2003.07.27 LG Chem

LG Chem, expands its PVC capacity

at Tianjin to 340,000 ton/year

http://www.lg.co.kr/english/news/press/view.jsp?news_num=4781&page=2

LG Chem, Ltd., the largest chemical company in Korea,

announced today that it has raised its PVC capacity at its

Tianjin LG Dagu Chemical facility by 100,000 ton/year. A

dedication ceremony took place on the 25th of July in Tianjin

City, China.

TIANJIN LG DAGU CHEMICAL CO. LTD. (www.lgdagu.com.cn)

| Location |

Tianjin, China |

| Establishment |

1998. 5. |

| Capital/ Ownership |

US$ 37.4million /

75%(LG group 85%) |

| Capacity |

100,000 ton/year

('98.4)

150,000 ton/year ('99.10)

240,000 ton/year ('01.10)

340,000 ton/year ('03.7) |

2003.07.28 LG Chem

LG Chem marks an

epoch in the Non-phosgene Polycarbonate Process

http://www.lg.co.kr/english/news/press/view.jsp?news_num=4780&page=2

LG Chem, Ltd., the largest chemical company in Korea,

announced today that it has independently developed a new

Non-phosgene Polycarbonate Process using its own technology.

With the development of this new 'Condensed Non-phosgene

Polycarbonate Process', LG Chem has marked an epoch in the

non-phosgene polycarbonate process.

The Condensed

Non-phosgene Polycarbonate Process is a result of

perseverance and countless hours invested in its development

since 1997. In addition, it is the outcome of LG Chem's

decade-long effort to develop environment-friendly processes

along with the Non-phosgene MDI (Methylene Diphenyl

Diiocyanate) process developed in 1995. The Condensed Non-phosgene

Polycarbonate Process is currently patent pending in 9

countries such as the U.S., Japan and Germany.

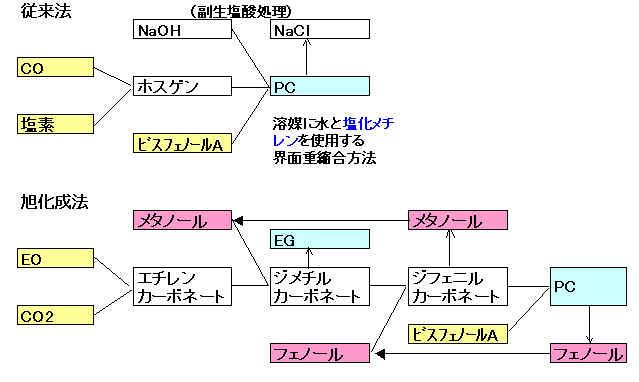

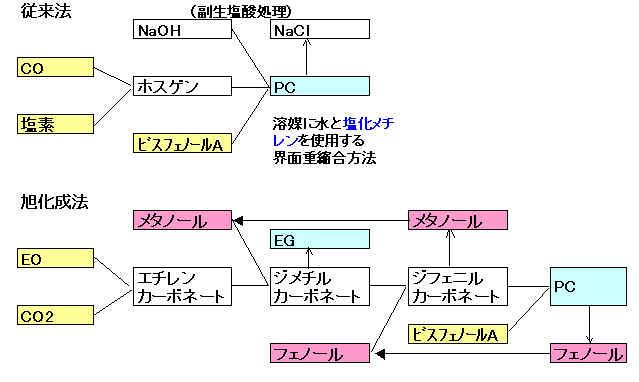

Phosgene

/ Non-phosgene Polycarbonate process

There are two conventional polycarbonate processes: the

interfacial polymerization process and the melt

polymerization/solid-state polymerization process.

| 1)

|

Interfacial

polymerization process (phosgene process) |

| |

The

interfacial polymerization is carried out in a

solution of bisphenol-A (BPA) and phosgene at the

interface. Although this process can easily produce

high molecular weight polycarbonate resins, it has

disadvantages such as the safety problem of handling

highly toxic phosgene and the large investment cost

of dealing with the environmental problems created by

the process. |

| |

|

| 2) |

Melt

polymerization and Solid-state polymerization

process(non-phosgene process) |

| |

The

melt polymerization involves the reaction of diphenyl

carbonate (DPC) with bisphenol-A (BPA) to produce a

low molecular weight polycarbonate prepolymer at the

melt state. High molecular weight polycarbonate is

synthesized at the solid-state polymerization

step.High temperature and high vacuum equipments are

required to handle highly viscous

reactants, which lowers the quality of the resin in

the melt polymerization step. Long production time is

required at the solid-state polymerization process. |

| |

|

| LG Chem's Condensed

Non-phosgene Polycarbonate process |

| |

LG

Chem's Condensed Non-phosgene Polycarbonate Process

cut the production time of polycarbonate in half

compared to other non-phosgene processes. The

melt-polymerization process of trans-esterification

between DPC and BPA is designed to reduce the

production time with excellent prepolymer quality.

Polycarbonate prepolymer is further crystallized and

polymerized to form polycarbonate in the solid-state

polymerization process by adopting a newly designed

single reactor. |

|

Overview of

MDI (Methylene Diphenyl Diiocyanate)

MDI is a raw material for Polyurethane. Pure MDI is used for

casting elastomers and spandex fiber, thermoplastic

elastomers. Polymeric MDI is mostly used for insulating and

automotive materials. The global market size for MDI in the

year 2000 was 2.4 million metric ton. Annual production of

MDI in Korea is 130,000 metric ton.

The process for MDI production generally involves the use of

phosgene, a toxic substance.

However, in 1995, LG Chem succeeded in developing an

environmentally friendly and cost effective process that eliminates the use of

phosgene. This

newly developed process was introduced in the 'PEP Review', a

research booklet published by Stanford Research Institute

(SRI), with 11 domestic and 3 international patents.

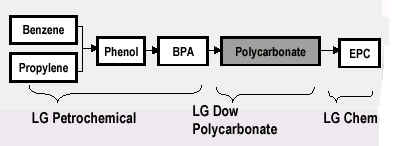

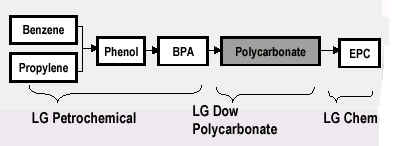

2004/1/14 LG-Chem

LG-Dow Polycarbonate

Acquisition

http://www.lgchem.com/upload/ir/eng_hot_issue/LG-Dow_polycarbonateAcquisition_e.pdf

In order to expand a

rapidly growing Engineering Plastic Business and to strengthen a

synergy effect on business by a vertical integration, LG Chem

determined to acquire LG-Dow shares which had been held by LG

Corp.

Share Acquisiton

Contents

◆Terms of

Acquisition

-Contents :

acquire 50% of shares owned by LG Corp

-Number of shares

: 5,274,085 shares

-Acquisition

Price per share :

・Evaluated

Price per share according to Inheritance & Gift Tax :KW 3,640

・Acquisition

amount :KW 19.2bil

◆Acquisition

schedule

-Approval by BOD

:'03.Dec 22

-Payment &

Closing :by '03.Dec.30

-Approval by Fair

Trade Commission : '04.Jan

Background &

Outlook

◆Reinforcing a

synergy by a Vertical Integration

◆Expanding a

rapidly growing Engineering Plastic Business

・LG Dow BPA consumption : 62,000ton/yr

(KW 7.5bil)

・LG Chem PC

consumption : 25,000ton/yr (KW 4.9bil)

◆Expecting

enhanced business value when the balance of demand and supply is

better.

2004/1/15 LG Chem

LG Chem develops a new Acrylic Acid production process

http://www.lgchem.com/press/releases/releases_view.jsp?idx=104

LG Chem, Ltd., the largest

chemical company in Korea, announced today that it has

successfully developed a newly advanced Acrylic Acid production

process using its own technology.

Acrylic Acid, which is the raw material for Acrylates, is a

monomer widely used over 3000 products such as SAP (Super

Absorbent Polymer), paint, adhesives, etc. This diversity in

usage comes from its superior reaction quality.

Based on its wide properties, the global Acrylic Acid market is a

KRWon 5 trillion market with an estimated annual growth of 5%.

Currently, China has a dominant share with an annual growth of

more than 15%.

With the development and integration of a new reacting structure

and an innovative recovery & purification technique, LG

Chem's new Acrylic Acid production process has greatly enhanced

the production efficiency and stability. In 1998, the company

also succeeded in the development of the oxidation catalyst,

which is crucial in producing Acrylic Acids and commercialized it

in 2000.

"The development of a new Acrylic Acid production process is

the result of perseverance and countless hours invested in its

development since 2001. The success has great significance since

it is based on our own technology and that it is an improved

process with a cost saving effect compared to the conventional

process," said Jong-Kee Yeo, the CTO and president of LG

Chem.

Only a few companies, worldwide, have succeeded in developing

this Acrylic Acid production process. With the successful

development of this technology as well as its commercialized

oxidation catalyst, LG Chem has now become the world's 4th

company to possess the entire process to produce Acrylic Acid.

Moreover, LG Chem has taken a step further than its competitors

by enhancing the lifespan of catalysts, productivity, and saving

energy.

"The new process is expected to create an incremental net

profit in our Acrylates business. Furthermore, additional

benefits are expected as we have plans to export our new

technology and to establish our own new facility in the near

future," the CTO added.

Patents related to the company's new Acrylic Acid production

process technology are currently pending in 9 countries such as

Korea, the U.S., Japan and Germany.

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high-value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

With annual sales of KRW 5.4 trillion (Yr 2002) and a global

workforce of approximately 10,000 employees, LG Chem plans to

realize positive progress towards sustainable growth by

consolidating its leadership in the domestic and international

market.

Overview of the Acrylic Acid market

The global Acrylic Acid market is approximately KRWon 5 trillion

(3.1 million ton per year). Leading players in the market are

BASF(25%), R&H(18%), and NSCL(13% *日本触媒).

LG Chem's new Acrylic Acid production process

A. Reaction system

The new reaction system of LG Chem makes it easier to control the

reaction temperature under severe reaction condition even with a

highly active catalyst bed, which greatly enhances the stability

of the system. Moreover, productivity is greatly increased by

minimizing the production of by-products and the lifespan of

catalysts are expanded by more than 20% from the effective

elimination of the heat derived from the reaction.

B. Refining system

LG Chem's new refining system greatly raises the efficiency in

the absorption unit of the Acrylic Acid produced, which reduces

the size of the following purification system. This reduction in

the size of the system leads to the significant decrease of the

equipment cost. Moreover, the energy saving merit coupled with

the elimination of dimmers, derived from high temperature,

provides a profit increase of KRWon 1 billion.

2004-1-22 Asia Chemical

Weekly

S Korea LG International in Russian ethylene, refining jv

LG International Corp (LGI),

the foreign investment arm of South Korea's LG Group, said

that has it formed a joint venture, the Tatar-Korean

Petrochemical Co (TKNK),

with partners in Russia to construct a refinery and

petrochemical complex in Nizhnekamsk, Republic of Tatarstan,

Russian Federation.

The complex will produce 600 000 tonne/year of ethylene and have the capacity to refine 7m tonne/year

of oil, LGI said. It will

also include plants for the production and refinement of

polymers, the company said.

Tatneft JSC owns 45.45% of the new company, while Nizhnekamskneftekhim

Inc has a 36.37% stake.

Svyazinvestneftekhim, an Ignatov & Co Group company that

holds shares in both Tatneft and Nizhnekamskneftekhim, and LGI both hold 9%

stakes.

正しくは

9.09%

Tatneft News Summery

Jan. 2004

OAO

Tattar-Korean Petrochemical Company (TKNK) Established in

Tatarstan

http://test.tatneft.ru/doc/FinReport/01_January_eng4.pdf

OAO Tatneft, OAO

Nizhnekamskneftekhim, OAO Svyazinvestneftekhim, and

South-Korean LG established OAO Tatar-Korean petrochemical

company (TKNK).

TKNK will

implement a project of constructing a petrochemical and crude

oil refining complex on the basis of Nizhnekamsk refinery.

The constituent

documents of the new venture were signed by Tatneft CEO

Shafagat Takhautdinov, Nizhnekamskneftekhim CEO Vladimir

Busygin, and vice-president of LG corp. Je Il Yang. At the

board meeting, which took place the same day, Tatneft CEO S.

Takhautdinov was elected chairman of the BOD of TKNK, and CEO

of Nizhnekamsk refinery Khamza Bagmanov was appointed general

director of TKNK.

TKNK's

authorized capital amounts to $220 thousand. Major

shareholders are Tatneft (45 percent),

Nizhnekamskneftekhim (36 percent), Svyazinvestneftekhim (8

percent), LG (10 percent,正しくは 9.09%). LG proceeded to a

feasibility study, and plans to attract first international

bank loans through the Korean Export-Import Bank in summer

2004.

The complex will

incorporate a refinery with annual output of 7 mln. t; an ethylene

plant with

annual output of 600 thousand tonnes, and polymer manufacturing and processing

facility. Total project budget amounts to ca. $2.5 bln.

Platts 2004/6/30

LG expects Tatarstan oil/petchem project financing by

year-end

South Korea's LG group expects to settle a financing plan by

December for a joint venture oil refinery and

petrochemicals project

in the republic of Tatarstan, sources at LG said Wednesday. A

source from LG's construction and engineering subsidiary said

the project's final scope and investment requirements would

not be finalized until the end of the year.

2004/9/22 Reuters

LG発表

LG clinches $3bn Russian deal

http://edition.cnn.com/2004/BUSINESS/09/21/russia.lg.reut/

South Korea's LG

International Corp. and affiliate LG Construction Co. have

clinched a $3 billion petrochemical plant deal with Russian oil firm Tatneft, LG

International said Wednesday.

The deal, which LG said was the biggest of its kind in

Russia, was struck during South Korean President Roh

Moo-hyun's visit to Moscow for talks with Kremlin chief

Vladimir Putin.

2004/9/22 Platts

Tatarstan sign $1.7-bil

petchem, refinery deal.

Tatarstan-Korean Petrochemical Co and South Korean LG

have signed a $1.7-bil agreement to construct a

refinery in Tatarstan. The agreement was signed in the

presence of Russian president Vladimir Putin and South

Korean president Roh Moo-Hyun in Moscow. The project is

expected to be expanded to include a petrochemical

complex pushing the total project cost to $3-bil. The first stage of the project

proposes construction of a 7-mil mt/yr (140,000 b/d) refinery to handle heavy, high sulfur oil

produced in Tatarstan and Bashkortostan and is to start

at the end of the year. The second stage, at a cost of

$1.2-bil, envisages a 600,000mt/yr ethylene unit. The Tatarstan-Korean

Petrochemical Co was set up in January by Tatneft

(45.45%), Nizhnekamskneftekhim(36.37%), Tatarstan

authorities (9.09%) and South Korea's LG International

(9.09%).

2004.09.23 LG

International

LG International-LG E&C won a $3 billion project from

Tatarstan

http://www.lgicorp.com/eng/about/press_v.jsp?num=66¤t_page=1&gubun=D

■ Signed a $ 1.7 billion

contract for a phase I project and agreed on a 1.3 billion phase

II project, to build a petrochemical and oil refining complex.

■ The largest ever, paved

the way for entering the Russian plant market in the future.

LG International Corp., together with LG Engineering

&Construction, won a $ 3 billion project to build a

petrochemical and oil refining complex in Tatarstan. The project

is the largest ever in the history of Korea-Russia relations.

In the Moscow Kremlin on September 21, 2004, LG International

Corp. and the Republic of Tatarstan agreed to build a

petrochemical and refining complex through the two-stage project

worth $ 3 billion in total. Attended by presidents from Korea and

Russia, LG International Corp and the Tatarstan government signed

a $ 1.74 billion agreement for the construction of oil processing

facilities through the phase I project.

This $ 3 billion project is designed to build the petrochemical

and oil refining complex during the phase 1 and phase 2($1.3

billion) in the eastern area, about 1000 km away from Moscow in

Russia.

The project of TKNK(Tatarstan Korea Neftekhim), a joint venture

is the largest construction of petrochemical facilities in the

history of Russia. LG International and LG E&C participated

in the joint venture. LG International will finance the project

while LG E&C will carry out the designing, procurement and

construction (EPC turnkey) for the project.

Platts 2004/2/12

Korea's LG Chem short lists three sites in China for EDC project

LG Chem, South Korea's

largest chemical producer, has short listed Tianjin(天津), Guangdong(広東省), and central China as three likely

locations for a planned worldscale EDC plant, a company

official said Thursday.

2004/2/19 LG Chem

LG Chem develops new EP material applying nanotechnology

http://www.lgchem.com/press/releases/releases_view.jsp?idx=106

LG Chem, Ltd., the largest

chemical company in Korea, announced today that it has

successfully developed a new high barrier EP material named

HYPERIER® by applying

nanotechnology.

EP (Engineering Plastics) Engineering Plastics are high

performing plastics that are used as alternatives for metal

hardware. They are highly durable to heat and impact, which makes

it ideal for automobiles and electronic appliances components by

enabling them to be more lightweight and portable.

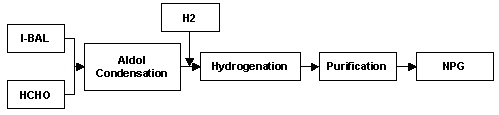

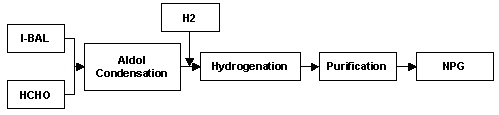

2004/7/14 LG Chem

LG Chem becomes a global NPG producer through expansion

http://www.lgchem.com/press/releases/releases_view.jsp?idx=110

LG Chem, Ltd., the largest

chemical company in Korea, announced today that it would expand

its NPG (Neopentyl Glycol) capacity by 20,000 tonne to 50,000

tonne/year by 2005. Such an increase will position the company as

the No.3 global producer and the No.1 producer in Asia.

NPG is the raw material for alkyd resin, unsaturated resin and

powder resin. Such resins are used in paints for construction

materials, electronic appliances, automobiles. Moreover, it is

well known as an environment-friendly product.

NPG Production Process

Global NPG Producers

| Rank |

Company |

Capacity

(1,000 tonne) |

Ratio |

1

|

BASF

|

135

|

36%

|

2

|

Eastman

|

87

|

23%

|

3

|

MGC

|

35

|

9%

|

4

|

LG Chem

|

30

|

8%

|

-

|

Others

|

89

|

24%

|

Total

|

376

|

100%

|

2004/7/26 中国・ASEANニュース速報 Degussa enters into research alliance with

LG Chem

LG化学、独デグサと共同研究

http://www.e-plastics.gr.jp/japanese/nna_news/news/news0407_4/04072601.htm

LG化学は22日、独デグサ(Degussa)社と共同研究のための覚書(MOU)を締結したと明らかにした。両社は、情報電子部品に用いられる高性能素材の共同研究や技術情報の交換を推進する。

LG化学は、米メリルランド研究所の設立(96年)を皮切りに、日本、中国にも研究開発(R&D)センターを構築。今後も欧州の化学会社や研究機関との共同研究体制を拡大し、現地に合った製品・技術開発を強化するという。

デグサ社は、塗料・染料、高機能性ポリマー、情報電子素材など精密化学素材メーカー。世界50カ国・地域で研究センターを運営し、基礎素材の研究分野では世界トップレベル。

Korea Times

2004/7/22

LG Chem, Degussa

Sign MOU

http://times.hankooki.com/lpage/biz/200407/kt2004072218004611910.htm

LG Chem and

German-based Degussa have signed a memorandum of

understanding (MOU) for joint research on high-function

materials for next-generation electronics.

LG Chem CTO

president Yeo Jong-kee and Alfred Oberholz, an executive of

Degussa's research and development (R&D) unit, signed the

MOU in Dusseldorf, Germany.

With the MOU, LG

Chem seeks to consolidate its R&D capability through

joint studies on technology developments in Europe to

maximize synergy effect.

"We will

focus on strengthening our power in R&D for European

operations," Yeo said.

Degussa, a

leading multinational chemical firm, is operating 50 research

centers across the globe and producing paints and polymers.

2004/8/23 LG

LG Chem Signs Li-Ion Polymer Battery Development Contract With

the USABC

http://www.lgchem.com/press/releases/releases_view.jsp?idx=112

LG Chem, Ltd., the largest

chemical company in Korea, announced today that it has been

granted a USD 4.6 million contract by the United States Advanced

Battery Consortium (USABC) to develop advanced Lithium-ion

Polymer Battery cells for Hybrid Electric Vehicles (HEVs).

The USABC was

formed in 1991 by the United States Department of Energy (DOE)

and the BIG Three Automakers (GM, Ford, DaimlerChrysler) with the objective of pursuing research

and development of advanced energy storage systems. Under the

contract, LG Chem and Compact Power Inc. (CPI, LG Chem's U.S.

battery system research institute,) will jointly carry out the

project.

The project is the first step of a two-phase project for the

development of high-tech battery pack systems for HEVs. During

the course of the first phase, which will last until August 2005,

LG Chem will develop a highly advanced lithium-ion polymer

battery cells, while CPI will take charge of the development of

the battery management system electronics and software.

"We received the highest scores in all categories that USABC

put out to evaluate the candidates for the Li-Ion Polymer Battery

Development Project. Our advanced technology in rechargeable

batteries and battery systems has enabled us to become the first

Asian company to sign a development contract with USABC,"

said Jong-Kee Yeo, the CTO and president of LG Chem.

LG Chem's highly advanced technology in Li-Ion Polymer batteries

has received recognition for being the first to be applied in

prototype HEVs. It was also the crucial factor in LG Chem winning

the U.S. Pikes Peak International Hill Climb rally in 2002 and

2003 with its self-developed Li-Ion Polymer electric vehicle.

Moreover, NASA/JPL (Jet Propulsion Laboratory) is currently

evaluating LG Chem's technology for the Mars Explorer mission

scheduled for 2007.

"Our Li-Ion Polymer battery can reduce the size and weight

of the battery pack by 50% while doubling power and energy

compared to Nickel Metal Hydride (NiMH) batteries, which are

currently used in HEVs. Moreover, our customers have recognized

our product as the most powerful battery in the market compared

to the Li-Ion batteries presently under development by our global

competitors. We intend to become the world industry leader by

taking advantage of and constantly upgrading our technological

edge," the CTO added.

In accordance to the annul growth of over 80% of HEVs in the U.S.

market since the year 2000, demand for HEV batteries are

forecasted to dramatically increase as well. "With its

contract with USABC, LG Chem is now in an advantageous position

for securing the Big Three Automakers as potential

customers," said Yeo.

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high-value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

About CPI

Compact Power Inc. (CPI) is located in Monument just north of

Colorado Springs, Colorado. CPI, together with its majority

shareholder, LG Chem Ltd. of Korea, is a global leader in the

research, development, and production of advanced technology

battery systems for customers worldwide. Together with LG Chem,

CPI design large lithium-ion polymer batteries (LiPBs) for

electric vehicles (EVs), hybrid electric vehicles (HEVs), and

related commercial and military-aerospace applications.

About HEV

Hybrid Electric Vehicles (HEVs) are vehicles that combine an

internal combustion engine with a small electric motor and a

battery. They are now finding commercial acceptance as an

effective measure to counter global warming and pollution and

reduce the dependence on fossil fuels without sacrificing vehicle

performance.

2004/9/13 LG Chem

LG Chem Advances Into The PDP Filter Business With Ambition

http://www.lgchem.com/press/releases/releases_view.jsp?idx=113

LG Chem, Ltd.,

the largest chemical company in Korea, announced today that it

has advanced into the PDP filter business. The initial capacity

is 720,000 pieces/year at Ochang Techno Park, the company's

industrial complex located in Korea for the production of various

Information & Electronic materials.

Plasma Display Panel (PDP) filter is the core optical material

for PDP TVs, which improves optical properties of the PDP image

and protects near infrared rays and electromagnetic radiation

from the PDP module. Due to such essential functions, the PDP

filter market is skyrocketing at an annual growth rate of over

50%.

The company's successful development and commercialization of PDP

filters, which took only 2 years, are based on its own advanced

technology in Precision Coating and Thin Film Processing,

accumulated through its current polarizer business. Moreover, the

company has moved a step further by developing a unique optical

designing ability, which is expected to greatly contribute to

satisfying the customer's various needs.

"The global PDP filter market is expected to be

approximately KRW 570 billion in 2004, in which we aim to achieve

a total sales of KRW 30 billion. Moreover, we intend to expand

this market share to 35% by 2008 through aggressive marketing and

expansion," said Soon-yong Hong, Executive Vice President

and Chief of LG Chem's Information & Electronic Materials

Business.

In addition, by selecting the PDP filter business as one of its

core business areas, the company plans to expand its capacity to

1.8 million piece/year and secure a global market share of 20% by

2005.

"PDP is the next generation display, which provides a larger

display area as well as higher picture quality. By entering into

the PDP filter business, we expect to benefit from the rapid boom

in the PDP market while enhancing the competency of the PDP

manufactures in terms of both cost and quality," Hong added.

As part of its strategy to strengthen its Information &

Electronic Materials business, LG Chem has been solidifying its

rechargeable battery and polarizer businesses as well as seeking

new business areas. With the advancement into the PDP filter

business, the company further plans to advance into new areas

such as HEV (Hybrid Electric Vehicle) batteries, fuel cells and

other display materials in the following years.

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high-value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

About PDPs

PDP, Plasma Display Panel is the digital and multimedia display

system for the future and it is designed to be able to hang onto

the wall. PDP can create the bright and clear picture more than

other display devices. PDP has the thickness less than 10 cm, as

well.

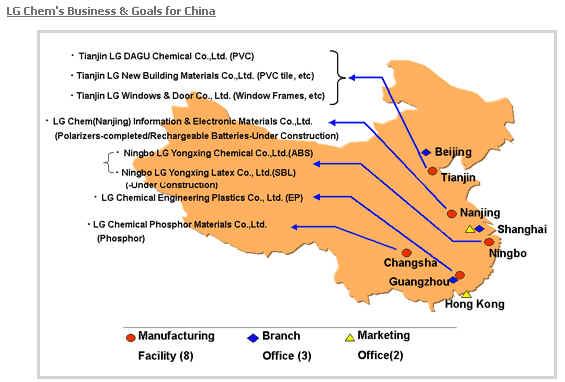

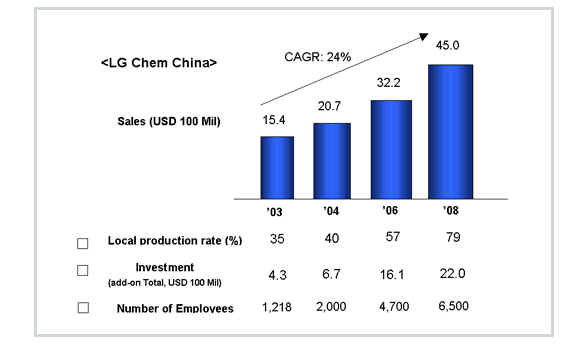

2004/9/16 LG Chem

LG Chem To Establish A Holding Company In China

http://www.lgchem.com/press/releases/releases_view.jsp?idx=114

LG Chem, Ltd.,

the largest chemical company in Korea, announced today that it

will establish a holding company in Beijing, China by 2005. The

formation of the holding company, 'LG Chem (China) Investment

Co., Ltd.' is part of the company's plan to become the Top 5

chemical company in China.

The holding company, scheduled to open on January 1st 2005, will

cover the overall management of LG Chem's business in China, such

as business strategies, financials, Human Resources, and legal

affairs. The company currently has 8 manufacturing facilities, 2

marketing offices, and 3 branch offices in the region.

"We have advanced our initial plan to switch our Chinese

Central Office into a holding company by 2008 in order to deal

with the explosive business expansion trend in China. The

establishment of a holding company will enable LG Chem to

increase its management efficiency over its current businesses as

well as lay grounds for the entrance into new business areas in

China," said Jong-Pal Kim, President of LG Chem China.

In addition to the formation of a holding company, LG Chem plans

to set up a R&D center to complete its business structure

from its initial stage of product development to manufacturing

and sales. Such completion is expected to meet local customers'

needs in a timely fashion.

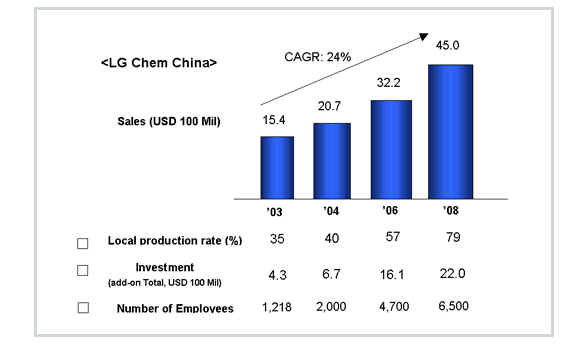

"Local production currently takes up about 40%(USD 820

million) of our sales in China. We plan to increase this portion

to 57%(USD 1.84 billion) by 2006 and 79%(USD 3.56 billion) by

2008, ultimately reaching the level of 100%," Kim added.

With the company's success in its petrochemical business in

China, LG Chem plans to expand its complete business structure

from production to sales for its Industrial Materials and

Information & Electronic Materials business in China.

"We are forecasting an increase in our sales in China from

last year's USD 1.5 billion to USD 2.1 billion in 2004 and USD

3.2 billion in 2006. Moreover, with sales of USD 4.5 billion and

an operating profit rate of 7% by 2008, the company aims to

become the Top 5 chemical company in China in terms of both scale

and profitability," Kim said.

中国・ASEANニュース速報

【韓国】LG化学、自動車用EPで米攻略

LG化学は20日、米レテック(RheTech)社と、自動車のバンパーなどに用いられる高機能性エンジニアリング・プラスチック(EP)生産のためのODM(デザイン・仕様の決定を受託側が行う委託生産)契約の調印式を行った。

これによりLG化学は、来年からレテック社の工場の一部を利用してODM方式で生産を開始し、LG化学ブランドで販売していく。米国へのEP輸出規模も、今年の300万米ドルから来年は1,000万米ドルに引き上げる計画だ。

レテック社は米ミシガン州に年産7万トン規模のEP工場を保有している。

RheTech http://www.rhetech.com/

We are known in the

industry for our comprehensive ability to design, manufacture

and deliver a complete line of polyolefin alloys, compounds

and concentrates.

2005/7/27 LG Chem

LG Chem to Expand Acrylic Acid Plant in Yeosu

LG Chem, Ltd., the largest chemical company in Korea, announced

its plans to add a fourth acrylic acid plant in Yeosu by the end

of 2007. The new plant will produce 80,000 mt/yr of

crude acrylic acid.

Through the new investment, LG Chem will have a total of 4

acrylic acid plants with a total production capacity of 240,000 mt/yr.

The new investment is particularly noteworthy, as LG Chem will be

using

its own developed production

technology. LG Chem's new process is an

enhanced technology that improves the production efficiency and

stability through a new reaction system and innovative

purification technique.

Overview of LG Chem

LG Chem, Ltd., is the leading chemical company in Korea in terms

of both size and performance. It is a vertically integrated

chemical company that manufactures a wide range of products from

petrochemical goods to high value added plastics and high

performance industrial materials. It also extends its chemical

expertise to high-tech materials for electronics and information

technology such as state-of-the-art rechargeable batteries and

display materials.

2004 Acrylic Acid Producers in terms of capacity Unit: KMT

| Rank |

Company |

Capacity |

License |

1

|

BASF

(Germany)

|

750

|

Own

Technology

|

2

|

R&H

(U.S.A)

|

575

|

Japan

|

3

|

DOW

(U.S.A)

|

516

|

Japan

|

4

|

NSCL

(Japan)

|

450

|

Own

Technology

|

7

|

LG Chem (Korea)

|

160

|

Japan

|

* LG

Chem’s new plant will apply its own

technology.

Acrylic Acid Supply and Demand Unit: KMT

| Category |

2004 |

2008 |

2010 |

CAGR

('04~'10) |

| Capa |

Demand |

Capa |

Demand |

Capa |

Demand |

Global

|

3,617

|

3,333

|

4,351

|

3,834

|

4,491

|

4,143

|

4%

|

China

|

165

|

463

|

645

|

745

|

645

|

937

|

13%

|

Korea

|

160

|

130

|

160

|

151

|

160

|

180

|

5%

|

* Source: Tecnon (2004),

LG Chem

2005/8/31 LG Chem

LG Chem Develops New

Production Method for LCD Color Filters

http://www.lgchem.com/press/releases/releases_view.jsp?idx=130

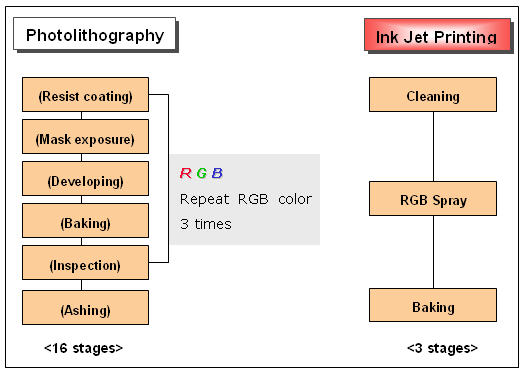

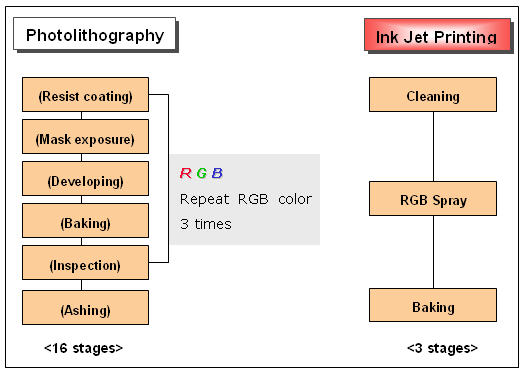

LG Chem, Ltd., the

largest chemical company in Korea, announced today that it

developed its own production method to produce color filters, a

key component for LCDs. Also the new development is a departure

from the previous 'photolithography

method'.

A color filter is a key component, which sharpens the color of

LCDs. It also accounts for 20% of the manufacturing cost of the

LCDs.

The new production method enables LG Chem to simplify the

manufacturing process and saves manufacturing cost and time by

reducing its production stages from 16 to 3 steps.

The new process is an 'Ink Jet Printing Process' which prints ink on the surface

of the LCD glass plate. It is a process that can be described as

printing paper on an ink jet color printer.

Comparison between the previous and new method

The new production method greatly reduces manufacturing cost and

time, making the previous 16 development stages into 3.

September 06, 2005

Dow

LG-DOW Proceeds with

Project for Second Polycarbonate Train

Start-up Will Bring 65,000 Metric Tons to Korea and Broader

Pacific Markets

http://news.dow.com/dow_news/prodbus/2005/20050906a.htm

LG DOW

Polycarbonate Ltd. (LG-DOW),

a 50/50 joint venture between The Dow Chemical Company and LG

Chem, Ltd., today announced the next steps in a plan to build its second

polycarbonate train in Yeosu, Korea.

"Basic engineering work for the second polycarbonate train

is already completed, paving the way for us to initiate the

construction process," said Mark Remmert, LG-DOW President

and one of two representative directors for the JV. "We have

also appointed a full-time project manager to take us through

detailed engineering to a fully operational train."

LG-DOW's second polycarbonate train has a planned nameplate

capacity of 65,000 metric tons (143 million pounds), which is

designated to supply Korea and other markets in Asia Pacific.

Assuming that all milestones are achieved, it could be fully

operational in less time than the industry average of two years.

This would be made possible in part because critical

infrastructure for a second train was included in the

construction of the joint venture's first polycarbonate train,

which began in July 2001.

About LG DOW Polycarbonate Ltd.

A 50/50 joint venture between The Dow Chemical Company (Dow) and

LG Chem, Ltd. LG- DOW is among the largest petrochemical

investments in Korea. LG-DOW commenced operations on July 1,

2001, when it started its first 65,000 MTA plant in Yeosu, Korea,

assuming the market franchise for CALIBRE Polycarbonate resins

from The Dow Chemical Company. The primary business of LG-DOW is

the manufacture and supply of CALIBRE Polycarbonate resins to

customers in Asia Pacific.

2005/9/28 LG Chem

LG Chem Plans to Commercialize Portable Fuel Cell

http://www.lgchem.com/press/releases/releases_view.jsp?idx=131

LG Chem, Ltd., the

largest chemical company in Korea, announced today that it has

completed its development of portable fuel cells and plans to

commercialize the product within this year. Methanol fuel will be used to power the fuel

cells.

The durability of LG Chem's fuel cells lasts for more than 4,000

hours, which is 8 times longer than products developed by its

competitors.

| Editor's

Note |

| Overview

of LG Chem |

| |

LG Chem, Ltd.,

is the leading chemical company in Korea in terms of both

size and performance. It is a vertically integrated

chemical company that manufactures a wide range of

products from petrochemical goods to high value added

plastics and high performance industrial materials. It

also extends its chemical expertise to high-tech

materials for electronics and information technology such

as state-of-the-art rechargeable batteries and display

materials. |

| |

|

| Fuel

Cell |

| |

Fuel cell is a

mechanism, which transform chemical energy such as

hydrogen and methanol into electric energy. Unlike

batteries, which require recharging, fuel cells can

continuously produce electricity under the condition that

fuel is constantly supplied. It is also environment

friendly and is considered the next generation of energy.

|

| |

|

| Development

Trend of Portable Fuel Cell |

| |

A portable fuel

cell can be largely classified into methanol fuel cell

and a hydrogen macromolecule fuel cell that requires a

miniature reformer.

The hydrogen macromolecule fuel is not adequate to be

applied on mobile IT devices since it requires a macro

reformer or a hydrogen storage container to generate

power. On the other hand, the DMFC (Direct Methanol Fuel

Cell) can contain higher levels of energy and uses less

dangerous methanol to generate power; therefore, the DMFC

is widely being developed over the hydrogen macromolecule

fuel cell.

LG Chem developed the DMFC. |

| |

|

| Direct

Methanol Fuel Cell |

| |

Methanol fuel

cells generate electric power by mixing methanol with air

(oxygen); therefore, it does not require a macro

reformer. It's also much more portable than hydrogen

macromolecule fuel cells. Moreover, methanol fuel cells

are less dangerous than hydrogen macromolecule fuel cells

as it generates power under 100°C. In addition, methanol fuel

cells contain 4,759 Wh/L of energy density, which is much

higher than the energy density of rechargeable batteries

(450 Wh/L).

|

| |

|

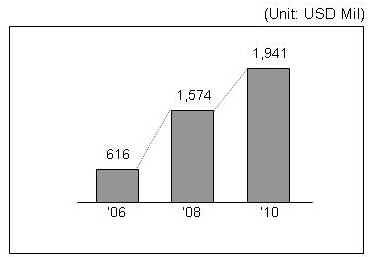

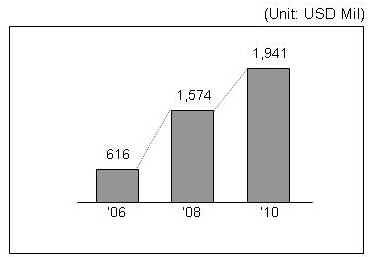

| Global

Market for Portable Fuel Cell |

| |

|

| |

* Source: Fuel

Cells for Portable Power, Darnell for US Fuel Cell

Council, 2003 |

2005/10/4 LG Chem

LG Chem Launches HI-MACS

Manufacturing Facility in U.S.A. 人工大理石板

http://www.lgchem.com/press/releases/releases_view.jsp?idx=132

10.04.2005

LG Chem, Ltd., the

largest chemical company in Korea, announced today that it will

open its first U.S manufacturing facility, LG Chem Industrial

Materials Inc. (LG

CIM), in Gordon County, Georgia. LG Chem will commemorate the

grand opening of the facility on 3rd October 2005.

The new facility will produce LG HI-MACS, which is an artificial acrylic

solid surface,

mainly applied to bathroom and kitchen counter tops.

朝鮮日報 2005/11/29

世界初 LG化学、宇宙服などの先端繊維原料の工程開発

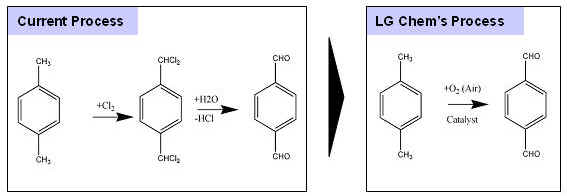

LG化学が防弾チョッキと防火服、宇宙服など先端繊維の原料として用いられるテレフタルアルデヒド(TPAL)の地球に優しい工程を世界で初めて開発した。

LG化学は29日、大田(テジョン)技術研究院でテレフタルアルデヒドの大量生産が可能な新工程を独自に開発したことを明らかにした。

LG化学は今回の地球に優しいテレフタルアルデヒド新工程技術と関連する多数の特許を国内及び米国、日本、ドイツなど海外9カ国に出願中で、2008年ごろから商業生産に入る計画だ。

2005/11/29 LG Chem

LG Chem Develops a New Production Process for TPAL

テレフタルアルデヒド

http://www.lgchem.com/press/releases/releases_view.jsp?idx=134

LG Chem, Ltd., the

largest chemical company in Korea, announced today that it

developed a new environment-friendly process to mass-produce

terephthalaldehyde (TPAL).

TPAL is an organic synthesis intermediate for dyestuffs,

pharmaceuticals, specialty polymers, electronic materials, and at

present it is mostly used to produce fluorescent whitening

agents. 蛍光増白剤

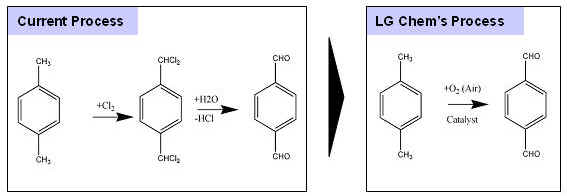

The existing TPAL

production process involves chlorination of para-xylene and

hydrolysis 加水分解of the chlorinated xylene. The

process is harmful to the environment as it uses chlorine as a

reactant and emits hydrochloric acid as a by-product. Another

problem with the existing process is that it is not cost

effective enough to mass-produce. Currently, China and India are

major producers.

LG Chem's new manufacturing process resolved these problems by using air instead

of chlorine,

thus making the process environment-friendly. Furthermore, LG

Chem lowered production cost by implementing its own high

performance catalyst and optimized the overall production

process.

The company's ability to mass-produce, could cut the price of

TPAL down to more than half of its current price, broadening its

usage and opening a wider market for the product. One of many

applications where TPAL can be used is in specialty fibers

for protective fabrics such as bulletproof vests, flame retardant

clothes and space suits.

"The new process holds great significance as it is both

environment-friendly and cost effective," said Jong-Kee Yeo,

President and CTO of LG Chem.

Overall, LG Chem has already applied for several patents and

currently waits for approvals from the U.S, Japan, Germany and

nine other countries. Future plans for the company are to sell

its technology license and start mass production by 2008.

Existing Process Vs. LG Chem’s Process

The existing process requires chlorine (Cl2), which emits

hydrochloric acid (HCl). LG Chem's new process uses air instead

of chlorine as a reactant.

Platts 2006/9/6

S Korea's LG may scrap

80,000 mt/year PVC line in efficiency move

South Korea's LG Chem has

been considering scrapping an 80,000 mt/year polyvinyl chloride

line in the company's Yeosu complex during November or December

this year in an effort to improve production efficiency, a

company source said Wednesday.

2006/10/20 YONHAP NEWS

GSグループの石油化学工場、12月に商業稼動

GSグループオーナー一族が6億ドルを投資し中国の山東省青島に建設したパラキシレン工場が、近く商業稼動を始める見通しだ。GSカルテックスの許東秀(ホ・ドンス)会長が19日、記者団に対し明らかにした。

許会長によると、麗東石油化学有限公司の青東工場は現在試験稼動中だ。許会長らの共同出資で2003年にシンガポールに設立したGSアロマティックスが、麗東石油化学の株式60%を保有している。麗東石油化学は当初、9月に工場を完工し操業する計画だったが、中国政府が原料のナフサの輸入を許可せず難航していた。しかし、中国との認可問題が解決し12月初めからは商業稼動に入る見込み。許会長は「パラキシレン70万トンにベンゼンやトルエンまで合わせると年間110万トンの芳香族化合物を生産し、中国で販売することになる」と説明した。青東にほかに40万坪の土地を確保しており、事業が軌道に乗れば拡大に取り組む考えだ。

GSカルテックスや系列会社ではなくオーナー一族の個人投資で会社を設立したのは、中国では個人投資が有利なため。GSカルテックス関係者は、中国がナフサに高い関税を課しているために芳香族製品の生産に障壁となっていると指摘し、韓中自由貿易協定(FTA)締結で解決するのが望ましいとした。許会長によると、現在河北省では年産2万トン規模のポリプロピレン工場を操業している。このほか青島一帯でガソリンスタンドと整備のチェーン事業にも本格的に乗り出すなど、中国内で事業を拡大していく考えだ。中国でガソリンスタンドが400〜500か所に増えれば、韓国で生産された石油製品を販売することで相乗効果が期待されるという。

60% by GS

Aromatics, 30% by OOC and 10% by Red Star Chemical Group Ltd

2006/02/20 朝鮮日報

GSカルテックスは18日、中国青島市経済技術開発区でGSガソリンスタンド1号店の起工式と中国現地法人「GSカルテックス石油有限公社」の開所式を行ったと19日、明らかにした。

2007/5/25 Asia Chemical

Weekly

Qingdao Lidong commissions aromatics project commercially

On May 22 2007, Qingdao Lidong Chemical Company (Lidong Chem 麗東石油化学) hold a ceremony for the

commercial commission of aromatics project in Qingdao Economic

Development Zone, Qingdao, Shandong Province.

The project construction was completed in late 2006. It has

started trial operation for 5 months. With total investment

around USD 600 million, the project includes 700,000 tonne/year

paraxylene (PX), 250,000 tonne/year benzene, 150,000 tonne/year

toluene and 113,000 tonne/year raffinate.

The project also integrates with a 35,000 bbl/day reformer, using

the continuous reforming technology from UOP. The feedstock -

heavy naphtha - is mostly sourced from S. Korea by GS Caltex;

while the output will supply the China domestic market, in which

there are lots of PTA project were planned or under construction.

Lidong Chem was setup in late 2003, it is the 60:30:10 jv by GS

Aromatics (Singapore subsidiary of South Korean refiner GS

Caltex), Oman Oil Co (OOC) and Qingdao Redstar Chemical Group

(Redstar Chem 青島紅星化学).

Redstar Chem is a local government owned company which mainly

produces inorganic salt (particularly barium and strontium

carbonates) and other chemicals.

Apr 3, 2008 Reuters

GS Aromatics, Sinopec sign joint investment deal

South Korea's GS Aromatics has signed a joint investment

agreement with China's Sinopec Corp to co-manage Qingdao Lidong Chemical Co Ltd, GS Caltex said on Thursday.

Under the deal, Sinopec will secure part of the shares in the

petrochemical company, which is now owned by GS Aromatics

with 60 percent stake, GS Caltex said in a statement.

GS Aromatics, a petrochemical company under GS Holdings Corp,

and Sinopec will jointly run Lidong Chemical, the statement

added.

"Sinopec will secure part of the shares, but the amount

has not been set yet," said Kang Tae-hwa, a spokesman at

GS Caltex.

Qingdao Lidong Chemical, which started commercial production

in 2006, has an annual capacity of producing 1.1 million

tonnes of aromatics.

British Plastics

& Rubber October 30, 2006

LG bids for supremacy in polypropylene

LG International is to start selling polypropylene in Britain as

its new plant in Oman comes on stream. The company will take 250,000 -

300,000 tonnes per year of the 340,000 tonnes capacity of the Oman Polypropylene plant - a 20:80 joint venture between LGI

and the Oman Oil company - and plans to sell 100,000 tonnes of

this into European markets. Its target is to sell 20,000 tonnes

of homopolymer in the UK within two years at 'competitive prices'

and to become the largest stockist of PP homopolymer in the

country.

Platts 2006/11/15

S Korea's LG

Petrochemical to become propylene exporter in 2007

South Korea's LG

Petrochemical is set to become a net exporter of propylene from

2007, following the completion of its olefins conversion unit at

Yeosu in September this year, company sources said Tuesday. The

OCU is able to produce 80,000 mt/year of propylene.

May.31,2007 english.chosun.com

LG Opens LCD Cluster in

Poland

LG has established a

bridgehead in Poland to further advance into the European market,

with a one-stop manufacturing cluster for LCD components and

televisions that opened on Wednesday.

Key components for the

cluster in Poland will come from Korea. LG plans to assemble and

produce LCD components and finished TV sets at the cluster for

distribution in Europe, the world's largest LCD TV market.

LG held a dedication

ceremony for the LG Poland LCD Cluster near the city of Wroclaw

in the southern part of the Central European country.

Four LG Group affiliate

facilities are operating in the cluster -- LG Electronics' finished TV set assembly line, LG.Phillips' LCD module assembly plant, LG Chem's polarizer plant and LG Innotek's inverter and power module

manufacturing plant.

The W500 billion

(US$1=W931), 1.5 million-sq.m cluster is LG's third largest

manufacturing base after the Paju Display Cluster measuring 4.4

million sq.m and the Nanjing Display Cluster measuring 2.04

million sq.m. LG plans to produce 2.4 million LCD units annually

at the Poland site.

Japan's

Toshiba, which holds a 19.9 percent stake in the Poland

subsidiary of LG.Phillips LCD, is now building an LCD TV plant

in the area which should begin operating in August. Toshiba is

expected to become a major buyer from LG.

Jul 05, 2007 Thomson Financial via COMTEX

SKorea's LG

Chemical to merge with LG Petrochemical to boost synergy

South Korea's largest chemical company LG Chemical Ltd said

Thursday its board has approved a plan to merge with LG

Petrochemical Co Ltd in a move aimed at boosting operational

synergies between the two.

LG Chemical already holds 40 percent of LG Petrochemical as of end-2006.

Following the merger, LG Chemical said it will have an annual

ethylene production capacity of 1.66 million tons, placing it as

the second largest domestic producer and fifth in the Asian

region.

LG Chem currently has

40% ownership of LGPC, with 49.8% of shares floated on the

Korea Stock Exchange, and 10% owned by LGPC's treasury from a

share buy-back scheme rolled out last year.

June 25, 2008 Asia Pulse

LG Chem signs formal deal to buy Kolon's facility

LG Chem Ltd., South Korea's largest chemical maker, said Tuesday

it has signed a formal contract to buy a facility to produce

super-absorbent polymers from Kolon Industries Co. for some 90 billion won (US$86.8

million).

Super-absorbent polymers, which can absorb many times their own

weight in liquid, are used in personal disposable hygiene

products such as baby diapers and feminine napkins.

With the acquisition, LG Chem aims to expand sales of the

material to 1.5 trillion won by 2015 from the current 100 billion

won, the company said in a statement.

"The acquisition of the SAP production line is the first

visible result of LG Chem's efforts to seek growth through

takeovers," LG Chem Vice Chairman Kim Ban-seok said in the

statement.

The facility, which has an annual production capacity of 70,000 tons of

super-absorbent polymers, is located at a city of

Gimcheon, 234 kilometers south of Seoul.

ーーー

June 24, 2008 Thomson Financial via COMTEX

SKorea's LG Chem buys

Kolon's SAP operations for 90 bln won

South Korea's biggest

chemical maker LG Chem Ltd. said on Tuesday it had agreed to buy

Kolon Industries Inc.'s super absorbent polymer (SAP) operations

for about 90 billion won ($87 million).

Kolon

Industries is the world's sixth-largest maker of SAP, which is

used to make diapers and sanitary pads.

LG Chem,

which provides glacial acrylic acid

精製アクリル酸, a key

raw material for SAP, said the purchase was a "win-win

strategy" for both companies as key global SAP makers expand

their capacity and seek vertical integration.

The

company said it plans to use Kolon as a foothold to form business

tie-ups with petrochemical companies in South America and the

Middle East for glacial acrylic acid and SAP operations.

"We

are currently studying a plan to form joint ventures with

overseas companies but ... a detailed decision has not been made

yet," LG Chem spokeswoman Tracey Park said.

LG Chem

said it aims to achieve over 1.5 trillion won in revenue from the

glacial acrylic acid and SAP business by 2015 by actively

boosting capacity.

LG Chem

currently derives about 300 billion won in annual revenue from

its glacial acrylic acid operation, while Kolon Industries is

expected to generate 100 billion won in revenue this year from

its SAP business.

Kolon

1985

Establishment of the production process for Super

Absorbent Polymer (jointly with Korea Institute of

Science & Technology)

1987 Commercialization of the production process (in

Incheon)

1993 Expansion of Super Absorbent Polymer plant (in

Gimcheon 慶尚北道金泉市)

2002 Expansion of Super Absorbent Polymer plant (for the

capacity of 41,000 tons a year)

2007 Expansion of Super Absorbent Polymer plant (in

Gimcheon)

| Chemical

Material Org |

| : |

Fibers |

: |

Nylon、Polyester、Specification、miocell |

| |

Chamude |

|

Staple

Fiber、Substrate、Suede、Others |

| |

Industrial

Materials |

|

Tirecord、Spunbond、Tech-Yarn、Airbag、Heracron(R) |

| |

Films

|

|

PET

Film、Nylon Film、Stamping Foil、Window Film、Metalized Film |

| |

Electronic

Materials |

|

Diffuser

Sheet、Prism sheet、Diffuser Plate、Overcoat、Column Spacer、Black Matrix、

Light

Diffusing Agent form Diffuser、DFR for PDP、Dry Film Photo Resist、Solder Mask、

Liquid

Photoimageable Resist Ink、Polyimide Film |

| |

Engineering

Plastics |

|

ENPLA |

| |

|

|

|

| Performance

Material Org] |

| |

Hydrocarbon

Resin |

|

SUKOREZ、HIKOREZ、HIKOTACK |

| |

Super

Absorbent Polymer |

|

K-SAM |

| |

Phenolic

Resin |

|

HIRENOL |

| |

Polyurethane

Resin |

|

KONY

URETHANE |

| |

Thermoplastic

Polyurethane Resin |

|

ELLAS |

1970-79

The Petrochemical Industry Complex was established in Ulsan

through Government initiative to make Korea an export

powerhouse with the development of the

capital/technology-intensive heavy chemical industry. In

1976, we established a business in the Ulsan Petrochemical

Industry Complex with the aim to produce Hydrocarbon resin

products with our own technology.

1980-89

During the period, Korean economy made rapid progress through

brisk exports and Yeosu Chemical Industry Complex was

established. KOLON INDUSTRIES grew as a leading export

business based on the momentum gained in successful

development of phenolic resin and super

absorbent polymer.

1990-99

Chemical businesses vied with each other for large-scale

expansion of their production capacities, thus laying the

groundwork for the national economy.

In the wake of the financial crisis, Asia economic crisis hit

Korea in 1997 and 1998, however, the chemical industry had to

go through a process of restructuring as other industries

did. Despite various difficulties, KOLON INDUSTRIES managed

to overcome obstacles, pouring all possible efforts into

development of new technology, managerial innovation and

internal restructuring, thus gaining momentum to enhance its

competitiveness.

2000-

At present, chemical businesses in Korea are accelerating

their effort to make forays into overseas markets and expand

their business scale in an attempt to cope with competition

from later starters, including BRICs and the Middle East

countries, mergers among the world's major chemical

businesses, and the jump in crude oil prices. KOLON

INDUSTRIES is also following suit, having established a local

phenolic resin joint venture in Suzhou, China as a forward

base for forays into overseas markets, with the aim to be a

Great Company with formidable competitiveness.

2008/12/1 LG Chem

LG Chem to spin off Industrial Material Division

The board of LG Chem

Ltd., South Korea's leading producer of chemicals, decided

Tuesday to spin off its industrial

material division

by the end of March next year to secure a new growth engine.

Shareholders will hold a meeting on January 23 to vote on the

proposed spinoff, LG Chem said in a regulatory filing.

"The move is aimed at seeking a new growth engine by

enhancing the competitive edge of each business and boosting

investor interest," the company said.

LG Chem's business portfolio ranges from petrochemicals,

batteries, information and technology materials to industrial

materials, including auto parts and construction interior

materials.

----------------

IT & Electronic

Materials

Optical & Display

Materials

Rechargeable Batteries

Printed Circuit Materials

Toners

Chemicals & Polymers

PVC/Plasticizers

ABS/PS

PO (PE)

Acrylates/IPA/NPG/Polycarboxylate

EP

Specialty Polymers

Alcohol

Daesan Plant

Synthetic Rubbers

Industrial

Materials

LG

FLOORS

LG VIZUON(塩ビフィルム)

LG

HI-MACS(人工大理石)

LG

XPRO(ジオメンブレン:土壌補強膜)

LG

ProSol(防水加工布)

LG

NUTREX

LG XCLA

LG Automotive Components(バンパー、燃料タンク、ハンドル、その他)

Housing

Materials (

窓枠、ドア材、サイディング、パイプ、人工皮革など)

2009/3/11 トステム

トステムとLG化学が新合弁会社を設立

住生活グループのトステム株式会社(本社:東京都江東区、社長:小川康彦、以下トステム)と韓国LGグループの株式会社LG化学(LG

Chem. Ltd.、本社:大韓民国ソウル市、CEO:金磐石[キムバンソク]、以下LG化学)は、韓国ソウル市にアルミ建材および産業用アルミニウム製品の供給拠

点となる合弁会社「LG−TOSTEM BM Co., Ltd. ※(以下LG−TOSTEM)」(設立日:2009年4月予定)を設立することに合意し、本日、新会社設立に関する「合弁会社契約書」を締結しました。

「LG−TOSTEM」は、トステムのアルミ建材の製造技術と、LG化学の樹脂サッシ等産業建材の販売力を融合させ、近年建物の高層化など、アルミサッシ需要が高まる韓国における販売拡大を目指します。

LG 化学は、2009年4月1日に3つの事業分野(石油化学、情報電子素材、産業材)のうち産業材事業部門を分社化し、新しく「LG Hausys(LGハウシス)Co., Ltd(以下LG

Hausys)」を設立します(本件は2008年12月発表済み)。「LG−TOSTEM」は、新会社「LG

Hausys」の子会社として、アルミ建材、産業用アルミニウム製品などを韓国の市場に供給していきます。

【新会社の概要】

会社名:LG−TOSTEM BM Co., Ltd.(4月設立時の社名予定)

所在地:大韓民国ソウル市

設 立:2009年4月(予定)

資本金:60億ウォン

出資比率:LG化学 51%、トステム 49%

従業員数:25名(設立時)

事業内容:アルミ建材および産業用アルミニウム製品の製造、販売

LG化学のパク・スンベ・アルミ事業担当常務は「LG化学が持つポリ塩化ビニル(PVC)サッシ事業の競争力とトステムのアルミサッシ先進技術を接続し、サッシ市場全体をリードするシナジー効果を創出したい」と述べた。

May 15, 2009

LG Chem plans US$50 mln

plant in China

LG Chem Ltd., South

Korea's top chemicals maker, said Friday it plans to spend US$50

million to build a synthetic rubber plant in China.

The new plant, to be

located in Tianjin, will be completed in the first

half of next year, LG Chem said in a regulatory filing.

LG Chem aims to generate

$150 million in sales by 2011, according to the filing.

中国の天津渤天化工有限責任公司と合弁会社を設立、総額5000万ドルを投じ、天津に年産6万トン規

模のスチレン・ブタジエン・スチレン(SBS)の新工場を建設する。今月着工、来年上半期の完成を目指す。中国のSBS市場は年率8%以上の高成長を誇る

一方、自給率が70%未満とされており、国内生産が需要の伸びに追いついていない。LG化学は現地生産拠点を構えることで、中国の旺盛な需要に応え、11年までに1億5000万ドルの売り上げを目指している。

2009/7/22

LG Chem、中国海洋石油との合弁で広東省でABSを生産

LG Chem は7月21日、中国海洋石油(CNOOC)との50/50 JVで370百万ドルを投じてABS工場を建設すると発表した。

JV名はCNOOC & LG Petrochemicals Co で、広東省恵州市に建設する。

2011年に先ず15万トンをスタート、2013年に倍増して計30万トンを生産する。

製品は全国の340万トンの半分を消費する南中国で販売し、販売目標を2012年に3億米ドル、2014年に6億ドルとしている。

原料はCNOOCがその製油所とエチレンセンター(中海シェル石化)から供給する。

LG Chemは浙江省寧波市に寧波LG甬興化工(LG Chem 75%/甬興化工

25%)を有しており、増設を重ねて2006年9月に48万トンとしたが、その後の手直しで現在能力は58万トンとなっている。

同社ではこれを2012年に70万トンとする予定で、恵州プラントが完成すれば、LG Chem の中国の能力は100万トンとなり、麗川の60万トンと合わせ、全体能力は160万トンとなる。

台湾のChi

Mei は台湾に100万トン、江蘇省鎮江に70万トンの能力を持つ。

中国のABSメーカー

2011/4/8 plastemart.com

LG Chem mulls

investment of US$1.3 bln in Polypropylene facility in Kazakh

Leading South Korean chemical manufacturer LG Chem is seeking to

invest up to US$1.3 bln in a Kazakhstan facility to produce

551,000 tpa polypropylene. Kazakh energy officials are scouting

for another partner in the venture located in the Western Caspian

Sea province of Atyrau, as per europeanplasticsnews.com.

International Petroleum Investment Company (IPIC) tops the list

of potential investors.

Total investment is estimated at US$4 bln, of which South Korean

banks will provide US$2.7 bln and the balance US$1.3 bln will be

invested by the participants.

Output will be ramped up to 882,000 tons per year with launch of

the facility’s second phase.

September 21, 2011

Badger Licensing to Provide Cumene and BPA

Licenses to LG Chem in South Korea

Badger Licensing LLC (Badger) today announced

that it was awarded contracts by LG Chem Ltd. (LG) to license its proprietary

technology for a 200,000 metric tons per annum cumene

plant and a 120,000 metric tons per annum bisphenol A

(BPA) plant in Daesan, South Korea. The new plants

will be part of an integrated, world-scale facility scheduled for mechanical

completion and startup in 2012.

“This repeat business reinforces our commitment to customer satisfaction as we

continue to develop and improve these technologies.”

LG operates one cumene plant and two BPA plants at their

Yeosu site, all licensed by Badger.

“Badger’s cumene technology provides high product purity, low capital cost,

feedstock flexibility and exceptionally long catalyst cycles, and our BPA plants

have an industry reputation for high operational reliability and superior

product quality,” said Mark Healey, president of Badger. “This repeat business

reinforces our commitment to customer satisfaction as we continue to develop and

improve these technologies.”

More than nine million metric tons of cumene capacity has been licensed by

Badger and its predecessor companies since the technology was introduced in

1995.

Badger began marketing BPA technology in 2004 and has licensed nearly two

million metric tons of capacity.

Badger Licensing LLC, headquartered in Cambridge, MA, is a venture of affiliates

of The Shaw Group and Exxon Mobil Corporation. Badger Licensing is principally

engaged in marketing, licensing, and developing technologies for ethylbenzene,

styrene monomer, cumene, and bisphenol A. The venture also supplies basic

engineering packages for the licensed processes through Shaw and facilitates

catalyst supply to its licensees through ExxonMobil Catalyst Technologies LLC.

Badger Licensing LLC is a joint venture between Badger Technology Holdings LLC

(affiliate of The Shaw Group Inc.) and Alkylation Licensing LLC (affiliate of

Exxon Mobil Corporation).

09/26/2011 SustainableBusiness.com

S. Korean Electronics Giant LG to Invest $7 Billion in Green Business

South Korea's electronics giant LG announced it will invest

$6.83 billion in green business sectors by 2015.

The conglomerate says the investments - in electric vehicle batteries, LED

lighting, solar PV and water treatment technologies - will generate $8.4 billion

in revenue, while creating 10,000 green jobs around the world. It will also

boost business for about 660 small and midsized enterprises in its supply chain.

About a third of the investment will be in lithium

batteries for electric vehicles (by 2013). It's also planning to get into

the solar polysilicon business by 2014.

LG said on Sunday it will invest 8

trillion won ($6.83 billion) in "Green New Business" sectors such as

electric vehicle parts, LED lighting and sewage treatment industries by

2015.

The business group also said it was

aiming to generate 10 trillion won in revenues and create 10,000 new jobs

through these investments.

LG will invest 2

trillion won in the electric vehicle battery area by 2013,

1 trillion won in the photovoltaic, LED and water

treatment sectors and 490 billion won in the

polysilicon business by 2014.

In addition, another

400 billion won was set aside to build facilities to

produce solar cell wafers on a step-by-step basis by 2015, according

to an LG statement.

Its LG Chem

division says its goal is to be the world's top lithium battery manufacturer,

taking a 25% share by 2015. It currently supplies

Li batteries for GM's Chevy Volt and Opel Ampera. And it's working with GM on

electric vehicle development.

LG Innotek, which makes LEDs, is looking for a

10% global market share. Its vertical manufacturing process makes all the

components including chips, modules and packaging.

Its flagship company, LG Electronics, will expand

solar manufacturing from its current level of 300

megawatts (MW) to 1,000 megawatts by 2014. There too, they expect to be the

global leader by 2015. They entered the US solar market in 2010.

In water treatment, LG recently acquired specialist Daewoo

ENTEC, allowing it to offer a "total water treatment solution." Through

the LG-Hitachi joint venture, the two compaies will

collaborate on developing new technologies and services for the huge water

treatment market, valued at over $430 billion a year.

It also follows the announcement last

month that the company is to acquire sewage treatment services specialist

Daewoo ENTEC in a move designed to further bolster the company's presence in

the water treatment market.

LG said the deal would allow the company

to offer a "total water treatment solution", combining its existing

engineering and construction capabilities with ENTEC's services expertise.

The acquisition will also help support

the launch next month of the new LG-Hitachi Water Solutions joint venture,

which will see LG and Hitachi co-operate on the development of new water

treatment technologies and services.

"With the market expected to grow at an

annual rate of five per cent due to increased pollution and the effects of

climate change, we see the water treatment business as a crucial component of

LG's future success," says Young-ha, Lee, CEO of LG Electronics Home Appliance

Company.

Last year, LG announced it would invest $17.8 billion in green product

development to lower greenhouse gas emissions 40% from 2009 levels by 2020.

Its competitor, Samsung, is also invest heavily in green with $5 billion in

investments by 2013.

South Korea has set an emissions reduction target of 30% by 2020. At the

beginning of the worldwide recession, the country was widely praised for

allocating about 80% of its stimulus spending toward green-oriented projects.

朝鮮日報

LGグループは、2015年までに8兆ウォン(約5380億円)を電気自動車部品、発光ダイオード(LED)、太陽光、水処理などの分野に投資することを柱とする「グリーン新事業中長期戦略」を25日確定した。

LGはグループ全体の売上高の15%をこれらのグリーン新事業から上げることを目標としている。

計画によると、LG化学は電気自動車のバッテリーに2兆ウォン(約1350億円)を投資し、現在年10万台の生産能力を13年までに35万台に拡充する。

15年には世界シェア25%以上を目指す。また、電気自動車分野ではモーター、動力変換装置などの生産をLGイノテック、LG電子が担当する。これに先立ち、LGは先月25日、米ゼネラル・モーターズ(GM)と電気自動車の重要部品を共同開発することで合意した。

太陽光分野では、LG電子が生産規模を今年の330メガワットから2‐3年以内に1ギガワットへと拡大し、15年に世界10位圏入りを目指すことを目標に掲げた。LGは現在、ポリシリコン(LG化学)、ウエハー(LGシルトロン)、セル・モジュール(LG電子)、発電所運営(LGソーラーエナジー)という太陽光事業の垂直系列化を進めている。

LG電子はまた、今年7月に水処理事業で日本の日立プラントテクノロジーと提携し、合弁会社を設立したのに続き、先月には公共水処理専門企業の大宇エンテックを買収した。LGイノテックはLEDチップ、LEDモジュールなどの生産を行っている京畿道坡州工場を本拠地として、15年にはLEDの世界シェアを10%台に高める戦略だ。

LGはグリーン新事業の推進過程で、今後5年間に競争力を備えた中小企業660社を発掘し、総額1000億ウォン(約67億円)を支援することも決めた。同社関係者は「新規に1万人分の雇用機会を創出し、競争力ある中小企業の発掘を続けたい」と説明した。