demonstrates our unwavering commitment to invest in high-value,

innovation-rich sectors through strategic partnerships. Together our companies

will apply science, world-class manufacturing capabilities and technical

expertise to deliver innovative solutions that address some of the world’s most

pressing challenges, such as increasing the energy capture of wind turbines,

improving the fuel economy of automobiles, and extending the life of roads and

buildings.”

Akkök Group of Companies Chief Executive Officer and Aksa Board Chairman Mehmet

Ali Berkman said, “Making Turkey the second biggest acrylic fiber market in the

world with its leading position in technical fiber and production capacity in

acrylic fiber, AKSA has achieved an important position in the international

market with the carbon fiber. Carbon fiber composites, which will replace metal

as the material of the future, have significant importance for fundamental

industries in Turkey such as transportation (automobile, high-speed train,

vessels, heavy vehicles, etc.), wind energy technologies and construction,

particularly for earthquake-resistant buildings. The recognition of carbon fiber

and carbon fiber composites within the scope of strategically important

industries will enable Aksa and Dow to expand their joint investment targets and

create significant economic value and employment for Yalova. In addition, this

cooperation will contribute to 2023 targets of the Government of Republic of

Turkey by creating significant added value and employment in energy efficiency,

renewable energy, infrastructure investments and increasing exports.”

Executive Vice-President and Chief Commercial Officer Heinz Haller said, “This

joint venture will leverage Dow’s expertise in composites technology,

formulation, and technical service as well as market knowledge and channels.

Upon completion, the joint venture will be the carbon fiber composites

industry’s only large-scale, full-service, integrated solution provider, serving

the emerging needs of the world’s leading industries. With this agreement, we

aim to create competitive advantage in the global markets in which carbon fiber

composites are used.”

İlker Aycı, President of Turkey’s Investment Support and Promotion Agency, said,

“This joint venture represents advancement for Turkey’s industrial and economic

diversification into strategically important critical industries aimed at

providing value-added solutions to significant and expanding regional and global

markets. We are pleased about the formation of an enterprise that will meet the

increasing demand for fiber composite technology and bring an opportunity for

significant impact on the expansion of value-added exports.”

The joint venture agreement was signed today in a meeting attended by Minister

of Industry and Trade Nihat Ergün, President of Turkey’s Investment Support and

Promotion Agency İlker Aycı, Dow Executive Vice President and Chief Commercial

Officer Heinz Haller and Akkök Group of Companies Chief Executive Officer and

Aksa Board Chairman Mehmet Ali Berkman.

AKSA Akrilik Kimya Sanayii A.Ş. is the world’s largest producer of

acrylic fiber with 308,000 tons per year capacity

and more than 14,2 percent share of the worldwide market. Products include

acrylic textile fibers, technical fibers, and carbon fiber. Aksa’s mission is to

be the choice for acrylic-based textiles and technical fibers, to work

efficiently and in harmony with the environment, to be innovative and customer

focused. Aksa has around 1,000 employees working at its production site in

Yalova Turkey and offices in Istanbul. Aksa’s turnover in 2010 was more than

US$850 million, and is expected to exceed $900 million in 2011. Aksa is a member

of the AKKÖK Group of Companies which is comprised of 15 companies operating in

Turkey’s chemical, energy, real estate and textile sectors. The Group has more

than 3,200 employees. In 2010, the Group’s turnover was more than US$2.7

billion. More information about Aksa can be found at www.aksa.com.

--------------------------

June 29, 2012 Dow

Talks

Dow and Aksa Announce Formation of Joint

Venture for Carbon Fiber and Derivatives

DowAksa to focus on solutions that reduce overall costs, thereby enhancing

economics and driving adoption in a broader array of industrial markets

Emphasis to be on integrated carbon fiber composite solutions for growing

energy, transportation and infrastructure markets globally

The Dow Chemical Company, through its wholly-owned subsidiary Dow Europe Holding

BV, and Aksa Akrilik Kimya Sanayii A.Ş., a world-leading acrylic fiber company,

today announced the official formation of DowAksa Advanced

Composites Holdings BV (DowAksa), a joint venture (JV) to manufacture and

commercialize carbon fiber and derivatives. Aksa and Dow had previously signed a

definitive agreement to form the JV on December 20, 2011.

DowAksa will develop and globally market a broad range of products and technical

service support in the rapidly expanding carbon-fiber composites industry. The

JV will have a particular focus on bringing solutions to market that reduce

overall costs, thereby enhancing economics and driving adoption in a broader

array of markets. Emphasis will be on bringing cost-effective solutions to

industrial market applications for energy, transportation, and infrastructure

globally.

Very strong and lightweight, carbon-fiber based materials are used in a variety

of applications in growth industries, where weight savings, emissions reduction,

durability, and energy efficiency are key performance factors. Currently, the

carbon fiber composites industry is estimated at USD $10 billion globally and is

expected to reach USD $40 billion by 2022.

Aksa’s carbon fiber which is the output behind the R&D’s success, has been being

produced since 2009 in the Yalova Factory. The JV will

expand on existing carbon fiber production assets in Yalova, Turkey, and

will capture growth by creating a large-scale, integrated production capability

for the manufacture and supply of advanced carbon fiber technologies.

Aksa and Dow each hold a 50 percent stake in the

JV, which will finance its growth through cash flow from operations and

financial institutions.

Dow Chairman and CEO Andrew Liveris said, “The formation of this JV is another

demonstration that Dow is advancing its innovation and growth strategy and our

commitment to pursue high-value, innovation-rich sectors through strategic

partnerships. Together our companies will apply science, world-class

manufacturing capabilities and technical expertise for innovative solutions that

address pressing global challenges, such as improving the fuel economy of

automobiles, and extending the life of roads and buildings.”

Akkök Group of Companies Chief Executive Officer and Aksa Board Chairman Mehmet

Ali Berkman said, “Already a world leader in acrylic fiber, Aksa took steps in

2011 in the carbon fiber sector with the target of increasing market share

through investment in manufacturing capacity and productivity. With the

formation of the joint venture, we are pleased that our carbon fiber

technologies and production capabilities in Turkey will be essential to

DowAksa’s future as world leader in advanced carbon fiber and derivatives.

Carbon fiber composites, which are expected to replace metal as the material of

the future, have significant importance in Turkey and around the world for

fundamental industries such as transportation (automobile, high-speed train,

vessels, heavy vehicles, etc.), wind energy technologies and construction,

particularly for earthquake-resistant buildings.”

Executive Vice-President and Chief Commercial Officer Heinz Haller said, “This

joint venture leverages Dow’s expertise in composites technology, formulation,

and technical service as well as market knowledge and channels. Upon

implementation of the joint venture strategy, DowAksa will be the carbon fiber

composites industry’s only large-scale, full-service, integrated solution

provider, serving the emerging needs of the world’s leading industries and will

have competitive advantage in the global markets in which carbon fiber

composites are used.”

AKSA Board of Directors Member and Akkök Executive Board Member Mustafa Yılmaz

emphasized that the cooperation made with Dow was very significant in terms of

creating new business opportunities. “AKSA functions as a reliable business

partner for market and business world stakeholders that possesses technical

expertise and provides better performance and economical advantage. While

combining the market and technical knowledge of both companies with this joint

venture we will also provide the carbon fiber and composite industry with higher

performance products. This cooperation will also make positive contributions

towards the growth of the composite industry in our country and our region.”

2011/7/27 Braskem

Braskem becomes the leading

polypropylene producer in North America

The acquisition of the Dow Chemical Polypropylene Business, including plants in

the USA and Europe, expands Braskem´s global industrial footprint

Braskem, the leading resin producer in

the Americas, announced the acquisition of the Polypropylene Business from The

Dow Chemical Company for US$323 million. This transaction represents an

important step in Braskem’s growth strategy in the Americas and

consolidates its polypropylene leadership in the U.S.

The assets involved in the deal include two manufacturing plants in the U.S. and

two in Germany, with a total annual polypropylene production capacity of 2.3

billion pounds. The plants in the U.S. are located at Freeport, TX and Seadrift,

TX, and will increase Braskem’s polypropylene capacity by 50% in the region to

an annual production capacity of 3.1 billion pounds.

2010/2/3 Sunoco、ポリプロ事業をブラジルのBraskemに売却

Sunocoは2月1日、子会社Sunoco ChemicalsのPP事業をブラジルのBraskemに売却する契約を締結したと発表した。現金350百万ドルでの売却で、必要な承認を得て、3月末までに売却を完了する。

対象プラントはペンシルベニア州Marcus Hook、テキサス州La

Porte、ウエストバージニア州Nealにある3つで、合計能力は95万トン、米国全体のPP能力の約13%を占める。PittsburghにあるR&Dセンターも売却する。

なお、Sunocoは昨年春にテキサス州Bayportの能力18万トンの工場を閉鎖している。

このうち、La PorteとNealは同社が2000年に三菱商事から買収した旧Aristech Chemical

のプラント。

Marcus Hookは元はSunoco とBAR-L のJVの Epsilon Products のプラント。

The two plants located in Germany, at

the petrochemical complexes of Wesseling and Schkopau, have annual capacity of

1.2 billion pounds of polypropylene.

"The acquisition of Dow’s assets consolidates our leadership in

polypropylene in the U.S., the largest thermoplastic resins market, and it also

enhances our current position in Europe, an important market for our biopolymers

strategy," said Braskem’s CEO Carlos Fadigas. "In addition, as our 2nd

acquisition in the U.S., this transaction will enable Braskem to capture

approximately US$140 million in synergies (net present value) through a more

diversified portfolio, a more leveraged fixed cost base and working capital,

logistics and supply optimization," he added.

The transaction is expected to close by the third quarter 2011 pending

regulatory approvals.

Braskem remains committed to its 2020 strategic vision to become the world

leader in sustainable Chemistry, innovating to better serve people.

---

Dow

The Dow Chemical Company announced today

that it has signed a definitive agreement under which Dow’s global Polypropylene business will be divested

to Braskem for a total enterprise value to Dow of $340 million, comprised of

$323 million cash purchase price plus other cash and contingency assumptions of

$17 million. Enterprise value multiple to Dow is 6.7x EBITDA(1).

Dow expects to report a gain on this divestment, and the transaction is expected

to close by the end of the third quarter 2011, pending

regulatory approval. In addition to this transaction, the two companies will

continue to evaluate potential future collaborations on growth opportunities in

connection to their strategies.

“This divestiture is

yet another strong example of Dow’s disciplined and ongoing approach to portfolio

management and is directly aligned with our strategy to transform our

Performance Plastics franchise to focus on downstream, technology-differentiated

solutions,”

said Andrew N. Liveris, Dow's

Chairman and Chief Executive Officer. “This business has delivered historic margins that

do not meet our expectations moving forward and is no longer core to Dow’s strategy. We are shifting our Plastics

portfolio from a commodity focus to that of a performance focus. This divestment

is directly in line with that strategy, and allows us to continue to focus on

our three main priorities: retiring debt, remunerating shareholders and

investing in our innovation agenda so that we deliver consistent earnings

growth.”

The divestiture includes Dow’s polypropylene manufacturing facilities at

Schkopau and Wesseling, Germany, and Freeport and Seadrift(2),

Texas. Also included are inventory, business know-how, certain product and

process technology and customer contracts and lists.

Approximately 200 employees are expected

to transition employment status to Braskem at transaction close. Dow’s Polypropylene Licensing & Catalyst business and

related catalyst facilities are excluded from the scope of the transaction.

Under terms of the purchase agreement,

Braskem will honor customer and supplier contracts and related agreements. Both

companies are committed to working together for a seamless transition for all

stakeholders.

1 EBITDA is

defined as earnings (i.e., “Net Income”) before interest, income taxes,

depreciation and amortization.

2 The

Seadrift site is owned by Union Carbide Corporation, a wholly owned subsidiary

of The Dow Chemical Company.

August 22, 2011 Dow

Qinghai Salt Lake Industry, Co. Selects

UNIPOL™ Polypropylene Technology for PP Project

UNIPOL PP Process Technology chosen for simplicity, low investment cost and

broad product range

Popularity for UNIPOL PP Process Technology in China continues to grow

The Qinghai Salt Lake Industry Co.

青海塩業股份 has

selected UNIPOL™ Polypropylene Process Technology from The Dow Chemical Company

(Dow) for its new 160 KTA polypropylene unit. The

unit will provide polypropylene as part of Qinghai’s

integrated magnesium metal project to produce homopolymers, random

copolymers and impact copolymers.

マグネシウム

ダウ法

海水に石灰乳を加えて水酸化マグネシウムを沈殿させ、次に塩化水素を加えて塩化マグネシウムとしてから脱水処理した含水塩化マグネシウムを原料とします。これを電解し、マグネシウムと塩化水素を生産する方法。(米 Dow

Chemical Co.)

新電解法

海水を浄化と濃縮することにより良質の塩化マグネシウムを作り、脱水してから電解をする方法。

ピジョン法

焼成ドロマイトとケイ素鉄との混合ペレットを高温真空で加熱し、ケイ素の還元作用でできたマグネシウム蒸気を冷却部で凝結させる方法。

The world's production of metal magnesium currently adopts two methods:

the Pidgeon process and the electrolytic process. As the Pidgeon process

features a number of advantages including smaller investment, lower cost,

shorter construction span and easier control, it has become the globally

dominant method, which is adopted by all Chinese magnesium producers.

In contrast, the electrolytic method entails the utilization of anhydrous

magnesium chloride as its feed stock, the preparation of which involves

knocking off the crystalline water in bischofite at harsh operating

conditions, resulting in severe corrosion. Extended studies on resolving

this issue have been conducted for years in China, but no industrial

application of the electrolytic process has been witnessed so far.

Qinghai Province is known for its huge deposits of magnesium

chloride resources. ISL strives to boost the development of novel processes

for producing metal magnesium using salt lake magnesium chloride resources.

The institute initiated the key provincial project of Study on a Clean

Process for Producing Metal Magnesium from Salt Lake Magnesium Chloride

in 2008. The project involved preparing the lightest structural

metal–magnesium, which has a much promising outlook of applications, using

salt lake magnesium chloride and industrial by-product lime, whereby a novel

proprietary process has been developed and consolidated by one patent grant

and another pending application.

The method circumvents the huge emission of gaseous

pollutants such as carbon dioxide and sulfur oxides characterized by

conventional Pidgeon process, by synthesizing its intermediate raw material

calcined dolomite. Thus, clean production of metal magnesium by the improved

Pidgeon process can truly be realized. Besides, the calcination temperature

for calcined dolomite has been greatly lowered and the reduction time

substantially shortened, thereby meeting the mechanism of the circular and

low carbon economy. The process can produce magnesium ingots meeting the