Back

2002.12.23 LG

EDC Plant in Australia

http://www.lgchemir.com/ceil/pdf/EEDC.pdf

Background

LG Chem will build EDC manufacturing plant with capacity of

300,000 MT in Gladstone, Australia by 2005 through

cooperation with Cheetham Salt Ltd. of Australia and others.

Why Australia

We chose Australia since it has

easy access to low-cost electricity and salts, and a large

market for caustic soda, its byproducts.

Production status of PVC

& EDC

2002.04.12 LG

Divestiture of Epoxy

Business

http://www.lgchemir.com/ceil/pdf/epoxy.pdf

Based on the company

strategy to focus on selective core business areas, and the

company’s restructuring efforts, the epoxy

business was decided to be sold to Bakelite, a German

company.

Background of the sale and

expected benefit

Epoxy business is recognized

as a non-core business for the long-term business strategy,

with limitations in gaining competitive edge due to increased

competition and excess supply.

On Bakelite

Bakelite is the world’s

first developer of Phenol, specializing in thermo setting

resin. Recently, Bakelite is making aggressive entry into the

Asian region in areas such as EP compound and Epoxy resin.

2014/3/19

韓国LG化学 米のRO膜メーカー買収

韓国LG化学は、逆浸透(RO)膜事業に進出する。米国RO膜メーカーのNanoH2Oを2億ドルで買収、4月末までに契約完了を目指す。

海水淡水化に特化したRO膜メーカーの買収により、日本メーカーが高いシェアを持つRO膜市場へ本格参入する。

LGグループは2012年にLG電子が日立プラントテクノロジーと水処理の合弁会社を設立するなど水処理事業に注力している。RO膜を手掛けることで水ビジネスの拡大に乗り出す。

---------------

Mar 17, 2014 Bloomberg

LG Chem to Acquire U.S. Desalination Membrane

Innovator NanoH2O

NanoH2O Inc., a manufacturer of reverse-osmosis

membranes 逆浸透(RO)膜 that purify seawater to

drinking quality while lowering the cost of desalination, is being purchased by

Seoul-based LG Chem Ltd. for $200 million.

The Southern California startup, established in 2005 from research that stemmed

from the University of California at Los Angeles, makes water potable from

fresh, brackish and saltwater sources. The acquisition is expected to close next

month, LG Chem said in a filing to the Korea Exchange on March 14.

The purchase takes place amid record drought from California to southeast Asia

and rising water-scarcity issues. NanoH2O, whose nanocomposite and polymer

technologies improve energy-efficiency and power costs in water production, has

been backed by investors including Khosla Ventures, Oak

Investment Partners, BASF Venture Capital GmbH, Total Energy Ventures

International and the China-focused fund Keytone Ventures.

NanoH2O agreed in 2013 to build a plant on the Yangtze River delta at Liyang,

China, that’s due to be completed later this year. With the second-largest

economy, China is one of the biggest desalination markets in the world.

LG Chem’s board of directors approved buying NanoH2O to boost its

water-treatment filter business, according to the March 14 statement. The Korea

Economic Daily and Yonhap News Agency earlier reported the deal.

October 21,

2013 中国に生産工場NanoH2O

Inc., manufacturer of the most efficient and cost-effective reverse osmosis

(RO) membranes for seawater desalination, today announced plans to build a

manufacturing facility in Liyang 栗陽, China, a

city in the Yangtze River Delta 250 kilometers west of Shanghai. The 10,000

square meter facility will be the company’s second fully integrated

manufacturing plant, following the first located in Los Angeles, California.

The China facility comes at a total investment of $45 million and is

expected to be operational by the end of 2014.

November

4, 2013 サウジで海水淡水化 2件受注

NanoH2O, Inc., manufacturer of the most efficient and cost

effective reverse osmosis (RO) membranes for seawater desalination, has been

selected for two large projects in the Kingdom of

Saudi Arabia. The first project, awarded by Al Fatah Water and Power

International, is for phase II of the Jubail desalination plant in which

QuantumFlux membranes will produce 13,000 cubic meters of water per day. The

second project, a desalination plant to be designed by AES Arabia at the

King Abdullah University of Science and Technology (“KAUST”) Research Park,

will produce 15,000 cubic meters of water per day. Both installations are

scheduled for 2014.

-----

2012年1月31日

LG電子と日立プラントテクノロジーの水事業合弁会社

「LG-Hitachi Water Solutions」が発足

LG Electronics,

Inc.と、日立プラントテクノロジーは、2011年7月の合弁契約締結を受けて設立準備を進めてきた水事業に関する合弁会社LG-Hitachi Water

Solutions Co., Ltd.(本社:韓国ソウル市)が2012年2月1日に発足することをお知らせします。

出資比率はLG電子が51%、日立プラントテクノロジーが49%

LG-Hitachi Water

Solutionsでは、主に韓国における各種工場の排水処理設備や上水・下水処理施設向けの機器の製造・販売をはじめ、システムの設計・調達・建設(EPC)、施設の運転・維持管理(O&M)、および水処理技術の研究開発を行います。また、将来的には、第三国における水事業に参画していくことも検討します。

2014/05/21

Yonhap

Renault inks MOU with LG Chem to jointly

develop future EV batteries

Renault S.A., the world's largest

manufacturer of electric vehicles (EV), said Wednesday that it has signed an

agreement with LG Chem to jointly develop high density batteries that will

power its next-generation zero emission cars.

The French automaker, which controls

Renault-Nissan Alliance and South Korea's

Renault Samsung Motors Co., said the agreement lays the foundation

for its next-generation EVs to be powered by lithium ion batteries made by

LG Chem, already an established leader in the vehicle power storage sector.

The batteries will give cars longer endurance and reduce range concerns that

have restricted growth of the global EV market.

2000年、三星自動車は会社設立から約6年、操業から1年4か月で経営破綻した。

ルノーが株式の80.1%を取得して筆頭株主となった(残りの19.9%は三星グループが保有)

Renault currently markets the Twizy, Zoe,

Fluence Z.E. and Kangoo Van Z.E. electric cars. Counting Nissan's Leaf, the

world's fourth-largest automotive alliance had sold 100,000 EV as of July

2013. In South Korea, Renault Samsung sells the SM3 Z.E. that is based on

the Fluence.

Thierry Bollore, the carmaker's chief

competitive officer who signed the agreement for Renault in Seoul, outlined

the company's commitment to making battery packs that can power zero

emission cars. The executive confirmed the company's desire to contribute to

the growth of South Korea's car industry through Renault Samsung.

LG Chem said the latest

tie-up with Renault will speed up demand for EVs and make them more

commonplace.

ーーーーーーーー

Renault, the world's top

producer of electric vehicles (EVs), has agreed with Korea's LG Chem to

use LG-developed batteries for its next-generation EVs, LG Chem said

Wednesday.

"LG Chem will jointly collaborate with Renault Group for the development

of next-generation rechargeable batteries to be used in Renault's new

and premium EVs, which will be coming out a few years later," said LG

Chem spokesman C.S. Song.

Song said that Renault's upcoming EVs will adopt LG-patented

high-density and energy-efficient lithium-ion batteries.

The spokesman declined to unveil additional details such as the

guaranteed battery volume LG promised to the French car manufacturer.

Under the agreement, Renault technicians will be coming to LG's

battery-manufacturing factory in the local provincial city of Ochang,

south of Seoul.

"Two or three more years will be needed to report visible results," the

official said.

LG Chem President Kwon Young-soo said the agreement will help the firm

stay ahead of its rivals in the heated race for EV batteries.

Kwon said LG Chem will further strengthen its strategic business

partnership with Renault.

Renault is one of the most-trusted of LG Chem's battery partners.

While Renault has a battery-making division ― AESC, a joint venture

between Nissan and NEC ― the French automaker has been consistent in

using LG-developed batteries over the last few years.

オートモーティブエナジーサプライ株式会社 (略称:AESC)

Automotive Energy Supply Corporation

日産自動車 51%、日本電気

42%、NECエナジーデバイス

7%

LG Chem has been supplying its batteries to Renault's three EV models ―

Twizy, Zoe and SM3 Z.E.

-------------

2012/7/30 monoist.atmarkit.co.jp

ルノーがLG ChemとEV用電池で提携、「ZOE」は日産製電池を採用せず

ルノーとフランス原子力庁は、電気自動車(EV)用次世代電池の量産開発でLG Chemと提携すると発表した。LG Chemは、このEV用次世代電池の工場をフランス国内に建設するとともに、同工場で2015年末からEV用電池の現行品の量産を開始する。ルノーが

2012年末発売予定の小型EV「ZOE」も、LG Chem製の電池を採用することが明らかになった。

Renault(ルノー)とフランス原子力庁(CEA)は2012年7月27日(欧州時間)、研究を進めていた電気自動車(EV)用次世代電池の量産開発でLG

Chemと提携すると発表した。LG Chemは、このEV用次世代電池の工場をフランス国内に建設するとともに、同工場で2015年末からEV用電池の現行品の量産を開始する。EV用次世代電池の量産は2017年前半に始める計画だ。2012年9月に、3者の間で正式契約を結ぶ予定だ。

LG Chemは、EV用次世代電池の量産化技術開発への貢献が期待されている。ルノーとCEAは、EV用リチウムイオン電池で有力なLG

Chemの工場を誘致することにより、フランス国内における経済的価値と雇用、EV技術で世界をリードする地位を獲得できるとしている。

日産のEV用電池量産計画は?

ルノーと日産自動車のアライアンス(ルノー・日産アライアンス)は2009年11月、日産自動車の子会社であるオートモーティブエナジーサプライ(AESC)の技術をベースにしたEV用電池工場を、2012年半ばまでにルノーのフラン工場に建設する計画を発表していた。しかしルノーは2011年7

月、建設計画の2014年までの延期を表明。さらに2011年9月には、日産自動車がルノーのフラン工場を借り上げて、EV用電池を単独で生産する方針に転換したと報道されていた。

この頃まで、ルノーが2012年末に出荷を予定している小型EV「ZOE」の電池は、AESCの技術がベースになると考えられていた。しかし

2012年7月上旬には、LG ChemがZOEの電池を供給することが明らかになった。なお、現在ルノーが販売中のEVの電池については、小型商用車「Kangoo

Z.E.」とセダン「Fluence Z.E.」向けはAESCが、2人乗りの超小型車「Twizy」向けはLG Chemが供給している。

今回の発表により、ルノーはLG ChmeとEV用電池の開発と量産で強固な提携を結ぶことになる。これにより、日産自動車が計画していた、ルノーのフラン工場におけるEV用電池の生産がどうなるかが注目される。

---

中央日報日本語版 5月20日韓国LG化学、“バッテリー宗主国”日本に特許輸出

LG化学が独自開発した特許を“バッテリー宗主国”の日本に輸出した。

LG化学は日本電池材料生産会社の宇部マクセルに安全性強化セパレーター(SRS)関連特許を有償で販売する内容のライセンス契約を結んだと18日、発表した。

LG化学のSRS技術はバッテリーの核心素材セパレーターにセラミックをコーティングし、熱と機械的強度を高め、内部の短絡(ショート)を防ぐ役割をする。代表的な二次電池であるリチウムイオンバッテリーの安全性を決める核心技術だ。

LG化学はSRS関連技術の特許を2007年に韓国、2010年に米国、2012年に中国で登録した。

May 23, 2014

First ABS plant in South China on stream

South China, which houses a significant

share of China’s plastic manufacturing, has never had local ABS production,

until now.

CNOOC & LG Chem Petrochemicals Co. Ltd., a

50/50 joint venture between China’s state-owned CNOOC and Seoul-based LG

Chem, has commenced production on its 150,000-ton

phase one project in the spring of 2014, the company told Plastics News.

The company is “actively preparing for”

the second phase, which has been approved by the provincial government and

double the plant’s capacity to 300,000 tons upon

completion.

The plant is located in the

Daya Bay Petrochemical Industrial District in Huizhou,

Guangdong province, neighboring CSPS (a JV between CNOOC and Shell)

and the Huizhou Refinery and Ethylene project.

It conveniently sources feedstock “across

the wall” from its neighbors, the company said in a statement.

Given the oversaturation of China’s

standard ABS market, this plant is focused on

specialty grades and high-end standard grades, serving processors in

South and East China. The company said it is supplying materials to

appliances giants as well as makers of consumer products and toys.

The total investment of the plant comes

to 2.5 billion yuan ($400.8 million).

The project was initiated in 2008, when

the two companies signed a framework agreement.

Sep 12, 2016

LG Chem to buy LG Life Sciences for nearly $1

billion

South Korean chemicals and battery maker LG Chem on Monday said it plans to

acquire pharmaceutical affiliate LG Life Sciences

for about 1.1 trillion won ($989.56 million) to make its

bio business a new growth engine.

LG Life Sciences investors will receive about 0.26 of a common share in LG Chem

for each share they own and about 0.25 of a preferred share in LG Chem, the two

companies said in a regulatory filing.

株主

|

LG Corp. |

30.4% |

|

National

Pension Service of Korea |

13.1% |

|

Allianz Global

Investors Korea Ltd. |

5.07% |

LG Chem said it would complete a merger by

Jan. 1.

In January, LG Chem agreed to buy seeds, pesticides and fertilisers maker

Dongbu Farm Hannong for 515.2 billion won.

2016/1/18

LG

Chem、農業化学に進出

The company said it would achieve a sales of 5 trillion won from its bio

business by 2025.

ーーー

"LG Group seems to be

seeking next-generation growth engines through the merger," said an analyst.

LG Life Sciences was

spun off from LG Chem in 2002 but failed to

make a major breakthrough in the country's pharmaceutical industry ― its

sales amounted to 450.5 billion won last year, less than half of market

leader Hanmi Pharmaceutical's 1.32 trillion won.

ーーー

In August 2002, LG

Life Sciences was upgraded from a business division to a full-fledged LG

affiliate in order to grow as a life sciences specialist and maximize

shareholder value.

LG Life Sciences began research in

genetic engineering in 1981 and has invested steadily in the life sciences

ever since. This effort has already resulted in world-class technology and

product capabilities. The company has focused R&D resources and know-how on

three areas-pharmaceuticals, animal health and specialty chemicals.

LG Life Sciences has developed and

commercialized an array of pharmaceuticals over the years. These include

interferon in 1989 (Intermax-gamma) and 1992 (Intermax-alpha),

hepatitis B vaccine in 1992 (EUVAX B™),

human growth hormone in 1993 (EUTROPIN™),

degenerative arthritis treatment in 2005 (HYRUAN

Plus™), rhFSH (recombinant human follicle stimulating hormone) in 2006 (Follitrope™),

and SR-hGH (Sustained Release-human Growth Hormone) in 2007 (Declage™). A

company milestone was reached in 2003, when its next-generation quinolone

antibiotic (FACTIVE®) was approved by the FDA in the United

States.

LG Life Sciences has succeeded in

animal health products including the 1994

commercialization of recombinant bovine somatotropin (BST, product name

BOOSTIN®). The product, which is used to increase milk production

in lactating dairy cows, has achieved the top share in numerous national

markets. In 2006, LG Life Sciences has also launched a bovine mastitis

vaccine (MastaVac) that reduces the number of somatic cells, relieving

clinical symptoms in a cow that has been infected with mastitis.

As for specialty chemicals, LG Life

Sciences completed in-house development of Korea's first new

herbicide (PYANCOR®) for rice in

1997 and fungicide (GUARDIAN®) for

use in horticulture in 1999. A new herbicide (FLUXO®) for both

pre- and post-emergence rice was completed in 2004.

December 26, 2017

LG Chem plans $279 million expansion of

SAP, acrylic acid capacities

LG Chem will invest

a total of 300 billion won ($278.6 million) to expand its petrochemical

facilities in Yeosu, South Jeolla Province, the company said Tuesday.

With the investment, the company plans to increase the annual production

capacities of crude acrylic acid and super absorbent

polymer by 180,000 tons and 100,000 tons, respectively.

When the expansion

is completed by 2019, the chemical giant’s production capacity of

CAA will increase to 700,000 tonnes/year and

SAP to 500,000 tonnes/year. LG Chem expects its

annual sales to grow by US$280 million, it said in a statement.

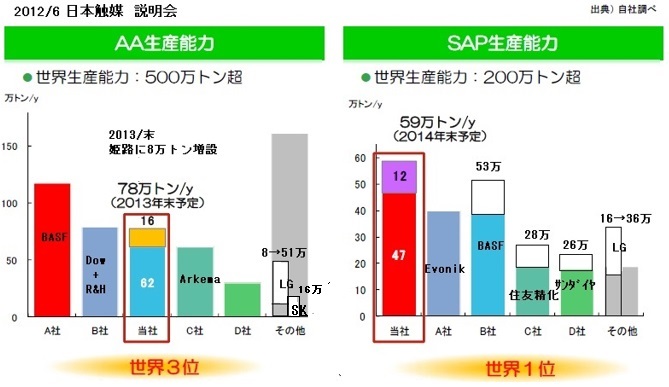

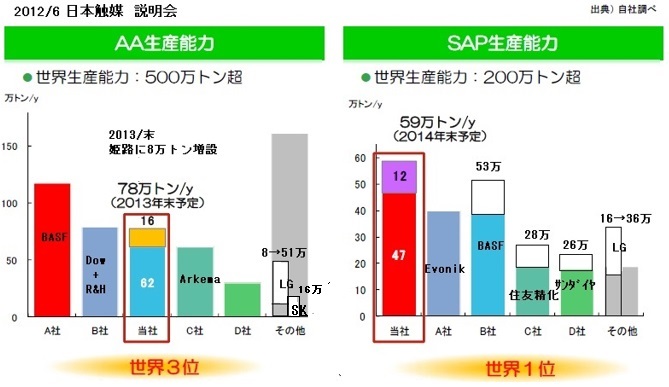

2012年6月の日本触媒の会社説明会資料では、世界のアクリル酸の能力は500万トン超、SAPは200万トン超としているが、その後、各社の増強計画が続いている。

付記 日触は2014年7月31日、中国倍増計画中止を発表→2014年末 56万トン

2015/1/4

LG Chem Aims to be Global No. 1 Material

Company

Its fourth SAP plant at the Yeosu complex will bring the compnay's annual

SAP production capability to 360,000 tons

LG Chem’s fourth super absorbent polymer (SAP) plant in the Yonseong

district of the Yeosu National Industrial Complex is under construction. If

the new plant launches production in September as planned, it will bring the

company’s annual SAP production capacity from the current 280,000 tons

to 360,000 tons.

“SAP requires an advanced technology, so it has emerged as a strategic

material to make a difference between our company and Chinese competitors,”

said Song Hee-yoon, head of LG Chem chemical products plant.

He went on to say that LG Chem sees its production capacity surge five-fold

in seven years after the company entereed the SAP business in 2008.

SAP is a polymer material that can absorb pure water up to several hundred

times its own weight.

Despite the sagging chemical industry, LG Chem plans to expand investments

into new materials for new growth engines.

In a recent meeting with reporters, LG Chem Vice Chairman Park Jin-soo

unveiled a blueprint to create inorganic materials, innovative batteries and

future materials that have not yet hit the global market, with the goal of

raising revenues in those segments to 1 trillion won by 2020.

To this end, he said LG Chem plans to expand R&D outlays from 600 billion

won this year to 900 billion won by 2018, and raise the number of

researchers from 3,100 to 4,100.

Research manpower specializing in future materials will work at LG Chem’s

research center in Gwacheon, Gyeonggi-do, which is scheduled to open soon,

and LG Science Park LG Group plans to construct in the Magok District in

Seoul will be utilized to research new materials.

Vice Chairman Park said LG Chem, which started out with nothing at the Yeosu

plant 40 years ago, has now evolved into a business with an 1,800-fold

production increase, and the Yeosu plant will create a new chapter in LG

Chem’s history. He said LG Chem will continue to invest into the materials

sector until people recall LG Chem is No. 1 when it comes to materials that

make human lives richer.

LG Chem aim to raise sales in the overall materials field, including basic

material segments such as Sap and engineering plastic, information

electronics like OLED lightings and energy storage systems to 12 trillion

won by 2018. The company targets at 2 trillion won in sales in 2015, a

two-fold increase form 2014.

LG Chem Petrochemical business unit has eight domestic and 26 overseas

plants, including a plant in Gimcheon and a newly established Yeosu SAP

plant.

The new 36KT SAP plant in Yeosu will help

strengthen SAP business as LG Chem’s core and strategic businesses.

Moreover, with continuous investment in SAP business further expansion is

scheduled each year.

LG Chem SAP Unit’s Strong Points

The vertically integrated facility guarantees highly sustainable source of

supply for customers. Second, through state-of-art R&D and high quality

products, the company will continue to develop. Finally, with a

customer-oriented mindset, LG Chem says it will support customers’ needs and

value creation by solution partner project.

By taking control of raw materials from naphtha and SAP, LG Chem is one of

the few chemical companies in the world that is truly and vertically an

integrated SAP supplier.

From GS Caltex, naphtha is delivered to LG Chem’s NCC plant where 1,130KT

propylene produces as the raw material. Then, this propylene is delivered to

the Acrylic Acid (AA) plant, which produces 193KT of Acrylic Acid. And

finally, at the Gimcheon and Yeo-su plant, AA is transformed into SAP with

an annual capacity of 108KT to 72KT in Kimcheon 36KT here in Yeo-su.

Caustic Soda is also vertically integrated from upstream to SAP plants with

the capacity of 225KT.

LG Chem guarantees its customers a stable supply of SAP to a perfect

vertical integration.

South Korea's LG

Chem to set up battery material JVs with China's

Zhejiang Huayou Cobalt

South Korea’s LG Chem Ltd said

on Wednesday it had agreed to build two joint ventures with

China’s Zhejiang Huayou Cobalt

浙江華友鈷業股份有限公司

to lock in

supplies of cobalt for lithium-ion batteries.

The plan comes as South

Korean companies step up efforts to secure battery metals

including cobalt to meet rising demand for electric vehicles.

Huayou Cobalt confirmed the

arrangements.

Under the deal, LG Chem said

it would raise a total of 239.4 billion won ($224.8 million) by

2020 to set up precursor and cathode joint

ventures in China.

The joint ventures are

expected to start producing 40,000 tonnes a year of precursors

and cathodes from 2020, the South Korean battery maker said in

the statement.

LG Chem said it plans to use

precursor and cathode materials produced from the joint ventures

for its battery plants in China and Poland.

2022.08.16 LG Chem

LG

Chem, ADM Complete Agreement for ‘Eco-friendly Bio Plastic’

Joint Ventures in Illinois, USA

LG Chem and ADM (Archer

Daniels Midland) have completed agreement for ‘Eco-friendly

Bio Plastic’ Joint Ventures.

LG Chem announced on the 16th at the LG Chem Magok R&D

Campus in Gangseo-gu, Seoul that it held the ‘Celebrating

the Launch of LA (lactic acid) and PLA

(poly lactic acid) 乳酸・ポリ乳酸 Ventures’ with ADM. ADM

(Archer Daniels Midland), a global leader in nutrition and

sustainable products and solutions, has a global

agricultural supply chain and processing technology, and LG

Chem has cooperated in developing plant-based bio materials.

This agreement is the main contract following the conclusion

of the Heads of Agreement (HOA) signed by the two companies

in September of last year.

The two companies will establish two joint ventures to

respond to the demand for plant-based products and

bioplastics. The LA production corporation

‘GreenWise Lactic’ will be in

charge of the raw materials to produce

150,000 tons of high-purity corn-based lactic acid annually.

The second joint venture, ‘LG Chem

Illinois Biochem,’ will use GreenWise Lactic’s lactic

acid to produce 75,000 tons of

bioplastics annually. If LG Chem Illinois Biochem

makes 500ml eco-friendly water bottles with bioplastics from

the factory, it can produce about 2.5 billion bottles. The

production facility will be built in Decatur, Illinois,

U.S., with the aim of completing it in late 2025 or early

2026. Construction is scheduled to begin in 2023, when the

final decision of the boards of both companies are

completed.

The first joint

venture, GreenWise Lactic, would produce up

to 150,000 tons of high-purity corn-based lactic acid

annually. ADM would be the

majority owner of GreenWise, and would contribute

fermentation capacity from its Decatur bioproducts

facility to the venture.

The second joint

venture, LG Chem Illinois Biochem, would be

majority-owned by LG Chem.

It would build upon LG Chem’s expertise in bioplastics

to build a facility that will use product from GreenWise

Lactic to produce approximately 75,000 tons of

polylactic acid (PLA) per year.

LG Chem is the first Korean company to build a PLA plant

with integrated production capacities ranging from raw

materials to the final product. With the establishment of

these JVs, LG Chem will not only procure production

capacities for highly pure lactic acid needed for

commercial-scale PLA production, but will also be able to

apply bio-materials in the development of various high

value-added bio-materials.

PLA is a representative biodegradable bioplastic made with

lactic acid produced by fermenting corn, and is mainly used

in food containers, straws, water bottles, tableware, and

tea bags that are harmless to the human body. PLA is

naturally decomposed within a few months by microorganisms

when certain conditions are met. It also emits only a

quarter of greenhouse gases during the production process

compared to general plastics, and is thus drawing attention

as a sustainable eco-friendly material. Global demand for

bioplastics is projected to grow from USD 10.7 billion in

2021 to USD 29.7 billion by 2026, representing annual growth

of 22.7%.

ADM CEO Juan R. Luciano stated, “Sustainability is one of

the enduring global trends that is powering ADM’s strategy

and growth.” and added, “We’re pleased to expand our

collaboration with LG Chem, and we’re planning to take the

next growth step, greatly expanding our ability to meet

growing demand for plant-based solutions.”

LG Chem Chief Executive Officer Hak Cheol Shin commented,

“The establishment of this joint venture is a sustainable

growth strategy that can directly contribute in solving

environmental issues such as climate change and waste

plastics,” and added, “Based on eco-friendly materials,

which is an axis for new growth engines, we will respond to

the rapidly changing market and customers, while becoming a

market leader.”

June 28, 2023

LG Chem Starts Mass Production of

Single-Crystal High-Nickel Cathodes in Korea

LG Chem starts mass production of single-crystal high-nickel cathodes in Korea.

LG Chem continues its leadership in battery materials with Korea’s first-ever

mass production of single-crystal high-nickel cathodes.

LG Chem announced that it has started the mass production of

single-crystal high-nickel cathodes for

next-generation batteries at its cathode plant located in Cheongju, 120

kilometers southwest of Seoul. The first batches will be sent to global clients

starting from July. LG Chem then plans to expand the single-crystal high-nickel

cathode production line to its Gumi plant by 2027 and increase total annual

production scale to more than 50,000 tons.

Shin Hak-cheol, LG Chem CEO said:

We believe single-crystal high-nickel cathodes are a game-changing innovation in

the future battery material market and also the key to solving our customers’

pain points.

“LG Chem will lead the market with advanced

battery material technology and diversified product portfolio to become the

largest integrated battery materials provider in the world.”

In the initial phases, LG Chem will be mixing

single-crystal cathode materials to conventional cathode materials by a ratio of

2:8, and gradually switch to those containing 100% single-crystals. LG Chem will

also expand the application of these cathode materials to next-generation

batteries such as 4680 cylindrical cells (with external dimensions of 46

millimeters in diameter and 80 millimeters in height) from existing pouch-type

batteries.

Single-crystal high-nickel cathodes are made

from single particles of several metals such as nickel, cobalt, and manganese,

and are expected to play a pivotal role in settling the key challenges of

next-generation batteries in terms of lifespan and capacity. It can help

boosting the battery lifespan by more than 30% and increasing the capacity by

10% or higher.

LG Chem is the first to mass-produce

single-crystal high-nickel cathode materials in Korea. Since 2021, LG Chem has

been researching and developing ways to solve the pain point of customers,

namely the battery gas.