アルミ、アルミナ

Aluminum Corporation of China Limited (“Chalco”)

2006/12 CHALCO Starts up Alumina Project

2006/8/11 Chalco signed an agreement for acquisition of 51% equity interest in Gansu Hualu Aluminum

2006/7/14 Chalco Signed an Agreement to Acquire 55% Equity Interest of Huayu Aluminmum and Power

2006/6/19 Chalco Signed a Cooperation Agreement to Acquire 66.4% Equity Interest of Zunyi Aluminum

2006/3/11 Chalco Signs a Share Transfer Contract with Fushun Aluminum Plant

2004/8 中国アルミ、ブラジルでアルミナJV

2004/6/17 Chalco Entered into the Letter of Intent on Cooperation with Lanzhou Aluminum

2005/10 800 000 T/A Alumina Expansion Project Starts Production in Shanxi

2005/11 NDRC Approves Aluminum Oxide Project of Jinbei Aluminum

Qingtongxia Aluminum Industry Group

2006/8/12 Swiss firm eyes China aluminum deal

2004/3/10 Alcan and Qingtongxia Aluminum Company Finalize Joint Venture

| 2006/8/14 http://www.tmcnet.com/usubmit/-chalco-continues-china-takeover-/2006/08/14/1793683.htm Those moves result partly from the fiercer competition brought by home rival. Qingtongxia Aluminum Industry Group, the No. 2 aluminum maker in China by output, last Friday agreed to sell some stake to Glencore International AG, the world's largest commodities trader based in Switzerland. Based in the northwest, Qingtongxia Aluminum expects to increase the annual aluminum capacity to 700,000 tons by 2010 from the current 430,000 tons. State-owned Chalco vows to lift the primary aluminium annual capacity to around 3 million tons this year from 2005's 1.5 million tons and the alumina annual capacity to 12 million tons in the next three years from 2005's 8.33 million tons. (USD 1 = CNY 7.9) |

Chalco http://www.chinalco.com.cn/english/about/introduction.htm

We

are the only producer of alumina and the largest producer

of primary aluminum

in China, the fastest growing major aluminum market in the world.

Alumina and primary aluminum are our principal products. Alumina

is refined from bauxite through a chemical process and is the key

raw material for producing primary aluminum, which in turn is a

widely used metal and the key raw material for aluminum

fabrication.

We produced approximately 4.3

million tonnes of alumina products (including alumina, alumina

hydrate and alumina chemicals) in 2000, which supplied

approximately 70% of all alumina products consumed in China in

that year and which made us the third largest producer of alumina

in the world. Our alumina production has increased rapidly in the

past five years, and we expect to continue to capture the growth

of China's alumina market through ongoing expansion. From 1996 to

2000, our alumina production grew at a compound annual rate of

14.0%.

Our primary aluminum production

(including aluminum ingots and other primary aluminum products)

of 669,800 tonnes in 2000 accounted for approximately 23.7% of

China's domestic primary aluminum production and approximately

20.8% of domestic primary aluminum consumption for 2000. From

1996 to 2000, our primary aluminum production grew at a compound

annual rate of 12.1%.Sales of our alumina and primary aluminum

products combined accounted for 95.0% and 92.5% of our total

revenues in 2000 and in the six months ended June 30,

2001,respectively.

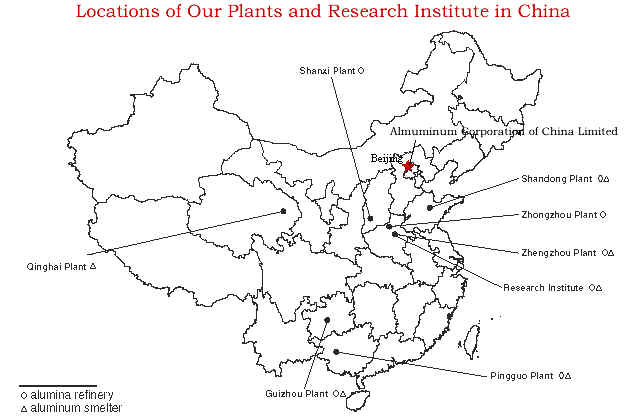

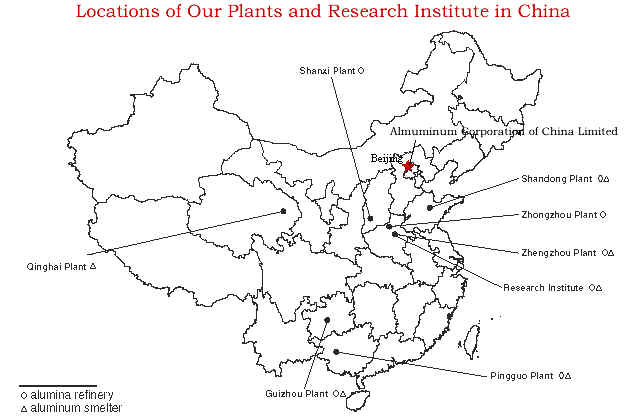

Our key operating assets include

four integrated alumina and primary aluminum production plants,

two alumina refineries, one primary aluminum smelter and one

research institute. Our refineries are located in reasonable

proximity to abundant bauxite reserves .The map below indicates

the locations of our alumina refineries, primary aluminum

smelters and Research Institute in China.

We were established on September 10, 2001 as part of the restructuring of China's state-owned aluminum industry. Aluminum Corporation of China, or Chinalco, was formed on February 21, 2001 to own and operate 12 state-owned entities engaged in the production and distribution of alumina, primary aluminum, fabricated aluminum products and other products. In connection with our formation, Chinalco transferred to us substantially all of its business and assets relating to the production and sales of alumina and primary aluminum in exchange for shares in our company.

Chalco , Aluminum

Corporation of China Limited , is the sole producer of

alumina and gallium and

also the

largest producer of primary aluminum , alumina chemicals , anode

and cathode blocks

in China. Its main assets include four integrated alumina and

aluminum plants ( Shandong Branch , Zhengzhou Branch , Guizhou

Branch and Pingguo Branch ) , two alumina refineries ( Shanxi

Branch and Zhongzhou Branch ) , one aluminum smelter ( Qinghai

Branch ) and one research institute (Zhengzhou Light Metals

Research Institute).

The Guangxi Branch 広西壮族自治区

The Guangxi Branch commenced operations in 1994 and is located in Guangxi Zhuang Autonomous Region in southwestern China, an area rich in bauxite resources. The Guangxi Branch is our newest alumina and primary aluminum plant, and is equipped with imported facilities and technology. It is one of the most technologically advanced alumina and primary aluminum plants in China. It is also the third largest smelter in China in terms of production volume.Guizhou Branch 貴州

Our primary aluminum production facilities in Guizhou Branch Province commenced operations in 1966 and have undergone numerous upgrades in technology since its establishment. With an annual production capacity of 235,000 tonnes, the Guizhou Branch is China's largest primary aluminum plant in terms of production volume. Its primary aluminum facilities consist of three large-scale pre-baked reduction pot-lines, ranging from 160 kA to 186 kA. As a result of technological innovations and overhauls since its inception, our Guizhou Branch is among the most technologically advanced smelters in China. Its primary aluminum products are sold primarily in southwestern China.Zhengzhou Branch 河南省鄭州

Our Zhengzhou Branch is located in Zhengzhou, Henan Province, a province rich in bauxite resources. Its alumina and primary aluminum production commenced operations in 1966 and 1967, respectively. The Zhengzhou Branch was the first refinery in China to develop the hybrid Bayer-sintering process. Since its inception, its production facilities have undergone substantial technological upgrades, based on equipment imported from Germany and Denmark. The refinery has also benefitted from its access to high alumina-to-silica ratio bauxite from our own mines and through local market purchases. It retains part of its alumina output for its primary aluminum production, and sells the remainder to our other smelters and external customers.Shandong Branch 山東

The Shandong Branch commenced operations in 1954 and has both alumina and primary aluminum production capacity. Its refinery was China's first production facility for alumina. Both the refinery and smelter are owned and operated by Shandong Aluminum, a joint stock limited company whose class A ordinary shares have been publicly offered to investors in the PRC and are listed on the Shanghai Stock Exchange. We currently hold a 71.4% equity interest in this listed company.

The Branch produces the majority of its alumina through the sintering process, but has a small production line to produce alumina through the Bayer process using imported bauxite. The Bayer production line is currently being converted into an ore-dressing sintering operation. The Shandong Branch purchases the majority of its bauxite requirements from small independent mines in Henan and Shanxi Provinces. The refinery supplies all of the alumina needs for the Branch's primary aluminum production.Qinghai Branch 青海

Located in Qinghai Province, our Qinghai Branch is a stand-alone primary aluminum production facility and is also China's second largest smelter by production volume. This Branch commenced operations in 1987, and together with our Guangxi and Guizhou Branchs, stands at the technological forefront of primary aluminum smelters in China. It operates automated 160 kA pre-baked anode reduction pot lines that were developed domestically. It benefits from relatively low electricity costs in Qinghai Province resulting from substantial hydroelectric power stations in the region. Historically, the Branch has relied on our hanxi, Shandong, Zhengzhou and Zhongzhou Branchs for its alumina supply, as well as imported alumina. Because of its relatively remote location, the Branch incurs higher transportation costs for both raw materials and its primary aluminum products. It sells its products in southwestern and southern China.Shanxi Branch 山西

The Shanxi Branch commenced operations in 1987 and is located in Shanxi Province, a province with the largest bauxite deposits in China. Our Shanxi Branch is a stand-alone alumina Branch and is currently China's largest alumina Branch in terms of production volume.

The Shanxi Branch's production facilities are primarily imported and are technologically advanced compared with other domestic alumina refineries. A portion of the facilities are currently undergoing technical upgrade, the completion of which is scheduled during 2000. The Branch relies on bauxite from our own mines as well as outside purchases principally from Henan Province. In close proximity to large coal mines and substantial water resources, the Branch currently has the largest power cogeneration capacity of all of our alumina Branchs. It has historically been a main supplier of alumina to our Qinghai Branch and sells the rest of its output in northern and northeastern China.Zhongzhou Branch 河南省

Situated in Henan Province, our Zhongzhou Branch is a stand-alone alumina Branch, located near bauxite, coal and water supplies. The Branch commenced operations in 1993 and is equipped with imported and self-developed technology and has undergone various improvements and upgrades, including improved sintering technology. It sources bauxite in Henan and Shanxi Provinces. The Branch's alumina and other alumina products are sold mainly within Henan Province and it is also a supplier of alumina to our Qinghai Branch.

Chalco signed an

agreement for acquisition of 51% equity interest in Gansu Hualu

Aluminum

On 11 August 2006, Aluminum Corporation of China

Limited (“Chalco”) entered into an

agreement with Baiyin Nonferrous Metal (Group) Co. Ltd. (“Baiyin Nonferrous”) and Baiyin Honglu Aluminum Co.

Ltd. (“Baiyin Honglu”) in relation to the share

transfer of Gansu Hualu Aluminum Co. Ltd.(“Hualu Aluminum”).

Chalco

will acquire 51% equity interest in Hualu Aluminum held by Baiyin

Honglu and become the controlling shareholder after the

acquisition. The remaining 49% equity interest will be held by

Baiyin Honglu, which may transfer to Baiyin Nonferrous in future.

Hualu Aluminum owns production lines for aluminum smelting with

annual production capacity of 127,000 tonnes and their ancillary facilities.

The registered capital is RMB529 million. As of 31 December 2005,

the audited total asset and the net assets were valued at

RMB1,590 million and RMB529 million respectively. The entire

consideration payable by Chalco for the acquisition is RMB270

million.

中国アルミが、2.7億元(約39.1億円)で白銀紅鷺アルミから甘粛華鷺アルミの株式51%を買収すると発表した。取引完了後、白銀紅鷺アルミの持ち株比率は49%となる。

華鷺アルミは年間12.7万トンの電解アルミを生産。昨年末の総資産は15.9億元(約230.37億円)、純資産は約5.29億元(約76.64億円)。

Chalco Signed an Agreement to Acquire 55% Equity Interest of Huayu Aluminmum and Power

On 14 July 2006, Aluminum

Corporation of China Limited (“Chalco”) signed an agreement with Linyi

Jiangtai Aluminum Company Limited (臨沂江泰) (“Linyi Jiangtai”) and Shandong Huasheng Jiangquan

Thermal and Power Company Limited (山東華盛江泉熱電有限公司) (“Huasheng Jiangquan”) in respect of the share transfer

of Shandong Huayu Aluminum and Power Company Limited (山東華宇) (“Huayu Aluminum and Power”).

Chalco

will acquire 40.69% and 14.31% equity interest in Huayu Aluminum

and Power

held by Linyi Jiangtai and Huasheng Jiangquan respectively.

Following the Acquisition, Chalco will hold 55% equity interest

of Huayu Aluminum and Power, and Linyi Jiangtai and Huasheng

Jiangquan will remain to hold 25% and 20% equity interest of

Huayu Aluminum and Power respectively.

Huayu Aluminum and Power owns production lines for aluminum

smelting with production capacity of 100,000 tonnes and their ancillary facilities

and two 13.5MW generation units. As at 31 December 2005, the

audited net assets was approximately RMB899 million. The entire

consideration payable by Chalco for the Acquisition is RMB412

million.

2006/1/9 Chalco

Letter of Intent of Cooperation between Chalco and Huasheng Jiangquan

On January 9, 2006, Chalco entered into a letter of intent for cooperation with Shandong Huasheng Jiangquan Group Co., Ltd. ("Huasheng Jiangquan") and Linyi Municipal Government of Shandong Province. Pursuant to the letter of intent, Chalco will acquire 60% of equity interests in a new company owned by Huasheng Jiangquan, including a production line with annual capacity of 100,000 tonnes of aluminum and ancillary facilities and 2 x 135MW coal-fired generating units.

Chalco Signed a Cooperation Agreement to Acquire 66.4% Equity Interest of Zunyi Aluminum 遵義

On 19 June 2006, Aluminum

Corporation of China Limited (“Chalco”) jointly signed a Cooperation

Agreement with Wujiang Hydropower Development Corporation Ltd. (“Wujiang Hydropower”), State-owned Asset Investment

and Operation Company Limited of Zunyi Municipal(遵義市國有資産投資經營有限公司), State-owned Asset Investment and

Operation Company Limited of Zunyi County(遵義縣國有資産投資經營有限公司), Guizhou Provincial Resources

Development Company(貴州省資源開發總公司), China Non-ferrous Metal

Industrial (Guiyang) Company(中國有色金屬工業貴陽公司), Guizhou Qianneng (Holdings)

Company(貴州黔能企業(集團)公司), Guizhou Aluminum Factory(貴州?廠), China Orient Asset Management

Corporation and Zunyi Municipal Resources Development Company(遵義市資源開發公司)to acquire a portion of the equity

interest of Zunyi Aluminum Co. Ltd. (“Zunyi Aluminum”) held by Wujiang Hydropower and

all equity interest of Zunyi Aluminum held by other 8 companies.

The effective of the equity interest in Zunyi Aluminum held among

Wujiang Hydropower and other 8 companies shall be subject to the

final approval of superior administration. Upon the acquisition, Chalco will hold

66.4% of the equity interest of Zunyi Aluminum.

Zunyi Aluminum owns production lines for aluminum smelting with

production capacity of 113,000 tonnes and their ancillary facilities.

As at 12 December, 2005, the audited total assets and net assets

were approximately RMB1,023 million and RMB307 million

respectively. The entire consideration payable by Chalco for the

Acquisition is RMB219 million.

Chalco Signs a Share

Transfer Contract with Fushun Aluminum Plant

On March 11, 2006, Aluminum Corporation of China Limited (“Chalco”, stock code: 2600) signed a share

transfer contract with Fushun Aluminum Plant, by which Fushun

Aluminum Plant will transfer its 100% equity in

Fushun Aluminum Company Limited (“Fulv Company”) to Chalco.

Fulv Company is mainly engaged in production of primary aluminum

and carbon products, with smelting capacity of 140,000

tonnes in

2005. As of the end of February 2006, the evaluated total assets

and net assets were RMB1,270 million and RMB503 million

respectively. The consideration amounted to RMB500 million.

2005/12/15 Chalco

Understanding Memorandum entered between Chalco and Vietnam

Charcoal Group in relation to the jointly development of Dak Nong

Project in Vietnam

Aluminum Corporation of China Limited (“Chalco”, Stock code: 2600) has entered

into an Understanding Memorandum with Vietnam Charcoal

Group in

connection with the jointly development of Dak Nong Project in

Vietnam.

The project includes bauxite mining, alumina production

and the feasibility study of power generation plant development

and smelting integration. There are two phases for the

development of alumina project. The annual production capacity is

1,900,000 tonnes in the first phase and it is planned to reach

4,000,000 tonnes in annual production capacity in the second

phase.

2004/6/17 Chalco

Chalco Entered into the Letter of Intent on Cooperation with

Lanzhou Aluminum 蘭州

The signing

ceremony in respect of the letter of intent on cooperation

between Aluminum Corporation of China Limited (“Chalco”; SEHK: 2600, NYSE: ACH) and Lanzhou Aluminum

Corporation Limited (“Lanzhou Aluminum”) was held in Lanzhou on June 16,

2004.

Chalco plans to acquire some portion of the state-owned legal

shares in Lanzhou Aluminum held by Lanzhou Aluminum Plant. After

the completion of the acquisition, Chalco will hold

29% of the total share capital of Lanzhou Aluminum and thereby become its largest

shareholder. The specific consideration of the acquisition

together with the terms and conditions will be finalized in the

acquisition agreement to be entered into.

Incorporated in April 1999, Lanzhou Aluminum got listed on

Shanghai Stock Exchange (A Shares, stock code: 600296)) in July

2000. The existing total share capital of Lanzhou Aluminum

comprises 540 million shares, of which 300 million are listed

shares. Lanzhou Aluminum Plant holds 42.4% of its total share

capital. After the acquisition of its 29% of share capital by

Chalco, Lanzhou Aluminum Plant will become the second largest

shareholder of Lanzhou Aluminum, holding 13.4% of its shares.

Lanzhou Aluminum mainly produces aluminum and aluminum processing

products. Its production of aluminum and aluminum processing

products in 2003 reached 209,000 tonnes and 34,000 tonnes, respectively.

The realized sales revenue and net profit amounted to RMB 2.56

billion and RMB 168 million, respectively. Earnings per share was

RMB 0.571 . Its production volume ranks third in China’s aluminum industry.

Qingtongxia 青銅峡 Aluminium, located in western Ningxia Autonomous region, was founded in 1964. It has hydropower and coal-fired power stations. The company set up the country's first aluminum joint venture with Alcan, the world's second- biggest aluminum producer, two years ago, including a 150,000- ton smelter and a coal-fired power plant.

Qingtongxia Aluminium ranks behind Aluminum Corp. of China Ltd. in Chinese production. It has capacity of more than 400,000 tons a year on top of the Alcan venture. It aims to double production to 700,000 tons by 2010, with profit exceeding 1 billion yuan ($125 million), the company said on its Web site.

The company's integrated hydro and coal-fired power stations probably added to its attraction for Glencore, said Antaike's Wang. Antaike is a research affiliate of the China Nonferrous Metals Industry Association, and advises government on industry policies. Power accounts for a third of the cost of producing aluminum.

2004/3/10 Alcan

Alcan and Qingtongxia Aluminum Company Finalize Joint Venture

Alcan will invest approximately US$150 million for a 50% stake in

world-class smelter in China

Alcan Inc. announced today it has secured the necessary

regulatory and government approvals to move forward with its

previously announced definitive joint venture

agreement with the Qingtongxia Aluminum Company ("QTX")

and the Ningxia Electric Power Development and Investment Co.

Ltd. ("NEI").

"Alcan is proud to be associated with QTX and NEI, a joint

venture that will further enhance our position in China, the

world’s fastest growing economy and the

world’s second largest consumer of

unwrought aluminum. For Alcan this joint-venture represents the

best value-creating opportunity within the Primary Metal

Group," said Cynthia Carroll, President of Alcan’s Primary Metal Group. "We

will work closely with QTX, NEI and the local authorities to

ensure the successful operation of this sustainable world-class

smelter."

Under the agreement Alcan will invest approximately US $150

million for a 50-per-cent participation

and for a secure power supply in an existing 150-kilotonne modern

pre-bake smelter located in the Ningxia autonomous region, in the Peoples’

Republic of China.

The agreement provides for the joint venture to obtain long-term

access to dedicated power on competitive terms sufficient to meet

the energy requirements of the smelter. The joint venture also

gives Alcan a substantial operating role and the option to

acquire, through additional investment, up to 80 per cent

of a new 250-kilotonne potline, already under construction.

Alcan and QTX have been working together since June 2002 to

develop this joint venture project. The joint venture will be

effective on or about April 1, 2004.

Alcan is a multinational, market-driven company and a global

leader in aluminum and packaging, as well as aluminum recycling.

With world-class operations in primary aluminum, fabricated

aluminum as well as flexible and specialty packaging, aerospace

applications, bauxite mining and alumina processing, today's

Alcan is even better positioned to meet and exceed its customers'

needs for innovative solutions and service. Alcan employs 88,000

people and has operating facilities in 63 countries.

Swiss firm eyes China aluminum deal

GLENCORE International AG, a Switzerland-based commodities

trader, plans to buy a stake in China's second-biggest aluminum

maker by output, a source close to the deal told Shanghai Daily.

Glencore has entered into a memorandum of understanding with

state-owned Qingtongxia Aluminum Group Co for the acquisition,

the Swiss company's first aluminum investment in China.

The size and price of the stake will be decided after due

diligence is completed. The deal can be finalized either by

purchasing existing shares or for Qingtongxia to issue new shares

via a private placement, the source said.

"On one hand, the company buys into a Chinese aluminum

producer to secure resources as global demand rises," Pan

Shifei, an analyst at Northeast Securities Co in Shanghai, said

after being informed of the possible deal. "On the other,

capacity in Europe is declining because of higher energy costs

and environmental concerns."

Qingtongxia was founded in 1964 in the northwestern Ningxia Hui

Autonomous Region. It operates hydro and coal-fired power

stations. The firm is ranked second in China's aluminum business

after Beijing-based industry leader Aluminum Corp of China.

Qingtongxia earlier set up an aluminum joint

venture with Montreal-based Alcan Inc, the world's second-largest

aluminum producer, in Ningxia autonomous region.

GLENCORE International AG http://www.glencore.com/

Founded in 1974, Glencore initially focused on the physical marketing of Ferrous and Non-Ferrous Metals, Minerals and Crude Oil. Subsequently, the Company expanded into Oil Products and Coal as part of the Energy Products group. The acquisition of a well established Dutch Grain marketing company in 1982 created the basis for the Agricultural Products group.

Following the acquisitions of interests in production assets in mining, smelting, refining and processing, Glencore evolved from a pure physical commodity marketing company into a diversified natural resources group.

In 1987, a subsidiary of Glencore acquired 27% of the Mt. Holly Aluminium smelter in the United States. The first controlling interest in an industrial asset was secured in 1988, with the purchase of a 66.7% interest in Perubar, a Zinc/Lead mine in Peru. Today, the Company and its subsidiaries own and operate 18 large scale production assets across a range of commodities. In addition, Glencore directly or through its subsidiaries holds significant stakes in publicly listed companies Xstrata Plc. (UK), Century Aluminum (USA) and Minara Resources (Australia).

Glencore is a privately held company, wholly owned by its management and key employees.

This structure aligns the interests of shareholders with management and has developed the strong culture of excellence and teamwork which has been an important element of the Company's successful growth over the past 32 years.

The Swiss company already directly controls aluminum smelters with a capacity of 385,000 metric tons. It also owns 29 percent of the shares in Century Aluminum Co., North America's third-largest producer.

Century Aluminum was formed in 1995 by Glencore International of Switzerland as a holding company for its aluminum-producing assets. These assets consisted of Ravenswood Aluminum Corporation, an integrated producer of rolled aluminum products at Ravenswood, WV; a 26.67-percent share in a 215,000 metric-ton-per-year (mtpy) aluminum reduction plant at Mt. Holly, SC; and an alumina refinery in St. Croix that was subsequently sold.

Century became publicly owned in March 1996.Aluminium · Alumina · Bauxite

Glencore and its subsidiaries are involved in all stages of the production of primary aluminium. This includes the mining of Bauxite and refining of Alumina as feedstock for production assets owned by our subsidiaries, as well as for world markets. Glencore and its subsidiaries are also large participants in the marketing of both Aluminium and Alumina from world markets, as well as from the owned industrial assets.

The supply sources and customer bases are well diversified and underline our reputation for strong relationships amongst both market segments. Through the physical exchange of

Bauxite and Alumina of different origins, Glencore helps to optimise the production systems of a number of integrated Aluminium and Alumina producers, including those production assets owned by our subsidiaries. Our breadth of experience and role in production provide market leading expertise in the flow of these commodities.Aluminium production

A subsidiary of Glencore owns and operates 100% of the Columbia Falls Aluminium smelter

Montana 168,000 MT Aluminium

A subsidiary of Glencore owns and operates 100% of the Evergreen Aluminium smelter

State of Washington 115,000 MT Aluminium

A subsidiary of Glencore owns and operates 100% of the Kubikenborg Aluminium AB (Kubal) Aluminium smelter

Sweden 102,000 MT Aluminium

A subsidiary of Glencore owns 29% in Century Aluminum Company, a NASDAQ-quoted company whose assets include: the Ravenswood Aluminium smelter

Ravenswood, WV 170,000 metric tons a year

a 49.7% equity interest in the Mt. Holly Aluminium smelter

(Alcoa, Inc. 50.3%) Goosecreek, SC 222,000 metric tpa

a 100% equity interest in the Hawesville Aluminium smelter

Hawesville, KY 244,000 metric tons a year

a 100% equity interest in the Nordural Aluminium smelter

Grundartangi、Iceland

Current capacity of 90,000 metric tonnes per year

expansion currently underway will increase capacity to 180,000 mtpy by 2006.

a 50% equity interest in the Gramercy Alumina refinery

(Noranda 50%) Gramercy, LA

1.2 million metric tons per year

- Smelter grade alumina (SGA) 80%

- Chemical grade alumina (CGA) 20%

* The balance of shares in Century are publicly held. Alumina production A subsidiary of Glencore owns and operates 100% of the Aughinish Alumina refinery

Ireland 1,850,000 MT Alumina

A subsidiary of Glencore owns and operates 93% of the Windalco Alumina refinery

Jamaica 1,265,000 MT Alumina

A subsidiary of Glencore owns 65% of the Alpart Alumina refinery

(Hydro Aluminium 35%) Jamaica 1,650,000 MT Alumina

A subsidiary of Glencore owns 44% of the Eurallumina Aluminarefinery

(The Rio Tinto Group 56%) イタリア Sardinia島 1,080,000 MT Alumina

China Chemical Reporter

2006/12/30

CHALCO Starts up Alumina Project

Principal facilities of the 600 000 t/a Bayer-process alumina

expansion project in Shandong Aluminum Corporation (SALCO) were

recently completed and put on stream in Zibo, Shandong province

SALCO is a subsidiary of China Aluminum Co., Ltd. (CHALCO). The

execution of the project has taken nearly one year. It is an

important project of the aluminum base established by CHALCO on

the basis of minerals from outside sources. The project includes

13 facilities and has a total investment of RMB708 million. It is

an expansion project based on the 320 000 t/a Bayer-process unit.